Resilience against Catastrophic Cyber Incidents: A Multistakeholder Analysis of Cyber Insurance

Abstract

1. Introduction

2. Background

2.1. Cyber Insurance History and Current Market

2.2. Catastrophic Cyber Incidents

2.3. Past Federal Insurance Programs

2.4. Using TRIP for Cyber Catastrophes

2.5. Prior Research on Catastrophic Risk and Insurance

2.6. Research Questions

- What specific factors and conditions elevate a cyber incident to the level of a catastrophe, impacting businesses and society at large?;

- How can the impact of catastrophic cyber incidents be effectively mitigated, and what role does insurance play in this mitigation strategy?;

- Does the current cyber insurance sector possess the necessary capacity to address potential catastrophic cyber incidents adequately?;

- If the current cyber insurance sector lacks sufficient capacity, what roles and methods of support can the government employ to enhance this capacity, and how can these governmental support mechanisms be effectively implemented?

3. Methodology

3.1. Research Design and Approach

3.2. Data Selection

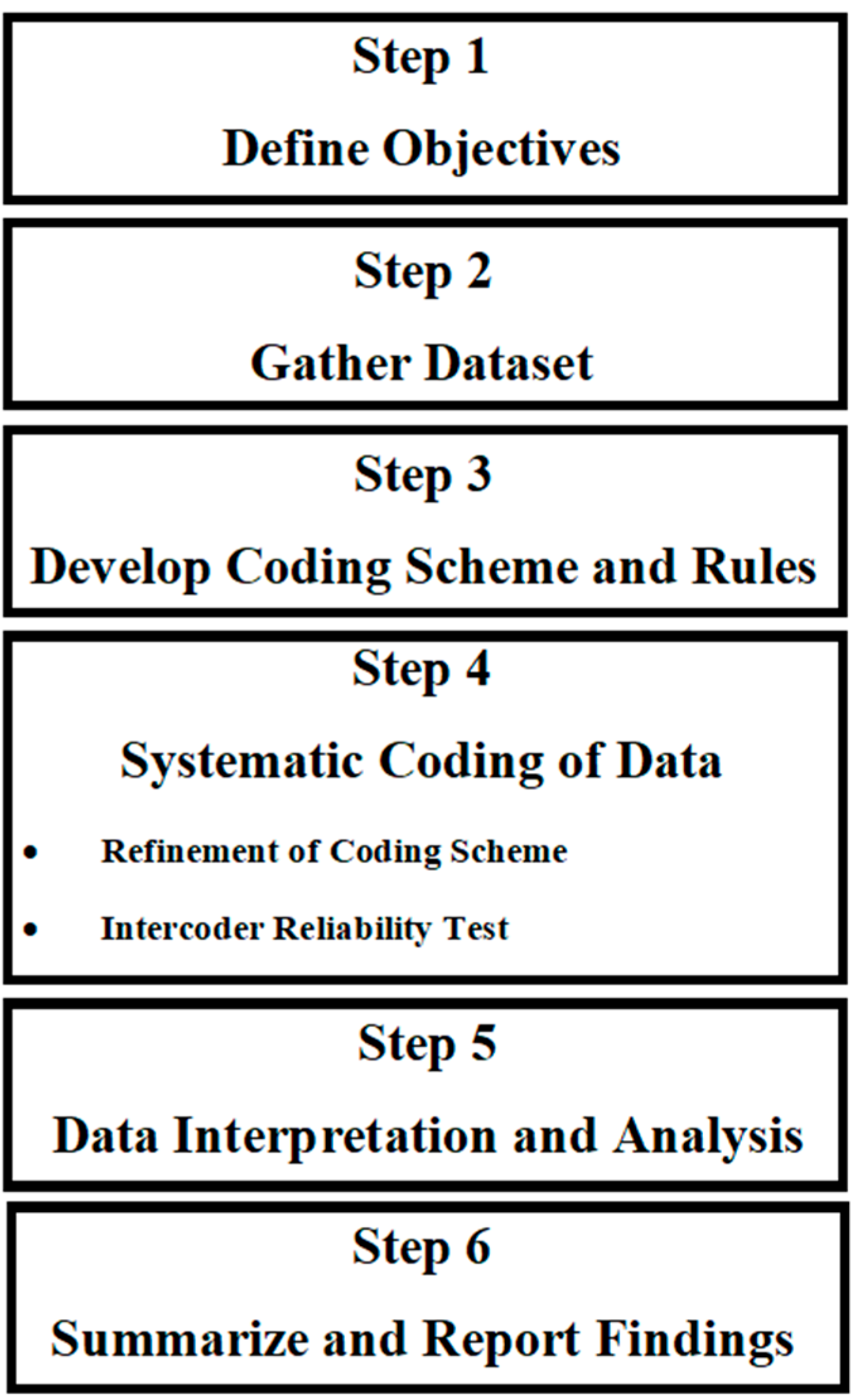

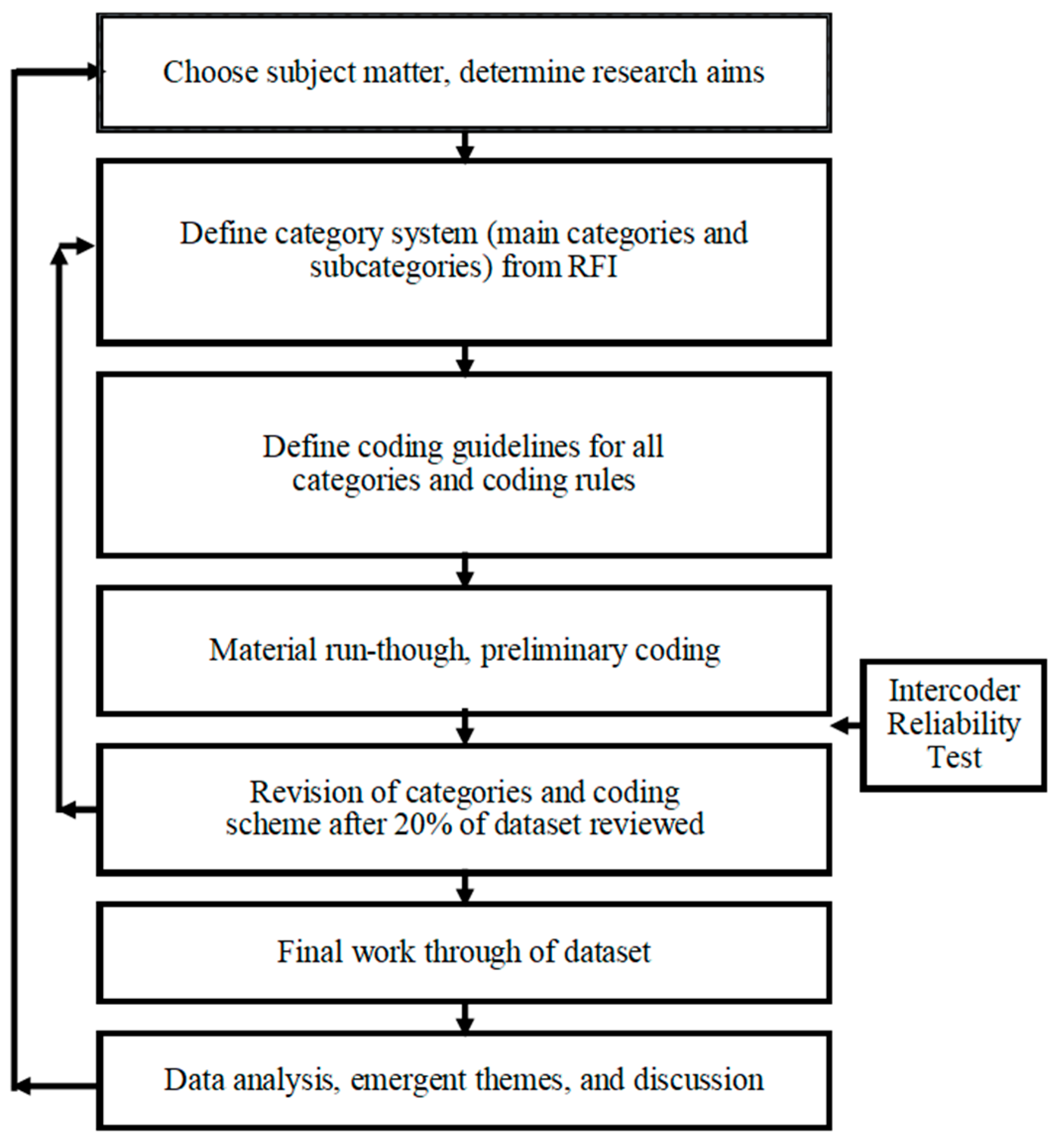

3.3. Conducting the Conceptual Analysis

3.3.1. Coding Scheme

3.3.2. Intercoder Reliability

4. Results

4.1. Organizing the Sample

4.1.1. Comment Distribution across Groups

4.1.2. Variety of Questions Answered and Response Rate

4.2. Findings

4.2.1. Defining Catastrophic Cyber Incidents (CCIs)

4.2.2. Mitigating Catastrophic Cyber Incidents

4.2.3. Capacity of the Cyber Insurance Industry

4.2.4. Potential Governmental Support Mechanism

5. Concerns and Benefits of a Federal Backstop

5.1. Concerns Surrounding a Federal Backstop

5.2. Potential Benefits of a Federal Backstop

6. Picturing the Backstop

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Beer, J. “WannaCry” Ransomware Attack Losses Could Reach $4 Billion. CBS News. 2017. Available online: https://www.cbsnews.com/news/wannacry-ransomware-attacks-wannacry-virus-losses/ (accessed on 6 September 2023).

- Greenberg, A. The Untold Story of NotPetya, The Most Devastating Cyberattack in History. Wired. 2018. Available online: https://www.wired.com/story/notpetya-cyberattack-ukraine-russia-code-crashed-the-world/ (accessed on 6 September 2023).

- Kreese, B. The Insurance Market Is Hardening: What Does That Mean for Your Business? Buffalo Business First. 2021. Available online: https://www.bizjournals.com/buffalo/news/2021/01/25/the-insurance-market-is-hardening-what-does-that.html (accessed on 6 September 2023).

- GAO (U.S. Government Accountability Office). Cyber Insurance: Action Needed to Assess Potential Federal Response to Catastrophic Attacks. (GAO-22-104256). 2022. Available online: https://www.gao.gov/products/gao-22-104256 (accessed on 6 September 2023).

- U.S. Treasury Department. Potential Federal Insurance Response to Catastrophic Cyber Incidents, 87 FR 59161. Federal Register. 2022. Available online: https://www.federalregister.gov/documents/2022/11/09/2022-24476/potential-federal-insurance-response-to-catastrophic-cyber-incidents (accessed on 6 September 2023).

- Marotta, A.; Martinelli, F.; Nanni, S.; Orlando, A.; Yautsiukhin, A. Cyber-insurance survey. Comput. Sci. Rev. 2017, 24, 35–61. [Google Scholar] [CrossRef]

- FIO (Federal Insurance Office). Report on the Effectiveness of the Terrorism Risk Insurance Program. U.S. Department of the Treasury. 2022. Available online: https://home.treasury.gov/system/files/311/2022%20Program%20Effectiveness%20Report%20%28FINAL%29.pdf (accessed on 6 September 2023).

- Woods, D.; Simpson, A. Policy measures and cyber insurance: A framework. J. Cyber Policy 2017, 2, 209–226. [Google Scholar] [CrossRef]

- Xie, X.; Lee, C.; Eling, M. Cyber insurance offering and performance: An analysis of the U.S. cyber insurance market. Geneva Pap. Risk Insur. Issues Pract. 2020, 45, 690–736. [Google Scholar] [CrossRef]

- Baker, T.; Shortland, A. Insurance and enterprise: Cyber insurance for ransomware. Geneva Pap. Risk Insur. Issues Pract. 2022, 48, 275–299. [Google Scholar] [CrossRef]

- Sophos. The Critical Role of Frontline Cyber Defenses in Cyber Insurance Adoption. [Whitepaper]. 2023. Available online: https://assets.sophos.com/X24WTUEQ/at/qmqkh63jxfbpmtpfftrxsnq/sophos-cyber-insurance-adoption-survey-2023-wp.pdf (accessed on 14 November 2023).

- Falco, G.; Eling, M.; Jablanski, D.; Miller, V.; Gordon, L.A.; Wang, S.S.; Schmit, J.; Thomas, R.; Elvedi, M.; Maillart, T.; et al. A Research Agenda for Cyber Risk and Cyber Insurance. In Proceedings of the Workshop on the Economics of Information Security (WEIS), Boston, MA, USA, 3–4 June 2019; Available online: https://cyber.fsi.stanford.edu/publication/research-agenda-cyber-risk-and-cyber-insurance (accessed on 6 September 2023).

- Romanosky, S.; Ablon, L.; Kuehn, A.; Jones, T. Content analysis of cyber insurance policies: How do carriers price cyber risk? J. Cybersecur. 2019, 5, tyz002. [Google Scholar] [CrossRef]

- Tsohou, A.; Diamantopoulou, V.; Gritzalis, S.; Lambrinoudakis, C. Cyber insurance: State of the art, trends and future directions. Int. J. Inf. Secur. 2023, 22, 737–748. [Google Scholar] [CrossRef] [PubMed]

- Cowbell Cyber. Survey Results: The Economic Impact of Cyber Insurance (Small and Mid-Size Enterprises in the U.S.). 2020. Available online: https://cowbell.insure/wp-content/uploads/2020/06/Cowbell-Cyber-data-report.pdf (accessed on 14 November 2023).

- Morgan, S. Cybercrime to Cost the World $10.5 Trillion Annually by 2025. Cybercrime Magazine. 2020. Available online: https://cybersecurityventures.com/cybercrime-damage-costs-10-trillion-by-2025/ (accessed on 6 September 2023).

- Biener, C.; Eling, M.; Wirfs, J.H. Insurability of Cyber Risk: An Empirical Analysis. Geneva Pap. Risk Insur. Issues Pract. 2015, 40, 131–158. [Google Scholar] [CrossRef]

- Kshetri, N. The evolution of cyber-insurance industry and market: An institutional analysis. Telecommun. Policy 2020, 44, 102007. [Google Scholar] [CrossRef]

- Mondelez, V. Zurich (Mondelez International Inc. v. Zurich American Insurance Co.), No. 2018L11008 (Circuit Court of Cook County, Illinois). 2018. Available online: https://regmedia.co.uk/2022/11/02/pacer_mondelez_zurich_complaint.pdf (accessed on 6 September 2023).

- Ferland, J. Cyber insurance—What coverage in case of an alleged act of War? Questions raised by the Mondelez v. Zurich case. Comput. Law Secur. Rev. 2019, 35, 369–376. [Google Scholar] [CrossRef]

- Tatar, U.; Nussbaum, B.; Gokce, Y.; Keskin, O.F. Digital force majeure: The Mondelez case, insurance, and the (un)certainty of attribution in cyberattacks. Bus. Horiz. 2021, 64, 775–785. [Google Scholar] [CrossRef]

- Department of Financial Services. Insurance Circular Letter No. 2. New York State. 2021. Available online: https://www.dfs.ny.gov/industry_guidance/circular_letters/cl2021_02 (accessed on 7 September 2023).

- Tatar, U.; Nussbaum, B.; Keskin, O.F.; Dubois, E.; Foti, D.; Setting the Scene: Framing Catastrophic Cyber Risk An Expert Panel Discussion Part 1. The Society of Actuaries Research Institute. 2023. Available online: https://www.soa.org/resources/research-reports/2023/cat-cyber-risk/ (accessed on 6 September 2023).

- The Geneva Association. Cyber Risk Accumulation: Fully Tackling the Insurability Challenge. 2023. Available online: https://www.genevaassociation.org/sites/default/files/2023-11/cyber_accumulation_report_91123.pdf (accessed on 14 November 2023).

- CyberCube. Designing a Cyber Catastrophe: A Guide to the Thought Process behind Creating Cyber Disaster Scenarios. 2020. Available online: https://insights.cybcube.com/en/a-guide-to-designing-scenario-narratives-for-cyber-catastrophe (accessed on 7 September 2023).

- Dubois, E.V.; Keskin, O.F.; Tatar, U. Cyber Risk Modeling Methods and Data Sets. SOA. 2022. Available online: https://www.soa.org/4a81c2/globalassets/assets/files/resources/research-report/2022/cyber-risk-modeling.pdf (accessed on 19 June 2024).

- Cremer, F.; Sheehan, B.; Fortmann, M.; Kia, A.N.; Mullins, M.; Murphy, F.; Materne, S. Cyber risk and cybersecurity: A systematic review of data availability. Geneva Pap. Risk Insur. Issues Pract. 2022, 47, 698–736. [Google Scholar] [CrossRef] [PubMed]

- Sylvester, J. Two Years Later: An Analysis of SolarWinds and the Impact on the Cyber Insurance Industry. Gallagher USA. 2022. Available online: https://www.ajg.com/us/news-and-insights/2022/aug/two-years-later-an-analysis-of-solarwinds-and-the-impact-on-the-cyber-insurance-industry/ (accessed on 25 September 2023).

- CISA (The Cybersecurity and Infrastructure Security Agency). The Attack on Colonial Pipeline: What We’ve Learned & What We’ve Done over the Past Two Years [Blog]. 2023. Available online: https://www.cisa.gov/news-events/news/attack-colonial-pipeline-what-weve-learned-what-weve-done-over-past-two-years (accessed on 25 September 2023).

- BBC. Cyber-Attack on Irish Health Service ‘Catastrophic’. 2021. Available online: https://www.bbc.com/news/world-europe-57184977 (accessed on 19 June 2024).

- PwC. Conti Cyber Attack on the HSE: Independent Post Incident Review. 2021. Available online: https://www.hse.ie/eng/services/publications/conti-cyber-attack-on-the-hse-full-report.pdf (accessed on 19 June 2024).

- European Parliament. Cyber Security Strategy for the Energy Sector [Study]. 2016. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2016/587333/IPOL_STU(2016)587333_EN.pdf (accessed on 19 June 2024).

- World Economic Forum. Global Cybersecurity Outlook 2023. 2023. Available online: https://www3.weforum.org/docs/WEF_Global_Security_Outlook_Report_2023.pdf (accessed on 19 June 2024).

- ENISA; Robinson, N.; RAND Europe. Incentives and Barriers of the Cyber Insurance Market in Europe. 2012. Available online: https://www.enisa.europa.eu/publications/incentives-and-barriers-of-the-cyber-insurance-market-in-europe (accessed on 19 June 2024).

- ENISA. Cyber Insurance—Models and Methods and the Use of AI. 2024. Available online: https://www.enisa.europa.eu/publications/cyber-insurance-models-and-methods-and-the-use-of-ai (accessed on 19 June 2024).

- ENISA. Commonality of Risk Assessment Language in Cyber Insurance. 2017. Available online: https://www.enisa.europa.eu/publications/commonality-of-risk-assessment-language-in-cyber-insurance (accessed on 19 June 2024).

- ENISA. Demand Side of Cyber Insurance in the EU. 2023. Available online: https://www.enisa.europa.eu/publications/demand-side-of-cyber-insurance-in-the-eu (accessed on 19 June 2024).

- Lloyd’s of London. Business Blackout: The Insurance Implications of a Cyber Attack on the U.S. Power Grid. 2015. Available online: https://www.lloyds.com/news-and-insights/risk-reports/library/business-blackout/ (accessed on 7 September 2023).

- Congressional Research Service. A Brief Introduction to the National Flood Insurance Program. 2023. Available online: https://crsreports.congress.gov/product/pdf/IF/IF10988 (accessed on 6 September 2023).

- Congressional Research Service. Federal Crop Insurance: A Primer. 2021. Available online: https://crsreports.congress.gov/product/pdf/R/R46686 (accessed on 6 September 2023).

- Congressional Research Service. Farm Bill Primer: Federal Crop Insurance Program. 2022. Available online: https://crsreports.congress.gov/product/pdf/IF/IF12201 (accessed on 6 September 2023).

- Vicevich, D.L. The Case for a Federal Cyber Insurance Program. Neb. L. Rev. 2018, 97, 555. Available online: https://digitalcommons.unl.edu/nlr/vol97/iss2/7 (accessed on 19 June 2024).

- Bace, B. The Insurer of Last Resort: Investigating a Federal Insurance Backstop for Catastrophic Cyber Incidents. 2023. Available online: https://scholarsarchive.library.albany.edu/honorscollege_pos/43/ (accessed on 7 September 2023).

- Cunningham, B.; Talesh, S.A. Uncle Sam RE: Improving Cyber Hygiene and Increasing Confidence in the Cyber Insurance Ecosystem via Government Backstopping. Conn. Insur. Law J 2021, 28, 1–84. Available online: https://cilj.law.uconn.edu/wp-content/uploads/sites/2520/2022/10/CILJ-Vol.-28.1.pdf (accessed on 6 September 2023).

- Pal, P.; Huang, Z.; Yin, X.; Liu, M.; Lototsky, S.; Crowcroft, J. Sustainable Catastrophic Cyber-Risk Management in IoT Societies. In Proceedings of the 2020 Winter Simulation Conference (WSC), Orlando, FL, USA, 14–18 December 2020; pp. 3105–3116. [Google Scholar] [CrossRef]

- Pal, R.; Huang, Z.; Lototsky, S.; Yin, X.; Liu, M.; Crowcroft, J.; Sastry, N.; De, S.; Nag, B. Will Catastrophic Cyber-Risk Aggregation Thrive in the IoT Age? A Cautionary Economics Tale for (Re-)Insurers and Likes. ACM Trans. Manag. Inf. Syst. 2021, 12, 17. [Google Scholar] [CrossRef]

- Cremer, F.; Sheehan, B.; Mullins, M.; Fortmann, M.; Ryan, B.J.; Materne, S. On the insurability of cyber warfare: An investigation into the German cyber insurance market. Comput. Secur. 2024, 142, 103886. [Google Scholar] [CrossRef]

- Bateman, J. War, Terrorism, and Catastrophe in Cyber Insurance: Understanding and Reforming Exclusions. Carnegie Endowment. 2020. Available online: https://carnegieendowment.org/research/2020/10/war-terrorism-and-catastrophe-in-cyber-insurance-understanding-and-reforming-exclusions?lang=en (accessed on 25 June 2024).

- Baker, T.; Shortland, A. The government behind insurance governance: Lessons for ransomware. Regul. Gov. 2023, 17, 1000–1020. [Google Scholar] [CrossRef]

- Eling, M.; Elvedi, M.; Falco, G. The Economic Impact of Extreme Cyber Risk Scenarios. N. Am. Actuar. J. 2023, 27, 429–443. [Google Scholar] [CrossRef]

- Knake, R.K. Creating a Federally Sponsored Cyber Insurance Program. Council on Foreign Relations. 2016. Available online: https://www.cfr.org/report/creating-federally-sponsored-cyber-insurance-program (accessed on 25 June 2024).

- Sayre, M. Impossible Math: The Need for Government-Backed Cyber Insurance. Tort Trial Insur. Pract. Law J. 2022. Available online: https://ssrn.com/abstract=4699671 (accessed on 25 June 2024).

- Prior, L. Content Analyses. In The Oxford Handbook of Qualitative Research, 1st ed.; Leavy, P., Ed.; Oxford University Press: Oxford, UK, 2014; p. 359. ISBN 9780199811755. [Google Scholar]

- Mayring, P.A.E. Qualitative content analysis. In International Encyclopedia of Education, 4th ed.; Tierney, R.J., Rizvi, F., Ercikan, K., Eds.; Elsevier Inc.: Amsterdam, The Netherlands, 2023; pp. 314–322. [Google Scholar] [CrossRef]

- Weber, R. Basic Content Analysis, 2nd ed.; Sage: Newbury Park, CA, USA, 1990. [Google Scholar]

- Wrede, D.; Stegen, T.; Von der Schulenburg, J.M.G. Affirmative and silent cyber coverage in traditional insurance policies: Qualitative content analysis of selected insurance products from the German insurance market. Geneva Pap. Risk Insur. Issues Pract. 2020, 45, 657–689. Available online: https://link.springer.com/article/10.1057/s41288-020-00183-6 (accessed on 8 September 2023). [CrossRef]

- Elo, S.; Kääriäinen, M.; Kanste, O.; Pölkki, T.; Utriainen, K.; Kyngäs, H. Qualitative Content Analysis: A Focus on Trustworthiness. SAGE Open 2014, 4. [Google Scholar] [CrossRef]

- Lombard, M.; Snyder-Duch, J.; Bracken, C.C. Practical Resources for Assessing and Reporting Intercoder Reliability in Content Analysis Research Projects. 2005. Available online: https://www.researchgate.net/publication/242785900 (accessed on 25 June 2024).

- Drisko, J.W.; Maschi, T. Content Analysis; Oxford University Press: Oxford, UK, 2016; pp. 81–121. [Google Scholar]

- IBM Security & Ponemon Institute. Cost of Data Breach Report 2023. IBM. 2023. Available online: https://www.ibm.com/downloads/cas/E3G5JMBP (accessed on 8 September 2023).

- Miller, M. The Mounting Death Toll of Hospital Cyberattacks. Politico. 2022. Available online: https://www.politico.com/news/2022/12/28/cyberattacks-u-s-hospitals-00075638 (accessed on 8 September 2023).

- Association of Bermuda Insurers and Reinsurers. Comment from Association of Bermuda Insurers and Reinsurers. TREAS-DO-2022-0019-0042. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0042 (accessed on 15 November 2023).

- Berger, M. Comment from Berger, Mitchell. TREAS-DO-2022-0019-0010. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0010 (accessed on 15 November 2023).

- McLennan, M. Comment from Marsh McLennan. TREAS-DO-2022-0019-0025. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0025 (accessed on 15 November 2023).

- Reinsurance Association of America. Comment from Reinsurance Association of America. TREAS-DO-2022-0019-0028. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0028 (accessed on 15 November 2023).

- Axio. Comment from Axio. TREAS-DO-2022-0019-0017. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0017 (accessed on 15 November 2023).

- American Property Casualty Insurance Association. Comment from American Property Casualty Insurance Association (APCIA). TREAS-DO-2022-0019-0050. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0050 (accessed on 15 November 2023).

- CyberCube Analytics Inc. Comment from CyberCube Analytics Inc. TREAS-DO-2022-0019-0029. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0029 (accessed on 15 November 2023).

- Zurich North America. Comment from Zurich North America. TREAS-DO-2022-0019-0047. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0047 (accessed on 15 November 2023).

- HITRUST. Comment from HITRUST. TREAS-DO-2022-0019-0062. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0062 (accessed on 15 November 2023).

- Rasmussen, G.T. Comment from Rasmussen—Federal Cyber Insurance Feedback. TREAS-DO-2022-0019-0005 Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0005 (accessed on 15 November 2023).

- Institute of International Finance. Comment from Institute of International Finance. TREAS-DO-2022-0019-0031 Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0031 (accessed on 15 November 2023).

- Underwriters at Lloyd’s London. Comment from Underwriters at Lloyd’s, London. TREAS-DO-2022-0019-0026. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0026 (accessed on 15 November 2023).

- Aon. Comment from Aon. TREAS-DO-2022-0019-0040. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0040 (accessed on 15 November 2023).

- Cowbell. Comment from Cowbell. TREAS-DO-2022-0019-0022. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0022 (accessed on 15 November 2023).

- Converge Inc. Comment from Converge Inc. TREAS-DO-2022-0019-0006. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0006 (accessed on 15 November 2023).

- Fedtribe. Comment from Fedtribe. TREAS-DO-2022-0019-0014. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0014 (accessed on 15 November 2023).

- Centers for Better Insurance LLC. Comment from Centers for Better Insurance, LLC. TREAS-DO-2022-0019-0024. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0024 (accessed on 15 November 2023).

- Roscini, M. Cyber Operations and the jus ad bellum. In Cyber Operations and the Use of Force in International Law; Oxford University Press: Oxford, UK, 2014; pp. 43–116. [Google Scholar]

- Gallagher, R.; Comment from Gallagher Re. TREAS-DO-2022-0019-0048. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0048 (accessed on 15 November 2023).

- Greenwald, J. Experts Weigh Cyber Risks, Need for Federal Backstop. Business Insurance. 2023. Available online: https://www.businessinsurance.com/article/20230302/NEWS06/912355809/Experts-eigh-cyber-risks,-need-for-federal-backstop (accessed on 15 November 2023).

- Marius Insurance. Comment from Marius Insurance. TREAS-DO-2022-0019-0052. Regulations.gov. 2022. Available online: https://www.regulations.gov/comment/TREAS-DO-2022-0019-0052 (accessed on 15 November 2023).

| Group | # of Comments |

|---|---|

| Insurance Providers | 15 |

| Critical Infrastructure | 15 |

| Cybersecurity | 10 |

| Insurance-Affiliated Entities | 8 |

| Private Citizens | 8 |

| Total Sample | 56 |

| Group | Average Response Rate |

|---|---|

| Insurance-Affiliated Entities | 61% |

| Insurance Providers | 52% |

| Critical Infrastructure | 28% |

| Cybersecurity | 25% |

| Private Citizens | 25% |

| Research Question No. | Request for Information Question Category |

|---|---|

| 1 | 1, 2 |

| 2 | 3 |

| 3 | 6 |

| 4 | 7 |

| Q: Do You Support the Creation of a Federal Backstop? | |||

|---|---|---|---|

| Group | Yes | No | Cautious Support |

| Insurance-Affiliated Entities | 87.5% | - | 12.5% |

| Private Citizens | 66.7% | - | 33.3% |

| Cybersecurity | 66.7% | 33.3% | - |

| Critical Infrastructure | 50.0% | - | 50.0% |

| Insurance-Providers | 50.0% | 25.0% | 25.0% |

| Q: Do You Support Using TRIP as a Model for a New Backstop for CCIs? | ||||

|---|---|---|---|---|

| Group | Yes | Extend TRIP to CCIs | No | Mentions/Endorses Some Other Model |

| Critical Infrastructure | 55.6% | - | 22.2% | 22.2% |

| Insurance-Affiliated Entities | 37.5% | 25.0% | 12.5% | 25.0% |

| Private Citizens | 33.3% | 33.3% | - | 33.3% |

| Insurance Providers | 16.7% | 16.7% | 25.0% | 41.7% |

| Cybersecurity | - | 33.3% | 33.3% | 33.3% |

| Q: Do You Support Using TRIP as a Model for a New Backstop for CCIs? | |||

|---|---|---|---|

| Group | Yes | No | Does Not Explicitly Say |

| Private Citizens | 100% | - | - |

| Cybersecurity | 87.5% | - | 12.5% |

| Insurance-Affiliated Entities | 66.7% | - | 33.3% |

| Critical Infrastructure | 50.0% | - | 50.0% |

| Insurance Providers | 42.8% | 28.6% | 28.6% |

| Problem: Catastrophic cyber incidents—events of low probability but high impact, with the potential to incur billions in damages—are prompting insurers to elevate premiums, create higher barriers for potential buyers, and tighten policies with exclusions. These responses have led to a notable gap in market protection. | |

| Method: Content analysis of 56 unique comments submitted in response to the Treasury Department Request for Information. The answers commenters provided to the RFI questions were used to answer our research questions. | |

| Research Questions | Findings |

| What specific factors and conditions elevate a cyber incident to the level of a catastrophe, impacting businesses and society at large? |

|

| How can the impact of catastrophic cyber incidents be effectively mitigated, and what role does insurance play in this mitigation strategy? |

|

| Does the current cyber insurance sector possess the necessary capacity to address potential catastrophic cyber incidents adequately? |

|

| If the current cyber insurance sector lacks sufficient capacity, what roles and methods of support can the government employ to enhance this capacity, and how can these governmental support mechanisms be effectively implemented? |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bace, B.; Dubois, E.; Tatar, U. Resilience against Catastrophic Cyber Incidents: A Multistakeholder Analysis of Cyber Insurance. Electronics 2024, 13, 2768. https://doi.org/10.3390/electronics13142768

Bace B, Dubois E, Tatar U. Resilience against Catastrophic Cyber Incidents: A Multistakeholder Analysis of Cyber Insurance. Electronics. 2024; 13(14):2768. https://doi.org/10.3390/electronics13142768

Chicago/Turabian StyleBace, Brianna, Elisabeth Dubois, and Unal Tatar. 2024. "Resilience against Catastrophic Cyber Incidents: A Multistakeholder Analysis of Cyber Insurance" Electronics 13, no. 14: 2768. https://doi.org/10.3390/electronics13142768

APA StyleBace, B., Dubois, E., & Tatar, U. (2024). Resilience against Catastrophic Cyber Incidents: A Multistakeholder Analysis of Cyber Insurance. Electronics, 13(14), 2768. https://doi.org/10.3390/electronics13142768