Abstract

The implementation of nature-based solutions (NBSs) for coastal adaptation to climate change is limited by a well-documented lack of finance. Scholars agree that financial innovation represents a solution to this problem, particularly due to its potential for mobilising private investments. It remains unclear however how exactly innovative solutions address the specific barriers found in NBS implementation and, given the distinctive local characteristics of NBSs, to what extent successful innovations can be replicated in other locations. This study addresses this issue by reviewing the literature and case studies of innovative financial solutions currently implemented in NBS projects, highlighting which financial barriers these arrangements address and which contextual conditions affect their applicability. We find that there is no “low-hanging fruit” in upscaling finance in NBSs through financial innovation. Innovative solutions are nevertheless expected to become more accessible with the increase in NBS project sizes, the increased availability of data on NBS performance, and the establishment of supportive policy frameworks. The flow of finance into NBS projects can be further enhanced through the external support of both public (de-risking and regulation) and private actors (financial expertise).

1. Introduction

Coastal areas are highly vulnerable to climate change impacts, including rising sea levels, storm surges, and erosion. The difficulty of adapting to these impacts is exacerbated by the diverse morphological features of coastal landscapes and the intersection of multiple socio-economic and environmental needs. Nature-based solutions (NBSs), consisting of the sustainable management, conservation, and restoration of natural resources, provide innovative and multifunctional approaches to address the interconnected environmental, social, and economic challenges posed by coastal adaptation. The implementation of these solutions is, however, limited by a well-documented lack of funding. Today, NBSs are predominantly funded through public and, to a lesser extent, philanthropic sources with limited scalability [1,2,3,4,5]. At the same time, the complexities within ecosystem service (ESS) dynamics and conflicting stakeholder interests pose financial barriers that prevent the development of alternative funding models based on private investments [6,7].

Financial innovation provides opportunities to address this issue. Instruments such as green bonds, crowd-funding, and environmental credits have been developed to reduce transaction costs and to mobilise investments from the private sector [8,9,10].

Despite the growing relevance, the relationship between innovative financial solutions and financial barriers, as well as the conditions influencing their applicability, remains unclear.

We attempt to bridge these gaps by addressing the following research questions: What innovative financial solutions have been employed in NBS projects globally? Which financial barriers do they address? Which conditions influence their applicability?

In our study, we employ methods and theories from transaction cost economics, identifying the link between NBS transaction properties and fitting innovative financial solutions, as well as gathering empirical evidence on the conditions of the applicability of each solution under review.

2. State of the Art

2.1. Barriers to Funding and Financing of NBSs

The literature on NBSs was initially dedicated to defining NBSs [11,12] and demonstrating their cost-effectiveness [13,14], particularly as an alternative to engineered infrastructure [15]. More recently, attention was brought to the challenges related to the implementation of NBSs [16,17,18,19]. Overall, scholars identified four categories of NBS implementation barriers:

- Technical/knowledge barriers: impediments arising due to limited expertise, technology, and information;

- Governance barriers: impediments arising due to fragmented and incoherent policy frameworks, institutional inertia, and conflicts among stakeholders;

- Economic/effectiveness barriers: impediments due to the overall benefits or effects of NBSs being “less” than their overall costs;

- Financial barriers: impediments arising in accessing sufficient financial resources for implementing NBSs.

Authors argue that financial barriers are particularly crucial and challenging, as they persistently represent a leading cause of the lack of large-scale implementation of NBSs [18,19,20]. Currently, NBSs predominantly rely on public funding and, to a lesser extent, philanthropic donations [1]. These sources alone are inadequate for implementing NBSs at the scale required to sufficiently counteract climate change due to tight public budgets, competing policy priorities, and contingencies on relatively short political cycles [3,18,21,22].

Private investment is regarded as the most promising alternative source of additional funds [1,10,23,24] based on the potential to align environmental goals with economic interests through NBSs. In addition, this approach would diversify funding sources, foster resilience partnerships, and improve efficiency by tapping into expertise and other non-financial resources of the private sector.

However, the market for NBSs is currently underdeveloped due to the existence of several financial barriers. While NBSs are typically cost-effective, investors find it challenging to gain sufficient benefits, as these are distributed across several actors and groups [10]. Crucially, the valuation and monetisation of NBS benefits are often challenging [25]. In addition, high risks are involved due to the limited performance track records of NBS initiatives [18,19] and the uncertainties related to natural systems and climate change impacts [17]. These risks are compounded by the long time horizons implicit in the development of ESSs via ecosystem restoration [26], horizons that also pose challenges to balancing present costs with future benefits and that conflict with investors’ preference for higher and short-term returns.

Furthermore, NBSs usually consists of small-scale projects, for which transaction costs are high and not always justifiable due to, e.g., high due diligence costs [27]. Several benefits provided by NBSs (e.g., public health, biodiversity, and nutrient regulation) are not accounted for by the prevailing accounting methodologies for investment decisions [28]. The lack of financial expertise of project developers in structuring attractive business models and missed opportunities in adopting standards for performance metrics and financial arrangements [6] result in a lack of investment-ready project pipelines [29]. This challenging landscape is further complicated by the absence of an appropriate enabling environment in terms of public policy, e.g., due to path dependency [30], incoherent policy frameworks [6], perverse regulatory incentives [10], and challenges in coordinating broader partnerships involving private investors [28].

2.2. Pathways for Overcoming Barriers to Funding and Financing NBSs

The emerging literature on financing NBSs suggests four pathways to overcome financial barriers. The first pathway aims at increasing the private funding of NBSs for Corporate Social Responsibility (CSR), capitalising on the alignment between multiple NBS value streams and business’ growing commitments to sustainability. Regulatory requirements for the disclosure of financial entities’ impact on biodiversity [10] are expected to contribute to this alignment. NBS implementation should develop and adopt standards for NBSs and performance metrics, especially when combined with online databases for enhanced data accessibility and benchmarking [26].

The second pathway aims at demonstrating that there are economic benefits beyond CSR that make it meaningful for private investors to engage in NBS financing and funding. These economic benefits include avoiding future costs or damages, offsetting environmental impacts, and profiting from the sale of ESSs. Generally, private sector investments in natural assets are expected to grow in response to escalating climate risks [31]. The diffusion of the disclosure of climate risks and ESS dependency and the introduction of regulatory incentives, such as tax breaks and subsidies, are expected to accelerate this process [5]. Furthermore, adopting business models that structure and present NBSs in terms of value proposition, delivery, and capture can facilitate the engagement of private investors by making NBS investment proposals more appealing and understandable [4,21]. In particular, business models combining NBSs with grey infrastructure elements can act as a bridge for stakeholders more accustomed to investing in conventional infrastructure [19].

The third pathway aims at improving the institutions in which NBS project funding and financing are embedded. This includes the removal of administrative barriers [16], the incorporation of natural capital in accounting models, and the development of comparable data on NBS financial outcomes, all of which can enhance investment opportunities [32]. Scholars have proposed the layering and diversification of funding sources as a financial approach that coherently matches the multifunctionality aspect of NBSs [6,10]. To this end, but also more generally, broad consortia for public–private financial coordination and the involvement of stakeholders are advocated [32]. Partnerships leveraging private investments through blended finance approaches have attracted particular interest [33,34]. Blended finance refers to the strategic deployment of public funding with the purpose of improving the risk–return profile of an NBS. An example would be public grants funding the pre-feasibility phase of an NBS, setting the ground for a revenue-generating NBS business model.

The final and fourth pathway for overcoming financial barriers is the development and application of innovative financial instruments (solutions) that could upscale financial resources for NBS projects. This includes, for example, green bonds, environmental credits, and smart contracts [8,9,35]. Experimenting with these and other financial innovations is widely recognised in the literature as a useful approach to improve the investment attractiveness of NBS projects by aggregating projects, bridging long time horizons, distributing risks, and establishing innovative value capture and business models [6,10,17,28,36].

Despite these four proposed pathways for overcoming financial barriers to NBS implementation, private financial flows remain marginal [1]. This underscores the necessity to further study barriers and possible strategies to overcome them. In this paper, we focus on the pathway of financial innovations, as this avenue has not yet been thoroughly explored [10]. The existing literature often presents financial barriers and innovative financial solutions in isolation, lacking a framework that identifies the most effective solutions for specific barriers. This separation hinders a detailed understanding of how to strategically match solutions to barriers. Furthermore, despite NBSs being characterised by place-based complexities, proposals for financial solutions neglect the challenges to direct replications, as factors affecting applicability are not discussed [37].

2.3. Financial Innovation

The financial economics literature describes financial innovation as a complex, multi-actor process that consists of the introduction and diffusion of new financial instruments, processes, markets, actors, and institutions in a given economic sector [38]. Innovative financial solutions are based on contractual structuring, i.e., the innovative design and organisation of the terms and conditions of contracts or agreements between the parties involved in a transaction. One example of such solutions is crowdfunding, which increases the accessibility of funding by allowing project developers to raise funds from a large number of small funders, typically via online platforms.

The purpose of financial innovation is to enhance the functions of financial systems, including transferring and pooling funds, managing risks, and addressing asymmetric information [39]. Financial innovation achieves this primarily by reducing the transaction costs that market actors face due to the existence of financial barriers [40], thus moving the overall system towards an idealised goal of “full efficiency” [39] (p. 26). For instance, new financial products can set incentives for aligning interest between investors and beneficiaries/consumers, or they can provide tools for sharing risk between lenders and borrowers in markets characterised by high risk.

The factors driving financial innovation remain only partially understood, particularly due to the scarcity of empirical studies [41]. Generally speaking, financial innovation is driven by the desire to increase the profitability of economic activities (here, NBSs) in cases of low returns, which arise through existing financial barriers. Other important driving factors are technological change and changes in public regulation (ibid.). In NBS finance, the purpose of financial innovation thus consists of lowering transaction costs by overcoming financial barriers, ultimately improving the efficiency of financial functions within the NBS sector (the transfer of funds, the management of risks, etc.). It is not clear however which financial barriers can be addressed by which innovative financial solutions, and which conditions (enabling or hindering) affect the applicability of these solutions. The goal of this study is precisely to address these questions.

3. Theoretical Framework from Transaction Cost Economics

3.1. Transactions

Transaction cost economics [42,43,44] provides a suitable framework for better understanding financial barriers and solutions. Transactions are the basic units underlying any economic or financial activity. They are defined as voluntary exchanges among participating actors by which goods, services, resources, benefits, and disbenefits are allocated [45]. We can further distinguish transactions as either financial transactions, which exchange financial values (e.g., money and financial assets), or economic transactions, which exchange a broader range of goods and services using money as a medium.

Two different kinds of costs are associated with every transaction. The first kind comprises production costs, which consist of the direct costs associated with the production of goods and services. The second kind comprises transaction costs, which include the costs of gathering information (e.g., about the other party involved in the transaction, the general market, and the quality of the good or service), negotiating an (contractual) agreement between the parties, and enforcing the agreement and exchange (e.g., enforcing property rights and settling disputes via courts) [43].

The properties of transactions play a crucial role in determining transaction costs. Transactions occurring regularly, for example, monthly rent payments between a landlord and a tenant, tend to be more predictable and may lead to the development of conventions that reduce transaction costs, e.g., automatic bank transfers. In contrast, exchanges that occur rarely or only once, for example, the acquisition of large-scale manufacturing assets, typically involve incomplete information and greater uncertainty, leading to higher transaction costs.

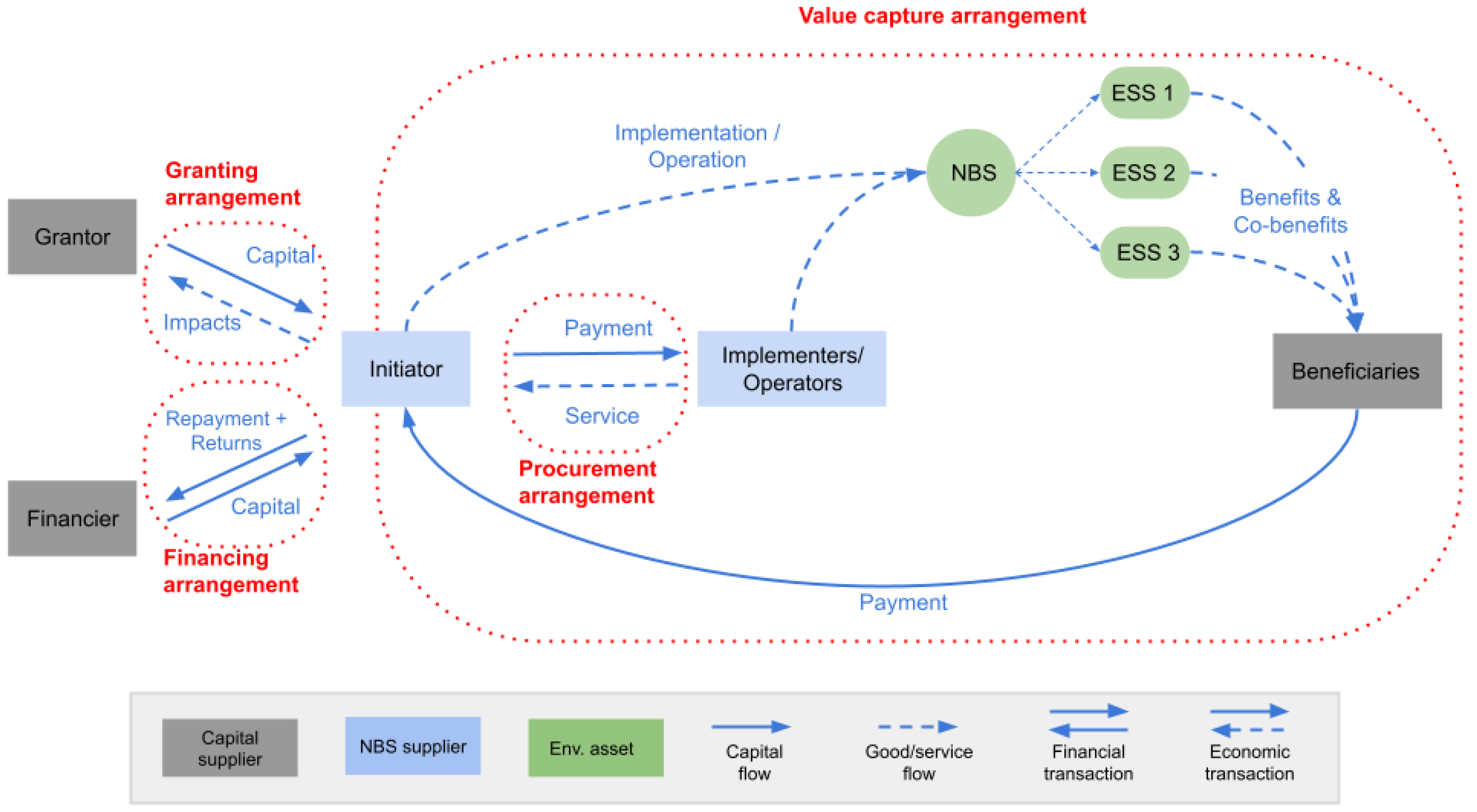

In an ideal-typical NBS project, we can identify four main types of financial and economic transactions: financing transactions, granting transactions, procurement transactions, and value capture transactions (Figure 1). A financing transaction involves a financier providing upfront capital to an initiator for project costs, with repayment typically including interest. The initiator manages project-level NBS finance and holds ultimate implementation responsibility, while the financier seeks a productive use of capital while supporting the NBS. The second type is the granting transaction, which occurs between the initiator and a grantor. Unlike financing, the grantor’s capital, provided for NBS implementation and operation costs, does not require repayment. The grantor is therefore primarily interested in non-financial outcomes. The third type, value capture transactions, aims to establish revenue streams by having identified beneficiaries financially contribute to NBS benefits. Granting and value capture transactions fall under the funding category, addressing NBS costs either ex ante through grants or ex post through beneficiary payments. Funding further allows projects to acquire the capital required to repay financiers. The fourth and final type, procurement transactions, involves acquiring resources and services for NBS realisation through subcontracting specialised actors.

Figure 1.

Fundamental transactions and related financial arrangements in NBS projects.

When information is limited, formal and informal constraints reduce the costs associated with human interaction [43]. In this context, a reduction in transaction costs is achieved by assigning governance structures to transactions. The choice of the appropriate governance structure depends on the attributes of the transaction, as well as the costs and adaptive capacities associated with the governance structure itself [44]. Key governance structures in this sense are contracts, which are tools for aligning the interests of parties who may have conflicting objectives when conducting transactions. Each type of transaction is thus assigned to the corresponding contractual arrangement (financing arrangement, granting arrangement, value capture arrangement, or procurement arrangement), which establishes formal constraints for the efficient governance of the underlying transaction.

In practice, however, the efficient conduction of these transactions is hindered by the transaction costs arising from financial barriers. Consequently, as mentioned in Section 2.1, NBS projects over-rely on granting arrangements mainly from public sector sources [1]. Financing arrangements that convey investments in NBSs and value capture arrangements for the generation of cash flows are often missing.

Tailoring financial arrangements to align with the specific properties of underlying transactions enables the removal of the financial barriers presented by those properties and the achievement of more efficient transactions [42]. We therefore hypothesise that financial innovation, i.e., adapting financial arrangements to the properties of NBS transactions, can be a solution to overcome the financial barriers that arise due to the aforementioned transaction properties. This, in turn, allows for an efficient execution of NBS business models.

3.2. Core Properties of Nature-Related Transactions

Transactions that occur in NBSs and other nature-related sectors display properties that emerge due to the interconnectedness and complexity of natural systems. These properties are listed in the transaction cost literature as key determinants of transaction costs [42,46,47]. We use these properties and the associated literature to develop a comprehensive typology of financial barriers (Section 5.2). The specific properties are as follows:

- Frequency. Frequency indicates how often a transaction occurs. Frequent transactions tend to have lower transaction costs because parties acquire knowledge, establish standardised processes, and do not need continuous negotiation. In contrast, infrequent transactions may require more negotiation and information gathering among the parties, leading to higher transaction costs.

- Uncertainty. Uncertainty denotes the level of risk and predictability involved in a transaction. High uncertainty results in higher transaction costs due to the need for more extensive information gathering, risk mitigation measures, and enforcement mechanisms.

- Asset specificity. Asset specificity refers to how specialised the assets involved in a transaction are. Due to high specificity, assets cannot be easily redeployed for other uses, parties become more dependent on each other, and this dependence can lead to opportunistic behaviour. This, in turn, may necessitate more detailed contracts and monitoring, increasing transaction costs.

- Excludability. Transaction costs are lower when access to environmental goods can be excluded and the property rights of land and ESSs are well defined. Well-defined property rights reduce the potential for conflicts and the need for costly monitoring and enforcement. However, when access to environmental goods is open and non-excludable, transaction costs increase due to costly monitoring and enforcement activities, as well as high incentives to free ride.

- Separability. Separability refers to the degree of functional interdependence of a transaction with other transactions that originate within the same biophysical system. Highly interconnected systems result in transactions with low separability, which in turn require additional coordination efforts.

- Modularity. Modularity refers to the decomposability of the structures of transactions or the possibility to reduce a system to smaller sub-parts that are practically independent from one another. Modular structures allow for less complex transactions that can be managed more easily.

- Observability. Observability refers to the degree to which transaction-relevant conditions, activities, and outcomes can be monitored and assessed. The lower the observability property, the higher the transaction costs will be for accessing these types of information.

- Dimensions of time and scale. Time and scale dimensions play a critical role in transactions. Longer time horizons and larger spatial scales generally result in higher transaction costs. The former require long-term planning, coordination, and possibly adaptive management and periodic reassessment, while the latter might imply physical relational distance [47] and other coordination issues related to cross-scale dynamics.

4. Methodology

4.1. Barriers and Solutions Considered in This Study

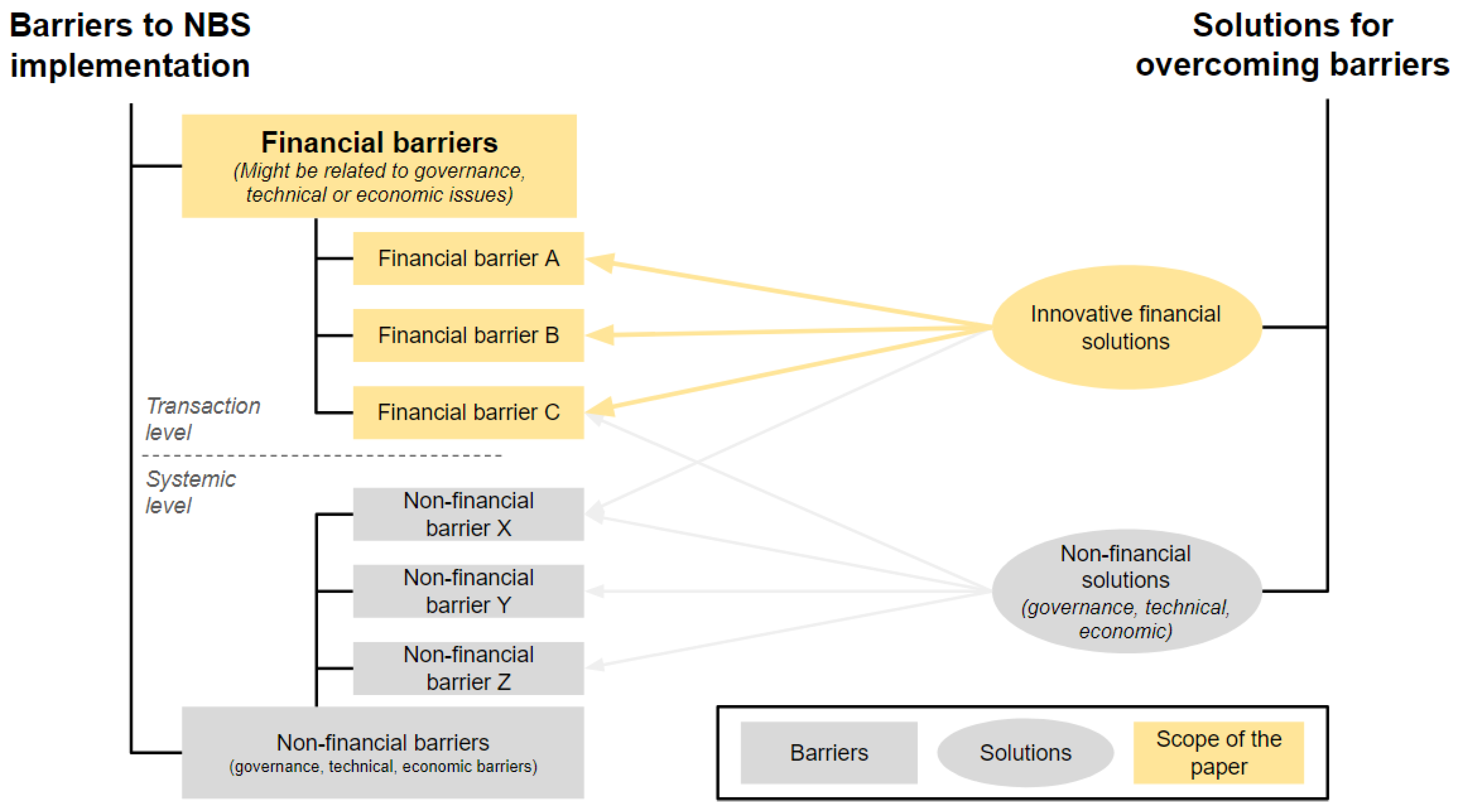

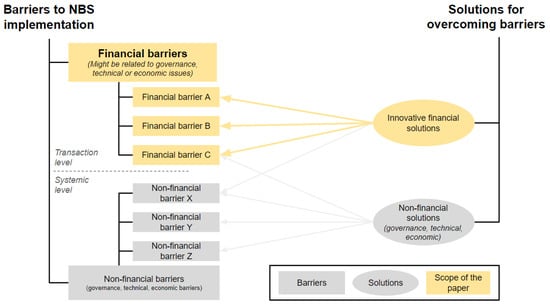

As discussed in the State of the Art Section, different types of barriers and solutions can be distinguished within the broad issue of NBS implementation (Figure 2). Note that there is no one-to-one correspondence between different types of barriers and solutions. For example, one solution may address several barriers, or one barrier may be addressed by several solutions.

Figure 2.

Scope of this paper within the system of barriers and solutions for the implementation of NBSs.

Furthermore, in the literature, it is often hard to separate financial barriers from other types of barriers because issues of governance and of an economic and technical nature can represent impediments in accessing sufficient financial resources [19,21,28]. For example, political preferences and conflicts among stakeholders (governance barriers) might direct funds towards alternative uses, and insufficient cost–benefit ratios (economic barrier) preclude private investments. Adopting the concept of a financial barrier from the financial economics literature (Section 2.3) provides a more coherent classification of barriers. Therefore, we define financial barriers as constraints that increase transaction costs for individuals or entities involved in economic activities. Innovative financial solutions are hence defined as instruments that allow for the overcoming of financial barriers by means of (innovative) contractual structuring that lower the overall transaction cost. Hence, we apply frameworks and theories from transaction cost economics to more clearly define the different kinds of financial barriers arising in NBSs. Barriers that originate beyond the level of transaction cost necessitate either technical or economic innovations or systemic-level solutions (governance) and fall outside the scope of our research. An example of the former would be an innovative wetland restoration technology that pushes an NBS activity from being unprofitable to being profitable. An example of the latter would be a new law that requires public or private entities to invest more money into NBSs.

4.2. Literature Selection and Coding

We surveyed the grey and peer-reviewed literature covering both the general literature on funding and financing NBSs (see references in Section 2.1 and Section 2.2), as well as the literature on specific NBS funding and financing case studies (see references in Supplementary Materials). We therefore proceeded as follows:

- First, we generated a list of targeted financial barriers. In our literature review, we used the key properties of NBS transactions to identify a list of financial barriers that can be addressed through the implementation of innovative financial solutions. The financial barriers found in the literature that originated from the same property of transaction were clustered in our typology as financial challenges associated with a single, overarching financial barrier.

- Second, we selected a list of targeted financial innovations. As financial innovation unfolds in a multitude of possible arrangements and variations [48], it is impossible to exhaustively cover all financial innovations. Hence, we focused on the innovative financial instruments proposed in the existing NBS literature that are supported by empirical evidence of practical implementation in NBSs [4,9,32,35,36,49,50,51]. We therefore focused specifically on innovations aimed at leveraging investments and other resources from the private sector, given the acknowledged potential for the significant upscaling of NBS finance. Consequently, we excluded from our selection innovative financial solutions such as (government intermediate) payments for ESSs, debt-for-nature swaps, ecological fiscal transfers, and crowd-funding, as they are associated with the currently prevailing financial model based on public and philanthropic granting.

- Third, for each selected financial innovation, we describe how they lower financial barriers by adapting contractual structures to NBS transaction properties.

- Finally, we gathered empirical evidence on each solution’s conditions of applicability, i.e., factors that typically affect (positively or negatively) their implementation and transfer in other NBS projects. Towards this end, we searched for and analysed 48 case studies. This list of analysed case studies, together with contextual information (e.g., country, type of NBS, project size, project status, and public and private external support), can be found in Tables S1–S4 in the Supplementary Materials. References to the specific case studies (CSs) supporting our propositions on the conditions of applicability are provided in the text.

5. Results

5.1. Overview

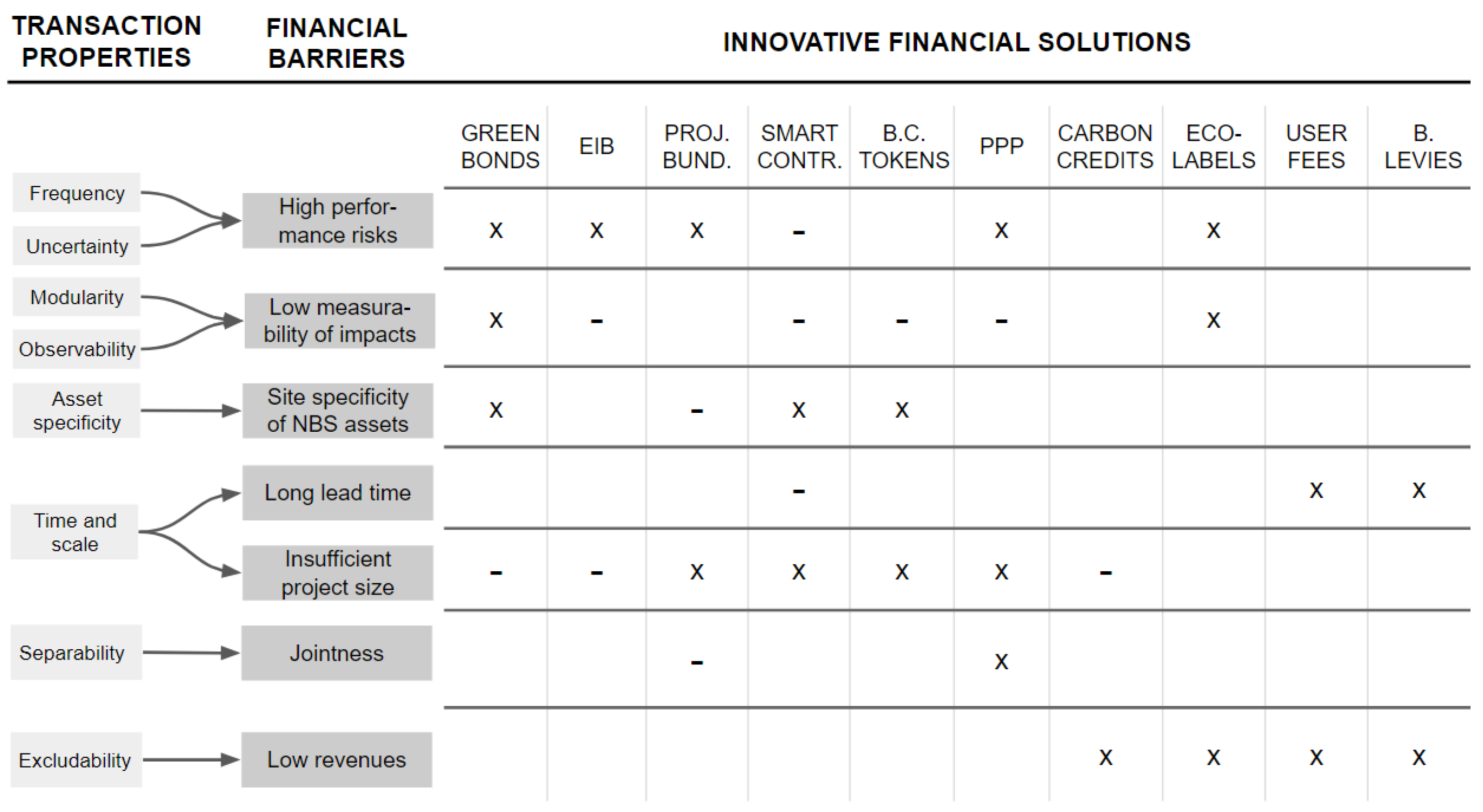

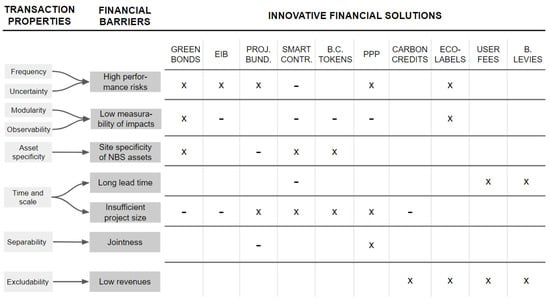

Our paper shows how innovative financial solutions address financial barriers rooted in key NBS transactions (Figure 3). Various solutions can tackle a single barrier, and a single solution can address multiple barriers simultaneously. Empirical evidence of implementation in NBS projects varies in quality, with some solutions being implemented mostly through proof-of-concept projects (smart contracts and blockchain tokens) or in isolated cases (EIBs and PPPs). These gaps are even more evident when looking at coastal areas specifically.

Figure 3.

Overview of financial barriers and innovative financial solutions for NBSs. “x” indicates which barriers are lowered by a certain solution, while “-” represents a condition that hinders solution applicability.

5.2. Financial Barriers

We identified seven financial barriers. Each barrier is described below in terms of the properties of the transactions that give rise to the barrier, as well as the consequences that this barrier has for potential financiers.

5.2.1. Financial Barrier 1 (FB 1)—High Performance Risks

The transaction properties of uncertainty and low frequency translate to high performance risks in NBSs. The ecosystem processes of coastal environments follow particularly complex dynamics as compared to terrestrial ecosystems, such as watersheds and inland forests [27]. Data limitations and dynamic interactions amount to uncertainties in the mapping and modelling of ESS flows, particularly when climate change and anthropogenic pressures are considered [19]. As a consequence of these challenges, the financial and non-financial performance risks of coastal NBS projects are rather high, with a negative impact on the overall risk–return profile.

5.2.2. Financial Barrier 2 (FB 2)—Low Measurability of Impacts

The transaction properties of low modularity and low observability in ecological and social systems result in a low measurability of NBS impacts. While new metrics and methodologies are being developed for the quantification of ESSs and the valuation of their impact [52], significant gaps and challenges persist for intangible services such as biodiversity and cultural values [21]. Therefore, the achievement of impact milestones, the demonstration of additionality, and the objective assessment of the overall value generated by an NBS are often challenging [53].

The low measurability of ESSs results in higher risks and uncertainty in NBS transactions, thus worsening the NBS risk–return profile:

- The low measurability of ESSs represents a disincentive for investors considering not only financial returns but also positive social and environmental investment outcomes. The inability to effectively quantify social and environmental impacts undermines their ability to assess the success of their investments. Investors might even question the project for green washing.

- Since contractual arrangements often rely on clear and measurable indicators to set goals, define success, and outline penalties and incentives, low measurability may hinder the ability of the parties to incorporate precise performance metrics into their contract. Such circumstances introduce ambiguity and make it difficult to clearly define and enforce contractual obligations.

- Outcomes that are difficult to measure tend to be sacrificed when competing with other outcomes that can be easily quantified (e.g., provisional services, cost savings, and other financial goals) [54], leading, for instance, to trade-offs between public welfare and cost-saving interests.

- Principal–agent problems resulting in moral hazard can arise when a principal (who delegates a task) cannot monitor the activity of an agent (who performs the task) or assess its outcomes. This may result in conflicts of interest and moral hazard whereby the agent prioritises personal interests over those of the principal.

5.2.3. Financial Barrier 3 (FB 3)—Site Specificity of NBS Assets

Due to the transaction property of asset specificity, NBS assets are illiquid and difficult to scale out. Due to the locally determined interactions between various ecosystem processes, landscape geography, and human activities, NBSs need to be designed and implemented in a site-specific manner by considering the unique characteristics and conditions of a particular location [55]. Consequently, some of the investments made for the design and implementation of an NBS are specific to that project or site. Site-specific investments for an NBS project include the acquisition of not only physical assets, like the land where the NBS is implemented, but also intangible asset investments, as in the case of research and information gathering regarding the specific features of the site. The site specificity of NBS assets contributes to worsening the risk–return profile of investment by increasing the risks and transaction costs of managing them:

- The site specificity of NBSs makes related investments illiquid, as it is difficult to divert these to alternative productive uses or convert them into cash without losing significant value [44]. This represents a potential problem for investors because, in case of necessity, they would not be able to rely on efficient asset liquidation and may be exposed to losses [24].

- Site specificity implies that NBS investments are difficult to scale by means of direct replications in other locations [10].

- Site specificity may also result in hold-up problems [56]. A hold-up problem occurs when the asset specificity of an investment also implies specificity in the relationship with certain actors. In the case of NBSs, this would typically be the relationship with the owner of the site, the suppliers of particular products, services or information, or other key stakeholders. These irreplaceable partners acquire a disproportionate bargaining power once the illiquid investment is made, which could be exploited through an opportunistic renegotiation of contractual terms [44].

5.2.4. Financial Barrier 4 (FB 4)—Long Lead Time

The transaction property of a long time scale results in a long lead time in NBS investments. The restoration process of degraded ecosystems requires time to develop. Consequently, there is generally a considerable time lag between the initial NBS investment and the generation of financial and non-financial outcomes. Overall, time lags for project impacts contribute to uncertainty, worsening the risk–return profile of investments by increasing risks:

- Longer time horizons require equally long-lasting financial commitments for ongoing development and maintenance costs [21], as well as long-term research and monitoring to assess project success [57].

- Private investment opportunities are affected, as the longer the time horizons, the greater the uncertainty surrounding ecosystem dynamics, policy and regulatory changes, market conditions, and other factors affecting project effectiveness and financial outcomes.

- The delayed generation of revenues and profits generally does not match investors’ preference for near-term, competitive returns [53].

- The long-term nature of NBS projects may require sustained cooperation and commitment from various stakeholders. A lack of trust among stakeholders, especially in the context of new partnerships, can constitute a financial barrier if there are doubts about long-term commitments.

5.2.5. Financial Barrier 5 (FB 5)—Insufficient Project Size

The transaction property of a small spatial scale results in insufficient NBS project sizes. The ESSs produced by NBSs typically span across different spatial scales [58]. Nevertheless, most NBS projects are characterised by small scales [10]. A small project size, coupled with high risks, worsens the overall risk–return profiles of NBSs:

- A lack of access to large-scale investment opportunities is one of the most relevant barriers that prevents asset owners and managers from investing in natural capital [24]. Although the long-term liabilities of institutional investors align well with projects with long time horizons [22], small investment sizes and the related low rates of return do not fit with the requirements of institutional investors [21].

- Transaction costs are high relative to project size and project revenues and, hence, worsen the risk–return profile of smaller-sized projects due to constrained budgets and the lack of economies of scale [10].

5.2.6. Financial Barrier 6 (FB 6)—Jointness

The transaction property of low separability results in problems of jointness in NBSs. Multifunctionality, i.e., the joint production of multiple ESSs, is one of the distinguishing features of NBSs. Each ESS produces its own set of benefits (and disbenefits), which have an impact on specific groups of beneficiaries. The fact that multifunctionality leads to interdependent and inseparable transactions is known as the problem of jointness [42]. Jointness in NBSs requires additional coordination efforts, thus resulting in higher transaction costs:

- Each ESS can potentially be subject to its own property rights regime (access, management, withdrawal, exclusion, and alienation rights), so the interdependencies between the flows of ESSs and the related transactions often result in a complex legal and administrative environment.

- In addition to co-benefits, ESSs can result in disbenefits for certain stakeholders [59], for instance, due to increased pollen and/or mosquitos, or social displacement due to increased property value. The inseparability of NBS benefits and disbenefits may result in conflicts and trade-offs, thus requiring coordination efforts.

- Due to the multiple, distributed NBS benefits that yield low returns, the diversification and stacking of multiple sources of funding and financing is considered a useful approach to cover all relevant activities and potential values [6,10,34]. However, coordinating multiple funders and financiers can be a complex and time-consuming challenge [53], as different funders and financiers may have different criteria and conditions for supporting or investing in a project. Harmonising private and public preferences is particularly delicate due to the existing trade-offs between profitability and welfare generation [28]. While an initiator may secure an initial funding source, they may lack the resources or financial expertise to organise and coordinate subsequent arrangements.

5.2.7. Financial Barrier 7 (FB 7)—Low Revenues

The transaction property of low excludability results in distributed benefits and low revenues. Some ESSs have public good characteristics, with low degrees of excludability [4]. Low excludability implies that it is difficult (costly) to establish exclusive ownership rights over the service. When exclusion is difficult, NBS initiators might not be able to capture the value of the service by directly charging beneficiaries. This results in high incentives for beneficiaries to free ride [28]. Without the possibility to capture the full range of benefits of the NBS, private investors may find it difficult to generate sufficient returns on their investment. Please note that low revenues that are not due to low excludability but rather some other reason, i.e., when generated revenues are lower than production costs, qualify as economic barriers in our framework, and they will not be discussed.

5.3. Innovative Financial Solutions

For each of the ten financial innovations considered, we identify targeted financial barriers and the conditions of their applicability.

5.3.1. Green Bonds

The funds raised through green bonds are earmarked for projects that promote sustainability and climate resilience. Project requirements are identified using dedicated standards, which are verified by independent third parties. Financiers thus benefit from lower green-washing risks related to the low measurability of outcomes and the low monitorability of agents (FB 2). Investors are also familiar with bond investments and bond standard mechanisms, and they may approach NBS investments more easily if they are framed as such. As tradable debt instruments, green bonds are also rather liquid financial assets (FB 3), and performance risks are for the most part shifted to the issuer, who can rely on revenues external to the project to repay financiers (FB 1).

By their nature, NBS projects are typically well aligned with the common requirements of green bond standards [60]. The issuance process of green bonds nevertheless requires significant financial capacity and resources to cover the upfront and ongoing transaction costs of green labelling and the associated certification, reporting, verification, and monitoring obligations. For this reason, green bonds are mostly issued by governments (CSs 1–3) [49,61,62,63] or large utilities (CS 4) [49] to finance large investment programs that bundle several projects [64], while individual, smaller-sized projects might not reach the required investment size (FB 5). Further green bond issuances benefit from economies of scale, making these instruments particularly attractive to governments committed to long-term adaptation and NBS upscaling [65]. Another common issue is that a high credit rating of the issuer is needed for the green bond to be attractive to investors (CS 1 and CS 4) [49]. For issuers with insufficient credit ratings, development banks and conservation funds can provide credit enhancement instruments such as guarantees to reduce interest rates (CS 2) [61,62].

5.3.2. Environmental Impact Bonds (EIBs)

EIBs are debt instruments that incorporate pay-for-success mechanisms that reward investors with higher returns when project performance metrics pass a predetermined threshold. Below-market rates are applied in the case of underperformance. Part of the performance risk is thus shifted from the initiator to the investors (FB 1). The transfer of risks is particularly beneficial when private investors have the possibility to leverage specific financial capacity and other types of expertise to absorb and effectively manage the risk [66]. Pay-for-success mechanisms can also be applied to procurement arrangements [67], providing incentives for the delivery of effective restoration that mitigates principal–agent problems (FB 2). An attractive feature for impact-oriented investors is the commitment of the issuer to post-implementation impact measurement and disclosure, as auditing and monitoring processes are pre-arranged and included in the structure of service delivery (FB 1 and FB 2) [68]. The fact that the process of identifying, achieving, and measuring the performances of NBSs is systematically monitored and documented make EIBs useful instruments for the generation of comparable data that can be transferred to other projects.

EIBs are particularly complex financial mechanisms that require substantial financial know-how, and, therefore, specialised financial service providers with experience in structuring performance-based financing arrangements need to be involved (CSs 5–10) [67,69,70,71,72,73,74,75,76]. Associated high transaction costs might limit the scope of EIBs to larger projects (FB 5). At the same time, investors prefer simple and familiar kinds of financing arrangements, so it is generally advisable to avoid over-complicated EIB structures that would be costly for financiers to analyse (CSs 9, 10, and 13) [67,68,76,77]. As financial outcomes are contingent on a particular ESS outcome, the identification of adequate performance metrics is a crucial step in the development of an EIB. Targeted ESSs should be a) directly attributable to the NBS, b) highly valued by stakeholders (and investors), and c) easily measurable and verifiable (FB 2). Proxy metrics might be used to overcome measurability issues when deemed satisfactory by investors and stakeholders (CSs 8, 9, and 12) [67,69,75,78]. When the aim of the NBS is to avoid future damages and costs, EIBs could represent a fitting solution [68]. In several case studies (CSs 5, 7–11) [67,69,70,74,75,76,79], this circumstance allowed the initiator to fund the EIB’s higher financial rewards to investors using part of the cost savings incurred due to the project’s good performance.

5.3.3. Project Bundling

Project bundling is the aggregation of several individual projects, usually geographically or thematically related, into a single investment product. The risks of underlying NBS projects are diversified, reducing overall risks and providing more attractive investment opportunities (FB 1). Moreover, bundling projects increases overall ticket sizes, unlocking economies of scale and enhancing the financial viability of NBS initiatives (FB 5). Bundling NBSs with more traditional types of projects can increase investors’ confidence, as they are familiar with risk diversification mechanisms [80].

The projects included in a bundled portfolio need to be financially viable and profitable [81,82,83,84] (CSs 14 and 15). In other words, each project should contribute positively to the financial performance of the bundled portfolio. Financial expertise is a determining factor for successfully combining various NBS projects to generate collective revenues and mitigate risks. Real-world examples demonstrate that the capacity to consolidate assets and create financial products that align with investor expectations is primarily achievable by large entities such as governments capable of issuing green bonds (CSs 1–4) [49,61,62,63] and specialised restoration investment funds (CSs 14–17) [82,83,84,85,86,87]. Project initiators without the know-how and resources to bundle projects and structure financial products would need the support of financial intermediaries. Bundling several smaller projects into a larger investment product also entails more complex coordination challenges across a larger and more diverse set of stakeholders (CSs 14–16) (FB 5) [82,83,84,85,86]. Different projects may also have different timeframes for delivering value and returns on investment, which may represent a disincentive for investors with different expectations. Generally speaking, homogeneous projects with respect to the ESS delivered, type of NBS, used methodologies, etc., are easier to bundle than highly specific and diverse projects (FB 3). The local aggregation of NBSs with complementary built infrastructure—a green-grey hybrid approach—has been successful in unlocking synergies and attracting investors [19,49,69,75,88] (CSs 1, 4, and 8).

5.3.4. Smart Contracts

Smart contracts are blockchain-based applications for the automatic execution of contractual terms based on predefined algorithmic rules. When pre-codified inputs are provided (e.g., sensors’ measurements), a defined action (e.g., payments) is executed automatically and irreversibly. The automatic execution of contracts prevents renegotiations, as contractual terms are unalterable once the agreement is made [89]. This eliminates the risk of hold-up problems (FB 3), as actors cannot redefine contractual terms once they acquire a dominant bargaining position [90]. Automatic executions also prevent contract breaching, remove the necessity to trust third parties, and remove the need for risk-mitigating measures such as collaterals or guarantees, as well as the recourse to legal action for enforcement (FB 4) [91]. Monitoring and eventual disputes regarding compliance are also avoided for similar reasons [89]. Due to these features, smart contracts are particularly useful in contexts of low governance standards and weak institutions [51]. The elimination of intermediaries can bring a considerable reduction in transaction costs, thus improving the risk–return profile of NBSs, with particular benefits for smaller-sized projects (FB 5) [92].

Smart contracting requires an ex ante and precise specification of future contingencies and outcomes, which may pose significant implementation challenges in the context of NBSs where, as discussed, uncertainty and complexity are typical features (FBs 1, 2, and 4) [93]. However, in cases where simple, short-term, and deterministic transactions can be identified within the NBS project, smart contracts might indeed be a viable option to consider. For instance, smart contracts have been implemented to reward individual tree planting or increased forest coverage (CSs 19 and 20) [94,95,96,97], yet integration into arrangements for long-term and more comprehensive ecosystem management activities has not been achieved (CS 20) [96,97]. Similarly, smart contracts have been developed for bypassing intermediation in green bond issuance, yet third-party validation has not been replaced (CS 21) [98]. While smart contracts leverage cutting-edge technologies like blockchain, Internet of Things, and artificial intelligence (CS 19) [94,95], challenges can be brought by underdeveloped regulation and the level of stakeholders’ digital literacy (CS 20) [96,97].

5.3.5. Blockchain Tokens

Blockchain tokens are digital assets stored and transferred on a blockchain, which represents the ownership of, or access to, a certain asset. Blockchain tokens are divisible, and, thus, they enable the fractional ownership of assets, allowing individuals to own a portion of high-value assets that they might not be able to afford in whole. This results in increased accessibility, as markets traditionally dominated by larger investors (e.g., infrastructures) open up to a broader range of actors. Tokenisation also increases accessibility to finance for NBS initiators, particularly for smaller projects, due to the transaction cost savings achieved with the use of blockchains (FB 5) [99]. Other benefits of blockchain technology include higher transaction transparency, security, and immutability, which contribute to enhancing asset liquidity (FB 3) [49].

Blockchain tokens have been implemented in contexts such as blue carbon crediting schemes (CS 22) [100], biodiversity crediting schemes (CS 23) [101], and commercial reforestation (CS 24) [92]. The valuation of blockchain tokens relies on solid ESS quantification methods (FB 2), which are often achieved by deploying multiple monitoring instruments such as satellites, drones, and Internet of Things networks (CSs 18 and 19) [96,97,102,103].

Due to the novelty of such solutions, there are limited data on the advantages and challenges associated with their implementation. This lack of information makes their adoption more difficult. The diffusion of digital tokens is hindered by the lack of comprehensive and coherent regulatory frameworks for digital currencies found in most jurisdictions (CS 24) [92]. Partnerships with regulatory authorities to experiment with supporting regulation may be appropriate (CS 23) [101]. An alternative solution involves the integration of blockchain applications with off-chain components while trying to preserve the key advantages brought by tokenised assets [99].

5.3.6. Public–Private Partnerships (PPPs)

PPPs involve collaborations between a public entity and a company (or consortium) for the provision of public services or infrastructures. While the term PPP is sometimes used to refer to any form of such collaboration, the prevailing definition used in public finance, and adopted here, limits PPPs to partnerships characterised by a long-term duration, bundled contracts, functional/performance indicators rather than technical requirements, and shared risk and financial responsibilities [66]. An essential advantage lies in efficiently allocating and sharing risks based on the parties’ ability to manage them (FB 1) [ibid.]. The private partner of a PPP typically assumes significant risk and management responsibilities across the contract’s lifespan, including design, construction, operation and maintenance, and financing. The government retains the ultimate responsibility for service quality (project specifications) and certain residual risks beyond the private partners’ control, i.e., regulatory risks and uninsurable nature disaster risks [104]. Notably, performance risks are largely transferred to the private sector (FB 1) [105]. While the initial costs of drafting complex PPP contracts are relatively high, bundling these contracts minimises subsequent expenses by enhancing project management, decision-making, and coordination efficiency (FB 8). PPPs also attract experienced suppliers through higher-value calls for tender, which might not be attracted by smaller contracts (FB 5) [106]. By involving private contractors throughout the project’s life cycle, PPPs adopt a whole-life cost approach. This approach, emphasising a long-term perspective and risk–reward sharing, aligns the interests of public and private partners, reducing the likelihood of principal–agent problems (FB 2) [105].

Empirical evidence of PPPs has only been found in rather isolated cases related to beach nourishment (CS 25) [22,107], green corridors (CS 26) [9,108], sediment bypass (CS 27) [109], flood-bank restoration (CS 29) [110], and urban riverfront flood protection (CS 28) [9,111]. Indeed, in the context of NBSs, the lack of sufficient investment size and revenue streams represents a limiting factor (FB 5), as the financial viability and clarity of outputs are needed to justify the implementation of such complex contractual arrangements (FB 1) [112]. Additional preconditions include meaningful tender competition [113] and high potential for life-cycle cost savings [22,107,114] (CS 25). Part of the complexity of PPP financial structures lies in the need to allocate risks and to manage the potentially diverging interests between public and private partners. In particular, in order to avoid potential trade-offs between service quality and cost savings, and to guarantee accountability, it should be relatively easy to develop contracts for ESSs, i.e., ESSs should be measurable (FB 2) [114].

5.3.7. Carbon Credits

Carbon credits are tradable assets that represent a quantified reduction in carbon emissions, often certified by a carbon standard, allowing entities to offset their own emissions by investing in projects that reduce an equivalent amount of carbon. Carbon credits allow for the assignment of clear property rights (carbon rights) and the trading of an ecosystem service, i.e., carbon sequestration, that would otherwise be a non-excludable global public good (FB 7).

Clear methodologies, including those for blue carbon projects (Verra’s VM0033, Verra’s VM0007, Verra’s VM0024, and Clean Development Mechanism’s AR-AM0003), exist, including specific applicability conditions. While most case studies apply prevailing standards (CSs 30, 31, 37, 38, and 40) [115,116,117,118,119,120,121], other ad hoc methodologies and carbon crediting schemes are also used (CSs 34, 35, and 36) [122]. Mangrove restoration dominates implementation (CSs 30, 31, 33, and 38) [115,116,117,120,121], but cases of seagrass (CSs 34–36) [122] and tidal wetland restoration (CS 37) [118,119] are also found. While carbon credit markets are relatively mature, NBS-based carbon credits are not yet well established, and related markets remain underdeveloped [10]. Proving additionality, quantifying carbon removals and emissions, and ensuring permanent sequestration are very challenging, and current carbon credit prices are too low to generate reliable revenues on their own [123]. Implementation in small- to medium-scale projects is especially difficult due to the necessity of involving several intermediaries and financial service providers in carbon crediting processes (FB 5) [124], resulting in high transaction costs and lengthy bureaucratic processes (CSs 30 and 32) [115,116]. A similar, yet more complex, approach applies to issuing biodiversity credits (CS 23) [101], though related markets are much less developed and typically depend on supportive regulatory schemes.

5.3.8. Eco-Labels

Eco-labels are certifications indicating that a product or service meets specific environmental standards, defined by a standard-setting entity and verified by a third party. Eco-labels bridge the mature markets of provisional ESSs like fish, fibres, and timber with ESSs with characteristics of public goods, whose value is difficult to capture (e.g., biodiversity and public health) (FB 7) [125]. Consumers are familiar with product labelling, and they understand the underlying mechanism of linked provision [126]. The effectiveness of eco-labelling depends on factors such as the type of label, the credibility of the certifying body, and market demand. Depending on the specific requirements of the eco-label standard, the intensity of ESSs tracked might not affect the price of labelled products or revenues more generally (FB 1) [127]. This is particularly evident when the certification of products is contingent on processes (the adoption of sustainable production practices) rather than outcomes (ESSs and impacts), which are assumed to be consequences (FB 2) [127].

While inland NBS projects typically apply eco-labels to food and timber, coastal NBSs primarily certify aquaculture and fishery products (CSs 4, 39, 41, and 48) [32,49,128,129,130]. Certifications for sustainably managed beaches are also found [131], though their link to both ecosystem restoration and revenue generation is more indirect. Eco-labels come in different forms and are rather flexible instruments. Their effectiveness relies on consumers’ willingness to pay premiums for certified products, which is not always guaranteed [132]. Quantifying market demand for certified products is therefore crucial to assess their cost-effectiveness [8,32,116,128] (CSs 32 and 39). Eco-labels can be used to provide economic incentives for private actors to voluntarily implement restoration (CS 48) [130]. However, possible barriers include a lack of environmental management skills [133] and trade-offs between sustainable practices and other economic activities. A priority for investors is the credibility of certifying bodies [49,81] (CS 4). The size of the restoration project may be a relevant factor depending on the certification type and requirements. Small-scale projects allow for more detailed monitoring, but they may incur excessively high transaction costs if the requirements are too stringent (FB 5) [134].

5.3.9. Ecotourism User Fees

Ecotourism user fees are charges levied on visitors for the use of specific facilities, services, or attractions in a destination, earmarked to support nature restoration/conservation. They generate revenues by capturing biodiversity and recreational ESSs, which have public good characteristics (FB 7). Unlike other value capture instruments, implementing user fees is relatively cheap and straightforward, especially in their most simple form [135]. Notably, user fees can generate revenues near the start of an NBS project (FB 4) [136]. In areas where high tourism volumes pose environmental challenges, user fees also serve as a tool for managing and mitigating the negative impacts on ecosystems [137].

Tourism user fees are a key means for revenue generation in coastal restoration, with the precondition of existing, or at least potential, touristic value in the project area. The presence of biodiversity-rich ecosystems and iconic species such as sea turtles and flamingos considerably strengthens the case for tourism user fees. These conditions are usually met in protected areas (CSs 42 and 43) [138,139]. Tourism user fees can also be charged to visitors to a whole jurisdiction, from the local (CS 45) [140] to the national level (CS 44) [141]. While simple visitor fees for entry are straightforward to establish [135], more complex pricing structures (including precise earmarking, willingness-to-pay assessments, marketing, and differentiated pricing) and services require a sufficient tourist volume to offset increased operating costs [138,139] (CS 42). In particular, effectively monitoring users’ access might be more challenging in marine and coastal areas with multiple entry points [138]. User fee schemes, based on restricting access to ESSs, carry the risk of alienating local communities accustomed to free access. Therefore, ensuring social acceptance among local stakeholders is crucial [138,142] (CS 43).

5.3.10. Betterment Levies

Betterment levies are fees imposed on property owners to fund public infrastructure improvements that enhance the value of their properties. They ensure that public investment costs are shared by property owners who directly benefit from the improvements rather than placing the entire burden on the broader taxpayer base (FB 7). In many cases, betterment levies are introduced as part of the approval process for a development project, and they are typically imposed at the time of approval or permitting (FB 4).

Betterment levies offer a value capture option for governments with sufficient fiscal capacity. Betterment levies are particularly fitting to urban and developing contexts (CS 46) [143], which present more opportunities to harness the increased value of contiguous properties [144]. Applicability is limited in sparsely populated coastal areas, especially in protected areas with land-use restrictions, with the exception of beach nourishments for touristic preservation (CS 47) [145]. Like other fiscal tools, social resistance to additional charges can pose political barriers [143,146] (CS 46). Establishing a clear connection between the NBS investment and increased property value is crucial for securing social acceptance among affected residents. Flood risk reduction and passive recreational value (e.g., amenities and green areas) have been identified as key ecosystem services driving increases in property values [143,145,147] (CSs 46 and 47). In some cases, bundling restoration with development projects may be necessary to enhance the value proposition [148].

6. Discussion

Despite the availability of solutions, challenges persist in their implementation and transfer. Our study emphasises that the interconnected nature of financial barriers, innovative financial solutions, and applicability conditions is a key reason for this. For instance, carbon credits may unlock new revenue streams, but their implementation in small-scale projects is challenging because of high certification and validation costs. Aggregating several small projects might solve this issue, but doing so entails its own challenges. Contextual factors such as social acceptance, regulatory barriers, and market maturity are case-specific and may further hinder the applicability of innovative financial solutions.

Avoiding financial barriers is easier than overcoming them. Considering investors’ perspectives and avoiding potential constraints to the development of business models during the earliest phases of project planning (e.g., project site selection, NBS type selection, and the selection and development of performance metrics) may be more cost-effective than overcoming financial barriers once they arise.

Improvements in the standardisation of NBSs and financial arrangements will be important for developing investment opportunities in the sector. Higher standardisation in NBS projects could directly address financial barriers and increase the feasibility of innovative financial solutions by enhancing the performance predictability, impact measurability, and overall efficiency of business models.

Our study shows how the complexity of developing innovative NBS business models led to the emergence of private financial service providers and financial intermediaries as new actors in NBS governance. These entities provide specialised expertise in transaction structuring, standard setting, project bundling, and performance measurement/verification, and they often acquire a dominant role within project settings where innovative solutions are implemented.

The public sector’s role in funding projects and enabling private investments remains indispensable. Governments should strive to maintain the alignment of NBSs with public interest goals and social benefits in the context of the increasing influence of private actors in NBS governance. Defining clear goals, increasing strategic public investments, setting regulatory incentives, and establishing networks with private entities would greatly contribute to the development of an enabling environment for innovative NBS governance models.

While our study prioritised empirical case studies for coastal adaptation, our results are largely applicable to the broader NBS sector. Our research was limited to the role of innovative financial solutions in addressing financial barriers to private investments in NBSs. Public policies beyond the project-level institutional dimension provide further options to tackle these problems, including providing enabling conditions for the deployment of the solutions that we discussed. Research on this topic would complement our contribution. We also encourage the investigation of the welfare and ecological impacts of financial innovation for NBSs in order to define needs for policy safeguards.

7. Conclusions

We identified a set of innovative financial solutions that have been employed in NBS projects globally, outlining the specific financial barriers that they address, along with the conditions influencing their applicability.

Overall, our study highlights how financial innovation is capable of providing effective instruments to address several financial barriers related to the implementation of NBSs. We also found, however, that limited track records and site-specific constellations of financial barriers and socio-ecological conditions require detailed assessments for the design of tailored financial solutions. As a result, implementing these solutions often depends on substantial support from public grantors and regulators, as well as private actors with specific financial know-how. We expect the diffusion of innovative financial solutions to increase the influence of financial intermediaries and other financial service providers in NBS governance. Integrating investors’ requirements in NBS planning, developing NBSs and NBS business model standards, and enhancing databases on NBS performance will be critical for advancing the diffusion of innovative financial solutions, the growth of private investments in natural capital, and, in turn, the mainstreaming of NBSs for coastal adaptation to climate change.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/cli12040053/s1, Tables S1–S4: Case study database (Section 1, Section 2, Section 3 and Section 4). References [61,62,63,69,70,71,72,73,74,75,76,77,78,79,82,83,84,85,86,87,94,95,96,97,98,100,101,102,103,107,108,109,110,111,115,116,117,118,119,120,121,122,128,129,130,139,140,141,143,145] are cited in the Supplementary Materials.

Author Contributions

Both authors significantly contributed to the preparation of the present manuscript. F.F. executed data gathering, analysis, and the writing of the first draft. J.H. aided in the study design, conceptualisation, and review and writing of the final draft. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the European Union’s Horizon 2020 research and innovation Programme, under Grant Agreement no. 101037097.

Data Availability Statement

No new data were created or analyzed in this study. Secondary data presented in the study are included in the Supplementary Materials, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest. Issues of research and publication ethics have been appropriately considered.

References

- UNEP. State of Finance for Nature 2022, UNEP, ELD, Nairobi. 2022. Available online: https://wedocs.unep.org/20.500.11822/41333 (accessed on 8 August 2023).

- Deutz, A.; Kellet, J.; Zoltani, T. Innovative Finance for Resilient Coasts and Communities; The Nature Conservancy: Arlington, VA, USA; UNDP: New York, NY, USA, 2018. [Google Scholar]

- Droste, N.; Schröter-Schlaack, S.; Hansjürgens, B.; Horst, Z. (Eds.) Implementing Nature-Based Solutions in Urban Areas: Financing and Governance Aspects. In Nature-Based Solutions to Climate Change Adaptation in Urban Areas: Theory and Practice of Urban Sustainability Transitions; Springer International Publishing: Cham, Switzerland, 2017; pp. 307–321. [Google Scholar] [CrossRef]

- Altamirano, M.A.; De Rijke, H.; Carrera, L.B.; Jaimerena, B.A. Handbook for the Implementation of Nature-Based Solutions for Water Security: Guidelines for Designing an Implementation and Financing Arrangement; EU Horizon 2020 NAIAD Project, Grant Agreement N°730497 Dissemination; Deltares: Delft, The Netherlands, 2021. [Google Scholar]

- EIB. Investing in Nature: Financing Conservation and Nature-Based Solutions; European Commission: Brussels, Belgium; EIB: Luxembourg, 2020. [Google Scholar]

- Eiselin, M.; Schep, S.; Duinmeijer, C.; Van Pul, J. Financing Nature-Based Solutions for Coastal Protection; IUCN—Netherlands Enterprise Agency: Amsterdam, The Netherlands, 2022. [Google Scholar]

- König, A.-N.; Club, C.; Apampa, A. Innovative Development Finance Toolbox; KfW Development Bank: Frankfurt am Main, Germany, 2020. [Google Scholar]

- Agardy, T.; Pascal, N. Innovative financial mechanisms for coastal management in the Pacific: A state of the art. In Proceedings of the ESCCUE Experts Meeting on Project Approach and Methodology, Noumea, New Caledonia, 11 July 2014. [Google Scholar]

- Baroni, L.; Whiteoak, K.; Nicholls, G. Approaches to Financing Nature-Based Solutions in Cities. 2019. Available online: https://growgreenproject.eu/wp-content/uploads/2019/03/Working-Document_Financing-NBS-in-cities.pdf (accessed on 6 April 2023).

- EIB. Investing in Nature-Based Solutions: State of Play and Way forward for Public and Private Financial Measures in Europe; European Investment Bank: Luxembourg, 2023; Available online: https://data.europa.eu/doi/10.2867/031133 (accessed on 24 July 2023).

- Cohen-Shacham, E.; Walters, G.; Janzen, C.; Maginnis, S. Nature-Based Solutions to Address Global Societal Challenges; IUCN: Gland, Switzerland, 2016. [Google Scholar] [CrossRef]

- Nesshöver, C.; Assmuth, T.; Irvine, K.N.; Rusch, G.M.; Waylen, K.A.; Delbaere, B.; Haase, D.; Jones-Walters, L.; Keune, H.; Kovacs, E.; et al. The science, policy and practice of nature-based solutions: An interdisciplinary perspective. Sci. Total Environ. 2017, 579, 1215–1227. [Google Scholar] [CrossRef] [PubMed]

- Kabisch, N.; Frantzeskaki, N.; Pauleit, S.; Naumann, S.; Davis, M.; Artmann, M.; Haase, D.; Knapp, S.; Korn, H.; Stadler, J.; et al. Nature-based solutions to climate change mitigation and adaptation in urban areas: Perspectives on indicators, knowledge gaps, barriers, and opportunities for action. Ecol. Soc. 2016, 21, art39. [Google Scholar] [CrossRef]

- Narayan, S.; Beck, M.W.; Reguero, B.G.; Losada, I.J.; Van Wesenbeeck, B.; Pontee, N.; Sanchirico, J.N.; Ingram, J.C.; Lange, G.-M.; Burks-Copes, K.A.; et al. Costs and Coastal Protection Benefits of Natural and Nature-Based Defences. PLoS ONE 2016, 11, e0154735. [Google Scholar] [CrossRef] [PubMed]

- Sutton-Grier, A.; Gittman, R.; Arkema, K.; Bennett, R.; Benoit, J.; Blitch, S.; Burks-Copes, K.; Colden, A.; Dausman, A.; DeAngelis, B.; et al. Investing in Natural and Nature-Based Infrastructure: Building Better Along Our Coasts. Sustainability 2018, 10, 523. [Google Scholar] [CrossRef]

- Egusquiza, A.; Cortese, M.; Perfido, D. Mapping of innovative governance models to overcome barriers for nature based urban regeneration. IOP Conf. Ser. Earth Environ. Sci. 2019, 323, 012081. [Google Scholar] [CrossRef]

- Sánchez-Arcilla, A.; Cáceres, I.; Roux, X.L.; Hinkel, J.; Schuerch, M.; Nicholls, R.J.; Otero, D.M.; Staneva, J.; De Vries, M.; Pernice, U.; et al. Barriers and enablers for upscaling coastal restoration. Nat.-Based Solut. 2022, 2, 100032. [Google Scholar] [CrossRef]

- Sarabi, S.E.; Han, Q.; Romme, A.G.L.; Vries, B.d.; Wendling, L. Key Enablers of and Barriers to the Uptake and Implementation of Nature-Based Solutions in Urban Settings: A Review. Resources 2019, 8, 121. [Google Scholar] [CrossRef]

- Seddon, N.; Chausson, A.; Berry, P.; Girardin, C.A.J.; Smith, A.; Turner, B. Understanding the value and limits of nature-based solutions to climate change and other global challenges. Philos. Trans. R. Soc. B Biol. Sci. 2020, 375, 20190120. [Google Scholar] [CrossRef] [PubMed]

- Frantzeskaki, N.; McPhearson, T.; Collier, M.J.; Kendal, D.; Bulkeley, H.; Dumitru, A.; Walsh, C.; Noble, K.; Van Wyk, E.; Ordóñez, C.; et al. Nature-Based Solutions for Urban Climate Change Adaptation: Linking Science, Policy, and Practice Communities for Evidence-Based Decision-Making. BioScience 2019, 69, 455–466. [Google Scholar] [CrossRef]

- Mayor, B.; Toxopeus, H.; McQuaid, S.; Croci, E.; Lucchitta, B.; Reddy, S.E.; Egusquiza, A.; Altamirano, M.A.; Trumbic, T.; Tuerk, A.; et al. State of the Art and Latest Advances in Exploring Business Models for Nature-Based Solutions. Sustainability 2021, 13, 7413. [Google Scholar] [CrossRef]

- Bisaro, A.; Hinkel, J. Mobilizing private finance for coastal adaptation: A literature review. WIREs Clim. Change 2018, 9, e514. [Google Scholar] [CrossRef]

- OECD. A Comprehensive Overview of Global Biodiversity Finance, Paris. 2020. Available online: https://www.oecd.org/environment/resources/biodiversity/report-a-comprehensive-overview-of-global-biodiversity-finance.pdf (accessed on 10 August 2023).

- Cooper, G.; Trémolet, S. Investing in Nature: Private Finance for Nature-Based Resilience; The Nature Conservancy: Arlington, VA, USA; Environmental Finance: London, UK, 2019. [Google Scholar]

- Dworczyk, C.; Burkhard, B. Challenges Entailed in Applying Ecosystem Services Supply and Demand Mapping Approaches: A Practice Report. Land 2022, 12, 52. [Google Scholar] [CrossRef]

- WWF. Nature Based Solutions—A Review of Current Financing Barriers and How to Overcome These; WWF: Gland, Switzerland; Terranomics: London, UK, 2022. [Google Scholar]

- Shilland, R.; Grimsditch, G.; Ahmed, M.; Bandeira, S.; Kennedy, H.; Potouroglou, M.; Huxham, M. A question of standards: Adapting carbon and other PES markets to work for community seagrass conservation. Mar. Policy 2021, 129, 104574. [Google Scholar] [CrossRef]

- Toxopeus, H.; Polzin, F. Reviewing financing barriers and strategies for urban nature-based solutions. J. Environ. Manag. 2021, 289, 112371. [Google Scholar] [CrossRef] [PubMed]

- Adhikari, B.; Chalkasra, L.S.S. Mobilizing private sector investment for climate action: Enhancing ambition and scaling up implementation. J. Sustain. Financ. Invest. 2021, 13, 1110–1127. [Google Scholar] [CrossRef]

- Davies, C.; Lafortezza, R. Transitional path to the adoption of nature-based solutions. Land Use Policy 2019, 80, 406–409. [Google Scholar] [CrossRef]

- Colgan, C.S. Financing Natural Infrastructure for Coastal Flood Damage Reduction. Clim. Change 2017, 45, 8. [Google Scholar]

- GPC. A Market Review of Nature-Based Solutions, Green Purposes Company, Finance Earth. 2021. Available online: https://finance.earth/wp-content/uploads/2021/05/Finance-Earth-GPC-Market-Review-of-NbS-Report-May-2021.pdf (accessed on 22 August 2023).

- Barkley, L.; Short, C.; Chivers, C.A. Long-Term Agreements and Blended Finance for Landscape Recovery; Countryside and Community Research Institute: Gloucestershire, UK, 2022. [Google Scholar]

- Security, E. The Blended Finance Playbook for Nature-Based Solutions; Earth Security: London, UK, 2021. [Google Scholar]

- Brears, R.C.; Solutions, F.N.-B. Private, and Blended Finance Models and Case Studies; Springer International Publishing: Cham, Switzerland, 2022. [Google Scholar] [CrossRef]

- Kok, S.; Bisaro, A.; de Bel, M.; Hinkel, J.; Bouwer, L.M. The potential of nature-based flood defences to leverage public investment in coastal adaptation: Cases from the Netherlands, Indonesia and Georgia. Ecol. Econ. 2021, 179, 106828. [Google Scholar] [CrossRef]

- Den Heijer, C.; Coppens, T. Paying for green: A scoping review of alternative financing models for nature-based solutions. J. Environ. Manag. 2023, 337, 117754. [Google Scholar] [CrossRef] [PubMed]

- Lerner, J.; Tufano, P. The Consequences of Financial Innovation: A Counterfactual Research Agenda. Annu. Rev. Financ. Econ. 2011, 3, 41–85. [Google Scholar] [CrossRef]

- Merton, R.C. A Functional Perspective of Financial Intermediation. Financ. Manag. 1995, 24, 23. [Google Scholar] [CrossRef]

- Silber, W.L. The Process of Financial Innovation. Am. Econ. Rev. 1983, 73, 89–95. [Google Scholar]

- Frame, W.S.; White, L.J. Empirical Studies of Financial Innovation: Lots of Talk, Little Action? J. Econ. Lit. 2004, 42, 116–144. [Google Scholar] [CrossRef]

- Hagedorn, K. Particular requirements for institutional analysis in nature-related sectors. Eur. Rev. Agric. Econ. 2008, 35, 357–384. [Google Scholar] [CrossRef]

- D.C. North. Institutions, Institutional Change, and Economic Performance; Cambridge University Press: Cambridge, UK; New York, NY, USA, 1990. [Google Scholar]

- Williamson, O.E. The Economic Institutions of Capitalism; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Williamson, O.E. The New Institutional Economics: Taking Stock, Looking Ahead. J. Econ. Lit. 2000, 38, 595–613. [Google Scholar] [CrossRef]

- Williamson, O.E. Transaction-Cost Economics: The Governance of Contractual Relations. J. Law Econ. 1979, 22, 233–261. [Google Scholar] [CrossRef]

- Thiel, A.; Schleyer, C.; Hinkel, J.; Schlüter, M.; Hagedorn, K.; Bisaro, S.; Bobojonov, I.; Hamidov, A. Transferring Williamson’s discriminating alignment to the analysis of environmental governance of social-ecological interdependence. Ecol. Econ. 2016, 128, 159–168. [Google Scholar] [CrossRef]

- Tufano, P. Financial Innovation. In Handbook of the Economics of Finance; Elsevier: Amsterdam, The Netherlands, 2003; pp. 309–335. [Google Scholar]

- Marsters, L.; Morales, G.; Ozment, S.; Silva, G.; Watson, G.; Netto, M.; Frisari, G.L. Nature-Based Solutions in Latin-America and the Caribbean Financing Mechanisms for Regional Replication; Inter-American Development Bank and World Resources Institute: Washington, DC, USA, 2021. [Google Scholar]

- Schletz, M.; Nassiry, D.; Lee, M.-K. Blockchain and Tokenized Securities: The Potential for Green Finance; Asian Development Bank: Tokyo, Japan, 2020; Available online: https://www.adb.org/publications/blockchain-tokenized-securitiespotential-green-finance (accessed on 26 May 2023).

- Somarakis, G.; Stagakis, S.; Chrysoulakis, N. ThinkNature Nature-Based Solutions Handbook; European Commission: Brussels, Belgium, 2019. [Google Scholar] [CrossRef]

- Bordt, M.; Saner, M. A critical review of ecosystem accounting and services frameworks. One Ecosyst. 2018, 3, e29306. [Google Scholar] [CrossRef]

- Kedward, K.; Ermgassen, S.O.S.E.Z.; Ryan-Collins, J.; Wunder, S. Nature as an Asset Class or Public Good? The Economic Case for Increased Public Investment to Achieve Biodiversity Targets. SSRN Electron. J. 2022, 1–21. [Google Scholar] [CrossRef]

- Holmstrom, B.; Milgrom, P. Multitask Principal-Agent Analyses: Incentive Contracts, Asset Ownership, and Job Design. J. Law Econ. Organ. 1991, 7, 24–52. [Google Scholar] [CrossRef]

- Cohen-Shacham, E.; Andrade, A.; Dalton, J.; Dudley, N.; Jones, M.; Kumar, C.; Maginnis, S.; Maynard, S.; Nelson, C.R.; Renaud, F.G.; et al. Core principles for successfully implementing and upscaling Nature-based Solutions. Environ. Sci. Policy 2019, 98, 20–29. [Google Scholar] [CrossRef]

- Schmitz, P.W. The Hold-Up Problem and Incomplete Contracts: A Survey of Recent Topics in Contract Theory. Bull. Econ. Res. 2001, 53, 1–17. [Google Scholar] [CrossRef]