Abstract

This research investigates the synergistic relationship between sustainability and financial prosperity in businesses, specifically focusing on the impact of consumers on profit growth in Kosovo and Albania. The study aims to understand consumers’ perceptions of their purchases, the factors influencing their choice of businesses, and the types of businesses that effectively support consumers in these countries. Data were collected through a survey completed by 200 consumers and 200 businesses. The analysis, utilizing multivariate analysis of variance, descriptive analysis, and reliability analysis with SPSS, reveals that consumers significantly influence the sustainability of business profit growth. Moving forward, it is recommended that businesses prioritize offering reasonable prices, quality products/services, easy access to products/services, clear information about products/services, and convenient locations. The research has profound implications for businesses, consumers, and countries and suggests the need for further exploration of the impact of consumers on profit growth in diverse contexts.

1. Introduction

In today’s dynamic business environment, the intricate interplay between sustainability and financial prosperity has risen to paramount importance. Drawing on the insights of Stevenson and Nelson (1967), they emphasized the need for firms to satisfy consumer demands by offering products/services. This includes considerations of quality, technology, support during and after purchase, and accurate information about products/services. In addition, the research seeks to explore how consumers can enhance the competitiveness and performance of companies, building on the findings of Tyla and Gomez (2022). They argue that sustainable ideas and innovations are crucial for companies to have sustainability and financial prosperity. According to Hagens (2020) and Thomas and Mantri (2022), the importance of business profit growth through quality products and services, customers, profit growth, sustainability strategies, and financial prosperity is emphasized. Over the past decade, Kosovo has experienced steady economic growth, marked by a nearly 50 percent increase in per capita income and a 35 percent decrease in the poverty rate. The country has successfully moved away from a heavy reliance on foreign aid and has outperformed similar nations in terms of income thanks to a steady increase in spending and investment. Factors such as contributions from expatriates, government investment in infrastructure, and improvements in financial services have played a significant role. Fiscal stability and low inflation have also contributed to this progress. In 2023, GDP growth is expected to reach 3.2%, driven by strong exports and private consumption. Looking ahead, the outlook remains optimistic, with growth expected to reach 4%, bringing Kosovo’s economic activity closer to its full potential (World Bank 2024a). Albania is undertaking important structural reforms aimed at promoting more equitable growth, increasing productivity and competitiveness, boosting job creation, and improving governance and public services. Improving connectivity within the region and access to global markets, as well as diversifying exports and markets, are also seen as drivers for faster growth. However, growth is expected to moderate to 3.6% in 2023 due to challenging global financial conditions, sluggish economic growth in Europe, and the completion of post-earthquake reconstruction efforts. Tourism and construction are expected to drive growth in exports, consumption, and investment, returning to prepandemic levels. In addition, inflation is projected to gradually approach the 3% target by 2024 (World Bank 2024b). To achieve financial prosperity and ensure sustainable profit growth, countries must prioritize business support through equitable distribution of public spending, especially in the form of subsidies, especially in light of the significant challenges posed by COVID-19 (Lulaj 2023). It is crucial to exercise more control over the allocation of public funds (Lulaj et al. 2022) to strengthen support for businesses, especially considering that nearly 98% of businesses contribute through corporate income tax payments (Lulaj and Dragusha 2022).

Finally, exploring the synergistic relationship between corporate sustainability and financial prosperity, particularly in the context of consumer influence on profit growth in Kosovo and Albania, is of significant importance in contemporary business discourse. As businesses increasingly navigate the complexities of sustainability and economic viability, understanding the dynamics of consumer behavior becomes critical. This study provides a novel perspective by exploring the interplay between consumer perceptions, business decisions, and the sustainability of profit growth within the specific socio-economic contexts of Kosovo and Albania. Unlike previous literature, which often focuses on general trends or single case studies, this research adopts a comparative approach across two distinct yet interrelated markets. The goal is to unravel the complex structure of corporate profit growth through consumer-centric strategies, shedding light on how consumers shape the sustainability of corporate profit growth. Central to this investigation are several research questions, including identifying consumers’ perceptions of their purchases, the underlying factors that influence consumers’ business decisions, and the types of businesses that garner significant consumer support in both Kosovo and Albania. By addressing these questions, the study aims to fill a critical gap in the literature by providing insights into the specific mechanisms through which consumer behavior impacts business profitability and sustainability in emerging markets, thereby contributing to a better understanding of sustainable business practices. At the end of the introduction, it is emphasized that this paper consists of several sections. First, Section 2 provides the literature review and hypothesis construction, which aims to facilitate the evaluation of hypotheses. This is followed by the methodology in Section 3, which explains the significance of the selected research methods. Thereafter, Section 4 presents detailed findings from Kosovo and Albania. Finally, Section 5 and Section 6 include the discussion and conclusions, respectively, synthesizing the findings and their implications.

2. Literature Review and Hypotheses Development

2.1. Theoretical Analysis

To see a clear outlook of the results of previous and existing research on how consumers can affect the sustainability of business profit growth, as well as the factors that influence the sustainability of profit growth, the contributions provided by other researchers related to this research were analyzed. Therefore, the review of the literature will provide what is now known, what is not known, and what (and why) should be known regarding the sustainability of business profit growth through consumer-centric strategies, to further understand and analyze what sustainability and financial prosperity mean to increase business profit. Therefore, according to (Ardalan 2018), it is said that the business profit growth through consumer-centric strategies includes fundamental paradigms such as business operation, information interpretations, and cash flow structure, but a similar opinion was also voiced by Boianovsky (2021), where the extraordinary influence of some economists in these paradigms is emphasized regarding the sustainability and financial prosperity of business profit growth. According to (Pym 1980), to have the sustainability and financial prosperity of business profit growth through consumer-centric strategies, the issues of technology failures were analyzed to facilitate the work of employees, to perform services for customers based on their requirements during and after purchases, as well as how to have profit stability and financial prosperity. According to (Hysa and Rehman 2021) and (Rehman and Hysa 2021), the findings underscore the role of financial development and remittances in influencing the reduction in economic growth in the Western Balkan countries (WBC). In addition, the study by Morina et al. (2020) shows that exchange rate volatility significantly hampers real economic growth. However, factors such as population growth, remittances, and labor force participation are found to be insignificant for sustainable growth. Conversely, Jushi et al. (2021) highlight the importance of previous levels of GDP, trade, and FDI as predictors of economic growth. According to Manta et al. (2021), there is an emphasis on the creation of systematic financial and social imbalances that directly affect the stability of the national economy. According to Lulaj et al. (2024), unraveling the structure of business profit growth through consumer-centric strategies suggests that if employees cannot quickly adapt to changes in the environment, and there is no managerial skills and proper leadership to implement ideas that increase profit, ensure regular repayment of debts and loans, use innovative strategies, maintain the legal status of a company, and evaluate the work of employees, then businesses will struggle to increase their strategic profit and ensure their market survival compared to their competitors. Furthermore, the text suggests that the COVID-19 pandemic has exacerbated financial problems among the population, necessitating structural changes and adjustments.

The issues of the value of business profit growth through consumer-centric strategies and the connection with market efficiency were analyzed by (O’Connor et al. 2015) and (Li and Jin 2018), where it is emphasized that inflation and interest rates affect the sustainability and investment funds, according to (Macintosh et al. 2000), and highlighted the real, material, and social consequences of business profit growth through consumer-centric strategies, suggesting future research on profit sustainability. Below, the variables of business sustainability will be analyzed by identifying consumer perceptions.

The main hypothesis H: Consumers affects the sustainability of profit growth in businesses.

The purpose of the study is to examine the effects of consumers on the sustainability of profit growth in businesses based on sections, factors, and variables of this study in both countries (KOS and AL). Therefore, to support the main hypothesis, its sub-hypotheses were formulated/set for respective sections.

2.2. Synergizing Sustainability and Financial Prosperity through Identifying Consumer Perceptions

So far, it is known that (Kamal et al. 2022) consumers play an important role in the sustainability and financial prosperity of business profit growth through consumer-centric strategies and their perceptions enabling businesses to move forward. Also, according to (Massimo and Nora 2022), effective communication with customers, business performance measurement tools, improving staff skills, etc., are emphasized, enabling businesses profit growth through consumer-centric strategies, but (Rajagopal 2020) pointed out two important indicators of the importance of business profit growth through consumers such as corporate culture and organizational behavior. Therefore, successful businesses in the manufacturing or service sectors must understand the challenges of where they are and the opportunities to improve and achieve sustainability and financial prosperity. According to (Amirmokhtar Radi and Shokouhyar 2021), it is noted that the environment, materials, technology, and corporate social responsibility are the main points that customers are interested in during their purchases. To see the synergizing sustainability and financial prosperity of business profit growth through consumer-centric strategies, taking into account product/service quality according to (Moro et al. 2022), it is pointed out that manufacturing companies are still struggling to change their production models to provide quality service systems for products/services to generate sustainable profit. Regarding speed in purchasing the product/service through consumers according to (Zheng et al. 2022), it is stated that for businesses to have a sustainable profit, they must build customer loyalty for products/services by offering consumers the opportunity to have speed during their purchase. While, according to (Le and Ha 2021), it is emphasized that negative information (about the product, the worker) and managerial responses (scale and importance of responses) in terms of speed in purchase have a decisive influence on the perceptions and behaviors of potential customers to purchase products/services and also in business profit growth through the speed of the purchase and the perceptions of the old customers portrayed to the new customers. Regarding the price of the product/service through consumers according to (Wang et al. 2021), buyers’ especially value the business quality, price, intensity of promotion, the reputation of the business, as well as the brand of the product/service. Therefore, when consumers buy, they take into account price and quality, making connections, and the perceptions of purchases by other consumers. However, according to (Chen et al. 2022), appropriate pricing and compensation attract consumers by influencing the sustainability of business profitability and financial prosperity. According to (Schaefers et al. 2022), it is stated that businesses should take as a basis the reactions of consumers during their purchases to achieve profit growth. Regarding the product/service reliability, according to (Huang et al. 2021), to achieve reliability, businesses must provide a guarantee for consumers in case of damage or poor quality of products/services, but according to (Respício and Domingos 2015), businesses must increase and expand the information about the reliability of products/services to have sustainability and financial prosperity of business profit growth based on all phases of business processes. According to (Hysa et al. 2023), the relationship between innovation capacity, financial development, and demand for renewable energy is a critical consideration. The study highlights the potential stimulation of demand for renewable energy through advances in innovation capacity and financial development. Building on this, findings from (Kacani et al. 2022) underscore the importance of comparing risk across sub-industries. The comparison tool shows that sub-industries that perform well in both short- and long-term risks have higher contracting potential and greater opportunities for integration into global value chains. These findings connect to the overarching theme of business prosperity by highlighting the importance of risk management and strategic positioning in the global marketplace. In addition, (Lulaj et al. 2023) highlight the essential elements for sustainable business prosperity. The recommendations include careful management of total liabilities, increased performance of total assets, improved net financial income, improved performance of total business income, and development of employee skills and technology. These aspects are crucial components in the structure of business profit growth and are consistent with the theme of synergizing sustainability and financial prosperity.

According to (Brombacher et al. 2005), the reliability of the product/service is seen as an attribute of the product or service based on innovations, certain technology trends, and some combinations of strategies to make profit more stable for the future. Regarding customer support from the business side (employees) during the purchase of the product/service, according to (Tierney et al. 2022), it is emphasized that the support of employees is useful in shaping consumers’ perceptions during their purchases, while the practice of the dark side or lack of support from the business side for consumers may put at risk the sustainability of profit growth and the existence of the business. Businesses must therefore analyze where they are and how they should move forward given the workers’ support for consumers. According to (Xie et al. 2020), it is stated that businesses that have sustainability of business profit growth should build an innovative collaborative customer support model by examining the effects of customer orientation, employee adaptability, and customer participation in service innovation in a changing business world by adapting to customer needs. But according to (Ho Jung et al. 2021), managers and workers in retail sales are critical through behaviors and attitudes focusing on the integration of customer-focused results. Aligning financial products with sustainability goals and enhancing accessibility can contribute to consumer-centric strategies, fostering long-term growth and positive stakeholder relationships. In exploring the connection between financial issues and economic development during crises, as discussed by (Hysa and Hoxha 2014), the paper can underscore the importance of sustainable financial practices in mitigating the impacts of crises and driving economic resilience. By weaving these insights together, the paper aims to unravel the intricate relationship between sustainability, financial prosperity, and consumer-centric strategies, providing a comprehensive framework for businesses seeking holistic growth.

In terms of research based on consumer perceptions, many sustainability factors of business profit growth through consumer-centric strategies were addressed, highlighting how they affect performance and how they increase competitiveness so far such as quality in products/services, business culture, and behavior, social responsibility, innovations, customer loyalty, etc.). But as gaps where businesses must know how to move forward by improving and filling them, they are integrating strategies by building innovative customer support models and offering guarantees for products/services, prices, quality, etc.

H1:

There is a difference between the age groups of consumers regarding the identification perceptions for business through consumers.

H2:

There is a difference in consumer income regarding the identification perceptions for business through consumers.

H3:

There is a difference between the genders of consumers regarding the identification perceptions for business through consumers.

H4:

There is a difference between the types of businesses during the purchase of consumer products/services regarding the identification perceptions for business through consumers.

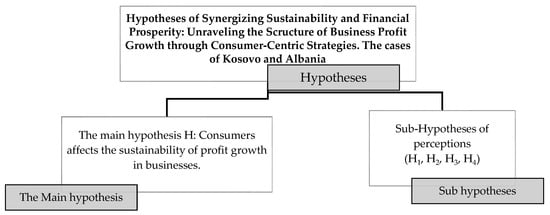

Figure 1 presents the elaboration of the hypotheses related to Section 2.1 and Section 2.2. Therefore, through the main hypothesis and under the supporting hypotheses, it is quite important to treat this research taking into account the review of the literature and the support in the results of this research to contribute to the advancement of knowledge about synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies. The cases of Kosovo and Albania are depicted below.

Figure 1.

Elaboration of hypotheses of synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies. The cases of Kosovo and Albania.

3. Research Methodology

3.1. The Purpose of the Paper

This research investigates the synergistic relationship between sustainability and financial prosperity in businesses, specifically focusing on the impact of consumers on business profit growth in Kosovo and Albania. Therefore, the main goal is how consumers can affect the sustainability of business profit growth, based on the questions raised about this goal, such as identifying consumer perceptions of their purchases, and what drives consumers to make business choices in the case of product/service purchases, as well as which types of businesses are most supported by (KOS and AL) consumers during their purchases. Through this research, the aim is to confirm the hypotheses based on the factors obtained in this study. Therefore, it is emphasized that this research: (a) Brings a new approach to business profit growth through consumer-centric strategies, (b) Analyzes the impact of consumers through perceptions, purchases, and reasons why consumers choose businesses ‘X’, (c) Provides new information for businesses on how they currently operate and how they should proceed with the consumer at the center. As mentioned in the Introduction, the questionnaire was completed by consumers and businesses (N = 200) using the Likert scale (from 1—I strongly disagree and I am dissatisfied to 5—I strongly agree and I am very satisfied).

Methods

In this research, data were collected from two countries (KOS and AL) through a survey completed with consumers (N = 200) and businesses (N = 200). In some businesses and among some of the consumers (N = 109), the completion of this survey was carried out in physical form, while in some others the completion was carried out by sending the online questionnaire (N = 91) together with a request for the participants advising them about their rights and that all data were confidential only to research the viability of the businesses. The questionnaire was filled out willingly because it was anonymous, and within the questionnaire, it was stated that the data are confidential for research purposes only. Approval was also received to set the general demographic data without specifying each respondent individually. In general, demographic data (gender, age, income, etc.) were set. Adherence to ethical rules and respondents’ desire to complete the questionnaire were ensured, clarifying every detail related to the research. Therefore, all participants (consumers and businesses) express their willingness to complete the questionnaire and to have more interviews, giving their opinions on the sustainability of business profit growth through consumers.

Furthermore, the two-way MANOVA analysis and the reliability analysis regarding the sustainability and financial prosperity of business profit growth through consumer-centric strategies, using the two-way MANOVA analysis tests (Levene’s test of equality of error variances, Box’s test of equality of covariance matrices, tests of between-subjects’ effects, homogeneous subsets), as well as the reliability analysis tests (Cronbach’s Alpha, Hotelling’s T-Squared, ANOVA with Tukey’s Test for Nonadditivity), were carried out. However, to see the contribution of other authors in the research regarding the analysis of two-way MANOVA in relation to the sustainability of business profit growth, according to (Grice and Iwasaki 2007), it is emphasized that MANOVA allows the identification and testing of multivariate effects related to the sustainability of business profit, making the adjustment of a certain set of factors for the three sessions elaborated on the purpose of the research. Whereas, according to (Grice and Iwasaki 2007), it is emphasized that MANOVA presents estimates of magnitudes and confidence intervals of perceptions, purchases, and reasons for business decisions to purchase products/services. So, Tukey’s Test was chosen for its effectiveness in analyzing nonadditivity in the data, which is crucial for meeting the study’s objectives. This method enhances the robustness of the findings and strengthens the basis for the conclusions drawn for both countries (KOS and AL).

In order to elaborate on the synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies, the mathematical equations elaborated by (Liu 2016) were taken as follows:

where and are the matrices S between the group of consumers in both countries, (F1.CO) Kosovo (KOS) and Albania (AL) or (CO.KOS and CO.AL), and within the groups (all factors and all variables of the synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies).

The three components of Equation (2) are consumers’ perception based on (X1, … X5) factors [Age (F2.A), Incomes (F3.INC), Gender (F4.G), and Businesses (F5.B)], which are presented as Matrix S of the synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies related to factors (X1, … X5), to the levels of variables (K) and to the combinations of the consumer-business model to look at the synergizing sustainability and financial prosperity (Liu 2016).

The MANOVA analysis model of business profit growth through consumer-centric strategies (S matrix) is denoted as:

Therefore, considering the business profit growth through consumer-centric strategies, for the sections and their interaction with the variables (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS), and factors (F1.CO, F2.A, F3.INC, F4.G, and F5.B), business profit growth through consumer-centric strategies identifying findings can be noted as follows:

or

- —the synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies

- —Consumer perceptions

- —Consumer purchases

- —Consumer-centric strategies (businesses and consumers in KOS and AL).

4. Results

This research study analyzes the results of two sections: one that explores the descriptive analysis related to synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies from the consumer’s perspective, and another that investigates consumer perceptions regarding the synergistic potential of sustainability and financial prosperity for all factors and variables. These sections provide valuable insights into the integration of sustainability and financial prosperity, providing a deeper understanding of consumer perspectives in this context for both countries (KOS and AL).

4.1. Descriptive Analysis of the Synergizing Sustainability and Financial Prosperity in the Context of Unraveling the Structure of Business Profit Growth through Consumer-Centric Strategies

In this section of the synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies, five factors were analyzed in two countries, Kosovo (KOS) and Albania (AL): The Country factor (F1.CO) with two sub-factors: F.1.1. CO. KOS (Kosovo) and F.1.2. CO. AL (Albania); age factor (F2.A) with six sub-factors: F2.1. A (15–25 years old), F2.2. A (26–35 years old), F2.3. A (36–45 years old), F2.4. A (46–55 years old), F2.4. A (46–55 years old), F2.5. A (56–65 years old), and F2.6. A (Over 65 years old); income factor (F3.INC) with four sub-factors: F3.1.INC (100–300 Euro), F3.2.INC (301–500 Euro), F3.3.INC (501–1000 Euro), and F3. 4.INC (Over 1000 Euro); gender factor (F4.G) with three sub-factors: F4.1. G (Men), F4.2. G (Women), and F4.3. G (I prefer not to answer); the factor of businesses that customers visit (F5.B) with four sub-factors: F5.1. B (Small businesses), F5.2. B (Medium businesses), F5.3. B (Big businesses), and F5.4. B (Big, medium, and small businesses).

Table 1 presents the descriptive analysis related to synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies. The cases of Kosovo and Albania: F1. CO (Country) includes two sub-factors as Kosovo (F1.1. CO. KOS) and Albania (F1.2. CO. AL); F2.A (Age) including these sub-factors as F2.1. A (15–25 years old), F2.2. A (26–35 years old), F2.3. A (36–45 years old), F2.4. A (46–55 years old), F2.5. A (56–65 years old), and F2.6. A (over 65); F3.INC (Income) including these sub-factors as F3.1.INC (100–300 euros), F3.2.INC (301–500 euros), F3.3.INC (501–1000 euros), and F3. 4. INC (over 1000 euros); furthermore, F4.G (gender) including such sub-factors as F4.1. G (Men), F4.2. G (Women), and F4.3. G (Prefer not to answer); finally, F5.B (Businesses you visit most) including these sub-factors as F5.1. B (small businesses), F5.2. B (medium businesses), F5.3. B (large businesses), and F5.4. B (small businesses, medium and large). According to the factor (F1.CO), it is noted that the biggest response was given by consumers from Albania (F1. CO. AL = 101). According to the factor (F2.A), it is noted that the consumers of the sub-factor (F2.2. A) or age (26–35 years = 57 consumers) gave the greatest response. According to the factor (F3.INC), it is noted that the consumers of the sub-factor (F3.3.INC) or (more income 501–1000 Euro = 84) gave the greatest response. According to the factor (F4.G), it is noted that the consumers of the sub-factor (F4.2. G) or of the female gender (Women = 159) gave the greatest response. According to the factor (F5.B), it is noted that the consumers of the sub-factor (F5.2B) or consumers who visit medium businesses (Medium businesses = 95) gave the greatest response.

Table 1.

Descriptive analysis of the synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies.

4.2. Synergizing Sustainability and Financial Prosperity through Identifying Consumer Perceptions

In this section, the data on the sustainability and financial prosperity of business profit growth were analyzed through the identification of consumer perceptions of products and services offered by businesses, as well as according to the identification of perceptions of consumers, which of the following factors have the greatest impact on the business profit growth:

- VAR1PSQ or Product/Service Quality;

- VAR2PSPS or Product/Service Purchase Speed;

- VAR3PSP or Product/Service Price;

- VAR4PSR or Product/Service Reliability;

- VAR5BSCS or Customer Support from the side of the business (employees) during the purchase of the product/service.

Using two-way MANOVA’s analysis tests (Levene’s Test of Equality of Error Variances, Box’s Test of Equality of Covariance Matrices, Tests of Between-Subjects Effects, and Homogeneous Subsets), as well as reliability analysis tests (Cronbach’s Alpha, Hotelling’s T-Squared, and ANOVA with Tukey’s Test for Nonadditivity).

4.2.1. Two-Way MANOVA Analysis

Table 2 presents the results of the MANOVA analysis tests (Levene’s Test of Equality of Error Variances, Box’s Test of Equality of Covariance Matrices, and Tests of Between-Subjects Effects) for the factors (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS). According to Levene’s Test of Equality of Error Variances, it is emphasized that the equality of variances has been ensured for each dependent variable according to the groups of independent variables. According to Box’s Test of Equality of Covariance Matrices, it is emphasized that the covariance matrices are equal since the p-value is greater than 0.05 (Sig. = 0.097). According to the Tests of Between-Subjects Effects and according to the significance value, it is emphasized that each of the factors (VAR1PSQ < 0.005, VAR2PSPS < 0.005, VAR3PSP < 0.005, VAR4PSR < 0.005, and VAR5BSCS < 0.005) has a significant impact on the business profit growth through the consumer-centric strategies or the identification of their perceptions. According to PES, it is noted that (VAR1PSQ = 0.907) or the quality of the product/service mostly affects the sustainability and financial prosperity in the context of the structure of business profit growth through the identification of consumer perceptions, then there are (VAR5BSCS = 0.838, VAR4PSR = 0.832) or customer support from the business side during purchase as well as reliability in products/services. Whereas, it least affects the sustainability of business profit (VAR2PSPS = 0.551) or the speed in purchasing products/services according to consumer perceptions.

Table 2.

MANOVA analysis.

Table 3 presents the results according to Homogeneous Subsets (F2.A) for the factors (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS) regarding the impact of groups on products/services acquisition and business profit growth. In terms of factor (VAR1PSQ), consumers of the age group of 56–65 years (F2.5A) emphasize that the quality of products/services is an important factor in the sustainability and financial prosperity of business, while consumers of the 15–25 age group (F2.1A) do not see it as an important factor. Regarding the factor (VAR2PSPS), consumers of the age group of 26–35 years (F2.2A) emphasize that the speed in purchasing products/services is an important factor in the business profit growth, while consumers of the 15–25 age group (F2.1A) do not see it as an important factor. In terms of factor (VAR3PSP), consumers of the age group over 65 years old (F2.6A) emphasize that the price is important in business profit growth, whereas consumers of the age group over 15–25 years old (F2.1A) do not see it as an important factor. Regarding the factor (VAR4PSR), consumers of the age group of 56–65 years (F2.5. A) emphasize that reliability affects the sustainability of business profit growth, whereas consumers aged over 65 (F2.6. A) do not see it as an important factor. Regarding the factor (VAR5BSCS), consumers of the age group over 65 years old (F2.6. A) emphasize that the support from the business (workers) during the purchase affects the sustainability and financial prosperity of business profit growth, while consumers in the age group of 15–25 years (F2.1. A) do not see it as an important factor.

Table 3.

Homogeneous Subsets (F2.A).

Table 4 presents the results according to Homogeneous Subsets (F3.INC) for the factors (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS) related to the impact of income on the purchase of products/services and business profit growth. Regarding the factor (VAR1PSQ), it is emphasized that consumers with the highest income of 100–300 euros (F3.1INC) do not demand high quality of products/services, affecting the instability of business profit, while the highest-income consumers above 1000 euros (F3.4 INC) demand quality of products/services. Regarding the factor (VAR2PSPS), it is noted that consumers with the income of 100–300 euros (F3.1INC) do not require speed during the purchase, whereas consumers with income above 1000 euros (F3.4 INC) demand speed during the purchase. Regarding the factor (VAR3PSP), it is emphasized that consumers with the highest income of 100–300 euros (F3.1INC) do not have the opportunity to buy products/services at higher prices, while consumers with incomes over 1000 euros (F3.4 INC) can afford it. Considering the factor (VAR4PSR), it is emphasized that consumers with incomes of 100–300 euros (F3.1INC) do not require great reliability in products/services due to low income, while the highest-income consumers above 1000 euros (F3.4 INC) require great reliability during the purchase. Regarding the factor (VAR5BSCS), it is noted that consumers with incomes of 100–300 euros (F3.1INC) require the most support from the business (employees) to guide them to the products where they have discounts, while consumers with the highest income of 501–1000 euros (F3.3 INC) do not require great support from the business (employees).

Table 4.

Homogeneous Subsets (F3.INC).

Table 5 presents the results according to Homogeneous Subsets (F4.G) for the factors (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS) regarding gender impact on the purchase of products/services and business profit growth. According to the factor (VAR1PSQ), male consumers (F4.1G) emphasize that quality affects the sustainability of business profit growth, while female consumers (F4.2G) think less about quality. According to the factor (VAR2PSPS), female consumers (F4.2G) emphasize that they do not desire speed when purchasing products/services, while male consumers (F4.1G) crave speed when purchasing. According to the factor (VAR3PSP), male consumers (F4.1G) do not look at the price when purchasing products, while female consumers (F4.2G) look at purchase prices. According to the factor (VAR4PSR), male consumers (F4.1G) demand reliability of products/services, while female consumers (F4.2G) do not think so. According to the factor (VAR5BSCS), male consumers (F4.1G) emphasize wanting support from the business (workers) when purchasing products/services, while female consumers (F4.2G) do not want great support from the business (employees).

Table 5.

Homogeneous Subsets (F4.G).

Table 6 presents the results according to Homogeneous Subsets (F5.B) for the factors (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS) regarding the impact of business size on the purchase of products/services by consumers and business profit growth. According to factors (VAR1PSQ), consumers emphasize that the quality of products/services is higher in large businesses (F5.3B), while lower in (F5.4B). According to the factor (VAR2PSPS), consumers point out that the speed during the purchase of products/services is greater in medium-sized businesses, while less in (F5.4B). According to the factor (VAR3PSP), consumers emphasize that prices are higher in large businesses (F5.B3), while lower in (F5.4B). According to the factor (VAR4PSR), consumers emphasize that the reliability of products/services is greater in small businesses (F5.B1), while lower in (F5.4B). According to the factor (VAR5BSCS), consumers emphasize that the support from the business (employees) during the purchase of products/services is greater in large businesses (F5.3B), while lower in small businesses (F5.1B).

Table 6.

Homogeneous Subsets (F5.B).

4.2.2. Reliability Analysis

Regarding the reliability analysis, the factors were analyzed (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS) for both countries, KOS and AL.

Table 7 presents the data reliability analysis for the factors (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS) for both countries, KOS and AL, through tests (Cronbach’s Alpha, Hotelling’s T-Squared and ANOVA with Tukey’s Test for Nonadditivity). According to Cronbach’s Alpha (0.809), it is emphasized that the data are reliable for sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies. According to Hotelling’s T-Squared Test (Sig. 0.000), it is emphasized that there is a significant difference between the factors related to the perceptions of consumers during the purchase of products/services. Therefore, the hypotheses (H1, H2, H3, and H4) are proven.

Table 7.

Reliability analysis.

5. Discussion

To clarify how the research of other researchers enriches the knowledge of this research regarding the synergizing sustainability and financial prosperity in the context of unraveling the structure of business profit growth through consumer-centric strategies, a connection was made between the research of other authors and the findings of this study. In the context of international instruments, (Panait et al. 2022) shed light on entities leveraging frameworks like the principles of the equator or non-financial reporting standards to create a positive image among stakeholders. However, the text suggests that such efforts may not always align with socially responsible behavior. Integrating sustainability practices into these international frameworks could be essential for businesses aiming to synergize financial prosperity with a genuine commitment to social responsibility. Furthermore, as highlighted by (Raimi et al. 2021), digitization and financial innovation provide avenues to attract new consumers to the financial system. However, this shift brings forth challenges related to the protection of personal data and cybersecurity. Balancing financial innovation with sustainable practices and consumer-centric strategies becomes paramount in navigating these challenges and ensuring a holistic approach to business growth. Additionally, the dynamic nature of the financial market, as emphasized by (Panait et al. 2023), calls for constant adaptation and improvement. According to (Lulaj 2023), achieving sustainable business profits through customer-centric strategies depends on several key factors, including the behavior of employees and staff, expedited processing of inquiries, pre- and post-purchase business support, and the provision of comprehensive information through applications such as discounts, product usage guidelines, expiration dates, product content details, available payment methods, as well as transportation services provided by the company to consumers.

In this case, to see the effect of product/service quality (VAR1PSQ) on business profit growth, according to (Li et al. 2022), it is noted that every day, the demand for high-quality products/services increases more and more to survive such a competitive business environment. Therefore, the way of centralized decision-making in the supply chain is favorable for improving the quality of service but not for improving the quality of the product. Regarding (VAR2PSPS) or product/service purchase speed, according to (Song et al. 2022), it is noted that product/service purchase time through accounting efficiency is improved by 41%. Regarding (VAR3PSP) or the price of the product/service, according to (Baghdadi et al. 2022), it is noted that consumers make decisions for purchasing products/services based on the cost–benefit balance. Further, according to (Lulaj and Iseni 2018), it is emphasized that the amount of products produced has a positive effect on the sustainability of profit growth, and that (Lulaj 2021) large businesses have a stronger financial position compared to small businesses. Related to (VAR4PSR) or product/service reliability, according to (Oldfrey et al. 2021), it is highlighted that customer reliability will increase if businesses consider reliable systems approaches, digital fabrication, repair and reuse, and product/service recovery.

Regarding (VAR5BSCS) or customer support from the business side (workers) during the purchase of the product/service, according to (Blštáková et al. 2020), it is emphasized that understanding, communication, and cooperation dominate in terms of business sustainability and financial prosperity. According to the results of the Homogeneous Subsets analysis, the findings for all factor variables (VAR1PSQ, VAR2PSPS, VAR3PSP, VAR4PSR, and VAR5BSCS) were highlighted. Therefore, according to (F2.A) for factors (VAR1PSQ: Sig. 0.184; VAR2PSPS: Sig. 0.994; VAR3PSP: Sig. 0.347; VAR4PSR: Sig. 0.638; and VAR5BSCS: Sig. 0.432), according to (F3.INC) for factors (VAR1PSQ: Sig. 0.495; VAR2PSPS: Sig. 0.953; VAR3PSP: Sig. 0.714; VAR4PSR: Sig. 0.265; and VAR5BSCS: Sig. 0.285), according to (F4.G) for factors (VAR1PSQ: Sig. 0.997; VAR2PSPS: Sig. 0.858; VAR3PSP: Sig. 0.768; VAR4PSR: Sig. 0.621; and VAR5BSCS: Sig. 0.065), according to (F5.B) for factors (VAR1PSQ: Sig. 0.791; VAR2PSPS: Sig. 0.970; VAR3PSP: Sig. 0.077; VAR4PSR: Sig. 0.198; and VAR5BSCS: Sig. 0.869), it is mentioned that it was identified that there is a difference between the perceptions of age groups, income, gender, and business size regarding all the factors and variables by which consumers affect the sustainability of profit growth in businesses. In this case, the sub-hypotheses (H1, H2, H3, and H4) were accepted; this was also confirmed through data reliability analysis (Cronbach’s Alpha = 87%). However, if it examined the differences in perceptions between the consumers of the two countries (KOS and AL) on factor 5, there are different perceptions; mainly, Albanian consumers support small businesses more for all variables, while Kosovo consumers support all types of businesses (small, medium and large). Therefore, it is concluded that since there are differences between age groups, income, gender, and business size concerning all factors and variables, as well as the sustainability of profit growth in businesses through consumer-centric strategies. Thus, the sub-hypotheses (H1, H2, H3, and H4) support the main hypothesis (H) that consumers affect the sustainability of profit growth in businesses.

6. Conclusions and Future Studies

In conclusion, this study has shed light on the intricate relationship between sustainability and financial prosperity in businesses, with a specific focus on consumer influence on profit growth in Kosovo (KOS) and Albania (AL). The research aimed to explore how consumers impact the sustainability of business profit growth, investigating consumer perceptions, purchasing behaviors, and the factors guiding their choices. The results of the study confirm the main hypothesis that consumers have a significant impact on the sustainability of corporate profit growth. Through the analysis of various factors and variables, including age groups, income, gender, and company size, it was found that these factors do indeed influence consumer perceptions, thereby affecting the sustainability of company profits. In addition, differences in consumer perceptions were observed between the two countries (KOS and AL), especially regarding the support of small businesses. Therefore, the sub-hypotheses (H1, H2, H3, and H4) supporting the main hypothesis (H) were validated, indicating that understanding consumer dynamics is crucial for businesses seeking sustainable profit growth. This research offers a fresh perspective by highlighting the pivotal role of consumers in shaping sustainability, financial prosperity, and business profit growth. It provides valuable insights for businesses, advocating for consumer-centric strategies to navigate and thrive in the marketplace. Practical recommendations have been outlined, including offering competitive prices, ensuring product/service quality, and expediting service delivery to enhance consumer engagement and drive profit growth sustainability. Academically, the study contributes to a deeper understanding of the dynamics between consumers and business success, through detailed analyses of relevant variables. However, limitations such as geographic scope and a limited number of variables exist, suggesting avenues for future research to extend the analysis to diverse business environments and countries for a more comprehensive understanding.

Author Contributions

Conceptualization, E.L., B.D., E.H. and M.C.V.; methodology, E.L. and B.D.; software, E.L. and B.D.; validation, E.L. and B.D.; formal analysis, E.L.; investigation, E.L., E.H. and M.C.V.; resources, E.L. and B.D.; data curation, E.L., E.H. and M.C.V.; writing—original draft preparation, E.L.; writing—review and editing, E.L., E.H. and M.C.V.; visualization, E.L.; supervision, E.L. and E.H.; project administration, E.L. and E.H.; funding acquisition, E.H. and M.C.V. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki, and ethical review and approval were waived for this study, for the reason that this study was conducted individually and independently by the institution where they work, respecting the anonymity of the interviewer.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data used to support and prove the findings of this study are available from the corresponding author upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Amirmokhtar Radi, Sanaz, and Sajjad Shokouhyar. 2021. Toward consumer perception of cellphones sustainability: A social media analytics. Sustainable Production and Consumption 25: 217–33. [Google Scholar] [CrossRef]

- Ardalan, Kavous. 2018. The “modern” in “modern finance”: A multi-paradigmatic look. Research in International Business and Finance 45: 475–87. [Google Scholar] [CrossRef]

- Baghdadi, Esmat, Mahmood Shafiee, and Babakalli Alkali. 2022. Upgrading Strategy, Warranty Policy and Pricing Decisions for Remanufactured Products Sold with Two-Dimensional Warranty. Sustainability 14: 7232. [Google Scholar] [CrossRef]

- Blštáková, Jana, Zuzana Joniaková, Nadežda Jankelová, Katarína Stachová, and Zdenko Stacho. 2020. Reflection of Digitalization on Business Values: The Results of Examining Values of People Management in a Digital Age. Sustainability 12: 5202. [Google Scholar] [CrossRef]

- Boianovsky, Mauro. 2021. Economists, scientific communities, and pandemics: An exploratory study of Brazil (1918–2020). EconomiA 22: 1–18. [Google Scholar] [CrossRef]

- Brombacher, Aarnout Cornelis, Peter C. Sander, Peter J. M. Sonnemans, and Jan L. Rouvroye. 2005. Managing product reliability in business processes ‘under pressure’. Reliability Engineering & System Safety 88: 137–46. [Google Scholar] [CrossRef]

- Chen, Fuzan, Aijun Lu, Harris Wu, and Minqiang Li. 2022. Compensation and pricing strategies in cloud service SLAs: Considering participants’ risk attitudes and consumer quality perception. Electronic Commerce Research and Applications 56: 101215. [Google Scholar] [CrossRef]

- Grice, James W., and Michiko Iwasaki. 2007. A truly multivariate approach to MANOVA. Applied Multivariate Research 12: 199–226. [Google Scholar] [CrossRef]

- Hagens, Nathan John. 2020. Economics for the future—Beyond the superorganism. Ecological Economics 169: 106520. [Google Scholar] [CrossRef]

- Huang, Hongfu, Feng Liu, and Peng Zhang. 2021. To outsource or not to outsource? Warranty service provision strategies considering competition, costs and reliability. International Journal of Production Economics 242: 108298. [Google Scholar] [CrossRef]

- Hysa, Eglantina, and Mimi Hoxha. 2014. Does financial aid help or harm developing countries: Case of Albania. EuroEconomica, 33. [Google Scholar]

- Hysa, Eglantina, and Naqeeb Ur Rehman. 2021. Economic Growth Through Financial Development: Empirical Evidences from New Member States and Western Balkan Countries. In International Conference on Economic Scientific Research-Theoretical, Empirical and Practical Approaches. Cham: Springer International Publishing, pp. 49–67. [Google Scholar] [CrossRef]

- Hysa, Eglantina, Minhas Akbar, Ahsan Akbar, Iges Banda, and Simona Andreea Apostu. 2023. Renewable energy through the lenses of financial development and technological innovation: The case of CEE Countries. LUMEN Proceedings 19: 82–96. [Google Scholar] [CrossRef]

- Jung, Jin Ho, Jay Jaewon Yoo, and Todd J. Arnold. 2021. The influence of a retail store manager in developing frontline employee brand relationship, service performance and customer loyalty. Journal of Business Research 122: 362–72. [Google Scholar] [CrossRef]

- Jushi, Esmeralda, Eglantina Hysa, Arjona Cela, Mirela Panait, and Marian Catalin Voica. 2021. Financing Growth through Remittances and Foreign Direct Investment: Evidences from Balkan Countries. Journal of Risk and Financial Management 14: 117. [Google Scholar] [CrossRef]

- Kacani, Jolta, Lindita Mukli, and Eglantina Hysa. 2022. A Framework for Short- vs. Long-Term Risk Indicators for Outsourcing Potential for Enterprises Participating in Global Value Chains: Evidence from Western Balkan Countries. Journal of Risk and Financial Management 15: 401. [Google Scholar] [CrossRef]

- Kamal, Muhammad Mustafa, Rosnida Mamat, Sachin Kumar Mangla, Patanjal Kumar, Stella Despoudi, Manoj Dora, and Benny Tjahjono. 2022. Immediate return in circular economy: Business to consumer product return information sharing framework to support sustainable manufacturing in small and medium enterprises. Journal of Business Research 151: 379–96. [Google Scholar] [CrossRef]

- Le, Long Hoang, and Quang-An Ha. 2021. Effects of negative reviews and managerial responses on consumer attitude and subsequent purchase behavior: An experimental design. Computers in Human Behavior 124: 106912. [Google Scholar] [CrossRef]

- Li, Weiping, and Daxiang Jin. 2018. On the design of financial products along OBOR. The Journal of Finance and Data Science 4: 55–70. [Google Scholar] [CrossRef]

- Li, Yiling, Xiaowei Lin, Xideng Zhou, and Minglin Jiang. 2022. Supply Chain Quality Decisions with Reference Effect under Supplier Competition Environment. Sustainability 14: 14939. [Google Scholar] [CrossRef]

- Liu, Xian. 2016. Chapter 2—Traditional methods of longitudinal data analysis. In Methods and Applications of Longitudinal Data Analysis. New York: Academic Press, pp. 19–59. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2021. Quality and reflecting of financial position: An enterprises model through logistic regression and natural logarithm. Journal of Economic Development Environment and People 10: 26–50. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2023. A sustainable business profit through customers and its impacts on three key business domains: Technology, innovation, and service (TIS). Business, Management and Economics Engineerin 21: 19–47. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, Aishwarya Gopalakrishnan, and Kafayat Kehinde Lamidi. 2024. Financing and Investing in Women-Led Businesses: Understanding Strategic Profits and Entrepreneurial Expectations by Analysing the Factors That Determine Their Company Success. Periodica Polytechnica Social and Management Sciences. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, and Blerta Dragusha. 2022. Incomes, Gaps and Well-Being: An Exploration of Direct Tax Income Statements Before and During COVID-19 through the Comparability Interval. International Journal of Professional Business Review 7: e0623. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, and Etem Iseni. 2018. Role of Analysis CVP (Cost-Volume-Profit) as Important Indicator for Planning and MakingDecisions in the Business Environment. European Journal of Economics 4: 104. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, Blerta Dragusha, and Eglantina Hysa. 2023. Investigating Accounting Factors through Audited Financial Statements in Businesses toward a Circular Economy: Why a Sustainable Profit through Qualified Staff and Investment in Technology? Administrative Sciences 13: 72. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, Ismat Zarin, and Shawkat Rahman. 2022. A Novel Approach to Improving E-Government Performance from Budget Challenges in Complex Financial Systems. Complexity 2022: 2507490. [Google Scholar] [CrossRef]

- Macintosh, Norman B., Teri Shearer, Daniel B. Thornton, and Michael Welker. 2000. Accounting as simulacrum and hyperreality: Perspectives on income and capital. Accounting, Organizations and Society 25: 13–50. [Google Scholar] [CrossRef]

- Manta, Otilia, Eglantina Hysa, and Alba Kruja. 2021. Finances and National Economy: Frugal Economy as a Forced Approach of the COVID Pandemic. Sustainability 13: 6470. [Google Scholar] [CrossRef]

- Massimo, Battaglia, and Annesi Nora. 2022. Barriers to organizational learning and sustainability: The case of a consumer cooperative. Journal of Co-operative Organization and Management 10: 100182. [Google Scholar] [CrossRef]

- Morina, Fatbardha, Eglantina Hysa, Uğur Ergün, Mirela Panait, and Marian Catalin Voica. 2020. The effect of exchange rate volatility on economic growth: Case of the CEE countries. Journal of Risk and Financial Management 13: 177. [Google Scholar] [CrossRef]

- Moro, Suzana Regina, Paulo Augusto Cauchick-Miguel, and Glauco Henrique de Sousa Mendes. 2022. Adding sustainable value in product-service systems business models design: A conceptual review towards a framework proposal. Sustainable Production and Consumption 32: 492–504. [Google Scholar] [CrossRef]

- O’Connor, Fergal, Brian Lucey, Jonathan Batten, and Dirk G Baur. 2015. The financial economics of gold—A survey. International Review of Financial Analysis 41: 186–205. [Google Scholar] [CrossRef]

- Oldfrey, Ben, Giulia Barbareschi, Priya Morjaria, Tamara Giltsoff, Jessica Massie, Mark Miodownik, and Catherine Holloway. 2021. Could Assistive Technology Provision Models Help Pave the Way for More Environmentally Sustainable Models of Product Design, Manufacture and Service in a Post-COVID World? Sustainability 13: 10867. [Google Scholar] [CrossRef]

- Panait, Mirela, Eglantina Hysa, and Lukman Raimi. 2023. Catching up with sustainable development in emerging markets through financial innovation. In Innovation and Sustainable Manufacturing. Cambridge: Woodhead Publishing, pp. 125–49. [Google Scholar] [CrossRef]

- Panait, Mirela, Lukman Raimi, Eglantina Hysa, and Abiodun S. Isiaka. 2022. CSR Programs of Financial Institutions: Development-Oriented Issues or Just Greenwashing? In Creativity Models for Innovation in Management and Engineering. Hershey: IGI Global, pp. 110–37. [Google Scholar] [CrossRef]

- Pym, Denis. 1980. Towards the dual economy and emancipation from employment. Futures 12: 223–37. [Google Scholar] [CrossRef]

- Raimi, Lukman, Mirela Panait, and Eglantina Hysa. 2021. Financial inclusion in ASEAN countries–A gender gap perspective and policy prescriptions. LUMEN Proceedings 15: 38–55. [Google Scholar] [CrossRef]

- Rajagopal. 2020. Barriers and Benefits Towards Sustainability Driven Business Models. Encyclopedia of Renewable and Sustainable Materials 5: 318–27. [Google Scholar] [CrossRef]

- Rehman, Naqeeb Ur, and Eglantina Hysa. 2021. The effect of financial development and remittances on economic growth. Cogent Economics & Finance 9: 1932060. [Google Scholar] [CrossRef]

- Respício, Ana, and Dulce Domingos. 2015. Reliability of BPMN Business Processes. Procedia Computer Science 64: 643–50. [Google Scholar] [CrossRef]

- Schaefers, Tobias, Marina Leban, and Florian Vogt. 2022. On-demand features: Consumer reactions to tangibility and pricing structure. Journal of Business Research 139: 751–61. [Google Scholar] [CrossRef]

- Song, Wei, Shuailei Yuan, Yun Yang, and Chufeng He. 2022. A Study of Community Group Purchasing Vehicle Routing Problems Considering Service Time Windows. Sustainability 14: 6968. [Google Scholar] [CrossRef]

- Stevenson, Harold W., and J. Russell Nelson. 1967. Profits in the Modern Economy: Selected Paper from a Conference on Understanding Profits. Available online: https://www.jstor.org/stable/10.5749/j.cttttkh2 (accessed on 25 February 2024).

- Thomas, John, and Pam Mantri. 2022. Design for financial sustainability. Patterns 3: 100585. [Google Scholar] [CrossRef] [PubMed]

- Tierney, Kieran D., Ingo Oswald Karpen, and Kate Westberg. 2022. Brand meaning and institutional work: The light and dark sides of service employee practices. Journal of Business Research 151: 244–56. [Google Scholar] [CrossRef]

- Tyla, Benjamin, and Armelle Gomez. 2022. The hidden face of the value in eco-design tools2: Theoretical basis of an essential concept. Sustainable Production and Consumption 31: 794–804. [Google Scholar] [CrossRef]

- Wang, Chong, Yanqing Wang, Jixiao Wang, Jiuling Xiao, and Jian Liu. 2021. Factors influencing consumers’ purchase decision-making in O2O business model: Evidence from consumers’ overall evaluation. Journal of Retailing and Consumer Services 61: 102565. [Google Scholar] [CrossRef]

- World Bank. 2024a. World Bank. Available online: https://www.worldbank.org/en/country/albania/overview#1 (accessed on 29 March 2024).

- World Bank. 2024b. World Bank. Available online: https://www.worldbank.org/en/country/kosovo/overview#3 (accessed on 29 March 2024).

- Xie, Lishan, Xinhua Guan, Xunliang Lin, and Tzung-Cheng Huand. 2020. Triad collaboration of hotel employers, employees and customers for service innovation in a changing world. Journal of Hospitality and Tourism Management 44: 10–18. [Google Scholar] [CrossRef]

- Zheng, Bing, Hui Wang, Amir-Mohammad Golmohammadi, and Alireza Goli. 2022. Impacts of logistics service quality and energy service of Business to Consumer (B2C) online retailing on customer loyalty in a circular economy. Sustainable Energy Technologies and Assessments 52: 102333. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).