The Impact of Uncertain Welfare Quality on Equity Market Performance

Abstract

1. Introduction

The Trends of Countries’ Welfare Uncertainty

2. Investors’ Sentiment and Stock Returns

3. Welfare Dimensions of Financial Markets

4. Indicators of Equity Market Performance

5. Data and Variables

5.1. Data

5.2. Dependent Variables

5.3. Independent Variables

6. Results and Discussion

6.1. Effects of Welfare Quality on Market Capitalization as a Percentage of GDP

6.2. Effects of Welfare Quality on the Market Capitalization of Listed Domestic Companies

6.3. Effects of Welfare Quality on the Turnover Ratio of Domestic Stocks

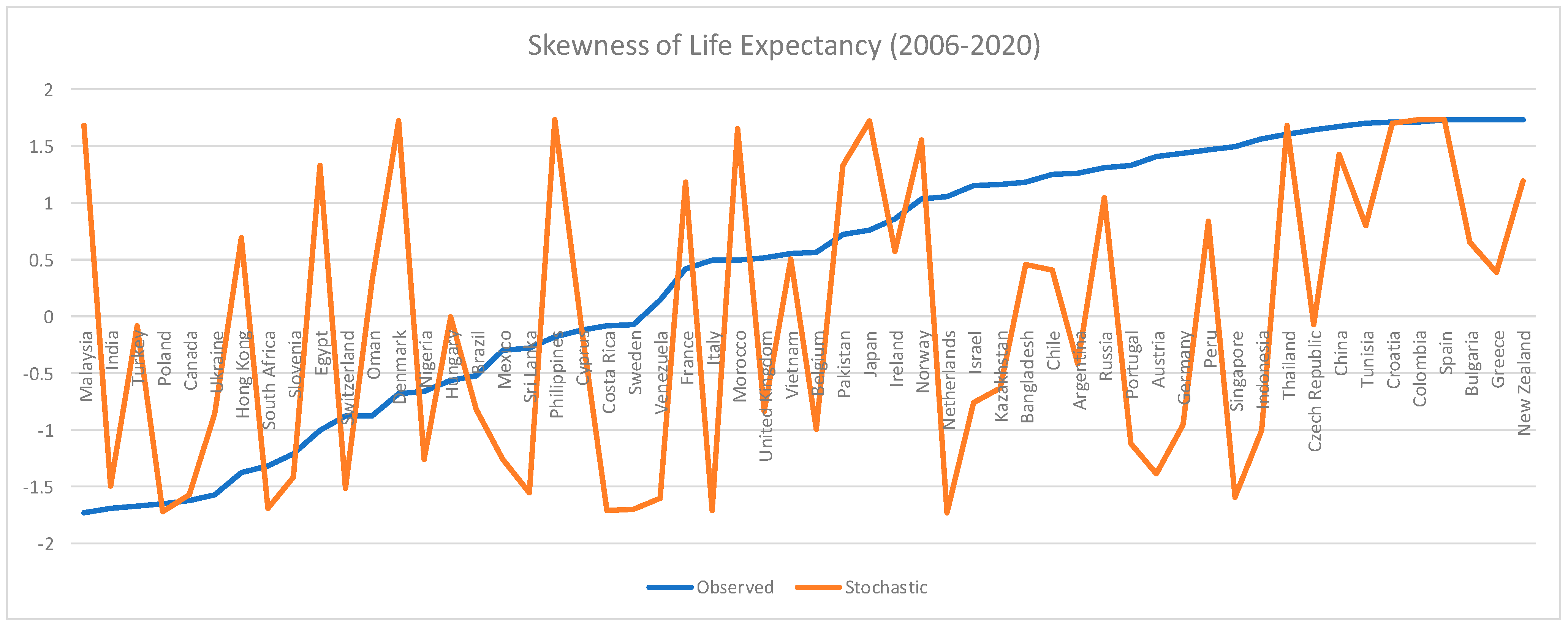

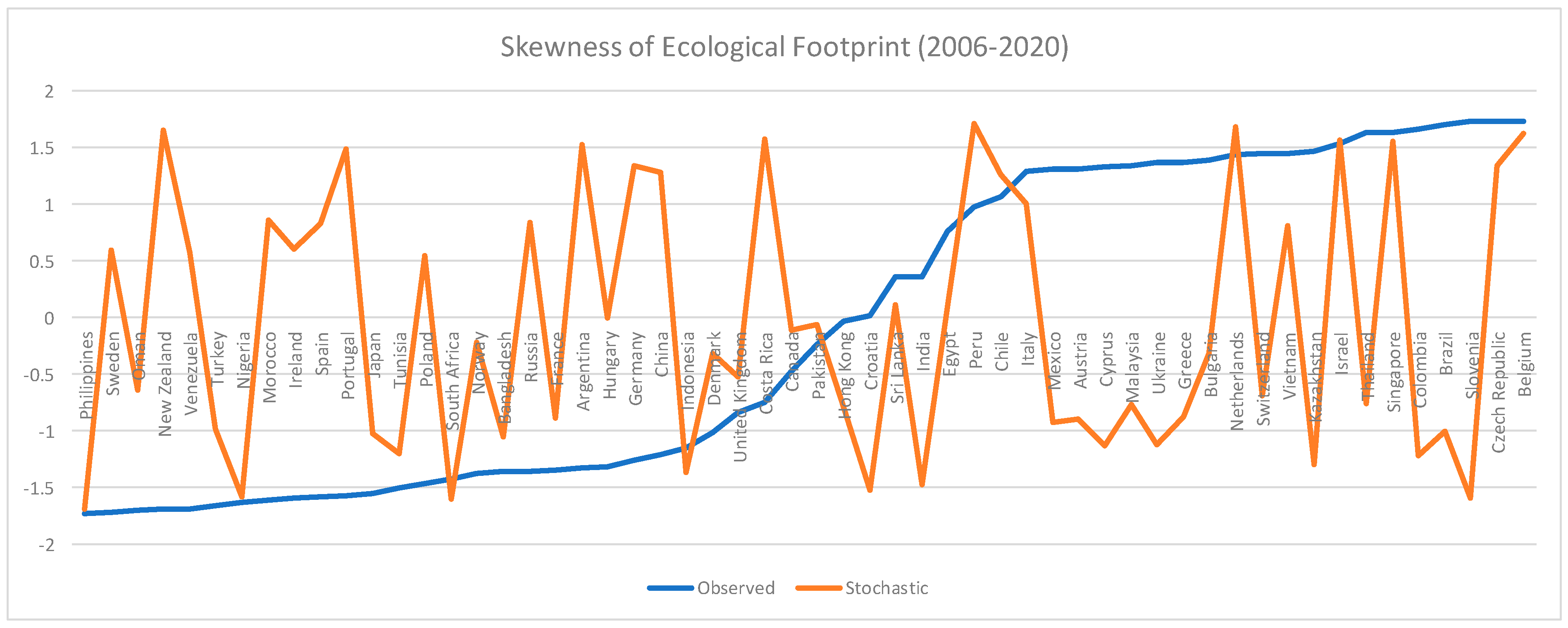

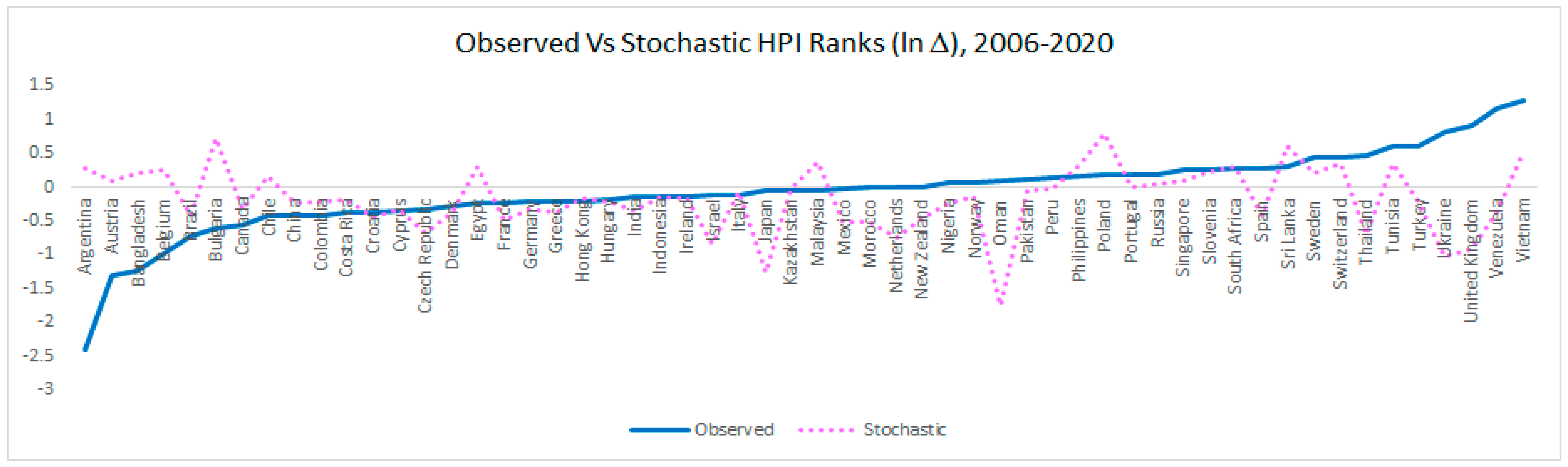

6.4. Expected Welfare Quality and Equity Market Performance: Implications from Stochastic Simulation

7. Conclusions

7.1. The Behavioral Perspectives of Equity Market Development

7.2. Institutional Perspectives on Equity Market Development

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Market Capitalization as a Percentage of GDP | Market Capitalization of Listed Domestic Companies (ln) | Y6 = Turnover Ratio of Domestic Stocks | Ln Life Satisfaction Score | Ln Life Expectancy Score | Ln Ecological Footprint Score | Africa | Middle East & North Africa | Caribbean & West Pacific | Western World | Central & South America | Asia | Former Communist Countries | Sub-Saharan Africa | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 1.445 | 25.732 | 50.927 | 1.831 | 4.310 | 1.140 | 0.009 | 0.111 | 0.111 | 0.316 | 0.031 | 0.036 | 0.160 | 0.027 |

| Standard Error | 0.318 | 0.064 | 1.933 | 0.006 | 0.003 | 0.022 | 0.003 | 0.011 | 0.011 | 0.016 | 0.006 | 0.006 | 0.012 | 0.005 |

| Mode | 0.038 | 21.115 | 60.700 | 1.932 | 4.297 | 0.182 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Kurtosis | 120.933 | −0.332 | 12.564 | −0.190 | 7.423 | −0.268 | 109.9 | 4.245 | 4.245 | −1.374 | 27.816 | 23.712 | 1.500 | 33.289 |

| Skewness | 10.038 | −0.260 | 3.072 | −0.648 | −2.322 | −0.769 | 10.53 | 2.492 | 2.492 | 0.799 | 5.438 | 5.050 | 1.867 | 5.916 |

| Range | 124.257 | 8.506 | 348.208 | 0.859 | 0.655 | 2.785 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Minimum | −2.926 | 21.115 | 1.803 | 1.281 | 3.770 | −0.554 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Maximum | 121.330 | 29.622 | 350.011 | 2.140 | 4.426 | 2.231 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Count | 869 | 869 | 869 | 869 | 869 | 869 | 869 | 869 | 869 | 869 | 869 | 869 | 869 | 869 |

Appendix B

| Market Capitalization as a Percentage of GDP | Ln Market Capitalization of Listed Domestic Companies | Turnover Ratio of Domestic Stocks | |

|---|---|---|---|

| F stat (MacKinnon one-sided p values) | 167.4 *** | 137.9 *** | 485.6 *** |

Appendix C

| Stock Market Performance Indicators | Test Statistic (Significance) |

|---|---|

| Market capitalization of listed domestic companies (% of GDP) | F (3, 793) = 2.8538 ** |

| LN Market capitalization of listed domestic companies (current USD) | F (3, 793) = 5.5654 *** |

| Turnover Ratio of Domestic Stocks | F (3, 793) = 4.7783 *** |

Appendix D

| Stock Market Performance Indicators | Market Capitalization as a Percentage of GDP | LN Market Capitalization of Listed Domestic Companies | Turnover Ratio of Domestic Stocks |

|---|---|---|---|

| Test Statistic (significance) | (3) = 0.9851 | (3) = 4.157 | (3) = 5.83 |

Appendix E

| Stock Market Performance Indicators | Test Statistic (Significance) |

|---|---|

| Market capitalization of listed domestic companies (% of GDP) | (3) = 8.32446 ** |

| LN Market capitalization of listed domestic companies (current USD) | (3) = 9.66267 ** |

| Turnover Ratio of Domestic Stocks | (3) = 9.76335 ** |

Appendix F

| Pillars of Happy Planet Index | Market Capitalization as a Percentage of GDP | LN Market Capitalization of Listed Domestic Companies | Turnover Ratio of Domestic Stocks |

|---|---|---|---|

| Ln Life Satisfaction score | −2.3766 ** | −0.6766 | 2.55911 ** |

| Ln Life Expectancy score | 0.5119 * | 2.13256 ** | −1.2289 |

| Ln Ecological Footprint score | 1.19602 | 1.26895 | 2.438 ** |

| 1 | It is worth noting that two indicators of equity market development turn out to be impractical in this paper as they are insignificant statistically across the three pillars of HPI. The two indicators are (1) Total Value of Traded Stocks as percentage of GDP and (2) Total Number of Listed Domestic Companies |

References

- Abdallah, S., Michaelson, J., Shah, S., Stoll, L., & Marks, N. (2012). The happy planet index 2012 report. A global index of sustainable well-being. New Economics Foundation. [Google Scholar]

- Abdallah, S., Sam, H., Michaelson, J., & Marks, N. (2009). The happy planet index 2.0: Why good lives don’t have to cost. The New Economics Foundation. [Google Scholar]

- Acemoglu, D., & Johnson, S. (2007). Disease and development: The effect of life expectancy on economic growth. Journal of Political Economy, 115(6), 925–985. [Google Scholar] [CrossRef]

- Aggarwal, S., Kumar, S., & Goel, U. (2019). Stock market response to information diffusion through internet sources: A literature review. International Journal of Information Management, 45, 118–131. [Google Scholar] [CrossRef]

- Akerlof, G. A., & Shiller, R. J. (2009). Animal spirits: How human psychology drives the economy, and why it matters for global capitalism. Princeton University Press. [Google Scholar]

- Angeletos, G. M., & Pavan, A. (2009). Policy with dispersed information. Journal of the European Economic Association, 7(1), 11–60. [Google Scholar] [CrossRef]

- Atkinson, A. B. (1999). The contributions of amartya sen to welfare economics. Scandinavian Journal of Economics, 101(2), 173–190. [Google Scholar] [CrossRef]

- Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross-section of stock returns. Journal of Finance, 61, 1645–1680. [Google Scholar] [CrossRef]

- Barajas, A., Chami, R., & Yousefi, S. R. (2013). The finance and growth nexus re-examined: Do all countries benefit equally [IMF Working Papers, WP/13/130]. International Monetary Fund. [Google Scholar]

- Barberis, N., Huang, M., & Santos, T. (2001). Prospect theory and asset prices. The Quarterly Journal of Economics, 116(1), 1–53. [Google Scholar] [CrossRef]

- Basu, S., Pascali, L., Schiantarelli, F., & Serven, L. (2022). Productivity and the welfare of nations. Journal of the European Economic Association, 20(4), 647–1682. [Google Scholar] [CrossRef]

- Benjamin, D. J., Guzman, J. D., Fleurbaey, M., Heffetz, O., & Kimball, M. (2023). What do happiness data mean? Theory and survey Evidence. Journal of the European Economic Association, 21(6), 2377–2412. [Google Scholar] [CrossRef]

- Bernheim, B. D. (2009). Behavioral welfare economics. Journal of the European Economic Association, 7(2–3), 267–319. [Google Scholar] [CrossRef]

- Bernheim, B. D., & Rangel, A. (2009). Beyond revealed preference: Choice-theoretic foundations for behavioral welfare economics. The Quarterly Journal of Economics, 124(1), 51–104. [Google Scholar] [CrossRef]

- Blau, B. (2018). Income inequality, poverty, and the liquidity of stock markets. Journal of Development Economics, 130, 113–126. [Google Scholar] [CrossRef]

- Boersch-Supan, A. H., & Winter, J. K. (2001). Population aging, savings behavior and capital markets [NBER Working Paper No. 8561]. National Bureau of Economic Research. [Google Scholar]

- Bondarchika, J., Nska-Sabukab, M. J., Linnanena, L., & Kauranne, T. (2016). Improving the objectivity of sustainability indices by a novel approach for combining contrasting effects: Happy planet index revisited. Ecological Indicators, 69, 400–406. [Google Scholar] [CrossRef]

- Bouacida, E., & Martin, D. (2021). Predictive power in behavioral welfare economics. Journal of the European Economic Association, 19(3), 1556–1591. [Google Scholar] [CrossRef]

- Bramoullé, Y., & Treich, N. (2009). Can uncertainty alleviate the commons problem? Journal of the European Economic Association, 7, 1042–1067. [Google Scholar] [CrossRef]

- Brown, S., & Taylor, K. (2010). Social interaction and stock market participation: Evidence from British panel data [IZA Discussion Papers, No. 4886]. Institute for the Study of Labor (IZA). [Google Scholar]

- Brulé, G. (2022). Evaluation of existing indices of sustainable well-being and propositions for improvement. Sustainability, 14, 1027. [Google Scholar] [CrossRef]

- Choi, H. (2017). The effect of longevity risks on the performance of stock market. Investment Management and Financial Innovations, 14(1.1), 173–180. [Google Scholar] [CrossRef]

- Costanza, R., de Groot, R., Sutton, P., van der Ploeg, S., Anderson, S. J., Kubiszewski, I., Farber, S., & Turner, K. R. (2014). Changes in the global value of ecosystem services. Journal of Global Environmental Change, 26, 152–158. [Google Scholar] [CrossRef]

- Dang, A.-T. (2014). Amartya sen’s capability approach: A framework for well-being evaluation and policy analysis? Review of Social Economy, 72(4), 460–484. [Google Scholar] [CrossRef]

- Deaton, A. (2008). Income, health and wellbeing around the world: Evidence from the gallup world poll. Journal of Economic Perspectives, 22, 53–72. [Google Scholar] [CrossRef]

- Deaton, A. (2012). The financial crisis and the well-being of Americans. Oxford Economic Papers, 64(1), 1–26. [Google Scholar] [CrossRef]

- Delis, M., & Mylonidis, N. (2015). Trust, happiness, and households’ financial decision. Munich Personal RePEc Archive, 9, 64906. [Google Scholar] [CrossRef]

- De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Noise trader risk in financial markets. Journal of Political Economy, 98, 703–738. [Google Scholar] [CrossRef]

- Demirguc-Kunt, A., & Levine, R. (1996). Stock market development and financial intermediaries: Stylized facts. The World Bank Economic Review, 10, 291–321. [Google Scholar] [CrossRef]

- Easterlin, R. A. (2003). Explaining happiness. Proceedings of the National Academy of Science, 100(19), 11176–11183. [Google Scholar] [CrossRef] [PubMed]

- Engelberg, J., & Parsons, C. (2016). Worrying about the stock market: Evidence from hospital admissions. Journal of Finance, 71(3), 1227–1250. [Google Scholar] [CrossRef]

- Evans, M. D., & Hnatkovska, V. V. (2007). Financial integration, macroeconomic volatility, and welfare. Journal of the European Economic Association, 5(2–3), 500–508. [Google Scholar] [CrossRef]

- Feduzi, A., & Runde, J. (2011). The uncertain foundations of the welfare state. Journal of Economic Behavior & Organization, 80, 613–627. [Google Scholar]

- Fellowes, M. (2016). Living too frugally? Economic sentiment & spending among older americans. United Income Inc. [Google Scholar]

- Galina, A., Iryna, S., & Sergii, K. (2015). Analysis of the global stock market trends. Journal of Finance and Economics, 3(4), 67–71. [Google Scholar]

- Garcia, V., & Liu, L. (1999). Macroeconomic determinants of stock market development. Journal of Applied Economics, 2(1), 29–59. [Google Scholar] [CrossRef]

- Gastwirth, J. L., Gel, Y. R., & Miao, W. (2009). The impact of levene’s test of equality of variances on statistical theory and practice. Statistical Science, 24(3), 343–360. [Google Scholar] [CrossRef]

- Gromb, D., & Vayanos, D. (2010). A model of financial market liquidity based on intermediary Capital. Journal of the European Economic Association, 8(2–3), 456–466. [Google Scholar] [CrossRef]

- Hall, A. R. (2005). Generalized method of moments. Oxford University Press Inc. [Google Scholar]

- Hansen, L. P. (1982). Large sample properties of generalized method of moments estimators. Econometrica, 50(4), 1029–1054. [Google Scholar] [CrossRef]

- Harris, R. (2010). Life expectancy and ecological footprint: Societal sustainability and health equity. The International Journal of Environmental, Cultural, Economic, and Social Sustainability: Annual Review, 6(4), 187–200. [Google Scholar] [CrossRef]

- Hausman, J. A. (1978). Specification tests in econometrics. Econometrica, 46(6), 1251–1271. [Google Scholar] [CrossRef]

- Hausman, J. A., & Taylor, W. E. (1981). Panel data and unobservable individual effects. Econometrica, 49(6), 1377–1398. [Google Scholar] [CrossRef]

- Hayashi, F. (2000). Econometrics. Princeton University Press. [Google Scholar]

- Hicks, J. R. (1939). The foundations of welfare economics. The Economic Journal, 49(196), 711–712. [Google Scholar] [CrossRef]

- Hill, R. C., Griffiths, W. E., & Lim, G. C. (2011). Principles of econometrics (4th ed.). John Wiley & Sons, Inc. [Google Scholar]

- Ho, S. Y., & Lyke, B. N. (2017). Determinants of stock market development: A review of the literature. Studies in Economics and Finance, 34(1), 143–164. [Google Scholar] [CrossRef]

- Hong, H., Kubik, J. D., & Stein, J. C. (2004). Social interaction and stock-market participation. The Journal of Finance, 59(1), 137–163. [Google Scholar] [CrossRef]

- Isen, A. M. (2000). Positive Affect and Decision Making. In M. Lewis, & J. M. Haviland-Jones (Eds.), Handbook of emotions (pp. 417–435). Guilford Press. [Google Scholar]

- Kahneman, D., & Riepe, M. W. (1998). Aspects of investor psychology. Journal of Portfolio Management, 24, 52–65. [Google Scholar] [CrossRef]

- Kahneman, D., & Tversky, A. (1972). Subjective probability: A judgment of representativeness. Cognitive Psychology, 3, 430–454. [Google Scholar] [CrossRef]

- Kahneman, D., & Tversky, A. (1973). On the psychology of prediction. Psychological Review, 80, 237–251. [Google Scholar] [CrossRef]

- Kaldor, N. (1939). Welfare propositions of economics and interpersonal comparisons of utility. The Economic Journal, 49(195), 549–552. [Google Scholar] [CrossRef]

- Karp, L., & Traeger, C. (2024). Smart cap. Journal of the European Economic Association, 23(2), 554–593. [Google Scholar] [CrossRef]

- Keynes, J. M. (1936). The general theory of employment, interest and money. McMillan. [Google Scholar]

- Kim, D., Chung, C. Y., Kim, K. S., & Sul, H. K. (2019). Daily stock trading by investor type and information asymmetry: Evidence from the korean market. Emerging Markets Finance & Trade, 55, 13–28. [Google Scholar]

- Kim, S. H., & Kim, D. (2014). Investor sentiment from internet message postings and the predictability of stock return. Journal of Economic Behavior & Organization, 107, 708–709. [Google Scholar]

- Kim, S. W., & Lee, B. S. (2008). Stock returns, asymmetric volatility, risk aversion, and business cycle: Some new evidence. Journal of Economic Inquiry, 46(2), 48–131. [Google Scholar] [CrossRef]

- Kruskal, W. H., & Wallis, W. A. (1952). Use of ranks in one-criterion variance analysis. Journal of the American Statistical Association, 47(260), 583–621. [Google Scholar] [CrossRef]

- Lall, S. (1981). Welfare economics and development problems. In Developing countries in the international economy: Selected papers. The Macmillan Press Ltd. [Google Scholar]

- Larson, D. A., & Wilford, W. T. (1979). On the physical quality of life index and evaluating economic welfare between nations. Economics Letters, 3, 193–197. [Google Scholar] [CrossRef]

- Le Breton, M. (1991). Stochastic orders in welfare economics. Stochastic orders and decision under risk. Stochastic Orders and Decision under Risk, 19, 190–206. [Google Scholar]

- Lee, C., Shleifer, A., & Thaler, R. (1991). Investor sentiment and the closed-end fund puzzle. The Journal of Finance, 46(1), 75–109. [Google Scholar]

- Levene, H. (1960). Robust tests for equality of variances. In I. Olkin (Ed.), Contributions to probability and statistics (pp. 278–292). Stanford University Press. [Google Scholar]

- Levine, R., & Zervos, S. (1998). Capital control liberalization and stock market development. World Development, 26, 1169–1183. [Google Scholar] [CrossRef]

- Liang, P., & Guo, S. (2015). Social interaction, internet access and stock market participation: An empirical study in China. Journal of Comparative Economics, 43, 883–901. [Google Scholar] [CrossRef]

- Lintner, J. (1965). Security prices, risk and maximal gains from diversification. Journal of Finance, 20, 587–616. [Google Scholar]

- Little, I. M. D. (1957). A critique of welfare economics. Clarendon Press. [Google Scholar]

- Liu, Z., & Spiegel, M. M. (2011). Boomer retirement: Headwinds for US equity markets? FRBSF Economic Letter, 26. Available online: https://www.frbsf.org/wp-content/uploads/el2011-26.pdf (accessed on 21 July 2023).

- Loewenstein, G., & Small, D. A. (2007). The scarecrow and the tin man: The vicissitudes of human sympathy and caring. Review of General Psychology, 11, 112–126. [Google Scholar] [CrossRef]

- Mandler, M. (2014). Indecisiveness in behavioral welfare economics. Journal of Economic Behavior & Organization, 97, 219–235. [Google Scholar]

- Marks, N., Abdallah, S., Simms, A., & Thompso, S. (2006). The happy planet index. New Economics Foundation. [Google Scholar]

- Merkle, C., & Egan, D. (2015). Investor happiness. Journal of Economic Psychology, 49, 167–186. [Google Scholar] [CrossRef]

- Molinari, M. C. (2014). A second best theory of institutional quality. Public Organization Review: A Global Journal, 14(4), 545–559. [Google Scholar] [CrossRef]

- Murphy, D. (2016). Welfare consequences of asymmetric growth. Journal of Economic Behavior & Organization, 126, 1–17. [Google Scholar]

- Nayak, A. R., & Pradhan, K. C. (2024). Institutional quality and economic performance: A study of asian countries. Millennial Asia. [Google Scholar] [CrossRef]

- Nazir, M., Nawaz, M., & Gilani, U. (2010). Relationship between economic growth and stock market development. African Journal of Business Management, 4(16), 3473–3479. [Google Scholar]

- New Economic Foundation. (2016). The happy planet index 2016: A global index of sustainable wellbeing. Available online: https://happyplanetindex.org (accessed on 18 January 2023).

- Nunnally, J. C., & Bernstein, I. H. (1994). Psychometric theory. McGraw-Hill. [Google Scholar]

- Orlitzky, M. (2005). Payoffs to social and environmental performance. Journal of Investing, 14(3), 48–51. [Google Scholar] [CrossRef]

- Oyinlola, M. A., & Adedeji, A. (2019). Human capital, financial sector development and inclusive growth in sub-Saharan Africa. Journal of Economic Change and Restructuring, 52(1), 43–66. [Google Scholar] [CrossRef]

- Pagano, M. (1993). Financial markets and growth: An overview. European Economic Review, 37, 613–622. [Google Scholar] [CrossRef]

- Porshnev, A. V., Lakshina, V. V., & Redkin, I. E. (2016). Using emotional markers’ frequencies in stock market ARMAX-GARCH Model. CEUR Workshop Proceeding: Experimental Economics and Machine Learning, 1627, 61–72. [Google Scholar]

- Ramsey, J. B. (1969). Tests for specification errors in classical linear least squares regression analysis. Journal of Royal Statistical Society B, 31(2), 350–371. [Google Scholar] [CrossRef]

- Rick, S., & Loewenstein, G. (2008). The role of emotion in economic behavior (3rd ed.). Guilford Press. [Google Scholar]

- Risius, M., Akolk, F., & Beck, R. (2015). Differential emotions and the stock market—The case of company-specific trading. [ECIS 2015 Completed Research Papers. Paper 147]. AIS Electronic Library (AISeL). [Google Scholar] [CrossRef]

- Robinson, J. (2019). A socioecological approach to measure progress for ontario’s transition to a green economy: The use of the happy planet index [Master’s thesis, York University]. [Google Scholar]

- Salomons, R., & Grootveld, H. (2003). The equity risk premium: Emerging vs. developed markets. Emerging Markets Review, 4, 121–144. [Google Scholar] [CrossRef]

- Sapra, S. (2005). A regression error specification test (RESET) for generalized linear models. Economics Bulletin, 3(1), 1–6. [Google Scholar]

- Seetanah, B., & Ramessur, S. (2008). Financial development and economic growth. Journal of Economic Studies, 36, 124–134. [Google Scholar] [CrossRef]

- Sen, A. K. (1988). Freedom of choice, concept and content. European Economic Review, 32(2–3), 269–294. [Google Scholar] [CrossRef]

- Sen, A. K. (1990). Justice: Means versus freedoms. Philosophy & Public Affairs, 19(2), 111–121. [Google Scholar]

- Sgroi, D., Hills, T., O’Donnell, G., Oswald, A., & Proto, E. (2017). Understanding happiness: A CAGE Policy report. Social Market Foundation. [Google Scholar]

- Sharpe, W. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442. [Google Scholar]

- Shleifer, A. (2000). Inefficient markets: An introduction to behavioral finance. Oxford University Press. [Google Scholar]

- Siganos, A., Vagenas-Nanos, E., & Verwijmeren, P. (2017). Divergence of sentiment and stock market trading. Journal of Banking and Finance, 78, 130–141. [Google Scholar] [CrossRef]

- Smales, L. (2014). The relationship between financial asset returns and the well-being of US households. Applied Economics Letters, 21(17), 1184–1188. [Google Scholar] [CrossRef]

- Smith, G. T., McCarthy, D. M., & Zapolski, T. C. B. (2009). On the value of homogeneous constructs for construct validation, theory testing, and the description of psychopathology. Psychological Assessment, 21(3), 272–284. [Google Scholar] [CrossRef] [PubMed]

- Straussi, M. E., & Smithii, G. T. (2009). Construct validity: Advances in theory and methodology. Annual Review of Clinical Psychology, 5(1), 1–25. [Google Scholar] [CrossRef]

- Stubbs, W., Higgins, C., & Milne, M. (2013). Why do companies not produce sustainability reports? Business Strategy and the Environment, 22, 456–470. [Google Scholar] [CrossRef]

- Thorsten, B., & Levine, R. (2003). Stock markets, banks, and growth: Panel evidence. Journal of Banking and Finance, 28, 423–442. [Google Scholar]

- Thursby, J. G., & Schmidt, P. (1977). Some properties of tests for specification error in a linear regression. Journal of the American Statistical Association, 72(359), 635–641. [Google Scholar] [CrossRef]

- Thursby, J. G., & Schmidt, P. (1979). Alternative specification error tests: A comparative study. Journal of the American Statistical Association, 74(365), 222–225. [Google Scholar] [CrossRef]

- Van Hoorn, A. (2008). Income, leisure, and happiness. Nijmegen Center for Economics (NICE). [Google Scholar]

- Vives, A., & Wadhwa, B. (2012). Sustainability indices in emerging markets: Impacts on responsible practices and financial market development. Journal of Sustainable Finance and Investment, 2, 318–337. [Google Scholar]

- Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69(6), 709–748. [Google Scholar] [CrossRef]

- Wooldridge, J. M. (2025). Introductory econometrics—A Modern approach (8th ed.). Cengage Learning. [Google Scholar]

- Wurgler, J. (2000). Financial markets and the allocation of capital. Journal of Financial Economics, 58, 187–214. [Google Scholar] [CrossRef]

- Zhang, W., Li, X., Shen, D., & Teglio, A. (2016). Daily happiness and stock return: Some international evidence. Physica A, 460, 201–209. [Google Scholar] [CrossRef]

| Test | Test Value |

|---|---|

| Levene’s Test for Equality of Variances | (F = 81.57); p value = 0.00 |

| Kruskal–Wallis Test for equality of Medians | Chi-Square, df (153.9, 2); p Value = 0.00 |

| Variables | Life Satisfaction | Life Expectancy | Ecological Footprint | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Y1 | Y2 | Y3 | Y1 | Y2 | Y3 | Y1 | Y2 | Y3 | |

| Constant | −0.035 (−2.7) *** | −0.007 (−0.371) | −0.025 (−1.38) | 0.43 (1.1) | −0.041 (−0.92) | 1.012 (0.972) | 0.445 (1.51) | 0.003 (0.171) | −0.27 (−0.32) |

| Ln Life Satisfaction score | 0.589 (2.533) ** | −0.463 (−1.43) | 0.296 (1.991) ** | ||||||

| Ln Life Expectancy score | 0.1326 (1.911) ** | 3.007 (1.226) | −0.66 (−2.39) *** | ||||||

| Ln Ecological Footprint score | 0.217 (2.937) ** | 0.183 (2.698) ** | 7.27 (0.69) | ||||||

| Low HPI (Dummy) | −0.036 (−2.96) ** | −0.0014 (−0.047) | −0.021 (−2.06) ** | 0.3799 (0.53) | 0.0075 (0.405) | 2.784 (1.153) | −0.401 (−2.63) ** | −0.016 (−0.46) | 0.413 (0.191) |

| High HPI (Dummy) | 0.029 (0.643) | 0.125 (2.78) *** | 0.037 (0.79) | −0.154 (−2.75) *** | 0.101 (2.27) ** | −1.38 (−0.64) | −0.169 (−0.85) | 0.111 (2.65) ** | −1.852 (−0.834) |

| Regions (Dummies) | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Effect (Dummy) | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 812 | 812 | 812 | 812 | 812 | 812 | 812 | 812 | 812 |

| 0.135 | 0.115 | 0.143 | 0.1429 | 0.3334 | 0.153 | 0.0422 | 0.1332 | 0.14 | |

| S.E. of regression | 0.2111 | 0.2393 | 0.2102 | 3.454 | 0.2414 | 16.992 | 3.450 | 0.237 | 16.59 |

| J-statistic (Prob.) | 8.72 (0.068) | 6.449 (0.167) | 9.548 (0.048) | 9.8849 (0.0424) | 4.622 (0.3282) | 13.697 (0.0083) | 1.269 (0.866) | 15.88 (0.0071) | 6.884 (0.195) |

| Durbin-Watson stat | 2.3102 | 1.949 | 2.471 | 2.003 | 1.8368 | 2.942 | 1.997 | 1.929 | 2.968 |

| Variables | Life Satisfaction | Life Expectancy | Ecological Footprint | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Y1 | Y2 | Y3 | Y1 | Y2 | Y3 | Y1 | Y2 | Y3 | |

| Constant | −0.1612 (−3.17) *** | 0.0628 (1.874) ** | 0.035 (0.11) | 0.7527 (1.447) | −0.004 (−0.04) | 0.4428 (0.514) | 1.1685 (0.597) | 0.1835 (0.593) | 1.7290 (0.300) |

| Ln Life Satisfaction | 2.78 (2.68) *** | 1.162 (2.103) ** | 1.2192 (3.367) *** | ||||||

| Ln Life Expectancy | −29.795 (−0.823) | 3.12582 (0.414) | −40.559 (−0.5939) | ||||||

| Ln Ecological Footprint | −7.8612 (−0.38) | −1.871 (−0.581) | −18.386 (−0.308) | ||||||

| Low HPI (Dummy) | 0.072 (2.71) ** | −0.032 (−0.540) | −0.065 (−2.84) ** | 2.147 (1.385) | −0.0309 (−0.525) | 6.0715 (1.049) | 1.710 (0.550) | −0.1698 (−0.546) | 5.889 (0.701) |

| High HPI (Dummy) | −0.0102 (−0.096) | 0.094 (3.340) *** | 0.0870 (0.497) | 0.21889 (0.5538) | 0.0846 (2.29) ** | 0.4115 (0.594) | 0.326 (0.28) | 0.2217 (1.05) | 0.9543 (0.294) |

| Regions (Dummies) | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Effect (Dummy) | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 812 | 812 | 812 | 812 | 812 | 812 | 812 | 812 | 812 |

| 0.1625 | 0.4024 | 0.1971 | 0.1331 | 0.1550 | 0.1309 | 0.1727 | 0.1290 | 0.1529 | |

| S.E. of regression | 0.3679 | 0.2813 | 0.3188 | 9.4094 | 0.2439 | 35.09 | 9.5868 | 0.4695 | 35.467 |

| J-statistic (Prob.) | 3.9382 (0.047) | 4.1878 (0.0407) | 4.17977 (0.0401) | 0.1377 (0.7105) | 1.5358 (0.215) | 1.2303 (0.2673) | 0.0814 (0.7752) | 0.9868 (0.320515) | 1.05204 (0.305) |

| Durbin-Watson stat | 2.2115 | 1.9039 | 2.244 | 2.0082 | 1.9041 | 2.0112 | 1.9635 | 1.9216 | 1.998 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Eldomiaty, T.; Azzam, I.; El Kolaly, H.; Youssef, N.; Sedik, M.A.; ElShahawy, R. The Impact of Uncertain Welfare Quality on Equity Market Performance. Int. J. Financial Stud. 2025, 13, 67. https://doi.org/10.3390/ijfs13020067

Eldomiaty T, Azzam I, El Kolaly H, Youssef N, Sedik MA, ElShahawy R. The Impact of Uncertain Welfare Quality on Equity Market Performance. International Journal of Financial Studies. 2025; 13(2):67. https://doi.org/10.3390/ijfs13020067

Chicago/Turabian StyleEldomiaty, Tarek, Islam Azzam, Hoda El Kolaly, Nermeen Youssef, Marwa Anwar Sedik, and Rehab ElShahawy. 2025. "The Impact of Uncertain Welfare Quality on Equity Market Performance" International Journal of Financial Studies 13, no. 2: 67. https://doi.org/10.3390/ijfs13020067

APA StyleEldomiaty, T., Azzam, I., El Kolaly, H., Youssef, N., Sedik, M. A., & ElShahawy, R. (2025). The Impact of Uncertain Welfare Quality on Equity Market Performance. International Journal of Financial Studies, 13(2), 67. https://doi.org/10.3390/ijfs13020067