Platform Operations under Dual-Channel Catering Supply Chain

Abstract

:1. Background

2. Literature Review

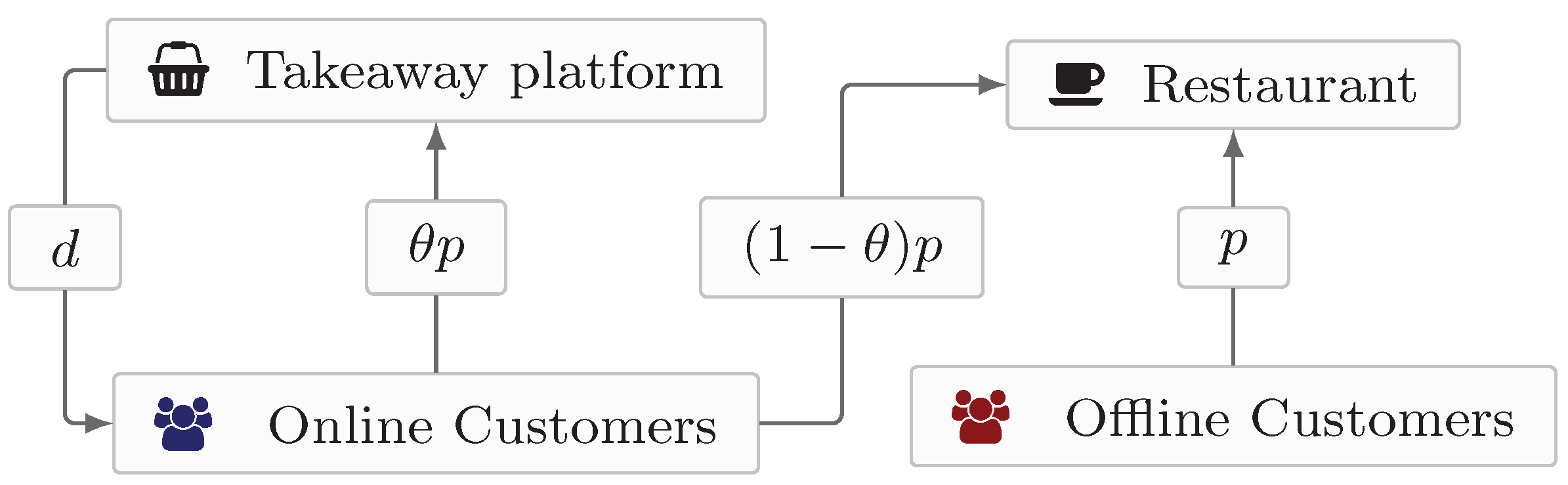

3. Model

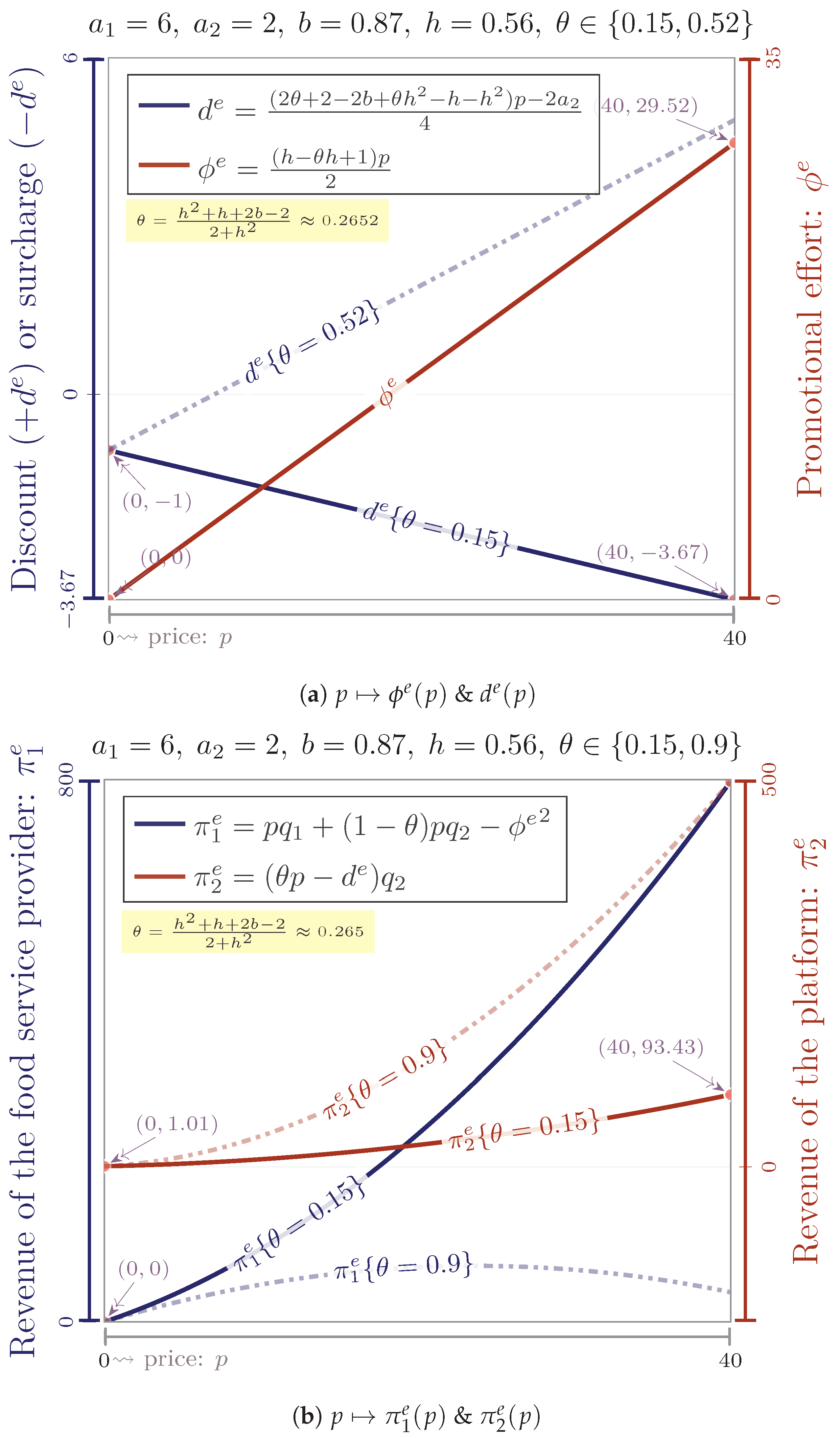

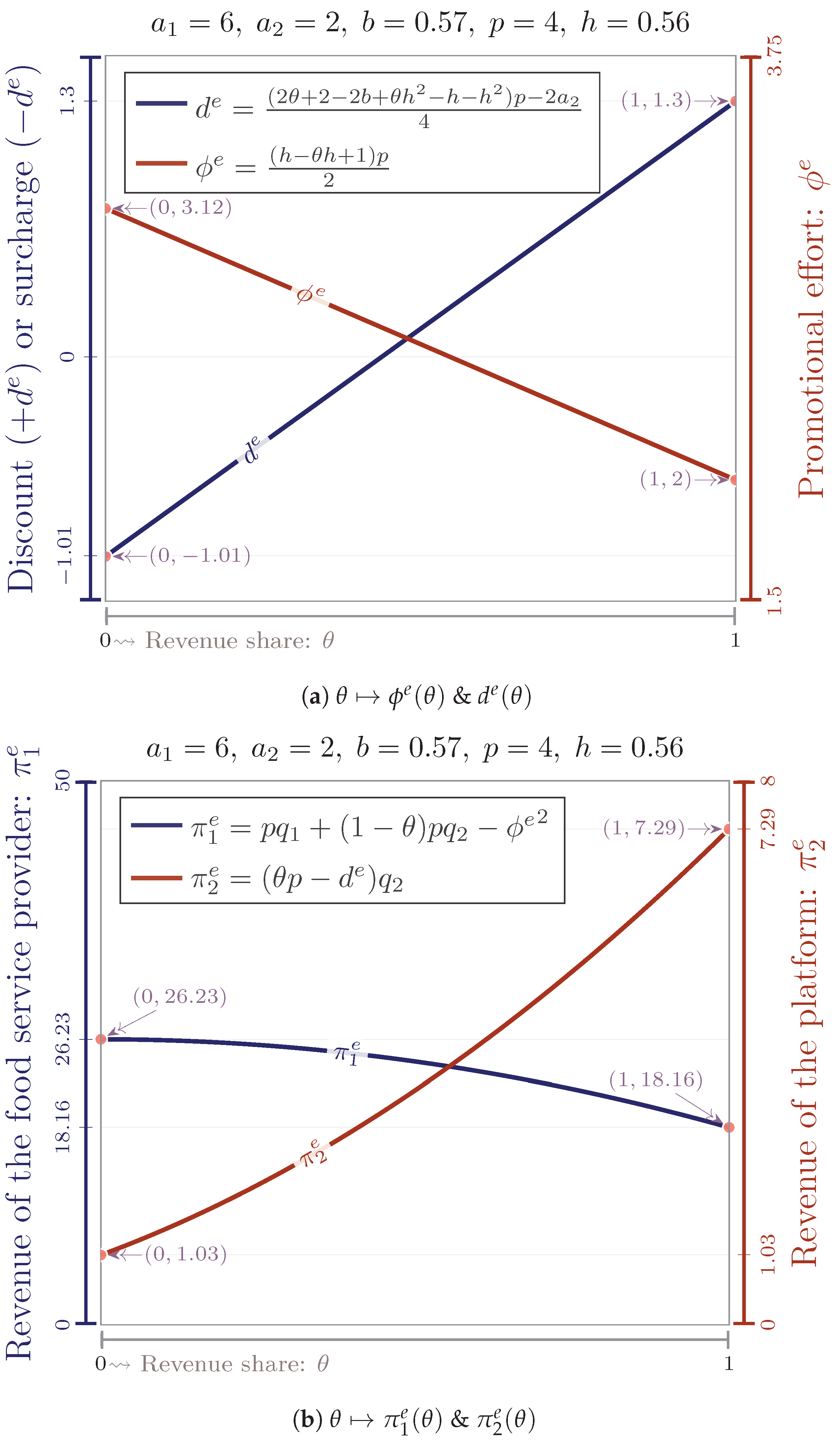

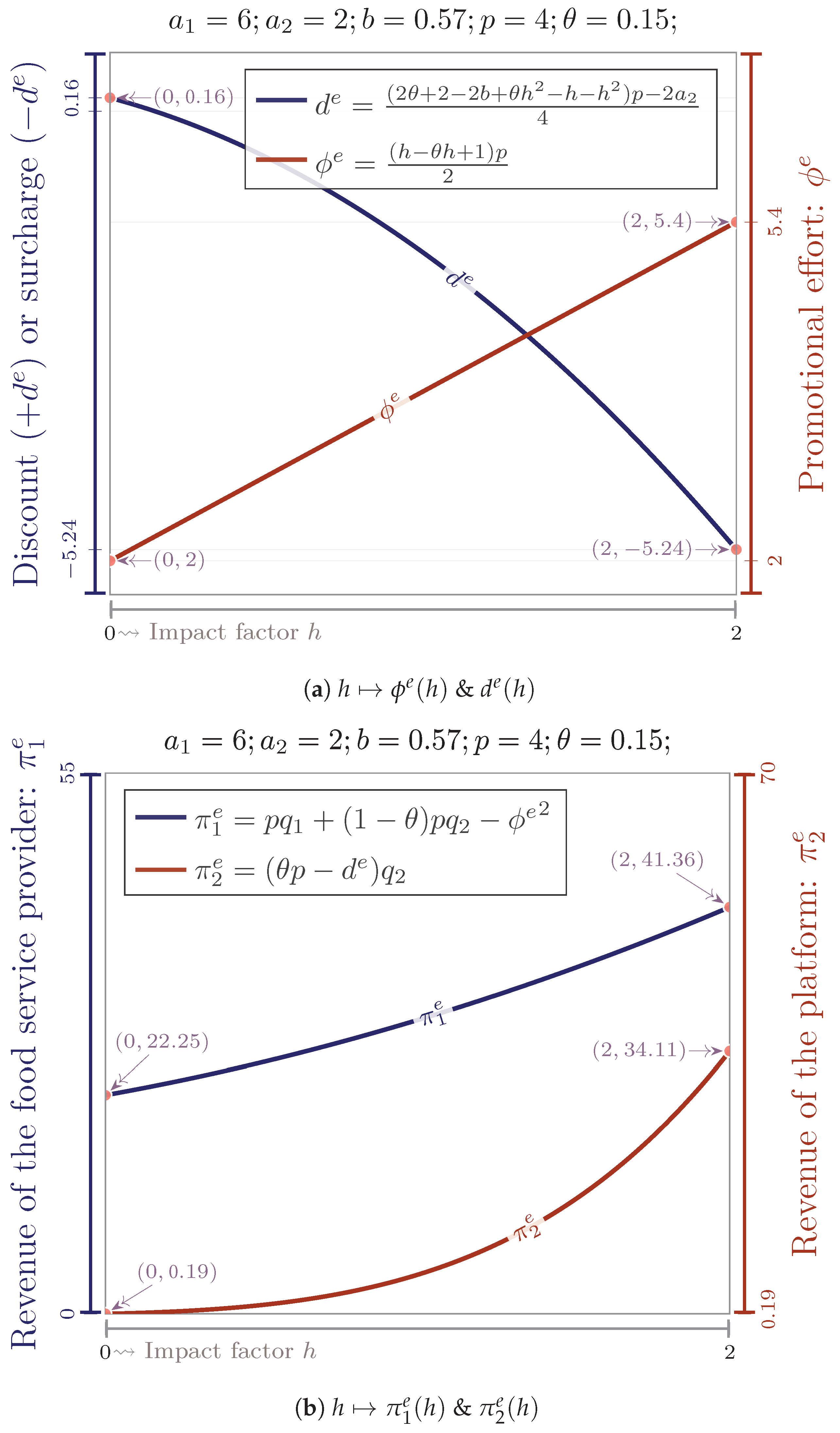

3.1. Decentralized Decision Model

- (i)

- If , increase in p, else decreases in p, and if , increase in p, else decreases in p;

- (ii)

- strictly decreases b, and strictly increases b;

- (iii)

- strictly increases in θ; If , decreases in θ, else increases in θ;

- (iv)

- if , increase in h but decrease in h, else decreases in h but increase in h.

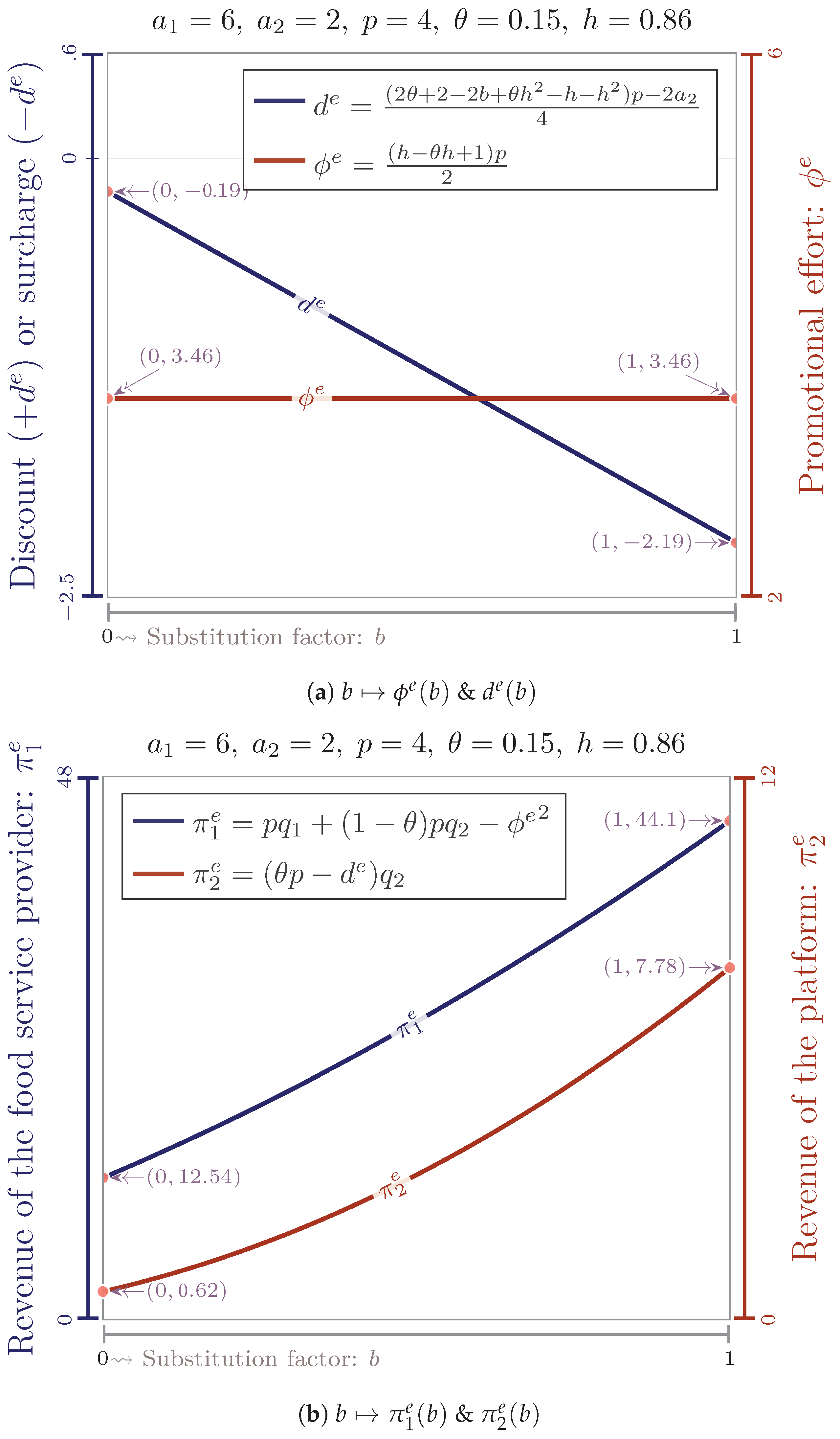

3.2. Equilibrium Decision Model

- (i)

- strictly decreases in b, h, but increases in θ;

- (ii)

- if , increases in p, else decreases in p;

- (iii)

- strictly increases in p and h, but decreases in θ.

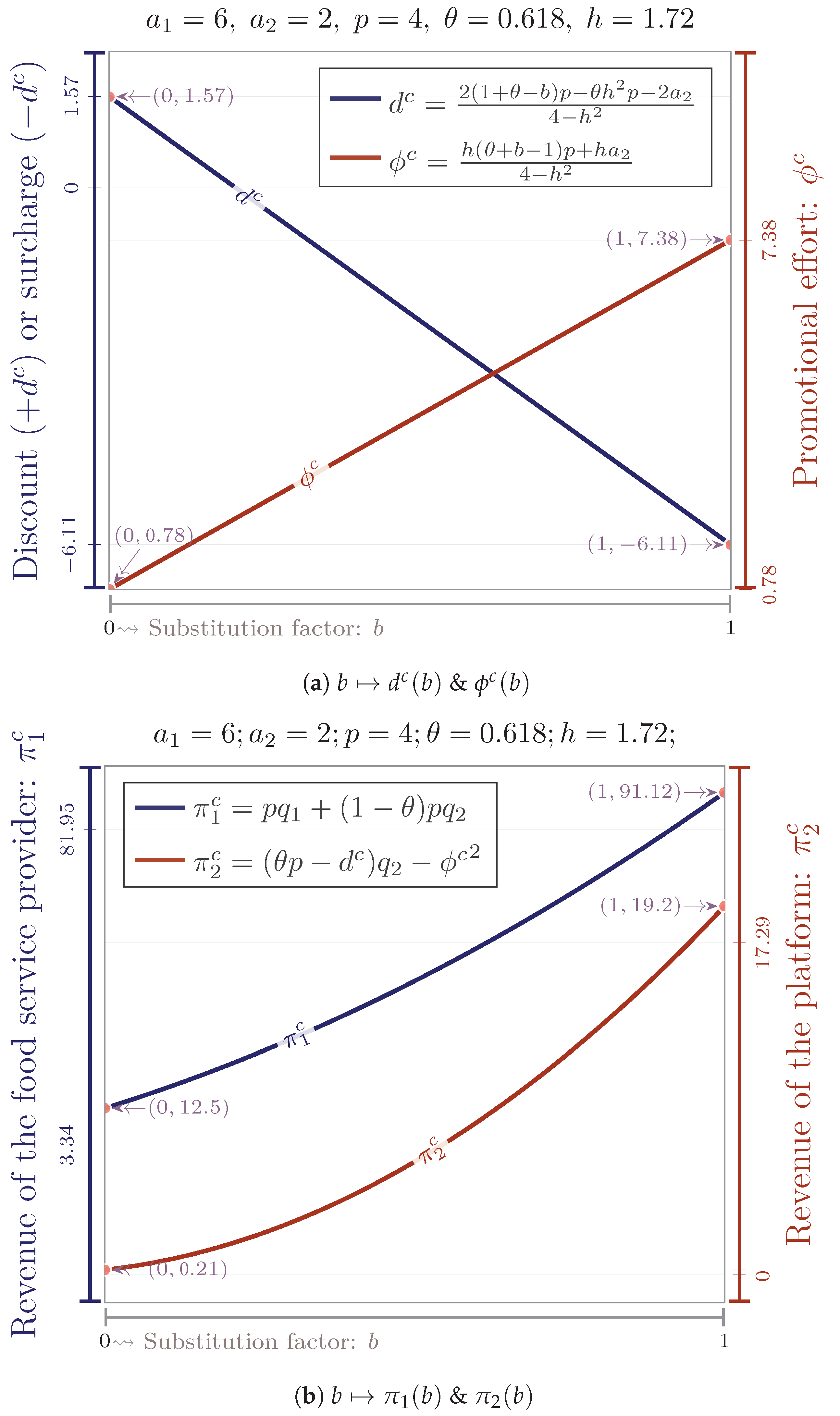

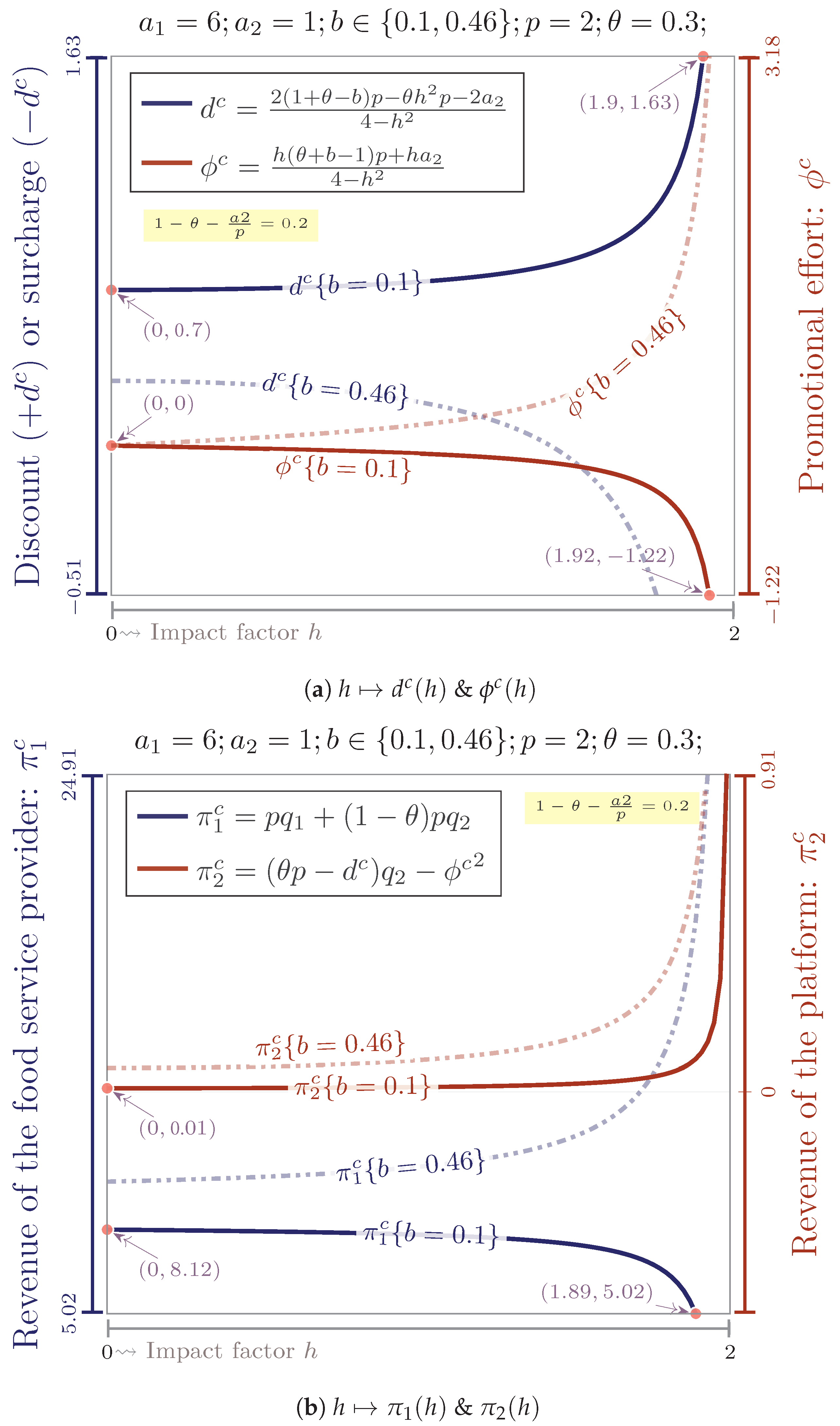

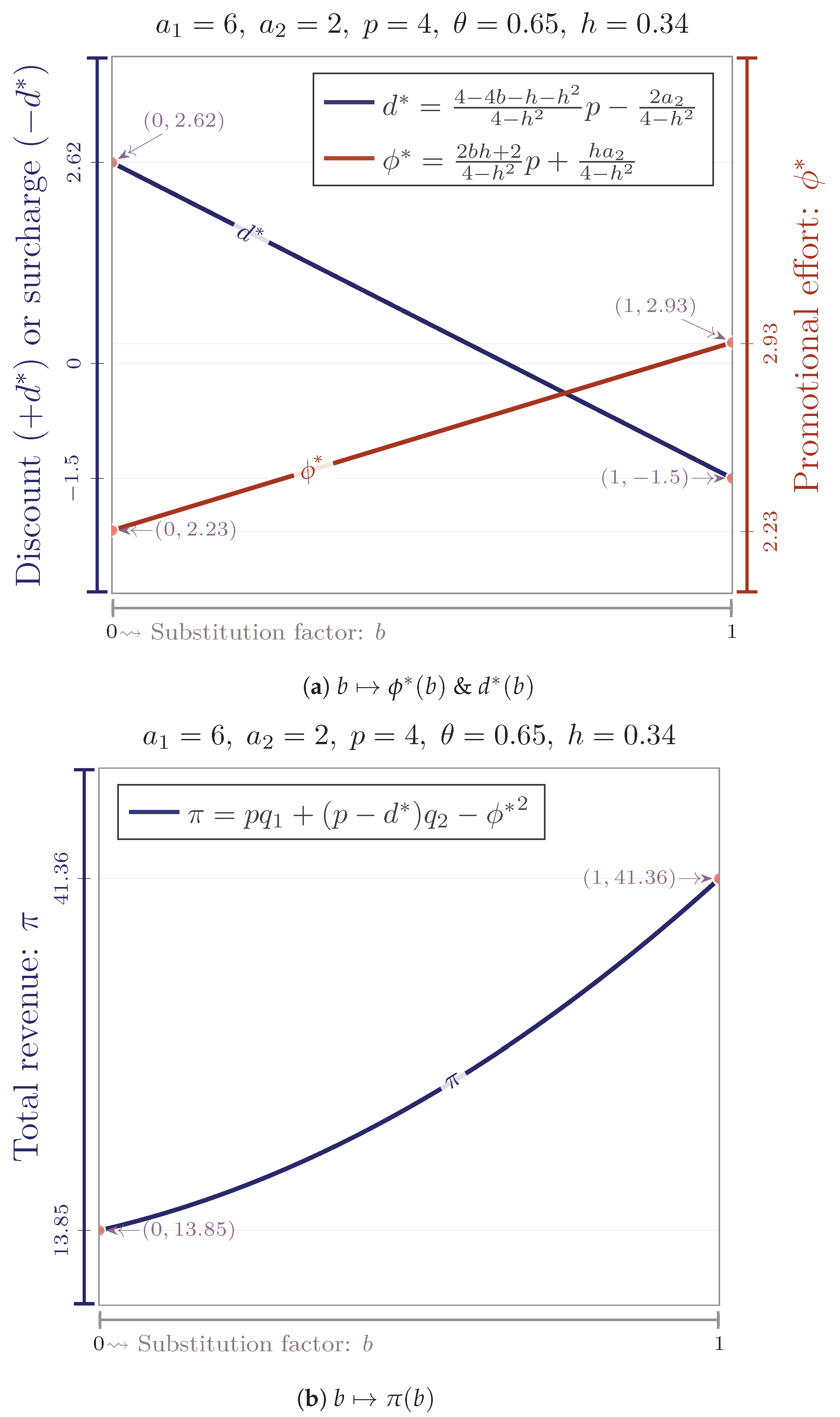

3.3. Centralized Decision Model

- (i)

- strictly decreases in b and h;

- (ii)

- If , decreases in p, else increases in p;

- (iii)

- strictly increases in price p, b and h.

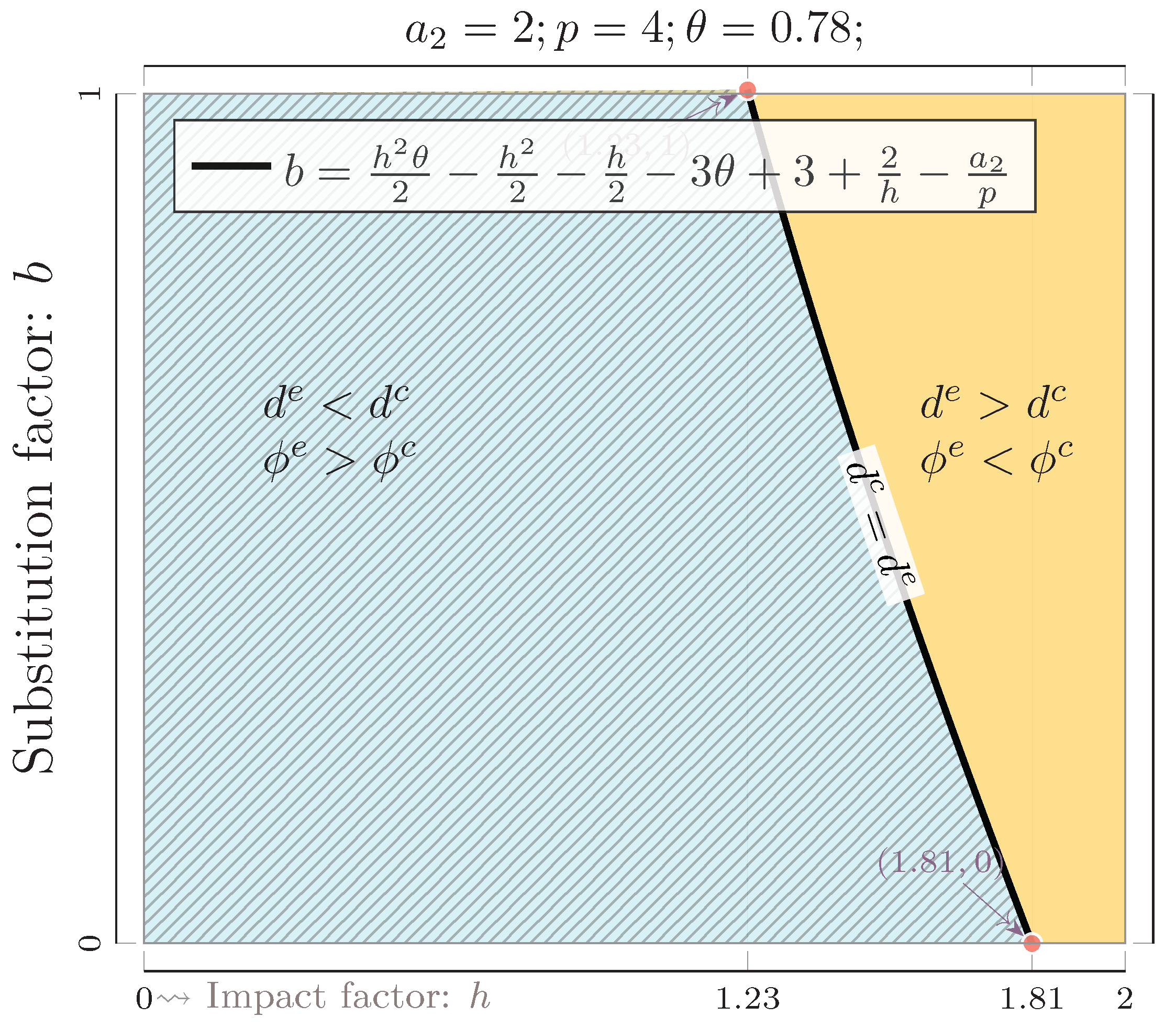

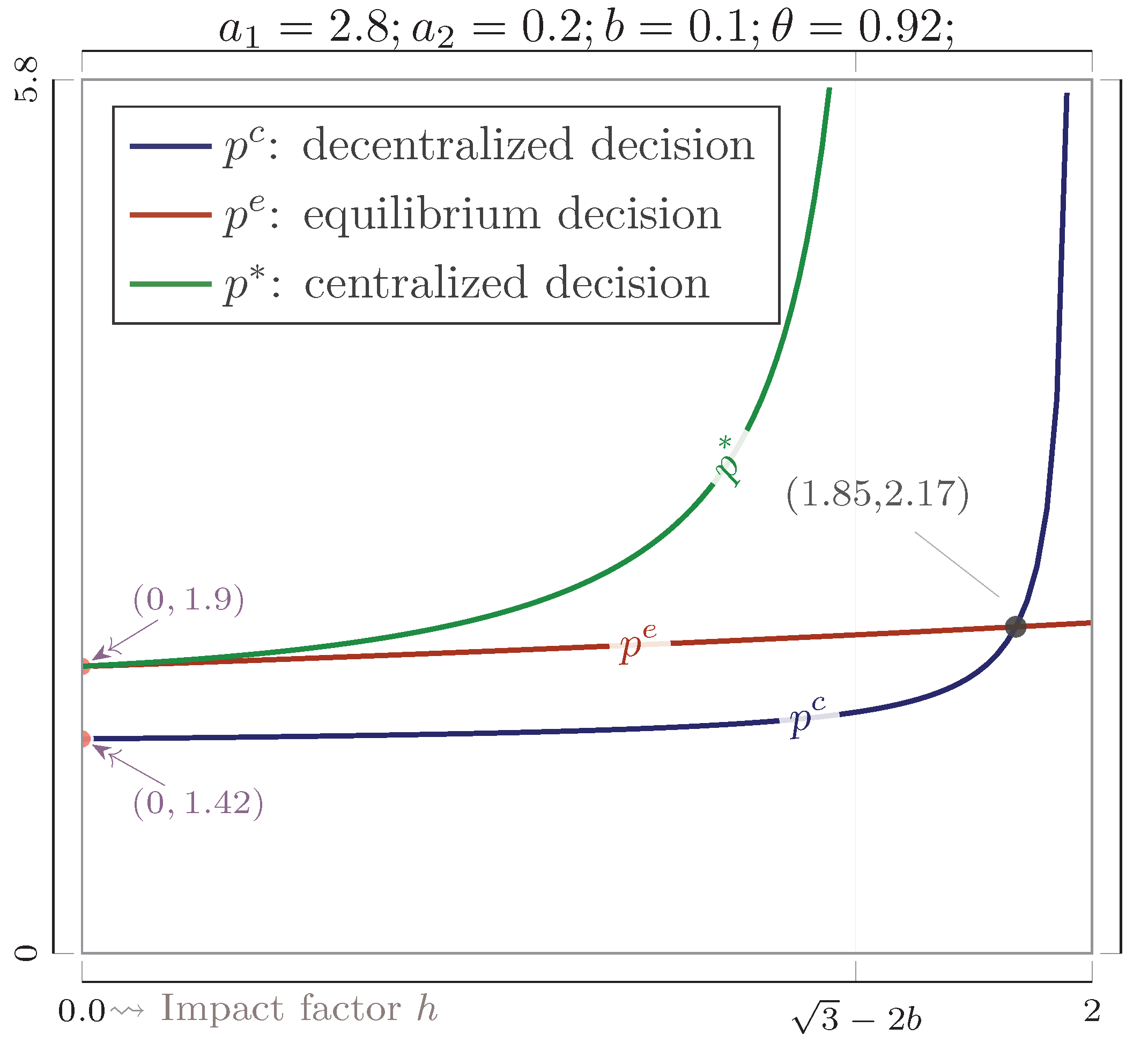

4. The Comparison of the Three Scenarios

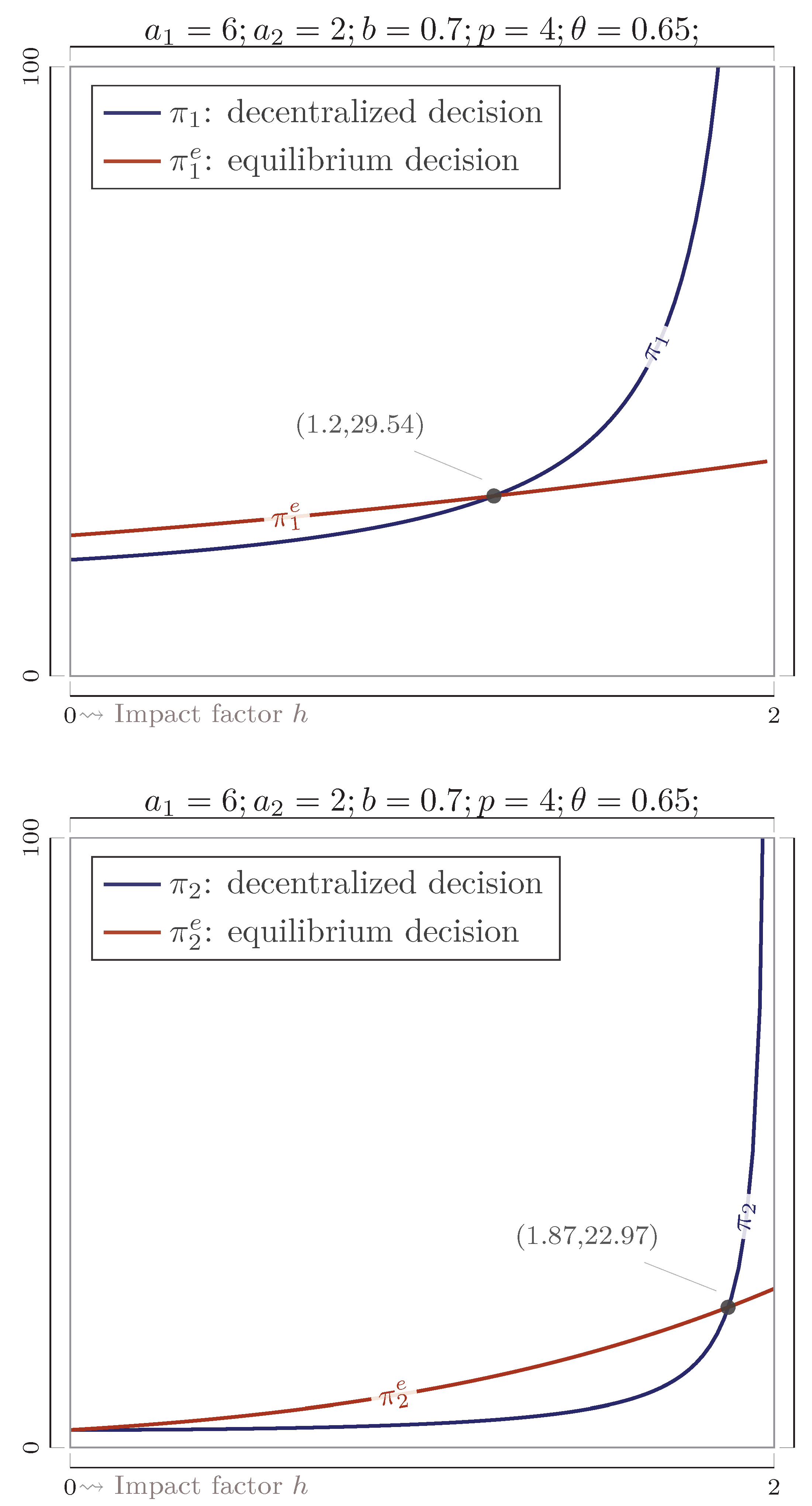

4.1. Comparing the Profit of Each Member under Different Scenarios

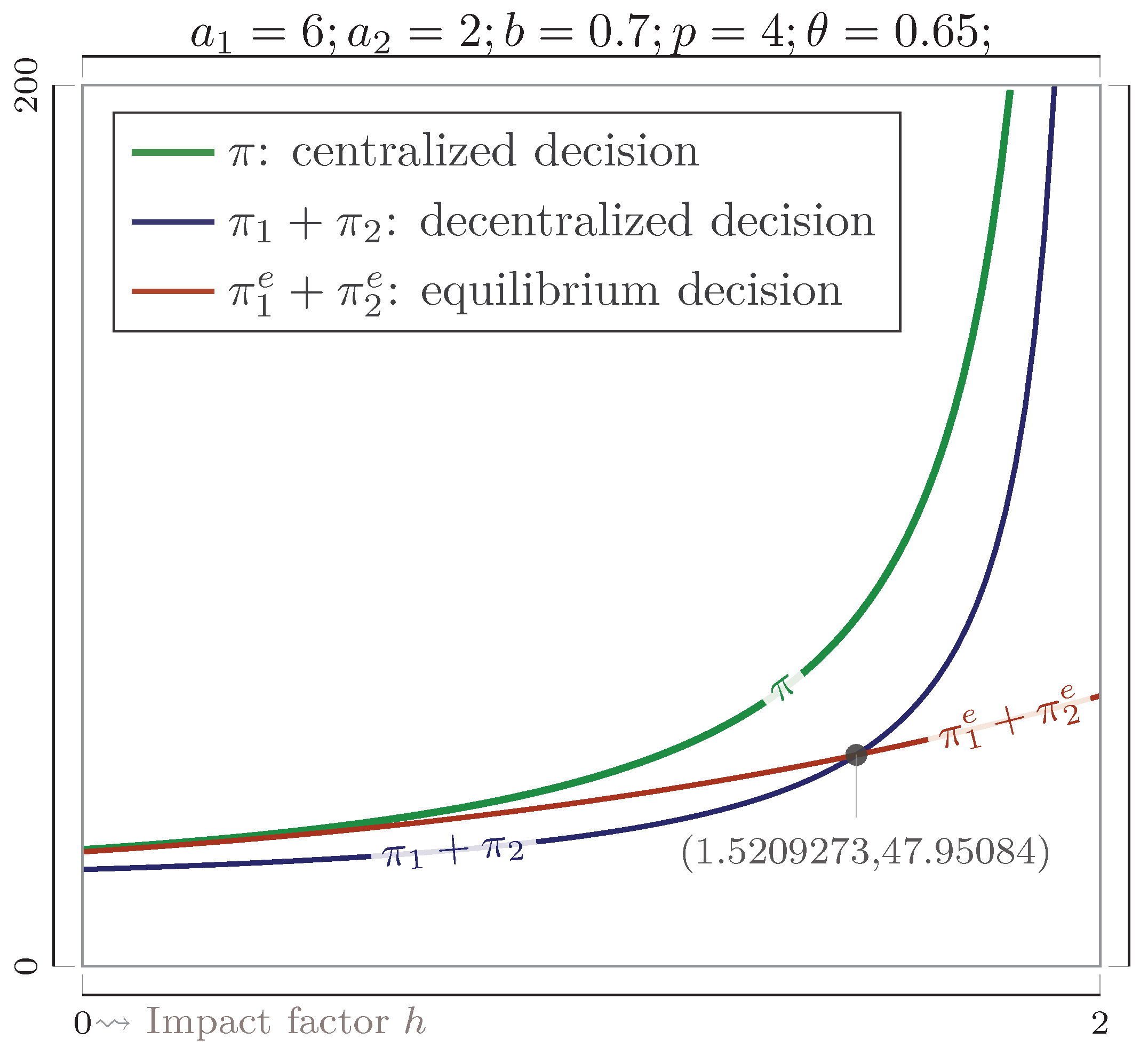

4.2. Comparing the Total Profits under Different Scenarios

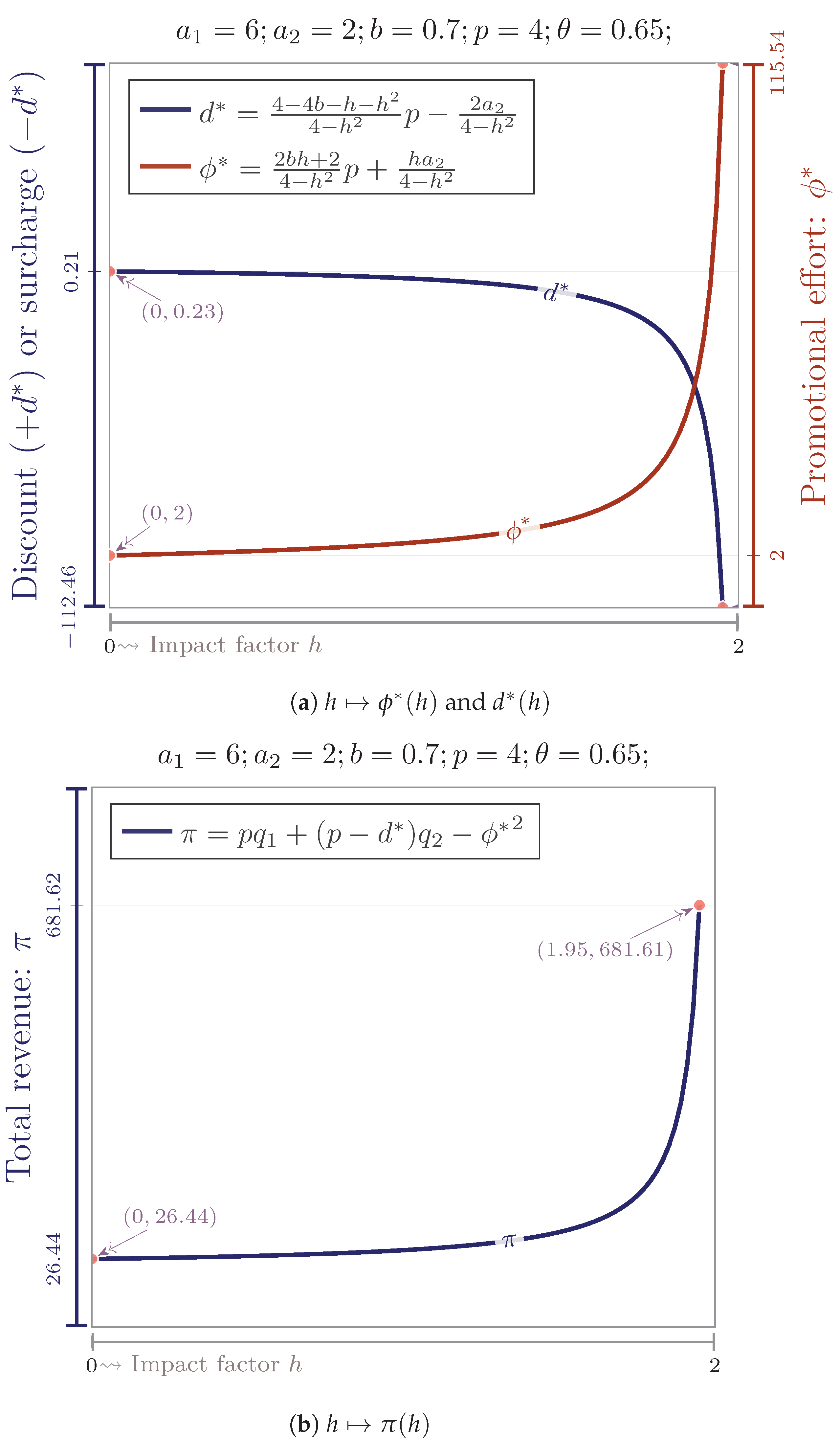

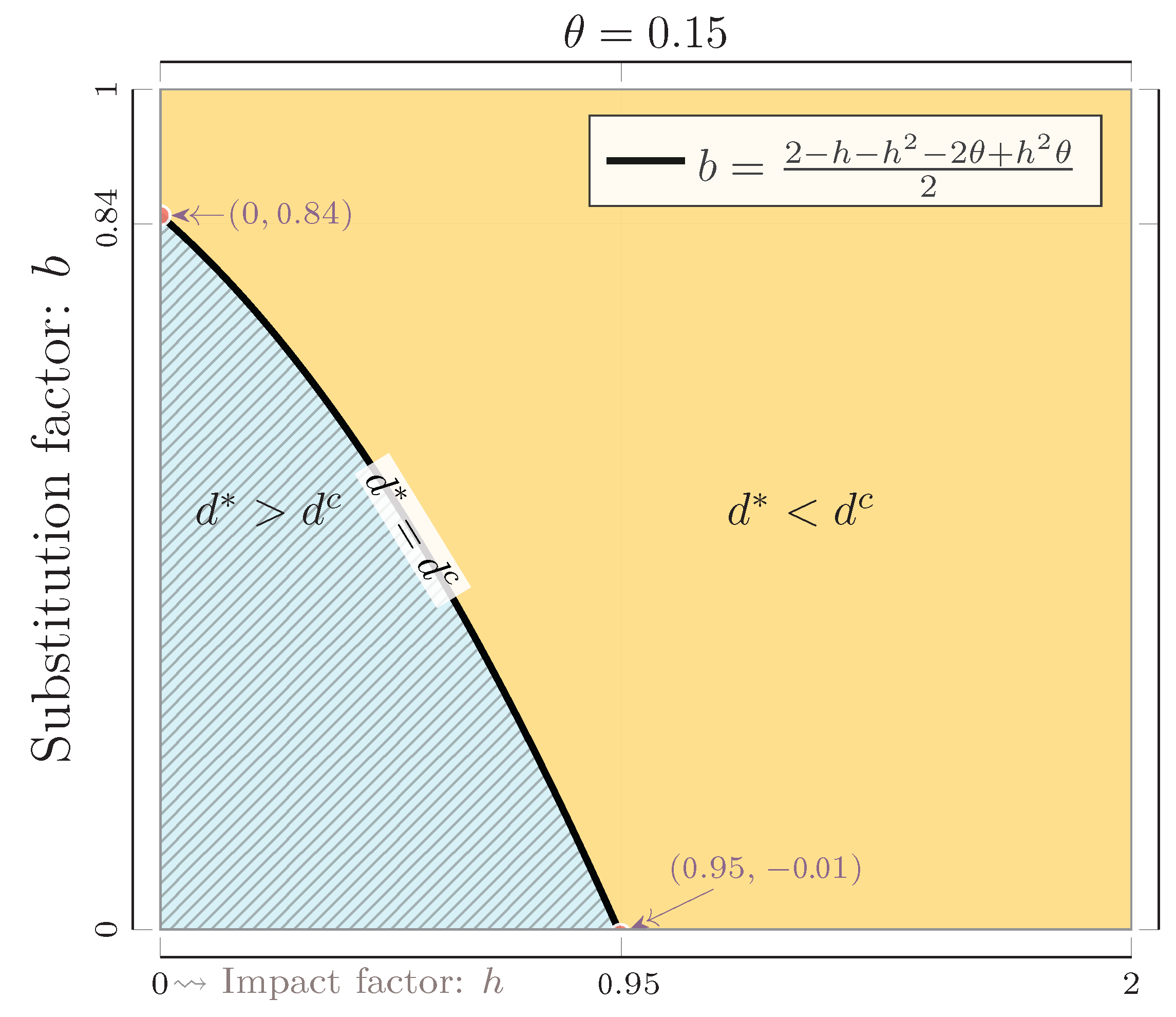

4.3. Comparing Platform Discounts and Optimal Promotional Efforts under Different Scenarios

5. Extension

6. Conclusions

6.1. Results Summary

6.2. Managerial Implications

6.3. Limitations and Further Study

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| O2O | Online to Offline |

Appendix A

Appendix A.1. Proof of Lemma 1

Appendix A.2. Proof of Proposition 1

Appendix A.3. Proof of Lemma 2

Appendix A.4. Proof of Proposition 2

Appendix A.5. Proof of Lemma 3

Appendix A.6. Proof of Proposition 3

Appendix A.7. Proof of Proposition 4

Appendix A.8. Proof of Proposition 5

Appendix A.9. Proof of Proposition 6

Appendix A.10. Proof of Proposition 7

References

- Zhao, X.; Lin, W.; Cen, S.; Zhu, H.; Duan, M.; Li, W.; Zhu, S. The online-to-offline (O2O) food delivery industry and its recent development in China. Eur. J. Clin. Nutr. 2021, 75, 232–237. [Google Scholar] [CrossRef] [PubMed]

- Zhi-Wei, Z.; Han, Q.; Statistics, S.O. Will Restaurants Earn More after They Joined the Take-out Platform?—A Survey Based on 267 Restaurants in Kaifeng. Econ. Surv. 2018, 35, 121–127. [Google Scholar]

- Anand, K.S.; Aron, R. Group buying on the web: A comparison of price-discovery mechanisms. Manag. Sci. 2003, 49, 1546–1562. [Google Scholar] [CrossRef]

- Kauffman, R.J.; Wang, B. New buyers’ arrival under dynamic pricing market microstructure: The case of group-buying discounts on the Internet. J. Manag. Inf. Syst. 2001, 18, 157–188. [Google Scholar] [CrossRef]

- Lai, H.; Doong, H.S.; Yang, C.Y. The effect of price dispersion in an e-market on consumers’ intentions to join group buying. In Proceedings of the 39th IEEE Annual Hawaii International Conference on System Sciences (HICSS’06), Kauia, HI, USA, 4–7 January 2006; Volume 6, p. 116a. [Google Scholar]

- Kim, H.; Ryu, M.H.; Lee, D.; Kim, J.H. Should a small-sized store have both online and offline channels? An efficiency analysis of the O2O platform strategy. J. Retail. Consum. Serv. 2022, 64, 102823. [Google Scholar] [CrossRef]

- Qin, B.; Hou, H. Research on O2O model of fresh products. In Proceedings of the 2016 IEEE International Conference on Logistics, Informatics and Service Sciences (LISS), Sydney, NSW, Australia, 24–27 July 2016; pp. 1–4. [Google Scholar] [CrossRef]

- Pei, Y.; Xue, W.; Yang, Y.; Li, D.; Li, Y. The Impacts of user experience on user loyalty based on O2O innovation platform. J. Electron. Commer. Organ. (JECO) 2019, 17, 79–87. [Google Scholar] [CrossRef]

- Hsiao, L.; Chen, Y.J. Strategic motive for introducing internet channels in a supply chain. Prod. Oper. Manag. 2014, 23, 36–47. [Google Scholar] [CrossRef]

- Zhang, P.; He, Y.; Zhao, X. “Preorder-online, pickup-in-store” strategy for a dual-channel retailer. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 27–47. [Google Scholar] [CrossRef]

- Pei, Z.; Wooldridge, B.R.; Swimberghe, K.R. Manufacturer rebate and channel coordination in O2O retailing. J. Retail. Consum. Serv. 2021, 58, 102268. [Google Scholar] [CrossRef]

- Govindan, K.; Malomfalean, A. A framework for evaluation of supply chain coordination by contracts under O2O environment. Int. J. Prod. Econ. 2019, 215, 11–23. [Google Scholar] [CrossRef]

- Viswanathan, S.; Wang, Q. Discount pricing decisions in distribution channels with price-sensitive demand. Eur. J. Oper. Res. 2003, 149, 571–587. [Google Scholar] [CrossRef]

- Lei, Q.; He, J.; Huang, F. Impacts of Online and Offline Channel Structures on Two-Period Supply Chains with Strategic Consumers. Mathematics 2020, 8, 34. [Google Scholar] [CrossRef]

- Yi, S.; Yu, L.; Zhang, Z. Research on Pricing Strategy of Dual-Channel Supply Chain Based on Customer Value and Value-Added Service. Mathematics 2021, 9, 11. [Google Scholar] [CrossRef]

- Fang, Y.; Ren, Z.; Yang, F. The Impact of Carbon Allowance Allocation Rules on Remanufacturing Decisions in a Closed-Loop Supply Chain. Mathematics 2023, 11, 2817. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhou, S. The Impact of Two-Sided Market Platforms on Participants’ Trading Strategies: An Evolutionary Game Analysis. Mathematics 2023, 11, 1927. [Google Scholar] [CrossRef]

- Chen, M.; Hu, M.; Wang, J. Food delivery service and restaurant: Friend or foe? Manag. Sci. 2022, 68, 6539–6551. [Google Scholar] [CrossRef]

- Du, Z.; Fan, Z.P.; Gao, G.X. Choice of O2O food delivery mode: Self-built platform or third-party platform? Self-delivery or third-party delivery? IEEE Trans. Eng. Manag. 2021, 70, 2206–2219. [Google Scholar] [CrossRef]

- Pei, Y.L.; Li, D.D.; Xue, W.X. The evaluation of customer experience using BP neural network-taking catering O2O takeout. Concurr. Comput. Pract. Exp. 2020, 32, e5515. [Google Scholar] [CrossRef]

- Yeo, V.C.S.; Goh, S.K.; Rezaei, S. Consumer experiences, attitude and behavioral intention toward online food delivery (OFD) services. J. Retail. Consum. Serv. 2017, 35, 150–162. [Google Scholar] [CrossRef]

- Jun, K.; Yoon, B.; Lee, S.; Lee, D.S. Factors influencing customer decisions to use online food delivery service during the COVID-19 pandemic. Foods 2022, 11, 64. [Google Scholar] [CrossRef]

- Wang, T. A Study on the Choice of Online Marketplace Co-Opetition Strategy Considering the Promotional Behavior of a Store on an E-Commerce Platform. Mathematics 2023, 11, 2263. [Google Scholar] [CrossRef]

- Zhang, J.C.; Savage, S.J.; Chen, Y. Consumer uncertainty and price discrimination through online coupons: An empirical study of restaurants in Shanghai. Inf. Econ. Policy 2015, 33, 43–55. [Google Scholar] [CrossRef]

- Luo, K.; Ni, G. The effects of price subsidy on take-away pricing and revenue. In Proceedings of the 2019 IEEE International Conference on Industrial Engineering and Systems Management (IESM), Shanghai, China, 25–27 September 2019; pp. 1–5. [Google Scholar]

- Zheng, X.; Guo, X. E-retailing of restaurant services: Pricing strategies in a competing online environment. J. Oper. Res. Soc. 2016, 67, 1408–1418. [Google Scholar] [CrossRef]

- Tang, C.; Cao, E.; Shi, Z. Channel Competition and Coordination of a Dual-Channel Supply Chain under Interval Demand. Mathematics 2023, 11, 2720. [Google Scholar] [CrossRef]

- Dan, B.; Xu, G.; Liu, C. Pricing policies in a dual-channel supply chain with retail services. Int. J. Prod. Econ. 2012, 139, 312–320. [Google Scholar] [CrossRef]

| Symbol | Description |

|---|---|

| Parameters: | |

| The original market size offline; | |

| The original market size online; | |

| Offline sales volume; | |

| Online sales volume; | |

| b | Substitution factor; |

| p | The price of producing products; |

| Platform’s revenue share of the online sales; | |

| h | Impact factor of promotion on online sales; |

| Decision variables: | |

| d | A discount (when ) or a surcharge (when ) for the online sales; |

| Promotional effort; | |

| Revenue functions: | |

| The revenue of the food service provider; | |

| The revenue of the platform; | |

| Total revenue of the food service provider and the platform. |

| Conditions | Property | Conditions | Property | |

|---|---|---|---|---|

| p | ↘ | ↗ | ||

| ↗ | ↘ | |||

| b |  | ↘ |  | ↗ |

| ↘ |  | ↗ | ||

| ↗ | ||||

| h | ↘ | ↗ | ||

| ↗ | ↘ | |||

: without conditions.

: without conditions.| Conditions | Property | Conditions | Property | |

| p | ↗ |  | ↗ | |

| ↘ | ||||

| b |  | ↘ | none | none |

| ↗ |  | ↘ | |

| h |  | ↘ |  | ↗ |

: Without conditions; none: Independent.

: Without conditions; none: Independent.| Conditions | Property | Conditions | Property | |

|---|---|---|---|---|

| p | ↘ |  | ↗ | |

| ↗ | ||||

| b |  | ↘ |  | ↗ |

| none | none | none | none | |

| h |  | ↘ |  | ↗ |

: Without conditions; none: Independent.

: Without conditions; none: Independent.Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, X.; Li, K.; Li, Y. Platform Operations under Dual-Channel Catering Supply Chain. Mathematics 2023, 11, 3610. https://doi.org/10.3390/math11163610

Li X, Li K, Li Y. Platform Operations under Dual-Channel Catering Supply Chain. Mathematics. 2023; 11(16):3610. https://doi.org/10.3390/math11163610

Chicago/Turabian StyleLi, Xin, Kenan Li, and Yongjian Li. 2023. "Platform Operations under Dual-Channel Catering Supply Chain" Mathematics 11, no. 16: 3610. https://doi.org/10.3390/math11163610