Risk Transmission in Low-Carbon Supply Chains Considering Corporate Risk Aversion

Abstract

1. Introduction

2. Low-Carbon Supply Chain Risk Transmission Modelling

2.1. Research Questions and Hypotheses

2.2. Model Solution

2.2.1. Scenario 1: Low-Carbon Supply Chain Members Are Risk-Neutral

2.2.2. Scenario 2: Only Suppliers Exhibit Risk Aversion Characteristics

2.2.3. Scenario 3: Only the Manufacturer Exhibits Risk Aversion

2.2.4. Scenario 4: Risk Aversion among All Members of the Low-Carbon Supply Chain

3. Risk Transfer Utility of Low-Carbon Supply Chain with Risk Aversion Characteristics

3.1. Abatement Risk Transfer Utility

3.2. Revenue Risk Transmission Utility

4. Risk Transfer Utility of Low-Carbon Supply Chain with the Degree of Risk Aversion

5. Numerical Simulation

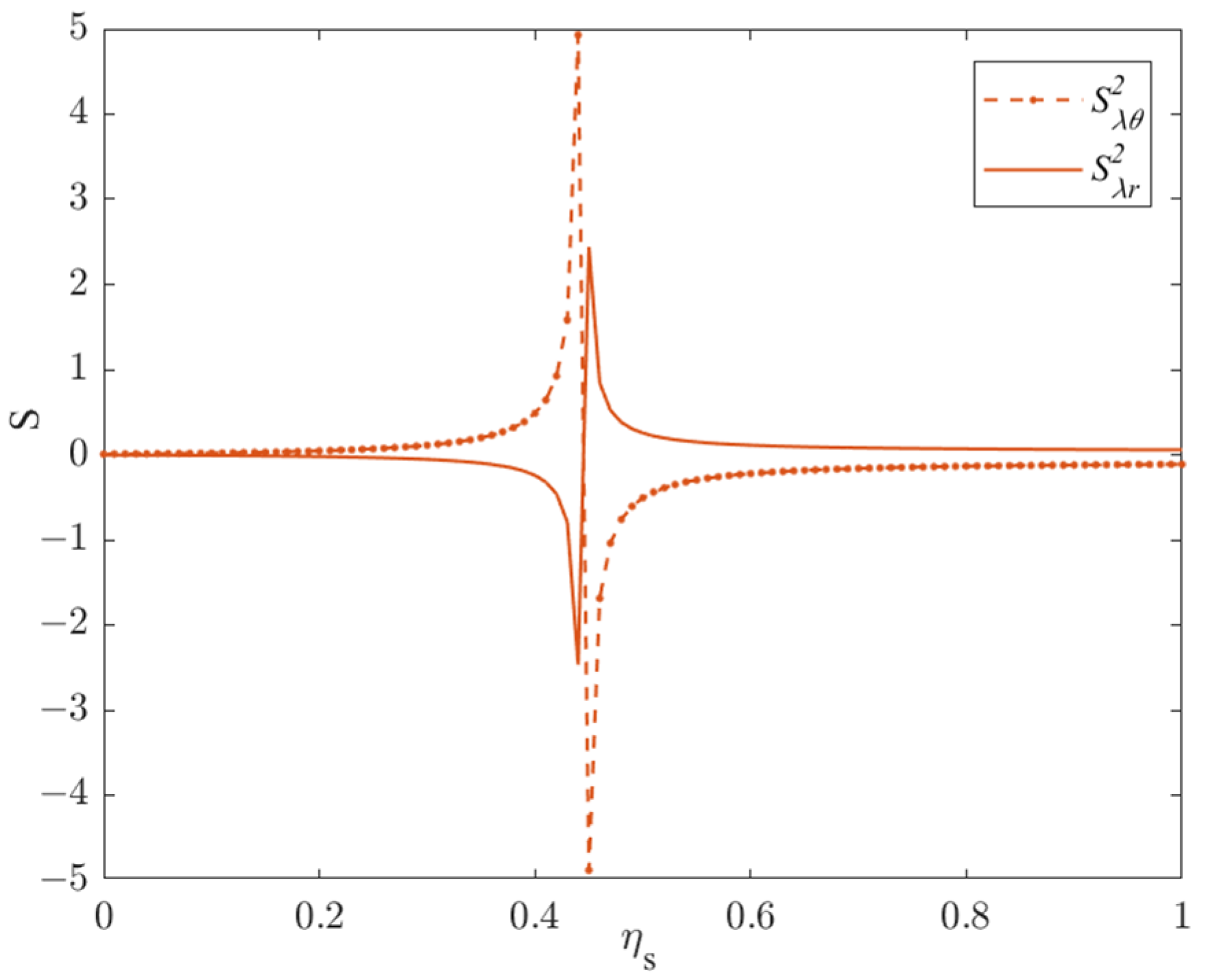

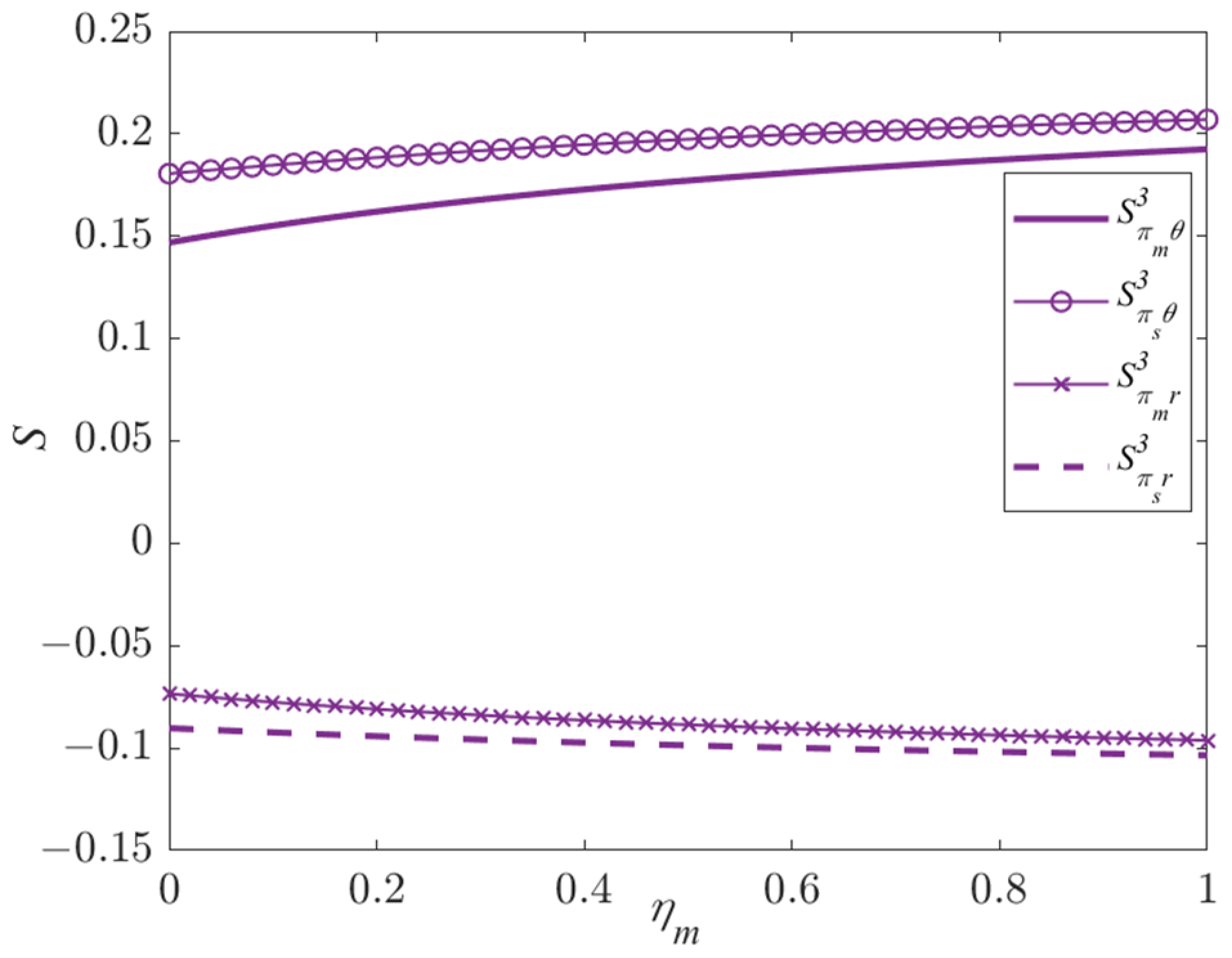

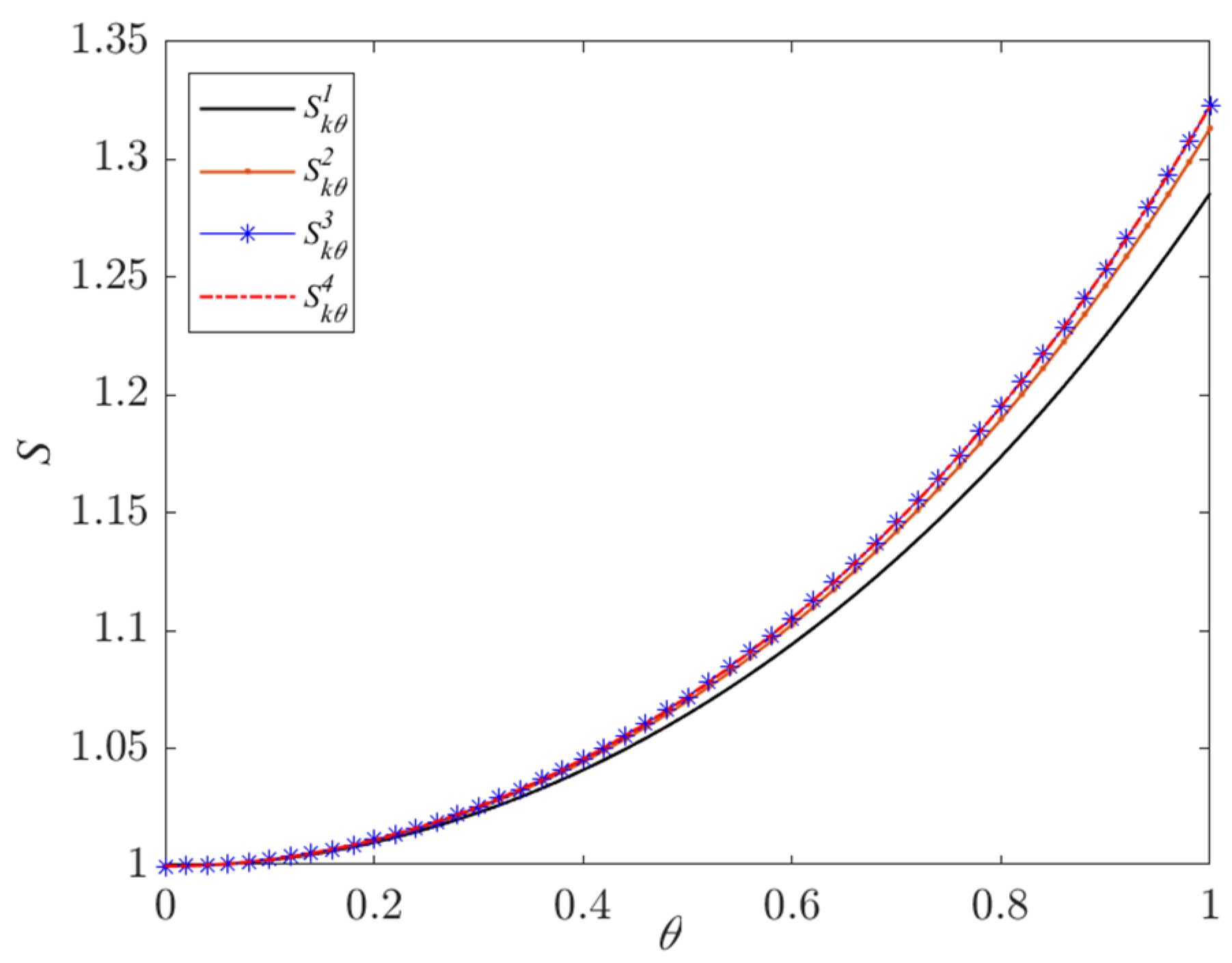

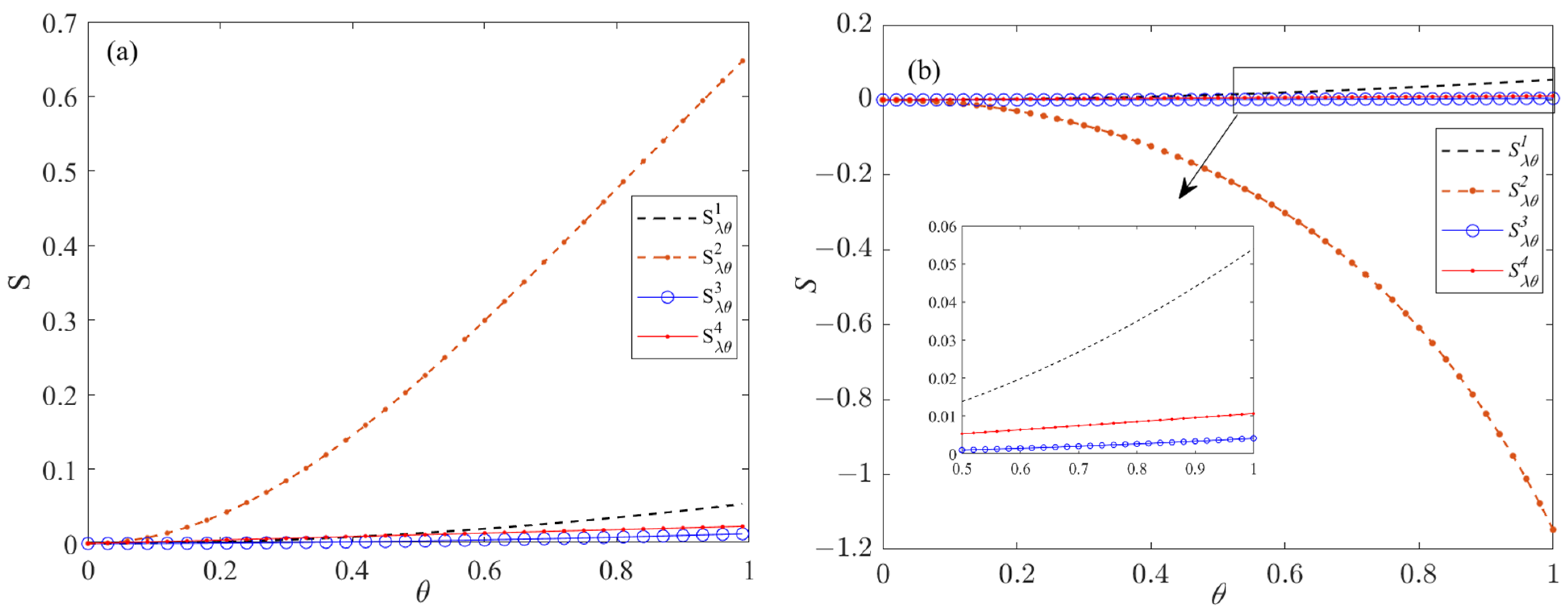

5.1. Risk Transfer Utility of Risk Aversion Degree

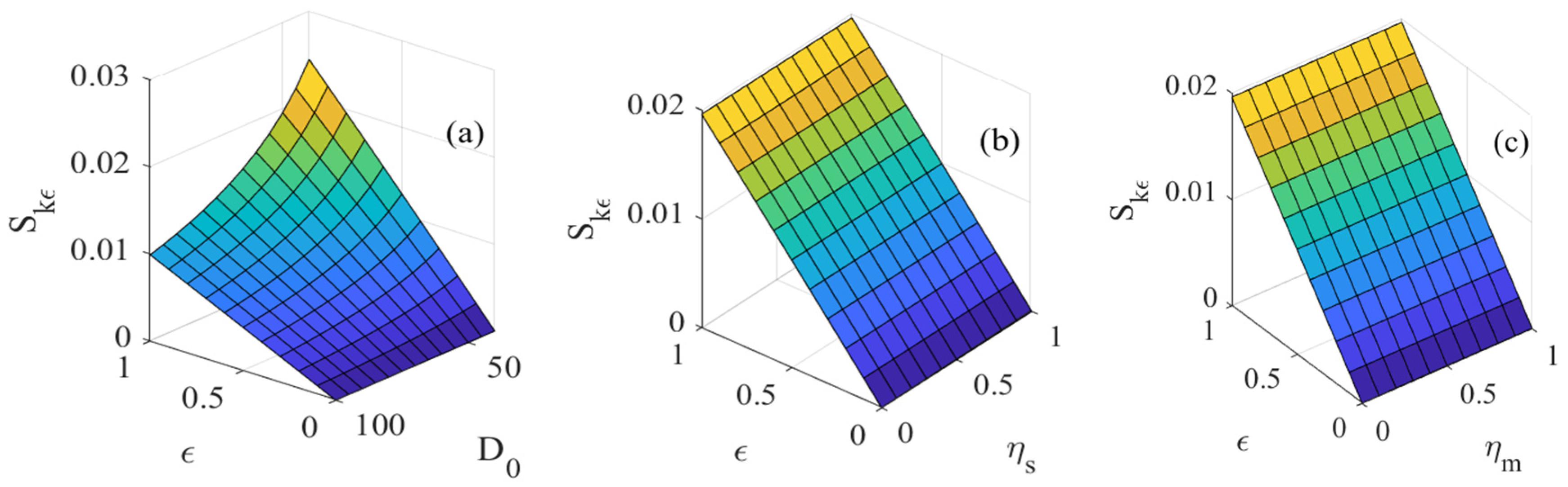

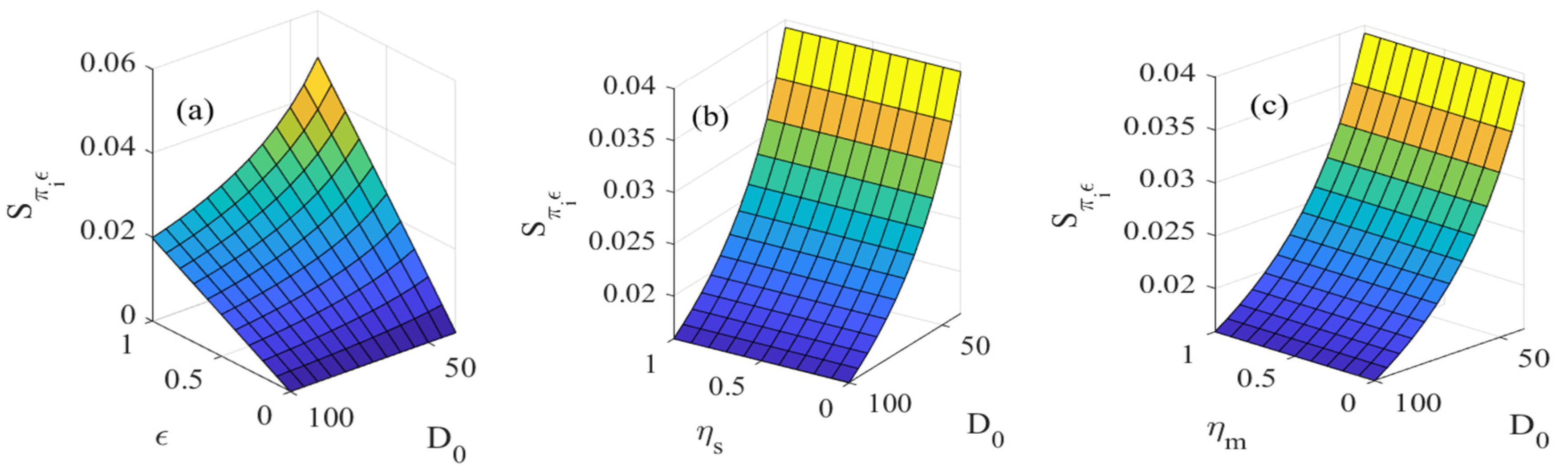

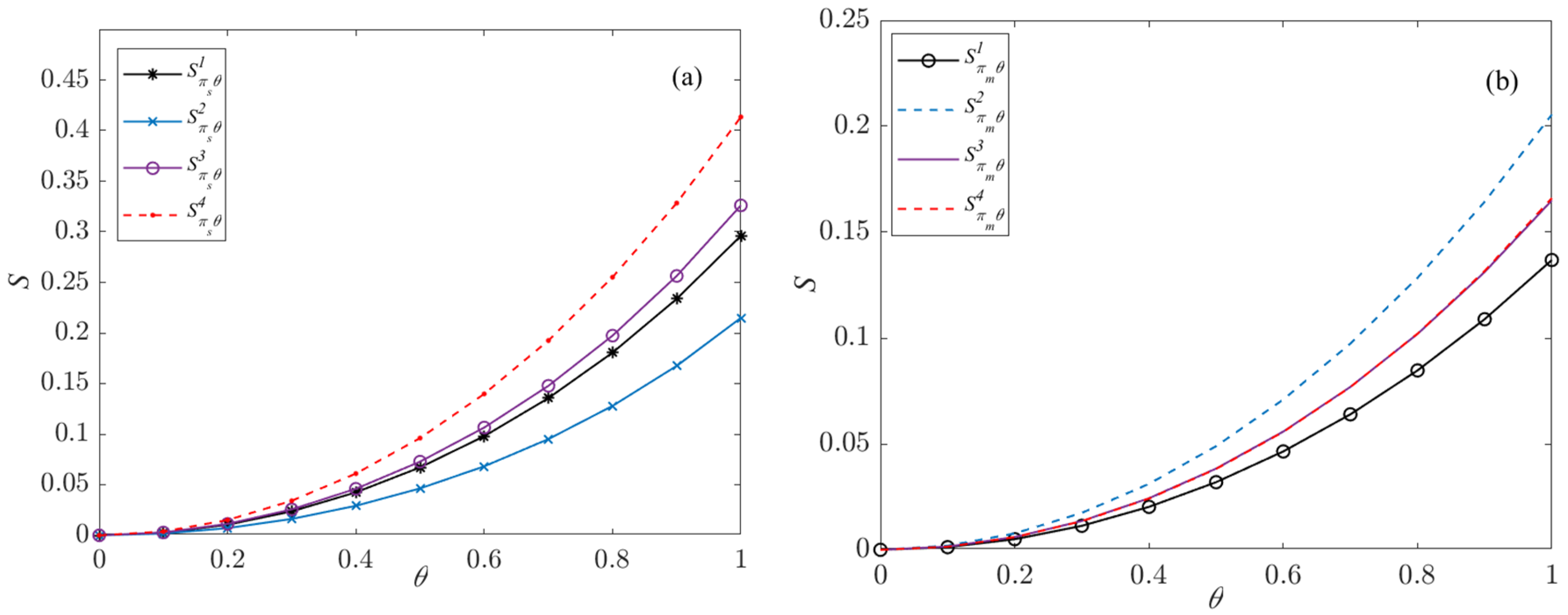

5.2. Risk Transmission Utility of Risk Aversion Characteristics

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Erdoğan, S.; Yıldırım, S.; Yıldırım, D.Ç.; Gedikli, A. The Effects of Innovation on Sectoral Carbon Emissions: Evidence from G20 Countries. J. Environ. Manag. 2020, 267, 110637. [Google Scholar] [CrossRef] [PubMed]

- Liu, M.; Li, Z.; Anwar, S.; Zhang, Y. Supply Chain Carbon Emission Reductions and Coordination When Consumers Have a Strong Preference for Low-Carbon Products. Environ. Sci. Pollut. Res. 2021, 28, 19969–19983. [Google Scholar] [CrossRef] [PubMed]

- Karuppiah, K.; Sankaranarayanan, B.; Ali, S.M. A Novel Quality Function Deployment Based Integrated Framework for Improving Supply Chain Sustainability. Eng. Manag. J. 2023, 35, 285–298. [Google Scholar] [CrossRef]

- Moshood, T.D.; Nawanir, G.; Mahmud, F.; Sorooshian, S.; Adeleke, A. Green and Low Carbon Matters: A Systematic Review of the Past, Today, and Future on Sustainability Supply Chain Management Practices Among Manufacturing Industry. Clean. Eng. Technol. 2021, 4, 100144. [Google Scholar] [CrossRef]

- Pourjavad, E.; Shahin, A. A Hybrid Model for Analyzing the Risks of Green Supply Chain in a Fuzzy Environment. J. Ind. Prod. Eng. 2020, 37, 422–433. [Google Scholar] [CrossRef]

- Chen, T.; Hou, Y.; Wang, L.; Li, Z. Counterparty Risk Contagion Model of Carbon Quota Based on Asset Price Reduction. Sustainability 2023, 15, 11377. [Google Scholar] [CrossRef]

- Titman, S. Risk Transmission Across Supply Chains. Prod. Oper. Manag. 2021, 30, 4579–4587. [Google Scholar] [CrossRef]

- Zong, S.; Huang, N. Optimal Financing Decision with Financial Constraints for a Manufacturer in a Low-Carbon Supply Chain. Environ. Sci. Pollut. Res. 2023, 30, 86998–87015. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, W. Carbon Reduction Initiatives in Supply Chains: A System Dynamics Approach to Assessing Risk Contagion. J. Oper. Manag. 2021, 30, 451–468. [Google Scholar]

- Wang, J.; Zhou, H.; Jin, X. Risk Transmission in Complex Supply Chain Network with Multi-Drivers. Chaos Solitons Fractals 2021, 143, 110259. [Google Scholar] [CrossRef]

- Taghavi, S.M.; Ghezavati, V.; Bidhandi, H.M.; Al-E-Hashem, S.M.J.M. Green-Resilient Supplier Selection and Order Allocation Under Disruption by Utilizing Conditional Value at Risk: Mixed Response Strategies. Process Integr. Optim. Sustain. 2023, 7, 359–380. [Google Scholar] [CrossRef]

- Birge, J.R.; Capponi, A.; Chen, P.C. Disruption and Rerouting in Supply Chain Networks. Oper. Res. 2023, 71, 750–767. [Google Scholar] [CrossRef]

- Wang, J.; Zhou, H.; Zhu, Y. Behavior Evolution of Supply Chain Networks Under Disruption Risk—From Aspects of Time Dynamic and Spatial Feature. Chaos Solitons Fractals 2022, 158, 112073. [Google Scholar] [CrossRef]

- Dewaelheyns, N.; Schoubben, F.; Struyfs, K.; Van Hulle, C. The Influence of Carbon Risk on Firm Value: Evidence from the European Union Emission Trading Scheme. J. Environ. Manag. 2023, 344, 118293. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W.; Lee, L.H.; Chan, F.T.; Zhang, Y. Modelling the Impacts of Low Carbon Supply Chain Collaboration on Carbon Emission Reduction. Int. J. Prod. Econ. 2019, 216, 259–271. [Google Scholar]

- Lemma, T.T.; Azmi Shabestari, M.; Freedman, M.; Lulseged, A.; Mlilo, M. Corporate Carbon Risk, Voluntary Disclosure and Debt Maturity. Int. J. Account. Inf. Manag. 2020, 28, 667–683. [Google Scholar] [CrossRef]

- Bimpikis, K.; Candogan, O.; Ehsani, S. Supply Disruptions and Optimal Network Structures. Manag. Sci. 2019, 65, 5504–5517. [Google Scholar] [CrossRef]

- Zhou, X.; Wu, X. Decisions for a Retailer-Led Low-Carbon Supply Chain Considering Altruistic Preference Under Carbon Quota Policy. Mathematics 2023, 11, 911. [Google Scholar] [CrossRef]

- Guan, Z.; Mou, Y.; Zhang, J. Incorporating Risk Aversion and Time Preference into Omnichannel Retail Operations Considering Assortment and Inventory Optimization. Eur. J. Oper. Res. 2024, 314, 579–596. [Google Scholar] [CrossRef]

- Sun, H.; Zhong, Y. Carbon Emission Reduction and Green Marketing Decisions in a Two-Echelon Low-Carbon Supply Chain Considering Fairness Concern. J. Bus. Ind. Mark. 2023, 38, 905–929. [Google Scholar] [CrossRef]

- Zhu, B.; Wen, B.; Ji, S.; Qiu, R. Coordinating a Dual-Channel Supply Chain with Conditional Value-at-Risk Under Uncertainties of Yield and Demand. Comput. Ind. Eng. 2020, 139, 106181. [Google Scholar] [CrossRef]

- Choi, T.M.; Ma, C.; Shen, B.; Sun, Q. Optimal Pricing in Mass Customization Supply Chains with Risk-Averse Agents and Retail Competition. Omega 2019, 88, 150–161. [Google Scholar] [CrossRef]

- Wang, Y.H.; Sheng, X.Q.; Xie, Y.D. The Coordination Mechanism of a Risk-Averse Green Supply Chain. Chin. Manag. Stud. 2024, 18, 174–195. [Google Scholar] [CrossRef]

- Gupta, V.; Ivanov, D. Dual Sourcing Under Supply Disruption with Risk-Averse Suppliers in the Sharing Economy. Int. J. Prod. Res. 2020, 58, 291–307. [Google Scholar] [CrossRef]

- Raza, S.A.; Govindaluri, S.M. Pricing Strategies in a Dual-Channel Green Supply Chain with Cannibalization and Risk Aversion. Oper. Res. Perspect. 2019, 6, 100118. [Google Scholar] [CrossRef]

- Ma, Y.; Zhang, M.; Zhao, J. Pricing Decision of Dual-Channel Supply Chain with Members’ Risk-Aversion Under the Participation of E-Commerce Platform. Procedia Comput. Sci. 2023, 221, 138–145. [Google Scholar] [CrossRef]

- Mou, Y.; Guan, Z.; Zhang, J. Integrated Optimization of Assortment, Inventory and Pricing Considering Omnichannel Retailer’s Risk Aversion and Customer’s Time Preference. Expert Syst. Appl. 2024, 237, 121479. [Google Scholar] [CrossRef]

- Zhou, Y.W.; Li, J.; Zhong, Y. Cooperative advertising and ordering policies in a two-echelon supply chain with risk-averse agents. Omega 2018, 75, 97–117. [Google Scholar] [CrossRef]

- Zou, H.; Qin, J.; Long, X. Coordination Decisions for a Low-Carbon Supply Chain Considering Risk Aversion Under Carbon Quota Policy. Int. J. Environ. Res. Public Health 2022, 19, 2656. [Google Scholar] [CrossRef]

- Wang, Z.; Brownlee, A.E.I.; Wu, Q. Production and Joint Emission Reduction Decisions Based on Two-Way Cost-Sharing Contract Under Cap-and-Trade Regulation. Comput. Ind. Eng. 2020, 146, 106549. [Google Scholar] [CrossRef]

- Wang, M.; Zhang, Y.; Dong, Y.; Zou, G.; Zhao, W. Interactive Information Disclosure and Non-Penalty Regulatory Review Risk. J. Manag. Sci. Eng. 2023, 8, 149–166. [Google Scholar] [CrossRef]

- Cao, Q.; Zhou, Y.; Du, H.; Ren, M.; Zhen, W. Carbon Information Disclosure Quality, Greenwashing Behavior, and Enterprise Value. Front. Psychol. 2022, 13, 892415. [Google Scholar] [CrossRef] [PubMed]

- Wang, J. Green Finance and the Relationship with Goodwill: A Study Based on the Perspectives of Accounting Information Quality and Financing Constraints. Int. Rev. Econ. Financ. 2024, 93, 833–846. [Google Scholar] [CrossRef]

- Liu, M.; Cao, E.; Salifou, C.K. Pricing Strategies of a Dual-Channel Supply Chain with Risk Aversion. Transp. Res. Part E Logist. Transp. Rev. 2016, 90, 108–120. [Google Scholar] [CrossRef]

- Song, H.; Wang, Y.; Mao, X.; Wang, C. Decision-Making in a Low-Carbon Supply Chain Considering Consumers’ Fairness Concerns. Expert Syst. Appl. 2024, 237, 121606. [Google Scholar] [CrossRef]

- Wang, Q.; He, L. Managing Risk Aversion for Low-Carbon Supply Chains with Emission Abatement Outsourcing. Int. J. Environ. Res. Public Health 2018, 15, 367. [Google Scholar] [CrossRef]

- Liu, J.; Li, C. Dynamic Game Analysis on Cooperative Advertising Strategy in a Manufacturer-Led Supply Chain with Risk Aversion. Mathematics 2023, 11, 512. [Google Scholar] [CrossRef]

- Feng, Y.; Hu, Y.; He, L. Research on Coordination of Fresh Agricultural Product Supply Chain Considering Fresh-Keeping Effort Level Under Retailer Risk Avoidance. Discret. Dyn. Nat. Soc. 2021, 2021, 5527215. [Google Scholar] [CrossRef]

- Adhikari, A.; Bisi, A.; Avittathur, B. Coordination Mechanism, Risk Sharing, and Risk Aversion in a Five-Level Textile Supply Chain Under Demand and Supply Uncertainty. Eur. J. Oper. Res. 2020, 282, 93–107. [Google Scholar] [CrossRef]

- Xing, Y.; Zhao, L. The Impact of Supply Chain Structure on the Promotion of Maritime Green Energy Consumption Under Carbon Emission Regulation. J. Ind. Manag. Optim. 2024. [Google Scholar] [CrossRef]

- Kazaz, B.; Webster, S. Price-Setting Newsvendor Problems with Uncertain Supply and Risk Aversion. Oper. Res. 2015, 63, 807–811. [Google Scholar] [CrossRef]

- Wang, H.; Zhang, X. Research on Supply Chain Risk Transmission Mechanism Based on Improved SIRS Model. Math. Probl. Eng. 2022, 2022, 9502793. [Google Scholar] [CrossRef]

- Song, Z.; Tang, W.; Zhao, R.; Zhang, G. Inventory Strategy of the Risk Averse Supplier and Overconfident Manufacturer with Uncertain Demand. Int. J. Prod. Econ. 2021, 234, 108066. [Google Scholar] [CrossRef]

- Xia, J.; Niu, W. Carbon-Reducing Contract Design for a Supply Chain with Environmental Responsibility Under Asymmetric Information. Omega 2021, 102, 102390. [Google Scholar] [CrossRef]

- Paul, S.K.; Karuppiah, K.; Sankaranarayanan, B.; Ali, S.M. Barriers for Sustainable Supply Chain Management and Their Overcoming Strategies in Context of the Indian Automobile Industry. In Data Analytics for Supply Chain Networks; Springer International Publishing: Cham, Switzerland, 2023; pp. 129–165. [Google Scholar]

- Jermsittiparsert, K. Examining the Sustainable Energy and Carbon Emission on the Economy: Panel Evidence from ASEAN. Int. J. Econ. Financ. Stud. 2021, 13, 405–426. [Google Scholar]

| Symbol | Meaning | Range of Values |

|---|---|---|

| Price markup of manufacturer | ||

| Manufacturer’s optimal price mark-up in scenario | , | |

| Price markup of supplier | ||

| Supplier‘s optimal price mark-up in scenario | , | |

| Manufacturer’s emission reduction investment level | ||

| Optimal level of mitigation investment by manufacturers in scenario | , | |

| Supplier’s abatement cost-sharing level | ||

| Optimal level of mitigation investment by suppliers in scenario | , | |

| Quality of carbon emissions disclosure | ||

| Potential market demand | ||

| Market demand sensitivity factor | ||

| Uncertainty of market demand | ||

| Level of risk aversion | where denotes the manufacturer and denotes the supplier | |

| Carbon emission reduction investment cost coefficient | ||

| Optimal benefits for manufacturers in scenario | , | |

| Optimal benefits for suppliers in scenario | , | |

| Risk elasticity coefficient of risk point with respect to in scenario |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, T.; Zhu, R.; Wang, L. Risk Transmission in Low-Carbon Supply Chains Considering Corporate Risk Aversion. Mathematics 2024, 12, 2009. https://doi.org/10.3390/math12132009

Chen T, Zhu R, Wang L. Risk Transmission in Low-Carbon Supply Chains Considering Corporate Risk Aversion. Mathematics. 2024; 12(13):2009. https://doi.org/10.3390/math12132009

Chicago/Turabian StyleChen, Tingqiang, Ruirui Zhu, and Lei Wang. 2024. "Risk Transmission in Low-Carbon Supply Chains Considering Corporate Risk Aversion" Mathematics 12, no. 13: 2009. https://doi.org/10.3390/math12132009

APA StyleChen, T., Zhu, R., & Wang, L. (2024). Risk Transmission in Low-Carbon Supply Chains Considering Corporate Risk Aversion. Mathematics, 12(13), 2009. https://doi.org/10.3390/math12132009