Chinese Family Farm Business Risk Assessment Using a Hierarchical Hesitant Fuzzy Linguistic Model

Abstract

:1. Introduction

2. Family Farm Business Risk Indicator System

3. Family Farm Business Risk Assessment Model

3.1. Indicator Weight Calculation Model—HFLTS

3.2. Risk Assessment Model—HFWA

- (1)

- Statistical hesitant fuzzy evaluation sets

- (2)

- Calculating each indicator score

- (3)

- Calculating the final evaluation score

4. Case Study

4.1. Calculate the Indicator Weight Based on HFLTS

- (1)

- Constructing the hesitant fuzzy linguistic judgment matrix

- (2)

- Converting to HFLTS envelope

- (3)

- Integrating the preference between pessimism and optimism

- (4)

- Calculating the weight of indicators

4.2. Calculate the Risk Score Based on HFWA

- (1)

- Statistical hesitant fuzzy evaluation sets

- (2)

- Calculating each indicator score

- (3)

- Calculating the final evaluation score

5. Conclusions

- (1)

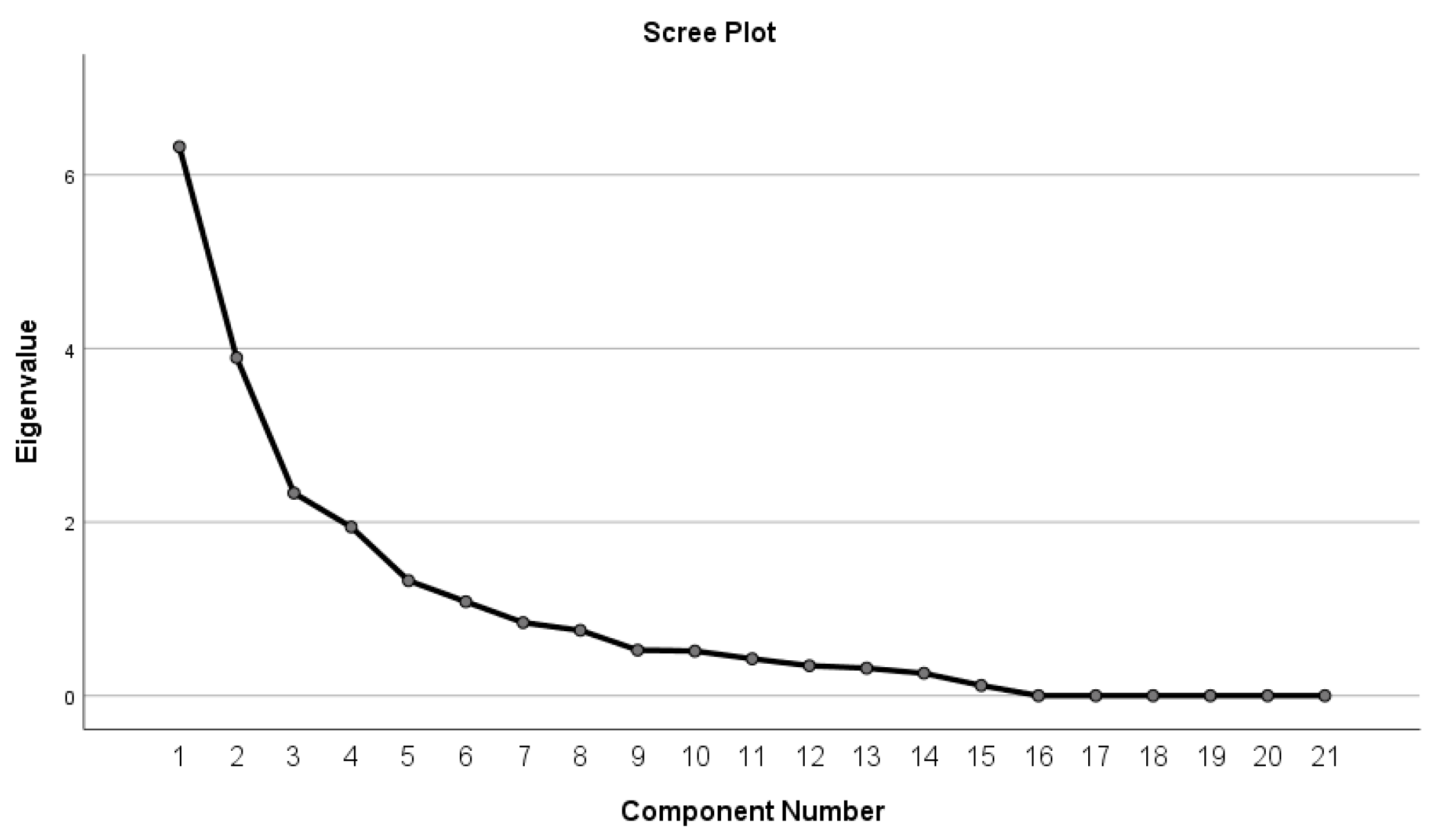

- A family farm business risk indicator system was built and the key factors were identified based on factor analysis.

- (2)

- The HFLTS and HFWA model were constructed for family farm business risk assessment, and a solution was provided for when experts hesitate between several linguistic expressions in family farm business risk assessment.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wang, J.H.; Su, Y.X. The embedding analysis of family farms from the perspective of village—Based on the survey of Zhang Cun, a village of Shandong Province. J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2016, 36, 64–69+144. [Google Scholar] [CrossRef]

- Sun, Y.H. Organization Pattern and Action Logic of New Agricultural Management Entities under Rural Revitalization. Jianghai Acad. J. 2022, 5, 81–87. [Google Scholar]

- Sara, B.; Olivia, V.; Whitney, K. Family farms’ resilience under the COVID-19 crisis: Challenges and opportunities with agritourism. Land Use Policy 2023, 134, 106902. [Google Scholar] [CrossRef]

- Xu, X. Study on the Restrictive Factors and Cultivation Path of High-Quality Development of Family Farms in Chengdu. Master’s Thesis, Sichuan Academy of Social Sciences, Chengdu, China, 2024. [Google Scholar]

- Chen, W.H.; Jiang, N.H. Study on the Influence of External Risks on Scale Selections of Grain-production Family Farms. Econ. Probl. 2022, 44, 85–92. [Google Scholar] [CrossRef]

- Ullah, R.; Shivakoti, G.P.; Zulfiqar, F.; Kamran, M.A. Farm risks and uncertainties: Sources, impacts and management. Outlook Agric. 2016, 45, 199–205. [Google Scholar] [CrossRef]

- Görg, H.; Spaliara, M.E. Financial Health, Exports and Firm Survival: Evidence from UK and French Firms. Economica 2014, 81, 419–444. [Google Scholar] [CrossRef]

- Adjognon, S.G.; Liverpool-Tasie, L.S.O.; Reardon, T.A. Agricultural input credit in Sub-Saharan Africa: Telling myth from facts. Food Policy 2017, 67, 93–105. [Google Scholar] [CrossRef]

- Lan, Y.; Xie, X.X.; Yi, Z.H. The development of Chinese-style family farm: Strategic intention, actual deviation and correction path—The analysis of the investigation of a county in Central China. Jiangxi Soc. Sci. 2015, 35, 205–210. [Google Scholar]

- Shi, G.Q.; Yin, Q.S. Accurate understanding, implementation difficulties and countermeasures of modern family farms. J. Northwest AF Univ. (Soc. Sci. Ed.) 2015, 15, 135–139. [Google Scholar]

- Gao, Q.; Kong, X.Z.; Shao, F. Study on the risk for the rented land management of industrial and commercial enterprises and its prevention system. Acad. J. Zhongzhou 2016, 38, 43–48. [Google Scholar]

- Zhang, Y.Y.; Yuan, B.; Chen, C. Agricultural management entities, agricultural risk and agricultural insurance. Jiangxi Soc. Sci. 2016, 36, 38–43. [Google Scholar]

- Bui, T.D.; Le, V.K. Assessing the risks to clam farming in Northern Vietnam within a climate change context. Aquac. Res. 2022, 53, 6272–6282. [Google Scholar] [CrossRef]

- Lepp, L.J.; Murtonen, M.; Kauranen, I. Farm Risk Map: A contextual tool for risk identification and sustainable management on farms. Risk Manag. 2012, 14, 42–59. [Google Scholar] [CrossRef]

- Hu, Y.X. The Influence of Social Networks and Financial Capability on Risk Management Tool Adoption: Take Planting Farms in Shaanxi Province as an Example. Ph.D. Thesis, Northwest A&F University, Xianyang, China, 2023. [Google Scholar] [CrossRef]

- Khan, M.A.; Guttormsen, A.G.; Roll, K.H. Production risk of Pangas (Pangasius hypophthalmus) fish farming. Aquac. Econ. Manag. 2018, 22, 192–208. [Google Scholar] [CrossRef]

- Kabir, J.; Cramb, R.; Alauddin, M.; Gaydon, D.S.; Roth, C.H. Farmers’ perceptions and management of risk in rice/shrimp farming systems in South-West Coastal Bangladesh. Land Use Policy 2020, 95, 104577. [Google Scholar] [CrossRef]

- Liu, L.H.; Li, M.Y.; Ren, J.Y. Problems and Countermeasures of Specific Assets Induced by Family Farm Exit. China Land Sci. 2020, 34, 79–87. [Google Scholar] [CrossRef]

- Berentsen, P.B.M.; Van Asseldonk, M.A.P.M. An empirical analysis of risk in conventional and organic arable farming in The Netherlands. Eur. J. Agron. 2016, 79, 100–106. [Google Scholar] [CrossRef]

- Duden, C.; Offermann, F. Income risk of German farms and its drivers. Ger. J. Agric. Econ. 2020, 69, 85–107. [Google Scholar] [CrossRef]

- Hazell PB, R. Application of Risk Preference Estimates in Firm-Household and Agricultural Sector Models. Am. J. Agric. Econ. 1982, 64, 384–390. [Google Scholar] [CrossRef]

- Lü, H.M.; Zhu, Y.X. Research on the development mode of the family farm: Base on the quantitative analysis of the questionnaire: Case of Ningbo City, Zhejiang Province. Issues Agric. Econ. 2015, 30, 19–26. [Google Scholar]

- Xiao, E.F. Research on Farmers’ Operation Risk Perception of Family Farm and its’ Influence Factors. Commer. Res. 2017, 60, 175–182. [Google Scholar] [CrossRef]

- Zhao, K.; Zhao, H.; Yang, K.B. Practice and enlightenment of the development of family farms in Songjiang District, Shanghai City. Issues Agric. Econ. 2015, 36, 9–13+110. [Google Scholar]

- Wu, Y.G.; Ren, H. Research on assessment of family farm business risk. Rural. Econ. Sci.-Technol. 2019, 30, 1–2+10. [Google Scholar]

- Deng, M. Research on the Prevention of the Business Risks of Family Farms in Heilongjiang Province. Master’s Thesis, Northeast Agricultural University, Harbin, China, 2019. [Google Scholar]

- Liu, C.; Deng, M.; Su, H.Q.; Cai, Y.; Zhang, X.M. The evaluation of the business risks of family farms and the influencing factors. Res. Agric. Mod. 2018, 39, 770–779. [Google Scholar] [CrossRef]

- Chen, W.H. Study on Influence of Internal and External Risks on Scale of Grain-production Family Farms—Based on Yangzhou City, Jiangsu Province. Ph.D. Thesis, Yangzhou University, Yangzhou, China, 2023. [Google Scholar] [CrossRef]

- Alekneviciene, V.; Vaitkevicius, S.; Girdziute, L.; Miceikiene, A. Integrated Risk Assessment: Case Study of Lithuanian Family Farms. Eng. Econ. 2019, 30, 402–410. [Google Scholar] [CrossRef]

- Zhang, Y.Z.; Geng, X.L. Risk assessment of service outsourcing based on DEMATEL and VIKOR. Comput. Eng. Appl. 2016, 52, 240–245. [Google Scholar]

- Malik, N.; Singh, V.; Kumar, K.; Elumalai, S.P. VOC source apportionment, reactivity, secondary transformations, and their prioritization using fuzzy-AHP method in a coal-mining city in India. Environ. Sci. Pollut. Res. 2024, 31, 25406–25423. [Google Scholar] [CrossRef] [PubMed]

- Rangzan, K.; Kabolizadeh, M.; Zaheri Abdehvand, Z.; Karimi, D.; Jafarnejadi, A.; Mokarram, M. Optimized Land Suitability Mapping for Wheat Cultivation by Integrating Fuzzy Hierarchical Analysis and Satellite Images. J. Indian Soc. Remote Sending 2024, 52, 1135–1151. [Google Scholar] [CrossRef]

- Zhang, Y.M.; Shang, K.J. Evaluation of mine ecological environment based on fuzzy hierarchical analysis and grey relational degree. Environ. Res. 2024, 257, 119370. [Google Scholar] [CrossRef]

- Buckley, J.J. Fuzzy hierarchical analysis. Fuzzy Sets Syst. 1985, 34, 187–195. [Google Scholar] [CrossRef]

- Kahraman, C.; Onar, S. Ztay IB B2C Marketplace Prioritization Using Hesitant Fuzzy Linguistic, AHP. Int. J. Fuzzy Syst. 2018, 20, 2202–2215. [Google Scholar] [CrossRef]

- Kosamia, N.; Sanchez, A.; Rakshit, S. Multi-criteria decision analysis of succinic acid production using hesitant fuzzy analytical hierarchy process. Ind. Crops Prod. 2023, 206, 117620. [Google Scholar] [CrossRef]

- Yavuz, M.; Oztaysi, B.; Onar, S.C.; Kahraman, C. Multi-criteria evaluation of alternative-fuel vehicles via a hierarchical hesitant fuzzy linguistic mode. Expert Syst. Appl. 2015, 42, 2835–2848. [Google Scholar] [CrossRef]

- Xia, M.M.; Xu, Z.S. Hesitant fuzzy information aggregation in decision making. Int. J. Approx. Reason. 2011, 52, 395–407. [Google Scholar] [CrossRef]

- Torra, V. Hesitant fuzy sets. Int. J. Intell. Syst. 2010, 25, 529–539. [Google Scholar]

- Rodríguez, R.M.; Martínez, L.; Herrera, F. A group decision making model dealing with comparative linguistic expressions based on hesitant fuzzy linguistic term sets. Inf. Sci. 2013, 241, 28–42. [Google Scholar] [CrossRef]

- Rodríguez, R.M.; Martinez, L.; Herrera, F. Hesitant fuzzy linguistic term sets for decision making. IEEE Trans. Fuzzy Syst. 2012, 20, 109–119. [Google Scholar] [CrossRef]

| No. | Risk Factor |

|---|---|

| 1 | Incidence of natural disaster |

| 2 | Incidence of diseases from pests |

| 3 | Technical adaptation degree |

| 4 | Technical staff satisfaction degree |

| 5 | Farm-scale |

| 6 | Potential market capacity |

| 7 | Product matching degree |

| 8 | Price fluctuations degree |

| 9 | Product quality |

| 10 | Policy support degree |

| 11 | Policy fluctuations degree |

| 12 | Product diversity |

| 13 | Social service system degree |

| 14 | Means of production value fluctuations degree |

| 15 | Frequency of land disputes |

| 16 | Contract performance degree |

| 17 | Risk cognition ability |

| 18 | Management decision-making ability |

| 19 | Organizational coordination ability |

| 20 | Financial management ability |

| 21 | Innovation ability |

| No. | Component | |||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 6 | 0.817 | |||||

| 4 | 0.753 | |||||

| 3 | 0.702 | |||||

| 9 | 0.682 | |||||

| 5 | ||||||

| 16 | 0.584 | |||||

| 11 | 0.560 | |||||

| 21 | 0.501 | |||||

| 7 | ||||||

| 12 | ||||||

| 13 | 0.786 | |||||

| 18 | 0.632 | |||||

| 15 | ||||||

| 1 | 0.769 | |||||

| 2 | 0.651 | |||||

| 17 | ||||||

| 10 | 0.575 | |||||

| 14 | 0.528 | |||||

| 8 | 0.663 | |||||

| 1 | 0.524 | |||||

| 21 | ||||||

| No. | First Layer Indicators | No. | Second Layer Indicators |

|---|---|---|---|

| A1 | Natural risk | A11 | Incidence of natural disaster |

| A12 | Incidence of diseases from pests | ||

| A2 | Technical risk | A21 | Technical adaptation degree |

| A22 | Technical staff satisfaction degree | ||

| A3 | Market risk | A31 | Potential market capacity |

| A32 | Product matching degree | ||

| A33 | Price fluctuations degree | ||

| A4 | Policy risk | A41 | Policy support degree |

| A42 | Policy fluctuations degree | ||

| A5 | Social risk | A51 | The social service system degree |

| A52 | Means of production value fluctuations degree | ||

| A53 | Contract performance degree | ||

| A6 | Management risk | A61 | Management decision-making ability |

| A62 | Organizational coordination ability | ||

| A63 | Financial management ability |

| Level | Value |

|---|---|

| No importance (N) | 0 |

| Very low importance (VL) | 1 |

| Low importance (L) | 2 |

| Medium importance (M) | 3 |

| High importance (H) | 4 |

| Very high importance (VH) | 5 |

| Absolute importance (A) | 6 |

| Level | Very Low Risk | Low Risk | Medium Risk | High Risk | Very High Risk |

|---|---|---|---|---|---|

| Range | [0, 0.2) | [0.2, 0.4) | [0.4, 0.6) | [0.6, 0.8) | [0.8, 1] |

| Indicators | A1 | A2 | A3 | A4 | A5 | A6 |

|---|---|---|---|---|---|---|

| A1 | - | at least H | M | M | M and H between | between M and VH |

| A2 | less than M | - | at most L | at most L | M | more than M |

| A3 | M | at least M | - | M and H between | more than M | between M and VH |

| A4 | between L and M | more than H | between L and M | - | at least H | between H and VH |

| A5 | at most M | M | less than M | between L and M | - | between VH and A |

| A6 | between VL and M | at most L | between VL and M | less than L | at most L | - |

| A1 | - | between H and VH | between M and H | at most M | M | VH |

| A2 | between VL and L | - | L | at most L | between M and H | more than M |

| A3 | at most M | at least M | - | between M and H | more than M | between M and H |

| A4 | L | at least M | between L and M | - | H | between H and VH |

| A5 | M | between H and VH | less than M | at most M | - | between H and VH |

| A6 | less than M | less than M | between VL and L | between L and M | at most M | - |

| A1 | - | M | H | M | between M and H | between VH and A |

| A2 | M | - | M | at most L | between M and H | less than M |

| A3 | between M and H | M | - | between M and H | more than M | between M and H |

| A4 | M | at least M | M | - | at least M | M |

| A5 | between L and M | between H and VH | less than M | at most M | - | at most M |

| A6 | less than M | more than M | between VL and L | M | more than M | - |

| A1 | - | M | between VL and L | M | M | L |

| A2 | M | - | H | M | between M and H | between M and H |

| A3 | at least M | at most M | - | at most H | between M and H | between M and H |

| A4 | between L and M | M | M | - | between L and M | M |

| A5 | M | between H and VH | between L and M | between M and H | - | M |

| A6 | more than M | between L and M | between VL and L | M | M | - |

| Indicators | A1 | A2 | A3 | A4 | A5 | A6 |

|---|---|---|---|---|---|---|

| A1 | - | [H, A] | [M, M] | [M, M] | [M, H] | [M, VH] |

| A2 | [N, L] | - | [N, L] | [N, L] | [M, M] | [H, A] |

| A3 | [M, M] | [M, A] | - | [M, H] | [H, A] | [M, VH] |

| A4 | [L, M] | [VH, A] | [L, M] | - | [H, A] | [H, VH] |

| A5 | [N, M] | [M, M] | [N, L] | [L, M] | - | [VH, A] |

| A6 | [VL, M] | [N, L] | [VL, M] | [N, VL] | [N, L] | - |

| A1 | - | [H, VH] | [M, H] | [N, M] | [M, M] | [VH, VH] |

| A2 | [VL, L] | - | [L, L] | [N, L] | [M, H] | [H, A] |

| A3 | [N, M] | [M, A] | - | [M, H] | [H, A] | [M, VH] |

| A4 | [L, L] | [M, A] | [L, M] | - | [H, H] | [H, VH] |

| A5 | [M, M] | [H, VH] | [N, L] | [N, M] | - | [H, VH] |

| A6 | [N, L] | [N, L] | [VL, L] | [L, M] | [N, M] | - |

| A1 | - | [M, M] | [H, H] | [M, M] | [M, H] | [VH, A] |

| A2 | [M, M] | - | [M, M] | [N, L] | [M, H] | [N, L] |

| A3 | [M, H] | [M, M] | - | [M, H] | [H, A] | [M, VH] |

| A4 | [M, M] | [M, A] | [M, M] | - | [M, A] | [M, M] |

| A5 | [L, M] | [H, VH] | [N, L] | [N, M] | - | [N, M] |

| A6 | [N, L] | [H, A] | [VL, L] | [M, M] | [H, A] | - |

| A1 | - | [M, M] | [VL, L] | [M, M] | [M, M] | [L, L] |

| A2 | [M, M] | - | [H, H] | [M, M] | [M, H] | [M, H] |

| A3 | [M, A] | [N, M] | - | [N, H] | [M, H] | [M, VH] |

| A4 | [L, M] | [M, M] | [M, M] | - | [L, M] | [M, M] |

| A5 | [M, M] | [H, VH] | [L, M] | [M, H] | - | [M, M] |

| A6 | [H, A] | [L, M] | [VL, L] | [M, M] | [M, M] | - |

| Indicators | A1 | A2 | A3 | A4 | A5 | A6 |

|---|---|---|---|---|---|---|

| A1 | - | [H, −0.5] | [M, −0.25] | [M, +0.25] | [M, 0] | [H, −0.25] |

| A2 | [L, −0.25] | - | [L, +0.25] | [VL, −0.25] | [M, 0] | [M, −0.25] |

| A3 | [L, +0.25] | [L, +0.25] | - | [L, +0.25] | [H, −0.25] | [M, 0] |

| A4 | [L, +0.25] | [L, +0.25] | [L, +0.25] | - | [H, −0.25] | [H, −0.5] |

| A5 | [L, 0] | [H, −0.5] | [VL, −0.5] | [VL, +0.25] | - | [M, 0] |

| A6 | [VL, +0.25] | [H, −0.25] | [VL, 0] | [L, 0] | [L, −0.25] | - |

| Indicators | A1 | A2 | A3 | A4 | A5 | A6 |

|---|---|---|---|---|---|---|

| A1 | - | [H, +0.25] | [L, +0.25] | [M, 0] | [H, −0.5] | [H, 0] |

| A2 | [L, +0.5] | - | [M, −0.25] | [L, +0.25] | [H, −0.25] | [H, +0.5] |

| A3 | [H, 0] | [H, +0.5] | - | [H, 0] | [VH, +0.5] | [VH, 0] |

| A4 | [M, −0.25] | [VH, +0.25] | [M, 0] | - | [H, −0.25] | [H, 0] |

| A5 | [M, 0] | [H, +0.5] | [L, +0.25] | [M, +0.25] | - | [H, +0.25] |

| A6 | [M, +0.25] | [M, +0.25] | [L, +0.25] | [L, +0.25] | [M, +0.5] | - |

| Indicators | Linguistic Intervals | Numerical Interval | Mean Value | Weight |

|---|---|---|---|---|

| A1 | [(M, −0.46);(M, −0.17)] | [2.54, 2.83] | 2.69 | 0.18 |

| A2 | [(L, −0.25);(M, −0.37)] | [1.75, 2.63] | 2.19 | 0.15 |

| A3 | [(L, +0.25);(H, −0.37)] | [2.25, 3.83] | 3.04 | 0.20 |

| A4 | [(L, +0.46);(H, +0.13)] | [2.46, 3.13] | 2.79 | 0.19 |

| A5 | [(L, −0.25);(M, −0.12)] | [1.75, 2.88] | 2.31 | 0.16 |

| A6 | [(VL, +0.25);(M, +0.46)] | [1.25, 2.46] | 1.85 | 0.12 |

| Indicators | Weight | Experts Evaluation Score | |||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | ||

| A11 | 0.079 | 0.5 | 0.6 | (0.4, 0.5) | (0.5, 0.6) |

| A12 | 0.070 | (0.5, 0.7) | 0.7 | 0.6 | 0.5 |

| A21 | 0.059 | 0.5 | (0.4, 0.5) | 0.3 | (0.4, 0.6) |

| A22 | 0.064 | (0.4, 0.5, 0.6) | 0.5 | (0.5, 0.6) | 0.6 |

| A31 | 0.068 | 0.3 | 0.5 | 0.4 | 0.5 |

| A32 | 0.072 | 0.5 | (0.5, 0.6) | (0.4, 0.6) | (0.5, 0.6) |

| A33 | 0.071 | 0.3 | (0.2, 0.3, 0.4) | (0.3, 0.4) | 0.4 |

| A41 | 0.073 | 0.6 | 0.5 | 0.5 | (0.4, 0.5, 0.6) |

| A42 | 0.071 | (0.4, 0.5) | 0.4 | (0.5, 0.6) | 0.5 |

| A51 | 0.065 | 0.4 | 0.6 | 0.4 | (0.5, 0.6) |

| A52 | 0.066 | 0.3 | (0.1, 0.3) | 0.3 | (0.2, 0.3) |

| A53 | 0.067 | 0.2 | (0.3, 0.4) | 0.4 | 0.3 |

| A61 | 0.056 | (0.5, 0.7) | (0.5, 0.7) | (0.4, 0.5) | 0.6 |

| A62 | 0.057 | (0.3, 0.4) | 0.3 | 0.3 | (0.4, 0.5) |

| A63 | 0.062 | (0.5, 0.6) | 0.5 | (0.5, 0.6) | 0.5 |

| Indicators | Score Integration | Score |

|---|---|---|

| A11 | {0.505, 0.527, 0.532, 0.553} | 0.529 |

| A12 | {0.584, 0.634} | 0.609 |

| A21 | {0.404, 0.431, 0.462, 0.486} | 0.446 |

| A22 | {0.505, 0.532, 0.527, 0.553, 0.553, 0.557} | 0.541 |

| A31 | {0.431} | 0.431 |

| A32 | {0.477, 0.577, 0.477, 0.577, 0.477, 0.577, 0.477, 0.577} | 0.527 |

| A33 | {0.304, 0.352, 0.352, 0.330, 0.326, 0.376} | 0.340 |

| A41 | {0.505, 0.527, 0.553} | 0.528 |

| A42 | {0.452, 0.505, 0.452, 0.505} | 0.479 |

| A51 | {0.482, 0.510} | 0.496 |

| A52 | {0.229, 0.300, 0.229, 0.300} | 0.265 |

| A53 | {0.304, 0.330} | 0.317 |

| A61 | {0.505, 0.634, 0.505, 0.634, 0.505, 0.634, 0.505, 0.634} | 0.569 |

| A62 | {0.326, 0.381, 0.326, 0.381} | 0.354 |

| A63 | {0.500, 0.553, 0.500, 0.553} | 0.526 |

| Indicators | First Layer Indicators’ Score | First Layer Indicators’ Weight | Target Layer Score |

|---|---|---|---|

| A1 | 0.567 | 0.181 | 0.474 |

| A2 | 0.495 | 0.147 | |

| A3 | 0.433 | 0.204 | |

| A4 | 0.504 | 0.188 | |

| A5 | 0.358 | 0.155 | |

| A6 | 0.484 | 0.125 |

| Method | First Layer Indicators’ Weight | Target Layer Score | |||||

|---|---|---|---|---|---|---|---|

| A1 | A2 | A3 | A4 | A5 | A6 | ||

| Buckley’s AHP | 0.180 | 0.148 | 0.201 | 0.185 | 0.152 | 0.133 | 0.475 |

| HFLTS | 0.181 | 0.147 | 0.204 | 0.188 | 0.155 | 0.125 | 0.474 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mou, Y.; Li, X. Chinese Family Farm Business Risk Assessment Using a Hierarchical Hesitant Fuzzy Linguistic Model. Mathematics 2024, 12, 2216. https://doi.org/10.3390/math12142216

Mou Y, Li X. Chinese Family Farm Business Risk Assessment Using a Hierarchical Hesitant Fuzzy Linguistic Model. Mathematics. 2024; 12(14):2216. https://doi.org/10.3390/math12142216

Chicago/Turabian StyleMou, Yu, and Xiaofeng Li. 2024. "Chinese Family Farm Business Risk Assessment Using a Hierarchical Hesitant Fuzzy Linguistic Model" Mathematics 12, no. 14: 2216. https://doi.org/10.3390/math12142216