Approximate Closed-Form Solutions for Pricing Zero-Coupon Bonds in the Zero Lower Bound Framework

Abstract

:1. Introduction

2. Methodology

2.1. Modeling Interest Rates Using the Inverse-Call Transformation

2.1.1. Inverse-Call Transformation

2.1.2. Shadow Rates and Instantaneous Interest Rates

2.2. The ZCB Price under the Vasicek Model

2.3. The ZCB Price under the MeLo-1-V Model

2.3.1. The Monte-Carlo Price

2.3.2. The ZCB-Price Approximation Using the Gauss-Hermite Quadrature

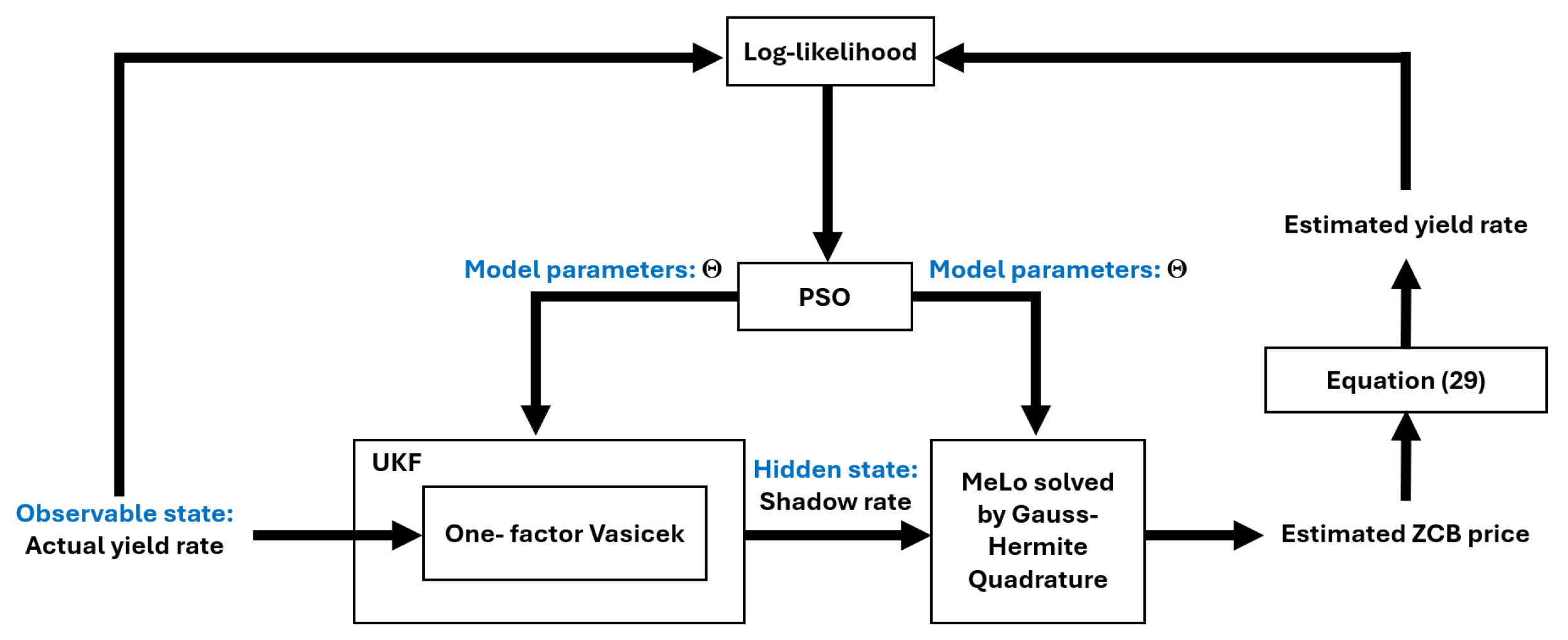

2.4. Estimation of Unobservable State Variable and Model-Parameter Calibration

2.4.1. State-Space Model

2.4.2. Maximum-Likelihood Estimation (MLE)

2.4.3. Unscented Kalman Filter (UKF)

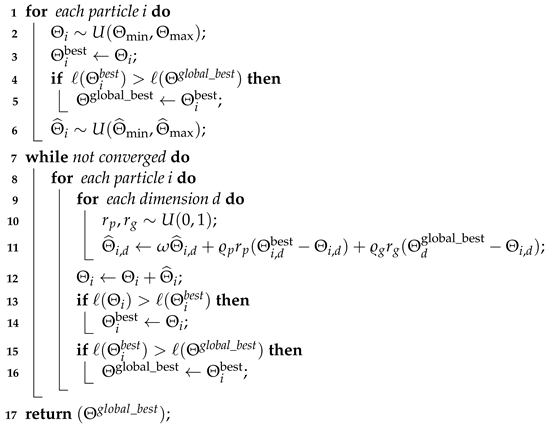

2.4.4. Particle Swarm Optimization (PSO)

| Algorithm 2: Particle Swarm Optimization (PSO) [14] |

|

3. Results

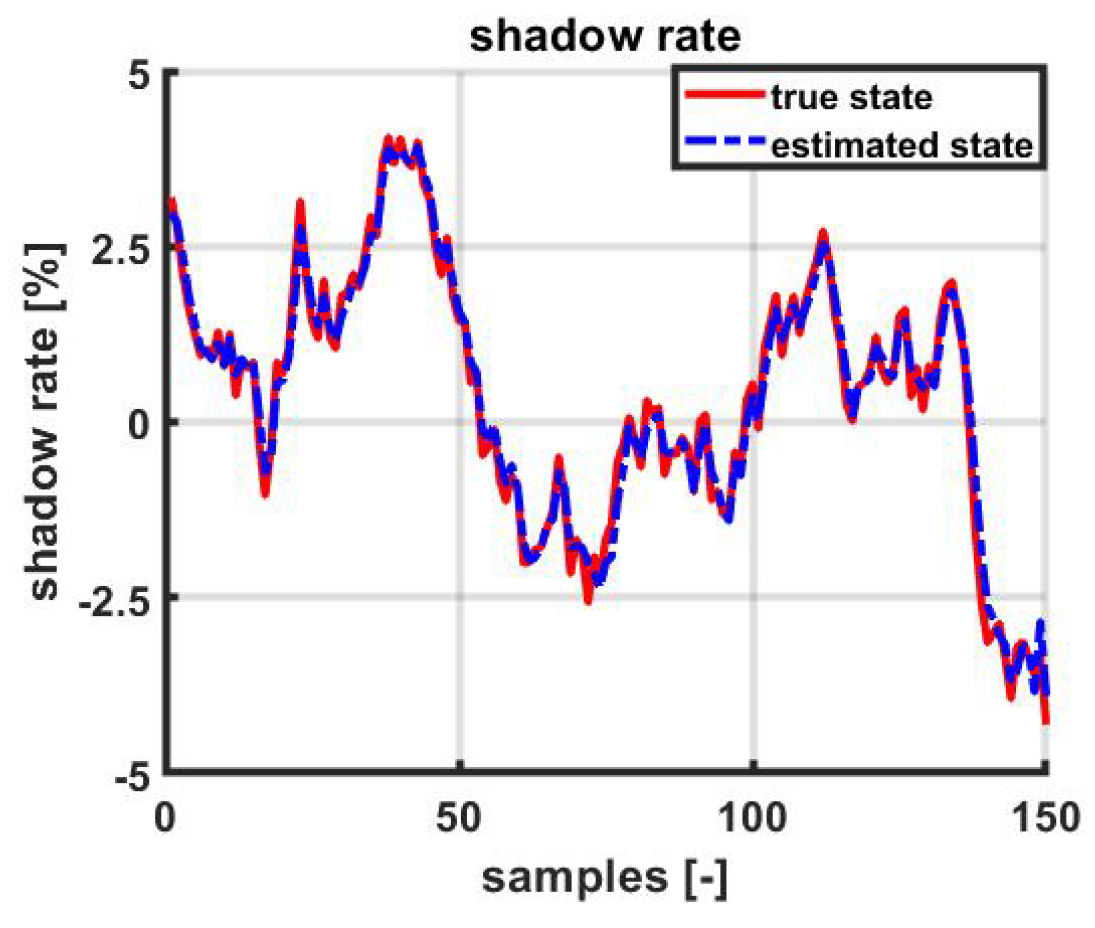

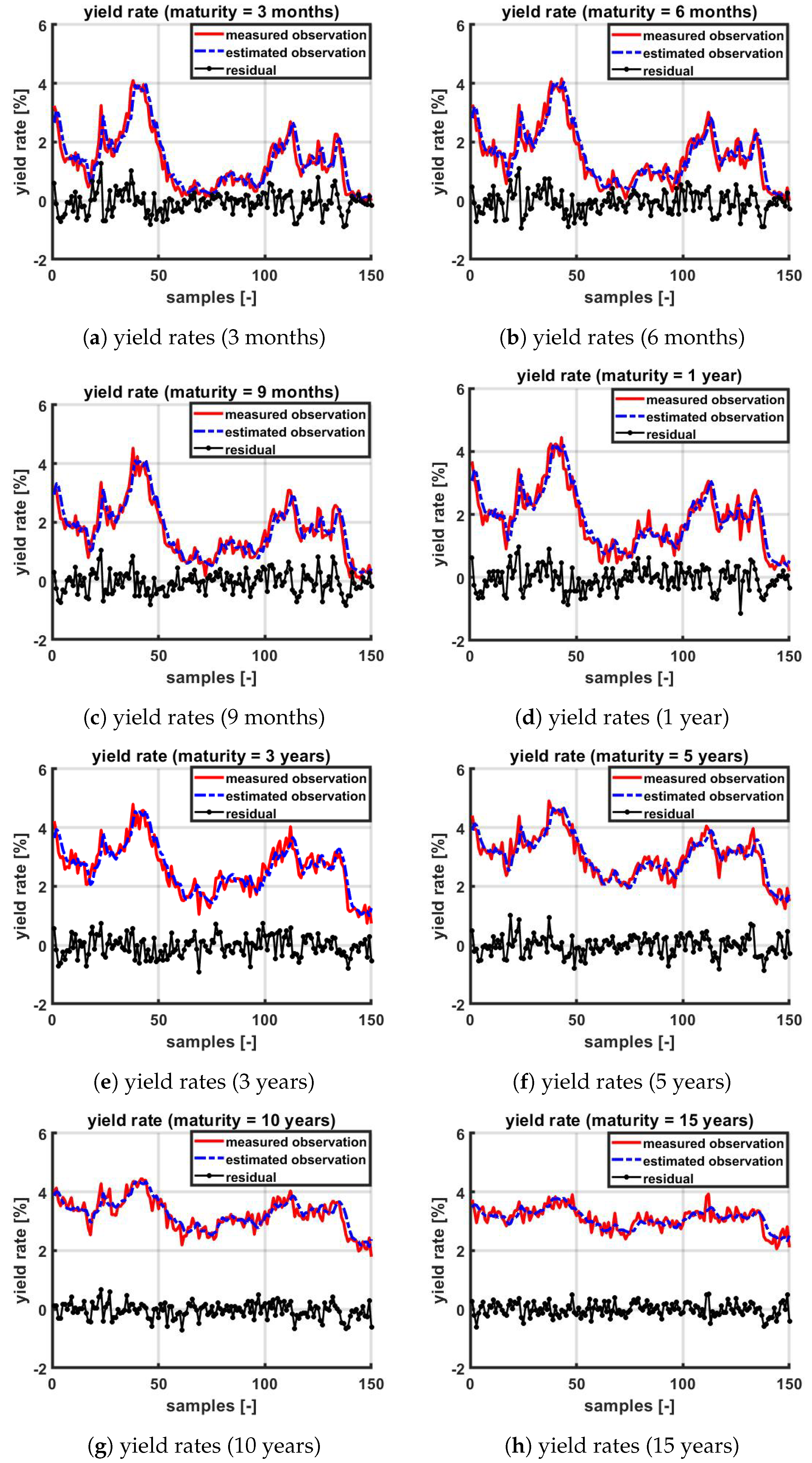

3.1. The MeLo-1-V Model with Synthetically Generated Data

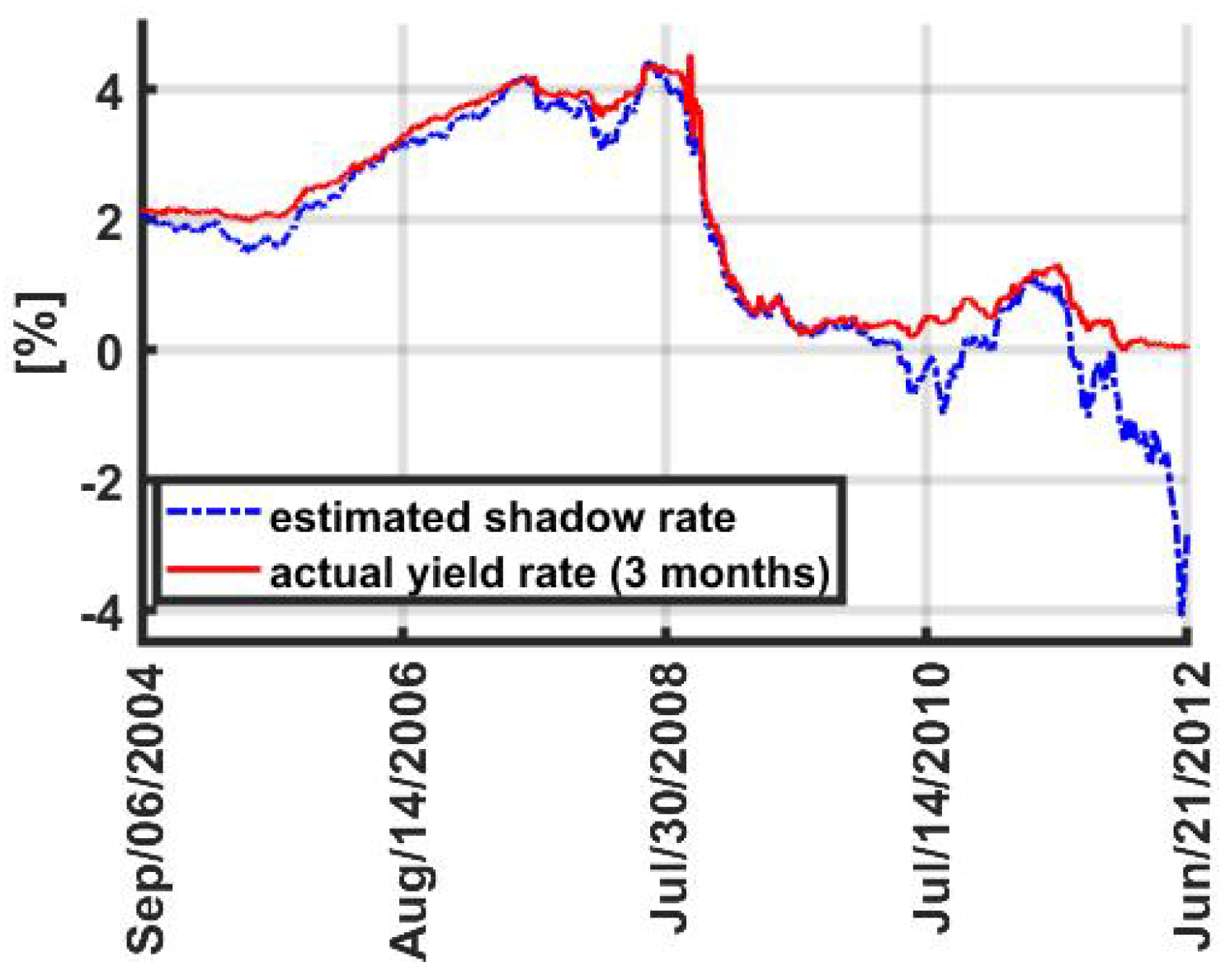

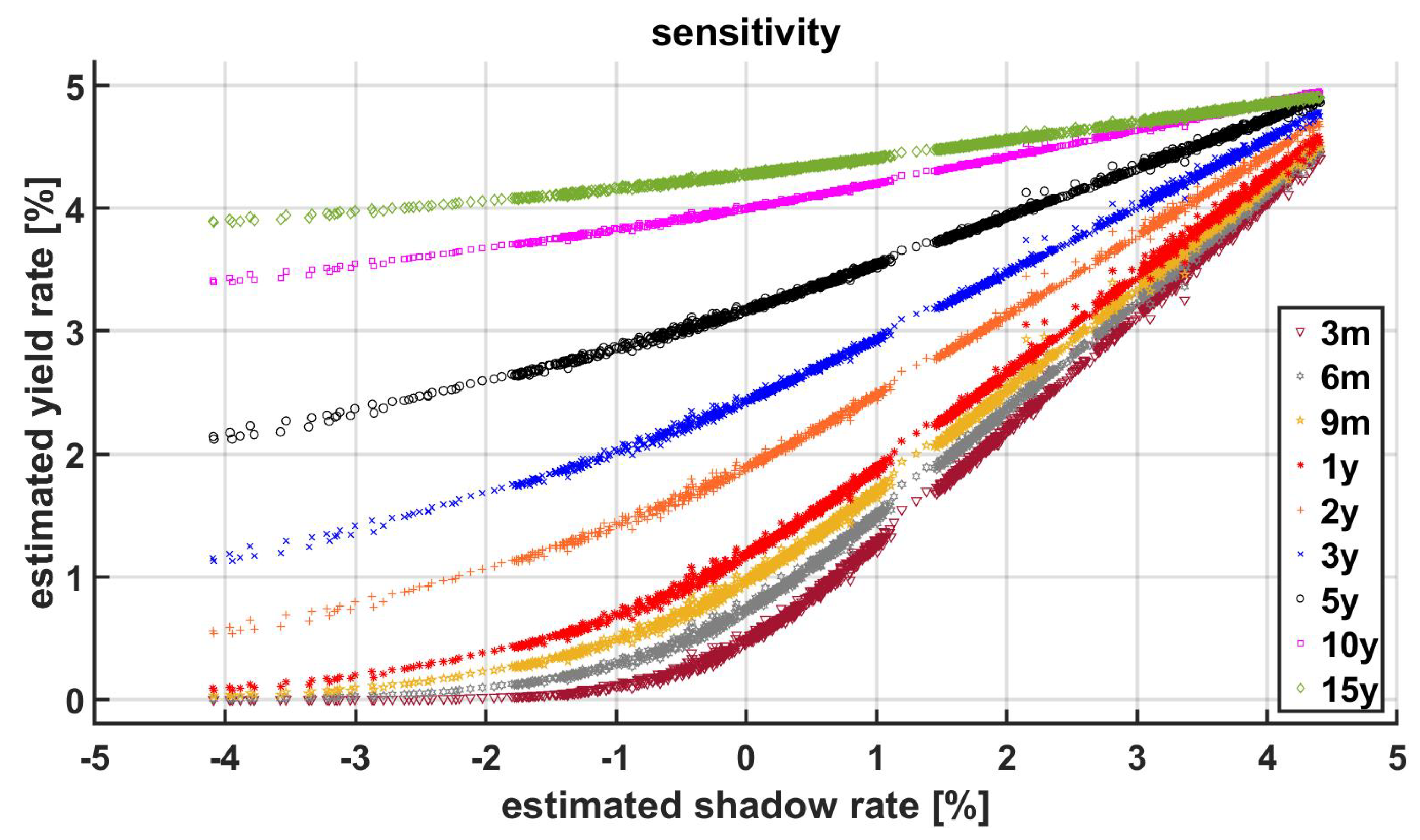

3.2. The MeLo-1-V Model with Actual Data

4. Discussion

4.1. Negative Interest Rates under the Vasicek

4.2. Comparison between the Vasicek Model and the MeLo-1-V Model

4.2.1. Scenarios Where the MeLo-1-V and Its Underlying Vasicek Are Roughly the Same

4.2.2. Scenarios Where the Vasicek Curve Seems to Be Unreliable

5. Conclusions and Future Work

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Proof of Theorem 1

- with

- with and

- with and .

- Case with and

- Case with and

Appendix B. Proof of Theorem 2

References

- Brigo, D.; Mercurio, F. Interest Rate Models—Theory and Practice: With Smile, Inflation and Credit; Springer: Berlin/Heidelberg, Germany, 2006. [Google Scholar] [CrossRef]

- Leblon, G.; Moraux, F. Quadratic, affine and hybrid Gaussian term structure models in discrete time: Theory and evidence. In Proceedings of the Finance International Meeting AFFI-EUROFIDAI, Paris, France, 17–18 December 2009. [Google Scholar] [CrossRef]

- Cox, J.C.; Ingersoll, E.I., Jr.; Ross, S.A. A theory of the term structure of interest rates. Econometrica 1985, 53, 385–407. [Google Scholar] [CrossRef]

- Leippold, M.; Wu, L. Asset pricing under the quadratic class. J. Financ. Quant. Anal. 2002, 37, 271–295. [Google Scholar] [CrossRef]

- Black, F. Interest rate as options. J. Financ. 1995, 50, 1371–1376. [Google Scholar] [CrossRef]

- Kim, D.H.; Priebsch, M. Estimation of Multi-Factor Shadow-Rate Term Structure Models; Federal Reserve Board Discussion Paper Series; Federal Reserve Board: Washington, DC, USA, 2013.

- Krippner, L. Modifying Gaussian Term Structure Models When Interest Rates Are Near the Zero Lower Bound; Reserve Bank of New Zealand Discussion Paper Series; Reserve Bank of New Zealand: Wellington, New Zealand, 2012. [Google Scholar]

- Richard, S. A Non-Linear Macroeconomic Term Structure Model; The Wharton School Research Paper: Philadelphia, PA, USA, 2013. [Google Scholar]

- Wu, J.C.; Xia, F.D. Measuring the macroeconomic impact of monetary policy at the zero lower bound. J. Money Credit. Bank. 2016, 48, 253–291. [Google Scholar] [CrossRef]

- Meucci, A.; Loregian, A. Neither “normal” nor “lognormal”: Modeling interest rates across all regimes. Financ. Anal. J. 2016, 72, 68–82. [Google Scholar] [CrossRef]

- Vasicek, O. An equilibrium characterization of the term structure. J. Financ. Econ. 1977, 5, 177–188. [Google Scholar] [CrossRef]

- Abramowitz, M.; Stegun, I.A. Handbook of Mathematical Functions: With Formulas, Graphs, and Mathematical Tables; United States Government Printing Office: Washington, DC, USA, 1964.

- Wan, E.; Van Der Merwe, R. The unscented Kalman filter for nonlinear estimation. In Proceedings of the Adaptive Systems for Signal Processing, Communications, and Control Symposium, Lake Louise, AB, Canada, 4 October 2000; pp. 153–158. [Google Scholar] [CrossRef]

- Kennedy, J.; Eberhart, R. Particle swarm optimization. In Proceedings of the IEEE International Conference on Neural Networks, Perth, WA, Australia, 27 November–1 December 1995; pp. 1942–1948. [Google Scholar] [CrossRef]

- ECB. AAA-Rated Euro-Area Yield Curve, 2004–2012. Available online: https://www.ecb.europa.eu/stats/financial_markets_and_interest_rates/euro_area_yield_curves/html/index.en.html (accessed on 1 July 2024).

- Christensen, J.H.E.; Rudebusch, G.D. Modeling yields at the zero lower bound: Are shadow rates the solution? Dyn. Factor Model. 2016, 35, 75–125. [Google Scholar] [CrossRef]

- Monfort, A.; Pegoraro, F.; Renne, J.P.; Roussellet, G. Staying at zero with affine processes: A new dynamic term structure model. J. Econom. 2017, 201, 348–366. [Google Scholar] [CrossRef]

- Uhlenbeck, G.E.; Ornstein, L.S. On the theory of the Brownian motion. Phys. Rev. 1930, 36, 823. [Google Scholar] [CrossRef]

- Christensen, J.H.E.; Diebold, F.X.; Rudebusch, G.D. The affine arbitrage-free class of Nelson-Siegel term structure models. J. Econom. 2011, 164, 4–20. [Google Scholar] [CrossRef]

- Thrun, S.; Burgard, W.; Fox, D. Probabilistic Robotics; Intelligent Robotics and Autonomous Agents Series; The MIT Press: Cambridge, MA, USA, 2005. [Google Scholar]

- Dang-Nguyen, S.; Rakotondratsimba, Y. On the Generation of Negative Yields under the Vasicek One-Factor Model. 22 December 2014; Available at SSRN. [Google Scholar] [CrossRef]

| Maturity | Min | Max | Mean | Std | Skewness | Kurtosis | 1Q | 2Q | 3Q |

|---|---|---|---|---|---|---|---|---|---|

| 3 months | −0.0244 | 4.5116 | 1.9620 | 1.4480 | 0.2013 | 1.5266 | 0.4811 | 2.0542 | 3.5388 |

| 6 months | 0.0148 | 4.6650 | 2.0797 | 1.4304 | 0.1895 | 1.5455 | 0.6716 | 2.0830 | 3.5441 |

| 9 months | 0.0304 | 4.8286 | 2.1967 | 1.3658 | 0.1776 | 1.6462 | 0.9727 | 2.1525 | 3.6033 |

| 1 year | 0.0708 | 4.8734 | 2.3127 | 1.2894 | 0.1357 | 1.7636 | 1.2945 | 2.2189 | 3.6097 |

| 3 years | 0.9586 | 4.7681 | 3.1776 | 0.7458 | −0.5211 | 2.7179 | 2.7851 | 3.2962 | 3.7141 |

| 5 years | 1.9980 | 4.8807 | 3.8579 | 0.4881 | −0.6204 | 3.0262 | 3.5364 | 3.9703 | 4.2129 |

| 10 years | 3.1180 | 5.7411 | 4.5384 | 0.4659 | 0.0373 | 2.2455 | 4.1477 | 4.5291 | 4.9369 |

| 15 years | 2.8365 | 5.5144 | 4.4929 | 0.5141 | −0.2366 | 2.2964 | 4.1005 | 4.4825 | 4.9547 |

| Maturity | Min | Max | Mean | Std | Skewness | Kurtosis | 1Q | 2Q | 3Q |

|---|---|---|---|---|---|---|---|---|---|

| 3 months | 0.0000 | 4.4627 | 1.9467 | 1.3896 | 0.1975 | 1.6029 | 0.6384 | 1.9025 | 3.3335 |

| 6 months | 0.0036 | 4.5071 | 2.1120 | 1.3346 | 0.1545 | 1.6378 | 0.8968 | 2.0844 | 3.4368 |

| 9 months | 0.0279 | 4.5477 | 2.2668 | 1.2809 | 0.1166 | 1.6740 | 1.1287 | 2.2525 | 3.5322 |

| 1 year | 0.0799 | 4.5848 | 2.4118 | 1.2284 | 0.0843 | 1.7093 | 1.3387 | 2.4076 | 3.6206 |

| 3 years | 1.1236 | 4.7882 | 3.2795 | 0.8759 | -0.0444 | 1.8868 | 2.5519 | 3.3023 | 4.1293 |

| 5 years | 2.1200 | 4.8881 | 3.7883 | 0.6423 | -0.0775 | 1.9469 | 3.2614 | 3.8088 | 4.4092 |

| 10 years | 3.3998 | 4.9491 | 4.3401 | 0.3556 | -0.0827 | 1.9647 | 4.0489 | 4.3513 | 4.6834 |

| 15 years | 3.8850 | 4.9103 | 4.5025 | 0.2371 | -0.0711 | 1.9498 | 4.3077 | 4.5090 | 4.7317 |

| Maturity | Min | Max | Mean | Median | Std | MAE | RMSE |

|---|---|---|---|---|---|---|---|

| 3 months | −0.8880 | 1.2776 | −0.0581 | −0.0541 | 0.3811 | 0.2940 | 0.3842 |

| 6 months | −0.9239 | 1.0959 | −0.0574 | −0.0806 | 0.3881 | 0.3156 | 0.3910 |

| 9 months | −0.8265 | 1.0415 | −0.0386 | −0.0398 | 0.3700 | 0.3004 | 0.3708 |

| 1 year | −1.1321 | 0.9634 | −0.0443 | −0.0411 | 0.3786 | 0.3065 | 0.3800 |

| 3 years | −0.9165 | 0.7445 | −0.0293 | −0.0219 | 0.3503 | 0.2882 | 0.3504 |

| 5 years | −0.8517 | 1.0144 | −0.0126 | −0.0187 | 0.3376 | 0.2690 | 0.3367 |

| 10 years | −0.7106 | 0.6723 | −0.0389 | −0.0142 | 0.2641 | 0.2086 | 0.2661 |

| 15 years | −0.5981 | 0.5265 | −0.0038 | −0.0141 | 0.2292 | 0.1846 | 0.2285 |

| Maturity | Min | Max | Mean | Median | Std | MAE | RMSE |

|---|---|---|---|---|---|---|---|

| 3 months | −0.5407 | 1.2452 | 0.0153 | 0.0385 | 0.1779 | 0.1390 | 0.1785 |

| 6 months | −0.4733 | 0.3394 | −0.0324 | −0.0039 | 0.1589 | 0.1276 | 0.1621 |

| 9 months | −1.3801 | 0.4284 | −0.0703 | −0.0873 | 0.1708 | 0.1478 | 0.1847 |

| 1 year | −1.6317 | 0.4660 | −0.0992 | −0.0950 | 0.2009 | 0.1631 | 0.2240 |

| 3 years | −0.8926 | 1.0397 | −0.1022 | −0.1908 | 0.4012 | 0.3551 | 0.4139 |

| 5 years | −0.8815 | 1.3998 | 0.0692 | −0.0352 | 0.5328 | 0.4552 | 0.5371 |

| 10 years | −0.8618 | 1.6063 | 0.1980 | 0.1416 | 0.5550 | 0.4633 | 0.5891 |

| 15 years | −1.0749 | 1.1497 | −0.0100 | −0.0766 | 0.4710 | 0.3902 | 0.4710 |

| Maturity | Yield (Ex. 1) | Yield (Ex. 2) | Yield (Ex. 3) | Yield (Ex. 4) | Yield (Ex. 5) |

|---|---|---|---|---|---|

| 1/12 | 5.7957 | 5.7911 | 0.2480 | −0.4961 | −4.8534 |

| 4/12 | 5.7718 | 5.7305 | 0.2165 | −0.4901 | −4.5738 |

| 6/12 | 5.6981 | 5.5345 | 0.1019 | −0.4854 | −4.1859 |

| 8/12 | 5.5801 | 5.2154 | −0.0915 | −0.4858 | −3.8324 |

| 1 | 5.4191 | 4.7768 | −0.3615 | −0.4910 | −3.5098 |

| 2 | 4.3687 | 1.8931 | −2.1652 | −0.5580 | −2.4706 |

| 3 | 2.7224 | −2.6475 | −5.0306 | −0.6928 | −1.7293 |

| 4 | 0.5467 | −8.6592 | −8.8389 | −0.8881 | −1.1891 |

| 5 | −2.0974 | −15.9733 | −13.4820 | −1.1368 | −0.7870 |

| 6 | −5.1548 | −24.4364 | −18.8616 | −1.4330 | −0.4815 |

| 7 | −8.5753 | −33.9090 | −24.8885 | −1.7709 | −0.2448 |

| 8 | −12.3132 | −44.2644 | −31.4815 | −2.1454 | −0.0580 |

| 9 | −16.3273 | −55.3877 | −38.5670 | −2.5518 | 0.0921 |

| 10 | −20.5799 | −67.1744 | −46.0782 | −2.9860 | 0.2146 |

| 12 | −29.6680 | −92.3696 | −62.1415 | −3.9228 | 0.4015 |

| 15 | −44.3380 | −133.0506 | −88.0919 | −5.4516 | 0.5906 |

| 20 | −70.1354 | −204.6084 | −133.7631 | −8.1688 | 0.7806 |

| 25 | −96.0515 | −276.5105 | −179.6724 | −10.9203 | 0.8947 |

| 30 | −120.9957 | −345.7247 | −223.8763 | −13.5814 | 0.9708 |

| 35 | −144.3949 | −410.6574 | −265.3527 | −16.0857 | 1.0252 |

| 50 | −203.6505 | −575.1068 | −370.4153 | −22.4504 | 1.1230 |

| Case 1 | Case 2 | |||||

|---|---|---|---|---|---|---|

| Maturity | Yield (Vasicek) | Yield (MeLo-1-V) | Diff. | Yield (Vasicek) | Yield (MeLo-1-V) | Diff. |

| 1/12 | 2.5047 | 2.5047 | 0.0000 | 0.0246 | 0.5361 | −0.5115 |

| 4/12 | 2.5142 | 2.5142 | 0.0000 | 0.0729 | 0.6468 | −0.5739 |

| 6/12 | 2.5282 | 2.5282 | 0.0000 | 0.1429 | 0.7898 | −0.6469 |

| 8/12 | 2.5421 | 2.5421 | 0.0000 | 0.2103 | 0.9140 | −0.7037 |

| 1 | 2.5559 | 2.5558 | 0.0001 | 0.2750 | 1.0254 | −0.7504 |

| 2 | 2.6094 | 2.6091 | 0.0003 | 0.5101 | 1.3910 | −0.8809 |

| 3 | 2.6608 | 2.6601 | 0.0007 | 0.7113 | 1.6754 | −0.9641 |

| 4 | 2.7101 | 2.7089 | 0.0012 | 0.8839 | 1.9065 | −1.0226 |

| 5 | 2.7574 | 2.7556 | 0.0018 | 1.0322 | 2.0977 | −1.0655 |

| 6 | 2.8029 | 2.8003 | 0.0026 | 1.1598 | 2.2572 | −1.0974 |

| 7 | 2.8466 | 2.8430 | 0.0036 | 1.2698 | 2.3908 | −1.1210 |

| 8 | 2.8885 | 2.8840 | 0.0045 | 1.3648 | 2.5026 | −1.1378 |

| 9 | 2.9289 | 2.9231 | 0.0058 | 1.4471 | 2.5962 | −1.1491 |

| 10 | 2.9677 | 2.9606 | 0.0071 | 1.5185 | 2.6740 | −1.1555 |

| 12 | 3.0411 | 3.0308 | 0.0103 | 1.6345 | 2.7912 | −1.1567 |

| 15 | 3.1413 | 3.1254 | 0.0159 | 1.7592 | 2.8940 | −1.1348 |

| 20 | 3.2860 | 3.2581 | 0.0279 | 1.8854 | 2.9399 | −1.0545 |

| 25 | 3.4075 | 3.3649 | 0.0426 | 1.9560 | 2.8964 | −0.9404 |

| 30 | 3.5104 | 3.4507 | 0.0597 | 1.9983 | 2.8073 | −0.8090 |

| 35 | 3.5982 | 3.5192 | 0.0790 | 2.0254 | 2.6967 | −0.6713 |

| 50 | 3.7952 | 3.6475 | 0.1477 | 2.0676 | 2.3444 | −0.2768 |

| Example 1 | Example 3 | Example 5 | ||||

|---|---|---|---|---|---|---|

| Maturity | Yield (Vasicek) | Yield (MeLo-1-V) | Yield (Vasicek) | Yield (MeLo-1-V) | Yield (Vasicek) | Yield (MeLo-1-V) |

| 1/12 | 5.7957 | 5.8618 | 0.2480 | 1.7537 | −4.8534 | 0.0128 |

| 4/12 | 5.7718 | 6.1852 | 0.2165 | 2.8204 | −4.5738 | 0.0204 |

| 6/12 | 5.6981 | 6.6505 | 0.1019 | 3.8359 | −4.1859 | 0.0403 |

| 8/12 | 5.5801 | 7.0312 | −0.0915 | 4.5639 | −3.8324 | 0.0728 |

| 1 | 5.4191 | 7.3388 | −0.3615 | 5.1264 | −3.5098 | 0.1170 |

| 2 | 4.3687 | 8.0579 | −2.1652 | 6.4461 | −2.4706 | 0.3570 |

| 3 | 2.7224 | 8.2548 | −5.0306 | 6.9329 | −1.7293 | 0.6075 |

| 4 | 0.5467 | 8.1533 | −8.8389 | 6.9861 | −1.1891 | 0.8208 |

| 5 | −2.0974 | 7.8840 | −13.4820 | 6.8093 | −0.7870 | 0.9906 |

| 6 | −5.1548 | 7.5285 | −18.8616 | 6.5191 | −0.4815 | 1.1222 |

| 7 | −8.5753 | 7.1376 | −24.8885 | 6.1822 | −0.2448 | 1.2232 |

| 8 | −12.3132 | 6.7417 | −31.4815 | 5.8356 | −0.0580 | 1.3007 |

| 9 | −16.3273 | 6.3579 | −38.5670 | 5.4988 | 0.0921 | 1.3601 |

| 10 | −20.5799 | 5.9952 | −46.0782 | 5.1811 | 0.2146 | 1.4058 |

| 12 | −29.6680 | 5.3454 | −62.1415 | 4.6152 | 0.4015 | 1.4675 |

| 15 | −44.3380 | 4.5553 | −88.0919 | 3.9324 | 0.5906 | 1.5139 |

| 20 | −70.1354 | 3.6158 | −133.7631 | 3.1265 | 0.7806 | 1.5297 |

| 25 | −96.0515 | 2.9812 | −179.6724 | 2.5835 | 0.8947 | 1.5112 |

| 30 | −120.9957 | 2.5303 | −223.8763 | 2.1976 | 0.9708 | 1.4782 |

| 35 | −144.3949 | 2.1955 | −265.3527 | 1.9105 | 1.0252 | 1.4389 |

| 50 | −203.6505 | 1.5688 | −370.4153 | 1.3710 | 1.1230 | 1.3141 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jun, J.-Y.; Rakotondratsimba, Y. Approximate Closed-Form Solutions for Pricing Zero-Coupon Bonds in the Zero Lower Bound Framework. Mathematics 2024, 12, 2690. https://doi.org/10.3390/math12172690

Jun J-Y, Rakotondratsimba Y. Approximate Closed-Form Solutions for Pricing Zero-Coupon Bonds in the Zero Lower Bound Framework. Mathematics. 2024; 12(17):2690. https://doi.org/10.3390/math12172690

Chicago/Turabian StyleJun, Jae-Yun, and Yves Rakotondratsimba. 2024. "Approximate Closed-Form Solutions for Pricing Zero-Coupon Bonds in the Zero Lower Bound Framework" Mathematics 12, no. 17: 2690. https://doi.org/10.3390/math12172690