Analysis of Queueing System with Dynamic Rating-Dependent Arrival Process and Price of Service

Abstract

1. Introduction

2. Rating and Price Formation Mechanisms and Queueing Model

3. The Markov Process Describing the System and the Derivation of Its Generator

- The underlying process of the customer’s arrival leaves the current state. The corresponding transition intensities are determined by the modules of the diagonal entries of the matrices

- A customer is serviced. The corresponding transition rates are given by the matrices

- A customer reneges (leaves the buffer) due to impatience. The matrices set the corresponding intensities.

- The price level is changed. The transition rates are determined by the diagonal entries of the matrix

- The off-diagonal entries of the matrices when the underlying process makes a jump without a customer generation;

- The off-diagonal entries of the matrices when an arriving customer abandons the system at the entrance and he or she is not surveyed;

- The off-diagonal entries of the matrices when an arriving customer abandons the system at the entrance and he or she is surveyed, but the system already has the lowest rating;

- The off-diagonal entries of the matrices when the system changes its price level.

- The customer does not participate in the survey. The corresponding transition rates are given by the entries of the matrices

- The customer participates in the survey and (i) states that the queue length is acceptable and does not change the rating; (ii) considers the queue length too long and wants to decrease the rating, but the system already has the lowest rating; (iii) considers the queue length short and wants to increase the rating, but the system already has the highest rating. The corresponding rates are given by the matrices in case (i), matrices in case (ii), and matrices in case (iii).

4. The Stationary Distribution of the System States and the Calculation of Its Performance Measures

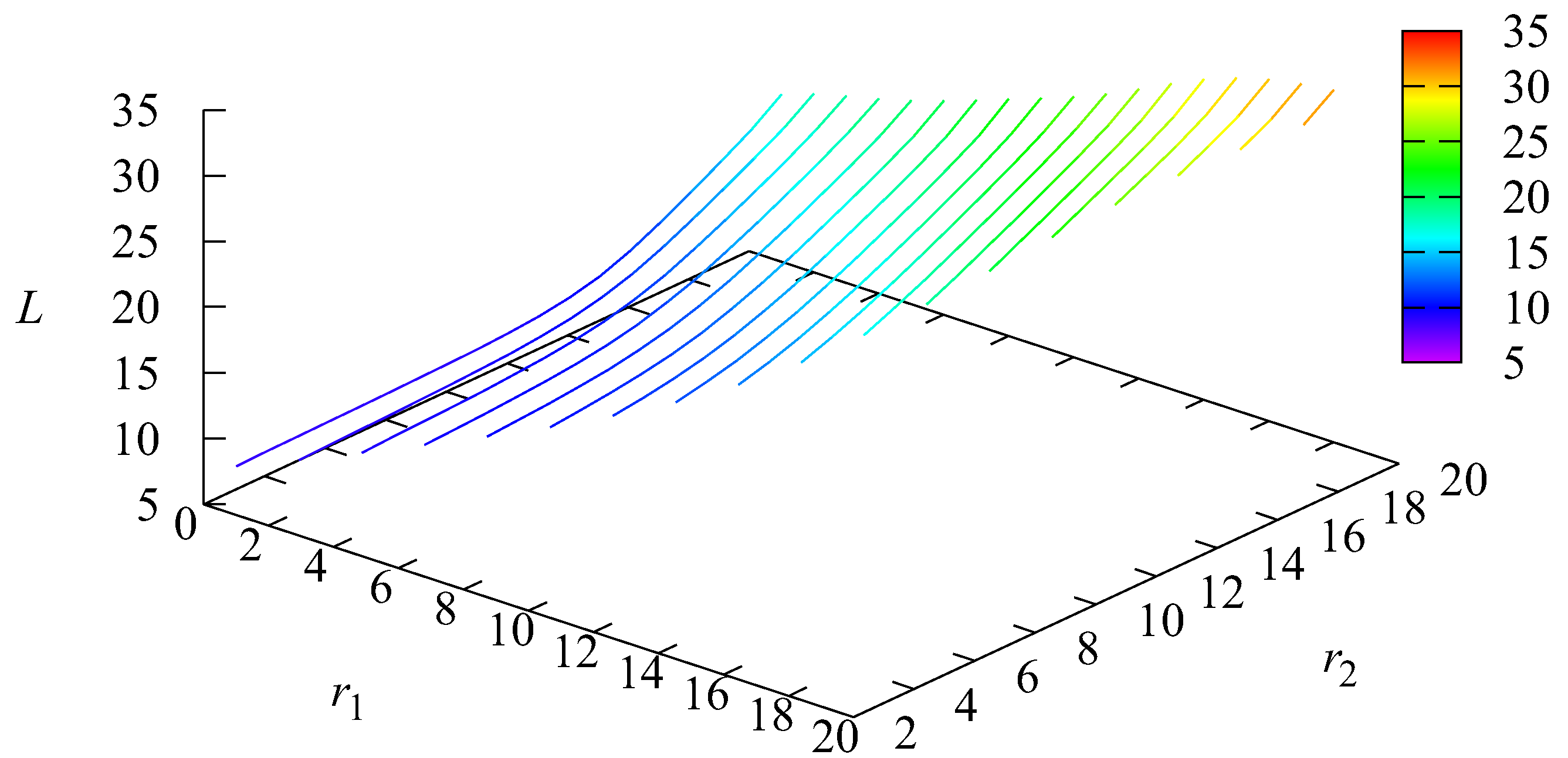

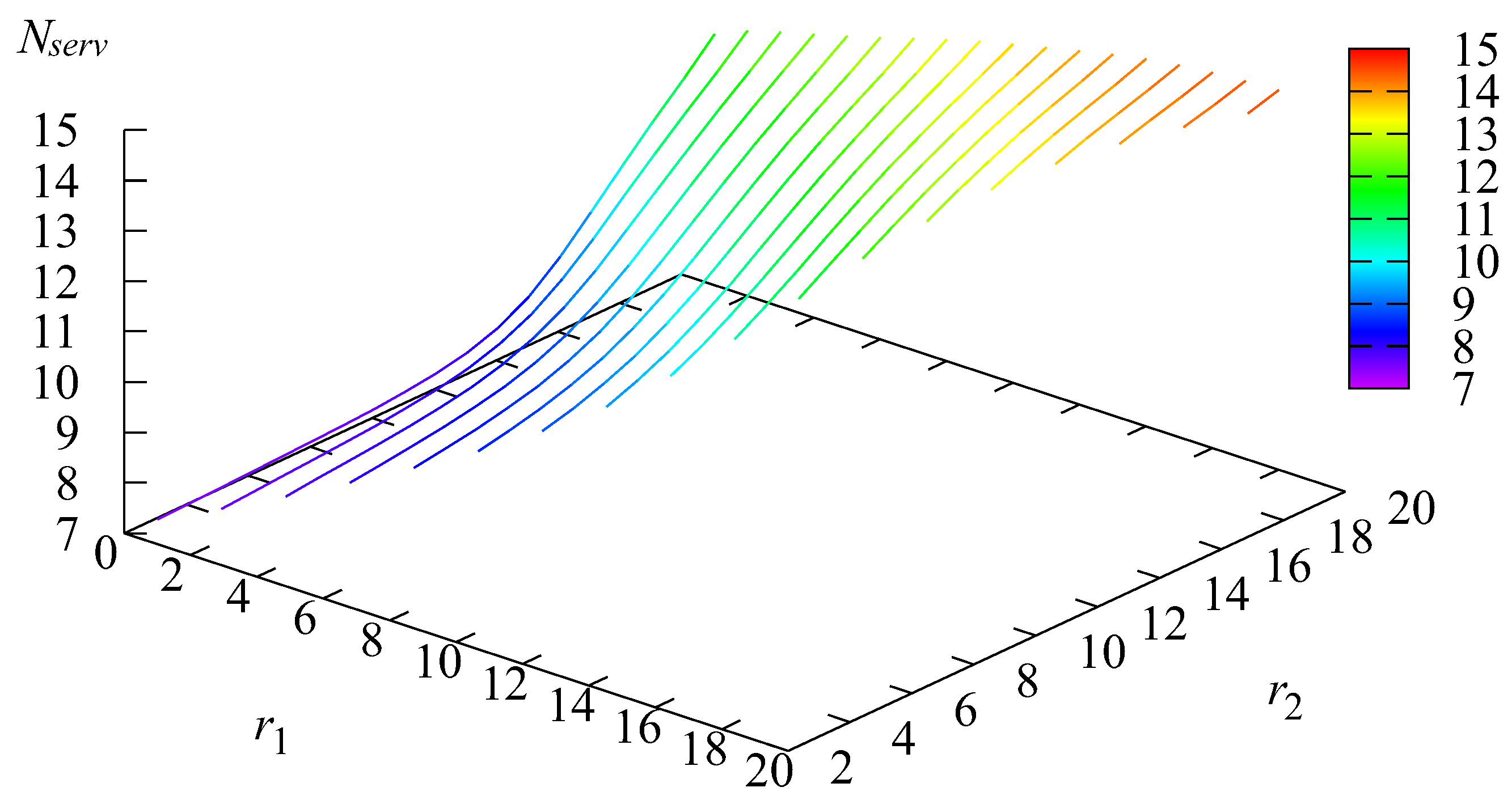

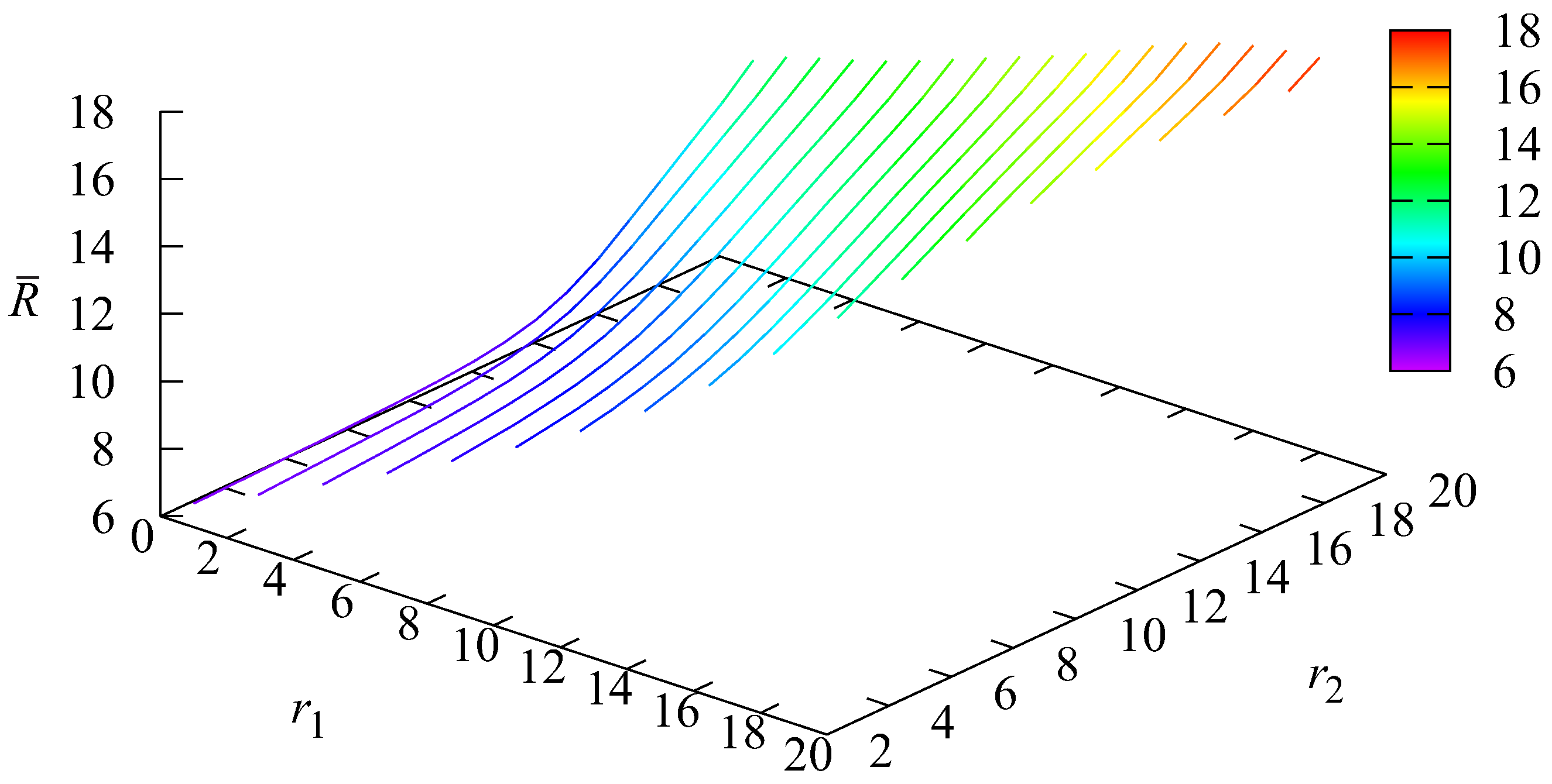

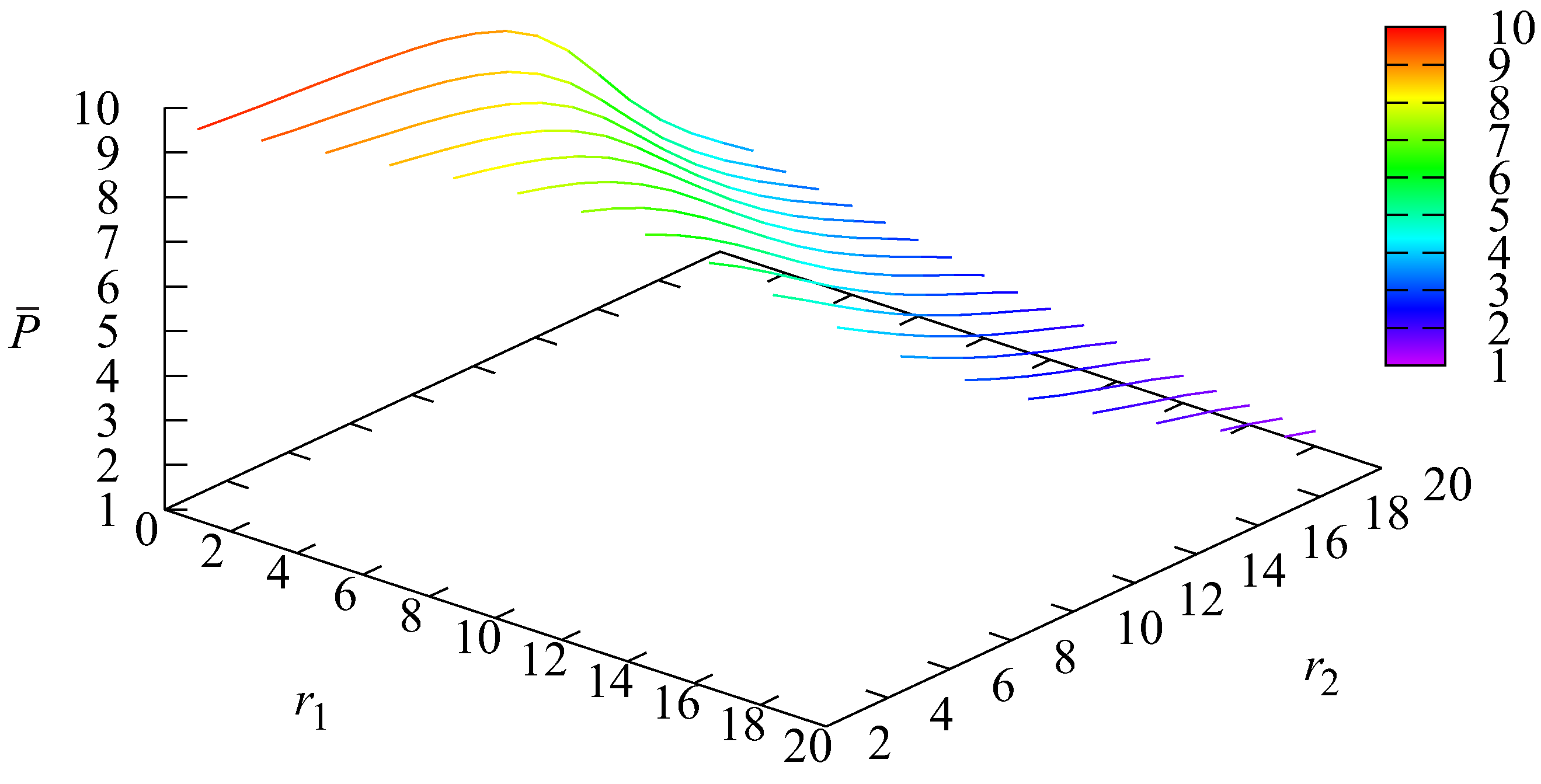

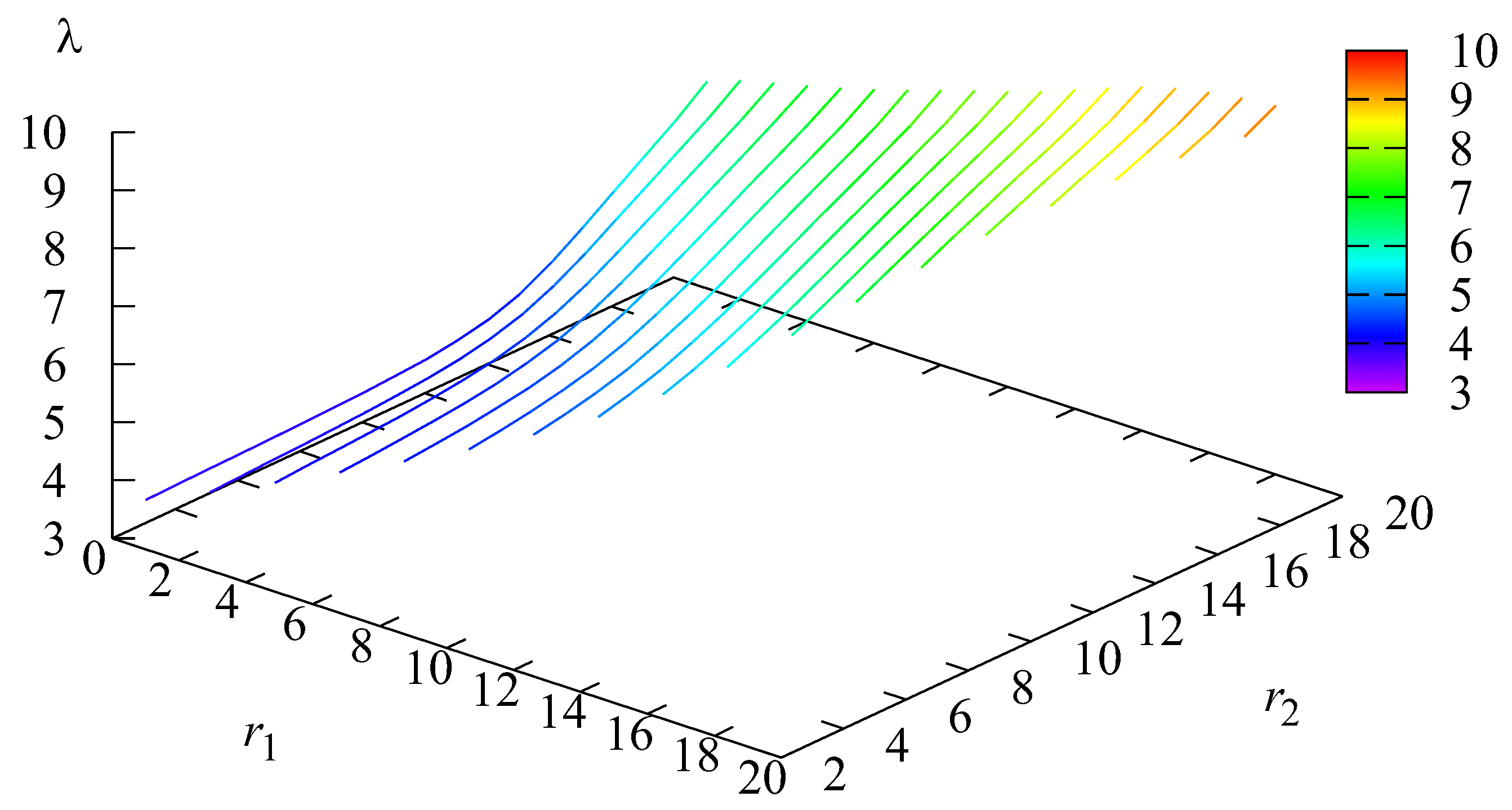

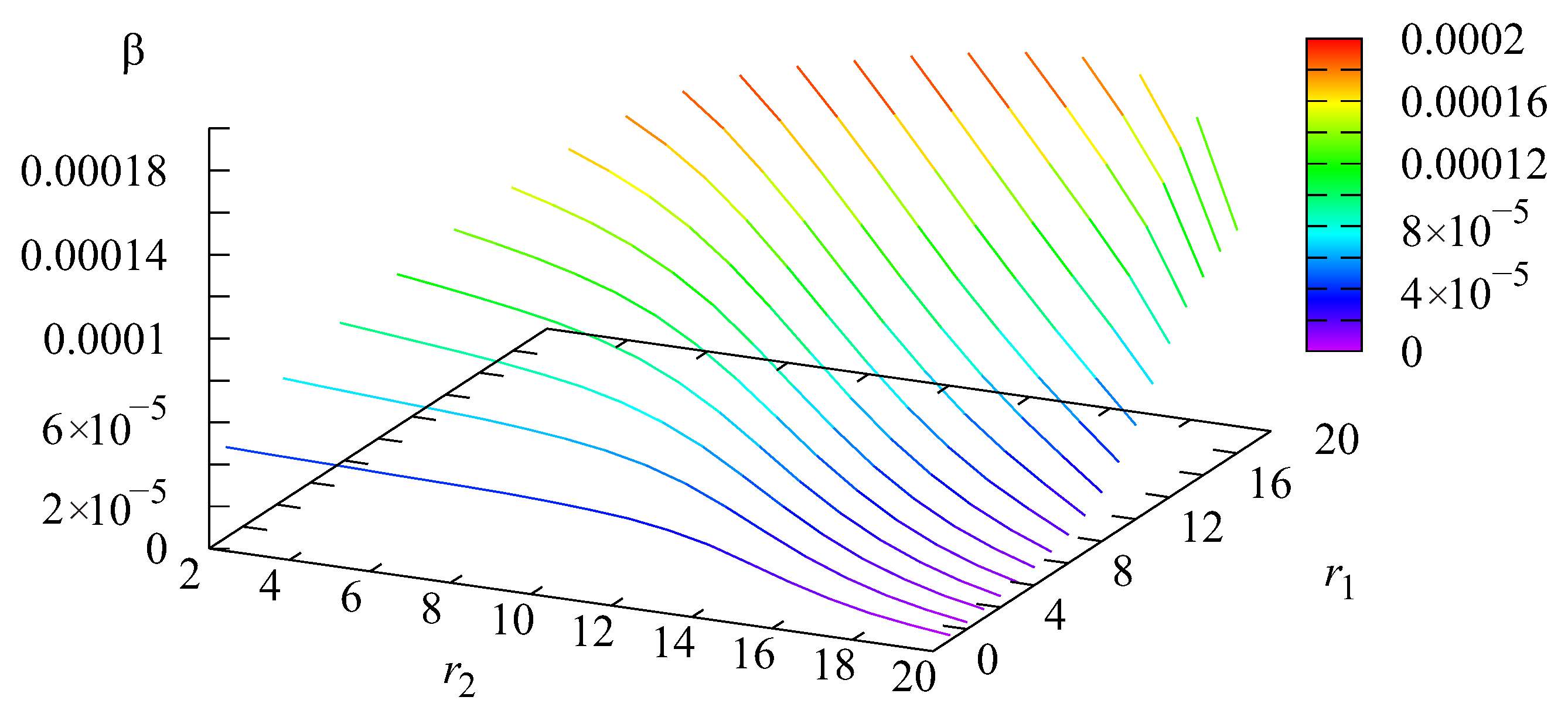

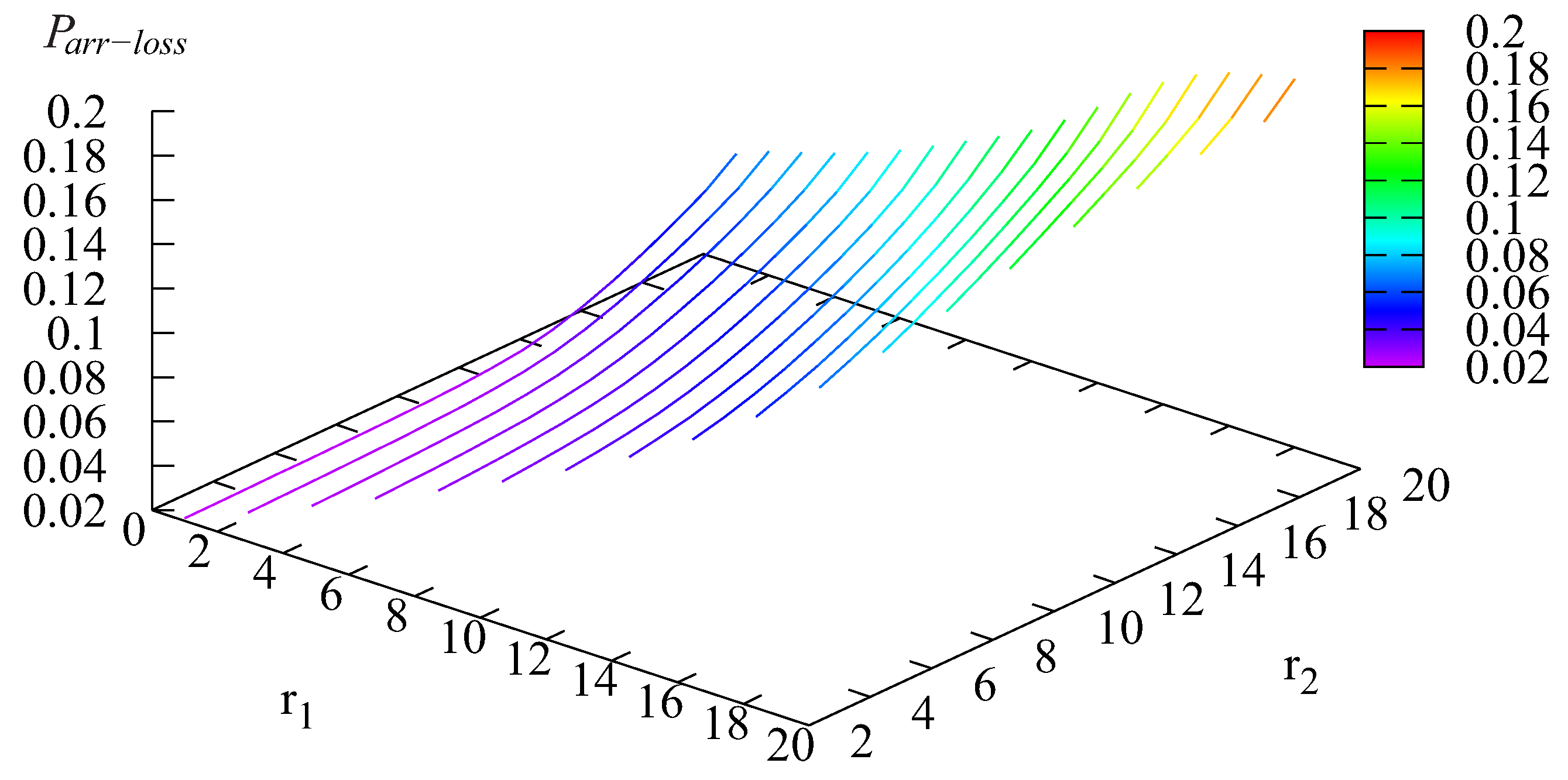

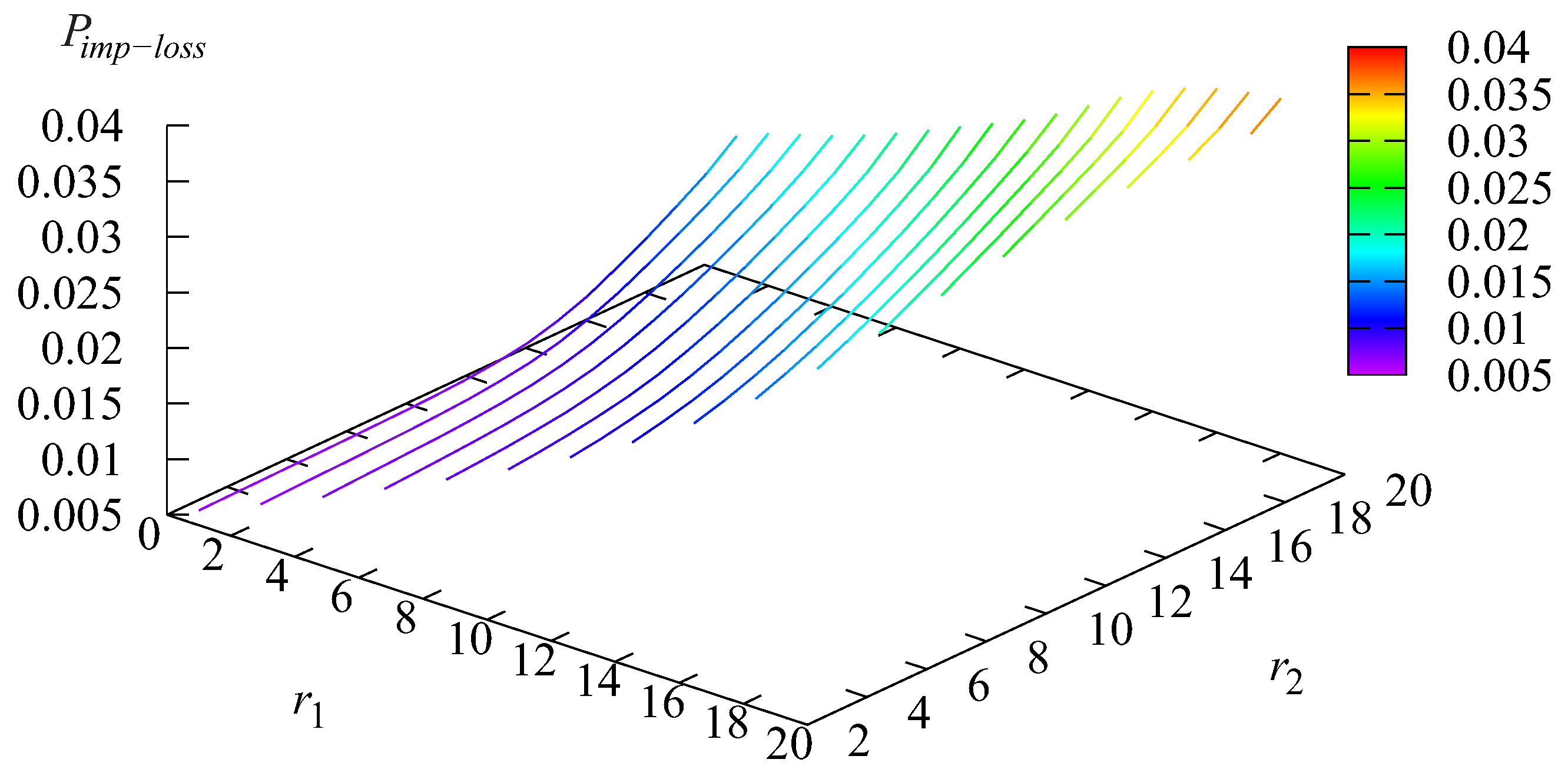

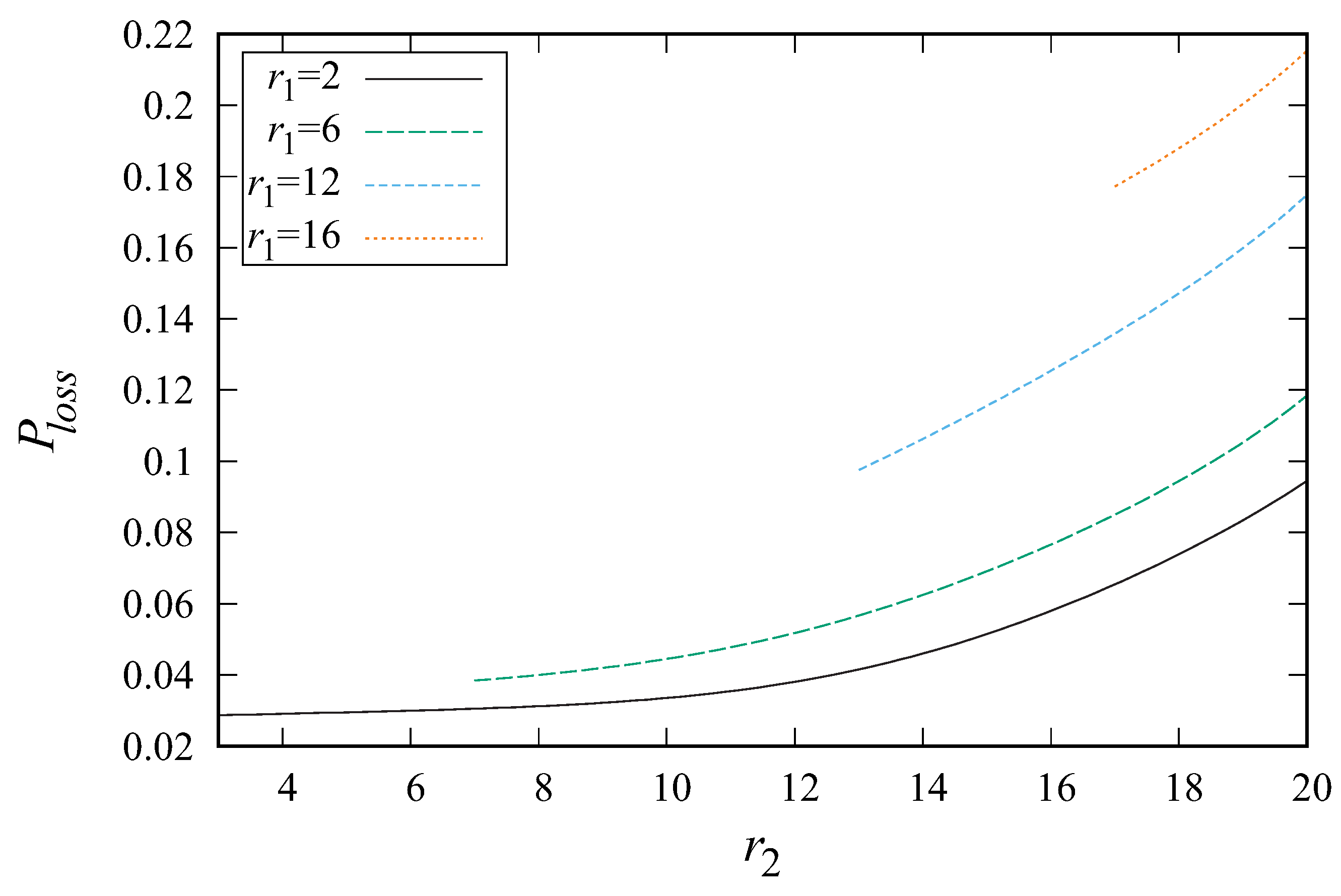

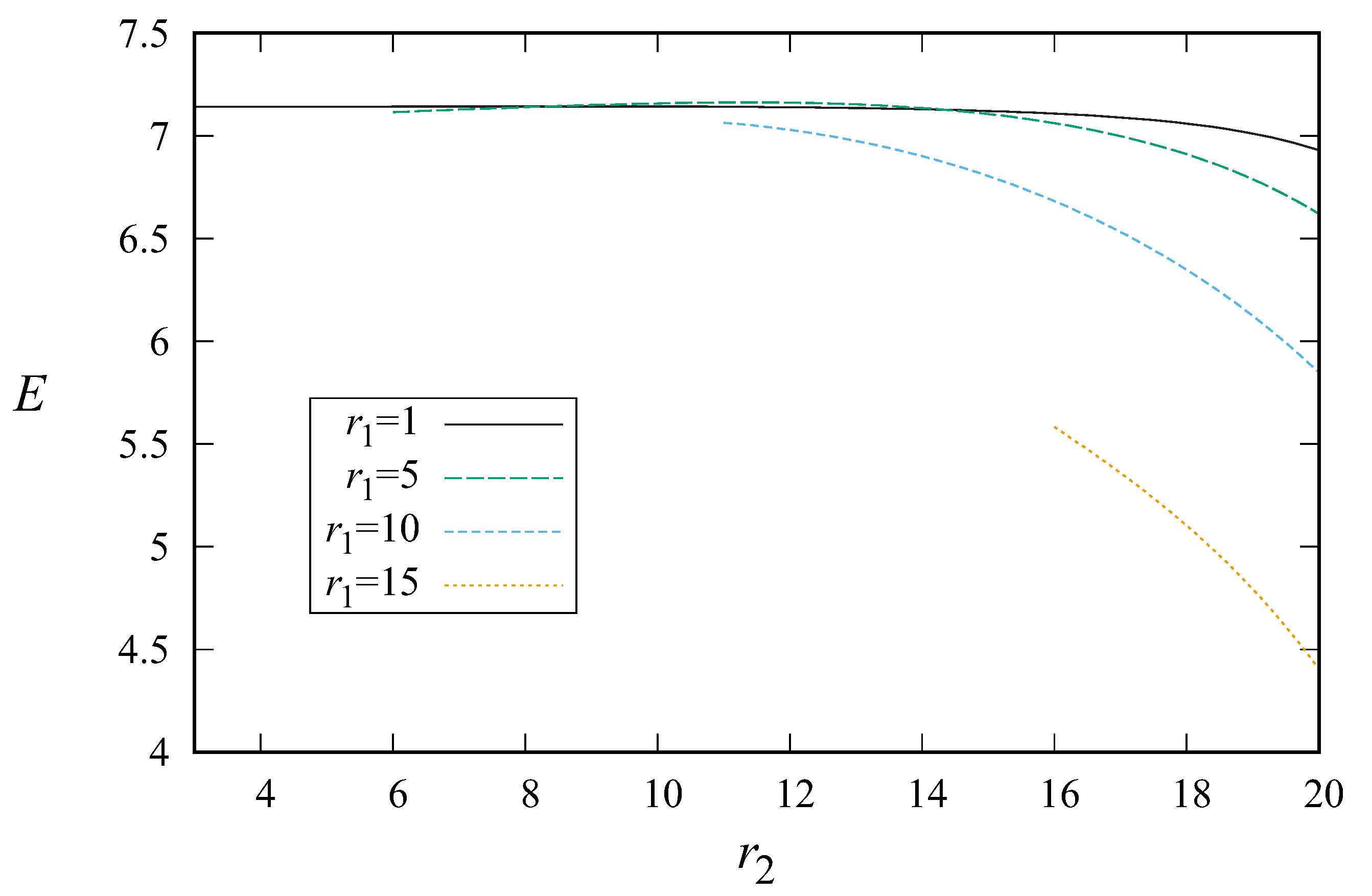

5. Numerical Example

- a is the average profit from servicing one customer.

- c is the charge for the loss of one customer. It may include lost profits and reputational costs.

- d is the charge related to a change in price.

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Hennig-Thurau, T.; Gwinner, K.P.; Walsh, G.; Gremler, D.D. Electronic word-of-mouth via consumer-opinion platforms: What motivates consumers to articulate themselves on the internet? J. Interact. Mark. 2004, 18, 38–52. [Google Scholar] [CrossRef]

- Bai, X.; Marsden, J.R.; Ross, W.T., Jr.; Wang, G. A note on the impact of daily deals on local retailers’ online reputation: Mediation effects of the consumer experience. Inf. Syst. Res. 2020, 31, 1132–1143. [Google Scholar] [CrossRef]

- De Vries, J.; Roy, D.; De Koster, R. Worth the wait? How restaurant waiting time influences customer behavior and revenue. J. Oper. Manag. 2018, 63, 59–78. [Google Scholar] [CrossRef]

- Hwang, J.; Gao, L.; Jang, W. Joint demand and capacity management in a restaurant system. Eur. J. Oper. Res. 2010, 207, 465–472. [Google Scholar] [CrossRef]

- Huang, F.; Guo, P.; Wang, Y. Cyclic pricing when customers queue with rating information. Prod. Oper. Manag. 2019, 28, 2471–2485. [Google Scholar] [CrossRef]

- Forman, C.; Ghose, A.; Wiesenfeld, B. Examining the relationship between reviews and sales: The role of reviewer identity disclosure in electronic markets. Inf. Syst. Res. 2008, 19, 291–313. [Google Scholar] [CrossRef]

- Zhang, K.; Chu, D.; Tu, Z.; Li, C. Service availability assessment model based on user tolerance. Mob. Netw. Appl. 2023, 1–16. [Google Scholar] [CrossRef]

- Pholsook, T.; Wipulanusat, W.; Ratanavaraha, V. A hybrid MRA-BN-NN approach for analyzing airport service based on user-generated contents. Sustainability 2024, 16, 1164. [Google Scholar] [CrossRef]

- Nunkoo, R.; Teeroovengadum, V.; Ringle, C.M.; Sunnassee, V. Service quality and customer satisfaction: The moderating effects of hotel star rating. Int. J. Hosp. Manag. 2020, 91, 102414. [Google Scholar] [CrossRef]

- Dudin, A.; Dudina, O.; Dudin, S.; Gaidamaka, Y. Self-service system with rating dependent arrivals. Mathematics 2022, 10, 297. [Google Scholar] [CrossRef]

- Dudin, A.N.; Dudin, S.A.; Dudina, O.S.; Samouylov, K.E. Competitive queueing systems with comparative rating dependent arrivals. Oper. Res. Perspect. 2020, 7, 100139. [Google Scholar] [CrossRef]

- Allon, G.; Federgruen, A. Service competition with general queueing facilities. Oper. Res. 2008, 56, 827–849. [Google Scholar] [CrossRef]

- Bulatovic, I.; Dempere, J.M.; Papatheodorou, A. The explanatory power of the SKYTRAX’s airport rating system: Implications for airport management. Transp. Econ. Manag. 2023, 1, 104–111. [Google Scholar] [CrossRef]

- Lucantoni, D. New results on the single server queue with a batch Markovian arrival process. Commun. -Stat. -Stoch. Model. 1991, 7, 1–46. [Google Scholar] [CrossRef]

- Lucantoni, D.M. The BMAP/G/1 queue: A tutorial. In IFIP International Symposium on Computer Performance Modeling, Measurement and Evaluation; Springer: Berlin/Heidelberg, Germany, 1993; pp. 330–358. [Google Scholar]

- Chakravarthy, S.R. The batch Markovian arrival process: A review and future work. Adv. Probab. Theory Stoch. Process. 2001, 1, 21–49. [Google Scholar]

- Chakravarthy, S.R. Introduction to Matrix-Analytic Methods in Queues 1: Analytical and Simulation Approach—Basics; ISTE Ltd.: London, UK; John Wiley and Sons: New York, NY, USA, 2022. [Google Scholar]

- Chakravarthy, S.R. Introduction to Matrix-Analytic Methods in Queues 2: Analytical and Simulation Approach—Queues and Simulation; ISTE Ltd.: London, UK; John Wiley and Sons: New York, NY, USA, 2022. [Google Scholar]

- Dudin, A.N.; Klimenok, V.I.; Vishnevsky, V.M. The Theory of Queuing Systems with Correlated Flows; Springer Nature: Cham, Switzerland, 2020. [Google Scholar]

- Sharma, S.; Kumar, R.; Soodan, B.S.; Singh, P. Queuing models with customers’ impatience: A survey. Int. J. Math. Oper. Res. 2023, 26, 523–547. [Google Scholar] [CrossRef]

- Bassamboo, A.; Randhawa, R.; Wu, C. Optimally Scheduling Heterogeneous Impatient Customers. Manuf. Serv. Oper. Manag. 2023, 25, 1066–1080. [Google Scholar] [CrossRef]

- Yin, M.; Yan, M.; Guo, Y.; Liu, M. Analysis of a Pre-Emptive Two-Priority Queuing System with Impatient Customers and Heterogeneous Servers. Mathematics 2023, 11, 3878. [Google Scholar] [CrossRef]

- Ahmadi, M.; Golkarifard, M.; Movaghar, A.; Yousefi, H. Processor sharing queues with impatient customers and state-dependent rates. IEEE/ACM Trans. Netw. 2021, 29, 2467–2477. [Google Scholar] [CrossRef]

- Aalto, S. Whittle index approach to multiserver scheduling with impatient customers and DHR service times. Queueing Syst. 2024, 1–30. [Google Scholar] [CrossRef]

- Liu, H.L.; Li, Q.L. Matched Queues with Flexible and Impatient Customers. Methodol. Comput. Appl. Probab. 2023, 25, 4. [Google Scholar] [CrossRef]

- Graham, A. Kronecker Products and Matrix Calculus with Applications; Ellis Horwood: Chichester, UK, 1981. [Google Scholar]

- Neuts, M. Matrix-Geometric Solutions in Stochastic Models; The Johns Hopkins University Press: Baltimore, MD, USA, 1981. [Google Scholar]

- Klimenok, V.I.; Dudin, A.N. Multi-dimensional asymptotically quasi-Toeplitz Markov chains and their application in queueing theory. Queueing Syst. 2006, 54, 245–259. [Google Scholar] [CrossRef]

- Horn, R.A.; Johnson, C.R. Topics in Matrix Analysis; Cambridge University Press: Cambridge, UK, 1991. [Google Scholar]

- Dudin, S.; Dudin, A.; Kostyukova, O.; Dudina, O. Effective algorithm for computation of the stationary distribution of multi-dimensional level-dependent Markov chains with upper block-Hessenberg structure of the generator. J. Comput. Appl. Math. 2020, 366, 112425. [Google Scholar] [CrossRef]

- Dudin, S.; Dudina, O. Retrial multi-server queuing system with PHF service time distribution as a model of a channel with unreliable transmission of information. Appl. Math. Model. 2019, 65, 676–695. [Google Scholar] [CrossRef]

- Falin, G.I. A survey of retrial queues. Queueing Syst. 1990, 7, 127–167. [Google Scholar] [CrossRef]

- Gomez-Corral, A. A bibliographical guide to the analysis of retrial queues through matrix analytic techniques. Ann. Oper. Res. 2006, 141, 163–191. [Google Scholar] [CrossRef]

- Falin, G.I.; Templeton, J.G.C. Retrial Queues; Chapman & Hall: London, UK, 1997. [Google Scholar]

- Artalejo, J.R.; Gomez-Corral, A. Retrial Queueing Systems; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Dudin, A.N.; Manzo, R.; Piscopo, R. Single server retrial queue with group admission of customers. Comput. Oper. Res. 2015, 61, 89–99. [Google Scholar] [CrossRef]

- Asmussen, S. Applied Probability and Queues; Springer: New York, NY, USA, 2003; Volume 2. [Google Scholar]

- He, Q.M.; Alfa, A.S. Space reduction for a class of multidimensional Markov chains: A summary and some applications. INFORMS J. Comput. 2018, 30, 1–10. [Google Scholar] [CrossRef]

- O’Cinneide, C.A. Characterization of phase-type distributions. Stoch. Model. 1990, 6, 1–57. [Google Scholar] [CrossRef]

- Wu, B.; Cui, L.; Fang, C. Generalized phase-type distributions based on multi-state systems. IISE Trans. 2020, 52, 104–119. [Google Scholar] [CrossRef]

- Dudin, A.; Kim, C.; Dudina, O.; Dudin, S. Multi-server queueing system with a generalized phase-type service time distribution as a model of a call center with a call-back option. Ann. Oper. Res. 2016, 239, 401–428. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

D’Apice, C.; Dudin, A.N.; Dudina, O.S.; Manzo, R. Analysis of Queueing System with Dynamic Rating-Dependent Arrival Process and Price of Service. Mathematics 2024, 12, 1101. https://doi.org/10.3390/math12071101

D’Apice C, Dudin AN, Dudina OS, Manzo R. Analysis of Queueing System with Dynamic Rating-Dependent Arrival Process and Price of Service. Mathematics. 2024; 12(7):1101. https://doi.org/10.3390/math12071101

Chicago/Turabian StyleD’Apice, C., A. N. Dudin, O. S. Dudina, and R. Manzo. 2024. "Analysis of Queueing System with Dynamic Rating-Dependent Arrival Process and Price of Service" Mathematics 12, no. 7: 1101. https://doi.org/10.3390/math12071101

APA StyleD’Apice, C., Dudin, A. N., Dudina, O. S., & Manzo, R. (2024). Analysis of Queueing System with Dynamic Rating-Dependent Arrival Process and Price of Service. Mathematics, 12(7), 1101. https://doi.org/10.3390/math12071101