Co-Movements between Eu Ets and the Energy Markets: A Var-Dcc-Garch Approach

Abstract

:1. Introduction

2. Literature Review

3. Data and Methods

3.1. The Data

3.2. The Model

3.3. Impulse Response Analysis

4. Results

4.1. Estimation of the Model

4.2. Impulse Response Analysis

4.2.1. Shock in a Single Variable

- Impulse response curves for the conditional mean

- Impulse response curves for the conditional variance

- Impulse response curves for the conditional correlation

4.2.2. Shocks in Two Variables

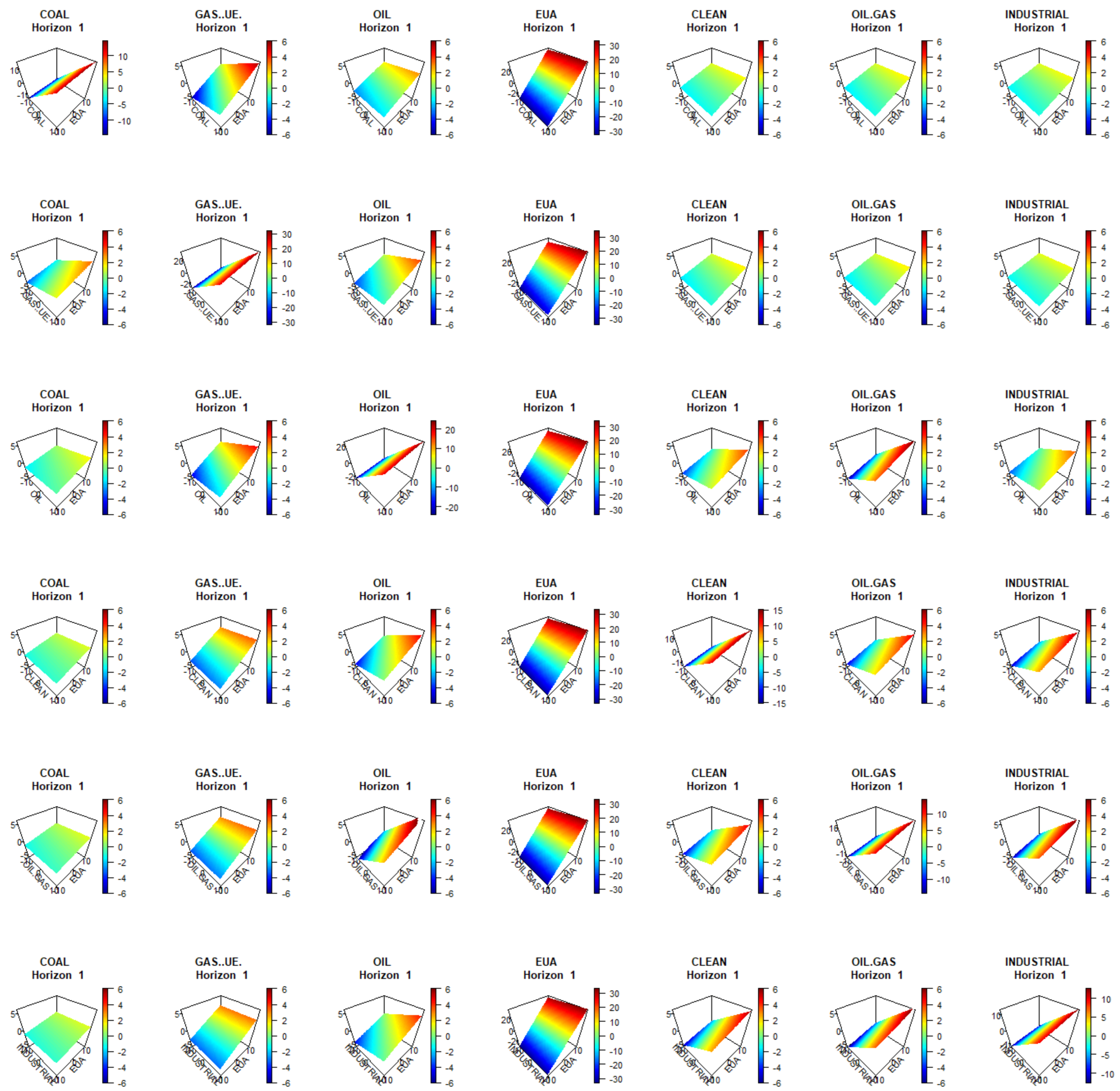

- Impulse response surfaces for conditional mean

- Impulse response surfaces for the conditional volatility

- Impulse response surfaces for the conditional correlation

4.3. Optimal Portfolio Weights

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Diebold–Mariano Test to Compare the Volatilities of Two Dynamic Portfolios

- Let the hypothesized vector of the returns determined by each one of the three strategies (monthly, quarterly, yearly)

- Let the estimated conditional covariance matrices of {rt; t = 1, …, T}

- Let the minimizing volatility weigths of the portfolios

- Let the portfolio returns.

- Let VT = and we set up the modelwhere 1T is a vector of T ones and εv,T is an error term. The null hypothesis is H0: βv = 0 and we use a Diebold–Mariano test based on → N(βv1T,IT) where , Gv is an heteroscedasticity and autocorrelation consistent (HAC) estimator of the covariance matrix estimator of More details can be found in [55].VT = βv1T + εv,T

References

- Ellerman, A.D. New entrant and closure provisions: How do they distort? Energy J. 2008, 29. [Google Scholar] [CrossRef] [Green Version]

- Ellerman, D.; Convery, F.; De Perthuis, C. The European carbon market in action: Lessons from the first trading period. J. Eur. Environ. Plan. Law 2008, 5, 215–233. [Google Scholar] [CrossRef] [Green Version]

- Parsons, J.E.; Feilhauer, S.; Ellerman, A.D. Designing a U.S. market for CO2. J. Appl. Corp. Financ. 2009, 21, 79–86. [Google Scholar] [CrossRef]

- Hu, J.; Crijns-Graus, W.; Lam, L.; Gilbert, A. Ex-ante evaluation of EU ETS during 2013–2030: EU-internal abatement. Energy Policy 2015, 77, 152–163. [Google Scholar] [CrossRef]

- Dhamija, A.K.; Yadav, S.S.; Jain, P. Volatility spillover of energy markets into EUA markets under EU ETS: A multi-phase study. Environ. Econ. Policy Stud. 2017, 20, 561–591. [Google Scholar] [CrossRef]

- Jiménez-Rodríguez, R. What happens to the relationship between EU allowances prices and stock market indices in Europe? Energy Econ. 2019, 81, 13–24. [Google Scholar] [CrossRef]

- Chèze, B.; Chevallier, J.; Berghmans, N.; Alberola, E. On the CO2 emissions determinants during the EU ETS phases I and II: A plant-level analysis merging the EUTL and Platts power data. Energy J. 2020, 41. [Google Scholar] [CrossRef]

- Uddin, G.S.; Hernandez, J.A.; Shahzad, S.J.H.; Hedström, A. Multivariate dependence and spillover effects across energy commodities and diversification potentials of carbon assets. Energy Econ. 2018, 71, 35–46. [Google Scholar] [CrossRef]

- Lamphiere, M.; Blackledge, J.; Kearney, D. Carbon futures trading and short-term price prediction: An analysis using the fractal market hypothesis and evolutionary computing. Mathematics 2021, 9, 1005. [Google Scholar] [CrossRef]

- Rockström, J.; Steffen, W.; Noone, K.; Persson, Å.; Chapin, F.S.I.; Lambin, E.; Lenton, T.M.; Scheffer, M.; Folke, C.; Schellnhuber, H.J.; et al. Planetary boundaries: Exploring the safe operating space for humanity. Ecol. Soc. 2009, 14, 1–33. [Google Scholar] [CrossRef]

- Jones, C.M.; Kaul, G. Oil and the stock markets. J. Financ. 1996, 51, 463–491. [Google Scholar] [CrossRef]

- Park, J.; Ratti, R.A. Oil price shocks and stock markets in the U.S. and 13 European countries. Energy Econ. 2008, 30, 2587–2608. [Google Scholar] [CrossRef]

- Kilian, L.; Park, C. The impact of oil price shocks on the U.S. stock market. Int. Econ. Rev. 2009, 50, 1267–1287. [Google Scholar] [CrossRef]

- Managi, S.; Okimoto, T. Does the price of oil interact with clean energy prices in the stock market? Jpn. World Econ. 2013, 27, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Kumar, S.; Managi, S.; Matsuda, A. Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis. Energy Econ. 2012, 34, 215–226. [Google Scholar] [CrossRef]

- Gallego-Álvarez, I.; Segura, L.; Martinez-Ferrero, J. Carbon emission reduction: The impact on the financial and operational performance of international companies. J. Clean. Prod. 2015, 103, 149–159. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Noor, H. Return and volatility linkages between CO2 emission and clean energy stock prices. Energy 2018, 164, 803–810. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Wei, Y.-M. An overview of current research on EU ETS: Evidence from its operating mechanism and economic effect. Appl. Energy 2010, 87, 1804–1814. [Google Scholar] [CrossRef]

- Subramaniam, N.; Wahyuni, D.; Cooper, B.J.; Leung, P.; Wines, G. Integration of carbon risks and opportunities in enterprise risk management systems: Evidence from Australian firms. J. Clean. Prod. 2015, 96, 407–417. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Sun, Y.-F. The dynamic volatility spillover between European carbon trading market and fossil energy market. J. Clean. Prod. 2016, 112, 2654–2663. [Google Scholar] [CrossRef]

- Wang, Y.; Guo, Z. The dynamic spillover between carbon and energy markets: New evidence. Energy 2018, 149, 24–33. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Dynamic linkages and spillover effects between CET market, coal market and stock market of new energy companies: A case of Beijing CET market in China. Energy 2019, 172, 1198–1210. [Google Scholar] [CrossRef]

- Xia, T.; Ji, Q.; Zhang, D.; Han, J. Asymmetric and extreme influence of energy price changes on renewable energy stock performance. J. Clean. Prod. 2019, 241, 118338. [Google Scholar] [CrossRef]

- Chevallier, J. A model of carbon price interactions with macroeconomic and energy dynamics. Energy Econ. 2011, 33, 1295–1312. [Google Scholar] [CrossRef]

- Castagneto-Gissey, G. How competitive are EU electricity markets? An assessment of ETS phase II. Energy Policy 2014, 73, 278–297. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, D.K.; Sousa, R. Energy prices and CO2 emission allowance prices: A quantile regression approach. Energy Policy 2014, 70, 201–206. [Google Scholar] [CrossRef] [Green Version]

- Hammoudeh, S.; Lahiani, A.; Nguyen, D.K.; Sousa, R. An empirical analysis of energy cost pass-through to CO2 emission prices. Energy Econ. 2015, 49, 149–156. [Google Scholar] [CrossRef]

- Chevallier, J.; Nguyen, D.K.; Reboredo, J.C. A conditional dependence approach to CO2-energy price relationships. Energy Econ. 2019, 81, 812–821. [Google Scholar] [CrossRef]

- Liu, H.-H.; Chen, Y.-C. A study on the volatility spillovers, long memory effects and interactions between carbon and energy markets: The impacts of extreme weather. Econ. Model. 2013, 35, 840–855. [Google Scholar] [CrossRef]

- Marimoutou, V.; Soury, M. Energy markets and CO2 emissions: Analysis by stochastic copula autoregressive model. Energy 2015, 88, 417–429. [Google Scholar] [CrossRef]

- Filis, G. Macro economy, stock market and oil prices: Do meaningful relationships exist among their cyclical fluctuations? Energy Econ. 2010, 32, 877–886. [Google Scholar] [CrossRef]

- Choi, K.; Hammoudeh, S. Volatility behavior of oil, industrial commodity and stock markets in a regime-switching environment. Energy Policy 2010, 38, 4388–4399. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Cao, H.; Zhang, D. Oil shocks and their impact on energy related stocks in China. Energy Econ. 2012, 34, 1888–1895. [Google Scholar] [CrossRef] [Green Version]

- Antonakakis, N.; Filis, G. Oil prices and stock market correlation: A time-varying approach. Int. J. Energy Stat. 2013, 1, 17–29. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. Oil prices and the stock prices of alternative energy companies. Energy Econ. 2008, 30, 998–1010. [Google Scholar] [CrossRef]

- Sadorsky, P. Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ. 2012, 34, 248–255. [Google Scholar] [CrossRef]

- Bondia, R.; Ghosh, S.; Kanjilal, K.; Bondia, R.; Ghosh, S.; Kanjilal, K. International crude oil prices and the stock prices of clean energy and technology companies: Evidence from non-linear cointegration tests with unknown structural breaks. Energy 2016, 101, 558–565. [Google Scholar] [CrossRef]

- Reboredo, J.C. Is there dependence and systemic risk between oil and renewable energy stock prices? Energy Econ. 2015, 48, 32–45. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D.; Geng, J.-B. Information linkage, dynamic spillovers in prices and volatility between the carbon and energy markets. J. Clean. Prod. 2018, 198, 972–978. [Google Scholar] [CrossRef]

- Oberndorfer, U. EU emission allowances and the stock market: Evidence from the electricity industry. Ecol. Econ. 2009, 68, 1116–1126. [Google Scholar] [CrossRef] [Green Version]

- Bushnell, J.B.; Chong, H.; Mansur, E.T. Profiting from regulation: Evidence from the European carbon market. Am. Econ. J. Econ. Policy 2013, 5, 78–106. [Google Scholar] [CrossRef]

- Jong, T.; Couwenberg, O.; Woerdman, E. Does EU emissions trading bite? An event study. Energy Policy 2014, 69, 510–519. [Google Scholar] [CrossRef] [Green Version]

- Oestreich, A.M.; Tsiakas, I. Carbon emissions and stock returns: Evidence from the EU emissions trading scheme. J. Bank. Financ. 2015, 58, 294–308. [Google Scholar] [CrossRef]

- Moreno, B.; Da Silva, P.P. How do Spanish polluting sectors’ stock market returns react to European Union allowances prices? A panel data approach. Energy 2016, 103, 240–250. [Google Scholar] [CrossRef]

- Tian, Y.; Akimov, A.; Roca, E.; Wong, V. Does the carbon market help or hurt the stock price of electricity companies? Further evidence from the European context. J. Clean. Prod. 2016, 112, 1619–1626. [Google Scholar] [CrossRef] [Green Version]

- Ji, Q.; Xia, T.; Liu, F.; Xu, J.-H. The information spillover between carbon price and power sector returns: Evidence from the major European electricity companies. J. Clean. Prod. 2019, 208, 1178–1187. [Google Scholar] [CrossRef]

- Ma, Y.; Wang, L.; Zhang, T. Research on the dynamic linkage among the carbon emission trading, energy and capital markets. J. Clean. Prod. 2020, 272, 122717. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Tse, Y.K.; Tsui, A.K.C. A multivariate generalized autoregressive conditional heteroscedasticity model with time-varying correlations. J. Bus. Econ. Stat. 2002, 20, 351–362. [Google Scholar] [CrossRef]

- Engle, R.; Sheppard, K. Theoretical and Empirical Properties of Dynamic Conditional Correlation Multivariate GARCH; National Bureau of Economic Research: Cambridge, MA, USA, 2001; p. 8554. [Google Scholar]

- Hafner, C.M.; Herwartz, H. Volatility impulse responses for multivariate GARCH models: An exchange rate illustration. J. Int. Money Financ. 2006, 25, 719–740. [Google Scholar] [CrossRef]

- Sharpe, W.F.; Alexander, G.J.; Bailey, J.V. Investments, 6th ed.; Prentice Hall: Upper Saddler River, NJ, USA, 1999; ISBN 978-0-13-010130-3. [Google Scholar]

- Tsay, R.S. An Introduction to Analysis of Financial Data with R; Wiley and Sons: Hoboken, NJ, USA, 2013; ISBN 978-0-470-89081-3. [Google Scholar]

- Fleming, J.; Kirby, C.; Ostdiek, B. The economic value of volatility timing using “realized” volatility. J. Financ. Econ. 2003, 67, 473–509. [Google Scholar] [CrossRef]

- Engle, R.; Colacito, R. Testing and valuing dynamic correlations for asset allocation. J. Bus. Econ. Stat. 2006, 24, 238–253. [Google Scholar] [CrossRef]

- Dichtl, H.; Drobetz, W.; Wendt, V. How to build a factor portfolio: Does the allocation strategy matter? Eur. Financ. Manag. 2020, 27, 20–58. [Google Scholar] [CrossRef]

- Diebold, F.X.; Mariano, R.S. Comparing predictive accuracy. J. Bus. Econ. Stat. 2002, 20, 134–144. [Google Scholar] [CrossRef]

- Song, Y.; Ji, Q.; Du, Y.-J.; Geng, J.-B. The dynamic dependence of fossil energy, investor sentiment and renewable energy stock markets. Energy Econ. 2019, 84, 104564. [Google Scholar] [CrossRef]

| Minimum | Maximum | Mean | Std. Dev. | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|

| COAL | −18,090 | 19,416 | −0.009 | 1394 | 0.737 * | 47,574 * |

| GAS.UE | −17,253 | 34,275 | 0.012 | 2926 | 1.098 * | 11,975 * |

| OIL | −27,976 | 19,077 | −0.009 | 2303 | −1.043 * | 21,159 * |

| EUA | −42,252 | 21,586 | 0.039 | 3244 | −0.979 * | 15,572 * |

| CLEAN | −12,497 | 11,033 | 0.013 | 1527 | −0.606 * | 7415 * |

| OIL.GAS | −17,953 | 12,387 | −0.012 | 1527 | −1.067 * | 17,061 * |

| INDUSTRIAL | −14,344 | 9414 | 0.041 | 1337 | −0.928 * | 9818 * |

| VAR(1)-GARCH(1,1)-DCC(1,1) | VAR(2)-GARCH(1,1)-DCC(1,1) | VAR(3)-GARCH(1,1)-DCC(1,1) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Distribution | AIC | BIC | HQC | AIC | BIC | HQC | AIC | BIC | HQC |

| M. Normal | 25.127 | 25.332 | 25.202 | 25.160 | 25.473 | 25.273 | 25.201 | 25.622 | 25.353 |

| M. T Student | 24.319 | 24.526 | 24.394 | 24.357 | 24.672 | 24.471 | 24.408 | 24.831 | 24.561 |

| M. Laplace | 24.655 | 24.860 | 24.729 | 24.698 | 25.011 | 24.811 | 24.759 | 25.180 | 24.912 |

| Coefficients | COAL(-1) | GAS.UE(-1) | OIL(-1) | EUA(-1) | CLEAN(-1) | OIL.GAS(-1) | INDUSTRIAL(-1) |

|---|---|---|---|---|---|---|---|

| COAL | 0.02338 | 0.05579 ** | 0.00922 | −0.00919 | 0.02650 | −0.05097 * | 0.03341 |

| (0.24255) | (0.00000) | (0.51479) | (0.28874) | (0.25299) | (0.07805) | (0.30190) | |

| GAS.UE | 0.02176 | 0.05417 ** | −0.00455 | 0.00584 | 0.01190 | −0.10689 * | −0.01403 |

| (0.60628) | (0.00818) | (0.87886) | (0.74917) | (0.80771) | (0.07985) | (0.83716) | |

| OIL | −0.03012 | −0.00792 | 0.07510 ** | 0.00359 | 0.06640 * | 0.01437 | −0.13066 ** |

| (0.36423) | (0.62306) | (0.00138) | (0.80293) | (0.08432) | (0.76465) | (0.01498) | |

| EUA | −0.11469 ** | −0.05019 ** | −0.01282 | 0.00617 | 0.04902 | −0.15851 ** | 0.04049 |

| (0.01410) | (0.02686) | (0.69803) | (0.76041) | (0.36527) | (0.01894) | (0.59218) | |

| CLEAN | −0.04084 * | 0.01264 | 0.00291 | 0.01138 | 0.13734 ** | 0.05042 | −0.11047 ** |

| (0.06196) | (0.23390) | (0.85097) | (0.22939) | (0.00000) | (0.11099) | (0.00180) | |

| OIL.GAS | −0.01479 | −0.00295 | 0.00410 | −0.01071 | 0.06667 ** | 0.06888 ** | −0.05208 |

| (0.50154) | (0.78264) | (0.79208) | (0.26052) | (0.00891) | (0.03034) | (0.14340) | |

| INDUSTRIAL | −0.01428 | −0.00292 | 0.02909 ** | −0.01063 | 0.09595 ** | 0.00449 | −0.06639 ** |

| (0.45801) | (0.75483) | (0.03263) | (0.20168) | (0.00002) | (0.87190) | (0.03298) |

| Coefficients | COAL | GAS.UE | OIL | EUA | CLEAN | OIL.GAS | INDUSTRIAL |

|---|---|---|---|---|---|---|---|

| ωi | 0.0098 ** | 0.0629 * | 0.0325 ** | 0.1089 ** | 0.0286 ** | 0.0226 ** | 0.0394 ** |

| (0.0374) | (0.0504) | (0.0328) | (0.0479) | (0.0107) | (0.0104) | (0.0000) | |

| αi | 0.0087 * | 0.1051 ** | 0.0797 ** | 0.1196 ** | 0.01018 ** | 0.0925 ** | 0.1106 ** |

| (0.0527) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0001) | (0.0000) | |

| βi | 0.9866 ** | 0.8939 ** | 0.9179 ** | 0.8794 ** | 0.8880 ** | 0.9019 ** | 0.8666 ** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| a | 0.0116 ** | ||||||

| (0.0000) | |||||||

| b | 0.9683 ** | ||||||

| (0.0000) | |||||||

| ν | 6.3634 ** | ||||||

| (0.0000) |

| Monthly | Quarterly | Yearly | |

|---|---|---|---|

| Monthly | 2.2707 | −2.1427 | |

| Quarterly | −2.2707 | −2.5858 | |

| Yearly | 2.1427 | 2.5858 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gargallo, P.; Lample, L.; Miguel, J.A.; Salvador, M. Co-Movements between Eu Ets and the Energy Markets: A Var-Dcc-Garch Approach. Mathematics 2021, 9, 1787. https://doi.org/10.3390/math9151787

Gargallo P, Lample L, Miguel JA, Salvador M. Co-Movements between Eu Ets and the Energy Markets: A Var-Dcc-Garch Approach. Mathematics. 2021; 9(15):1787. https://doi.org/10.3390/math9151787

Chicago/Turabian StyleGargallo, Pilar, Luis Lample, Jesús A. Miguel, and Manuel Salvador. 2021. "Co-Movements between Eu Ets and the Energy Markets: A Var-Dcc-Garch Approach" Mathematics 9, no. 15: 1787. https://doi.org/10.3390/math9151787