Abstract

This paper presents the Pythagorean membership grade induced ordered weighted moving average (PMGIOWMA) operator with some particular cases and theorems. The main advantage of this new operator is that can include the knowledge, expectation, and aptitude of the decision maker into the Pythagorean membership function by using a weighting vector and induced variables. An application in financial knowledge based on a survey conducted in 13 provinces in Boyacá, Colombia, is presented.

1. Introduction

Many different proposals and approaches have been developed in decision-making under uncertainty. Among these approaches, those related to the theory of aggregation functions have been highlighted. [1]. These functions provide compensatory properties, where the low values of some inputs are compensated for by the high values of the others [1]. In this sense, an average result can be obtained that is a representative value of the inputs [1,2]. One such function that has been extensively studied is the ordered weighted average (OWA) operator, which associates weights not with a particular input, but rather with its value [1,3]. Based on this function, proposals have been developed that allow different types of data to be aggregated. For example, some operators focus on probability [4], distance measures [5,6,7], linguistic [8,9] and induced variables [10], prioritized items [11], Bonferroni means [12], Choquet integrals [13], moving averages [14], Pythagorean operators [15], etc.

Here, we focused on progress in the induced variables, the Pythagorean operator and moving averages. The authors of [10] introduced the Induced OWA (IOWA) operator that uses induced values in the reordering process instead of using the values of the arguments. However, the authors of [15] introduced Pythagorean membership grades in combination with an OWA operator as a nonstandard Pythagorean fuzzy subset whose membership grades are pairs (a, b) that satisfy the requirement . However, [14] introduced the moving average, which is a classical formulation in statistics but can be used in a wide range of problems and can be combined with the OWA operator to generate new possibilities for data analysis by becoming the ordered weighted moving average (OWMA) operator [16,17]. Based on these methods, proposals have been developed along different lines. For example, along the IOWA operator line, many proposals have taken a variety of approaches, which have used linguistic variables [18,19], fuzzy preference [20], intuitionistic fuzzy sets [21,22,23], distance measures [24,25], and heavy and prioritized operators [16,26,27], with others applying means such as Bonferroni means [28], VIKOR [29], Choquet [30], etc. For the OWMA operator, [31] generalized moving averages, distance measures and OWA; [16] proposed induced heavy moving averages, which can be applied in forecasting approaches [17,32,33,34]. Finally, the Pythagorean membership grade operator has focused on Pythagorean fuzzy sets, which have been extensively studied. Relevant studies have focused on multicriteria decision-making [35,36,37], and several applications have been developed to solve problems in finance [38,39] and business [40]. In this sense, we observed the potential of these methods and found a gap that allowed us to propose a new extension that can combine these operators into one.

The main aim of the present study was to present the Pythagorean membership grade induced ordered weighted moving average (PMGIOWMA) operator, with some cases and theorems. To achieve this, an aggregation operator [2] is proposed as a new extension of the ordered weighted average (OWA) operator [3], with Pythagorean membership grades [15] proposed on the basis of including the induced variables [10] and moving averages [32]. The objective of this new operator, called the Pythagorean membership grade induced ordered weighted moving average (PMGIOWMA) operator, is used to combine the reordering process of the OWA operator, based on induced values, in a set of arguments that needs to be analyzed as the moving average of a series, to analyze the Pythagorean membership grade. The most important theorems and formulations of the PMGIOWMA operator have been developed. Moreover, cases applying the Pythagorean membership grade induced ordered weighted average (PMGIOWA) operator and the Pythagorean membership grade ordered weighted moving average (PMGOWMA) operator are presented. Its mathematical application was focused on an analysis of financial knowledge based on a survey of 1914 individuals from 13 different provinces in the department of Boyacá, Colombia, with different educational levels. Specifically, the survey explored if their perceptions of savings and credits were related to their membership grade. One of the main advantages of this new formulation is that the data can be analyzed in a more complex way than with the usual average, moving average or OWA operator by itself. One of the disadvantages of the new formulation is that it can be too complex to apply, and more information is needed by the decision-maker. Therefore, if the problem is considered to be simple in terms of the elements behind the analysis, the use of an average may be sufficient to solve it.

The remainder of the study is organized as follows. In Section 2, the main formulations and definitions of the OWA operator, some of its extensions and Pythagorean membership grades are presented. Section 3 presents the formulations of the PMGIOWMA operator and its cases; the main theorems are also shown. Section 4 presents an application in Boyacá, Colombia. Finally, Section 5 summarizes the main conclusions of the paper.

2. Preliminaries

This section presents the basic concepts that have been used throughout the paper including OWA, IOWA, OWMA operators and Pythagorean membership grades, their formulations and their main characteristics.

2.1. The OWA Operator and Its Extensions

The main advantage of the OWA operator developed by [3] is that the process of reordering the weights is based on the values of the attributes. Thus, it is possible to obtain the maximum and minimum results. The formulation is as given below.

Definition 1.

An OWA operator of dimension n is a mapping that has an associated weighting vector W of n dimensions with and , such that:

where is the jth largest of .

Instead of basing its reordering process on the values of the attributes, the induced OWA (IOWA) operator [10] uses an induced vector. This makes it possible to discriminate some arguments by using weights based on the information and knowledge of the decision-maker. The formulation is as follows:

Definition 2.

An IOWA operator ofdimensions is an applicationthat has an associated weighting vector W of n dimensions, where the sum of the weights is 1 and, where an induced set of ordering variables is includedsuch that the formula is:

whereis thevalue of the OWA pairwith the jth largest,is the order inducing variable andis the argument variable.

The moving average is a method used to forecast the future for different variables by using historical data, which is why it is a common technique in economics and statistics [41]. The moving average can be defined as follows [42]:

Definition 3.

Given, the moving average of n dimensions is defined as the sequence, which is obtained by taking the arithmetic mean of the sequence ofterms, such that:

It is important to note that, in every case, n < N.

Moreover, following the idea of moving averages and the OWA operator, the ordered weighted moving average (OWMA) and the induced ordered weighted moving average can be proposed [31].

Definition 4.

An OWMA operator ofdimensions is a mappingthat has an associated weighting vector W ofdimensions withand, such that:

whereis thelargest argument of,is the total number of arguments considered in the whole sample andindicates the movement of the average from the initial analysis.

Definition 5.

An IOWMA operator ofdimensions is a mappingthat has an associated weighting vector W ofdimensions withand, such that:

whereis thevalue of the IOWMA pair,isthelargest,is the order-inducing variable,is the argument variable,is the total number of arguments considered in the whole sample andindicates the movement of the average from the initial analysis.

2.2. Pythagorean Membership Grades Used in Multiple Criteria Decision-Making

Definition 6.

MCDM considers a finite collectionof alternatives and a set ofcriteria that we desire to satisfy. These criteria are referred to asforto. Each criterionis associated with an importance weightsuch thatand. Likewise,indicates the degree of satisfaction of criterionby alternative.

Let us now consider the situation in which the values ofare Pythagorean membership grades [15]. Here, each , where and and .

where and indicate the degree of satisfaction of criterion by alternative .

Additionally, this formulation is completed via the following function, which is based on fuzzy rules [15].

3. Pythagorean Membership Grade Aggregation Operators

This section presents new operators that combine the IOWA and OWMA operators with Pythagorean membership grades.

3.1. Extensions of the Pythagorean OWA

Extensions of the Pythagorean OWA are new propositions that combine the characteristics of IOWA and OWMA operators and Pythagorean membership grades. These new formulations are important because, when imprecise and ambiguous information is present in the problem, this needs to be analyzed, Pythagorean and OWA operators have proven to be useful [43,44,45,46]. Due to this, expanding the formulations by using more complex situations, such as those that can be analyzed with the IOWA and OWMA operators, presents a good opportunity to generate new results by considering a new reordering process based on induced values or problems that use time series. The new formulations are as follows. Since we present a new formulation, the notation to corresponds to the notation to distinguish the new contribution.

Proposition 1.

A Pythagorean membership grade induced OWA operator (PMGIOWA) is an extension of the OWA operator. Thus, an PMGIOWA operator is a mapthat is associated with a weight vector w, withand. Additionally, each, whereandand, such that:

whereandindicate the degree of satisfaction of criterionby alternative. Thus,is thevalue of the OWA pairwith the jth largest,is the order-inducing variable andis the argument variable.

Proposition 2.

A Pythagorean membership grade OWMA operator (PMGOWMA) is a mappingthat has an associated weighting vector W ofdimensions withand. Additionally, each, whereandand, such that:

whereandindicate the degree of satisfaction of criterionby alternative. Thus,is thelargest argument of,is the total number of arguments considered in the whole sample andindicates the movement of the average from the initial analysis.

Proposition 3.

A Pythagorean membership grade induced OWMA operator (PMGIOWMA) is a mapthat that has an associated weighting vector W ofdimensions withand. Additionally, each, whereandandsuch that:

whereandindicate the degree of satisfaction of criterionby alternative. Thus,is thevalue of the OWA pairwith the jth largestis the order-inducing variable andis the argument variable. Likewise,is the total number of arguments considered in the whole sample andindicates the movement of the average from the initial analysis.

The Pythagorean membership grade has the property that the sum of the squares must be less than 1 [15]. We now prove that the new operators meet that condition.

Theorem 1.

If for, we have and with and , then .

Proof.

□

Theorem 2.

For a moving average, if for, we have andwithand, then.

Proof.

□

Theorem 3.

For an induced moving average, if for, we have andwithand, then.

Proof.

□

3.2. Numerical Example

In this example, we have three criteria (C1, C2, and C3) with the importance weights w1 = 0.25, w2 = 0.45, and w3 = 0.30. We must choose between two alternatives, x and y. The two alternatives satisfy the criteria as follows, where the induced variables are .

By using Equations (7)–(9), we calculate the following:

Now, and can be obtained as: and . Here, and . Additionally, if trigonometric values are used, it is possible to apply the function . In this case, the results are as follows: and ; and . By following the same process, we can obtain the results of Equations (8) and (9). In PMGOWMA, the moving average is calculated as: . The same process can be used to obtain B and B′ for each PMGOWMA and PMGIOWMA. In all cases, the best option is (see Table 1).

Table 1.

Consolidated results.

As can be seen in Table 1, even when different aggregation operators were used, the results were the same, but an interesting finding is that the results were not the same for all the formulations, and in some the difference between x and y was smaller, but in others it was larger. Therefore, analyzing the information with the use of more data is important for better understanding of the phenomenon under study.

4. Case Study

The financial environment nowadays has become more precarious. The new generation has problems related to mortgages, credit availability, borrowing options, pensions, savings and investing options [47]. In addition to these problems, many citizens do not understand the financial concepts that are crucial for consumers’ financial decision-making [48]. The main idea of financial education is to provide individuals with the knowledge, aptitude and skill base necessary to become questioning and informed consumers of financial services and to manage their finances effectively [49]. Among the benefits of having good financial knowledge is that it is directly correlated with self-beneficial financial behavior [50]. Due to this, it is important to analyze the impact of financial education so that it is possible to answer the question as to whether financial knowledge allows people with more financial education to achieve better decisions than those with less [51]. Among the aspects that should be better understood are savings and credit. On the one hand, saving is an action in which a reserve of capital from income is kept for future use, which depends on the level of income, generating a positive or negative rate. On the other hand, credit is a means of financing that can be used to start a new business or project at a personal or business level, although it can also be used when acquiring goods that do not generate income. To provide a better understanding of these concepts, they will be briefly explained below.

4.1. Savings

The importance of the concept of savings in financial education derives from the economy, from both macroeconomic and microeconomic approaches. From the macroeconomic view, savings is the surplus of income over what is spent on consumption [52]. Likewise, good financial intermediation between savers and investors increases the economic development of a nation [53]. In this sense, [54] indicated that, if a nation has high savings rates, this is correlated with economic growth, pointing out that there is a cycle between savings and prosperity. Hence, macroeconomic principles have led several authors to explore diverse concepts that contribute to improving the development of a nation. From a microeconomic view, an individual demonstrates a saving behavior if he/she balances current consumption against expected consumption. This indicates that a well-informed individual will not consume all his/her income and will save for difficult times [55]. Likewise, some approaches have indicated that an environment of uncertainty is relevant to having such savings in the future [56]. Moreover, other studies have incorporated liquidity restrictions derived from imperfections in credit markets [57]. Additionally, savings behavior is driven by externalities produced by inadequate financial intermediation and by imperfections in the credit and insurance markets [58].

4.2. Credit

The concept of credit is related to macroeconomic factors, such as inflation and financial market volatility, which have produced small and inefficient financial systems in Latin America. The authors of [59] stated that the consequences of the macroeconomic environment of a country are reflected in its financial intermediaries (banks, financial corporations, insurance companies, among others) and their characteristics. As indicated by [60], the function of financial intermediaries is to stimulate and collect savings in an economy, and to give credit to those who require capital and thus develop their economic activities.

Another aspect to consider is credit rationing. For [61], this rationing occurs when the borrower is denied credit, even if he/she is willing to meet the provisions of the loan contract. The authors of [62] also suggested that credit rationing occurs in two ways: first, when one or all members of a group are rationed; second, when some members of the group are rationed. Finally, [63] mentioned that credit restrictions can be classified in analyses of the credit market environment into those on the credit offering side and those on credit demanders. In conclusion, credit rationing has several factors that look for imperfections, such as high interest rates, credit ceilings, usury laws, the level of financial intermediation, the number of borrowers and credit risk, among others.

4.3. Process of Analyzing Financial Knowledge Levels

This section presents the main steps taken to analyze financial knowledge levels and the use of the new method of criteria satisfaction to obtain the best alternative. The decision-making problem is associated with savings and credit perceptions through a combination of the features, to determine which of them satisfies personal criteria. For this purpose, this study used a dataset of the 13 provinces of the department of Boyacá, Colombia, regarding financial knowledge. For the selection of the database sample, the provinces were classified into three groups in proportion to the population, and the best offers of financial services in the cities and municipalities were established as the selection criteria. A 95% confidence level and a 5% error were selected for a sample of 1914 people. Following is the step-by-step decision-making process.

Step 1. Analyze and determine the significant characteristics for savings (Sav) and credit (Cred) perceptions, which comprise six actions for Sav and five actions for Cred, which are considered to be characteristics. Each characteristic of the sector is considered as a property (see Table 2).

Table 2.

Savings and credit actions.

Step 2. In this step, the educational level is established as a determining condition for saving or taking credit. Three groups were established for this analysis: Group 1: none and primary; Group 2: high school and technical; Group 3: undergraduate and postgraduate. These classifications are based on the Colombian educational system (see Table 3).

Table 3.

Education level groups.

Step 3. Using the database, construct the matrices containing the satisfactory conditions for savings or credit, considering the classifications described in Steps 1 and 2. Here, each value comprised the criterion, knowledge, and the subjectivity of the decision-maker (see Table 4 and Table 5).

Table 4.

Saving values ratios.

Table 5.

Credit values ratios.

Step 4. Weight vectors are determined by using the sources of information most often used by people when deciding to save or take out credit. These vectors are represented by . Likewise, the induced values are established, using the actions most often used to make savings or take credit as a reference. These values are represented by . (see Table 6 and Table 7).

Table 6.

Weighting vectors and induced values for savings.

Table 7.

Weighting vectors and induced values for credit.

5. Results

For analysis of savings and credit perceptions, we used the following: the PMGOWA operator, the PMGIOWA operator, the PMGOWMA operator and the PMGIOWMA operator (see Table 8).

Table 8.

Results of the PMGOWA, PMGIOWA, PMGOWMA and PMGIOWMA.

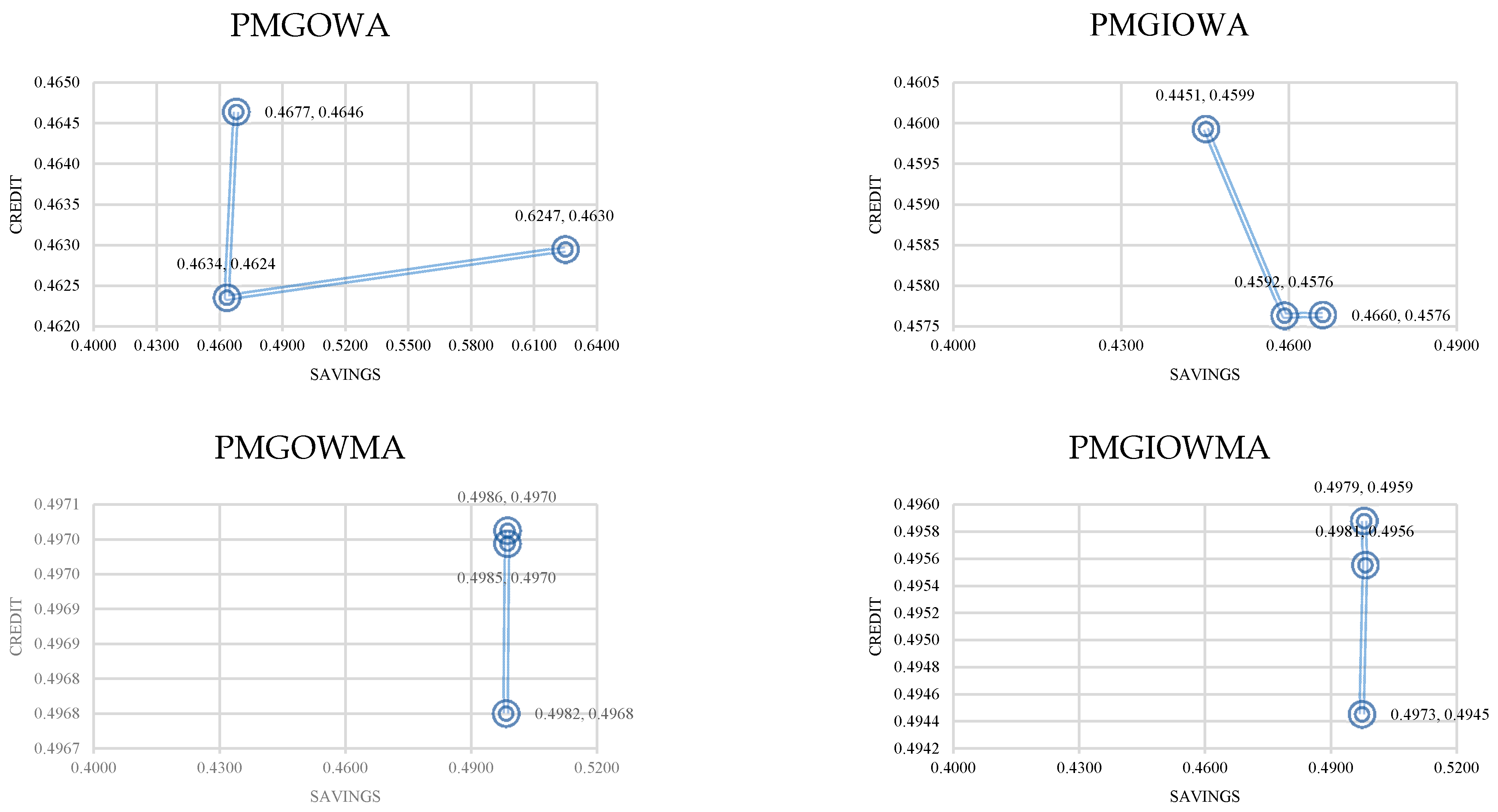

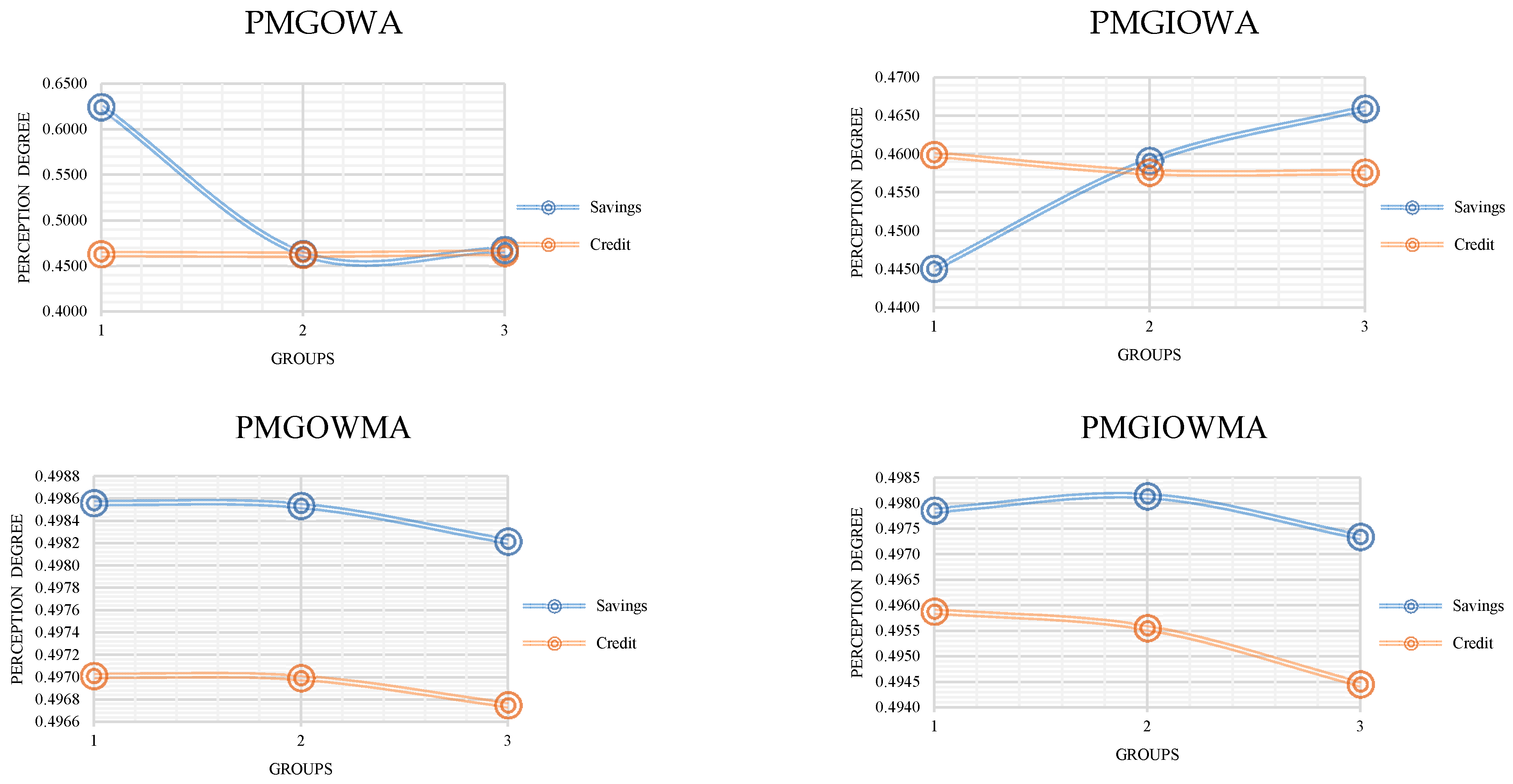

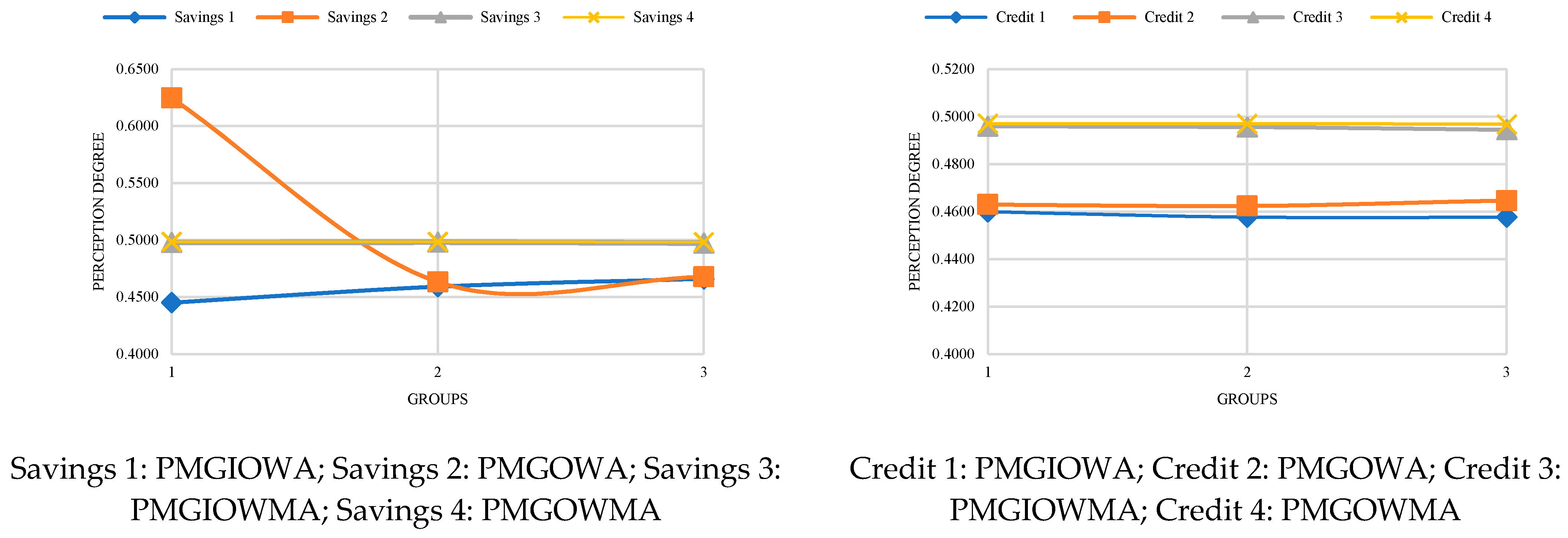

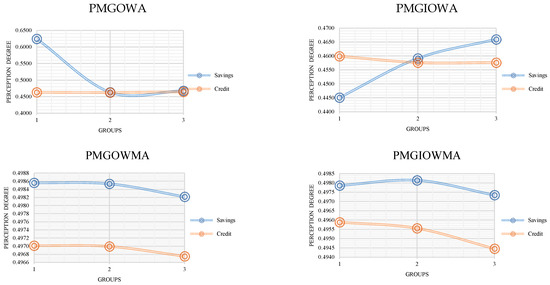

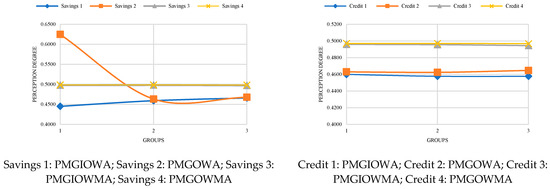

With the results obtained, it is possible to graph and observe the change in perceptions about credit and savings. Figure 1 shows the relationship between perceptions for each method. Figure 2 shows the perceptions for each group regarding credit and savings for each method used. Figure 3 shows the perceptions grouped into savings and credit.

Figure 1.

Perception relationships of savings and credit for each method.

Figure 2.

Perceptions of savings and credit by each method.

Figure 3.

Perception of savings and credit by group.

Based on the different graphs presented in Figure 1, it is possible to see that, with the PMGOWA operator, the relationship between credit and savings can change drastically from (0.4634, 0.4624) to (0.6247, 0.4630), but if a more complex operator is used, such as the PMGIOWMA operator the changes are not that important and are between (0.4973, 0.4945) and (0.4979, 0.4959). Finally, as a conclusion and considering all the results obtained by the operators, the relationships between the perceptions are 0.4500–0.500 and 0.4500–0.5000; higher results than these are seldom seen.

Based on Figure 2, it is possible to see that the results are very similar between the groups, with exception of savings with the PMGOWA, where perception changed from 0.4634 to 0.6247, with Group 1 giving a higher value to savings.

Figure 3 shows the different results for saving and credit by group. As seen before, the results for saving in Group 1, specifically Savings 1 (PMGOWA operator), had a higher value than the other operators.

Finally, based on all the information provided by Figure 1, Figure 2 and Figure 3, the main result is that the education of the people who responded to the survey, the importance of savings and credits and the relationship between them were shown to have similar levels. This information can be useful, because sometimes decision-makers believe that this perception can change based on the educational level, but with the information and the operators used in this research, it is possible to affirm that in the case of Boyacá, Colombia, this was not the case.

Since the moving average allows us to calculate averages over time, it is often used in financial problems such as pricing, sales, and others. The main idea of using the moving average in this research was that it can demonstrate the change in perception that it can indicate in a decision problem and that it can show a trend in the collected data, where is the number of times that an answer can be repeated. Due to this characteristic and in combination with the induced variables and the Pythagorean membership grade, it offers a more complex method that considers the changes in perception in an uncertain system. Hence, the selected case considers that credit and savings can be influenced by people’s schooling and their own reasoning, which changes over time. Additionally, it shows that the Cartesian relationship of two variables can be considered as independent variables and used to aggregate variables in the same system, which offers a representative value of the degree of perception and the relationships of perceptions. By analyzing the degree of perception, we seek to highlight the benefit of limited reasoning and the subjectivity of individuals.

6. Conclusions

The objective of this study was to present the Pythagorean membership grade induced ordered weighted moving average (PMGIOWMA) operator. The main characteristic of this new proposition is that it combines a weighting vector with a Pythagorean membership grade to include the knowledge, expertise, and expectations of the decision-maker, as well as a reordering step based on induced values and the application of a series of data based on moving averages.

Additionally, the main definitions and theorems of the PMGIOWMA operator are provided here, as well as some other extensions that are less complex, such as the PMGOWMA or PMGIOWA operators. These two extensions are considered less complex because in the first, the reordering is not based on induced values, and in the second, there is not a moving average. The main idea of presenting fewer complex formulations is based on the problem that needs to be solved. To reduce the uncertainty, it is possible to use a simpler formula. Moreover, sometimes not all the information needed for using the most complex operator can be obtained and the analysis must be carried out with another operator.

The PMGIOWMA operator was used to visualize the perceptions of and relationship between savings and credit based on a survey of 1914 people from 13 provinces of the department of Boyacá, Colombia. Among the main results, it was possible to see that the three different groups had the same perceptions of saving and credits, and the relationship degree was also the same. This idea is important, considering that the groups were based on their educational level, and it was possible to see that, regarding the financial topics of saving and credits, their perceptions were the same. Another interesting result was that the perception of saving in Group 1 (people with no and primary education) was 50% higher with the PMGOWA operator.

Futures research should focus on fuzzy decision-making [64] to propose more extension of the Pythagorean membership grade and OWA operator [65], possibly through the use of distance operators [40], linguistic variables [8,66], logarithmic operators [67], heavy operators [33] or prioritized operators [68].

Author Contributions

Conceptualization, J.R.-M. and F.B.-M.; methodology, F.B.-M. and E.L.-C.; formal analysis, F.B.-M. and E.L.-C.; writing—original draft preparation, J.R.-M. and F.B.-M.; writing—review and editing, F.B.-M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Universidad Pedagogica y Tecnologica de Colombia (grant number SGI-2589). Author Number 2 acknowledges support from the Chilean Government through FONDECYT initiation grant No. 11190056.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Universidad Pedagogica y Tecnologica de Colombia.

Informed Consent Statement

All subjects gave their informed consent for inclusion before they participated in the study. The study was conducted in accordance with the Declaration of Helsinki.

Data Availability Statement

The database used is from a secondary source provided by the Eugene Fama research group of the Financial Literacy in Boyacá project (2018–2019).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Beliakov, G.; Bustince Sola, H.; Calvo Sánchez, T. A Practical Guide to Averaging Functions, 1st ed.; Kacprzyk, J., Ed.; Springer International Publishing: Cham, Switzerland, 2016; ISBN 9783319247533. [Google Scholar]

- Blanco-Mesa, F.; León-Castro, E.; Merigó, J.M. A Bibliometric Analysis of Aggregation Operators. Appl. Soft Comput. J. 2019, 81, 105488. [Google Scholar] [CrossRef]

- Yager, R.R. On Ordered Weighted Averaging Aggregation Operators in Multicriteria Decision-Making. IEEE Trans. Syst. Man Cybern. 1988, 18, 183–190. [Google Scholar] [CrossRef]

- Merigó, J.M. Probabilities in the OWA Operator. Expert Syst. Appl. 2012, 39, 11456–11467. [Google Scholar] [CrossRef]

- Gil-Lafuente, A.M.; Merigó, J.M. The Ordered Weighted Averaging Distance Operator. Lect. Model. Simul. 2007, 8, 84–95. [Google Scholar]

- Xu, Z.; Chen, J. Ordered Weighted Distance Measure. J. Syst. Sci. Syst. Eng. 2008, 17, 432–445. [Google Scholar] [CrossRef]

- Merigó, J.M.; Gil-Lafuente, A.M. On the Use of the OWA Operator in the Euclidean Distance. Int. J. Comput. Sci. Eng. 2008, 2, 170–176. [Google Scholar]

- Herrera, F.; Martinez, L. A 2-Tuple Fuzzy Linguistic Representation Model for Computing with Words. IEEE Trans. Fuzzy Syst. 2000, 8, 746–752. [Google Scholar] [CrossRef] [Green Version]

- Yu, D. A Scientometrics Review on Aggregation Operator Research. Scientometrics 2015, 105, 115–133. [Google Scholar] [CrossRef]

- Yager, R.R.; Filev, D.P. Induced Ordered Weighted Averaging Operators. IEEE Trans. Syst. Man Cybern. Part B (Cybern.) 1999, 29, 141–150. [Google Scholar] [CrossRef]

- Chen, L.; Xu, Z. A Prioritized Aggregation Operator Based on the OWA Operator and Prioritized Measure. J. Intell. Fuzzy Syst. 2014, 27, 1297–1307. [Google Scholar] [CrossRef]

- Yager, R.R. On Generalized Bonferroni Mean Operators for Multi-Criteria Aggregation. Int. J. Approx. Reason. 2009, 50, 1279–1286. [Google Scholar] [CrossRef] [Green Version]

- Modave, F.; Ceberio, M.; Kreinovich, V. Choquet Integrals and OWA Criteria as a Natural (and Optimal) Next Step after Linear Aggregation: A New General Justification; Springer: Berlin/Heidelberg, Germany, 2008; pp. 741–753. [Google Scholar]

- Yager, R.R. Time Series Smoothing and OWA Aggregation. IEEE Trans. Fuzzy Syst. 2008, 16, 994–1007. [Google Scholar] [CrossRef]

- Yager, R.R. Pythagorean Membership Grades in Multicriteria Decision Making. IEEE Trans. Fuzzy Syst. 2014, 22, 958–965. [Google Scholar] [CrossRef]

- León-Castro, E.; Avilés-Ochoa, E.; Merigó, J.M. Induced Heavy Moving Averages. Int. J. Intell. Syst. 2018, 33, 1823–1839. [Google Scholar] [CrossRef]

- Espinoza-Audelo, L.; Aviles-Ochoa, E.; Leon-Castro, E.; Blanco-Mesa, F. Forecasting Performance of Exchange Rate Models with Heavy Moving Average Operators. Fuzzy Econ. Rev. 2019, 24, 3–21. [Google Scholar] [CrossRef]

- Xu, Z. Induced Uncertain Linguistic OWA Operators Applied to Group Decision Making. Inf. Fusion 2006, 7, 231–238. [Google Scholar] [CrossRef]

- Merigó, J.M.; Casanovas, M.; Palacios-Marqués, D. Linguistic Group Decision Making with Induced Aggregation Operators and Probabilistic Information. Appl. Soft Comput. 2014, 24, 669–678. [Google Scholar] [CrossRef]

- Chiclana, F.; Herrera-Viedma, E.; Herrera, F.; Alonso, S. Some Induced Ordered Weighted Averaging Operators and Their Use for Solving Group Decision-Making Problems Based on Fuzzy Preference Relations. Eur. J. Oper. Res. 2007, 182, 383–399. [Google Scholar] [CrossRef]

- Atanassov, K.T. Intuitionistic fuzzy sets. In Intuitionistic Fuzzy Sets; Springer: Berlin/Heidelberg, Germany, 1999; pp. 1–137. [Google Scholar]

- Shouzhen, Z.; Qifeng, W.; Merigó, J.M.; Tiejun, P. Induced Intuitionistic Fuzzy Ordered Weighted Averaging: Weighted Average Operator and Its Application to Business Decision-Making. Comput. Sci. Inf. Syst. 2014, 11, 839–857. [Google Scholar] [CrossRef]

- Xu, Y.; Wang, H. The Induced Generalized Aggregation Operators for Intuitionistic Fuzzy Sets and Their Application in Group Decision Making. Appl. Soft Comput. 2012, 12, 1168–1179. [Google Scholar] [CrossRef]

- Merigó, J.M.; Gil-Lafuente, A.M. Decision Making with the Induced Generalized Adequacy Coefficient. Appl. Comput. Math. 2011, 10, 321–339. [Google Scholar]

- Merigó, J.M.; Casanovas, M. Decision-Making with Distance Measures and Induced Aggregation Operators. Comput. Ind. Eng. Ind. Eng. 2011, 60, 66–76. [Google Scholar] [CrossRef] [Green Version]

- Perez-Arellano, L.A.; Leon-Castro, E.; Blanco-Mesa, F.; Fonseca-Cifuentes, G. The Ordered Weighted Government Transparency Average: Colombia Case. J. Intell. Fuzzy Syst. 2021, 40, 1837–1849. [Google Scholar] [CrossRef]

- Merigó, J.M.; Casanovas, M. Induced and Uncertain Heavy OWA Operators. Comput. Ind. Eng. 2011, 60, 106–116. [Google Scholar] [CrossRef]

- Blanco-Mesa, F.; León-Castro, E.; Merigó, J.M.; Xu, Z. Bonferroni Means with Induced Ordered Weighted Average Operators. Int. J. Intell. Syst. 2019, 34, 3–23. [Google Scholar] [CrossRef] [Green Version]

- Liu, H.-C.; Mao, L.-X.; Zhang, Z.-Y.; Li, P. Induced Aggregation Operators in the VIKOR Method and Its Application in Material Selection. Appl. Math. Model. 2013, 37, 6325–6338. [Google Scholar] [CrossRef]

- Tan, C.; Chen, X. Induced Choquet Ordered Averaging Operator and Its Application to Group Decision Making. Int. J. Intell. Syst. 2010, 25, 59–82. [Google Scholar] [CrossRef]

- Merigó, J.M.; Yager, R.R. Generalized Moving Average, Distance Measures and OWA Operators. Int. J. Uncertain. Fuzziness Knowl. Based Syst. 2013, 21, 533–559. [Google Scholar] [CrossRef]

- Olazabal-Lugo, M.; Leon-Castro, E.; Espinoza-Audelo, L.F.; Merigó, J.M.; Gil Lafuente, A.M. Forgotten Effects and Heavy Moving Averages in Exchange Rate Forecasting. Econ. Comput. Econ. Cybern. Stud. Res. 2019, 53, 79–96. [Google Scholar] [CrossRef]

- León-Castro, E.; Avilés-Ochoa, E.; Merigó, J.M.; Gil-Lafuente, A.M. Heavy Moving Averages and Their Application in Econometric Forecasting. Cybern. Syst. 2018, 49, 26–43. [Google Scholar] [CrossRef] [Green Version]

- Fonseca-Cifuentes, G.; Leon-Castro, E.; Blanco-Mesa, F. Predicting the Future Price of a Commodity Using the OWMA Operator: An Approximation of the Interest Rate and Inflation in the Brown Pastusa Potato Price. J. Intell. Fuzzy Syst. 2021, 40, 1971–1981. [Google Scholar] [CrossRef]

- Zhang, X.; Xu, Z. Extension of TOPSIS to Multiple Criteria Decision Making with Pythagorean Fuzzy Sets. Int. J. Intell. Syst. 2014, 29, 1061–1078. [Google Scholar] [CrossRef]

- Peng, X.; Yang, Y. Some Results for Pythagorean Fuzzy Sets. Int. J. Intell. Syst. 2015, 30, 1133–1160. [Google Scholar] [CrossRef]

- Ren, P.; Xu, Z.; Gou, X. Pythagorean Fuzzy TODIM Approach to Multi-Criteria Decision Making. Appl. Soft Comput. J. 2016, 42, 246–259. [Google Scholar] [CrossRef]

- Liu, M.; Zeng, S.; Baležentis, T.; Streimikiene, D. Picture Fuzzy Weighted Distance Measures and Their Application to Investment Selection. Amfiteatru Econ. J. 2019, 21, 682–695. [Google Scholar] [CrossRef]

- Zhang, H.; Liao, H.; Wu, X.; Zavadskas, E.K.; Al-Barakati, A. Internet Financial Investment Product Selection with Pythagorean Fuzzy DNMA Method. Eng. Econ. 2020, 31, 61–71. [Google Scholar] [CrossRef] [Green Version]

- Mariño-Becerra, G.; Blanco-Mesa, F.; León-Castro, E. Pythagorean Membership Grade Distance Aggregation: An Application to New Business Ventures. J. Intell. Fuzzy Syst. 2021, 40, 1827–1836. [Google Scholar] [CrossRef]

- Evans, M.K. Practical Business Forecasting; Blackwell Publishers: Oxford, UK, 2002; ISBN 9780631220657. [Google Scholar]

- Kenney, J.; Keeping, E. Moving Averages; Van Nostrand: Princeton, NJ, USA, 1962. [Google Scholar]

- Zhang, X. Multicriteria Pythagorean Fuzzy Decision Analysis: A Hierarchical QUALIFLEX Approach with the Closeness Index-Based Ranking Methods. Inf. Sci. 2016, 330, 104–124. [Google Scholar] [CrossRef]

- Naz, S.; Ashraf, S.; Akram, M. A Novel Approach to Decision-Making with Pythagorean Fuzzy Information. Mathematics 2018, 6, 95. [Google Scholar] [CrossRef] [Green Version]

- Zeng, S.; Chen, J.; Li, X. A Hybrid Method for Pythagorean Fuzzy Multiple-Criteria Decision Making. Int. J. Inf. Technol. Decis. Mak. 2016, 15, 403–422. [Google Scholar] [CrossRef]

- Yager, R.R. Pythagorean Fuzzy Subsets. In Proceedings of the 2013 Joint IFSA World Congress and NAFIPS Annual Meeting (IFSA/NAFIPS), Edmonton, AB, Canada, 24–28 June 2013; IEEE: Piscataway, NJ, USA, 2013; pp. 57–61. [Google Scholar]

- Fernandes, D.; Lynch, J.G.; Netemeyer, R.G. Financial Literacy, Financial Education, and Downstream Financial Behaviors. Manag. Sci. 2014, 60, 1861–1883. [Google Scholar] [CrossRef]

- Fox, J.; Bartholomae, S.; Lee, J. Building the Case for Financial Education. J. Consum. Aff. 2005, 39, 195–214. [Google Scholar] [CrossRef]

- Mason, C.L.J.; Wilson, R.M.S. Conceptualising Financial Literacy; Business School, Loughborough University: Loughborough, UK, 2000; Volume 7. [Google Scholar]

- Mandell, L.; Schmid Klein, L. The Impact of Financial Literacy Education on Subsequent Financial Behavior. J. Financ. Couns. Plan. 2009, 20, 1–10. [Google Scholar]

- Romero-Muñoz, J.; Fonseca-Cifuentes, G.; Blanco-Mesa, F. Analysis and Evaluation of Financial Education in Boyacá, 1st ed.; Editorial UPTC: Tunja, Colombia, 2021; ISBN 978-958-660-484-0. [Google Scholar]

- Keynes, J.M. The General Theory of Employment, Interest, and Money; Stellar Classics: Bloomington, IN, USA, 2016; ISBN 198781780X. [Google Scholar]

- Gurley, J.G.; Shaw, E.S. Financial Aspects of Economic Development. Am. Econ. Rev. 1955, 45, 515–538. [Google Scholar] [CrossRef]

- Karlan, D.; Ratan, A.L.; Zinman, J. Savings by and for the Poor: A Research Review and Agenda. Rev. Income Wealth 2014, 60, 36–78. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Modigliani, F. The Life Cycle Hypothesis of Saving, the Demand for Wealth and the Supply of Capital. Soc. Res. 1996, 33, 160–217. [Google Scholar] [CrossRef]

- Carroll, C.D. Precautionary Saving and the Marginal Propensity to Consume out of Permanent Income. J. Monet. Econ. 2009, 56, 780–790. [Google Scholar] [CrossRef] [Green Version]

- Hayashi, F. Tests for liquidity constraints: A critical survey and some new observations. In Advances in Econometrics; Bewley, T.F., Ed.; Cambridge University Press: CT, USA, 2008; pp. 91–120. [Google Scholar]

- Liu, L.-Y.; Woo, W.T. Saving Behaviour under Imperfect Financial Markets and the Current Account Consequences. Econ. J. R. Econ. Soc. 1994, 104, 512–527. [Google Scholar] [CrossRef]

- Kiguel, M.A.; Levy Yeyati, E.; Galindo, A.; Panizza, U.; Miller, M.; Rojas-Suárez, L.; Bebczuk, R.N.; López-de-Silanes, F.; Bernal, O.; Auerbach, P.; et al. Desencadenar El Crédito: Cómo Ampliar y Estabilizar La Banca; Banco Interamericano de Desarrollo: Washington, DC, USA, 2004. [Google Scholar]

- Baldivia Urdininea, J. Las Microfinanzas: Un Mundo de Pequeños Que Se Agrandan; Fundación Milenio: La Paz, Bolivia, 2004. [Google Scholar]

- Baltensperger, E. The Borrower-Lender Relationship, Competitive Equilibrium, and the Theory of Hedonic Prices. Am. Econ. Rev. 1976, 66, 401–405. [Google Scholar]

- Keeton, W.R. Equilibrium Credit Rationing; Garland Publishing: New York, NY, USA; London, UK, 1979. [Google Scholar]

- Murcia, A. Determinantes Del Acceso al Crédito de Los Hogares Colombianos. In Borradores de Economía; No. 449; Banco de la Republica: Bogotá, Colombia, 2007. [Google Scholar]

- Blanco-Mesa, F.; Merigó, J.M.; Gil-Lafuente, A.M. Fuzzy Decision Making: A Bibliometric-Based Review. J. Intell. Fuzzy Syst. 2017, 32, 2033–2050. [Google Scholar] [CrossRef] [Green Version]

- Baez-Palencia, D.; Olazabal-Lugo, M.; Romero-Muñoz, J. Toma de Decisiones Empresariales a Través de La Media Ponderada Ordenada. Inquiet. Empres. 2019, 19, 11–23. [Google Scholar]

- Garg, H. Linguistic Pythagorean Fuzzy Sets and Its Applications in Multiattribute Decision-Making Process. Int. J. Intell. Syst. 2018, 33, 1234–1263. [Google Scholar] [CrossRef]

- Alfaro-García, V.G.; Merigó, J.M.; Gil-Lafuente, A.M.; Kacprzyk, J. Logarithmic Aggregation Operators and Distance Measures. Int. J. Intell. Syst. 2018, 33, 1488–1506. [Google Scholar] [CrossRef] [Green Version]

- Pérez-Arellano, L.A.; León-Castro, E.; Avilés-Ochoa, E.; Merigó, J.M. Prioritized Induced Probabilistic Operator and Its Application in Group Decision Making. Int. J. Mach. Learn. Cybern. 2019, 10, 451–462. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).