An Econometric Approach Regarding the Impact of Fiscal Pressure on Equilibrium: Evidence from Electricity, Gas and Oil Companies Listed on the New York Stock Exchange

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

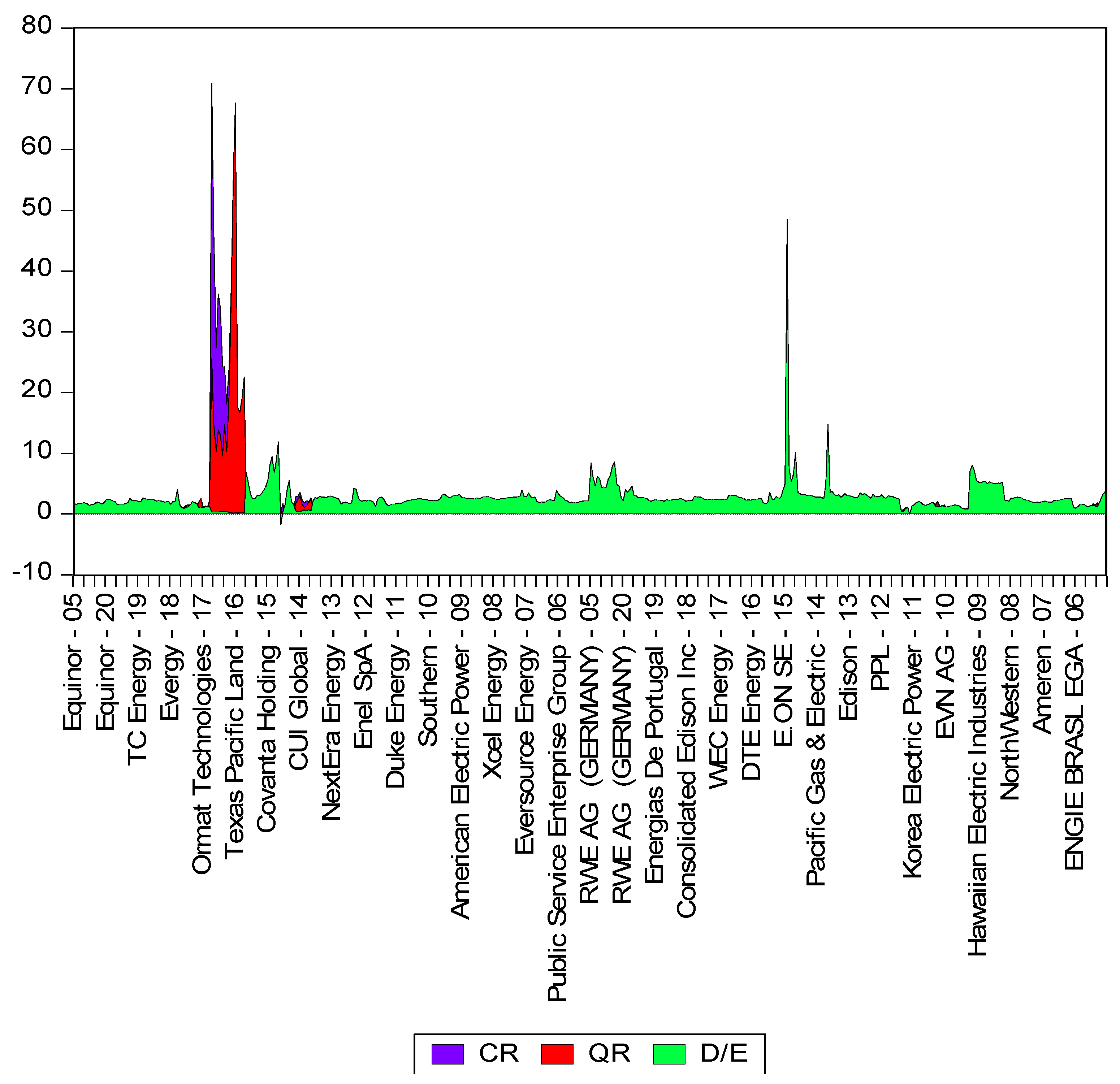

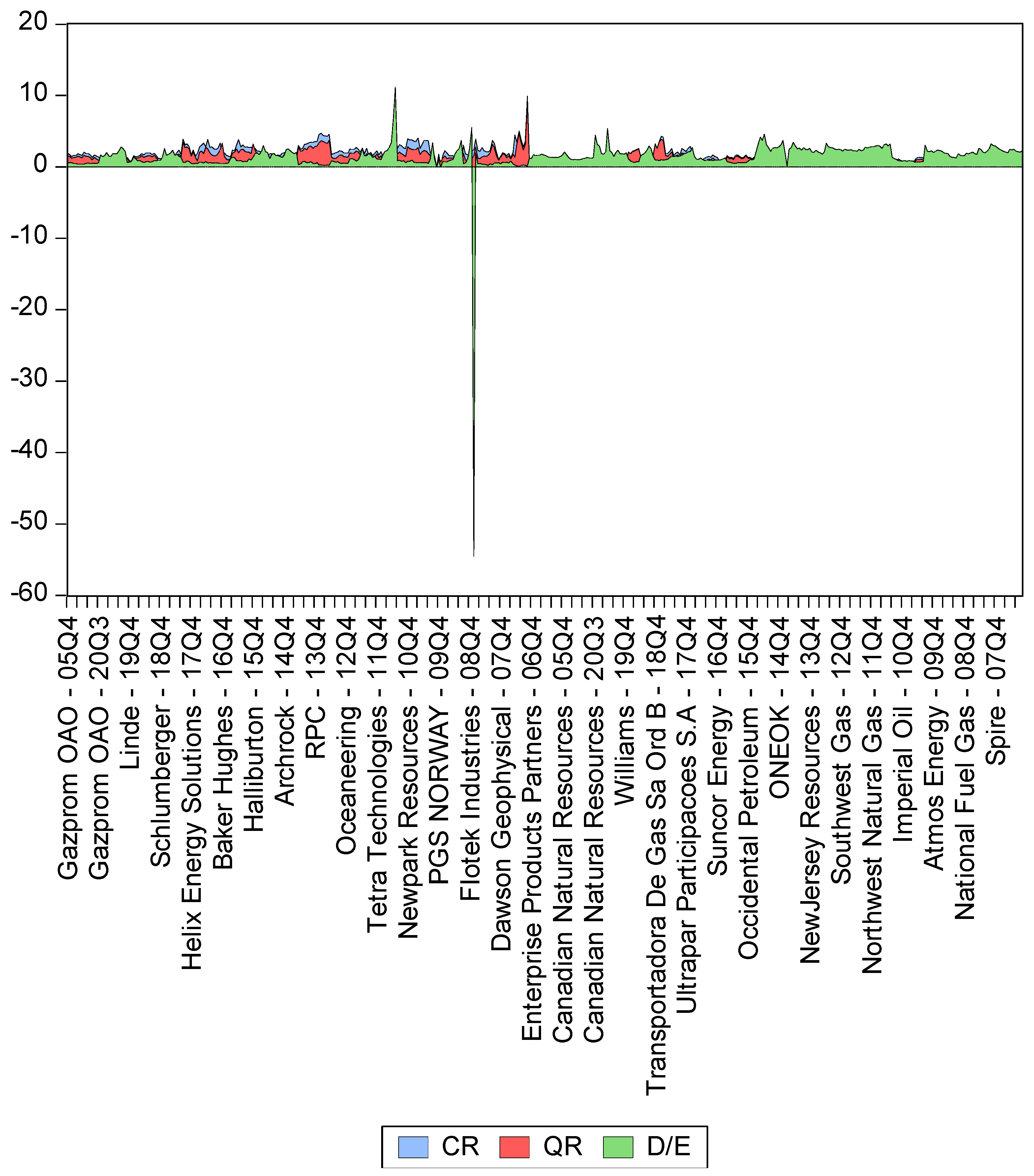

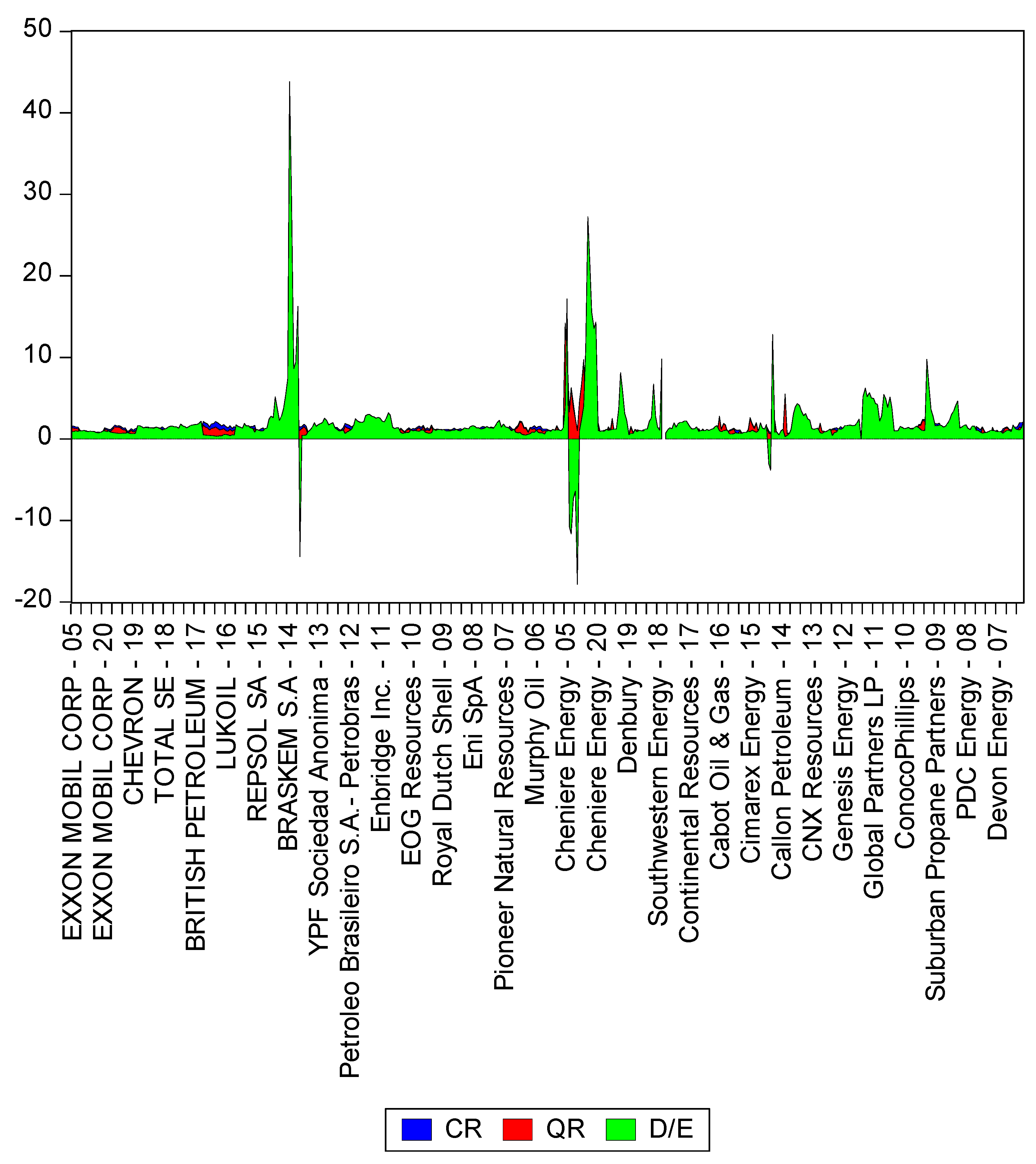

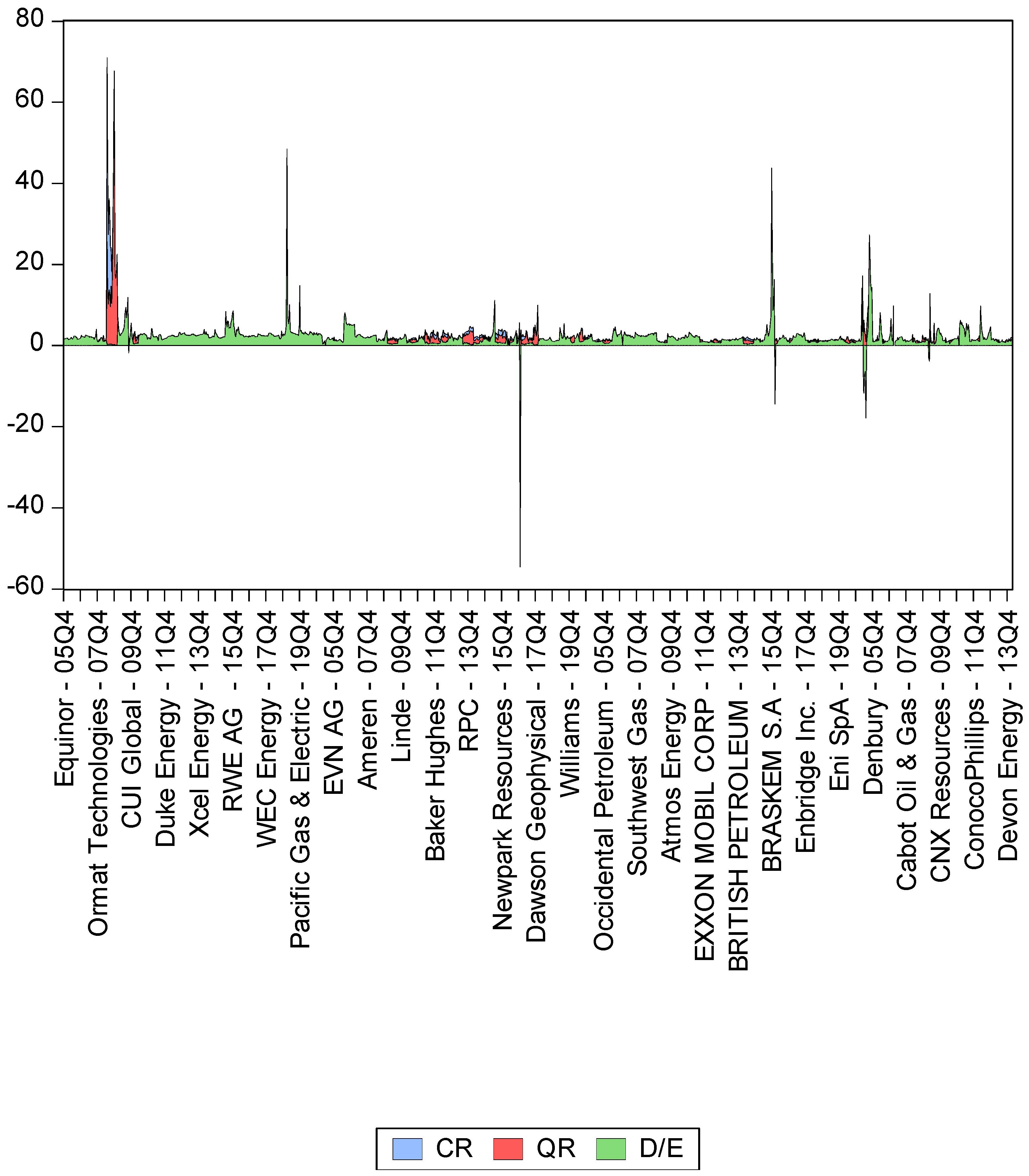

- Current liquidity ratio (CR), which reflects the capacity of current assets (e.g., inventory, short-term investments) to turn into cash that should cover the outstanding debts of the company. According to financial analysts, a company has a favorable liquidity when the current ratio ranges from 150% to 250% (generally);

- Quick ratio (QR), determined as a ratio between more liquid current assets (receivables, short-term investments) and current liabilities. A favorable quick ratio should range between 50% and 100% (generally);

- Debt to equity ratio (D/E), expressing the ability of a company to cope with external payments, is calculated by dividing debt to equity. The optimum value of the indicator is 0–30% (the so-called “green area”). The range 31–50% is called the “brown area,” 51–70% is the “red area,” while everything above 70% belongs to the “black area.”

- 4.

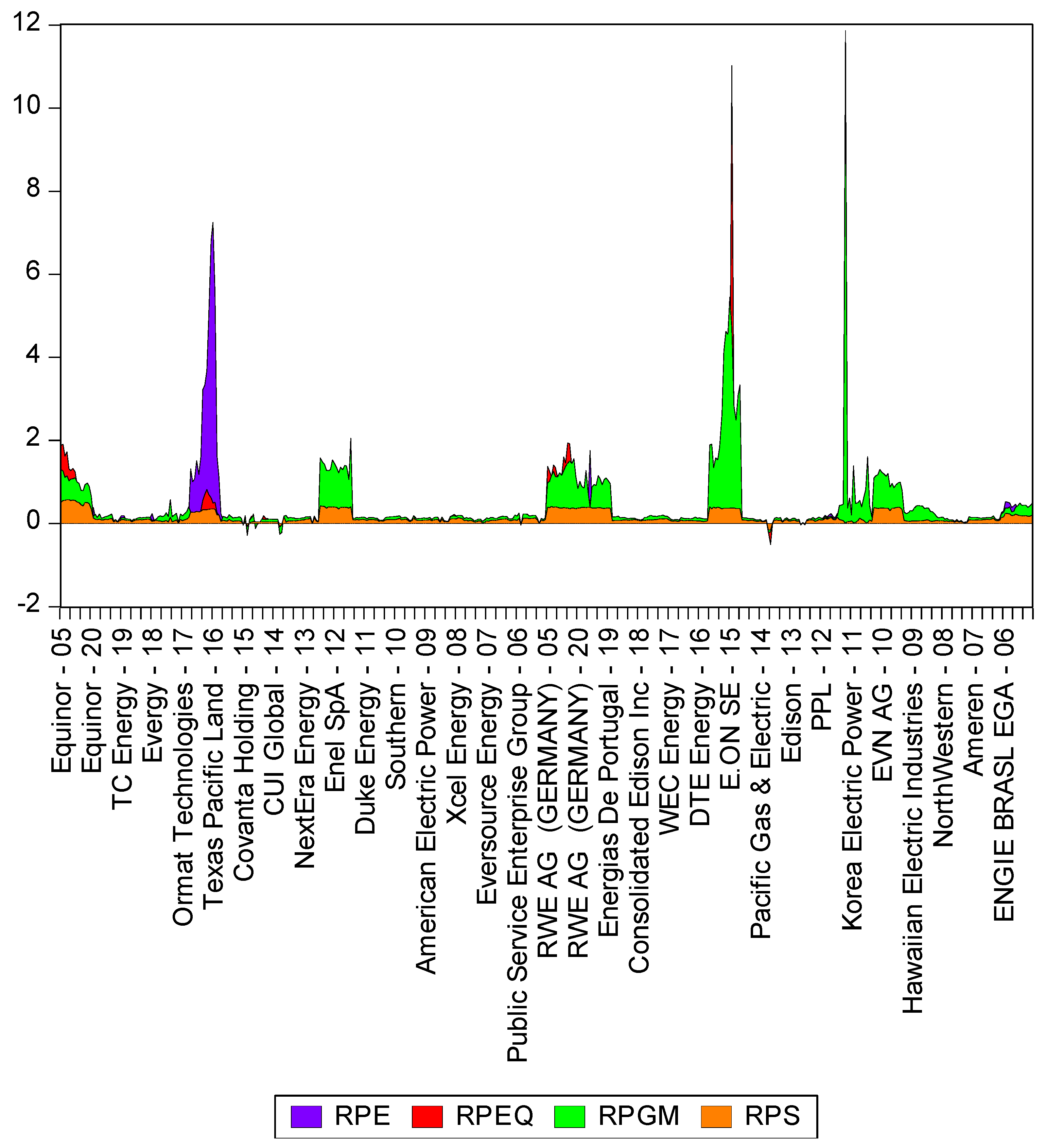

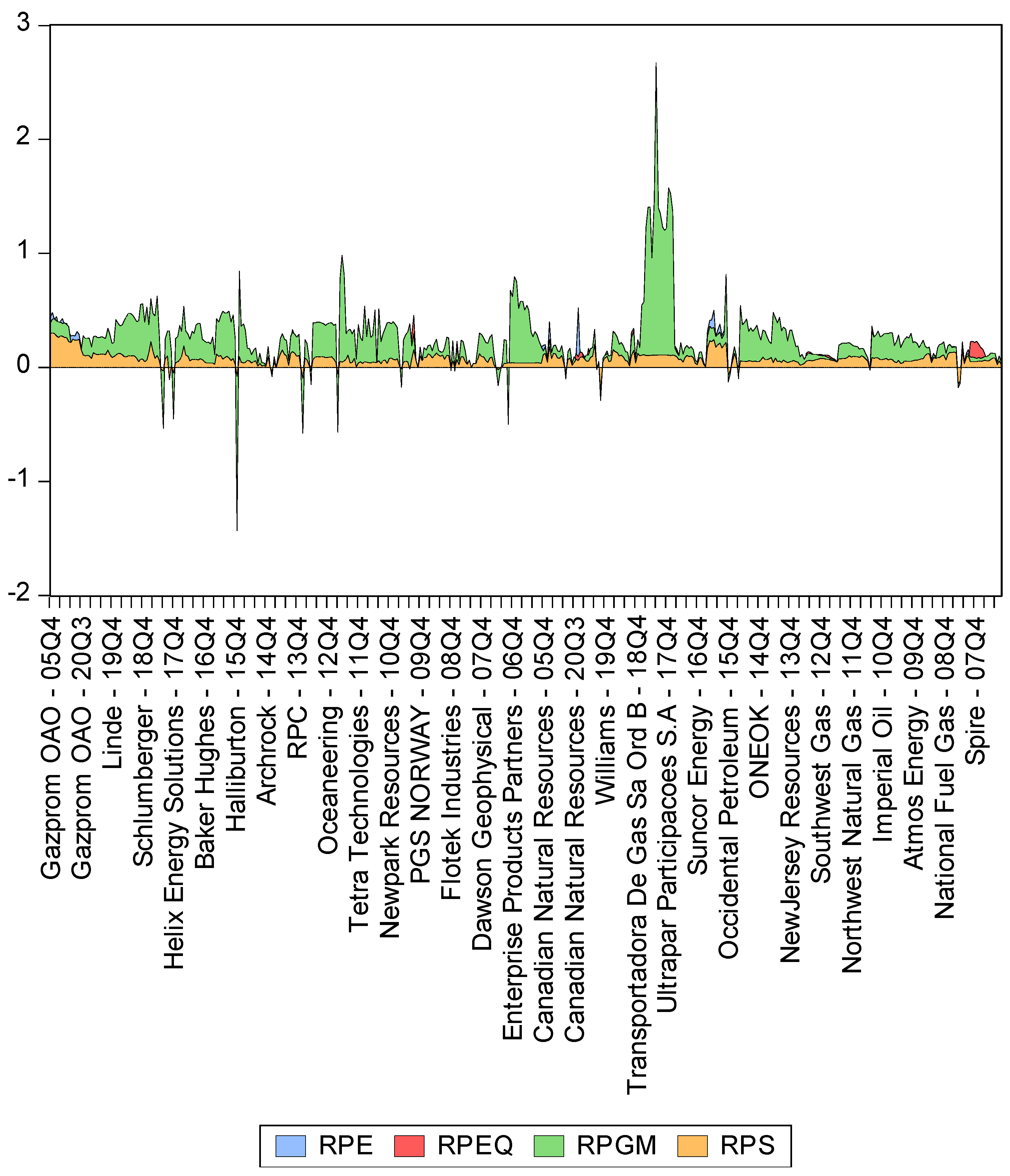

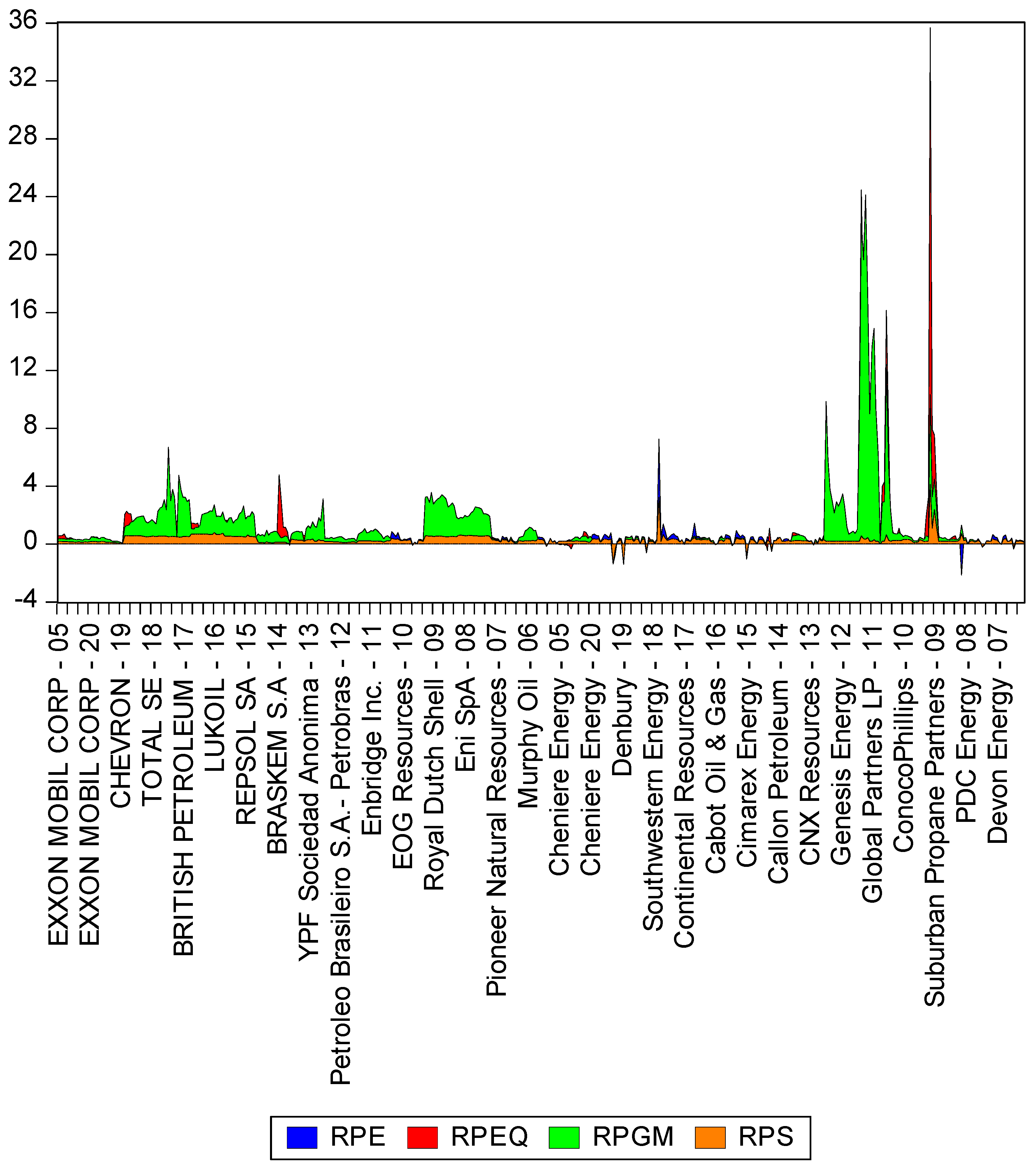

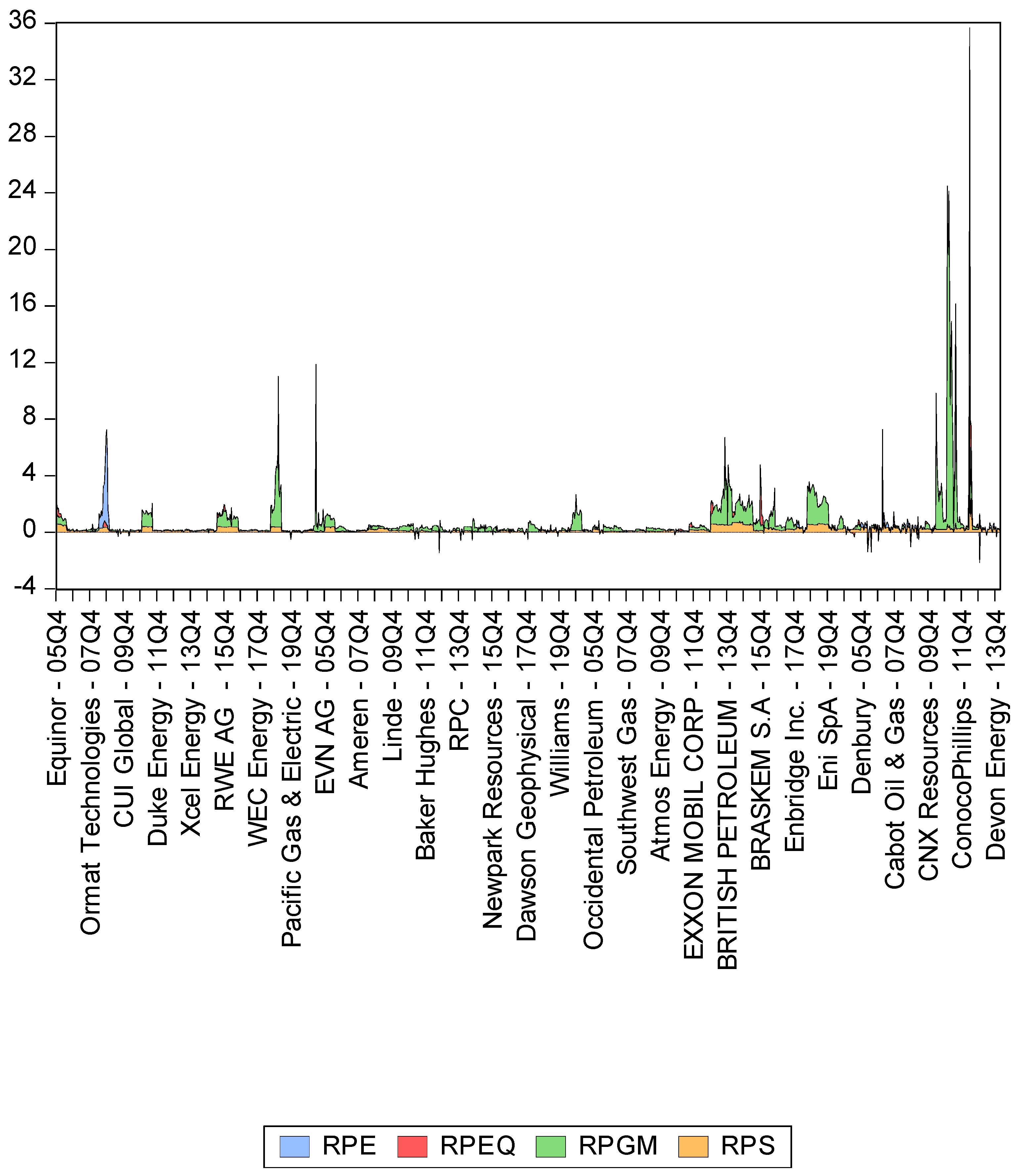

- Fiscal pressure to gross margin ratio (RPGM), determined by dividing excises and income tax to gross margin. The indicator highlights the level of own resources allocated by a company to meet taxation requirements;

- 5.

- Fiscal pressure to equity ratio (RPEQ), calculated by dividing excises and income tax to equity. The indicator shows the capacity of the company to meet mandatory fiscal obligations based on its equity;

- 6.

- Fiscal pressure to sales (RPS), calculated as a ratio of taxation to sales. The indicator shows the capacity of a company to pay fiscal obligations from its sales;

- 7.

- Fiscal pressure to expenses (RPE), computed as a ratio of taxation to total expenses of the company.

4. Results

4.1. Analysis of Central Tendency and Variation

4.2. Correlation Analysis

4.3. Econometric Models

- represents the intercept;

- represents the coefficient of the predictors;

- A represents the predictors;

- i refers to the company activity;

- t refers to the time frame considered;

- represents fixed effects controlling for financial crises;

- refers to the error term.

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CR | Current liquidity ratio |

| D/E | Debt to equity ratio |

| NYSE | New York Stock Exchange |

| Q1 | First quarter of the fiscal year |

| Q3 | Third quarter of the fiscal year |

| QR | Quick ratio |

| RPE | Fiscal pressure to expenses |

| RPEQ | Fiscal pressure to equity |

| RPGM | Fiscal pressure to gross margin ratio |

| RPS | Fiscal pressure to sales |

| USA | United States of America |

| VAT | Value added tax |

Appendix A

References

- Fujiwara, I.; Ueda, K. The fiscal multiplier and spillover in a global liquidity trap. J. Econ. Dyn. Control 2013, 37, 1264–1283. [Google Scholar] [CrossRef] [Green Version]

- Bai, J.; Lu, J.; Li, S. Fiscal pressure, tax competition and environmental pollution. Environ. Resour. Econ. 2019, 73, 431–447. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhao, W. Research on financial pressure, poverty governance, and environmental pollution in China. Sustainability 2018, 10, 1834. [Google Scholar] [CrossRef] [Green Version]

- Qi, Y.; Peng, W.; Xiong, N.N. The effects of fiscal and tax incentives on regional innovation capability: Text extraction based on Python. Mathematics 2020, 8, 1193. [Google Scholar] [CrossRef]

- Batrancea, L.M.; Nichita, R.A.; Batrancea, I.; Moldovan, B.A. Tax compliance models: From economic to behavioral approaches. Transylv. Rev. Adm. Sci. 2012, 8, 13–26. [Google Scholar]

- Batrancea, L.; Nichita, A.; Batrancea, I.; Gaban, L. The strength of the relationship between shadow economy and corruption: Evidence from a worldwide country-sample. Soc. Indic. Res. 2018, 138, 1119–1143. [Google Scholar] [CrossRef]

- Batrancea, L.; Nichita, A. Which is the best government? Colligating tax compliance and citizens’ insights regarding authorities’ actions. Transylv. Rev. Adm. Sci. 2015, 11, 5–22. [Google Scholar]

- Cannell, J. The Financial Crisis and Its Impact on the Electric Utility Industry; Edison Electric Institute: Washington, WA, USA, 2009. [Google Scholar]

- Mimouni, K.; Temimi, A. What drives energy efficiency? New evidence from financial crises. Energy Policy 2018, 122, 332–348. [Google Scholar] [CrossRef]

- Altdorfer, F. Impact of the Economic crisis on the EU’s industrial energy consumption. Odysee-Mure Policy Brief. 2017. Available online: https://www.odyssee-mure.eu/publications/policy-brief/impact-economic-crisis-industrial-energy-consumption.pdf (accessed on 14 January 2020).

- Naeem, M.A.; Balli, F.; Shahzad, S.J.H.; de Bruin, A. Energy commodity uncertainties and the systematic risk of US industries. Energy Econ. 2020, 85, 104589. [Google Scholar] [CrossRef]

- Schmoll, M. Weak street-level enforcement of tax laws: The role of tax collectors’ persistent but broken public service expectations. J. Dev. Stud. 2021, 57, 209–225. [Google Scholar] [CrossRef]

- Duernecker, G.; Herrendorf, B. On the allocation of time—A quantitative analysis of the roles of taxes and productivities. Eur. Econ. Rev. 2018, 102, 169–187. [Google Scholar] [CrossRef]

- Ji, J.; Ye, Z.; Zhang, S. Welfare analysis on optimal enterprise tax rate in China. Econ. Model. 2013, 33, 149–158. [Google Scholar] [CrossRef]

- Khan, U.; Nallareddy, S.; Rouen, E. The role of taxes in the disconnect between corporate performance and economic growth. Manag. Sci. 2020, 66, 5427–5447. [Google Scholar] [CrossRef] [Green Version]

- PricewaterhouseCoopers; the World Bank; International Finance Corporation. Paying Taxes 2020: The Changing Landscape of Tax Policy and Administration across 190 Economies; PwC: Washington, WA, USA, 2019. [Google Scholar]

- Slemrod, J. The consequences of taxation. Soc. Philos. Policy 2006, 23, 73–87. [Google Scholar] [CrossRef]

- Battiston, P.; Gamba, S. The impact of social pressure on tax compliance: A field experiment. Int. Rev. Law Econ. 2016, 46, 78–85. [Google Scholar] [CrossRef]

- Listokin, Y. Taxation and liquidity. Yale Law J. 2011, 120, 1682–1732. [Google Scholar]

- Evans, L.R.; Dewitt, C.K. (Eds.) Fiscal Pressure Facing State & Local Government. American Political, Economic and Security Issues: Government Procedures and Operations; Nova Science Publishers: Hauppauge, NY, USA, 2012. [Google Scholar]

- Molina-Morales, A.; Amate-Fortes, I.; Guarnido-Rueda, A. Economic and institutional determinants in fiscal pressure: An application to the European case. J. Econ. Issues 2011, 45, 573–592. [Google Scholar] [CrossRef]

- Villar Rubio, E.; Quesada Rubio, J.M.; Molina Moreno, V. Convergence analysis of environmental fiscal pressure across EU-15 countries. Energy Environ. 2015, 26, 789–802. [Google Scholar] [CrossRef]

- Trussel, J.M.; Patrick, P.A. Predicting fiscal distress in special district governments. J. Public Budg. Account. Fin. Manag. 2013, 25, 589–616. [Google Scholar] [CrossRef]

- Ezeoha, A.E.; Ogamba, E. Corporate tax shield or fraud? Insight from Nigeria. Int. J. Law Manag. 2010, 52, 5–20. [Google Scholar] [CrossRef]

- Bubić, J.; Mladineo, L.; Šušak, T. VAT rate change and its impact on liquidity. Management 2016, 21, 151–166. [Google Scholar]

- Baltagi, B.H. Econometric Analysis of Panel Data; John Wiley & Sons: Chichester, UK, 2008. [Google Scholar]

- Man, J. Fiscal pressure, tax competition and the adoption of tax increment financing. Urban Stud. 1999, 36, 1151–1167. [Google Scholar] [CrossRef]

- U.S. Government Accountability Office. State and Local Governments: Fiscal Pressures Could Have Implications for Future Delivery of Intergovernmental Programs; U.S. Government Accountability Office: Washington, WA, USA, 2019.

- Wang, R.; Zhang, Q. Local governments’ fiscal pressure and the dependence on polluting industries in China. China World Econ. 2017, 25, 109–130. [Google Scholar] [CrossRef]

- Liu, S.; Weng, R.; Yang, D. Natural disaster, fiscal pressure and tax avoidance: A typhoon-based study. China J. Account. Stud. 2018, 5, 468–509. [Google Scholar] [CrossRef]

| CR | QR | D/E | RPE | RPEQ | RPGM | RPS | |

|---|---|---|---|---|---|---|---|

| Mean | 2.0596 | 1.5029 | 2.6900 | 0.2682 | 0.2497 | 0.4474 | 0.1479 |

| Median | 0.9100 | 0.7100 | 2.3700 | 0.1110 | 0.0891 | 0.1579 | 0.0865 |

| Maximum | 70.9800 | 67.6759 | 48.4900 | 7.2488 | 11.0196 | 11.8650 | 0.5704 |

| Minimum | 0.0000 | 0.0000 | –1.7700 | –0.1005 | –0.5079 | –0.2565 | –0.1598 |

| Std. dev. | 6.7087 | 4.9829 | 2.6352 | 0.6450 | 0.6172 | 0.8437 | 0.1389 |

| Skewness | 7.2430 | 9.2367 | 11.5093 | 7.6216 | 11.6726 | 6.9473 | 1.2118 |

| Kurtosis | 61.1622 | 103.5865 | 192.8383 | 70.0098 | 195.3905 | 78.3583 | 3.3238 |

| Jarque–Bera | 71,853.69 *** | 209,178.1 *** | 731,368.4 *** | 94,453.34 *** | 751,182.5 *** | 117,438.6 *** | 119.5688 *** |

| Observations | 480 | 480 | 480 | 480 | 480 | 480 | 480 |

| CR | QR | D/E | RPE | RPEQ | RPGM | RPS | |

|---|---|---|---|---|---|---|---|

| Mean | 1.6745 | 1.2925 | 1.3986 | 0.0966 | 0.1291 | 0.2628 | 0.0759 |

| Median | 1.4500 | 1.1400 | 1.3350 | 0.0829 | 0.1072 | 0.2362 | 0.0707 |

| Maximum | 9.9400 | 9.1371 | 11.2000 | 0.5232 | 1.0408 | 2.6704 | 0.3020 |

| Minimum | 0.0000 | 0.0000 | –54.5200 | –0.2343 | –0.1319 | –1.4322 | –0.2073 |

| Std. dev. | 1.0085 | 0.8464 | 2.8016 | 0.0891 | 0.1556 | 0.2918 | 0.0595 |

| Skewness | 2.0151 | 2.5548 | –17.0448 | 1.7508 | 3.6054 | 2.0833 | 0.5249 |

| Kurtosis | 12.5368 | 18.9359 | 343.9065 | 8.4817 | 19.5711 | 19.2487 | 7.0256 |

| Jarque–Bera | 2,072.397 *** | 5,414.521 *** | 2,269,333 *** | 817.9810 *** | 6,314.202 *** | 5,440.004 *** | 334.6165 *** |

| Observations | 464 | 464 | 464 | 464 | 464 | 464 | 464 |

| CR | QR | D/E | RPE | RPEQ | RPGM | RPS | |

|---|---|---|---|---|---|---|---|

| Mean | 1.3262 | 1.0868 | 1.8761 | 0.3688 | 0.9196 | 1.2542 | 0.2943 |

| Median | 1.1900 | 0.9400 | 1.2300 | 0.2754 | 0.2868 | 0.4376 | 0.2324 |

| Maximum | 14.2100 | 13.9765 | 43.8200 | 7.2552 | 35.6649 | 24.1177 | 4.1195 |

| Minimum | 0.0000 | 0.0000 | –17.8500 | –2.1492 | –1.3598 | –1.4106 | –1.3769 |

| Std. dev. | 1.0384 | 1.0426 | 3.8104 | 0.4819 | 2.7809 | 2.5141 | 0.3339 |

| Skewness | 7.5879 | 7.7845 | 4.5923 | 7.8821 | 7.6966 | 5.5094 | 4.6981 |

| Kurtosis | 77.6372 | 79.0535 | 48.5739 | 107.2933 | 75.8318 | 40.4130 | 56.7641 |

| Jarque–Bera | 111,911.3 *** | 116,261.8 *** | 41,695.78 *** | 215,094.9 *** | 106,903.1 *** | 29,408.87 *** | 57,591.56 *** |

| Observations | 463 | 463 | 463 | 464 | 463 | 464 | 464 |

| CR | QR | D/E | RPE | RPEQ | RPGM | RPS | |

|---|---|---|---|---|---|---|---|

| Mean | 1.6912 | 1.2966 | 1.9963 | 0.2448 | 0.4304 | 0.6525 | 0.1724 |

| Median | 1.1100 | 0.8800 | 1.6300 | 0.1216 | 0.1203 | 0.2655 | 0.1013 |

| Maximum | 70.9800 | 67.6759 | 48.4900 | 7.2552 | 35.6649 | 24.1177 | 4.1195 |

| Minimum | 0.0000 | 0.0000 | –54.5200 | –2.1492 | –1.3598 | –1.4322 | –1.3769 |

| Std. dev. | 4.0140 | 3.0135 | 3.1636 | 0.4829 | 1.6730 | 1.5919 | 0.2293 |

| Skewness | 11.8212 | 14.5247 | 0.9601 | 9.0865 | 12.5941 | 8.3908 | 5.9315 |

| Kurtosis | 166.7452 | 267.7619 | 139.3414 | 114.7421 | 205.1669 | 96.0584 | 95.3250 |

| Jarque–Bera | 1,604,651 *** | 4,159,018 *** | 1,089,994 *** | 751,903.8 *** | 2,433,282 *** | 524,567.1 *** | 508,324.9 *** |

| Observations | 1407 | 1407 | 1407 | 1408 | 1407 | 1408 | 1408 |

| Indicators | Electricity Companies | Gas Companies | Oil Companies | Overall Sample |

|---|---|---|---|---|

| Current ratio (CR) | 205.96% | 167.45% | 132.62% | 169.12% |

| Quick ratio (QR) | 150.29% | 129.25% | 108.68% | 129.66% |

| Debt to equity ratio (D/E) | 269.00% | 139.86% | 187.61% | 199.63% |

| CR | QR | D/E | RPE | RPEQ | RPGM | RPS | |

|---|---|---|---|---|---|---|---|

| CR | 1 | ||||||

| QR | 0.901 | 1 | |||||

| D/E | –0.154 | –0.146 | 1 | ||||

| RPE | 0.751 | 0.873 | –0.126 | 1 | |||

| RPEQ | 0.039 | 0.051 | 0.706 | 0.190 | 1 | ||

| RPGM | –0.024 | –0.019 | 0.239 | 0.099 | 0.515 | 1 | |

| RPS | 0.184 | 0.177 | 0.016 | 0.427 | 0.541 | 0.520 | 1 |

| CR | QR | D/E | RPE | RPEQ | RPGM | RPS | |

|---|---|---|---|---|---|---|---|

| CR | 1 | ||||||

| QR | 0.941 | 1 | |||||

| D/E | –0.173 | –0.160 | 1 | ||||

| RPE | –0.079 | –0.033 | –0.018 | 1 | |||

| RPEQ | 0.044 | 0.039 | 0.089 | 0.250 | 1 | ||

| RPGM | 0.037 | 0.030 | 0.027 | 0.244 | 0.765 | 1 | |

| RPS | –0.072 | –0.038 | –0.008 | 0.924 | 0.343 | 0.364 | 1 |

| CR | QR | D/E | RPE | RPEQ | RPGM | RPS | |

|---|---|---|---|---|---|---|---|

| CR | 1 | ||||||

| QR | 0.988 | 1 | |||||

| D/E | 0.048 | 0.035 | 1 | ||||

| RPE | –0.042 | –0.068 | –0.071 | 1 | |||

| RPEQ | 0.008 | –0.051 | 0.168 | 0.456 | 1 | ||

| RPGM | –0.009 | –0.073 | 0.092 | 0.247 | 0.832 | 1 | |

| RPS | 0.027 | –0.007 | –0.052 | 0.847 | 0.520 | 0.334 | 1 |

| CR | QR | D/E | RPE | RPEQ | RPGM | RPS | |

|---|---|---|---|---|---|---|---|

| CR | 1 | ||||||

| QR | 0.904 | 1 | |||||

| D/E | –0.073 | –0.070 | 1 | ||||

| RPE | 0.610 | 0.701 | –0.054 | 1 | |||

| RPEQ | –0.002 | –0.008 | 0.186 | 0.279 | 1 | ||

| RPGM | –0.023 | –0.030 | 0.096 | 0.188 | 0.813 | 1 | |

| RPS | 0.050 | 0.048 | –0.014 | 0.564 | 0.534 | 0.422 | 1 |

| Model E1: | Model E2: | Model E3: | ||||

|---|---|---|---|---|---|---|

| Constant | 1.4812 *** (2.9210) | 1.6635 *** (2.9715) | 2.2655 *** (3.1206) | 2.3238 *** (3.1484) | 3.8851 *** (6.1474) | 3.6299 *** (5.7803) |

| 2.6029 (1.2065) | 2.6366 (1.2081) | 6.0328 *** (3.6193) | 6.0341 *** (3.5944) | 0.0123 (0.0815) | 0.0185 (0.1161) | |

| –0.2623 * (–1.6567) | –0.3920 * (–1.7460) | –0.1418 * (–1.7775) | –0.2113 ** (–2.2649) | 4.1549 *** (12.1410) | 4.1892 *** (14.1019) | |

| 0.0766* (1.9268) | 0.0967 (1.1230) | 0.0322 (0.4960) | 0.0381 (0.5269) | –0.1311 (–1.1679) | –0.1279 (–1.1207) | |

| RPS | –0.5984 (–0.0987) | –1.7340 (–0.2665) | –15.9555 *** (–2.6556) | –16.2532 *** (–2.6300) | –14.7234 *** (–3.4106) | –13.0765 *** (–2.9314) |

| White cross-section standard errors & covariance (d.f. corrected) | Yes | Yes | Yes | Yes | Yes | Yes |

| Prob. > F | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Cross-section effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | No | Yes | No | Yes | No | Yes |

| R2 | 0.8033 | 0.8109 | 0.8518 | 0.8578 | 0.8385 | 0.8509 |

| Adjusted R2 | 0.7888 | 0.7898 | 0.8409 | 0.8420 | 0.8265 | 0.8343 |

| F-statistic | 55.2066 | 38.4967 | 77.7054 | 54.1736 | 70.1556 | 51.2486 |

| Observations | 480 | 480 | 480 | 480 | 480 | 480 |

| Model G1: | Model G2: | Model G3: | ||||

|---|---|---|---|---|---|---|

| Constant | 1.8333 *** (31.9986) | 1.8179 *** (28.1981) | 1.4618 *** (28.2845) | 1.4265 *** (24.5352) | 1.0552 ** (2.2812) | 0.7973 * (1.7733) |

| 0.4764 (0.5270) | 0.5423 (0.5792) | 0.1944 (0.2384) | 0.2499 (0.2959) | –3.0060 (–1.1108) | –3.0752 (–1.0832) | |

| –0.3457 (–0.9271) | –0.1620 (–0.4001) | –0.6133 * (–1.8236) | –0.4889 (–1.3390) | 4.3765 ** (2.2077) | 5.6715 ** (2.5403) | |

| –0.7181 *** (–3.7462) | –0.7548 *** (–3.8159) | –0.6814 *** (–3.9403) | –0.6655 *** (–3.7303) | –0.5104 (–1.5252) | –0.6250 (–1.5622) | |

| RPS | 0.374914 (0.256514) | 0.3091 (0.2067) | 0.9235 (0.7005) | 1.0507 (0.7790) | 2.6754 (0.5239) | 4.3545 (0.6668) |

| White cross-section standard errors & covariance (d.f. corrected) | Yes | Yes | Yes | Yes | Yes | Yes |

| Prob. > F | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0001 | 0.0000 |

| Cross-section effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | No | Yes | No | Yes | No | Yes |

| R2 | 0.6935 | 0.6992 | 0.6459 | 0.6527 | 0.1499 | 0.1957 |

| Adjusted R2 | 0.6707 | 0.6652 | 0.6196 | 0.6134 | 0.0868 | 0.1049 |

| F-statistic | 30.4735 | 20.5770 | 24.5687 | 16.6322 | 2.3751 | 2.1540 |

| Observations | 464 | 464 | 464 | 464 | 464 | 464 |

| Model O1: | Model O2: | Model O3: | ||||

|---|---|---|---|---|---|---|

| Constant | 1.3448 *** (25.1243) | 1.3766 *** (23.0901) | 1.1190 *** (19.0453) | 1.1460 *** (19.4428) | 2.7027 *** (6.2697) | 2.3003 *** (11.5668) |

| –0.3314 * (–1.6926) | –0.3668 (–1.5647) | –0.4019 ** (–2.2341) | –0.4300 ** (–1.9931) | –1.1688 (–1.5901) | –0.5547 (–0.8105) | |

| 0.0189 (1.1056) | 0.0290 (1.2934) | 0.0191 (1.1180) | 0.0269 (1.2266) | 0.6550 ** (2.1664) | 0.5529 * (1.8182) | |

| –0.0236 * (–1.6160) | –0.0353 * (–1.7731) | –0.0232 * (–1.7934) | –0.0321 * (–1.7479) | –0.4141 (–1.5725) | –0.2772 (–1.0672) | |

| 0.3848 (1.4086) | 0.3363 (0.9983) | 0.4217 * (1.7954) | 0.3760 (1.2590) | –1.7284 * (–1.6598) | –1.3543 (–1.3672) | |

| White cross-section standard errors & covariance (d.f. corrected) | Yes | Yes | Yes | Yes | Yes | Yes |

| Prob. > F | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Cross-section effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | No | Yes | No | Yes | No | Yes |

| R2 | 0.4203 | 0.4375 | 0.4338 | 0.4535 | 0.1973 | 0.2352 |

| Adjusted R2 | 0.3772 | 0.3738 | 0.3916 | 0.3916 | 0.1376 | 0.1486 |

| F-statistic | 9.7432 | 6.8687 | 10.2941 | 7.3262 | 3.3036 | 2.7155 |

| Observations | 463 | 463 | 463 | 463 | 463 | 463 |

| Model A1: | Model A2: | Model A3: | ||||

|---|---|---|---|---|---|---|

| Constant | 1.4739 *** (9.7149) | 1.4542 ** (8.8516) | 0.9236 *** (7.4013) | 0.8739 *** (5.1947) | 2.6974 *** (6.6836) | 2.5817 *** (7.7558) |

| 2.1623 (1.1498) | 2.1493 (1.1366) | 4.7689 *** (2.9129) | 4.7617 *** (2.9003) | –0.2357 * (–1.7109) | –0.2412 * (–1.7963) | |

| –0.0811 * (–1.8527) | –0.1007 * (–1.9501) | –0.1030 * (–1.6766) | –0.1278 * (–1.8854) | 1.0341 * (1.8831) | 0.9755 * (1.7814) | |

| 0.0414 (1.3692) | 0.0558 (1.3745) | 0.0617 (1.4864) | 0.0897 * (1.7698) | –0.5461 (–1.4695) | –0.4822 (–1.3231) | |

| –1.7223 (–0.9287) | –1.5939 (–0.8898) | –4.5030 *** (–2.6191) | –4.2449 *** (–2.5571) | –4.3134 * (–1.9510) | –3.7224 * (–1.7495) | |

| White cross-section standard errors & covariance (d.f. corrected) | Yes | Yes | Yes | Yes | Yes | Yes |

| Prob. > F | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Cross-section effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | No | Yes | No | Yes | No | Yes |

| R2 | 0.7887 | 0.7921 | 0.7906 | 0.7949 | 0.2643 | 0.2783 |

| Adjusted R2 | 0.7740 | 0.7752 | 0.7761 | 0.7782 | 0.2134 | 0.2195 |

| F-statistic | 53.9295 | 46.7285 | 54.5520 | 47.5425 | 5.1909 | 4.7294 |

| Observations | 1407 | 1407 | 1407 | 1407 | 1407 | 1407 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Batrancea, L. An Econometric Approach Regarding the Impact of Fiscal Pressure on Equilibrium: Evidence from Electricity, Gas and Oil Companies Listed on the New York Stock Exchange. Mathematics 2021, 9, 630. https://doi.org/10.3390/math9060630

Batrancea L. An Econometric Approach Regarding the Impact of Fiscal Pressure on Equilibrium: Evidence from Electricity, Gas and Oil Companies Listed on the New York Stock Exchange. Mathematics. 2021; 9(6):630. https://doi.org/10.3390/math9060630

Chicago/Turabian StyleBatrancea, Larissa. 2021. "An Econometric Approach Regarding the Impact of Fiscal Pressure on Equilibrium: Evidence from Electricity, Gas and Oil Companies Listed on the New York Stock Exchange" Mathematics 9, no. 6: 630. https://doi.org/10.3390/math9060630

APA StyleBatrancea, L. (2021). An Econometric Approach Regarding the Impact of Fiscal Pressure on Equilibrium: Evidence from Electricity, Gas and Oil Companies Listed on the New York Stock Exchange. Mathematics, 9(6), 630. https://doi.org/10.3390/math9060630