Stochastic Claims Reserve in the Healthcare System: A Methodology Applied to Italian Data

Abstract

1. Introduction

2. Structure and Main Ideas

3. Theoretical Background

3.1. Run-Off Triangles and Chain-Ladder Approach

3.2. Generalized Linear Model

- The relation between the response variable and the explicative variables is not linear;

- The explicative variables Y do not take values from the interval ;

- The variance is not constant;

- It is not possible to assume the response variable Y following the normal distribution.

3.3. Quasi-Likelihood Function

3.4. Gauss–Newton Algorithm

3.4.1. The Hessian Modification

3.4.2. Limits of the GN Algorithm

3.5. The Genetic Algorithm

3.6. Expectation Values and Error Estimation

4. Comparison with SoA Models

4.1. Comparison with Strascia and Tripodi (2018)

4.2. Comparison with Verdonck et al. (2009)

5. The Healthcare Study: The Case of Claims in the Tuscany Region

5.1. Preliminary Analysis

- Time evolution of the paid claims;

- Single payment for years of the specific claim;

- Total paid amounts.

5.2. Chain-Ladder Results

5.3. Stochastic Approach Results

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | Data in the present paper are smoothed for policy and legal motivations. |

| 2 | A nuisance parameter is any unspecified parameter necessary to ensure that the model describes the system adequately. In our case, it represents the dispersion of the measured data. |

References

- Bertoli, Paola, and Veronica Grembi. 2018. Courts, scheduled damages, and medical malpractice insurance. Empirical Economics 55: 831–54. [Google Scholar] [CrossRef]

- Conn, Andrew, Nicholas Gould, and Philippe Toint. 1991. A globally convergent augmented lagrangian algorithm for optimization with general constraints and simple bounds. SIAM Journal on Numerical Analysis 28: 2. [Google Scholar] [CrossRef]

- Conn, Andrew, Nicholas Gould, and Philippe Toint. 1997. A globally convergent augmented lagrangian barrier algorithm for optimization with general inequality constraints and simple bounds. Mathematics of Computation 66: 261–68. [Google Scholar] [CrossRef]

- England, Peter, and Richard Verrall. 1999. Analytic and bootstrap estimates of prediction errors in claims reserving. Insurance: Mathematics and Economics 25: 281–93. [Google Scholar] [CrossRef]

- England, Peter D., and Richard J. Verrall. 2002. Stochastic claims reserving in general insurance. British Actuarial Journal 8: 443–544. [Google Scholar] [CrossRef]

- Fletcher, Roger. 2000. Practical Methods of Optimization, 2nd ed. London: Wiley. [Google Scholar] [CrossRef]

- Goldberg, David E. 1989. Genetic Algorithms in Search, Optimization and Machine Learning. Boston: Addison-Wesley Longman Publishing Co., Inc. [Google Scholar]

- Grembi, Veronica, and Nuno Garoupa. 2013. Delays in medical malpractice litigation in civil law jurisdictions: Some evidence from the italian court of cassation. Health Economics, Policy and Law 8: 423–52. [Google Scholar] [CrossRef] [PubMed]

- Haupt, Randy L., and Sue Ellen Haupt. 2004. Practical Genetic Algorithms. London: John Wiley & Sons. [Google Scholar] [CrossRef]

- Hess, Klaus Th., and Klaus D. Schmidt. 2002. A comparison of models for the chain–ladder method. Insurance: Mathematics and Economics 31: 351–64. [Google Scholar] [CrossRef]

- Hindley, David. 2017. Claims Reserving in General Insurance. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Institute of Medicine (U.S.) Committee on Quality of Health Care in America. 2000. To Err Is Human-Building a Safer Health System. Washington, DC: National Academies Press. [Google Scholar]

- Kendall, Maurice George, and Alan Stuart. 1967. The Advanced Theory of Statistics, 2nd ed. New York: Hafner. [Google Scholar]

- Larsen, Christian Roholte. 2007. An individual claims reserving model. ASTIN Bulletin 37: 113–32. [Google Scholar] [CrossRef]

- Mascarenhas, Walter. 2013. The divergence of the bfgs and gauss-newton methods. Mathematical Programming 147: 1–2. [Google Scholar] [CrossRef][Green Version]

- Mushinski, David, Sammy Zahran, and Aanston Frazier. 2022. Physician behaviour, malpractice risk and defensive medicine: An investigation of cesarean deliveries. Health Economics, Policy and Law 17: 247–65. [Google Scholar] [CrossRef] [PubMed]

- Nelder, John Ashworth, and Robert William Maclagan Wedderburn. 1972. Generalized Linear Model. Journal of the Royal Statistical Society: Series A 135: 370. [Google Scholar] [CrossRef]

- Nocedal, Jorge, and Stephen J. Wright. 2006. Numerical Optimization, 2nd ed. New York: Springer. [Google Scholar]

- OECD. 2018. Delivering Quality Health Services: A Global Imperative for Universal Health Coverage. Paris: OECD Publishing. [Google Scholar]

- OECD. 2021. State of Health in the EU: Italy. OECD, European Commission & European Observatory on Health Systems and Policies. Paris: OECD Publishing. [Google Scholar]

- Renshaw, Arthur E., and Richard J. Verrall. 1998. A stochastic model underlying the chain-ladder technique. British Actuarial Journal 4: 903–23. [Google Scholar] [CrossRef]

- Schmidt, Klaus D. 2006. Methods and models of loss reserving based on run-off triangles: A unifying survey. Casualty Actuarial Society Forum 2006: 269–317. [Google Scholar]

- Schmidt, Klaus D. 2012. Loss prediction based on run-off triangles. AStA Advances in Statistical Analysis 96: 265–310. [Google Scholar] [CrossRef]

- Strascia, Stefano, and Agostino Tripodi. 2018. Overdispersed-poisson model in claims reserving: Closed tool for one-year volatility in glm framework. Risks 6: 139. [Google Scholar] [CrossRef]

- Verdonck, Tim, Martine Van Wouwe, and Jan Dhaene. 2009. A robustification of the chain-ladder method. North American Actuarial Journal 13: 280–98. [Google Scholar] [CrossRef]

- Verrall, Richard J. 1991. Chain ladder and maximum likelihood. Journal of the Institute of Actuaries (1886–1994) 118: 489–99. [Google Scholar] [CrossRef]

- Verrall, Richard J. 2000. An investigation into stochastic claims reserving models and the chain-ladder technique. Insurance: Mathematics and Economics 26: 91–99. [Google Scholar] [CrossRef]

- Wedderburn, Robert W. M. 1974. Quasi-likelihood functions, generalized linear models, and the gauss-newton method. Biometrika 61: 439–47. [Google Scholar] [CrossRef]

- Wedderburn, Robert W. M. 1976. On the existence and uniqueness of the maximum likelihood estimates for certain generalized linear models. Biometrika 63: 27–32. [Google Scholar] [CrossRef]

| 0 | 1 | … | j | … | J | ||

|---|---|---|---|---|---|---|---|

| 1 | … | … | |||||

| 2 | … | … | |||||

| ⋮ | ⋮ | ⋮. | ⋮ | ||||

| i | … | ||||||

| ⋮ | ⋮ | ⋮ | |||||

| I |

| Response Variable | Entries | |

|---|---|---|

| Matrix-like Notation (Table 1) | ||

| Vector-like Notation |

| 0 | 1 | … | j | … | J | ||

|---|---|---|---|---|---|---|---|

| 1 | … | … | |||||

| 2 | … | … | |||||

| ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ⋮ | ||

| i | … | … | |||||

| ⋮ | ⋮. | ⋮ | ⋮ | ⋮ | ⋮ | ||

| … | … | ||||||

| I | … | … |

| Budget Year (t) | Paid ( €) Literature | ( €) Literature | ( €) Residual (Equation (48)) | ( €) Residual (Equation (49)) |

|---|---|---|---|---|

| 0 | 22.60 | - | 22.60 ± 1.43 | 22.60 ± 1.43 |

| 1 | 62.32 | - | 62.32 ± 5.70 | 62.32 ± 5.65 |

| 2 | 101.93 | - | 101.93 ± 9.25 | 101.93 ± 9.03 |

| 3 | 124.59 | - | 124.59 ± 12.12 | 124.59 ± 11.57 |

| 4 | 152.04 | - | 152.04 ± 14.82 | 152.04 ± 13.85 |

| 5 | 188.65 | - | 188.65 ± 17.33 | 188.65 ± 16.03 |

| 6 | 185.31 | - | 185.31 ± 19.72 | 185.31 ± 18.45 |

| 7 | 203.38 | - | 203.38 ± 21.77 | 203.38 ± 20.40 |

| 8 | 213.67 | - | 213.67 ± 23.03 | 213.67 ± 21.37 |

| 9 | 207.65 | - | 207.65 ± 23.39 | 207.65 ± 21.63 |

| 10 | 197.67 | - | 197.67 ± 23.64 | 197.67 ± 21.84 |

| 11 | 184.68 | - | 184.68 ± 24.99 | 184.68 ± 23.10 |

| 12 | 194.08 | - | 194.08 ± 29.10 | 194.08 ± 27.00 |

| 13 | - | 177.71 ± 41.39 | 183.87 ± 27.96 | 179.53 ± 25.78 |

| 14 | - | 139.04 ± 33.41 | 146.17 ± 22.90 | 140.69 ± 20.80 |

| 15 | - | 112.39 ± 27.91 | 119.75 ± 19.38 | 113.99 ± 17.43 |

| 16 | - | 93.69 ± 24.06 | 101.15 ± 16.98 | 95.37 ± 15.13 |

| 17 | - | 80.55 ± 21.36 | 85.66 ± 14.89 | 81.93 ± 13.48 |

| 18 | - | 66.73 ± 18.32 | 71.52 ± 12.90 | 67.97 ± 11.61 |

| 19 | - | 52.05 ± 14.84 | 57.26 ± 10.72 | 53.14 ± 9.43 |

| 20 | - | 38.71 ± 11.50 | 42.30 ± 8.21 | 39.44 ± 7.26 |

| 21 | - | 29.33 ± 9.05 | 32.14 ± 6.44 | 29.97 ± 5.71 |

| 22 | - | 23.89 ± 7.62 | 26.14 ± 5.41 | 24.38 ± 4.78 |

| 23 | - | 18.78 ± 6.39 | 20.36 ± 4.50 | 19.19 ± 4.00 |

| 24 | - | 12.95 ± 4.93 | 13.69 ± 3.40 | 12.85 ± 3.01 |

| Residual (Equation (48)) | Reference | ( €) | ||

| Strascia and Tripodi (2018) | 8.46 ± 2.20 | |||

| Our work | 9.00 ± 1.54 | |||

| Residual (Equation (49)) | Reference | ( €) | ||

| Strascia and Tripodi (2018) | 8.46 ± 2.20 | |||

| Our work | 8.58 ± 1.38 |

| Budget Year (t) | Paid ( €) Literature | ( €) Literature | ( €) Residual (Equation (48)) | ( €) Residual (Equation (49)) |

|---|---|---|---|---|

| 0 | 135.34 | - | 135.34 ± 3.05 | 135.34 ± 2.92 |

| 1 | 216.03 | - | 216.03 ± 7.56 | 216.03 ± 7.38 |

| 2 | 294.31 | - | 294.31 ± 11.12 | 294.31 ± 10.84 |

| 3 | 353.38 | - | 353.38 ± 14.22 | 353.38 ± 13.84 |

| 4 | 431.01 | - | 431.01 ± 17.14 | 431.01 ± 16.69 |

| 5 | 463.80 | - | 463.80 ± 19.19 | 463.80 ± 18.65 |

| 6 | 478.03 | - | 478.03 ± 20.99 | 478.03 ± 20.33 |

| 7 | 493.10 | - | 493.10 ± 22.89 | 493.10 ± 22.20 |

| 8 | 507.59 | - | 507.59 ± 25.35 | 507.59 ± 24.53 |

| 9 | 535.26 | - | 535.26 ± 28.75 | 535.26 ± 27.84 |

| 10 | - | 401.96 | 403.74 ± 23.07 | 402.54 ± 22.35 |

| 11 | - | 309.07 | 310.82 ± 18.74 | 309.57 ± 18.13 |

| 12 | - | 236.98 | 238.43 ± 15.25 | 237.42 ± 14.75 |

| 13 | - | 178.16 | 179.39 ± 12.26 | 178.56 ± 11.86 |

| 14 | - | 129.86 | 131.02 ± 9.57 | 130.23 ± 9.24 |

| 15 | - | 92.78 | 93.62 ± 7.45 | 93.08 ± 7.19 |

| 16 | - | 62.85 | 63.36 ± 5.61 | 63.08 ± 5.43 |

| 17 | - | 36.63 | 37.03 ± 3.82 | 36.83 ± 3.69 |

| 18 | - | 15.12 | 14.87 ± 1.93 | 15.11 ± 1.90 |

| Residual (Equation (48)) | Reference | ( €) | ||

| Verdonck et al. (2009) | - | - | 1.46 | |

| Our work | 1.47 ± 0.09 | |||

| Residual (Equation (49)) | Reference | ( €) | ||

| Verdonck et al. (2009) | - | - | 1.46 | |

| Our work | 1.47 ± 0.09 |

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2.80 | 5.94 | 10.1 | 5.00 | 4.06 | 4.28 | 2.74 | 1.98 | 2.64 | 1.06 | 1.20 | 1.27 |

| 2011 | 2.13 | 11.3 | 6.15 | 1.79 | 2.82 | 4.29 | 5.26 | 7.76 | 4.91 | 3.35 | 1.43 | |

| 2012 | 0.95 | 7.61 | 7.19 | 3.25 | 4.77 | 3.08 | 5.03 | 5.65 | 3.64 | 1.74 | ||

| 2013 | 0.72 | 8.66 | 5.68 | 1.63 | 3.44 | 4.06 | 4.89 | 3.95 | 2.50 | |||

| 2014 | 0.97 | 9.76 | 7.67 | 6.49 | 4.07 | 5.66 | 4.41 | 3.90 | ||||

| 2015 | 1.50 | 11.4 | 7.17 | 3.95 | 6.52 | 5.76 | 7.87 | |||||

| 2016 | 1.15 | 5.14 | 9.14 | 9.74 | 3.33 | 2.95 | ||||||

| 2017 | 0.19 | 6.96 | 8.92 | 5.77 | 3.63 | |||||||

| 2018 | 0.10 | 5.90 | 9.36 | 3.68 | ||||||||

| 2019 | 2.35 | 5.55 | 10.9 | |||||||||

| 2020 | 0.27 | 6.57 | ||||||||||

| 2021 | 0.81 |

| t | (€) |

|---|---|

| 2011 | |

| 2012 | |

| 2013 | |

| 2014 | |

| 2015 | |

| 2016 | |

| 2017 | |

| 2018 | |

| 2019 | |

| 2020 | |

| 2021 |

| Residual (Equation (48)) | Residual (Equation (49)) | ||||

|---|---|---|---|---|---|

| Variable | Value | Error | Variable | Value | Error |

| c | 14.183 | 0.221 | c | 14.109 | 0.226 |

| 0.175 | 0.155 | 0.197 | 0.156 | ||

| −0.022 | 0.164 | 0.002 | 0.165 | ||

| −0.103 | 0.170 | −0.114 | 0.172 | ||

| 0.126 | 0.165 | 0.140 | 0.166 | ||

| 0.286 | 0.165 | 0.313 | 0.166 | ||

| 0.191 | 0.177 | 0.178 | 0.179 | ||

| 0.048 | 0.193 | 0.055 | 0.195 | ||

| −0.011 | 0.209 | −0.047 | 0.213 | ||

| 0.164 | 0.217 | 0.190 | 0.216 | ||

| −0.158 | 0.313 | −0.191 | 0.320 | ||

| −0.572 | 0.889 | −0.498 | 0.883 | ||

| 1.655 | 0.205 | 1.701 | 0.210 | ||

| 1.682 | 0.207 | 1.740 | 0.212 | ||

| 1.244 | 0.220 | 1.247 | 0.226 | ||

| 0.994 | 0.233 | 1.034 | 0.237 | ||

| 1.026 | 0.237 | 1.075 | 0.241 | ||

| 1.216 | 0.238 | 1.248 | 0.242 | ||

| 1.239 | 0.248 | 1.252 | 0.253 | ||

| 0.894 | 0.285 | 0.925 | 0.289 | ||

| 0.430 | 0.355 | 0.418 | 0.364 | ||

| −0.186 | 0.522 | −0.124 | 0.519 | ||

| −0.125 | 0.724 | −0.051 | 0.719 | ||

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 1.44 | 7.55 | 7.76 | 5.01 | 3.90 | 4.03 | 4.87 | 4.98 | 3.53 | 2.22 | 1.20 | 1.27 |

| 2011 | 1.72 | 9.00 | 9.24 | 5.97 | 4.65 | 4.80 | 5.80 | 5.94 | 4.20 | 2.64 | 1.43 | 1.52 |

| 2012 | 1.41 | 7.39 | 7.59 | 4.90 | 3.82 | 3.94 | 4.77 | 4.87 | 3.45 | 2.17 | 1.17 | 1.25 |

| 2013 | 1.30 | 6.81 | 7.00 | 4.52 | 3.52 | 3.63 | 4.39 | 4.49 | 3.18 | 2.00 | 1.08 | 1.15 |

| 2014 | 1.64 | 8.57 | 8.80 | 5.68 | 4.42 | 4.57 | 5.52 | 5.65 | 4.00 | 2.52 | 1.36 | 1.44 |

| 2015 | 1.92 | 10.1 | 10.3 | 6.67 | 5.19 | 5.36 | 6.48 | 6.63 | 4.70 | 2.95 | 1.60 | 1.70 |

| 2016 | 1.75 | 9.14 | 9.39 | 6.06 | 4.72 | 4.88 | 5.89 | 6.03 | 4.27 | 2.69 | 1.45 | 1.54 |

| 2017 | 1.52 | 7.93 | 8.14 | 5.26 | 4.09 | 4.23 | 5.11 | 5.23 | 3.70 | 2.33 | 1.26 | 1.34 |

| 2018 | 1.43 | 7.47 | 7.68 | 4.96 | 3.86 | 3.99 | 4.82 | 4.93 | 3.49 | 2.20 | 1.19 | 1.26 |

| 2019 | 1.70 | 8.90 | 9.14 | 5.90 | 4.60 | 4.75 | 5.74 | 5.87 | 4.16 | 2.62 | 1.41 | 1.50 |

| 2020 | 1.23 | 6.45 | 6.63 | 4.28 | 3.33 | 3.44 | 4.16 | 4.25 | 3.01 | 1.90 | 1.02 | 1.09 |

| 2021 | 0.81 | 4.26 | 4.38 | 2.83 | 2.20 | 2.27 | 2.75 | 2.81 | 1.99 | 1.25 | 0.68 | 0.72 |

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 1.34 | 7.35 | 7.64 | 4.67 | 3.77 | 3.93 | 4.67 | 4.69 | 3.38 | 2.04 | 1.18 | 1.27 |

| 2011 | 1.63 | 8.95 | 9.30 | 5.68 | 4.59 | 4.79 | 5.69 | 5.71 | 4.12 | 2.48 | 1.44 | 1.55 |

| 2012 | 1.34 | 7.36 | 7.66 | 4.68 | 3.78 | 3.94 | 4.68 | 4.70 | 3.39 | 2.04 | 1.19 | 1.28 |

| 2013 | 1.20 | 6.56 | 6.82 | 4.17 | 3.37 | 3.51 | 4.17 | 4.19 | 3.02 | 1.82 | 1.06 | 1.14 |

| 2014 | 1.54 | 8.45 | 8.79 | 5.37 | 4.34 | 4.52 | 5.37 | 5.40 | 3.89 | 2.34 | 1.36 | 1.47 |

| 2015 | 1.83 | 10.0 | 10.4 | 6.38 | 5.16 | 5.37 | 6.38 | 6.41 | 4.62 | 2.79 | 1.62 | 1.74 |

| 2016 | 1.60 | 8.78 | 9.13 | 5.58 | 4.51 | 4.70 | 5.58 | 5.61 | 4.04 | 2.43 | 1.42 | 1.52 |

| 2017 | 1.42 | 7.77 | 8.07 | 4.93 | 3.99 | 4.15 | 4.93 | 4.96 | 3.58 | 2.15 | 1.25 | 1.35 |

| 2018 | 1.28 | 7.01 | 7.29 | 4.45 | 3.60 | 3.75 | 4.46 | 4.48 | 3.23 | 1.94 | 1.13 | 1.22 |

| 2019 | 1.62 | 8.88 | 9.24 | 5.64 | 4.56 | 4.75 | 5.64 | 5.67 | 4.09 | 2.46 | 1.43 | 1.54 |

| 2020 | 1.11 | 6.07 | 6.31 | 3.86 | 3.12 | 3.25 | 3.86 | 3.88 | 2.79 | 1.68 | 0.98 | 1.05 |

| 2021 | 0.81 | 4.47 | 4.64 | 2.84 | 2.29 | 2.39 | 2.84 | 2.85 | 2.06 | 1.24 | 0.72 | 0.77 |

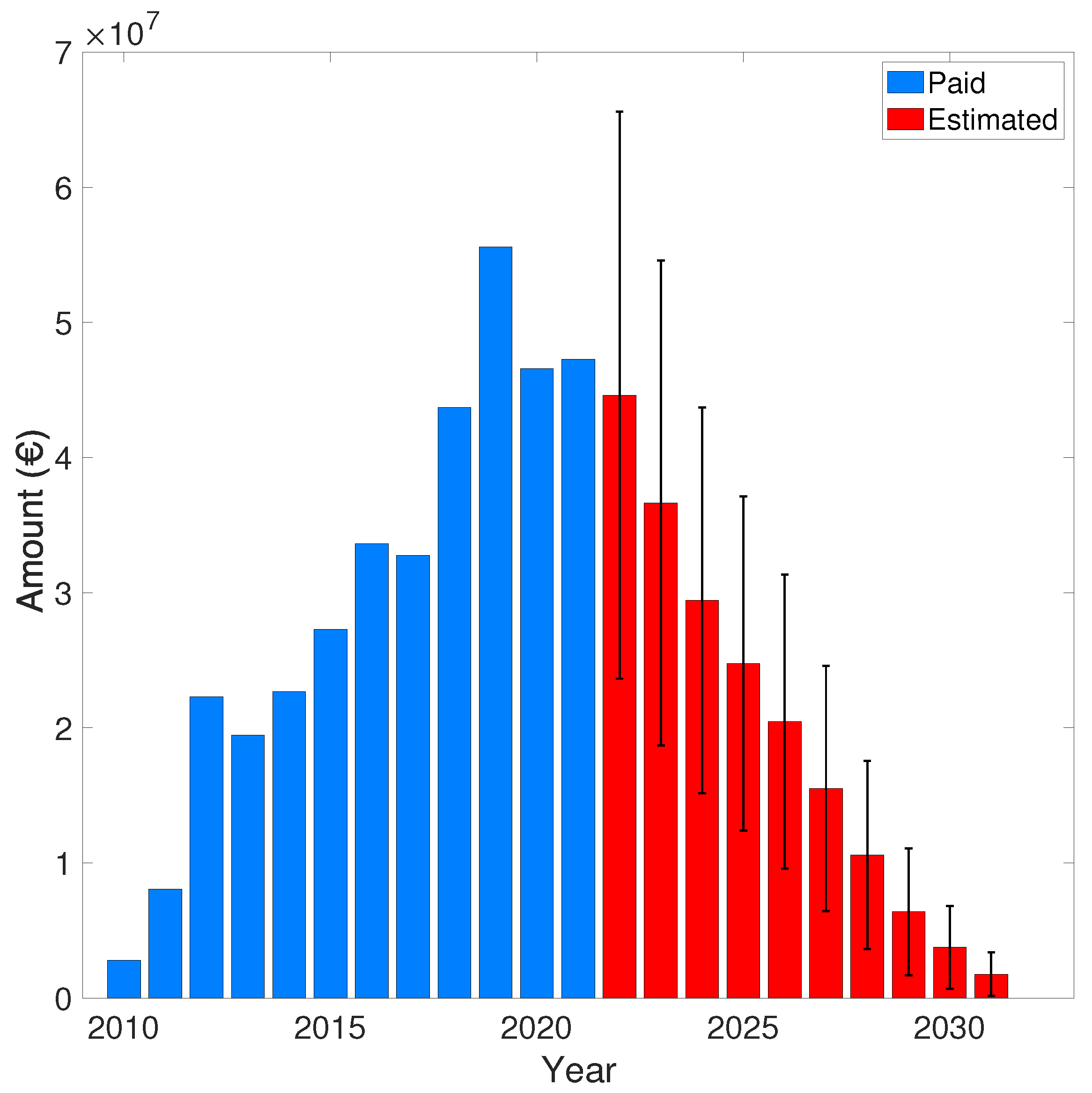

| Budget Year (t) | (106 €) Paid Amount | (106 €) Residual (Equation (48)) | (106 €) Residual (Equation (49)) |

|---|---|---|---|

| 2010 | 2.80 | 1.44 ± 0.32 | 1.34 ± 0.30 |

| 2011 | 8.08 | 9.27 ± 2.74 | 8.98 ± 2.71 |

| 2012 | 22.3 | 18.2 ± 5.79 | 17.9 ± 5.83 |

| 2013 | 19.5 | 22.9 ± 7.61 | 22.5 ± 7.63 |

| 2014 | 22.7 | 25.9 ± 8.76 | 25.2 ± 8.69 |

| 2015 | 27.3 | 31.1 ± 10.6 | 30.3 ± 10.5 |

| 2016 | 33.6 | 38.6 ± 13.3 | 37.8 ± 13.3 |

| 2017 | 32.8 | 44.9 ± 15.7 | 43.7 ± 15.5 |

| 2018 | 43.7 | 47.7 ± 17.0 | 46.2 ± 16.8 |

| 2019 | 55.6 | 48.8 ± 17.9 | 47.0 ± 17.5 |

| 2020 | 46.6 | 50.5 ± 19.1 | 48.7 ± 18.8 |

| 2021 | 47.3 | 50.5 ± 20.7 | 48.8 ± 20.3 |

| 2022 | - | 46.1 ± 21.2 | 44.6 ± 21.0 |

| 2023 | - | 37.9 ± 18.1 | 36.7 ± 17.9 |

| 2024 | - | 30.7 ± 14.6 | 29.4 ± 14.3 |

| 2025 | - | 25.7 ± 12.6 | 24.8 ± 12.4 |

| 2026 | - | 21.3 ± 11.1 | 20.5 ± 10.9 |

| 2027 | - | 16.2 ± 9.27 | 15.5 ± 9.08 |

| 2028 | - | 11.0 ± 7.10 | 10.6 ± 6.97 |

| 2029 | - | 6.56 ± 4.75 | 6.39 ± 4.69 |

| 2030 | - | 3.78 ± 3.08 | 3.76 ± 3.06 |

| 2031 | - | 1.76 ± 1.60 | 1.77 ± 1.62 |

| (106 €) | (106 €) | |||

|---|---|---|---|---|

| Measured | - | - | 47.3 | - |

| CL (Table 9) | - | - | 31.7 | - |

| Residual (Equation (48)) | 6.78 × 103 | 6.05 × 105 | 50.5 ± 20.7 | 201 ± 103 |

| Residual (Equation (49)) | 3.27 × 107 | 5.94 × 105 | 48.8 ± 20.3 | 194 ± 102 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mazzi, C.; Damone, A.; Vandelli, A.; Ciuti, G.; Vainieri, M. Stochastic Claims Reserve in the Healthcare System: A Methodology Applied to Italian Data. Risks 2024, 12, 24. https://doi.org/10.3390/risks12020024

Mazzi C, Damone A, Vandelli A, Ciuti G, Vainieri M. Stochastic Claims Reserve in the Healthcare System: A Methodology Applied to Italian Data. Risks. 2024; 12(2):24. https://doi.org/10.3390/risks12020024

Chicago/Turabian StyleMazzi, Claudio, Angelo Damone, Andrea Vandelli, Gastone Ciuti, and Milena Vainieri. 2024. "Stochastic Claims Reserve in the Healthcare System: A Methodology Applied to Italian Data" Risks 12, no. 2: 24. https://doi.org/10.3390/risks12020024

APA StyleMazzi, C., Damone, A., Vandelli, A., Ciuti, G., & Vainieri, M. (2024). Stochastic Claims Reserve in the Healthcare System: A Methodology Applied to Italian Data. Risks, 12(2), 24. https://doi.org/10.3390/risks12020024