Relationship between Occupational Pension, Corporate Social Responsibility (CSR), and Organizational Resilience: A Study on Listed Chinese Companies

Abstract

1. Introduction

2. Theory and Hypothesis Development

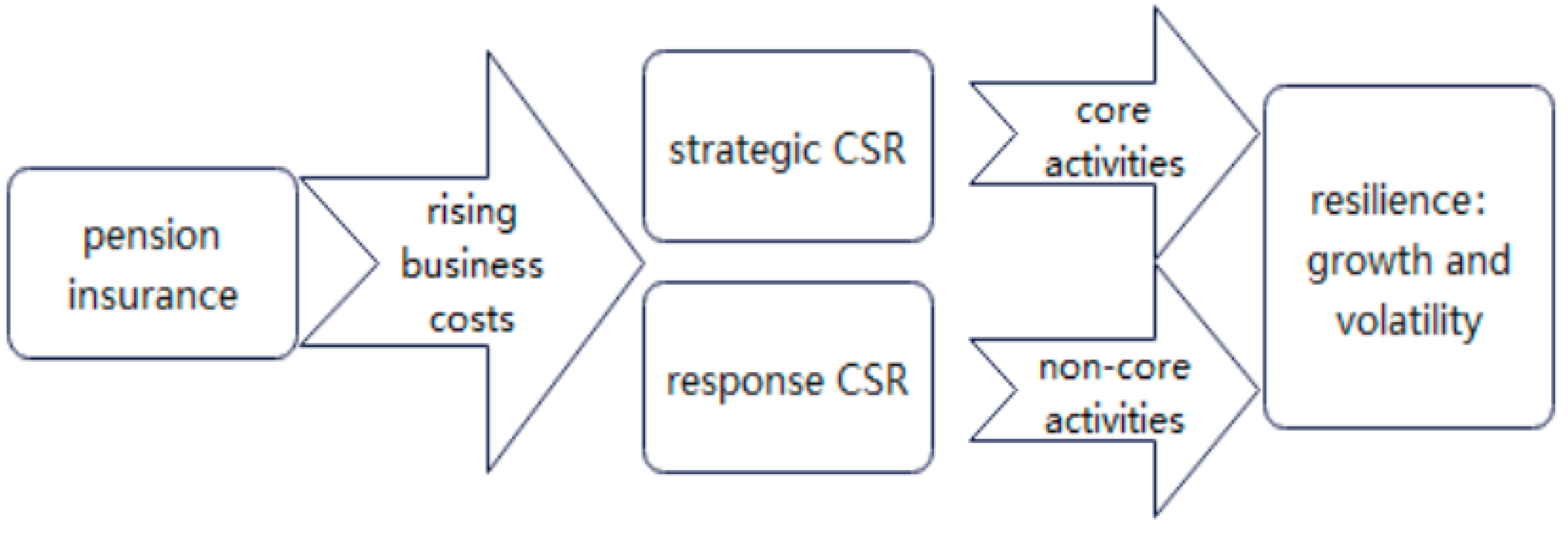

2.1. Occupational Pension, Strategic and Responsive CSR

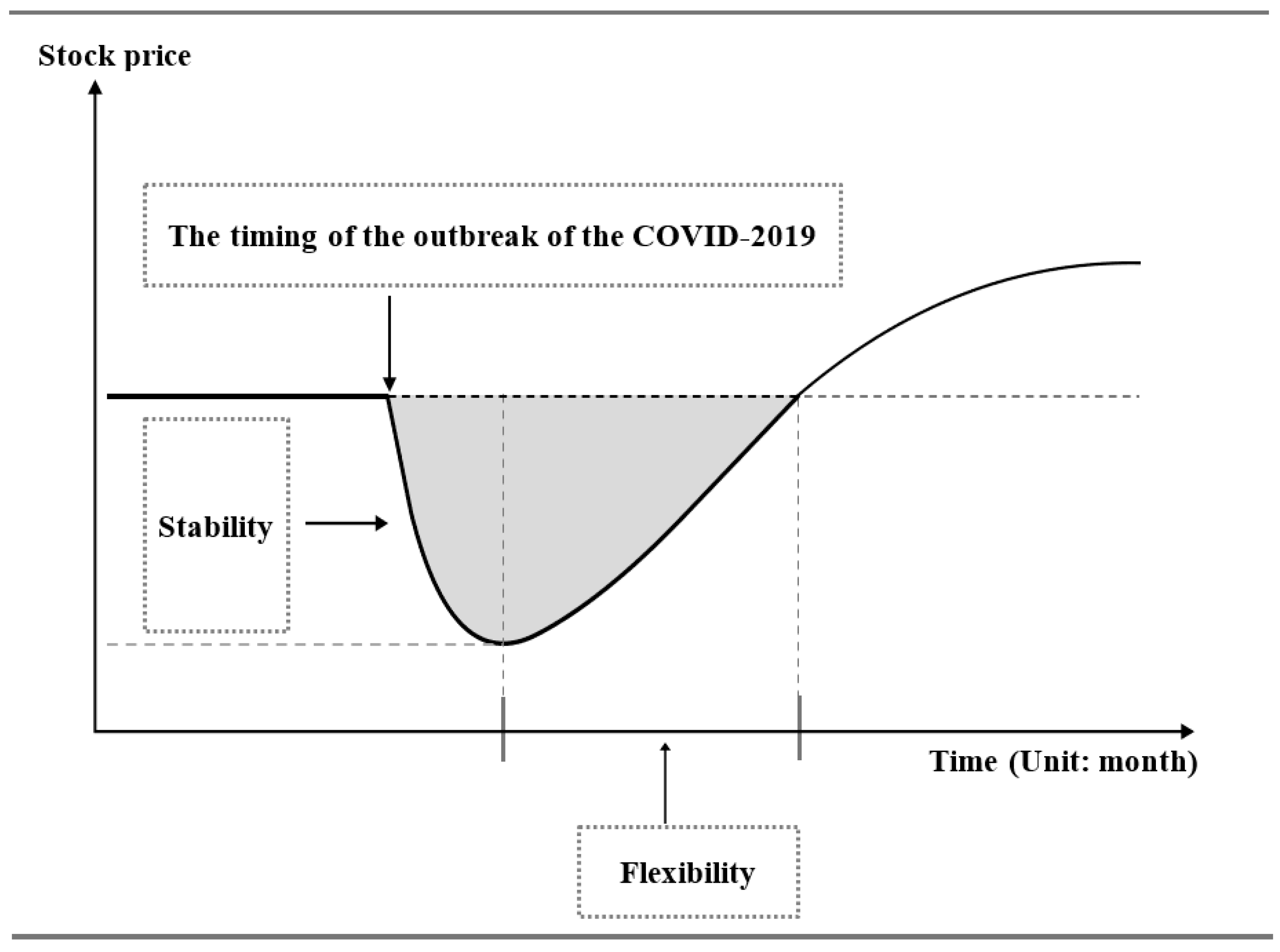

2.2. Strategic and Responsive CSR and Organizational Resilience

2.2.1. The Impact of Strategic CSR on Organizational Resilience

2.2.2. The Impact of Responsive CSR on Organizational Resilience

2.3. The Moderating Role of Minimum Wage

2.4. The Moderating Role of Population Aging

2.5. The Moderating Role of Digital Transformation

2.6. The Moderating Role of Marketing Capability

3. Methodology

3.1. Sample

3.2. Measures

3.3. Methods

4. Results

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Study One: Impact of Occupational Pension on CSRs

4.4. Study Two: Impact of CSRs on Organizational Resilience

4.5. Robustness Tests

4.5.1. DID Tests for the Relationship between Occupational Pension and CSRs

4.5.2. Adding Industry-Controlled Regressions for Study One and Study Two

4.5.3. Changing the Measurement of the Dependent Variable for the Relationship between CSRs and Organizational Resilience

4.5.4. Cointegration and Causality Tests for Dynamic Panel Data

4.5.5. Tests for Mediating Effects

5. Further Studies

The Moderating Effects Tests

6. Conclusions and Discussions

6.1. Main Conclusions

6.2. Theoretical Contributions

6.3. Management Implications

7. Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Agarwal, Sumit, Jessica Pan, and Wenlan Qian. 2020. Age of decision: Pension savings withdrawal and consumption and debt response. Management Science 66: 43–69. [Google Scholar] [CrossRef]

- Akee, Randall, Liqiu Zhao, and Zhong Zhao. 2019. Unintended consequences of China’s new labor contract law on unemployment and welfare loss of the workers. China Economic Review 53: 87–105. [Google Scholar] [CrossRef]

- Ali, Muhammad Amjad, Nausherwan Nobel Nawab, Amjad Abbas, M. Zulkiffal, and M. Sajjad. 2009. Evaluation of selection criteria in Cicer arietinum L. using correlation coefficients and path analysis. Australian Journal of Crop Science 3: 65. [Google Scholar]

- Al-Mamun, Abdullah, and Michael Seamer. Board of director attributes and CSR engagement in emerging economy firms: Evidence from across Asia. Emerging Markets Review 46: 100749. [CrossRef]

- Anderson, Mark C., Rajiv D. Banker, and Surya N. Janakiraman. 2003. Are Selling, General, and Administrative Costs “Sticky”? Journal of Accounting Research 41: 47–63. [Google Scholar] [CrossRef]

- Andersson, Thomas, Mikael Cäker, Stefan Tengblad, and Mikael Wickelgren. 2019. Building traits for organizational resilience through balancing organizational structures. Scandinavian Journal of Management 35: 36–45. [Google Scholar] [CrossRef]

- Bai, Chen, and Xiaoyan Lei. 2020. New trends in population aging and challenges for China’s sustainable development. China Economic Journal 13: 3–23. [Google Scholar] [CrossRef]

- Bansal, Pratima, Guoliang F. Jiang, and Jae C. Jung. 2015. Managing Responsibly in Tough Economic Times: Strategic and Tactical CSR During the 2008–2009 Global Recession. Long Range Planning 48: 69–79. [Google Scholar] [CrossRef]

- Barnea, Amir, and Amir Rubin. 2010. Corporate Social Responsibility as a Conflict Between Shareholders. Journal of Business Ethics 97: 71–86. [Google Scholar] [CrossRef]

- Barta, Gergő, and Gergely Görcsi. 2021. Risk management considerations for artificial intelligence business applications. International Journal of Economics and Business Research 21: 87–106. [Google Scholar] [CrossRef]

- Bebchuk, Lucian Arye, and Jesse M. Fried. 2003. Executive compensation as an agency problem. Journal of Economic Perspectives 17: 71–92. [Google Scholar] [CrossRef]

- Bellino, Stefania, Ornella Punzo, Maria Cristina Rota, Martina Del Manso, Alberto Mateo Urdiales, Xanthi Andrianou, Massimo Fabiani, Stefano Boros, Fenicia Vescio, Flavia Riccardo, and et al. 2020. COVID-19 disease severity risk factors for pediatric patients in Italy. Pediatrics 146: e2020009399. [Google Scholar]

- Buslei, Hermann, Johannes Geyer, and Peter Haan. 2023. Midijob reform: Increased redistribution in pension insurance-noticeable costs, relief not well targeted. DIW Weekly Report 13: 63–70. [Google Scholar]

- Bustinza, Oscar F., Ferran Vendrell-Herrero, MªNieves Perez-Arostegui, and Glenn Parry. 2019. Technological capabilities, resilience capabilities and organizational effectiveness. The International Journal of Human Resource Management 30: 1370–92. [Google Scholar] [CrossRef]

- Campbell, John L., Nathan C. Goldman, and Bin Li. 2021. Do financing constraints lead to incremental tax planning? Evidence from the Pension Protection Act of 2006. Contemporary Accounting Research 38: 1961–99. [Google Scholar] [CrossRef]

- Carvalho, Ana, and Nelson Areal. 2016. Great places to work®: Resilience in times of crisis. Human Resource Management 55: 479–98. [Google Scholar] [CrossRef]

- Chen, Chun-Da, Ching-Hui Joan Su, and Ming-Hsiang Chen. 2022. Are ESG-committed hotels financially resilient to the COVID-19 pandemic? An autoregressive jump intensity trend model. Tourism Management 93: 104581. [Google Scholar] [CrossRef] [PubMed]

- Chen, Shengqi, and Hong Zhang. 2021. Does digital finance promote manufacturing servitization: Micro evidence from China. International Review of Economics & Finance 76: 856–69. [Google Scholar]

- Chen, Yian, Li Guiping, and Wenjing Gao. 2023. Is pension insurance a barrier to entrepreneurship? New evidence from China. Economic Research-Ekonomska Istraživanja 36: 2155207. [Google Scholar] [CrossRef]

- Clemens, Jeffrey. 2021. How do firms respond to minimum wage increases? understanding the relevance of non-employment margins. Journal of Economic Perspectives 35: 51–72. [Google Scholar] [CrossRef]

- Cooper, Russell, Guan Gong, and Ping Yan. 2018. Costly labour adjustment: General equilibrium effects of China’s employment regulations and financial reforms. The Economic Journal 128: 1879–922. [Google Scholar] [CrossRef]

- Costa, Mabel D., and Ahsan Habib. 2023. Cost stickiness and firm value. Journal of Management Control 34: 235–73. [Google Scholar] [CrossRef]

- Crane, Andrew, and Dirk Matten. 2020. COVID-19 and the Future of CSR Research. Journal of Management Studies 58: 280–84. [Google Scholar] [CrossRef]

- de Oliveira Teixeira, Eduardo, and William B. Werther, Jr. 2013. Resilience: Continuous renewal of competitive advantages. Business Horizons 56: 333–42. [Google Scholar] [CrossRef]

- DesJardine, Mark, Pratima Bansal, and Yang Yang. 2019. Bouncing back: Building resilience through social and environmental practices in the context of the 2008 global financial crisis. Journal of Management 45: 1434–60. [Google Scholar] [CrossRef]

- DesJardine, Mark R., Emilio Marti, and Rodolphe Durand. 2021. Why activist hedge funds target socially responsible firms: The reaction costs of signaling corporate social responsibility. Academy of Management Journal 64: 851–72. [Google Scholar] [CrossRef]

- Ding, Xiong, and Min Ran. 2021. Research on the application of role theory in active aging education service system design. Paper presented at the HCI International 2021-Late Breaking Papers: Cognition, Inclusion, Learning, and Culture: 23rd HCI International Conference, HCII 2021, Virtual Event, July 24–29. Proceedings 23. [Google Scholar]

- Do, Hoa, Pawan Budhwar, Helen Shipton, Hai-Dang Nguyen, and Bach Nguyen. 2022. Building organizational resilience, innovation through resource-based management initiatives, organizational learning and environmental dynamism. Journal of Business Research 141: 808–21. [Google Scholar] [CrossRef]

- Duan, Ru, Suresh Ramakrishnan, and Sanil S. Hishan. 2023. Impact of CSR on Organizational Resilience across Chinese Listed Firms: Combination of Process-oriented and Outcome-oriented Perspectives. Migration Letters 20: 963–82. [Google Scholar] [CrossRef]

- Du, Pengcheng, and Shuxun Wang. 2020. The effect of minimum wage on firm markup: Evidence from China. Economic Modelling 86: 241–50. [Google Scholar] [CrossRef]

- Duckett, Jane. 2020. Neoliberalism, authoritarian politics and social policy in China. Development and Change 51: 523–39. [Google Scholar] [CrossRef]

- Elhendy, Abdou, Jeane M. Tsutsui, Edward L. O’Leary, Feng Xie, and Thomas R. Porter. 2006. Noninvasive Diagnosis of Coronary Artery Bypass Graft Disease by Dobutamine Stress Real-time Myocardial Contrast Perfusion Imaging. Journal of the American Society of Echocardiography 19: 1482–87. [Google Scholar] [CrossRef]

- Encina, Jenny. 2013. Pension Reform in Chile: A Difference in Difference Matching Estimation. Estudios de economía 40: 81–95. [Google Scholar] [CrossRef][Green Version]

- Etinzock, Mfongeh N., and Umakrishnan Kollamparambil. 2019. Subjective well-being impact of old age pension in South Africa: A difference in difference analysis across the gender divide. South African Journal of Economic and Management Sciences 22: 1–12. [Google Scholar]

- Fama, Eugene F. 1980. Agency problems and the theory of the firm. Journal of Political Economy 88: 288–307. [Google Scholar] [CrossRef]

- Fan, Gang, Xiaolu Wang, and Liwen Zhang. 2001. Annual report 2000: Marketization index for China’s provinces. China & World Economy 5: 1–12. [Google Scholar]

- Feyen, Erik, Jon Frost, Leonardo Gambacorta, Harish Natarajan, and Matthew Saal. 2021. Fintech and the Digital Transformation of Financial Services: Implications for Market Structure and Public Policy. BIS Papers. Basel: Bank for International Settlements, number 117. [Google Scholar]

- Fieseler, Christian, Eliane Bucher, and Christian Pieter Hoffmann. 2019. Unfairness by design? The perceived fairness of digital labor on crowdworking platforms. Journal of Business Ethics 156: 987–1005. [Google Scholar] [CrossRef]

- Freeman, R. Edward, Sergiy D. Dmytriyev, and Robert A. Phillips. 2021. Stakeholder theory and the resource-based view of the firm. Journal of Management 47: 1757–70. [Google Scholar] [CrossRef]

- Friedman, Milton. 1970. The Social Responsibility of Business is to Increase its Profits. New York Times Magazine, September 13. [Google Scholar]

- Fukuda, Katsufumi, and Yasunori Ouchida. 2020. Corporate social responsibility (CSR) and the environment: Does CSR increase emissions? Energy Economics 92: 104933. [Google Scholar] [CrossRef]

- Gao, Wenqun, Yang Chen, Shaorui Xu, Oleksii Lyulyov, and Tetyana Pimonenko. 2023. The Role of Population Aging in High-Quality Economic Development: Mediating Role of Technological Innovation. SAGE Open 13: 21582440231202385. [Google Scholar] [CrossRef]

- Gao, Ya-dong, Mei Ding, Xiang Dong, Jin-jin Zhang, Ahmet Kursat Azkur, Dilek Azkur, Hui Gan, Yuan-li Sun, Wei Fu, and Wei Li. 2021. Risk factors for severe and critically ill COVID-19 patients: A review. Allergy 76: 428–55. [Google Scholar] [CrossRef]

- Gao, Yihong, and Jiayan Gao. 2023. Employee protection and trade credit: Learning from China’s social insurance law. Economic Modelling 127: 106486. [Google Scholar] [CrossRef]

- Gu, Leilei, Jinyu Liu, and Yuchao Peng. 2022. Locality stereotype, CEO trustworthiness and stock price crash risk: Evidence from China. Journal of Business Ethics 175: 773–97. [Google Scholar] [CrossRef]

- Guo, Mengmeng, Yicheng Kuai, and Xiaoyan Liu. 2020. Stock market response to environmental policies: Evidence from heavily polluting firms in China. Economic Modelling 86: 306–16. [Google Scholar] [CrossRef]

- Habib, Ahsan, and Mostafa Monzur Hasan. 2016. Auditor-provided tax services and stock price crash risk. Accounting and Business Research 46: 51–82. [Google Scholar] [CrossRef]

- Habib, Ahsan, and Mostafa Monzur Hasan. 2019. Corporate Social Responsibility and Cost Stickiness. Business & Society 58: 453–92. [Google Scholar] [CrossRef]

- Hillmann, Julia, and Edeltraud Guenther. 2021. Organizational resilience: A valuable construct for management research? International Journal of Management Reviews 23: 7–44. [Google Scholar] [CrossRef]

- Huang, Wenchuan, Shouming Chen, and Luu Thi Nguyen. 2020. Corporate social responsibility and organizational resilience to COVID-19 crisis: An empirical study of Chinese firms. Sustainability 12: 8970. [Google Scholar] [CrossRef]

- Hu, Bing, Daiyan Peng, Yuedong Zhang, and Jiyu Yu. 2020. Rural population aging and the hospital utilization in cities: The rise of medical tourism in China. International Journal of Environmental Research and Public Health 17: 4790. [Google Scholar] [CrossRef]

- Hu, Jin, Peter-Josef Stauvermann, Surya Nepal, and Yuanhua Zhou. 2023. Can the Policy of Increasing Retirement Age Raise Pension Revenue in China—A Case Study of Anhui Province. International Journal of Environmental Research and Public Health 20: 1096. [Google Scholar] [CrossRef]

- Ibrahim, Awad Elsayed Awad, Hesham Ali, and Heba Aboelkheir. 2022. Cost stickiness: A systematic literature review of 27 years of research and a future research agenda. Journal of International Accounting, Auditing and Taxation 46: 100439. [Google Scholar] [CrossRef]

- Jarzebski, Marcin Pawel, Thomas Elmqvist, Alexandros Gasparatos, Kensuke Fukushi, Sofia Eckersten, Dagmar Haase, Julie Goodness, Sara Khoshkar, Osamu Saito, and Kazuhiko Takeuchi. 2021. Ageing and population shrinking: Implications for sustainability in the urban century. Npj Urban Sustainability 1: 17. [Google Scholar] [CrossRef]

- Jiang, Yawei, Brent W. Ritchie, and Martie-Louise Verreynne. 2019. Building tourism organizational resilience to crises and disasters: A dynamic capabilities view. International Journal of Tourism Research 21: 882–900. [Google Scholar] [CrossRef]

- Jin, Gang, Jiwen Zhang, Yongwei Ye, Shiqi Yao, and Jingxiang Song. 2024. Social insurance law and firm markup in China. Economic Modelling 132: 106645. [Google Scholar] [CrossRef]

- Jumaniyazov, I. T., and A. Xaydarov. 2023. The importance of social insurance in social protection. Science and Education 4: 1033–43. [Google Scholar]

- Kahn, William A, Michelle A Barton, Colin M Fisher, Emily D Heaphy, Erin M Reid, and Elizabeth D Rouse. 2018. The geography of strain: Organizational resilience as a function of intergroup relations. Academy of Management Review 43: 509–29. [Google Scholar] [CrossRef]

- Kang, Jingoo. 2016. Labor market evaluation versus legacy conservation: What factors determine retiring CEOs’ decisions about long-term investment? Strategic Management Journal 37: 389–405. [Google Scholar] [CrossRef]

- Kantur, Deniz, and Arzu Iseri Say. 2015. Measuring organizational resilience: A scale development. Journal of Business Economics and Finance 4: 456–72. [Google Scholar] [CrossRef]

- Ketter, Eran. 2022. Bouncing back or bouncing forward? Tourism destinations’ crisis resilience and crisis management tactics. European Journal of Tourism Research 31: 3103. [Google Scholar] [CrossRef]

- Kong, Dongmin, Yanan Wang, and Jian Zhang. 2020. Efficiency wages as gift exchange: Evidence from corporate innovation in China. Journal of Corporate Finance 65: 101725. [Google Scholar] [CrossRef]

- Lanzolla, Gianvito, Annika Lorenz, Ella Miron-Spektor, Melissa Schilling, Giulia Solinas, and Christopher L Tucci. 2020. Digital transformation: What is new if anything? Emerging patterns and management research. Academy of Management Discoveries 6: 341–50. [Google Scholar]

- Levin, Andrew, Chien-Fu Lin, and Chia-Shang James Chu. 2002. Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108: 1–24. [Google Scholar] [CrossRef]

- Li, Honglei, Ziyu Yang, Chunhua Jin, and Jinxia Wang. 2023a. How an industrial internet platform empowers the digital transformation of SMEs: Theoretical mechanism and business model. Journal of Knowledge Management 27: 105–20. [Google Scholar] [CrossRef]

- Linnenluecke, Martina K. 2017. Resilience in business and management research: A review of influential publications and a research agenda. International Journal of Management Reviews 19: 4–30. [Google Scholar] [CrossRef]

- Li, Qianqian, Zhengtang Zhao, and Tingting Chen. 2023b. Social Insurance Contribution Rate Reduction Policy and Enterprise Innovation: Evidence from China. Emerging Markets Finance and Trade 59: 1012–24. [Google Scholar] [CrossRef]

- Li, Shuyang, Yichuan Wang, Raffaele Filieri, and Yuzhen Zhu. 2022. Eliciting positive emotion through strategic responses to COVID-19 crisis: Evidence from the tourism sector. Tourism Management 90: 104485. [Google Scholar] [CrossRef] [PubMed]

- Liu, Guanchun, Yuanyuan Liu, Chengsi Zhang, and Yueteng Zhu. 2021. Social insurance law and corporate financing decisions in China. Journal of Economic Behavior & Organization 190: 816–37. [Google Scholar]

- Liu, Hualing, Xirui Wang, Huabi Liang, and Liuyue Wang. 2022a. Research on Hot Topics and Development Trend of Digital Transformation from the Perspective of Bibliometrics: Based on the analysis of CSSCI. Paper presented at the Proceedings of the 3rd International Conference on Industrial Control Network and System Engineering Research, Shenyang, China, March 15–16. [Google Scholar]

- Liu, Jun, Mengting Yue, Fan Yu, and Yun Tong. 2022b. The contribution of tourism mobility to tourism economic growth in China. PLoS ONE 17: e0275605. [Google Scholar] [CrossRef] [PubMed]

- Lopez, Luciano, and Sylvain Weber. 2017. Testing for Granger causality in panel data. The Stata Journal 17: 972–84. [Google Scholar] [CrossRef]

- Lu, Qiang, Yudong Yang, and Miao Yu. 2022. Can SMEs’ quality management promote supply chain financing performance? An explanation based on signalling theory. International Journal of Emerging Markets. ahead-of-print. [Google Scholar] [CrossRef]

- Maestas, Nicole, Kathleen J. Mullen, and David Powell. 2023. The Effect of Population Aging on Economic Growth, the Labor Force, and Productivity. American Economic Journal: Macroeconomics 15: 306–32. [Google Scholar] [CrossRef]

- Manfield, Russell Charles, and Lance Richard Newey. 2017. Resilience as an entrepreneurial capability: Integrating insights from a cross-disciplinary comparison. International Journal of Entrepreneurial Behavior & Research 175: 1–25. [Google Scholar]

- Ma, Shanshan, Liu Su, Zhaoyu Wang, Feng Qiu, and Ge Guo. 2018. Resilience enhancement of distribution grids against extreme weather events. IEEE Transactions on Power Systems 33: 4842–53. [Google Scholar] [CrossRef]

- Meyer, Alan D. 1982. How ideologies supplant formal structures and shape responses to environments. Journal of Management Studies 19: 45–61. [Google Scholar] [CrossRef]

- Mishra, Saurabh, and Sachin B. Modi. 2016. Corporate social responsibility and shareholder wealth: The role of marketing capability. Journal of Marketing 80: 26–46. [Google Scholar] [CrossRef]

- Moi, Ludovica, and Francesca Cabiddu. 2021. Leading digital transformation through an Agile Marketing Capability: The case of Spotahome. Journal of Management and Governance 25: 1145–77. [Google Scholar] [CrossRef]

- Morgan, Neil A. 2012. Marketing and business performance. Journal of the Academy of Marketing Science 40: 102–19. [Google Scholar] [CrossRef]

- Muller, Alan, and Roman Kräussl. 2011. Doing good deeds in times of need: A strategic perspective on corporate disaster donations. Strategic Management Journal 32: 911–29. [Google Scholar] [CrossRef]

- Nadkarni, Swen, and Reinhard Prügl. 2021. Digital transformation: A review, synthesis and opportunities for future research. Management Review Quarterly 71: 233–341. [Google Scholar] [CrossRef]

- Ntounis, Nikos, Cathy Parker, Heather Skinner, Chloe Steadman, and Gary Warnaby. 2022. Tourism and Hospitality industry resilience during the Covid-19 pandemic: Evidence from England. Current Issues in Tourism 25: 46–59. [Google Scholar] [CrossRef]

- Nwagbara, Uzoechi, and Patrick Reid. 2013. Corporate Social Responsibility (CSR) and Management Trends: Changing Times and Changing Strategies. Economic Insights-Trends & Challenges, 65. [Google Scholar]

- Ortiz-de-Mandojana, Natalia, and Pratima Bansal. 2016. The long-term benefits of organizational resilience through sustainable business practices. Strategic Management Journal 37: 1615–31. [Google Scholar] [CrossRef]

- Pancieri, Letícia, Rosane M. M. Silva, Monika Wernet, Luciana M. M. Fonseca, Shaffa Hameed, and Debora F. Mello. 2022. Safe care for premature babies at home: Parenting and stimulating development. Journal of Child Health Care 28: 8–21. [Google Scholar] [CrossRef]

- Pandey, Neena, and Abhipsa Pal. 2020. Impact of digital surge during Covid-19 pandemic: A viewpoint on research and practice. International Journal of Information Management 55: 102171. [Google Scholar]

- Pollman, Elizabeth. 2019. Corporate social responsibility, ESG, and compliance. In Forthcoming, Cambridge Handbook of Compliance. Edited by D. Daniel Sokol and Benjamin van Rooij. Loyola Law School, Los Angeles Legal Studies Research Paper (2019–35), Penn Carey Law: Legal Scholarship Repository. Philadelphia: The U.S. State of Pennsylvania. [Google Scholar]

- Polyzos, Efstathios, Anestis Fotiadis, and Aristeidis Samitas. 2021. COVID-19 tourism recovery in the ASEAN and East Asia region: Asymmetric patterns and implications. In ERIA Discussion Paper Series, Paper (379). Jakarta: Economic Research Institute for ASEAN and East Asia. [Google Scholar]

- Porter, Michael E., and Mark R. Kramer. 2006. Strategy and society: The link between competitive advantage and corporate social responsibility. Harvard Business Review 84: 78–92. [Google Scholar]

- Porter, Michael E., and Mark R. Kramer. 2011. The Big Idea: Creating Shared Value. CFA Digest 41: 12–13. [Google Scholar]

- Ren, Shuang, Jia Hu, Guiyao Tang, and Doren Chadee. 2023. Digital connectivity for work after hours: Its curvilinear relationship with employee job performance. Personnel Psychology 76: 731–57. [Google Scholar] [CrossRef]

- Roodman, David. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal 9: 86–136. [Google Scholar] [CrossRef]

- Russell, Andrew L. 2013. The internet that wasn’t. IEEE Spectrum 50: 39–43. [Google Scholar] [CrossRef]

- Sajko, Miha, Christophe Boone, and Tine Buyl. 2021. CEO greed, corporate social responsibility, and organizational resilience to systemic shocks. Journal of Management 47: 957–92. [Google Scholar] [CrossRef]

- Semadeni, Matthew, Michael C. Withers, and S. Trevis Certo. 2014. The perils of endogeneity and instrumental variables in strategy research: Understanding through simulations. Strategic Management Journal 35: 1070–79. [Google Scholar] [CrossRef]

- Shan, Xiaoyue, and Albert Park. 2023. Access to pensions, old-age support, and child investment in China. Journal of Human Resources 59: 0321-11555R3. [Google Scholar] [CrossRef]

- Sharma, Gagan Deep, Asha Thomas, and Justin Paul. 2021. Reviving tourism industry post-COVID-19: A resilience-based framework. Tourism Management Perspectives 37: 100786. [Google Scholar] [CrossRef]

- Shen, Zheng, Xiaodong Zheng, and Hualei Yang. 2020. The fertility effects of public pension: Evidence from the new rural pension scheme in China. PLoS ONE 15: e0234657. [Google Scholar] [CrossRef]

- Starr, Evan. 2019. Consider this: Training, wages, and the enforceability of covenants not to compete. ILR Review 72: 783–817. [Google Scholar] [CrossRef]

- Tao, Weiting, and Baobao Song. 2020. The interplay between post-crisis response strategy and pre-crisis corporate associations in the context of CSR crises. Public Relations Review 46: 101883. [Google Scholar] [CrossRef]

- Torres, Pedro, and Mário Augusto. 2021. Attention to social issues and CEO duality as enablers of resilience to exogenous shocks in the tourism industry. Tourism Management 87: 104400. [Google Scholar] [CrossRef]

- Torruam, J. T., and C. C. Abur. 2014. Public expenditure on human capital development as a strategy for economic growth in Nigeria: Application of co integration and causality test analysis. International Journal of Research in Humanities and Social Studies 1: 14–23. [Google Scholar]

- Tsionas, Efthymios G. 2002. Stochastic frontier models with random coefficients. Journal of Applied Econometrics 17: 127–47. [Google Scholar] [CrossRef]

- Van Marrewijk, Marcel. 2003. Concepts and definitions of CSR and corporate sustainability: Between agency and communion. Journal of Business Ethics 44: 95–105. [Google Scholar] [CrossRef]

- Venieris, George, Vasilios Christos Naoum, and Orestes Vlismas. 2015. Organisation capital and sticky behaviour of selling, general and administrative expenses. Management Accounting Research 26: 54–82. [Google Scholar] [CrossRef]

- Wahyudi, S., H. Hasanudin, and I. Pangestutia. 2020. Asset allocation and strategies on investment portfolio performance: A study on the implementation of employee pension fund in Indonesia. Accounting 6: 839–50. [Google Scholar] [CrossRef]

- Wang, Huan, and Jianyuan Huang. 2023. How Can China’s Recent Pension Reform Reduce Pension Inequality? Journal of Aging & Social Policy 35: 37–51. [Google Scholar]

- Wang, Jin, Deli Wang, Hai Long, and Yu Chen. 2023a. Do firms’ pension contributions decrease their investment efficiency in Chinese context? South African Journal of Business Management 54: 13. [Google Scholar] [CrossRef]

- Wang, Jingyong, Zixiang Song, and Lida Xue. 2023b. Digital technology for good: Path and influence—Based on the study of ESG performance of listed companies in China. Applied Sciences 13: 2862. [Google Scholar] [CrossRef]

- Watts, Nicholas A., and Frank A. Feltus. 2017. Big Data Smart Socket (BDSS): A system that abstracts data transfer habits from end users. Bioinformatics 33: 627–28. [Google Scholar] [CrossRef]

- Wei, Qi, Xiaojun Li, Chao Liang, Zhipeng Zhang, Jia Guo, Guo Hong, Guichuan Xing, and Wei Huang. 2019. Recent progress in metal halide perovskite micro-and nanolasers. Advanced Optical Materials 7: 1900080. [Google Scholar] [CrossRef]

- Wernerfelt, Birger. 1984. A resource-based view of the firm. Strategic Management Journal 5: 171–80. [Google Scholar] [CrossRef]

- Wieczorek-Kosmala, Monika. 2022. A study of the tourism industry’s cash-driven resilience capabilities for responding to the COVID-19 shock. Tourism Management 88: 104396. [Google Scholar]

- Williams, Trenton A, Daniel A Gruber, Kathleen M Sutcliffe, Dean A Shepherd, and Eric Yanfei Zhao. 2017. Organizational response to adversity: Fusing crisis management and resilience research streams. Academy of Management Annals 11: 733–69. [Google Scholar] [CrossRef]

- Wu, Xiaohu, Francesco De Pellegrini, Guanyu Gao, and Giuliano Casale. 2019. A framework for allocating server time to spot and on-demand services in cloud computing. ACM Transactions on Modeling and Performance Evaluation of Computing Systems (TOMPECS) 4: 1–31. [Google Scholar] [CrossRef]

- Xiong, Guiyang, and Sundar Bharadwaj. 2013. Asymmetric roles of advertising and marketing capability in financial returns to news: Turning bad into good and good into great. Journal of Marketing Research 50: 706–24. [Google Scholar] [CrossRef]

- Yang, Man, Jinman Wang, Zhaorui Jing, Biao Liu, and Hebin Niu. 2022. Evaluation and regulation of resource-based city resilience: Evidence from Shanxi Province, China. International Journal of Disaster Risk Reduction 81: 103256. [Google Scholar] [CrossRef]

- Zhang, J. Q., and Y. X. He. 2022. Research on the impact of population aging on the development of digital economy. Academic Journal of Business & Management 4: 107–15. [Google Scholar]

- Zhang, Jianjun, Christopher Marquis, and Kunyuan Qiao. 2016. Do political connections buffer firms from or bind firms to the government? A study of corporate charitable donations of Chinese firms. Organization Science 27: 1307–24. [Google Scholar] [CrossRef]

- Zhang, Zhe, Jing Chen, and Ming Jia. 2023. How and when does mandatory csr disclosure affects firms’ CSR disclosure strategy? Management and Organization Review 19: 64–97. [Google Scholar] [CrossRef]

- Zheng, Wei, Youji Lyu, Ruo Jia, and Katja Hanewald. 2023. The impact of expected pensions on consumption: Evidence from China. Journal of Pension Economics & Finance 22: 69–87. [Google Scholar]

| Variable | Obs | Mean | Std.dev. | Min | Max |

|---|---|---|---|---|---|

| LnPensions | 34,145 | 13.307 | 1.955 | 6.962 | 17.751 |

| DID | 34,145 | 0.374 | 0.484 | 0.000 | 1.000 |

| LnStability | 34,145 | −8.36 × 10−9 | 2.07 × 10−8 | −5.96 × 10−8 | 0.000 |

| LnFlexibility | 34,145 | 3.527 | 0.041 | 3.332 | 3.584 |

| LnMiwage | 34,145 | 7.416 | 0.235 | 6.721 | 7.816 |

| LnAging | 34,145 | −1.745 | 0.318 | −3.103 | −1.047 |

| LnDigitaltrans | 34,145 | 0.439 | 0.520 | −0.715 | 1.599 |

| LnCmkt | 34,145 | −1.483 | 0.127 | −1.836 | −1.012 |

| LnSCSR | 34,145 | 1.593 | 0.407 | 0.000 | 2.079 |

| LnRCSR | 34,145 | 1.514 | 0.748 | −1.609 | 3.315 |

| LnGrowth | 34,145 | 2.502 | 1.228 | −1.648 | 6.102 |

| LnVolatility | 34,145 | −2.138 | 0.359 | −3.085 | −1.074 |

| LnSize | 34,145 | 3.098 | 0.043 | 2.997 | 3.255 |

| LnLev | 34,145 | −1.015 | 0.464 | −2.726 | −0.140 |

| LnROA | 34,145 | −3.248 | 0.732 | −6.133 | −1.619 |

| LnCashflow | 34,145 | −2.929 | 0.634 | −5.818 | −1.507 |

| LnRevenue | 34,145 | −1.880 | 0.733 | −5.084 | 0.528 |

| LnTop5 | 34,145 | −0.670 | 0.244 | −1.525 | −0.139 |

| LnListAge | 34,145 | 0.701 | 0.356 | −0.367 | 1.193 |

| Variables for calculating marketing capabilities. To ensure consistent decimal counting, we use scientific notation. All variables are in CNY: Yuan. | |||||

| Accounts receivable | 34,145 | 1.860 × 109 | 2.650 × 1010 | 0.000 | 2.100 × 1012 |

| Management expense | 34,145 | 2.720 × 108 | 3.960 × 108 | −6.580 × 107 | 1.110 × 1010 |

| Sale expense | 34,145 | 2.620 × 108 | 5.980 × 108 | 0.000 | 2.150 × 1010 |

| Sale income | 34,145 | 5.600 × 109 | 9.440 × 109 | 8469.060 | 2.400 × 1011 |

| Customer relationship costs | 34,145 | 1.080 × 1021 | 1.700 × 1021 | 0.000 | 5.090 × 1022 |

| Intangible assets cost | 34,145 | 4.560 × 108 | 1.370 × 109 | 0.000 | 5.080 × 1010 |

| Instrumental variables | |||||

| Lnsocial | 34,145 | 11.999 | 1.703 | −3.912 | 21.190 |

| Lnadmin | 34,145 | −18.700 | 0.828 | −23.131 | −14.128 |

| Lnselling | 34,145 | 18.120 | 1.191 | 6.751 | 23.771 |

| LnPensions | DID | LnSCSR | LnRCSR | LnStability | LnFlexibility | LnMiwage | LnAging | LnDigitaltrans | LnCmkt | LnGrowth | LnVolatility | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LnPensions | 1 | |||||||||||

| DID | 0.648 *** | 1 | ||||||||||

| LnSCSR | 0.156 *** | 0.095 *** | 1 | |||||||||

| LnRCSR | 0.120 *** | 0.108 *** | 0.058 *** | 1 | ||||||||

| LnStability | 0.020 *** | 0.006 | 0.023 *** | 0.013 ** | 1 | |||||||

| LnFlexibility | 0.021 *** | 0.027 *** | 0.051 *** | −0.005 | 0.011 ** | 1 | ||||||

| LnMiwage | −0.524 *** | −0.296 *** | −0.157 *** | −0.126 *** | 0.002 | −0.016 *** | 1 | |||||

| LnAging | −0.170 *** | −0.077 *** | −0.058 *** | −0.037 *** | −0.012 ** | 0.010 * | 0.358 *** | 1 | ||||

| LnDigitaltrans | −0.267 *** | −0.139 *** | −0.103 *** | −0.021 *** | −0.027 *** | −0.017 *** | 0.442 *** | 0.193 *** | 1 | |||

| LnCmkt | 0.095 *** | 0.056 *** | 0.073 *** | 0.083 *** | 0.052 *** | −0.001 | −0.064 *** | −0.036 *** | −0.108 *** | 1 | ||

| LnGrowth | 0.199 *** | 0.149 *** | 0.088 *** | 0.063 *** | 0.005 | −0.009 * | −0.077 *** | 0.038 *** | −0.088 *** | 0.323 *** | 1 | |

| LnVolatility | −0.042 *** | −0.079 *** | −0.052 *** | −0.050 *** | 0.007 | 0.042 *** | −0.011 ** | −0.148 *** | −0.011 ** | −0.041 *** | −0.056 *** | 1 |

| Model | (1) | (2) |

|---|---|---|

| LnSCSR | LnRCSR | |

| LnPensions | 0.0094 *** | −0.0153 *** |

| (0.0029) | (0.0045) | |

| LnSize | 0.4798 *** | −0.4795 ** |

| (0.1368) | (0.2146) | |

| LnLev | −0.1120 *** | −0.0172 |

| (0.0108) | (0.0162) | |

| LnROA | 0.0421 *** | −0.0911 *** |

| (0.0055) | (0.0088) | |

| LnCashflow | −0.0067 | 0.0294 *** |

| (0.0051) | (0.0081) | |

| LnRevenue | 0.0047 | 0.0123 ** |

| (0.0038) | (0.0063) | |

| LnTop5 | 0.1693 *** | 0.0737 ** |

| (0.0226) | (0.0342) | |

| LnListAge | −0.0409 *** | −0.0268 * |

| (0.0102) | (0.0158) | |

| Firm_fixed effects | YES | YES |

| Year_fixed effects | YES | YES |

| _cons | 0.2680 | 3.2501 *** |

| (0.4166) | (0.6606) | |

| N | 34,145 | 34,145 |

| r2 | 0.1389 | 0.0495 |

| Model | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| LnSCSR | LnSCSR | LnSCSR | LnRCSR | LnRCSR | LnRCSR | |

| Grouped by Company Size | Small | Medium | Large | Small | Medium | Large |

| LnPensions | 0.0031 | 0.0115 | 0.0010 | −0.0021 | −0.0100 | −0.0217 *** |

| (0.0047) | (0.0084) | (0.0042) | (0.0069) | (0.0127) | (0.0074) | |

| LnSize | 0.9038 | −24.9096 *** | 3.1339 *** | 2.7013 *** | −10.9519 *** | 2.7636 ** |

| (0.5797) | (2.7799) | (0.6061) | (0.8374) | (3.7494) | (1.2418) | |

| LnLev | −0.1243 *** | −0.0855 ** | −0.2156 *** | −0.0155 | −0.0131 | −0.1588 *** |

| (0.0175) | (0.0336) | (0.0345) | (0.0286) | (0.0485) | (0.0581) | |

| LnROA | 0.0519 *** | 0.0500 *** | 0.0262 *** | −0.1007 *** | −0.1038 *** | −0.1218 *** |

| (0.0091) | (0.0171) | (0.0086) | (0.0151) | (0.0231) | (0.0158) | |

| LnCashflow | −0.0237 *** | 0.0325 * | −0.0104 | 0.0395 *** | 0.0502 ** | 0.0090 |

| (0.0081) | (0.0167) | (0.0076) | (0.0116) | (0.0245) | (0.0144) | |

| LnGrowth | −0.0016 | 0.0164 | 0.0108 * | 0.0182 * | 0.0474 *** | −0.0061 |

| (0.0053) | (0.0137) | (0.0061) | (0.0100) | (0.0174) | (0.0098) | |

| LnTop5 | 0.1816 *** | 0.0352 | 0.1913 *** | 0.2059 ** | 0.0800 | −0.0088 |

| (0.0653) | (0.0552) | (0.0550) | (0.0954) | (0.0867) | (0.1009) | |

| LnListAge | −0.0287 ** | 0.0814 ** | −0.0537 | 0.0709 *** | −0.0134 | 0.0450 |

| (0.0112) | (0.0325) | (0.0359) | (0.0187) | (0.0509) | (0.0620) | |

| _cons | −0.9179 | 79.0654 *** | −8.0244 *** | −6.7322 *** | 35.7210 *** | −6.7164 * |

| (1.7563) | (8.6234) | (1.8929) | (2.5389) | (11.6218) | (3.8847) | |

| Firm_fixed effects | YES | YES | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES | YES | YES |

| N | 11,974 | 11,643 | 10,528 | 11,974 | 11,643 | 10,528 |

| r2 | 0.1557 | 0.2286 | 0.0747 | 0.0348 | 0.0366 | 0.1490 |

| Models | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| LnStability | LnStability | LnFlexibility | LnFlexibility | |

| LnSCSR | 0.0011 *** | 0.0048 *** | ||

| (0.0003) | (0.0007) | |||

| LnRCSR | −0.0003 * | −0.0006 * | ||

| (0.0002) | (0.0003) | |||

| LnSize | −0.0016 | −0.0008 | 0.0406 *** | 0.0474 *** |

| (0.0033) | (0.0033) | (0.0067) | (0.0067) | |

| LnLev | 0.0005 * | 0.0004 | −0.0010 * | −0.0017 *** |

| (0.0003) | (0.0003) | (0.0006) | (0.0006) | |

| LnROA | 0.0005 *** | 0.0005 *** | 0.0017 *** | 0.0019 *** |

| (0.0002) | (0.0002) | (0.0003) | (0.0003) | |

| LnCashflow | 0.0006 *** | 0.0006 *** | 0.0005 | 0.0006 * |

| (0.0002) | (0.0002) | (0.0004) | (0.0004) | |

| LnRevenue | 0.0002 | 0.0002 | 0.0002 | 0.0001 |

| (0.0002) | (0.0002) | (0.0003) | (0.0003) | |

| LnTop5 | 0.0009 * | 0.0009 * | −0.0041 *** | −0.0033 *** |

| (0.0005) | (0.0005) | (0.0010) | (0.0010) | |

| LnListAge | 0.0014 *** | 0.0013 *** | 0.0015 ** | 0.0014 * |

| (0.0004) | (0.0004) | (0.0008) | (0.0008) | |

| Firm_fixed effects | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES |

| _cons | −0.0015 | −0.0023 | 3.3969 *** | 3.3859 *** |

| (0.0104) | (0.0105) | (0.0212) | (0.0212) | |

| N | 34,145 | 34,145 | 34,145 | 34,145 |

| r2 | 0.0018 | 0.0014 | 0.0060 | 0.0041 |

| Model | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | LnStability | LnStability | LnStability | LnStability | LnStability | LnStability | LnFlexibility | LnFlexibility | LnFlexibility | LnFlexibility | LnFlexibility | LnFlexibility |

| Grouped by Company Size | Small | Medium | Large | Small | Medium | Large | Small | Medium | Large | Small | Medium | Large |

| LnSCSR | 0.0926 * | 0.0251 | 0.1929 *** | 0.0012 | 0.0067 *** | 0.0040 *** | ||||||

| (0.0526) | (0.0548) | (0.0531) | (0.0010) | (0.0013) | (0.0011) | |||||||

| LnRCSR | −0.0057 | −0.0255 | −0.0647 ** | −0.0005 | −0.0005 | −0.0003 | ||||||

| (0.0272) | (0.0258) | (0.0281) | (0.0006) | (0.0005) | (0.0005) | |||||||

| LnSize | 1.8044 ** | −6.6600 | 0.3341 | 1.8385 ** | −7.4472 | 0.6191 | 0.1284 *** | −1.2668 *** | −0.0216 * | 0.1297 *** | −1.4278 *** | −0.0133 |

| (0.9127) | (7.5249) | (0.6998) | (0.9157) | (7.4131) | (0.6965) | (0.0186) | (0.1433) | (0.0131) | (0.0186) | (0.1414) | (0.0130) | |

| LnLev | 0.1181 *** | −0.0138 | −0.0443 | 0.1049 *** | −0.0176 | −0.0723 | −0.0028 *** | −0.0045 ** | 0.0008 | −0.0030 *** | −0.0053 *** | 0.0002 |

| (0.0393) | (0.0966) | (0.0544) | (0.0391) | (0.0969) | (0.0538) | (0.0008) | (0.0018) | (0.0011) | (0.0008) | (0.0017) | (0.0010) | |

| LnROA | 0.0873 *** | 0.0672 | −0.0043 | 0.0944 *** | 0.0704 | 0.0064 | 0.0015 *** | 0.0025 ** | 0.0016 *** | 0.0016 *** | 0.0028 ** | 0.0017 *** |

| (0.0271) | (0.0622) | (0.0256) | (0.0269) | (0.0622) | (0.0257) | (0.0005) | (0.0011) | (0.0005) | (0.0005) | (0.0011) | (0.0005) | |

| LnCashflow | 0.0757 *** | −0.0183 | 0.0475 * | 0.0747 *** | −0.0183 | 0.0483 * | −0.0005 | 0.0013 | 0.0014 *** | −0.0004 | 0.0018 | 0.0015 *** |

| (0.0273) | (0.0615) | (0.0280) | (0.0275) | (0.0613) | (0.0281) | (0.0005) | (0.0012) | (0.0005) | (0.0005) | (0.0012) | (0.0005) | |

| LnGrowth | −0.0143 | 0.0176 | 0.0526 ** | −0.0157 | 0.0173 | 0.0538 ** | 0.0011 ** | 0.0011 | −0.0012 *** | 0.0011 ** | 0.0009 | −0.0012 *** |

| (0.0229) | (0.0558) | (0.0246) | (0.0229) | (0.0558) | (0.0246) | (0.0004) | (0.0009) | (0.0004) | (0.0004) | (0.0009) | (0.0004) | |

| LnTop5 | 0.0170 | 0.4847 *** | 0.0810 | 0.0274 | 0.4796 *** | 0.0897 | −0.0009 | −0.0045 | −0.0043 *** | −0.0007 | −0.0037 | −0.0037 *** |

| (0.0783) | (0.1560) | (0.0725) | (0.0785) | (0.1557) | (0.0726) | (0.0016) | (0.0029) | (0.0013) | (0.0016) | (0.0029) | (0.0013) | |

| LnListAge | 0.1103 ** | 0.3594 *** | 0.1181 * | 0.1025 ** | 0.3515 *** | 0.1073 | 0.0025 ** | 0.0051 ** | −0.0022 * | 0.0024 ** | 0.0050 ** | −0.0021 |

| (0.0502) | (0.1290) | (0.0718) | (0.0502) | (0.1295) | (0.0720) | (0.0010) | (0.0024) | (0.0013) | (0.0010) | (0.0024) | (0.0013) | |

| Firm_fixed effects | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| _cons | −5.8657 ** | 20.0386 | −2.0955 | −5.8054 ** | 22.4866 | −2.7586 | 3.1335 *** | 7.4481 *** | 3.5984 *** | 3.1325 *** | 7.9619 *** | 3.5803 *** |

| (2.7988) | (23.3408) | (2.2075) | (2.8058) | (22.9680) | (2.2018) | (0.0570) | (0.4444) | (0.0410) | (0.0571) | (0.4382) | (0.0409) | |

| N | 11,974 | 11,643 | 10,528 | 11,974 | 11,643 | 10,528 | 11,974 | 11,643 | 10,528 | 11,974 | 11,643 | 10,528 |

| r2 | 0.0046 | 0.0018 | 0.0033 | 0.0043 | 0.0018 | 0.0025 | 0.0086 | 0.0172 | 0.0065 | 0.0086 | 0.0137 | 0.0050 |

| Model | (1) | (2) |

|---|---|---|

| LnSCSR | LnRCSR | |

| DID | 0.0330 *** | −0.0568 *** |

| (0.0115) | (0.0181) | |

| LnSize | 0.5018 *** | −0.5081 ** |

| (0.1353) | (0.2143) | |

| LnLev | −0.1131 *** | −0.0154 |

| (0.0108) | (0.0162) | |

| LnROA | 0.0420 *** | −0.0908 *** |

| (0.0055) | (0.0088) | |

| LnCashflow | −0.0068 | 0.0295 *** |

| (0.0051) | (0.0081) | |

| LnRevenue | 0.0045 | 0.0126 ** |

| (0.0038) | (0.0063) | |

| LnTop5 | 0.1694 *** | 0.0739 ** |

| (0.0226) | (0.0343) | |

| LnListAge | −0.0384 *** | −0.0313 ** |

| (0.0103) | (0.0159) | |

| Firm_fixed effects | YES | YES |

| Year_fixed effects | YES | YES |

| _cons | 0.3538 | 3.0891 *** |

| (0.4208) | (0.6657) | |

| N | 34,145 | 34,145 |

| r2 | 0.1386 | 0.0493 |

| Model | (1) | (2) |

|---|---|---|

| LnSCSR | LnRCSR | |

| LnPensions | 0.0089 *** | −0.0152 *** |

| (0.0028) | (0.0045) | |

| LnSize | 1.4692 *** | −0.0881 |

| (0.1528) | (0.2506) | |

| LnLev | −0.1476 *** | −0.0280 * |

| (0.0109) | (0.0166) | |

| LnROA | 0.0367 *** | −0.0951 *** |

| (0.0055) | (0.0089) | |

| LnCashflow | −0.0067 | 0.0289 *** |

| (0.0050) | (0.0081) | |

| LnRevenue | 0.0033 | 0.0110 * |

| (0.0038) | (0.0063) | |

| LnTop5 | 0.1048 *** | 0.0577 |

| (0.0230) | (0.0353) | |

| LnListAge | 0.0533 *** | 0.0018 |

| (0.0117) | (0.0172) | |

| Firm_fixed effects | YES | YES |

| Year_fixed effects | YES | YES |

| Industry_fixed effects | YES | YES |

| _cons | −2.8944 *** | 1.9927 ** |

| (0.4694) | (0.7744) | |

| N | 34,145 | 34,145 |

| r2 | 0.1847 | 0.0571 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| LnStability | LnStability | LnFlexibility | LnFlexibility | |

| LnSCSR | 0.0921 *** | 0.0041 *** | ||

| (0.0306) | (0.0007) | |||

| LnRCSR | 0.0372 ** | −0.0001 | ||

| (0.0165) | (0.0003) | |||

| LnSize | −0.5714 | −0.5158 | 0.0699 *** | 0.0752 *** |

| (0.3492) | (0.3499) | (0.0068) | (0.0068) | |

| LnLev | 0.0765 ** | 0.0636 ** | −0.0010 * | −0.0016 *** |

| (0.0311) | (0.0309) | (0.0006) | (0.0006) | |

| LnROA | 0.0638 *** | 0.0720 *** | 0.0010 *** | 0.0012 *** |

| (0.0179) | (0.0180) | (0.0003) | (0.0003) | |

| LnCashflow | 0.0498 *** | 0.0490 *** | 0.0006 * | 0.0007 * |

| (0.0187) | (0.0187) | (0.0004) | (0.0004) | |

| LnRevenue | 0.0125 | 0.0117 | 0.0003 | 0.0002 |

| (0.0160) | (0.0160) | (0.0003) | (0.0003) | |

| LnTop5 | 0.1019 ** | 0.1075 ** | −0.0023 ** | −0.0019 * |

| (0.0511) | (0.0511) | (0.0010) | (0.0010) | |

| LnListAge | 0.1256 *** | 0.1180 *** | 0.0031 *** | 0.0029 *** |

| (0.0399) | (0.0399) | (0.0008) | (0.0008) | |

| Firm_fixed effects | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES |

| Industry_fixed effects | YES | YES | YES | YES |

| _cons | 1.2232 | 1.1643 | 3.3053 *** | 3.2966 *** |

| (1.0972) | (1.1007) | (0.0215) | (0.0215) | |

| N | 34,145 | 34,145 | 34,145 | 34,145 |

| r2 | 0.0175 | 0.0174 | 0.0452 | 0.0438 |

| Models | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| LnGrowth | LnGrowth | LnVolatility | LnVolatility | |

| LnSCSR | 0.0863 *** | −0.0617 *** | ||

| (0.0150) | (0.0051) | |||

| LnRCSR | −0.0224 *** | 0.0199 *** | ||

| (0.0081) | (0.0023) | |||

| LnSize | 13.8375 *** | 13.8967 *** | −0.8552 *** | −0.8902 *** |

| (0.1861) | (0.1858) | (0.0532) | (0.0532) | |

| LnLev | 0.1357 *** | 0.1239 *** | 0.0253 *** | 0.0335 *** |

| (0.0160) | (0.0159) | (0.0045) | (0.0045) | |

| LnROA | 0.1507 *** | 0.1568 *** | 0.0177 *** | 0.0131 *** |

| (0.0091) | (0.0091) | (0.0028) | (0.0028) | |

| LnCashflow | −0.0094 | −0.0099 | 0.0007 | 0.0013 |

| (0.0097) | (0.0097) | (0.0030) | (0.0030) | |

| LnRevenue | 0.1253 *** | 0.1246 *** | 0.0400 *** | 0.0404 *** |

| (0.0078) | (0.0078) | (0.0024) | (0.0024) | |

| LnTop5 | 0.1568 *** | 0.1643 *** | −0.0481 *** | −0.0527 *** |

| (0.0255) | (0.0255) | (0.0079) | (0.0079) | |

| LnListAge | −0.8262 *** | −0.8347 *** | −0.0713 *** | −0.0645 *** |

| (0.0181) | (0.0182) | (0.0047) | (0.0047) | |

| Firm_fixed effects | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES |

| _cons | −38.9184 *** | −38.9751 *** | 0.8179 *** | 0.8419 *** |

| (0.5823) | (0.5824) | (0.1669) | (0.1672) | |

| N | 34,145 | 34,145 | 34,145 | 34,145 |

| r2 | 0.2693 | 0.2688 | 0.3194 | 0.3167 |

| LLC | ||

|---|---|---|

| Variables | Adjusted t | p-Value |

| LnSCSR | −32.8413 | 0.0000 |

| LnRCSR | −1.90 × 102 | 0.0000 |

| LnPensions | −1.30 × 102 | 0.0000 |

| LnGrowth | −1.50 × 102 | 0.0000 |

| LnVolatility | −1.00 × 102 | 0.0000 |

| Dependent Variables | Independent Variables | Modified Phillips–Perron t | Phillips–Perron t | Augmented Dickey–Fuller t |

|---|---|---|---|---|

| LnSCSR | LnPensions | 23.664 *** | −87.9911 *** | −67.5438 *** |

| (0.0000) | (0.0000) | (0.0000) | ||

| LnRCSR | LnPensions | 3.8255 *** | −138.5295 *** | −152.3568 *** |

| (0.0001) | (0.0000) | (0.0000) | ||

| LnGrowth | LnSCSR | 34.9716 *** | −59.6715 *** | −92.7945 *** |

| (0.0000) | (0.0000) | (0.0000) | ||

| LnGrowth | LnRCSR | 34.709 *** | −58.5468 *** | −97.2845 *** |

| (0.0000) | (0.0000) | (0.0000) | ||

| LnVolatility | LnSCSR | 11.5928 *** | −109.5435 *** | −124.4538 *** |

| (0.0000) | (0.0000) | (0.0000) | ||

| LnVolatility | LnRCSR | 14.915 *** | −99.3537 *** | −119.6057 *** |

| (0.0000) | (0.0000) | (0.0000) |

| Models | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| LnPensions | LnSCSR | LnRCSR | LnGrowth | LnVolatility | |

| Lnsocial | 0.4905 | ||||

| (0.0500) | |||||

| LnPensions | 0.0272 *** | −0.0115 *** | |||

| (0.0048) | (0.0025) | ||||

| Lnadmi | 0.0118 *** | ||||

| (0.0034) | |||||

| Lnselling | 0.1035 ** | ||||

| (0.0424) | |||||

| LnSCSR | 5.5347 *** | −2.8605 *** | |||

| (0.8345) | (0.8345) | ||||

| LnRCSR | −1.8636 *** | 0.0527 *** | |||

| (0.5150) | (0.0156) | ||||

| Controls | YES | YES | YES | YES | YES |

| Firm_fixed effects | YES | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES | YES |

| Models | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| LnSCSR | LnRCSR | LnGrowth | LnGrowth | LnVolatility | LnVolatility | |

| LnSCSR | 2.9636 *** | −0.9414 *** | ||||

| (0.0000) | (0.0000) | |||||

| L1.LnSCSR | 0.2206 *** | −0.9219 | 0.0953 | |||

| (0.0000) | (0.1600) | (0.3910) | ||||

| L2.LnSCSR | −0.0275 ** | 0.0301 | −0.0041 | |||

| (0.0250) | (0.8460) | (0.8090) | ||||

| LnPensions | 0.0100 *** | −0.2760 *** | ||||

| (0.0000) | (0.0000) | |||||

| L1.LnPensions | −0.0022 *** | −0.0363 | ||||

| (0.0000) | (0.3900) | |||||

| L2.LnPensions | 0.0003 *** | 0.0133 | ||||

| (0.0027) | (0.5150) | |||||

| LnRCSR | −0.0100 *** | 0.7728 *** | ||||

| (0.0000) | (0.0000) | |||||

| L1.LnRCSR | 0.0843 | 5.85 × 10−6 | −0.1534 | |||

| (0.1150) | (0.8640) | (0.1410) | ||||

| L2.LnRCSR | 0.0297 | 9.58 × 10−7 | −0.0856 | |||

| (0.2100) | (0.8970) | (0.1170) | ||||

| L1.LnGrowth | 0.1861 ** | 0.0003 | ||||

| (0.0260) | (0.9360) | |||||

| L2.LnGrowth | −0.0012 | 0.0001 | ||||

| (0.9600) | (0.8900) | |||||

| L1.LnVolatility | 0.0905 | 0.1703 * | ||||

| (0.4470) | (0.0810) | |||||

| L2.LnVolatility | −0.0048 | 0.0892 | ||||

| (0.7600) | (0.1100) | |||||

| Controls | YES | YES | YES | YES | YES | YES |

| Firm_fixed effects | YES | YES | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES | YES | YES |

| AR (1) test z-value | 0.000 | 0.000 | 0.002 | 0.000 | 0.003 | 0.000 |

| AR (2) test z-value | 0.118 | 0.533 | 0.406 | 0.382 | 0.954 | 0.460 |

| Hansen test chi2-value | 0.388 | 0.248 | 0.735 | 0.713 | 0.593 | 0.805 |

| Model | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| LnSCSR | LnGrowth | LnGrowth | LnVolatility | LnVolatility | |

| LnPensions | 0.0094 *** | 0.0243 *** | 0.0234 *** | 0.0004 | 0.0001 |

| (0.0029) | (0.0076) | (0.0076) | (0.0023) | (0.0023) | |

| LnSCSR | 0.0963 *** | −0.0386 *** | |||

| (0.0269) | (0.0090) | ||||

| _cons | 0.2680 | −31.2977 *** | −31.3235 *** | −1.4512 *** | −1.4409 *** |

| (0.4166) | (1.3376) | (1.3367) | (0.3275) | (0.3280) | |

| Controls | Yes | Yes | Yes | Yes | Yes |

| Firm_fixed | Yes | Yes | Yes | Yes | Yes |

| Year_fixed | Yes | Yes | Yes | Yes | Yes |

| N | 34,145 | 34,145 | 34,145 | 34,145 | 34,145 |

| r2 | 0.1389 | 0.1593 | 0.1601 | 0.3706 | 0.3719 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| LnRCSR | LnGrowth | LnGrowth | LnVolatility | LnVolatility | |

| LnPensions | −0.0153 *** | 0.0243 *** | 0.0238 *** | 0.0004 | 0.0003 |

| (0.0045) | (0.0076) | (0.0076) | (0.0023) | (0.0013) | |

| LnRCSR | −0.0356 ** | 0.0057 * | |||

| (0.0159) | (0.0029) | ||||

| _cons | 3.2501 *** | −31.2977 *** | −31.1821 *** | −1.4512 *** | −1.4328 *** |

| (0.6606) | (1.3376) | (1.3372) | (0.3275) | (0.2252) | |

| Controls | Yes | Yes | Yes | Yes | Yes |

| Firm_fixed | Yes | Yes | Yes | Yes | Yes |

| Year_fixed | Yes | Yes | Yes | Yes | Yes |

| N | 34,145 | 34,145 | 34,145 | 34,145 | 34,145 |

| r2 | 0.0495 | 0.1593 | 0.1596 | 0.3706 | 0.3707 |

| Dependent Variables | Independent Variables | HPJ Wald Test | p_Value_HPJ | Coefficient (p > |z|) |

|---|---|---|---|---|

| LnSCSR | L.LnPensions | 17.8949 | 0.0001 | 1.40 × 10−8 *** |

| (0.000) | ||||

| LnRCSR | L.LnPensions | 5.0 × 103 | 0.0000 | −6.45 × 10−8 *** |

| (0.000) | ||||

| LnGrowth | L.LnSCSR | 28.6597 | 0.0000 | 2.6787 *** |

| (0.000) | ||||

| LnGrowth | L.LnRCSR | 14.7444 | 0.0006 | −41.6031 *** |

| (0.004) | ||||

| LnVolatility | L.LnSCSR | 28.9465 | 0.0000 | −0.8819 *** |

| (0.000) | ||||

| LnVolatility | L.LnRCSR | 76.6644 | 0.0000 | 0.0869 *** |

| (0.005) |

| Models | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| LnSCSR | LnSCSR | LnRCSR | LnRCSR | |

| Lnmiwage*Lnpensions | −0.0404 *** | −0.4959 *** | ||

| (0.0132) | (0.0260) | |||

| Lnaging*Lnpensions | −0.0144 ** | −0.0967 *** | ||

| (0.0065) | (0.0103) | |||

| LnSize | 0.4663 *** | 0.4742 *** | −0.5886 *** | −0.4903 ** |

| (0.1365) | (0.1367) | (0.2104) | (0.2143) | |

| LnLev | −0.1116 *** | −0.1115 *** | −0.0113 | −0.0157 |

| (0.0108) | (0.0108) | (0.0160) | (0.0162) | |

| LnROA | 0.0424 *** | 0.0423 *** | −0.0905 *** | −0.0904 *** |

| (0.0055) | (0.0055) | (0.0085) | (0.0087) | |

| LnCashflow | −0.0066 | −0.0066 | 0.0288 *** | 0.0308 *** |

| (0.0051) | (0.0051) | (0.0078) | (0.0080) | |

| LnRevenue | 0.0047 | 0.0048 | 0.0123 ** | 0.0129 ** |

| (0.0038) | (0.0038) | (0.0060) | (0.0062) | |

| LnTop5 | 0.1676 *** | 0.1704 *** | 0.0439 | 0.0733 ** |

| (0.0226) | (0.0227) | (0.0333) | (0.0341) | |

| LnListAge | −0.0413 *** | −0.0409 *** | −0.0310 ** | −0.0279 * |

| (0.0102) | (0.0102) | (0.0155) | (0.0158) | |

| Firm_fixed effects | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES |

| _cons | 3.1684 ** | 0.6283 | 55.8966 *** | 5.2630 *** |

| (1.5340) | (0.4428) | (2.9628) | (0.7040) | |

| N | 34,145 | 34,145 | 34,145 | 34,145 |

| r2 | 0.1403 | 0.1396 | 0.0939 | 0.0592 |

| Model | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| LnStability | LnStability | LnStability | LnStability | LnFlexibility | LnFlexibility | LnFlexibility | LnFlexibility | |

| LnDigitaltrans*LnSCSR | 8.5493 *** | 9.9694 *** | ||||||

| (0.5621) | (0.0036) | |||||||

| LnDigitaltrans*LnRCSR | 2.6108 *** | 5.1581 *** | ||||||

| (0.2870) | (0.0561) | |||||||

| LnCmkt*LnSCSR | 13.6306 *** | 0.1004 ** | ||||||

| (0.4437) | (0.0436) | |||||||

| LnCmkt*LnRCSR | 3.7790 *** | 0.0516 ** | ||||||

| (0.1419) | (0.0227) | |||||||

| LnSize | −0.0018 | −0.0005 | −0.0074 ** | −0.0084 ** | 0.0403 *** | 0.0568 *** | 0.0455 *** | 0.0516 *** |

| (0.0033) | (0.0033) | (0.0032) | (0.0033) | (0.0004) | (0.0045) | (0.0070) | (0.0070) | |

| LnLev | 0.0005 | 0.0004 | −0.0004 | −0.0001 | −0.0011 *** | −0.0020 *** | −0.0007 | −0.0015 *** |

| (0.0003) | (0.0003) | (0.0003) | (0.0003) | (0.0000) | (0.0004) | (0.0006) | (0.0006) | |

| LnROA | 0.0005 *** | 0.0006 *** | 0.0003 * | 0.0005 ** | 0.0017 *** | 0.0024 *** | 0.0018 *** | 0.0020 *** |

| (0.0002) | (0.0002) | (0.0002) | (0.0002) | (0.0000) | (0.0002) | (0.0003) | (0.0003) | |

| LnCashflow | 0.0005 *** | 0.0005 *** | 0.0004 ** | 0.0006 *** | 0.0005 *** | 0.0008 *** | 0.0006 * | 0.0007 * |

| (0.0002) | (0.0002) | (0.0002) | (0.0002) | (0.0000) | (0.0003) | (0.0004) | (0.0004) | |

| LnRevenue | 0.0002 | 0.0002 | 0.0003 * | 0.0003 * | 0.0002 *** | 0.0003 | 0.0002 | 0.0001 |

| (0.0002) | (0.0002) | (0.0001) | (0.0002) | (0.0000) | (0.0002) | (0.0003) | (0.0003) | |

| LnTop5 | 0.0006 | 0.0008 | 0.0011 ** | 0.0003 | −0.0044 *** | −0.0046 *** | −0.0039 *** | −0.0031 *** |

| (0.0005) | (0.0005) | (0.0005) | (0.0005) | (0.0001) | (0.0007) | (0.0010) | (0.0010) | |

| LnListAge | 0.0014 *** | 0.0012 *** | 0.0014 *** | 0.0010 *** | 0.0015 *** | 0.0008 | 0.0014 * | 0.0013 * |

| (0.0004) | (0.0004) | (0.0004) | (0.0004) | (0.0000) | (0.0005) | (0.0008) | (0.0008) | |

| Firm_fixed effects | YES | YES | YES | YES | YES | YES | YES | YES |

| Year_fixed effects | YES | YES | YES | YES | YES | YES | YES | YES |

| _cons | 0.0074 | −0.0011 | −0.3008 *** | −0.0552 *** | 3.4073 *** | 3.3997 *** | 3.3983 *** | 3.3785 *** |

| (0.0104) | (0.0105) | (0.0151) | (0.0114) | (0.0011) | (0.0141) | (0.0256) | (0.0233) | |

| N | 34,145 | 34,145 | 34,145 | 34,145 | 34,145 | 34,145 | 34,145 | 34,145 |

| r2 | 0.0099 | 0.0043 | 0.1351 | 0.0416 | 0.9966 | 0.5160 | 0.0065 | 0.0044 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, H.; Zhang, T.; Wang, X.; Zheng, J. Relationship between Occupational Pension, Corporate Social Responsibility (CSR), and Organizational Resilience: A Study on Listed Chinese Companies. Risks 2024, 12, 65. https://doi.org/10.3390/risks12040065

Wang H, Zhang T, Wang X, Zheng J. Relationship between Occupational Pension, Corporate Social Responsibility (CSR), and Organizational Resilience: A Study on Listed Chinese Companies. Risks. 2024; 12(4):65. https://doi.org/10.3390/risks12040065

Chicago/Turabian StyleWang, Hao, Tao Zhang, Xi Wang, and Jiansong Zheng. 2024. "Relationship between Occupational Pension, Corporate Social Responsibility (CSR), and Organizational Resilience: A Study on Listed Chinese Companies" Risks 12, no. 4: 65. https://doi.org/10.3390/risks12040065

APA StyleWang, H., Zhang, T., Wang, X., & Zheng, J. (2024). Relationship between Occupational Pension, Corporate Social Responsibility (CSR), and Organizational Resilience: A Study on Listed Chinese Companies. Risks, 12(4), 65. https://doi.org/10.3390/risks12040065