Risk Management in the Area of Bitcoin Market Development: Example from the USA

Abstract

:1. Introduction

2. Literature Review

2.1. Risk and Investment Capital Management on the Cryptocurrency Exchange

2.2. Uncertainties and Risks

2.3. Bitcoin Return Relationship with Economic Uncertainty

2.4. Economic Uncertainty, Inflation, and Bitcoin Return

2.5. Legal Risk in Risk Management

3. Research Methods

3.1. Economic Policy Uncertainty in the USA

3.2. Current Crypto Market in USA

3.3. Inflation in the USA

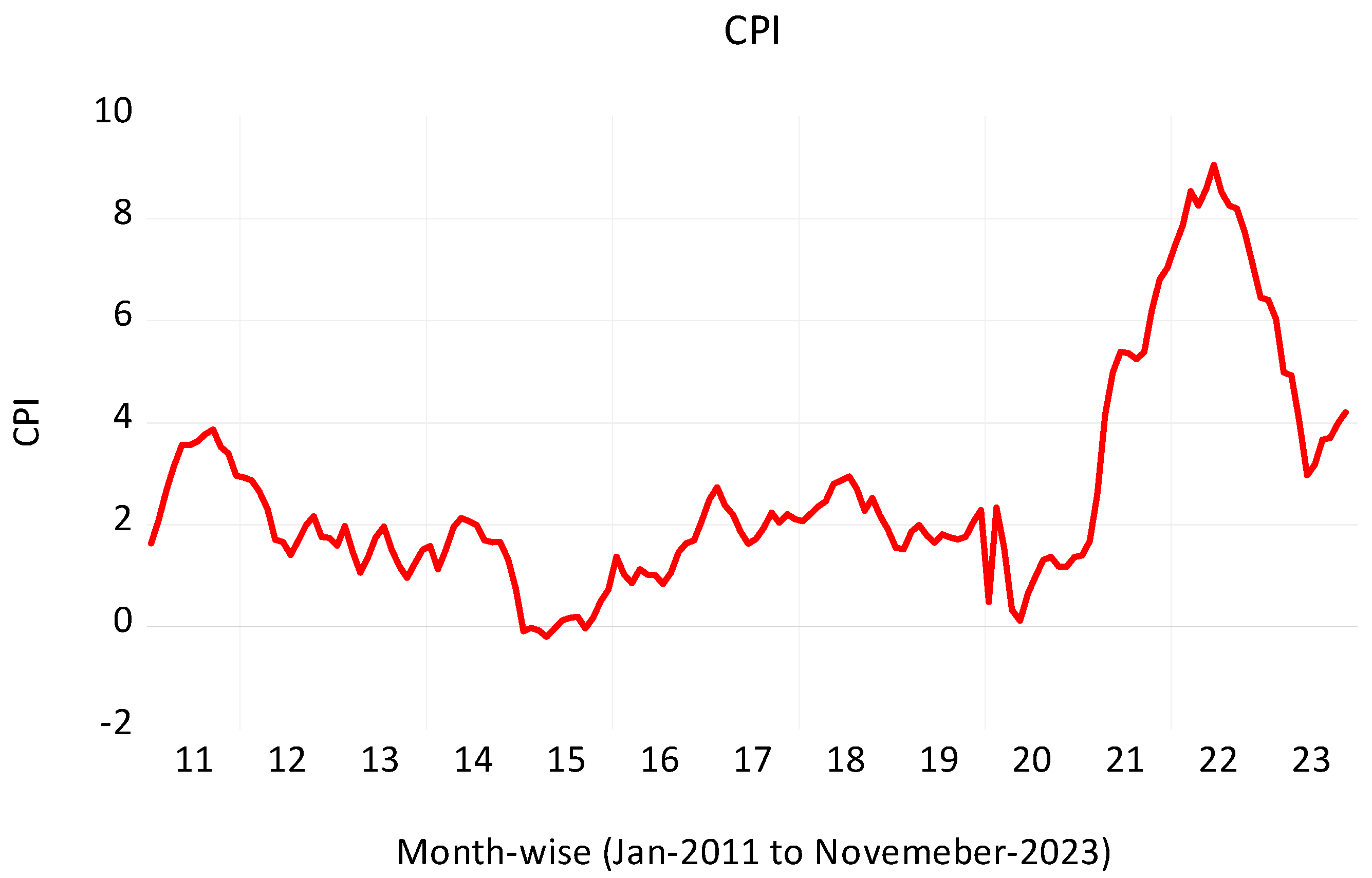

3.4. Empirical Analysis

3.5. Unit Root Tests

3.6. Augmented Dickey–Fuller (ADF) Unit Root Test

3.7. Phillips–Perron (PP) Unit Root Test

3.8. QARDL

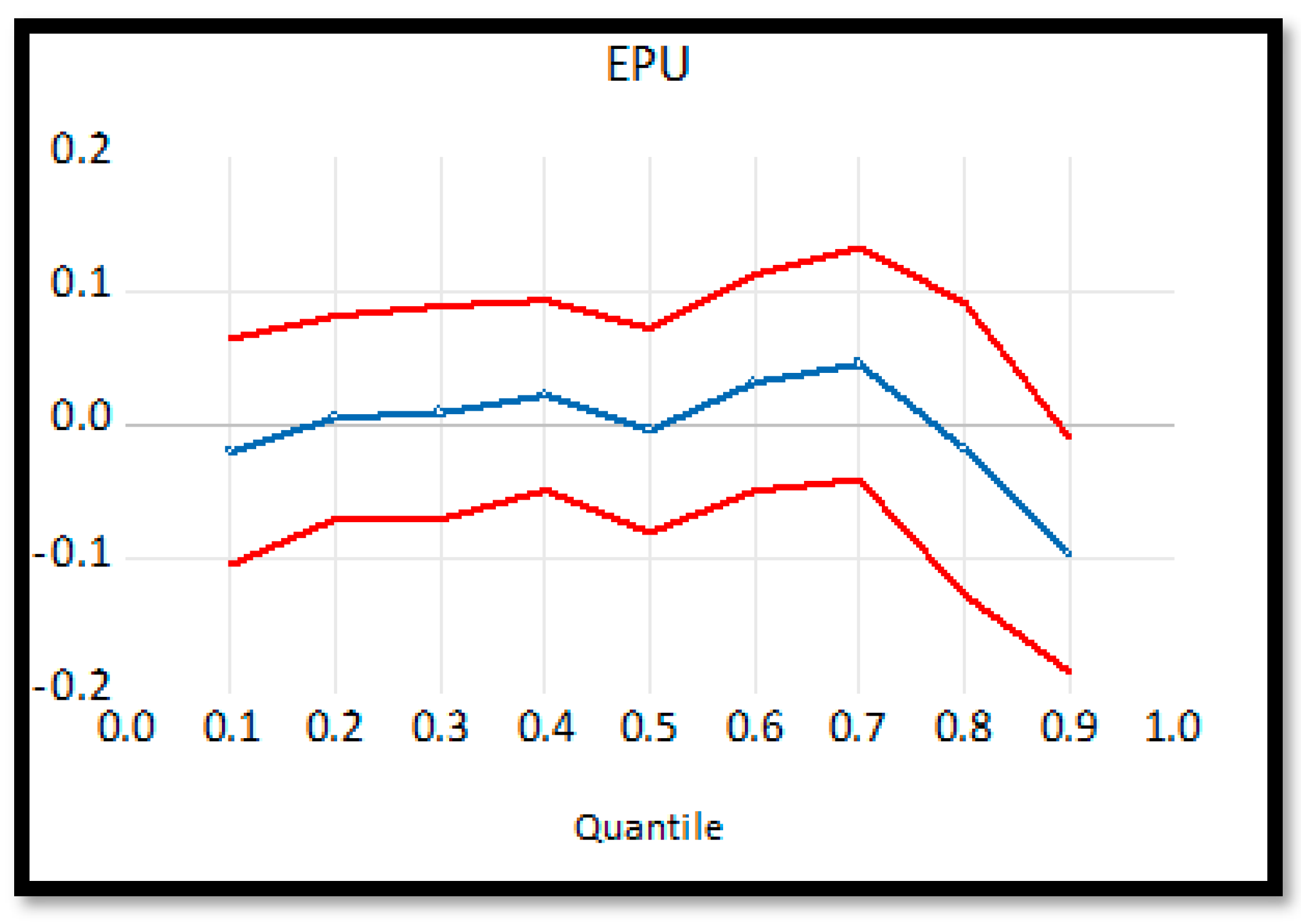

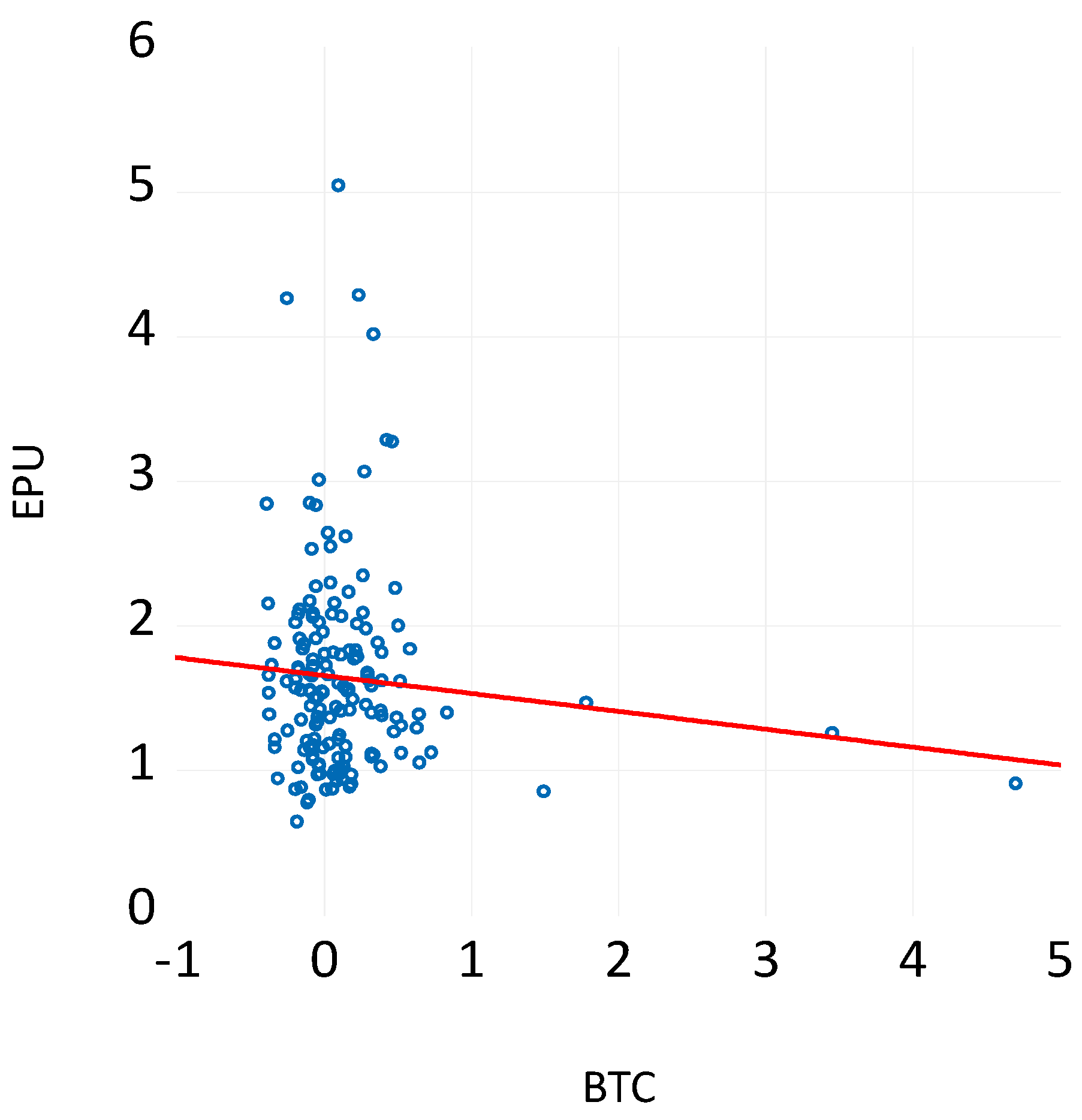

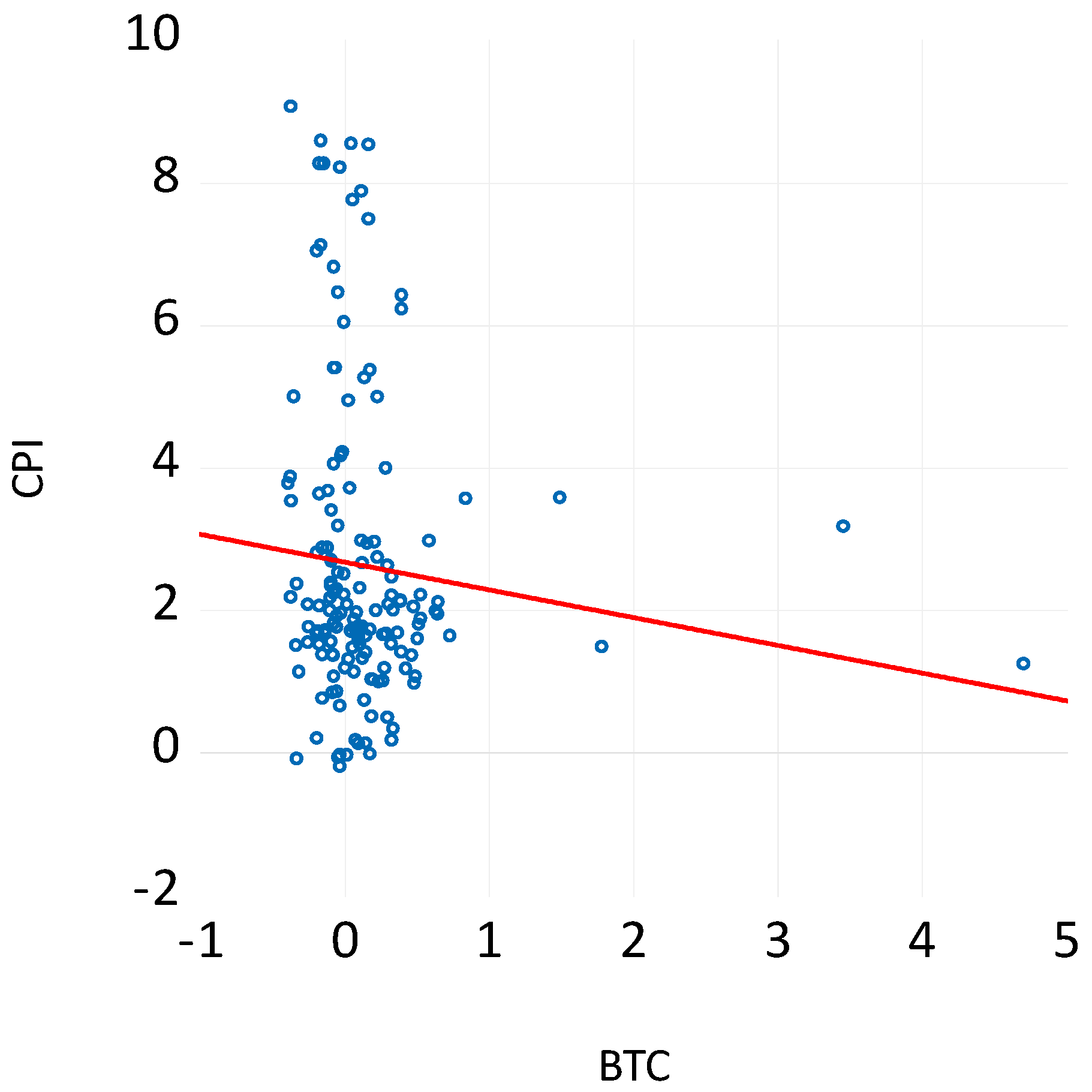

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | CFD stands for Contract for Difference. A CFD is a contract between two parties that undertakes to settle an amount equal to the difference between the opening and closing prices of a position. Hence the term “contract for difference”—http://www.xtb.com (accessed on 1 November 2023). |

| 2 | Phillips and Perron (1988) stated that there were essential findings that the assumptions of the DF test were wrong. |

| 3 | Phillips and Perron (1988) did not recommend using the PP test in a model with harmful moving average components, as it causes dimensionality-skewness. |

References

- Aiello, Darren, Scott R. Baker, Tetyana Balyuk, Marco Di Maggio, Mark Johnson, and Jason D. Kotter. 2023. Who Invests in Crypto? Wealth, Financial Constraints, and Risk Attitudes. Working Paper 31856. Cambridge: National Bureau of Economics. Available online: https://www.nber.org/papers/w31856 (accessed on 8 January 2024).

- Almeida, Dora, Andreia Dionísio, Isabel Vieira, and Paulo Ferreira. 2022. Uncertainty and risk in the cryptocurrency market. Journal of Risk and Financial Management 15: 532. [Google Scholar] [CrossRef]

- Almeida, José, and Tiago Cruz Gonçalves. 2023. Portfolio Diversification, Hedge and Safe-Haven Properties in Cryptocurrency Investments and Financial Economics: A Systematic Literature Review. Journal of Risk and Financial Management 16: 3. [Google Scholar] [CrossRef]

- Alvarez, Michelle. 2018. A comparative analysis of cryptocurrency regulation in the United States, Nigeria, and China: The potential influence of illicit activities on regulatory evolution. ILSA Journal of International and Comparative Law 25: 33. [Google Scholar]

- Amoroso, Donald, and Rémy Magnier-Watanabe. 2012. Building a research model for mobile wallet consumer adoption: The case of mobile Suica in Japan. Journal of Theoretical and Applied Electronic Commerce Research 7: 94–110. [Google Scholar] [CrossRef]

- Apostu, Simona Andreea, Mirela Panait, Iza Gigauri, and Valentina Vasile. 2023. Foreign Direct Investment and Competitiveness. Evidences from Romanian Economy. LUMEN Proceedings 19: 36–47. [Google Scholar] [CrossRef]

- Arsi, Sonia, Soumaya Ben Khelifa, Yosra Ghabri, and Hela Mzoughi. 2022. Cryptocurrencies: Key risks and challenges. In Cryptofinance: A New Currency for a New Economy. Singapore: World Scientific Publishing Company, pp. 121–45. [Google Scholar]

- Auboin, Marc, and Michele Ruta. 2011. The relationship between exchange rates and international trade: A review of economic literature. World Trade Review 12: 577–605. [Google Scholar] [CrossRef]

- Auer, Raphael, Giulio Cornelli, and Jon Frost. 2020. Rise of the Central Bank Digital Currencies: Drivers, Approaches and Technologies. CESifo Working Paper No. 8655. Available online: https://www.cesifo.org/DocDL/cesifo1_wp8655.pdf (accessed on 14 February 2024).

- Aysan, Ahmet Faruk, Ender Demir, Giray Gozgor, and Chi Keung Marco Lau. 2019. Effects of the geopolitical risks on Bitcoin returns and volatility. Research in International Business and Finance 47: 511–18. [Google Scholar] [CrossRef]

- Baer, Katherine, Ruud De Mooij, Shafik Hebous, and Michael Keen. 2023. Taxing cryptocurrencies. Oxford Review of Economic Policy 39: 478–97. [Google Scholar] [CrossRef]

- Barnett, William A., Fredj Jawadi, and Zied Ftiti. 2020. Causal relationships between inflation and inflation uncertainty. Studies in Nonlinear Dynamics & Econometrics 24: 20190094. [Google Scholar]

- Bianchi, Daniele. 2020. Cryptocurrencies as an asset class? An empirical assessment. The Journal of Alternative Investments 23: 162–79. [Google Scholar] [CrossRef]

- Blandin, Apolline, Ann Sofie Cloots, Hatim Hussain, Michel Rauchs, Rasheed Saleuddin, Jason G. Allen, Bryan Zheng Zhang, and Katherine Cloud. 2020. Global Cryptoasset Regulatory Landscape Study. Cambridge: Cambridge Centre for Alternative Finance. [Google Scholar]

- Bloom, Nicholas. 2014. Fluctuations in uncertainty. Journal of Economic Perspectives 28: 153–76. [Google Scholar] [CrossRef]

- Bouri, Elie, Rangan Gupta, Amine Lahiani, and Muhammad Shahbaz. 2018. Testing for asymmetric nonlinear short-and long-run relationships between bitcoin, aggregate commodity and gold prices. Resources Policy 57: 224–35. [Google Scholar] [CrossRef]

- Bruhn, Pascal, and Dietmar Ernst. 2022. Assessing the Risk Characteristics of the Cryptocurrency Market: A GARCH-EVT-Copula Approach. Journal of Risk and Financial Management 15: 346. [Google Scholar] [CrossRef]

- Chen, Yan, and Cristiano Bellavitis. 2020. Blockchain disruption and decentralized finance: The rise of decentralized business models. Journal of Business Venturing Insights 13: e00151. [Google Scholar] [CrossRef]

- Chiu, Jonathan, and Thorsten V. Koeppl. 2022. The economics of cryptocurrency: Bitcoin and beyond. Canadian Journal of Economics/Revue Canadienne D’économique 55: 1762–98. [Google Scholar] [CrossRef]

- Cho, Jin Seo, Tae-hwan Kim, and Yongcheol Shin. 2015. Quantile cointegration in the autoregressive distributed-lag modeling framework. Journal of Econometrics 188: 281–300. [Google Scholar] [CrossRef]

- Choi, Jin Seo, Tae-hwan Kim, and Yongcheol. 2022. Bitcoin: An inflation hedge but not a safe haven. Finance Research Letters 46: 102379. [Google Scholar] [CrossRef]

- Chong, Yen Yee. 2004. Investment Risk Management. Hoboken, NJ: John Wiley & Sons. [Google Scholar]

- Chokor, Ahmad, and Elise Alfieri. 2021. The Quarterly Review of Economics and Finance Long and short-term impacts of regulation in the cryptocurrency market. The Quarterly Review of Economics and Finance 81: 157–73. [Google Scholar] [CrossRef]

- Chu, Jeffrey, Stephen Chan, Saralees Nadarajah, and Joerg Osterrieder. 2017. GARCH Modelling of Cryptocurrencies. Journal of Risk and Financial Management 10: 17. [Google Scholar] [CrossRef]

- Claeys, Grégory, Maria Demertzis, and Konstantinos Efstathiou. 2018. Cryptocurrencies and Monetary Policy. (No. 2018/10). Bruegel: Bruegel Policy Contribution. [Google Scholar]

- Cogley, Timothy, and Thomas J. Sargent. 2005. Cogley, Timothy, and Thomas J. Sargent. 2005. The conquest of US inflation: Learning and robustness to model uncertainty. Review of Economic Dynamics 8: 528–63. [Google Scholar] [CrossRef]

- Corbet, Shaen, Brian Lucey, Andrew Urquhart, and Larisa Yarovaya. 2019. Cryptocurrencies as a financial asset: A systematic analysis. International Review of Financial Analysis 62: 182–99. [Google Scholar] [CrossRef]

- Corbet, Shaen, Charles Larkin, Brian M. Lucey, Andrew Meegan, and Larisa Yarovaya. 2020. The impact of macroeconomic news on Bitcoin returns. The European Journal of Finance 26: 1396–416. [Google Scholar] [CrossRef]

- Cumming, Douglas J., Sofia Johan, and Anshum Pant. 2019. Regulation of the crypto-economy: Managing risks, challenges, and regulatory uncertainty. Journal of Risk and Financial Management 12: 126. [Google Scholar] [CrossRef]

- De Maria, Marcus. 2017. Profiting From Cryptocurrencies. The Lunchtime Trader. Available online: https://investmentmastery.b-cdn.net/Profiting%20from%20Cryptocurrencies%20by%20Marcus%20de%20Maria-v2.pdf (accessed on 2 December 2023).

- De Vries, Jan. 2013. Between purchasing power and the world of goods: Understanding the household economy in early modern Europe. In Consumption and the World of Goods. London: Routledge, pp. 85–132. [Google Scholar]

- Demir, Ender, Giray Gozgor, Chi Keung Marco Lau, and Samuel A. Vigne. 2018. Does economic policy uncertainty predict the Bitcoin returns? An empirical investigation. Finance Research Letters 26: 145–49. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 49: 1057–72. [Google Scholar] [CrossRef]

- Durst, Susanne, and Malgorzata Zieba. 2020. Durst, Susanne, and Malgorzata Zieba. 2020. Knowledge risks inherent in business sustainability. Journal of Cleaner Production 251: 119670. [Google Scholar] [CrossRef]

- Dyhrberg, Anne Haubo. 2016. Bitcoin, gold and the dollar—A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef]

- Erinle, Yimika, Yathin Kethepalli, Yebo Feng, and Jiahua Xu. 2023. SoK: Design, Vulnerabilities and Defense of Cryptocurrency Wallets. arXiv arXiv:2307.12874. [Google Scholar]

- Fan, Shuhui, Shaojing Fu, Haoran Xu, and Xiaochun Cheng. 2021. Al-SPSD: Anti-leakage smart Ponzi schemes detection in blockchain. Information Processing & Management 58: 102587. [Google Scholar] [CrossRef]

- Faraji-Rad, Ali, and Michel Tuan Pham. 2017. Uncertainty increases the reliance on affect in decisions. Journal of Consumer Research 44: 1–21. [Google Scholar] [CrossRef]

- Garrido, José. 2023. Digital Tokens: A Legal Perspective. IMF Working Paper, WP/23/151. International Monetary Fund, (Working Paper No. 2023/151). Available online: https://www.imf.org/en/Publications/WP/Issues/2023/07/28/Digital-Tokens-A-Legal-Perspective-537041 (accessed on 1 November 2023).

- Ghosh, Arunima, Shashank Gupta, Amit Dua, and Neeraj Kumar. 2020. Security of Cryptocurrencies in blockchain technology: State-of-art, challenges and future prospects. Journal of Network and Computer Applications 163: 102635. [Google Scholar] [CrossRef]

- Gigauri, Iza, Laeeq Razzak Janjua, Mirela Panait, and Felix Puime Guillen. 2023. Exploring The Nexus Between Financial Inclusion, Poverty, Digitalization And Sustainable Development Goal. LUMEN Proceedings 19: 63–81. [Google Scholar] [CrossRef]

- Guseva, Alya, and Akos Rona-Tas. 2001. Uncertainty, risk, and trust: Russian and American credit card markets compared. American Sociological Review 66: 623–46. [Google Scholar] [CrossRef]

- Hacioglu, Umit, Dounia Chlyeh, Mustafa K. Yilmaz, Ekrem Tatoglu, and Dursun Delen. 2021. Crafting performance-based cryptocurrency mining strategies using a hybrid analytics approach. Decision Support Systems 142: 113473. [Google Scholar] [CrossRef]

- Hairudin, Aiman, Imtiaz Mohammad Sifat, Azhar Mohamad, and Yusniliyana Yusof. 2022. Cryptocurrencies: A survey on acceptance, governance and market dynamics. International Journal of Finance & Economics 27: 4633–59. [Google Scholar]

- Haq, Inzamam Ul, Apichit Maneengam, Supat Chupradit, Wanich Suksatan, and Chunhui Huo. 2021. Economic policy uncertainty and cryptocurrency market as a risk management avenue: A systematic review. Risks 9: 163. [Google Scholar] [CrossRef]

- Hasan, Md Bokhtiar, M. Kabir Hassan, Zulkefly Abdul Karim, and Md Mamunur Rashid. 2022. Exploring the hedge and safe haven properties of cryptocurrency in policy uncertainty. Finance Research Letters 46: 102272. [Google Scholar] [CrossRef]

- Higgins, Stan. 2017. From $900 to $20,000: Bitcoin’s Historic 2017 Price Run Revisited, CoinDesk. Available online: https://www.coindesk.com/ (accessed on 30 October 2023).

- Hon, Henry, Kevin Wang, Michael Bolger, William Wu, and Joy Zhou. 2022. Crypto Market Sizing. Global Crypto Owners Reaching 300 M. Crypto.com. Available online: https://assets.ctfassets.net/hfgyig42jimx/5i8TeN1QYJDjn82pSuZB5S/85c7c9393f3ee67e456ec780f9bf11e3/Cryptodotcom_Crypto_Market_Sizing_Jan2022.pdf (accessed on 28 October 2023).

- Hougan, Matt, and David Lawant. 2021. Cryptoassets: The Guide to Bitcoin, Blockchain, and Cryptocurrency for Investment Professionals. Charlottesville: CFA Institute Research Foundation. [Google Scholar]

- Iqbal, Najaf, Zeeshan Fareed, Guangcai Wan, and Farrukh Shahzad. 2021. Asymmetric nexus between COVID-19 outbreak in the world and cryptocurrency market. International Review of Financial Analysis 73: 101613. [Google Scholar] [CrossRef]

- Jermann, Urban J. 2021. Cryptocurrencies and Cagan’s model of hyperinflation. Journal of Macroeconomics 69: 103340. [Google Scholar] [CrossRef]

- Kajtazi, Arton, and Andrea Moro. 2019. The role of bitcoin in well diversified portfolios: A comparative global study. International Review of Financial Analysis 61: 143–57. [Google Scholar] [CrossRef]

- Kalyvas, Antonios, Panayiotis Papakyriakou, Athanasios Sakkas, and Andrew Urquhart. 2020. What drives Bitcoin’s price crash risk? Economics Letters 191: 108777. [Google Scholar] [CrossRef]

- Khan, Khalid, Jiluo Sun, Sinem Derindere Koseoglu, and Ashfaq U. Rehman. 2021. Revisiting bitcoin price behavior under global economic uncertainty. Sage Open 11: 21582440211040411. [Google Scholar] [CrossRef]

- Kim, Jong-Min, Seong-Tae Kim, and Sangjin Kim. 2020. On the relationship of cryptocurrency price with us stock and gold price using copula models. Mathematics 8: 1859. [Google Scholar] [CrossRef]

- Koenker, Roger, and Gilbert Bassett, Jr. 1978. Regression quantiles. Econometrica: Journal of the Econometric Society 46: 33–50. [Google Scholar] [CrossRef]

- Koutmos, Dimitrios, Timothy King, and Constantin Zopounidis. 2021. Hedging uncertainty with cryptocurrencies: Is bitcoin your best bet? Journal of Financial Research 44: 815–37. [Google Scholar] [CrossRef]

- Kozak, Sylwester, and Seweryn Gajdek. 2021. Risk of investment in cryptocurrencies. Economic and Regional Studies 14: 294–304. [Google Scholar] [CrossRef]

- Kristoufek, Ladislav. 2015. What are the main drivers of the Bitcoin price? Evidence from wavelet coherence analysis. PLoS ONE 10: e0123923. [Google Scholar] [CrossRef]

- Lundström, Christian. 2019. Day Trading Returns Across Volatility States. IFTA Journal 19: 75–87. [Google Scholar]

- MacKinnon, James G. 1996. Numerical distribution functions for unit root and cointegration tests. Journal of Applied Econometrics 11: 601–18. [Google Scholar] [CrossRef]

- Makurin, Andriy. 2020. Economic and legal risk of cryptocurrency use. Economic Scope 161: 119–23. [Google Scholar] [CrossRef]

- Marella, Venkata, Bikesh Upreti, Jani Merikivi, and Virpi Kristiina Tuunainen. 2020. Understanding the creation of trust in cryptocurrencies: The case of Bitcoin. Electronic Markets 30: 259–71. [Google Scholar] [CrossRef]

- Mazur, Mieszko. 2022. Misperceptions of Bitcoin Volatility. The Journal of Alternative Investments 24: 33–44. [Google Scholar] [CrossRef]

- Mikhaylov, Alexey. 2020. Cryptocurrency market analysis from the open innovation perspective. Journal of Open Innovation: Technology, Market, and Complexity 6: 197. [Google Scholar] [CrossRef]

- Mishchenko, Svitlana, Svitlana Naumenkova, Volodymyr Mishchenko, and Dmytro Dorofeiev. 2021. Innovation risk management in financial institutions. Investment Management and Financial Innovations 18: 191–203. [Google Scholar] [CrossRef]

- Obstfeld, Maurice. 2019. Global Dimensions of US Monetary Policy. International Journal of Central Banking 16: 73–132. [Google Scholar] [CrossRef]

- Omari, Cyprian, and Anthony Ngunyi. 2021. The predictive performance of extreme value analysis based-models in forecasting the volatility of cryptocurrencies. Journal of Mathematical Finance 11: 438–65. [Google Scholar] [CrossRef]

- Orphanides, Athanasios. 2004. Monetary policy rules, macroeconomic stability, and inflation: A view from the trenches. Journal of Money, Credit and Banking 36: 151–75. [Google Scholar] [CrossRef]

- Papic, Marko. 2020. Geopolitical Alpha: An Investment Framework for Predicting the Future. Hoboken: John Wiley & Sons. [Google Scholar]

- Perron, Pierre. 1997. Further evidence on breaking trend functions in macroeconomic variables. Journal of Econometrics 80: 355–85. [Google Scholar] [CrossRef]

- Perkins, David W. 2020. Cryptocurrency: The Economics of Money and Selected Policy Issues; New York: Congressional Research Service, pp. 1–27.

- Pesaran, M. Hashem. 2015. Time Series and Panel Data Econometrics. Oxford: Oxford University Press. [Google Scholar]

- Pesaran, M. Hashem, and Yongcheol Shin. 1995. An Autoregressive Distributed lag Modelling Approach to Cointegration Analysis. Cambridge: Department of Applied Economics, University of Cambridge, vol. 9514. [Google Scholar]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Petropoulos, Fotios, Daniele Apiletti, Vassilios Assimakopoulos, Mohamed Zied Babai, Devon K. Barrow, Souhaib Ben Taieb, Christoph Bergmeir, Ricardo J. Bessa, Jakub Bijak, John E. Boylan, and et al. 2022. Forecasting: Theory and practice. International Journal of Forecasting 38: 705–871. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for Unit Roots in Time Series Regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Platanakis, Emmanouil, and Andrew Urquhart. 2020. Should investors include bitcoin in their portfolios? A portfolio theory approach. The British Accounting Review 52: 100837. [Google Scholar] [CrossRef]

- Rana, Meghavi, Sumedha Bhardwaj, Ishaan Dawar, Vipul Gupta, Shirshendu Layek, and Megha Bhushan. 2023. Risk Analysis for Cryptocurrency: Challenges and Future Scope. Paper presented at the 2023 3rd International Conference on Emerging Smart Technologies and Applications (eSmarTA), Taiz, Yemen, October 10–11; Taiz: IEEE, pp. 1–7. [Google Scholar]

- Rodgers, Tom. 2023. Six Cryptocurrency Tips (and Five Mistakes to Avoid), The Times, Money Mentor. Available online: https://www.thetimes.co.uk/money-mentor/investing/cryptocurrency/crypto-tips-mistakes (accessed on 17 November 2023).

- Rudys, Valentinas, and Daniel Svogun. 2023. Investing in cryptocurrencies with information costs. Applied Economics Letters, 1–4. [Google Scholar] [CrossRef]

- Sahid, Abdelkebir, Yassine Maleh, Shahram Atashi Asemanjerdi, and Pedro Antonio Martín-Cervantes. 2023. A Bibliometric Analysis of the FinTech Agility Literature: Evolution and Review. International Journal of Financial Studies 11: 123. [Google Scholar] [CrossRef]

- Sarker, Provash Kumer, and Lei Wang. 2022. Co-movement and Granger causality between Bitcoin and M2, inflation and economic policy uncertainty: Evidence from the UK and Japan. Heliyon 8: e11178. [Google Scholar] [CrossRef] [PubMed]

- Schmitz, Tim, and Ingo Hoffmann. 2020. Re-evaluating cryptocurrencies’ contribution to portfolio diversification—A portfolio analysis with special focus on German investors. arXiv arXiv:2006.06237. [Google Scholar] [CrossRef]

- Scott, Brett. 2016. How can Cryptocurrency and Blockchain technology play a role in building social and solidarity finance? United Nations Research Institute for Social Development 1: 17–564. [Google Scholar] [CrossRef]

- Sen, Ishita. 2023. Regulatory limits to risk management. The Review of Financial Studies 36: 2175–223. [Google Scholar] [CrossRef]

- Settembre-Blundo, Davide, Rocío González-Sánchez, Sonia Medina-Salgado, and Fernando E. García-Muiña. 2021. Flexibility and Resilience in Corporate Decision Making: A New Sustainability-Based Risk Management System in Uncertain Times. Global Journal of Flexible Systems Management 22: 107–32. [Google Scholar] [CrossRef]

- Shahbazi, Zeinab, and Yung- Cheol Byun. 2022. Machine learning-based analysis of cryptocurrency market financial risk management. IEEE Access 10: 37848–56. [Google Scholar] [CrossRef]

- Sharif, Arshian, Chaker Aloui, and Larisa Yarovaya. 2020. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis 70: 101496. [Google Scholar] [CrossRef]

- Smales, Lee A. 2022. Cryptocurrency as an alternative inflation hedge? Accounting & Finance. [Google Scholar] [CrossRef]

- Stavroyiannis, Stavros, and Vassilios Babalos. 2017. Dynamic properties of the Bitcoin and the US market. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Sun, Wei, Alisher Tohirovich Dedahanov, Ho Young Shin, and Ki Su Kim. 2020. Switching intention to crypto-currency market: Factors predisposing some individuals to risky investment. PLoS ONE 15: e0234155. [Google Scholar] [CrossRef] [PubMed]

- Tomić, Nenad, Violeta Todorović, and Božidar Čakajac. 2020. The potential effects of cryptocurrencies on monetary policy. The European Journal of Applied Economics 17: 37–48. [Google Scholar] [CrossRef]

- Tu, Kevin V., and Michael W. Meredith. 2015. Rethinking virtual currency regulation in the Bitcoin age. Washington Law Review 90: 271. [Google Scholar]

- Wang, Gang-Jin, Chi Xie, Danyan Wen, and Longfeng Zhao. 2019. When Bitcoin meets economic policy uncertainty (EPU): Measuring risk spillover effect from EPU to Bitcoin. Finance Research Letters 31. [Google Scholar] [CrossRef]

- Wang, Kevin. 2021. Measuring Global Crypto Users: A Study to Measure Market Size Using On-Chain Metrics. Crypto.com, July. Available online: https://crypto.com/images/202107_DataReport_OnChain_Market_Sizing.pdf (accessed on 1 November 2023).

- Won, Jonggwan, and Taeho Hong. 2021. The prediction of cryptocurrency on using text mining and deep learning techniques: Comparison of Korean and USA market. Knowledge Management Research 22: 1–17. [Google Scholar]

- Wu, Wanshan, Aviral Kumar Tiwari, Giray Gozgor, and Huang Leping. 2021. Does economic policy uncertainty affect cryptocurrency markets? Evidence from Twitter-based uncertainty measures. Research in International Business and Finance 58: 101478. [Google Scholar] [CrossRef]

- Yen, Kuang-Chieh, and Hui-Pei Cheng. 2021. Economic policy uncertainty and cryptocurrency volatility. Finance Research Letters 38: 101428. [Google Scholar] [CrossRef]

- Yurtkuran, Suleyman. 2021. The effect of agriculture, renewable energy production, and globalization on CO2 emissions in Türkiye: A bootstrap ARDL approach. Renewable Energy 171: 1236–45. [Google Scholar] [CrossRef]

- Zheng, Zibin, Shaoan Xie, Hongning Dai, Xiangping Chen, and Huaimin Wang. 2017. An Overview of Blockchain Technology: Architecture, Consensus, and Future Trends. Paper presented at the 2017 IEEE International Congress on Big Data (BigData Congress), Honolulu, HI, USA, June 25–30; pp. 557–64. [Google Scholar] [CrossRef]

| Variables | BTC | EPU | CPI |

|---|---|---|---|

| Mean | 0.148 | 1.637 | 2.622 |

| Median | 0.050 | 1.538 | 1.978 |

| Maximum | 4.709 | 5.040 | 9.060 |

| Minimum | −0.386 | 0.639 | −0.200 |

| Std. Dev. | 0.549 | 0.698 | 2.106 |

| Skewness | 5.405 | 1.935 | 1.433 |

| Kurtosis | 40.682 | 8.366 | 4.434 |

| Observations | 155 | 155 | 155 |

| Variable | ADF | PP | ||

|---|---|---|---|---|

| t Stat. | p-Value | t Stat. | p-Value | |

| BTC | −6.26 (0) *** | 0.00 | −6.26 (2) *** | 0.00 |

| EPU | −5.91 (2) *** | 0.00 | −5.92 (10) *** | 0.00 |

| INF | −1.45 (0) | 0.55 | −1.48 (3) | 0.53 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | 309.8220 | NA | 2.06 × 10−16 | −13.41431 | −13.09313 | −13.29458 |

| 1 | 722.6936 * | 660.5945 * | 3.98 × 10−23 | −28.91971 * | −26.02905 * | −27.84211 * |

| 2 | 842.8537 | 149.5326 | 4.30 × 10−24 * | −31.41572 | −25.95559 | −29.38024 |

| Variable | Coefficient | Standard Error | T-Statistic | Probability |

|---|---|---|---|---|

| EPU | −0.003 | 0.038 | −0.0974 | 0.067 |

| INF | −0.024 | 0.011 | −2.147 | 0.033 |

| Constant | 0.121 | 0.073 | 1.661 | 0.098 |

| Variable | Coefficient | Standard Error | T-Statistic | Probability |

|---|---|---|---|---|

| ΔEPU | −0.054 | 0.047 | −1.135 | 0.258 |

| ΔEPU(−1) | −0.043 | 0.062 | −0.069 | 0.486 |

| ΔEPU(−2) | −0.051 | 0.050 | −1.023 | 0.307 |

| ΔINF | −0.121 | 0.051 | −2.378 | 0.018 |

| ΔINF (−1) | −0.019 | 0.053 | −0.370 | 0.071 |

| ΔINF (−2) | −0.122 | 0.046 | −2.621 | 0.009 |

| ECM(−1) | −0.839 | 0.166 | −5.045 | 0.000 |

| Variable | 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 |

| EPU | −0.019 (0.043) | 0.006 (0.038) | 0.009 (0.040) | 0.022 (0.036) | −0.003 (0.038) | −0.032 (0.041) ** | 0.046 (0.044) | −0.016 (0.055) ** | −0.096 (0.044) |

| INF | −0.005 (0.010) | −0.012 (0.010) ** | −0.015 (0.010) ** | −0.025 (0.010) ** | −0.024 (0.011) | −0.020 (0.011) | −0.013 (0.013) | −0.029 (0.015) ** | −0.032 (0.022) |

| Constant | −0.158 (0.068) ** | −0.079 (0.068) | −0.048 (0.072) | −0.012 (0.066) | 0.121 (0.073) | 0.121 (0.076) | 0.159 (0.084) ** | 0.417 0.146) ** | 0.373 (0.156) |

| Diagnostic Test | F-Stat | p-Values |

|---|---|---|

| BP-LM | 0.16 | 0.64 |

| Ramsey Reset | 1.00 | 0.43 |

| Jargua–Bera | 0.01 | 0.97 |

| BP-G | 0.47 | 0.91 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Janjua, L.R.; Gigauri, I.; Wójcik-Czerniawska, A.; Pohulak-Żołędowska, E. Risk Management in the Area of Bitcoin Market Development: Example from the USA. Risks 2024, 12, 67. https://doi.org/10.3390/risks12040067

Janjua LR, Gigauri I, Wójcik-Czerniawska A, Pohulak-Żołędowska E. Risk Management in the Area of Bitcoin Market Development: Example from the USA. Risks. 2024; 12(4):67. https://doi.org/10.3390/risks12040067

Chicago/Turabian StyleJanjua, Laeeq Razzak, Iza Gigauri, Agnieszka Wójcik-Czerniawska, and Elżbieta Pohulak-Żołędowska. 2024. "Risk Management in the Area of Bitcoin Market Development: Example from the USA" Risks 12, no. 4: 67. https://doi.org/10.3390/risks12040067

APA StyleJanjua, L. R., Gigauri, I., Wójcik-Czerniawska, A., & Pohulak-Żołędowska, E. (2024). Risk Management in the Area of Bitcoin Market Development: Example from the USA. Risks, 12(4), 67. https://doi.org/10.3390/risks12040067