An Integrated Risk Management Methodology for Deposits and Loans

Abstract

:1. Introduction

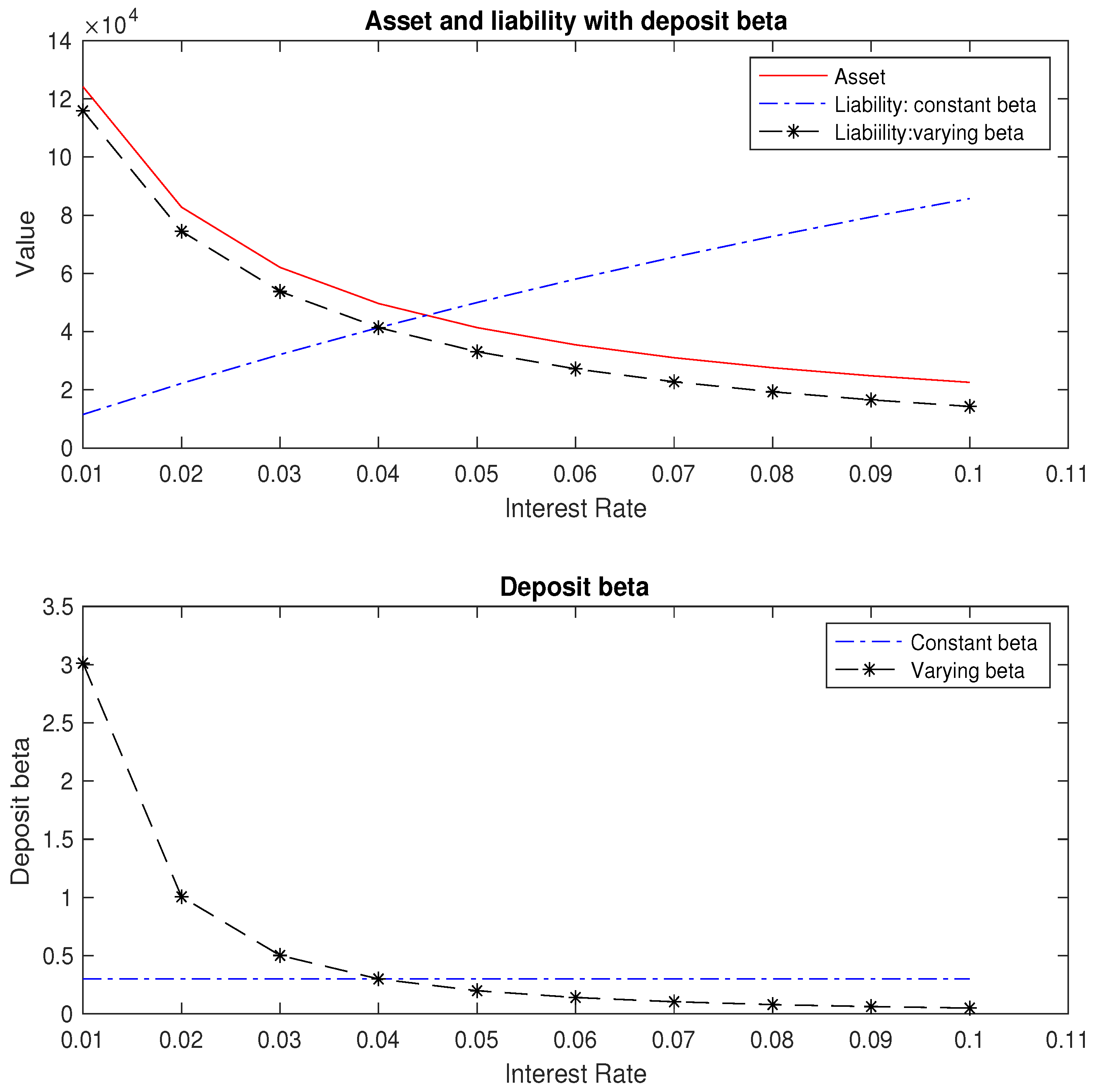

2. A Motivated Example

3. Deposits

3.1. Behavior Segment

- In a bank-run situation where customers withdraw their deposits, we have .

- For deposit with a constant maturity T, . As an example, months represents short-term liabilities in the form of deposits;

- When deposit withdrawal follows a geometric distribution, , with . Here, represents the probability of exiting the deposit account each period. For instance, an average maturity of 4 months corresponds to a decay rate of ;

- Alternatively, if has a Poisson distribution with parameter , the probability is given by . While the average maturity remains the same as the previous example when , the decay rate in each period differs for both distributions of .

3.2. An Equilibrium Model

3.3. Deposit Rate and Balance in Equilibrium

3.4. Deposit Valuation

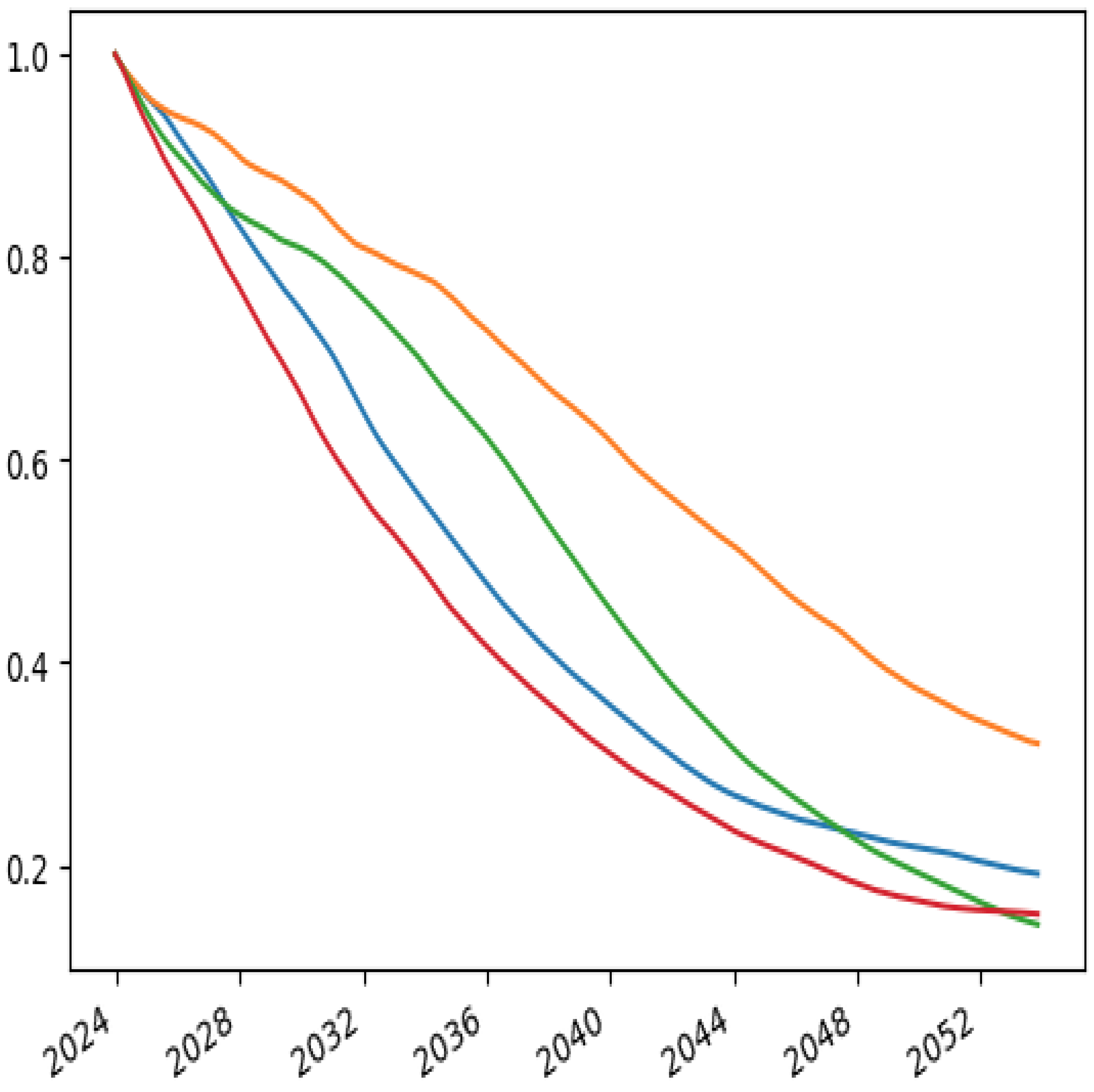

3.5. Run-Off Balance

4. Mortgage Loans

4.1. Segment

4.2. Prepayment Model

4.3. Loan Demand Model

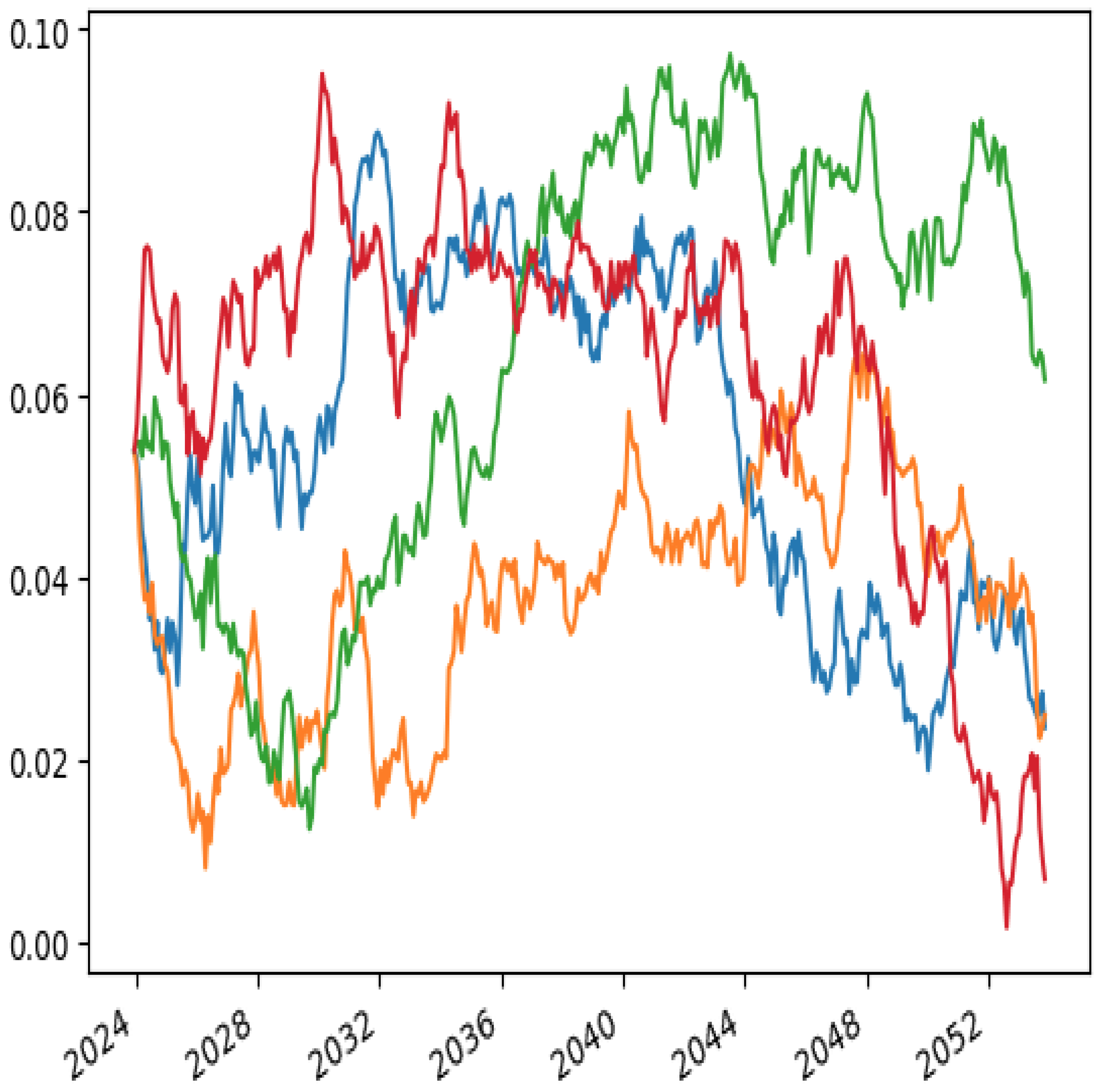

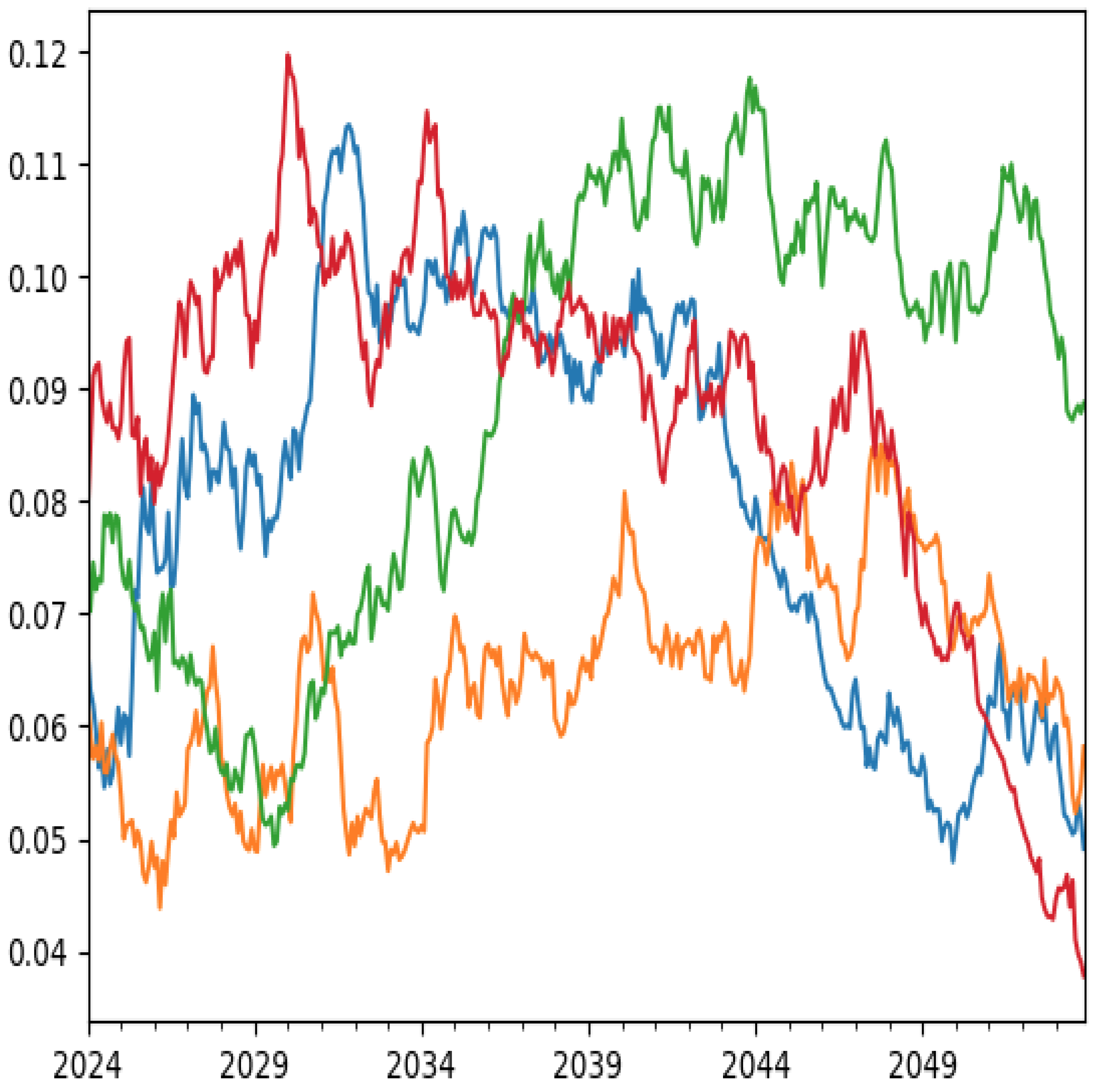

5. Simulation Results

6. Economic Value of Equity

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Deposit Rate and Deposit Balance

Appendix B. Interest Rate and Economic Factor Model

- for ;

- , for ;

- for .

| 1 | Regulators have long been closely monitoring these issues, with significant guidance provided by the Basel Committee on Banking Supervision (BCBS). See, for example, the discussion on interest rate risk in BCBS (2016). For a comprehensive review of regulatory risk management in commercial banks, refer to Tian (2017). Additionally, Basel III has introduced more stringent minimum capital requirements and regulatory capital buffers, as explained in Labonte and Scott (2023). |

| 2 | Here, denotes the asset value when the interest rate is R. |

| 3 | We discuss the difference between congenial and combative deposit rate in equilibrium in Hackworth et al. (2024). Here, we make use of the congenial assumptions for segments. |

| 4 | For instance, for one deposit account only, let for a function , as in Greenwald et al. (2023), by viewing deposit rates behavior more like options; we can construct a specification of for such that |

| 5 | For instance, , as in Chernov et al. (2018). |

References

- Ahn, Dong-Hyun, Robert F. Dittmar, and A. Ronald Gallant. 2002. Quadratic term structure models: Theory and evidence. Review of Financial Studies 15: 243–88. [Google Scholar] [CrossRef]

- Andersen, Leif B. G., and Vladimir V. Piterbarg. 2010. Interest Rate Modeling, (II): Term Structure Models. London: Atlantic Financial Products. [Google Scholar]

- Barr, Michael. 2023. Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank. Board of Governors of the Federal Reserve System. Available online: https://elischolar.library.yale.edu/cgi/viewcontent.cgi?article=4955&context=ypfs-documents2 (accessed on 1 December 2024).

- BCBS. 2016. Standards: Interest rate risk in the banking book. In Basel Committee on Banking Supervision Consultative Document. Basel: BCBS. [Google Scholar]

- Boyle, Phelim P., and Weidong Tian. 1999. Quadratic Interest Rate Models as Approximation to Effective Rate Models. Journal of Fixed Income 9: 69–80. [Google Scholar] [CrossRef]

- Chernov, Mikhail, Brett R. Dunn, and Francis A. Longstaff. 2018. Macroeconomic-Driven Prepayment Risk and the Valuation of Mortgage-Backed Securities. Review of Financial Studies 31: 1132–83. [Google Scholar] [CrossRef]

- Detemple, Jerome, and Weidong Tian. 2002. The Valuation of American Option for a Class of Diffusion Process. Management Science 48: 917–37. [Google Scholar] [CrossRef]

- Diamond, Douglas W., and Philip H. Dybvig. 1983. Bank Runs, Deposit Insurance and Liquidity. Journal of Political Economy 91: 401–19. [Google Scholar] [CrossRef]

- Drechsler, Itamar, Alexi Savov, and Philipp Schnabl. 2021. Banking on Deposits: Maturity Transformation Without Interest Rate Risk. Journal of Finance 76: 1091–143. [Google Scholar] [CrossRef]

- Duffie, Darrell, Jun Pan, and Kenneth Singleton. 2000. Transform Analysis and Asset ricing for Affine Jump-Diffusions. Econometrica 68: 1343–76. [Google Scholar] [CrossRef]

- Fermanian, Jean-David. 2013. A Top-Down Approach for Asset-Backed Securities: A Consistent Way of Managing Prepayment, Default and Interest Rate Risks. Journal of Real Estate Finance and Economics 46: 480–515. [Google Scholar] [CrossRef]

- Fisher, Lawrence, and Roman L. Weil. 1971. Coping with the Risk of Interest-Rate Fluctuations: Returns to Bondholders from Naïve and Optimal Strategies. Journal of Business 44: 408–31. [Google Scholar] [CrossRef]

- Greenwald, Emily, Sam Schulhofer-Wohl, and Josh Younger. 2023. Deposit Convexity, Monetary Policy, and Financial Stability. Federal Reserve Bank of Dallas. Available online: https://ssrn.com/abstract=4602078 (accessed on 1 December 2024).

- Hackworth, Gregory R., Weidong Tian, and Michael R. Vandenberg. 2024. Deposit Betas and Market Shares Across Banks. Journal of Finance and Banking Review. forthcoming. [Google Scholar]

- Hutchison, David E. 1995. Retail Bank Deposit Pricing: An Intertemporal Asset Pricing Approach. Journal of Money, Credit and Banking 27: 217–31. [Google Scholar] [CrossRef]

- Hutchison, David E., and George G. Pennacchi. 1996. Measuring Rents and Interest Rate Risk in Imperfect Markets: The Case of Retail Bank Deposits. Journal of Financial and Quantitative Analysis 31: 399–417. [Google Scholar] [CrossRef]

- Janosi, Tibor, Robert Alan Jarrow, and Ferdinando Zullo. 1999. An Empirical Analysis of the Jarrowe-van Deventer Model for Valuing Non-Maturity Demand Deposits. Journal of Derivatives 7: 8–31. [Google Scholar] [CrossRef]

- Jarrow, Robert A., and Donald R. Van Deventer. 1998. The Arbitrage-free Valuation and Hedging of Demand Deposits and Credit Card Loans. Journal of Banking and Finance 22: 249–72. [Google Scholar] [CrossRef]

- Karpishpan, Yakov, Ozgur Turel, and Alexander Hasha. 2010. Introducing the Citi LMM Term Structure Model for Mortgages. Journal of Fixed Income 20: 44–58. [Google Scholar] [CrossRef]

- Labonte, Marc, and Andrew P. Scott. 2023. Bank Capital Requirements: Basel III Endgame. CRS Report. Available online: https://crsreports.congress.gov/product/pdf/R/R47855 (accessed on 1 December 2024).

- Moulin, Serge. 2020. Modeling of N Maturity Deposits for IRRBB: Statistical or Behavioral Approach? ALM-Vision. Available online: https://www.researchgate.net/publication/344515893_Modeling_of_No_Maturity_Deposits_for_IRRBB_Statistical_or_behavioral_approach (accessed on 1 December 2024).

- Rao, Calyampudi Radhakrishna. 1965. Linear Statistical Inference and Its Applications. New York: Wiley. [Google Scholar]

- Sheehan, Richard G. 2013. Valuing Core Deposits. Journal of Financial Service 43: 197–220. [Google Scholar] [CrossRef]

- Stanton, Richard. 1995. Rational Prepayment and the Valuation of Mortgage-Backed Securities. Review of Financial Studies 8: 677–708. [Google Scholar] [CrossRef]

- Tian, Weidong. 2017. Commercial Banking Risk Management: Regulation in the Wake of the Financial Crisis, 1st ed. London: Palgrave Macmillan. [Google Scholar]

- Wyle, Robert J. 2014. Asset and Liability Management: Applications for Management and Modeling of Non-Maturing Deposits. New York: Moody’s Analytics. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hackworth, G.R.; Tian, W.; Vandenberg, M.R. An Integrated Risk Management Methodology for Deposits and Loans. Risks 2025, 13, 52. https://doi.org/10.3390/risks13030052

Hackworth GR, Tian W, Vandenberg MR. An Integrated Risk Management Methodology for Deposits and Loans. Risks. 2025; 13(3):52. https://doi.org/10.3390/risks13030052

Chicago/Turabian StyleHackworth, Gregory R., Weidong Tian, and Michael R. Vandenberg. 2025. "An Integrated Risk Management Methodology for Deposits and Loans" Risks 13, no. 3: 52. https://doi.org/10.3390/risks13030052

APA StyleHackworth, G. R., Tian, W., & Vandenberg, M. R. (2025). An Integrated Risk Management Methodology for Deposits and Loans. Risks, 13(3), 52. https://doi.org/10.3390/risks13030052