Simulation and Economic Analysis of Helium Extraction Process from Natural Gas

Abstract

:1. Introduction

2. Research Methods

2.1. Process Development

2.1.1. Process Model Method

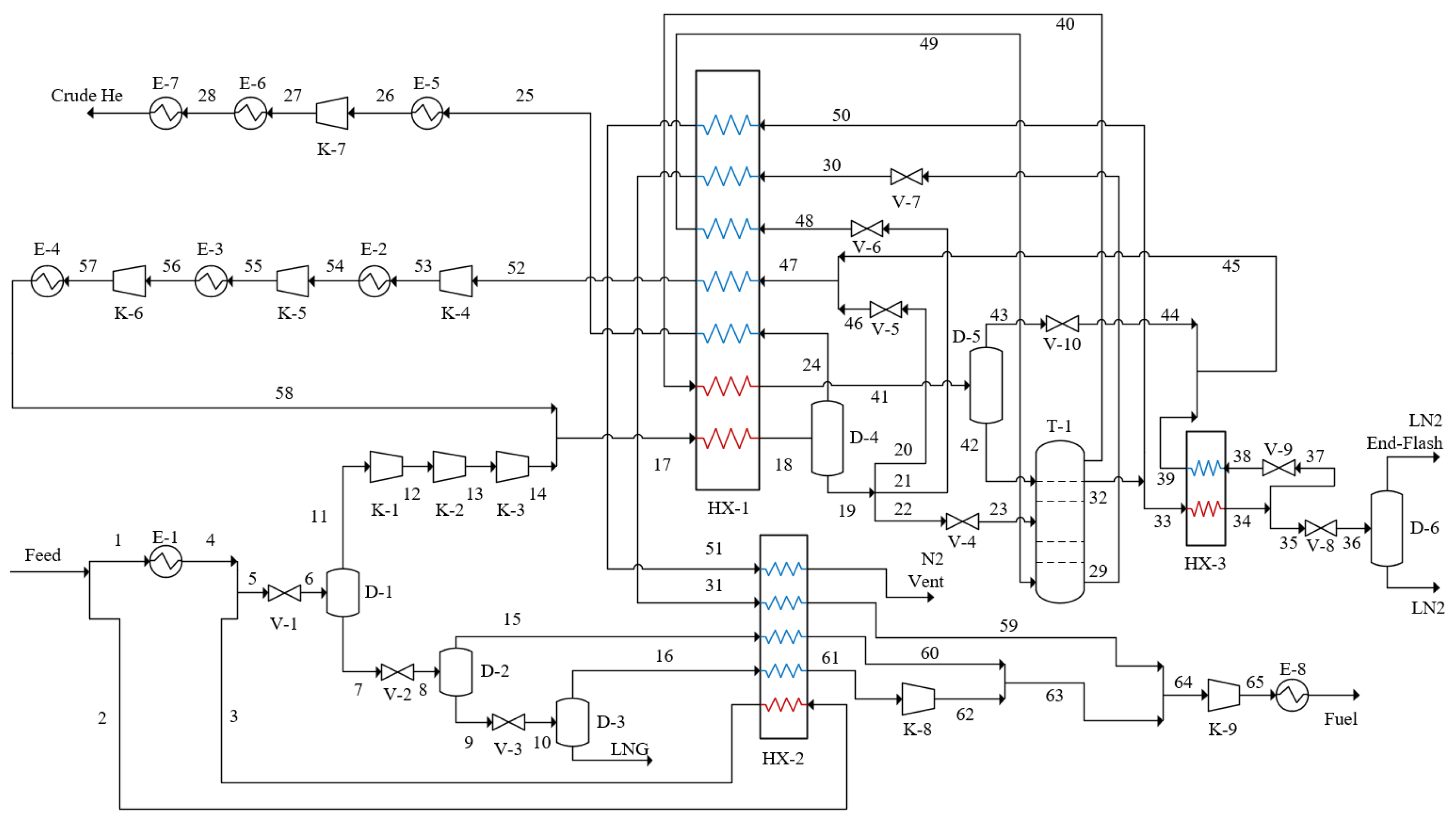

2.1.2. Linde Integrated Process

2.1.3. Exxon Mobil Integrated Process

2.1.4. Research on Adaptability of Feed

2.2. Economic Evaluation

3. Results and Discussion

3.1. Effect of Feed Composition

3.1.1. Analysis of Linde Integrated Process

3.1.2. Analysis of Exxon Mobil Integrated Process

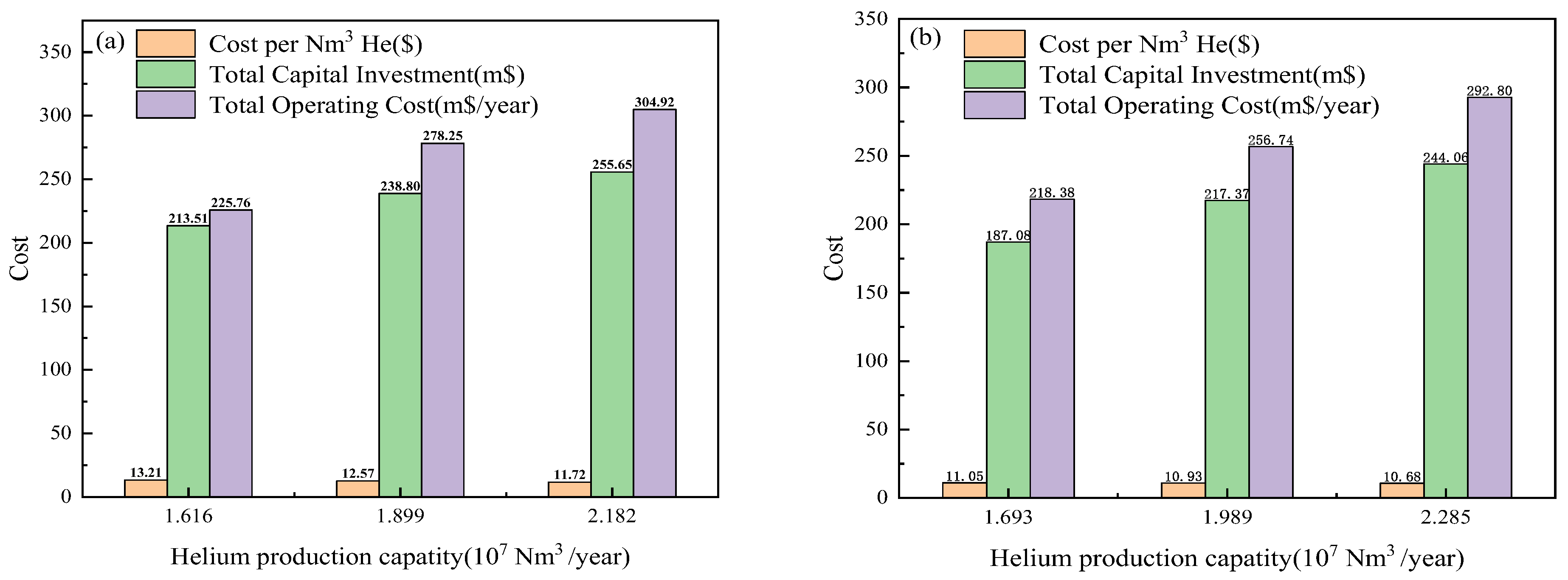

3.2. Effect of Processing Capacity

3.3. Comparative Analysis of Linde and Exxon Mobil Integrated Processes

3.4. Sensitivity Analysis

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Mokhatab, S.; Poe, W.A.; Mak, J.Y. Nitrogen Rejection and Helium Recovery. In Handbook of Natural Gas Transmission and Processing; Elsevier: Amsterdam, The Netherlands, 2019; pp. 395–408. ISBN 978-0-12-815817-3. [Google Scholar]

- Grynia, E.; Griffin, P.J. Helium in Natural Gas—Occurrence and Production. J. Nat. Gas Eng. 2016, 1, 163–215. [Google Scholar] [CrossRef]

- Quader, M.A.; Rufford, T.E.; Smart, S. Integration of Hybrid Membrane-Distillation Processes to Recover Helium from Pre-Treated Natural Gas in Liquefied Natural Gas Plants. Sep. Purif. Technol. 2021, 263, 118355. [Google Scholar] [CrossRef]

- Weh, R.; Xiao, G.; Pouya, E.S.; May, E.F. Direct Helium Recovery from Natural Gas by Dual Reflux Pressure Swing Adsorption Cascade. Chem. Eng. J. 2022, 450, 137894. [Google Scholar] [CrossRef]

- McElroy, L.; Xiao, G.; Weh, R.; May, E.F. A Case Study of Helium Recovery from Australian Natural Gas. Case Stud. Chem. Environ. Eng. 2022, 5, 100200. [Google Scholar] [CrossRef]

- Boreham, C.J.; Edwards, D.S.; Poreda, R.J.; Darrah, T.H.; Zhu, R.; Grosjean, E.; Main, P.; Waltenberg, K.; Henson, P.A. Helium in the Australian Liquefied Natural Gas Economy. APPEA J. 2018, 58, 209. [Google Scholar] [CrossRef]

- Bi, Y.; Ju, Y. Design and Analysis of an Efficient Hydrogen Liquefaction Process Based on Helium Reverse Brayton Cycle Integrating with Steam Methane Reforming and Liquefied Natural Gas Cold Energy Utilization. Energy 2022, 252, 124047. [Google Scholar] [CrossRef]

- Fan, Y.; Li, M.; Li, B.; Li, Q. Progress of Helium Purification Technology. Pet. Process. Petrochem. 2022, 53, 127–134. [Google Scholar]

- Rufford, T.E.; Chan, K.I.; Huang, S.H.; May, E.F. A Review of Conventional and Emerging Process Technologies for the Recovery of Helium from Natural Gas. Adsorpt. Sci. Technol. 2014, 32, 49–72. [Google Scholar] [CrossRef]

- Ansarinasab, H.; Mehrpooya, M.; Pouriman, M. Advanced Exergoeconomic Evaluation of a New Cryogenic Helium Recovery Process from Natural Gas Based on the Flash Separation—APCI Modified Process. Appl. Therm. Eng. 2018, 132, 368–380. [Google Scholar] [CrossRef]

- Moganti, S.; Noble, R.D.; Koval, C.A. Analysis of a Membrane/Distillation Column Hydrid Process. J. Membr. Sci. 1994, 93, 31–44. [Google Scholar] [CrossRef]

- Alders, M.; Winterhalder, D.; Wessling, M. Helium Recovery Using Membrane Processes. Sep. Purif. Technol. 2017, 189, 433–440. [Google Scholar] [CrossRef]

- Scholes, C.A.; Ghosh, U. Helium Separation through Polymeric Membranes: Selectivity Targets. J. Membr. Sci. 2016, 520, 221–230. [Google Scholar] [CrossRef]

- Dai, Z.; Deng, J.; He, X.; Scholes, C.A.; Jiang, X.; Wang, B.; Guo, H.; Ma, Y.; Deng, L. Helium Separation Using Membrane Technology: Recent Advances and Perspectives. Sep. Purif. Technol. 2021, 274, 119044. [Google Scholar] [CrossRef]

- Jahromi, P.E.; Fatemi, S.; Vatani, A.; Ritter, J.A.; Ebner, A.D. Purification of Helium from a Cryogenic Natural Gas Nitrogen Rejection Unit by Pressure Swing Adsorption. Sep. Purif. Technol. 2018, 193, 91–102. [Google Scholar] [CrossRef]

- Burgers, I.; Dehdari, L.; Xiao, P.; Li, K.G.; Goetheer, E.; Webley, P. Techno-Economic Analysis of PSA Separation for Hydrogen/Natural Gas Mixtures at Hydrogen Refuelling Stations. Int. J. Hydrogen Energy 2022, 47, 36163–36174. [Google Scholar] [CrossRef]

- Jia, L.; Ma, B.; Wang, H.; Yu, Y.; Xu, J.; Cheng, J.; Xing, J. Progress and Utilization Status of Global Helium Exploration and Development. Geol. China 2022, 49, 1427–1437. [Google Scholar]

- Jiang, H.; Chen, Y.; Cheng, X. Process Design and Analysis of Extracting Helium from Low Helium Natural Gas and Co-Producing LNG. Low-Carbon Chem. Chem. Eng. 2023, 48, 169–175. [Google Scholar]

- Froehlich, P.; Clausen, J.J.; Weisend, J.G.; Barclay, J.; Breon, S.; Demko, J.; DiPirro, M.; Kelley, J.P.; Kittel, P.; Klebaner, A.; et al. Large Scale Helium Liquefaction and Considerations for Site Services for a Plant Located in Algeria. In Proceedings of the AIP Conference Proceedings, Chattanooga, TN, USA, 16–20 July 2007; AIP: College Park, MD, USA, 2008; Volume 985, pp. 549–556. [Google Scholar]

- Mehrpooya, M.; Shafaei, A. Advanced Exergy Analysis of Novel Flash Based Helium Recovery from Natural Gas Processes. Energy 2016, 114, 64–83. [Google Scholar] [CrossRef]

- Jiang, H.; Gao, P.; Li, H. Optimization of Co-Production Process of Cryogenic Helium Concentration and Liquefied Natural Gas. Appl. Therm. Eng. 2023, 225, 120153. [Google Scholar] [CrossRef]

- Li, J.; He, L.; Chai, L. Present Situation and Suggestion of Helium Extraction from Natural Gas. Chem. Eng. Oil Gas 2018, 47, 41–44. [Google Scholar]

- Jiang, H.; Zhu, M.; Zhang, W. Study on Technology for Recovering Helium from Natural Gas by Double-Tower. Mod. Chem. Ind. 2022, 42, 214–218+222. [Google Scholar] [CrossRef]

- Shafaei, A.; Mehrpooya, M. Process Development and Sensitivity Analysis of Novel Integrated Helium Recovery from Natural Gas Processes. Energy 2018, 154, 52–67. [Google Scholar] [CrossRef]

- Mehrpooya, M.; Mood, N.G.; Ansarinasab, H.; Alsagri, A.S.; Mehdipourrad, M. A Novel Sensitivity Analysis of a New Integrated Helium Extraction Process through the Interaction of Costs and Environmental Impacts. Appl. Therm. Eng. 2019, 159, 113787. [Google Scholar] [CrossRef]

- Kim, D.; Gundersen, T. Helium Extraction from Lng End-Flash. Chem. Eng. Trans. 2015, 45, 595–600. [Google Scholar] [CrossRef]

- Hamedi, H. An Innovative Integrated Process for Helium and NGL Recovery and Nitrogen Removal. Cryogenics 2021, 113, 103224. [Google Scholar] [CrossRef]

- Al-Sobhi, S.A.; AlNouss, A.; Alsaba, W.; Elkamel, A. Sustainable Design and Analysis for Helium Extraction from Sale Gas in Liquefied Natural Gas Production. J. Nat. Gas Sci. Eng. 2022, 102, 104599. [Google Scholar] [CrossRef]

- Bureau of Land Management Crude Helium Price. Available online: https://www.blm.gov/sites/blm.gov/files/docs/2021-06/FY2022%20Posted%20Price.pdf (accessed on 3 March 2024).

- Rosewall, T.; Lane, K. Bulletin June Quarter 2015; Reserve Bank of Australia: Sydney, Australia, 2015; pp. 1–8. [Google Scholar]

| Parameter | Feed | LNG | Fuel | LN2 | Crude He |

|---|---|---|---|---|---|

| Composition (mol%) | |||||

| Helium | 0.05 | 0.00 | 0.04 | 0.01 | 54.66 |

| Nitrogen | 5.00 | 1.00 | 28.39 | 99.24 | 42.30 |

| Methane | 87.85 | 90.73 | 71.56 | 0.75 | 3.04 |

| Ethane | 4.73 | 5.51 | 0.01 | 0.00 | 0.00 |

| Propane | 1.64 | 1.91 | 0.00 | 0.00 | 0.00 |

| n-Butane | 0.38 | 0.45 | 0.00 | 0.00 | 0.00 |

| i-Butane | 0.34 | 0.40 | 0.00 | 0.00 | 0.00 |

| Temperature (°C) | 25.0 | −160.8 | 35.0 | −194.0 | −43.0 |

| Pressure (kPa) | 6000 | 130 | 2000 | 130 | 2000 |

| Flow rate (kmol/h) | 235,000 | 201,839 | 32,588 | 104.0 | 192.7 |

| Parameter | Feed | LNG | Fuel | Crude He |

|---|---|---|---|---|

| Composition (mol%) | ||||

| Helium | 0.05 | 0.00 | 0.02 | 46.02 |

| Nitrogen | 5.00 | 0.99 | 30.58 | 51.83 |

| Methane | 87.85 | 90.81 | 69.39 | 2.15 |

| Ethane | 4.73 | 5.47 | 0.01 | 0.00 |

| Propane | 1.64 | 1.90 | 0.00 | 0.00 |

| n-Butane | 0.38 | 0.44 | 0.00 | 0.00 |

| i-Butane | 0.34 | 0.39 | 0.00 | 0.00 |

| Temperature (°C) | 25.0 | −160.7 | 26.8 | 25.0 |

| Pressure (kPa) | 6000 | 130 | 2000 | 2000 |

| Flow rate (kmol/h) | 235,000 | 203,329 | 31,487 | 241.3 |

| Composition (mol%) | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 | Case 6 | Case 7 |

|---|---|---|---|---|---|---|---|

| Helium | 0.05 | 0.10 | 0.20 | 0.50 | 1.00 | 1.50 | 2.00 |

| Nitrogen | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 |

| Methane | 87.86 | 87.81 | 87.71 | 87.41 | 86.91 | 86.41 | 85.91 |

| Ethane | 4.73 | 4.73 | 4.73 | 4.73 | 4.73 | 4.73 | 4.73 |

| Propane | 1.64 | 1.64 | 1.64 | 1.64 | 1.64 | 1.64 | 1.64 |

| n-Butane | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 |

| i-Butane | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 |

| Composition (mol%) | Case a | Case b | Case c | Case d |

|---|---|---|---|---|

| Helium | 0.05 | 0.05 | 0.05 | 0.05 |

| Nitrogen | 5.00 | 10.00 | 15.00 | 20.00 |

| Methane | 87.86 | 82.86 | 77.86 | 72.86 |

| Ethane | 4.73 | 4.73 | 4.73 | 4.73 |

| Propane | 1.64 | 1.64 | 1.64 | 1.64 |

| n-Butane | 0.38 | 0.38 | 0.38 | 0.38 |

| i-Butane | 0.34 | 0.34 | 0.34 | 0.34 |

| Property | Value |

|---|---|

| Helium extraction rate | ≥90% |

| Crude He content | ≥50% |

| N2 content in LNG | ≤1% |

| N2 content in fuel gas | ≤40% |

| Parameter | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 | Case 6 | Case 7 |

|---|---|---|---|---|---|---|---|

| Total Capital Cost | 238.80 | 243.18 | 245.62 | 253.65 | 275.52 | 285.96 | 296.41 |

| Total Income (m$) | 1391 | 1408 | 1439 | 1532 | 1620 | 1845 | 1984 |

| IRR (%) | 101.30 | 101.63 | 105.25 | 116.21 | 126.02 | 151.90 | 170.21 |

| Payback Period (year) | 3.08 | 3.07 | 3.03 | 2.90 | 2.81 | 2.65 | 2.53 |

| Parameter | Case a | Case b | Case c | Case d | |||

| Total Capital Cost | 238.80 | 393.63 | 505.63 | 543.85 | |||

| Total Income (m$) | 1391 | 1301 | 1225 | 1127 | |||

| IRR (%) | 101.30 | 84.32 | 73.65 | 62.57 | |||

| Payback Period (year) | 3.08 | 3.46 | 3.77 | 4.19 |

| Parameter | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 | Case 6 | Case 7 |

|---|---|---|---|---|---|---|---|

| Total Capital Cost | 217.37 | 224.56 | 226.59 | 226.89 | 227.42 | 229.15 | 231.71 |

| Total Income (m$) | 1391 | 1408 | 1442 | 1552 | 1739 | 1939 | 2139 |

| IRR (%) | 101.30 | 103.27 | 107.31 | 120.43 | 143.34 | 167.71 | 192.42 |

| Payback Period (year) | 3.07 | 3.04 | 2.98 | 2.84 | 2.66 | 2.52 | 2.41 |

| Case a | Case b | Case c | Case d | ||||

| Total Capital Cost | 217.37 | 249.70 | 268.92 | 281.09 | |||

| Total Income (m$) | 1391 | 1247 | 1123 | 1007 | |||

| IRR (%) | 101.30 | 87.44 | 75.40 | 64.62 | |||

| Payback Period (year) | 3.07 | 3.34 | 3.68 | 4.11 |

| Components (m$) | Case a1 | Case a2 | Case a3 |

|---|---|---|---|

| Total Capital Investment | 213.51 | 238.80 | 255.65 |

| Installed equipment costs | 94.71 | 104.65 | 111.81 |

| Construction cost | 47.36 | 52.32 | 55.91 |

| Total Operating Cost | 225.76 | 278.25 | 304.92 |

| Total Utilities Cost | 211.29 | 262.47 | 285.63 |

| Feed gas | 442.97 | 520.62 | 598.01 |

| Cost per Nm3 he($) | 13.21 | 12.57 | 11.72 |

| Total Income | 1186 | 1391 | 1601 |

| IRR(%) | 101.75 | 101.30 | 100.14 |

| Payback Period(year) | 3.03 | 3.08 | 3.11 |

| Components (m$) | Case a1 | Case a2 | Case a3 |

|---|---|---|---|

| Total Capital Investment | 187.08 | 217.37 | 244.06 |

| Installed equipment costs | 81.96 | 94.99 | 106.54 |

| Construction cost | 40.98 | 47.50 | 53.27 |

| Total Operating Cost | 218.38 | 256.74 | 292.80 |

| Total Utilities Cost | 205.58 | 241.23 | 276.78 |

| Feed gas | 442.97 | 520.62 | 598.01 |

| Cost per Nm3 he($) | 11.05 | 10.93 | 10.68 |

| Total Income | 1184 | 1391 | 1598 |

| IRR(%) | 102.13 | 101.30 | 100.77 |

| Payback Period(year) | 3.03 | 3.07 | 3.10 |

| Parameter | Linde | Exxon Mobil |

|---|---|---|

| Total Utilities Cost (m$) | 262.47 | 241.23 |

| Total Operating Cost (m$) | 278.25 | 256.74 |

| Total Income (m$) | 1391 | 1391 |

| IRR (%) | 101.30 | 101.30 |

| Payback Period (year) | 3.08 | 3.07 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, Y.; Chen, R.; Li, W.; Yang, R.; Yi, C.; Wu, Y.; Xia, G.; Xu, X.; Liu, Y. Simulation and Economic Analysis of Helium Extraction Process from Natural Gas. Processes 2024, 12, 1892. https://doi.org/10.3390/pr12091892

He Y, Chen R, Li W, Yang R, Yi C, Wu Y, Xia G, Xu X, Liu Y. Simulation and Economic Analysis of Helium Extraction Process from Natural Gas. Processes. 2024; 12(9):1892. https://doi.org/10.3390/pr12091892

Chicago/Turabian StyleHe, Yuanyuan, Rong Chen, Wanting Li, Ruiyi Yang, Chenggao Yi, Yiping Wu, Gaohaili Xia, Xiaoling Xu, and Yansheng Liu. 2024. "Simulation and Economic Analysis of Helium Extraction Process from Natural Gas" Processes 12, no. 9: 1892. https://doi.org/10.3390/pr12091892