Optimisation for Sustainable Supply Chain of Aviation Fuel, Green Diesel, and Gasoline from Microalgae Cultivated in Sugarcane Vinasse

Abstract

:1. Introduction

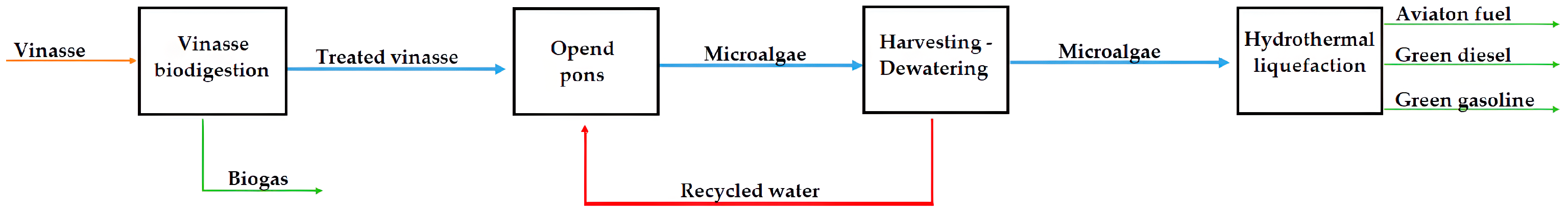

2. Materials and Methods

3. Structure, Formulation and Data of the Model

3.1. Definition of Set

3.2. Investment Cost Updating and Linearization

3.3. Unit Selection and Scaling Adjustment

3.4. Objective Function

3.5. Mass Balance

3.6. Availability and Demand Constraints

3.7. Transport Restrictions

3.8. Transport Modal Unitary Cost

3.9. Economic Analysis

3.10. Emissions

GHG Emission in Transportation

4. Case Study

5. Results and Analysis

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CEPCI | Chemical Engineering Plant Cost Index |

| COD | Chemical Oxygen Demand |

| HHV | High Heating Value |

| HRAP | high-rate algae pond |

| MILP | mixed-integer linear programming |

| MINLP | mixed-integer nonlinear programming |

| NDC | Nationally Determined Contribution |

| NPV | net present value |

| PSA | pressure swing adsorption |

| SAF | sustainable aviation fuel |

References

- Tena, M.; Buller, L.S.; Sganzerla, W.G.; Berni, M.; Forster-Carneiro, T.; Solera, R.; Pérez, M. Techno-Economic Evaluation of Bioenergy Production from Anaerobic Digestion of By-Products from Ethanol Flex Plants. Fuel 2022, 309, 122171. [Google Scholar] [CrossRef]

- Toscan, A.; Morais, A.R.C.; Paixão, S.M.; Alves, L.; Andreaus, J.; Camassola, M.; Dillon, A.J.P.; Lukasik, R.M. High-Pressure Carbon Dioxide/Water Pre-Treatment of Sugarcane Bagasse and Elephant Grass: Assessment of the Effect of Biomass Composition on Process Efficiency. Bioresour. Technol. 2017, 224, 639–647. [Google Scholar] [CrossRef]

- Okafor, C.C.; Nzekwe, C.A.; Ajaero, C.C.; Ibekwe, J.C.; Otunomo, F.A. Biomass Utilization for Energy Production in Nigeria: A Review. Clean. Energy Syst. 2022, 3, 100043. [Google Scholar] [CrossRef]

- Zhu, X.; Xiao, J.; Wang, C.; Zhu, L.; Wang, S. Global Warming Potential Analysis of Bio-Jet Fuel Based on Life Cycle Assessment. Carbon Neutrality 2022, 1, 25. [Google Scholar] [CrossRef]

- Yu, B.-Y.; Tsai, C.-C. Rigorous Simulation and Techno-Economic Analysis of a Bio-Jet-Fuel Intermediate Production Process with Various Integration Strategies. Chem. Eng. Res. Des. 2020, 159, 47–65. [Google Scholar] [CrossRef]

- Aniza, R.; Chen, W.-H.; Kwon, E.E.; Bach, Q.-V.; Hoang, A.T. Lignocellulosic Biofuel Properties and Reactivity Analyzed by Thermogravimetric Analysis (TGA) toward Zero Carbon Scheme: A Critical Review. Energy Convers. Manag. X 2024, 22, 100538. [Google Scholar] [CrossRef]

- Kalifa, M.A.; Habtu, N.G.; Jembere, A.L.; Genet, M.B. Characterization and Evaluation of Torrefied Sugarcane Bagasse to Improve the Fuel Properties. Curr. Res. Green Sustain. Chem. 2024, 8, 100395. [Google Scholar] [CrossRef]

- Gollakota, A.R.K.; Shu, C.-M.; Sarangi, P.K.; Shadangi, K.P.; Rakshit, S.; Kennedy, J.F.; Gupta, V.K.; Sharma, M. Catalytic Hydrodeoxygenation of Bio-Oil and Model Compounds—Choice of Catalysts, and Mechanisms. Renew. Sustain. Energy Rev. 2023, 187, 113700. [Google Scholar] [CrossRef]

- Ghosh, N.; Halder, G. Current Progress and Perspective of Heterogeneous Nanocatalytic Transesterification Towards Biodiesel Production from Edible and Inedible Feedstock: A Review. Energy Convers. Manag. 2022, 270, 116292. [Google Scholar] [CrossRef]

- Karmakar, B.; Halder, G. Progress and Future of Biodiesel Synthesis: Advancements in Oil Extraction and Conversion Technologies. Energy Convers. Manag. 2019, 182, 307–339. [Google Scholar] [CrossRef]

- Rabelo, S.C.; Paiva, L.B.B.D.; Pin, T.C.; Pinto, L.F.R.; Tovar, L.P.; Nakasu, P.Y.S. Chemical and Energy Potential of Sugarcane. In Sugarcane Biorefinery, Technology and Perspectives; Elsevier: Amsterdam, The Netherlands, 2020; pp. 141–163. ISBN 978-0-12-814236-3. [Google Scholar]

- Garcia-Perez, T.; Ortiz-Ulloa, J.A.; Jara-Cobos, L.E.; Pelaez-Samaniego, M.R. Adding Value to Sugarcane Bagasse Ash: Potential Integration of Biogas Scrubbing with Vinasse Anaerobic Digestion. Sustainability 2023, 15, 15218. [Google Scholar] [CrossRef]

- Pereira, I.Z.; Santos, I.F.S.D.; Barros, R.M.; Castro E Silva, H.L.D.; Tiago Filho, G.L.; Moni E Silva, A.P. Vinasse Biogas Energy and Economic Analysis in the State of São Paulo, Brazil. J. Clean. Prod. 2020, 260, 121018. [Google Scholar] [CrossRef]

- Moraes, B.S.; Junqueira, T.L.; Pavanello, L.G.; Cavalett, O.; Mantelatto, P.E.; Bonomi, A.; Zaiat, M. Anaerobic Digestion of Vinasse from Sugarcane Biorefineries in Brazil from Energy, Environmental, and Economic Perspectives: Profit or Expense? Appl. Energy 2014, 113, 825–835. [Google Scholar] [CrossRef]

- Soto, M.F.; Diaz, C.A.; Zapata, A.M.; Higuita, J.C. BOD and COD Removal in Vinasses from Sugarcane Alcoholic Distillation by Chlorella Vulgaris: Environmental Evaluation. Biochem. Eng. J. 2021, 176, 108191. [Google Scholar] [CrossRef]

- Parsaee, M.; Kiani Deh Kiani, M.; Karimi, K. A Review of Biogas Production from Sugarcane Vinasse. Biomass Bioenergy 2019, 122, 117–125. [Google Scholar] [CrossRef]

- Calixto, C.D.; Da Silva Santana, J.K.; De Lira, E.B.; Sassi, P.G.P.; Rosenhaim, R.; Da Costa Sassi, C.F.; Da Conceição, M.M.; Sassi, R. Biochemical Compositions and Fatty Acid Profiles in Four Species of Microalgae Cultivated on Household Sewage and Agro-Industrial Residues. Bioresour. Technol. 2016, 221, 438–446. [Google Scholar] [CrossRef]

- Chhandama, M.V.L.; Ruatpuia, J.V.L.; Ao, S.; Chetia, A.C.; Satyan, K.B.; Rokhum, S.L. Microalgae as a Sustainable Feedstock for Biodiesel and Other Production Industries: Prospects and Challenges. Energy Nexus 2023, 12, 100255. [Google Scholar] [CrossRef]

- Gaurav, K.; Neeti, K.; Singh, R. Microalgae-Based Biodiesel Production and Its Challenges and Future Opportunities: A Review. Green Technol. Sustain. 2024, 2, 100060. [Google Scholar] [CrossRef]

- Sousa, V.; Pereira, R.N.; Vicente, A.A.; Dias, O.; Geada, P. Microalgae Biomass as an Alternative Source of Biocompounds: New Insights and Future Perspectives of Extraction Methodologies. Food Res. Int. 2023, 173, 113282. [Google Scholar] [CrossRef]

- Goswami, R.K.; Agrawal, K.; Upadhyaya, H.M.; Gupta, V.K.; Verma, P. Microalgae Conversion to Alternative Energy, Operating Environment and Economic Footprint: An Influential Approach towards Energy Conversion, and Management. Energy Convers. Manag. 2022, 269, 116118. [Google Scholar] [CrossRef]

- Fal, S.; Smouni, A.; Arroussi, H.E. Integrated Microalgae-Based Biorefinery for Wastewater Treatment, Industrial CO2 Sequestration and Microalgal Biomass Valorization: A Circular Bioeconomy Approach. Environ. Adv. 2023, 12, 100365. [Google Scholar] [CrossRef]

- Arias, A.; Feijoo, G.; Moreira, M.T. Biorefineries as a Driver for Sustainability: Key Aspects, Actual Development and Future Prospects. J. Clean. Prod. 2023, 418, 137925. [Google Scholar] [CrossRef]

- Julio, A.A.V.; Batlle, E.A.O.; Rodriguez, C.J.C.; Palacio, J.C.E. Exergoeconomic and Environmental Analysis of a Palm Oil Biorefinery for the Production of Bio-Jet Fuel. Waste Biomass Valorization 2021, 12, 5611–5637. [Google Scholar] [CrossRef]

- Real Guimarães, H.; Marcon Bressanin, J.; Lopes Motta, I.; Ferreira Chagas, M.; Colling Klein, B.; Bonomi, A.; Maciel Filho, R.; Djun Barbosa Watanabe, M. Bottlenecks and Potentials for the Gasification of Lignocellulosic Biomasses and Fischer-Tropsch Synthesis: A Case Study on the Production of Advanced Liquid Biofuels in Brazil. Energy Convers. Manag. 2021, 245, 114629. [Google Scholar] [CrossRef]

- Brobbey, M.S.; Louw, J.; Görgens, J.F. Biobased Acrylic Acid Production in a Sugarcane Biorefinery: A Techno-Economic Assessment Using Lactic Acid, 3-Hydroxypropionic Acid and Glycerol as Intermediates. Chem. Eng. Res. Des. 2023, 193, 367–382. [Google Scholar] [CrossRef]

- Mohammad, R.E.A.; Abdullahi, S.S.; Muhammed, H.A.; Musa, H.; Habibu, S.; Jagaba, A.H.; Birniwa, A.H. Recent Technical and Non-Technical Biorefinery Development Barriers and Potential Solutions for a Sustainable Environment: A Mini Review. Case Stud. Chem. Environ. Eng. 2024, 9, 100586. [Google Scholar] [CrossRef]

- Gupta, S.S.; Shastri, Y.; Bhartiya, S. Optimization of Integrated Microalgal Biorefinery Producing Fuel and Value-added Products. Biofuels Bioprod. Biorefin. 2017, 11, 1030–1050. [Google Scholar] [CrossRef]

- Kenkel, P.; Wassermann, T.; Zondervan, E. Renewable Fuels from Integrated Power- and Biomass-to-X Processes: A Superstructure Optimization Study. Processes 2022, 10, 1298. [Google Scholar] [CrossRef]

- Aristizábal-Marulanda, V.; Cardona A., C.A.; Martín, M. Supply Chain of Biorefineries Based on Coffee Cut-Stems: Colombian Case. Chem. Eng. Res. Des. 2022, 187, 174–183. [Google Scholar] [CrossRef]

- Harahap, F.; Leduc, S.; Mesfun, S.; Khatiwada, D.; Kraxner, F.; Silveira, S. Meeting the Bioenergy Targets from Palm Oil Based Biorefineries: An Optimal Configuration in Indonesia. Appl. Energy 2020, 278, 115749. [Google Scholar] [CrossRef]

- Varshney, D.; Mandade, P.; Shastri, Y. Multi-Objective Optimization of Sugarcane Bagasse Utilization in an Indian Sugar Mill. Sustain. Prod. Consum. 2019, 18, 96–114. [Google Scholar] [CrossRef]

- Macowski, D.H.; Bonfim-Rocha, L.; Orgeda, R.; Camilo, R.; Ravagnani, M.A.S.S. Multi-Objective Optimization of the Brazilian Industrial Sugarcane Scenario: A Profitable and Ecological Approach. Clean Technol. Environ. Policy 2020, 22, 591–611. [Google Scholar] [CrossRef]

- Gutierrez-Franco, E.; Polo, A.; Clavijo-Buritica, N.; Rabelo, L. Multi-Objective Optimization to Support the Design of a Sustainable Supply Chain for the Generation of Biofuels from Forest Waste. Sustainability 2021, 13, 7774. [Google Scholar] [CrossRef]

- Moretti, S.M.L.; Bertoncini, E.I.; Abreu-Junior, C.H. Characterization of Raw Swine Waste and Effluents Treated Anaerobically: Parameters for Brazilian Environmental Regulation Construction Aiming Agricultural Use. J. Mater. Cycles Waste Manag. 2020, 23, 165–176. [Google Scholar] [CrossRef]

- Gilani, H.; Sahebi, H. A Multi-Objective Robust Optimization Model to Design Sustainable Sugarcane-to-Biofuel Supply Network: The Case of Study. Biomass Convers. Biorefin. 2021, 11, 2521–2542. [Google Scholar] [CrossRef]

- Basile, F.; Pilotti, L.; Ugolini, M.; Lozza, G.; Manzolini, G. Supply Chain Optimization and GHG Emissions in Biofuel Production from Forestry Residues in Sweden. Renew. Energy 2022, 196, 405–421. [Google Scholar] [CrossRef]

- Vitale, I.; Dondo, R.G.; González, M.; Cóccola, M.E. Modelling and Optimization of Material Flows in the Wood Pellet Supply Chain. Appl. Energy 2022, 313, 118776. [Google Scholar] [CrossRef]

- Infante, J.E.; Garcia, V.F.; Ensinas, A.V. Optimal Superstructure Model of Sugarcane-Microalgae Based Biorefinery. In WASTES: Solutions, Treatments and Opportunities IV; CRC Press: Boca Raton, FL, USA, 2023; ISBN 978-1-003-34508-4. [Google Scholar]

- Loon, L.K.; Shukery, M.F.; Hashim, N. MILP Model for Optimal Operation of Biomass Facility Treatment for Efficient Oil Palm Biomass Management. Clean Technol. Environ. Policy 2024, 26, 2007–2019. [Google Scholar] [CrossRef]

- Jabbarzadeh, A.; Shamsi, M. Designing a Resilient and Sustainable Multi-Feedstock Bioethanol Supply Chain: Integration of Mathematical Modeling and Machine Learning. Appl. Energy 2025, 377, 123794. [Google Scholar] [CrossRef]

- Eslamipoor, R. Contractual Mechanisms for Coordinating a Sustainable Supply Chain with Carbon Emission Reduction. Bus. Strategy Environ. 2025, 1–28. [Google Scholar] [CrossRef]

- Pina, E.A.; Palacios-Bereche, R.; Chavez-Rodriguez, M.F.; Ensinas, A.V.; Modesto, M.; Nebra, S.A. Reduction of Process Steam Demand and Water-Usage through Heat Integration in Sugar and Ethanol Production from Sugarcane—Evaluation of Different Plant Configurations. Energy 2017, 138, 1263–1280. [Google Scholar] [CrossRef]

- Santos, R.F.; Borsoi, A.; Secco, D.; Melegari De Souza, S.N.; Constanzi, R.N. Brazil’s Potential for Generating Electricity from Biogas from Stillage. In Proceedings of the World Renewable Energy Congress–Sweden, Linköping, Sweden, 8–13 May 2011; pp. 425–432. [Google Scholar]

- Fuess, L.T.; Zaiat, M. Economics of Anaerobic Digestion for Processing Sugarcane Vinasse: Applying Sensitivity Analysis to Increase Process Profitability in Diversified Biogas Applications. Process Saf. Environ. Prot. 2018, 115, 27–37. [Google Scholar] [CrossRef]

- Guieysse, B.; Béchet, Q.; Shilton, A. Variability and Uncertainty in Water Demand and Water Footprint Assessments of Fresh Algae Cultivation Based on Case Studies from Five Climatic Regions. Bioresour. Technol. 2013, 128, 317–323. [Google Scholar] [CrossRef] [PubMed]

- Marques, S.S.I.; Nascimento, I.A.; De Almeida, P.F.; Chinalia, F.A. Growth of Chlorella Vulgaris on Sugarcane Vinasse: The Effect of Anaerobic Digestion Pretreatment. Appl. Biochem. Biotechnol. 2013, 171, 1933–1943. [Google Scholar] [CrossRef]

- Mian, A.; Ensinas, A.V.; Marechal, F. Multi-Objective Optimization of SNG Production from Microalgae through Hydrothermal Gasification. Comput. Chem. Eng. 2015, 76, 170–183. [Google Scholar] [CrossRef]

- Zamalloa, C.; Vulsteke, E.; Albrecht, J.; Verstraete, W. The Techno-Economic Potential of Renewable Energy through the Anaerobic Digestion of Microalgae. Bioresour. Technol. 2011, 102, 1149–1158. [Google Scholar] [CrossRef]

- Stephenson, A.L.; Kazamia, E.; Dennis, J.S.; Howe, C.J.; Scott, S.A.; Smith, A.G. Life-Cycle Assessment of Potential Algal Biodiesel Production in the United Kingdom: A Comparison of Raceways and Air-Lift Tubular Bioreactors. Energy Fuels 2010, 24, 4062–4077. [Google Scholar] [CrossRef]

- Fasaei, F.; Bitter, J.H.; Slegers, P.M.; Van Boxtel, A.J.B. Techno-Economic Evaluation of Microalgae Harvesting and Dewatering Systems. Algal Res. 2018, 31, 347–362. [Google Scholar] [CrossRef]

- Snowden-Swan, L.; Billing, J.; Thorson, M.; Schmidt, A.; Santosa, M.; Jones, S.; Hallen, R. Wet Waste Hydrothermal Liquefaction and Biocrude Upgrading to Hydrocarbon Fuels: 2019 State of Technology; Pacific Northwest National Laboratory: Richland, WA, USA, 2020. [Google Scholar]

- Zhu, Y.; Xu, Y.; Schmidt, A.; Thorson, M.; Cronin, D.; Santosa, D.; Edmundson, S.; Li, S.; Snowden-Swan, L.; Valdez, P. Microalgae Hydrothermal Liquefaction and Biocrude Upgrading: 2022 State of Technology; Pacific Northwest National Laboratory: Richland, WA, USA, 2023. [Google Scholar]

- García Sánchez, F.J. Producción de Biometano a Partir de Biogás de Vertedero. Available online: https://biblus.us.es/bibing/proyectos/abreproy/70769/fichero/TFM+-+Producci%C3%B3n+de+biometano+a+partir+de+biog%C3%A1s+de+vertedero+-+Versi%C3%B3n+final.pdf (accessed on 14 September 2024).

- Garcia, V.F.; Ensinas, A.V. Simultaneous Optimization and Integration of Multiple Process Heat Cascade and Site Utility Selection for the Design of a New Generation of Sugarcane Biorefinery. Entropy 2024, 26, 501. [Google Scholar] [CrossRef]

- Garcia, V.F.; Palacios, R.; Ensinas, A. Optimisation of Ammonia Production and Supply Chain from Sugarcane Ethanol and Biomethane: A Robust Mixed-Integer Linear Programming Approach. Processes 2024, 12, 2204. [Google Scholar] [CrossRef]

- Turton, R. (Ed.) Analysis, Synthesis, and Design of Chemical Processes, 3rd ed.; Prentice Hall PTR International Series in the Physical and Chemical Engineering Sciences; Prentice Hall: Upper Saddle River, NJ, USA, 2009; ISBN 978-0-13-512966-1. [Google Scholar]

- Peters, M.S.; Timmerhaus, K.D.; West, R.E. Plant Design and Economics for Chemical Engineers, 5th ed.; McGraw-Hill Chemical Engineering Series; McGraw-Hill: New York, NY, USA, 2003; ISBN 978-0-07-239266-1. [Google Scholar]

- Agência Nacional de Transportes Terrestres Calcular Piso Mínimo de Frete. Available online: https://calculadorafrete.antt.gov.br/?Length=4 (accessed on 18 January 2025).

- CEIC Brazil BR: Discount Rate: End of Period. Available online: https://www.ceicdata.com/en/brazil/money-market-and-policy-rates-annual/br-discount-rate-end-of-period (accessed on 2 December 2024).

- Agência Nacional do Petróleo, Gás Natural e Biocombustíveis Produtores de Etanol. Available online: https://app.powerbi.com/view?r=eyJrIjoiMmRhZWU2NDUtZWE2Yi00NzI5LWJjMGQtNjIwNjE0MjM0MjEzIiwidCI6IjQ0OTlmNGZmLTI0YTYtNGI0Mi1iN2VmLTEyNGFmY2FkYzkxMyJ9 (accessed on 18 January 2025).

- Agência Nacional do Petróleo, Gás Natural e Biocombustíveis Vendas, Pelas Distribuidoras, Dos Derivados Combustíveis de Petróleo. Available online: https://www.gov.br/anp/pt-br/centrais-de-conteudo/dados-estatisticos/de/vdpb/vendas-combustiveis-m3.xls (accessed on 24 January 2025).

- Hayward, J.A.; O’Connell, D.A.; Raison, R.J.; Warden, A.C.; O’Connor, M.H.; Murphy, H.T.; Booth, T.H.; Braid, A.L.; Crawford, D.F.; Herr, A.; et al. The Economics of Producing Sustainable Aviation Fuel: A Regional Case Study in Queensland, Australia. GCB Bioenergy 2015, 7, 497–511. [Google Scholar] [CrossRef]

- Wang, W.-C. Techno-Economic Analysis for Evaluating the Potential Feedstocks for Producing Hydro-Processed Renewable Jet Fuel in Taiwan. Energy 2019, 179, 771–783. [Google Scholar] [CrossRef]

- Agência Nacional de Aviação Civil (Anac). Inventário Nacional de Emissões Atmosféricas da Aviação Civil. Available online: https://www.gov.br/anac/pt-br/assuntos/meio-ambiente/inventario-nacional-de-emissoes-atmosfericas-da-aviacao-civil (accessed on 27 January 2025).

- Brazilian Government Brasil Presenta a la ONU una Nueva NDC Alineada con el Acuerdo de París. Available online: https://www.gov.br/secom/es/ultimas-noticias/2024/11/brasil-presenta-a-la-onu-una-nueva-ndc-alineada-con-el-acuerdo-de-paris (accessed on 28 January 2025).

| States | Anhydrous Ethanol Production Capacity (m3/d) | Hydrated Ethanol Production Capacity (m3/d) | Vinasse |

|---|---|---|---|

| Alagoas (AL) | 3618 | 5193 | 21,918,244 |

| Goiás (GO) | 17,754 | 41,085 | 170,762,546 |

| Mato Grosso (MT) | 16,370 | 21,584 | 110,150,099 |

| Mato Grosso del Sur (MS) | 12,440 | 24,470 | 107,070,202 |

| Minas Gerais (MG) | 13,390 | 23,648 | 107,491,684 |

| Paraíba (PB) | 1880 | 3115 | 12,452,562 |

| Paraná (PR) | 7120 | 13,110 | 58,711,506 |

| Pernanbuco (PE) | 2172 | 3488 | 14,079,816 |

| Sao Paulo (SP) | 58,495 | 117,125 | 509,684,364 |

| States | Demand (Tonnes/Year) |

|---|---|

| Alagoas (AL)—Maiceo | 39,694 |

| Goiás (GO)—Brasilia | 46,682 |

| Mato Grosso (MT)—Cuiba | 54,250 |

| Mato Grosso del Sur (MS)—Campo Grande | 16,996 |

| Minas Gerais (MG)—Belo Horizonte | 118,256 |

| Paraíba (PB)—João Pessoa | 34,804 |

| Paraná (PR)—Curitiba | 69,357 |

| Pernanbuco (PE)—Recife | 212,572 |

| São Paulo (SP)—São Paulo | 3,034,811 |

| State | Gasoline | Diesel | Aviation Fuel | Biomethane |

|---|---|---|---|---|

| Alagoas (AL) | 9458 | 20,145 | 14,474 | 54,908 |

| Goiás (GO) | 30,504 | 64,974 | 46,682 | 177,094 |

| Minas Gerais (MG) | 51,269 | 109,205 | 78,461 | 297,650 |

| Mato Grosso do Sul (MS) | 10,513 | 22,393 | 16,089 | 61,036 |

| Mato Grosso (MT) | 35,449 | 75,507 | 54,250 | 205,805 |

| Paraíba (PB) | 4159 | 8858 | 6364 | 24,145 |

| Pernambuco (PE) | 7082 | 15,085 | 10,838 | 41,115 |

| Paraná (PR) | 28,561 | 60,836 | 43,709 | 165,816 |

| São Paulo (SP) | 257,872 | 549,273 | 394,639 | 1,497,113 |

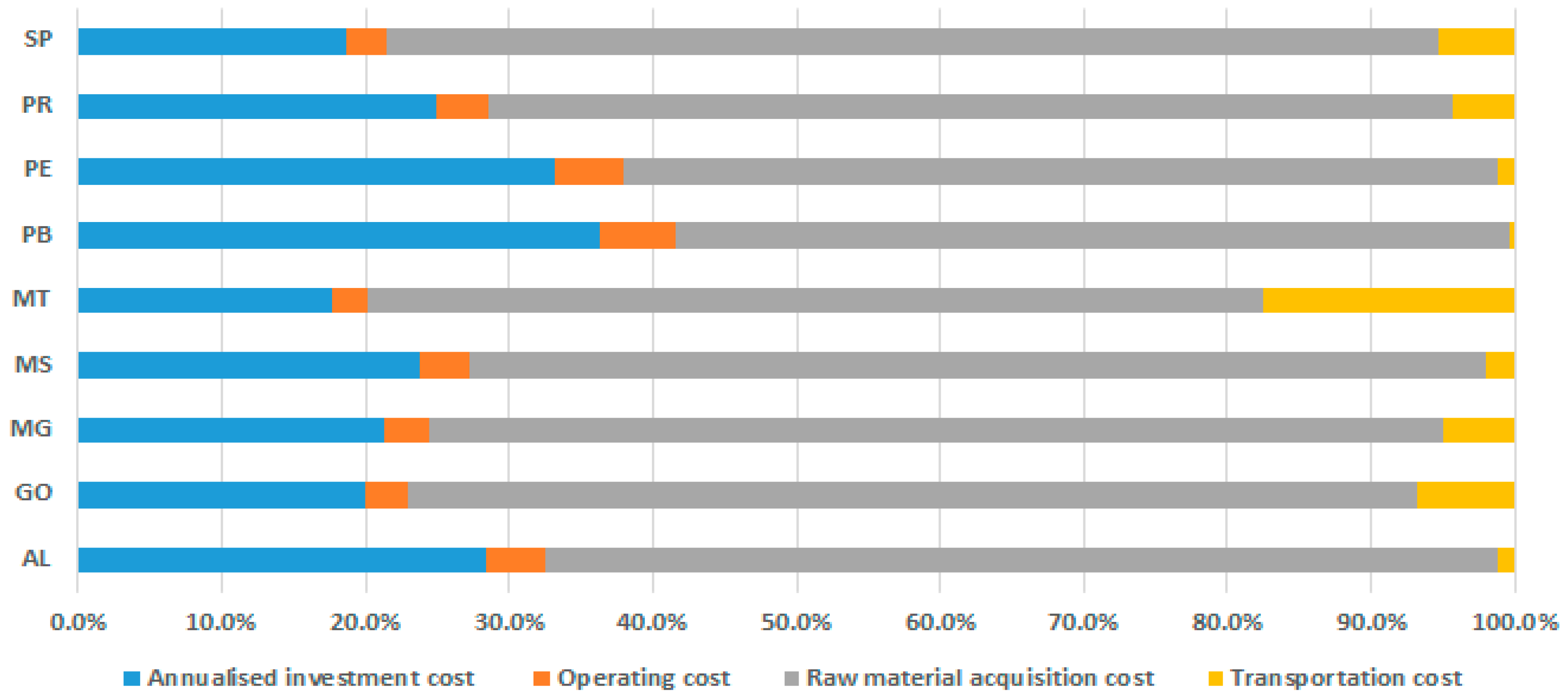

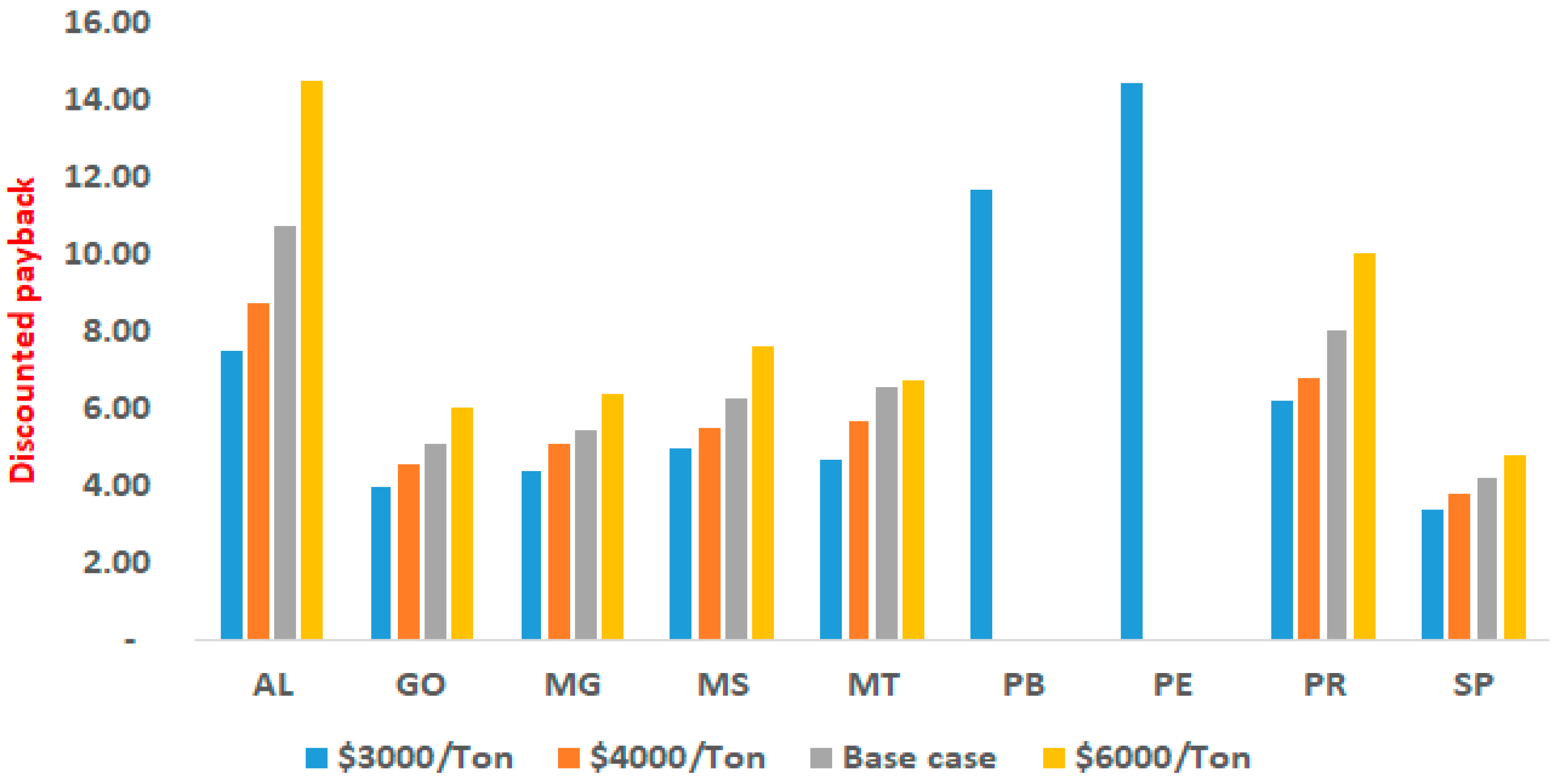

| Parameter | Configurations | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| AL | GO | MG | MS | MT | PB | PE | PR | SP | |

| INVC | 12.73 | 27.16 | 48.37 | 11.07 | 31.40 | 8.16 | 12.07 | 33.23 | 206.76 |

| OPEC | 1.86 | 3.96 | 7.06 | 1.62 | 4.58 | 1.19 | 1.76 | 4.85 | 30.19 |

| TRNC | 0.52 | 9.30 | 11.42 | 0.95 | 31.09 | 0.08 | 0.43 | 5.79 | 59.37 |

| RMAC | 29.66 | 95.68 | 160.81 | 32.97 | 111.19 | 13.04 | 22.21 | 89.58 | 808.82 |

| PRSC | 72.23 | 232.97 | 391.56 | 80.29 | 270.74 | 31.76 | 54.09 | 218.13 | 1969.46 |

| FO | −27.45 | −96.88 | −163.91 | −33.68 | −92.49 | −9.28 | −17.62 | −84.68 | −864.33 |

| CF | 40.19 | 124.03 | 212.28 | 44.76 | 123.88 | 17.44 | 29.69 | 117.91 | 1071.09 |

| NPV | 28.08 | 260.01 | 417.97 | 75.63 | 198.66 | −25.42 | −17.34 | 141.25 | 2641.78 |

| IRR | 21.66 | 31.85 | 30.57 | 28.10 | 27.40 | 13.85 | 16.39 | 24.53 | 36.19 |

| DPb | 10.72 | 5.10 | 5.45 | 6.27 | 6.55 | 8.05 | 4.22 | ||

| CP | 0.010 | 0.009 | 0.009 | 0.009 | 0.010 | 0.011 | 0.011 | 0.010 | 0.009 |

| States | Emissions (Tonne CO2 eq) | |||

|---|---|---|---|---|

| Avoided | Emitted by RMA | Emitted by Transport | Net Balance | |

| Alagoas (AL) | 340,178.35 | 5142.21 | 30.60 | 335,005.55 |

| Goiás (GO) | 1,097,172.97 | 16,585.09 | 516.97 | 1,080,070.90 |

| Minas Gerais (MG) | 1,844,068.49 | 27,875.32 | 668.15 | 1,815,525.02 |

| Mato Grosso do Sul (MS) | 378,144.32 | 5716.11 | 48.92 | 372,379.29 |

| Mato Grosso (MT) | 1,275,044.64 | 19,273.84 | 1809.41 | 1,253,961.39 |

| Paraíba (PB) | 149,585.63 | 2261.17 | 4.35 | 147,320.11 |

| Pernambuco (PE) | 254,723.33 | 3850.45 | 25.37 | 250,847.51 |

| Paraná (PR) | 1,027,299.63 | 15,528.87 | 339.83 | 1,011,430.93 |

| São Paulo (SP) | 9,275,238.78 | 140,206.43 | 3486.53 | 9,131,545.81 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Infante Cuan, J.E.; Fernández García, V.; Palacios, R.; Viana Ensinas, A. Optimisation for Sustainable Supply Chain of Aviation Fuel, Green Diesel, and Gasoline from Microalgae Cultivated in Sugarcane Vinasse. Processes 2025, 13, 1326. https://doi.org/10.3390/pr13051326

Infante Cuan JE, Fernández García V, Palacios R, Viana Ensinas A. Optimisation for Sustainable Supply Chain of Aviation Fuel, Green Diesel, and Gasoline from Microalgae Cultivated in Sugarcane Vinasse. Processes. 2025; 13(5):1326. https://doi.org/10.3390/pr13051326

Chicago/Turabian StyleInfante Cuan, Jorge Eduardo, Víctor Fernández García, Reynaldo Palacios, and Adriano Viana Ensinas. 2025. "Optimisation for Sustainable Supply Chain of Aviation Fuel, Green Diesel, and Gasoline from Microalgae Cultivated in Sugarcane Vinasse" Processes 13, no. 5: 1326. https://doi.org/10.3390/pr13051326

APA StyleInfante Cuan, J. E., Fernández García, V., Palacios, R., & Viana Ensinas, A. (2025). Optimisation for Sustainable Supply Chain of Aviation Fuel, Green Diesel, and Gasoline from Microalgae Cultivated in Sugarcane Vinasse. Processes, 13(5), 1326. https://doi.org/10.3390/pr13051326