What Is the Right Innovation Type for Your Industry? Evidence from Chemical Firms in Korea

Abstract

1. Introduction

- (1)

- First, while different arguments exist on the appropriate innovation strategy in mature industries, this study is expected to identify which innovation type is more appropriate for chemical firms.

- (2)

- On top of that, we verify the most appropriate innovation strategy in terms of innovation efficiency, with considering the inputs required to achieve innovation as well.

2. Theoretical Background

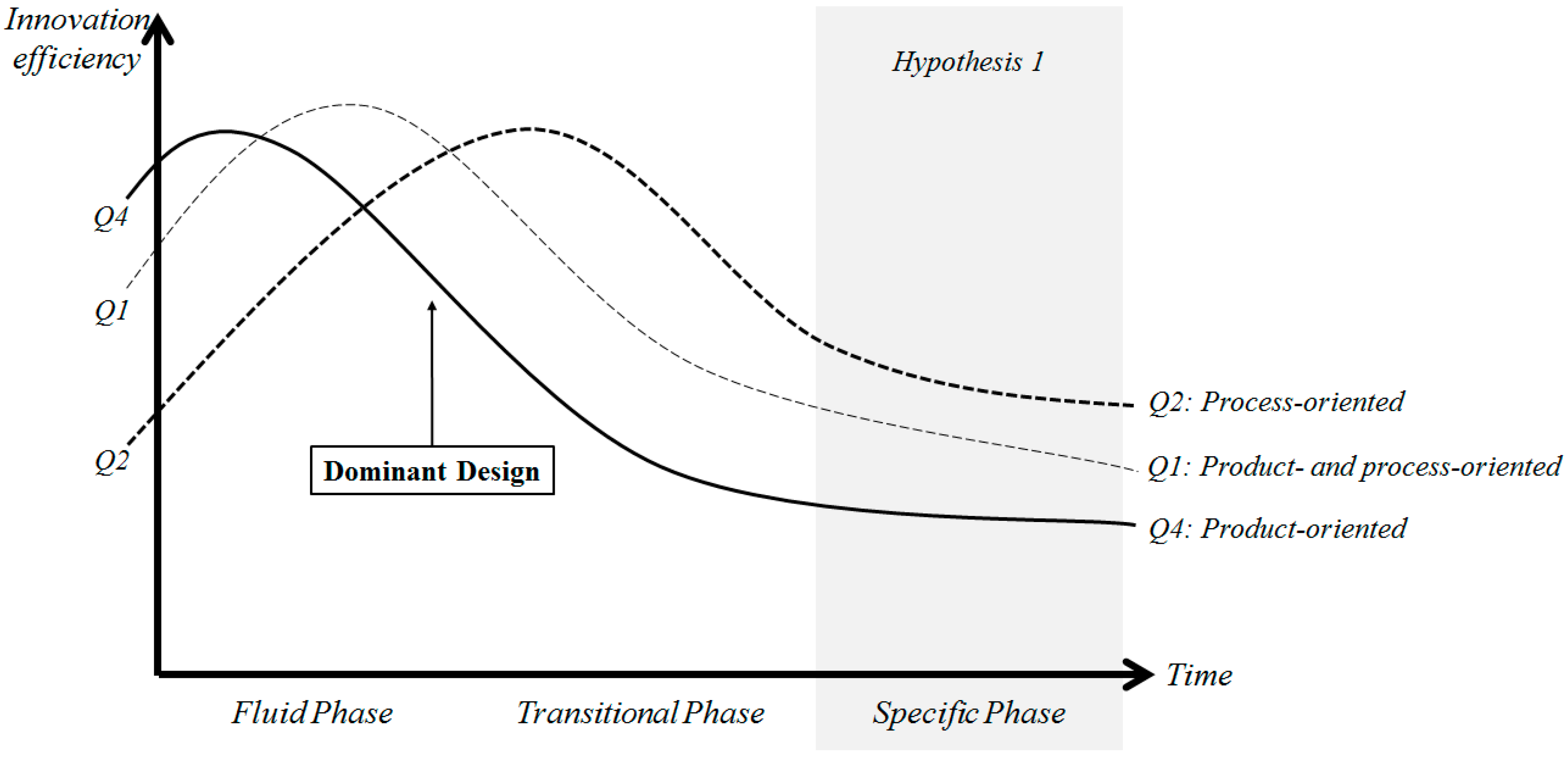

2.1. Innovation Types and the Industry’s Maturity

2.2. Innovation in the Chemical Industry

2.3. Innovation Efficiency

3. Research Method

3.1. Efficiency Measurement

3.2. Research Model

3.3. Data

4. Results

4.1. Kruskal–Wallis One-Way ANOVA

4.2. Asymptotics and Consistent Bootstraps for the Non-Parametric Model

5. Conclusions

5.1. Discussion

5.2. Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A. Data Envelopment Analysis Results

| DMU | Efficiency | RTS | DMU | Efficiency | RTS | ||

|---|---|---|---|---|---|---|---|

| CRS | VRS | CRS | VRS | ||||

| 1 | 0.0765 | 0.4545 | IRS | 33 | 0.1535 | 0.2045 | IRS |

| 2 | 0.0508 | 0.0587 | IRS | 34 | 0.2764 | 0.3846 | IRS |

| 3 | 0.0979 | 0.1556 | IRS | 35 | 0.1333 | 0.1500 | IRS |

| 4 | 0.1947 | 0.4488 | IRS | 36 | 0.0559 | 0.1181 | IRS |

| 5 | 0.6719 | 1.0000 | IRS | 37 | 0.0948 | 0.2021 | IRS |

| 6 | 0.0557 | 0.0582 | IRS | 38 | 0.1939 | 0.3792 | DRS |

| 7 | 0.3935 | 0.4247 | IRS | 39 | 0.4212 | 1.0000 | DRS |

| 8 | 0.0528 | 0.4412 | IRS | 40 | 0.1551 | 0.1623 | IRS |

| 9 | 0.0595 | 0.1282 | IRS | 41 | 0.0947 | 0.1379 | IRS |

| 10 | 0.0264 | 0.2381 | IRS | 42 | 0.1164 | 0.2632 | IRS |

| 11 | 0.1947 | 1.0000 | IRS | 43 | 0.445 | 0.4830 | IRS |

| 12 | 0.0065 | 0.0292 | IRS | 44 | 0.0573 | 0.1193 | IRS |

| 13 | 0.9268 | 0.9390 | IRS | 45 | 0.0356 | 0.1027 | IRS |

| 14 | 0.1377 | 0.1830 | IRS | 46 | 0.2225 | 0.2415 | IRS |

| 15 | 0.0786 | 0.4545 | IRS | 47 | 0.3894 | 0.6581 | IRS |

| 16 | 0.0668 | 0.1312 | IRS | 48 | 0.0311 | 0.0509 | IRS |

| 17 | 0.1549 | 0.364 | DRS | 49 | 0.0441 | 0.0744 | IRS |

| 18 | 0.0195 | 0.0564 | IRS | 50 | 0.0587 | 0.0702 | IRS |

| 19 | 0.0855 | 0.1431 | DRS | 51 | 0.4988 | 1.0000 | DRS |

| 20 | 0.0822 | 0.1353 | IRS | 52 | 0.1331 | 0.1366 | IRS |

| 21 | 0.3171 | 0.5629 | IRS | 53 | 0.0388 | 0.0541 | IRS |

| 22 | 0.0834 | 0.3272 | IRS | 54 | 1.0000 | 1.0000 | CRS |

| 23 | 0.0834 | 0.4286 | IRS | 55 | 0.4906 | 0.7020 | IRS |

| 24 | 0.0949 | 0.1141 | IRS | 56 | 0.2453 | 0.2856 | IRS |

| 25 | 0.0844 | 0.1611 | IRS | 57 | 0.5209 | 0.5566 | IRS |

| 26 | 0.1362 | 0.5297 | IRS | 58 | 0.1244 | 0.8333 | IRS |

| 27 | 0.0927 | 0.2094 | IRS | 59 | 0.2225 | 0.5225 | IRS |

| 28 | 0.0927 | 0.3243 | IRS | 60 | 0.0619 | 0.7353 | IRS |

| 29 | 0.1601 | 0.2148 | DRS | 61 | 0.2235 | 0.8824 | IRS |

| 30 | 0.1994 | 0.2177 | DRS | 62 | 0.071 | 0.5906 | IRS |

| 31 | 0.1443 | 0.1512 | IRS | 63 | 0.0314 | 0.1066 | IRS |

| 32 | 0.0621 | 0.1054 | IRS | 64 | 0.6123 | 0.7741 | IRS |

References

- Abernathy, W.J.; Utterback, J.M. Patterns of industrial innovation. Technol. Rev. 1978, 80, 40–47. [Google Scholar]

- Pries, F.; Janszen, F. Innovation in the construction industry: The dominant role of the environment. Constr. Manag. Econ. 1995, 13, 43–51. [Google Scholar] [CrossRef]

- Lager, T. Product and process development intensity in process industry: A conceptual and empirical analysis of the allocation of company resources for the development of process technology. Int. J. Innov. Manag. 2002, 6, 105–130. [Google Scholar] [CrossRef]

- Sinclair, G.; Klepper, S.; Cohen, W. What’s experience got to do with it? Sources of cost reduction in a large specialty chemicals producer. Manag. Sci. 2000, 46, 28–45. [Google Scholar] [CrossRef]

- Bauer, M.; Leker, J. Exploration and exploitation in product and process innovation in the chemical industry. R D Manag. 2013, 43, 196–212. [Google Scholar] [CrossRef]

- Pisano, G.P. The Development Factory: Unlocking the Potential of Process Innovation; Harvard Business School Press: Boston, MA, USA, 1997. [Google Scholar]

- Martinez-Ros, E. Explaining the decisions to carry out product and process innovations: The Spanish case. J. High Technol. Manag. Res. 1999, 10, 223–242. [Google Scholar] [CrossRef]

- Damanpour, F.; Gopalakrishnan, S. The dynamics of the adoption of product and process innovations in organizations. J. Manag. Stud. 2001, 38, 45–65. [Google Scholar] [CrossRef]

- Reichstein, T.; Salter, A. Investigating the sources of process innovation among UK manufacturing firms. Ind. Corp. Chang. 2006, 15, 653–682. [Google Scholar] [CrossRef]

- Gilbert, X.; Strebel, P. Strategies to outpace the competition. J. Bus. Strategy 1987, 8, 28–36. [Google Scholar] [CrossRef]

- Hollanders, H.J.G.M.; Celikel-Esser, F. Measuring innovation efficiency. In 2007 European Innovation Scoreboard; European Commission: Brussels, Belgium, 2007. [Google Scholar]

- Guan, J.; Chen, K. Modeling the relative efficiency of national innovation systems. Res. Policy 2012, 41, 102–115. [Google Scholar] [CrossRef]

- Manual, O. Guidelines for Collecting, Reporting and Using Data on Innovation, 4th ed.; OECD Publishing: Paris, France, 2018. [Google Scholar]

- Lim, L.P.; Garnsey, E.; Gregory, M. Product and process innovation in biopharmaceuticals: A new perspective on development. R D Manag. 2006, 36, 27–36. [Google Scholar] [CrossRef]

- Utterback, J.M.; Abernathy, W.J. A dynamic model of process and product innovation. Omega 1975, 3, 639–656. [Google Scholar] [CrossRef]

- Klepper, S. Entry, exit, growth, and innovation over the product life cycle. Am. Econ. Rev. 1996, 86, 562–583. [Google Scholar]

- Adner, R.; Levinthal, D. Demand heterogeneity and technology evolution: Implications for product and process innovation. Manag. Sci. 2001, 47, 611–628. [Google Scholar] [CrossRef]

- Boer, H.; During, W.E. Innovation, what innovation? A comparison between product, process and organizational innovation. Int. J. Technol. Manag. 2001, 22, 83–107. [Google Scholar] [CrossRef]

- Brem, A.; Nylund, P.A.; Schuster, G. Innovation and de facto standardization: The influence of dominant design on innovative performance, radical innovation, and process innovation. Technovation 2016, 50, 79–88. [Google Scholar] [CrossRef]

- Pavitt, K. Sectoral patterns of technical change: Towards a taxonomy and a theory. Res. Policy 1984, 13, 343–373. [Google Scholar] [CrossRef]

- Robson, M.; Townsend, J.; Pavitt, K. Sectoral patterns of production and use of innovations in the UK: 1945–1983. Res. Policy 1988, 17, 1–14. [Google Scholar] [CrossRef]

- Linn, R.A. Product development in the chemical industry: A description of a maturing business. J. Prod. Innov. Manag. 1984, 1, 116–128. [Google Scholar] [CrossRef]

- Hivner, W.; Hopkins, W.E.; Hopkins, S.A. Facilitating, accelerating, and sustaining the innovation diffusion process: An epidemic modeling approach. Eur. J. Innov. Manag. 2003, 6, 80–89. [Google Scholar] [CrossRef]

- Frenkel, A. Barriers and Limitations in the Development of Industrial Innovation in the Region. Eur. Plan. Stud. 2003, 11, 115–137. [Google Scholar] [CrossRef]

- Fernandes, C.I.; Ferreira, J.J.; Raposo, M.L. Drivers to firm innovation and their effects on performance: An international comparison. Int. Entrep. Manag. J. 2013, 9, 557–580. [Google Scholar] [CrossRef]

- Ee Shiang, L.; Nagaraj, S. Impediments to innovation: Evidence from Malaysian manufacturing firms. Asia Pac. Bus. Rev. 2011, 17, 209–223. [Google Scholar] [CrossRef]

- Barnett, B.D.; Clark, K.B. Technological newness: An empirical study in the process industries. J. Eng. Technol. Manag. 1996, 13, 263–282. [Google Scholar] [CrossRef]

- Liu, Z.; Chen, X.; Chu, J.; Zhu, Q. Industrial development environment and innovation efficiency of high-tech industry: Analysis based on the framework of innovation systems. Technol. Anal. Strateg. Manag. 2018, 30, 434–446. [Google Scholar] [CrossRef]

- Shin, J.; Kim, C.; Yang, H. Does Reduction of Material and Energy Consumption Affect to Innovation Efficiency? The Case of Manufacturing Industry in South Korea. Energies 2019, 12, 1178. [Google Scholar] [CrossRef]

- Asimakopoulos, G.; Revilla, A.J.; Slavova, K. External Knowledge Sourcing and Firm Innovation Efficiency. Br. J. Manag. 2019. [Google Scholar] [CrossRef]

- Li, H.; He, H.; Shan, J.; Cai, J. Innovation efficiency of semiconductor industry in China: A new framework based on generalized three-stage DEA analysis. Socio Econ. Plan. Sci. 2019, 66, 136–148. [Google Scholar] [CrossRef]

- Kim, C.; Shin, W.S. Does Information from the Higher Education and R and D Institutes Improve the Innovation Efficiency of Logistic Firms? Asian J. Shipp. Logist. 2019, 35, 70–76. [Google Scholar] [CrossRef]

- Shi, X.; Wu, Y.; Fu, D. Does University-Industry collaboration improve innovation efficiency? Evidence from Chinese Firms. Econ. Model. 2019. [Google Scholar] [CrossRef]

- Wang, Y.; Zhu, Z.; Liu, Z. Evaluation of technological innovation efficiency of petroleum companies based on BCC–Malmquist index model. J. Pet. Explor. Prod. Technol. 2019, 9, 2405–2416. [Google Scholar] [CrossRef]

- Shin, J.; Kim, C.; Yang, H. The effect of sustainability as innovation objectives on innovation efficiency. Sustainability 2018, 10, 1966. [Google Scholar] [CrossRef]

- Park, J.H. Open innovation of small and medium-sized enterprises and innovation efficiency. Asian J. Technol. Innov. 2018, 26, 115–145. [Google Scholar] [CrossRef]

- Wang, Q.; Hang, Y.; Sun, L.; Zhao, Z. Two-stage innovation efficiency of new energy enterprises in China: A non-radial DEA approach. Technol. Forecast. Soc. Chang. 2016, 112, 254–261. [Google Scholar] [CrossRef]

- Suh, Y.; Kim, M.S. A taxonomy of service innovations based on the innovative activity efficiency of service firms: A DEA approach. Int. J. Serv. Technol. Manag. 2014, 20, 267–289. [Google Scholar] [CrossRef]

- Cruz-Cázares, C.; Bayona-Sáez, C.; García-Marco, T. You can’t manage right what you can’t measure well: Technological innovation efficiency. Res. Policy 2013, 42, 1239–1250. [Google Scholar] [CrossRef]

- Wang, C.H.; Lu, Y.H.; Huang, C.W.; Lee, J.Y. R and D, productivity, and market value: An empirical study from high-technology firms. Omega 2013, 41, 143–155. [Google Scholar] [CrossRef]

- Claudio, C.C.; Teresa, G.M.; Cristina, B.S. Does technological innovation efficiency really matter for firm performance. Res. Policy 2013, 42, 1239–1250. [Google Scholar]

- Chen, K.; Guan, J. Measuring the efficiency of China’s regional innovation systems: Application of network data envelopment analysis (DEA). Reg. Stud. 2012, 46, 355–377. [Google Scholar] [CrossRef]

- Bae, Y.; Chang, H. Efficiency and effectiveness between open and closed innovation: Empirical evidence in South Korean manufacturers. Technol. Anal. Strateg. Manag. 2012, 24, 967–980. [Google Scholar] [CrossRef]

- Aigner, D.; Lovell, C.K.; Schmidt, P. Formulation and estimation of stochastic frontier production function models. J. Econ. 1977, 6, 21–37. [Google Scholar] [CrossRef]

- Theodoridis, A.M.; Anwar, M.M. A comparison of DEA and SFA methods: A case study of farm households in Bangladesh. J. Dev. Areas 2011, 45, 95–110. [Google Scholar] [CrossRef]

- Andor, M.; Hesse, F. A Monte Carlo Simulation Comparing DEA, SFA and Two Simple Approaches to Combine Efficiency Estimates. Master’s Thesis, Center of Applied Economic Research Münster (CAWM), University of Münster, Münster, Germany, 2011. [Google Scholar]

- Kruskal, W.H.; Wallis, W.A. Use of ranks in one-criterion variance analysis. J. Am. Stat. Assoc. 1952, 47, 583–621. [Google Scholar] [CrossRef]

- Dasgupta, S.; Sarkis, J.; Talluri, S. Influence of information technology investment on firm productivity: A cross-sectional study. Logist. Inf. Manag. 1999, 12, 120–129. [Google Scholar] [CrossRef]

- Talluri, S.; Vickery, S.K.; Droge, C.L. Transmuting performance on manufacturing dimensions into business performance: An exploratory analysis of efficiency using DEA. Int. J. Prod. Res. 2003, 41, 2107–2123. [Google Scholar] [CrossRef]

- Guan, J.; Chen, K. Measuring the innovation production process: A cross-region empirical study of China’s high-tech innovations. Technovation 2010, 30, 348–358. [Google Scholar] [CrossRef]

- Zhong, W.; Yuan, W.; Li, S.X.; Huang, Z. The performance evaluation of regional R and D investments in China: An application of DEA based on the first official China economic census data. Omega 2011, 39, 447–455. [Google Scholar] [CrossRef]

- Shun-Cai, L.; Ling, C.; Feng-zhu, L.I.U. The analysis of innovation efficiency of enterprises in Hubei Province based on DEA method. Int. Assoc. Manag. Technol. 2015, 3, 1244–1260. [Google Scholar]

- Qin, X.; Du, D. Do external or internal technology spillovers have a stronger influence on innovation efficiency in China? Sustainability 2017, 9, 1574. [Google Scholar]

- Diaz-Balteiro, L.; Herruzo, A.C.; Martinez, M.; González-Pachón, J. An analysis of productive efficiency and innovation activity using DEA: An application to Spain’s wood-based industry. For. Policy Econ. 2006, 8, 762–773. [Google Scholar] [CrossRef]

- Hashimoto, A.; Haneda, S. Measuring the change in R and D efficiency of the Japanese pharmaceutical industry. Res. Policy 2008, 37, 1829–1836. [Google Scholar] [CrossRef]

- Gascón, F.; Lozano, J.; Ponte, B.; de la Fuente, D. Measuring the efficiency of large pharmaceutical companies: An industry analysis. Eur. J. Health Econ. 2017, 18, 587–608. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Sensitivity analysis of efficiency scores: How to bootstrap in nonparametric frontier models. Manag. Sci. 1998, 44, 49–61. [Google Scholar] [CrossRef]

- Kneip, A.; Simar, L.; Wilson, P.W. Asymptotics and consistent bootstraps for DEA estimators in nonparametric frontier models. Econ. Theory 2008, 24, 1663–1697. [Google Scholar] [CrossRef]

- Chiaroni, D.; Chiesa, V.; Frattini, F. Unravelling the process from Closed to Open Innovation: Evidence from mature, asset-intensive industries. R D Manag. 2010, 40, 222–245. [Google Scholar] [CrossRef]

- Wang, C.H.; Chen, K.L. Do Relationships have a Dark Side for Innovation Performance in the High-Tech Industry? Int. J. Innov. Technol. Manag. 2018, 15, 1850018. [Google Scholar] [CrossRef]

- Guimaraes, T.; Paranjape, K.; Cornick, M.; Armstrong, C.P. Empirically testing factors increasing manufacturing product innovation success. Int. J. Innov. Technol. Manag. 2018, 15, 1850019. [Google Scholar] [CrossRef]

- Alexander, B.; Joe, T. (Eds.) Managing Innovation: What do We Know about Innovation Success Factors? World Scientific: London, UK, 2019; Volume 33. [Google Scholar]

- Rauter, R.; Globocnik, D.; Perl-Vorbach, E.; Baumgartner, R.J. Open innovation and its effects on economic and sustainability innovation performance. J. Innov. Knowl. 2018. [Google Scholar] [CrossRef]

- Nylund, P.A.; Arimany-Serrat, N.; Ferras-Hernandez, X.; Viardot, E.; Boateng, H.; Brem, A. Internal and external financing of innovation: Sectoral differences in a longitudinal study of European firms. Eur. J. Innov. Manag. 2019. [Google Scholar] [CrossRef]

- Aronson, Z.H.; Reilly, R.R.; Lynn, G.S. Understanding the Role of Team Member Personal Style in Project Performance: Does the Type of Innovation Matter? Int. J. Innov. Technol. Manag. 2019, 16, 1940002. [Google Scholar] [CrossRef]

- Trachuk, A.; Linder, N. Innovation and performance: An empirical study of Russian industrial companies. Int. J. Innov. Technol. Manag. 2018, 15, 1850027. [Google Scholar] [CrossRef]

| Source | Method | DMUs | Input Factors | Output Factors |

|---|---|---|---|---|

| Shin et al. [29] | DEA | 388 Korean manufacturing companies | (1) R and D employee (2) R and D expense | (1) Patent application (2) Innovation sales |

| Asimakopoulos et al. [30] | DEA | 3024 Spanish firms | (1) Percentage of R and D staff (2) Percentage of R and D expense | (1) Percentage sales of products new to the firm (2) Percentage sales of products new to the market |

| Li et al. [31] | DEA | 64 Chinese semiconductor companies | (1) The number of R and D personnel (2) Total R and D capital expenditure (3) Total investment in patent management | (1) The incremental increase in sales over the previous year (2) The number of patent applications |

| Kim and Shin [32] | DEA | 72 Korean logistics firms | (1) The number of employee (2) The innovative activity cost | (1) The sales |

| Shi et al. [33] | Network DEA | 443 Chinese innovative firms | (1) Internal R and D expenditure (2) R and D personnel (3) Total number of patents (4) Total number of invention patents | (1) Value of new product (2) Profit (3) Revenue (4) Tax |

| Wang et al. [34] | DEA/Malmquist index | 10 Chinese petroleum firms | (1) R and D stuff (2) R and D investment (3) Non R and D investment | (1) Innovative product patent (2) Innovative product sales (3) Innovative products market share |

| Shin et al. [35] | DEA | 441 Korean manufacturing companies | (1) R and D employee (2) R and D expense | (1) Patent application (2) Innovation sales |

| Park [36] | DEA | 1778 Korean manufacturing SMEs | (1) R and D expenditure divided by total sales (2) share of R and D staff in total employment | (1) Percentage of sales from R and D activities |

| Wang et al. [37] | DEA | 38 Chinese new energy enterprises | (1) Fixed assets (2) Staff wages (3) R and D costs | (1) Total profits (2) Market value |

| Suh and Kim [38] | DEA | 300 Korean service firms | (1) Number of researchers (2) Investment in IT infrastructure (3) Innovation cost for physical resources | (1) Service innovation (2) Process innovation (3) patents |

| Cruz-Cázares et al. [39] | DEA/Malmquist index | 415 (first stage)/362 (second stage) Spanish manufacturing firms | (1) R and D capital stock (2) High-skill staff | (1) The number of product innovations (2) The number of patents |

| Wang et al. [40] | DEA | Top 65 high-technology firms | (1) Employees (2) Assets (3) Number of researchers (4) R and D expenditures | (1) Market value (2) Return on investment |

| Claudio et al. [41] | DEA | 3111 observations of 536 Spanish manufacturing firms | (1) R and D capital stock (2) High-skilled staff | (1) New products (2) Patents |

| Chen and Guan [42] | DEA | 30 Chinese province-level regions | (1) Expenditure on science and technology (2) Number of science and technology personnel (3) Foreign direct investment (4) Expenditure on the import of technology (5) Expenditure on the purchase of domestic technology (6) Value of contractual inflows in domestic technical markets | (1) Gross domestic products (2) Sale of new products (3) Value of exports (4) Annual income in urban residents per capita |

| Bae and Chang [43] | DEA | 1251 Korean manufacturing firms | (1) Innovation expenditures | (1) R and D personnel (2) The number of registered patents (3) The turnover (4) Operating profits |

| Guan and Chen [12] | DEA | 22 countries | (1) Number of full-time equivalent scientists and engineers (2) Incremental R and D expenditure (3) Prior accumulated knowledge stock breeding upstream knowledge production | (1) Added value of industries (2) Export of new products in high-tech industries |

| Variable | Description | Source |

|---|---|---|

| The number of R and D employees | The number of personnel dedicated to R and D among the firm’s regular employees | Guan and Chen [50]; Zhong et al. [51]; Shun-Cai et al. [52]; Qin and Du [53] |

| Total innovation cost | Total amount of money spent on corporate innovation activities | Guan and Chen [50]; Zhong et al. [51]; Shun-Cai et al. [52]; Qin and Du [53] |

| Total sales | Income from the selling of goods and/or products | Díaz-Blateiro et al. [54], Hashimoto and Haneda [55]; Gascón et al. [56] |

| Division | Input Factors | Output Factor | |

|---|---|---|---|

| The Number of R&D Employees | Total Innovation Cost (Million KRW) | Total Sales (Million KRW) | |

| Max | 30 | 3000 | 141,133 |

| Min | 0 | 30 | 1291 |

| Mean | 7 | 611 | 27,584 |

| St.dev. | 6.487 | 652.034 | 32,554.458 |

| Comparison | Test Statistic | Std. Error | Std. Test Statistic | Sig. Test Statistic |

|---|---|---|---|---|

| C1(Q1–Q2) | −30.991 | 9.634 | −3.217 | 0.008 *** |

| C2(Q1–Q3) | −13.138 | 7.787 | −1.687 | 0.549 |

| C3(Q1–Q4) | −7.873 | 7.434 | −1.059 | 1.000 |

| C4(Q2–Q3) | 17.854 | 8.175 | 2.184 | 0.174 |

| C5(Q2–Q4) | 23.118 | 7.839 | 2.949 | 0.019 ** |

| C6(Q3–Q4) | 5.265 | 5.410 | 0.973 | 1.000 |

| Quadrant | Innovation Type | Bootstrap Efficiency Mean |

|---|---|---|

| Quadrant 1 | Product and Process-oriented Innovation | 0.1999 |

| Quadrant 2 | Process-oriented Innovation | 0.4362 |

| Quadrant 3 | Non-oriented Innovation | 0.2561 |

| Quadrant 4 | Product-oriented Innovation | 0.2515 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shin, J.; Kim, Y.; Yang, H.; Kim, C. What Is the Right Innovation Type for Your Industry? Evidence from Chemical Firms in Korea. Processes 2019, 7, 643. https://doi.org/10.3390/pr7100643

Shin J, Kim Y, Yang H, Kim C. What Is the Right Innovation Type for Your Industry? Evidence from Chemical Firms in Korea. Processes. 2019; 7(10):643. https://doi.org/10.3390/pr7100643

Chicago/Turabian StyleShin, Jaeho, Yeongjun Kim, Hongsuk Yang, and Changhee Kim. 2019. "What Is the Right Innovation Type for Your Industry? Evidence from Chemical Firms in Korea" Processes 7, no. 10: 643. https://doi.org/10.3390/pr7100643

APA StyleShin, J., Kim, Y., Yang, H., & Kim, C. (2019). What Is the Right Innovation Type for Your Industry? Evidence from Chemical Firms in Korea. Processes, 7(10), 643. https://doi.org/10.3390/pr7100643