Risk Transmission and Resilience of China’s Corn Import Trade Network

Abstract

:1. Introduction

1.1. Research Background

1.2. Literature Review

1.2.1. External Risks and Corn Trade

1.2.2. Cascade Effect and Resilience of Network

2. Data and Methods

2.1. Data Sources and Data Processing

2.2. Method

2.2.1. Methods of Complex Network Analysis

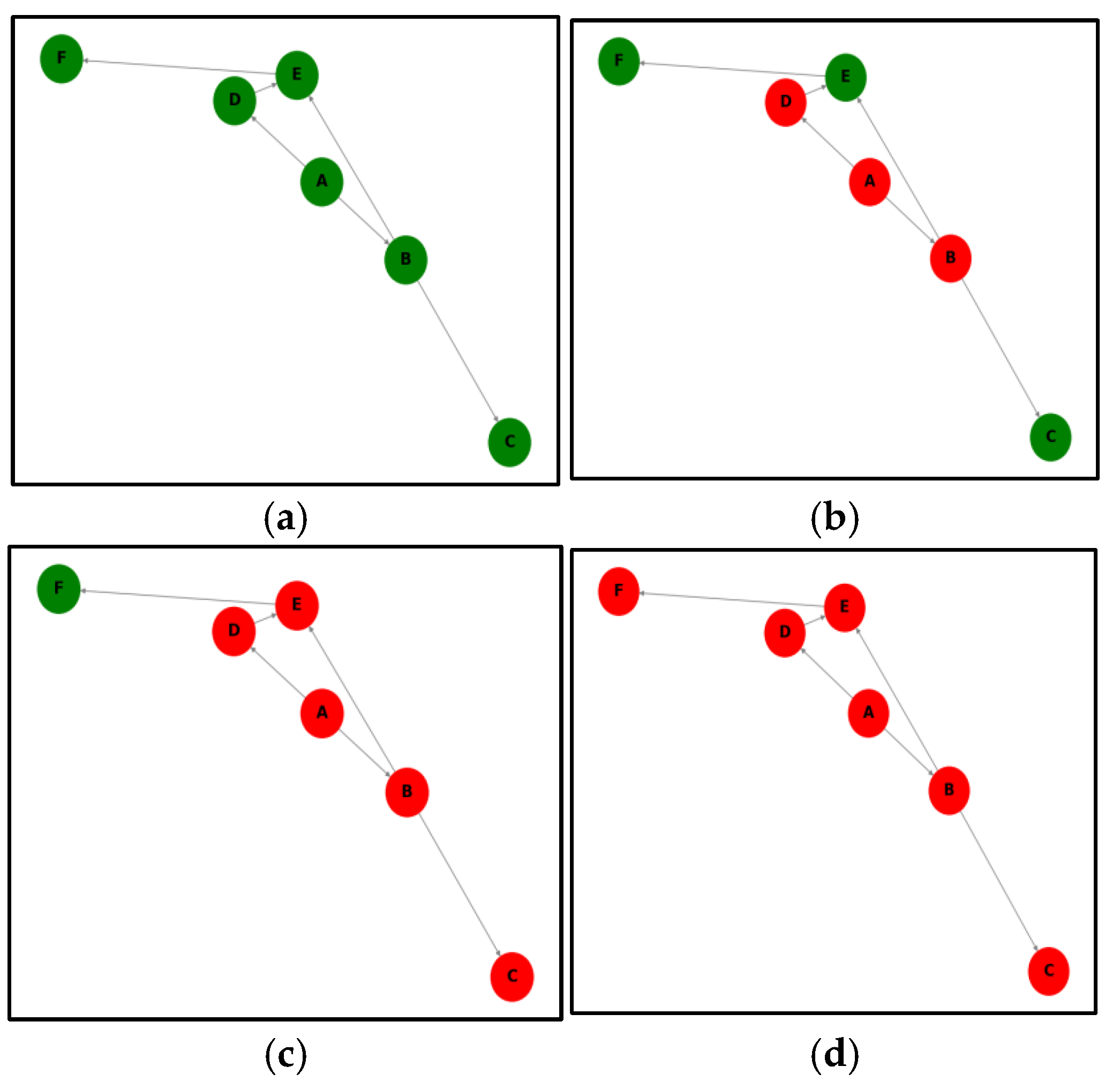

2.2.2. Method of Cascade Effect Simulation Analysis

2.2.3. Method of Indicator Quantification

2.3. Evaluation Framework for Trade Network Resilience

2.3.1. Complex Network Modeling of China’s Corn Import Trade System

2.3.2. Identification of Risk Sources in Global Corn Trade System

2.3.3. Resilience Capacity Assessment of China’s Corn Import System

2.3.4. Risk Propagation Pathways in China’s Corn Import Network

3. Results

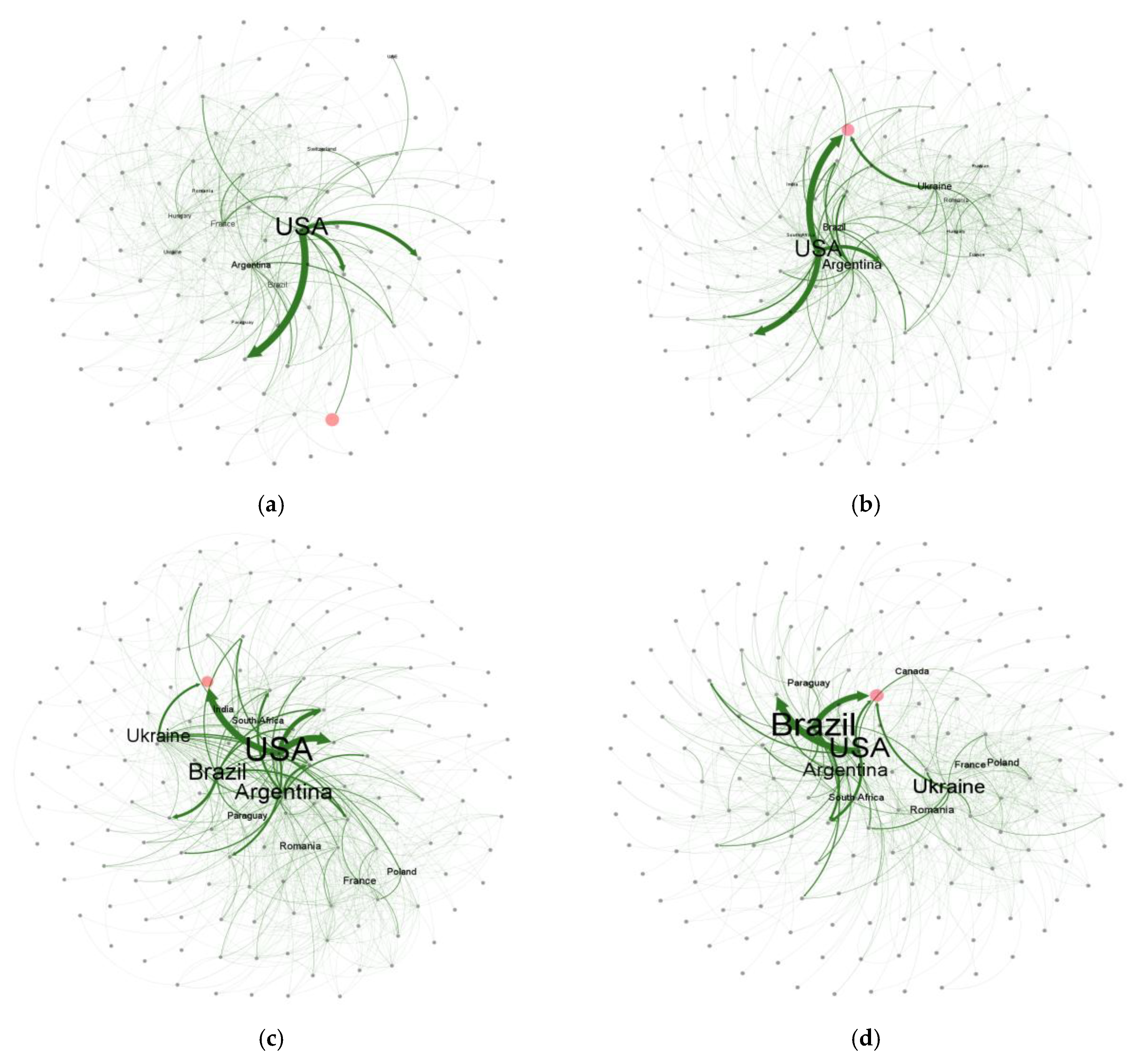

3.1. The Evolution of the Structure of the Global Corn Trade Network

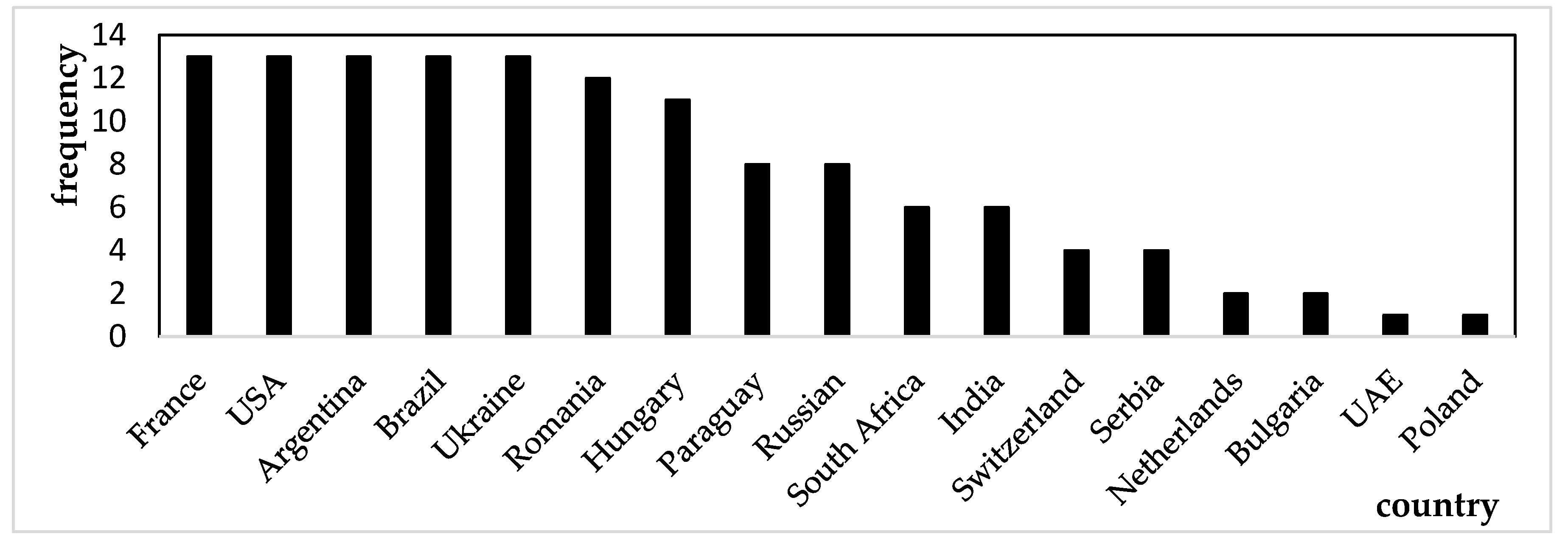

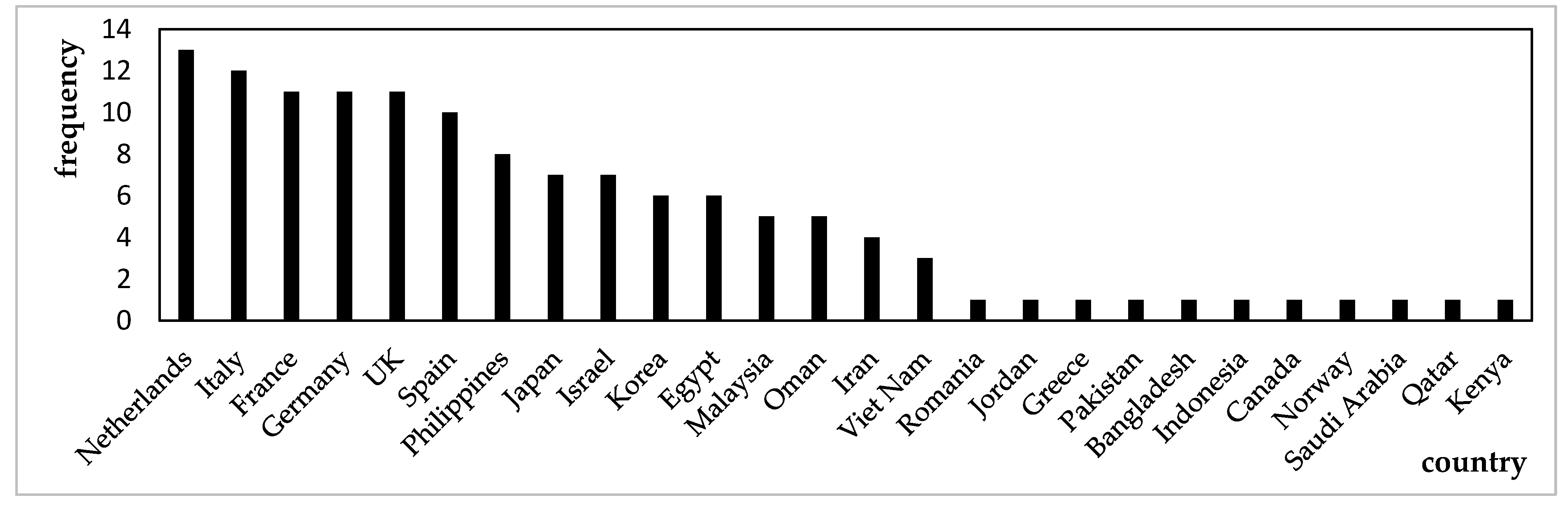

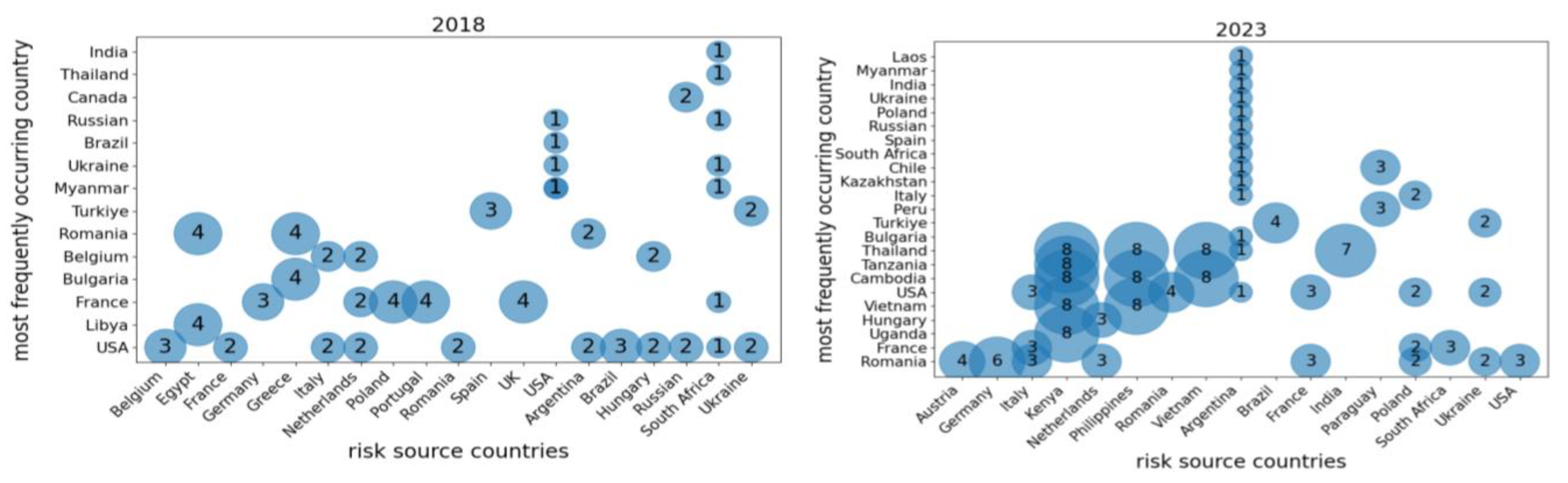

3.2. The Analysis of the Importance of Countries in the Corn Trade Network

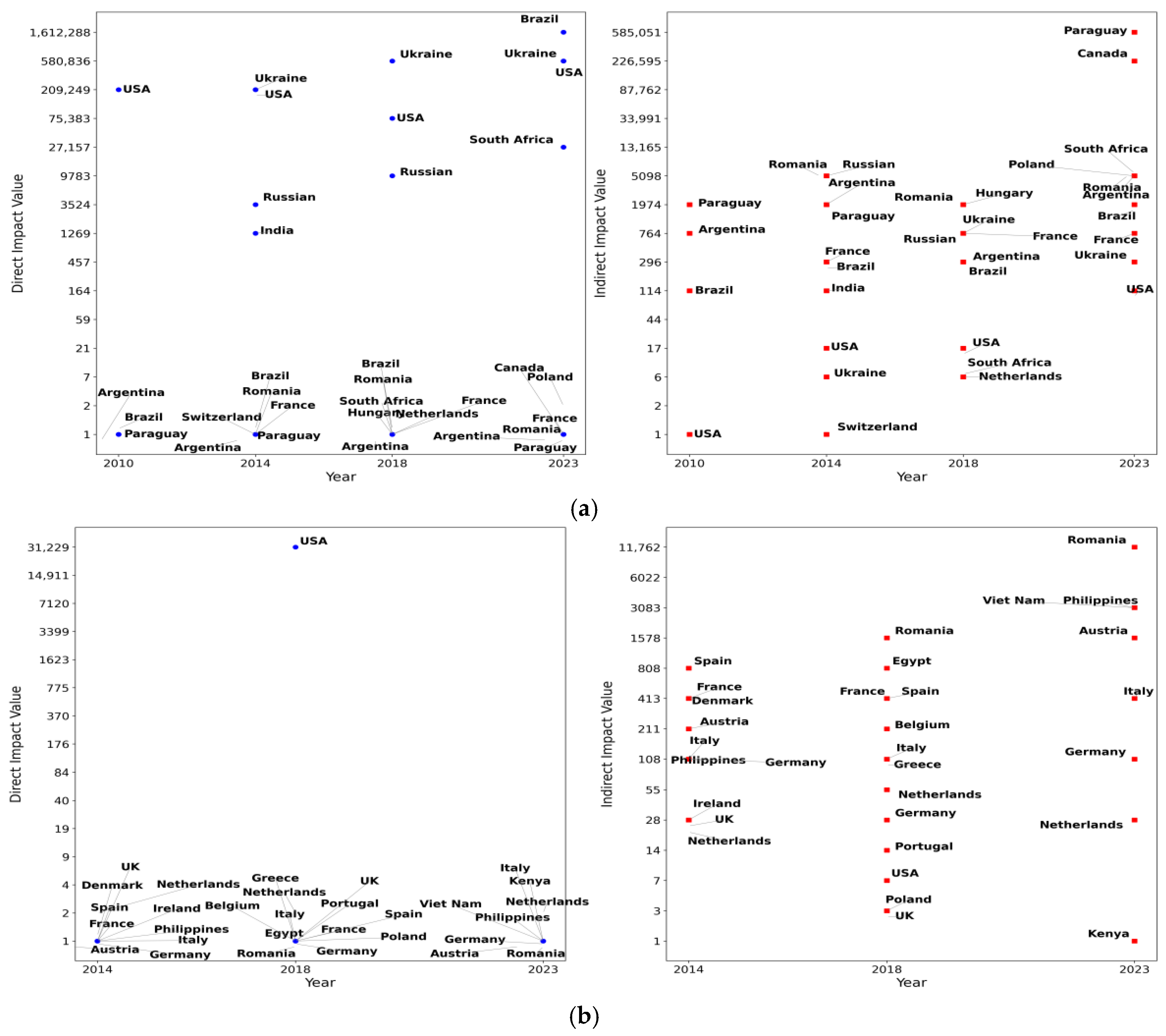

3.3. Resistance Capacity of China’s Corn Import Trade Network

3.4. Recovery Capacity of China’s Corn Import Trade Network

3.5. The Analysis of the Resilience of China’s Corn Imports Under the Background of the Russia–Ukraine Conflict

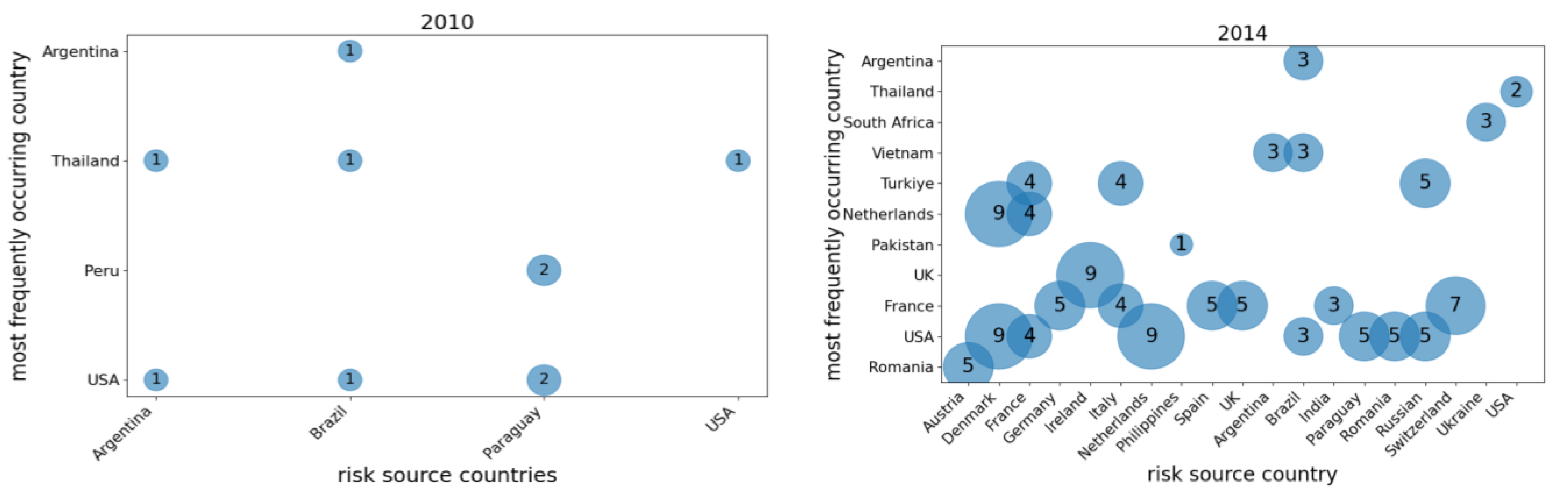

3.6. Risk Transmission Pathways in China’s Corn Imports

3.6.1. General Analysis of Risk Transmission Paths

3.6.2. Detailed Analysis of Risk Transmission Paths: A Case Study of 2023

4. Discussion

5. Conclusions and Recommendations

5.1. Conclusions

- China’s corn import trade network has demonstrated enhanced resilience against external risks from key exporting countries, primarily attributed to the complementary planting cycles between the Northern and Southern Hemispheres. This structural improvement was further accelerated by the Russia–Ukraine conflict, which reshaped global trade dynamics.

- Our analysis identifies the U.S., France, Romania, and Turkey as critical intermediaries in China’s corn import risk transmission network, leveraging their geographical proximity, trade network centrality, and export advantages.

- Regional risk transmission paths vary: South American risks transit through the U.S., while Asian risks propagate within regional networks with limited cross-regional impact.

5.2. Policy Recommendations

- Strengthening trade cooperation with Southern Hemisphere countries: China should actively enhance trade cooperation with Southern Hemisphere countries such as Argentina and South Africa. These countries possess significant natural resource advantages and considerable room for expanding agricultural production. By fostering bilateral cooperation, China can encourage these countries to expand their corn cultivation, optimize their planting techniques, and boost their export capacity, thereby securing a more stable and substantial supply of corn.

- Mitigating risk transmission effects through focused engagement with intermediary countries: Intermediary countries play a pivotal role in the propagation and diffusion of risks. Therefore, focusing on intermediary countries is critical to ensuring the stability of China’s corn imports. On the one hand, China should actively negotiate bilateral agreements with intermediary countries, setting clear annual supply targets, establishing flexible adjustment mechanisms, and ensuring export volumes to China during emergencies (such as natural disasters or international conflicts). On the other hand, China should create regional supply buffer zones with intermediary countries. Strategic reserve centers should be established in key areas, such as U.S. border regions, French border zones, and in proximity to Turkey and the Middle East, specifically for the storage of corn and its processed products. Additionally, logistics parks should be set up at critical ports and railway junctions, integrating warehousing, processing, packaging, and export functions. China should also invest in modern unloading equipment and warehousing facilities at ports like the Port of Marseille in France, the Port of Le Havre, and Black Sea ports in Turkey to improve logistics efficiency.

- Optimizing the internal network structure of the Asian region: As risk transmission within Asian countries primarily occurs through regional internal networks, imbalances within these regional structures can lead to the aggregation of localized risks. To address this, China can enhance the role of existing regional trade agreements. For instance, within the RCEP framework, corn trade can be prioritized, and unified regional regulatory standards (such as for quality, transportation, processing, etc.) should be established to reduce trade friction and improve trade efficiency. Additionally, regional trade support platforms should be developed. By leveraging digital tools (e.g., electronic trading platforms), China can create a regional corn trade market that offers supply–demand data, transaction matching, price transparency, and other services to reduce transaction costs. Regional financial instruments and risk-hedging mechanisms can also be developed. For example, China could establish a corn futures exchange or trade insurance system within the region, helping regional traders and farmers manage price volatility.

5.3. Research Suggestions for Future Studies

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Falkendal, T.; Otto, C.; Schewe, J. Grain export restrictions during COVID-19 risk food insecurity in many low- and middle-income countries. Nat. Food 2021, 2, 11–14. [Google Scholar] [CrossRef] [PubMed]

- Felicia, W.; Hasan, G. Global Maize Trade and Food Security: Implications from a Social Network Model. Risk Anal. 2013, 33, 245–265. [Google Scholar]

- Shen, X.; Qiu, C. Research on the Mechanism of Corn Price Formation in China Based on the PLS-SEM Model. Foods 2024, 13, 875. [Google Scholar] [CrossRef] [PubMed]

- He, X.; Carriquiry, M.; Zhang, W.; Hayes, D.J. Predicting China’s corn acreage and production in 2021/22 and 2022/23. Agric. Policy Rev. 2021, 10–11. [Google Scholar]

- He, H. Study on the current situation and influencing factors of corn import trade in China—Based on the trade gravity model. J. Intell. Syst. 2024, 33, 20240040. [Google Scholar] [CrossRef]

- Lu, G.; Miao, Y.; Dong, X.; Dong, Z.; An, H.; Li, X. Strategies for improving food security under the impact of external grain price fluctuations: Evidence from China. Appl. Econ. 2024, 57, 887–903. [Google Scholar] [CrossRef]

- Muhammad, A.; Smith, S.A.; Grant, J.H. Can China meet its purchase obligations under the Phase One Trade Agreement? Appl. Econ. Perspect. Policy 2022, 44, 1393–1408. [Google Scholar] [CrossRef]

- Zhang, Z.Y.; Mao, X.F.; Yang, J. Maize at the Crossroads: Staple Food Grain or Feed Grain? Chin. Rural Econ. 2019, 6, 38–53. [Google Scholar]

- Gang, W.; Li, B.-H.; Liu, X.-X. Evolution of global grain trade network and supply risk assessment based on complex network. New Medit. Mediterr. J. Econ. Agric. Env. 2023, 22, 43–55. [Google Scholar]

- Tu, Y.-J.; Shu, Z.-H.; Wu, W.-J.; He, Z.-Y. Spatiotemporal analysis of global grain trade multilayer networks considering topological clustering. Trans. GIS 2024, 28, 345–355. [Google Scholar] [CrossRef]

- Lin, F.-Q.; Li, X.-C.; Jia, N.-Y.; Fan, F.; Hai, H.; Huang, J.-X. The impact of Russia-Ukraine conflict on global food security. Glob. Food Secur. 2023, 23, 34. [Google Scholar] [CrossRef]

- Yaghoob, J.; Helena, E.; Andrea, Z. The multiple dimensions of resilience in agricultural trade networks. Q Open 2024, 4, qoae024. [Google Scholar]

- Wei, C.Z.; Liu, X.-F.; Zhang, L.-P.; Wan, Y.-M.; Huang, G.-Z. Resilience analysis of global agricultural trade. Environ. Plan. B Urban Anal. City Sci. 2024, 13, 1240–1266. [Google Scholar] [CrossRef]

- Hu, Q.; Guo, M.; Wang, F.; Shao, L.; Wei, X. External supply risk of agricultural products trade along the Belt and Road under the background of COVID-19. Front. Public Health 2023, 11, 342167. [Google Scholar] [CrossRef] [PubMed]

- Ouyang, M.; Dueñas-Osorio, L.; Min, X. A three-stage resilience analysis framework for urban infrastructure systems. Struct. Saf. 2012, 36, 23–31. [Google Scholar] [CrossRef]

- Tan, W.J.; Zhang, A.N.; Cai, W. A graph-based model to measure structural redundancy for supply chain resilience. Int. J. Prod. Res. 2019, 57, 6385–6404. [Google Scholar] [CrossRef]

- Baker, J.W.; Schubert, M.; Faber, M.H. On the assessment of robustness. Struct. Saf. 2008, 30, 253–267. [Google Scholar] [CrossRef]

- Ouyang, M.; Wang, Z. Resilience assessment of interdependent infrastructure systems: With a focus on joint restoration modeling and analysis. Reliab. Eng. Syst. Saf. 2015, 141, 74–82. [Google Scholar] [CrossRef]

- Ding, Y.; Zhang, M.; Chen, S.; Nie, R. Assessing the resilience of China’s natural gas importation under network disruptions. Energy 2020, 211, 118459. [Google Scholar] [CrossRef]

- Karakoc, D.B.; Konar, M. A complex network framework for the efficiency and resilience trade-off in global food trade. Environ. Res. Lett. 2021, 16, 105003. [Google Scholar] [CrossRef]

- Wei, N.; Xie, W.-J.; Zhou, W.-X. Robustness of the international oil trade network under targeted attacks to economies. Energy 2022, 251, 123939. [Google Scholar] [CrossRef]

- Hao, H.; Ma, Z.; Wang, A.; Xing, W.; Song, H.; Zhao, P.; Wei, J.; Zheng, S. Modeling and assessing the robustness of the lithium global trade system against cascading failures. Resour. Policy 2023, 85, 103822. [Google Scholar] [CrossRef]

- Chen, Z.; Wang, H.; Liu, X.; Wang, Z.; Wen, S. Risk diffusion of international oil trade cuts: A network-based dynamics model. Energy Rep. 2022, 8, 11320–11333. [Google Scholar] [CrossRef]

- Zhou, X.-Y.; Lu, G.; Xu, Z.; Yan, X.; Khu, S.-T.; Yang, J.; Zhao, J. Influence of Russia-Ukraine war on the global energy and food security. Resour. Conserv. Recycl. 2023, 188, 106657. [Google Scholar] [CrossRef]

- Huang, H.; Zhao, J.; Liu, H.; Ren, S.; Liu, M.; Liu, H.; An, F.; Guo, Y.; An, H. Research on the crisis propagation in the global coal trade under the Russia-Ukraine conflict. Sci. Rep. 2023, 13, 15954. [Google Scholar] [CrossRef]

- Niu, X.; Moussawi, A.; Korniss, G.; Szymanski, B.K. Evolution of threats in the global risk network. Appl. Netw. Sci. 2018, 3, 24. [Google Scholar] [CrossRef]

- Rehak, D.; Hromada, M.; Onderkova, V.; Walker, N.; Fuggini, C. Dynamic robustness modelling of electricity critical infrastructure elements as a part of energy security. Int. J. Electr. Power Energy Syst. 2022, 136, 107700. [Google Scholar] [CrossRef]

- Ma, F.; Shi, W.; Yuen, K.F.; Sun, Q.; Xu, X.; Wang, Y.; Wang, Z. Exploring the robustness of public transportation for sustainable cities: A double-layered network perspective. J. Clean. Prod. 2020, 265, 121747. [Google Scholar] [CrossRef]

- Cai, H.; Song, Y. The state’s position in international agricultural commodity trade. China Agric. Econ. Rev. 2016, 8, 430–442. [Google Scholar] [CrossRef]

- Zhang, D.; Broadstock, D.C. Global financial crisis and rising connectedness in the international commodity markets. Int. Rev. Financ. Anal. 2020, 68, 101239. [Google Scholar] [CrossRef]

- Hao, H.; Xing, W.; Wang, A.; Song, H.; Han, Y.; Zhao, P.; Xie, Z.; Chen, X. Multi-layer networks research on analyzing supply risk transmission of lithium industry chain. Resour. Policy 2022, 79, 102933. [Google Scholar] [CrossRef]

- An, F.; Wu, S.; Gao, X.; Eugene Stanley, H.; Gao, J. A quantification method of non- failure cascading spreading in a network of networks. Chaos Interdiscip. J. Nonlinear Sci. 2021, 31, 123122. [Google Scholar] [CrossRef] [PubMed]

- Yu, Y.; Ma, D.; Zhu, W. Resilience assessment of international cobalt trade network. Resour. Policy 2023, 83, 103636. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, J. Risk analysis and resilience assessment of China’s oil imports after the Ukraine Crisis: A network-based dynamics model. Energy 2024, 299, 131502. [Google Scholar] [CrossRef]

- Yang, W.; Du, D.; Ma, Y.; Jiao, M. Network structure and proximity of the trade network in the Belt and Road region. Geogr. Res. 2018, 37, 2218–2235. [Google Scholar]

- Ji, Q.; Liu, W.; Chen, W. Structure of global copper- containing products trade network based on industrial chain perspective. Sci. Geogr. Sin. 2021, 41, 44–54. [Google Scholar]

- Albert, R.; Barabási, A.-L. Statistical mechanics of complex networks. Rev. Mod. Phys. 2002, 74, 47–97. [Google Scholar] [CrossRef]

- Newman, M.E.J. The structure and function of complex networks. SIAM Rev. 2003, 45, 167–256. [Google Scholar] [CrossRef]

- Duan, W. Estimating trade flow based on network topology. Phys. A Stat. Mech. Its Appl. 2008, 387, 519–527. [Google Scholar] [CrossRef]

- Haoyuan, D.; Yuying, J.; Ziyuan, L.; Wenjing, X. The relationship between international trade and capital flow: A network perspective. J. Int. Money Financ. 2019, 91, 1–11. [Google Scholar]

- Beckman, J.; Estrades, C.; Flores, M.; Aguiar, A. The Impacts of Export Taxes on Agricultural Trade; NBER Working Paper 24894; National Bureau of Economic Research: Cambridge, MA, USA, 2018. [Google Scholar]

- Liu, K.; Fu, Q. Does Geopolitical Risk Affect Agricultural Exports? Chinese Evidence from the Perspective of Agricultural Land. Land 2024, 13, 371. [Google Scholar] [CrossRef]

- Yu, T.E.; Tokgoz, S.; Wailes, E.; Chavez, E. A quantitative analysis of trade policy responses to higher world agricultural commodity prices. Food Policy 2011, 36, 545–561. [Google Scholar]

- Tetsuji, T.; Nobuhiro, H. Does agricultural trade liberalization increase risks of supply-side uncertainty?: Effects of productivity shocks and export restrictions on welfare and food supply in Japan. Food Policy 2011, 36, 368–377. [Google Scholar]

- Zhou, L.; Tong, G. Structural Evolution and Sustainability of Agricultural Trade between China and Countries along the “Belt and Road”. Sustainability 2022, 14, 9512. [Google Scholar] [CrossRef]

- Xu, S.W.; Zhang, H.J.; Qian, J.F. The network characteristics and influencing factors of agricultural products trade in RCEP region. J. Nat. Resour. 2024, 39, 2206–2223. [Google Scholar] [CrossRef]

- Gutiérrez-Moya, E.; Adenso-Díaz, B.; Lozano, S. Analysis and vulnerability of the international wheat trade network. Food Sec 2021, 13, 113–128. [Google Scholar] [CrossRef]

- Guan, J.; Song, Z.; Liu, W. Change of the global grain trade network and its driving factors. Prog. Geogr. 2022, 41, 755–769. [Google Scholar] [CrossRef]

- Wang, X.; Ma, L.; Yan, S.; Chen, X.; Growe, A. Trade for Food Security: The Stability of Global Agricultural Trade Networks. Foods 2023, 12, 271. [Google Scholar] [CrossRef]

- Tryggvi, G.; Vladimir, K.; Leandro, M.; Boaz, N.; Dmitry, P.; Francisco, S.; Di, Y. Emerging markets: Prospects and challenges. J. Policy Model. 2022, 44, 827–841. [Google Scholar]

- Jia, N.; Xia, Z.; Li, Y. The Russia-Ukraine war reduced food production and exports with a disparate geographical impact worldwide. Commun. Earth Environ. 2024, 5, 765. [Google Scholar] [CrossRef]

- Huang, X.; Wang, Z.; Pang, Y.; Tian, W.; Zhang, M. Static Resilience Evolution of the Global Wood Forest Products Trade Network: A Complex Directed Weighted Network Analysis. Forests 2024, 15, 1665. [Google Scholar] [CrossRef]

- Haralambides, H. The Red Sea crisis and chokepoints to trade and international shipping. Marit. Econ. Logist. 2024, 26, 367–390. [Google Scholar] [CrossRef]

- Gong, X.; Xu, J. Geopolitical risk and dynamic connectedness between commodity markets. Energy Econ. 2022, 110, 5221–5245. [Google Scholar] [CrossRef]

- Liu, L.; Wang, W.; Yan, X.; Shen, M.; Chen, H. The cascade influence of grain trade shocks on countries in the context of the Russia-Ukraine conflict. Humanit. Soc. Sci. Commun. 2023, 10, 449. [Google Scholar] [CrossRef]

- Rajayya, A.; Kumar, G.A.; Rose, R.L. How the Russia–Ukraine Conflict Caused Trade Diversion? Harnessing AI Mach. Learn. IoT Intell. Bus. 2025, 55, 1053–1065. [Google Scholar]

- Sun, Q.; Hou, M.; Shi, S.; Cui, L.; Xi, Z. The Influence of Country Risks on the International Agricultural Trade Patterns Based on Network Analysis and Panel Data Method. Agriculture 2022, 12, 361. [Google Scholar] [CrossRef]

- Herrera, D.; Matias, L.; Mathilde, S.-M.; Stokenberga, A. Shrinking Economic Distance: Understanding How Markets and Places Can Lower Transport Costs in Developing Countries; World Bank Group: Washington, DC, USA, 2024; pp. 84–85. [Google Scholar]

- González, A. Revitalizing the US Trade Agenda in Latin America: Building on the FTA Platform. J. Int. Econ. Law 2009, 12, 539–546. [Google Scholar] [CrossRef]

- Pérez-Oviedo, W.; Cajas-Guijarro, J.; Vallejo, M.C. South America: Trade and Integration in the New Global Trade Network. In Regionalism, Development and the Post-Commodities Boom in South America; Vivares, E., Ed.; International Political Economy Series; Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar]

- Brondino, G.; Lucero, J.; Roitbarg, H. Productive specialization and integration in South America: A global input–output analysis. Struct. Change Econ. Dyn. 2023, 67, 89–97. [Google Scholar] [CrossRef]

- Nelson, V. The effects of China’s growth on the food prices and the food exports of other developing countries. Agric. Econ. 2012, 43, 499–514. [Google Scholar]

- Le, A.-T.; Tran, T.P. Does geopolitical risk matter for corporate investment? Evidence from emerging countries in Asia. J. Multinatl. Financ. Manag. 2021, 62, 100703. [Google Scholar] [CrossRef]

- Soong, J.J.; Nguyen, K.N. China’s OBOR Initiative and Vietnam’s Political Economy: Economic Integration with Political Conflict. Chin. Econ. 2018, 51, 342–355. [Google Scholar] [CrossRef]

- Zhouying, S.; Shuyun, C.; Yu, Y. The trade network of the Belt and Road Initiative and its topological relationship to the global trade network. J. Geogr. Sci. 2018, 28, 1249–1262. [Google Scholar]

- Li, J.; Xiao, Q.; Wu, H.; Li, J. Unpacking the Global Rice Trade Network: Centrality, Structural Holes, and the Nexus of Food Insecurity. Foods 2024, 13, 604. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Zhou, H.; Jin, X. Risk transmission in complex supply chain network with multi-drivers. Chaos Solitons Fractals 2021, 143, 110259. [Google Scholar] [CrossRef]

- Berger, N.; Schulze-Schwering, S.; Long, E.; Spinler, S. Risk management of supply chain disruptions: An epidemic modeling approach. Eur. J. Oper. Res. 2023, 304, 1036–1051. [Google Scholar] [CrossRef]

- Wang, J.; Zhou, H.; Sun, X.; Yuan, Y. A novel supply chain network evolving model under random and targeted disruptions. Chaos Solitons Fractals 2023, 170, 113371. [Google Scholar] [CrossRef]

- Li, Z.; Zhuoming, R.; Ziyi, Z. Topological perturbations on resilience of the world trade competition network. Humanit. Soc. Sci. Commun. 2024, 11, 536. [Google Scholar] [CrossRef]

- Wang, M.; Tian, L.; Du, R. Research on the interaction patterns among the global crude oil import dependency countries: A complex network approach. Appl. Energy 2016, 180, 779–791. [Google Scholar] [CrossRef]

- Kumar, N.; Jensen, H.J.; Viegas, E. Economic Trading Susceptibility: Constructing Networks of Mutual Influence through the Fitness of Countries. Entropy 2023, 25, 141. [Google Scholar] [CrossRef]

| Formula | Interpretation | |

|---|---|---|

| Weighted Out-Degree | represents the edge weight from node v to node u. | In international trade, a country can both export and import, which can be represented using a directed graph according to graph theory. In a directed graph, edges are represented by arrows, and the number of arrows pointing away from a vertex represents its out-degree. The weighted out-degree refers to the sum of the weights of all edges originating from a certain node. It not only counts the number of outgoing edges but also considers the weight of each outgoing edge [2]. |

| Closeness Centrality | represents the shortest path distance between node v and node u; and V represents the set of all nodes in the network. | Closeness centrality reflects the reciprocal of the average distance from a node to all other nodes in the network. It is used to measure how quickly a node can reach all other nodes in the network. Nodes with a high closeness centrality are usually located at the center of the network, with shorter paths to other nodes [2]. |

| Year | Reducing Countries | Increasing Countries | Direct Reduction | Direct Increase | Indirect Reduction | Indirect Increase | Total Impact |

|---|---|---|---|---|---|---|---|

| 2010 | USA | Argentina | 150,177.90 | 0 | 0.06 | 1763.99 | −148,413.96 |

| USA | Brazil | 150,177.90 | 0 | 0.06 | 347.45 | −149,830.50 | |

| USA | South Africa | 150,177.90 | 0 | 0.06 | 14.39 | −150,163.57 | |

| Ukraine | Argentina | 0 | 0 | 0 | 1959.97 | 1959.97 | |

| Ukraine | Brazil | 0 | 0 | 0 | 386.05 | 386.05 | |

| Ukraine | South Africa | 0 | 0 | 0 | 14.55 | 14.55 | |

| 2014 | USA | Argentina | 102,706.87 | 0 | 8.64 | 3309.02 | −99,406.49 |

| USA | Brazil | 102,706.87 | 0 | 8.64 | 670.22 | −102,045.30 | |

| USA | South Africa | 102,706.87 | 0 | 8.64 | 497.14 | −102,218.38 | |

| Ukraine | Argentina | 96,437.30 | 0 | 75.21 | 3674.54 | −92,837.97 | |

| Ukraine | Brazil | 96,437.30 | 0 | 75.21 | 675.39 | −95,837.12 | |

| Ukraine | South Africa | 96,437.30 | 0 | 75.21 | 496.29 | −96,016.22 | |

| 2018 | USA | Argentina | 31,229.81 | 0 | 6.80 | 836.29 | −30,400.32 |

| USA | Brazil | 31,229.81 | 0 | 6.80 | 870.15 | −30,366.46 | |

| USA | South Africa | 31,229.81 | 0 | 6.80 | 18.83 | −31,217.79 | |

| Ukraine | Argentina | 292,985.53 | 0 | 0.97 | 929.17 | −292,057.32 | |

| Ukraine | Brazil | 292,985.53 | 0 | 0.97 | 966.71 | −292,019.78 | |

| Ukraine | South Africa | 292,985.53 | 0 | 0.97 | 18.51 | −292,967.98 | |

| 2023 | USA | Argentina | 565,888.85 | 45.46 | 0 | 14,797.43 | −551,136.8764 |

| USA | Brazil | 565,888.85 | 45.46 | 8,061,423.50 | 6718.78 | 7,502,207.971 | |

| USA | South Africa | 565,888.85 | 45.46 | 83,062.94 | 1339.97 | −481,531.4001 | |

| Ukraine | Argentina | 544,022.40 | 122.34 | 0 | 16,394.76 | −527,749.974 | |

| Ukraine | Brazil | 544,022.40 | 122.34 | 8,061,430.28 | 7464.56 | 7,524,750.103 | |

| Ukraine | South Africa | 544,022.40 | 122.34 | 83,062.95 | 1339.73 | −459,742.064 |

| Year | Reducing Countries | Increasing Countries | Direct Reduction | Direct Increase | Indirect Reduction | Indirect Increase | Total Impact |

|---|---|---|---|---|---|---|---|

| 2021 | USA | Argentina | 1,982,713.20 | 0 | 0 | 58,585.32 | −1,924,127.884 |

| USA | Brazil | 1,982,713.20 | 0 | 0 | 52,951.00 | −1,929,762.202 | |

| USA | South Africa | 1,982,713.20 | 0 | 827.82 | 263.45 | −1,981,621.931 | |

| Ukraine | Argentina | 823,391.70 | 3989.48 | 0 | 65,077.93 | −762,303.2428 | |

| Ukraine | Brazil | 823,391.70 | 3989.48 | 0 | 58,451.55 | −768,929.6251 | |

| Ukraine | South Africa | 823,391.70 | 3989.48 | 827.82 | 290.88 | −826,262.4776 | |

| 2022 | USA | Argentina | 1,486,467.6 | 0.43 | 0 | 33,816.16 | −1,452,651.87 |

| USA | Brazil | 1,486,467.6 | 0.43 | 0 | 23,394.64 | −1,463,073.39 | |

| USA | South Africa | 1,486,467.6 | 0.43 | 310.71 | 19,413.68 | −1,466,743.64 | |

| Ukraine | Argentina | 526,393.85 | 362.07 | 0 | 37,570.24 | −489,185.68 | |

| Ukraine | Brazil | 526,393.85 | 362.07 | 0 | 25,972.51 | −500,783.41 | |

| Ukraine | South Africa | 526,393.85 | 362.07 | 310.71 | 21,568.76 | −504,876.45 | |

| 2023 | USA | Argentina | 565,888.85 | 45.46 | 0 | 14,797.43 | −551,136.8764 |

| USA | Brazil | 565,888.85 | 45.46 | 8,061,423.50 | 6718.78 | 7,502,207.971 | |

| USA | South Africa | 565,888.85 | 45.46 | 83,062.94 | 1339.97 | −481,531.4001 | |

| Ukraine | Argentina | 544,022.40 | 122.34 | 0 | 16,394.76 | −527,749.974 | |

| Ukraine | Brazil | 544,022.40 | 122.34 | 8,061,430.28 | 7464.56 | 7,524,750.103 | |

| Ukraine | South Africa | 544,022.40 | 122.34 | 83,062.95 | 1339.73 | −459,742.064 |

| Type | Year | I | II | I | II | Year | I | II | I | II |

|---|---|---|---|---|---|---|---|---|---|---|

| Closeness Centrality | 2010 | —— | 2014 | Austria | 4.56 | Italy | 4.89 | |||

| Denmark | 5.22 | Netherlands | 4.22 | |||||||

| France | 4.33 | Philippines | 3 | |||||||

| Germany | 4.89 | Spain | 4.89 | |||||||

| Ireland | 5.89 | UK | 4.89 | |||||||

| 2018 | Belgium | 3.75 | Netherlands | 4.25 | 2023 | Austria | 4.14 | Romania | 3.75 | |

| Egypt | 5.25 | Poland | 4.25 | Germany | 4.5 | Vietnam | 6.38 | |||

| France | 3.25 | Portugal | 4.25 | Italy | 4.38 | |||||

| Germany | 4.25 | Romania | 3.25 | Kenya | 9.38 | |||||

| Greece | 5.25 | Spain | 4.25 | Netherlands | 4.43 | |||||

| Italy | 4.25 | UK | 4.25 | Philippines | 7.38 | |||||

| USA | 3 | |||||||||

| Weighted Out-Degree | 2010 | Argentina | 3 | 2014 | Argentina | 3.67 | Romania | 3.89 | ||

| Brazil | 3.5 | Brazil | 4 | Russia | 4.56 | |||||

| Paraguay | 4.5 | France | 4.33 | Switzerland | 4.86 | |||||

| USA | 2.5 | India | 3.44 | Ukraine | 4 | |||||

| Paraguay | 4.11 | USA | 3.22 | |||||||

| 2018 | Argentina | 3.75 | Romania | 3.25 | 2023 | Argentina | 3.75 | Poland | 4.29 | |

| Brazil | 3.5 | Russia | 3.75 | Brazil | 4 | Romania | 3.75 | |||

| France | 3.25 | South Africa | 3.75 | France | 4.13 | South Africa | 3.75 | |||

| Hungary | 3.75 | Ukraine | 3.5 | India | 5.25 | Ukraine | 4.13 | |||

| Netherlands | 4.25 | USA | 3 | Paraguay | 4.75 | USA | 3.63 | |||

| Risk Source Countries | Risk Transmission Path | Impact (tons) |

|---|---|---|

| USA | USA → China | 1,486,467.60 |

| Ukraine | Ukraine → China | 526,393.85 |

| Romania | Romania → USA → China | 11,302.82 |

| Argentina | Argentina → USA → China | 7511.78 |

| Paraguay | Paraguay → Peru → USA → China | 6191.64 |

| Brazil | Brazil → USA → China | 5174.42 |

| South Africa | South Africa → Mexico → USA → China | 4312.03 |

| Philippines | Philippines → Vietnam → Cambodia → Thailand → China | 1654.80 |

| Vietnam | Vietnam → Cambodia → Thailand → China | 1654.80 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, J.; Zhu, J. Risk Transmission and Resilience of China’s Corn Import Trade Network. Foods 2025, 14, 1401. https://doi.org/10.3390/foods14081401

Wu J, Zhu J. Risk Transmission and Resilience of China’s Corn Import Trade Network. Foods. 2025; 14(8):1401. https://doi.org/10.3390/foods14081401

Chicago/Turabian StyleWu, Jun, and Jing Zhu. 2025. "Risk Transmission and Resilience of China’s Corn Import Trade Network" Foods 14, no. 8: 1401. https://doi.org/10.3390/foods14081401

APA StyleWu, J., & Zhu, J. (2025). Risk Transmission and Resilience of China’s Corn Import Trade Network. Foods, 14(8), 1401. https://doi.org/10.3390/foods14081401