Abstract

Manufacturing activities are at the heart of contemporary capitalist economies, with observable geographical patterns of production. Debates about the interconnections between transportation technology advancements and land use acknowledge that airports can influence the spatial distribution of firms, including those involved in manufacturing. However, the manufacturing-related literature describes the land-use mix of airports and their surroundings without an in-depth spatial economic analysis of the firms positioned near airports. This study aimed to conduct a spatial economic analysis of manufacturing firms positioned in the environs of Cape Town International Airport, South Africa. Primary data were collected through survey interviews conducted with the representatives of 23 manufacturing firms situated in the environs of the airport. The study discovered the potential existence of a spatial cluster of manufacturing firms. This cluster is characterized by dense inter- and intraindustry linkages within the study area. It is recommended that planning authorities and other stakeholders augment the clustering of manufacturing firms in the vicinity of Cape Town International Airport, which comprises firms with direct and indirect linkages with the airport.

1. Introduction

Manufacturing has been an essential driver of economic development throughout the history of capitalism [1]. Despite the proclaimed transition to the so-called post-industrial age, commodity production and distribution processes are still crucial in contemporary capitalist economies characterized by the growing services sector [1,2]. During particular periods in history, specific geographical production patterns were observable, and with the transition from one production regime to another, the range of locational outcomes was extended. As shifts occurred, a continuum of spatial responses became noticeable, spanning from the reorganization of industrial zones established in the earlier regimes of accumulation to the development of new industrial areas [3].

Although the direction of causality is not always clear-cut [4], the literature acknowledges that transport infrastructure, directly and indirectly, positively impacts development and the economy [5,6,7]. This influence manifests in several interrelated ways. First, the availability of quality transport infrastructure improves the attractiveness of an area [5], an attribute essential for investment opportunities. Second, improved access augments trade linkages, which could span different geographical scales and administrative boundaries. Third, accessibility generates positive externalities from the firms’ interactions with other firms and with markets [6]. These manifestations affect the efficiency of individual firms and, most importantly, influence the organization of economic activity across space [6].

Against this backdrop of the potential influence of transport infrastructure on development, the empirical literature has acknowledged that in different contexts across the globe, the environs of airports are characterized by the concentration of manufacturing establishments [8,9,10,11,12,13,14,15,16]. The existing literature, however, describes the land-use mix of the environs of airports without comprehensively analying the spatial economic attributes of the manufacturing establishments situated in the environs of airports. This is the gap that this study intended to fill. The literature asserts that the appropriate location choice can assist companies in gaining a competitive advantage and improving overall operational performance [17]; hence, location is one of the critical factors that influence the success of companies [18].

Furthermore, despite the aforementioned importance of manufacturing in the contemporary economy, it has historically been argued that the amount of empirical research is not proportionate to the significance of the geography of industrial establishments in metropolitan areas [3]. Thus, it is imperative to empirically analyze the role of airports in the placement and operations of manufacturing establishments. Therefore, this study aimed to conduct a spatial economic analysis of the manufacturing firms in the vicinity of Cape Town International Airport, South Africa. This paper addresses two specific objectives:

- Analysis of the linkages of the manufacturing firms positioned in the vicinity of Cape Town International Airport, and

- Analysis of the locational behaviour of the manufacturing firms positioned in the vicinity of Cape Town International Airport.

The remainder of the paper is structured as follows. The next section focuses on the review of the literature, concentrating specifically on the conceptual frame of reference that this paper hinges on. The third section discusses the research methods adopted to address the aim of the study. The fourth section presents the results of the analysis conducted. The final section concludes the paper.

2. Literature Review: A Conceptual Frame of Reference

The placement of economic activity in the environs of airports is typically analyzed through the normative models of airport-led development, which are used worldwide to advance proposals on the idealized urban form of activities understood to be linked to or dependent upon airports. A plethora of such models include the airport city, aerotropolis, airport region, airfront, global transpark, airport corridor, airea, decoplex, aircity, aeropolis, aeropark, aviopolis, avioport, flight forum, sky city, airpark, aero city and aeroscape [16]. The model that is dominantly used in contemporary literature and practice (and more explicit on the placement of manufacturing activities) is the so-called aerotropolis. The aerotropolis is a sub-region in which land use, infrastructure and different elements of the economy in a territory hinge on a major airport. The logic of the aerotropolis is that businesses in the region benefit from the speedy connectivity to suppliers, markets and business partners inter-regionally, nationally and globally [19]. The aerotropolis is anchored by the core airport area, which is responsible for providing logistics services. The airport area is surrounded by manufacturers and distribution centres responsible for the speedy transportation of inputs and manufactured products [20]. Notwithstanding the wide use of the aerotropolis in urban and regional planning policy, it is essential to acknowledge that most aerotropolis developed organically and were driven by, among other factors, market forces [21].

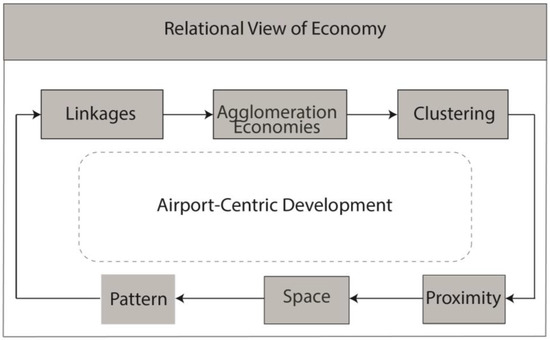

Informed by a relational view of the economy, Mokhele and Geyer [22] highlighted several concepts appropriate to the analysis of the positioning of economic activities in general and, specifically, development in the environs of airports. These concepts, which have traditionally been central to analyzing the positioning of economic activities in human geography and allied disciplines, include linkages, agglomeration economies and clustering. These are given substance by the closely associated concepts of space, proximity and pattern (Figure 1).

Figure 1.

Conceptual foundation for analysing the environs of airports.

Although agglomeration economies have received considerable and diverse attention throughout history, the seminal work of Parr [23] arguably presents the most comprehensive dissection of the concept, which is understood to consist partly of internal economies and partly of external economies. The economies that are internal to the firm are controlled by that firm concerned and are not directly influenced by the activities of other firms. These are typically classified into economies of scale and of scope. The concept of internal economies of scale, also referred to as economies of horizontal integration, denotes benefits to the firm that result from increases in the extent of its operations. Internal economies of scope (lateral integration) are realized because of the firm’s diversity of products and/or services. The notion of economies of scope is based upon the logic that an undertaking by a firm of two or more activities could happen more efficiently than would be the case if different firms performed such activities [23,24,25]. It is important to note that agglomeration economies based on internal economies do not necessarily result in the spatial concentration of firms but typically result in the individual firms involved becoming large [23].

Unlike internal economies, external economies are influenced by the actions of other associated firms and are beyond the total control of the individual firm [23]. External economies comprise localization economies, urbanization economies and activity-complex economies. Localization economies emanate from the common location of independent firms in the same economic sector or industry [26,27,28]. Though external to the firm, these economies are internal to the industry [23]. Agglomeration economies of this nature were advanced by Marshall [29], and they formed the foundation for what is known as industrial districts. Urbanization economies are typical of diversified urban areas, and they result from the common location of firms involved in different activities [27,28,29,30]. For instance, urbanization economies could result from the use of transport infrastructure [31], such as airports. Urbanization economies, which are external to the individual firm and the industry or sector, are internal to the urban concentration area [32]. It is argued that urbanization economies may be interpreted as economies of scope, that is, as benefits emanating from the scope or diversity of products and services within the urban concentration area [23]. Activity-complex economies result from the common location of a set of firms that exist in a production or service provision chain, which forms an activity complex. These economies are primarily a function of the interrelatedness of firms. In this regard, a firm has backward or upstream linkages to the firms supplying it and forward or downstream linkages to the firms it supplies. Activity-complex economies are external to the individual firm but internal to the complex or concentration to which it belongs [23].

Linkages, which denote the flows of information, materials and/or services between firms and within a firm, are essential for the realization of agglomeration economies highlighted previously. The linkages of a firm can be classified into three categories, the first two of which are backward linkages, which provide goods and/or services as input to the firm’s activities or output, and forward linkages, which provide links with the customers buying its products or services. Backward and forward linkages are synonymous with upstream and downstream linkages, respectively. If businesses are connected through an input–output (buyer and supplier) structure, the downstream industry forms the market for the upstream industry [33,34,35,36]. Therefore, the firms in a vertical arrangement are partners and collaborators [33]. The third category pertains to horizontal, lateral or sideways linkages, which are interactions with other firms involved in the same processes that share customers and technology [34]. The horizontal dimension thereby consists of economic agents who share the market [33]. All in all, the concept of linkages used in the paper refers to the flow of information, materials and services in accordance with the categories of forward, backward and lateral linkages as well as linkages within a firm.

The existence of linkages and the resultant agglomeration economies can result in the clustering of firms. Two interrelated categories of clustering, which are differentiated by spatial proximity, can be discerned in the literature. In the first interpretation, clusters are defined as linked firms located in the same geographical area à la Porter [34]. These are regarded as spatial clusters. The literature has identified different groupings of spatial clusters, which include the pure agglomeration model, industrial-complex model and social-network model [36]; they also include Marshallian and Italianate industrial districts, hub-and-spoke industrial districts, satellite platforms and state-anchored industrial districts [37].

In the second interpretation of organizational clustering, clusters are understood as firms that are linked, regardless of their separate geographical locations. The paper adopts the position that clustering can be based on agglomeration economies that are internal or external to a firm. In terms of the internal dimension, when different units of a firm (such as headquarters, branches and production units) have functional linkages with each other, whether situated within the same geographical area, city, country or even across national borders, such a situation would be interpreted as an organizational cluster resulting from internal economies. There might, however, be instances in which the operations of the units of multi-locational firms are not dependent upon one another, implying weak (or an absence of) linkages [38].

As noted earlier in this section, the concepts of agglomeration economies, linkages and clustering are given substance by the equally elastic concepts of space, proximity and pattern. Unlike absolute space, which is essentially a fixed frame that contains economic agents and their activities, relative space is defined by the interrelations between economic agents [39,40]. In the relational understanding, space does not exist without linkages and underlying relationships [41]. Space cannot be comprehensibly understood without the concept of proximity or distance, where, generally, a distinction can be made between geographical and organizational proximity [42]. Although geographical proximity denotes the physical distance between actors, organizational proximity refers to the closeness of actors regardless of the physical distance between them (refer to the previous overview of spatial and organizational clustering). Finally, the activities of firms are understood to create particular patterns in absolute, relative or relational space. Traditionally, the geographical patterns in absolute space have comprised points, lines and areas, understood through the measures of, for instance, point pattern, nearest neighbour analysis and quadrant sampling [43]. In light of the relational view of space and proximity, this paper is inclined towards a position that the driving forces of airport-centric developments in general (and manufacturing firms in particular) may not create patterns that are mappable in geographical space.

The nuanced conceptual frame of reference above (amid the influence of transport infrastructure on economic development and a plethora of normative models of airport-led development) was used to inform the analysis and findings that this paper reports on.

3. Methods

3.1. Study Area

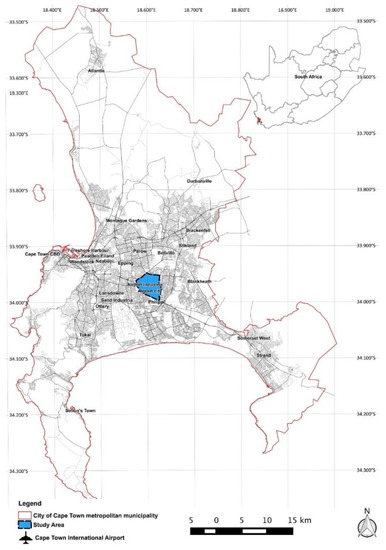

As alluded to in the Introduction section, the paper is based on the study area of the environs of Cape Town International Airport, South Africa (Figure 2). The study area comprised two levels of analysis, namely the landholding of the airport and the neighbouring industrial zones of Airport City and Airport Industria. Established in 1954, Cape Town International Airport is located in the City of Cape Town municipality, Western Cape province. As the second busiest airport in the country, Cape Town International Airport handled 40,943 tonnes of cargo in the 2020/2021 financial year, a decline from 68,191 tonnes in the previous financial year [44] that was arguably because of COVID-19-related travelling restrictions. The area around the airport is one of the primary industrial nodes in the City of Cape Town municipality. This attribute makes it an appropriate focus area for investigating the connection between manufacturing firms and airports. The origins of the concentration of manufacturing in the vicinity of the airport can be traced to the 1970s and 1980s, when the government promoted industrial activity within the area by, for instance, zoning acres of land for industrial purposes [38].

Figure 2.

Study area within the broader context. Adapted from Mokhele and Mokhele [45].

3.2. Methods

3.2.1. Firm Database Collation

In preparation for the descriptive survey, manufacturing firms positioned in the vicinity of Cape Town International Airport were documented through the triangulation of the following secondary sources:

- The business database available on the Airport Industria City Improvement District’s website [46], which contained information on the firms’ business names, business street addresses and telephone numbers [38]. Manufacturing firms were identified from a generic database on the website through the description of activities conducted by the firms, i.e., manufacturing;

- Microsoft Excel spreadsheet obtained from the City of Cape Town municipality, which contained information on the firm names, types of economic activity conducted, contact details and physical addresses of manufacturing firms situated in Airport Industria;

- Google Maps, which entailed manually clicking and viewing the details of the firms listed online [38];

- Company websites, where available, were used to cross-check the information obtained from the Airport Industria website, the City of Cape Town industrial study and Google Maps.

Following the data cleaning and verification processes, 67 manufacturing firms were catalogued using a combination of the four sources mentioned above. The requisite information was captured on Microsoft Excel and consolidated into a single database that contained details on each firm’s business name, physical address and telephone number. The physical addresses were subsequently used to create a geographical information system (GIS) shapefile of all manufacturing firms within the study area. This was done to aid the visual depiction of the geographical distribution of the firms, as presented in the Findings section.

3.2.2. Descriptive Survey

The study hinged on a descriptive survey approach, which intends to learn about a population by analyzing a sample [47]. However, because it is unnecessary to sample a population of fewer than 100 elements [47], an attempt was made to interview the representatives of all 67 manufacturing firms within the study area. Primary data were collected in November 2021 using a process in which, depending on their willingness to participate, the firms’ representatives were asked to respond to a structured questionnaire containing a range of open- and closed-ended questions. The questionnaire contained 31 questions that can be grouped into three main categories, as summarized in Table 1.

Table 1.

Main elements of the questionnaire.

With each interview lasting a maximum of 10 min, the researcher asked for employees who occupied senior positions or owners of the firms, as they were the ones who would know the information required.

Although face-to-face interviewing was the preferred data collection technique, some firm representatives requested that the researcher leaves the questionnaires so, in the manner of self-administered questionnaires, they would complete them when an opportunity arose. To complement face-to-face interviews and self-administered questionnaires, the researcher conducted telephonic interviews with some representatives of the manufacturing firms that were not available for face-to-face interviews and did not state a preference for the self-administered option. In addition to being comparable to face-to-face interviews, telephonic interviews save time and are cheaper to conduct [48,49].

Of a population of 67 manufacturing firms, 23 participated in the survey using the three data collection techniques mentioned above. This response rate represented 33% of the manufacturing firms’ population near Cape Town International Airport. This response rate, however, makes the study susceptible to non-response bias [50].

3.2.3. Data Analysis

This study undertook two forms of analysis: basic statistical analysis (frequency distributions) conducted in Microsoft Excel and spatial analysis. Spatial analyses (comprising kernel density and buffer analysis) were undertaken through ArcGIS to determine the geographical patterns of manufacturing firms in the vicinity of CTIA. Kernel density was employed to establish and visually depict the intensity of manufacturing firms in the vicinity of the airport. Kernel density calculates the density of manufacturing firm points employing a prescribed bandwidth where the value is highest at the location of a particular point and decreases with the increasing distance from that point [47]. The buffer technique was employed to establish the geographical proximity of the manufacturing firms to the airport.

4. Findings

4.1. Composition and Overview of the Manufacturing Firms

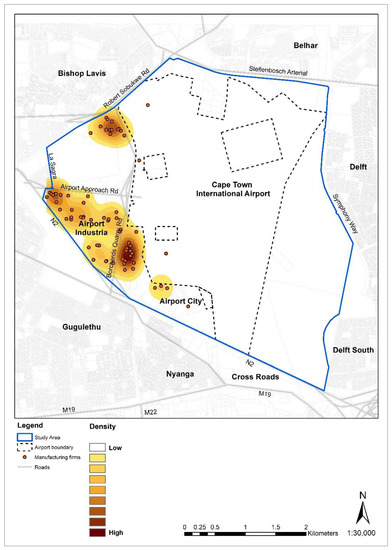

Manufacturing firms were not evenly distributed across the study area. Most firms were situated in Airport Industria, followed by a few in Airport City, whereas three firms were located on the landholding of Cape Town International Airport. However, it is noted in Figure 3 that the density of the manufacturing firms was higher in Airport City, followed by Airport Industria north and south of the Airport Approach Road. While noting that the representatives of 23 firms participated in the survey, Figure 3 displays the locational pattern of the population of 67 manufacturing firms.

Figure 3.

Spatial distribution of manufacturing firms.

To establish the mix of the manufacturing firms in the vicinity of the airport, the firms were, as informed by the information gathered from the survey interviews, grouped into the applicable divisions of the South African Standard Industrial Classification (SIC) [51]. Table 2 reflects the diversity of business activities of the manufacturing firms in the vicinity of Cape Town International Airport, which range from wood products manufacturing to fabricated metal products manufacturing. The findings show that there was no unique manufacturing specialization in the vicinity of the airport.

Table 2.

Mix of manufacturing firms located around Cape Town International Airport.

It was also imperative to analyze the size of the manufacturing firms, where the number of employees was used as a proxy for size. The Republic of South Africa [52] proposes the following categories of the size of manufacturing establishments: micro (up to 5 employees); very small (up to 20 employees); small (up to 50 employees); and medium (up to 200 employees). It was discovered that 22.7% of the firms employed fewer than 10 people; a similar number of the firms (constituting 22.7%) employed fewer than 20 people; 18.2% employed between 30 and 40 people. Only a minute number of the firms (9.1%) were medium-sized and had between 100 and 150 employees. The findings show that the majority of the firms (about 45%) employed between 1 and 19 people, providing evidence that most manufacturing firms located in the vicinity of Cape Town International Airport were very small.

Against the backdrop of the size of the manufacturing firms, the majority of the firms (54.5%) confirmed that they did not have multi-office structures, and the remaining firms (45.5%) stated that they had multi-office structures. Per the previous discussion on the size of firms, the findings provide evidence that manufacturing firms in the environs of Cape Town International Airport were predominantly (very) small stand-alone establishments.

It was discovered that the significant majority (70%) of the manufacturing firms with multi-office structures were branches, 20% were subsidiary firms and 10% were head offices. As most of the firms around the airport were branches, it can be interpreted that they were possibly linked to their headquarters and other branches located elsewhere. It was discovered that 31% of the headquarters of the branch firms around the airport were located across different provinces of South Africa; 9.1% of the firms were subsidiaries whose parent firms were located outside South Africa. The findings show that the presence of multinational companies was limited in the vicinity of Cape Town International Airport.

Communication between the branches and their headquarters as well as between subsidiaries and their parent firms was analyzed to ascertain the frequency of intrafirm linkages essential for the internal economies discussed in the Literature Review section. The findings reveal that 40.9% of the branches and/or subsidiaries communicated with their headquarters daily, and 31.8% of the branches communicated with other branches daily. This shows the existence of dense intrafirm linkages that are not contained by the geographical space and physical distance between head offices and branches.

4.2. Linkages, Agglomeration Economies and Clustering

4.2.1. Linkages with the Airport

The linkages between the manufacturing firms and the airport, in part, ascertain the airport’s significance on the placement and operations of the firms and the potential existence of urbanization economies. Table 3 shows that over half (56.5%) of the manufacturing firms used Cape Town International Airport for airfreight purposes.

Table 3.

Manufacturing firms that used Cape Town International Airport.

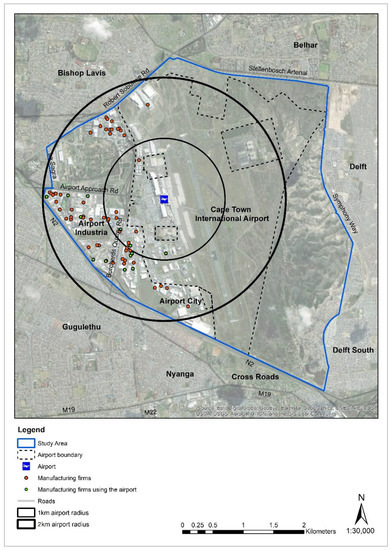

Figure 4 shows that most firms that used the airport for airfreight purposes were positioned within a 1–2 km radius of the airport.

Figure 4.

Manufacturing firms that use the airport for airfreight purposes.

Of the firms that used the airport for airfreight purposes, 47.1% specifically used it to receive raw materials or input to the manufacturing processes, whereas 52.9% specifically shipped their finished products through the airport.

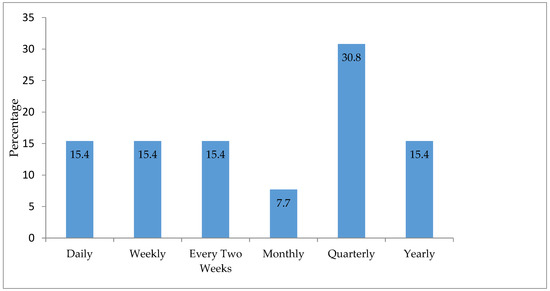

Building upon this discussion, it was essential to analyze the frequency of the use of the airport in order to establish the level of the airport’s significance on the operations of the manufacturing firms. Figure 5 shows that most firms (30.8%) received their raw materials and/or shipped their products through the airport at least every three months (quarterly), whereas a lower number of the firms (constituting 15.4%) used the airport daily, weekly, fortnightly and yearly. A much smaller number of the firms (representing 7.7%) used the airport once per month. Given that the findings depict that a smaller number of the firms used the airport daily, weekly and fortnightly, it can be asserted that most manufacturing firms did not use Cape Town International Airport regularly. The findings suggest that the manufacturing firms possibly interacted more regularly with suppliers, distributors and buyers through other modes of transport.

Figure 5.

Frequency of airport use.

4.2.2. Linkages with Firms around the Airport and Elsewhere

As agglomeration economies depend upon linkages, it was crucial to analyze the inter- and intraindustry linkages of the manufacturing firms in the vicinity of Cape Town International Airport. The interaction between firms in the economy reflects a peculiar relationship involving a balance of competition and cooperation [53]. The findings reveal that the significant majority (78.3%) of the manufacturing firms located in the vicinity of the airport had business interactions with other companies that were situated within the study area, whereas a smaller number of the manufacturing firms (constituting 22.7%) confirmed that they did not have business interactions with their neighbouring establishments. These geographically close linkages within the study area show signs of a potential spatial cluster.

Despite the aforesaid dense business linkages within the study area, the findings reveal that face-to-face engagements were not strictly important in business interactions. Most firms (57.9%) did not value face-to-face engagements when conducting business with the neighbouring firms. Fewer than half of the firms relied on face-to-face interactions with the neighbours. The findings bring into question, at least in part, scholars who argue that face-to-face interactions are highly critical to the successful coordination of the economy [54].

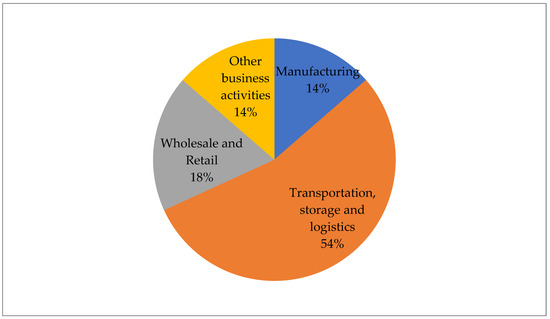

The manufacturing firms confirmed that they had business interactions with the neighbouring firms in the following sectors: manufacturing, transportation, storage and logistics and wholesale and retail. As shown in Figure 6, more than half (54%) of the manufacturing firms had business connections with the neighbouring transport, storage and logistics firms, possibly for transporting the input and/or finished products. The literature notes a close relationship between the logistics sector and manufacturing, whose analysis is essential for improving the efficiency of the two sectors [55]. Historically, logistics activities were associated with manufacturing because logistics demand mainly came from the firms that needed to store their input and products [56].

Figure 6.

Business linkages of the firms located around Cape Town International Airport.

Approximately 14% of the firms noted that their business interactions were with the manufacturing firms located in the vicinity of the airport, depicting intraindustry linkages that could result in localization economies. As discussed in the Literature Review section, traceable to the seminal work of Marshall [29], localization economies are benefits that stem from the co-location of companies in the same industry [57]. In this regard, the business interactions of the manufacturing firms show possibilities of localization economies stemming from geographically proximate intraindustry linkages.

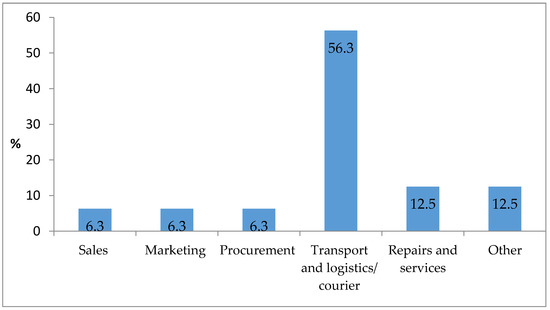

To elaborate on the findings presented in Figure 7, the intraindustry and interindustry interactions of the manufacturing firms located on and around Cape Town International Airport encompassed sales, marketing, procurement, transport and logistics and repairs and services. As shown in Figure 6, most (56.3%) of the interactions revolved around transport and logistics activities. Services and repair constituted 12.5% of the business interactions between the manufacturing firms and other firms in the airport’s environs. Sales, marketing and procurement each constituted a small percentage (6.3%) of the interactions between manufacturing firms and neighbouring establishments.

Figure 7.

Nature of business interactions with neighbouring firms.

Only 17.4% of the manufacturing firms confirmed hiring employees from the surrounding firms, whereas most (82.6%) never hired employees from the neighbouring establishments. Similarly, 17.4% of the respondents confirmed losing some employees to their neighbouring counterparts. The findings show that the firms positioned within the same geographical location or within the same cluster may transfer knowledge, skills and even personnel from one organization to another. However, as most manufacturing firms did not hire employees from the neighbouring firms, it can be commented that the firms around the airport potentially utilized other means of knowledge-sharing instead of employing personnel from the neighbouring companies. This element is elaborated on below in the discussion about linkages/business interactions within the study area.

It was also pertinent to analyze the existence of subcontracting to, at least in part, decipher the extent of interfirm linkages of the manufacturing firms across different geographical scales. Kawasaki, cited in Kimura [58], defines subcontracting as the contractual relationship in which one firm conducts commissioned work under the dominant position of another firm. A popular strategy, subcontracting offers the involved parties benefits pertaining to cost savings [59]. By nature, subcontracting services between (large and small) firms enhance interfirm linkages that could contribute to developing industrial clusters or districts if the linkages occur within the same geographical area. As shown in Table 4, on the one hand, about 61% of the manufacturing firms subcontracted the services of other firms; on the other, 52% of the manufacturing firms located in the environs of Cape Town International Airport subcontracted their services to other companies.

Table 4.

Subcontracting of services.

The literature argues that firms in industry agglomerations are inclined to subcontract [58]; hence, it was essential to ascertain the location of the firms that subcontracted their services to the manufacturing firms on and around the airport and vice versa. Most subcontracted firms (47.4%) were located elsewhere in the City of Cape Town municipality, and 21.1% were located within the study area, showing signs of spatial clustering. A small number (constituting 5.3%) of the subcontracted manufacturing firms were outside South Africa (Table 5). It is noted that the manufacturing firms located in the environs of Cape Town International Airport were more related (i.e., from a subcontracting point of view) to the firms that were located elsewhere in Cape Town and thereby valued geographical proximity more at a metropolitan scale as opposed to the environs of the airport.

Table 5.

Location of the subcontracted firms.

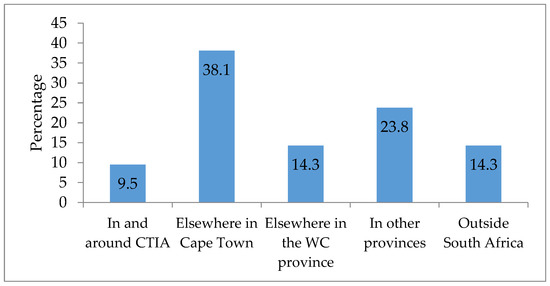

As shown in Figure 8, the majority (38.1%) of the firms that subcontracted the services of the manufacturing firms in the vicinity of Cape Town International Airport were located elsewhere in the City of Cape Town municipality, and 23.8% of the firms were situated in other provinces of South Africa. A small number (9.5%) of the firms that subcontracted the services were located within the study area, whereas 14.3% of the manufacturing firms that subcontracted the services of the manufacturing firms were located outside South Africa. Similar to the previous discussion, the findings show the possibility of subcontracting-related agglomeration at a metropolitan or municipal scale.

Figure 8.

Location of the firms that subcontract the services of the manufacturing firms.

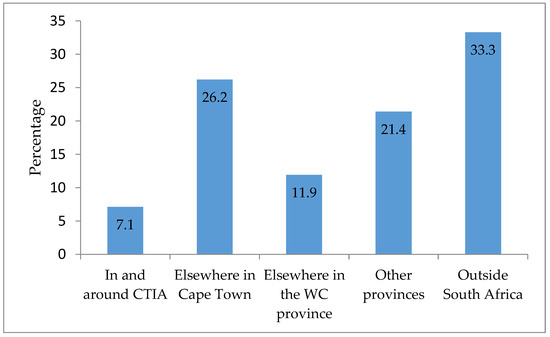

It was also crucial to analyze the backward and forward linkages of the manufacturing firms. The analysis uncovered that the majority (33.3%) of the manufacturing firms located in the environs of Cape Town International Airport obtained their inputs predominantly outside South Africa, 26.2% of the manufacturing firms obtained their inputs from areas within the City of Cape Town municipal area, 21.4% of the firms obtained their inputs from other provinces and a smaller number of the firms (constituting 7.1%) obtained their input from the firms located on and around Cape Town International Airport (Figure 9). The findings show that geographical proximity is not a determinant, as most of the firms sourced their inputs from geographically distant locations extending beyond the borders of South Africa. This could partly explain the linkages between the firms and the airport while acknowledging that the input or output from other countries may be transported through road and sea-based modes of transport.

Figure 9.

Origin of the inputs used by the manufacturing firms.

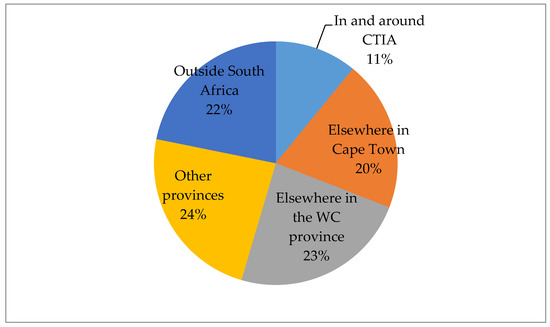

In terms of the destination of the output of the manufacturing firms, the findings presented in Figure 10 show that most firms (24%) sent their output to other provinces of South Africa, namely Gauteng and KwaZulu-Natal, and 23% of the firms within the study area sent their products to other places within the Western Cape province. This shows that geographical proximity was not a significant factor, as only 11% of the firms confirmed that their products were delivered within the study area. The foregoing findings on the source of input and destination of final products, in part, negate the assertion that, regarding industries that are vertically linked through an input–output structure, the upstream industry is drawn to areas where there are many downstream firms [29]. Venable’s [29] assertion is based on the influence of demand linkages and cost linkages on the placement of firms. Unlike in the case of the source of inputs, notably, no manufacturing firms located in the environs of the airport indicated that they sent their products to other countries.

Figure 10.

Destination of output.

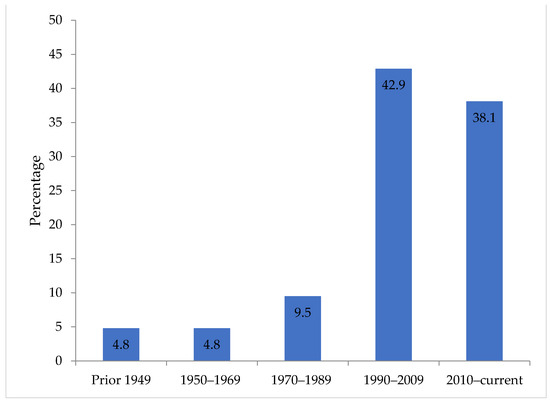

4.3. Locational Behaviour

As shown in Figure 11, one representative (constituting 4.8%) confirmed that their firm was established in the study area in the early 1900s before Cape Town International Airport (formerly called DF Malan) was opened in 1954. It should, however, be noted that, notwithstanding this response, other studies [38] report that even in 1958 after the airport’s opening, there was no urban development within the study area. Another firm (representing 4.8%) confirmed it was established on the premises between 1950 and 1969. Furthermore, 9.5% of the manufacturing firms were established at their premises between 1970 and 1989. Most of the firms (42.9%) were located at their premises between 1990 and 2009, whereas 38.1% were located there between 2010 and 2021. Providing a partial explanation of these findings, though not explicitly referring to manufacturing firms, Mokhele [38] notes that a large part of Airport Industria was developed in 2000, and at the time, Airport City, which is to the south of the airport, was not yet established. The findings thereby reveal that manufacturing firms are relatively young regarding the year of location at the current premises in the vicinity of the airport.

Figure 11.

Years of the establishment of manufacturing firms around Cape Town International Airport.

More than half (54.5%) of the respondents of the manufacturing firms confirmed that prior to being located on their current premises, their firms were located elsewhere, whereas 45.5% of the firms reported that they had always been situated in the vicinity of Cape Town International Airport. It should be noted that among the firms that were previously located elsewhere, a significant majority (75%) used to be situated in other industrial sites or business premises within the City of Cape Town municipal area, whereas 25% were previously located at other premises within the study area, which reflects some stickiness of the study area and the municipal area. Stickiness is defined as the ability of an area to attract and, most importantly, retain businesses [31].

Table 6 shows that most manufacturing firms (60%) relocated from the previous premises because they lacked adequate space to run their business operations efficiently. For instance, some respondents cited inadequate storage facilities at their previous premises. Additionally, 10% of the representatives of the manufacturing firms pointed out that they moved from their previous premises because they had acquired land to build their infrastructure. The other 10% of the respondents moved from their previous locations because they wanted their companies closer to freight distribution companies near the airport. Another 10% of the firms explicitly noted that they moved to the current sites because they wanted to be closer to the airport, whereas the remaining 10% of the respondents chose the current sites because of other reasons.

Table 6.

Reasons for relocation.

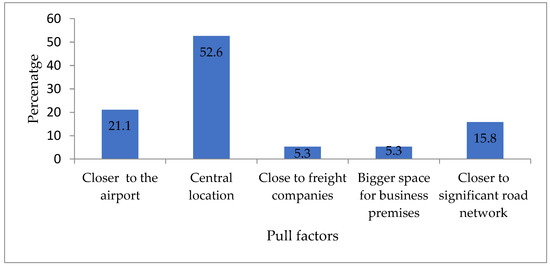

In addition to the “push” factors from the previous locations above, it was crucial to investigate the “pull” factors that influenced the placement of the manufacturing firms in the vicinity of Cape Town International Airport. As shown in Figure 12, the majority (52.6%) of the manufacturing firms were attracted to their current location by the centrality of the study area, and 21.1% of the firms explicitly cited the advantages of being located close to Cape Town International Airport. In addition, 15.8% of the manufacturing firms noted that the study area was advantageous due to its proximity to significant local, regional and national road networks. A few (5.3%) of the firms pointed out that the current location was ideal because they were positioned geographically close to the concentration of freight distribution companies. In addition, the current premises had adequate space, which was required for their daily operations. It can be commented that most manufacturing firms selected their locations not purely for airport-related reasons but primarily because of the centrality and accessibility of the study area. There were, however, nuances of preferring to locate close to airport-related firms.

Figure 12.

Advantages of the study area.

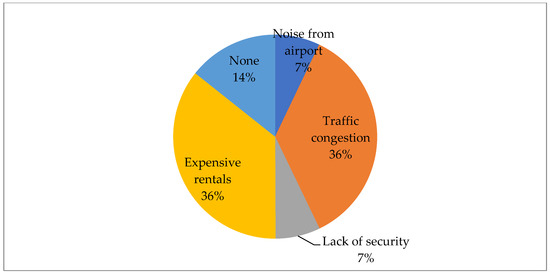

Although there were benefits that influenced the placement of the manufacturing firms, it was also crucial to investigate the disadvantages associated with the environs of Cape Town International Airport. As shown in Figure 13, 36% of the respondents confirmed that the study area was not ideal, as their firms were negatively impacted by traffic congestion and high rentals. In addition, 7% of the respondents pointed out that their firms were adversely affected by the noise from the aircraft landing and taking off. Another 7% highlighted security concerns in the study area. Notably, 14% of the respondents did not note any disadvantages, reflecting complete satisfaction with the study area.

Figure 13.

Disadvantages of the study area.

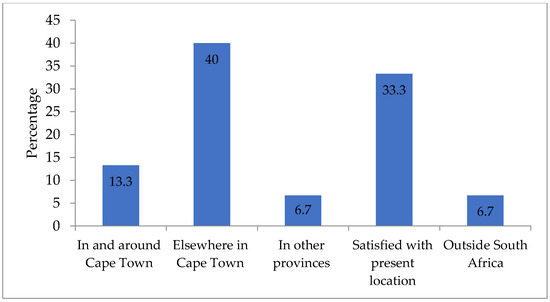

To analyze the extent of the disadvantages of the study area, it was essential to ascertain areas the firms would move to in case they had to relocate from their current premises. Figure 14 shows that the majority (40%) of the firms preferred to relocate to other industrial sites across the City of Cape Town municipality, and 13.3% of the firms preferred to relocate to the neighbouring premises in the environs of Cape Town International Airport, i.e., they preferred to relocate from their current sites to other sites within the study area. A significant number (33.3%) of the manufacturing firms were satisfied with their location and had no intention of relocating, corroborating a high number that did not note disadvantages in the previous discussion. Meanwhile, 6.7% of the firms preferred to relocate to other provinces in South Africa, and the remaining 6.7% of the manufacturing firms preferred to relocate to other countries outside South Africa. The findings, once again, point to the stickiness of the study area and the metropolitan area wherein the firms preferred to move to areas within the municipality or not move at all.

Figure 14.

Preferred location if firms were to relocate from their premises.

5. Conclusions

Against the backdrop of the manufacturing-related literature that merely describes the land-use composition of airports and the environs, this article reports the findings of a spatial economic analysis of the manufacturing firms positioned near Cape Town International Airport, South Africa. In light of the intra- and interindustry linkages between the manufacturing firms and the neighbouring companies within the study area, it can be concluded that the concentration of manufacturing firms has signs of a spatial cluster. This cluster predominantly accommodates small firms that do not have multi-office structures and also young establishments with regard to the year of their placement within the study area. The airport appears to be part of the glue that binds the cluster, given that most firms use the airport for airfreight purposes (for transporting input to the manufacturing processes and/or the firms’ output), albeit the frequency of use varied. Although some firms may not have direct linkages with the airport, they have linkages with those that utilize the airport for shipping purposes. Centrality and accessibility of the study area as well as the concentration of logistics-related firms were found to be the main factors that influenced the location-choice decisions of the manufacturing firms. The high rate of business interactions between manufacturing firms and logistics-related firms within the study area cements the importance of these factors. The study also discovered vital signs of the stickiness of the environs of Cape Town International Airport, pertaining to the attractiveness of the study area and its ability to retain manufacturing firms.

In light of the study’s findings, the municipality and relevant stakeholders are encouraged to explore the possibilities of harnessing the clustering of manufacturing firms in the vicinity of Cape Town International Airport, including supporting and augmenting the underlying intra- and interindustry linkages. The focus should not only be on the firms that have direct airfreight-related linkages with the airport but also on the firms that have indirect linkages with the airport by being associated with the airport-related firms. This nuanced consideration could, for instance, be used to inform planning guidelines or planning frameworks for placing manufacturing firms (and firms in associated economic sectors) in the vicinity of the airport. This approach would ensure that agglomeration economies are fully realized for the benefit of the firms positioned near the airport and for the economy of the municipality at large.

To shed further light on the topic, it is recommended that future studies analyze, among other factors, the institutional arrangements that influence the placement of manufacturing firms in the vicinity of airports. Combined with the findings reported in this paper, that analysis would provide policymakers with further insight into how to plan for industrial clusters or industrial districts in the environs of airports.

Author Contributions

Conceptualization, M.M.; methodology, M.M. and F.G.; software, F.G. and M.M.; validation, M.M.; formal analysis, F.G.; investigation, F.G.; writing—original draft preparation, M.M.; writing—review and editing, M.M.; supervision, M.M.; project administration, M.M. and F.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the Research Ethics Committee of the Faculty of Informatics and Design, Cape Peninsula University of Technology (13 September 2021).

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- United Nations Economic Commission for Africa. Transformative Industrial Policy for Africa; Economic Commission for Africa: Addis Ababa, Ethiopia, 2016. [Google Scholar]

- Haraguchi, N.; Cheng, C.F.C.; Smeets, E. The importance of manufacturing in economic development: Has this changed? World Dev. 2017, 93, 293–315. [Google Scholar] [CrossRef]

- Scott, A.J. New Industrial Spaces. Flexible Production Organization and Regional Development in North America and Western Europe; Pion Limited: London, UK, 1988. [Google Scholar]

- Button, K.; Yuan, J. Airfreight transport and economic development. Urban Stud. 2013, 50, 329–340. [Google Scholar] [CrossRef]

- Tveter, E. The effect of airports on regional development: Evidence from the construction of regional airports in Norway. Res. Transp. Econ. 2017, 63, 50–58. [Google Scholar] [CrossRef]

- Gibbons, S.; Wu, W. Airports, access and local economic performance: Evidence from China. J. Econ. Geogr. 2020, 20, 903–937. [Google Scholar] [CrossRef]

- Küçükönal, H.; Sedefoğlu, G. The causality of air transport and socio-economics factors: The case of OECD countries. Transp. Res. Procedia 2017, 28, 16–26. [Google Scholar] [CrossRef]

- Keeble, D.E. Airport location, exporting, and industrial growth. Town Ctry. Plan. 1968, 36, 209–214. [Google Scholar]

- Struyk, R.J.; James, F.J. Intrametropolitan Industrial Location: The Pattern and Process of Change; Lexington Books: Lexington, MA, USA, 1975. [Google Scholar]

- Delaney, G. Electronics multinationals in the Cork region and Limerick/Shannon. Ir. Geogr. 1988, 21, 101–103. [Google Scholar] [CrossRef]

- Giuliano, G.; Small, K. Subcentres in the Los Angeles region. Reg. Sci. Urban Econ. 1991, 21, 163–182. [Google Scholar] [CrossRef]

- McMillen, D.P.; McDonald, J.F. Suburban subcentres and employment density in metropolitan Chicago. J. Urban Econ. 1998, 43, 157–180. [Google Scholar] [CrossRef]

- Rogerson, C.M. High-technology clusters and infrastructure development: International and South African experiences. Dev. South. Afr. 1998, 15, 875–905. [Google Scholar] [CrossRef]

- Sohn, J. Information technology in the 1990s: More footloose or more location-bound. Pap. Reg. Sci. 2004, 83, 467–485. [Google Scholar] [CrossRef]

- Prosperi, D.C. Airports as centres of economic activity: Empirical evidence from three US metropolitan areas. In Proceedings of the REAL CORP 007, Vienna, Austria, 20–23 May 2007. [Google Scholar]

- Mokhele, M. Spatial economic attributes of O.R. Tambo and Cape Town airport-centric developments in South Africa. J. Transp. Supply Chain Manag. 2018, 12, a344. [Google Scholar] [CrossRef]

- Chen, L.; Olhager, J.; Tang, O. Manufacturing facility location and sustainability: A literature review and research agenda. Prod. Econ. 2014, 149, 154–163. [Google Scholar] [CrossRef]

- Rahman, S.M.T.; Kabir, A. Factors influencing location choice and cluster pattern of manufacturing small and medium enterprises in cities: Evidence from Khulna City of Bangladesh. J. Glob. Entrep. Res. 2019, 9, 61. [Google Scholar] [CrossRef]

- Kasarda, J.D. Aerotropolis. In The Wiley Blackwell Encyclopedia of Urban and Regional Studies; Orum, A., Ed.; John Wiley & Sons: Hoboken, NJ, USA, 2019. [Google Scholar] [CrossRef]

- Huo, B.; Guo, M. How does an aerotropolis integrate? A case from Zhengzhou airport economy zone. Logistics 2021, 5, 26. [Google Scholar] [CrossRef]

- Kasarda, J.D.; Canon, M.H. Creating an Effective Aerotropolis Master Plan. Regional Economic Review 5. 2016. Available online: http://aerotropolisbusinessconcepts.aero/wpcontent/uploads/2016/08/CreatingAnEffectiveAerotropolisMasterPlan2.pdf (accessed on 10 December 2022).

- Mokhele, M.; Geyer, H.S. A theoretical foundation for investigating the spatial economic attributes of airport-centric developments. Bull. Geogr. Socio-Econ. Ser. 2021, 54, 21–31. [Google Scholar] [CrossRef]

- Parr, J.B. Missing elements in the analysis of agglomeration economies. Int. Reg. Sci. Rev. 2002, 25, 151–168. [Google Scholar] [CrossRef]

- Panzar, J.C.; Willig, R.D. Economies of scope. Am. Econ. Rev. 1981, 71, 268–272. [Google Scholar]

- Miyazaki, T. Economies of scope and local government expenditure: Evidence from creation of specially authorized cities in Japan. Sustainability 2021, 13, 2684. [Google Scholar] [CrossRef]

- Sohn, J. Industry classification considering spatial distribution of manufacturing activities. Area 2014, 46, 101–110. [Google Scholar] [CrossRef]

- Baldwin, J.R.; Brown, W.M.; Rigby, D.L. Agglomeration economies: Microdata panel estimates from Canadian manufacturing. J. Reg. Sci. 2010, 50, 915–934. [Google Scholar] [CrossRef]

- Fitjar, R.D.; Rodriguez-Pose, A. Nothing is in the air. Growth Chang. 2017, 48, 22–39. [Google Scholar] [CrossRef]

- Marshall, A. Principles of Economics: An Introductory Volume, 8th ed.; Macmillan and Co.: London, UK, 1920. [Google Scholar]

- Niu, Y.; Ding, C.; Knaap, G.-J. Employment centers and agglomeration economies: Foundations of a spatial economic development strategy. Econ. Dev. Q. 2014, 29, 14–22. [Google Scholar] [CrossRef]

- Isard, W. Location and Space-Economy; The Massachusetts Institute of Technology Press: Cambridge, MA, USA, 1956. [Google Scholar]

- Andersson, M.; Larsson, J.P.; Wernberg, J. The economic microgeography of diversity of specialization externalities—Firm-level evidence from Swedish cities. Res. Policy 2019, 48, 1385–1398. [Google Scholar] [CrossRef]

- Malmberg, A.; Maskell, P. The elusive concept of localization economies: Towards a knowledge-based theory of spatial clustering. Environ. Plan. A 2002, 34, 429–449. [Google Scholar] [CrossRef]

- Porter, M.E. The Competitive Advantage of Nations; Free Press: New York, NY, USA, 1990. [Google Scholar]

- Venables, A.J. Equilibrium locations of vertically linked industries. Int. Econ. Rev. 1996, 37, 341–359. [Google Scholar] [CrossRef]

- Gordon, I.R.; McCann, P. Industrial clusters: Complexes, agglomeration and/or social networks? Urban Stud. 2000, 37, 513–532. [Google Scholar] [CrossRef]

- Markusen, A. Sticky places in slippery space: A typology of industrial districts. Econ. Geogr. 1996, 72, 293–313. [Google Scholar] [CrossRef]

- Mokhele, M. Spatial Economic Attributes of Airport-Centric Developments in Cape Town and Johannesburg. Ph.D. Dissertation, Stellenbosch University, Stellenbosch, South Africa, 2016. [Google Scholar]

- Friedmann, J.; Alonso, W. (Eds.) Part 1. Space and planning introductory note. In Regional Development and Planning: A Reader; The Massachusetts Institute of Technology Press: Cambridge, MA, USA, 1964; pp. 17–20. [Google Scholar]

- Garretsen, H.; Martin, R. Rethinking (new) economic geography models: Taking geography and history more seriously. Spat. Econ. Anal. 2010, 5, 127–160. [Google Scholar] [CrossRef]

- Massey, D. For Space; Sage: London, UK, 2005. [Google Scholar]

- Boschma, R. Proximity & innovation: A critical assessment. Reg. Stud. 2005, 39, 61–74. [Google Scholar]

- Coffey, W.J. Geography: Towards a General Spatial Systems Approach; Methuen: London, UK; New York, NY, USA, 1981. [Google Scholar]

- Airports Company South Africa (ACSA). Integrated Annual Report. 2021. Available online: https://www.airports.co.za/Documents/ACSA%20IAR%202021.pdf (accessed on 19 January 2022).

- Mokhele, M.; Mokhele, T. Spatial Configuration of Logistics Firms Relative to Cape Town International Airport, South Africa. Logistics 2022, 6, 49. [Google Scholar] [CrossRef]

- Airport Industria CID (City Improvement District). Business Directory. 2021. Available online: www.airportcid.co.za (accessed on 2 October 2021).

- Leedy, P.D.; Ormrod, J.E. Practical Research. Planning and Design, 11th ed.; Pearson: Boston, MA, USA, 2015. [Google Scholar]

- Babbie, E. The Practice of Social Research, 9th ed.; Wadsworth: Belmont, CA, USA, 2001. [Google Scholar]

- Sheskin, I.M. Survey Research for Geographers; Association of American Geographers: Washington, DC, USA, 1985. [Google Scholar]

- Sedgwick, P. Non-response bias versus response bias. BMJ 2014, 348, g2573. [Google Scholar] [CrossRef]

- Statistics South Africa. Standard Industrial Classification of All Economic Activities (SIC), 7th ed.; Statistics South Africa: Pretoria, South Africa, 2012. [Google Scholar]

- Republic of South Africa. National Small Business Amendment Act. The Presidency, Cape Town, South Africa. 2003. Available online: https://www.gov.za/sites/default/files/gcis_document/201409/a26-03.pdf (accessed on 20 January 2022).

- Belussi, F.; Caldari, K. At the origin of the industrial district: Alfred Marshall and the Cambridge school. Camb. J. Econ. 2009, 33, 335–355. [Google Scholar] [CrossRef]

- Storper, M.; Venables, A.J. Buzz: Face-to-face contact and the urban economy. J. Econ. Geogr. 2004, 4, 351–370. [Google Scholar] [CrossRef]

- Yan, B.; Dong, Q.; Li, Q.; Yang, L.; Amin, F.U.I. A study of the interaction between logistics industry and manufacturing industry from the perspective of integration field. PLoS ONE 2022, 17, e0264585. [Google Scholar] [CrossRef] [PubMed]

- Solis-Trapero, E.; Plaza-Tabasco, J.; Sanchez-Mateo, H.S.M. Recent evolution of spatial patterns of logistics activity in metropolitan contexts: The case of the urban region of Madrid. J. Andal. Stud. (REA) 2019, 37, 94–124. [Google Scholar] [CrossRef]

- Claver-Cortés, E.; Marco-Lajara, B.; Manresa-Marhuenda, E. Types of agglomeration economies: Effects on business innovation. Contemp. Econ. 2016, 10, 217–232. [Google Scholar] [CrossRef]

- Kimura, F. Subcontracting and the performance of small and medium firms in Japan. Small Bus. Econ. 2002, 18, 163–175. [Google Scholar] [CrossRef]

- Holl, A. Production subcontracting and location. Reg. Sci. Urban Econ. 2008, 38, 299–309. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).