Emerging Trends in AI-Based Stock Market Prediction: A Comprehensive and Systematic Review †

Abstract

:1. Introduction

2. Literature Review

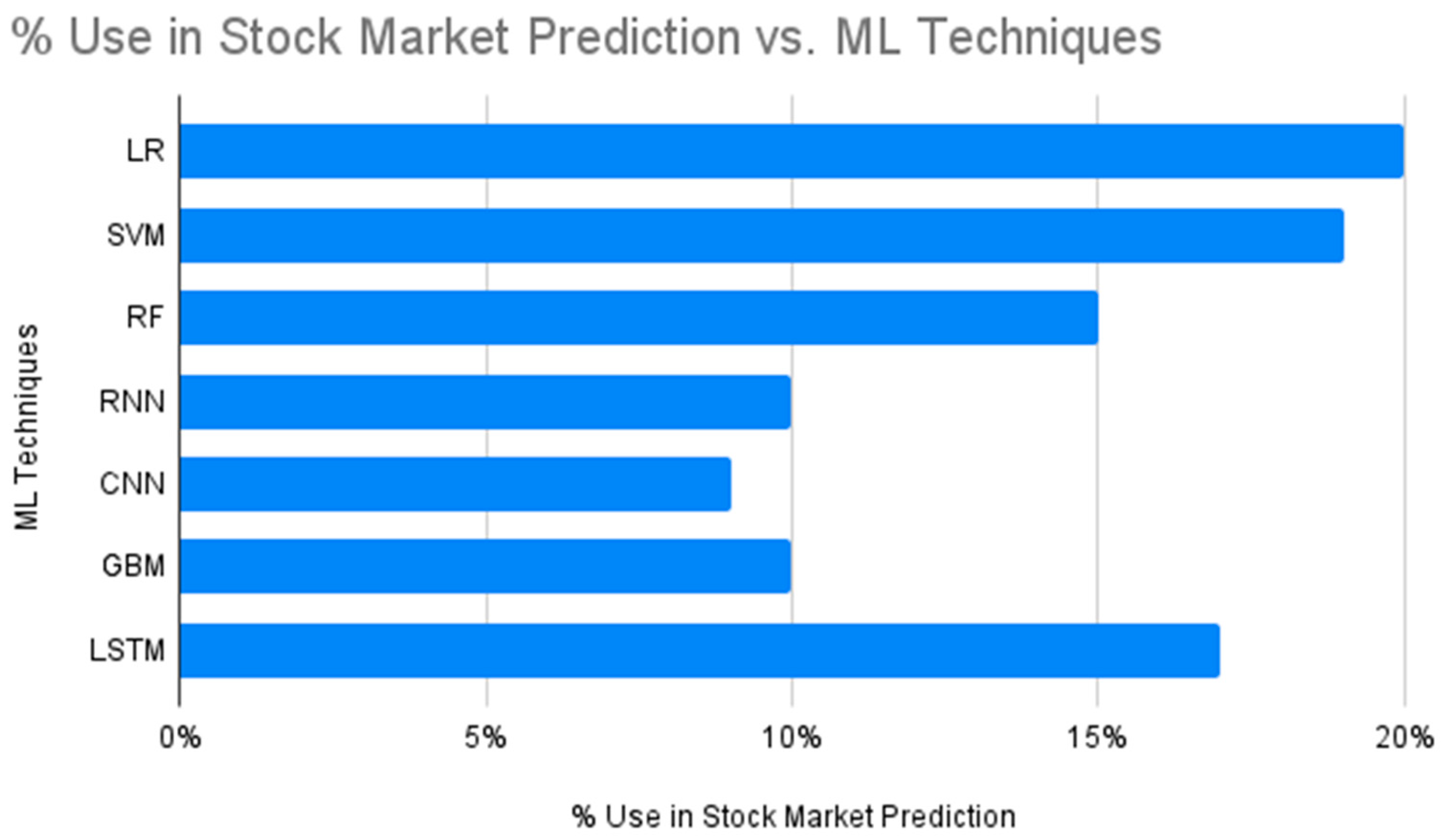

3. Results

4. Observations and Discussion

5. Limitations, Future Scope, and Challenges

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Mintarya, L.N.; Halim, J.N.; Angie, C.; Achmad, S.; Kurniawan, A. Machine learning approaches in stock market prediction: A systematic literature review. Procedia Comput. Sci. 2023, 216, 96–102. [Google Scholar] [CrossRef]

- Chaudhari, K.; Thakkar, A. Neural network systems with an integrated coefficient of variation-based feature selection for stock price and trend prediction. Expert Syst. Appl. 2023, 219. [Google Scholar] [CrossRef]

- Maqbool, J.; Aggarwal, P.; Kaur, R.; Mittal, A.; Ganaie, I.A. Stock Prediction by Integrating Sentiment Scores of Financial News and MLP-Regressor: A Machine Learning Approach. Procedia Comput. Sci. 2023, 218, 1067–1078. [Google Scholar] [CrossRef]

- Azevedo, V.; Hoegner, C. Enhancing stock market anomalies with machine learning. Rev. Quant. Finance Account. 2022, 60, 195–230. [Google Scholar] [CrossRef]

- Chhajer, P.; Shah, M.; Kshirsagar, A. The applications of artificial neural networks, support vector machines, and long–short term memory for stock market prediction. Decis. Anal. J. 2021, 2, 100015. [Google Scholar] [CrossRef]

- Han, Y.; Kim, J.; Enke, D. A machine learning trading system for the stock market based on N-period Min-Max labeling using XGBoost. Expert Syst. Appl. 2023, 211, 118581. [Google Scholar] [CrossRef]

- Jang, J.; Seong, N. Deep reinforcement learning for stock portfolio optimization by connecting with modern portfolio theory. Expert Syst. Appl. 2023, 218, 119556. [Google Scholar] [CrossRef]

- Costola, M.; Hinz, O.; Nofer, M.; Pelizzon, L. Machine learning sentiment analysis, COVID-19 news and stock market reactions. Res. Int. Bus. Finance 2023, 64, 101881. [Google Scholar] [CrossRef] [PubMed]

- Luo, J.; Zhu, G.; Xiang, H. Artificial Intelligent based day-ahead stock market profit forecasting. Comput. Electr. Eng. 2022, 99, 107837. [Google Scholar] [CrossRef]

- Lin, H.; Chen, X.; Chui, S.Y. Stock prediction and analysis using LSTM network. In Proceedings of the SPIE 12510, International Conference on Statistics, Data Science, and Computational Intelligence (CSDSCI 2022), Zhengzhou, China, 25–27 August 2022. [Google Scholar] [CrossRef]

- Li, Y.; Fu, K.; Zhao, Y.; Yang, C. How to make machine select stocks like fund managers? Use scoring and screening model. Expert Syst. Appl. 2022, 196, 116629. [Google Scholar] [CrossRef]

- Bansal, M.; Goyal, A.; Choudhary, A. Stock Market Prediction with High Accuracy using Machine Learning Techniques. Procedia Comput. Sci. 2022, 215, 247–265. [Google Scholar] [CrossRef]

- Ahmed, S.; Alshater, M.M.; El Ammari, A.; Hammami, H. Artificial intelligence and machine learning in finance: A bibliometric review. Res. Int. Bus. Finance 2022, 61, 101646. [Google Scholar] [CrossRef]

- Zhang, W.; Chen, Z.; Miao, J.; Liu, X. Research on Graph Neural Network in Stock Market. Procedia Comput. Sci. 2022, 214, 786–792. [Google Scholar] [CrossRef]

- Subasi, A.; Amir, F.; Bagedo, K.; Shams, A.; Sarirete, A. Stock Market Prediction Using Machine Learning. Procedia Comput. Sci. 2021, 194, 173–179. [Google Scholar] [CrossRef]

- Vaishali, I.; Sachin, D. SPDL-Stock Price Prediction with Deep Learning (June 26, 2021). In Proceedings of the 3rd International Conference on Communication & Information Processing (ICCIP) The Nutan College of Engineering and Research (NCER), Talegaon Dabhade Pune, India, 26–27 June 2021; Available online: https://ssrn.com/abstract=3911033 (accessed on 1 July 2023).

- Sunny, A.I.; Maswood, M.M.S.; Alharbi, A.G. Deep Learning-Based Stock Price Prediction Using LSTM and Bi-Directional LSTM Model. In Proceedings of the 2020 2nd Novel Intelligent and Leading Emerging Sciences Conference (NILES), Giza, Egypt, 24–26 October 2020; pp. 87–92. [Google Scholar] [CrossRef]

- Vachhani, H.; Obaidat, M.S.; Thakkar, A.; Shah, V.; Sojitra, R.; Bhatia, J.; Tanwar, S. Machine Learning Based Stock Market Analysis: A Short Survey. In Innovative Data Communication Technologies and Application. ICIDCA 2019. Lecture Notes on Data Engineering and Communications Technologies; Raj, J., Bashar, A., Ramson, S., Eds.; Springer: Cham, Switzerland, 2020; Volume 46. [Google Scholar] [CrossRef]

- Zerodha Technology. Available online: https://zerodha.com/technology (accessed on 18 August 2023).

- Upstox Pro: Trading App for the New Generation. Available online: https://upstox.com/products/upstox-pro/ (accessed on 18 August 2023).

- ICICI Direct: Online Share Trading and Investment Platform. Available online: https://www.icicidirect.com/idirectcontent/Home/Home.aspx (accessed on 18 August 2023).

- HDFC Securities: Online Trading and Stock Broking Services. Available online: https://www.hdfcsec.com/ (accessed on 18 August 2023).

- Motilal Oswal Research and Analytics. Available online: https://www.motilaloswal.com/research-and-analytics (accessed on 18 August 2023).

- 5Paisa.com: Best Online Share Trading & Stock Broking App in India. Available online: https://www.5paisa.com (accessed on 18 August 2023).

- Groww: Invest in Mutual Funds & Stocks. Available online: https://groww.in/ (accessed on 18 August 2023).

- Market Watch: Stock Market News. Available online: https://www.marketwatch.com/ (accessed on 18 August 2023).

- 55 Fascinating AI Statistics and Trends for 2023. Available online: https://dataprot.net/statistics/ai-statistics (accessed on 18 August 2023).

| Year | Objective | Dataset | F* | Techniques | PT* | Metrics | Results | RG* | R* |

|---|---|---|---|---|---|---|---|---|---|

| 2023 | SM* prediction | NA | NA | ML, ANN, SVM, NN, LSTM | NA | NA | High accuracy | NA* | [1] |

| 2023 | Stock price, trend prediction | NA | Price, Trend | BPNN, CNN, GRU, LSTM | NA | Accuracy, Error | High accuracy | NA | [2] |

| 2023 | Stock prediction | News | Price | ML, MLP, SVM, LSTM, ANN | M* | Accuracy | High accuracy | Market data and text data can lead to more accuracy | [3] |

| 2023 | Enhancing stock market anomalies | NA | Profit | ML | M | Profit margin | Fitness of model | The factor zoo | [4] |

| 2022 | ML models’ stock market prediction | NA | NA | ML, ANN, SVM, LSTM | NA | NA | NN working efficiently in depth | NA | [5] |

| 2023 | ML trading system for the SM | NASDAQ | Price, Trend | ML, NPMM, XGBoost | A* | Accuracy | Labelling is found productive | NA | [6] |

| 2023 | DRL for stock portfolio optimization | NA | Portfolio Optimization | DL, RL, DDPG | A, M, W* | Sharpe ratio | Algorithms outperformed by the suggested methods | Dynamically modifies the weight | [7] |

| 2023 | ML sentiment analysis and SM reactions | COVID-19 News, S&P 500 | Correlation | ML, NLP, BERT | A | Sentiment scores | Positively correlated and statistically significant | Brief window examining only | [8] |

| 2022 | AI-based day-ahead SM forecasting | China Stock Market | Profit | LSTM, SFLA | D | Profit margin | LSTM, AC-SFLA has high efficiency | NA | [9] |

| 2023 | Stock prediction and analysis | SSE | Price | LSTM | D* | Error | MAE of 0.029, MAPE of 0.61%, and RMSE of 0.037 | Refining the model architecture | [10] |

| 2022 | Automatic stock selection like fund managers | China’s A Share Market | Profit | ML, Scoring, Screening Model | NA | Profit margin | P-return is a notable increase | NA | [11] |

| 2022 | SM prediction | BSE, NSE | Profit | ML, K-NN, LR, SVR, DTR, LSTM | M | Accuracy | The LSTM is outperforming | In time series data, ML appears to produce less reliable | [12] |

| 2022 | GNN in SMP | NA | Price | GNN, GCN, GAT, GNA | NA | NA | GCN and GAT are the most frequently utilized | NA | [14] |

| 2021 | SM prediction based on ML Algorithms | NASDAQ, NYSE, NIKKEI, FTSE | Accuracy | DM, RF, SVM, ANN, Bagging, AdaBoost, Decision Trees, K-NN | NA | Accuracy | RF, Bagging with a leaked dataset results in high performance | NA | [15] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jain, R.; Vanzara, R. Emerging Trends in AI-Based Stock Market Prediction: A Comprehensive and Systematic Review. Eng. Proc. 2023, 56, 254. https://doi.org/10.3390/ASEC2023-15965

Jain R, Vanzara R. Emerging Trends in AI-Based Stock Market Prediction: A Comprehensive and Systematic Review. Engineering Proceedings. 2023; 56(1):254. https://doi.org/10.3390/ASEC2023-15965

Chicago/Turabian StyleJain, Rahul, and Rakesh Vanzara. 2023. "Emerging Trends in AI-Based Stock Market Prediction: A Comprehensive and Systematic Review" Engineering Proceedings 56, no. 1: 254. https://doi.org/10.3390/ASEC2023-15965