Increasing Block Tariffs in an Arid Developing Country: A Discrete/Continuous Choice Model of Residential Water Demand in Jordan

Abstract

:1. Introduction

1.1. Background: Residential Water Demand under Increasing Block Tariffs

1.2. Research Objectives

2. Data

3. Methods

4. Demand Function Estimation Results

5. Cross-Subsidization Analysis

5.1. Cost Recovery and Affordability under the 2013 IBTs

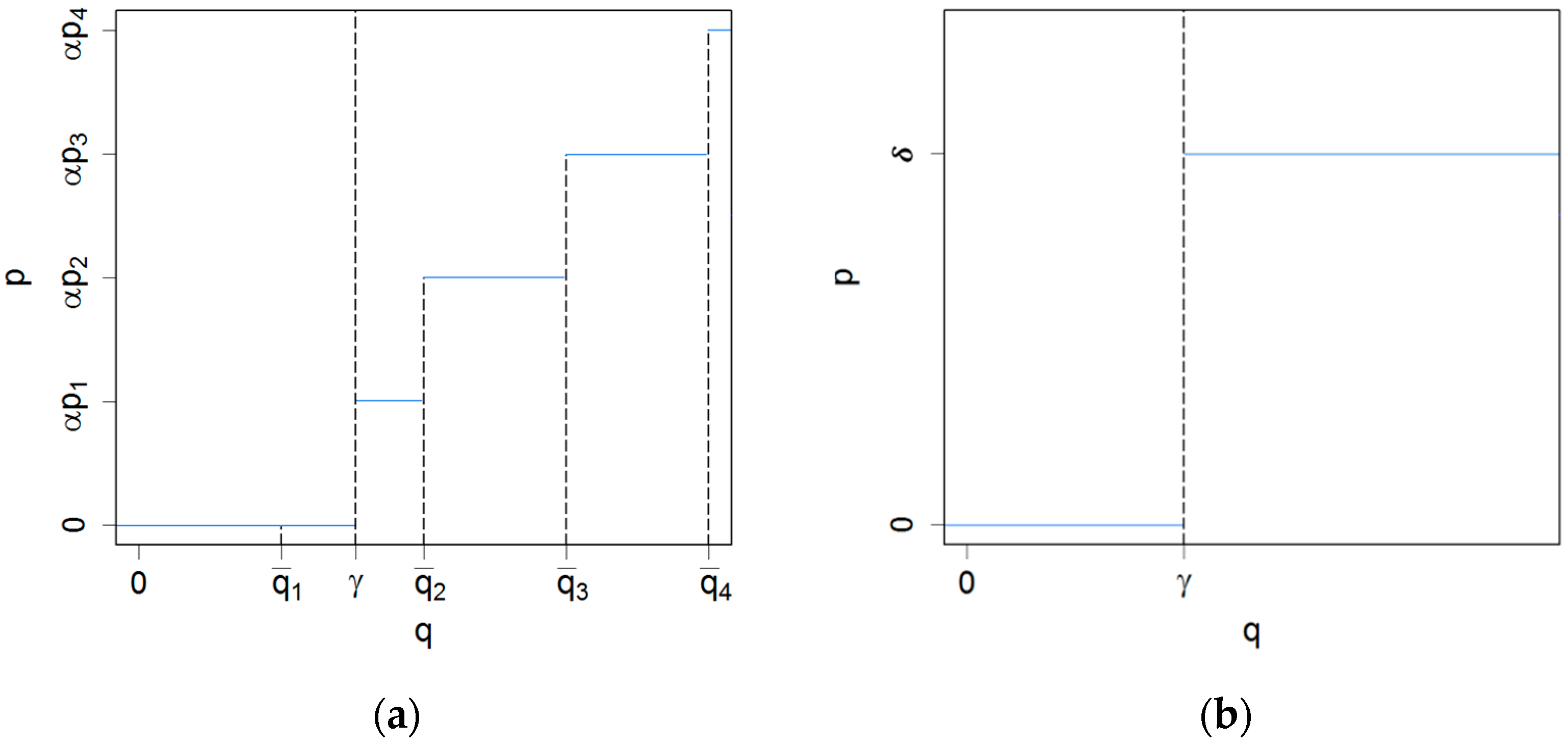

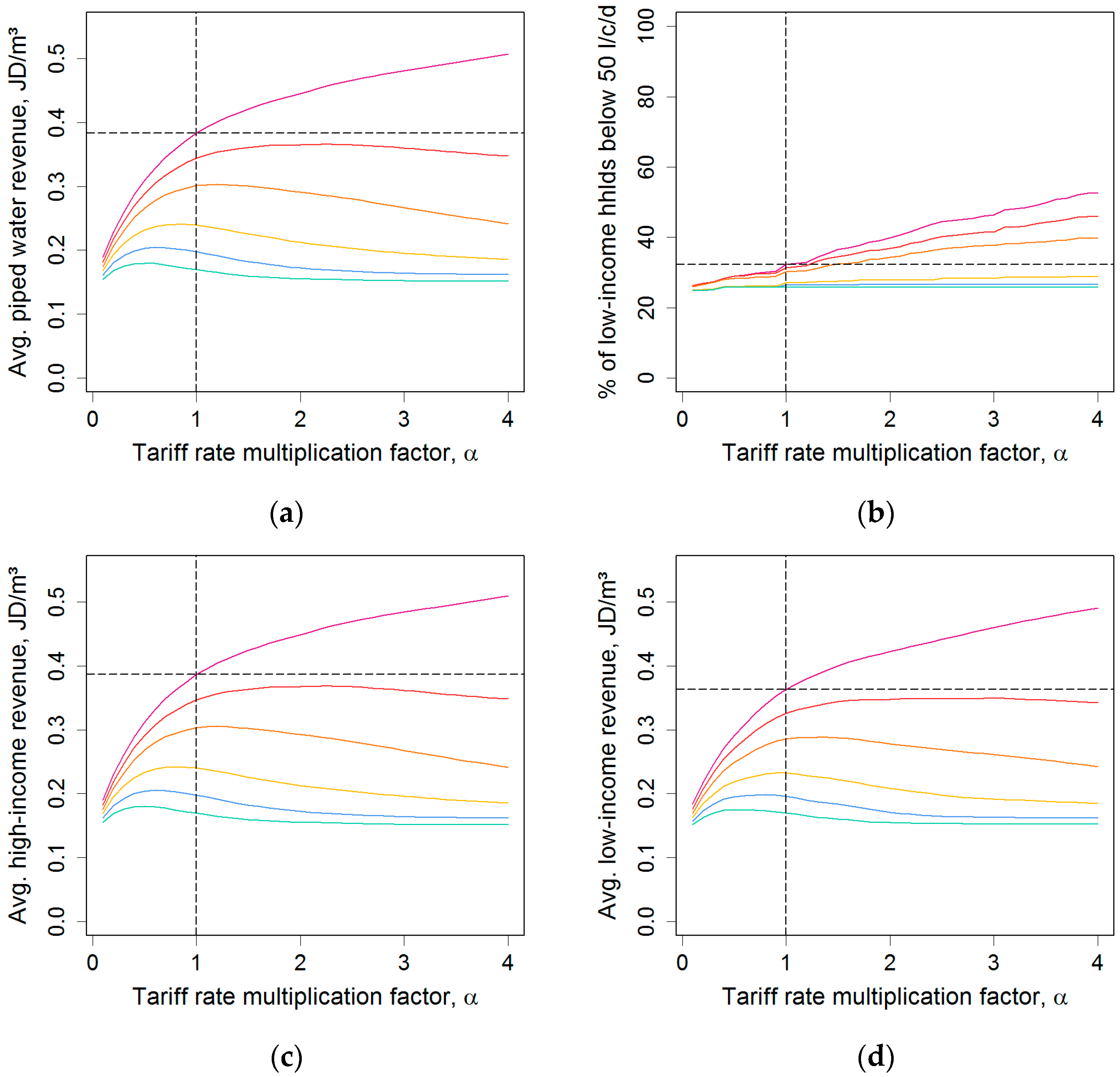

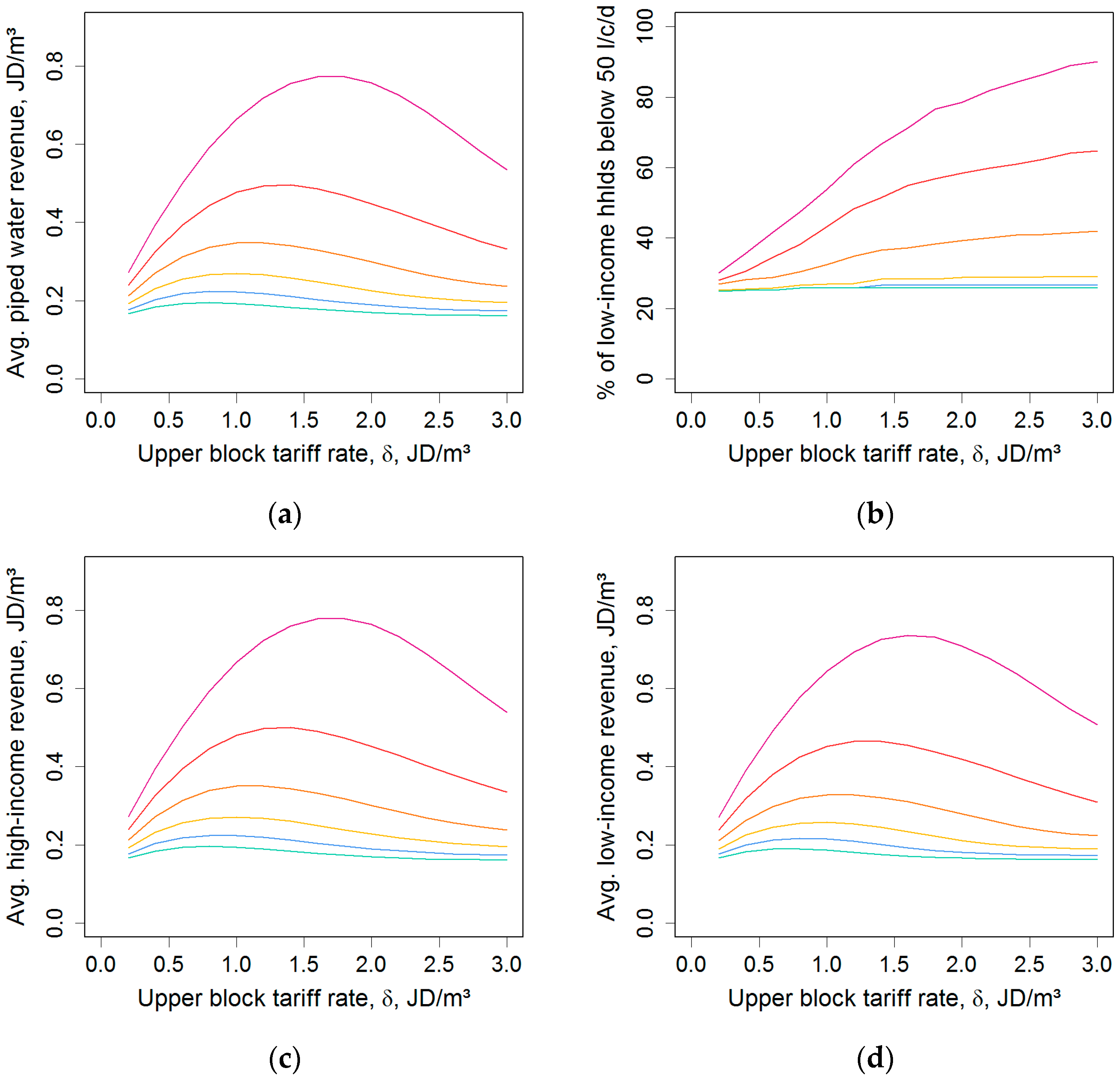

5.2. Simulation of IBT Modifications

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

References

- United Nations Development Program (UNDP). UNDP Support to the Implementation of Sustainable Development Goal 6: Sustainable Management of Water and Sanitation; United Nations High Commissioner for Refugees (UNHCR): New York, NY, USA, 2016. [Google Scholar]

- World Economic Forum (WEF). Global Risks 2015, 10th ed.; WEF: Geneva, Switzerland, 2015. [Google Scholar]

- Gawel, E.; Bretschneider, W. Specification of a human right to water: A sustainability assessment of access hurdles. Water Int. 2017, 42, 505–526. [Google Scholar] [CrossRef]

- Schlosser, C.A.; Strzepek, K.; Gao, X.; Fant, C.; Blanc, E.; Paltsev, S.; Jacoby, H.; Reilly, J.; Gueneau, A. The future of global water stress: An integrated assessment. Earth’s Future 2014, 2, 341–361. [Google Scholar] [CrossRef]

- Grey, D.; Sadoff, C.W. Sink or swim? Water security for growth and development. Water Policy 2007, 9, 545–571. [Google Scholar] [CrossRef]

- World Bank. Beyond Scarcity: Water Security in the Middle East and North Africa; MENA Development Report; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Organization for Economic Co-operation and Development (OECD). Pricing Water Resources and Water and Sanitation Services; OECD: Paris, France, 2010. [Google Scholar]

- United Nations (UN). World Economic Situation and Prospects 2016; UN: New York, NY, USA, 2016. [Google Scholar]

- Whittington, D. Adverse Effects of Increasing Block Water Tariffs in Developing Countries. Econ. Dev. Cult. Chang. 1992, 41, 75–87. [Google Scholar] [CrossRef]

- Organization for Economic Co-operation and Development (OECD). Managing Water for All: An OECD Perspective on Pricing and Financing; OECD: Paris, France, 2009. [Google Scholar]

- Boland, J.J.; Whittington, D. The political economy of water tariff design in developing countries: Increasing block tariffs versus uniform price with rebate. In The Political Economy of Water Pricing Reforms; Dinar, A., Ed.; Oxford UP: New York, NY, USA, 2000; pp. 215–236. [Google Scholar]

- Nauges, C.; Whittington, D. Estimation of Water Demand in Developing Countries: An Overview. World Bank Res. Obs. 2009, 25, 263–294. [Google Scholar] [CrossRef]

- Hewitt, J.A.; Hanemann, W.M. A discrete/continuous choice approach to residential water demand under block rate pricing. Land Econ. 1995, 71, 173–192. [Google Scholar] [CrossRef]

- Dalhuisen, J.M.; Florax, R.J.G.M.; de Groot, H.L.F.; Nijkamp, P. Price and income elasticities of residential water demand: A meta-analysis. Land Econ. 2003, 79, 292–308. [Google Scholar] [CrossRef] [Green Version]

- Sebri, M. A meta-analysis of residential water demand studies. Environ. Dev. Sustain. 2014, 16, 499–520. [Google Scholar] [CrossRef]

- Rietveld, P.; Rouwendal, J.; Zwart, B. Block rate pricing of water in Indonesia: An analysis of welfare effects. Bull. Indones. Econ. Stud. 2000, 36, 73–92. [Google Scholar] [CrossRef] [Green Version]

- Sebri, M. Intergovernorate disparities in residential water demand in Tunisia: A discrete/continuous choice approach. J. Environ. Plan. Manag. 2013, 56, 1192–1211. [Google Scholar] [CrossRef]

- Worthington, A.C.; Hoffman, M. An empirical survey of residential water demand modelling. J. Econ. Surv. 2008, 22, 842–871. [Google Scholar] [CrossRef]

- Espey, M.; Espey, J.; Shaw, W.D. Price elasticity of residential demand for water: A meta-analysis. Water Resour. Res. 1997, 33, 1369–1374. [Google Scholar] [CrossRef]

- Arbués, F.; García-Valiñas, M.A.; Martínez-Espiñeira, R. Estimation of residential water demand: A state-of-the-art review. J. Socio-Econ. 2003, 32, 81–102. [Google Scholar] [CrossRef]

- Yorke, V. Politics Matter: Jordan’s Path to Water Security Lies Through Political Reforms and Regional Cooperation; Swiss National Centre of Competence in Research (NCCR) Working Paper No. 2013/19; NCCR: Bern, Switzerland, 2013. [Google Scholar]

- Washington, K.; Brown, H.; Santacroce, M.; Tyler, A. Jordan Refugee Response: Vulnerability Assessment Framework Baseline Survey; United Nations High Commissioner for Refugees (UNHCR) Jordan: Amman, Jordan, 2015. [Google Scholar]

- Sadoff, C.W.; Hall, J.W.; Grey, D.; Aerts, J.C.J.H.; Ait-Kadi, M.; Brown, C.; Cox, A.; Dadson, S.; Garrick, D.; Kelman, J.; et al. Securing Water, Sustaining Growth: Report of the GWP/OECD Task Force on Water Security and Sustainable Growth; University of Oxford: Oxford, UK, 2015. [Google Scholar]

- Abu Amra, B.; Al-A’raj, A.; Al Atti, N.; Dersieh, T.; Hanieh, R.; Hendi, S.; Homoud, F.; Hussein, Y.; Jaloukh, R.; Rayyan, N. Amman Water Supply Planning Report, Volume 3, Appendices G & H; Report Prepared by CDM for the United States Agency for International Development (USAID), the Ministry of Water and Irrigation (MWI), and the Water Authority of Jordan (WAJ); USAID: Amman, Jordan, 2011.

- International Resources Group (IRG). Strategic Master Plan for Municipal Water Infrastructure: Final Report; Report Prepared for the Institutional Support and Strengthening Program (ISSP); United States Agency for International Development (USAID): Washington, DC, USA, 2015.

- Potter, R.B.; Darmame, K. Contemporary social variations in household water use, management strategies and awareness under conditions of ‘water stress’: The case of Greater Amman, Jordan. Habitat Int. 2010, 34, 115–124. [Google Scholar] [CrossRef]

- Rosenberg, D.E.; Talozi, S.; Lund, J.R. Intermittent water supplies: Challenges and opportunities for residential water users in Jordan. Water Int. 2008, 33, 488–504. [Google Scholar] [CrossRef]

- Sigel, K.; Klassert, C.; Zozmann, H.; Talozi, S.; Klauer, B.; Gawel, E. Impacts of Private Tanker Water Markets on Sustainable Urban Water Supply: An Empirical Study of Amman, Jordan; UFZ Report; Helmholtz Centre for Environmental Research—UFZ: Leipzig, Germany, 2018; In press. [Google Scholar]

- International Resources Group (IRG). Institutional Support & Strengthening Program: Institutional Assessment Report; Report Prepared for the Institutional Support and Strengthening Program (ISSP); United States Agency for International Development (USAID): Washington, DC, USA, 2011.

- Klassert, C.; Gawel, E.; Sigel, K.; Klauer, B. Sustainable transformation of urban water infrastructure in Amman, Jordan: Meeting residential water demand in the face of deficient public supply and alternative private water markets. In Urban Transformations; Kabisch, S., Gawel, E., Eds.; Future City 10; Springer: Berlin, Germany, 2018. [Google Scholar]

- Open Access Micro Data Initiative (OAMDI). Harmonized Household Income and Expenditure Surveys (HHIES), Version 2.0 of Licensed Data Files, HEIS 2002–2013, Department of Statistics (DOS); Economic Research Forum (ERF): Cairo, Egypt, 2014; Available online: http://www.erf.org.eg/cms.php?id=erfdataportal (accessed on 30 November 2017).

- Salman, A.; Al-Karablieh, E.K.; Haddadin, M.A. Limits of pricing policy in curtailing household water consumption under scarcity conditions. Water Policy 2008, 10, 295–304. [Google Scholar] [CrossRef]

- Al-Najjar, F.O.; Al-Karablieh, E.K.; Salman, A. Residential water demand elasticity in Greater Amman area. Jordan J. Agric. Sci. 2011, 7, 93–103. [Google Scholar]

- Tabieh, M.; Salman, A.; Al-Karablieh, E.; Al-Qudah, H.; Al-Khatib, H. The Residential Water Demand Function in Amman-Zarka Basin in Jordan. Wulfenia J. 2012, 19, 324–333. [Google Scholar]

- Coulibaly, L.; Jakus, P.M.; Keith, J.E. Modeling water demand when households have multiple sources of water. Water Resour. Res. 2014, 50, 6002–6014. [Google Scholar] [CrossRef]

- Gawel, E.; Sigel, K.; Bretschneider, W. Affordability of water supply in Mongolia: Empirical lessons for measuring affordability. Water Policy 2013, 15, 19–42. [Google Scholar] [CrossRef]

- Gawel, E.; Bretschneider, W. The affordability of water and energy pricing: The case of Germany. In International Handbook on Social Policy and the Environment; Fitzpatrick, T., Ed.; Edward Elgar: Cheltenham, UK, 2014; pp. 123–151. [Google Scholar]

- Water Authority of Jordan (WAJ). Water and Wastewater Tariff for Quarterly Bills for Governorates Which Are Managed by Companies 2012; WAJ: Amman, Jordan, 2012. Available online: http://www.waj.gov.jo/ (accessed on 30 November 2017).

- Water Authority of Jordan (WAJ). Water and Wastewater Tariff for Quarterly Bills for Governorates which are Not Managed by Companies 2012; WAJ: Amman, Jordan, 2012. Available online: http://www.waj.gov.jo/ (accessed on 30 November 2017).

- SEGURA/IP3 Partners. Pricing of Water and Wastewater Services in Amman and Subsidy Options. Conceptual Framework, Recommendations and Pricing Model; USAID: Washington, DC, USA, 2009.

- Department of Statistics (DOS). Household Expenditure and Income Survey 2010: Methodology; DOS: Amman, Jordan, 2010.

- Department of Statistics (DOS). Household Expenditure and Income Survey 2002: Methodology; DOS: Amman, Jordan, 2002.

- Department of Statistics (DOS). Household Expenditure and Income Survey 2006: Methodology; DOS: Amman, Jordan, 2006.

- Department of Statistics (DOS). Household Expenditure and Income Survey 2008: Methodology; DOS: Amman, Jordan, 2008.

- Department of Statistics (DOS). Household Expenditure and Income Survey 2013: Methodology; DOS: Amman, Jordan, 2013.

- Department of Statistics (DOS). Jordan Statistical Yearbook 2010; DOS: Amman, Jordan, 2010. Available online: http://www.dos.gov.jo/ (accessed on 30 November 2017).

- Department of Statistics (DOS). Jordan Statistical Yearbook 2013; DOS: Amman, Jordan, 2013. Available online: http://www.dos.gov.jo/ (accessed on 30 November 2017).

- Department of Statistics (DOS). General Census of Population and Housing 2015; DOS: Amman, Jordan, 2015.

- Holtkemper, S. Tariff Systems in the Water Sector. In Digital Water Master Plan, Volume 8, Water Sector Economics, Annex 10; Report Prepared for the Jordanian Ministry of Water and Irrigation (MWI) and the German Organization for Technical Cooperation (GTZ); Water Sector Planning Support Project (WSPSP): Amman, Jordan, 2004. [Google Scholar]

- Verme, P. Electricity Subsidies and Household Welfare in Jordan: Can Households Afford to Pay for the Budget Crisis? Background Paper for the Jordan Poverty Reduction Strategy; Ministry of Planning and International Cooperation (MoPIC): Amman, Jordan, 2011.

- Miyahuna. Tariff History for the Greater Amman Municipality; Miyahuna: Amman, Jordan, 2012. [Google Scholar]

- United Nations Statistics Division (UNSTAT). Classification of Expenditure According to Purposes: Classification of the Functions of Government (COFOG), Classification of Individual Consumption According to Purpose (COICOP), Classification of the Purposes of Non-Profit Institutions Serving Households (COPNI), Classification of the Outlays of Producers, According to Purpose (COPP); UNSTAT Statistical Papers Series M 84; UN: New York, NY, USA, 2000. [Google Scholar]

- Department of Statistics (DOS). Household Expenditure and Income Survey 2013; DOS: Amman, Jordan, 2013.

- Klassert, C.; Sigel, K.; Gawel, E.; Klauer, B. Modeling residential water consumption in Amman: The role of intermittency, storage, and pricing for piped and tanker water. Water 2015, 7, 3643–3670. [Google Scholar] [CrossRef]

- Ministry of Water and Irrigation (MWI). Water Sector Capital Investment Plan 2016–2025; MWI: Amman, Jordan, 2015.

- Taylor, L.D. The Demand for Electricity: A Survey. Bell J. Econ. 1975, 6, 74–110. [Google Scholar] [CrossRef]

- Nordin, J.A. A proposed modification of Taylor’s demand analysis: Comment. Bell J. Econ. 1976, 7, 719–721. [Google Scholar] [CrossRef]

- Olmstead, S.M.; Hanemann, W.M.; Stavins, R.N. Water demand under alternative price structures. J. Environ. Econ. Manag. 2007, 54, 181–198. [Google Scholar] [CrossRef]

- Vásquez Lavín, F.A.; Hernandez, J.I.; Ponce, R.D.; Orrego, S.A. Functional forms and price elasticities in a discrete continuous choice model of the residential water demand. Water Resour. Res. 2017, 53, 6296–6311. [Google Scholar] [CrossRef]

- Burtless, G.; Hausman, J.A. The effect of taxation on labor supply: Evaluating the Gary income maintenance experiment. J. Political Econ. 1978, 86, 1101–1130. [Google Scholar] [CrossRef]

- Martínez-Espiñera, R. Estimating water demand under increasing-block tariffs using aggregate data and proportions of users per block. Environ. Resour. Econ. 2003, 26, 5–23. [Google Scholar] [CrossRef]

- Grafton, R.Q.; Ward, M.B.; To, H.; Kompas, T. Determinants of residential water consumption: Evidence and analysis from a 10-country household survey. Water Resour. Res. 2011, 47, W08537. [Google Scholar] [CrossRef]

- Box, G.E.P.; Cox, D.R. An analysis of transformations. J. R. Stat. Soc. 1964, 26, 211–252. [Google Scholar]

- Moffitt, R. The econometrics of piecewise-linear budget constraints: A survey and exposition of the maximum likelihood method. J. Bus. Econ. Stat. 1986, 4, 317–328. [Google Scholar] [CrossRef]

- Moffitt, R. The econometrics of kinked budget constraints. J. Econ. Perspect. 1990, 4, 119–139. [Google Scholar] [CrossRef]

- Hewitt, J.A. Watering Households: The Two-Error Discrete-Continuous Choice Model of Residential Water Demand. Ph.D. Thesis, University of California, Berkeley, CA, USA, 1993. [Google Scholar]

- Nieswiadomy, M.L.; Molina, D.J. Comparing Residential Water Demand Estimates under Decreasing and Increasing Block Rates Using Household Data. Land Econ. 1989, 65, 280–289. [Google Scholar] [CrossRef]

- Corless, R.M.; Gonnet, G.H.; Hare, D.E.G.; Jeffrey, D.J.; Knuth, D.E. On the Lambert W function. Adv. Comput. Math. 1996, 5, 329–359. [Google Scholar] [CrossRef]

- Cavanagh, S.M.; Hanemann, W.M.; Stavins, R.N. Muffled Price Signals: Household Water Demand under Increasing-Block Prices; FEEM Working Paper 40; Fondazione Eni Enrico Mattei: Milan, Italy, 2002. [Google Scholar]

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2015; Available online: https://www.R-project.org/ (accessed on 30 November 2017).

- Bolker, B.; R Development Core Team. BBMLE: Tools for General Maximum Likelihood Estimation, R Package Version 1.0.18. 2016. Available online: https://CRAN.R-project.org/package=bbmle (accessed on 30 November 2017).

- Goerg, G.M. Lambert W random variables—A new family of generalized skewed distributions with applications to risk estimation. Ann. Appl. Stat. 2011, 3, 2197–2230. [Google Scholar] [CrossRef]

- Goerg, G.M. The Lambert Way to Gaussianize heavy-tailed data with the inverse of Tukey’s h transformation as a special case. Sci. World J. 2015. [Google Scholar] [CrossRef] [PubMed]

- Goerg, G.M. LambertW: An R package for Lambert W x F Random Variables, R Package version 0.6.4. 2016. Available online: https://cran.r-project.org/web/packages/LambertW/LambertW.pdf (accessed on 30 November 2017).

- Gleick, P.H. Basic water requirements for human activities: Meeting basic needs. Water Int. 1996, 21, 83–92. [Google Scholar] [CrossRef]

- Ministry of Water and Irrigation (MWI). Ministry of Water & Irrigation, Water Authority of Jordan, Jordan Valley Authority: Annual Report 2014; MWI: Amman, Jordan, 2014.

- Gawel, E. Environmental and Resource Costs Under Article 9 Water Framework Directive: Challenges for the Implementation of the Principle of Cost Recovery for Water Services; Studien zu Umweltökonomie und Umweltpolitik; Duncker & Humblot: Berlin, Germany, 2016. [Google Scholar]

- Kubursi, A.; Grover, V.; Darwish, A.R.; Deutsch, E. Water Scarcity in Jordan: Economic Instruments, Issues and Options; The Economic Research Forum (ERF) Working Paper 599; ERF: Cairo, Egypt, 2011. [Google Scholar]

- United Nations Development Program (UNDP). Jordan Poverty Reduction Strategy: Final Report; United Nations High Commissioner for Refugees (UNHCR): New York, NY, USA, 2013. [Google Scholar]

- Dang, H.A.H.; Lanjouw, P.F.; Serajuddin, U. Updating Poverty Estimates at Frequent Intervals in the Absence of Consumption Data: Methods and Illustration with Reference to a Middle-Income Country; World Bank Policy Research Working Paper 7043; World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Chenoweth, J. Minimum water requirement for social and economic development. Desalination 2008, 229, 245–256. [Google Scholar] [CrossRef] [Green Version]

- Gawel, E.; Bretschneider, W. Affordability as an institutional obstacle to water-related price reforms. In Perspectives on Institutional Change—Water Management in Europe; Theesfeld, I., Pirscher, F., Eds.; Studies on the Agricultural and Food Sector in Central and Eastern Europe 58; Leibniz-Institut für Agrarentwicklung in Mittel-und Osteuropa (IAMO): Halle (Saale), Germany, 2011; pp. 9–41. [Google Scholar]

- Liu, J.; Savenije, H.H.G.; Xu, J. Water as an economic good and water tariff design: Comparison between IBT-con and IRT-cap. Phys. Chem. Earth 2003, 28, 209–217. [Google Scholar] [CrossRef]

- García-Rubio, M.A.; Ruiz-Villaverde, A.; González-Gómez, F. Urban Water Tariffs in Spain: What Needs to Be Done? Water 2015, 7, 1456–1479. [Google Scholar] [CrossRef]

- SWEEP-Net. Country Report on the Solid Waste Management in Jordan; Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ): Bonn, Germany, 2014. [Google Scholar]

- Qdais, H.A.A. Techno-economic assessment of municipal solid waste management in Jordan. Waste Manag. 2007, 27, 1666–1672. [Google Scholar] [CrossRef] [PubMed]

- World Bank. Project Appraisal Document on a Proposed Loan in the Amount of US$25.0 Million to the Greater Amman Municipality with a Guarantee of the Hashemite Kingdom of Jordan for an Amman Solid Waste Management Project; World Bank Report No: 43358-50; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Department of Statistics (DOS). Household Expenditure and Income Survey 2002; DOS: Amman, Jordan, 2002.

- Department of Statistics (DOS). Household Expenditure and Income Survey 2006; DOS: Amman, Jordan, 2006.

- Department of Statistics (DOS). Household Expenditure and Income Survey 2008; DOS: Amman, Jordan, 2008.

- Department of Statistics (DOS). Household Expenditure and Income Survey 2010; DOS: Amman, Jordan, 2010.

| Variable | Units | Weighted | Min. | Max. | |

|---|---|---|---|---|---|

| Mean | Std. Dev. | ||||

| Household water demand (q) | m3/qtr. | 46.7084 | 31.9897 | 18.0 | 812.7 |

| Marginal Price (p) | JD/m3 | 0.5261 | 0.5546 | 0 | 4.8 |

| Income (y) | JD/a | 9469.8 | 10,965.6 | 84.0 | 844,349.1 |

| Virtual Income (y + d) | JD/qtr. | 9537.3 | 11,003.2 | 109.2 | 845,057.2 |

| No. of Adults (ADT) | Count | 3.7107 | 1.9786 | 1 | 15 |

| No. of Children (CHD) | Count | 1.8549 | 1.7735 | 0 | 12 |

| No. of Seniors (SEN) | Count | 0.2440 | 0.5312 | 0 | 3 |

| Marital Status (MAR) | Boolean | 0.8519 | 0.3552 | 0 | 1 |

| Higher Education Spouse (EDU) | Boolean | 0.1941 | 0.3955 | 0 | 1 |

| Own Residence (OWN) | Boolean | 0.7139 | 0.4520 | 0 | 1 |

| Large Residence (LGR) | Boolean | 0.1609 | 0.3674 | 0 | 1 |

| Rural/Urban (URB) | Boolean | 0.82984 | 0.37577 | 0 | 1 |

| Variable | 2013 Only | All Years | |||||

|---|---|---|---|---|---|---|---|

| OLS1 | OLS2 | DCC | OLS1 | OLS2 | DCC | ||

| Intercept | 3.2674*** (0.0522) | 2.2834*** (0.0913) | 1.9885*** (0.1508) | 3.3217*** (0.0343) | 1.9951*** (0.0590) | 1.4587*** (0.1019) | |

| 0.6065*** (0.0059) | – | −0.1877** (0.0602) | 0.7798*** (0.0043) | - | −0.4510*** (0.0601) | ||

| 0.0014 (0.0064) | 0.1216*** (0.0111) | 0.1536*** (0.0186) | −0.0067 (0.0042) | 0.1526*** (0.0071) | 0.2181*** (0.0125) | ||

| 0.0658*** (0.0085) | 0.1612*** (0.0150) | 0.2010*** (0.0162) | 0.0386*** (0.0047) | 0.1345*** (0.0081) | 0.1852*** (0.0132) | ||

| −0.0041*** (0.0009) | −0.0117*** (0.0016) | −0.0149*** (0.0016) | −0.0018*** (0.0005) | −0.0084*** (0.0008) | −0.0113*** (0.0012) | ||

| 0.0222*** (0.0024) | 0.0391*** (0.0043) | 0.0445*** (0.0054) | 0.0085*** (0.0015) | 0.0236*** (0.0026) | 0.0313*** (0.0038) | ||

| −0.0024 (0.0070) | 0.0492*** (0.0125) | 0.0612*** (0.0183) | −0.0124** (0.0045) | 0.0286*** (0.0079) | 0.0443*** (0.0116) | ||

| −0.0111 (0.0101) | −0.0372* (0.0180) | −0.0382 (0.0238) | 0.0076 (0.0068) | −0.0258* (0.0120) | −0.0423* (0.0167) | ||

| −0.0107 (0.0088) | −0.0569*** (0.0156) | −0.0638** (0.0221) | −0.0169** (0.0060) | −0.0409*** (0.0106) | −0.0542*** (0.0145) | ||

| 0.0595*** (0.0085) | 0.1337*** (0.0150) | 0.1421*** (0.0204) | 0.0762*** (0.0054) | 0.1493*** (0.0095) | 0.1673*** (0.0127) | ||

| 0.0115 (0.0108) | 0.0673*** (0.0192) | 0.1109*** (0.0300) | 0.0031 (0.0075) | 0.1055*** (0.0132) | 0.1546*** (0.0195) | ||

| −0.1993*** (0.0092) | −0.2218*** (0.0164) | −0.2430*** (0.0221) | −0.1970*** (0.0060) | −0.1951*** (0.0105) | −0.2268*** (0.0157) | ||

| N | 4847 | 4847 | 4847 | 15,811 | 15,811 | 15,811 | |

| RSE | 0.2094 | 0.3728 | - | 0.2764 | 0.4857 | - | |

| - | - | 0.0355 (0.0372) | - | - | 0.3315*** (0.0175) | ||

| - | - | 0.4167*** (0.0053) | - | - | 0.3996*** (0.0106) | ||

| R² | 0.7472 | 0.1984 | - | 0.7344 | 0.1797 | - | |

| Log-Likelihood | - | - | −2097.41 | - | - | −10,938.12 | |

| Price Elasticities by Observation Subset | Price Elasticities by 2013 Tariff Block | ||

|---|---|---|---|

| All Observations (0.5261 JD/m3) | −0.2373 | Tariff Block 1 (0 JD/m3) | 0 |

| All 2013 Observations (0.5812 JD/m3) | −0.2621 | Tariff Block 2 (0.1541 JD/m3) | −0.0695 |

| 2013 Income Quintile 1 a (0.3671 JD/m3) | −0.1656 | Tariff Block 3 (0.6203 JD/m3) | −0.2798 |

| 2013 Income Quintile 2 a (0.4949 JD/m3) | −0.2232 | Tariff Block 4 (1.0665 JD/m3) | −0.4810 |

| 2013 Income Quintile 3 a (0.5473 JD/m3) | −0.2468 | Tariff Block 5 (1.3612 JD/m3) | −0.6139 |

| 2013 Income Quintile 4 a (0.6418 JD/m3) | −0.2895 | Tariff Block 6 (1.8599 JD/m3) | −0.8388 |

| 2013 Income Quintile 5 a (0.8067 JD/m3) | −0.3638 | Tariff Block 7 (3.2040 JD/m3) | −1.4450 |

| Governorates Served by Companies | Governorates Served by WAJ | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Blocks | Variable Rate | Fixed Charge | Blocks | Variable Rate | Fixed Charge | ||||

| m3/qtr. | Water | WW | Water | WW | m3/qtr. | Water | WW | Water | WW |

| 0–20 | 0 | 0 | 4.53 | 0.6 | 0–18 | 0 | 0 | 3.9 | 0.6 |

| 20–38 | 0.145 | 0.04 | 6.18 | 0.6 | 18–36 | 0.075 | 0.04 | 5.1 | 0.6 |

| 38–56 | 0.5 | 0.25 | 7.83 | 0.6 | 36–54 | 0.4 | 0.2 | 6.75 | 0.6 |

| 56–74 | 0.935 | 0.495 | 7.83 | 0.6 | 54–72 | 0.715 | 0.33 | 6.75 | 0.6 |

| 74–92 | 1.15 | 0.69 | 7.83 | 0.6 | 72–90 | 0.748 | 0.345 | 6.75 | 0.6 |

| 92–128 | 1.61 | 0.805 | 7.83 | 0.6 | 90–126 | 1.15 | 0.575 | 6.75 | 0.6 |

| ≥128 | 3.2 | 1.6 | 7.83 | 0.6 | ≥126 | 1.44 | 0.84 | 6.75 | 0.6 |

| Simulation Experiment | Tariff Rate Multiplication Factor | Tariff Increase Threshold Value | Upper Block Tariff Rate, in JD/m3 | |||||

|---|---|---|---|---|---|---|---|---|

| Min. | Incr. | Max. | Unit | Values | Min. | Incr. | Max. | |

| 1 | 0.1 | 0.1 | 4.0 | m3/qtr. | 20, 30, 40, 50, 60, 70 | - | - | - |

| 2 | - | - | - | m3/qtr. | 20, 30, 40, 50, 60, 70 | 0.2 | 0.2 | 3.0 |

| 3 | - | - | - | L/day | 10, 20, 30, 50, 75, 100 | 0.2 | 0.2 | 10.0 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Klassert, C.; Sigel, K.; Klauer, B.; Gawel, E. Increasing Block Tariffs in an Arid Developing Country: A Discrete/Continuous Choice Model of Residential Water Demand in Jordan. Water 2018, 10, 248. https://doi.org/10.3390/w10030248

Klassert C, Sigel K, Klauer B, Gawel E. Increasing Block Tariffs in an Arid Developing Country: A Discrete/Continuous Choice Model of Residential Water Demand in Jordan. Water. 2018; 10(3):248. https://doi.org/10.3390/w10030248

Chicago/Turabian StyleKlassert, Christian, Katja Sigel, Bernd Klauer, and Erik Gawel. 2018. "Increasing Block Tariffs in an Arid Developing Country: A Discrete/Continuous Choice Model of Residential Water Demand in Jordan" Water 10, no. 3: 248. https://doi.org/10.3390/w10030248