1. Introduction: Uncertainty Management in Projects

Risk and uncertainty have long been of interest to mankind [

1]. The concept of dealing with uncertainty as a part of project management theory was first expressed during the mid-1950s when the program evaluation and review technique (PERT) for estimating time in networks was developed [

2,

3]. It can be argued that projects have traditionally strived towards predictability to keep all critical factors under control [

3,

4]. The first project management theory presented for what today are called projects was designed to gain control over a large complex and dynamic construction problem that had high internal and contextual uncertainty [

2,

5] The initial answer to the question of how to handle uncertainty and the problem of coordinating many people in order to deliver on time and cost was to standardize work breakdown, develop standard methods for time planning (e.g., the critical path method (CPM) and PERT) and focus on optimization [

2,

3,

5,

6,

7] (Bredillet 2008, Rolstadås 2008, Morris 2011, Rolstadås 2011, Morris 2013). Over the following 30–40 years, the project management society developed universal methods that would fit most projects most of the time [

2,

6,

8,

9].

In the classical project management school, project managers were told that they should “stick to the plan” and deliver their projects according to the specification and within the cost and time frame that was established at the beginning of the project. It can be argued that the standardization of tools and methods was prescribed as the solution for handling and dealing with the high internal and contextual uncertainty with which projects had to cope. However, in a shifting and changing environment with much foreseen and unforeseen uncertainty, “sticking to the plan” is often no longer an option for many projects. Project managers will need to manage uncertainty actively, since such predictability does not exist in reality for large and complex projects [

10,

11]

In since the early 2000s, there has been increasing focus on how to manage opportunities in projects. Ward and Chapman [

12] introduced the term uncertainty management as preferable to the terms risk management and opportunity management. In recent years, taking advantage of opportunities has been much discussed [

13], and some have tried to solve the problem of how to deal with opportunities in projects [

14]. However, projects still seem to fail to identify properly and exploit opportunities in practice.

Uncertainty is a two-sided coin [

15]: activities and processes could go better than planned or they could become worse. In his early work, Lichtenberg claimed that uncertainty is a neutral concept that deals with the future outcome and the fact that we (i.e., project managers and all members of the management team) do not have all of the information we need at the time when we need to make our decisions [

16,

17,

18]. Additionally, Ward and Chapman [

12] and Rolstadås et al. [

11] recommend that in risk workshops, we should use just as much time identifying and analyzing the opportunities as identifying and analyzing the threats. However, practical observations by the authors of this paper, who have performed uncertainty analysis consultancy since the mid-1990s, have revealed a different story: in workshops, it was most often much easier for the project members to identify threats than opportunities. Typically, eight- to ten-times the number of threats as opportunities were identified in the brainstorming process at the beginning of the analyses. Furthermore, threats were dominant later in the analyses, when we discussed what to manage.

According to the theory [

19,

20,

21] there should be a focus on risk and opportunities in the uncertainty analysis process, and in the uncertainty management process, there should be equal focus on the downside uncertainty (i.e., risks and threats) and the upside uncertainty (i.e., opportunities). However, what we experienced in practice and were told by project managers revealed a different story, and we therefore consider that there is a need to ask the following question:

How do project managers understand and relate to what is said to be the recommended practices in standards and project management textbooks on exploiting and harvesting opportunities, and do they really exploit and pursue opportunities in their projects?

This paper will shed light on how project managers in large public and private projects actually focus on and deal with uncertainty in their management of threats and opportunities in the planning and execution phase of a project. We will argue that different key stakeholders have different views on what the risk or opportunity for a project is and offer a decision scenario model that explains why exploiting opportunities is a more difficult and often more complex task than identifying and following up on threats seen from three different stakeholder views. Furthermore, we suggest that we need to develop a different approach if we really want project managers to explore and exploit opportunities in their projects.

2. Value of Uncertainty: The Background, the Terminology Debate and Handling of Uncertainty Seen from Different Stakeholders’ Perspectives

One of the first scholars to describe thoroughly the concept of analyzing and calculating the impact of uncertainties on project cost estimates was Steen Lichtenberg. In the early 1970s, Lichtenberg developed a new approach for calculating the cost of big projects called ‘the successive principle of cost estimation’ [

15,

22]. This work was performed together with researchers from Stanford University and MIT in the USA, Loughborough University in the U.K., the Chalmers University of Technology in Sweden and the Norwegian Institute of Technology (Norges tekniske høgskole, NTH) in Trondheim. Lichtenberg used the term uncertainty, and from the very beginning, it was a neutral concept that had a broader perspective than the risk concept, which only dealt with the downsides of projects (e.g., unexpected delays and higher costs). The concept was adapted by Norwegian project management researchers from the Norwegian Institute of Technology, and from the early 1990s, uncertainty analysis was used in Norway as a method to find the expected cost or expected time for projects, with the variability of cost/time expressed as a standard deviation. The step-by-step approach, the Norwegian evolution from the successive principle and stochastic estimation were introduced and, together with the uncertainty analysis concept, subsequently spread among consultants and practitioners [

16,

17,

18]. Initially, the focus was on the development of the technique: how to make a time schedule and a cost estimation with the consideration of uncertainty [

15,

16,

17,

18] and to design a process for performing uncertainty analysis. At the same time, Chapman and Ward developed their risk management frameworks and published their book

Project Risk Management: Processes,

Techniques and Insights [

19]. Simister [

20] continued on this path and developed a generic risk management model based on publications of national standards produced by the British Standards Institute, the Canada Standards Association and Standards Australia, as well as by professional institutions (Institution of Civil Engineers 1998, Japan Project Management Forum 2002, Project Management Institute 2008 and the Association of Project Management and government departments (United States Department of Defense 2003 and the U.K. Office of Government Commerce 2002)). Similar to Lichtenberg’s successive principle, Simister’s risk model presents the idea that risk management is more of a continuous, repetitive and iterative process than of isolated exercises and analyses.

2.1. The Terminology Debate Risk versus Uncertainty

Since the 1990s, there has been an ongoing terminology debate in the project management community regarding whether the handling of uncertainty in a project should be labelled risk or uncertainty management [

23,

24] Some scholars have argued the case for the term uncertainty [

19,

25] while others have argued for risk [

21]. Some consider uncertainty and risk as synonymous, and some consider them as separate terms with different interpretations. However, both terms are used in connection with the management of a project today, which means that how we define uncertainty and risk also has a direct impact on how we define and understand uncertainty management and risk management in practice.

Some scholars have been concerned about the origin of the concepts of uncertainty and risk (e.g., [

26] and have referred to the early work of economists Knight and Keynes and their respective work on economic theory published in the early 20th century as the starting point of defining risk and uncertainty [

27,

28]. Other scholars claim that risk, probability and uncertainty were understood much earlier than 1921. According to Bernstein [

1], the first work on probability and risk was published by De Movire as early as 1711. De Movire’s work was later translated and expanded in an English version titled

The Doctrine of Chance: Or, A Method of Calculating the Probability of Events in Play [

29]. According to De Movire, “The risk of losing any sum is the reverse of exaptation; and the true measure of it is, the product of the sum adventured multiplied by the probability of the loss”, quite in line with the current application of the formula: risk = consequence × probability.

Other scholars who have reviewed earlier research on project risk have discussed whether risk as a phenomenon essentially is objective or subjective [

24] without drawing the historical lines back to the work by Knight and Keynes [

27,

28]. Zhang [

24] categorizes his findings into two schools of thinking: “risk as an objective fact” and “risk as a subjective construction”. According to Zhang, the two schools have different definitions of risk and recommend different analytical methods and different policies for managing risks. The “risk as an objective fact” school considers that: (1) risks objectively exist and are probabilistic in epistemology; (2) risk analyses are objective, technical and neutral activities; and (3) management policies based on knowledge produced from an objective risk analysis are the outcome of rational decision-making. By contrast, the “risk as a subjective construction” school considers that risks are subjective and constructed phenomena and have multiple epistemological dimensions. These dimensions dominate the others depending on the observers, the context they choose and the perspective they adopt. Therefore, risk analyses are not objective and neutral activities, but subjective and rich in interpretation.

As already mentioned in the Introduction, Ward and Chapman [

12] suggested that the term risk management should be abounded and introduced the term uncertainty management. Their reasoning was that handling opportunity could then be part of the uncertainty management process.

In a more operational perspective, the Project Management Institute (PMI) defines risk as “an uncertain event or condition that, if it occurs, has a positive or negative effect on a project’s objectives” [

30] (p. 373). According to the PMI, risk is usually calculated as the probability of a desired outcome multiplied by the consequences if that outcome should occur. Moreover, according to the PMI’s definition, risk can be both positive and negative, and often, positive risk is referred to as opportunity. This makes it difficult to follow the logic in the PMI’s definition. Similarly, both the ISO 31000 standard for risk management and the ISO Guide 73:2009 to risk terminology suggest that risk is the effect of uncertainty on objectives, and it defines a terminology for discussing and calculating risks through consequences and likelihood.

2.2. What Kind of Definitions Should We Choose: Uncertainty or Risk?

The term risk has neutral and negative meanings, depending on which sources are consulted. Chapman and Ward [

31] and Hillson and Simon [

32] suggest that risk can consist of two parts: threats and opportunities. This understanding has strong similarities to how Lichtenberg [

15] and Klakegg [

17] defined uncertainty in their early work, namely as something that deals with threats and opportunities and was essentially used as a neutral concept. In common with risk, the term uncertainty has several meanings. Some authors point to the lack of knowledge; some point to potential outcomes and causal forces that may happen in the future; and some point to the positive or negative effects that uncertainty will have on a project’s objective. Johansen et al. [

14] suggest that the uncertainty can be defined as the controllable and non-controllable factors that may occur, as well as the variations and foreseeable events that occur during a project’s execution that have a significant impact on the project’s objective. Threats are factors, variations and events that may lead to undesired changes to the project objective and result in a loss of benefits for the project owner. Normally, project managers and project owners have much the same view on what constitutes a risk or threat to the project.

Opportunities are factors, variations and events that may lead to higher value or benefit for the project owner during the execution of the project. There could be changes that make the project able to deliver the same quality in less time or at a lower price than was initially agreed upon. Therefore, factors, variations and events that cause changes that could make the project deliver higher functionality or lead to higher positive net present value (NPV) after the project has been delivered should be considered as opportunities for the project.

Furthermore, the term “ambiguity” has been part of the debate relating to risk and uncertainty. In contrast to uncertainty, ambiguity can be understood as different interpretations of the same piece of information. When projects are in the early definition phase, it will be unclear what is to be delivered, what types of solutions will be most effective and what types of organization will be most appropriate; there will be a high level of uncertainty and ambiguity in this phase of the project [

31]. According to Galbraith [

33], Betts and Lansley [

34] and Kolltveit [

35] it is common for uncertainty to be understood as a lack of information, suggesting that uncertainty can be defined as follows: “The difference between the amounts of information required to perform the task and the amount of information already possessed by the organization”. Based on this definition, Brun and Sætre [

36] and Brun [

37] argued that uncertainty can be reduced by the provision of more information, but that ambiguity is not necessarily reduced as a result of the provision of more information.

Thus, one part of project uncertainty often has its root cause in the lack of available information, available knowledge or competence [

38]. Furthermore, one part of project uncertainty is linked to how the different stakeholders’ interpret the information available (ambiguity), and one part of project uncertainty is linked and related to how different stakeholders view the probability of a desired outcome and the consequences for the stakeholders should the outcome occur.

Matters are made even more complex by the fact that uncertainties and risk may also be divided into groups or categories. According to De Meyer et al. [

39], projects may be grouped into four categories or types that have different types of uncertainty. Projects could have uncertainty related to variation that comes from many small influences and yields a range of values that is possible for the outcome of activities. Foreseen uncertainty is an identifiable and understood influence that might or might not happen in projects. By contrast, some projects have to deal with unforeseen uncertainty, which is uncertainty that cannot be planned for and that the project management team is either unaware of or considers highly unlikely (also called unknown unknowns). The fourth group is projects that live with chaos and are characterized by the way that unforeseen events will change the project goal, plan and chosen approach. De Meyer et al. [

39] argue that the four types of projects need different uncertainty management approaches.

Rolstadås and Johansen [

10] suggest that risk can be divided into three types according to the level of the organization it affects: operational, strategic and contextual risks. Operational risk is connected to internal circumstances in the project and can normally be controlled by the project team. Such circumstances may include resource variations, productivity, coordination, team spirit or project culture. Strategic risk is the prospective impact on earnings or capital from adverse business decisions, improper implementation of decisions or lack of responsiveness to industry changes. Such risks are beyond the control of the project team, but may be controlled by the project owner or sponsor. A strategic risk is a function of the compatibility of an organization’s strategic goals, the business strategies developed, the resources deployed and the quality of the implementation. A contextual risk is risk connected to circumstances outside the project that may influence the scope of work and the performance of the organization. Examples are competing projects, change in ownership and management, legislation and governmental directives, media attention, extreme market conditions and accidents. Contextual risk also includes black swans. A black swan has three characteristics: it is an outlier; it has an extreme impact; and human nature makes us concoct explanations for its occurrence after the fact, making it seem explainable and predictable [

40].

The time, the level of detail and the type of risk constitute what Rolstadås and Johansen [

10] refer to as the three dimensions of project risk. A risk and uncertainty analysis is usually executed during the pre-study or the planning phase (front-end loading), but often it is not followed up or managed over time. Most risk analyses are directed towards managing the operational risk. According to Rolstadås and Johansen, the project management team often neglects contextual risks. An proactive uncertainty management approach needs to take all three of the above-mentioned dimensions into account and is a forward-looking uncertainty management process [

41] Hillson argues that risk equals uncertainty that matters, and he suggests that risk should be divided into four types or categories:

Stochastic uncertainty or event risk (may or may not happen)

Aleatoric uncertainty or variability risk (certain future events with variable characteristics)

Epistemic uncertainty or ambiguity risk (certain future events with ambiguous characteristics)

Ontological uncertainty or emergent risk (unknown unknowns)

Winch and Maytorena [

42] offers a cognitive decision-making model for managing risk and uncertainty in projects: the information spaces. They argue that effective management of risk is critical for the project and project portfolio performance and that successful implementation of uncertainty management lies primarily in the behavior of leadership and teams rather than processes and tools. Dealing with risk and uncertainty is fundamentally subjective, and it is about identifying, assessing, responding to and controlling, risk, known unknowns and unknown unknowns, which can range from certain

p = 1 to impossible

p = 0. More information and increased confidence play a huge part in how the project managers view the different types of risk, but there are no facts about the future. Only a rational and subjective perception of the future is possible, and that is what is dealt with in the uncertainty management process.

3. The Study and Research Design: Do Projects Harvest Opportunities in Practices?

The study on which this paper is based was performed using a combined approach with both qualitative and quantitative data collection methods [

43,

44,

45] We built our research upon two surveys and two cases studies that were conducted as a part of a larger Norwegian research project, “Practical Uncertainty Management in a Project Owner Perspective” (PUS) (2005–2013). The purpose for the survey was to map how the different participating companies understood the different terms related to uncertainty management, one at the beginning and one at the end of the PUS project. The first survey was conducted in 2006, among six different public and private companies, and was repeated in 2011. Electronic and paper-based questionnaires were distributed to a representative selection of 2701 persons, and the overall response rate was 802 persons who answered the two questionnaires (29.7%). The questionnaires were not entirely identical, and therefore, the results from the first survey had to be manually processed to enable comparison with the results of the second survey. The sample was unique for each survey, and the respondents were identified by representatives from the collaborating companies.

The first of the two case studies, in the energy sector, started with an introductory interview in each company to provide an initial insight into their way of handling uncertainty. Data were then collected from the risk registers of seven projects in a private company in the energy sector over a period of six months in the period 2008–2009 [

46]. The distribution and classification were finally tested and verified in a third round of interviews with project managers and risk managers from the chosen projects. For quality assurance, the initial results from the study were shared with persons with insight into the projects during the follow-up interviews. For the first part of the study in the energy sector, all identified uncertainties were categorized according to their possible impact on the project and the organization’s objective levels: operational, short-term strategic or long-term strategic. A criteria set had been established, making it possible to categorize risks based on information in the risk register. These criteria were developed on the basis of a study of the literature dealing with project objectives with long-term and short-term perspectives. There was also a further categorization into opportunities and threats, also called positive and negative risks [

46].

The second case study was conducted using mixed methods. One of the authors followed the public companies’ development, testing and implementation of a new uncertainty management system over a four-year period, using an action research approach. At the end of the implementation phase, an inquiry was held to see how five out of ten pilot projects that tested the new system had performed in their handling of threats and opportunities. The five projects were chosen because they all had been pilot projects testing the new uncertainty management process, and they had all finished at the time when the inquiry was held. The final inquiry was done in two rounds, and the first round was done with a quantitative approach, counting and classifying the threats and opportunities for the five projects. The data for the public sector projects were collected in spring 2013. In the first round of the study, data were collected from the risk registers at four different points in time: when the register was established, when the budget was established, halfway through the execution and the final month of the project. Only unique opportunities and threats that had been reported to the system in the planning phase and the execution phase were considered. For all threats and opportunities, the value was calculated by multiplying the cost consequences of the event with the associated likelihood of the occurrence. This was followed up in a second round, which was done with a qualitative approach (semi-structured interviews). All five project managers were interviewed in the second round, were asked to give feedback on the new uncertainty management system and to give an estimate of the actual outcome of the threats and opportunities in their projects. We asked which threats and opportunities had materialized and what the consequences had been for the project at close-out.

4. Findings: Case Studies

The projects studied in two case studies can all be characterized as large engineering and construction projects (i.e., costs > USD 100 million). They were selected to represent a broad range of projects in project size, phase and culture. The studied projects from the energy sector were in different phases, varying from before conceptual decisions to start-up of production, and were followed and examined over a two-year period, 2008–2009; see

Table 1.

Table 1 lists data for each project phase: Phase I “concept development”, Phase II “design” and Phase III “detail design, construction and test”. For each phase, the data are specified for the three risk categories opportunities, threats and opportunities/threats, the latter being risks that, from the descriptions in the risk register, could have both a positive and a negative impact. For each project, the first row in

Table 1 shows the number of risk elements. The second line shows the percentage of the total of risks for that project, through all of the project phases. The percentage for each category was calculated as the percentage of all risks across all project phases. The totals in the far right-hand column are totals across all project phases. The totals for all seven projects are shown at the bottom of

Table 2.

Table 2 shows that only 25% (nine out of 35) of the identified opportunities were exploited. The estimated value (cost savings) of the opportunities was in the range of USD 3.5–7.5 million. Of the identified uncertainties, opportunities represented 15.5% (35 out of 226). The project managers and project owners estimated that more than 80 threats had economic consequences in the five cases that we investigated. The estimated negative cost impact for the five cases is between USD 34 million and USD 41.5 million, or roughly eight- to ten-times the value of the opportunities that were exploited. The five public projects had more or less the same pattern:

Case 1: Sixteen opportunities were identified, and two were exploited; 40 threats were identified, and 22 of them had economic consequences: increased cost, more than USD 18 million–USD 20 million.

Case 2: Three opportunities were identified, and none were exploited; +50 threats were identified, and +30 of them had economic consequences in the form of project delays and increased cost +USD 4 million.

Case 3: Six opportunities were identified, and three were exploited; reduced cost of USD 1–1.5 million; +50 threats were identified, of which 18 had economic consequences in the form of project delays and increased cost of +USD 7.5–10 million.

Case 4: Ten opportunities were identified, and four were exploited; reduced cost of USD 1.5–3 million; 33 threats were identified, of which eight had economic consequences in the form of increased cost of +USD 3–5 million.

Case 5: No opportunities were identified, and none were exploited; 28 threats were identified, of which 3–5 had economic consequences in the form of increased cost of +USD 1.5–2.5 million.

The pattern is the same as the pattern for the five cases in the public sector study. The projects focused on threats and only to a lesser degree on the opportunities. The project participants were asked about uncertainty management through the follow-up questionnaire. In total, 76% responded that focus was mainly on risks, but also on opportunities; 15% said that they focus equally on threats and opportunities; and just 7% responded that they focused only on risks. The results of the survey show that uncertainties are addressed as opportunities and risks. However, in the handling and management, it seems that risks dominate the picture, as supported by the information in the risk registers (cf.

Table 1 and

Table 2).

The data from the two studies indicated the same pattern: there were many more threats than opportunities in the uncertainty and risk registers. The opportunities identified in the execution phase were few and often not exploited at all. Both the private and public sector seemed to focus on threats rather than opportunities, and private projects were no better at exploiting opportunities than public projects. The data in

Table 1 and

Table 2 indicate that projects only to a small extent actively seek opportunities in the execution phase. This does not mean that such opportunities do not exist there; it only means that many projects miss possible opportunities because they lack this focus when it comes to managing uncertainty. From the interviews and discussions about the findings, especially the reasoning about the few opportunities found in the material, we wondered why there were so few opportunities.

5. What Is the Value of an Opportunity, and Why Is Harvesting Opportunities so Difficult?

We have argued that different stakeholders view the value and the benefit of opportunities differently depending on their role during and after the project has been delivered. This might explain some of the differences in how changes, variations, external or internal factors or different events in the contexts of projects are interpreted as either opportunities or risks.

Commonly, the return that an opportunity might provide for the owner is used as a yardstick to quantify the reward for the project. This may come in the form of directly-created economic value or in subtler forms, such as indirect benefits. We wish to distinguish between benefits and value. In this paper, we consider that benefits are primarily connected to non-financial rewards from a delivered project result, whereas value is concerned with the financial rewards. Different stakeholders will normally receive different benefits and value, and the consequences (wanted and unwanted) of a project may be considered along several dimensions. Benefits could be defined as a positive attribute that stakeholders receive during or after the project is delivered, but not necessarily related to value. For example, society receives the benefit of a new road in the form of fewer accidents, but the road also provides for improved transportation of people and goods through higher capacity. It can also create value for society in terms of tolls or road taxes, whereby the owner collects income from the users of the road.

Value can also be connected to the process of constructing the new road. For example, if a project can choose between two types of bridges both satisfying the same objective, the one with the lowest price will normally be considered as the one that will deliver the highest value seen from a project owner perspective.

In general, there are at least three different perspectives in a project: the project management perspective, the owner perspective and the society/user perspective (see

Table 3). The project management is responsible for the execution of the project as a whole and the delivery of the project results. The owner has overall responsibility for the project charter and for approval, at a high level, of the design, approach and plans [

48]. By contrast, the user has little responsibility, but is concerned with the perceived value and benefit of a project. The relationship between the project management level, the owner and the user is regulated by an internal contract (i.e., business cases or a project charter) or through an external contract comprising a contract format and a pricing format [

5,

49].

The project manager level, the owner level and the society/user level often consider and carry different threats and opportunities within the same project, and this is one reason why they have different opinions on the value, the benefit and the potential opportunities and threats during the planning and execution of a project [

14].

The project managers, which represent the project, are interested in opportunities linked to the project objective; hence, opportunities for the project are linked to cost/time/quality

Opportunities in terms of cost: The project can deliver more at the cost that was previously determined or with the predetermined quality at a lower cost.

Opportunities in terms of time: The project can deliver a predetermined product/service quicker than planned, without increasing the cost and with the predetermined quality.

Opportunities in terms of quality: The project can deliver a concept that is better than the one that was originally agreed upon, within the same frame of time and cost. Operational solutions can also be considered in this respect; for example, a project can deliver a product/service according to the predetermined frame of time and cost, and the delivery is more optimal to operate.

The project owner starts and finishes the project and will benefit financially when the project is executed, as well as after selling services or products that the project has delivered. At the same time, the company also gains experience and skills that make it better prepared to deliver new projects. Furthermore, the delivery of a project will establish/maintain the organization’s justification for existing, and it (the organization) will want to maximize the value in that project that it executes and the value it creates as the promised benefit.

The society/user will experience the effect of the project, years after the project has been completed. They will have a demand/requirement before the project starts, such as a new school, hospital or road, and the expected benefit for them will typically be better education, better healthcare or faster/safer travel, respectively. This means that project benefit is the main concern for this stakeholder. In some cases, the user and the project owner are the same entity, but still have two different perspectives.

We would support the suggestion that some of the difficulties related to identifying and exploiting opportunities in a project are related to the fact that the above-described three roles naturally differ in their focus and, therefore, differ in their opinions as to what is the value and what is the benefit of potential opportunities and threats. For example, the reliability and the performance of the project manager may be a viewed as a threat on the owner’s side, while the choice of fabrication technology, feasibility, and so forth, may be viewed as threats that need to be handled by the project manager. At the other extreme, a threat for the owner may turn out to be an opportunity for a contracted project manager. This may be the case if, for some reason, the owner has to make substantial changes to the work scope. By contrast, society will rarely assume responsibility for or carry the burden of threats directly, but will rather face consequences, such as a delay in benefits.

5.1. Decision Scenarios: Why Is Harvesting Opportunities so Difficult?

Identifying new opportunities and deciding on which opportunities are worth analyzing and/or which opportunities to exploit are not necessarily easy tasks. The “new opportunity” is not well planned or described, and stakeholders may have different views on how or what is the best solution. This means that there is some ambiguity involved, and the different stakeholders might have different opinions on the likelihood and the potential impact that the threat and/or opportunity will have on the process or the product of the project. We have developed a small framework that can be used to illustrate three different views on opportunities: project, project owner and society/user views:

Project view: What is the value to the project if the opportunity occurs? Specifically, how much time is saved; how much cost savings can the project anticipate; and how high will the level of quality achieved be at the same cost if the measure succeeds?

Project owner view: What is the value and benefit for the owner in the production phase if the opportunity occurs?

Society/user view: What is the value and benefit for the society if the opportunity occurs?

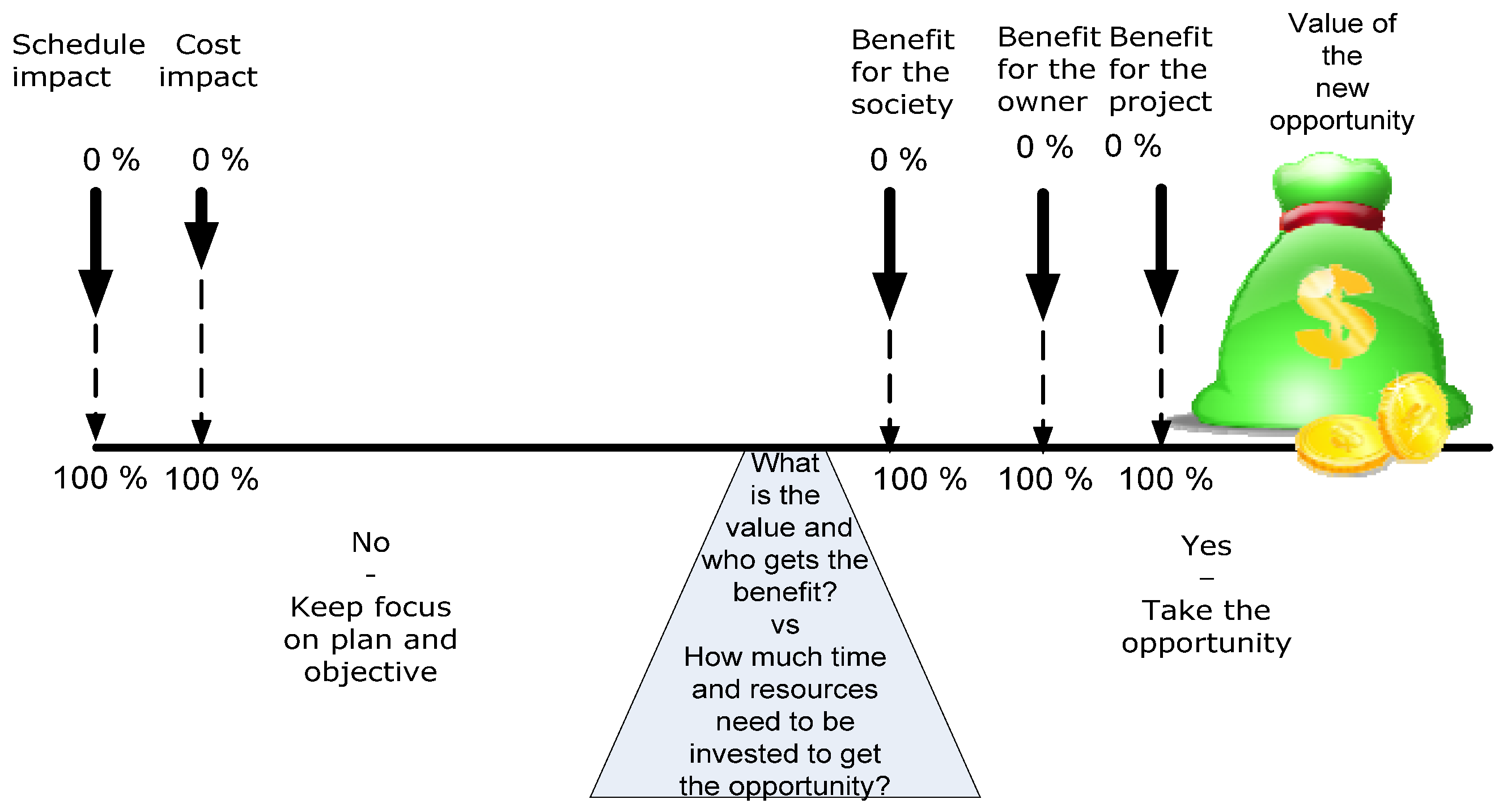

In a purely economically-rational decision, it is reasonable to assume that the value and benefit of a change will have to be balanced against the economic consequences in terms of the amount of time, cost and resources needed to exploit the opportunity (see

Figure 1). If the cost of exploitation exceeds the expected calculated return, a rational risk-taker should not take the risk, and therefore, only the favorable opportunities should and would be exploited and harvested.

The starting point for managing an opportunity is therefore a decision-making scenario in which a new idea emerges that requires, at least to some extent, the abandonment of a prior investment in time and money. Project managers will always need to ask: is this opportunity favorable for the project and the project owner, and will this change increase the value and/or the benefit for which hat project is planned and design?

5.2. Decision Scenario Examples

We have developed two scenarios as a discussion aid for describing and illustrating the decision that project managers face when an opportunity arises. We have chosen two different stages of a project: one scenario at the very beginning, close to project definition, and one scenario when an opportunity arises during execution. The point of presenting these two scenarios is that the underlying reasoning for the project manager differs. As the project proceeds, the cost of adopting new opportunities increases, not only in terms of financial cost, but also invested interest/sunk cost. Through these two scenarios, we demonstrate in the following sections why the key stakeholders have different opinions and place a different value on an opportunity, as well as how this will affect decision-making.

5.3. Scenario 1: Opportunity Presented “Up Front”

In a hypothetical construction project with an assumed value (for the owner) of USD 100 million, the project has just received its mandate and frozen the scope. During an uncertainty workshop, an idea for an alternative energy source for the central heating system is brought from one of the owner representatives. For the project manager, this requires changes to detailed planning and a slight change to cost, which will increase the uncertainty with regards to delivering on time and cost, seen from the project managers’ view. The original heating system was calculated to cost USD 2.5 million. After planning and re-calculations, the opportunity represents an increased cost of 30% to the heating system (i.e., an additional USD 750,000).

For the project manager, there are few, if any, direct benefits to be gained from adopting the change; it would also require additional negotiations with the owner about who will cover the additional cost. For the owner, the change represents a significant reduction in operating expenditures over the lifetime of the building, significantly outweighing the capital expenditure. The project manager’s interest (i.e., delivering within time/cost/quality) is obviously at odds with the interest of the owner (i.e., obtaining the best product for his or her use throughout the whole life cycle) (see

Figure 1).

From the project manager’s perspective, this scenario means:

- (1)

Possible increased cost of USD 750,000

- (2)

Increased uncertainty relating to scope (is the new solution within or outside the original cost/time scope?)

- (3)

Potential handling of the scope change

From the owner’s perspective, this scenario will give:

- (1)

Minor increase in total capital expenditure (<1%)

- (2)

Potentially significant reductions in operating costs over the project lifetime and return on investment within a few years of operation.

The society/users will most likely be neutral to this scenario.

From the project manager’s perspective, the conclusion would be not to chase this opportunity unless the owner insists. From the project manager’s perspective, this “opportunity” will increase the risk of a cost overrun, which means there is little upside to the project manager. The project manager would therefore treat this “opportunity” as a risk if the project owner does not guarantee the finances for such a change. With a frozen scope and mandate, the project manager can deliver without pursuing the opportunity and still deliver in accordance with the agreed-upon expectations. Why chase something that increases the risk in execution with regards to cost and time for only minimal benefit for the project?

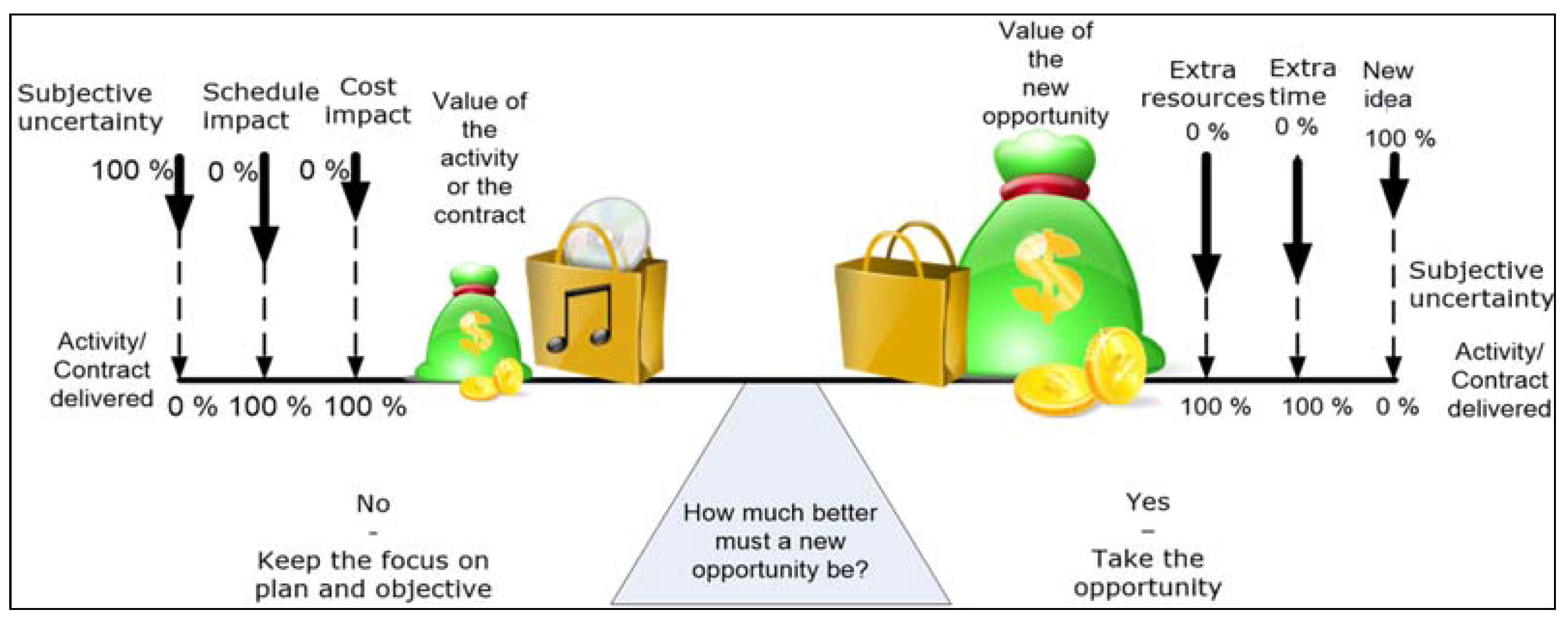

5.4. Scenario 2: Opportunity during Execution

In a hypothetical project with an assumed value for the owner of USD 10 million, the project is one month into the execution phase and has spent USD 10,000 on planning the groundwork for the building. The uncertainty of the cost estimate is 90% (i.e., there is a minimum value for the owner of USD 9 million). During an uncertainty workshop, an idea that appears to be an opportunity arises that some believe could provide an additional USD 5 million in value for the owner over the current concept. This would change the assumed value to USD 15 million if it succeeded (assuming that the estimation of both the original value and the opportunity value is correct). This gives the following decision scenario seen from the project manager’s perspective:

- (1)

Loss of one month’s planning work at a cost of USD 10,000.

- (2)

Some extra work needed to determine the value of the opportunity, and then, the project manager will need to spend some extra hours on re-planning the job, so that it can reach the same level as the one abandoned. In the worst case, there will be an estimated one month of re-planning (i.e., a complete re-plan will be required to reach the same level of detail as the original plan), at a similar cost of USD 10,000.

- (3)

If the probability of success is estimated as 50% (i.e., the classic estimation from a risk register), the new value (P50) based on probability × consequence will be USD 7.5 million (P50% × the new value of USD 15 million).

The conclusion of this scenario is that the potential opportunity represents a sunk cost of USD 10,000 for the original plan (1), an additional cost of USD 10,000 (2) and a new expected value of USD 7.5 million (3), which is USD 2.5 million lower than the original plan (see

Figure 2). This suggests that in a purely rational economy, few, if any, project managers would recommend such a change. Either the probability of success would need to be in excess of 60% before a change would be regarded as beneficial from the project manager’s perspective or the additional value would have to be 80%+ under 50% uncertainty, given that the project manager/owner accepts a cost of USD 20,000 for pursuing the opportunity. Again, this points to the fact that the evaluation of opportunities solely from a single project management perspective requires quite significant rewards and a high degree of confidence in order to be exploited.

One limitation of our discussion is that we have only considered the project logic after a project has been initiated and a mandate given. There are arguments for the case that the imbalance between opportunities and risks is opposite in the pre-project and initiation stages, when there is a good case for counting positive opportunities as certain and negative risks as unlikely in order to secure funding and management support. This, in turn, could mean that in the project, many of the opportunities have already been calculated in, and the failure of them to come to fruition would now be a negative risk rather than a potential upside. While the discussion in this paper has highlighted a project internal disconnect between opportunities and threats, neither of the latter should be interpreted as existing in a vacuum, unrelated to the politics of the larger organizations in which the projects exists.

6. Conclusions

Since the 1990s, there has been an ongoing terminology debate in the project management community about whether the handling of uncertainty in a project should be labeled risk or uncertainty management. The term risk has neutral and negative meanings, depending on which source is consulted. It has been suggested that risk can consist of two parts: threats and opportunities, and this understanding has strong similarities to how Lichtenberg [

15] and Klakegg [

17] defined uncertainty in their early work, namely as something that deals with threats and opportunities, and essentially used as a neutral concept. In common with risk, the term uncertainty has several meanings. Some point to the lack of knowledge; some point to potential outcomes and causal forces that may happen in the future; and some point to the positive or negative effects that uncertainty will have on a project objective.

It can be argued that dividing risk and uncertainty into different groups or categories has been done such that different tools, methods and strategies could be developed and used to analyze and manage risk and uncertainty in a better way. This effort has made the “toolbox” better and the analyses richer. Today’s projects and project managers should therefore be better equipped and better able to handle uncertainty and risk than ever before. However, our empirical data from complex public and private projects reveals that the majority of the cases performed quite poorly in terms of exploiting and harvesting opportunities.

Our findings indicate that the studied projects intended to focus on both opportunities and threats, but the results show that compared to the risks, very few of the opportunities were exploited. Textbooks and scholars lack a common understanding of what constitutes an opportunity management process, and negative risk management still appears to be the most common term for describing the process. This does not mean that opportunities do not exist, but our findings indicate that opportunities are fewer than threats in most projects and in most of the projects where the project managers are not interested in exploiting opportunities.

The starting point for exploiting an opportunity is a decision-making scenario in which a new idea emerges that requires abandoning an investment on which a project has spent time and money. We have shown that for many opportunities, the threshold for pursuing a potential opportunity is quite high, as pursuing the opportunity means:

- (1)

Losses in value and time from the work of that project that has already been done, since this had to be abandoned (“sunk costs”)

- (2)

A need to spend time and effort on determining the value of the opportunity

- (3)

A need to spend time and effort on re-planning the work to the same level of detail as the existing plan (without exploiting the opportunity)

- (4)

Uncertainty as to whether the new opportunity will succeed and who will share the additional value and benefit.

We suggest that harvesting opportunities and treating changes in scope are closely related. It is often not possible to exploit an opportunity without a willingness to change the original plan. This means that bringing an opportunity into the project requires willingness and authority from the project sponsor and project management, since both must disregard something that earlier was agreed upon as the best solution. This suggests that an opportunity has to be extremely interesting in order to be considered, for two reasons:

- (1)

The project must be willing to change contracts, concepts and plans to exploit a possible opportunity;

- (2)

The project must abandon something that earlier was accepted as the best solution;

Additionally, as already mentioned, the project will have to spend time and money on exploiting something that is uncertain (i.e., with a less than 50% chance for a return on investment). Moreover, it will take time before the project manager can be certain and can report to the owner that pursuing the opportunities “paid off” and delivered a positive or beneficial effect for the project or the project owner.

We claim that if the project owner wants to enhance the number of opportunities identified, the identification of such opportunities needs to be handled in a separate process. After identification, handling opportunities with the same methodology as risks (as shown by the decision scenarios) will mean that there will be very little motivation on the part of the project manager to pursue them. The owner has to be engaged in order to influence the management of the project and exploitation of opportunities, most likely in a different manner to how negative risks are handled. Hence, when addressing opportunities, it is vital to analyze and understand who will benefit from exploiting an opportunity, and if opportunities interfere with the project objectives, they are likely to be harder to exploit due to the extent of the scope change.

We consider that the management team, the owner and society might have different views and receive different benefits from adopting a change in the project, and it is therefore important to keep this in mind when opportunities are discussed. Our discussion relating to the balance of the scales and decision scenarios has been intended to address or exemplify how the value of the opportunity must be relatively much greater in order to motivate efforts from the project manager to exploit the opportunity, to the extent that a different system for managing opportunities seems to be required.