Analyzing Platinum and Palladium Consumption and Demand Forecast in Japan

Abstract

:1. Introduction

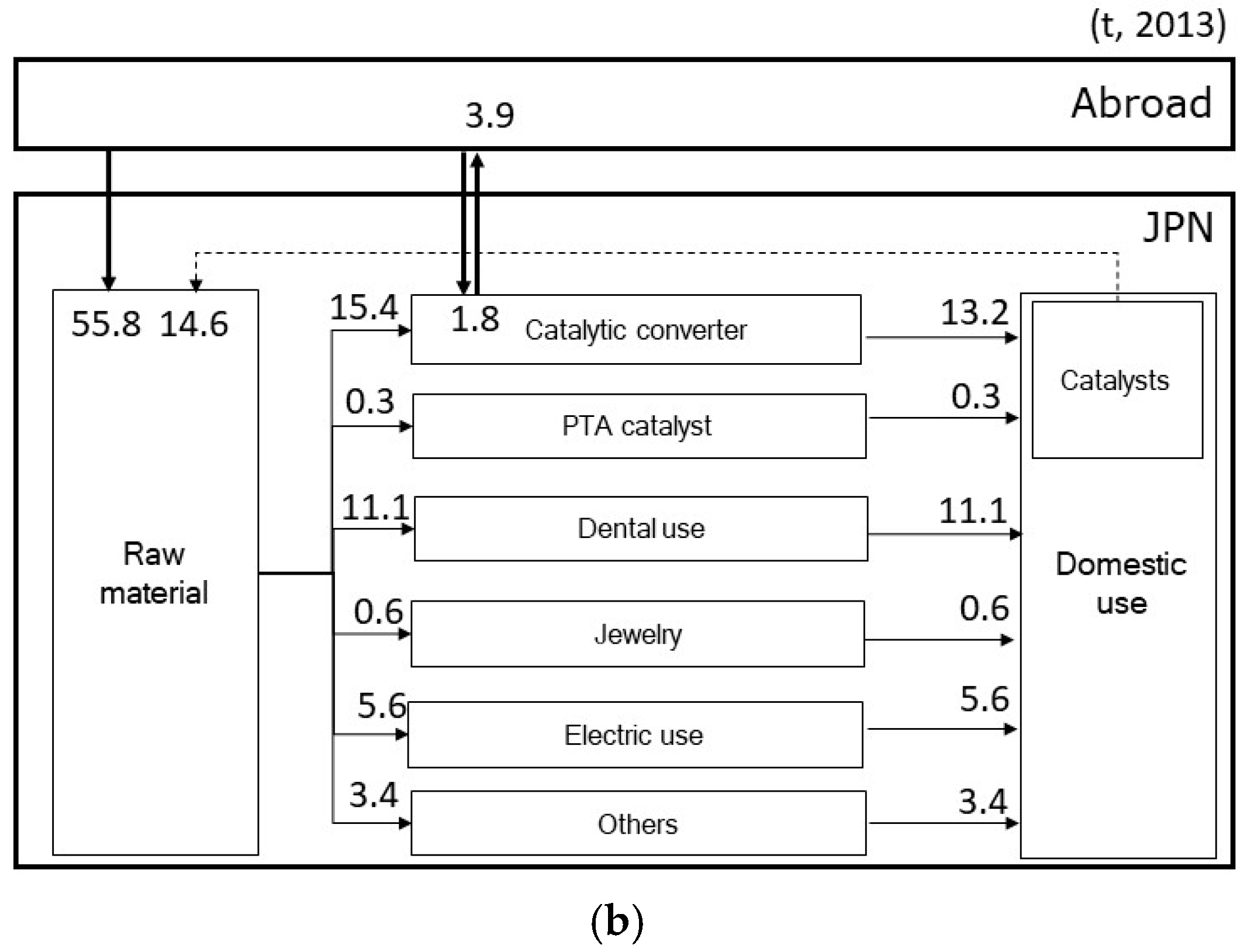

2. Substance Flow Analysis (SFA)

2.1. Import of Raw Materials

2.2. Fabrication and Manufacturing

2.2.1. Catalytic Converter

2.2.2. Silicone Release Coatings

2.2.3. Petroleum Refining Catalyst

2.2.4. Fuel Cell

2.2.5. Oxygen Sensors

2.2.6. Thermocouples

2.2.7. Dental Use

2.2.8. Pure Terephthalic Acid (PTA) Catalyst

2.3. Use

2.4. Recycling

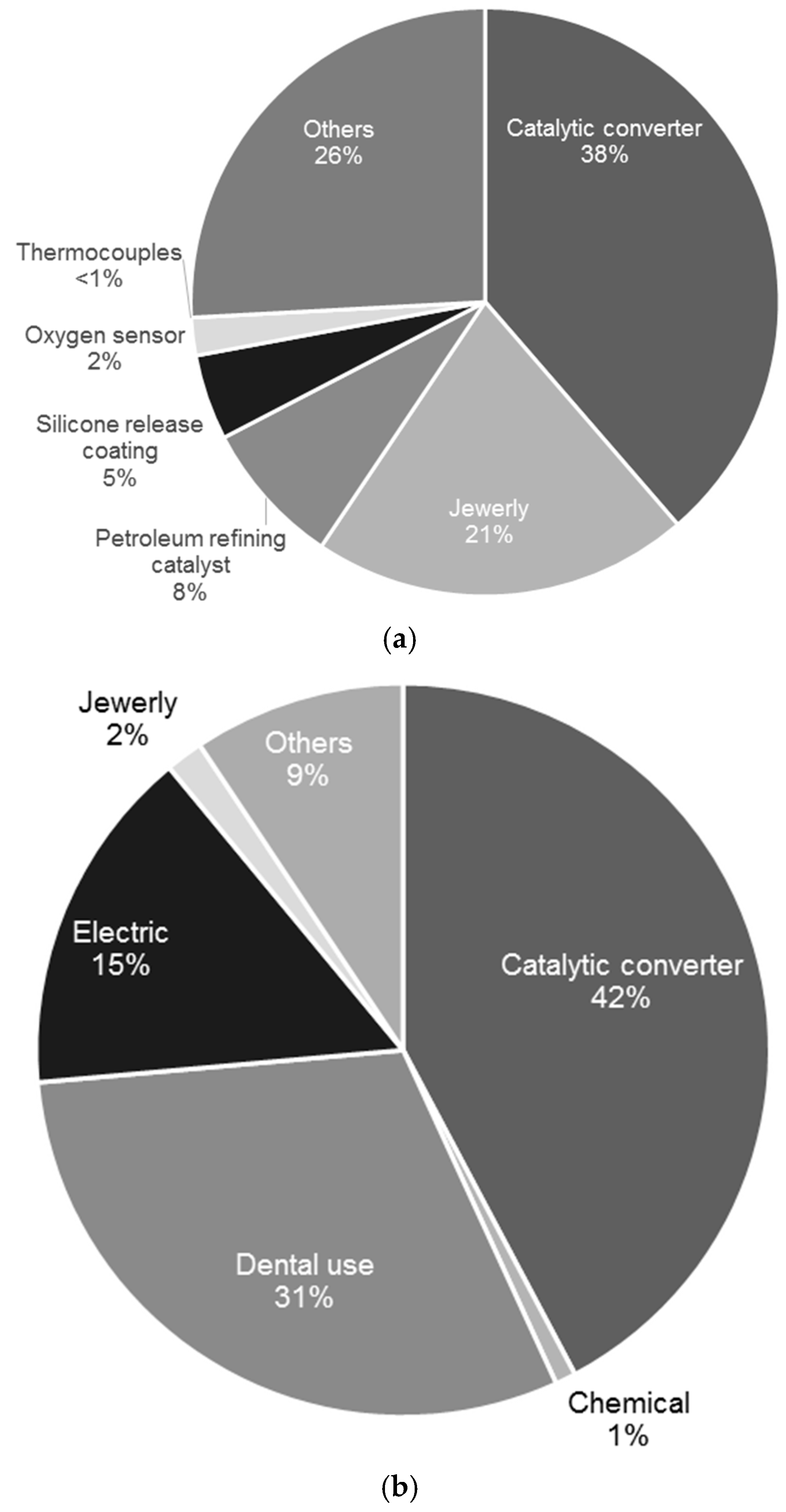

3. Domestic Consumption Trends of Platinum in Japan

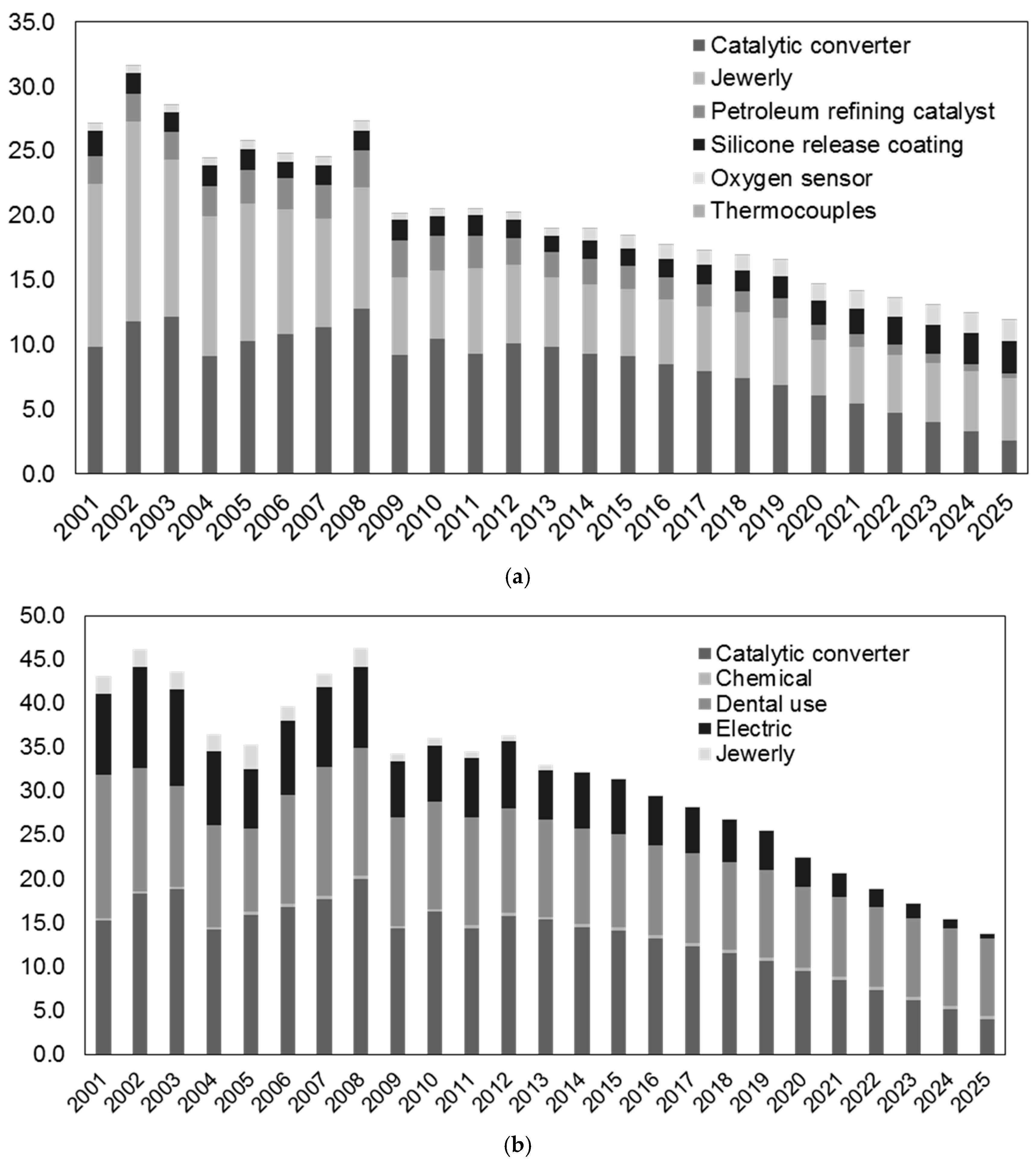

4. Historical Consumption and Demand Forecast of Platinum

5. Platinum/Palladium Use in Catalytic Converters

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Final Product Production Quantity (2013) | Catalytic Converter (t) | Silicone Release Coating (t) | Petroleum Refining Catalyst (t) | Oxygen Sensor (Unit) | Thermocouples (Unit) | PTA Catalyst (t) | Dental Use (t) |

|---|---|---|---|---|---|---|---|

| Platinum | 10,969.0 | 60.0 | 582.2 | 9,630,181.0 | 832.0 | - | - |

| Palladium | 10,969.0 | - | - | - | - | 60.0 | 55.3 |

| R2 | Significance F | ||

|---|---|---|---|

| Platinum | Catalytic converter | 0.73 | 0.7 × 10−3 |

| Jewelry | 0.93 | 0.3 × 10−3 | |

| Petroleum refining catalyst | 0.90 | 0.3 × 10−6 | |

| Silicone release coating | 0.95 | 0.2 × 10−8 | |

| Oxygen sensor | 0.95 | 1.6 × 10−3 | |

| Thermocouples | 0.96 | 0.2 × 10−8 | |

| Palladium | Catalytic converter | 0.73 | 0.7 × 10−3 |

| PTA catalyst | 0.91 | 0.2 × 10−6 | |

| Dental use | 0.84 | 0.3 × 10−2 | |

| Electric | 0.70 | 0.3 × 10−1 | |

| Jewelry | 0.74 | 0.2 × 10−1 | |

References

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 1995.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 1996.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 1997.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 1998.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 1999.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2000.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2001.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2002.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2003.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2004.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2005.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2006.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2007.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2008.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2009.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2010.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2011.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2012.

- METI (Ministry of Economy, Trade and Industry). Precious Metal Distribution Statistics Survey; METI: Tokyo, Japan, 2013.

- Emsley, J. Nature’s Building Blocks: An A–Z Guide to the Elements; Oxford University Press: New York, NY, USA, 2011. [Google Scholar]

- JOGMEC (Japan Oil, Gas and Metals National Corporation). Mineral Resource Material Flow; JOGMEC: Tokyo, Japan, 2014; pp. 51–67.

- USGS (U.S. Geology Survey). Mineral Commodity Summaries, 2014. Available online: https://minerals.usgs.gov/minerals/pubs/mcs/2014/mcs2014.pdf (accessed on 8 November 2016).

- Yager, T.R.; Soto-Viruet, Y.; Barry, J.J. Recent Strikes in South Africa’s Platinum-Group Metal Mines—Effects upon World Platinum-Group Metal Supplies; USGS Open-File Report; USGS: Reston, VA, USA, 2012.

- Johnson, M. PGM Market Report; Johnson Matthey: Hertfordshire, UK, 2001–2016. [Google Scholar]

- Daigo, I.; Fujimaki, D.; Matsuno, Y.; Adachi, Y. Development of a dynamic model for assessing environmental impact associated with cyclic use of steel. Tetsu Hagane 2005, 91, 171–178. [Google Scholar] [CrossRef]

- Du, X.; Graedel, T.E. Global in-use stocks of the rare earth elements: A first estimate. Environ. Sci. Technol. 2011, 45, 4096–4101. [Google Scholar] [CrossRef] [PubMed]

- Seo, Y.; Morimoto, S. Domestic yttrium consumption trends in Japan. J. Ind. Ecol. 2016, 20, 1064–1071. [Google Scholar] [CrossRef]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2002. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2003. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2004. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2005. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2006. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2007. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2008. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2009. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2010. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2011. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2012. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2013. [Google Scholar]

- Arum Publications. Industrial Rare Metals; Arum Publications: Tokyo, Japan, 2014. [Google Scholar]

- METI (Ministry of Economy, Trade and Industry). Industrial Statistics, 2001–2013. Available online: http://www.meti.go.jp/statistics/tyo/kougyo/index.html?utm_source=twitterfeed&utm_medium=twitter (accessed on 8 May 2017).

- Japan Custom. Trade Statistics of Japan. Available online: http://www.customs.go.jp/toukei/info/tsdl.htm (accessed on 12 December 2016).

- GTI (Global Trade Information Services). Global Trade Atlas; Global Trade Atlas®: Englewood, CO, USA, 2014. [Google Scholar]

- NIMS (National Institute of Materials Science). Worldwide Supply and Demand of Platinum Group Metals and Trends in the Recycling of Autocatalyst in Japan; NIMS-EMC MDE Report; NIMS: Tokyo, Japan, 2004.

- Larry, N.; Lewis, J.S.; Yan, G.; Robert, E. Colborn and Gudrun Hutchins. Platinum Catalysts Used in the Silicones Industry. Platin. Met. Rev. 1997, 41, 66–75. [Google Scholar]

- Morikawa, F. Industrial utilization of precious metal catalyst. J. Synth. Org. Chem. 1978, 35, 152–156. [Google Scholar] [CrossRef]

- Enecho (Agency for Natural Resources and Energy of Japan). Road Map Progress. 2016. Available online: http://www.meti.go.jp/committee/kenkyukai/energy/suiso_nenryodenchi/pdf/004_01_00.pdf (accessed on 5 December 2016).

- Enecho (Agency for Natural Resources and Energy of Japan). Production, Transportation and Storage of Hydrogen. Available online: http://www.meti.go.jp/committee/kenkyukai/energy/suiso_nenryodenchi/suiso_nenryodenchi_wg/pdf/005_02_00.pdf (accessed on 9 November 2016).

- MHLW (Ministry of Health, Labor, and Wealth). Pharmacovigilance Production Statistics Survey. 2001–2013. Available online: http://www.mhlw.go.jp/toukei/list/105-1c.html (accessed on 15 November 2016).

- Seo, Y.; Morimoto, S. Comparison of Dysprosium Security Strategies in Japan for 2010–2030. Resour. Policy 2014, 39, 15–20. [Google Scholar] [CrossRef]

- Maeda, M. Recycling of Precious Metals; Research Report on Comprehensive Research for Promoting Environmental Research; Ministry of Environment: Tokyo, Japan, 2012.

- Japan Catalyst Recovering Association (JCRA). Catalyst Recycling Report 2013; JCRA: Tokyo, Japan, 2013. [Google Scholar]

- IPCC (Intergovernmental Panel on Climate Change). Emissions Scenarios; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Yano Research. Jewelry & Precious Metal Market Yearbook; Market, A., Ed.; Yano Research: Tokyo, Japan, 2014. [Google Scholar]

- Japan Governmen (The Government of Japan). Tokyo Aims to Realize “Hydrogen Society” by 2020. 2016; Volume 14. Available online: http://www.japan.go.jp/tomodachi/2016/spring2016/tokyo_realize_hydrogen_by_2020.html (accessed on 10 May 2017).

- Saito, F. Japan’s Efforts toward Utilization of Hydrogen Energy and Future Prospects; Mizuho Information & Research Institute: Tokyo, Japan, 2013. [Google Scholar]

- Uehara, N.; Ishihara, A.; Matsumoto, M.; Imai, H.; Kohno, Y.; Matsuzawa, K.; Mitsushima, S.; Ota, K. Tantalum oxide-based electrocatalysts made from oxy-tantalum phthalocyanines as non-platinum cathodes for polymer electrolyte fuel cells. Electrochim. Acta 2015, 179, 146–153. [Google Scholar] [CrossRef]

- Reshetenkoa, T.; Serovb, A.; Artyushkovab, K.; Matanovicb, I.; Starihab, S.; Atanassovb, P. Tolerance of non-platinum group metals cathodes proton exchange membrane fuel cells to air contaminants. J. Power Sources 2016, 324, 556–571. [Google Scholar] [CrossRef]

- Kitada, K. Types and characteristics of precious metal plating baths. Surf. Finish. Soc. Jpn. 2004, 55, 626–629. [Google Scholar] [CrossRef]

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2001.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2002.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2003.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2004.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2005.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2006.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2007.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2008.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2009.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2010.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2011.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2012.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2013.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2014.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2015.

- Chunichisha (Japan Government Publication). Annual of Electronic Devices Components; Chunichisha: Tokyo, Japan, 2016.

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2001. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2002. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2003. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2004. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2005. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2006. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2007. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2008. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2009. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2010. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2011. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2012. [Google Scholar]

- R&D (Research and development). Annual of Dental Equipment and Materials; R&D: Tokyo, Japan, 2013. [Google Scholar]

- Yano Research. Survey Results on Dental Equipment and Materials Market; Yano Research: Tokyo, Japan, 2014. [Google Scholar]

- METI (Ministry of Economy, Trade and Industry). Market Trend of Catalyst and Measures to Preserve the Air Environment. 2014; pp. 50–59. Available online: http://www.meti.go.jp/statistics/toppage/report/bunseki/pdf/h16/h4a0503j3.pdf (accessed on 12 May 2017).

- MOE (Ministry of the Environment). Status of Automobile Environmental Policy Initiatives in Foreign Countries and Japan. Available online: https://www.env.go.jp/air/report/h21-01/ref3-1.pdf (accessed on 10 May 2017).

- Kuriki, S.; Daigo, I.; Matsuno, Y.; Adachi, Y. Recycling Potential of Platinum Group Metals in Japan. J. Jpn. Inst. Met. 2010, 74, 801–805. [Google Scholar] [CrossRef]

- MLIT (Ministry of Land, Infrastructure, Transport and Tourism). Emission Standards. Available online: http://www.mlit.go.jp/jidosha/jidosha_tk10_000002.html (accessed on 12 April 2017).

- Cooper, B.J. The Catalytic Control of Motor Vehicle Emissions. Honda Found. Rep. 2002, 102, 3–29. [Google Scholar]

- Wang, B. Recent development of non-platinum catalysts for oxygen reduction reaction. J. Power Sources 2005, 152, 1–15. [Google Scholar] [CrossRef]

- Jin-Hwan Kim, J.; Ishihara, A.; Mitsushima, S.; Kamiya, N.; Ota, K. Catalytic activity of titanium oxide for oxygen reduction reaction as a non-platinum catalyst for PEFC. Electrochim. Acta 2007, 52, 2492–2497. [Google Scholar]

- Serov, A.; Kwak, C. Review of non-platinum anode catalysts for DMFC and PEMFC application. Appl. Catal. B Environ. 2009, 90, 313–320. [Google Scholar] [CrossRef]

| Product | θ (%) | ε (%) | γ (g) | |||

|---|---|---|---|---|---|---|

| Pt | Pd | Pt | Pd | Pt | Pd | |

| Catalytic converter | 100 | 100 | 0.09 | 0.14 | - | - |

| Fuel cell (PEFC) | 100 | - | - | - | 0.69 | - |

| Silicone release coating | 100 | - | 2 | - | - | - |

| Petroleum refining catalyst | 100 | - | 0.35 | - | - | |

| Oxygen sensor | 100 | - | - | - | 0.055 | |

| Thermoelectric material | 100 | - | - | 3.17 | ||

| Dental Use | - | 100 | - | 20 | ||

| PTA catalyst | - | 100 | - | 0.55 | ||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Seo, Y.; Morimoto, S. Analyzing Platinum and Palladium Consumption and Demand Forecast in Japan. Resources 2017, 6, 61. https://doi.org/10.3390/resources6040061

Seo Y, Morimoto S. Analyzing Platinum and Palladium Consumption and Demand Forecast in Japan. Resources. 2017; 6(4):61. https://doi.org/10.3390/resources6040061

Chicago/Turabian StyleSeo, Yuna, and Shinichirou Morimoto. 2017. "Analyzing Platinum and Palladium Consumption and Demand Forecast in Japan" Resources 6, no. 4: 61. https://doi.org/10.3390/resources6040061