What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market?

Abstract

:1. Introduction

2. State of the Green Bond Market

2.1. A Simple Definition That Offers Some Degree of Flexibility

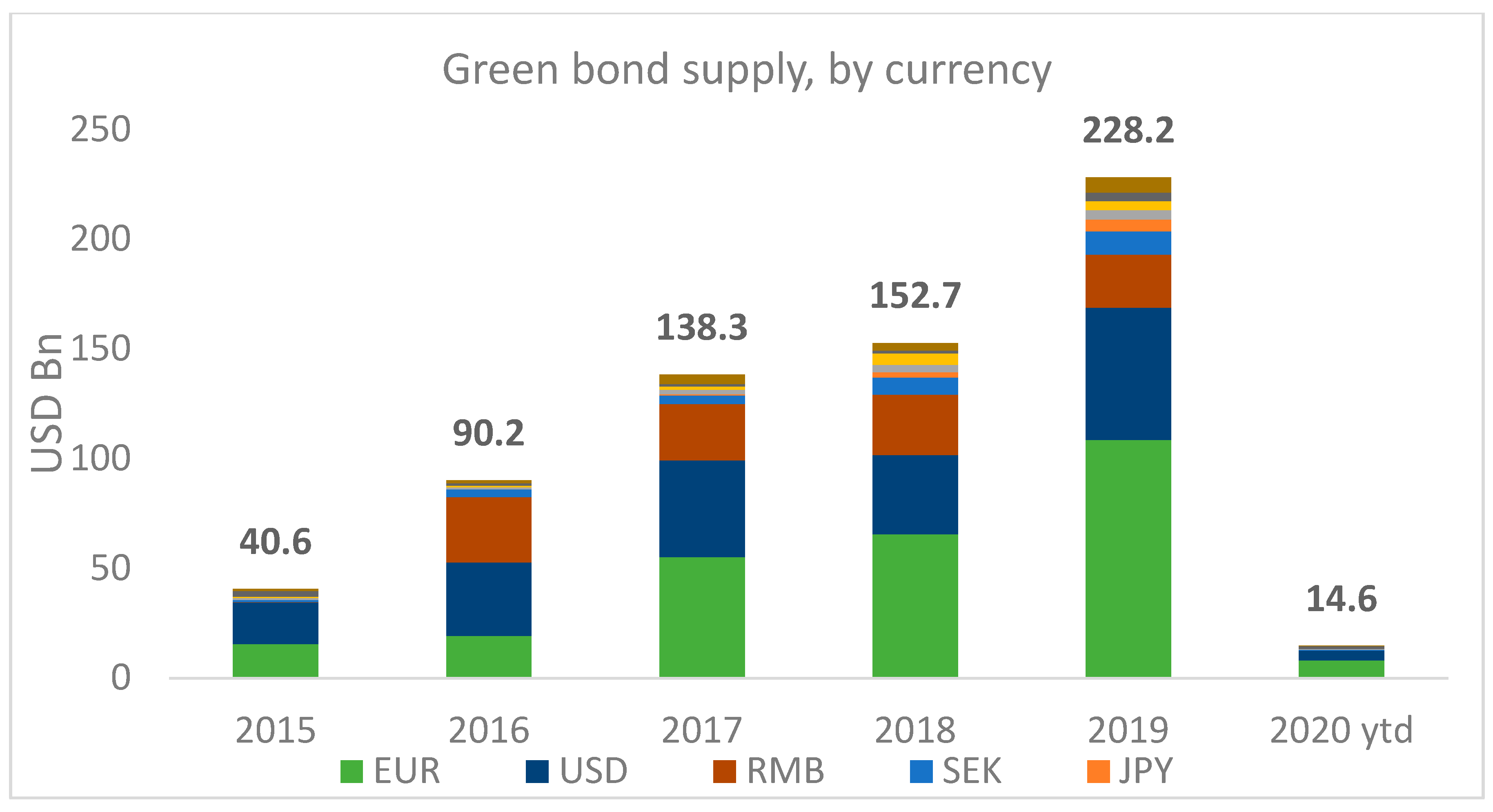

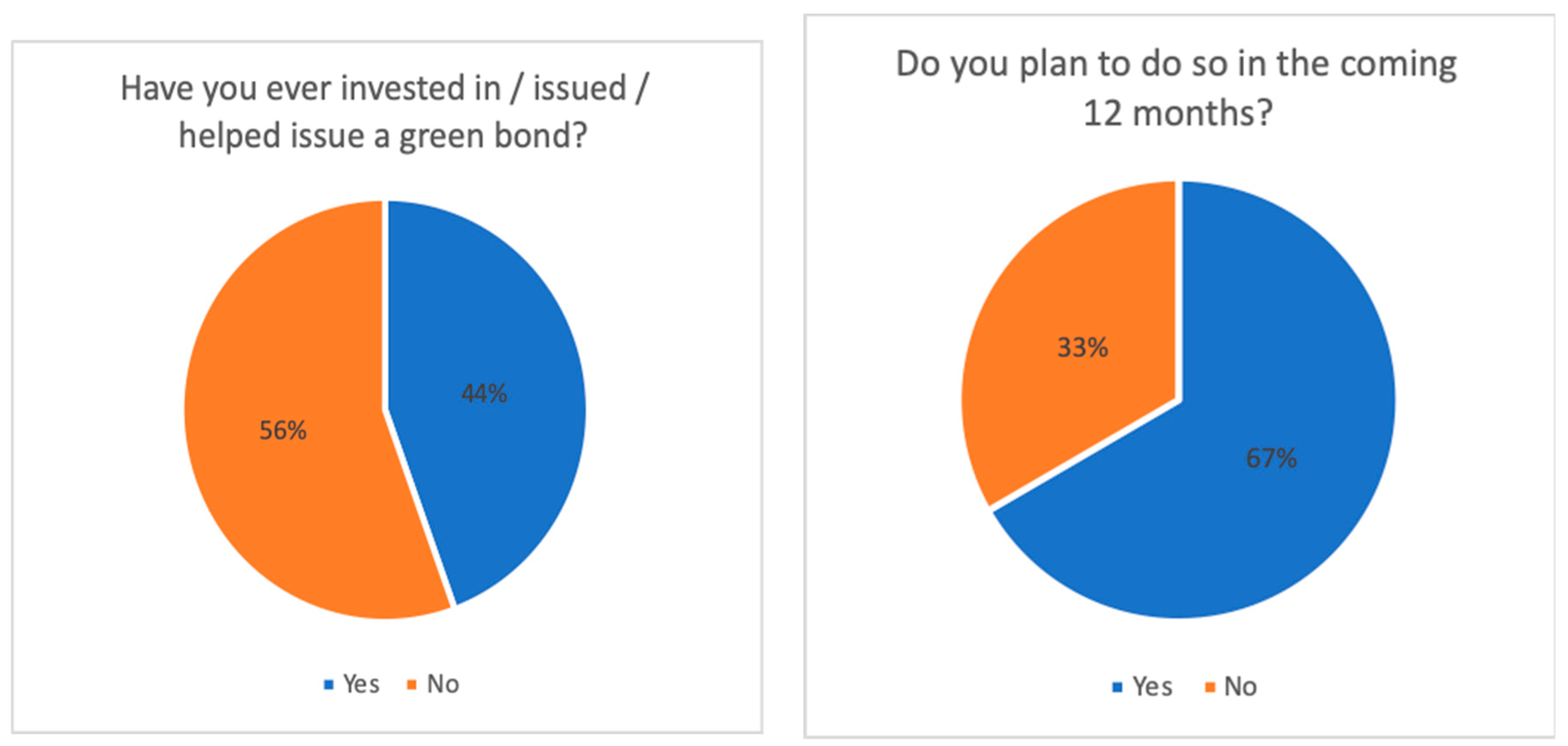

2.2. A Growing and Innovative Market

3. Several Drivers behind the Momentum

3.1. For Issuers, a Formidable Marketing Tool

3.2. Financial Institutions Encourage This Upward Trend

3.3. Pressure from Stakeholders to Join the Green Bond Market

4. The Green Bond Market Remains a Dwarf Due to a Combination of Challenges

4.1. Overall, a Marginal Market

- -

- There is a perception of uncertain benefits in a green bond issuance;

- -

- Green bond issuance is associated with higher costs and complex processes;

- -

- The lack of standardization, despite substantial improvements, remains a key obstacle for all market participants;

- -

- The green bond market is still relatively young, and it offers neither the level of credentials nor the amount of supply that investors are expecting;

- -

- Greenwashing remains a serious risk for all stakeholders.

- -

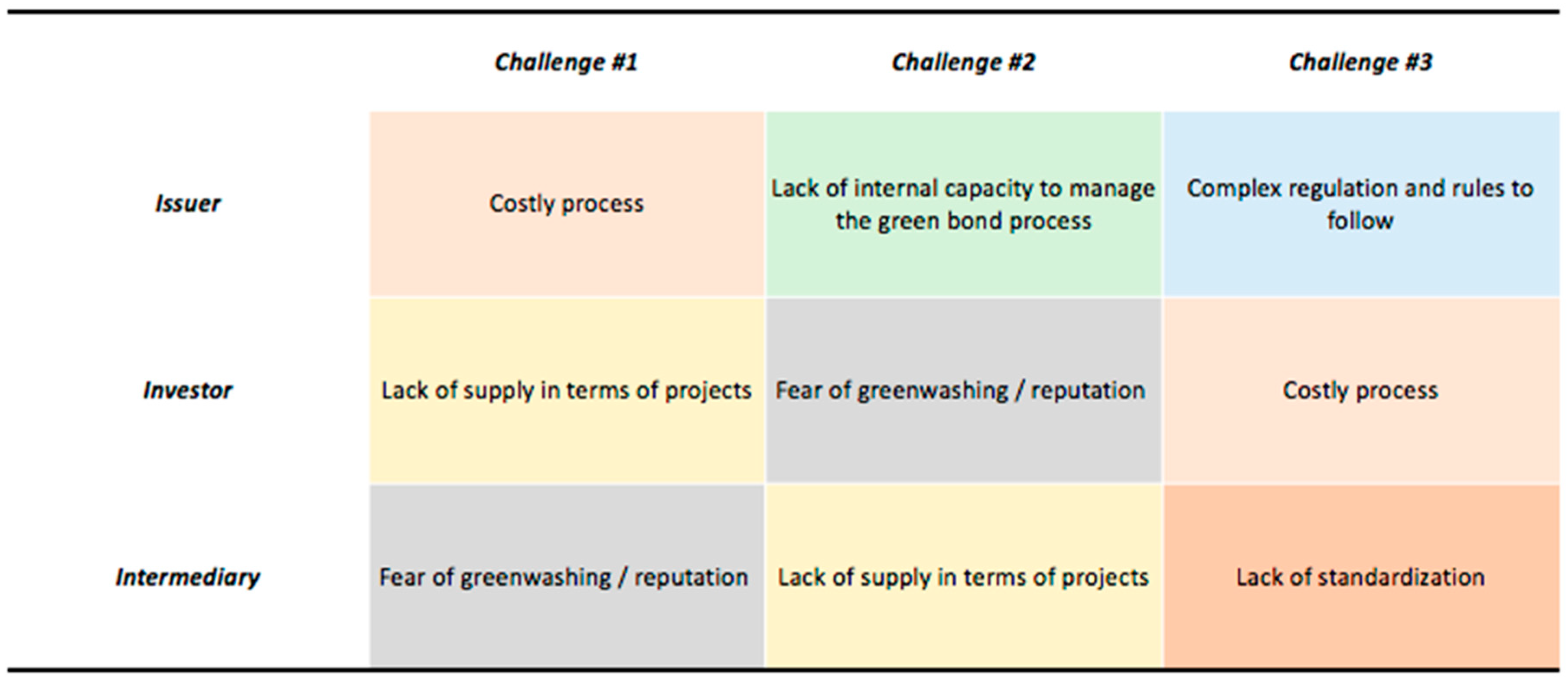

- For issuers, three main reasons help explain a certain reluctance to issue green bonds: a complex process without a clear financial incentive, a lack of identifiable projects to finance, and high risks of greenwashing.

- -

- For investors, the key issues regard the lack of standardized frameworks, the demanding level of requirements, and a problem of liquidity.

- -

- Financial institutions also have to deal with operational and management concerns when they engage with their clients on green bond issuance.

4.2. An Unclear Benefit

4.3. The Infancy of the Market and the Lack of Supply

4.4. How Costly Is the Process?

4.5. A Lack of Standardization for All Stakeholders

4.6. Risky Green Bonds?

5. Policy Recommendations for Growth

5.1. Standardize the Green Bond Market

5.2. Adopt High Standards of Disclosure and Reporting

5.2.1. Disclosure

5.2.2. Reporting

5.3. Develop Synergies with Other Sectors and Instruments

5.3.1. Transition Bonds

5.3.2. Generic Financing Instruments

5.4. Facilitate Investment in Emerging Economies

6. Conclusions

7. Definition of Terms

- -

- Factors to consider when measuring the sustainability and ethical impact of an investment.

- -

- Environmental: A responsible investing factor dealing with climate impact, energy consumption, biodiversity, waste management, and natural resource use.Example: Waste management—innovative packaging to reduce waste while cutting down material and transport costs.

- -

- Social: A responsible investing factor dealing with employee engagement and development, labor relations, human rights practice, product safety, and consumer protection.Example: Health and safety—effective health and safety programs can mitigate unexpected costs caused by workplace injuries, e.g., medical expenses, workplace disruption, productivity loss.

- -

- Governance: A responsible investing factor dealing with management structure, board accountability and independence, executive compensation, audits and internal controls, and shareholder rights.Example: Board diversity—a wide range of competencies, knowledge, and perspectives can lead to better decision-making and more effective corporate governance.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Issuer | PepsiCo |

|---|---|

| Issuance date | October 2019 |

| Nominal value | $1 billion |

| Nominal currency | USD |

| Rating (issuer, bond) | A+ (S&P), A (Moody’s) |

| Framework | Green bond |

| Tenure | 30 years |

| Coupon | 2.875% |

| Use of proceeds | Eco-friendly plastics, water use efficiency, packaging, and cleaner transportation |

| Bookrunners | Morgan Stanley, Goldman Sachs, Mizuho Financial group |

| Issuer | U.S. State of Massachusetts |

|---|---|

| Issuance date | September 2014 |

| Nominal value | $350 million |

| Nominal currency | USD |

| Rating (issuer, bond) | AA+ (Fitch), Aa1 (Moody’s), AA+ (S&P) |

| Framework | Green bond |

| Tenure | 3 to 17 years |

| Coupon | 2.45% |

| Subscription level | 3 times |

| Investor base | Residents and local retail investors |

| Use of proceeds | Water projects, offshore wind port facilities, energy-efficient buildings, and restoration and preservation projects |

| Bookrunners | Morgan Stanley |

| Issuer5 | MARFRIG |

|---|---|

| Issuance date | July 2019 |

| Nominal value | $500 million |

| Nominal currency | USD |

| Rating (issuer, bond) | BB-(S&P and Fitch) |

| Framework | Transition bond |

| Tenure | 6 August 2029 |

| Coupon | Fixed 6.625% |

| Optionality | Callable at 103.31 the 06 August 2029 |

| Rank | Senior Unsecured |

| Issuance price | Initial price talk in the high 6% range up to 7%, and then priced the 10-year notes to yield 6.625% |

| Subscription level | 3 times |

| Investor base | Europe, the United States, and Asia |

| External review | VigeoEiris6 |

| Use of proceeds | Exclusive allocation to the purchase of cattle7:

|

| Bookrunners | BNP Paribas, ING, and Santander |

| Issuer89 | Repsol International Finance |

|---|---|

| Issuance date | 23 May 2018 |

| Nominal value | €500 million |

| Nominal currency | EUR |

| Rating (issuer, bond) | Baa (Moody’s), BBB (S&P) |

| Framework | Green bond |

| Tenure | 4 years |

| Coupon | 0.50% |

| Rank | Senior Unsecured |

| Issuance price | 99.568% of the Aggregate Nominal Amount |

| Spread emission | +35 bps vs. m/s |

| External review | VigeoEiris |

| Use of proceeds | Energy efficiency upgrades in Repsol’s oil and chemical refineries |

| Bookrunners | Multiple (Morgan Stanley, Santander, HSBC) |

References

- Aghion, Philippe, Mathias Dewatripont, and Patrick Rey. 1994. Renegotiation Design with Unverifiable Information. Econometrica 62: 257. [Google Scholar] [CrossRef]

- Agliardi, Elettra, and Rossella Agliardi. 2019. EDE Financing environmentally-sustainable projects with green bonds. Environment and Development Economics 24: 608–23. [Google Scholar] [CrossRef] [Green Version]

- Asgari, Nikou. 2019. World’s Top Pension Fund Warns against Risk of Green-Bond ‘Fad’ | Financial Times. Available online: https://www.ft.com/content/f844f1c2-998e-11e9-8cfb-30c211dcd229 (accessed on 15 February 2020).

- Banga, Josué. 2019. The green bond market: A potential source of climate finance for developing countries. Journal of Sustainable Finance and Investment 9: 17–32. [Google Scholar] [CrossRef]

- Bowman, Louise. 2019. ESG: Green Bonds Have a Chicken and Egg Problem. Available online: https://www.euromoney.com/article/b1fxdsf5kpjxlg/esg-green-bonds-have-a-chicken-and-egg-problem (accessed on 15 February 2020).

- Byrne, John, Job Taminiau, Kyung Nam Kim, Jeongseok Seo, and Joohee Lee. 2016. A solar city strategy applied to six municipalities: Integrating market, finance, and policy factors for infrastructure-scale photovoltaic development in Amsterdam, London, Munich, New York, Seoul, and Tokyo. Wiley Interdisciplinary Reviews: Energy and Environment 5: 68–88. [Google Scholar] [CrossRef]

- Calvert. 2020. Calvert Green Bond Fund. Available online: https://www.calvert.com/media/23935.pdf (accessed on 15 February 2020).

- Carney, Mark. 2015. Breaking the Tragedy of the Horizon. Available online: https://www.bankofengland.co.uk/-/media/boe/files/speech/2015/breaking-the-tragedy-of-the-horizon-climate-change-and-financial-stability.pdf?la=en&hash=7C67E785651862457D99511147C7424FF5EA0C1A (accessed on 15 February 2020).

- CBI. 2018a. Green Bond Market Summary. Available online: https://www.climatebonds.net/files/reports/2018_green_bond_market_highlights.pdf (accessed on 15 February 2020).

- CBI. 2018b. Bonds and Climate Change. State of the Market 2018. Available online: https://www.climatebonds.net/files/reports/cbi_sotm_2018_final_01k-web.pdf (accessed on 15 February 2020).

- CBI. 2018c. Green Bond Pricing in the Primary Market H1 (Q1-Q2) 2018. Available online: https://www.climatebonds.net/files/reports/cbi_pricing_h1_2018_01l.pdf (accessed on 15 February 2020).

- CBI. 2020. 2019 Green Bond Market Summary. Available online: https://www.climatebonds.net/files/reports/2019_annual_highlights-final.pdf (accessed on 17 February 2020).

- Chatzitheodorou, Kyriakos, Antonis Skouloudis, Konstantinos Evangelinos, and Ioannis Nikolaou. 2019. Exploring socially responsible investment perspectives: A literature mapping and an investor classification. Sustainable Production and Consumption 19: 117–29. [Google Scholar] [CrossRef]

- Choi, Audrey. 2018. A New Threshold for Sustainable Finance. Available online: https://www.morganstanley.com/ideas/sustainability-morgan-stanley-audrey-choi (accessed on 15 February 2020).

- Cochu, Annica, Carsten Glenting, Dominic Hogg, Ivo Georgiev, Julija Skolina, F. Elsinger, Malene Jespersen, Rainer Agster, Steven Fawkes, and Tanzir Chowdury. 2016. Study on the potential of green bond finance for resource-efficient investments. European Comission, 1–174. [Google Scholar] [CrossRef]

- Croce, Raffaele Della, Christopher Kaminker, and Fiona Stewart. 2011. The Role of Pension Funds in Financing Green Growth Initiatives. Available online: http://www.oecd.org/finance/private-pensions/49016671.pdf (accessed on 16 February 2020).

- Curley, M. 2014. Finance Policy for Renewable Energy and a Sustainable Environment. Boca Raton: CRC Press/Taylor and Francis. [Google Scholar]

- De La Gorce, Noemie. 2019. Green Finance: Modest 2018 Growth Masks Strong Market Fundamentals For 2019. Available online: https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Public-research-resources/SP-Global2019-01-29Green-Finance-Modest-2018-Growth-Masks-Strong-Market-Fundamentals-For-2019-130219.pdf (accessed on 15 February 2020).

- Deloitte. 2014. Big Demands and High Expectations the Deloitte Millennial Survey. Available online: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/gx-dttl-2014-millennial-survey-report.pdf (accessed on 15 February 2020).

- ENEL. 2019. Enel Signs First Credit Line Linked to United Nations Sustainable Development Goals—enel.com. Available online: https://www.enel.com/media/press/d/2019/10/enel-signs-first-credit-line-linked-to-united-nations-sustainable-development-goals (accessed on 15 February 2020).

- Fatica, Serena, and Roberto Panzica. 2019. The pricing of green bonds: Are financial institutions special? JRC Working Papers in Economics and Finance. [Google Scholar] [CrossRef]

- Flammer, Caroline. 2018. Green Bonds Benefit Companies, Investors, and the Planet. Available online: https://hbr.org/2018/11/green-bonds-benefit-companies-investors-and-the-planet (accessed on 15 February 2020).

- Flammer, Caroline. 2020. Corporate Green Bonds. Available online: https://ssrn.com/abstract=3125518 (accessed on 15 February 2020).

- Gardes, Charlotte. 2018. Classify What Is “Green” to Better Guide Investors’. BSI Economics. Available online: http://www.bsi-economics.org/images/classifiervertinvestcg.pdf (accessed on 15 February 2020).

- Gore, Gareth, and Berrospi Miluska. 2019. Rise of Controversial Transition Bonds Leads to Call for Industry Standards. Available online: https://www.reuters.com/article/idUSL5N25X3IC (accessed on 15 February 2020).

- Hachenberg, Britta, and Dirk Schiereck. 2018. Are green bonds priced differently from conventional bonds? Journal of Asset Management 19: 371–83. [Google Scholar] [CrossRef]

- Hale, Thomas. 2018. The Green Bond That Wasn’t. Available online: https://ftalphaville.ft.com/2018/01/24/2198049/the-green-bond-that-wasnt/ (accessed on 15 February 2020).

- Hupart, Ruth. 2019. Cracking Open the Green Bond Market—What’s Next? Available online: https://blogs.worldbank.org/climatechange/cracking-open-green-bond-market-what-s-next (accessed on 18 February 2020).

- ICMA. 2017. The GBP Databases and Indices Working Group-Summary of Green Bond Database Providers. Available online: https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Green-Bond-Databases-Summary-Document-190617.pdf (accessed on 15 February 2020).

- IFC, and Amundi. 2018. Emerging Market Green Bonds Report 2018. Available online: https://www.ifc.org/wps/wcm/connect/9e8a7c68-5bec-40d1-8bb4-a0212fa4bfab/Amundi-IFC-Research-Paper-2018.pdf?MOD=AJPERES (accessed on 15 February 2020).

- Jun, Ma, Christopher Kaminker, Sean Kidney, and Nicholas Pfaff. 2016. Green Bonds: Country Experiences, Barriers and Options. Available online: http://unepinquiry.org/wp-content/uploads/2016/09/6_Green_Bonds_Country_Experiences_Barriers_and_Options.pdf (accessed on 15 February 2020).

- Kaminker, Christopher, Christine Majowski, and Rory Sullivan. 2018. Green Bonds-Ecosystem, Issuance Process and Case Studies. Available online: https://webapp.sebgroup.com/mb/mblib.nsf/a-w/3c57af239091dddfc125822400522b99/$file/giz_seb_greenbondpublication_web.pdf (accessed on 15 February 2020).

- Karpf, Andreas, and Antoine Mandel. 2017. Does It Pay to Be Green? Available online: http://emma.msrb.org (accessed on 15 February 2020). [CrossRef]

- Kumar, Rakhi, and Ali Weiner. 2019. The ESG Data Challenge Headwinds to ESG Data Quality. SSGA. Available online: https://www.ssga.com/investment-topics/environmental-social-governance/2019/03/esg-data-challenge.pdf (accessed on 15 February 2020).

- Le Houérou, Philippe. 2019. A Bigger Role for Green Bonds. Financial Times. Available online: https://www.ft.com/content/acb2c94c-86cd-11e9-a028-86cea8523dc2 (accessed on 18 February 2020).

- Li, Zhiyong, Ying Tang, Jingya Wu, Junfeng Zhang, and Qi Lv. 2019. The Interest Costs of Green Bonds: Credit Ratings, Corporate Social Responsibility, and Certification. Emerging Markets Finance and Trade. [Google Scholar] [CrossRef]

- Lo Giudice, Enrico. 2017. The Green Bond Market, Explained. World Economic Forum. Available online: https://www.weforum.org/agenda/2017/07/what-are-green-bonds-explainer/ (accessed on 15 February 2020).

- Lyons Hardcastle, J. n.d. ‘Greenwashing’ Costing Walmart $1 Million. Available online: https://www.environmentalleader.com/2017/02/greenwashing-costing-walmart-1-million/ (accessed on 16 February 2020).

- MacKerron, Conrad. 2019. How Will Pepsi Meet New Packaging Goals After Recent Failure on Past Commitments?—As You Sow. Available online: https://www.asyousow.org/blog/2019/9/26/pepsi-plastic-packaging-goals (accessed on 15 February 2020).

- Migliorelli, Marco, and Philippe Dessertine. 2019. The Rise of Green Finance in Europe: Opportunities and Challenges for Issuers, Investors and Marketplaces, 1st ed. Edited by Palgrave Studies. Cham: Palgrave Macmillan. [Google Scholar]

- Mirova. 2019. Mirova Global Green Bond Fund. Available online: https://www.im.natixis.com/us/fund-documents/mirova-global-green-bond-fact-sheet (accessed on 15 February 2020).

- Morgan Stanley Research. 2017. Behind the Green Bond Boom|Morgan Stanley. Available online: https://www.morganstanley.com/ideas/green-bond-boom (accessed on 15 February 2020).

- MSCI. 2019. Bloomberg Barclays MSCI Green Bond Index Consultation. Available online: https://www.msci.com/documents/1296102/12275477/Bloomberg+Barclays+MSCI+Green+Bond+Index+Consultation.pdf/e887b067-1513-c94d-4441-e18b39f6170d?t=1561734332189 (accessed on 15 February 2020).

- Nauman, Billy. 2019. Sharp Rise in Number of Investors Dumping Fossil Fuel Stocks. Financial Times. Available online: https://www.ft.com/content/4dec2ce0-d0fc-11e9-99a4-b5ded7a7fe3f (accessed on 15 February 2020).

- Ng, Artie W. 2018. From sustainability accounting to a green financing system: Institutional legitimacy and market heterogeneity in a global financial centre. Journal of Cleaner Production 195: 585–92. [Google Scholar] [CrossRef]

- Nguyen, Hong-Kong To, Quan-Hoang Vuong, Manh-Tung Ho, and Minh-Hoang Nguyen. 2019. The trilemma of sustainable industrial growth: Evidence from a piloting OECD’s Green city. Palgrave Commun 5. [Google Scholar] [CrossRef]

- Noor, Riasat. 2019. Global Overview and Market Analysis of Green Bond. MIT Climate. Available online: https://climate.mit.edu/posts/global-overview-and-market-analysis-green-bond (accessed on 18 February 2020).

- Petheram, Rhys. 2019. Beef Giant Issues Controversial Sustainable Transition Bond Framework: Environmental Finance. Available online: https://www.environmental-finance.com/content/news/beef-giant-issues-controversial-sustainable-transition-bond-framework.html (accessed on 15 February 2020).

- Prabhu, Aneesh, Corinne B. Bendersky, and Michael Tsahalis. 2019. Why Corporate Green Bonds Have Been Slow to Catch on in the U.S. Available online: https://www.spglobal.com/ratingsdirect (accessed on 15 February 2020).

- Preclaw, Ryan, and Anthony Bakshi. 2015. The Cost of Being Green. Available online: https://www.environmental-finance.com/content/research/the-cost-of-being-green.html (accessed on 15 February 2020).

- Packer, Frank, and Torsten Ehlers. 2017. Green bond finance and certification. BIS Quarterly Review. Available online: https://www.bis.org/publ/qtrpdf/r_qt1709h.htm (accessed on 17 February 2020).

- Reboredo, Juan C. 2018. Green bond and financial markets: Co-movement, diversification and price spillover effects. Energy Economics 74: 38–50. [Google Scholar] [CrossRef]

- Refinitiv. 2019. Green Bonds H1 Review. Available online: https://www.refinitiv.com/perspectives/market-insights/tracking-the-growth-of-green-bonds/ (accessed on 15 February 2020).

- Reichelt, Heike, and Colleen Keenan. 2017. Pension Fund Service. Available online: http://pubdocs.worldbank.org/en/554231525378003380/publicationpensionfundservicegreenbonds201712-rev.pdf (accessed on 15 February 2020).

- Reuters. 2019. UPDATE 1-Massachusetts to sell $1.1 bln new and refunding GOs|Article [AMP]|Reuters. Available online: https://mobile.reuters.com/article/amp/idUSL2N0E227O20130521 (accessed on 15 February 2020).

- Robeco. n.d. Socially Responsible Investing (SRI). Available online: https://www.robeco.com/en/key-strengths/sustainable-investing/glossary/socially-responsible-investing.html (accessed on 15 February 2020).

- SEC. 2016. 424B5—Prospectus Starbucks Bond. Available online: https://www.sec.gov/Archives/edgar/data/829224/000119312518061145/d543785d424b5.htm (accessed on 15 February 2020).

- Sewell, Alastair. 2019. Green Bond Funds: Mixed Climate for European Funds|Special Report|IPE. Available online: https://www.ipe.com/reports/special-reports/green-finance/green-bond-funds-mixed-climate-for-european-funds/10029278.article (accessed on 15 February 2020).

- Shishlov, Igor, and Romain Morel. 2016. Beyond Transparency: Unlocking the Full Potential of Green Bonds. Available online: https://www.cbd.int/financial/greenbonds/i4ce-greenbond2016.pdf (accessed on 15 February 2020).

- Sifma. 2019. SIFMA Capital Markets Fact Book, 2019. Available online: https://www.sifma.org/wp-content/uploads/2019/09/2019-Capital-Markets-Fact-Book-SIFMA.pdf (accessed on 15 February 2020).

- Smith, Molly, Archana Narayanan, Brian Smith, and Javier Blas. 2019. Aramco Sells $12 Billion of Bonds in Unprecedented Debut. Bloomberg. Available online: https://www.bloomberg.com/news/articles/2019-04-09/saudi-aramco-sells-12-billion-of-bonds-in-unprecedented-debut (accessed on 15 February 2020).

- Stanway, David. 2019. China Provides $1 Billion in ‘Green’ Finance to Coal Projects in First Half of the Year. Reuters. Available online: https://www.reuters.com/article/us-china-greenbonds-coal/china-provides-1-billion-in-green-finance-to-coal-projects-in-first-half-of-the-year-idUSKCN1V90FY (accessed on 15 February 2020).

- Takatsuki, Yo, and Julien Foll. 2019. Financing brown to green: Guidelines for Transition Bonds—AXA IM—Real Assets. Available online: https://realassets.axa-im.com/content/-/asset_publisher/x7LvZDsY05WX/content/financing-brown-to-green-guidelines-for-transition-bonds/23818 (accessed on 15 February 2020).

- Technical Expert Group on Sustainable Finance. 2020. Taxonomy: Final report of the Technical Expert Group on Sustainable Finance. Available online: https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/200309-sustainable-finance-teg-final-report-taxonomy_en.pdf (accessed on 12 March 2020).

- TEG. 2019. Report on EU Green Bond Standard. Available online: https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/190618-sustainable-finance-teg-report-green-bond-standard_en.pdf (accessed on 18 February 2020).

- Tolliver, Clarence, Alexander Ryota Keeley, and Shunsuke Managi. 2020. Drivers of green bond market growth: The importance of Nationally Determined Contributions to the Paris Agreement and implications for sustainability. Journal of Cleaner Production 244. [Google Scholar] [CrossRef]

- Tripathy, Aneil. 2017. Translating to risk: The legibility of climate change and nature in the green bond market. Economic Anthropology 4: 239–50. [Google Scholar] [CrossRef]

- The Green Finance Committee of China Society of Finance and Banking. 2015. Preparation Instructions on Green Bond Endorsed Project Catalogue (2015 Edition). Available online: http://www.greenfinance.org.cn/displaynews.php?id=468 (accessed on 18 February 2020).

- UNEP FI. 2018. Rethinking Impact to Finance the SDGs. Available online: https://www.unepfi.org/wordpress/wp-content/uploads/2018/11/Rethinking-Impact-to-Finance-the-SDGs.pdf (accessed on 17 February 2020).

- Van Eck. 2020. GRNB—VanEck Vectors Green Bond ETF|Overview|Income ETF|VanEck. Available online: https://www.vaneck.com/etf/income/grnb/overview/ (accessed on 15 February 2020).

- Vigeo Eiris. 2017. Second Party Opinion on the Sustainability of Repsol’s Green Bond. Available online: https://www.repsol.com/imagenes/global/en/Repsol_GreenBond_Second_Party_Opinion_tcm14-71044.pdf (accessed on 15 February 2020).

- Veys, Alex. 2010. The Sterling Bond Markets and Low Carbon or Green Bonds A report to E3G. Available online: https://www.e3g.org/docs/The_Sterling_Bond_Markets.pdf (accessed on 15 February 2020).

- Zerbib, Olivier David. 2018. Is There a Green Bond Premium? The Yield Differential between Green and Conventional Bonds. CEP Working Paper. Available online: https://www.cepweb.org/ (accessed on 15 February 2020).

| 1 | With 560 companies in its portfolio and 8750 gross leasable area. |

| 2 | Nafin received the first Green Bond-Mexico by Climate Bonds Initiative, Bond of the Year SSA by Environmental Finance and Latin American Green/SRI Bond Deal of the Year by Global Capital. |

| 3 | As of 28 April 2017, and 10 May 2017, respectively (JP Morgan EM Corporate bond index and Bloomberg). |

| 4 | With a correlation of only 0.53 points between their respective ESG scores. |

| 5 | Source: Bloomberg. |

| 6 | VigeoEiris, “Second Party Opinion on the Sustainability Credentials and Management of the Sustainable Transition Bond Issued by Marfrig.” |

| 7 | Marfrig, “Marfrig Sustainable Transition Bond.” |

| 8 | Bloomberg. |

| 9 | REPSOL, “Repsol Final Terms.” |

| Category | Definition |

|---|---|

| Green Use of Proceeds Bonds | Similar to traditional bonds by offering full recourse to the issuer and sharing the same credit rating as the issuer. |

| Green Use of Proceeds Revenue Bonds | Non-recourse to the issuer and repays investors based on a revenue stream such as tolls, fees, and taxes. |

| Green Project Bonds | Recourse or non-recourse to the issuer. |

| Green Securitized Bonds | Bond collateralized by one or more specific Green Project(s). The first source of repayment is generally the cash flows of the assets. |

| Categorie | Name |

|---|---|

| International standards | Green Bond Principles (by ICMA) |

| Climate Bond Standards (by Climate Bond Initiative) | |

| International indices | Barclays/MSCI Indices |

| S&P Dow Jones Green Bond Index and Green Bond Project Index | |

| Regional frameworks | ASEAN—ASEAN Green Bond Standard (GBS) |

| European Union—Action Plan for Financing Sustainable Growth | |

| SPO Frameworks and methodologies | VigeoEiris (CBI’s Verifier), Second Party Opinion Methodology for green bonds |

| Oekom, Green Bond Analysis Framework | |

| Stakeholders’ frameworks (issuers /Investors) | (Issuer) Citi Green bond Framework |

| (Issuer) Asian Development Bank Green bond framework | |

| (Investors) Axa Transition Bond Guidelines | |

| National frameworks | China—Green Bond Endorsed Project Catalogue (or the Catalogue); Green Bond Assessment and Verification Guidelines |

| France—Energy Transition Bill and National Low-Carbon Strategy | |

| Netherlands—Green Funds Scheme |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deschryver, P.; de Mariz, F. What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market? J. Risk Financial Manag. 2020, 13, 61. https://doi.org/10.3390/jrfm13030061

Deschryver P, de Mariz F. What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market? Journal of Risk and Financial Management. 2020; 13(3):61. https://doi.org/10.3390/jrfm13030061

Chicago/Turabian StyleDeschryver, Pauline, and Frederic de Mariz. 2020. "What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market?" Journal of Risk and Financial Management 13, no. 3: 61. https://doi.org/10.3390/jrfm13030061

APA StyleDeschryver, P., & de Mariz, F. (2020). What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market? Journal of Risk and Financial Management, 13(3), 61. https://doi.org/10.3390/jrfm13030061