Economic Stimulus and Financial Instability: Recent Case of the U.S. Household

Abstract

:1. Introduction

2. Literature Review

3. Background and Methodology

3.1. Theoretical Background

- is new loan minus (partial) payment of existing outstanding balance;

- is the average interest applied to the debt of agent i at time t;

- is new investment minus realization;

- is the funds transferred from agent j to agent i at time t;

- is the internal return on investment.

- (i)

- affects only j and induces a stream of returns at dates ;

- (ii)

- The total benefit (net utility) of the agent i for the investment iswhere is some utility of agent i receiving from j at time s. is the growth rate; is an actualization rate for utilities;

- (iii)

- Each agent i tries to maximize under the following constraints:

- : any shortage of money is immediately converted to a debt increase;

- There exists such that ; there is a limit to converting the invested asset into liquidities;

- : each agent i has a maximum level of debt .

3.2. Implementing Real Data

- The income in the calculation of the AII does not include return on investment, so interest, dividends, capital gains, and other internal return on investment are excluded from the SCF income;

- The weights of the four components—income, nonfinancial asset, financial asset, and liability—from two consecutive surveys are linearly distributed to each quarter within the three-year period;

- The 2019 weight of the financial asset in the SCF has been adjusted by the S&P 500® index (S&P 500® 2022) to assign weights up to 2021 Q3;

- Likewise, the 2019 weight of the nonfinancial asset in the SCF has been adjusted by the Case–Shiller Home Price Index (Case-Shiller Index 2022) to allocate weights up to 2021 Q3.

4. Result and Contribution

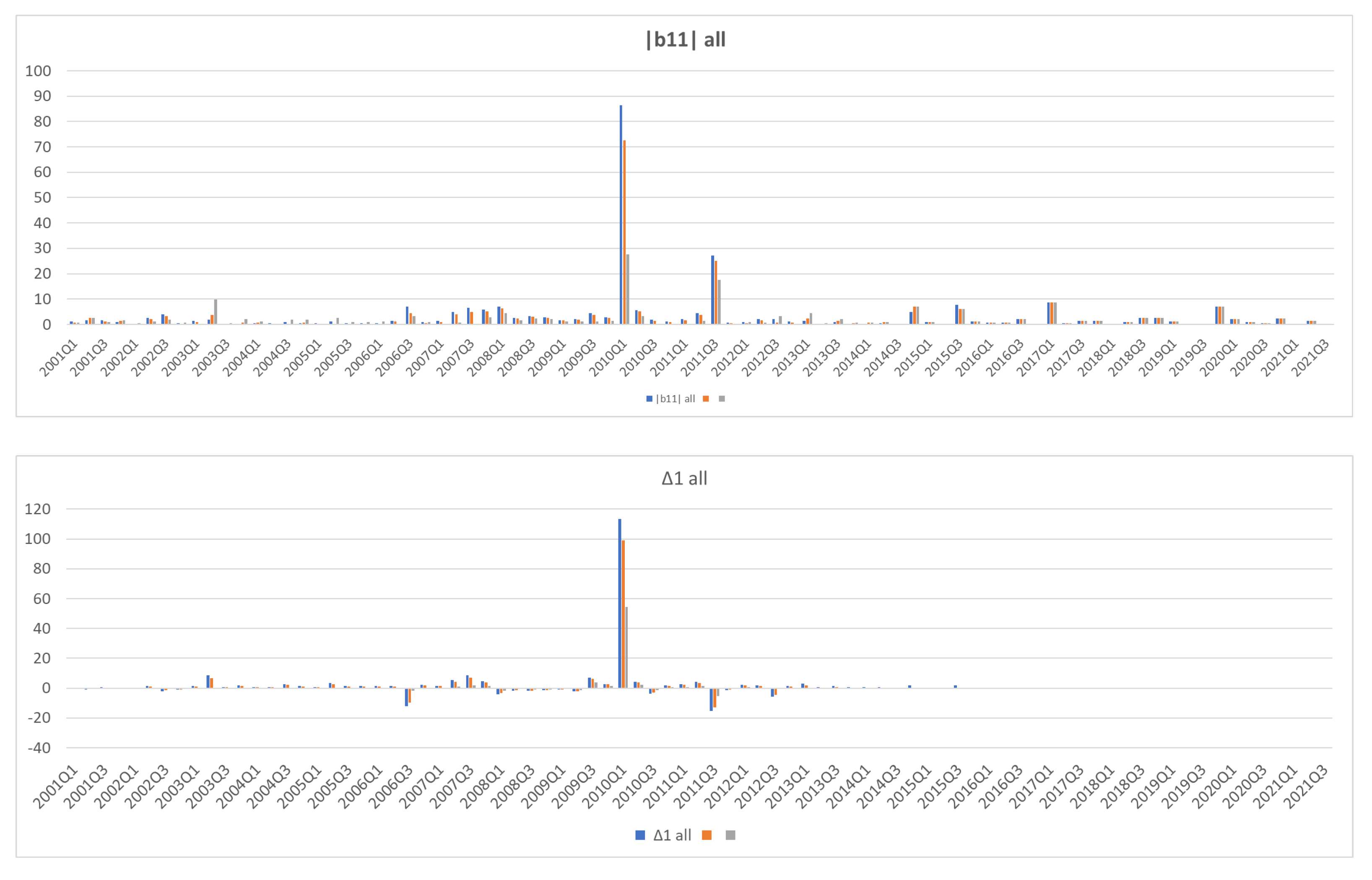

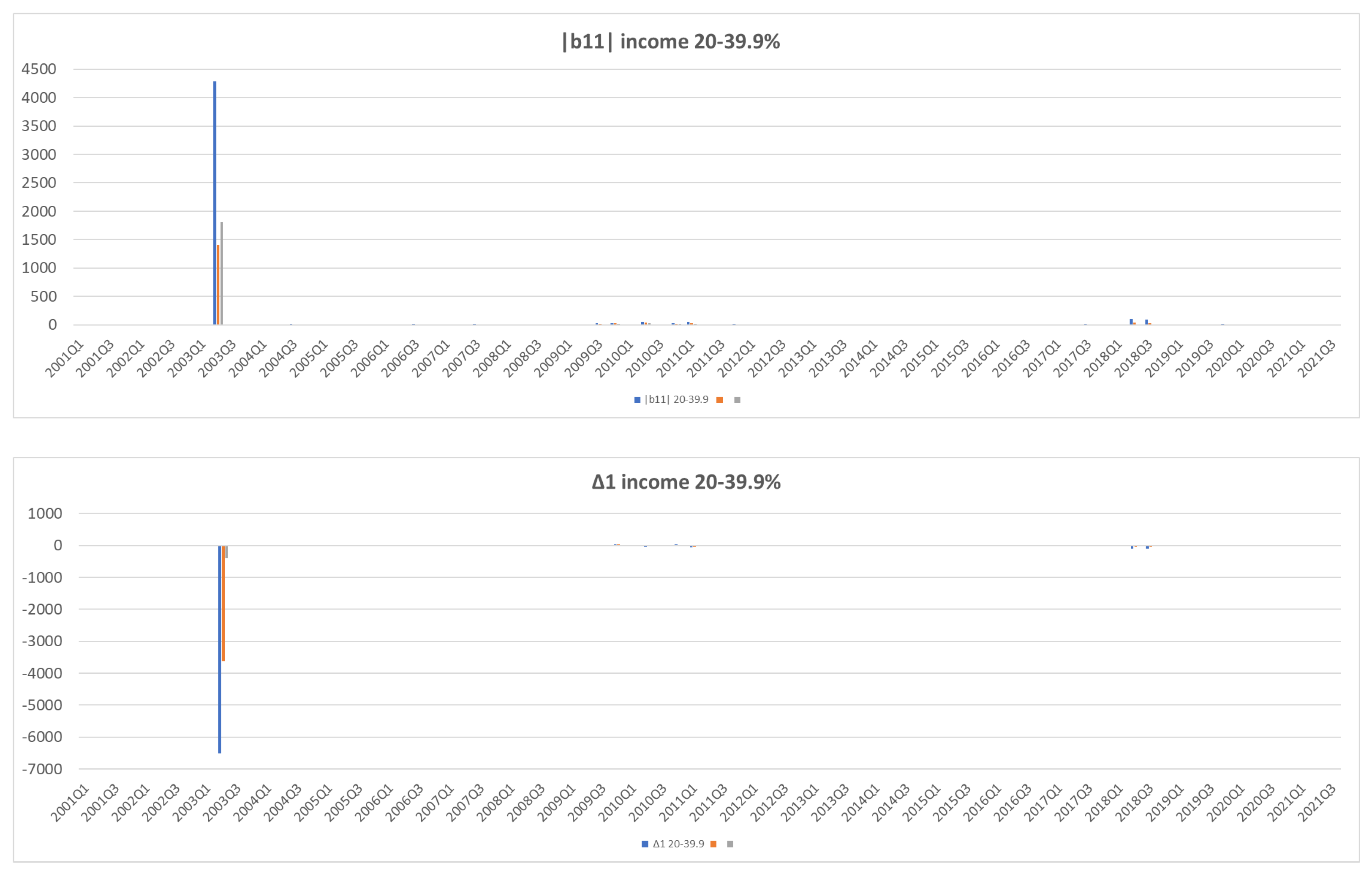

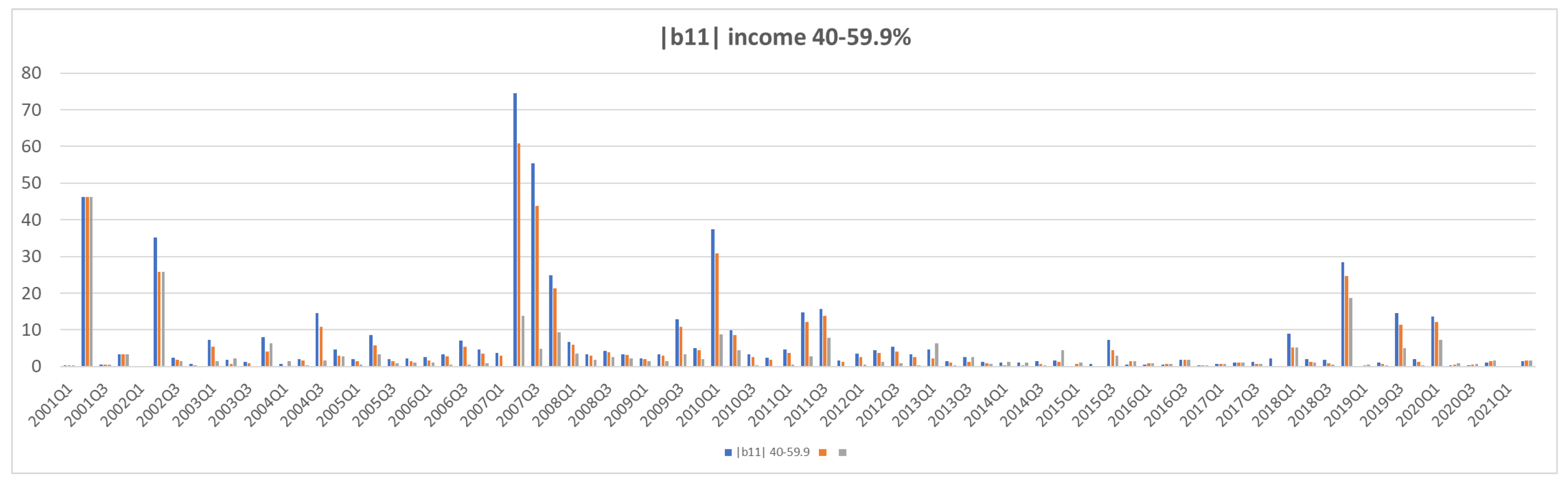

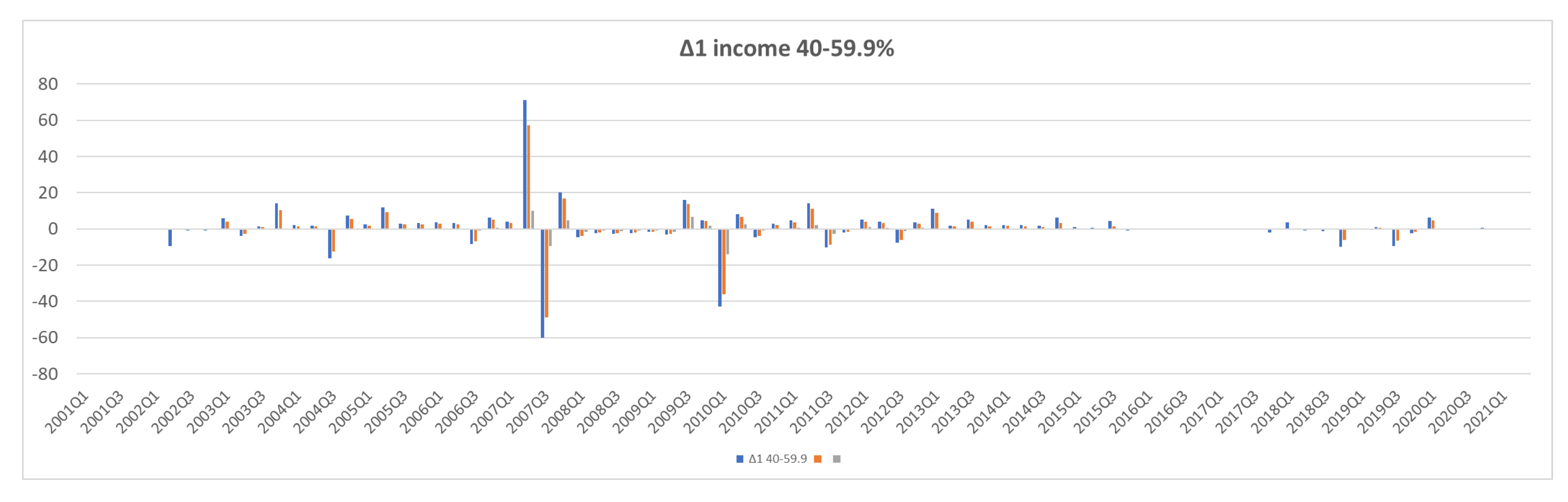

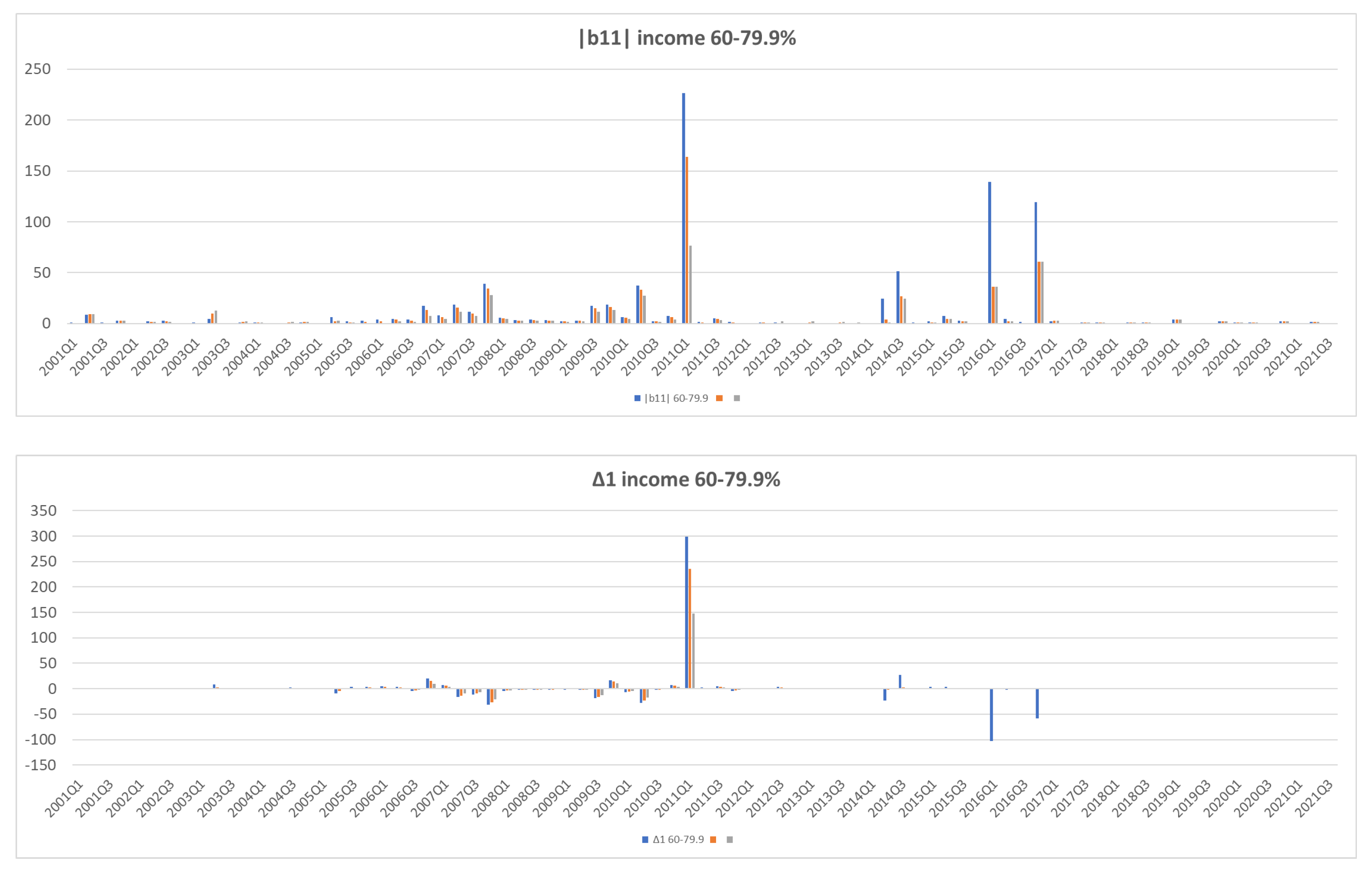

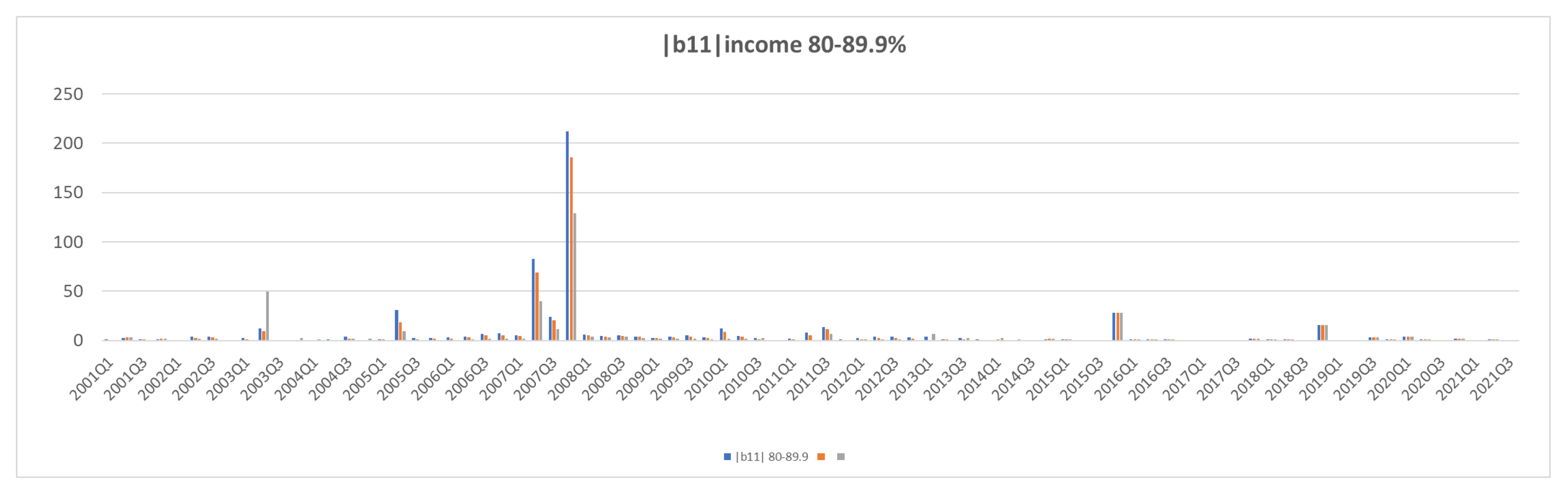

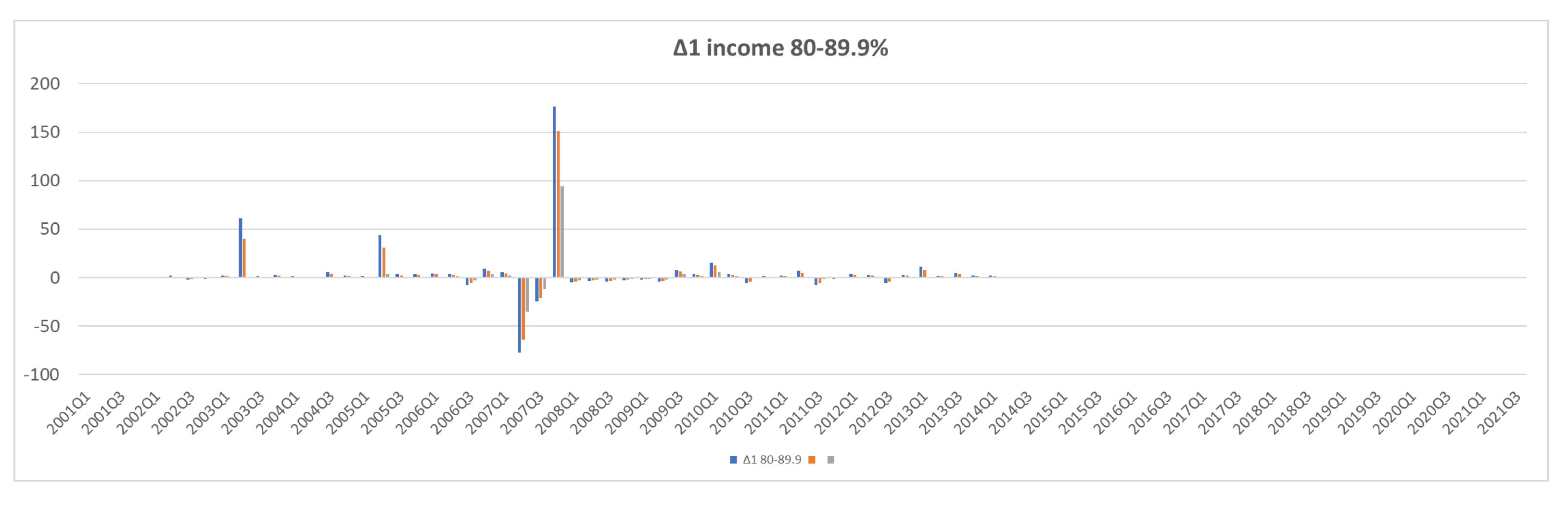

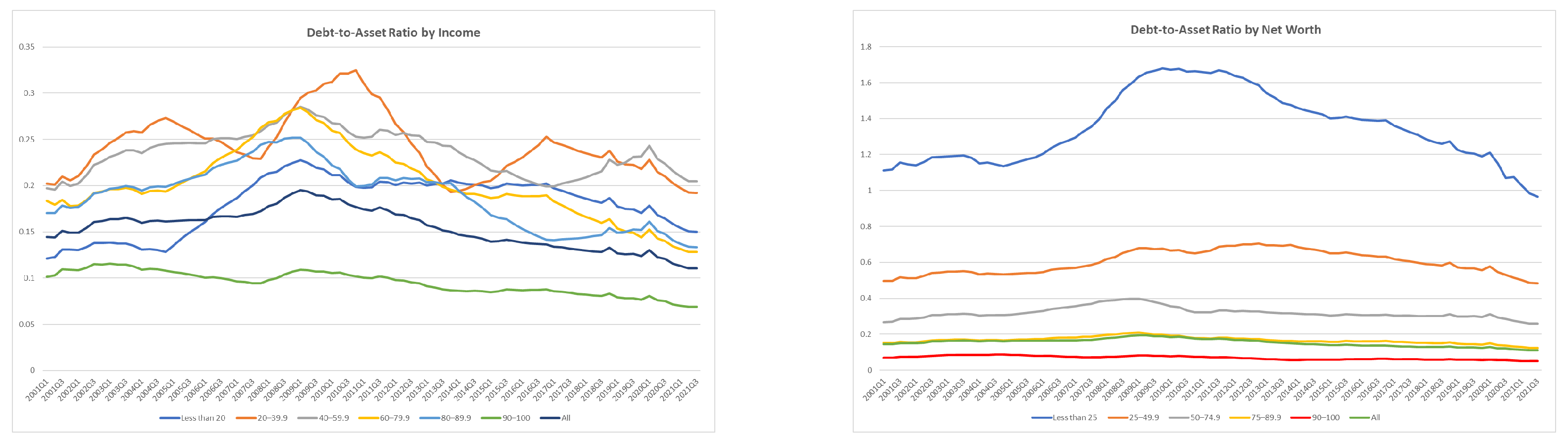

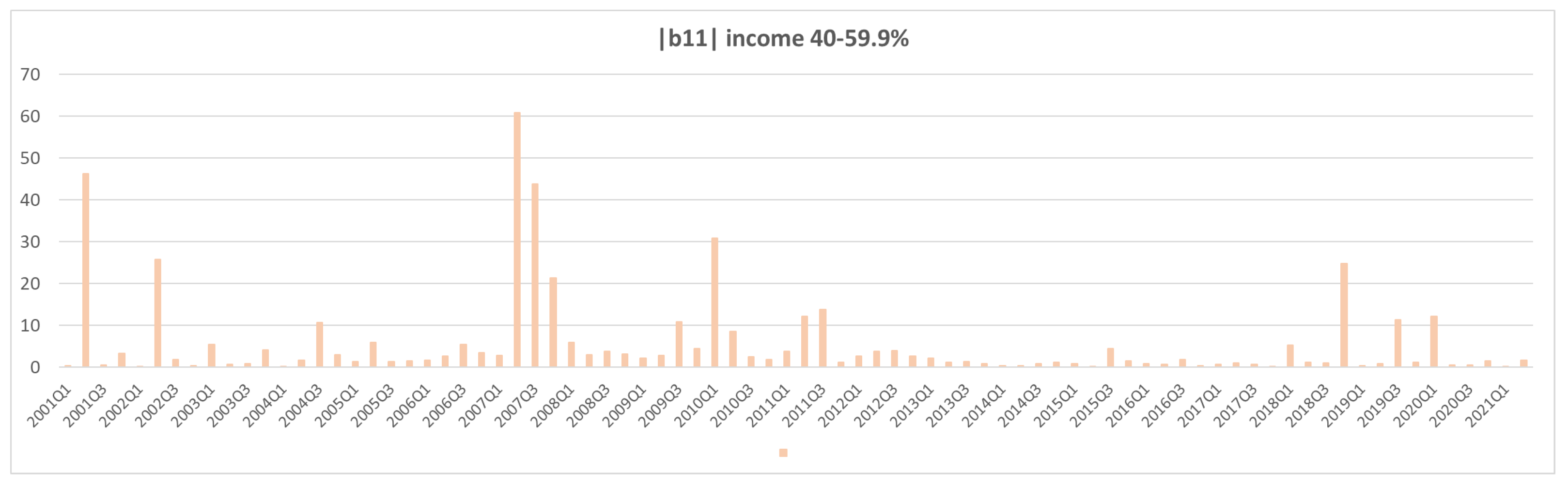

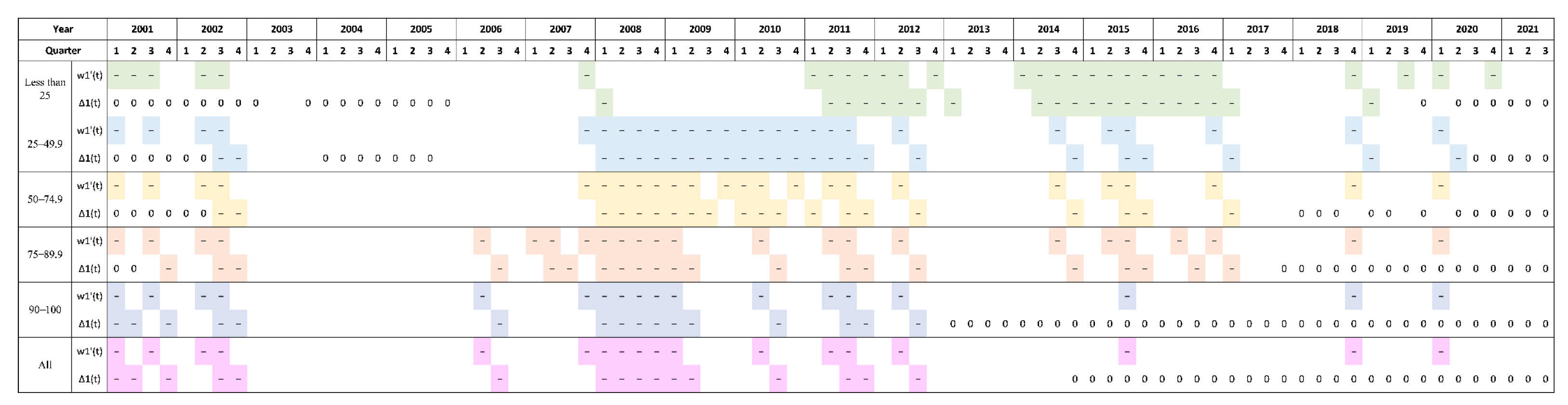

- The subgroups with income percentiles between 20% and 89.9% and the entire household experienced at least six consecutive quarters with negative and from 2007 to 2009, then three to four more quarters of negative – during the next three years. They kept receiving blocks of negative toward the end of 2019. While remained mostly at zero in 2015 for and , the two lower subgroups and still had negative sporadically;

- The top income group also had seven consecutive quarters of negative and ; it had only two quarters of negative and during 2010–2013 and two more quarters of and until the end of 2019;

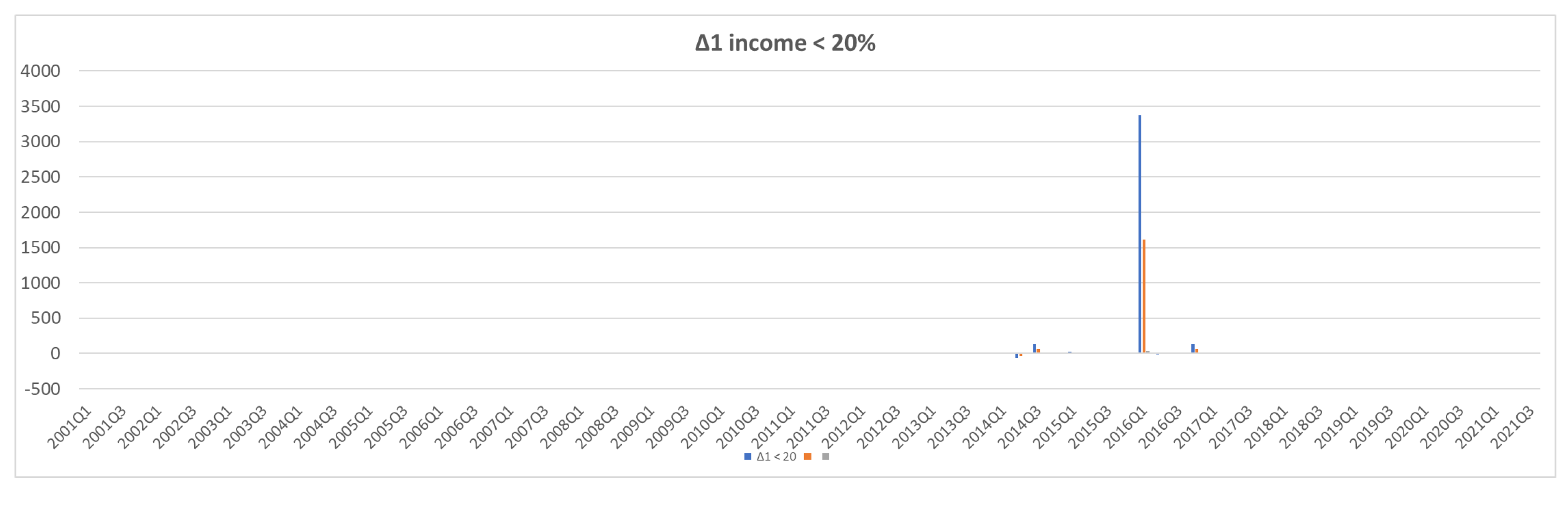

- The lowest income group passed the 2007–2009 period with positive and , yet had a longer streak of negative and much later, from 2011 to 2014, then five more quarters of negative – in 2015 and 2016. This is not surprising because does not have many assets to begin with and thus was not affected by the collapse of the real estate market followed by financial bubble bursting. It was rather affected by the recession that followed the financial crisis;

- On the other hand, all the subgroups had negative in 2020 Q1; only two subgroups, and had negative next quarter and the rest had zero until 2021 Q3. The two subgroups soon followed the others, and all the subgroups, as well as the entire household, had zero in 2021;

- It should be noted that the signs of and of closely match those of the entire household. This must be due to the strong income inequality in U.S. households and is a reason why monitoring the macroeconomic data of the household in its entirety does not provide an accurate assessment of the true economic state of the household sector.

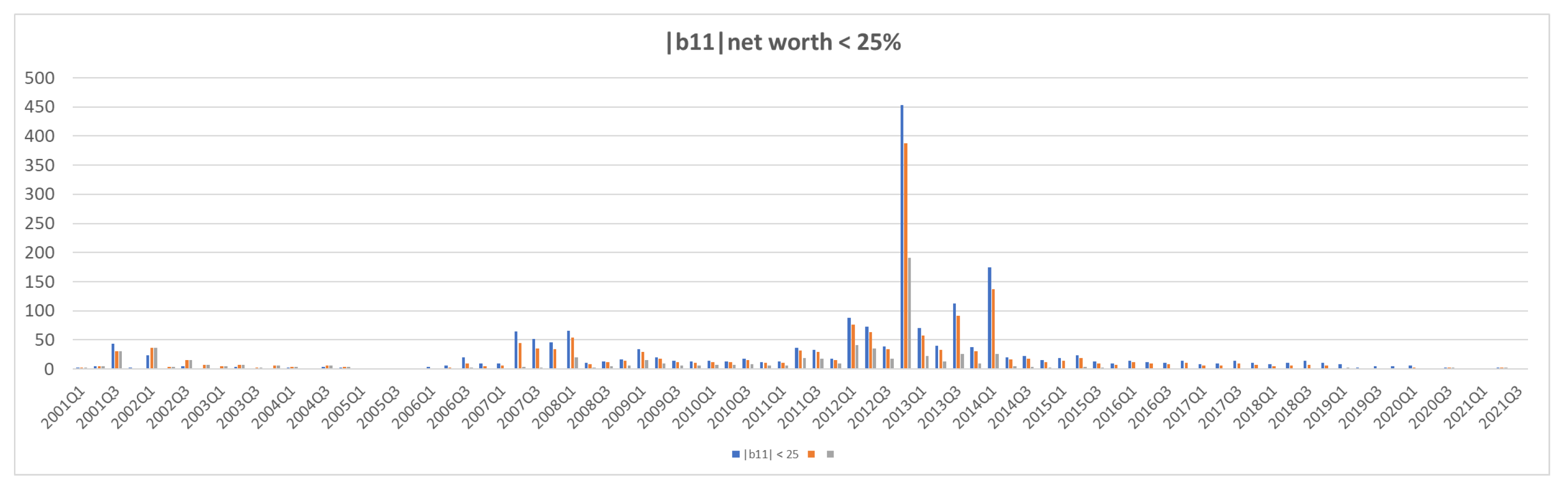

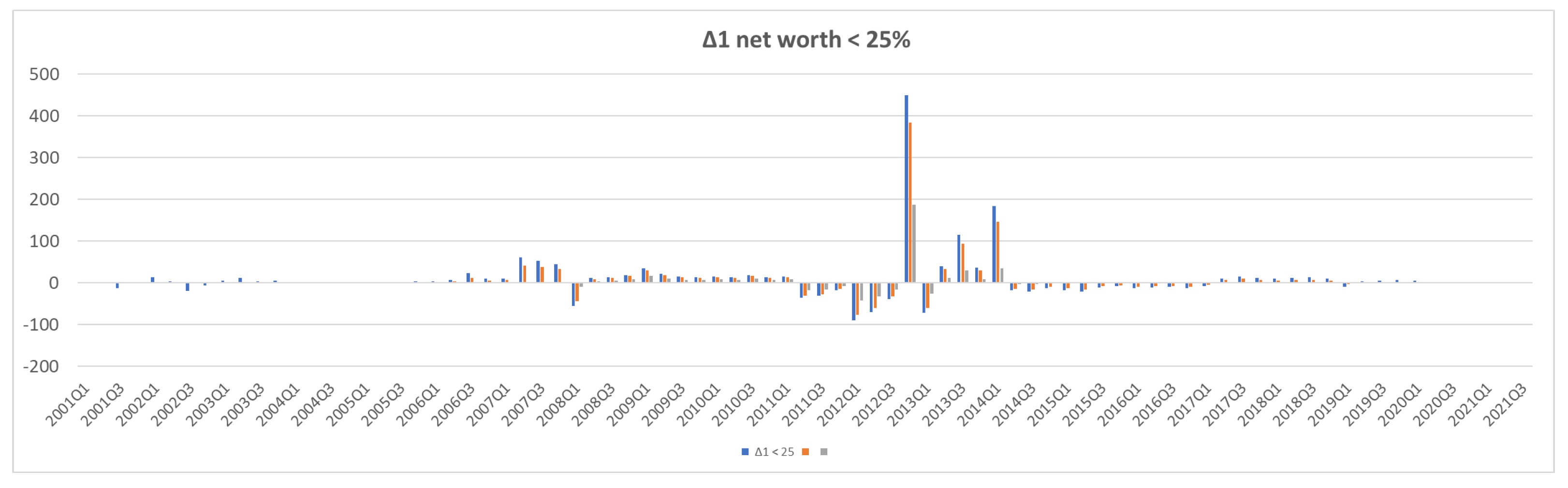

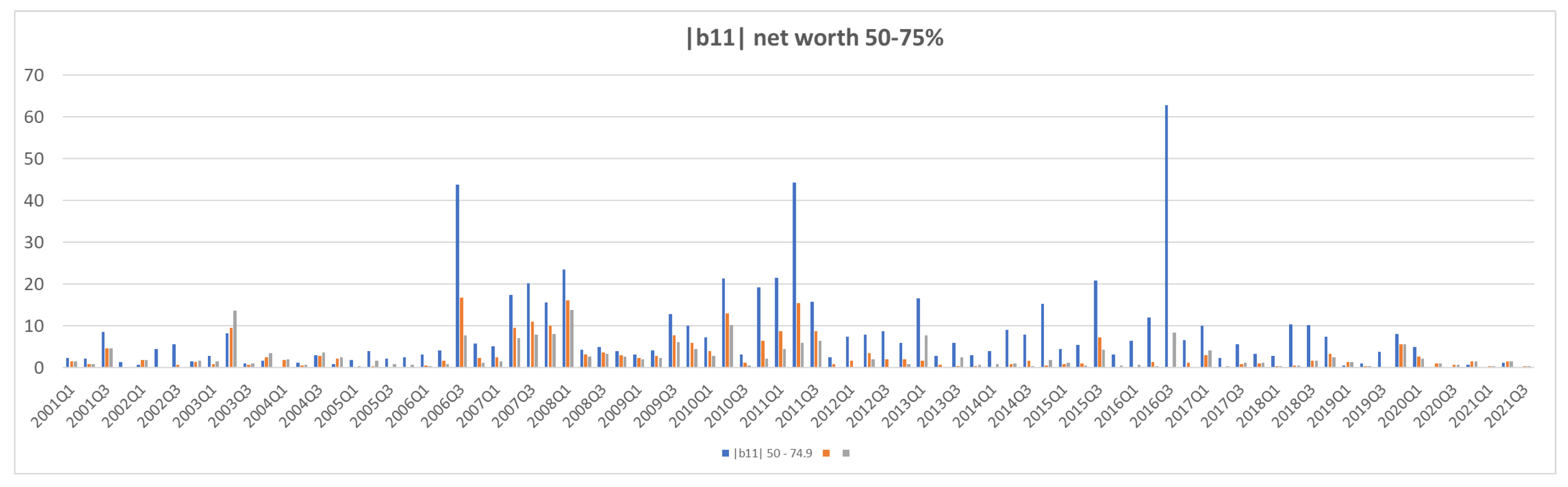

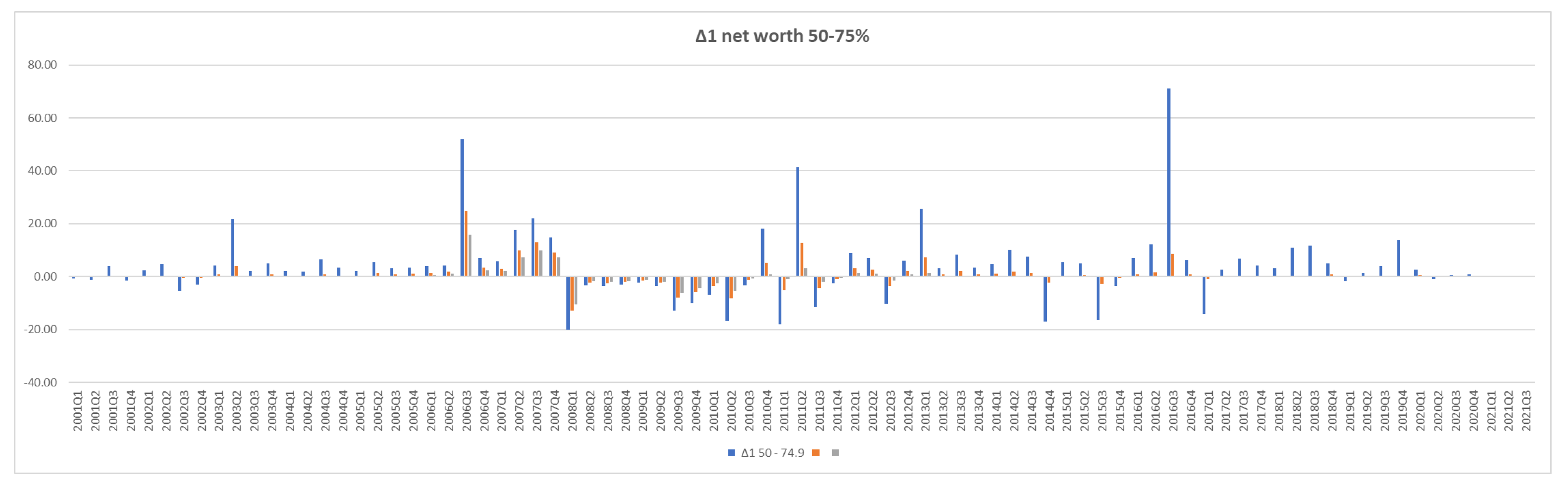

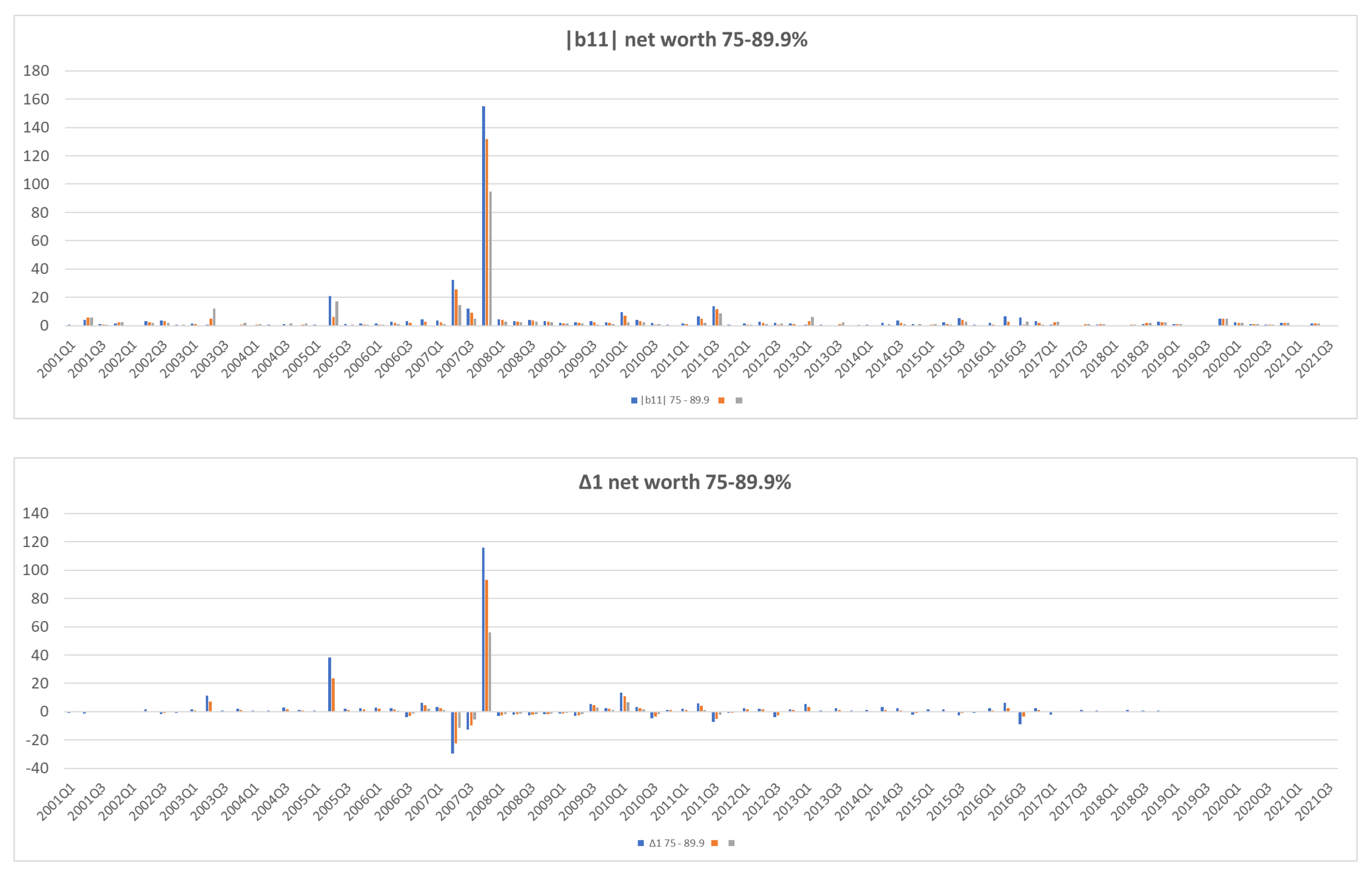

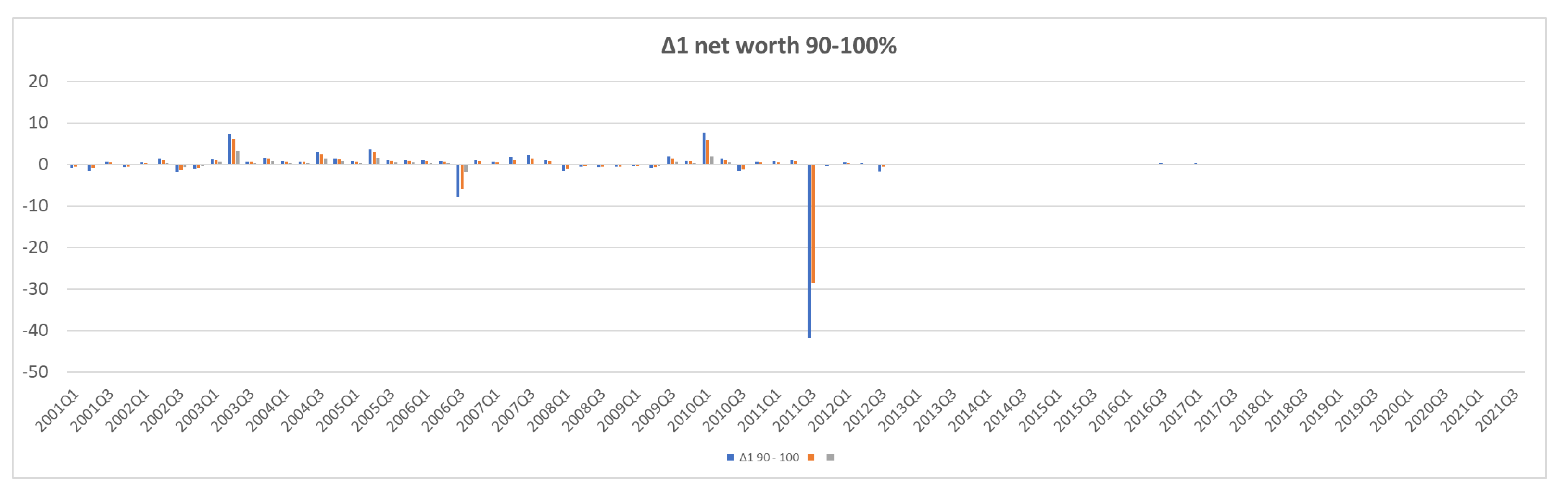

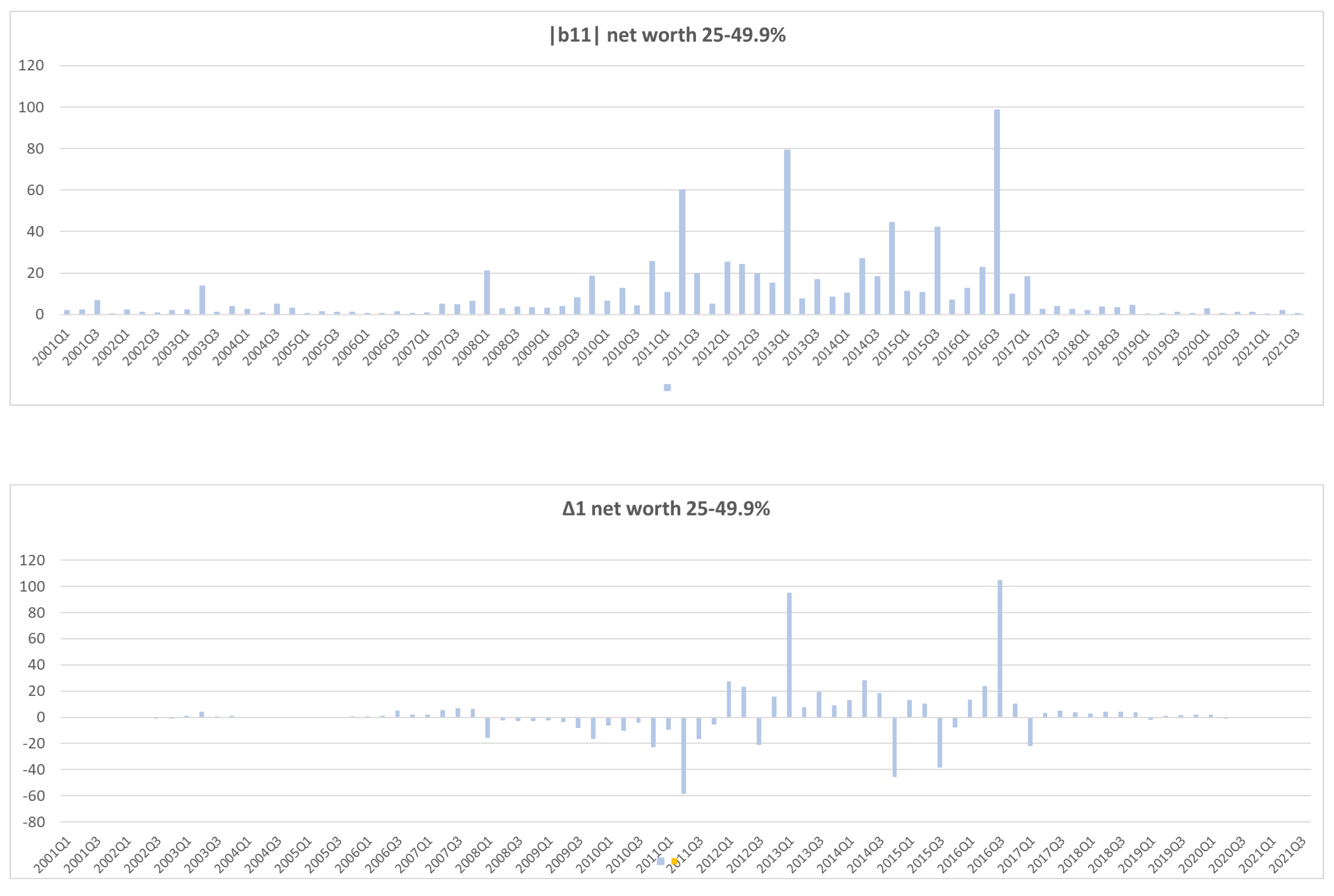

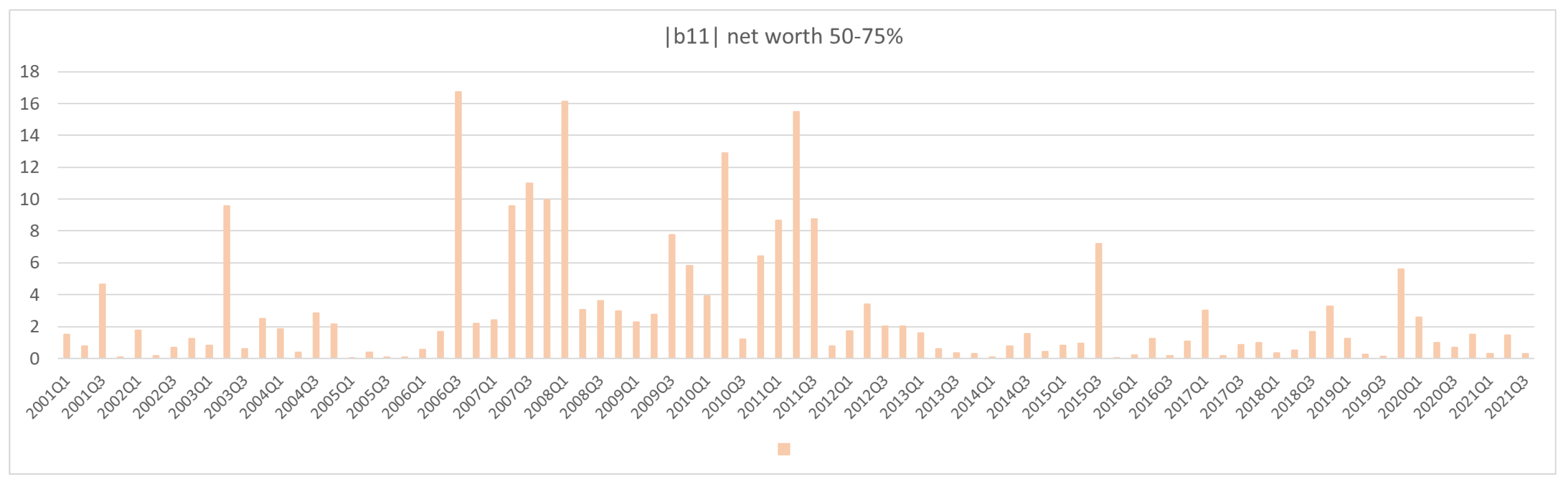

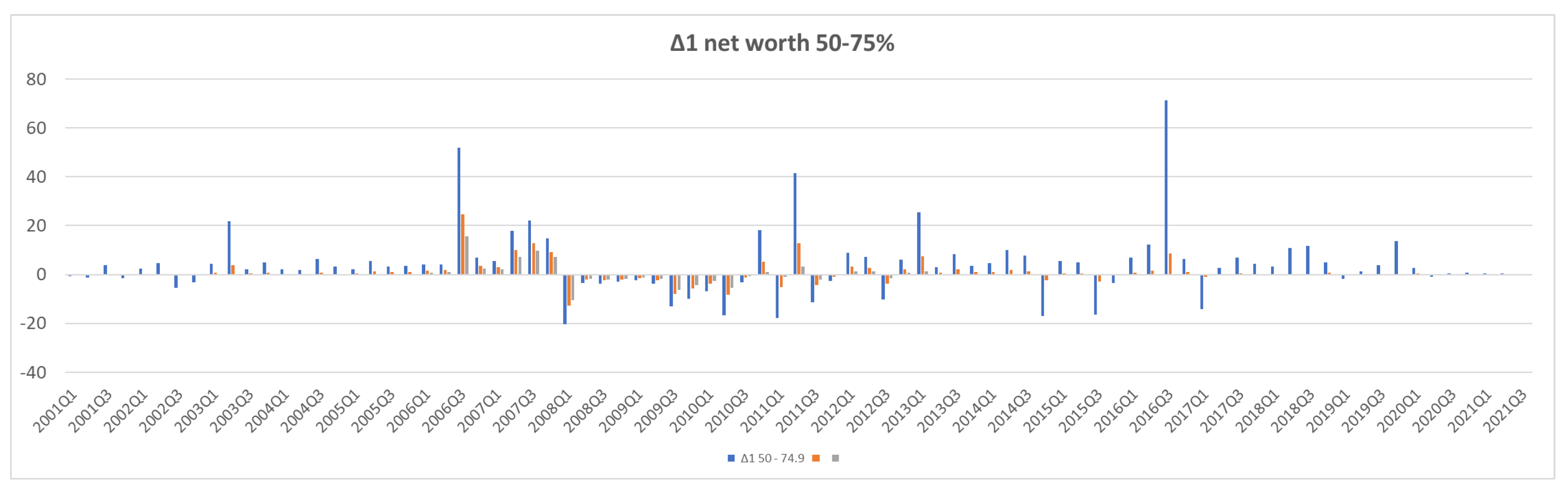

- It is clearly visible from the chart that the lower the net worth percentile, the longer the period in which and are negative. This implies that lower net worth subgroups have endured more prolonged financial distress and instability than their higher net worth counterparts;

- The lowest net worth subgroup does not show as much financial instability as other subgroups during the 2007 financial crisis and the Great Recession (its AII still rises during that time, as can be seen in Figure A8). This subgroup starts having negative and for six quarters from 2011 Q1 to 2012 Q2, which resumes, after a year’s pause, in 2014 Q1 and lasts for three years. has more debt than wealth (SCF 2019) and very little share of the total nonfinancial assets owned by the U.S. household, and therefore was not affected by the collapse of the real estate market followed by the financial bubble bursting.

- The household in its entirely shows the same level of financial instability as the top net worth group in terms of the signs of and , while the subgroups with lower percentiles of net worth fare much worse. This phenomenon show the extreme wealth inequality, far more severe than income inequality, prevalent in the U.S. household.

5. Discussion

5.1. Limitation

5.2. Targeted Monetary Expansion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| AII | Agent Instability Indicator |

| HM | Helicopter Money |

| IMA | Integrated Macroeconomic Accounts of the United States |

| MII | Market Instability Indicator |

| QE | Quantitative Easing |

| QT | Quantitative Tightening |

| SCF | Survey of Consumer Finances |

Appendix A

| 1 | Potential default denotes the situation in which liability exceeds the maximum allowable debt level, such that if a strict debt-to-asset ratio were imposed, a default—not in legal sense but failure to pay—would occur. |

| 2 | When dealing with discrete time data, the time derivative is replaced by finite difference. |

| 3 | The IMA puts the households and nonprofit institutions serving household into one group. Nevertheless, we consider this HNISH as U.S. households because the two sets of data are not separable. |

References

- Acharya, Viral, Tim Eisert, Christian Eufinger, and Christian Hirsch. 2019. Whatever It Takes: The Real Effects of Unconventional Monetary Policy. The Review of Financial Studies 32: 3366–411. [Google Scholar] [CrossRef]

- Adrian, Tobias, Daniel Covitz, and Nellie Liang. 2015. Financial Stability Monitoring. Annual Review of Financial Economics 7: 357–95. [Google Scholar] [CrossRef]

- Alpert, Gabe, Charles Potters, and Kirsten Rohrs Schimitt. 2022. A Breakdown of the Fiscal and Monetary Responses to the Pandemic; New York: Investopedia. Available online: https://www.investopedia.com/government-stimulus-efforts-to-fight-the-covid-19-crisis-4799723 (accessed on 29 May 2022).

- Annunziata, Filippo, and Michele Siri. 2020. Global crisis and financial stability. In Pandemic Crisis and Financial Stability. Edited by Christos V. Gortsos and Wolf-Georg Ringe. Frankfurt: European Banking Institute, pp. 317–37. [Google Scholar]

- Anstey, Chris. 2022. Why Quantitative Tightening Is on the Fed’s Agenda again. New York: Bloomberg, Available online: https://www.bloomberg.com/news/articles/2022-01-05/for-fed-taper-rates-then-quantitative-tightening-quicktake (accessed on 29 May 2022).

- Antolin, Pablo, Sebastian Schich, and Juan Yermo. 2011. The Economic Impact of Protracted Low Interest Rates on Pension Funds and Insurance Companies. Organisation for Economic Co-Operation and Development Journal: Financial Market Trends 2011: 5. [Google Scholar] [CrossRef]

- Bank of Korea. 2022. Definition and Importance of Financial Stability. Available online: https://www.bok.or.kr/eng/main/contents.do?menuNo=400037 (accessed on 29 May 2022).

- Batsaikhan, Uuriintuya, Stan Jourdan, and Baptiste Massenot. 2021. Summary of the Research on Helicopter Money. Available online: http://www.positivemoney.eu/wp-content/uploads/2021/07/litterature-review-helicopter-money-June2021.pdf (accessed on 29 May 2022).

- Bernanke, Ben Shalom. 2002. Deflation: Making Sure “It” Doesn’t Happen Here; Washington, DC: The Federal Reserve Board. Available online: https://www.federalreserve.gov/boarddocs/Speeches/2002/20021121/default.htm (accessed on 29 May 2022).

- Bernanke, Ben Shalom. 2016. What Tools Does the Fed Have Left? Part 3: Helicopter Money. Available online: https://www.brookings.edu/blog/ben-bernanke/2016/04/11/what-tools-does-the-fed-have-left-part-3-helicopter-money/ (accessed on 29 May 2022).

- Blanchet, Thomas, Emmanuel Saez, and Gabriel Zucman. 2022. Who Benefits from Income and Wealth Growth in the United States? Realtime Inequality. Available online: https://realtimeinequality.org (accessed on 29 May 2022).

- Borio, Claudio, Piti Disyatat, and Anna Zabai. 2016. Helicopter Money: The Illusion of a Free Lunch. Available online: https://voxeu.org/article/helicopter-money-illusion-free-lunch (accessed on 29 May 2022).

- Buiter, Willem H. 2014. The Simple Analytics of Helicopter Money: Why It Works—Always. Economics: The Open-Access, Open-Assessment E-Journal 8: 2014–28. [Google Scholar] [CrossRef]

- Bureau of Labor Statistics. 2022. Available online: https://www.bls.gov/ (accessed on 29 May 2022).

- Cavallo, Alberto, and Oleksiy Kryvtsov. 2021. What Can Stockouts Tell Us About Inflation? Evidence from Online Micro Data. In National Bureau of Economic Research Working Paper Series. Cambridge: NBER, Available online: https://www.nber.org/papers/w29209 (accessed on 29 May 2022).

- CDC Museum COVID-19 Timeline. 2022. Centers for Disease Control and Prevention. Available online: https://www.cdc.gov/museum/timeline/covid19.html (accessed on 29 May 2022).

- Center Forward Basics. 2020. History of Stimulus Packages. Available online: https://center-forward.org/wp-content/uploads/2020/07/Final-History-of-Stimulus-Packages.pdf (accessed on 29 May 2022).

- Choi, Youngna. 2018. Masked Instability: Within-Sector Financial Risk in the Presence of Wealth Inequality. Risks 6: 65. [Google Scholar] [CrossRef]

- Choi, Youngna. 2019. Borrowing Capacity, Financial Instability, and Contagion. International Journal of Theoretical and Applied Finance 22: 1850060. [Google Scholar] [CrossRef]

- Choi, Youngna, and Raphael Douady. 2012. Financial crisis dynamics: Attempt to define a market instability indicator. Quantitative Finance 12: 1351–65. [Google Scholar] [CrossRef]

- Copolla, Frances. 2019. The Case for People’s Quantitative Easing. Cambridge: Polity Press. [Google Scholar]

- Debelle, Guy. 2004. Household Debt and the Macroeconomy. Bank for International Settlements Quarterly Review. March 8. Available online: https://www.bis.org/publ/qtrpdf/r_qt0403e.pdf (accessed on 29 May 2022).

- DeLong, J. Bradford. 2017. Helicopter Money: When Zero Just Isn’t Low Enough. Milken Institute Review. January 17. Available online: https://www.milkenreview.org/articles/helicopter-money-when-zero-just-isnt-low-enough (accessed on 29 May 2022).

- Eichengreen, Barry. 2016. Helicopters on a Leash. Project Syndicate. Available online: https://www.project-syndicate.org/commentary/monetary-policy-limits-fiscal-expansion-by-barry-eichengreen-2016-03 (accessed on 29 May 2022).

- English, William B., Christopher J. Erceg, and David Lopez-Salido. 2017. Money-Financed Fiscal Programs: A Cautionary Tale. The Federal Reserve, Finance and Economics Discussion Series. Available online: https://www.federalreserve.gov/econres/feds/money-financed-fiscal-programs-a-cautionary-tale.htm#:~:text=A%20number%20of%20prominent%20economists,in%EF%AC%82ation%2C%20and%20signi%EF%AC%81cant%20%EF%AC%81scal%20strains (accessed on 29 May 2022).

- European Central Bank. 2022. Financial Stability. Available online: https://www.ecb.europa.eu/pub/financial-stability/html/index.en.html (accessed on 29 May 2022).

- Filardo, Andrew. 2009. Household Debt, Monetary Policy and Financial Stability: Still Searching for a Unifying Model. Bank for International Settlements Papers. May 25, vol. 46. Available online: https://www.bis.org/publ/bppdf/bispap46f.pdf (accessed on 29 May 2022).

- Friedman, Milton. 1969. The Optimum Quantity of Money, revised ed. London and New York: Routeledge, pp. 1–50. [Google Scholar]

- Gadanecz, Blaise, and Kaushik Jayaram. 2009. Measures of financial stability—A review. In Proceedings of the IFC Conference on “Measuring Financial Innovation and Its Impact”, Basel, Switzerland, August 26–27; Basel: Bank of International Settlement, pp. 365–80. Available online: https://www.bis.org/ifc/publ/ifcb31ab.pdf (accessed on 29 May 2022).

- Galí, Jordi. 2016. The Effects of a Money-Financed Fiscal Stimulus. Barcelona: Centre de Recerca en Economia Internacional, Available online: http://www.crei.cat/wp-content/uploads/2016/12/gmoney_dec2016-1.pdf (accessed on 29 May 2022).

- Gray, Dale F., Robert C. Merton, and Zvi Bodie. 2007. New Framework for Measuring and Managing Macrofinancial Risk and Financial Stability. In National Bureau of Economic Research Working Paper. Cambridge: NBER, p. 13607. Available online: https://www.nber.org/papers/w13607 (accessed on 29 May 2022).

- Hille, Kathrin, and Thomas Hale. 2022. Shanghai Lockdown Stokes Global Supply Chains Anxiety. Financial Times. Available online: https://www.ft.com/content/368121b2-5e44-4393-9ff8-f5b4fc40ba2b (accessed on 29 May 2022).

- Inhoffen, Justus, Atanas Pekanov, and Thomas Url. 2021. Low for Long: Side Effects of Negative Interest Rates. Luxembourg: European Parliament, Directorate-General for Internal Policies of the Union, Available online: https://data.europa.eu/doi/10.2861/980796 (accessed on 29 May 2022).

- Integrated Macroeconomic Accounts for the United States. 2022. Available online: https://www.bea.gov/data/special-topics/integrated-macroeconomic-accounts (accessed on 29 May 2022).

- International Monetary Fund. 2021. Global Financial Stability Report. Available online: https://www.imf.org/en/Publications/GFSR/Issues/2021/10/12/global-financial-stability-report-october-2021 (accessed on 29 May 2022).

- Irwin, Neil. 2016. Helicopter Money: Why Some Economists Are Talking about Dropping Money from the Sky. The New York Times. Available online: https://www.nytimes.com/2016/07/29/upshot/helicopter-money-why-some-economists-are-talking-about-dropping-money-from-the-sky.html#:~:text=%E2%80%9CHelicopter%20money%E2%80%9D%20is%20the%20term,take%20only%20a%20smaller%20action (accessed on 29 May 2022).

- Jackson, Howell E., and Steven L. Schwarcz. 2020. Financial Stability: Lessons from the Coronavirus Pandemic. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3644417 (accessed on 29 May 2022).

- Kaletsky, Anatole. 2016. Central Banking’s Final Frontier? Project Syndicate. Available online: https://www.project-syndicate.org/onpoint/central-bankings-final-frontier-by-anatole-kaletsky-2016-05 (accessed on 29 May 2022).

- Kapoor, Supriya, and Oana Peia. 2021. The impact of quantitative easing on liquidity creation. Journal of Banking & Finance 122: 105998. [Google Scholar] [CrossRef]

- Kihara, Leika. 2016. Japan Sinking Deeper into De-Facto Helicopter Money. Available online: https://www.reuters.com/article/us-japan-economy-boj-helicopter-analysis/japan-sinking-deeper-into-de-facto-helicopter-money-idUSKCN10U0DS (accessed on 29 May 2022).

- Koo, Richard. 2011. The world in balance sheet recession: Causes, cure, and politics. Real World Economic Review 58: 19–37. Available online: http://www.paecon.net/PAEReview/issue58/Koo58.pdf (accessed on 29 May 2022).

- Leika, Mindaugas, and Daniela Marchettini. 2017. A Generalized Framework for the Assessment of Household Financial Vulnerability. In International Monetary Fund Working Paper. WP/17/228. Washington, DC: International Monetary Fund, Available online: https://www.imf.org/en/Publications/WP/Issues/2017/11/07/A-Generalized-Framework-for-the-Assessment-of-Household-Financial-Vulnerability-45297 (accessed on 29 May 2022).

- Magyar Nemzeti Bank. 2022. Defining Financial Stability. Available online: https://www.mnb.hu/en/financial-stability/defining-financial-stability (accessed on 29 May 2022).

- Martin, Phillipe, Eric Monnet, Xavier Ragot, Thomas Renault, and Baptiste Savatier. 2021. Helicopter Money as a Last Resort Contingent Policy. Available online: https://voxeu.org/article/helicopter-money-last-resort-contingent-policy (accessed on 29 May 2022).

- Massenot, Baptiste. 2021. Helicopter Money will be Spent, Economists Unanimously Find. Available online: https://www.positivemoney.eu/2021/07/helicopter-money-effectiveness-research-review/ (accessed on 29 May 2022).

- Minsky, Hyman Philip. 1992. Financial Instability Hypothesis. In The Jerome Levy Economics Institute Working Paper. Annandale-on-Hudson: Levy Economics Institute, vol. 74. [Google Scholar]

- Monacelli, Tommaso. 2009. New Keynesian models, durable goods, and collateral constraints. Journal of Monetary Economics 56: 242–54. [Google Scholar] [CrossRef]

- Montecino, Juan Antonio, and Gerald Epstein. 2015. Did Quantitative Easing Increase Income Inequality? In Institute for New Economic Thinking Working Paper. New York: Institute for New Economic Thinking, vol. 28. [Google Scholar]

- Muellbauer, John. 2014. Combatting Eurozone Deflation: QE for the People. Available online: https://voxeu.org/article/combatting-eurozone-deflation-qe-people#:~:text=Eurozone%20deflation%20is%20likely%20to,of%20following%20the%20Fed’s%20lead (accessed on 29 May 2022).

- Rodnyansky, Alexander. 2017. The Effects of Quantitative Easing on Bank Lending Behavior. The Review of Financial Studies 30: 3858–87. [Google Scholar] [CrossRef]

- Rosengren, Eric S. 2011. Defining Financial Stability, and Some Policy Implications of Applying the Definition. Boston: Federal Reserve Bank of Boston, Available online: https://www.bostonfed.org/news-and-events/speeches/defining-financial-stability-and-some-policy-implications-of-applying-the-definition.aspx (accessed on 29 May 2022).

- S&P 500®. 2022. Available online: https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview (accessed on 29 May 2022).

- S&P CoreLogic Case-Shiller Home Price Indices. 2022. Available online: https://www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller/sp-corelogic-case-shiller-composite/#overview (accessed on 29 May 2022).

- Survey of Consumer Finances. 2019. Available online: https://www.federalreserve.gov/econres/scfindex.htm (accessed on 29 May 2022).

- System of National Accounts. 2008. Available online: https://unstats.un.org/unsd/nationalaccount/sna2008.asp (accessed on 29 May 2022).

- Taylor, Kate, and Andy Kiersz. 2021. Yes, You Can Earn More on Unemployment Instead of Working. Here’s the Gap between Average Benefits and Wages in Every Us State. Available online: https://www.businessinsider.com/unemployment-benefits-versus-average-wages-across-the-us-2021-5#:~:text=Business%20owners%20say%20that%20an,every%20state%20in%20the%20US (accessed on 29 May 2022).

- Tepper, Taylor. 2022. Why Is Inflation so High? Forbes Advisor. Available online: https://www.forbes.com/advisor/investing/why-is-inflation-rising-right-now/ (accessed on 29 May 2022).

- Tescher, Jennifer, and David Siberman. 2021. Measuring the Financial Health of Americans. Brookings Report. Available online: https://www.brookings.edu/research/measuring-the-financial-health-of-americans/ (accessed on 29 May 2022).

- The European System of National and Regional Accounts. 2010. Available online: https://ec.europa.eu/eurostat/web/esa-2010/overview (accessed on 29 May 2022).

- The Federal Reserve. 2022a. Principles for Reducing the Size of the Federal Reserve’s Balance Sheet. Available online: https://www.federalreserve.gov/newsevents/pressreleases/monetary20220126c.ht (accessed on 29 May 2022).

- The Federal Reserve. 2022b. Financial Accounts of the United States—Z.1. Available online: https://www.federalreserve.gov/releases/z1/ (accessed on 29 May 2022).

- The Federal Reserve. 2022c. Financial Stability Report. Available online: https://www.federalreserve.gov/publications/financial-stability-report.htm (accessed on 29 May 2022).

- Trading Economics. 2022. Available online: https://tradingeconomics.com/ (accessed on 29 May 2022).

- Turner, Adair. 2015. The case for monetary finance—An essentially political issue. In Proceedings of the IMF Jacques Polak Research Conference, Washington, DC, USA, November 5–6; Available online: https://www.imf.org/external/np/res/seminars/2015/arc/pdf/adair.pdf (accessed on 29 May 2022).

- Turner, Adair. 2016. Helicopters on a Leash. Project Syndicate. Available online: https://www.project-syndicate.org/commentary/helicopter-money-political-control-by-adair-turner-2016-05 (accessed on 29 May 2022).

- Wolf, Martin. 2013. The Case for Helicopter Money. Financial Times. Available online: https://www.ft.com/content/9bcf0eea-6f98-11e2-b906-00144feab49a#axzz2vaE3myVK (accessed on 29 May 2022).

- Zabai, Anna. 2017. Household Debt: Recent Developments and Challenges. Bank for International Settlements Quarterly Review. December 3. Available online: https://www.bis.org/publ/qtrpdf/r_qt1712f.pdf (accessed on 29 May 2022).

| Economic Interpretation | |||

|---|---|---|---|

| + | + | + | Economic boom, overleveraging |

| − | + | − | Economic improvement with no overleveraging |

| − | − | + | Economic downturn, deleveraging |

| + | − | − | Heading toward de facto default |

| 0 | ± | 0 | Liability remains within the maximum allowable debt limit |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Choi, Y. Economic Stimulus and Financial Instability: Recent Case of the U.S. Household. J. Risk Financial Manag. 2022, 15, 266. https://doi.org/10.3390/jrfm15060266

Choi Y. Economic Stimulus and Financial Instability: Recent Case of the U.S. Household. Journal of Risk and Financial Management. 2022; 15(6):266. https://doi.org/10.3390/jrfm15060266

Chicago/Turabian StyleChoi, Youngna. 2022. "Economic Stimulus and Financial Instability: Recent Case of the U.S. Household" Journal of Risk and Financial Management 15, no. 6: 266. https://doi.org/10.3390/jrfm15060266

APA StyleChoi, Y. (2022). Economic Stimulus and Financial Instability: Recent Case of the U.S. Household. Journal of Risk and Financial Management, 15(6), 266. https://doi.org/10.3390/jrfm15060266