1. Introduction

Artificial intelligence (AI) is a general-purpose technology that has the ability to perform tasks traditionally carried out by humans (

Crafts 2021). One of the highly debated topics concerning AI in the economic and social contexts focuses on whether AI will replace or augment human capabilities. While some argue that AI has the potential to replace humans, others advocate for its integration as a complement to human intelligence.

In an economy where data are reshaping how companies generate value and AI is transforming how companies operate, there is a growing belief that organizations will gradually replace human employees with intelligent machines (

De Cremer and Kasparov 2021). AI has demonstrated the potential to undertake tasks previously limited to human cognition, leading some to advocate for autonomous systems that can mimic or even replace human cognitive functions. However, cautionary voices have also emerged. Eminent physicist Stephen Hawking has expressed concerns, cautioning that the development of fully artificial intelligence could pose a threat to the existence of humanity, and has shared his fear that AI may eventually replace humans entirely (

Kumar and Choudhury 2022). Similarly, technology magnate Bill Gates has sounded the alarm, stressing that humans should be legitimately concerned about the potential risks associated with artificial intelligence (

Rawlinson 2015). In a noteworthy event on 2 May 2023, an attention grabbing letter appeared in The Guardian, signed by Elon Musk and numerous individuals, sparking controversy. The letter called for a pause in artificial intelligence research and raised concerns about the development of AI systems, such as GPT-4, that possess human-like capabilities (

Paul 2023).

On the other hand, there is an alternative perspective that proposes the use of AI not as a replacement for human intelligence, but as a means of augmenting it. This school of thought, known as AI, focuses on leveraging technology to enhance and support human cognition, with humans remaining central to the human–computer interaction (

Hassani et al. 2020). While AI operates based on the available data, humans possess a distinct form of intelligence that encompasses imagination, anticipation, emotions, and the ability to make judgments in dynamic situations. Augmented intelligence represents a significant advancement towards the future of intelligence work, where humans and technology collaborate to achieve greater outcomes.

These different viewpoints reflect the complexity and ongoing evolution of the AI debate in the economic and social contexts, highlighting the necessity for continued exploration and discourse regarding its future trajectory. Particularly, the adoption and development of AI and its interaction with other disruptive digital technologies, such as blockchain, require special attention, as the potential disruption induced by the combination of those digital technologies could significantly affect the trajectory of social and economic development worldwide.

This article explores the constraints on AI agents in independently accomplishing predefined goals. Even though AI agents are capable of researching, analyzing, and making decisions, their abilities to actually execute the decisions to achieve given objectives is hindered by the inability of AI agents to use economic and financial institutions, such as contracts, agreements, financial services, or marketplaces. The ability of human economic agents to participate in the economy and generate economic value is greatly amplified by their access to high-quality economic institutions (

Norton 2003). Therefore, if AI agents can access economic and financial institutions, more autonomous AI agents can be deployed to augment human productivity. Conventional economic and financial structures are rooted in tangible elements, encompassing laws and regulations, contracts and agreements, as well as the verification of human identities (Know Your Customer). The task of constructing interfaces that permit AI to engage with these traditional institutions poses technical challenges. Nevertheless, we propose that since blockchain technology can be viewed as an institutional technology, it offers a foundation for creating digital-native economic and financial institutions. AI agents can, both theoretically and practically, interact with these blockchain-based institutions through the management of private keys. This grants AI agents the ability to form and participate in contracts and agreements with other AI entities or humans via blockchain-based smart contracts. Moreover, it empowers AI agents to utilize financial services, such as payments, decentralized exchanges, decentralized financial services, and other types of decentralized platforms. In this paper, we aim to explain why the technological convergence of AI and blockchain can enable AI to overcome its limitations, particularly the lack of capacity to interact with economic institutions. By granting AI access to these institutions, we argue that it could lead to significant productivity gains and ultimately enhance economic growth.

There is a rapidly growing body of literature that investigates the convergence of AI and blockchain technologies (

Corea 2018,

2019;

Vikhyath et al. 2022). Numerous studies on blockchain and AI extensively explore how AI’s inherent ability to process and learn from large volumes of data can substantially improve blockchain systems’ security and efficiency (

Ekramifard et al. 2020;

Khanh and Khang 2021;

Lonescu et al. 2023;

Rjoub et al. 2023;

Singh et al. 2020). The studies also discuss how the decentralized and transparent nature of blockchain technology can offer a secure environment for AI, with the symbiotic relationship between the two promising innovation in various sectors (

Charles et al. 2023;

Gupta et al. 2023;

Li and Xu 2021;

Rajawat et al. 2022), such as finance, healthcare, and supply chain management, contributing to secure transactions, data integrity, privacy, transparency, and traceability (

Kumar et al. 2023;

Rajagopal et al. 2022).

Recent studies have extensively explored the applications of blockchain technology in the financial sector, highlighting its transformative impact.

Wu and Duan (

2019) demonstrated that blockchain significantly reduces transaction costs and enhances efficiency, particularly in cross-border payments and securitization within financial institutions.

Trivedi et al. (

2021) and

Ali et al. (

2020) further extended this analysis to e-finance, including e-insurance, e-banking, and online broking, emphasizing blockchain’s role in reducing reliance on intermediaries and mitigating fraud risks. Furthermore, blockchain technology improves customer experiences with financial services such as fund transfers and registration processes (

Garg et al. 2021). It facilitates the elimination of Know Your Customer (KYC) procedures (

Hassani et al. 2018), increases transparency and efficiency in the capital market (

Kimani et al. 2020), and aids in preventing fraud and reducing the need for intermediaries in the insurance sector (

Kar and Navin 2021).

Despite the extensive literature relating to the individual benefits of AI and blockchain and their interaction, to the best of our knowledge our paper is the first to analyze blockchain technology as an economic and financial institutional technology that can unlock the potential for autonomous AI agents. The current study aspires to motivate further research that perceives AI as a general-purpose technology capable of independently pursuing and executing assigned tasks. Additionally, we view blockchain as an institutional technology that can unleash the capabilities of autonomous AI agents and their intersections.

In the context of this study, ‘autonomous AI agents’ are defined as advanced software systems that are capable of achieving specific objectives, such as executing contracts, forming agreements, utilizing financial services, and participating in marketplaces, with minimal to no human intervention. These agents are designed to interact with both human users and other software systems, and their autonomy is derived from their ability to make decisions, learn from their experiences, and adapt to new situations. Importantly, these AI agents are capable of engaging with economic and financial institutions autonomously.

The structure of this study is as follows:

Section 2 explores the synergies between humans and AI, along with the delegation of tasks to AI.

Section 3 highlights the constraints faced by autonomous AI agents, particularly their inability to access economic and financial institutions.

Section 4 investigates how autonomous AI agents can utilize blockchain-based economic and financial institutions, and outlines a model for human agents and autonomous AI agents to collaborate and interact with these blockchain institutions. Finally,

Section 5 provides a summary and delves into various aspects and implications of autonomous AI agents.

2. Collaborations between Humans and AI

Artificial intelligence (AI), in its essence, represents the ambitious endeavor to endow machines with intelligent behavior, spanning a wide spectrum of functionalities including reasoning, learning, sensing, and interaction. Complementing this, machine learning (ML), as a specialized subset of AI, focuses on formulating and implementing algorithms that empower machines to independently learn from and adapt to new data. While AI seeks to emulate human-like intelligence across a diverse array of domains, ML focuses on the computational methods that render this aspiration viable, especially through pattern recognition and informed decision-making based on data (

Mehrotra 2019).

The evolution of AI, traced back to its initial conceptualization of computational intelligence, and leading to the establishment of robust theories and frameworks, highlights a significant transformation in the field (

Y. Lu 2019). This progression delineates a shift from the early adoption of rule-based systems (

Davis and King 1984) to the modern era dominated by data-driven methodologies (

El-Brawany et al. 2023). Concurrently, the development of ML has evolved from basic pattern recognition to advanced algorithms capable of autonomously learning from data. This evolution is underscored by notable advancements in methodologies such as decision trees, support vector machines, and the recent innovations in deep learning (i.e., neural networks) (

Boutaba et al. 2018).

The undeniable synergy between AI and ML has been a driving force in the substantial enhancement of AI systems’ capabilities. The complex interrelation between the two is evident in the way ML algorithms underpin AI, facilitating intricate computational tasks and decision-making processes (

Mehrotra 2019). The emergence of deep learning, a specialized branch of ML, has markedly accelerated AI’s progress, leading to significant achievements in areas like image and speech recognition, autonomous navigation, and, particularly, natural language processing (NLP). NLP’s evolution, especially with the introduction of the transformer model trained on extensive datasets, has led to the development of independent text generator models, known as generative AI (

Cao et al. 2023). This symbiosis is a testament to how ML’s methodological advancements significantly contribute to realizing AI’s broader objectives. Despite their interconnected nature, AI and ML maintain distinct core objectives and scopes. AI is an overarching term encompassing the quest for a broad spectrum of intelligent behaviors in machines, while ML is narrowly focused on algorithms that facilitate learning, prediction, and decision-making based on data.

In light of our comprehensive examination of both AI and ML, our paper will predominantly concentrate on the broader and more encompassing domain of AI. While acknowledging the significance and specificity of machine learning as a potent subset within AI, our exploration will be geared towards understanding the overarching paradigms, challenges, and prospects presented by AI.

With the use of AI capabilities in decision-making, analysis, and communication, numerous strands in the literature have discussed the delegation of tasks to AI, the synergy between humans and AI, as well as collaboration between AI and humans. This section delves into the dynamics of human–AI interaction, exploring how AI augments human capabilities and the essence of collaborative decision-making between humans and AI.

2.1. Augmentation of Human Capabilities and Human–AI Collaborative Decision-Making

AI technologies serve as significant adjuncts to human capabilities, offering data analysis, intelligent insights, and decision support. By harnessing AI, humans can make decisions that are more well-informed and perform tasks with higher efficiency (

Raisch and Krakowski 2021). AI systems and humans can establish effective partnerships, particularly in the realm of decision-making. AI algorithms are capable of handling large volumes of data, discerning patterns and trends, and generating recommendations for human decision-makers. These humans can then evaluate the AI-generated suggestions, considering the context, and ultimately make decisions based on their expertise and judgment. Proponents of task delegation to AI argue for the potential benefits of human–AI collaboration. They believe that AI systems can augment human capabilities, allowing humans to concentrate on tasks that require higher level skills such as critical thinking, problem-solving, and innovation. This synergy between humans and AI can pave the way for new advancements and opportunities (

Jarrahi 2018;

Sako 2020).

2.2. AI enhances Creativity and Innovation

While AI excels in data processing and pattern identification, humans possess unique creative abilities and the capacity for unconventional thinking. By delegating routine tasks to AI, humans can allocate more time and cognitive resources to creative problem-solving, ideation, and innovation. The fusion of human creativity and AI analytical abilities can lead to groundbreaking discoveries and solutions. It also has practical applications, AI can assume control of repetitive, rule-based tasks that do not necessitate complex decision-making. Consequently, humans are able to concentrate on tasks of higher value that demand creativity, critical thinking, and emotional intelligence. For example, in customer service, AI-powered chatbots can field basic customer inquiries, allowing human agents to tackle more complex issues and deliver personalized assistance (

Donepudi 2018). Collaboration research into human–AI collaboration, particularly in classification tasks, indicates that combined efforts often yield better results than individual performance. The best performance outcomes are achieved when the AI delegates tasks to humans rather than the reverse. Interestingly, the quality of AI delegation remains consistent even when paired with low-performing subjects. Humans, on the other hand, do not delegate effectively and fail to benefit from delegating tasks to the AI (

Fügener et al. 2022).

2.3. Arguments in Favor of Delegating Tasks to AI

Delegating tasks to AI systems has been shown to significantly improve efficiency and productivity. AI algorithms can rapidly produce content, which is both time-saving and more resource-efficient compared to manual creation. This advancement allows organizations to streamline their processes, fulfill demands faster, and assign human resources to more strategic or complex tasks (

Donepudi 2018;

Hemmer et al. 2023). In addition, generative AI can amplify human capabilities, enabling individuals to accomplish more. AI systems can free up humans to focus on higher level activities that require critical thinking, problem-solving, and emotional intelligence. This collaboration between humans and AI can lead to improved results and foster innovation

Jarrahi (

2018). AI platforms like ChatGPT still have a considerable distance to cover before they can autonomously drive significant products, processes, or business innovations. Their primary strength lies in their ability to enhance the human capacity for innovation by augmenting human capabilities (

Yogesh K. Dwivedi et al. 2023).

Generative AI can perform tasks on a scale that humans would find challenging. AI systems can produce vast amounts of content, customized to specific preferences, needs, or contexts. This scalability and customizability provide opportunities in areas such as personalized marketing, content creation, and product design. Generative AI can lend creative assistance to human creators. AI algorithms can come up with initial concepts, suggest improvements, or provide alternative ideas. This partnership between humans and AI can heighten creativity, spark new insights, and facilitate iterative and exploratory processes across various creative domains (

Vartiainen and Tedre 2023). AI systems excel in areas where humans may face limitations. For instance, in complex data analysis AI algorithms can process large datasets, identify patterns, and extract valuable insights at a speed and scale beyond human capacity. By delegating such tasks to AI systems, humans can utilize AI’s computational capabilities and make data-driven decisions more effectively (

Miller and Brown 2018). Assigning tasks to generative AI democratizes access to creative tools and content generation. AI systems empower individuals and organizations with the ability to generate content without the need for extensive expertise or specialized skills. This democratization facilitates wider participation in creative processes, fostering innovation and diversity.

2.4. Concerns about AI Adoption

While delegating tasks to AI presents significant benefits, it is crucial to address the challenges and ethical dilemmas associated with it. This process includes ensuring fairness, rectifying biases, enhancing transparency, and maintaining human oversight to minimize potential risks. Achieving a balance between human engagement and AI automation is pivotal to the responsible and advantageous usage of AI technologies.

A primary concern brought forth is the potential displacement of human labor as tasks previously carried out by humans are delegated to AI systems. There is ongoing debate about the implications of AI for employment and the necessity for workforce retraining and reskilling to adapt to the evolving job landscape (

Tyson and Zysman 2022). Secondly, the output generated by AI systems may not always match the quality standards or maintain the same level of authenticity as content created by humans. Critics argue that delegating tasks to AI might lead to a drop in quality or a dilution of originality, which could adversely affect various creative industries. Furthermore, they question if AI-generated content can truly emulate the depth, emotion, and originality that human creativity introduces. In addition, AI systems learn from massive quantities of data, which could introduce biases present in the training data (

Fernández 2019). Big data acts as a crucial resource for AI systems, particularly in enhancing their predictive analytics and algorithmic improvement. These vast and diverse datasets enable AI, especially machine learning and large language models, to train, recognize complex patterns, and make informed decisions. By analyzing large datasets, AI not only forecasts trends and identifies potential future outcomes across various fields but also continually refines and improves its algorithms. This exposure to real-world, voluminous data allows AI models to evolve, becoming more accurate and robust over time, which is essential for applications in areas like finance, healthcare, and marketing. This symbiotic relationship between AI and big data is fundamental in driving the advancement of predictive analytics and the continuous enhancement of AI capabilities. There are concerns about AI systems exacerbating or amplifying existing societal biases, such as racial or gender biases. The debate centers around addressing these biases and promoting fairness in AI-generated content (

Lewicki et al. 2023;

Zhou et al. 2022). Critics also express concerns about the lack of control and transparency in AI systems. Gaining a comprehensive understanding of the limitations associated with generative AI models is crucial due to the potential risks they pose. These risks include reputational and legal concerns, the use of offensive or copyrighted content, privacy breaches, fraudulent transactions, and the dissemination of false information (

Yogesh K. Dwivedi et al. 2023). Understanding the decision-making processes of AI, ensuring accountability, and providing avenues for human intervention when necessary are significant considerations when delegating tasks to AI.

2.5. AI and Economic Growth

The integration of AI in various economic domains has the potential to generate significant economic value and foster economic growth. Several studies have examined the impact of AI on economic growth, welfare, and productivity, providing insights into the potential benefits of AI adoption.

A study by

C.-H. Lu (

2021) developed a three-sector endogenous growth model to investigate the impact of AI development on economic growth. Their findings suggest that the development of AI can increase economic growth, particularly if it leads to rising productivity in the goods or AI sector. However, the impact on household short-run utility depends on the nature of AI accumulation. If AI is used to replace human labor, it can be detrimental to household short-run utility. The study emphasizes the importance of considering both the positive and negative effects of AI on economic welfare.

Bickley et al. (

2022) conducted a scientometric analysis to explore the diffusion of AI in economics. They mapped the use and discussion of AI within economic subfields over time, place, and subfield. While their study primarily focuses on the diffusion and engagement of economists with AI, it provides insights into the increasing integration of AI in economic research and practice. The widespread adoption of AI in economics suggests its potential to contribute to economic value and growth.

The relationship between AI development and economic growth has also been examined at the regional level.

Fan and Liu (

2021) investigated the relationship between AI development and economic growth in Chinese provinces. Their findings indicate that the development of AI not only has a direct effect on economic growth but also improves economic slowdown by inhibiting industrial structure upgrading. AI technologies have become an important driving force for high quality and sustainable economic growth.

Furthermore, studies have explored the impact of AI on income distribution and labor market dynamics.

Gries and Naudé (

2020) developed a growth model that integrates the task approach from labor economics to examine the economic impact of AI. They found that AI automation can decrease the share of labor income, regardless of the elasticity of substitution between AI and labor. The effects of AI on GDP growth, productivity, and wages depend on the elasticity of substitution. The model highlights the complexities of AI’s impact on income distribution and economic growth (

Gries and Naudé 2020).

These studies collectively demonstrate the potential economic value and growth that AI can help generate. AI has the capacity to enhance productivity, drive innovation, and transform industries across various sectors. However, it is essential to carefully consider the distributional implications, address potential inequalities, and implement policies that maximize the benefits of AI while ensuring inclusivity and sustainability (

Korinek et al. 2021).

Furthermore, forward-looking estimations made by prominent corporations like

Goldman Sachs (

2023) and

PWC (

2023) project that the economic value generated by AI will reach into the tens of trillions of dollars in the forthcoming decade. Consequently, the adoption and further development of AI could emerge as pivotal contributors to global economic growth.

2.6. Autonomous AI

Considering the substantial progress of AI systems, exemplified by technologies such as ChatGPT4, it is increasingly likely that a broadening range of tasks will be allocated to AI agents in order to boost productivity, a trend we have highlighted in earlier sections. Furthermore, recent research, including a study conducted by

Candrian and Scherer (

2022), reveals a growing preference among humans for delegating decisions with financial implications to autonomous AI agents rather than to their human counterparts. The study suggests that delegating tasks to AI agents is favored due to lower perceived social risks and the inherent human desire to maintain control.

In line with those considerations, there is anecdotal evidence indicating that corporations are actively exploring the substitution of human employees with AI agents. Recent reports indicate that IBM, a multinational technology company, has announced plans to temporarily halt hiring for certain roles that could potentially be replaced by AI and automation. This decision is expected to impact approximately 7800 jobs within the company (

Reuters 2023), mainly in back-office functions like Human Resources (HR) (

Ahmed 2018). IBM successfully reduced its HR expenditures by 107 million dollars in 2017 due to integrating AI, reinforcing the belief that AI will continue to support HRM in the future (

Gusain et al. 2023). While IBM is not alone in these changes—tech giants such as Meta Platforms Inc. (Menlo Park, California, USA), Amazon.com Inc. (410 Terry Ave N, Seattle 98109, WA, USA), Twitter Inc. (1355 Market Street, Downtown San Francisco, California, USA), and Microsoft Corp (Redmond, Washington, USA). have also seen recent layoffs—the trend is clear: AI is swiftly transforming the workforce. JP Morgan Chase, America’s largest bank, is an example of financial institutions employing AI for a variety of tasks, which include customer service and data analysis. AI-powered chatbots and virtual assistants are used to manage customer inquiries and offer support. AI algorithms also contribute to risk assessment, fraud detection, and investment analysis, enhancing the bank’s financial performance and market capitalization (

Kumari et al. 2021). In addition, call centers across industries, including telecommunications providers and customer service organizations, are incorporating AI-powered chatbots and virtual assistants. These AI systems are capable of handling customer inquiries, providing information, and assisting with basic troubleshooting, which reduces the demand for human call center agents in certain scenarios (

Khan and Iqbal 2020). This signifies yet another area where AI is transforming traditional job roles and tasks.

As the shift toward delegating tasks to AI agents appears to be gaining momentum, there is a growing emphasis on developing and exploring more autonomous versions of AI agents. These advanced systems are designed to plan, execute, inspect, and learn independently, as discussed in recent works like

Gao et al. (

2023). For instance, while ChatGPT is proficient at providing responses to specific questions or tasks, it does not possess the capacity to pursue overarching objectives or goals independently. In response to this limitation, alternative AI agents such as AutoGPT, AssistGPT, or AgentGPT, which are designed to actively accomplish specified objectives or goals, have been proposed. Despite being in the early stages of development, it is conceivable that these more autonomous AI agents—capable of planning, executing, inspecting, and learning in order to fulfil given objectives and goals—will become increasingly accessible in the near future.

3. Institutional Limitations That Hinder AI Agents to Become More Autonomous

Although AI agents exhibit remarkable proficiency in research, analysis, and decision-making, they encounter significant limitations when it comes to executing tasks autonomously and achieving set objectives. One of the key limitations of AI agents is their inability to interact directly with economic and financial institutions, such as engaging in contractual agreements or accessing financial services. In practice, this means that while an AI agent can make plans, identify business solutions or analyze economic trends, it cannot actually execute a contract or engage in financial transactions without human intervention. This section discusses several specific challenges that autonomous AI systems face when interfacing with traditional economic institutions. The potential challenges autonomous AI systems may encounter when dealing with established economic institutions, such as contractual agreements or financial services (e.g., Know Your Customer procedures), stem from the fundamentally physical nature of these entities. The majority of such institutions are characterized by their tangible infrastructure, physical interactions, and the prevalence of paper-based documentation, all of which could present difficulties for AI systems to effectively engage with.

Firstly, financial institutions are obligated to adhere to the Know Your Customer (KYC) framework and regulatory requirements. KYC serves as a mandatory procedure employed by banks and financial institutions to authenticate the identity of their customers and by other businesses to identify their clients. Its objective is to safeguard financial institutions against risks such as fraud, corruption, money laundering, and terrorist financing (

Malhotra et al. 2022;

Rajput 2013). It involves a manual process through which banks and financial institutions collect and verify customer information to ensure their identity and assess their risk and financial profiles. KYC helps in establishing the authenticity of customers and mitigating potential risks associated with financial transactions. Customers are required to provide various documents and information such as identification documents, proof of address, and additional supporting documents. This process is mandatory in banking and financial transactions. The diverse identification prerequisites within the financial sector, coupled with the dynamic nature of identity, can pose significant obstacles when it comes to accessing financial services (

Arner et al. 2019;

Malhotra et al. 2022).

As an AI agent is essentially a computer program lacking a recognizable identity in economic and societal contexts, it is unable to complete the KYC registration necessary to access financial services within traditional economic institutions. The question of whether AI agents should possess an identity is a topic of ongoing debate, as the social and economic implications of AI agents with identifiable personas could be profoundly challenging. Even in scenarios where AI agents are granted identities, there arises the question of acceptance of different types of online identification for these entities. This would necessitate modifications to existing regulatory requirements. Additionally, ensuring cross-compatibility of online identities, whether from a legal or technical perspective, poses another significant hurdle. This necessitates the development of a new regulatory framework and the design of technical utilities that can facilitate such interactions, as outlined by

Arner et al. (

2019). Without the ability to fulfill KYC requirements, AI agents are denied access to financial services. This limitation makes it impossible for autonomous AI agents to perform financial operations such as making payments, investing, or borrowing loans, thereby hindering their ability to reach their full potential in autonomous decision-making and execution.

Secondly, a contract is a legally recognized agreement made between two or more parties. Contracts figure prominently in many economic and organizational theories (

Rousseau and McLean Parks 1993). The argument is that contracts substitute for markets and trust, create organizational forms, and foster psychological attachment of members to organizations. As for who is legal to use or compose a contract, generally anyone who has the legal capacity to enter into a contract can use or compose one. This includes individuals, businesses, organizations, and even government entities. It is important to note that there may be specific legal requirements or restrictions depending on the jurisdiction and the nature of the contract (

Rousseau and McLean Parks 1993). Traditional economic institutions operate within specific legal jurisdictions and regulatory frameworks that are designed for human participation and compliance. Despite the capabilities of AI agents to scrutinize and assess digitized legal contracts, they are not endowed with the authority to engage in legal contracts to facilitate economic transactions with other AI agents or human beings.

Third, traditional economic institutions often involve physical infrastructure, assets, and resources. Autonomous AI systems, primarily designed to operate in the digital realm, may lack the capability to effectively access, control, or manage physical assets or infrastructure. In addition, many economic institutions, especially those in financial services, necessitate personalized interactions and understanding of individual circumstances. The capability of AI systems to cater to individual preferences, unique situations, and complex emotions influencing economic decision-making could be limited. Traditional institutions might store data in diverse formats and systems that are not easily accessible or compatible with AI systems. AI systems primarily rely on structured digital data sources, and therefore might find integrating data from diverse sources challenging. The challenge which is currently most significant is that customers are not digital and to win the trust of customers is a huge obstacle to them (

Mhlanga 2020).

4. Blockchain-Based Institutions for Autonomous Artificial Intelligence

Strikingly, blockchain technology can provide the economic and financial institutional services for autonomous AI agents, in theory and practice.

Davidson et al. (

2018) shed light on the transformative capacity of blockchain technology within capitalist economic structures, arguing that, beyond merely considering the disruptive implications of blockchain as a general-purpose technology, it should be viewed in a wider perspective as an institutional technology.

At its core, blockchain technology constructs an unalterable, decentralized public ledger, capable of storing a myriad of data structures—from property titles and certifications to contracts and more. This feature could enable enhanced efficiency and transparency in economic coordination and governance, which are key aspects of any economic institution. This point is exemplified by Bitcoin and other blockchain-based platforms, which have already started to challenge traditional financial systems and advocate for more decentralized, democratic economic structures (

Evans 2014;

Lange and Santarius 2020).

In the academic realm, some approaches propose that blockchains represent a manifestation of institutional evolution. As blockchain technology continues to mature and infiltrate various industries, it could potentially drive a transformation in economic institutions, making them more efficient, transparent, and inclusive (

Davidson et al. 2018). For instance, the integration of blockchain into the management of property rights could diminish the reliance on intermediaries, streamline transaction processes, and enhance security and trust among involved parties (

Dam et al. 2020;

Xu et al. 2023). Thus, blockchain technology holds considerable potential to revolutionize economic institutions by establishing a more streamlined, transparent, and decentralized system for economic coordination and governance. However, the successful integration of blockchain into these institutions necessitates thoughtful deliberation on various factors, including technological infrastructure and societal acceptance (

Ramprakash et al. 2023).

To underscore our analysis of blockchain’s potential for transforming economic institutions, we spotlight several cases featuring smart contracts as a form of economic institution. Blockchain technology has catalyzed the birth of a unique economic institution: automated or smart contracts (

Schär 2021). Smart contracts are computer protocols designed to enable, authenticate, and enforce agreements among various parties, even those lacking mutual trust, without the need for a trusted third party (

Khan et al. 2021). A concrete example of this is the burgeoning decentralized finance (DeFi) industry, an alternative financial infrastructure built on the Ethereum blockchain, using smart contracts to mirror existing financial services in a more accessible, interoperable, and transparent manner (

Schär 2021). DeFi represents a considerable shift in the financial sector, utilizing blockchain and distributed ledger technology to develop various financial applications.

Popescu (

2020) defines DeFi as an ecosystem of financial services, including savings, loans, trading, and insurance, globally accessible through a smartphone and internet connection. This innovation transforms traditional financial products into transparent, intermediary-free protocols on public blockchains.

Yavin and Reardon (

2021) and

Salami (

2020) emphasize that DeFi’s decentralized nature, backed by blockchain, presents a cost-effective alternative to traditional finance, with reduced fees and peer-to-peer processes. A key feature of DeFi is the use of smart contracts, which are self-executing programs on a blockchain, automating agreements between parties such as buyers, sellers, lenders, and borrowers.

Schär (

2021) observes that these contracts enable the replication of traditional financial services in a more open and transparent manner, thus redefining the financial services framework. DeFi reduces transaction costs, eliminates intermediary delays and failures, and decreases credit risk in lending (

Caldarelli and Ellul 2021). It is particularly vital for financial inclusion, offering accessible credit and benefiting individuals without a credit history (

Salami 2020).

Decentralized payment systems, exchanges, and financial services stand out as key economic institutions that utilize smart contracts (

Schär 2021). These systems leverage the immutable and transparent nature of blockchain technology to deliver secure, efficient, and trustless transactions. However, the application of smart contracts in economic institutions is not without its challenges. Security threats, vulnerabilities, and legal considerations present formidable hurdles (

Cai and Zhu 2016;

Khan et al. 2021). Despite these issues, ongoing research and development suggests a promising future for blockchain-based smart contracts as new governance tools (

Fiorentino and Bartolucci 2021).

4.1. Autonomous AI Agents Can Access Economic and Financial Institutions on the Blockchain

Accessing the services of new digital economic and financial institutions built on blockchain requires users to possess a private key. This private key serves as a unique identifier, granting users access to the services and transactions within the blockchain network. Interestingly, both in theory and practice, AI could manage these private keys. This capability opens up a new dimension of autonomous AI interactions within the blockchain based economic institutions (

Salah et al. 2019).

The inherent characteristics of blockchain technology make it theoretically and practically suitable for serving autonomous AIs. Blockchain’s decentralized nature, transparency, immutability, and security features align well with the requirements of AI systems. These features ensure that AI systems can operate in a secure and reliable environment, where data integrity is maintained, and transactions are transparent and verifiable (

Shinde et al. 2021).

Equipped with private keys, autonomous AI agents not only possess the capability to implement smart contracts on the blockchain, but also to examine existing smart contracts deployed thereon, which empowers them to make informed decisions on whether to enter these contracts or not. Specifically, these autonomous AI agents could innovate new smart contracts for decentralized exchanges and decentralized financial services, or utilize existing smart contract services, thus enabling the full autonomy of AI agents in the digital financial sphere.

While blockchain has the potential to grant AI agents access to a wide variety of economic institutions, there are only certain types of these institutions that AI can effectively utilize. This is primarily due to the specific requirements and complexities associated with different economic institutions. For instance, institutions that involve complex human judgement or subjective decision-making may not be fully accessible to AI. Take, for example, the legal system. While AI can be programmed to understand and apply laws, it may struggle with areas of law that require subjective judgement, such as family law or criminal law, where human empathy, understanding, and discretion play a significant role. Similarly, in the realm of financial services, while AI can manage and execute straightforward transactions, it might find it challenging to navigate areas like wealth management or financial advising, which often require a deep understanding of a client’s personal circumstances, risk tolerance, and long-term goals—elements that are often nuanced and subject to change. Moreover, institutions that rely heavily on interpersonal relationships and trust, such as certain types of banking or business partnerships, may also pose challenges for AI. These institutions often require a level of personal interaction and relationship-building that AI, in its current state, may not be able to fully replicate. However, institutions that involve data-driven decision-making or automated transactions can be effectively utilized by AI systems (

Zhang et al. 2021).

AI Management of Private Keys: A Practical Example

In practice, AI’s management of private keys can be exemplified in the realm of automated trading on decentralized exchanges. Here, an AI system can be programmed to manage a private key, allowing it to autonomously execute trades based on predefined algorithms or real time market analysis. This not only enhances the efficiency of trading operations but also opens up new possibilities for high frequency trading and algorithmic trading strategies in the blockchain space (

Fang et al. 2022;

Liu et al. 2021).

4.2. Model for Delegation to Autonomous AI Agents That Can Access the Economic and Financial Institutions on the Blockchain

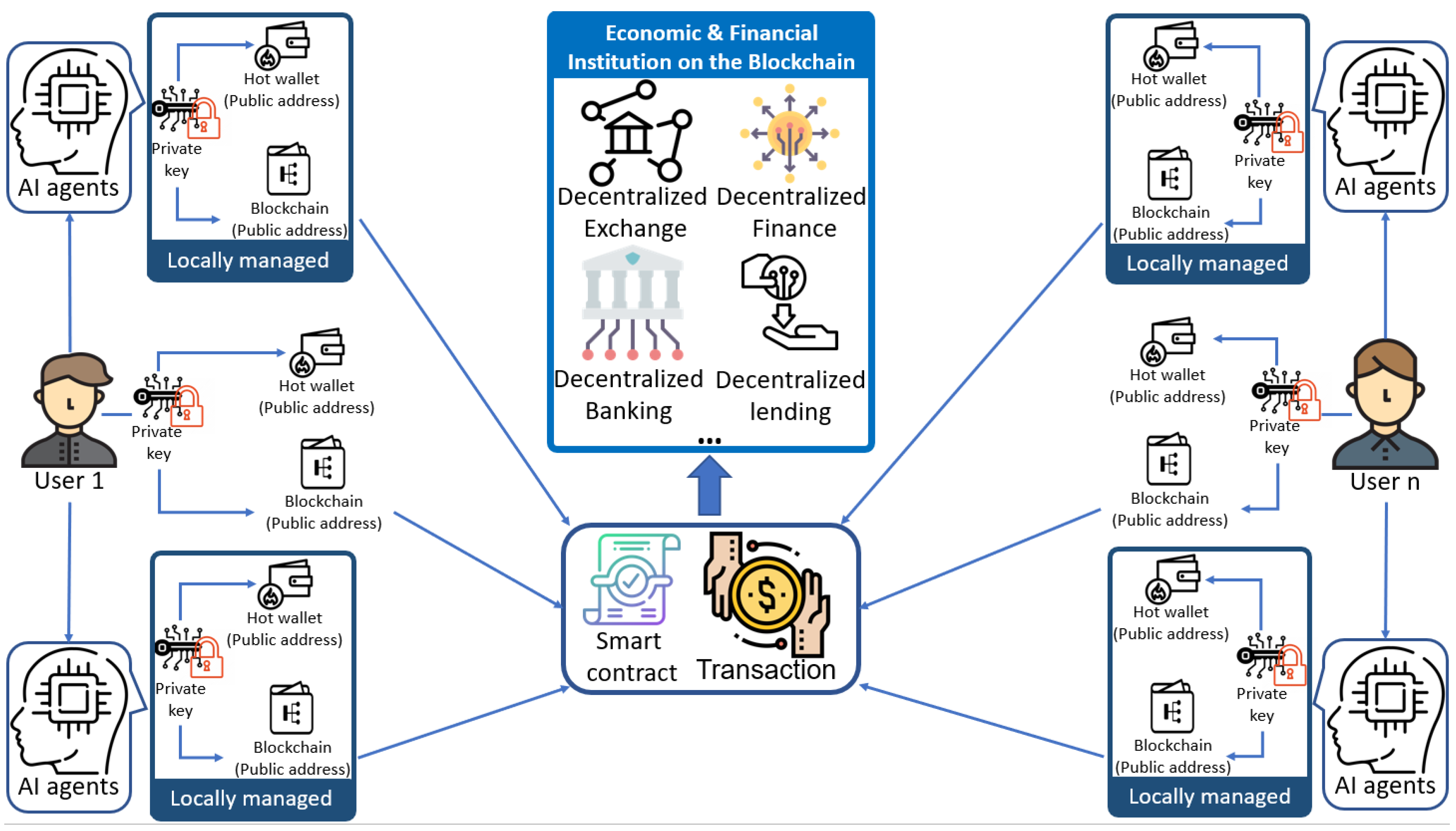

We put forward a model for the delegation of responsibilities to autonomous AI agents, thereby providing them with the capability to access and interact with economic and financial institutions on the blockchain. As depicted in

Figure 1, human agents can delegate objectives, goals, or tasks to autonomous AI agents that necessitate interfacing with economic and financial institutions. Within this proposed architecture, five principal components work in synergy to empower AI agents to autonomously engage with these institutions on a blockchain platform.

User: A user in this context is the individual or entity that owns an AI agent and assigns it specific economic and financial tasks. Users interact with the system, input initial instructions, and oversee the overall operation of their AI agent. However, once tasked, the AI agents can execute these functions independently. The user also establishes the private key for the autonomous AI agents to whom they wish to delegate tasks.

AI Agents: AI agents are unique actors created by users, capable of processing individual economic and financial tasks independently, including the execution of payment processes. These AI agents are capable of initiating and executing transactions on the blockchain autonomously, without needing constant user interaction or support. Each AI agent possesses a level of machine learning capabilities allowing them to learn and adapt over time for better task performance.

Public Key and Private Key: Each user and AI agent pair has a set of cryptographic keys: a public key, which can be freely shared, and a private key, which is kept confidential. In a blockchain context, the public key is used to create the blockchain address, while the private key is used to authorize transactions. In particular, each AI agent is equipped with a private key that it manages independently within a local management system (e.g., in a hot wallet). This private key is used to authorize transactions, ensuring that the AI agent can execute operations autonomously and securely. Unique to this architecture, the AI agent can use its private key to generate multiple public keys. Each of these public keys can be freely shared and used to create distinct blockchain addresses. This allows the AI agent to manage multiple wallet addresses simultaneously, enhancing its ability to interact with various blockchain-based services and execute diverse economic and financial tasks.

Smart Contract/Transaction: AI agents can create smart contracts and transactions without user intervention. Smart contracts are self-executing contracts with the terms of agreement directly written into lines of code. Both users and AI agents can create these contracts, with AI agents doing so autonomously based on their assigned tasks and learned behavior. Transactions, once authorized, are added to the blockchain and become part of the immutable record. AI agents also have the ability to verify and evaluate the content of smart contracts.

Examples of economic and financial institutions on the Blockchain that connects autonomous AI agents with both other AI and human agents:

Decentralized Exchange (DEX): DEXs allow for the direct exchange of assets (e.g., cryptocurrencies) between parties, facilitated by smart contracts rather than an intermediary. AI agents can engage with DEXs to execute trades autonomously based on their tasks and learned behavior.

Decentralized Finance (DeFi): DeFi platforms utilize smart contracts on blockchains to replicate traditional financial systems in a decentralized manner. AI agents can interact with DeFi platforms to perform tasks like lending, borrowing, or earning interest.

Decentralized Payment: Both AI and human agents can use decentralized payment to settle economic transactions worldwide.

Contracts: In general, autonomous AI can create and engage with smart contracts that govern the obligations of relevant parties.

The AI agent is given the ability to manage its private key independently and store it in a hot wallet. This private key is used to authorize transactions, ensuring that the AI agent can execute operations autonomously and securely. The AI agent’s ability to manage its private key is a critical aspect of its autonomy. It allows the AI agent to authorize transactions independently, without needing direct user input every time. This autonomous operation is made possible by the inherent security and trustworthiness of blockchain technology.

The process begins with the user creating an AI agent, designed to be a unique actor capable of performing individual economic and financial tasks. The AI agent is implemented with machine learning capabilities, allowing it to learn from past transactions and behaviors, adapt over time, and improve its performance in future tasks. Once the AI agent is created, it is assigned a private key. After the AI agent is equipped with its private key and the ability to generate public keys, the user provides the AI agent with overarching goals or specific tasks that require access to economic and financial institutions. These tasks could range from buying or selling goods and trading assets, to creating and engaging in (smart) contractual obligations. The AI agent receives these instructions and carries them out autonomously, interacting directly with the appropriate blockchain-based services. When a transaction is initiated, whether that is a trade, purchase, or sale, the payment process happens directly between AI agents or between the user and the AI agents, just like a regular transaction. The AI agent can independently authorize transactions using its private key, making the process seamless and efficient with minimal or no human intervention. Once the transaction is authorized, it is logged onto the blockchain. The blockchain serves as an immutable ledger, recording all transactions that occur. Each transaction is time-stamped and linked to the public keys of the parties involved, making it possible to trace and verify the transaction history. The transparency of blockchain technology also aids in preventing fraud and ensuring trust in the system.

Furthermore, it is possible for a user to employ multiple AI agents, all of which interact with each other through the blockchain by managing private keys. This setup is designed to achieve the goals established by the user. For instance, consider a hierarchical arrangement of two autonomous AI agents, where one acts as a supervising line manager, authorizing the financial transactions of the other, subordinate agent. The decisions of the subordinate AI agent, particularly in using equivalent financial services, might require approval from its superior. In blockchain terms, this could entail setting up a system where a financial transaction initiated by the subordinate agent requires the keys of both the supervisor and the subordinate. This arrangement adds an extra layer of auditing, allowing for the separation of tasks; the supervisor AI agent manages higher order goals set by the user, while the subordinate AI agent handles specific transactional tasks. This scenario exemplifies the potential possibilities arising from the integration of AI agents and blockchain technology.

Compared to the cryptocurrency market models, our proposed architecture integrates both human users and AI agents within the same operational framework. In conventional cryptocurrency models, the focus is primarily on transactional efficiency, often facilitated by automated bots operating within centralized or decentralized exchange environments. These bots, governed by algorithmic trading strategies, are typically designed to react to market conditions based on predefined rules or adaptive learning mechanisms that optimize for immediate financial outcomes. In contrast, our model expands the scope to account for the multifaceted nature of interactions that include human cognitive processes and AI-driven analytics. Human users bring to the table a complex array of decision-making factors, such as long-term strategic considerations or the ability to interpret nuanced signals beyond the quantitative data that bots usually process. Our AI agents are designed to complement these human capabilities by providing advanced data processing and pattern recognition, thereby enhancing the overall decision-making framework. This integration allows for a richer, more comprehensive approach to decision-making that transcends the rapid, often speculative transactions of typical cryptocurrency trading operations.

Moreover, the structural design of our model ensures that both human and AI participants are not just passive recipients of market data but active contributors to the ecosystem. The AI agents in our model are not limited to executing trades but are also involved in managing private and public keys, engaging with smart contracts, and interacting with decentralized financial services, which are functions not traditionally seen in cryptocurrency models geared towards high-frequency trading. The decentralized nature of our model, with its emphasis on smart contract transactions and decentralized finance (DeFi) services, positions it as a versatile framework capable of supporting a diverse range of economic activities on the blockchain. This stands in stark contrast to the narrower focus of traditional cryptocurrency models, which are predominantly centered on the exchange value of digital assets.

This architecture paves the way for a robust and efficient economic system in which AI agents can autonomously perform economic and financial transactions. Consequently, autonomous AI agents become more capable of aiding human agents, thus enhancing productivity and stimulating economic growth on a global scale.

4.3. Technical Limitations and Security Concerns of the Autonomous AI Agent’s Model

4.3.1. New Security Concerns of the Autonomous AI Agent

The integration of autonomous AI into blockchain infrastructure, while ripe with potential for augmenting human capability and enhancing productivity, introduces a complex array of security concerns that extend beyond the already intricate challenges of private key management and infrastructure robustness. The autonomous nature of these AI agents heightens the necessity for fortified security measures due to the increased attack vectors and potential for exploitation.

- (a)

Security Risks Associated with AI Autonomy

The introduction of autonomous AI agents brings forth the potential for novel security threats that must be meticulously accounted for. Autonomous AI agents, by virtue of their capacity for independent operation, could inadvertently become conduits for security breaches if not properly safeguarded. The risk of compromise is not limited to the mismanagement of private keys but extends to the integrity of the AI agents’ decision-making processes themselves. The algorithms driving these agents could be targets for adversarial attacks aimed at manipulating their learning processes or decision-making, thereby inducing unintended transactions that could undermine the stability and security of the blockchain network.

- (b)

Mitigation Strategies and Ongoing Vigilance

In light of these concerns, it is imperative to develop mitigation strategies that encompass both prevention and rapid response to security incidents. These strategies could involve implementing stringent access controls, employing real-time anomaly detection systems to monitor AI agent behaviors, and establishing protocols for swift incident response and recovery. Moreover, the potential for security issues necessitates ongoing vigilance, requiring regular updates to security protocols in line with emerging threats and the continuous evolution of cybersecurity best practices.

- (c)

Impact of Security Issues on Trust and Adoption

Furthermore, the emergence of new security issues has implications for trust in blockchain systems and the broader adoption of AI agents in economic settings. Stakeholders may exhibit heightened apprehension towards adopting autonomous AI agents if the security landscape is perceived as volatile or uncertain. Thus, addressing these security concerns is not only a technical necessity but also a foundational aspect of fostering a trusted environment that encourages the integration of AI in economic and financial infrastructures.

4.3.2. Private Key Management and Other Technique Limitations

- (a)

Private key management

The management of private keys in blockchain networks, particularly for autonomous AI agents, presents a unique set of challenges and limitations. These challenges primarily revolve around security, privacy, and the robustness of the infrastructure.

Firstly (Security): The private key is a critical component in the blockchain network. It authorizes transactions and provides access to the user’s digital assets. If an AI agent manages its private key, the security of that key becomes paramount. If the key is compromised, it could lead to unauthorized transactions or even theft of digital assets. Therefore, the AI agent must have robust security measures in place to protect the private key. This could include secure storage methods, advanced encryption techniques, and regular key rotation.

Secondly (Privacy): The use of a private key by an AI agent also raises privacy concerns. The AI agent’s activities, authorized by its private key, are recorded on the blockchain and can be traced. While blockchain transactions are pseudonymous, sophisticated analysis could potentially link these transactions back to the originating AI agent or even the user. This could lead to privacy breaches if sensitive information is inferred from the AI agent’s activities.

Thirdly (Infrastructure limitations): The current technical infrastructure may not be fully equipped to handle autonomous AI agents managing private keys. For instance, the process of key rotation, where a private key is periodically changed for security reasons, could be challenging to implement in an autonomous manner. Additionally, the infrastructure would need to support the secure storage and retrieval of private keys by AI agents, which could require significant resources and advanced technology.

A real-world example of these challenges can be seen in the case of cryptocurrency wallets, even for humans. These wallets, which are essentially blockchain-based hot wallets managed by users, have been subject to numerous security breaches over the years. In many cases, these breaches occurred due to compromised private keys. While these wallets are not managed by AI agents, the security and privacy challenges they face are similar to those that would be faced by autonomous AI agents managing private keys.

Certainly, one practical approach to mitigate the risks associated with autonomous AI agents managing private keys in blockchain networks is to limit the value of assets that the AI agent can control. Users could consider assigning a limited amount of digital assets to the AI agent’s hot wallet. By doing so, they can limit their exposure to potential losses in case of a security breach or malfunction of the AI agent. This approach mirrors the prudent use of a physical wallet; instead of carrying one’s entire life savings, one only keeps an amount intended for immediate expenses. For instance, if an AI agent is tasked with making regular small transactions, the user could periodically fund the AI agent’s wallet with just enough digital assets to cover these transactions. This way, even if the AI agent’s private key was compromised, the potential loss would be limited to the amount currently in the wallet.

Furthermore, users could implement safeguards such as transaction limits, or require manual approval for transactions above a certain value. This would add an extra layer of security and control, allowing users to monitor and manage high-value transactions. It is important to note that while these measures can reduce risk, they cannot eliminate it entirely. Therefore, ongoing efforts to improve the security and privacy of AI agents in blockchain networks remain crucial. Users should stay informed about the latest security practices and ensure their AI agents are configured to follow them.

- (b)

Other technical limitations

While the autonomous AI model described has significant potential, there are several technical limitations that need to be addressed.

Firstly, the AI agent’s ability to learn from past transactions and behaviors and adapt over time is dependent on the quality and quantity of the data it has access to. If the data are incomplete, inaccurate, or biased, the AI agent’s decision-making could be flawed. Furthermore, the AI agent’s learning and adaptation capabilities are limited by the sophistication of the machine learning algorithms it uses. Current algorithms may not be able to fully capture the complexity and unpredictability of economic and financial markets.

Secondly, the AI agent’s ability to carry out tasks autonomously and interact with blockchain-based services is limited by the complexity of these tasks and services. Some tasks may be too complex for the AI agent to handle autonomously, and some blockchain-based services may not be designed for interaction with AI agents. Furthermore, the AI agent’s ability to interact with these services is dependent on the interoperability of the AI agent and blockchain technologies.

Finally, the process of logging transactions onto the blockchain and verifying the transaction history is dependent on the scalability and efficiency of the blockchain technology. As the number of transactions increases, the blockchain can become more computationally intensive and slower to process transactions.

Addressing these technical limitations will require advancements in both AI and blockchain technologies, as well as careful design and implementation of the AI agent and the blockchain-based services it interacts with.

4.4. Further Discussions on Autonomous AI

Job Displacement and Labor Market Disruption: One of the primary concerns is the potential displacement of human labor due to the automation capabilities of autonomous AIs. As these technologies become more advanced, they can carry out tasks traditionally performed by humans, leading to job losses and potential disruptions in the labor market. Indeed, this limitation becomes particularly noteworthy in the financial services sector where blockchain technology and AI could serve as formidable tools. Blockchain can be utilized as an alternative backend infrastructure, offering enhanced security, transparency, and efficiency. Concurrently, autonomous AI agents have the potential to provide substantial assistance to humans in making financial decisions and executing them. The potential displacement of human labor requires careful management to ensure a smooth transition and mitigate the negative impact on employment. Strategies such as retraining and upskilling programs can help individuals adapt to the changing job landscape.

Ethical Considerations: The utilization of autonomous AIs brings forth significant ethical considerations. Questions regarding the moral status of machines, their decision-making processes, and the potential risks they pose to humans and other morally relevant entities emerge. It is vital to ensure the safety, transparency, and ethical standards of autonomous AI systems in order to build trust and mitigate potential harm. The establishment of ethical guidelines and regulations is necessary to address issues such as bias, privacy, accountability, and responsible AI use. Furthermore, when autonomous AI has the ability to engage in contracts and use financial services, the capabilities of these AI systems are dramatically augmented. It is essential to conduct more research on the boundaries and limitations of such arrangements, as the potential drawbacks of financially and economically capable autonomous AI agents could be catastrophic if not properly regulated.

Economic Inequality: The integration of autonomous AIs into economic institutions has the potential to exacerbate economic inequality. If the benefits of autonomous AI adoption are primarily concentrated in the hands of a few individuals or organizations, it can widen the gap between the rich and the poor. Ensuring equitable distribution of benefits and addressing socioeconomic disparities is essential to harness the potential of autonomous AIs for inclusive growth and societal well-being.

Data Privacy and Security: Autonomous AIs rely on vast amounts of data for learning and decision-making. This raises concerns about data privacy and security. Economic institutions must establish robust data protection measures to safeguard sensitive information and prevent unauthorized access or misuse. Blockchain technology, with its decentralized and transparent nature, can offer potential solutions to enhance data privacy and security in the context of autonomous AI systems.

Regulatory and Legal Challenges: The integration of autonomous AIs into economic institutions poses regulatory and legal challenges. Current laws and regulations may not adequately address the unique aspects and implications of autonomous AI technologies. New frameworks need to be developed to address issues such as liability, accountability, intellectual property rights, and governance of AI systems. Collaborative efforts between policymakers, industry stakeholders, and researchers are necessary to establish a regulatory environment that fosters innovation while ensuring ethical and responsible AI use.

Overcoming these hurdles indeed necessitates a multidisciplinary approach that merges technological advancements with ethical considerations, policy interventions, and multistakeholder collaborations. Addressing these challenges proactively is key to maximizing the potential of autonomous AI within economic institutions while concurrently mitigating the associated risks.

5. Conclusions

In conclusion, our exploration into the intersection of AI and blockchain technologies has revealed significant potential for the advancement of autonomous AI agents. We have identified the constraints faced by these agents, particularly their limited access to economic and financial institutions, which limits their ability to independently achieve predefined objectives. However, we propose that blockchain technology, as an institutional technology, can provide a solution to this challenge by creating digital native economic and financial institutions. Our study has shown that AI agents can theoretically and practically interact with these blockchain-based institutions through the management of private keys. This interaction extends their capabilities, allowing them to form and participate in contracts and agreements, and to utilize financial services autonomously. This potential for autonomy could lead to a significant increase in the deployment of AI agents, thereby augmenting human productivity.

While the debate on whether AI will replace or augment human capabilities continues, our study suggests a future where AI and humans coexist and collaborate. In this future, AI agents, empowered by blockchain technology, can perform tasks independently, while humans focus on tasks requiring unique human intelligence. This symbiotic relationship could lead to greater efficiency and productivity in various sectors, including finance, commerce, and supply chain management. Despite the potential benefits, the integration of AI and blockchain technologies also raises important questions and challenges that need to be addressed. These challenges encompass various dimensions, including economic factors, societal impact, regulatory constraints, privacy considerations, and the ethical implications regarding autonomous AI entities. Consequently, we strongly advocate for continued and extensive research in these critical areas.