Valuation of Patent-Based Collaborative Synergies under Strategic Settings with Multiple Uncertainties: Rainbow Real Options Approach

Abstract

1. Introduction

2. Key Literature Review

2.1. Electric Vehicle Industry as a Patent-Based Platform Business

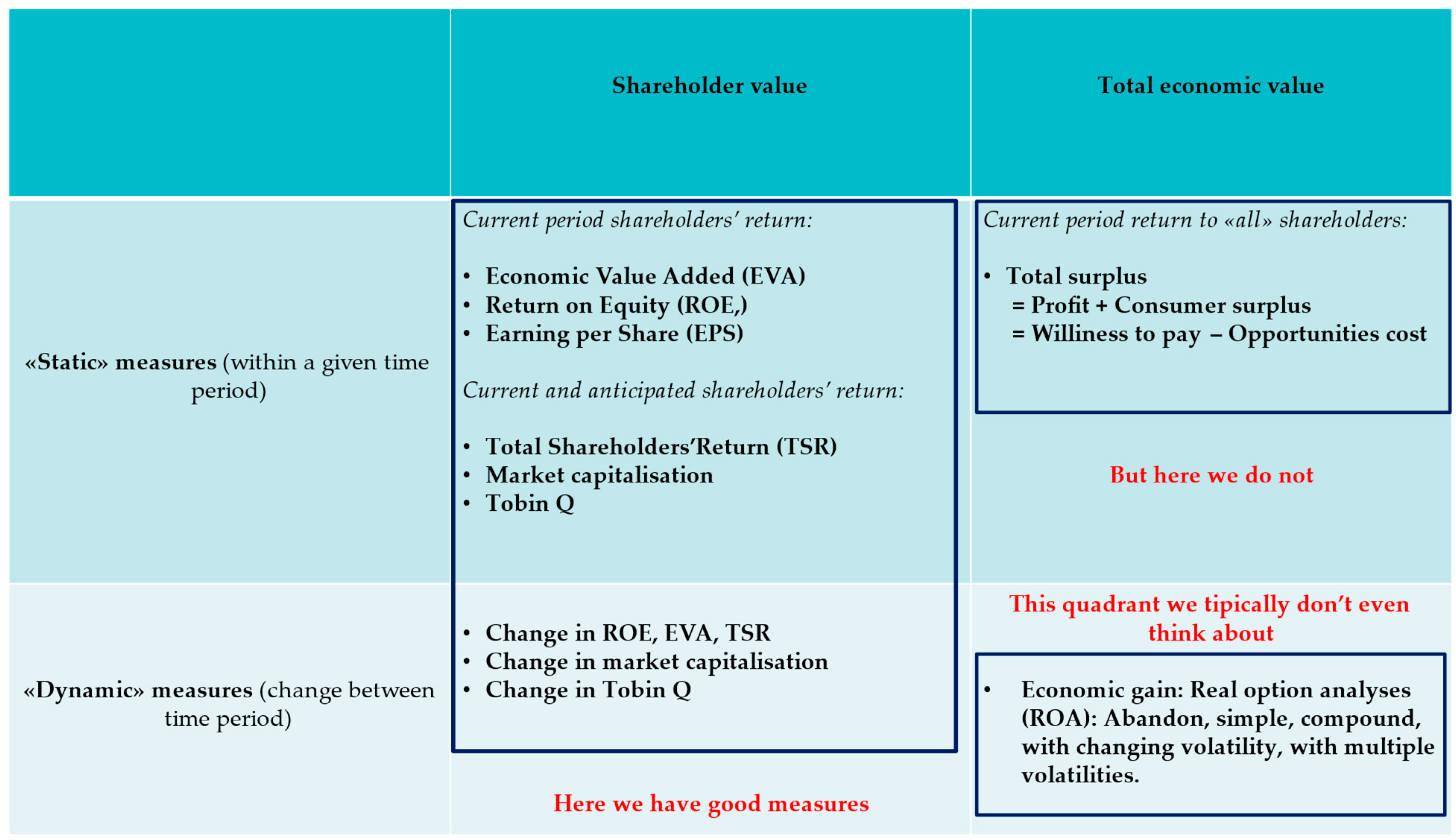

2.2. Exploring Types of Synergies and Valuation of Synergies in M&A Deals

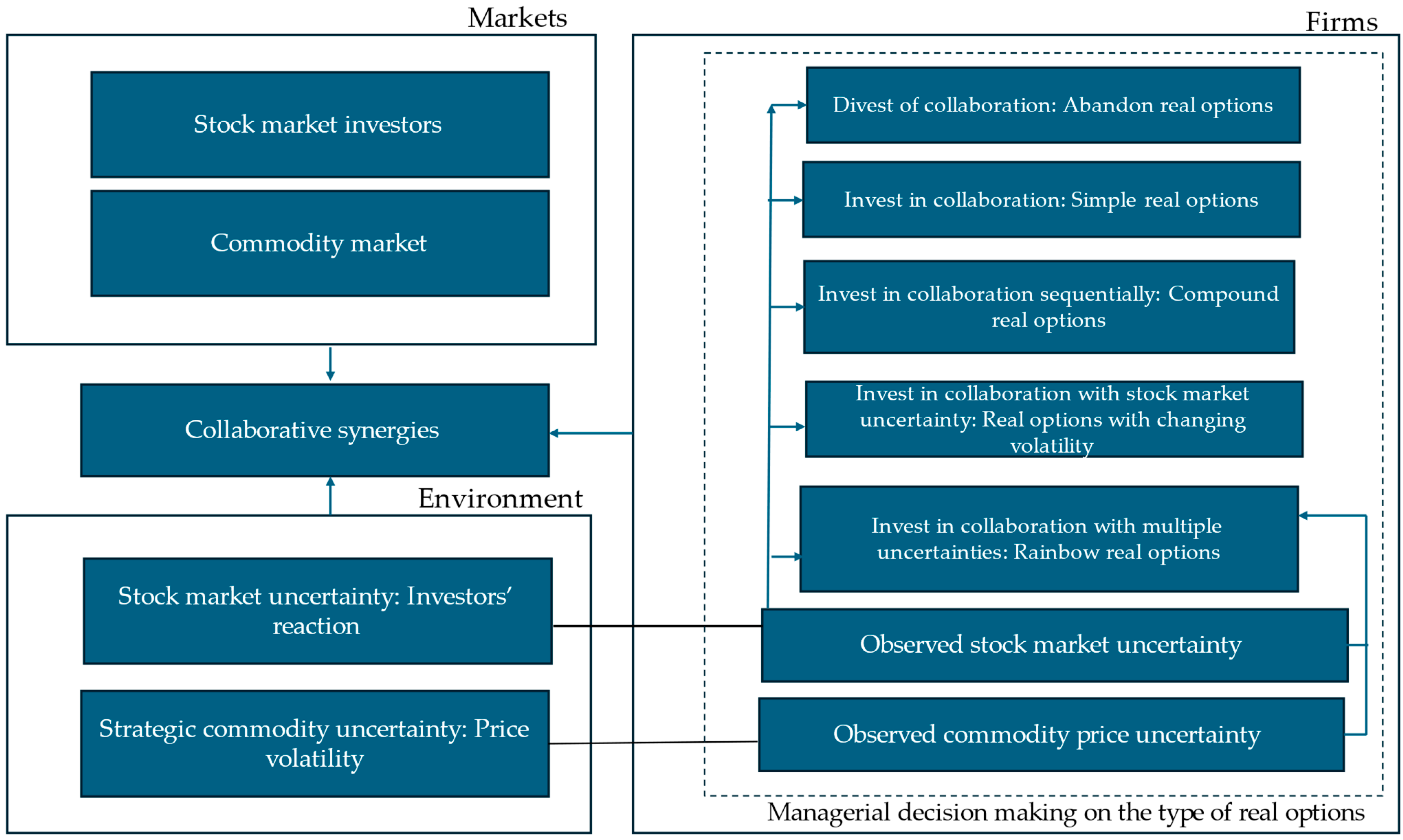

2.3. Developing a More Realistic Synergies Valuation Model: Enhancing Rainbow Real Options Application

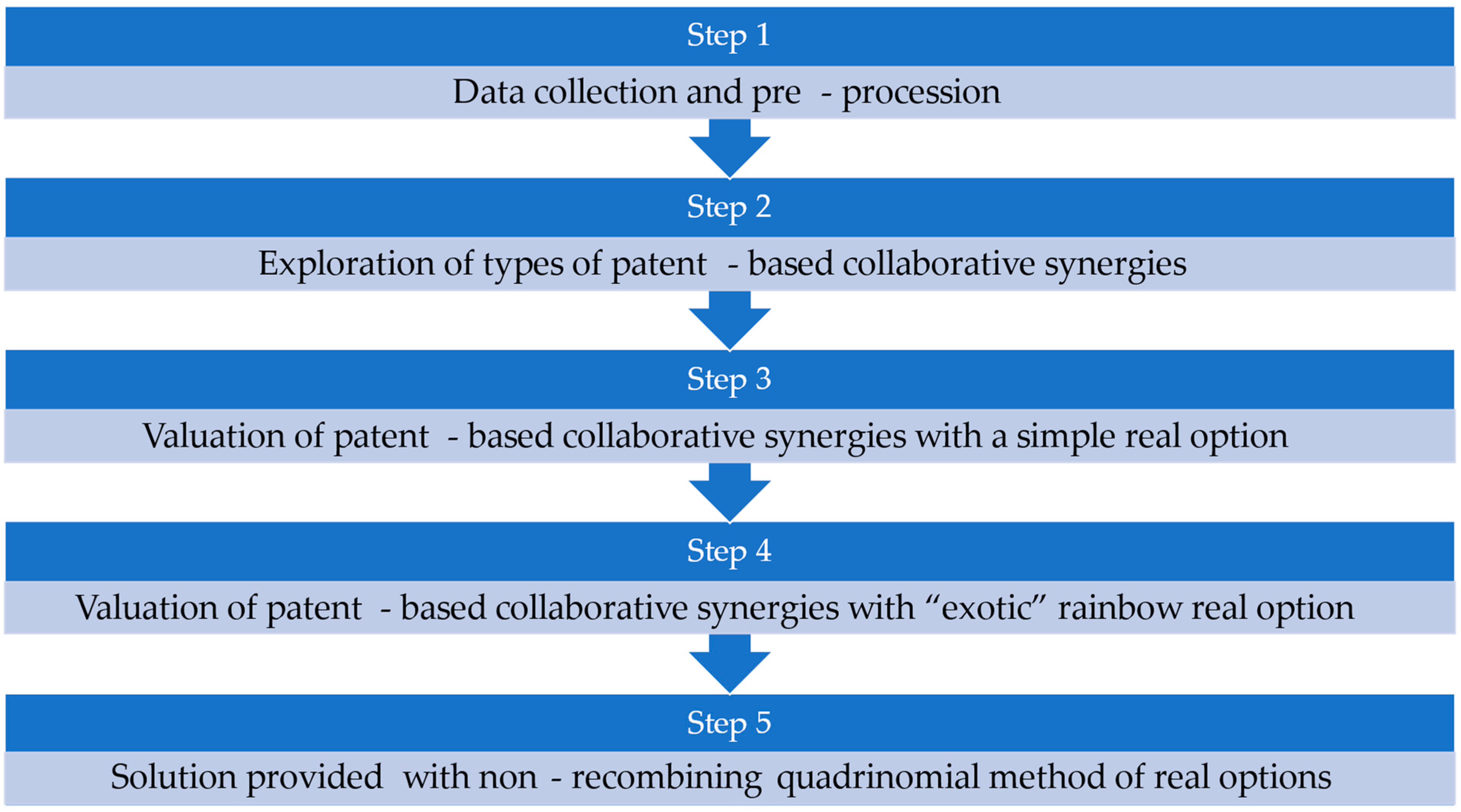

3. Methods

4. Case Study: Amazon’s Acquisition of ZOOX—Data Analysis and Interpretation

5. Discussion

6. Conclusions, Contributions, Limitations, and Future Work

6.1. The Theoretical Contribution

6.2. The Managerial and Policy Implications

6.3. Limitations and Future Work

Funding

Data Availability Statement

Conflicts of Interest

References

- Aaldering, Lukas Jan, Jens Leker, and Chie Hoon Song. 2019. Competition or collaboration?—Analysis of technological knowledge ecosystem within the field of alternative powertrain systems: A patent-based approach. Journal of Cleaner Production 212: 362–71. [Google Scholar] [CrossRef]

- Alvarez, Sharon, Nicolai Foss, William Hesterly, Kun Liu, Gideon Markman, Jeffrey Reuer, Heli Wang, and Stav Fainshmidt. 2023. Unleashing the Power of Property Rights: Exploring New Frontiers in Management Research. Journal of Management Studies. Available online: https://onlinelibrary.wiley.com/pb-assets/assets/14676486/JMS%20Call%20for%20Papers%20Property%20Rights%20Theory-1686756055077.pdf (accessed on 7 March 2024).

- Amazon.com. 2020. We’re Acquiring Zoox to Help Bring Their Vision of Autonomous Ride-Hailing to Reality. Available online: https://www.aboutamazon.com/news/company-news/were-acquiring-zoox-to-help-bring-their-vision-of-autonomous-ride-hailing-to-reality (accessed on 28 August 2023).

- Anderson, Edward G., Hemant K. Bhargava, Jonas Boehm, and Geoffrey Parker. 2022. Electric Vehicles Are a Platform Business: What Firms Need to Know. California Management Review 64: 135–54. [Google Scholar] [CrossRef]

- Anton, James, Hillary Greene, and Dennis Ya. 2006. Policy Implications of Weak Patent Rights. Innovation Policy and the Economy 6: 1–16. [Google Scholar] [CrossRef]

- Araya, Natalia, Yendery Ramírez, Andrzej Kraslawski, and Luis A. Cisternas. 2021. Feasibility of re-processing mine tailings to obtain critical raw materials using real options analysis. Journal of Environmental Management 284: 112060. [Google Scholar] [CrossRef] [PubMed]

- Azevedo, Alcino, and Dean Paxson. 2007. The Combined Effect of Market, Technical and Technological Uncertainties on New Technology Adoptions. Paper presented at 11th Annual Real Options Conference, Berkeley, CA, USA, June 6–9. [Google Scholar]

- Banerjee, Arindam. 2021. Amazon’s Acquisition of Souq.com: Synergies in the GCC Region. Journal of International Business Education 16: 1–8. [Google Scholar]

- Barney, Jay B. 1991. Firm resources and sustained competitive advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Bianconi, Marcelo, and Chih Ming Tan. 2019. Evaluating the instantaneous and medium-run impact of mergers and acquisitions on firm values. International Review of Economics and Finance 59: 71–87. [Google Scholar] [CrossRef]

- Black, Fischer, and Myron Scholes. 1973. The Pricing of Options and Corporate Liabilities. Journal of Political Economy 81: 637–54. [Google Scholar] [CrossRef]

- Boen, Lynn. 2020. European rainbow option values under the two-asset Merton jump-diffusion mode. Journal of Computational and Applied Mathematics 364: 112344. [Google Scholar] [CrossRef]

- Bogdan, Boris, and Ralph Villiger. 2007. Valuation in Life Sciences: A Practical Guide. Berlin/Heidelberg: Springer. Available online: https://link.springer.com/book/ (accessed on 9 January 2024).

- Boldrin, Michele, and David K. Levine. 2013. The Case against Patents. Journal of Economic Perspective 27: 3–22. [Google Scholar] [CrossRef]

- Boyle, Phelim P. 1993. New life forms on the options landscape. Journal of Financial Engineering 2: 217–52. [Google Scholar]

- Brach, M. 2003. Real Options in Practice. Hoboken: John Wiley & Sons, Inc. [Google Scholar]

- Brealey, Richard, Stewart Myers, and Franklin Allen. 2003. Principles of Corporate Finance, 7th ed. New York City: McGraw-Hill Companies, Inc. [Google Scholar]

- Cappelli, Riccardo, Marco Corsino, Keld Laursen, and Salvatore Torris. 2023. Technological competition and patent strategy: Protecting innovation, preempting rivals, and defending the freedom to operate. Research Policy 52: 104785. [Google Scholar] [CrossRef]

- Chelniciuc, Adelina. 2013. Hostile Takeover or Strategic Partnership? The KPI Institute. Available online: https://www.performancemagazine.org/hostile-takeover-or-strategic-partnership/ (accessed on 3 January 2024).

- Chi, Tailan, Li Jing, Trigeorgis G. Lenos, and Tsekrekos E. Andrianos. 2019. Real options theory in international business. Journal of International Business Studies 50: 525–53. [Google Scholar] [CrossRef]

- Cho, Joon Hyung, and So Young Sohn. 2018. A novel decomposition analysis of green patent applications for the evaluation of R&D efforts to reduce CO2 emissions from fossil fuel energy consumption. Journal of Cleaner Production 193: 290–99. [Google Scholar]

- Christensen, Thomas Budde. 2011. Modularised eco-innovation in the auto industry. Journal of Cleaner Production 19: 212–20. [Google Scholar] [CrossRef]

- Columbus, Louis. 2020. Using Patent Analytics to See Why Amazon Bought Zoox, Forbes. Available online: https://www.forbes.com/sites/louiscolumbus/2020/07/12/using-patent-analytics-to-see-why-amazon-bought-zoox/?sh=31f6d6da5ab6 (accessed on 27 August 2023).

- CompaniesMarketcap.com. 2023. The Market Capitalization of Amazon. Available online: https://companiesmarketcap.com/amazon/marketcap/ (accessed on 10 August 2023).

- Copeland, Thomas E. 1998. Making Real Options real. The McKinsey Quarterly, June 1, 128–41. [Google Scholar]

- Damodaran, Aswath. 2002. Investment Valuation: Tools and Techniques for Determining the Value of Any Asset, 2nd ed.Hoboken: John Wiley and Sons. [Google Scholar]

- Čirjevskis, Andrejs. 2021a. Measuring Synergies of Banks’ Cross-Border Mergers by Real Options: Case Study of Luminor Group AB. Journal of Risk and Financial Management 14: 403. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2021b. Value Maximizing Decisions in the Real Estate Market: Real Options Valuation Approach. Journal of Risk and Financial Management 14: 278. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2022. Valuing Collaborative Synergies with Real Options Application: From Dynamic Political Capabilities Perspective. Journal of Risk and Financial Management 15: 281. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2023a. Measuring Collaborative Synergies with Advanced Real Options: MNEs’ Sequential Acquisitions of International Ventures. Journal of Risk and Financial Management 16: 11. [Google Scholar] [CrossRef]

- Čirjevskis, Andrejs. 2023b. Measuring dynamic capabilities-based synergies using real options in M&A deals. International Journal of Applied Management Sciences 15: 73–85. [Google Scholar]

- Damodaran, Aswath. 2005. The Promise and Peril of Real Options. New York: Stern School of Business. Available online: https://archive.nyu.edu/handle/2451/26802 (accessed on 27 August 2023).

- Darabshaw, Sohrab. 2023. Experts Anticipate Long-Term Volatility in the Lithium Market. Available online: https://agmetalminer.com/2023/05/25/lithium-battery-market-volatility/ (accessed on 18 August 2023).

- Denicolò, Vincenzo, and Luigi Alberto Franzoni. 2004. The contract theory of patents. International Review of Law and Economics 23: 365–80. [Google Scholar] [CrossRef]

- Dockendorf, Jörg. 2010. Real Rainbow Options in Commodity Applications Valuing Multi-Factor Output Options under Uncertainty, 247. Available online: https://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.538472 (accessed on 27 August 2023).

- Dohse, Dirk, Rajeev K. Goel, and James W. Saunoris. 2023. Patenting uncertainty and its impact on innovation: Evidence from the United States. The Journal of Technology Transfer 48: 1839–59. [Google Scholar] [CrossRef]

- Driouchi, Tarik, Lenos Trigeorgis, and Raymond H. Y. So. 2020. Individual antecedents of real options appraisal: The role of national culture and ambiguity. European Journal of Operational Research 286: 1018–32. [Google Scholar] [CrossRef]

- Duch-Brown, Néstor, and María Teresa Costa-Campi. 2015. The diffusion of patented oil and gas technology with environmental uses: A forward patent citation analysis. Energy Policy 83: 267–76. [Google Scholar] [CrossRef]

- Dunis, Christian L., and Til Klein. 2005. Analyzing mergers and acquisitions in European financial services: An application of real options. European Journal of Finance 11: 339–55. [Google Scholar] [CrossRef]

- Eisenhardt, Kathleen M., and Melissa E. Graebner. 2007. Theory building from cases: Opportunities and challenges. Academy of Management Journal 50: 25–32. [Google Scholar] [CrossRef]

- Feldman, Emilie R., and Exequiel Hernandez. 2022. Synergy in Mergers and Acquisitions: Typology, Lifecycles, and Value. Academy of Management Review 47: 549–78. [Google Scholar] [CrossRef]

- Finbox. 2023. Available online: https://finbox.com/NASDAQGS:AMZN/explorer/ev_to_ebitda_ltm/ (accessed on 10 August 2023).

- Finerva. 2022. Reports: Tech, Trends and Valuation. Available online: https://finerva.com/report/self-driving-smart-vehicles-2022-valuation-multiples/ (accessed on 10 August 2023).

- Frąckiewiczin, Marcin. 2023. Zoox—A Robotics Company that Creates Autonomous Mobility with AI. Artificial Intelligence, Newson 30 April 2023. Available online: https://ts2.space/en/zoox-a-robotics-company-that-creates-autonomous-mobility-with-ai/ (accessed on 14 August 2023).

- Garcia-Castro, Roberto, and Ruth V. Aguilera. 2015, Incremental value creation and appropriation in a world with multiple stakeholders. Strategic Management Journal 36: 137–47.

- Grimpe, Christoph, Katrin Hussinger, and Wolfgang Sofka. 2023. Reaching beyond the acquirer-target dyad in M&A—Linkages to external knowledge sources and target firm valuation. Long Range Planning 56: 102321. [Google Scholar]

- Hankookandcompany.com. 2023. How Amazon Became an “Empire”. Hankook & Company Official Website. Available online: https://www.hankookandcompany.com/en/innovation/innovation-136.do (accessed on 15 August 2023).

- Hernandez, Exequiel, and J. Myles Shaver. 2019. Network Synergy. Administrative Science Quarterly 64: 171–202. [Google Scholar] [CrossRef]

- Hull, John C. 2012. Options, Futures, and Other Derivatives, 8th ed. Upper Saddle River: Prentice-Hall, p. 432. [Google Scholar]

- Iazzolino, Gianpaolo, and Giuseppe Migliano. 2015. The Valuation of a Patent through the Real Options Approach: A Tutorial. Journal of Business Valuation and Economic Loss Analysis 10: 99–116. [Google Scholar] [CrossRef]

- Jacobides, Michael M., Carmelo Cennamo, and Annabelle Gawer. 2018. Towards a Theory of Ecosystems. Strategic Management Journal 39: 2255–76. [Google Scholar] [CrossRef]

- Kasly, Krupa, and K. Bhagyalakshmi. 2020. Amazon acquires Zoox: A driveway for the future? Amit Research Centers Headquarters. Bangalore 320-0249-8: 1–4. [Google Scholar]

- Klein, Michael A. 2022. The reward and contract theories of patents in a model of endogenous growth. European Economic Review 147: 104178. [Google Scholar] [CrossRef]

- Kodukula, Prasad, and Chandra Papudesu. 2006. Project Valuation Using Real Options: A Practitioner’s Guide. Fort Lauderdale: Ross Publishing, Inc. [Google Scholar]

- Lambrecht, Bart M. 2017. Real Option in Finance. Journal of Banking and Finance 81: 166–71. [Google Scholar] [CrossRef]

- Lieberman, Marvin B., Natarajan Balasubramanian, and Garcia-Castro Roberto. 2018. Toward a dynamic notion of value creation and appropriation in firms: The concept and measurement of economic gain. Strategic Management Journal 39: 1546–72. [Google Scholar] [CrossRef]

- Lieberman, Marvin B., Roberto Garcia-Castro, and Natarajan Balasubramanian. 2020. Measuring Value Creation and Appropriation in Firms: The VCA Model | SMJ Video Abstract. Available online: https://www.youtube.com/watch?v=e0_YnddbMkI (accessed on 5 April 2024).

- Liu, Weiwei, Yifan Song, and Kexin Bi. 2021. Exploring the patent collaboration network of China’s wind energy industry: A study based on patent data from CNIPA. Renewable and Sustainable Energy Reviews 144: 110989. [Google Scholar] [CrossRef]

- Macrotrends. 2023. Available online: https://www.macrotrends.net/stocks/charts/AMZN/amazon/ebitda (accessed on 10 August 2023).

- Magney, Katelyn. 2020. The Role of Big Tech in AV Development: What Amazon, Apple, Google, and the Like are Doing to Advance the Industry. VSIabs. Available online: https://static1.squarespace.com/static/617081e9573c6732a21e3541/t/617808131995ec36b0198251/1635256339730/Tech+Giants+Whitepaper.pdf (accessed on 14 August 2023).

- MAGNiTT. 2017. A Different Story from the Middle East: Entrepreneurs Building an Arab Tech Economy. Available online: https://magnitt.com/news/different-story-middle-east-entrepreneurs-building-arab-tech-economy-20010 (accessed on 12 January 2023).

- Manzetti, Sergio, and Florin Mariasiu. 2015. Electric vehicle battery technologies: From present state to future systems. Renewable and Sustainable Energy Reviews 51: 1004–12. [Google Scholar] [CrossRef]

- Markman, Gideon D., Maritza I. Espina, and Phillip H. Phan. 2004. Patents as Surrogates for Inimitable and Non-Substitutable Resources. Journal of Management 30: 529–44. [Google Scholar] [CrossRef]

- Matousek, Mark. 2020. Jeff Bezos Bought Robotaxi Startup Zoox for $1.2 Billion—After Agreeing to This One Key Term, Says co-Founder. Available online: https://www.businessinsider.com/zoox-amazon-jeff-bezos-jesse-levinson-2020-12 (accessed on 8 March 2024).

- Mohanty, Suchita. 2022. Amazon to Acquire One Medical: A Strategy to Reinvent Health Care? Banglore: Amity Research Centers Headquarters, 322-0292-1. pp. 1–12. [Google Scholar]

- Mun, Johnnathan. 2002. Real Options Analysis, Tools and Techniques for Valuing Strategic Investments and Decisions. Hoboken: John Wiley and Sons. [Google Scholar]

- Mun, Johnnathan. 2003. Real Options Analysis Course: Business Cases and Software Applications. Hoboken: John Wiley and Sons. [Google Scholar]

- Noorizadeh, Abdollah, Timo Kuosmanen, and Antti Peltokorpi. 2021. Effective purchasing reallocation to suppliers: Insights from productivity dynamics and real options theory. International Journal of Production Economics 233: 108002. [Google Scholar] [CrossRef]

- OECD. 2004. Patents and Innovation: Trends and Policy Challenges. Available online: https://www.oecd.org/science/inno/24508541.pdf (accessed on 5 April 2024).

- Orlani, Raffaele, and Maurizio Sobrero. 2008. Uncertainty and the market valuation of R&D within a real option logic. Strategic Management Journal 29: 343–61. [Google Scholar]

- Pagani, Margherita, Milan Miric, and Omar El Sawy. 2021. The Octopus Effect: When and Who Platform Companies Acquire? Available online: https://blogs.lse.ac.uk/businessreview/2021/06/24/the-octopus-effect-when-and-who-platform-companies-acquire/ (accessed on 27 August 2023).

- Peeyush, Karnani, and Rehm Werner. 2023. The Times for Multiples: Five Situations When Multiples Need More than a Second Look. McKinsey & Company. Strategy & Corporate Finance. Available online: https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-times-for-multiples-five-situations-when-multiples-need-more-than-a-second-look#/ (accessed on 23 September 2023).

- Peng, Bin, and Fei Peng. 2009, Pricing Rainbow Asian Options. Systems Engineering—Theory & Practice 29: 76–83.

- Peteraf, Margaret A. 1993. The cornerstones of competitive advantage: A resource-based view. Strategic Management Journal 14: 179–91. [Google Scholar] [CrossRef]

- Porter, Jon. 2020. Amazon Is Acquiring a Self-Driving Car Startup Zoox. Available online: https://www.theverge.com/2020/6/26/21304111/amazon-zoox-acquisition-self-driving-car-autonomous-vehicles-startup-robotaxi-bi-directional-vehicle (accessed on 8 March 2024).

- Rashid, Yasir, Ammar Rashid, Muhammad Akib Warraich, Sana Sameen Sabir, and Ansar Waseem. 2019. Case Study Method: A Step-by-Step Guide for Business Researchers. International Journal of Qualitative Methods 18: 1–13. [Google Scholar] [CrossRef]

- Rubinstein, Mark. 1991. Somewhere over the Rainbow. Risk 4: 63–66. [Google Scholar]

- Schleich, Joachim, Rainer Walz, and Mario Ragwitz. 2017. Effects of policies on patenting in wind-power technologies. Energy Policy 108: 684–95. [Google Scholar] [CrossRef]

- Schwarth, Eduardo S., and Lenos Trigeorgis. 2001. Real Options and Investment Under Uncertainty: An Overview. Cambridge, MA and London: The MIT Press, p. 881. [Google Scholar]

- Seawright, Jason, and John Gerring. 2008. Case-Selection Techniques in Case Study Research: A Menu of Qualitative and Quantitative Options. Political Research Quarterly 61: 294–308. [Google Scholar] [CrossRef]

- Sharypin, Denis, Daniil Pitirimov, Anton Lipovskiy, Alina Racu, and Evgeny Semakin. 2020. Quintessentially Nickel. Nornickel. Available online: https://nornickel.com/upload/iblock/c4d/2020_12_01_Quintessentially_Ni.pdf (accessed on 27 August 2023).

- Shaver, J. Myles. 2006. A Paradox of Synergy: Contagion and Capacity Effects in Mergers and Acquisitions. Academy of Management Review 31: 962–76. [Google Scholar] [CrossRef]

- Siggelkow, Nicolaj. 2007. Persuasion with case studies. Academy of Management Journal 50: 20–24. [Google Scholar] [CrossRef]

- Silverman, Brian S. 1999. Technological resources and the direction of corporate diversification: Toward an Integration of the Resource-Based View and Transaction Cost Economics. Management Science 45: 1025–76. [Google Scholar] [CrossRef]

- Siripongvakin, Jatupol, and Nathee Athigakunagorn. 2020. Infrastructure project investment decision timing using a real options analysis framework with Rainbow option. ASCE-ASME Journal of Risk and Uncertainty in Engineering Systems, Part A: Civil Engineering 6: 04020036. [Google Scholar] [CrossRef]

- Stone, Louise. 2020. Amazon Makes Major Self-Driving Move, Acquires Zoox. Available online: https://aibusiness.com/companies/amazon-makes-major-self-driving-move-acquires-zoox (accessed on 8 March 2024).

- Tarsalewska, Monika. 2021. Ownership and cross-border patent sales in M&A transactions. Finance Research Letters 40: 101677. [Google Scholar]

- Teece, David J., Asta Pundziene, Sohvi Heaton, and Maaja Vadi. 2022. Managing Multi-Sided Platforms: Platform Origins and Go-to-Market Strategy. California Management Review 64: 5–19. [Google Scholar] [CrossRef]

- Teng, Tao. 2019. Application of Real Option Theory to Mergers and Acquisitions (M&A) in the Pharmaceutical Industry. IOP Conference Series: Materials Science and Engineering 677: 022119. [Google Scholar]

- Trigeorgis, Lenos, and Andrianos E. Tsekrekos. 2018. Real Options in Operations Research: A Review. European Journal of Operational Research 270: 1–24. [Google Scholar] [CrossRef]

- Trigeorgis, Lenos, and Jeffrey J. Reuer. 2017. Real options theory in strategic management. Strategic Management Journal 38: 42–63. [Google Scholar] [CrossRef]

- Trigeorgis, Lenos, and Scott P Mason. 1987. Valuing Managerial Flexibility. Midland. Corporate Finance Journal 5: 14–21. [Google Scholar]

- Tsai, Yu-Ching, Yu-Fen Huang, and Jing-Tang Yang. 2016. Strategies for the development of offshore wind technology for far-east countries—A point of view from patent analysis. Renewable and Sustainable Energy Reviews 60: 182–94. [Google Scholar] [CrossRef]

- US Department of the Treasury. 2023. Daily Treasury Par Yield Curve Rates. Available online: https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2020 (accessed on 10 August 2023).

- VentureBeat. 2020. Amazon Acquires Autonomous Vehicle Startup Zoox. Available online: https://venturebeat.com/business/amazon-acquires-autonomous-vehicle-startup-zoox/ (accessed on 14 August 2023).

- V-Lab. 2023a. Available online: https://vlab.stern.nyu.edu/volatility (accessed on 10 August 2023).

- V-Lab. 2023b. Available online: https://vlab.stern.nyu.edu/volatility/VOL.AMZN%3AUS-R.GARCH (accessed on 10 August 2023).

- Williamson, Oliver E. 1991. Comparative economic organization: The analysis of discrete structural alternatives. Administrative Science Quarterly 36: 269–96. [Google Scholar] [CrossRef]

- Yin, Conghui, Huaying Gu, and Shanjie Zhang. 2020. Measuring technological collaborations on carbon capture and storage based on patents: A social network analysis approach. Journal of Cleaner Production 274: 122867. [Google Scholar] [CrossRef]

- Yin, Robert K. 2009. Case study research: Design and methods. In Applied Social Research Series, 4th ed. Thousand Oaks, CA: Sage Publications, vol. 5. [Google Scholar]

- Yu, Allen K. 2007. Why It Might Be Time to Eliminate Genomic patents, Together with the Natural Extracts Doctrine Supporting Such Patents. IDEA: The Law Review of the Franklin Pierce Center for Intellectual Property, pp. 659–755. Available online: https://ipmall.law.unh.Jedu/sites/default/files/hosted_resources/IDEA/idea-vol47-no5-yu.pdf (accessed on 3 January 2024).

| Financial Options Variables | Real Option Variables | Sources of Data |

|---|---|---|

| Share price | The cumulated market value of collaborative business partners before the announced deal terms, excluding the week of an announcement (four-week average). | CompaniesMarketcap.com (accessed on 10 August 2023) Forbes.com (accessed on 27 August 2023) |

| Strike price | The hypothetical future market value of the separated entities forecast by the DCF or EV-based multiples. | Finbox.com (accessed on 10 August 2023) Macrotrends.net (accessed on 10 August 2023 Finerva.com (accessed 10 August 2023) |

| Standard deviation | The annualized standard deviation of stock within one week after the announcement. | https://vlab.stern.nyu.edu/docs/volatility/GARCH (accessed on 10 August 2023), own calculation |

| Risk-free rate | Domestic three-month rate with the leading collaborated partner. | US Department of the Treasury, https://home.treasury.gov (accessed on 10 August 2023) |

| Time to maturity | One year or based on the expectation of the management to obtain collaborative synergy. | The synergy life cycle. |

| Patent-Based Synergies | Definition of Synergies | Antecedents of Synergies: Amazon’s Acquisition of Zoox | Duration of Synergy Gains | Timing of Initial Synergy Realization | Results |

|---|---|---|---|---|---|

| Relational synergies | Synergies are based on partners’ patents and technological competencies. | Zoox’s patent portfolio is particularly strong in the areas of driving assistance, signaling, and cruise control, three areas Amazon needed to strengthen along with reinforcement-based machine learning techniques to support autonomous vehicles (Columbus 2020). | Medium, requiring continued investment | Medium to long | Autonomous ride-hailing services and logistics are two markets Amazon looks to expand into quickly with Zoox’s expertise. (Columbus 2020). By acquiring Zoox, Amazon will significantly strengthen its position in autonomous driving technology patents obtaining patents-based relational synergies. |

| Network synergies | Synergies are based on acquiring a target’s platform, network, and ecosystem. | Zoox has 154 patent families, with many of them reflecting the startup’s expertise with reinforcement machine learning (Columbus 2020) and the development of its EVs platform. | Short | Immediate | As a result of network synergies because of the acquisition, Amazon’s competitive impact on autonomous vehicles nearly tripled (Columbus 2020). |

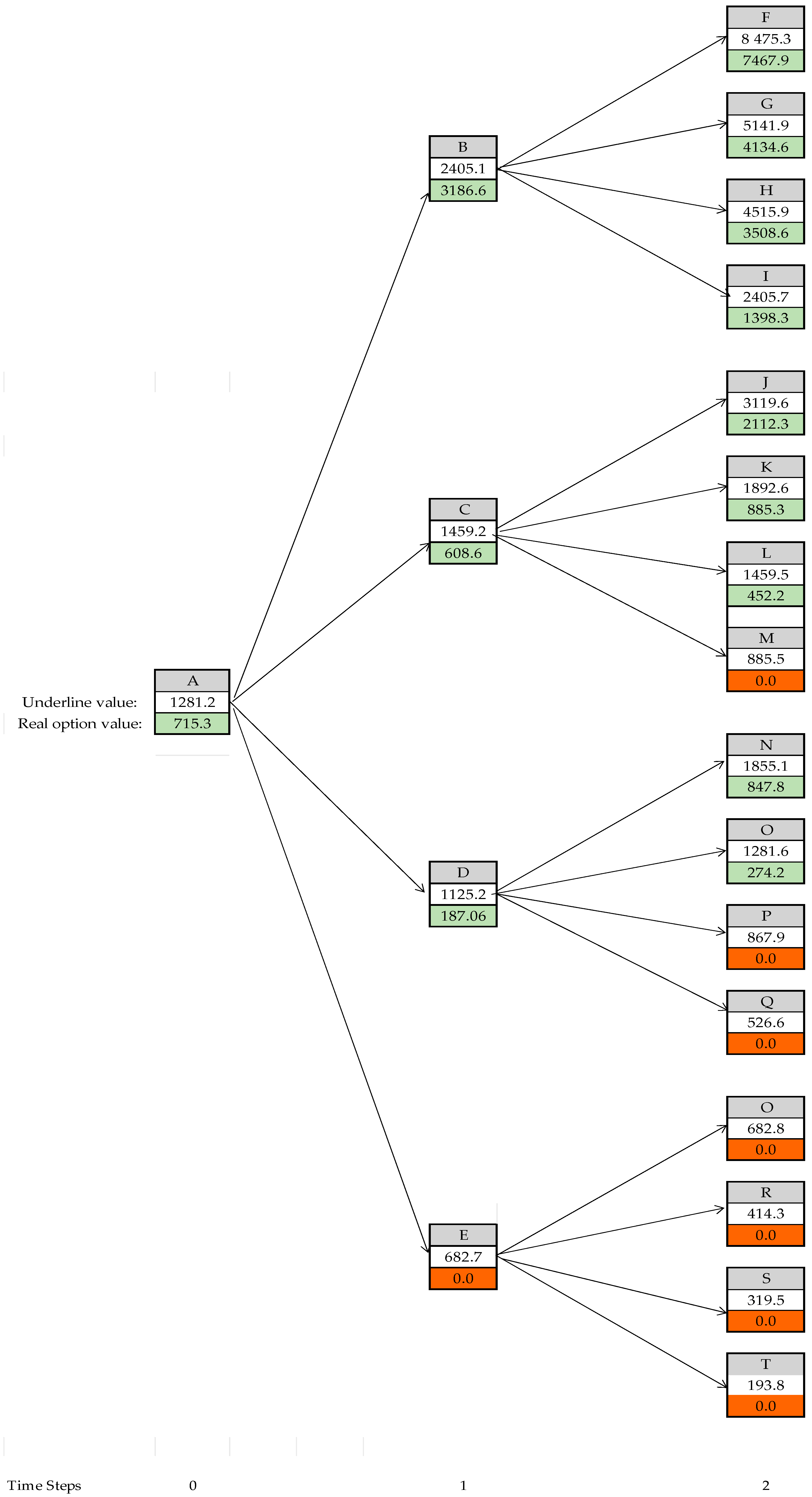

| Parameters of Financial Options | The Parameters of Simple and Rainbow (Two-Colors) Real Options, Data |

|---|---|

| Stock price (So) | The cumulated market values of Amazon and Zoox as the separated entities (four-week average) before the announcement of the acquisition. Amazon’s market capitalization on 29 May 2023 was USD 1220B, and on 26 June 2023, it was 1340B, thus the average market value of Amazon was USD 1280B (CompaniesMarketcap.com 2023). According to the Financial Times, Amazon paid USD 1.2B for Zoox (Columbus 2020). Thus, the stock price was USD 1281.2 bn. |

| The strike price (K) | The hypothetical future market value of Amazon as a separate entity is forecast by the EV/EBITDA multiples. The ev/EBITDA multiple for Amazon.com in the twelve months of 2019 was 27.7×, (Finbox 2023). EBITDA in 2019 was USD 36.330B (Macrotrends 2023); therefore, Amazon’s EV was USD 1006.34 bn. The hypothetical future market value of the separate entities is forecast by the EV/EBITDA multiples for Amazon and EV/Revenues for ZOOX in 2020. The median revenue multiple for self-driving and smart vehicle companies in the second quarter of 2020 was 2.0× (Finerva 2022). The annual revenue of Zoox varies between USD 100 M and USD 500 M. Thus, the hypothetical future market value of Zoox equals USD 500 M × 2.0 = 1.000 M or 1.0 bn. Thereby, the sum of hypothetical future market values as separated entities (strike price) was USD 1006.34 bn plus USD 1.0 bn equals USD 1007.34 bn. |

| Stock volatility of Amazon within the first week after the announcement of the acquisition of Zoox (σ1) | Amazon’s historical volatilities within the first week after the announcement of the partial acquisition of Zoox on 26 July 2020 was 38% (V-Lab 2023b). |

| Price volatility of a strategically important commodity for self-driving car production—the nickel spot (σ2) | The volatility of nickel price has remained at 25%, and this unprecedented turbulence has continued to reshape the nickel market throughout 2020 (Sharypin et al. 2020, p. 2). |

| Risk-free rate (r1) | Domestic US three-month rate in 2020 was 0.14% on 26 June 2020 (US Department of the Treasury 2023). |

| Time to maturity (T) | Duration (T) was the period from 2020 to 2020 (two years) when the volatility of nickel spiked upward by 35.8% (V-Lab 2023b), resulting in volatilities of Nickel of 35.8% in 2023 due to the Russian invasion of Ukraine. |

| Time increment (δt) | One-year time intervals for two years to account for the change in the up and down factors of the quadruple lattice-based real options method. |

| Simple Real Options Valuation with the Black–Scholes Option Pricing Model (BSOPM) | |

|---|---|

| Stock price (So): Cumulative average capitalization of Amazon and Zoox before announcement on 29th of May till 26th of June 2020 (in USD bn) | 1281.20 |

| Strike price (K): Cumulative theoretical market value of two separated entities without merger after one year in 2021 (in USD bn) | 1007.34 |

| The risk-free rate of return (Rf) on 26 June 2020 in the USA (%) | 0.14 |

| Assumption on the time to expiration (T) (in years) | 2.0 |

| The volatility of the stock price of Amazon (σ) within one week after the announcement of a deal during the period from 26th of June to 3rd of July of 2020 (%) | 38.0 |

| d1 = [(ln (So/X) + risk-free rate + variance/2) × T]/[ (square root of variance) × (square root of T)] | 0.721 |

| d2 = d1 − (square root of variance) × (square root of T) | 0.184 |

| Value of the call option (C) = Synergies (USD bn) | 404.1 |

| Rainbow Real Options Parameters and Data | |

|---|---|

| Time increment: ΔT (years) | 1.00 |

| First Up factor: | 1.462 |

| First Down factor: | 0.684 |

| First risk-neutral probability: | 0.408 |

| Second Up factor: | 1.284 |

| Second Down factor: | 0.779 |

| Second risk-neutral probability: | 0.441 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Čirjevskis, A. Valuation of Patent-Based Collaborative Synergies under Strategic Settings with Multiple Uncertainties: Rainbow Real Options Approach. J. Risk Financial Manag. 2024, 17, 157. https://doi.org/10.3390/jrfm17040157

Čirjevskis A. Valuation of Patent-Based Collaborative Synergies under Strategic Settings with Multiple Uncertainties: Rainbow Real Options Approach. Journal of Risk and Financial Management. 2024; 17(4):157. https://doi.org/10.3390/jrfm17040157

Chicago/Turabian StyleČirjevskis, Andrejs. 2024. "Valuation of Patent-Based Collaborative Synergies under Strategic Settings with Multiple Uncertainties: Rainbow Real Options Approach" Journal of Risk and Financial Management 17, no. 4: 157. https://doi.org/10.3390/jrfm17040157

APA StyleČirjevskis, A. (2024). Valuation of Patent-Based Collaborative Synergies under Strategic Settings with Multiple Uncertainties: Rainbow Real Options Approach. Journal of Risk and Financial Management, 17(4), 157. https://doi.org/10.3390/jrfm17040157