Abstract

Over the last few decades, remarkable technical advancements, including artificial intelligence, machine learning, big data, blockchain, cloud computing, and the Internet of Things, have emerged. These tools have the ability to change the accounting process. This study aims to conduct a systematic literature review on using the Internet of Things (IoT), blockchain, and eXtensible Business Reporting Language (XBRL) in a single accounting information system (AIS) to enhance the quality of digital financial reports. This paper employs a systematic literature review (SLR) methodology, specifically, by adopting the widely accepted PRISMA technique. The final sample of this study included 309 related studies from 2013 to 2023. Our findings highlight the lack of literature related to the integration of these three types of technologies within a unified AIS. This study is extremely significant because it proposes a new research stream that explores the possibility of integrating IoT, blockchain, and XBRL in a single accounting system, yielding a plethora of benefits to the accounting field. However, the potential benefits of such an integration are evident, including enhanced transparency, real-time reporting capabilities, and improved data security. Our paper’s main contribution is that it is the first paper, to the best of our knowledge, to explore the integration of these three technologies. We also identified important gaps in the research and pointed out ways for future research to somehow take a lead in exploring further how this integrated system is affecting accounting practices.

1. Introduction

The next wave of advanced technologies, including blockchain, IoT, and XBRL, provides transformative potential concerning the radical transformation of traditional accounting information systems. Blockchain technology is one of the most important and novel technologies of the last few years (Peters and Panayi 2016; Pilkington 2016; Salah et al. 2019). Blockchain technology originated and was initiated by Nakamoto (2008). He used several linked blocks to establish a distributed, openly accessible, and cryptographically protected digital currency system. The system, which is known as Bitcoin, permits decentralized digital cash exchange between individuals. This overcomes the necessity for financial intermediaries while protecting transaction security. The Bitcoin blockchain is a new form of accounting database that records the transactions of digital currency into blocks. The blocks are put together in a linear sequence based on time and sent to a network (Fanning and Centers 2016; Salah et al. 2019; Yermack 2017).

Since 2009, blockchain has been evolving through three distinct stages: blockchain 1.0, 2.0, and 3.0 (Lu 2018; Swan 2015). Blockchain 1.0 mainly focused on cryptocurrencies such as Bitcoin, which were largely used for issuing, distributing, and conducting transactions of digital currency in capital markets (Peters and Panayi 2016; Demirkan et al. 2020). Blockchain 2.0 expanded its scope from currency to include economic, market, and financial applications and introduced the term smart contracts (Swan 2015). To extend the scope of trade beyond digital currency, the second generation of blockchain developed a novel application known as a smart contract (Swan 2015). This application enables the trading of a wide range of products. Smart contracts are computer programs that operate on blockchains that can independently verify, enforce, and execute the terms stated in contracts (Iansiti and Lakhani 2017; Zhang et al. 2016). Subsequently, blockchain 3.0 has progressed beyond its original use in currency and finance, with diverse applications in several areas such as digital identity, electoral systems, supply chains, culture, and art (Swan 2015).

Additionally, the Internet of Things (IoT) has been a critical driver of change in many industries, including accountancy (Chen et al. 2014). Essentially, the main way the IoT is revolutionizing accounting is by making normal things or devices connected to the internet (Zghaibeh 2023). This connectivity offers chances for new data gathering, analysis, and automation. Basically, the simple concept of IoT in accounting revolves around adding sensors and computational capabilities to various corporate assets and procedures (Muthulakshmi and Chitra 2022). These devices, being interconnected, are then capable of communicating with one another as well as with centralized systems for producing enormous amounts of data in real time (Nord et al. 2019; Song 2022; Valentinetti and Flores Muñoz 2021; Varriale et al. 2023). IoT has many possible uses in many different areas of accounting, including automating accounting activities, thus reducing human error and enhancing performance (Desyatnyuk et al. 2022); tracking and oversight of accounting procedures (Song 2022); efficient asset management and enhancing employee productivity (Karmańska 2021); and inventory tracking and management, resulting in improved supply chain processes (Jarašūnienė et al. 2023; Mashayekhy et al. 2022).

Furthermore, one of the top ten accounting technologies is eXtensible Business Reporting Language (XBRL), which has a clear edge over traditional Web-based disclosure in that it allows interactive data disclosure (Chen et al. 2021). XBRL is utilized by around 60 countries globally (Cormier et al. 2019). XBRL is a computer language established by XBRL International, a worldwide collaboration including more than 200 financial services, technology, and accounting organizations (Hodge et al. 2004). Within the XBRL framework, every individual financial data item is allocated a distinct and predetermined data tag. Data tags function as barcodes that identify the content and structure of the information (Blankespoor et al. 2014; Bonsón et al. 2009). The existing research on accounting information systems has reached an agreement that the implementation of XBRL disclosure will lead to the production of financial reports that are both updated and transparent (Alles and Piechocki 2012; Blankespoor et al. 2014; Bonsón et al. 2009; Dong et al. 2016; Pinsker and Li 2008; Wang and Gao 2012; Yoon et al. 2011; Zhang et al. 2019).

Although blockchain, IoT, and XBRL are independent technologies with their independent development timelines and specific applications, they offer complementary benefits and can be integrated into any accounting information system. All these different technologies at diversified levels can represent different stages of any accounting system: input, process, and output. IoT represents a means of input. In this case, sensors quantify and share data in real time. Concerning AISs, IoT devices offer real-time data concerning physical assets, levels of inventory, resource consumption, and environmental conditions (Roszkowska 2021; Haddud et al. 2017). This proper data collection in real time serves as a critical process for the preparation of accurate financial reports and fact-based decision-making (Valentinetti and Flores Muñoz 2021). Additionally, blockchain technology represents the level of the process. Blockchain provides a decentralized, immutable ledger that enhances the transparency, security, and traceability of financial transactions. Its application in AIS ensures that the information made available is both reliable and free from errors during the processing stage (Dai and Vasarhelyi 2017). Also, with blockchain and using smart contracts, many transactions can be processed automatically. Furthermore, XBRL represents the output stage. XBRL is a standard and uniform language to convey business and financial information electronically. It enhances the ability to produce standardized machine-readable reports (Wang and Gao 2012; Yoon et al. 2011; Zhang et al. 2019). XBRL would help immensely in the smooth and accurate exchange of financial information from the institutions to various entities and regulatory bodies.

This research is motivated by the need to update accounting systems because of technological advances. While the development of blockchain, IoT, and XBRL can be foreseen, how they can function jointly remains comparatively unclear. This review is intended to fill this gap by providing an integrated view of the current research and identifying pathways for effective implementation. Additionally, this paper was motivated by the need to provide a comprehensive and structured overview of the evolving landscape of blockchain, IoT, and XBRL integration in accounting information systems (AISs). This overview is most necessary for researchers as well as practitioners so that they become able to eliminate complexities and enable all the potential promised by these technologies.

The importance of this research lies in conducting a systematic literature review concerning the integration of blockchain, IoT, and XBRL into AISs. First, the systematic approach ensures a comprehensive and unbiased synthesis of the available research for improved clarity regarding the present state of knowledge. Additionally, a literature review synthesizes prior studies, expands the knowledge base, and identifies research gaps to advance a field of research (Paul and Criado 2020). Moreover, examining the previous appropriate literature is a crucial aspect of any academic project. A well-executed review establishes a solid basis for the progression of knowledge. It aids in formulating theories, addresses regions with abundant existing studies, and reveals areas requiring further research (Webster and Watson 2002). Consequently, this study aims to explore the current literature related to some of the new tools of information technology, namely, blockchain, IoT, and XBRL.

While advancements like artificial intelligence and big data have reshaped various industries, the impact on accounting practices through the combined application of blockchain, IoT, and XBRL remains under-explored. Therefore, this study contributes to the existing body of knowledge in many ways. Firstly, it provides an integrated and synthesized understanding of the currently fragmented literature on this emerging topic. By consolidating disparate studies and perspectives, this research offers a comprehensive overview that enhances theoretical and practical understanding. Additionally, it aims to offer a practical roadmap for practitioners who may consider the adoption of these technologies in their AIS. This guidance will be crucial for navigating the complexities and harnessing the full potential of blockchain, IoT, and XBRL in accounting. Moreover, this study identifies critical gaps in the current research landscape, highlighting areas that require further investigation. By proposing future research directions, it encourages continued exploration and innovation in the field, ultimately driving advancements that could reshape accounting practices. This multifaceted contribution not only bridges existing knowledge gaps but also paves the way for future technological integration in accounting.

The subsequent sections of this paper are organized as follows: Literature review methodology, the method used to conduct the literature review, discussion of the blockchain literature, discussion of the IoT literature, discussion of the XBRL literature, discussion of the literature related to the integration of these technologies, future research agenda, and conclusion.

2. Methodology

This study adopted a systematic literature review (SLR) methodology (Tranfield et al. 2003; Kraus et al. 2020; Massaro et al. 2016) to investigate the variables. The preferred reporting items for systematic reviews and meta-analyses (PRISMA) method, a well-established framework for performing systematic literature reviews, as introduced by Moher et al. (2009), was adopted. The objective of a systematic review is to collect data on a specific research area while adhering to predefined eligibility standards. The approach seeks to minimize bias by adhering to consistent, previously documented systematic processes. Moher et al. (2009) initially introduced this detailed approach to literature review in 2009.

For the current part of the study, the PRISMA technique is suitable as it allows for the comprehensive collection of information from the literature, including the characterization, exploration, and future research topics (Moher et al. 2009; Snyder 2019). Greenhalgh et al. (2004) defined systematic literature review (SLR) as a strategy that stands out due to its categorical, rigorous, and transparent approach. Furthermore, this method allows us to (i) identify all relevant scientific evidence that meets the predetermined criteria for inclusion or exclusion; (ii) address the research question; and (iii) systematically, transparently, and reproducibly combine research findings to derive decisions and conclusions (Moher et al. 2009; Snyder 2019). Moreover, another reason for selecting PRISMA above other available protocols is its extensive scope, widespread adoption across several fields, and its potential to enhance consistency in reviews (Liberati et al. 2009). Contrarily, keyword searching is usually less systematic and may potentially miss important studies. Compared with standard keyword searching, SLR/PRISMA methodologies have advantages in comprehensiveness, transparency, methodical rigor, quality assessment, robust evidence synthesis, and standardization; hence, this offers a much more reliable and unbiased literature review.

Guidelines are crucial when conducting a systematic review of the literature (Kitchenham 2007). The literature highlights multiple approaches for selecting articles to review and identifying the subsequent stages (Christoffersen 2013; Dumay and Cai 2015; Thorpe et al. 2005; Watson and Webster 2020), which can be summarized into the following phases: define the research questions, search for the literature, apply exclusion and inclusion criteria, conduct a quality assessment, and discuss the results. The researchers followed the aforementioned steps to conduct this systematic review.

2.1. Definition of the Research Question

The systematic review technique is regulated by research questions that establish the topic, focus, and extent of the research (Paul and Criado 2020). The starting point of doing a systematic literature review (SRL) involves formulating primary research questions (Massaro et al. 2016). In light of this, the research questions the researchers aim to answer in this chapter are as follows:

RQ1.

What are the related studies in academic research on blockchain for accounting information systems?

RQ2.

What are the relevant studies in academic research on blockchain for accounting information quality?

RQ3.

What are the related developments in academic research on the IoT for accounting?

RQ4.

What are the associated studies in academic research on digital reporting and XBRL for accounting information quality?

RQ5.

What is the existing academic research on the integration of blockchain, the IoT, and XBRL for accounting information quality?

2.2. Search for Literature

This phase aims to determine the specific research papers that will be included in the literature review, considering both the appropriate databases to access the relevant literature and the most effective search strings to retrieve relevant results. To guarantee the scientific integrity and accuracy of this research, Scopus was utilized as the primary source of information. Scopus, a prestigious database, offers a vast repository of scholarly articles and over 20,000 peer-reviewed journals, ensuring comprehensive coverage of the research literature across various fields (Lombardi and Secundo 2020; Thies et al. 2023; Bellucci et al. 2022; Arshad et al. 2023).

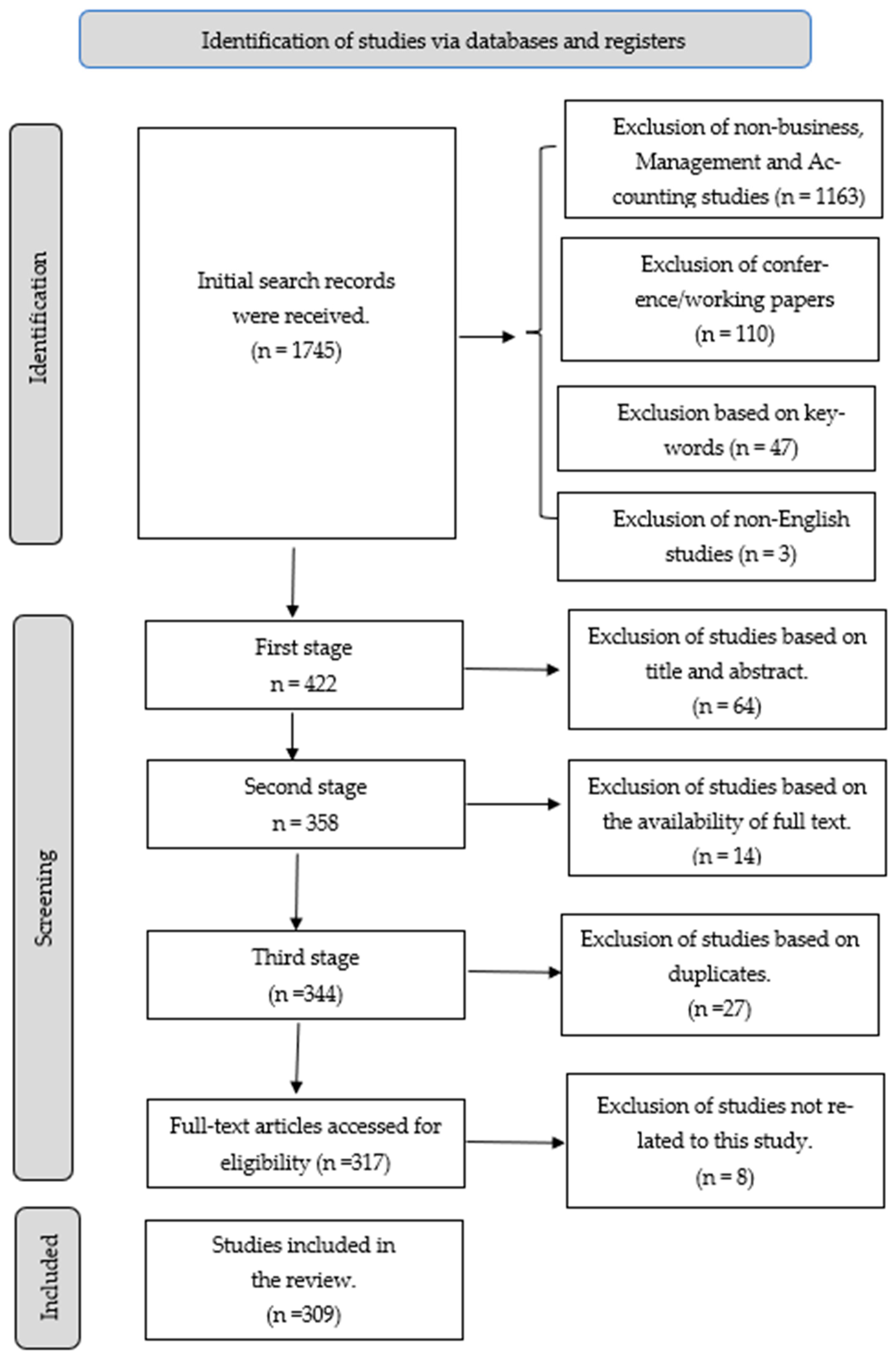

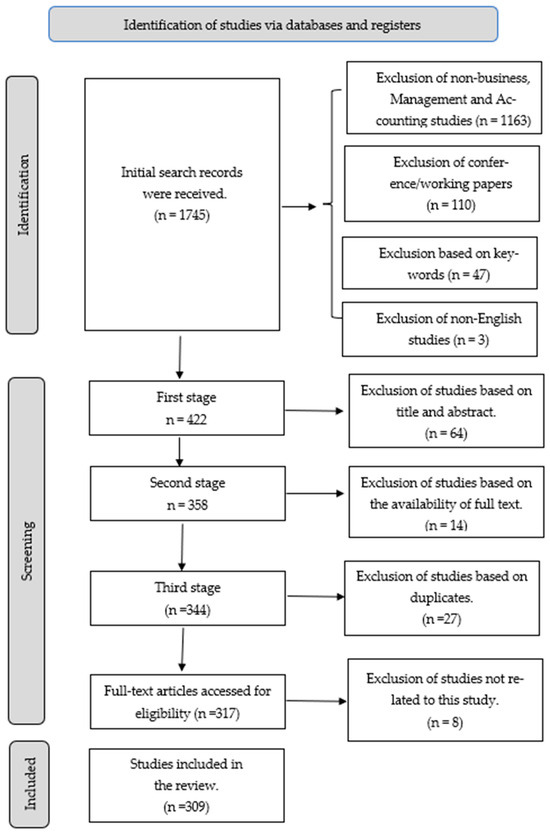

The researchers initiated the process by determining an initial collection of keywords that are pertinent to the various topics of discussion. To expand the search and discover more papers of interest, three separate keyword searches were utilized within the Scopus database. Initially, in trying to look for literature about blockchain technology, the researchers employed the specific keywords “blockchain and accounting”. Additionally, in looking for literature about the Internet of Things (IoT) and accounting, the researchers employed the specific keywords “Internet of Things (IoT) or IoT and accounting”. Additionally, in searching for literature pertaining to XBRL, the researchers specifically employed the phrase “XBRL”. Following the established framework, the systematic search process was carried out following the steps shown in Figure 1.

Figure 1.

PRISMA flow diagram.

2.3. Applying Inclusion and Exclusion Criteria

This phase focuses on identifying and selecting the most relevant literature that directly pertains to the specific variables under investigation in the current study. The research was restricted to articles, book chapters, and books. Furthermore, the researchers exclusively included papers that were classified under the category of “business, management, and accounting”. To increase the global relevance of this research and reduce linguistic understanding obstacles, the researchers specifically omitted resources written in languages other than English. Furthermore, the systematic review analysis does not encompass several exceptional papers listed in the references, as they fall outside the designated sample period. The specific criteria used to identify and include the relevant literature for the current study are presented in Table 1.

Table 1.

Inclusion and exclusion criteria of the literature.

2.4. Quality Assessment

The initial exploration of the study’s variables (BC, IoT, and XBRL) led to the identification of 1745 documents in the Scopus database, using a search that encompassed article titles, abstracts, and keywords. After applying specific inclusion and exclusion criteria, 1163 studies were eliminated as they pertained to fields other than business, management, and accounting. Additionally, 110 non-article materials, such as conference and working papers, were excluded. Furthermore, 3 studies were disregarded due to language restrictions, and 47 documents were removed based on keyword relevance. Consequently, 422 studies were considered for the initial screening stage.

Within this initial screening, 64 studies were excluded upon review of their titles and abstracts because they were not relevant to the current study; many of them were excessively technical in nature. In the second screening phase, 14 studies were removed as they were not available for download. Subsequently, 344 studies were imported into Mendeley software, with 27 duplicates being eliminated. Here, “duplicates” refers to instances where the same study appeared more than once in the dataset due to being indexed multiple times in the Scopus database under different search criteria or keywords. For example, when we searched papers using the search string “blockchain and accounting”, we retrieved some papers that discussed both blockchain and IoT, which also appeared in the search results for “Internet of Things (IoT) and accounting”. These studies were repeated because they combined blockchain and IoT in one paper. We excluded these repeated or duplicate papers to ensure that each study was counted only once in our analysis.

Finally, after a thorough examination of the full-text content, eight irrelevant documents were excluded. As a result, 309 studies were ultimately included for review. From the final set of 309 studies, a subset of papers was selected for in-depth analysis based on their relevance, impact, and contribution to the research questions. To comprehensively review a significant number of relevant studies, and given the novelty of certain variables in the study, additional studies were included based on a review of the references cited in the most highly cited papers that were already included. To ensure transparency and provide comprehensive access to all the literature reviewed, we provide two supplementary files. Supplementary File S1 contains the full list of all 1745 papers derived from our broad exploratory search. Supplementary File S2 displays the list of 309 filtered papers from the pool into which all studies had been selected based on the defined inclusion and exclusion criteria. These supplementary files contain each paper’s detailed bibliographic information: title, authors, journal, and year of publication. The supplementary files are available with the online version of this article on the journal’s website.

3. Results

In this section of the paper, the researchers separately discuss the studies that are related to each variable within this study.

3.1. Journal Analysis

To understand the diffusion of blockchain, IoT, and XBRL research in accounting information systems, we analyzed journals in which 309 selected papers were published. Journal frequency was computed to know the most frequent publishing venues. Summary information for all journals in which the selected papers were published is shown in Table 2.

Table 2.

Most common journals for selected papers.

According to Table 2, the Journal of Information Systems, with 34 papers, and the Journal of Emerging Technologies in Accounting, with 25 papers, have been two of the most prominent places for publishing research related to the benefits of blockchain, IoT, and XBRL in accounting information systems. The reputation of these journals within the area of accounting and information systems is very high; therefore, that fact reflects growing academic interest and authenticity toward these technologies. The next two positions are taken by the International Journal of Accounting Information Systems and the International Journal of Digital Accounting Research, with 12 and 9 papers, respectively. These journals are known for their focus on the intersection of accounting and information technology, making them ideal platforms for research on emerging digital tools in accounting.

3.2. Blockchain Studies

3.2.1. Overview Analysis

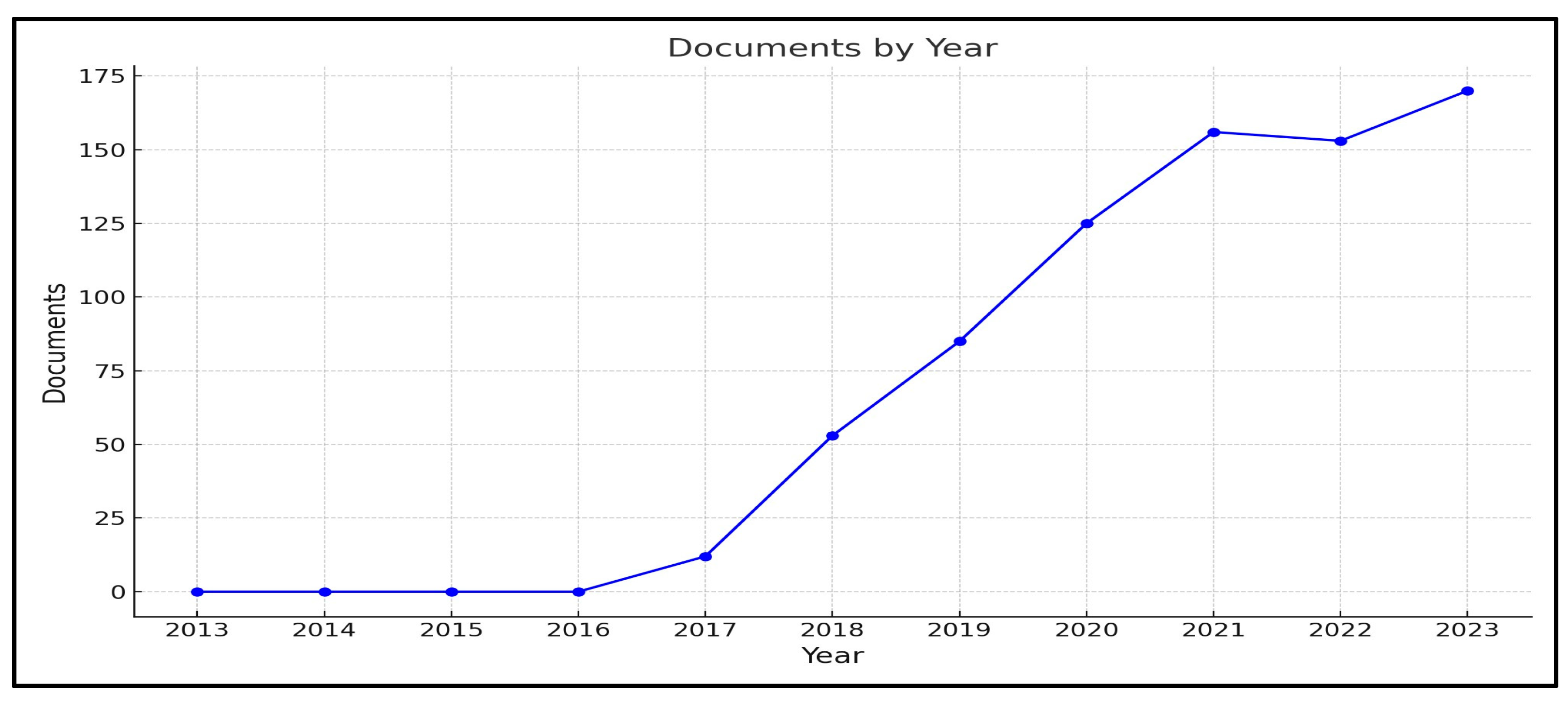

This section provides a brief overview of the analysis conducted on the literature about blockchain. An initial search, using the search query “blockchain and accounting”, during the specified time frame from 2013 to 2023, resulted in 757 publications. The following figure depicts the distribution of blockchain studies over the chosen period.

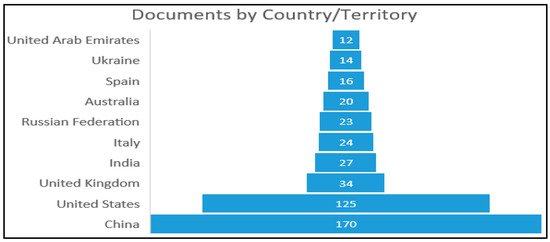

As evident from Figure 2, which depicts the number of blockchain studies by year, there has been a marked surge in the research focus on this technology in recent years. The year 2023 stands out as the peak period for blockchain-related studies, with 170 studies, indicating a heightened interest and recognition of its potential impact.

Figure 2.

The classification of blockchain studies by year.

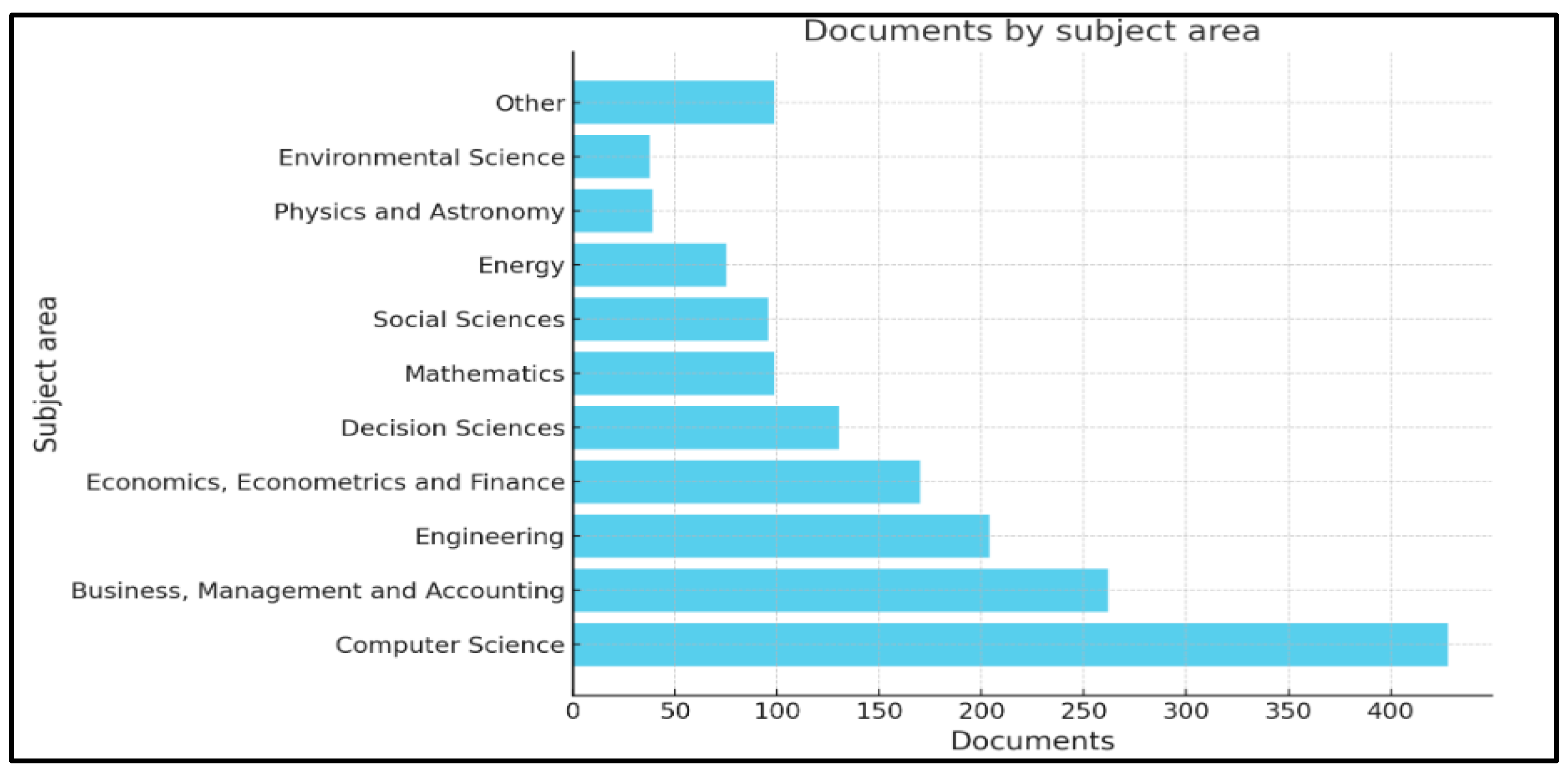

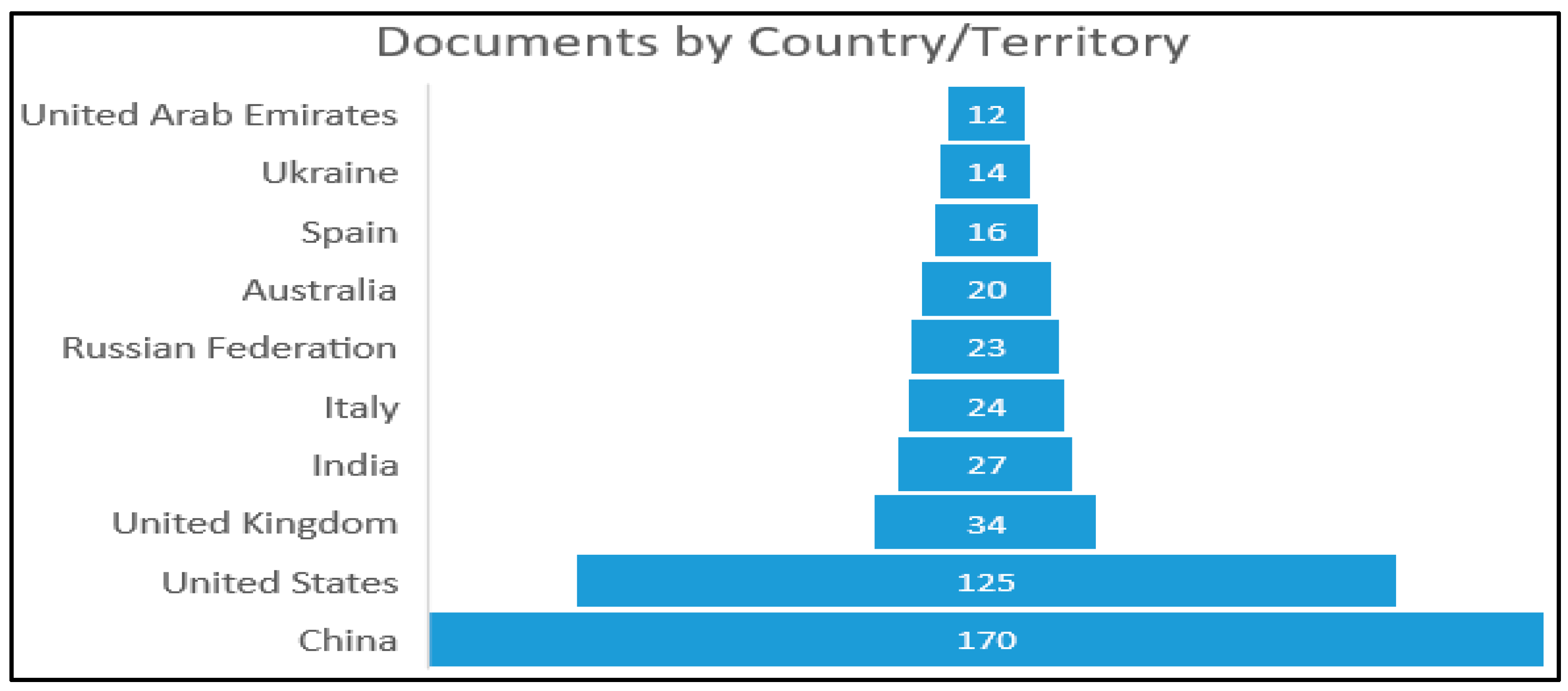

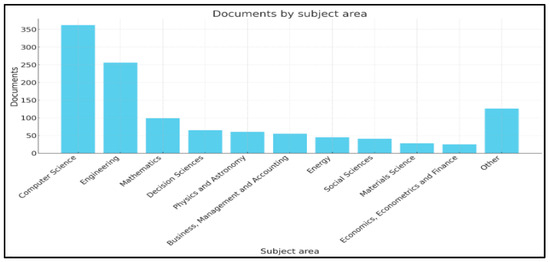

Regarding the distribution of blockchain studies across different subject areas, the provided figurehighlights that 428 studies, comprising 16.0% of the total number of documents, fall under the category of business, management, and accounting, as shown in Figure 3. Moreover, upon examining Figure 4, it can be concluded that China holds the top position in terms of the number of blockchain-related studies. This reflects the growing research capacity and output of Chinese institutions and researchers rather than the geographical location of academic journals.

Figure 3.

Classification of blockchain studies by subject area.

Figure 4.

The classification of blockchain studies by country.

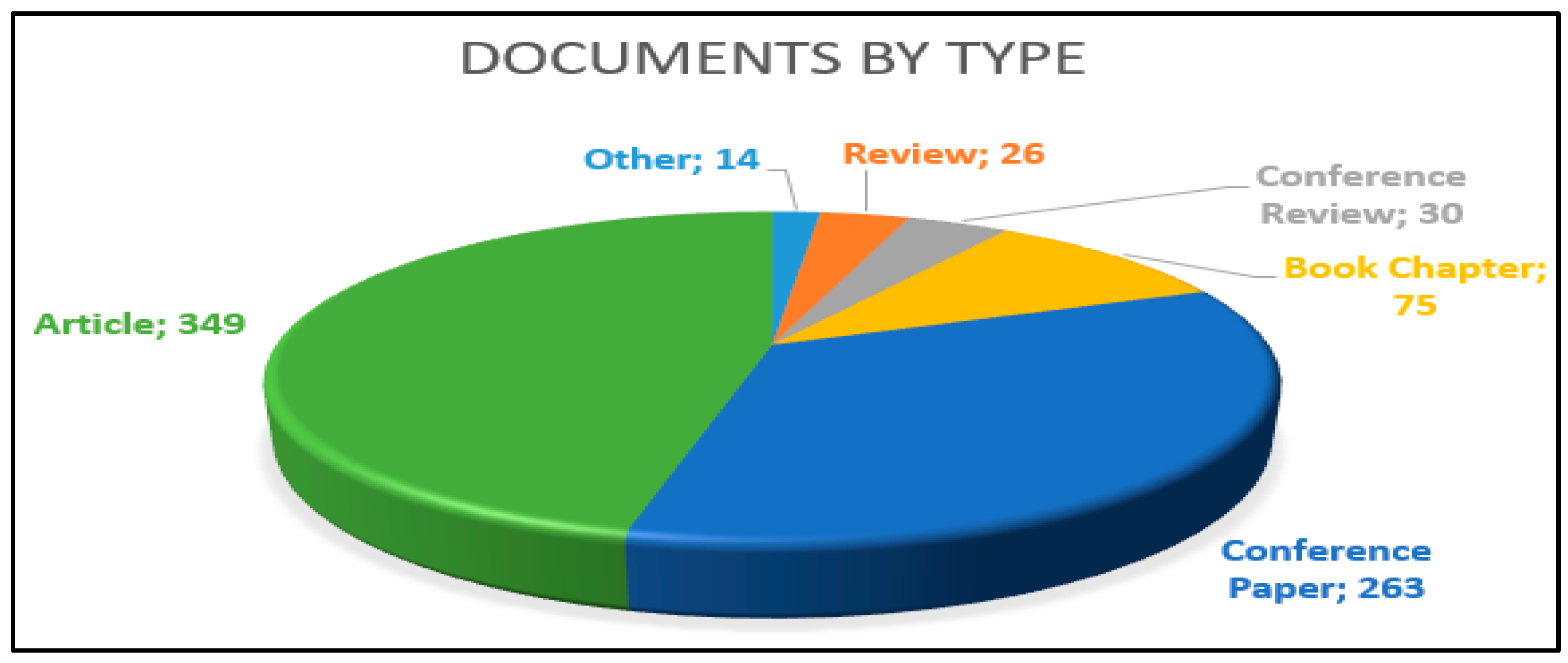

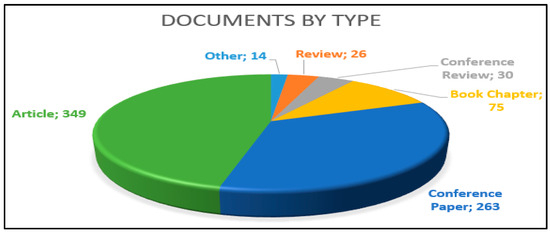

Figure 5 classifies the literature according to the type of document, indicating that articles account for 46.1% of the total number of documents, with 349 publications, while book chapters constitute 9.9%, amounting to 75 documents.

Figure 5.

Classification of blockchain studies by document type.

After implementing the exclusion and inclusion criteria, the number of relevant blockchain-related studies that aligned with the objectives of this research narrowed down to 118 studies. Table 3 shows the most-cited papers related to blockchain technology and its accounting relationship.

Table 3.

The most-cited papers in the blockchain literature.

The upcoming part examines the blockchain literature pertaining to the purpose of the present study. It is classified into two main themes: blockchain as an accounting system and blockchain and the quality of accounting information.

3.2.2. Blockchain as an Accounting System

This section aims to answer the first question in this review, which aims to examine the related academic literature on the use of blockchain in accounting information systems. The weaknesses of the current accounting system are that it is inadequate to prevent fraud and calls for the development of a more open accounting information system that can address the underlying problems with confidence between the parties (Cai 2021). For instance, external auditors must verify transactions recorded under the present double-entry accounting system to assure stakeholders of their validity. This is an expensive and time-consuming operation (Cai 2021). Furthermore, the time between the reporting period and the start of the audit process raises the possibility of manipulation and fraud (Cai 2021). The confidence and transparency of information are also threatened by possible manipulation because the transactions are documented under a central authority (Karajovic et al. 2019). The distributed, decentralized, and unchangeable characteristics of blockchain offer new possibilities and the ability to address issues with current accounting systems (Cai 2021; Dai and Vasarhelyi 2017; Karajovic et al. 2019).

It is crucial to establish a clear distinction between two distinct streams of the literature about the utilization of blockchain technology within accounting systems. The first stream primarily concentrated on the utilization of blockchain technology across several companies to strengthen the concept of a triple-entry accounting system. In contrast, the second stream of research placed its emphasis on employing blockchain as an accounting system within a single firm. The next section of this paper provides a comprehensive examination of the relevant literature about both streams.

Blockchain as a Triple-Entry Accounting System

Several researchers (Faccia and Mosteanu 2019; Peters and Panayi 2016; Schmitz and Leoni 2019) believe blockchain technology can be used to implement a triple-entry accounting system and transform the accounting ledger. Thus, writers and accounting professional institutes have attempted to describe a blockchain-enabled triple-entry accounting system.

Blockchain triple-entry could improve bookkeeping transparency and integrity by replacing double-entry (Faccia and Mosteanu 2019). Corporations would likely have to enter their transactions directly into a blockchain ledger, creating an extra copy in addition to the double-entry system. Faccia and Mosteanu (2019) call the third copy the confirmation receipt. Featuring the digital signatures of the sender, recipient, and approving authority, the receipt is a unique and cryptographically protected document that prevents unauthorized transactions.

Dai and Vasarhelyi (2017) examined how triple-entry accounting could benefit from blockchain technology. This method improves the double-entry system by adding a blockchain-documented third entry. This integration ensures entry verifiability and immutability. Dai and Vasarhelyi (2017) introduced blockchain-based triple-entry accounting. This method automates verification, decreasing the financial record concentration and manipulation risks. An organization’s ledger stores financial transactions and accounting data streams, enabling rapid reporting and financial visibility. Smart contracts on blockchain technology speed up transaction verification and ensure accounting and company compliance. Smart contracts can function independently under specific situations. This function enables a transparent, secure accounting information system supported by cryptography. This could improve data exchange among businesses and enable stakeholder reporting.

Additionally, Inghirami (2020) presented blockchain as a service. This could be an additional service to help accounting departments integrate triple-entry accounting (TEA). Also, Maiti et al. (2021) discussed a blockchain-based triple-entry accounting paradigm. The study examined three accounting methods, as follows: sophisticated double-entry accounting software, blockchain and triple-entry accounting, and disruptive technology.

In a similar vein, Cai’s (2021) study examined triple-entry accounting’s development and current state. The study used three case studies to assess blockchain technology in triple-entry accounting. Cai (2021) examined triple-entry accounting in a blockchain ecosystem and compared it to the longstanding double-entry system. Blockchain’s decentralized and immutable ledger structure minimizes the need for external auditors, according to Cai. Therefore, this might reduce fraud and errors while reducing the time and financial costs of standard auditing procedures. Blockchain accounting systems provide security, transparency, and real-time transaction recording. Cai’s study found that triple-entry accounting, enabled by blockchain and smart contracts, is a better way to manage financial data. Cai stated that this technology could alter the accounting industry by providing a continuous and transparent verification procedure that might make some auditing practices outdated.

Carlin (2019) added to prior research by doing a conceptual and theoretical analysis of blockchain technology’s transformative potential in accounting. Carlin suggested that blockchain could have a similar impact to double-entry accounting. Carlin examined historical double-entry accounting guidelines. His study analyzed blockchain technology’s contextual elements and its potential to enable this transformation. Carlin believed that blockchain technology may improve record-keeping and transaction-processing accuracy and efficiency while lowering costs. This technique might also simplify the transition from double-entry to triple-entry ledger systems. Blockchain can also improve transaction record security, offer real-time reporting, and reduce audit samples by using population-based assurance.

Similarly, Faccia et al. (2020) proposed using blockchain technology to replace the double-entry system with a triple-entry framework in accounting. The authors suggested adding a third axis, represented by transaction hashes, to improve the auditing design. This study used qualitative analysis to investigate accounting method development and validate the proposed model. Faccia et al. found that blockchain technology in accounting is a transformative advance that can overcome the limits of double-entry methods. Also, Desplebin et al. (2021) examined how blockchain technology could revolutionize accounting. They hypothesized that this technology could transform accounting practices and accountant and auditor roles. After reviewing the relevant literature, the study suggested that blockchain technology in accounting could start an evolutionary period like the switch from paper to digital databases. This technology would improve triple-entry accounting to provide a secure, immutable ledger.

A historical analysis by Ibañez et al. (2023) focused on the evolution of shared ledger systems, highlighting the rise of triple-entry accounting (TEA) and the resource-event-agent (REA) accounting design. This research successfully revealed the interconnected pathways of these accounting advancements by combining a comprehensive literature review with personal interviews with experts in REA, TEA, and blockchain. The study showed that shared ledger systems grew from concepts from three research streams that sometimes met but developed independently. This research by Ibañez et al. suggests that shared ledger systems like blockchain are an outcome of this convergence. These systems are decentralized and trustless, following triple-entry accounting principles.

Several research studies on using blockchain technology to implement triple-entry accounting show that the literature differs. Some authors (Cai 2021; Grigg 2024) define triple-entry accounting as a system in which two firms record their transactions in their ledgers, while a third ledger has an entry for both enterprises. Dai and Vasarhelyi (2017) developed a blockchain-based triple-entry accounting system. This system tracks business partner transactions and company data flow. Every transaction in their system generates double-entry and blockchain ledger entries. Dai and Vasarhelyi (2017) suggested tokens for enterprise data tracking.

Blockchain as a Single Accounting System

O’Leary’s (2017) study examined blockchain technology’s use in accounting and supply chain transaction processing. This analytical research examined blockchain construction and its potential effects on organizational structures. The study focused on cloud-based and private blockchain accounting systems in corporations. This study examined how blockchain technology interacts with data warehouses and databases. The paper differentiated blockchain systems by type: private, public, centralized, decentralized, peer-to-peer, and cloud-based. The study critically assessed several blockchain designs and their suitability for corporate applications, suggesting incorporating blockchain’s unique features into existing transaction-processing systems. O’Leary (2017) refers to blockchain’s advantages as including improved visibility, unalterable record-keeping, and consensus-based changes that promote transparency and security.

Moreover, Faccia and Petratos (2021) examined the ongoing debate over integrating blockchain technologies with management accounting and ERP systems. Faccia and Petratos illustrated their theoretical analysis with a literature review and e-procurement case study. The main goal was to evaluate the potential benefits of integrating blockchain technology into AIS and ERP systems. They said that distributed ledger technologies (DLTs) like blockchain can improve these processes by offering trust, transparency, accountability, and security. This is possible with smart contracts and immutable records.

Additionally, Saraiva and Vieira (2023) investigated and proposed a blockchain-based accounting record implementation method. Two proofs of concept were developed to improve the Portuguese accounting system using blockchain technology. The goal was to simplify blockchain accounting procedures, affecting accountants, financial information users, and software corporations. Blockchain technology might tokenize the Portuguese accounting system, according to the report. Saraiva and Vieira (2023) suggested using blockchain technology in accounting to increase transparency, speed up transaction settlement, reduce fraud, improve auditing, and improve monitoring. The benefits would include enabling a new accounting environment, automating assurance operations, and improving audit agility and accuracy.

In addition, the Gomaa, Gomaa, and Stampone study supports blockchain accounting systems. A case study by Gomaa et al. (2019) examined blockchain technology’s practical applications in accounting information systems. Their blockchain transaction example showed the tax implications and the need for internal and external auditors. Gomaa et al. found that blockchain technology improves security, decentralization, transparency, and transactional efficiency. The authors claimed that blockchain is essential for developing new business models and can solve problems through decentralization. Likewise, Tan and Low (2019) studied how blockchain technology may affect accounting. Blockchain integration into accounting information systems was their focus. Tan and Low (2019) claimed that blockchain technology can digitize validation, enhancing financial record accuracy and integrity. Tan and Low (2019) believed that blockchain could significantly transform the AIS database engine, but it would not eliminate the need for accountants’ knowledge in decision-making and financial reporting. Blockchain data’s unaltered nature may reduce fraud and errors, improving audit quality.

Moreover, Benedetti et al. (2020) also investigated blockchain’s potential for mitigating corporate fraud. The authors proposed a multi-level framework to highlight blockchain technology’s suitability for this purpose. The framework had five technology layers: information storage, flow, processing, enhancement, and financial integration. Benedetti et al. (2020) claimed that blockchain technology’s ability to reduce fraud and increase transparency might boost financial reporting trust. In addition, Wang and Kogan (2018) discussed a preliminary transaction processing system using blockchain technology, zero-knowledge proof, and homomorphic encryption. This system was created to demonstrate real-time accounting, monitoring, and fraud protection. Wang and Kogan (2018) describe a unique architecture that uses blockchain technology to maintain information privacy.

Additionally, Fullana and Ruiz (2021) examine blockchain’s use in accounting information systems and its potential drawbacks. Blockchain can be used in AIS for governance, transparency, trust, continuous auditing, smart contracts, and accounting. They clarify that the double-entry method is a centralized system that is prone to manipulation and requires greater labor to handle a large volume of operations. In addition, Fullana and Ruiz (2021) argue that blockchain-based systems decentralize power and control among network nodes, reducing manipulation risk and speeding processes. Smart contracts and blockchain-based AIS will enable self-execution and capacity control.

Karajovic et al. (2019) examined blockchain technology in accounting and related businesses. They highlighted that PwC, Deloitte, EY, and KPMG are integrating blockchain technology into their operations. PwC created a digital asset for its global client services using a blockchain platform. A new technique used by EY is an editable blockchain system with an automatic alert mechanism to detect and report transaction problems. KPMG and Microsoft are also developing BaaS (blockchain-as-a-service). Moreover, Karajovic et al. (2019) evaluated blockchain in three steps. Professional accounting firms can use blockchain to meet customer needs in the first phase. Blockchain technology is used in phase two to simplify taxation and insurance by eliminating unnecessary and complex operations. Due to the weakness of current accounting systems and the high risk of data management and storage, the main change would be transitioning from double-entry to triple-entry systems. Blockchain technology adds a real-time dimension to transactions, ensuring accurate data presentation and eliminating accountant bias. In the third phase, accountants can use blockchain to manage financial data, transact, and report.

3.2.3. Blockchain and the Quality of Accounting Information

This part of the paper aims to answer the second question in this review, which aims to explore the relevant research on the role of blockchain in enhancing accounting information quality.

The special technical characteristics of blockchain present several advantages for accounting practices: enhanced trust and transparency of information, immediate reporting, improved record-keeping, ongoing auditing, and decreased instances of human error and fraud (Bonsón and Bednárová 2019; Cai 2021; Karajovic et al. 2019; Kokina et al. 2017; Moll and Yigitbasioglu 2019; Rozario and Thomas 2019). Blockchain can offer a shared ledger that enables members to access an identical version of the ledger in real time through its decentralization and distribution. Because all participants have equal access to the ledger and transactions are linked together in blocks, it becomes challenging to modify records, especially in the case of public blockchains. Furthermore, the process of documenting transactions using a consensus protocol and verifying them by network participants can transfer trust from an external entity to the individuals within the network (Tan and Low 2019). Theoretically, it is extremely difficult if not impossible to manipulate or alter records due to the immutability of blockchain records. Therefore, having immediate access to the ledger, employing a consensus protocol to add transactions to the network, and validating transactions by network participants results in a heightened level of trust and transparency in accounting information (Centobelli et al. 2022; Mainelli and Smith 2015).

Yermack (2017) claimed that immutable records prevent managers from manipulating earnings by capitalizing costs instead of expenses or retroactively dating sales contracts. Traditional accounting systems also require department and authority confirmation of inventory purchases and payments. The manufacturing manager must authorize the purchase, and the warehousing manager must verify the inventory quality and amount. This method is time-consuming and prone to human mistakes and fraud. In a blockchain accounting system, all blockchain nodes certify inventory data before adding them to the network. This procedure speeds up and verifies accounting data (Tan and Low 2019). Additionally, an empirical study by Du et al. (2023) examined how blockchain technology affects company investments. The analysis focused on 2016–2020 Shanghai and Shenzhen stock exchange A-share enterprises. They examined how blockchain technology, which is decentralized, tamper-resistant, and transaction-tracking, affects corporate investment decisions and operational efficiency. Du et al. (2023) found that blockchain technology improves investment efficiency, especially in organizations that use blockchain to optimize their operational processes rather than only selling blockchain products or services. Blockchain technology effectively controls excessive and insufficient investment, according to the study.

In the same vein, Chowdhury et al. (2023) examined blockchain technology in accounting in Bangladesh, a developing country. The researchers used 217 standardized questionnaire responses for the primary data. Blockchain technology in accounting, particularly in developing countries, may enhance transparency, reduce workload, and improve data reliability, according to the study. Moreover, Pizzi et al. (2022) examined how blockchain technology improves sustainability reporting in a case study. A pioneer in using a public blockchain to notarize its non-financial statement was Banca Mediolanum in Italy. The study concluded that disclosing non-financial data on a public blockchain can reduce information asymmetry between organizations and stakeholders. Also, Pizzi et al. (2022) suggested that while blockchain has many benefits, few companies have adopted it to ensure data integrity.

In continuing empirical studies, Alkafaji et al. (2023) examined how blockchain technology affects accounting information in Iraqi listed and non-listed organizations. Their findings suggested that blockchain technology significantly affects financial reporting accuracy and reliability. Garman (2022) also examined how blockchain technology affects managers’ real earnings management. The survey sampled Chinese companies. Garman linked blockchain technology to a drop in Chinese companies’ real earnings manipulation. The study found that blockchain technology reduces manufacturing enterprises’ unanticipated production costs, and contract inflexibility limits earnings manipulation. Furthermore, Fang et al. (2023) investigated how blockchain technology affects accounting information quality. They examined 33,242 firm-year observations from Chinese stock exchange-listed A-share companies between 2007 and 2019. Fang et al. (2023) evaluated the accounting information quality by internal production and external auditing. The authors measured internal production quality using real-activities manipulation (RM) and below-the-line items (BL). External audit quality was assessed using discretionary accruals (ABSDA) and restatements (RES). Blockchain technology significantly improves accounting information, according to the study. Both the internal production and external auditing quality proxies improved.

Similarly, Zhang and Guan (2023) examined how blockchain technology influences real earnings management by Chinese publicly traded companies. They examined how institutional investors and independent directors affect this relationship. The study sampled Shanghai and Shenzhen A-share companies from 2012 to 2022. Zhang and Guan (2023) evaluated real earnings management tactics such as influencing sales, expenses, production, and asset disposal. The findings showed that blockchain technology reduced real earnings management by Chinese public enterprises. Zhang and Guan (2023) claimed that blockchain’s decentralized, transparent, and open ledger system for corporate financial transactions and information exchange makes this possible. Blockchain eliminates intermediaries and unnecessary audits; improves information-sharing efficiency, transparency, and reliability; and effectively monitors and restricts management opportunities, thereby preventing management from manipulating earnings. The transparency and traceability of blockchain technology make it difficult for managers to manipulate earnings through real corporate actions.

In their theoretical study, Yu et al. (2018) explored the important abilities of blockchain technology in the field of financial accounting. The study discussed the increasing adoption of blockchain technology and its consequences for financial reporting. They highlighted the fundamental features of blockchain, such as transparency, security, and immutability. The authors emphasized the potential of these features to significantly change the nature of financial information disclosure, reducing the asymmetry of information between companies and investors. Their study proposed that blockchain can function as an optional platform for sharing information, consequently increasing confidence in business financial statements. As a long-term outlook, Yu et al. (2018) suggested that incorporating blockchain technology into financial accounting might significantly decrease disclosure errors and earnings manipulation, resulting in an overall enhancement in the accuracy and reliability of financial reporting.

In a theoretical approach, Gomaa et al. (2023) aimed to create a single-ledger model-based methodological framework for blockchain technology in accounting. They intended to solve the accounting business’s reconciliation problem. Gomaa et al. (2023) introduced a blockchain-based transaction-tracking system. All participants in the transaction can access this ledger for trustworthy and transparent information. This paradigm solves the conventional accounting system’s transaction-reconciliation issues. This solution eliminates data reconciliation concerns and improves accounting data correctness by providing a single, dependable reference point for all transaction participants. They claimed that this architecture would increase transparency, reduce manual reconciliation, and eliminate accounting system redundancy.

3.3. Internet of Things Technology Studies

3.3.1. Overview Analysis

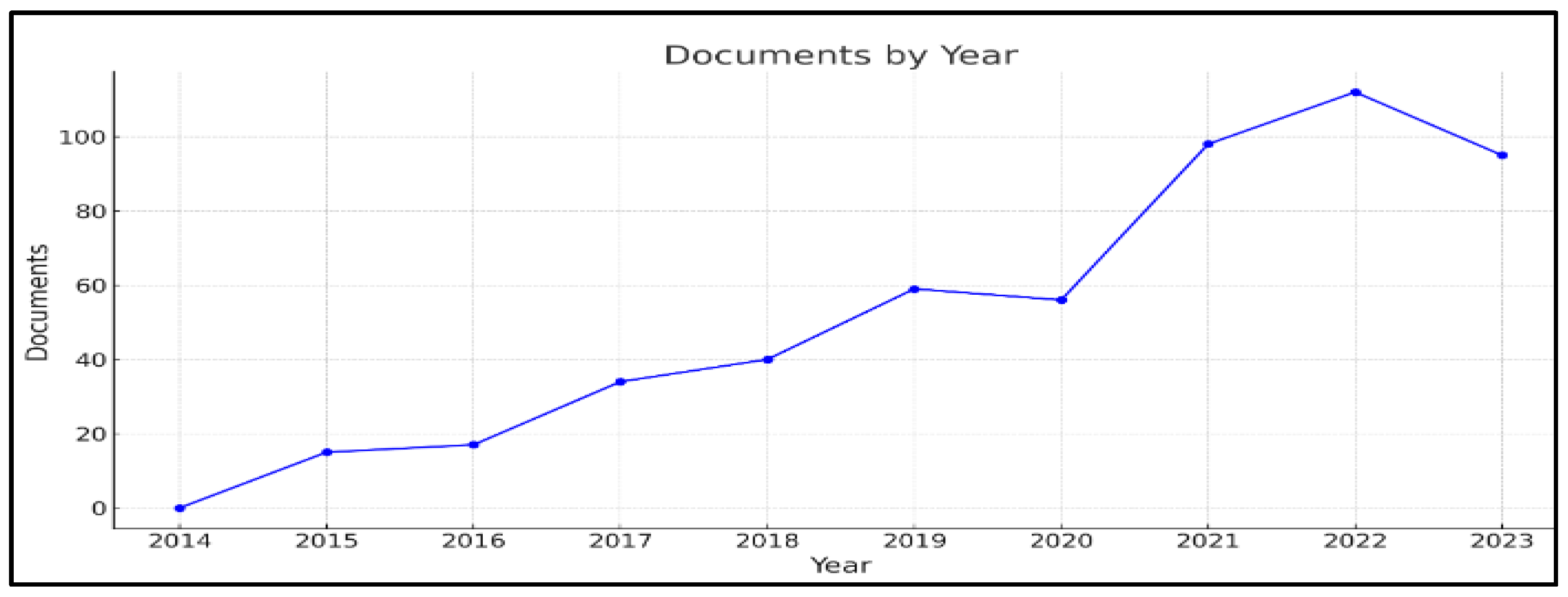

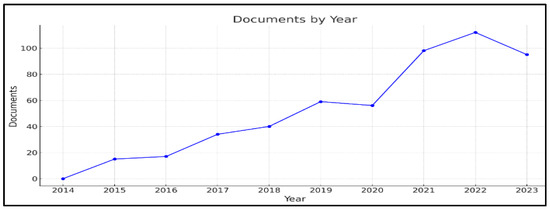

This section provides a brief overview of the analysis conducted on the literature about the Internet of Things. An initial search using the search query “Internet of things or IoT and accounting” during the specified time frame from 2013 to 2023 resulted in 541 publications. The graph in Figure 6 depicts the distribution of IoT studies over the chosen period.

Figure 6.

The classification of IoT studies by year.

As evident from Figure 6, which depict the number of IoT studies by year, there has been a marked surge in the research focus on this technology in recent years. The year 2022 stands out as the peak period for IoT-related studies, with 112 studies, indicating a heightened interest in and recognition of its potential impact.

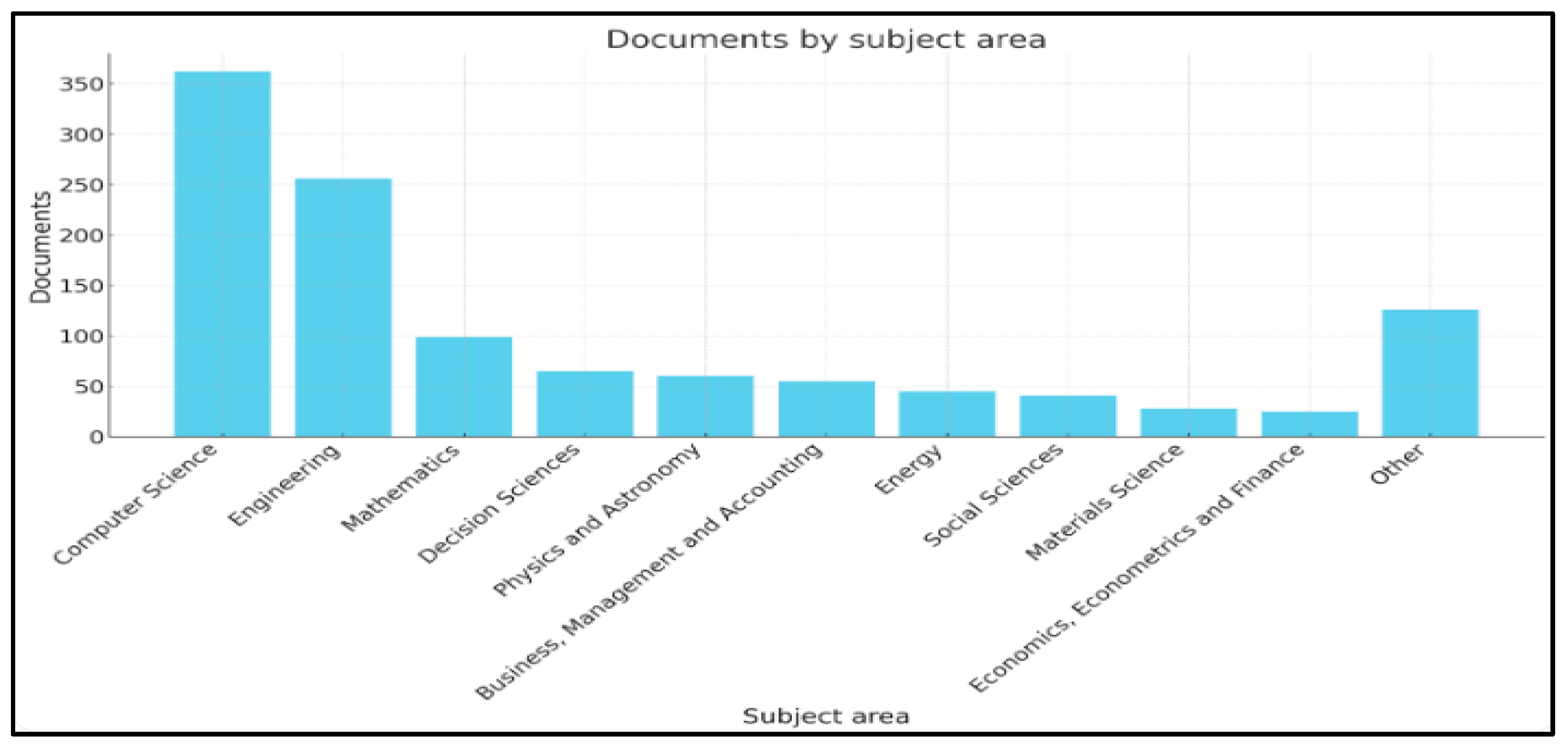

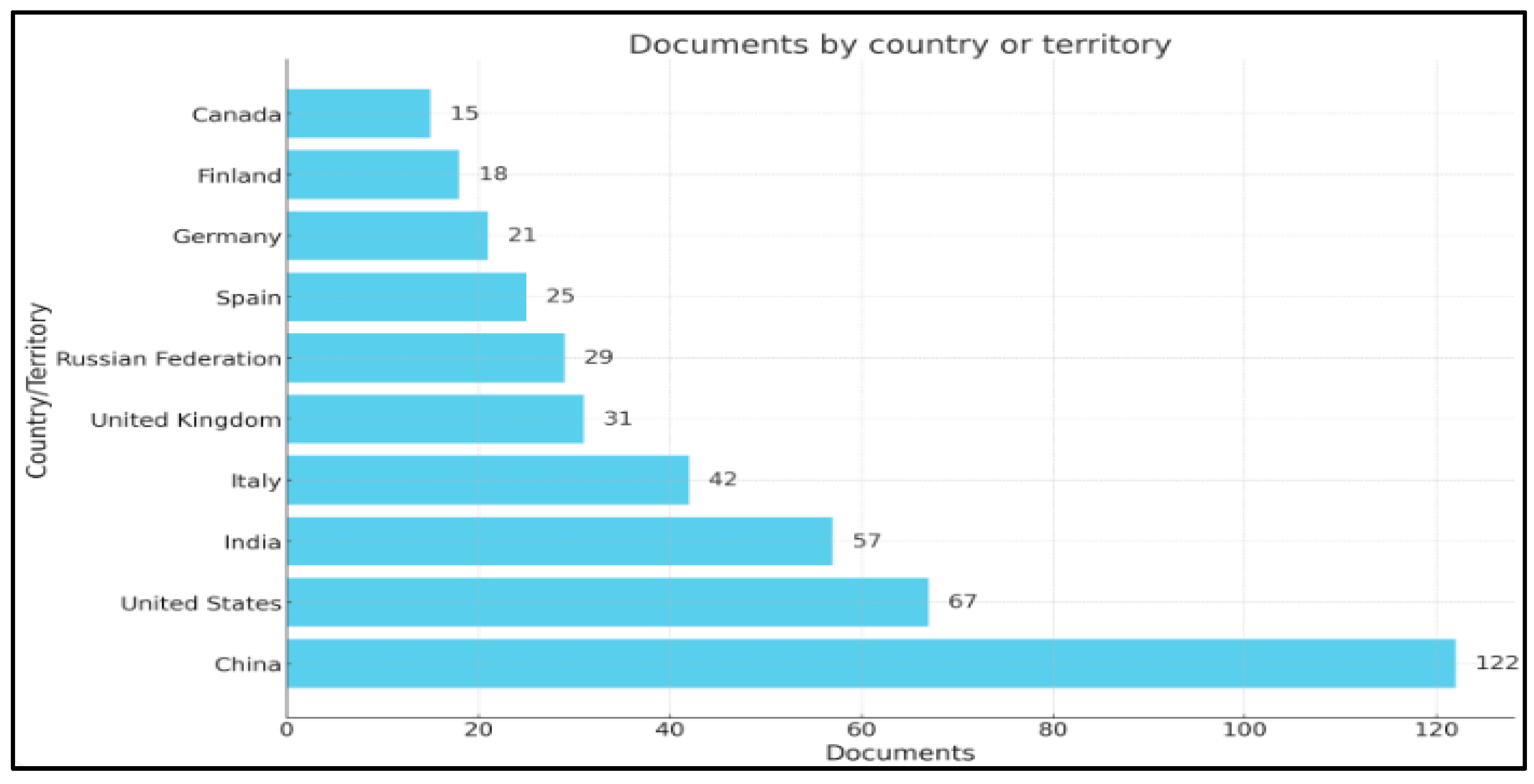

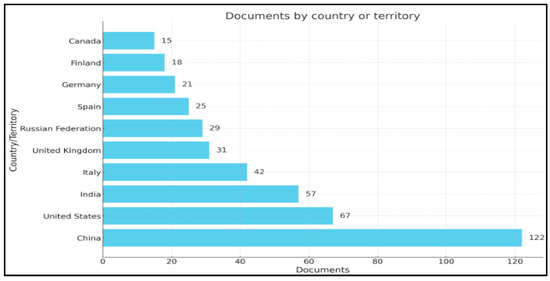

Regarding the distribution of IoT studies across different subject areas, Figure 7 highlights that only 55 studies, comprising 4.7% of the total number of documents, fall under the category of business, management, and accounting. Moreover, upon examining Figure 8, it can be concluded that China holds the top position in terms of the number of IoT-related studies. This reflects the growing research capacity and output of Chinese institutions and researchers rather than the geographical location of academic journals.

Figure 7.

Classification of IoT studies by subject area.

Figure 8.

The classification of IoT studies by country.

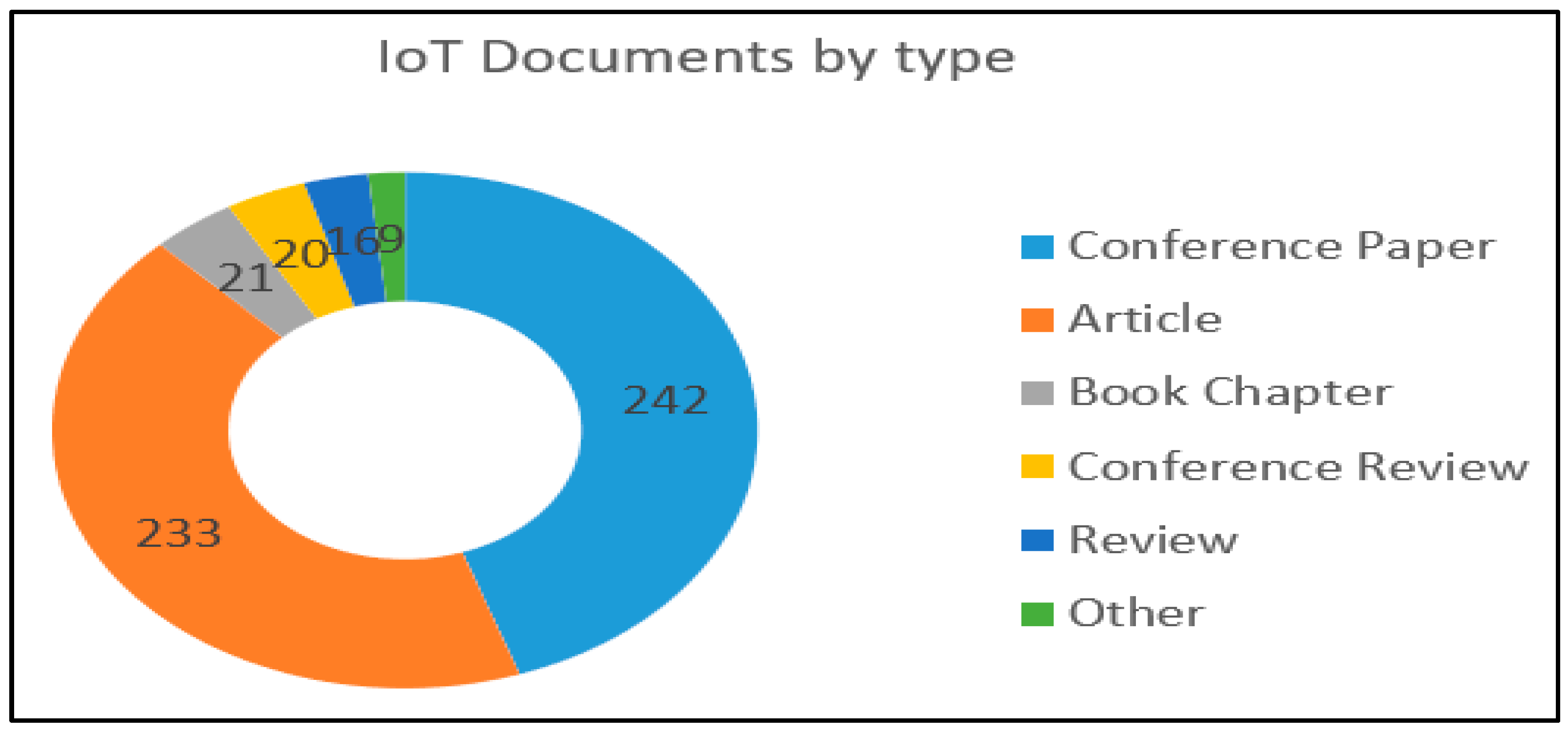

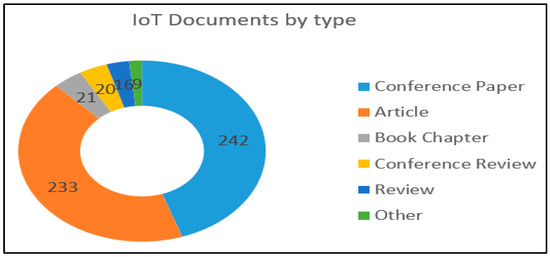

Figure 9 classifies the literature according to the type of document, indicating that articles account for 43.1% of the total number of documents, with 233 publications, while book chapters constitute 3.9%, amounting to 21 documents.

Figure 9.

Classification of IoT studies by document type.

After implementing the exclusion and inclusion criteria, the number of relevant IoT-related studies that aligned with the objectives of this research was narrowed down to 25 studies. Table 4 summarizes the most-cited papers in the IoT literature.

Table 4.

The most-cited papers of the IoT literature.

3.3.2. Using the Internet of Things (IoT) in the Accounting Field

This part of the paper aims to answer the third question in this review, which aims to explore the related academic research on the application of the Internet of Things (IoT) in accounting.

There is a lack of literature regarding the benefits of Internet of Things technology in the accounting sphere. Many scholarly publications focused on the possible advantages and difficulties related to the Internet of Things (IoT) in overall corporate operations. To begin with, Haddud et al. (2017) examined the benefits and drawbacks of using Internet of Things technology in organizations with 87 participants from 6 continents. The IoT can improve transparency and visibility of information and material flows, product tracking, inventory control and management, internal business process integration, and operational efficiency, according to the authors. The benefits include prompt decision-making and response times, automation of decision-making processes, improved planning, lower operating costs, new revenue streams, and increased client contact. In contrast, the five main challenges are device and network security risks, limited understanding of IoT benefits, difficulty recruiting qualified staff with the necessary skills and knowledge, risks associated with implementing a new business model, and technical and technological integration challenges.

Moreover, Van Niekerk and Rudman (2019) also found that integrating Internet of Things technology into company operations can increase value and information quality by providing real-time data. The IoT ensures financial information’s trustworthiness, accuracy, completeness, and timeliness, according to the authors. In contrast, Van Niekerk and Rudman (2019) stated that financial information risks include integrity, confidentiality, authenticity, network availability, and semantic technology vulnerabilities.

Furthermore, to explore the impact of the IoT on the accounting profession, Karmańska (2021) studied a road transport company to assess the benefits and drawbacks of integrating it into the accounting department. The study used questionnaires and interviews. According to the research, accountants feel that adopting IoT allows organizations to analyze reports utilizing a large amount of sensor data, cloud computing, and accounting automation. The infrastructure to accommodate new technologies was difficult to develop, and cybersecurity and privacy issues were raised. Wu et al. (2019) examined how IoT affects accounting information quality. The IoT has the potential to improve accounting information systems and data quality, according to the authors. This is due to new transactional data sources. Wu et al. (2019) noted that sensors are replacing manual data reading and input to collect and process accounting data in real time. They added that IoT may collect audio, location, and physical measurements like length, weight, and volume. Thus, the financial report would include more than just monetary data, allowing users to enter important numbers and estimate based on their evaluations.

Similarly, Roszkowska (2021) investigated how emerging technologies like the Internet of Things could address audit difficulties in financial scandals like Enron and Arthur Andersen. His research focused on how these technologies might improve accounting financial data reliability. Roszkowska (2021) asserted that IoT sensors can rapidly update financial data like inventories, manufacturing, equipment usage, and depreciation. These features give real-time data, reduce human costs, and prevent data tampering. IoT allows auditors to shift from checking financial statement data to more efficiently identifying corporate governance fraud, according to Roszkowska (2021). By eliminating the need to validate ledger balances with external sources, auditors may focus on IoT sensor data integrity. Roszkowska (2021) claimed that IoT in business operations and accounting systems can improve automation, efficiency, real-time data processing, labor costs, audit procedures, and fraud detection.

Additionally, Wang et al. (2021) examined the economic effects of IoT implementation in China. Their study focused on how IoT adoption affects the manipulation of financial earnings in Chinese stock-exchange-listed enterprises. The study examined 12,536 firm-year data observations, 1650 of which involved IoT announcements. This study found that IoT technology in Chinese publicly traded enterprises reduced earnings manipulation. Accrual-based and real earnings manipulation show this decline. The study found that the reduction of earnings manipulation benefits the capital market, financing, investment, and long-term operational effectiveness. Implementing IoT technology increases asset monitoring, information flow, agency problem costs, and internal control, according to Wang et al. (2021).

Professional membership organizations of chartered accountants and students also found IoT to be a matter of interest. An example of this is a paper prepared by the Institute of Chartered Accountants in England and Wales (Payne 2019) in collaboration with the Shanghai National Accounting Institute and Inspur. The report focused on the influence of the Internet of Things (IoT) on accounting. The research sample comprised 211 respondents from Chinese enterprises, of whom 20% primarily utilize IoT in sectors such as manufacturing, finance, IT, procurement, supply chain management, process quality improvement, and financial management. As per the survey participants, the Internet of Things (IoT) has a beneficial influence on performance, governance, organizational culture, and management. They mentioned the following advantages: enhanced transaction processing accuracy and automation; improved asset tracking, resulting in reduced downtime, enhanced information quality, and decreased audit expenses; automated stock verification, asset location, and improved asset analysis; improved asset utilization through the implementation of advanced processes and asset sharing; cost optimization achieved through analysis and preventive maintenance measures; enhanced pricing strategies through the generation and analysis of more accurate cost data; quantified employee performance by improving health and safety measures; and enhanced forecasting and budgeting capabilities.

Moreover, Valentinetti and Flores Muñoz (2021) aimed to investigate the potential of utilizing the Internet of Things (IoT) to improve corporate reporting and disclosure. They contended that the Internet of Things (IoT) has the potential to greatly enhance analytics and services, leading to more efficient forecasting processes, optimization, and improved stakeholder experiences. Consequently, it can surpass the capabilities of existing online and social media platforms, thereby strengthening corporate discourse. Furthermore, the Internet of Things (IoT) facilitates the gathering and analysis of data to autonomously respond to consumers’ informational requirements across diverse devices and platforms that are capable of transmitting, exchanging, and receiving data through the Internet. IoT devices can be equipped with corporate analytics tools, allowing for instantaneous decision-making at the data origin. Valentinetti and Flores Muñoz (2021) emphasized the revolutionary capability of IoT in improving digital reporting and corporate communication by providing more efficient, effective, and engaging methods of collecting, analyzing, and sharing data.

3.4. eXtensible Business Reporting Language (XBRL) Studies

3.4.1. Overview Analysis

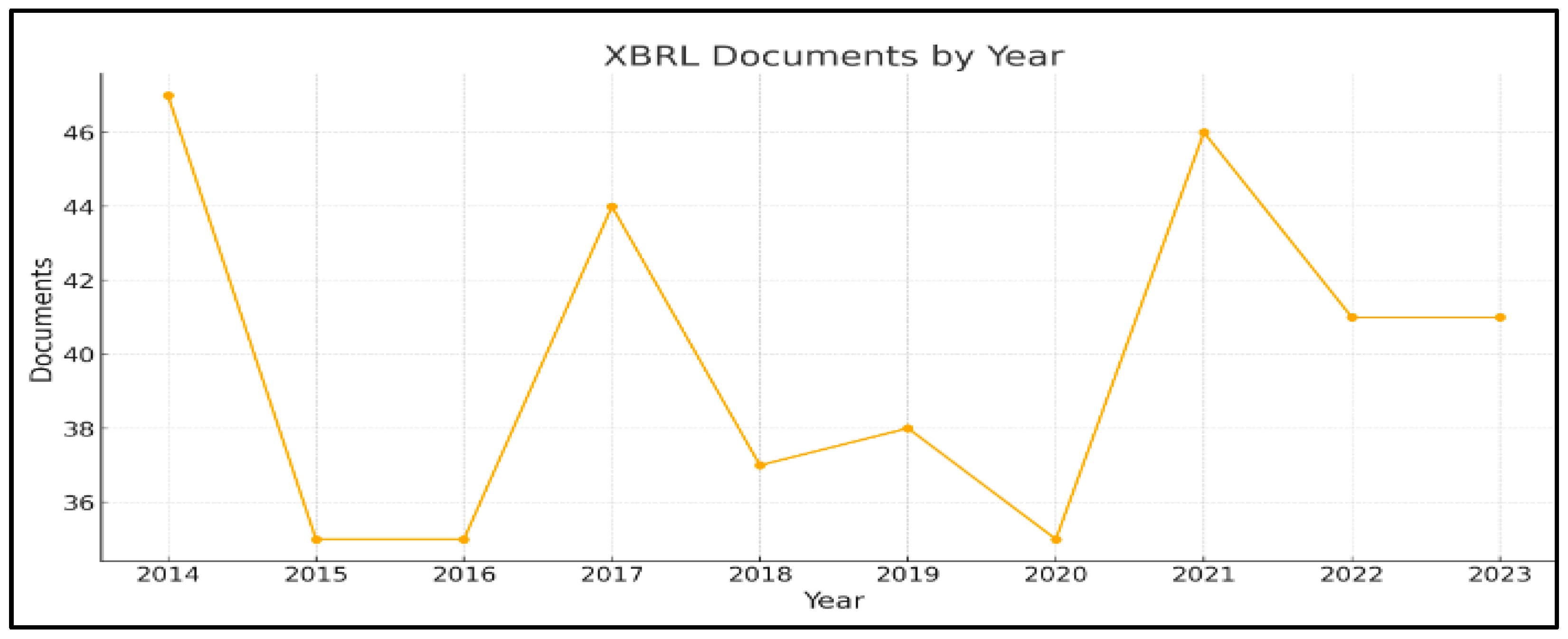

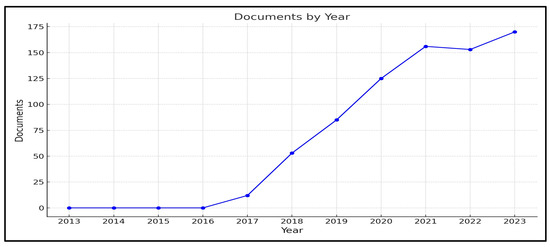

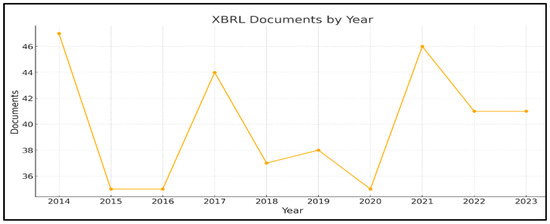

This section provides a brief overview of the analysis conducted on the literature about XBRL. An initial search using the search query “XBRL” during the specified time frame from 2013 to 2023 resulted in 447 publications. The graph in Figure 10 depicts the distribution of XBRL studies over the chosen period.

Figure 10.

The classification of XBRL studies by year.

As depicted in the provided figure illustrating the number of XBRL studies by year, the research focus on this technology has exhibited fluctuations over time. The year 2013 stands out as the peak period for XBRL-related studies, with 55 publications suggesting that this technology has a longer history compared with blockchain technology and IoT technology.

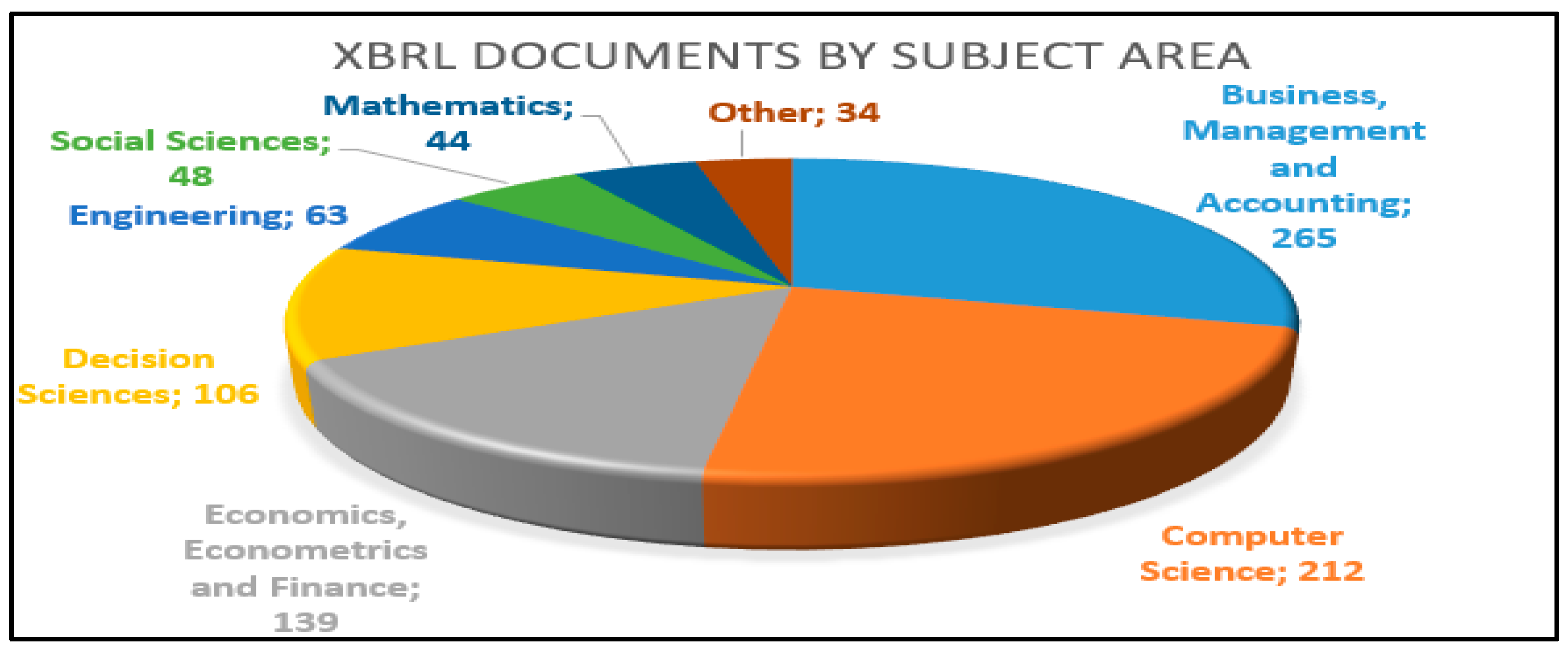

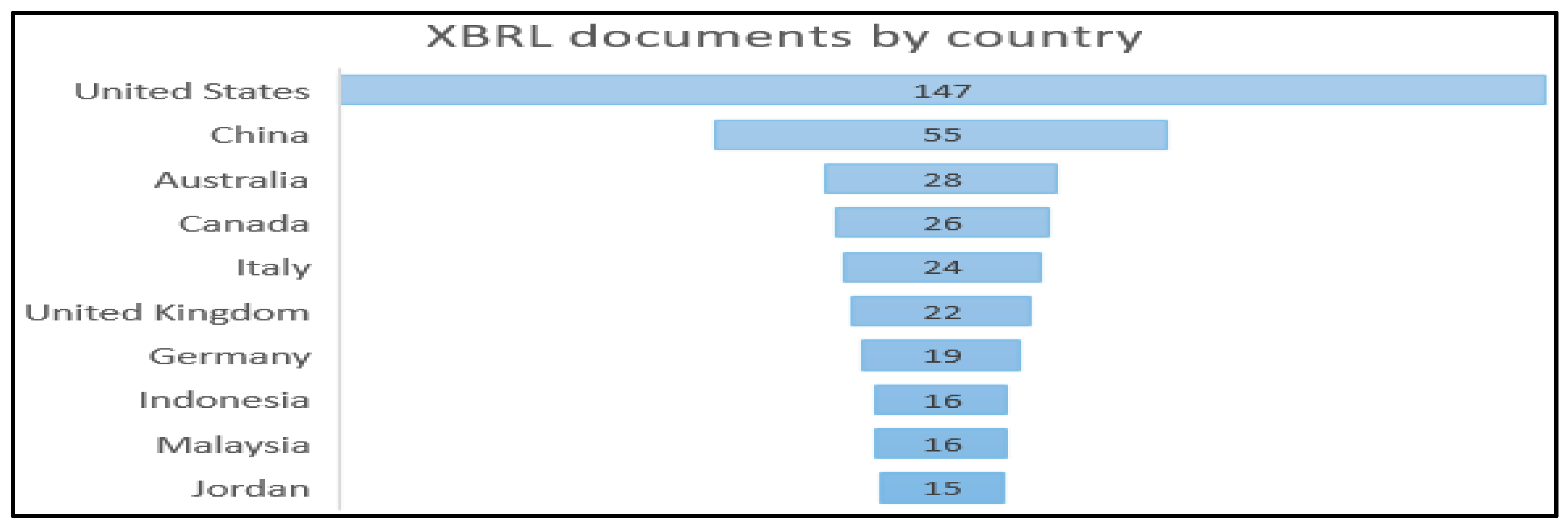

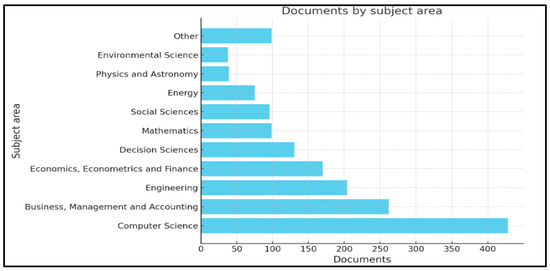

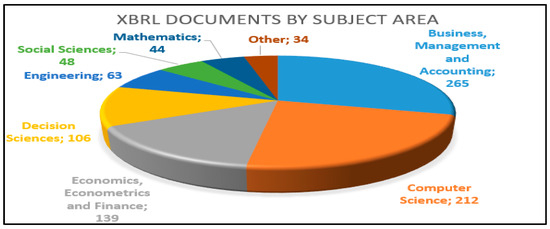

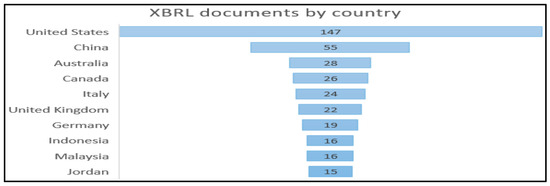

Regarding the distribution of XBRL studies across different subject areas, Figure 11 highlights that 265 studies, comprising 28.3% of the total number of documents, fall under the category of business, management, and accounting. Moreover, upon examining Figure 12, it can be concluded that the United States holds the top position in terms of the number of XBRL-related studies.

Figure 11.

Classification of XBRL studies by subject area.

Figure 12.

The classification of XBRL studies by country.

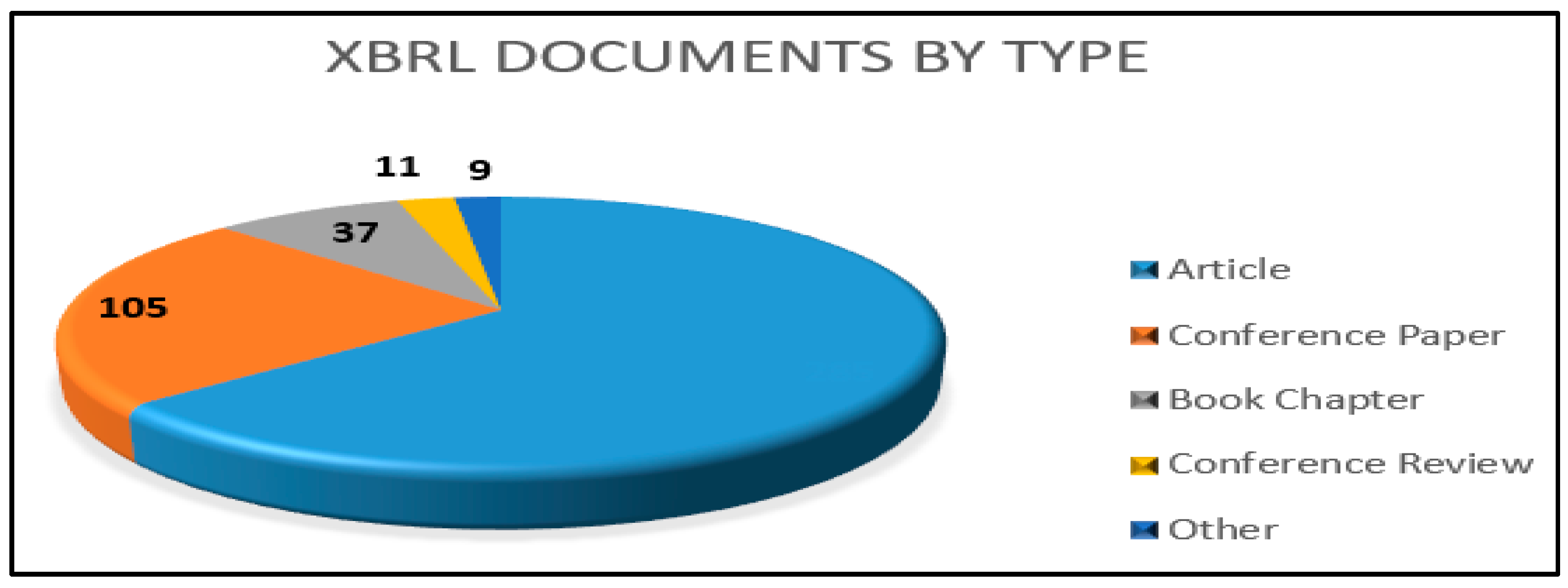

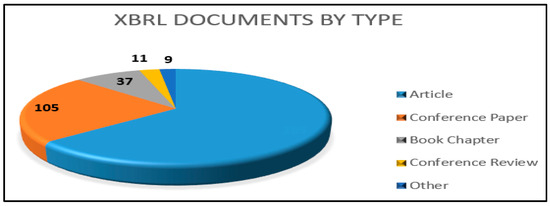

Figure 13 classifies the literature according to the type of document, indicating that articles account for 63.8% of the total number of documents, with 285 publications, while book chapters constitute 8.3%, amounting to 37 documents.

Figure 13.

Classification of XBRL studies by document type.

After implementing the exclusion and inclusion criteria, the number of relevant XBRL-related studies that aligned with the objectives of this research was narrowed down to 166 studies.

3.4.2. The Benefits of eXtensible Business Reporting Language (XBRL) in Accounting

This part of the paper aims to answer the fourth question in this review, which aims to discuss the latest literature related to digital reporting and XBRL for accounting information quality.

The number of XBRL filings worldwide is experiencing significant and quick growth. As of 2023, there have been 214 country implementations, as documented in the XBRL Project database maintained and constantly updated by XBRL International. The database may be accessed at https://www.xbrl.org/the-standard/why/xbrl-project-directory, accessed on 10 February 2024. First and foremost, Table 5 outlines the most frequently cited works of the XBRL literature.

Table 5.

The most-cited papers of XBRL literature.

Based on the data that were provided, it is evident that the study conducted by Hodge et al. (2004) was the most often-cited work. The objective of this study was to examine the impact of using XBRL on the ability of nonprofessional financial statement users to obtain and incorporate relevant financial information while making investment decisions. Their findings indicated that the utilization of XBRL enhances the transparency of organizations’ financial statement information, hence benefiting financial statement users. Additionally, the study of Debreceny and Gray (2001), which is the second most-cited paper, supports the findings of Hodge et al. (2004) that XBRL enables both individuals and intelligent software agents to work with financial information distributed on the Web with an exceptional degree of accuracy and reliability.

Moreover, XBRL has the advantage of decreasing information asymmetry in the stock market, as demonstrated by Yoon et al.’s (2011) study. The study found a significant and negative correlation between XBRL implementation and information asymmetry, suggesting that adopting XBRL could potentially reduce information asymmetry in the Korean stock market. Furthermore, they discovered that the effect of XBRL adoption on reducing information asymmetry is larger for large organizations than for medium-sized and small companies.

XBRL could improve financial reporting quality in various ways. For instance, the adoption of XBRL can improve the transparency of financial reports. Alkayed et al. (2023) discovered a noteworthy beneficial influence of implementing XBRL on enhancing the transparency of information and the efficiency of financial institutions in Jordan. Adopting a similar position, Tawiah and Borgi (2022) concluded that XBRL adoption increases financial reporting transparency and disclosures. First and foremost, they argued that XBRL can improve financial reporting by giving users more precise and complete information. Moreover, XBRL-formatted financial statements make searching and displaying information easier. This improves financial data analysis and understanding. Additionally, modern information technology like XBRL enhances information generation and reporting quality. Furthermore, XBRL-formatted financial statements improve financial reporting quality by improving search efficiency, display quality, and comparability. Finally, XBRL helps financial information meet IASB qualitative criteria like understandability, relevance, reliability, and comparability. It reduces financial report errors, clarifies content, reduces preparation time, and improves comparability.

Along the same lines, in 2017, Liu et al. examined how XBRL reduces information asymmetry in the European financial sector. The study examined Belgian non-financial enterprises, comparing market liquidity and information asymmetry before and after XBRL adoption. Liu et al. (2017) concluded that XBRL adoption increases market liquidity and reduces information asymmetry, benefiting larger and non-high-tech enterprises more. Additionally, Palas and Baranes (2019) aimed to evaluate the effectiveness of XBRL data in improving the precision of financial analysis, specifically, in forecasting changes in earnings. They contended that XBRL offers easily available and up-to-date financial information, which is valuable for financial analysis and decision-making. Palas and Baranes (2019) demonstrated that XBRL data exhibited a 65% overall accuracy in predicting earnings changes, with industry-based models achieving a higher accuracy of 71%. Hence, the study showcased that XBRL data can greatly increase investment decision-making by enhancing the accuracy of earnings predictions, which is particularly advantageous for smaller investors.

In their empirical study, Borgi and Tawiah (2022) aimed to examine the impact of XBRL adoption on the quality of financial reporting in different countries. They analyzed data from 98 countries and employed the World Economic Forum’s auditing and reporting standards index as the measure for assessing the quality of financial reporting. The index is derived from a comprehensive survey of expert viewpoints and measures financial reporting quality on a scale of 1 to 7, where higher values signify superior quality. In their study, Borgi and Tawiah (2022) found that the adoption of XBRL has a substantial positive effect on the quality of financial reporting, particularly in developing countries.

Further, in their empirical study, the objective of Kim et al. (2019) was to investigate the influence of XBRL adoption on earnings management in U.S. corporations, specifically, analyzing whether XBRL limits discretionary accruals. Kim et al. (2019) discovered a notable reduction in discretionary accruals following the implementation of XBRL, suggesting that XBRL limits the manipulation of earnings. The impact was more prominent when using standardized XBRL items. Kim et al. emphasized the significance of standardized XBRL features in improving the transparency of financial reporting and limiting the ability of managers to manipulate financial accounts. They stressed the value of XBRL in corporate governance and financial reporting standards. Similarly, Mayapada et al. (2020) conducted an empirical investigation into the impact of XBRL adoption on the practice of earnings management in manufacturing enterprises in Indonesia. They identified significant variations in earnings manipulation before and after the implementation of XBRL, suggesting that XBRL plays a crucial role in curbing management’s abusive actions and enhancing the quality of financial reporting.

In contrast to previous studies, some authors argue that adopting XBRL leads to increased earnings management. In 2023, Sanad conducted a study to investigate whether the mandatory implementation of XBRL leads to companies misclassifying components of their income statement to manipulate earnings. The study focused on non-financial companies listed on the Dubai Financial Market and the Abu Dhabi Securities Exchange in the UAE from 2012 to 2019. The research found that rather than improving transparency, XBRL reporting decreased the quality of financial reporting due to an increase in income statement misclassification. Likewise, Chen et al. (2021) conducted a study to investigate the effects of XBRL implementation on real earnings management in Chinese companies listed from 1999 to 2013. They used regression models to compare the level of real earnings management before and after the implementation of XBRL, with a particular focus on companies that have strong motives for engaging in real earnings management. The study found a significant increase in actual earnings manipulation following the adoption of XBRL, particularly when subjected to the combined oversight of XBRL regulations. The impact varied between state-owned and non-state-owned companies, with the latter showing a more significant increase in actual earnings manipulation.

In the same vein, the empirical research conducted by Ruan et al. (2021) found that the use of XBRL reduces the synchronization of corporate stock prices and improves the efficiency of capital market information in China, which emphasizes the benefits of XBRL.

3.5. The Integration of Blockchain, the Internet of Things, and XBRL

This part of the paper aims to answer the fifth question in this review, which aims to explore research on the integration of blockchain, the Internet of Things, and XBRL for accounting information quality.

The previous sections of this paper explained the benefits of blockchain and Internet of Things technologies and eXtensible Business Reporting Language to the accounting field. The current section aims to explore the possibility of the integration of the aforementioned technologies to propose an accounting information system.

Generally, a system refers to a collection of two or more interconnected components or subsystems that work together toward a shared objective (Hall 2007). Specifically, an accounting information system (AIS) is a thoroughly designed system that follows established procedures and protocols to gather, retain, analyze, and present accounting and financial data in a format that can be easily comprehended (Hall 2007; Inghirami 2020). Accounting information systems are vital internal procedures that play a crucial role in enhancing the effectiveness of decision-making and control inside businesses. According to scholars and academics, an information system must perform four main functions: data entry, data processing, data storage, and output extraction (Romney et al. 2012).

First and foremost, regarding Internet of Things (IoT) technology, numerous studies have confirmed its usefulness as a real-time data collection tool (Roszkowska 2021; Haddud et al. 2017; Valentinetti and Flores Muñoz 2021). Integrating the Internet of Things (IoT) with blockchain technology is an innovative and unique application (Atzori 2018; Christidis and Devetsikiotis 2016; Zhang and Wen 2017). Wu et al. (2019) aimed to suggest the possible application of a blockchain–Internet of Things (BC–IoT) transaction model within the accounting field. The Internet of Things (IoT) collects data from the physical world using sensors, creating a link between the digital and physical worlds. Wu et al. (2019) argued that a well-established and robust IoT infrastructure facilitates the seamless implementation of smart contracts. Additionally, the Internet of Things (IoT) functions as a robust and secure method for collecting and recording data, guaranteeing the prompt and accurate transmission of information to the blockchain.

Along the same line, a study conducted by Sherif and Mohsin (2021) strengthens the argument for integrating blockchain technology with Internet of Things (IoT) technology. The study’s objective was to examine the influence of three emerging technologies—blockchain, IoT, and AI (artificial intelligence)—on mitigating the risk of ethical blindness in accounting. Accounting ethical blindness occurs when, due to numerous circumstances, accountants fail to recognize, or ignore, ethical considerations, which may result in fraudulent activity. Sherif and Mohsin (2021) examined the combined effect of these technologies, which involves utilizing a decentralized blockchain framework for uploading data gathered from IoT devices. This approach proved effective in addressing issues like a singular point of failure. This integration is acclaimed for providing a high degree of transparency, which effectively decreases information asymmetry between accountants and regulators. It also acts as a safeguard against the manipulation of information and the misrepresentation of financial situations, thereby reducing ethical ignorance in accounting.

Smart contracts can be integrated with Internet of Things (IoT) technology to automatically record and manage the real-time status and actions of physical items (Dai and Vasarhelyi 2017). Furthermore, smart contracts can automatically record sales transactions on the blockchain ledger when an inventory item is confirmed to be leaving the organization, using geographic data sent by the Internet of Things (IoT). In addition, electronic devices are expected to have sensors, advanced processors, and connectivity capabilities (Dai and Vasarhelyi 2016); consequently, these devices may have the ability to automatically notify of any instances of inventory damage, non-delivery, or delays. These reports have the potential to activate smart contracts that will promptly modify the associated accounting data.

Despite the benefits of using Internet of Things technology in accounting, two critical limitations of the traditional IoT centralized architecture have been brought to light by the literature (Mistry et al. 2020): (i) the single point of failure, which potentially compromises the entire system’s integrity, and (ii) the inherent lack of trust among the entities participating in the system. Integrating the Internet of Things technology with blockchain resolves the issues related to IoT. Security and privacy concerns delayed the mainstream adoption and future applications of the Internet of Things (IoT) before the advent and acceptance of blockchain (BC). The worries centered around guaranteeing the true nature of data, avoiding tampering during the transfer between different systems, and protecting data from illegal access and theft. Blockchain technology effectively resolves the security and privacy concerns associated with IoT data (Wu et al. 2019). Smart contracts, which are based on blockchain technology, enhance the Internet of Things (IoT) by including social characteristics. This allows for interactions between various entities and the creation of new economic transaction models. The integration of these technologies enables the smooth and protected sharing of data, permitting the Internet of Things (IoT) to surpass its original constraints.

From a top-down view, the IoT system can be categorized into three layers: the sensing tier, the network tier, and the application tier (Xiao 2017). The application tier of the IoT exhibits a highly personalized nature, where the evolution of blockchain (BC) technology can establish a trustworthy foundation for the IoT’s application tier.

Regarding the integration of blockchain technology and XBRL, in their exploratory study, Faccia et al. (2019) aimed to present an integrated cloud-based system to optimize the financial accounting cycle, including technologies such as cloud computing, artificial intelligence, blockchain, and XBRL (eXtensible Business Reporting Language). Faccia et al. (2019) employed cloud computing as the core platform for the system, providing distributed, secure, and scalable storage and management of data. In addition, blockchain was employed to guarantee the immutability, transparency, and security of data. Blockchain facilitates a triple-entry accounting system by offering a shared ledger to record transactions, hence mitigating the potential for errors and fraudulent activities. Furthermore, they intended to employ artificial intelligence (AI) to improve data analysis, processing, and decision-making. Artificial intelligence automates the categorization and handling of accounting transactions for financial statements and tax returns, improving both efficiency and precision. XBRL serves to standardize financial reporting, hence enhancing comparison and analysis across diverse businesses and countries.

Furthermore, in their theoretical investigation, which aimed to explore the possible incorporation of blockchain technology with XBRL in the field of accounting and finance, Beerbaum (2018) emphasized the benefits of incorporating blockchain and XBRL. To begin with, blockchain can improve the reliability and accuracy of financial postings in XBRL. The second benefit is the validation of financial and non-financial data as blockchain technology facilitates the verification of information, guaranteeing the accuracy and reliability of financial and non-financial data recorded in XBRL. The third benefit is the expedited pace; the integration of XBRL and blockchain technology enables real-time reporting and accounting, resulting in accelerated and automated financial procedures. Similarly, the objective of Wahab’s study in 2019 was to explore the possibility of integrating XBRL and blockchain technologies to improve corporate reporting in Malaysia. The main objective was to enhance transparency, ensure data integrity, and enhance availability. The study evaluated the technological and regulatory feasibility of this integration. Wahab (2019) concluded that the integration can be made practicable and useful in the Malaysian corporate context by strategic planning and a commitment to technical improvement.

Additionally, Serag (2022) proposed a framework for integrating XBRL and blockchain technology. The aim was to take advantage of blockchain technology to distribute XBRL content to a decentralized peer-to-peer network while maintaining the government’s authority over the data. Serag (2022) highlighted the advantages of this integration, including enhanced transparency, enhanced integrity, improved data quality, superior security, efficient auditing processes, and real-time data availability. Similarly, Boixo et al. (2019) investigated a proposed XBRL chain, which is a demo that uses blockchain technology to ensure the integrity and non-repudiation of a document, usually an XBRL instance document that contains a business report. The XBRL chain depends on the immutability and transparency of blockchain technology to ensure the authenticity and integrity of financial reports. Consistent with the previous two studies, Le et al. (2019) presented a design and a prototype implementation of a blockchain-based financial reports ledger. The main objective of the proposed model was to increase trust and transparency in published financial reports, which can have a great impact on inter-organizational transactions. Le et al. (2019) argued that using blockchain technology can address the limitations of traditional storage methods and restore trust in financial reporting. They suggested storing XBRL reports on an Ethereum blockchain.

Furthermore, Shapovalova et al. (2023) aimed to modernize national accounting policy by integrating international trends and technological advances under the paradigm of accounting 4.0. Key digital instruments that were outlined in this area are cloud computing, blockchain, big data, AI, machine learning, and the Internet of Things. This would enhance data processing and make it possible to automate accounting with accuracy, openness, and transparency while enhancing decision-making. This research even shows that supporting tools for the national accounting and audit system are relatively unresearched, despite the adoption of UA IFRS XBRL. This modernization framework is aligned with accounting 4.0, regarding improving accounting efficiency, supporting the digital economy, enhancing international competitiveness, and ensuring reliable financial reporting through process automation and analytics enhancement.

4. Discussion

The topics of corporate reporting and digital technology research receive considerable attention. However, there are surprisingly few comprehensive studies that consider in general how digital and smart technologies may support and empower organizations in terms of raising the quality of their corporate reporting processes. Blockchain technology has recently been acknowledged to have meaningful impacts on transaction processing systems and in its prospective applications as an accounting information system. It does not merely offer a new way of maintaining conventional ownership ledgers using classical double-entry.