1.1. Introduction

Volatility prediction is a major consideration for energy-related processes or variables, which include, but are not limited to, oil prices, energy consumptions, electricity prices, energy generations from traditional and renewable sources, and meteorological variables such as wind speed. In recent years, renewable energy has become increasingly cost-competitive [

1]. In terms of levelized cost of generating electricity, the median costs of solar PV and onshore wind generations are lower than those of gas and coal generations in the United States, China, Europe, and India. Most notably, the generation of wind energy continued to grow in 2019 and 2020 despite the COVID-19 pandemic caused challenges [

2,

3]. As such, the volatility prediction of renewable energy processes becomes increasingly important in that it can mitigate the challenges stemming from the supply of intermittent power to market and thus facilitate the healthy and sustainable development of renewable energy [

4].

In the prediction process of many energy variables, one usually considers two aspects: the expectation (mean) and the variance. Take wind speed forecasting as an example: wind farms need not only the accurate mean wind speed, but also the turbulence (variance) of wind speed in order to effectively manage the operations with less risk. The expectation answers the question of “what is likely to happen?”, while the variance could be explained as “how much risk is associated?” A good understanding of this “risk” is critical to appropriately managing the energy conversion systems, such as preparing for suitable production plans and scheduling proactive maintenance. Also, factoring in the “risk” can provide invincible advantages for active participants of energy exchange market to develop effective electricity price bidding strategies.

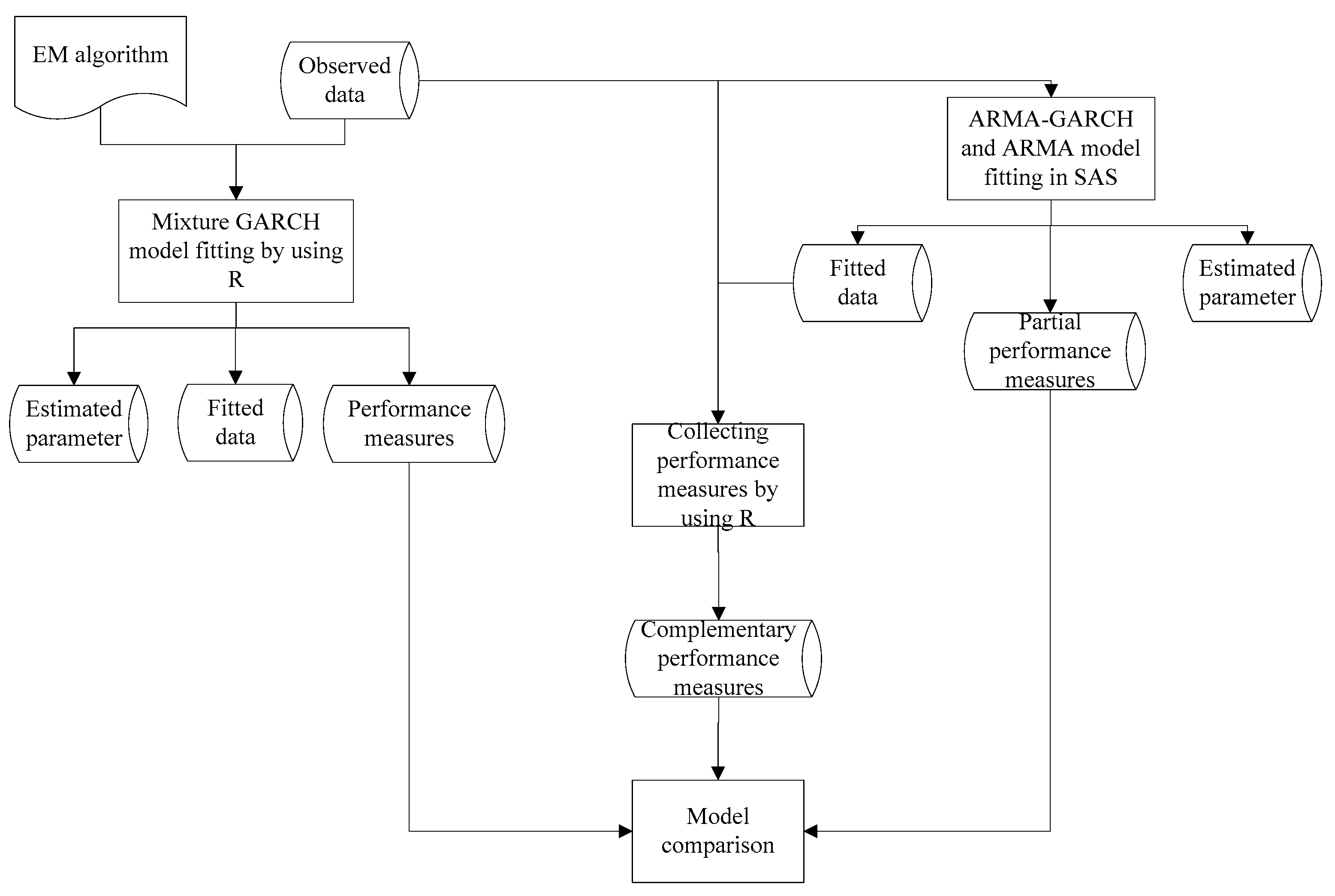

In this paper, we propose a novel two-component approach for forecasting means and variance of energy time series data. The approach involves finite mixture Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) models with the adoption of Expectation–Maximization (EM) algorithm for model parameter estimation. The approach adopts the general autoregressive–moving-average (ARMA) model and combines it with the mixed normal GARCH (MN-GARCH) model. To comprehensively evaluate the effectiveness of the proposed approach, three energy related subjects are selected, namely, wind speed, wind power generation, and electricity price. For each case, we develop the finite mixture GARCH models with the help of EM algorithm and compare their prediction performances with those of the traditional ARMA and ARMA-GARCH models. The main contributions of this research lie in two aspects: (1) the innovative approach of combining finite mixture GARCH and EM algorithm is for the first time proposed such that non-normal distributions could be handled and the parameter estimation could be processed efficiently; and (2) the proposed method is found to be superior in terms of volatility modeling compared with the traditional GARCH models based on the comprehensive evaluation of three types of energy time series data. As such, the proposed approach is a general methodology that should be applicable to both renewable and non-renewable sectors.

The remaining sections are organized as follows. In

Section 1.2, a brief literature review is provided regarding energy time series modeling and prediction, along with a critical analysis. In

Section 2, the principles of general finite mixture model and the EM algorithm, as well as the necessary formulations are briefly introduced. In

Section 3, we present the implementation procedure of the finite mixture GARCH approach with EM algorithm, and describe the framework. In

Section 4, the proposed approach is for the first time tested on wind speed, power generation, and electricity price data. The results are analyzed and compared against the ARMA and ARMA-GARCH models. Finally, conclusions are drawn in

Section 5.

1.2. Brief Literature Review

There are many data-driven approaches for modeling and predicting energy related variables, such as statistical models, neural networks, generalized impulse response analysis methods, and hybrid approaches [

5,

6,

7,

8,

9]. These approaches are usually for mean prediction. Meanwhile, the generalized autoregressive conditional heteroscedastic (GARCH) models have been developed to model the non-constant-volatility/heteroskedasticity [

10]. The heteroskedasticity generally implies that different time series observations have non-constant variance. However, in the commonly used ordinary least square (OLS) estimation, the presence of heteroskedasticity becomes a challenge because OLS estimation assumes constant variances. In this case, GARCH method becomes a promising tool to deal with time series data with time varying volatility. For various purposes, GARCH models have been extended into different forms, such as nonlinear GARCH (NGARCH), exponential GARCH (EGARCH), and the GARCH-in-mean (GARCH-M) model [

11,

12,

13,

14,

15]. GARCH model applications have appeared in various areas. In particular, the popularity of GARCH models has been increasing in energy related studies. For instance, Garcia et al. [

16] propose a GARCH model for electricity prices. The results can be further used to develop bidding strategies or negotiation skills in the electricity market. Liu et al. [

17] develop an approach to estimate the wind power generation by modeling wind speed volatility and thus the operation probability of wind turbines. The proposed approach is valuable not only for the management of wind farms, but also for the integration of wind energy in the electricity market. Sun et al. [

18] adopt ARMA-GARCH models for forecasting of solar radiation, and show that the ARMA-GARCH models can outperform other forecasting models without the consideration of volatility.

However, GARCH models cannot properly handle the data with heavy tailed or asymmetric distributions (e.g., non-normal distributions). To address this, the finite mixture GARCH approach has been developed, and it has received much attention from academia and industry in recent years. The original concept of finite mixture model was proposed for two normal probability density functions [

19]. However, it is until last two decades before that this methodology was adopted in serious applications due to the tremendous advancement of computing power [

20]. To date, the existing studies for finite mixture GARCH models are concentrated in financial related areas. Tang et al. [

21] indicate that the finite mixture ARMA-GARCH model is more effective than either the mixture of AR models or AR-GARCH models. Hossain and Nasser [

22] compare the performance of finite mixture ARMA-GARCH with those of neural network and support-vector machines (SVM) approaches for financial time series. The results indicate that the finite mixture ARMA-GARCH model outperforms the other two methods in terms of directional symmetry (DS) and weighted directional symmetry (WDS). Haas et al. [

23] propose a MN-GARCH model for the daily return data on a stock index. The empirical analysis suggests good performance of the MN-GARCH model for both in-sample fit and out-of-sample forecasting. Similarly, Alexander and Lazar [

24] apply the general normal mixture GARCH(1,1) for exchange rate modeling. The preliminary results reveal that the two-component mixture GARCH(1,1) model outperforms the mixture models with three or more components, as well as the symmetric and skewed student’s GARCH models. Broda et al. [

25] propose an approach that combines GARCH model with the mixtures of Paretian distributions. The approach is then applied to model seven major FX and equity indices, and it turns out to be more effective than the traditional GARCH-type models. Besides, other significant works include the mixture asymmetric GARCH model for option pricing [

26], and a class of mixture GARCH model for capturing volatility and periodicity in non-linear time series data [

27].

Although the mixture GARCH models are effective modeling tools for time series data, the major drawback is the existence of large number of parameters, which renders the process of model fitting rather difficult. One way for effectively estimating parameters in finite mixture models could be the expectation–maximization (EM) algorithm. Usually, the EM algorithm is comprised of two steps, namely, the expectation step (E-step) and the maximization step (M-step). The E-step provides the expectation on the missing information based on the conditional distribution of observations, while the M-step provides the maximum likelihood estimates (MLE) to the parameters based on the observations and expectation of the missing information. There are numerous applications of the EM algorithm, and particularly significant efforts have been made to fit the Gaussian mixture models by using various versions of EM algorithms [

28,

29,

30,

31]. The well-known drawbacks of EM algorithm lie in the local convergence and initialization, but recent studies have addressed the problem by combining new techniques, such as k-means, greedy learning, unsupervised learning, and genetic algorithm, with the EM algorithm [

32,

33,

34,

35].

The mixture GARCH model is also able to be fitted with the EM algorithm. However, the related studies are relatively scarce. Nikolaev et al. [

36] use the EM algorithm and mixture GARCH model for estimating the volatility of financial returns, where AR(1) is applied for mean equation and Student’s t distribution is used as the component for the mixture model. Cheng et al. [

37] combine the normal mixture GARCH model with the EM algorithm for S&P500 Index and Hang Seng Index forecasting, where AR(1) is also assumed for the mean equation. In addition, Wu and Lee [

38] apply the EM algorithm and the normal mixture GARCH model to study the excess market returns, where no mean equation is considered. Tang et al. [

21] extend the mixture AR-GARCH model to ARMA-GARCH model, which is fitted with EM algorithm and applied for the stock price forecasting. However, the mean equation is also considered as a mixture component, and this arrangement is lack of support from the mixture GARCH theory.

Although the literature shows potentials for financial applications of finite mixture GARCH models, the effort for adopting the methodology on energy related subjects has been lacking. More importantly, the combination of finite mixture GARCH approach with EM algorithm has not been attempted to the best of our knowledge. As such, the proposed research helps to bridge the research gap.