Empirical Evidence of the Cost of Capital under Risk Conditions for Thermoelectric Power Plants in Brazil

Abstract

:1. Introduction

2. Materials and Methods

2.1. Object of Study

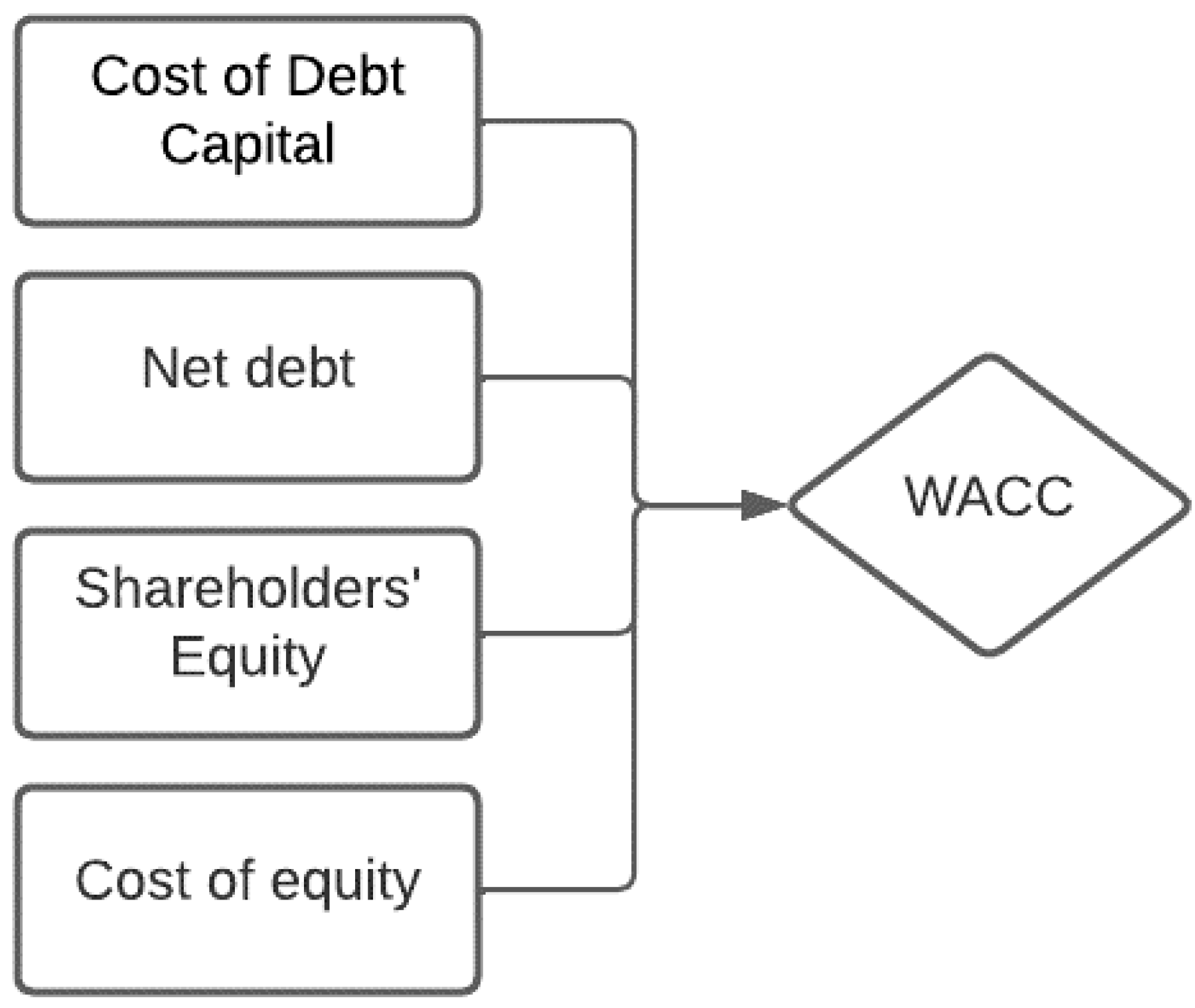

2.2. Model Development

2.3. Risk Identification and Uncertainty

2.4. Identification of Analysis Variables or Output Variables

2.5. Model Simulation and Analysis

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Agência Nacional de Energia Elétrica—ANEEL. Sistema de Informações da Geração da ANEEL. 2020. Available online: http://www2.aneel.gov.br/aplicacoes/capacidadebrasil/OperacaoCapacidadeBrasil.cfm (accessed on 5 May 2022).

- Empresa de Pesquisa Energética—EPE. Brazilian Energy Balance 2020 Year 2019; Empresa de Pesquisa Energetica: Rio de Janeiro, Brazil, 2020; 292p.

- Empresa de Pesquisa Energética—EPE. Expansão da Geração. 2022. Available online: https://www.epe.gov.br/pt/areas-de-atuacao/energia-eletrica/expansao-da-geracao/fontes (accessed on 16 January 2022).

- Operador Nacional do Sistema—ONS. Módulo 7—Planejamento da Operação Energética—Submódulo 7.2 Planejamento Anual da Operação Energética. Operador Nacional do Sistema Elétrico, Rio de Janeiro. 2020. Available online: http://www.ons.org.br/%2FProcedimentosDeRede%2FM%C3%B3dulo%207%2FSubm%C3%B3dulo%207.2%2FSubm%C3%B3dulo%207.2%202017.12.pdf (accessed on 10 December 2021).

- U.S. Department of Energy—DOE. Quadrennial Technology Review: An Assessment of Energy Technologies and Research Opportunities; U.S. Department of Energy: Washington, DC, USA, 2015.

- Brasil, Bolsa, Balcão (B3)—B3 S.A. Índice de Sustentabilidade Empresarial (ISE B3). 2022. Available online: https://www.b3.com.br/pt_br/market-data-e-indices/indices/indices-de-sustentabilidade/indice-de-sustentabilidade-empresarial-ise.htm (accessed on 24 May 2022).

- Edison Electric Institute—EEI. Delivering The Future. 2022. Available online: https://www.eei.org/ (accessed on 24 May 2022).

- United Nations Lead Agency on International Development—UNDP. Sustainable Development Goals (SDGs). 2022. Available online: https://www.undp.org/sustainable-development-goals (accessed on 24 May 2022).

- Brealey, R.; Allen, F.; Stewart, M. Principles of Corporate Finance, 13th ed.; Mc Graw Hill: New York City, NY, USA, 2020. [Google Scholar]

- Marcus, A.; Kane, A.; Bodie, Z. ISE Investments, 12th ed.; Mc Graw Hill: New York, NY, USA, 2020. [Google Scholar]

- Modigliani, F.; Miller, M.H. The Cost of Capital, Corporation Finance and the Theory of Investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Hawawini, G.; Viallet, C. Finance for Executives: Managing for Value Creation, 4th ed.; South-Western Cengage Learning: Mason, OH, USA, 2009. [Google Scholar]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Rocha, L.C.S.; Aquila, G.; Rotela Junior, P.; Paiva, A.P.; Pamplona, E.O.; Balestrassi, P.P. A stochastic economic viability analysis of residential wind power generation in Brazil. Renew. Sustain. Energy Rev. 2018, 90, 412–419. [Google Scholar] [CrossRef]

- Rotella, P., Jr.; Rocha, L.C.S.; Morioka, S.N.; Bolis, I.; Chicco, G.; Mazza, A.; Janda, K. Economic Analysis of the Investments in Battery Energy Storage Systems: Review and Current Perspectives. Energies 2021, 14, 2503. [Google Scholar] [CrossRef]

- Saluga, P.W.; Szczepariska-Woszczyna, K.; Miskiewicz, R.; Chlad, M. Cost of Equity of Coal-Fired Power Generation Projects in Poland: Its Importance for the Management of Decision-Making Process. Energies 2020, 13, 4833. [Google Scholar] [CrossRef]

- Steffen, B. Estimating the cost of capital for renewable energy projects. Energy Econ. 2020, 88, 104783. [Google Scholar] [CrossRef]

- Drozdowski, G. Economic calculus qua an instrument to support sustainable development under increasing risk. J. Risk Financ. Manag. 2021, 14, 15. [Google Scholar] [CrossRef]

- Eid, M.S.; Eldin, H.K. Evaluation of risk in investment alternatives. Comput. Ind. Eng. 1977, 1, 185–197. [Google Scholar]

- Aquila, G.; Rotella, P., Jr.; Pamplona, E.; De Queiroz, A. Wind Power Feasibility Analysis under Uncertainty in the Brazilian Electricity Market. Energy Econ. 2017, 65, 127–136. [Google Scholar] [CrossRef]

- Lacerda, L.S.; Rotela, P., Jr.; Peruchi, R.S.; Chicco, G.; Rocha, L.C.S.; Aquila, G.; Coelho, L.M., Jr. Microgeneration of Wind Energy for Micro and Small Businesses: Application of ANN in Sensitivity Analysis for Stochastic Economic Feasibility. IEEE Access 2020, 8, 73931–73946. [Google Scholar] [CrossRef]

- Silva, C.P.C.; Coelho, L.M., Jr.; Oliveira, A.D.; Scolforo, J.R.S.; Rezende, J.L.P.; Lima, I.C.G. Economic analysis of agroforestry systems with candeia. Cerne 2012, 18, 585–594. [Google Scholar] [CrossRef]

- Agência Nacional de Energia Elétrica—ANEEL. Nota Técnica 45/2020-SRM/ANEEL, de 14/04/2020, Conforme Detalhado no Item “III.4.1-Taxa Regulatória de Remuneração de Capital Real e Antes de Impostos—Segmento de Distribuição—Por Alíquotas de IRPJ e CSLL”; ANEEL: Brasília, Brazil, 2020.

- Agência Nacional de Energia Elétrica—ANEEL. Nota Técnica 34/2021—SGT-SRM/ANEEL, de 10/03/2021, Atualização da Taxa Regulatória de Remuneração do Capital; ANEEL: Brasília, Brazil, 2021.

- Hawawini, G.; Viallet, C. Finanças Para Executivos—Gestão Para a Criação de Valor; Tradução Técnica Antonio Zoratto Sanvicente; Cengage Learning: São Paulo, Brazil, 2009. [Google Scholar]

- Brasil, Bolsa, Balcão (B3)—B3 S.A. Índice de Energia Elétrica (IEE B3). Available online: https://www.b3.com.br/pt_br/market-data-e-indices/indices/indices-de-segmentos-e-setoriais/indice-de-energia-eletrica-iee.htm#:~:text=O%20IEE%20%C3%A9%20um%20%C3%ADndice,%E2%80%9Cex%2Dprovento%E2%80%9D) (accessed on 20 April 2021).

- New York Stock Exchange—NYSE. Listings. Available online: https://www.nyse.com/index (accessed on 20 April 2021).

- National Association of Securities Dealers Automatic Quotation System—NASDAQ. Market Activity. Available online: https://www.nasdaq.com/ (accessed on 20 April 2021).

- Lamers, P.; Roni, M.S.; Tumuluru, J.S.; Jacobson, J.J.; Cafferty, K.G.; Hansen, J.K.; Kenney, K.; Teymouri, F.; Bals, B. Techno-economic analysis of decentralized biomass processing depots. Bioresour. Technol 2015, 194, 205–213. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Damodaran, A. What Is the Riskfree Rate? A Search for the Basic Building Block. 2008. Available online: https://pages.stern.nyu.edu/~adamodar/pdfiles/papers/riskfreerate.pdf (accessed on 10 December 2021). [CrossRef] [Green Version]

- Anton, S.G.; Nucu, A.E. The impact of working capital management on firm profitability: Empirical evidence from the Polish listed firms. J. Risk Financ. Manag. 2020, 14, 9. [Google Scholar] [CrossRef]

| Code | Local Companies | Code | International Companies |

|---|---|---|---|

| ALUP11 | Alupar Investimento S.A. | FE | Firstenergy Corp. |

| CESP6 | Cesp—Cia Energética de São Paulo | EIX | Edison International |

| CMIG4 | Cemig—Cia Energética de Minas Gerais | ES | Eversource Energy |

| COCE5 | Coelce—Cia Energética do Ceará | PPL | Ppl Corporation |

| CPFE3 | CPFL energia | ED | Consolidated Edison, Inc. |

| CPLE6 | Copel—Cia Paranaense de Energia | AEP | American Electric Power Company, Inc. |

| EGIE3 | Engie Brasil Energia S.A. | PCG | Pg & e Corporation |

| ELET3 | Eletrobrás—Centrais Elétricas Bras. S.A. | OGE | Oge Energy Corp. |

| ENBR3 | EDP Energias do Brasil | EXC | Exelon Corporation |

| ENEV3 | Eneva S.A. | NWE | Northwestern Corporation |

| ENGI11 | Energisa S.A. | NEE | Nextera Energy, Inc. |

| EQTL3 | Equatorial Energia S.A. | AEE | Ameren Corporation |

| LIGT3 | Light Serviços de Eletricidade S.A. | IDA | Idacorp, Inc. |

| NEOE3 | Neoenergia S.A. | ETR | Entergy Corporation |

| OMGE3 | Ômega Geração S.A. | PEG | Public Service Enterprise Group Incorporated |

| TAEE11 | Taesa–Transm. Aliança de Energia Elétrica S.A. | ||

| TIET11 | AES Tiete Energia S.A. | ||

| TRPL4 | Isa Cteep—Cia Trans. Energia Elétrica Paulista |

| Code | Average Return | Standard Deviation | Leveraged Beta | D/E | Unleveraged Beta | Ke (USD) | Ke (BRL) | |

|---|---|---|---|---|---|---|---|---|

| Local | ALUP11 | 0.06% | 1.70% | 0.42 | 46.8% | 0.28 | 8.4% | 11.8% |

| CESP6 | 0.03% | 2.24% | 0.63 | 33.0% | 0.57 | 11.1% | 14.6% | |

| CMIG4 | 0.03% | 2.62% | 0.99 | 63.6% | 0.70 | 15.8% | 19.5% | |

| COCE5 | 0.06% | 1.67% | 0.32 | 15.4% | 0.21 | 7.0% | 10.4% | |

| CPFE3 | 0.04% | 1.66% | 0.56 | 105.4% | 0.37 | 10.3% | 13.7% | |

| CPLE6 | 0.04% | 2.23% | 0.89 | 54.6% | 0.73 | 14.6% | 18.2% | |

| EGIE3 | 0.06% | 1.49% | 0.50 | 14.5% | 0.24 | 9.4% | 12.8% | |

| ELET3 | 0.04% | 3.24% | 1.17 | 81.5% | 0.89 | 18.2% | 21.9% | |

| ENBR3 | 0.05% | 1.89% | 0.58 | 64.7% | 0.43 | 10.5% | 13.9% | |

| ENEV3 | −0.10% | 3.74% | 0.43 | 76.2% | 0.30 | 8.5% | 11.9% | |

| ENGI11 | 0.10% | 1.95% | 0.27 | 88.1% | 0.12 | 6.4% | 9.7% | |

| EQTL3 | 0.11% | 1.57% | 0.44 | 158.0% | 0.28 | 8.7% | 12.0% | |

| LIGT3 | 0.01% | 2.53% | 0.80 | 83.9% | 0.47 | 13.3% | 16.9% | |

| NEOE3 | 0.32% | 1.36% | 0.26 | 71.8% | 0.15 | 6.2% | 9.5% | |

| OMGE3 | 0.13% | 1.54% | 0.25 | 202.9% | 0.17 | 6.2% | 9.5% | |

| TAEE11 | 0.06% | 1.59% | 0.38 | 75.9% | 0.24 | 7.8% | 11.2% | |

| TIET11 | 0.06% | 1.54% | 0.43 | 99.0% | 0.18 | 8.5% | 11.9% | |

| TRPL4 | 0.04% | 1.75% | 0.41 | 184.4% | 0.37 | 8.2% | 11.6% | |

| International | AEE | 0.06% | 1.09% | 0.52 | 128.0% | 0.28 | 7.7% | 10.1% |

| AEP | 0.06% | 1.01% | 0.44 | 160.4% | 0.21 | 6.9% | 9.3% | |

| ED | 0.04% | 0.95% | 0.33 | 121.8% | 0.18 | 6.0% | 8.4% | |

| EIX | 0.04% | 1.35% | 0.50 | 163.5% | 0.24 | 7.5% | 9.9% | |

| ES | 0.06% | 1.04% | 0.49 | 127.0% | 0.26 | 7.3% | 9.8% | |

| ETR | 0.04% | 1.08% | 0.46 | 202.9% | 0.20 | 7.1% | 9.5% | |

| EXC | 0.02% | 1.20% | 0.50 | 118.7% | 0.28 | 7.4% | 9.8% | |

| FE | 0.03% | 1.27% | 0.51 | 314.1% | 0.17 | 7.6% | 10.0% | |

| IDA | 0.06% | 1.09% | 0.61 | 66.4% | 0.42 | 8.4% | 10.8% | |

| NEE | 0.08% | 1.00% | 0.47 | 128.7% | 0.26 | 7.2% | 9.6% | |

| NWE | 0.05% | 1.08% | 0.58 | 115.9% | 0.33 | 8.1% | 10.5% | |

| OGE | 0.04% | 1.16% | 0.68 | 98.8% | 0.41 | 9.0% | 11.4% | |

| PCG | −0.05% | 3.55% | 0.53 | 192.3% | 0.24 | 7.7% | 10.2% | |

| PEG | 0.04% | 1.12% | 0.53 | 104.5% | 0.31 | 7.7% | 10.1% | |

| PPL | 0.04% | 1.07% | 0.46 | 180.1% | 0.21 | 7.1% | 9.5% |

| Parameters | National | International |

|---|---|---|

| Leveraged beta | 0.38 | 0.28 |

| Unleveraged beta | 0.36 | 0.26 |

| Cost of equity (Ke) in reals | 11.32% | 10.48% |

| Cost of debt capital (Kd) in reals | 8.19% | 8.19% |

| WACC | 11.13% | 10.32% |

| WACC ANEEL (Technical Note N° 45/2020) | 10.55% | 10.55% |

| Brazil (BRL) | EUA (USD) | |||||

|---|---|---|---|---|---|---|

| Minimum | More Likely | Maximum | Minimum | More Likely | Maximum | |

| Unleveraged Beta | 0.12 | 0.37 | 0.89 | 0.17 | 0.27 | 0.42 |

| Net Debt (×106) | $1.11 | $9.10 | $35.75 | $1.70 | $21.84 | $46.98 |

| Shareholders’ Equity (×106) | $1.38 | $76.37 | $13.67 | $2.07 | $14.82 | $36.51 |

| Statistics | Brazilian Companies (IEE) | American Companies (EEI) |

|---|---|---|

| Average | 10.50% | 8.53% |

| Median | 10.40% | 8.49% |

| Standard Deviation | 1.35% | 0.63% |

| Variance | 0.02% | 0.00% |

| Kurtosis | 2.71 | 2.94 |

| Coefficient of Variation | 0.1286 | 0.0745 |

| Minimum | 6.64% | 6.79% |

| Maximum | 15.06% | 11.22% |

| Percentiles | ||

| 0% | 6.64% | 6.79% |

| 10% | 8.82% | 7.73% |

| 20% | 9.30% | 7.98% |

| 30% | 9.70% | 8.17% |

| 40% | 10.06% | 8.33% |

| 50% | 10.40% | 8.49% |

| 60% | 10.77% | 8.66% |

| 70% | 11.18% | 8.83% |

| 80% | 11.66% | 9.06% |

| 90% | 12.35% | 9.37% |

| 100% | 15.06% | 11.22% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Coelho Junior, L.M.; Fonseca, A.J.d.S.; Castro, R.; Mello, J.C.d.O.; Santos, V.H.R.d.; Pinheiro, R.B.; Sousa, W.L.; Santos Júnior, E.P.; Ramos, D.S. Empirical Evidence of the Cost of Capital under Risk Conditions for Thermoelectric Power Plants in Brazil. Energies 2022, 15, 4313. https://doi.org/10.3390/en15124313

Coelho Junior LM, Fonseca AJdS, Castro R, Mello JCdO, Santos VHRd, Pinheiro RB, Sousa WL, Santos Júnior EP, Ramos DS. Empirical Evidence of the Cost of Capital under Risk Conditions for Thermoelectric Power Plants in Brazil. Energies. 2022; 15(12):4313. https://doi.org/10.3390/en15124313

Chicago/Turabian StyleCoelho Junior, Luiz Moreira, Amadeu Junior da Silva Fonseca, Roberto Castro, João Carlos de Oliveira Mello, Victor Hugo Ribeiro dos Santos, Renato Barros Pinheiro, Wilton Lima Sousa, Edvaldo Pereira Santos Júnior, and Dorel Soares Ramos. 2022. "Empirical Evidence of the Cost of Capital under Risk Conditions for Thermoelectric Power Plants in Brazil" Energies 15, no. 12: 4313. https://doi.org/10.3390/en15124313

APA StyleCoelho Junior, L. M., Fonseca, A. J. d. S., Castro, R., Mello, J. C. d. O., Santos, V. H. R. d., Pinheiro, R. B., Sousa, W. L., Santos Júnior, E. P., & Ramos, D. S. (2022). Empirical Evidence of the Cost of Capital under Risk Conditions for Thermoelectric Power Plants in Brazil. Energies, 15(12), 4313. https://doi.org/10.3390/en15124313