A Review of the Levelized Cost of Wave Energy Based on a Techno-Economic Model

Abstract

1. Introduction

2. Literature Review

3. Current Wave Energy Technologies

4. Methodology

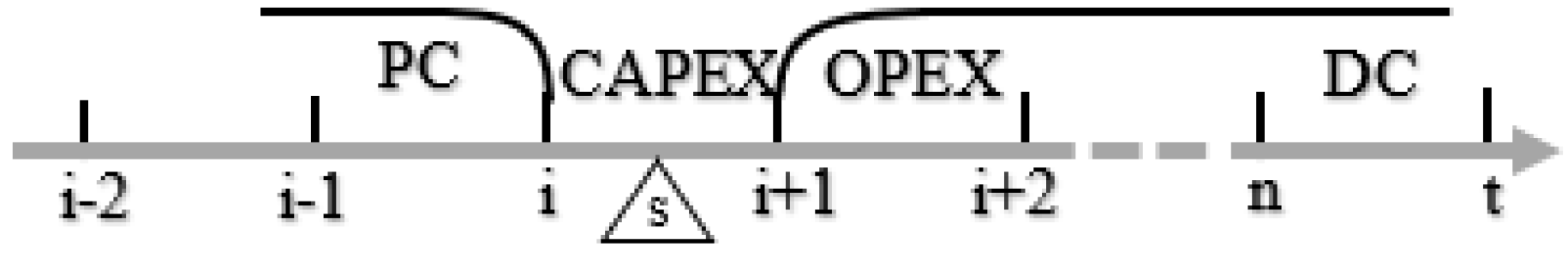

4.1. Distribution of Costs

4.2. Techno-Economic Model

- (1)

- Undiscounted cost of energy

- (2)

- Half-discounted cost of energy

- (3)

- Discounted cost of energy

4.3. Discount Factor

4.4. Levelized Cost of Wave Energy

5. Configuration of LCOE

5.1. Pre-Installation Cost and Decommissioning Cost

- (1)

- Pre-installation cost

- (2)

- Decommissioning costs

5.2. Capital Expenditure

5.2.1. Cost Measure

- (1)

- Mass cost

- (2)

- Flexible cost

- (3)

- Direct cost

- (4)

- Intangible cost

- (5)

- Percentage cost

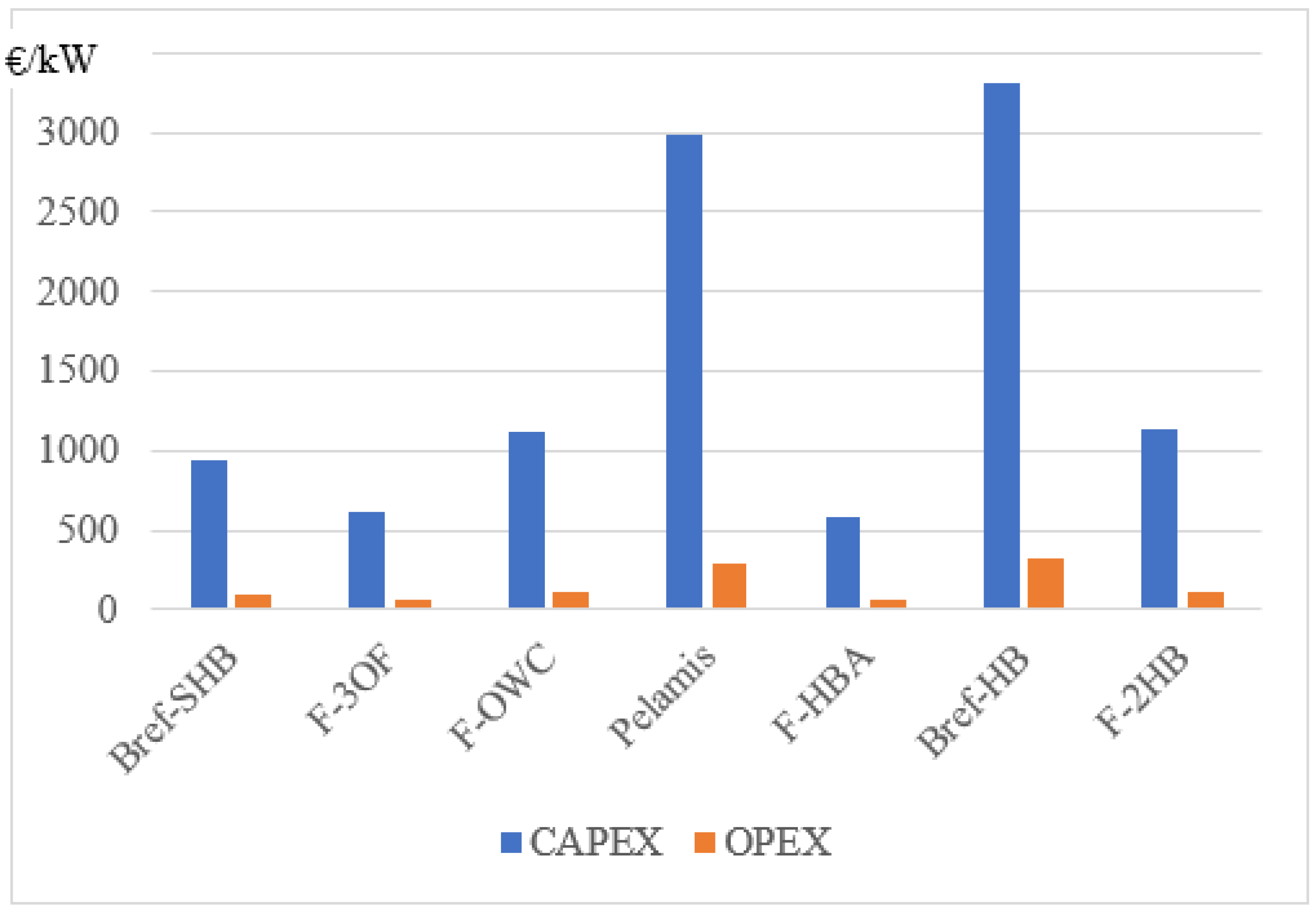

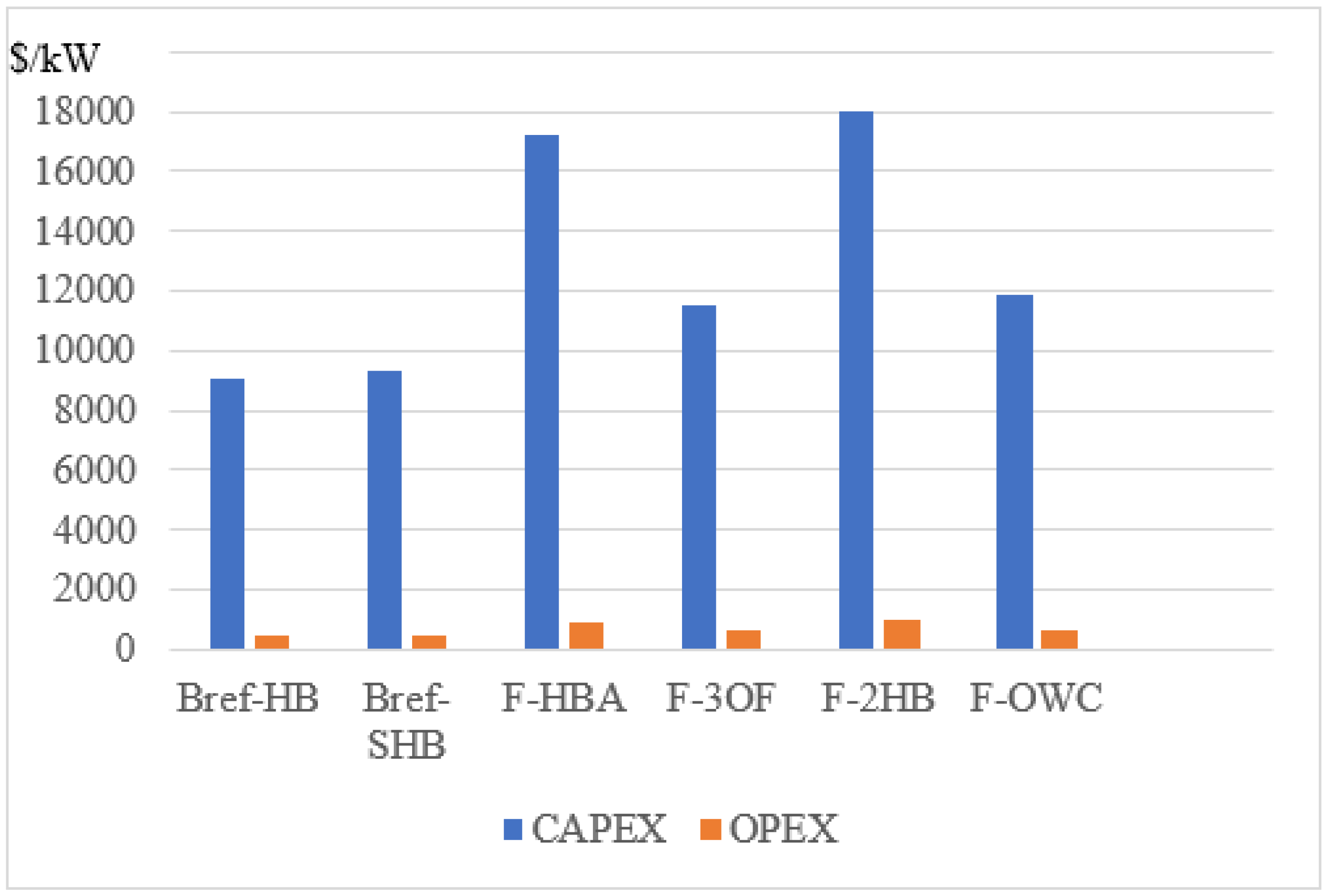

5.2.2. Comparison of CAPEX

5.3. Operational Expenditure

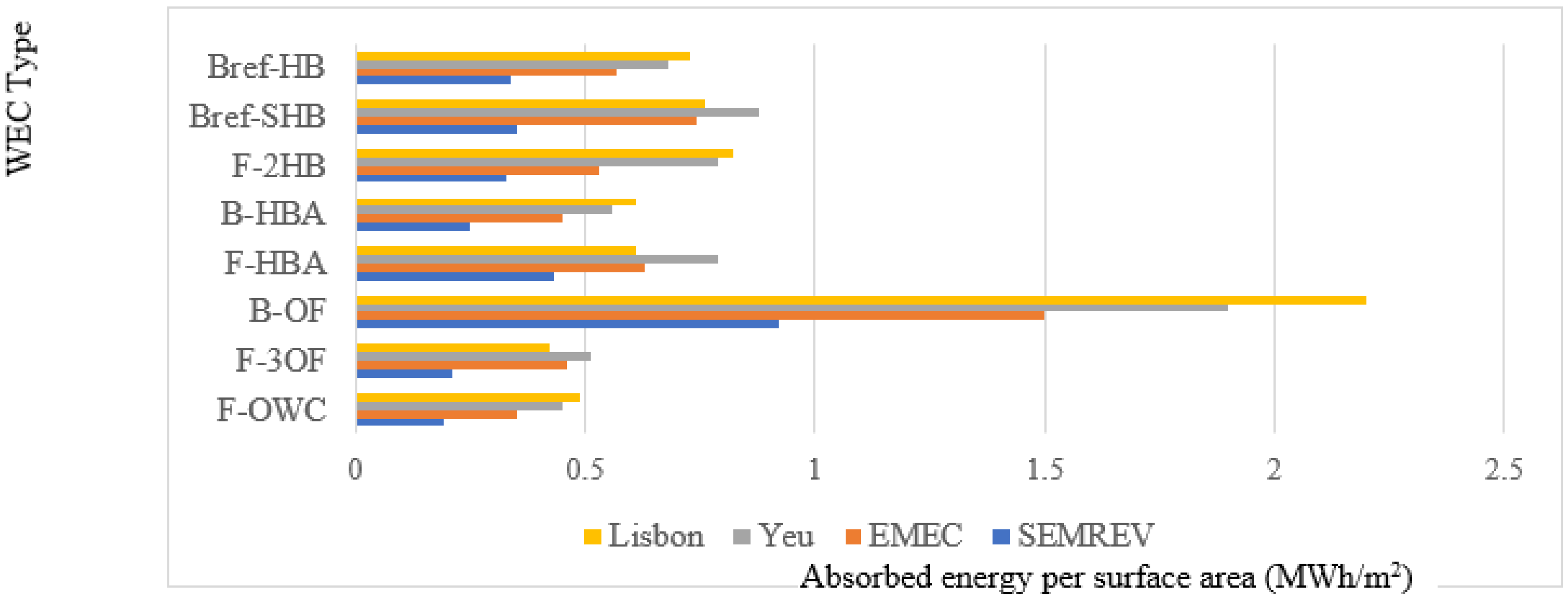

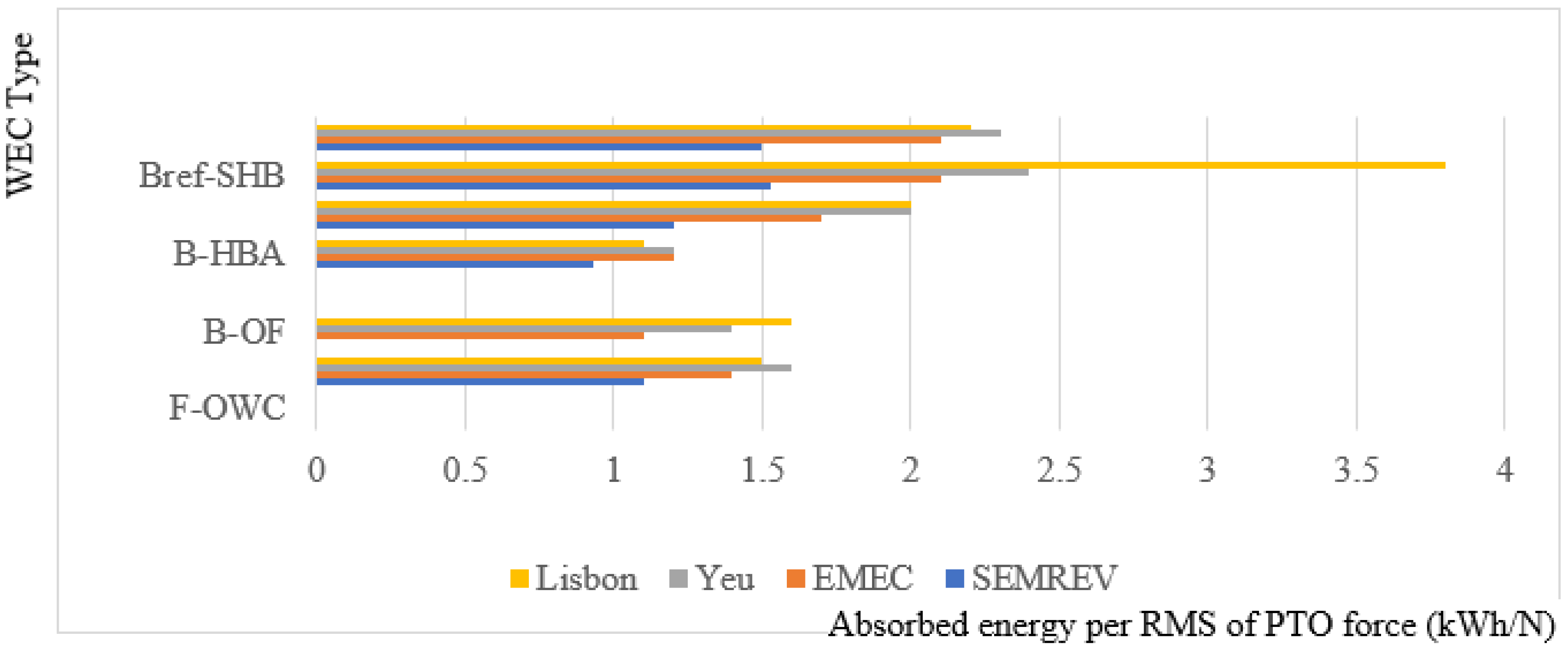

5.4. Annual Energy Production

5.5. Discount Rate and Lifespan of Project

5.6. Levelized Cost of Wave Energy

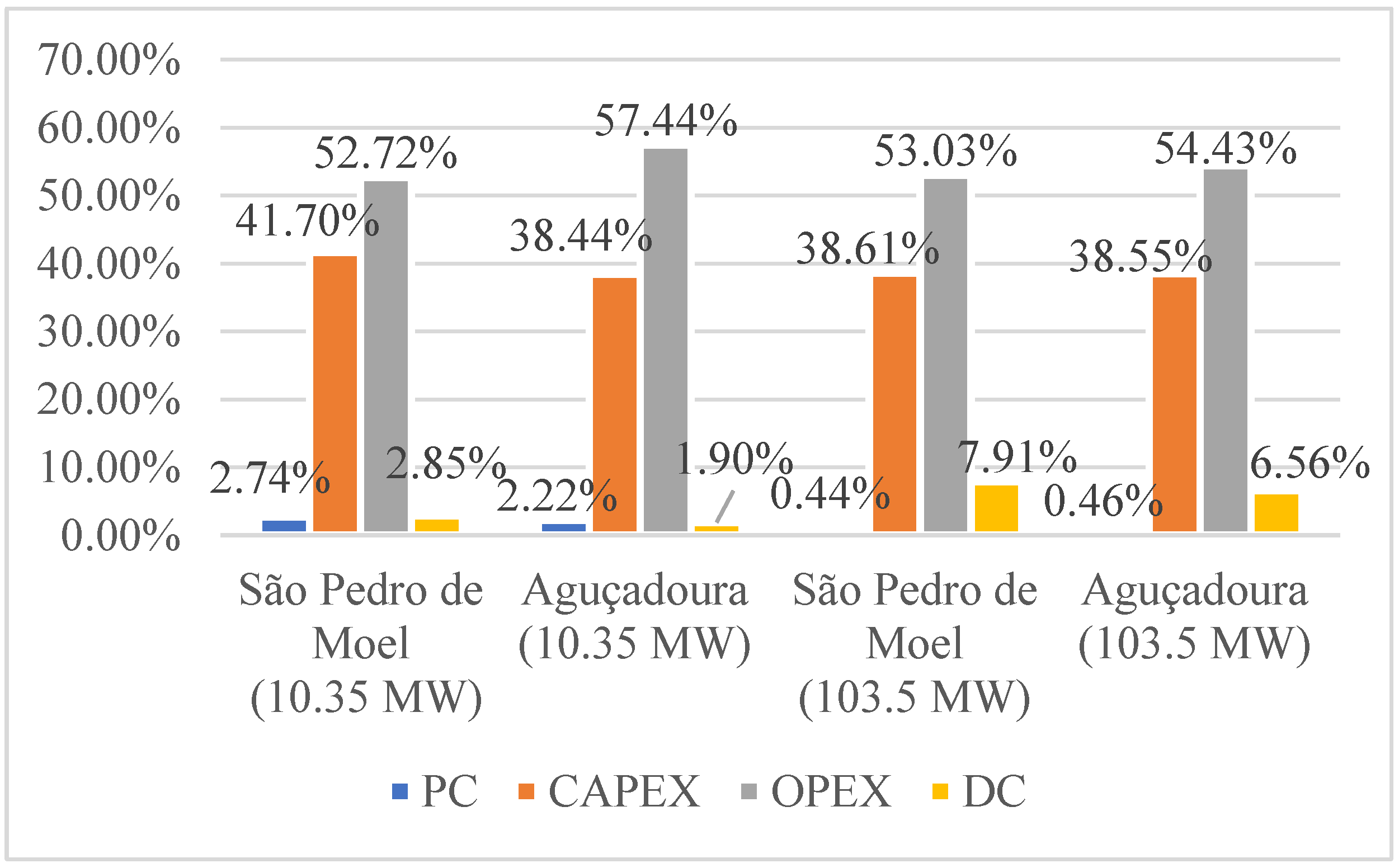

6. Case Study and Discussions

6.1. Assumption of Model

6.2. Results and Discussion

7. Concluding Remarks

- -

- The identification and estimation of sub-costs are a good way to calculate the CAPEX and OPEX more accurately. Some sub-costs can be measured by different element costs, and the cost of device occupies an important portion in the CAPEX mixture.

- -

- The calculation of the OPEX is relatively simpler than the CAPEX. The most used method is to use the percentage method to include both the flexible cost and fixed cost as the sub-costs of the OPEX.

- -

- The AEP is considered as a function of the project capacity, device capacity factor, device availability factor, and time. The discount rate often arranges from 5% to 15% to discount the costs. The AEP, discount rate, and project time may determine the uncertainty, risk, requirements of return on investment, and technological selection.

- -

- In the case study, one-step and multi-step models were proposed to analyze the difference in the LCOEs and to examine the influence of three variables—the CAPEX, OPEX, and AEP—on the LCOEs by considering the impact of the complex relationship between the CAPEX, OPEX, and AEP on the LCOE; the final project program is up to the appraisal of the LCOE and the arrangement of the CAPEX, OPEX and AEP.

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kober, T.; Schiffer, H.W.; Densing, M.; Panos, E. Global energy perspectives to 2060–WEC’s World Energy Scenarios 2019. Energy Strategy Rev. 2020, 31, 100523. [Google Scholar] [CrossRef]

- REN21.Renewables 2022 Global Status Report [R/OL]. 2022. Available online: https://www.ren21.net/wp-content/uploads/2019/05/GSR2022_Full_Report.pdf (accessed on 1 March 2022).

- European Climate Foundation (ECF). Roadmap 2050: A Practical Guide to a Prosperous, Low-Carbon Europe [R/OL]. Available online: https://www.roadmap2050.eu/attachments/files/Volume1_fullreport_PressPack.pdf (accessed on 1 March 2022).

- European Environment Agency. Climate Trends and Projections in Europe 2021 [R/OL]. Available online: https://www.eea.europa.eu/publications/trends-and-projections-in-europe-2021 (accessed on 2 March 2022).

- Reikard, G.; Robertson, B.; Bidlot, J.R. Combining wave energy with wind and solar: Short-term forecasting. Renew. Energy 2015, 81, 442–456. [Google Scholar] [CrossRef]

- Izadparast, A.H.; Niedzwecki, J.M. Estimating the potential of ocean wave power resources. Ocean. Eng. 2011, 38, 177–185. [Google Scholar] [CrossRef]

- Lenee-Bluhm, P.; Paasch, R.; Özkan-Haller, H.T. Characterizing the wave energy resource of the US Pacific Northwest. Renew. Energy. 2011, 36, 2106–2119. [Google Scholar] [CrossRef]

- Guo, B.; Ringwood, J.V. A review of wave energy technology from a research and commercial perspective. IET Renew. Power Gener. 2021, 14, 3065–3090. [Google Scholar] [CrossRef]

- Malik, A.Q. Renewables for Fiji–Path for green power generation. Renew. Energy Rev. 2021, 149, 111374. [Google Scholar] [CrossRef]

- Gunn, K.; Stock-Williams, C. Quantifying the global wave power resource. Renew. Energy 2012, 44, 296–304. [Google Scholar] [CrossRef]

- International Renewable Energy Agency. Wave Energy Technology Brief. Abu Dhabi, United Arab Emirates, 2014. Available online: https://www.irena.org/publications/2014/Jun/Wave-energy (accessed on 5 May 2022).

- Wang, L.; Zhao, T.; Lin, M.; Li, H. Towards realistic power performance and techno-economic performance of wave power farms: The impact of control strategies and wave climates. Ocean. Eng. 2022, 248, 110754. [Google Scholar] [CrossRef]

- Branker, K.; Pathak MJ, M.; Pearce, J.M. A review of solar photovoltaic levelized cost of electricity. Renew. Sustain. Energy Rev. 2011, 15, 4470–4482. [Google Scholar] [CrossRef]

- Tsvetkova, O.; Ouarda, T.B.M.J. A review of sensitivity analysis practices in wind resource assessment. Energy Convers. Manag. 2021, 238, 114112. [Google Scholar] [CrossRef]

- Coles, D.; Angeloudis, A.; Greaves, D.; Hastie, G.; Lewis, M.; Mackie, L.; McNaughton, J.; Miles, J.; Neill, S.; Piggott, M.; et al. A review of the UK and British Channel Islands practical tidal stream energy resource. Proc. R. Soc. A 2021, 477, 20210469. [Google Scholar] [CrossRef]

- Clauser, C.; Ewert, M. The renewables cost challenge: Levelized cost of geothermal electric energy compared to other sources of primary energy–Review and case study. Renew. Sustain. Energy Rev. 2018, 82, 3683–3693. [Google Scholar] [CrossRef]

- Astariz, A.V.S.; Iglesias, G. Evaluation and comparison of the levelized cost of tidal, wave, and offshore wind energy. J. Renew. Sustain. Energy 2015, 7, 053112. [Google Scholar] [CrossRef]

- Xu, Y.; Yang, K.; Yuan, J. Levelized cost of offshore wind power in China. Environ. Sci. Pollut. Res. 2021, 28, 25614–25627. [Google Scholar] [CrossRef]

- Arshad, M.; O’Kelly, B.C. Offshore wind-turbine structures: A review. Proc. Inst. Civ. Eng.-Energy 2013, 166, 139–152. [Google Scholar] [CrossRef]

- Joskow, P.L. Comparing the costs of intermittent and dispatchable electricity generating technologies. Am. Econ. Rev. 2011, 101, 238–241. [Google Scholar] [CrossRef]

- Teillant, B.; Costello, R.; Weber, J.; Ringwood, J. Productivity and economic assessment of wave energy projects through operational simulations. Renew. Energy 2012, 48, 220–230. [Google Scholar] [CrossRef]

- Wang, L.; Isberg, J.; Tedeschi, E. Review of control strategies for wave energy conversion systems and their validation:the wave-to-wire approach. Renew. Sustain. Energy Rev. 2018, 81, 266–279. [Google Scholar] [CrossRef]

- Barney, A.; Polatidis, H.; Jelić, M.; Tomašević, N.; Pillai, G.; Haralambopoulos, D. Transition towards decarbonisation for islands: Development of an integrated energy planning platform and application. Sustain. Energy Technol. Assess. 2021, 47, 101501. [Google Scholar] [CrossRef]

- Barutha, P.; Nahvi, A.; Cai, B.; Jeong, H.D.; Sritharan, S. Evaluating commercial feasibility of a new tall wind tower design concept using a stochastic levelized cost of energy model. J. Clean. Prod. 2019, 240, 118001. [Google Scholar] [CrossRef]

- Tazi, N.; Safaei, F.; Hnaien, F. Assessment of the levelized cost of energy using a stochastic model. Energy 2022, 238, 121776. [Google Scholar] [CrossRef]

- Harvey, L.D. Clarifications of and improvements to the equations used to calculate the levelized cost of electricity (LCOE), and comments on the weighted average cost of capital (WACC). Energy 2020, 207, 118340. [Google Scholar] [CrossRef]

- Geissmann, T.; Ponta, O. A probabilistic approach to the computation of the levelized cost of electricity. Energy 2017, 124, 372–381. [Google Scholar] [CrossRef]

- de Andres, A.; Medina-Lopez, E.; Crooks, D.; Roberts, O.; Jeffrey, H. On the reversed LCOE calculation: Design constraints for wave energy commercialization. Int. J. Mar. Energy 2017, 18, 88–108. [Google Scholar] [CrossRef]

- Astariz, S.; Iglesias, G. Wave energy vs. other energy sources: A reassessment of the economics. Int. J. Green Energy 2016, 13, 747–755. [Google Scholar] [CrossRef]

- Chang, G.; Jones, C.A.; Roberts, J.D.; Neary, V.S. A comprehensive evaluation of factors affecting the levelized cost of wave energy conversion projects. Renew. Energy 2018, 127, 344–354. [Google Scholar] [CrossRef]

- Shen, W.; Chen, X.; Qiu, J.; Hayward, J.A.; Sayeef, S.; Osman, P.; Meng, K.; Dong, Z.Y. A comprehensive review of variable renewable energy levelized cost of electricity. Renew. Sustain. Energy Rev. 2020, 133, 110301. [Google Scholar] [CrossRef]

- Choupin, O.; Henriksen, M.; Etemad-Shahidi, A.; Tomlinson, R. Strategically Estimated CapEx: Wave Energy Converter Costs Breakdown and Parameterization. 2020. Available online: https://assets.researchsquare.com/files/rs-133554/v1_covered.pdf?c=1631849668 (accessed on 10 May 2022).

- Astariz, S.; Iglesias, G. The economics of wave energy: A review. Renew. Sustain. Energy Rev. 2015, 45, 397–408. [Google Scholar] [CrossRef]

- Piscopo, V.; Benassai, G.; Della Morte, R.; Scamardella, A. Cost-Based design and selection of Point Absorber Devices for the Mediterranean Sea. Energies 2018, 11, 946. [Google Scholar] [CrossRef]

- Tan, J.; Polinder, H.; Laguna, A.; Wellens, P.; Miedema, S. The influence of sizing of wave energy converters on the techno-economic performance. J. Mar. Sci. Eng. 2021, 9, 52. [Google Scholar] [CrossRef]

- Göteman, M.; Giassi, M.; Engström, J.; Isberg, J. Advances and challenges in wave energy park optimization—A review. Front. Energy Res. 2020, 8, 26. [Google Scholar] [CrossRef]

- Biyela, S.S.; Cronje, W.A. Techno-economic analysis framework for wave energy conversion schemes under South African conditions: Modeling and simulations. Int. J. Energy Power Eng. 2016, 10, 786–792. [Google Scholar]

- Clemente, D.; Rosa-Santos, P.; Taveira-Pinto, F. On the potential synergies and applications of wave energy converters: A review. Renew. Sustain. Energy Rev. 2021, 135, 110162. [Google Scholar] [CrossRef]

- Shadman, M.; Silva, C.; Faller, D.; Wu, Z.; Assad, L.P.D.F.; Landau, L.; Levi, C.; Estefen, S.F. Ocean renewable energy potential, technology, and deployments: A case study of Brazil. Energies 2019, 12, 3658. [Google Scholar] [CrossRef]

- Ahamed, R.; McKee, K.; Howard, I. Advancements of wave energy converters based on power take off (PTO) systems: A review. Ocean. Eng. 2020, 204, 107248. [Google Scholar] [CrossRef]

- Myhr, A.; Bjerkseter, C.; Ågotnes, A.; Nygaard, T.A. Levelised cost of energy for offshore floating wind turbines in a life cycle perspective. Renew. Energy 2014, 66, 714–728. [Google Scholar] [CrossRef]

- Esteban, M.; Leary, D. Current developments and future prospects of offshore wind and ocean energy. Appl. Energy 2012, 90, 128–136. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhao, Y.; Sun, W.; Li, J. Ocean wave energy converters: Technical principle, device realization, and performance evaluation. Renew. Sustain. Energy Rev. 2021, 141, 110764. [Google Scholar] [CrossRef]

- King, A. Numerical modelling of the bomborawave energy conversion device. In Proceedings of the 19th Australasian Fluid Mechanics Conference, Melbourne, Australia, 8–11 December 2014. [Google Scholar]

- Collins, I.; Hossain, M.; Dettmer, W.; Masters, I. Flexible membrane structures for wave energy harvesting: A review of the developments, materials and computational modelling approaches. Renew. Sustain. Energy Rev. 2021, 151, 111478. [Google Scholar] [CrossRef]

- Liu, C.; Huang, Z. A flexible membrane breakwater with a piezoelectric layer for providing harborage and wave-energy conversion. J. Coast. Res. 2020, 36, 148–156. [Google Scholar] [CrossRef]

- Xu, S.; Wang, S.; Soares, C.G. Experimental investigation on hybrid mooring systems for wave energy converters. Renew. Energy 2020, 158, 130–153. [Google Scholar] [CrossRef]

- Aggidis, G.A.; Taylor, C.J. Overview of wave energy converter devices and the development of a new multi-axis laboratory prototype. IFAC-Pap. Online 2017, 50, 15651–15656. [Google Scholar] [CrossRef]

- Iglesias, G.; Carballo, R. Wave resource in El Hierro—An island towards energy self-sufficiency. Renew. Energy 2011, 36, 689–698. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Silva, D.; Bento, A.R.; Salvação, N.; Soares, C.G. Economic feasibility of wave energy farms in Portugal. Energies 2018, 11, 3149. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Filgueira-Vizoso, A.; Piegari, L. Calculation of the levelized cost of energy and the internal rate of return using GIS: The case study of a floating wave energy farm. In Proceedings of the 2019 International Conference on Clean Electrical Power (ICCEP), Otranto, Italy, 2–4 July 2019; pp. 674–679. [Google Scholar]

- Rusu, L.; Onea, F. Assessment of the performances of various wave energy converters along the European continental coasts. Energy 2015, 82, 889–904. [Google Scholar] [CrossRef]

- Zanuttigh, B.; Angelelli, E.; Kofoed, J.P. Effects of mooring systems on the performance of a wave activated body energy converter. Renew. Energy 2013, 57, 422–431. [Google Scholar] [CrossRef]

- Cameron, L.; Doherty, R.; Henry, A.; Doherty, K.; Van’t Hoff, J.; Kaye, D.; Naylor, D.; Bourdier, S.; Whittaker, T. Design of the next generation of the Oyster wave energy converter. In Proceedings of the 3rd International Conference on Ocean Energy, Bilbao, Spain, 6–9 October 2010; Volume 6, pp. 1–12. [Google Scholar]

- Zhang, D.; Li, W.; Lin, Y. Wave energy in China: Current status and perspectives. Renew. Energy 2009, 34, 2089–2092. [Google Scholar] [CrossRef]

- Arena, F.; Romolo, A.; Malara, G.; Ascanelli, A. On design and building of a U-OWC wave energy converter in the Mediterranean Sea: A case study. In Proceedings of the International Conference on Offshore Mechanics and Arctic Engineering, Nantes, France, 9–14 June 2013; Volume 55423, p. V008T09A102. [Google Scholar]

- Washio, Y.; Osawa, H.; Nagata, Y.; Fujii, F.; Furuyama, H.; Fujita, T. The offshore floating type Wave Power Device “Mighty Whale”: Open sea tests. In Proceedings of the Tenth International Offshore and Polar Engineering Conference, Seattle, WA, USA, 28 May–2 June 2000. [Google Scholar]

- Kofoed, J.P.; Frigaard, P.; Friis-Madsen, E.; Sørensen, H.C. Prototype testing of the wave energy converter wave dragon. Renew. Energy 2006, 31, 181–189. [Google Scholar] [CrossRef]

- Vicinanza, D.; Margheritini, L.; Kofoed, J.P.; Buccino, M. The SSG wave energy converter: Performance, status and recent developments. Energies 2012, 5, 193–226. [Google Scholar] [CrossRef]

- Babarit, A.; Hals, J.; Muliawan, M.; Kurniawan, A.; Moan, T.; Krokstad, J. Numerical benchmarking study of a selection of wave energy converters. Renew. Energy 2012, 41, 44–63. [Google Scholar] [CrossRef]

- Oliveira-Pinto, S.; Rosa-Santos, P.; Taveira-Pinto, F. Electricity supply to offshore oil and gas platforms from renewable ocean wave energy: Overview and case study analysis. Energy Convers. Manag. 2019, 186, 556–569. [Google Scholar] [CrossRef]

- Neill, S.P.; Hashemi, M.R. Wave power variability over the northwest European shelf seas. Appl. Energy 2013, 106, 31–46. [Google Scholar] [CrossRef]

- Langodan, S.; Viswanadhapalli, Y.; Dasari, H.P.; Knio, O.; Hoteit, I. A high-resolution assessment of wind and wave energy potentials in the Red Sea. Appl. Energy 2016, 181, 244–255. [Google Scholar] [CrossRef]

- Coe, R.G.; Michelen, C.; Eckert-Gallup, A.; Sallaberry, C. Full long-term design response analysis of a wave energy converter. Renew. Energy 2018, 116, 356–366. [Google Scholar] [CrossRef]

- Dang, T.D.; Phan, C.B.; Ahn, K.K. Design and investigation of a novel point absorber on performance optimization mechanism for wave energy converter in heave mode. Int. J. Precis. Eng. Manuf.-Green Technol. 2019, 6, 477–488. [Google Scholar] [CrossRef]

- Neshat, M.; Sergiienko, N.Y.; Amini, E.; Nezhad, M.M.; Garcia, D.A.; Alexander, B.; Wagner, M. A new bi-level optimisation framework for optimising a multi-mode wave energy converter design: A case study for the Marettimo Island, Mediterranean Sea. Energies 2020, 13, 5498. [Google Scholar] [CrossRef]

- Amini, E.; Asadi, R.; Golbaz, D.; Nasiri, M.; Naeeni, S.T.O.; Nezhad, M.M.; Piras, G.; Neshat, M. Comparative study of oscillating surge wave energy converter performance: A case study for southern coasts of the Caspian sea. Sustainability 2021, 13, 10932. [Google Scholar] [CrossRef]

- Orphin, J.; Nader, J.R.; Penesis, I. Size matters: Scale effects of an OWC wave energy converter. Renew. Energy 2022, 185, 111–122. [Google Scholar] [CrossRef]

- Sheng, W.; Tapoglou, E.; Ma, X.; Taylor, C.; Dorrell, R.; Parsons, D.; Aggidis, G. Hydrodynamic studies of floating structures: Comparison of wave-structure interaction modelling. Ocean. Eng. 2022, 249, 110878. [Google Scholar] [CrossRef]

- Rusu, E.; Onea, F. A review of the technologies for wave energy extraction. Clean Energy 2018, 2, 10–19. [Google Scholar] [CrossRef]

- Clark, C.E.; Miller, A.; DuPont, B. An analytical cost model for co-located floating wind-wave energy arrays. Renew. Energy 2019, 132, 885–897. [Google Scholar] [CrossRef]

- Sharay, A.; Gregorio, I. Enhancing wave energy competitiveness through co-located wind and wave energy farms. A review on the shadow effect. Energies 2015, 8, 7344–7366. [Google Scholar]

- Aldersey-Williams, J.; Rubert, T. Levelised cost of energy–A theoretical justification and critical assessment. Energy Policy 2019, 124, 169–179. [Google Scholar] [CrossRef]

- Brealey, R.; Myers, S.; Allen, F. Corporate Finance, 8th ed.; McGraw-Hill: New York, NT, USA, 2006. [Google Scholar]

- Têtu, A.; Fernandez Chozas, J. A proposed guidance for the economic assessment of wave energy converters at early development stages. Energies 2021, 14, 4699. [Google Scholar] [CrossRef]

- Nuclear Energy Agency, International Energy Agency. Projected Costs of Generating Electricity. March 2005. Available online: https://www.oecd-nea.org/upload/docs/application/pdf/2020-12/egc-2020_2020-12-09_18-26-46_781.pdf (accessed on 2 March 2022).

- Dalton, G.J.; Alcorn, R.; Lewis, T. Case study feasibility analysis of the Pelamis wave energy convertor in Ireland, Portugal and North America. Renew. Energy 2010, 35, 443–455. [Google Scholar] [CrossRef]

- Ramos, V.; Giannini, G.; Calheiros-Cabral, T.; López, M.; Rosa-Santos, P.; Taveira-Pinto, F. Assessing the effectiveness of a novel WEC concept as a co-located solution for offshore wind farms. J. Mar. Sci. Eng. 2022, 10, 267. [Google Scholar] [CrossRef]

- Darling, S.B.; You, F.; Veselka, T.; Velosa, A. Assumptions and the levelized cost of energy for photovoltaics. Energy Environ. Sci. 2011, 4, 3133–3139. [Google Scholar] [CrossRef]

- Giassi, M.; Castellucci, V.; Göteman, M. Economical layout optimization of wave energy parks clustered in electrical subsystems. Appl. Ocean. Res. 2020, 101, 102274. [Google Scholar] [CrossRef]

- Bajaj, S.; Sandhu, K.S. Analysis of sizing parameters of a wind turbine using LCOE technique. Int. J. Energy Environ. Econ. 2017, 25, 57–68. [Google Scholar]

- Sergent, P.; Baudry, V.; De Bonviller, A.; Michard, B.; Dugor, J. Numerical assessment of onshore wave energy in France: Wave energy, conversion and cost. J. Mar. Sci. Eng. 2020, 8, 947. [Google Scholar] [CrossRef]

- Astariz, S.; Iglesias, G. Co-located wind and wave energy farms: Uniformly distributed arrays. Energy 2016, 113, 497–508. [Google Scholar] [CrossRef]

- Frost, C.; Findlay, D.; Macpherson, E.; Sayer, P.; Johanning, L. A model to map levelised cost of energy for wave energy projects. Ocean. Eng. 2018, 149, 438–451. [Google Scholar] [CrossRef]

- Thomaz, T.B.; Crooks, D.; Medina-Lopez, E.; van Velzen, L.; Jeffrey, H.; Mendia, J.L.; Arias, R.R.; Minguela, P.R. O&M models for ocean energy converters: Calibrating through Real Sea Data. Energies 2019, 12, 2475. [Google Scholar]

- Gray, A.; Dickens, B.; Bruce, T.; Ashton, I.; Johanning, L. Reliability and O&M sensitivity analysis as a consequence of site specific characteristics for wave energy converters. Ocean. Eng. 2017, 141, 493–511. [Google Scholar]

- Bertram, D.V.; Tarighaleslami, A.H.; Walmsley, M.R.W.; Atkins, M.J.; Glasgow, G.D.E. A systematic approach for selecting suitable wave energy converters for potential wave energy farm sites. Renew. Sustain. Energy Rev. 2020, 132, 110011. [Google Scholar] [CrossRef]

- Pennock, S.; Garcia-Teruel, A.; Noble, D.R.; Roberts, O.; de Andres, A.; Cochrane, C.; Jeffrey, H. Deriving current cost requirements from future targets: Case studies for emerging offshore renewable energy technologies. Energies 2022, 15, 1732. [Google Scholar] [CrossRef]

- Lehmann, M.; Karimpour, F.; Goudey, C.A.; Jacobson, P.T.; Alam, M.R. Ocean wave energy in the United States: Current status and future perspectives. Renew. Sustain. Energy Rev. 2017, 74, 1300–1313. [Google Scholar] [CrossRef]

- Faraggiana, E.; Chapman, J.; Williams, A.; Masters, I. Genetic based optimisation of the design parameters for an array-on-device orbital motion wave energy converter. Ocean. Eng. 2020, 218, 108251. [Google Scholar] [CrossRef]

- Shelley, S.; Boo, S.Y.; Luyties, W. Levelized Cost of Energy for a 200 MW Floating Wind Farm with Variance Analysis. KOSMEE 2018 Fall Conference, 2018; pp. 191–204. Available online: http://www.vloffshore.com/index_htm_files/KOSMEE%202018%20Levelized%20Cost%20of%20Energy%20for%20a%20200%20MW%20Floating%20Wind%20Farm.pdf (accessed on 6 May 2022).

- Castro-Santos, L.; Martins, E.; Soares, C.G. Cost assessment methodology for combined wind and wave floating offshore renewable energy systems. Renew. Energy 2016, 97, 866–880. [Google Scholar] [CrossRef]

- ECONorthwest. Economic Impact Analysis of Wave Energy: Phase One; Oregon Wave Energy Trust: Portland, OR, USA, 2009; Available online: https://pacificoceanenergy.org/wp-content/uploads/2013/09/Economic-Impact-Analysis-of-Wave-Energy-Phase-One%E2%80%94September-2009.pdf (accessed on 2 July 2022).

- Klure, J.; Dragoon, K.; King, J.; Reikard, G.; Ventures, P.E. Wave Energy Utility Integration: Advanced Resource Characterization and Integration Costs and Issues. Oregon Wave Energy Trust, Portland, Oregon, 2013. Available online: https://ir.library.oregonstate.edu/concern/technical_reports/vx021f634 (accessed on 2 July 2022).

- Bedard, R.; Hagerman, G.; Siddiqui, O. System Level Design, Performance and Costs for San Francisco California Pelamis Offshore Wave Power Plant; Electric Power Research Institute (EPRI): San Francisco, CA, USA, 2004; Available online: http://www.re-vision.net/documents/System%20Level%20Design,%20Performance%20and%20Costs%20-%20San%20Francisco%20California%20Pelamis%20Offshore%20Wave%20Power%20Plant.pdf (accessed on 2 July 2022).

- Dunnett, D.; Wallace, J.S. Electricity generation from wave power in Canada. Renew. Energy 2009, 34, 179–195. [Google Scholar] [CrossRef]

- Laura, C.S.; Vicente, D.C. Life-cycle cost analysis of floating offshore wind farms. Renew. Energy 2014, 66, 41–48. [Google Scholar] [CrossRef]

- Sandberg, A.B.; Klementsen, E.; Muller, G.; De Andres, A.; Maillet, J. Critical factors influencing viability of wave energy converters in off-grid luxury resorts and small utilities. Sustainability 2016, 8, 1274. [Google Scholar] [CrossRef]

- Astariz, S.; Perez-Collazo, C.; Abanades, J.; Iglesias, G. Co-located wave-wind farms: Economic assessment as a function of layout. Renew. Energy 2015, 83, 837–849. [Google Scholar] [CrossRef]

- Stansby, P.; Moreno, E.C.; Stallard, T. Large capacity multi-float configurations for the wave energy converter M4 using a time-domain linear diffraction model. Appl. Ocean. Res. 2017, 68, 53–64. [Google Scholar] [CrossRef]

- Tan, J.; Wang, X.; Laguna, A.J.; Polinder, H.; Miedema, S. The influence of linear permanent magnet generator sizing on the techno-economic performance of a wave energy converter. In Proceedings of the 2021 13th International Symposium on Linear Drives for Industry Applications (LDIA), Wuhan, China, 1–3 July 2021; pp. 1–6. [Google Scholar]

- Thomsen, J.B.; Ferri, F.; Kofoed, J.P.; Black, K. Cost optimization of mooring solutions for large floating wave energy converters. Energies 2018, 11, 159. [Google Scholar] [CrossRef]

- Chandrasekaran, S.; Sricharan, V.V.S. Numerical study of bean-float wave energy converter with float number parametrization using WEC-Sim in regular waves with the Levelized Cost of Electricity assessment for Indian sea states. Ocean. Eng. 2021, 237, 109591. [Google Scholar] [CrossRef]

- Tan, J.; Polinder, H.; Laguna, A.J.; Miedema, S. The application of the spectral domain modeling to the power take-off sizing of heaving wave energy converters. Appl. Ocean. Res. 2022, 122, 103110. [Google Scholar] [CrossRef]

- Quitoras, M.R.D.; Abundo, M.L.S.; Danao, L.A.M. A techno-economic assessment of wave energy resources in the Philippines. Renew. Sustain. Energy Rev. 2018, 88, 68–81. [Google Scholar] [CrossRef]

- Stegman, A.; De Andres, A.; Jeffrey, H.; Johanning, L.; Bradley, S. Exploring marine energy potential in the UK using a whole systems modelling approach. Energies 2017, 10, 1251. [Google Scholar] [CrossRef]

- Guanche, R.; de Andrés, A.; Simal, P.; Vidal, C.; Losada, I. Uncertainty analysis of wave energy farms financial indicators. Renew. Energy 2014, 68, 570–580. [Google Scholar] [CrossRef]

- De Andres, A.; Maillet, J.; Todalshaug, J.H.; Möller, P.; Bould, D.; Jeffrey, H. Techno-economic related metrics for a wave energy converters feasibility assessment. Sustainability 2016, 8, 1109. [Google Scholar] [CrossRef]

- Lavidas, G.; Blok, K. Shifting wave energy perceptions: The case for wave energy converter (WEC) feasibility at milder resources. Renew. Energy 2021, 170, 1143–1155. [Google Scholar] [CrossRef]

- O’Connor, M.; Lewis, T.; Dalton, G. Operational expenditure costs for wave energy projects and impacts on financial returns. Renew. Energy 2013, 50, 1119–1131. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Renewable Power Generation Costs in 2014. 2015. Available online: https://www.irena.org/publications/2015/jan/renewable-power-generation-costs-in-2014 (accessed on 2 July 2022).

- U.S. Energy Information Administration. Levelized Costs of New Generation Resources in the Annual Energy Outlook 2022. 2022. Available online: https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf (accessed on 2 July 2022).

- Tran, T.T.D.; Smith, A.D. Incorporating performance-based global sensitivity and uncertainty analysis into LCOE calculations for emerging renewable energy technologies. Appl. Energy 2018, 216, 157–171. [Google Scholar] [CrossRef]

- Allan, G.; Gilmartin, M.; McGregor, P.; Swales, K. Levelised costs of wave and tidal energy in the UK: Cost competitiveness and the importance of “banded” Renewables Obligation Certificates. Energy Policy 2011, 39, 23–39. [Google Scholar] [CrossRef]

- Burgess, C.; Biswas, W.K. Eco-efficiency assessment of wave energy conversion in Western Australia. J. Clean. Prod. 2021, 312, 127814. [Google Scholar] [CrossRef]

- European Commission. Offshore Renewable Energy [N/OL]. 2011. Available online: https://energy.ec.europa.eu/topics/renewable-energy/offshore-renewable-energy_en (accessed on 1 August 2022).

- Crooks, D.; De Andres, A.; Medina-Lopez, E.; Jeffrey, H. Demonstration of a socio-economic cost of energy analysis of a wave energy converter array. In Proceedings of the 12th European Wave and Tidal Energy Conference, Cork, Ireland, 27 August–1 September 2017; pp. 1–11. [Google Scholar]

- Wave Energy Scotland. Wave Energy Scotland Awards £7.5m for Power Take Off Projects [N/online]. Available online: https://www.waveenergyscotland.co.uk/news-events/wave-energy-scotland-awards-75m-for-power-take-off-projects/ (accessed on 9 August 2022).

- Wiser, R.; Jenni, K.; Seel, J.; Baker, E.; Hand, M.; Lantz, E.; Smith, A. Forecasting Wind Energy Costs and Cost Drivers: The Views of the World’s Leading Experts. 2016. Berkeley Lab. Available online: https://eta-publications.lbl.gov/sites/default/files/lbnl-1005717.pdf (accessed on 10 August 2022).

- Carbon Trust. Accelerating Marine Energy: The Potential for Cost Reduction-Insights from the Carbon Trust Marine Energy Accelerator. 2011. Available online: https://ctprodstorageaccountp.blob.core.windows.net/prod-drupal-files/documents/resource/public/Accelerating%20marine%20energy%20-%20REPORT.pdf (accessed on 10 August 2022).

- Castro-Santos, L.; Bento, A.R.; Guedes Soares, C. The economic feasibility of floating offshore wave energy farms in the North of Spain. Energies 2020, 13, 806. [Google Scholar] [CrossRef]

- De Oliveira, L.; dos Santos IF, S.; Schmidt, N.L.; Tiago Filho, G.L.; Camacho, R.G.R.; Barros, R.M. Economic feasibility study of ocean wave electricity generation in Brazil. Renew. Energy 2021, 178, 1279–1290. [Google Scholar] [CrossRef]

- Esteban, M.D.; López-Gutiérrez, J.-S.; Negro, V.; Laviña, M.; Muñoz-Sánchez, P. A new classification of wave energy converters used for selection of devices. J. Coast. Res. 2018, 85, 1286–1290. [Google Scholar] [CrossRef]

- Khan MZ, A.; Khan, H.A.; Aziz, M. Harvesting energy from ocean: Technologies and perspectives. Energies 2022, 15, 3456. [Google Scholar] [CrossRef]

- Castro-Santos, L.; Garcia, G.P.; Estanqueiro, A.; Justino, P.A. The levelized cost of energy (LCOE) of wave energy using GIS based analysis: The case study of Portugal. Int. J. Electr. Power Energy Syst. 2015, 65, 21–25. [Google Scholar] [CrossRef]

- Oxera Consulting. Discount Rates for Low-Carbon and Renewable Generation Technologies. 2011. Oxford. Available online: https://www.oxera.com/wp-content/uploads/2018/03/Oxera-report-on-low-carbon-discount-rates-3.pdf (accessed on 12 September 2022).

- Choupin, O.; Henriksen, M.; Tomlinson, R. Interrelationship between variables for wave direction-dependent WEC/site-configuration pairs using the CapEx method. Energy 2022, 248, 123552. [Google Scholar] [CrossRef]

- Guanche, R.; de Andrés, A.; Losada, I.J.; Vidal, C. A global analysis of the operation and maintenance role on the placing of wave energy farms. Energy Convers. Manag. 2015, 106, 440–456. [Google Scholar] [CrossRef]

| Name | Type | Location of Application/Design Stage | Reference |

|---|---|---|---|

| AquaBuOY | Point absorber/OBWEC | Portugal Galicia, Northwest Spain | [50] [51] |

| Wavebob | Point absorber/OBWEC | laboratory of Ecole Centrale de Nan, France | [52] |

| Pelamis | Attenuator/OBWEC | Portugal | [50] |

| DEXA | Attenuator/OBWEC | Coastal Engineering Laboratory at Aalborg University, Denmark | [53] |

| TALOS II Multi-DOF WEC | Multi-axis series structure WEC/OBWEC | TALOS II multi-DOF WEC/laboratory in Lancaster University, UK | [48] |

| Wave Dragon | Overtopping WEC(OWEC) | Portugal, Spain (Castro-Santos) | [50] |

| Oyster | Terminator/ OBWEC | European Marine Energy Centre (EMEC) in Orkney, Scotland | [54] |

| Shoreline OWC Plant | Fixed structure/OWC | Zhelang Town, Shanwei City of Guangdong Province, China | [55] |

| U-OWC Devices | Breakwater/OWC | harbour of Civitavecch, Italy | [56] |

| Mighty Whale | Floating structure/OWC | mouth of Gokasho Bay in Mie Prefecture | [57] |

| Wave Dragon | Floating/OWEC | Nissum Bredning, Denmark | [58] |

| Sea-wave Slot-cone Generator (SSG) | Fixed/OWEC | Hanstholm, Denmark; island of Kvitsøy, Norway | [59] |

| Value | Description | Reference |

|---|---|---|

| EUR 4,080,690 | 0.75% of the initial cost | [99] |

| 3% of total cost | Dismantling and elimination of material, cleaning of site costs | [41] |

| 0.0017% of initial cost | Removal, transport, and recycle | [96] |

| EUR 0.8 million, EUR 0.2 million, EUR 0.4 million | Testing in the Bora Bora, Maldives, and Lanzarote, respectively | [98] |

| 1% of CAPEX | [53] | |

| EUR 255,000 | Dismantling the wind and wave device generator | [92] |

| EUR 75,048,681 | Dismantling the hybrid floating platforms | |

| EUR 496,096 | Dismantling the mooring and anchoring system | |

| EUR 2,759,920 | Dismantling the electric system | |

| EUR 1,730,914 | Dismantling the cleaning area | |

| EUR 80,290,611 | Total DC, São Pedro de Moel (105.4 MW) by Poseidon |

| Category | Value | Description | Reference |

|---|---|---|---|

| Devices cost | EUR 2125 | Gravity foundation | [80] |

| EUR 8400 | Buoy | ||

| EUR 21,120 | Translator | ||

| EUR 8100 | Stator | ||

| EUR 5300 | Casing | ||

| EUR 25,000 | Labor | ||

| EUR 10,000 | Extra material | ||

| Electrical systems cost | EUR 46/m | Intra-array cable | |

| EUR 72.5/m | Transmission cable to shore | ||

| EUR 2/m | Communication cable | ||

| EUR 168/km | Substation | ||

| Installation | EUR 4100 | WEC | |

| EUR 10,000 | Substation | ||

| EUR 500/km | Cables | ||

| Decommissioning cost | EUR 4100 | WEC | |

| EUR 10,000 | Substation | ||

| EUR 500/km | Cables | ||

| Structure Cost | 0.455 | Normalized value with one float | [90] |

| PTO Cost | 0.278 | ||

| Control Cost | 0.055 | ||

| Grid Cost | 0.054 | ||

| Mooring Cost | 0.037 | ||

| Installation Cost | 0.012 | ||

| Margin Cost | 0.110 | ||

| Structure | 38.2% | Mass-related capital cost | [35] |

| Foundation and mooring | 19.1% | ||

| Installation | 10.2% | ||

| PTO component | 24.2% | Power-related capital cost | |

| Grid connection | 8.3% | ||

| Development costs (EUR/kW) | EUR 250/Kw | 6%/CAPEX | [93] |

| Wave Energy Converter (Structure and Prime Mover) | EUR 1340/Kw | 33%/CAPEX | |

| Balance of Plant | EUR 1600/Kw | 38%/CAPEX | |

| Installation and Commissioning | EUR 590/Kw | 13%/CAPEX | |

| Decommissioning | EUR 420/Kw | 10%/CAPEX | |

| WEC and installation | EUR 2.5–6.0 million/Mw | [33] | |

| Mooring system | EUR 0.265/day | ||

| Mooring Installation | EUR 50,000/day | ||

| Underwater cable | 10% of CAPEX | ||

| Cable installation | EUR 2.07/m | ||

| Costs electrical substation | EUR ≈ 1.2 million |

| Category | Value | Reference |

|---|---|---|

| Repair of buoy | EUR 723/year | [80] |

| Repair of generator | EUR 10,000/year | |

| Site lease and insurance | EUR 5000/year | |

| Annual O&M | 29% of total OPEX | [110] |

| Overhaul | 15% of total OPEX | |

| Replacement | 45% of total OPEX | |

| Insurance | 11% of total OPEX | |

| OPEX | 5–15% of the CAPEX | [28,35,37,100,107,108,109] |

| Insurance | 1% of the total CAPEX | [102] |

| Inspection and maintenance | 4 vessel-days and 16 person-days | |

| Checking and adjustment of tension | After 1, 5, and 10 years | |

| Replacements | 1.5% of the CAPEX |

| Target Value | Description | Reference |

|---|---|---|

| USD 0.05–0.28/kWh | The LCOE of conventional energy generation projects such as coal, natural gas, and nuclear | [30] |

| EUR 0.15/kWh by 2025 and EUR 0.10/kWh by 2030 for tidal stream | Strategic Energy Technology (SET) Plan In EU | [116] |

| EUR 0.20/kWh by 2025 and EUR 0.15/kWh by 2030 for wave energy | ||

| GBP 150 MWh−1 | Wave Energy by Scotland (WES) | [115,117,118] |

| USD 0.17/kWh | Offshore wind | [119] |

| 15–20 p/kWh by 2020 | Wave energy and tidal energy with 0.4 GW of tidal and 0.3 GW of wave capacity | [120] |

| Values | Description | Reference | |

|---|---|---|---|

| EUR 513.17/MWh | Wave Dragon | Northwest area of the Galician region | [121] |

| EUR 1710.98/MWh | Pelamis | ||

| EUR 2627.60/MWh | AquaBuOY | ||

| USD 163.00/MWh | Pelamis | - | [122] |

| USD 138.00/MWh | Wave dragon | ||

| EUR 1.77–1.25/kWh | Overtopping system (SSG) | r = 10% | [82] |

| EUR 2.17–1.73/kWh | Oscillating water column (OWC) | ||

| EUR0.47–0.40/kWh | Oscillating flap | ||

| EUR 0.37–0.27/kWh | Oscillating float | ||

| EUR 1.52–1.05/kWh | Overtopping system (SSG) | r = 7.5% | |

| EUR 1.87–1.50/kWh | Oscillating water column (OWC) | ||

| EUR 0.41–0.35/kWh | Oscillating flap | ||

| EUR 0.32–0.23/kWh | Oscillating float | ||

| USD 0.88/kWh | 11 over the lifetime of 20 years (BFWEC-8) | [103] | |

| GBP 174.6/MWh | 50 years with 40 devices/TALOS | ||

| GBP 100/MWh | 70 years with 40 devices/TALOS | ||

| EUR 0.310/kWh | Bora Bora | 4 WECs | [98] |

| EUR 0.633/kWh | Maldives | 1 WECs | |

| EUR 0.282/kWh | Lanzarote | 2 WECs | |

| Items | BB | MA | LA |

|---|---|---|---|

| Average wave resource | 20–30 kW/m | 10–20 kW/m | 29 kW/m |

| Number of WECs | 4 | 1 | 2 |

| Average capacity factor (DCF) | 0.4 | 0.25 | 0.5 |

| Device availability (DAF) | 90% | 90% | 90% |

| Annual energy production (AEP) | 3154 MWh | 493 MWh | 1971 MWh |

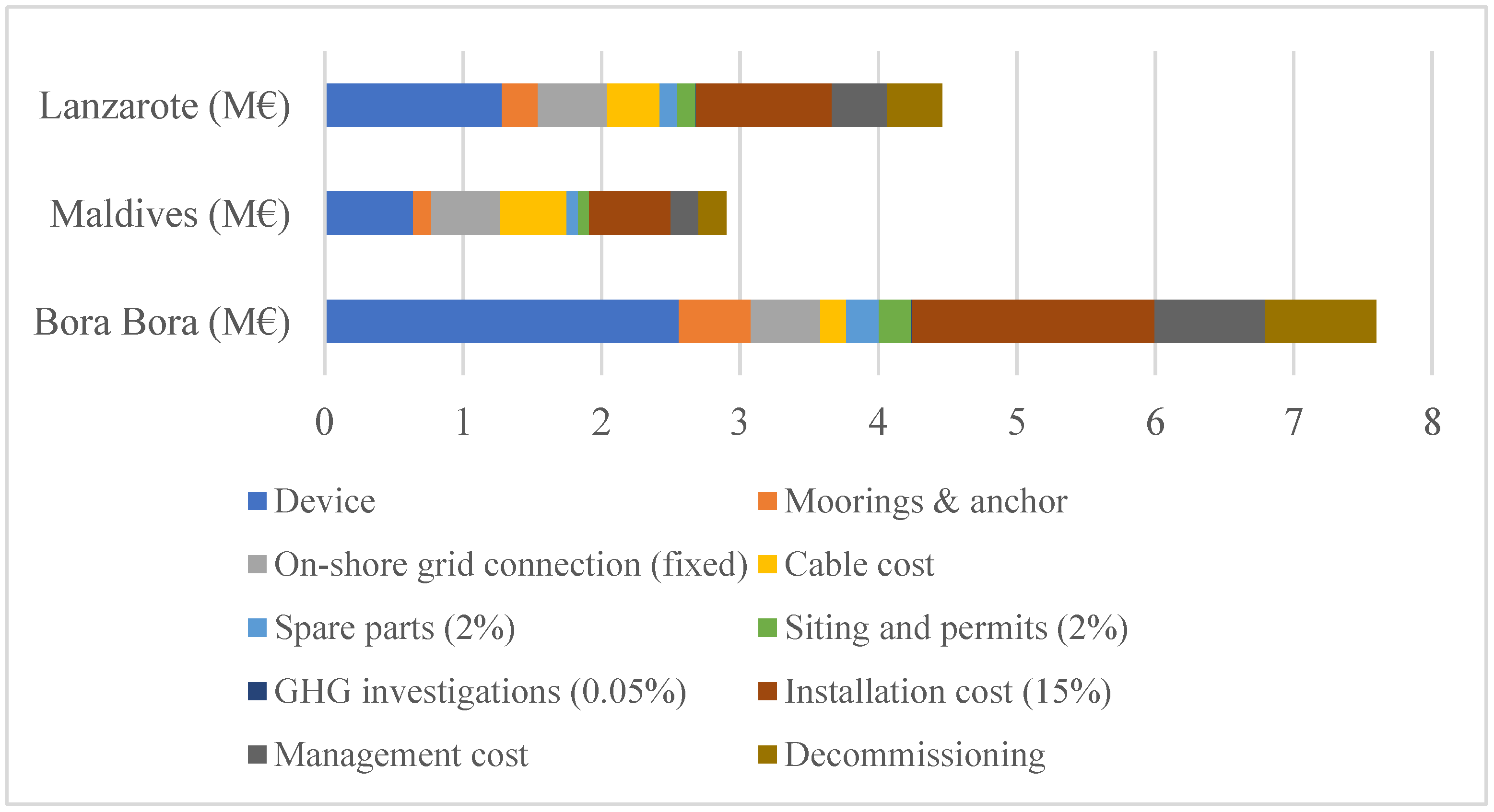

| Items | BB (EUR million) | MA (EUR million) | LA (EUR million) |

|---|---|---|---|

| Device CAPEX | 2.56 | 0.64 | 1.28 |

| Moorings and anchor | 0.52 | 0.13 | 0.26 |

| On-shore grid connection (fixed) | 0.5 | 0.5 | 0.5 |

| Cable cost | 0.19 | 0.48 | 0.38 |

| Spare parts | 0.234 | 0.08 | 0.13 |

| Siting and permits | 0.234 | 0.08 | 0.13 |

| GHG investigations | 0.006 | 0.002 | 0.003 |

| Installation cost | 1.75 | 0.59 | 0.98 |

| Management cost | 0.8 | 0.2 | 0.4 |

| O&M | 4.09 | 1.02 | 2.05 |

| Items | Scene 1 (Discount) | Scene 2 (Discount) | Scene 3 (Half-Discount) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| BB | MA | LA | BB | MA | LA | BB | MA | LA | |

| CAPEX EUR million | 19.465 | 7.741 | 11.641 | 9.240 | 3.675 | 5.526 | 33.97 | 13.51 | 20.315 |

| OPEX EUR million | 141.031 | 35.170 | 70.685 | 87.758 | 21.886 | 43.986 | 250.175 | 62.391 | 125.393 |

| AEP MWh | 108,751.443 | 16,998.878 | 67,961.031 | 67,674.740 | 10,578.201 | 42,291.348 | 788,500 | 123,250 | 492,750 |

| LCOE EUR/KWh | 1.476 | 2.524 | 1.211 | 1.433 | 2.416 | 1.171 | 0.360 | 0.616 | 0.296 |

| CAPEX/AEP EUR/KWh | 0.179 | 0.455 | 0.171 | 0.136 | 0.347 | 0.131 | 0.043 | 0.110 | 0.041 |

| OPEX/AEP EUR/KWh | 1.297 | 2.069 | 1.040 | 1.297 | 2.069 | 1.040 | 0.317 | 0.506 | 0.254 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, C.; Sheng, W.; De Silva, D.G.; Aggidis, G. A Review of the Levelized Cost of Wave Energy Based on a Techno-Economic Model. Energies 2023, 16, 2144. https://doi.org/10.3390/en16052144

Guo C, Sheng W, De Silva DG, Aggidis G. A Review of the Levelized Cost of Wave Energy Based on a Techno-Economic Model. Energies. 2023; 16(5):2144. https://doi.org/10.3390/en16052144

Chicago/Turabian StyleGuo, Chenglong, Wanan Sheng, Dakshina G. De Silva, and George Aggidis. 2023. "A Review of the Levelized Cost of Wave Energy Based on a Techno-Economic Model" Energies 16, no. 5: 2144. https://doi.org/10.3390/en16052144

APA StyleGuo, C., Sheng, W., De Silva, D. G., & Aggidis, G. (2023). A Review of the Levelized Cost of Wave Energy Based on a Techno-Economic Model. Energies, 16(5), 2144. https://doi.org/10.3390/en16052144