A Meta-Analysis of the Relationship between Financing Efficiency and Entrepreneurial Vitality: Evidence from Chinese College Students

Abstract

:1. Introduction

2. Literature Review and Research Hypothesis

2.1. Literature Review

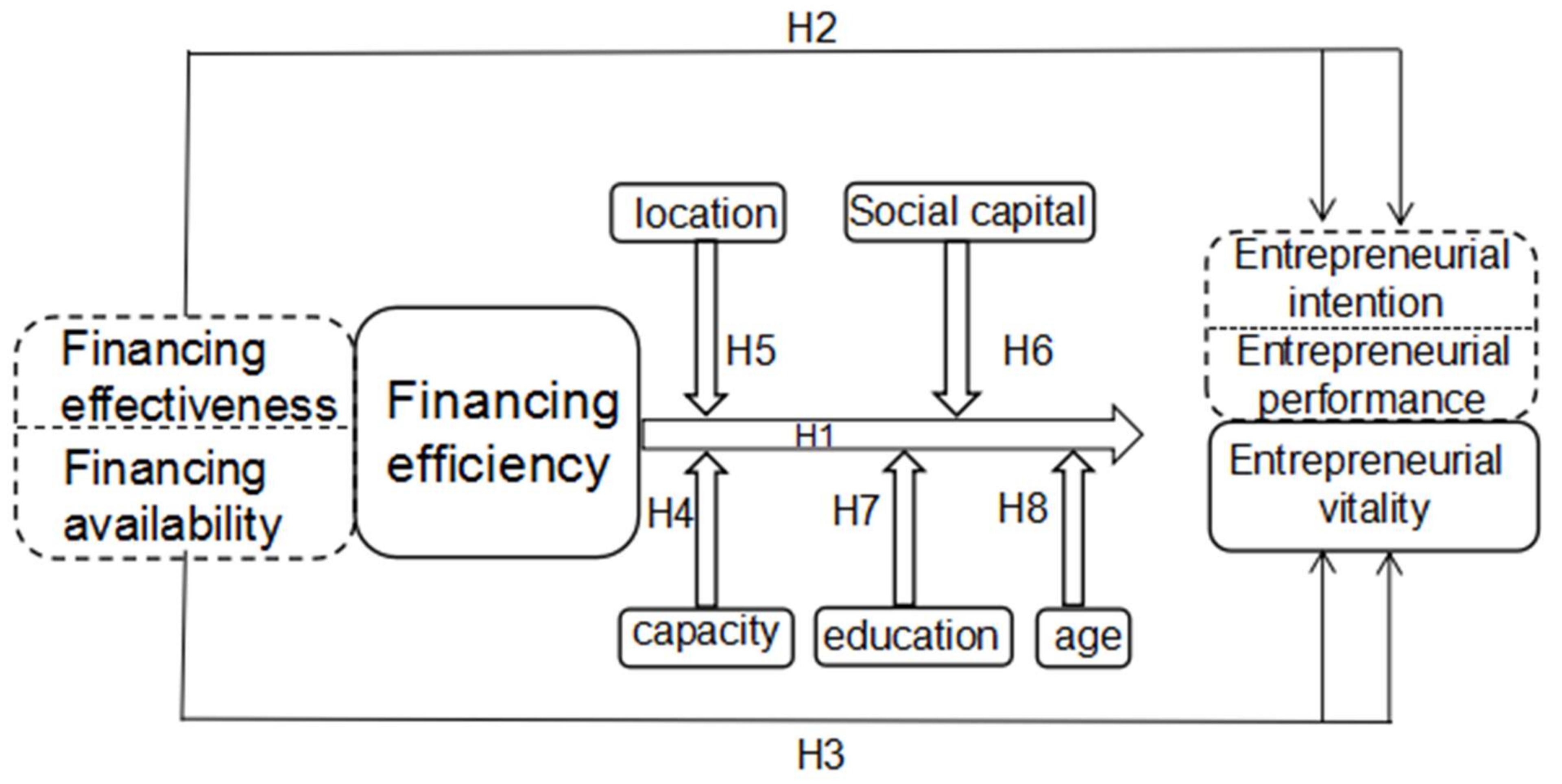

2.2. Hypotheses Development

3. Methods and Data

3.1. Meta-Analysis Method

3.2. Literature Search

3.3. Effect Size Integration and Literature Variable Information Summary

4. Empirical Analysis

4.1. Publication Bias Test

4.2. Heterogeneity Test

4.3. Main Effect Test

4.4. Test of Moderating Effect

5. Research Conclusions, Suggestions and Prospects

5.1. Research Conclusions

5.2. Suggestions

5.3. Main Motivation and Contribution

5.4. Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ministry of Education of the People’s Republic of China. Opinions of the State Council on Several Policies and Measures for Vigorously Promoting Mass Entrepreneurship and Innovation. Available online: http://www.gov.cn/zhengce/content/2015-06/16/content_9855.htm (accessed on 22 February 2021).

- Yan, X.; Gu, D. Fostering Sustainable Entrepreneurs: Evidence from China College Students’ “Internet Plus” Innovation and Entrepreneurship Competition (CSIPC). Sustainability 2018, 10, 3335. [Google Scholar] [CrossRef]

- Modigliani, F.; Millier, M.H. The Cost of Capital Corporation Finance and the Theory of Investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Robichek, A.A.; Myers, S.C. Problems in the theory of optimal capital structure. J. Financ. Quant. Anal. 1966, 1, 1–35. [Google Scholar] [CrossRef]

- Hogan, T.; Hutson, E. Capital Structure in New Technology-Based Firms: Financing in the Irish Software Sector. Available online: https://ssrn.com/sol3/papers.cfm?abstract_id=498283 (accessed on 1 March 2005).

- Bird, B.J.; Schjoedt, L. Entrepreneurial behavior: Its nature, scope, recent research, and agenda for future research. Underst. Entrep. Mind 2009, 24, 327–358. [Google Scholar]

- Thompson, E.R. Individual entrepreneurial intent: Construct clarification and development of an internationally reliable metric. Entrep. Theory Pract. 2009, 33, 669–694. [Google Scholar] [CrossRef]

- Klotz, A.C.; Hmieleski, K.M.; Bradley, B.H.; Busenitz, L.W. New venture teams: A review of the literature and roadmap for future research. J. Manag. 2014, 40, 226–255. [Google Scholar] [CrossRef]

- Valencia-Arias, A.; Arango-Botero, D.; Sánchez-Torres, J.A. Promoting entrepreneurship based on university students’ perceptions of entrepreneurial attitude, university environment, entrepreneurial culture and entrepreneurial training. High. Educ. Ski. Word-Based Learn. 2022, 2, 328–345. [Google Scholar] [CrossRef]

- Chakravarthy, B.S. Measuring strategic performance. Strateg. Manag. J. 1986, 7, 437–458. [Google Scholar] [CrossRef]

- Dess, G.G.; Robinson, R.B., Jr. Measuring Organizational performance in absence objective measures: The case of the privately-held. Strateg. Manag. J. 1984, 5, 265–273. [Google Scholar] [CrossRef]

- Shen, C.; Luo, L. The key factors of entrepreneurial success and entrepreneurial performance. J. Cent. South. Univ. 2006, 12, 231–235. [Google Scholar]

- Qian, H.; Haynes, K.E. Beyond innovation: The small business innovation research program as entrepreneurship policy. J. Technol. Transf. 2014, 39, 524–543. [Google Scholar] [CrossRef]

- Woolley, J.L.; Rottner, R.M. Innovation policy and nanotechnology entrepreneurship. Entrep. Theory Pract. 2008, 32, 791–811. [Google Scholar] [CrossRef]

- Dean, T.J.; Meyer, G.D. Industry environments and new venture formations in U.S. manufacturing: A conceptual and empirical analysis of demand determinants. J. Bus. Ventur. 1996, 11, 107–132. [Google Scholar] [CrossRef]

- Galindo, M.; Mendez, M.T. Entrepreneurship, economic growth, and innovation: Are feedback effects at work? J. Bus. Res. 2014, 67, 825–829. [Google Scholar] [CrossRef]

- Liang, W.; Jing, G. A Meta-analysis of the Relationship between Internationalization degree and firm performance. J. Xi‘an Jiaotong Univ. Soc. Sci. Ed. 2013, 33, 27–33. [Google Scholar]

- Kansas Department of Commerce. Kansas Economic Growth Act [EB/OL]. (2004-04-26) [2017-06-15]; Kansas Department of Commerce: Topeka, KS, USA, 2017. [Google Scholar]

- Shariff, M.N.M.; Peou, C.; Ali, J. Moderating effect of government policy on entrepreneurship and growth performance of small-medium enterprises in Cambodia. Int. J. Bus. Manag. Sci. 2010, 3, 57–72. [Google Scholar]

- Pergelova, A.; Angulo-Ruiz, F. The impact of government financial support on the performance of new firms: The role of competitive advantage as an intermediate outcome. Entrep. Reg. Dev. 2014, 26, 1–43. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Carree, M.A.; Van Stel, A.J.; Thurik, A.R. Impeded industrial restructuring: The growth penalty. Kyklos 2002, 55, 81–98. [Google Scholar] [CrossRef]

- Betz, M.R.; Partridge, M.D.; Kraybill, D.S.; Lobao, L. Why do localities provide economic development incentives? Geographic competition, political constituencies, and government capacity. Growth Change 2012, 43, 361–391. [Google Scholar] [CrossRef]

- Shane, S.; Venkataraman, S. The Promise of Entrepreneurship as a Field of Research. Acad. Manag. Rev. 2000, 25, 217–226. [Google Scholar] [CrossRef]

- Bruton, G.D. Review of International Entrepreneurship in Turbulent Times. Acad. Manag. Proc. 2017, 1, 14047. [Google Scholar]

- Chandler, G.N.; Hanks, S.H. Market attractiveness, resource-based capabilities, venture strategies, and venture performance. J. Bus. Ventur. 1994, 9, 331–349. [Google Scholar] [CrossRef]

- Duan, X.; Song, D. The Relationship between Entrepreneurial Orientation and Organizational Performance: A Meta-analysis. Sci. Technol. Manag. Res. 2011, 31, 176–180. [Google Scholar]

- Wu, T.; Wang, C. Entrepreneurial action and information in the Context of Internet Acquisition and New Innovation Performance—Evidence from Apple’s App Store. Stud. Sci. Sci. 2016, 34, 260–267. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Johnson, T.G. Measuring the benefits of entrepreneurship development policy. J. Entrep. Dev. 2007, 4, 35–44. [Google Scholar]

- Han, Z. Research on the Investment Value Evaluation of Angel Investment in College Students’ Start-Up Enterprises; Tianjin Polytechnic University: Tianjin, China, 2018. [Google Scholar]

- Kamm, J.B.; Shuman, J.C.; Seeger, J.A.; Nurick, A.J. Entrepreneurial teams in new venture creation: A research agenda. Entrep. Theory Pract. 1990, 14, 7–17. [Google Scholar] [CrossRef]

- Assibey-Yeboah, M.; Mohsin, M. Investment tax credit in an open economy with external debt and imperfect capital mobility. Econ. Rec. 2011, 87, 629–642. [Google Scholar] [CrossRef]

- Gnyawali, D.R.; Daniel, F. Environments for entrepreneurship development: Key dimensions and research implications. Entrep. Theory Pract. 1994, 18, 43–62. [Google Scholar] [CrossRef]

- Zhang, Y.; Hou, X. PEST Analysis and optimization strategy of college students’ entrepreneurial environment. In China Adult Education; CNKI: Beijing, China, 2016. [Google Scholar]

- Yang, Y.; Bo, S. On the optimization of entrepreneurial environment for college students in China. In China Adult Education; CNKI: Beijing, China, 2011. [Google Scholar]

- Sahin, F.; Karadag, H.; Tuncer, B. Big five personality traits, entrepreneurial self-efficacy and entrepreneurial intention A configurational approach. Int. J. Entrep. Behav. Res. 2019, 25, 1188–1211. [Google Scholar] [CrossRef]

- Nahapiet, J.; Ghoshal, S. Social capital, intellectual capital, and the organizational advantage. Acad. Manag. Rev. 1998, 23, 242–266. [Google Scholar] [CrossRef]

- Ripollés, M.; Blesa, A.; Monferrer, D. Factors enhancing the choice of higher resource commitment entry modes in international new ventures. Int. Bus. Rev. 2018, 4, 14–15. [Google Scholar] [CrossRef]

- Paray, Z.A.; Kumar, S. Does entrepreneurship education influence entrepreneurial intention among students in HEI’s: The Roleof Age, Gender and Degree Background. J. Int. Educ. Bus. 2020, 13, 55–72. [Google Scholar] [CrossRef]

- Hou, M.; Liu, H.; Fan, P.; Wei, Z. Does CSR practice pay off in East Asian firms? A meta analytic investigation. Asia Pac. J. Manag. 2016, 33, 195–228. [Google Scholar] [CrossRef]

- Otache, I. Entrepreneurship education and undergraduate students’ self-and paid-employment intentions. Educ. Train. 2019, 61, 46–64. [Google Scholar] [CrossRef]

- Du, K.; O’Connor, A. Entrepreneurship and advancing national level economic efficiency. Small Bus. Econ. 2018, 50, 91–111. [Google Scholar] [CrossRef]

- Reissová, A.; Šimsová, J.; Sonntag, R.; Kučerová, K. The influence of personal characteristics on entrepreneurial intentions: International comparison. Entrep. Bus. Econ. Rev. 2020, 8, 29–46. [Google Scholar] [CrossRef]

- Nguyen, T. The Impact of Access to Finance and Environmental Factors on Entrepreneurial Intention: The Mediator Role of Entrepreneurial Behavioural Control. Entrep. Bus. Econ. Rev. 2020, 8, 127–140. [Google Scholar] [CrossRef]

- Mahfud, T.; Triyono, M.B.; Sudira, P.; Mulyani, Y. The influence of social capital and entrepreneurial attitude orientation on entrepreneurial intentions: The mediating role of psychological capital. Eur. Res. Manag. Bus. Econ. 2020, 26, 33–39. [Google Scholar] [CrossRef]

- Shiau, W.L.; Yuan, Y.; Pu, X.; Ray, S.; Chen, C.C. Understanding fintech continuance: Perspectives from self-efficacy and ECT-IS theories. Indus. Manag. Data Syst. 2020, 120, 1659–1689. [Google Scholar] [CrossRef]

- Li, Y. Investigation on Contemporary College Students Entrepreneurship Status Quo and Education Guidance Countermeasures. Research. Educ. Res. 2017, 2, 65–72. [Google Scholar]

- Wu, W.; Wang, H.; Zheng, C.; Wu, Y.J. Effect of narcissism, psychopathy, and machiavellianism on entrepreneurial intention—The mediating of entrepreneurial self-efficacy. Front. Psychol. 2019, 10, 360. [Google Scholar] [CrossRef] [PubMed]

- Aguinis, H.; Dalton, D.R.; Bosco, F.A.; Pierce, C.A.; Dalton, C.M. Meta-analytic choices and judgment calls: Implications for theory building and testing, obtained effect sizes, and scholarly impact. J. Manag. 2011, 37, 5–38. [Google Scholar] [CrossRef]

- Patience, G.S.; Patience, C.A.; Blais, B.; Bertrand, F. Citation analysis of scientific categories. Heliyon 2017, 3, e00300. [Google Scholar] [CrossRef]

- Combs, J.G.; Crook, T.R.; Rauch, A. Metaanalytic research in management: Contemporary approaches, unresolved controversies, and rising standards. J. Manag. Stud. 2019, 56, 1–18. [Google Scholar] [CrossRef]

- Timmons, J.A.; Spinelli, S.; Tan, Y. New Venture Creation: Entrepreneurship for the 21st Century; McGraw-Hill/Irwin: New York, NY, USA, 2004. [Google Scholar]

- Rauch, A.; Van Doorn, R.; Hulsink, W. A qualitative approach to evidence-based entrepreneur ship: Theoretical considerations and an example involving business clusters. Entrep. Theory Pract. 2014, 38, 333–368. [Google Scholar] [CrossRef]

- Wu, J. Structure model and cultivation strategies of college students’ entrepreneurial competence under rural revitalization policy. Heilongjiang Res. High. Educ. 2021, 4, 6–12. [Google Scholar]

- Gimmon, E.; Levie, J. Instrumental value theory and the human capital of entrepreneurs. J. Econ. Issues 2009, 43, 715–732. [Google Scholar] [CrossRef]

- Liu, Y.; Lan, Y.; Shi, Y.; Jia, L. Research on the impact of universities’ creating space entrepreneurial environment on entrepreneurial performance of start-ups. Sci. Technol. Manag. Res. 2020, 21, 113–120. [Google Scholar]

- Gao, S. An empirical study on the influence of entrepreneurial motivation and entrepreneurial competency on entrepreneurial performance. In Proceedings of the 2nd International Conference on Economy, Management and Entrepreneurship (ICOEME 2019), Voronezh, Russia, 14–15 May 2019. [Google Scholar]

- Yang, D. The mediating effect of entrepreneurial motivation on the influencing factors of entrepreneurial growth. J. High. Educ. Manag. 2019, 13, 103–112. [Google Scholar]

- Ann, M. Entrepreneurial Environment on University Entrepreneurial Performance Empirical Study of The Induced Path. 2016. Available online: https://www.cnki.com.cn/Article/CJFDTOTAL-JXSH201609044.htm (accessed on 18 July 2022).

- Wu, L. Research on The Influence Mechanism of Entrepreneurial Environment and Psychological Environment on Entrepreneurial Performance of College Students. 2021. Available online: https://www.cnki.com.cn/Article/CJFDTotal-LBJY202106005.htm (accessed on 18 July 2022).

- Liu, Z. The Effect of Entrepreneurial Resources on College Students’ Entrepreneurial Performance—The Role of Entrepreneurial Competency. 2021. Available online: http://www.cnki.com.cn/Article/CJFDTotal-LNDZ202001013.htm (accessed on 18 July 2022).

- Chen, W. The Impact of Entrepreneurial Resource Sharing on College Students’ Entrepreneurial Performance: A Moderated Mediation Model. 2019. Available online: http://www.cnki.com.cn/Article/CJFDTOTAL-JSJI201906010.htm (accessed on 18 July 2022).

- Mu, W. The Linear and Nonlinear Effects of College Entrepreneurs’ Big Six Personality Traits on Entrepreneurial Performance: The Mediating Role of Entrepreneurial Self-Efficacy. 2020. Available online: https://www.cnki.com.cn/Article/CJFDTotal-GSXL202002008.htm (accessed on 18 July 2022).

- He, H. The Effect of College Students’ Venture Capital on Entrepreneurial Performance. 2015. Available online: https://www.xzbu.com/2/view-15219970.htm (accessed on 18 July 2022).

- Xu, Y. The willingness of rural vocational college students to return home to start businesses. Study on the influencing factors of Empirical analysis based on Logistic-ISM model. Jiangsu Bus. Theory 2022, 2, 2022. [Google Scholar]

- Huang, Y. Empirical study on influencing factors of college students’ entrepreneurial intention in Guangxi based on Logit model. Pop. Sci. Technol. 2022, 12, 101–105. [Google Scholar]

- Chen, X. Family Capital, Social Networks and Entrepreneurship. Multiple Regression Analysis of Entrepreneurial Survey Data. 2021. Available online: https://www.cnki.net/kcms/detail/detail.aspx?dbcode=CJFD&dbname=CJFDTEMP&filename=ZJQN201903004&v=w6uChBd6aavQ8zBNzjMOG2dsOEL0NfZF4oC5Vl0zIn9VImhInr2u706k4GwtCUfL (accessed on 18 July 2022).

- Ni, D. Social Networks, Resource Acquisition Ability and Entrepreneurial Performance of Young Entrepreneurs. 2021. Available online: https://www.cnki.com.cn/Article/CJFDTotal-HNSY202102009.htm (accessed on 18 July 2022).

- Duan, L. An Empirical Study on The Influencing Factors of Young College Students’ Entrepreneurial Willingness. 2021. Available online: https://cdmd.cnki.com.cn/Article/CDMD-10651-1021736040.htm (accessed on 18 July 2022).

- Sun, J. A Meta-Analysis of The Relationship Between Social Networks and Entrepreneurial Performance of Chinese College Students. 2021. Available online: https://www.cnki.com.cn/Article/CJFDTotal-ZJSK202105008.htm (accessed on 18 July 2022).

- Ge, H. The Impact of Social Capital on Entrepreneurial Performance the Moderating Effect Of Entrepreneurial Opportunity Perception Ability. 2020. Available online: https://www.cnki.com.cn/Article/CJFDTotal-JXJG202007008.htm (accessed on 18 July 2022).

- Zhang, Q. Research on the Applicability of Equity-Based Crowdfunding to Entrepreneurial College Students from the Perspective of Investors; Shandong Union College: Jinan, China, 2017. [Google Scholar]

- Dong, B. A Review of the Application of Meta-Analysis in Domestic and Foreign Entrepreneurship Research. Foreign Econ. Manag. 2017, 39, 18–39. [Google Scholar]

- Zhang, X.; Wang, C.; Li, S. Institutional Environment, Entrepreneurial Self-Efficacy and Entrepreneurial Intention. Sci. Res. Manag. 2021, 43, 59–66. [Google Scholar]

- Wang, F. Meta-Analysis on the Impact of Financial Support Policies on Entrepreneurship. China Econ. Q. 2018, 17, 1558–1580. [Google Scholar]

- Zou, Y. An Analysis of the Influence of Resource Endowment on Entrepreneurial Performance of College Students—A Case Study of Three Universities In Hefei. 2020. Available online: https://www.cnki.com.cn/Article/CJFDTotal-SJXB202002004.htm (accessed on 18 July 2022).

- Liu, E. Resource Dependence, Resource Mobilization and the Improvement of Innovative Entrepreneurial Financing Efficiency—An Analysis of the Project Data of “Internet +” College Students’ Innovation and Entrepreneurship Competition. 2021. Available online: https://ds.cnki.net/kmobile/Journal/detail/ZKZJ/ZNZX20210829001 (accessed on 18 July 2022).

- Peterson, R.A.; Brown, S.P. On the use of Beta coefficients in meta—Analysis. Appl. Psychol. J. 2005, 90, 175–181. [Google Scholar] [CrossRef]

- Ferreira, A.D.M.; Loiola, E.; Gondim, S.M.G.; Pereira, C.R. Effects of entrepreneurial competence and planning guidance on the relation between university students’ attitude and entrepreneurial intention. J. Entrep. 2022, 1, 7–29. [Google Scholar] [CrossRef]

- Su, H.; Pei, X. Research on the construction of College Students’ social entrepreneurship competency model. Contemp. Youth Stud. 2020, 2, 63–69. [Google Scholar]

- Zhao, X.; Ma, Z. The Relationship between entrepreneurial environment and entrepreneurial intention: A moderated mediation model. High. Educ. Explor. 2020, 11, 106–112. [Google Scholar]

- Kim, M.; Park, M.J. Entrepreneurial education program motivations in shaping engineering students’ entrepreneurial intention: The mediating effect of assimilation and accommodation. J. Entrep. Emerg. Econ. 2019, 11, 328–350. [Google Scholar] [CrossRef]

- Turulja, L.; Veselinovic, L.; Agic, E.; Pasic-Mesihovic, A. Entrepreneurial intention of students in Bosnia and Herzegovina: Whattype of support matters? Econ. Res.-Ekon. Istraživanja 2020, 33, 2713–2732. [Google Scholar] [CrossRef]

- Morris, M.H.; Shirokova, G.; Tsukanova, T. Student entrepreneurship and the university ecosystem: A multi-country empirical exploration. Eur. J. Int. Manag. 2017, 11, 65. [Google Scholar] [CrossRef]

- Islam, T. Cultivating Entrepreneurs: Role of the University Environment, Locus of Control and Self-efficacy. Proc. Comput. Sci. 2019, 158, 642–647. [Google Scholar] [CrossRef]

- Lindberg, E.; Bohman, H.; Hulten, P.; Wilson, T. Enhancing students’ entrepreneurial mindset: A Swedish experience. Educ. Train. 2017, 59, 768–779. [Google Scholar] [CrossRef]

- Jiang, Y.; Ou, J. Research on the influencing factors and policy analysis framework of college students’ entrepreneurship based on M-O-S Model. Jianghuai Trib. 2018, 1, 175–179. [Google Scholar]

- Hua, J.; Zheng, K.; Fan, S. The impact of entrepreneurial activities and college students’ entrepreneurial abilities in higher education—A meta-analytic path. Front. Psychol. 2022, 13, 843978. [Google Scholar] [CrossRef]

- Zhu, W.; Fang, Y.; Liu, Y.; Si, J. College students’ entrepreneurial intentions and associations with entrepreneurial values and entrepreneurial selfefficacy: Moderating effects of gender. Psychol. Res. 2021, 14, 341–349. [Google Scholar] [CrossRef] [Green Version]

| Author & Date | Sample Size | Control Variable | Research Method | Z | SE |

|---|---|---|---|---|---|

| Shi-jie gao (2020) [57] | 348 | Gender, age, education background, entrepreneurial industry, entrepreneurial scale | Multiple regression | 0.7999 | 0.0538 |

| Yang Daojian (2019) [58] | 418 | Entrepreneurial motivation and entrepreneurial environment | Structural equation | 0.6535 | 0.0491 |

| Ann Meichen (2016) [59] | 979 | Entrepreneurial financing environment, education environment | Structural equation | 0.6963 | 0.0320 |

| Wu Lishui (2021) [60] | 308 | Entrepreneurial competence and entrepreneurial environment | Regression equation | 0.3205 | 0.0573 |

| Liu Zhaomin (2020) [61] | 285 | Age, education background, scale of entrepreneurship | Multiple regression | 0.6155 | 0.0595 |

| Chen Wanming (2019) [62] | 187 | Age, education background, gender | Multiple regression | 0.0761 | 0.0737 |

| Mu Weiqi (2020) [63] | 208 | Age, gender, education level | Multiple regression | 0.1511 | 0.0698 |

| He Hongguang (2015) [64] | 625 | - | Multiple regression | 0.2908 | 0.0401 |

| Xu Yanxie (2022) [65] | 366 | - | Binary logistic regression | 1.6888 | 0.0525 |

| Huang Yabing (2021) [66] | 443 | - | Multiple logistic regression | 0.4132 | 0.0477 |

| Chen Xinmiao (2019) [67] | 451 | - | Multiple regression | 0.1277 | 0.0472 |

| Ni Dazhao (2021) [68] | 471 | Growth environment, parents’ occupation, gender, professional background | Multiple linear regression | 0.0774 | 0.0462 |

| Duan Lihua (2021) [69] | 905 | - | Multiple linear regression | 0.1563 | 0.0333 |

| Sun Junhua (2021) [70] | 5868 | Level of economic development, literature time, sample size, entrepreneurial category | Meta-analysis | 0.4860 | 0.0131 |

| Ge Hongxiang (2020) [71] | 733 | - | Mediation model | 0.7788 | 0.0370 |

| Zhang Qin (2017) [72] | 400 | - | Binary logistic regression | 0.2597 | 0.0502 |

| Sheng Yuxue (2021) [73] | 58,900 | Family, region, individual, school | Probit regression | 0.1040 | 0.0041 |

| Zhang Xiue (2019) [74] | 89,202 | Age, gender, education level | Hierarchical generalized linear model estimation | 0.0983 | 0.0033 |

| Wang Fuming (2017) [75] | 282,334 | Entrepreneurship index, industry attributes | Meta-analysis | 0.2090 | 0.0019 |

| Zou Yanan (2019) [76] | 185 | - | Regression analysis | 0.1934 | 0.0741 |

| Liu Enpei (2021) [77] | 490 | - | Structural equation | 1.8857 | 0.0453 |

| Relationship between Variables | Begg Test p-Value | Egger Test p-Value |

|---|---|---|

| Financing efficiency and entrepreneurial vitality | 0.6982 | 0.6063 |

| Financing efficiency and entrepreneurial intention | 0.6481 | 0.4218 |

| Financing efficiency and entrepreneurial performance | 0.6384 | 0.4922 |

| Model | Point Estimation | Document Number | Confidence Interval (95%) Upper Limit Lower Limit | p-Value | Q-Value | I2-Value | Standard Error | |

|---|---|---|---|---|---|---|---|---|

| Fixed effect model | 0.1827 | 21 | 0.1798 | 0.1856 | <0.0001 | 4811.97 | 99.58% | 0.0015 |

| Random effect model | 0.4794 | 21 | 0.4156 | 0.5431 | <0.0001 | 4811.97 | 99.58% | 0.0325 |

| Category | Point Estimate | Sample Size | Heterogeneity | Double Tail Test | Confidence Interval (95%) Upper Limit Lower Limit | ||||

|---|---|---|---|---|---|---|---|---|---|

| Q-Value | Df(Q) | I2-Value | Z-Value | p-Value | |||||

| Financing effectiveness and entrepreneurial intention | 0.3716 | 91064 | 946 | 6 | 99.69 | 3.1361 | <0.0001 | −0.0784 | 0.8997 |

| Financing effectiveness and entrepreneurial performance | 0.4946 | 353423 | 3189 | 13 | 99.94 | 4.1424 | <0.0001 | 0.2606 | 0.7287 |

| Financing availability and entrepreneurial willingness | 0.4541 | 58900 | 1970 | 8 | 99.82 | 2.6474 | <0.0001 | 0.1179 | 0.7902 |

| Financing availability and entrepreneurial performance | 0.5301 | 69331 | 3131 | 10 | 99.98 | 3.4049 | 0.0007 | 0.2250 | 0.8353 |

| Category | Coefficient | SE | Z-Value | p-Value | Confidence Interval (95%) | |

|---|---|---|---|---|---|---|

| Upper Limit | Lower Limit | |||||

| Constant | −0.3783 | 0.3130 | −1.2083 | 0.2269 | −0.9918 | 0.2353 |

| Entrepreneurial competence | 0.5243 | 0.2600 | 2.0168 | 0.0437 | 0.0148 | 1.0338 |

| Entrepreneurship education | 0.5108 | 0.1545 | 3.3057 | 0.0009 | 0.2079 | 0.8136 |

| Age | −0.0339 | 0.3620 | −0.0936 | 0.9255 | −0.7434 | 0.6756 |

| Entrepreneurial location environment | 0.7893 | 0.3553 | 2.2213 | 0.0263 | 0.0929 | 0.4857 |

| Social capital | −0.1782 | 0.3817 | −0.4669 | 0.6406 | −0.9263 | 0.5699 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ge, X.; Wang, J. A Meta-Analysis of the Relationship between Financing Efficiency and Entrepreneurial Vitality: Evidence from Chinese College Students. Sustainability 2022, 14, 10826. https://doi.org/10.3390/su141710826

Ge X, Wang J. A Meta-Analysis of the Relationship between Financing Efficiency and Entrepreneurial Vitality: Evidence from Chinese College Students. Sustainability. 2022; 14(17):10826. https://doi.org/10.3390/su141710826

Chicago/Turabian StyleGe, Xinming, and Jinbo Wang. 2022. "A Meta-Analysis of the Relationship between Financing Efficiency and Entrepreneurial Vitality: Evidence from Chinese College Students" Sustainability 14, no. 17: 10826. https://doi.org/10.3390/su141710826

APA StyleGe, X., & Wang, J. (2022). A Meta-Analysis of the Relationship between Financing Efficiency and Entrepreneurial Vitality: Evidence from Chinese College Students. Sustainability, 14(17), 10826. https://doi.org/10.3390/su141710826