How Does FDI Enhance Urban Sustainable Competitiveness in China?

Abstract

1. Introduction

2. Literature Review

2.1. The Concept of USC

2.2. The Relationship between FDI and USC

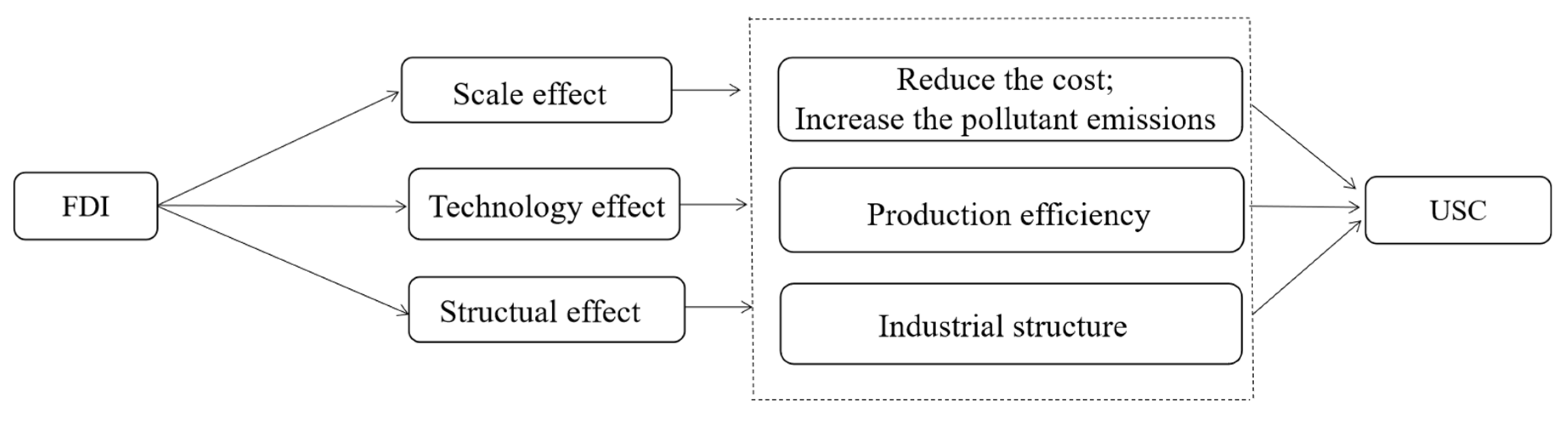

2.3. The Influencing Mechanism of FDI on USC

3. Research Design

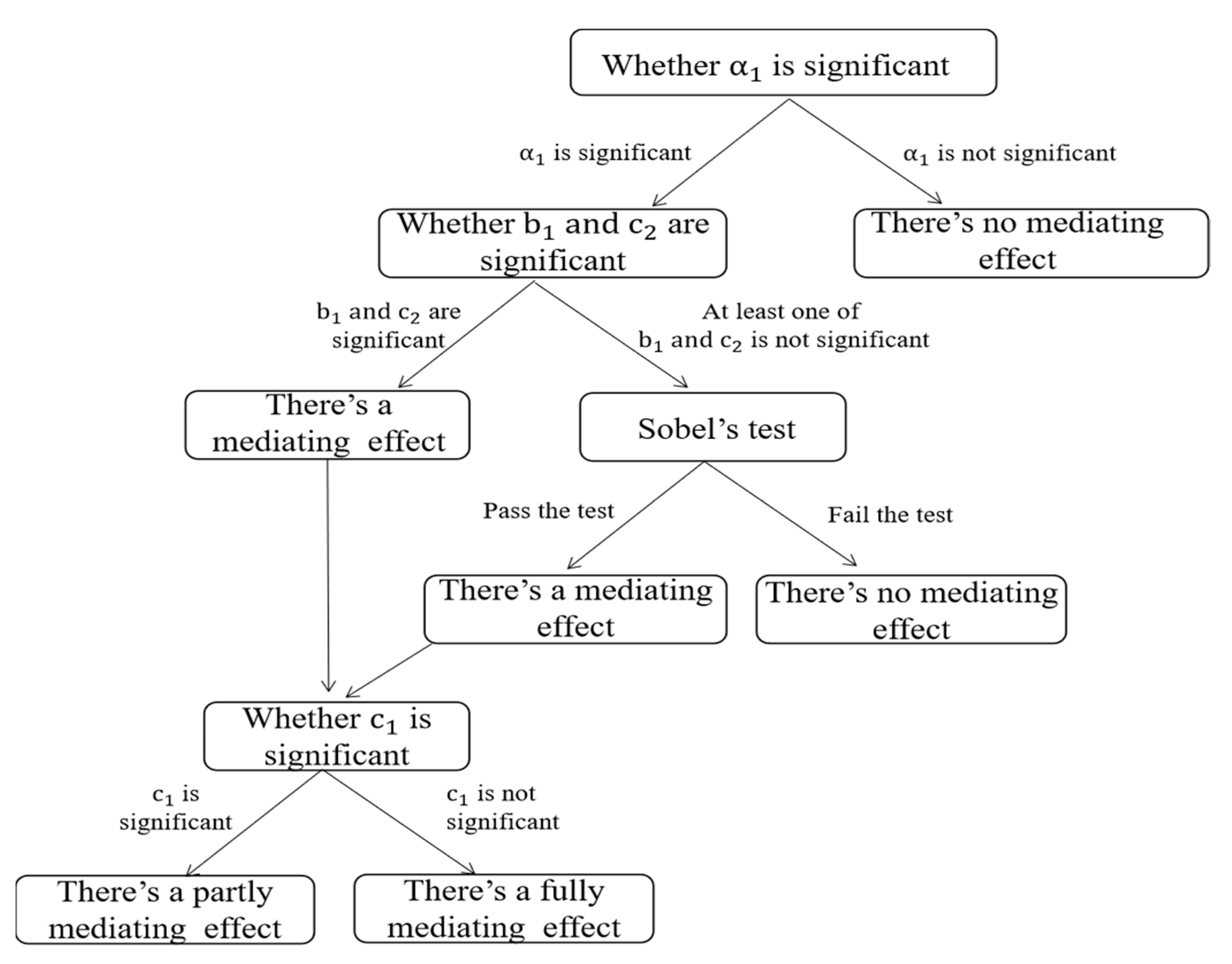

3.1. Measurement Model Construction

3.2. Variables

3.2.1. Dependent Variable

3.2.2. Independent and Intermediary Variables

3.2.3. Control Variables

3.3. Sample Data

4. Results and Discussion

4.1. Baseline Regression Results

4.2. Endogenous Discussion

4.3. Robustness Check

4.4. Heterogeneity Discussion

5. Conclusions and Policy Suggestions

5.1. Conclusions

5.2. Policy Suggestions

5.3. Further Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sun, X.; Liu, X.S.; Li, F.; Tao, Y.; Song, Y.S. Comprehensive evaluation of different scale cities’ sustainable development for economy, society, and ecological infrastructure in China. J. Clean. Prod. 2017, 163, S329–S337. [Google Scholar] [CrossRef]

- Yu, S.; Sial, M.S.; Tran, D.K.; Badulescu, A.; Thu, P.A.; Sehleanu, M. Adoption and implementation of Sustainable Development Goals (SDGs) in China—Agenda 2030. Sustainability 2020, 12, 6288. [Google Scholar] [CrossRef]

- Keivani, R. A review of the main challenges to urban sustainability. Int. J. Urban Sustain. Dev. 2010, 1, 5–16. [Google Scholar] [CrossRef]

- Camagni, R. Sustainable urban development: Definition and reasons for a research programme. Int. J. Environ. Pollut. 1998, 10, 6–27. [Google Scholar] [CrossRef]

- Spiliotopoulou, M.; Roseland, M. Urban sustainability: From theory influences to practical agendas. Sustainability 2020, 12, 7245. [Google Scholar] [CrossRef]

- Balkyte, A.; Tvaronaviciene, M. Perception of competitiveness in the context of sustainable development: Facets of “sustainable competitiveness”. J. Bus. Econ. Manag. 2010, 11, 341–365. [Google Scholar] [CrossRef]

- Ni, P. Annual Report on China’s Urban Competitiveness (No.11); Social Sciences Academic Press: Beijing, China, 2013. (In Chinese) [Google Scholar]

- Marco, K.; Ni, P. Global Urban Competitiveness Report (2019–2020); Chinese Academy of Social Sciences and United Nations Human Settlements Programme: Beijing, China, 2020. [Google Scholar]

- Aust, V.; Morais, A.I.; Pinto, I. How does foreign direct investment contribute to Sustainable Development Goals? Evidence from African countries. J. Clean. Prod. 2020, 245, 118823. [Google Scholar] [CrossRef]

- Sugiharti, L.; Yasin, M.Z.; Purwono, R.; Esquivias, M.A.; Pane, A.D. The FDI Spillover Effect on the Efficiency and Productivity of Manufacturing Firms: Its Implication on Open Innovation. J. Open Innov. Technol. Mark. Complex. 2022, 8, 99. [Google Scholar] [CrossRef]

- Ito, B.; Yashiro, N.; Xu, Z.; Chen, X.; Wakasugi, R. How do Chinese industries benefit from FDI spillovers? China Econ. Rev. 2012, 23, 342–356. [Google Scholar] [CrossRef]

- Tian, L.; Zhai, Y.; Zhang, Y.; Tan, Y.; Feng, S. Pollution emission reduction effect of the coordinated development of inward and outward FDI in China. J. Clean. Prod. 2023, 391, 136233. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report 2014—Investing in the SDGs: An Action Plan. 2014. Available online: https://unctad.org/en/PublicationsLibrary/wir2014_en.pdf (accessed on 27 August 2019).

- Isaac, K.O.; Francesco, F.; Nathanael, O. Towards sustainability: The relationship between foreign direct investment, economic freedom and inclusive green growth. J. Clean. Prod. 2023, 406, 137020. [Google Scholar] [CrossRef]

- James, X.Z. World investment report. In United Nations Conference on Trade and Development; United Nations: Geneve, Switzerland, 2020. [Google Scholar]

- Cheng, Z.H.; Li, L.S.; Liu, J. The impact of foreign direct investment on urban PM2.5 pollution in China. J. Environ. Manag. 2020, 265, 110532. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Z.; Zhao, Y.; Cai, H.; Ajaz, T. Influence of renewable energy infrastructure, Chinese outward FDI, and technical efficiency on ecological sustainability in belt and road node economies. Renew. Energy 2023, 205, 608–616. [Google Scholar] [CrossRef]

- Fagbemi, F.; Osinubi, T.T. Leveraging foreign direct investment for sustainability: An approach to sustainable human development in Nigeria. Resour. Environ. Sustain. 2020, 2, 100005. [Google Scholar] [CrossRef]

- Lever, W.; Turok, I. Competitive cities: Introduction to the review. Urban Stud. 1999, 36, 791–793. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; Simon and Schuster: Springfield, VA, USA, 1998. [Google Scholar]

- Kresl, P.; Singh, B. Competitiveness and the urban economy: Twenty-four large US metropolitan areas. Urban Stud. 1999, 36, 1017–1027. [Google Scholar] [CrossRef]

- Hu, R.; Blakely, E.J.; Zhou, Y. Benchmarking the competitiveness of Australian global cities: Sydney and Melbourne in the global context. Urban Policy Res. 2013, 31, 435–452. [Google Scholar] [CrossRef]

- Du, Q.; Wang, Y.; Ren, F.; Zhao, Z.; Liu, H.; Wu, C.; Li, L.; Shen, Y. Measuring and analysis of urban competitiveness of Chinese Provincial Capitals in 2010 under the constraints of major function-oriented zoning utilizing spatial analysis. Sustainability 2014, 6, 3374–3399. [Google Scholar] [CrossRef]

- Shen, J.; Yang, X. Analyzing urban competitiveness changes in major Chinese cities 1995–2008. Appl. Spat. Anal. Policy 2014, 7, 361–379. [Google Scholar] [CrossRef]

- Poot, J. Reflections on local and economy-wide effects of territorial competition. In Regional Competition; Batey, P.W.J., Friedrich, P., Eds.; Springer: Berlin/Heidelberg, Germany, 2000; pp. 205–230. [Google Scholar]

- Zhu, L.; Li, B.; Yi, H.; Wu, J. Making cities competitive and sustainable: Insights from comparative urban governance research. Urban Gov. 2022, 2, 233–235. [Google Scholar] [CrossRef]

- Tennøy, A.; Gundersen, F.; Øksenholt, K.V. Urban structure and sustainable modes’ competitiveness in small and medium-sized Norwegian cities. Transp. Res. Part D: Transp. Environ. 2022, 105, 103225. [Google Scholar] [CrossRef]

- Quaye, E.; Acquaye, A.; Yamoah, F.; Ndiaye, M. FDI interconnectedness and sustainable economic development: A linear and non-linear Granger causality assessment. J. Bus. Res. 2023, 164, 113981. [Google Scholar] [CrossRef]

- Narula, K. Sustainable Investing’ via the FDI Route for Sustainable Development. Procedia-Soc. Behav. Sci. 2012, 37, 15–30. [Google Scholar] [CrossRef]

- Kardos, M. The relevance of foreign direct investment for sustainable development. Empirical evidence from European Union, Procedia Econ. Financ. 2014, 15, 1349–1354. [Google Scholar] [CrossRef]

- Ayamba, E.C.; Chen, H.B.; Abdul-Rahaman, A.R.; Serwaa, O.E.; Osei-Agyemang, A. The impact of foreign direct investment on sustainable development in China. Environ. Sci. Pollut. Res. 2020, 27, 25625–25637. [Google Scholar] [CrossRef] [PubMed]

- Pan, A.; Qin, Y.; Li, H.; Zhang, W.; Shi, X. Can environmental information disclosure attract FDI? Evidence from PITI project. J. Clean. Prod. 2023, 403, 136861. [Google Scholar] [CrossRef]

- Gyamfi, B.A.; Adebayo, T.S.; Bekun, F.V.; Agyekum, E.B.; Kumar, N.M.; Alhelou, H.H.; Al-Hinai, A. Beyond environmental Kuznets curve and policy implications to promote sustainable development in Mediterranean. Energy Rep. 2021, 7, 6119–6129. [Google Scholar] [CrossRef]

- Zaman, M.; Pinglu, C.; Hussain, S.I.; Ullah, A.; Qian, N. Does regional integration matter for sustainable economic growth? Fostering the role of FDI, trade openness, IT exports, and capital formation in BRI countries. Heliyon 2021, 7, e08559. [Google Scholar] [CrossRef]

- Nepal, R.; Paija, N.; Tyagi, B.; Harvie, C. Energy security, economic growth and environmental sustainability in India: Does FDI and trade openness play a role? J. Environ. Manag. 2021, 281, 111886. [Google Scholar] [CrossRef]

- Aluko, Q.A.; Opoku, E.E.O.; Ibrahim, M.; Kufuor, N.K. Put on the light! Foreign direct investment, governance and access to electricity. Energy Econ. 2023, 119, 106563. [Google Scholar] [CrossRef]

- Demena, B.A.; Afesorgbor, S.K. The effect of FDI on environmental emissions: Evidence from a meta-analysis. Energy Policy 2020, 138, 111192. [Google Scholar] [CrossRef]

- Chishti, M.Z. Exploring the dynamic link between FDI, remittances, and ecological footprint in Pakistan: Evidence from partial and multiple wavelet based-analysis. Res. Glob. 2023, 6, 100109. [Google Scholar] [CrossRef]

- Adeel-Farooq, R.M.; Riaz, M.F.; Ali, T. Improving the environment begins at home: Revisiting the links between FDI and environment. Energy 2021, 215 Pt B, 119150. [Google Scholar] [CrossRef]

- Alvarez, I.; Marin, R. FDI and technology as levering factors of competitiveness in developing countries. J. Int. Manag. 2013, 19, 232–246. [Google Scholar] [CrossRef]

- Sekuloska, J.D. Innovation oriented FDI as a way of improving the national competitiveness. Procedia Soc. Behav. Sci. 2015, 213, 37–42. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, W.; Liu, X.; Li, H. The impact assessment of FDI on industrial green competitiveness in China: Based on the perspective of FDI heterogeneity. Environ. Impact Assess. Rev. 2022, 93, 106720. [Google Scholar] [CrossRef]

- Long, R.; Gan, X.; Chen, H.; Wang, J.; Li, Q. Spatial econometric analysis of foreign direct investment and carbon productivity in China: Two-tier moderating roles of industrialization development. Resour. Conserv. Recycl. 2020, 155, 104677. [Google Scholar] [CrossRef]

- Wang, X.; Luo, Y. Has technological innovation capability addressed environmental pollution from the dual perspective of FDI quantity and quality? Evidence from China. J. Clean. Prod. 2020, 258, 120941. [Google Scholar] [CrossRef]

- Nejati, M.; Taleghani, F. Pollution halo or pollution haven? A CGE appraisal for Iran. J. Clean. Prod. 2022, 344, 131092. [Google Scholar] [CrossRef]

- Hong, L. Does and how does FDI promote the economic growth? Evidence from dynamic panel data of prefecture city in China. IERI Procedia 2014, 6, 57–62. [Google Scholar] [CrossRef]

- Sgambati, S.; Gargiulo, C. The evolution of urban competitiveness studies over the past 30 years. A bibliometric analysis. Cities 2022, 128, 103811. [Google Scholar] [CrossRef]

- Sultana, N.; Turkina, E. Foreign direct investment, technological advancement, and absorptive capacity: A network analysis. Int. Bus. Rev. 2020, 29, 101668. [Google Scholar] [CrossRef]

- Pei, T.; Gao, L.; Yang, C.; Xu, C.; Tian, Y.; Song, W. The Impact of FDI on Urban PM2.5 Pollution in China: The Mediating Effect of Industrial Structure Transformation. Int. J. Environ. Res. Public Health 2021, 18, 9107. [Google Scholar] [CrossRef]

- Javorcik, B.S.; Wei, S.-J. Corruption and cross-border investment in emerging markets: Firm-level evidence. J. Int. Money Financ. 2009, 28, 605–624. [Google Scholar] [CrossRef]

- Kong, Q.; Chen, A.; Wong, Z.; Peng, D. Factor price distortion, efficiency loss and enterprises’ outward foreign direct investment. Int. Rev. Financ. Anal. 2021, 78, 101912. [Google Scholar] [CrossRef]

- Wu, J.; Li, N.; Shi, P. Benchmark wealth capital stock estimations across China’s 344 prefectures: 1978 to 2012. China Econ. Rev. 2014, 31, 288–302. [Google Scholar] [CrossRef]

- Mahmood, H.; Alkhateeb, T.; Furqan, M. Industrialization, urbanization and CO2 emissions in Saudi Arabia: Asymmetry analysis. Energy Rep. 2020, 6, 1553–1560. [Google Scholar] [CrossRef]

- Xie, Q.; Wang, X.; Cong, X. How does foreign direct investment affect CO2 emissions in emerging countries?New findings from a nonlinear panel analysis. J. Clean. Prod. 2019, 249, 119422. [Google Scholar] [CrossRef]

- Dar, A.A.; AmirKhalkhali, S. Government size, factor accumulation, and economic growth: Evidence from OECD countries. J. Policy Model. 2002, 24, 679–692. [Google Scholar] [CrossRef]

| Variable | Symbols | Measurements |

|---|---|---|

| USC | Urban sustainable competitiveness index | |

| FDI | The amount of foreign capital actually utilized | |

| Scale effect | Industrial sulfur dioxide emission | |

| technological effect | Green total factor productivity | |

| Structural effect | The output value of the secondary industry in GDP | |

| Economic growth | GDP | |

| Population size | The number of people at the end of the year | |

| Government expenditure | Government’s general budget expenditure | |

| Social security | The number of employees in public management, social security, and social organizations | |

| Health care | The number of hospitals | |

| Education expenditure | The total expenditure of education |

| Variable | N | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| 1972 | 0.326 | 0.148 | 0.001 | 0.989 | |

| 1861 | 10.14 | 1.862 | 1.099 | 14.94 | |

| 1871 | 10.08 | 1.177 | 0.693 | 13.14 | |

| 1974 | 0.243 | 0.675 | 0.059 | 1.081 | |

| 1968 | 3.827 | 0.248 | 2.608 | 4.477 | |

| 1969 | 16.46 | 0.978 | 12.76 | 19.60 | |

| 1972 | 5.882 | 0.699 | 2.986 | 8.133 | |

| 1969 | 14.74 | 0.807 | 10.10 | 18.24 | |

| 1970 | 10.66 | 0.624 | 6.215 | 13.09 | |

| 1965 | 4.942 | 0.811 | 1.609 | 8.024 | |

| 1867 | 9.968 | 2.171 | 2.996 | 16.14 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| 0.002 ** | −0.049 *** | 0.001 | −0.008 | 0.002 ** | 0.011 *** | 0.003 ** | |

| (2.020) | (−3.304) | (0.957) | (−0.886) | (1.990) | (3.683) | (2.226) | |

| −0.004 ** | |||||||

| (−2.460) | |||||||

| −0.004 * | |||||||

| (−1.763) | |||||||

| −0.022 * | |||||||

| (−1.853) | |||||||

| −0.005 | 0.005 | −0.003 | 0.028 | −0.004 | 0.124 *** | −0.002 | |

| (−0.966) | (0.067) | (−0.609) | (0.952) | (−0.946) | (6.007) | (−0.371) | |

| −0.098 *** | −0.322 | −0.093 *** | 0.180 | −0.097 *** | −0.052 | −0.099 *** | |

| (−5.865) | (−1.201) | (−5.721) | (1.037) | (−5.786) | (−1.094) | (−5.942) | |

| −0.007 ** | −0.030 | −0.008 ** | 0.011 | −0.007 ** | 0.032 *** | −0.006 ** | |

| (−2.248) | (−0.541) | (−2.335) | (0.459) | (−2.233) | (3.364) | (−2.023) | |

| 0.020 *** | 0.159 | 0.027 *** | −0.012 | 0.020 *** | −0.025 | 0.019 ** | |

| (2.615) | (0.681) | (3.514) | (−0.132) | (2.627) | (−0.971) | (2.508) | |

| 0.000 | 0.019 | −0.000 | 0.017 | 0.001 | −0.016 * | 0.000 | |

| (0.151) | (0.508) | (−0.011) | (0.659) | (0.170) | (−1.943) | (0.041) | |

| −0.001 * | 0.017 * | −0.001 * | 0.008 | −0.001 * | 0.002 | −0.001 * | |

| (−1.847) | (1.756) | (−1.769) | (1.247) | (−1.801) | (1.105) | (−1.778) | |

| Constant | 1.563 *** | 11.256 *** | 1.494 *** | −1.556 | 1.557 *** | 0.801 | 1.580 *** |

| (9.214) | (3.112) | (8.620) | (−0.988) | (9.180) | (1.535) | (9.323) | |

| N | 1749 | 1669 | 1668 | 1751 | 1749 | 1750 | 1748 |

| R2 | 0.957 | 0.849 | 0.960 | 0.781 | 0.957 | 0.906 | 0.957 |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| 0.007 *** | −0.077 *** | 0.006 *** | −0.021 | 0.007 *** | 0.006 | 0.007 *** | |

| (3.380) | (−2.652) | (2.724) | (−1.251) | (3.355) | (0.842) | (3.356) | |

| −0.004 ** | |||||||

| (−2.319) | |||||||

| −0.004 * | |||||||

| (−1.805) | |||||||

| −0.027 ** | |||||||

| (−2.456) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 1.551 *** | 11.230 *** | 1.492 *** | −1.530 | 1.545 *** | 0.812 * | 1.573 *** |

| (9.824) | (3.414) | (9.387) | (−1.058) | (9.798) | (1.694) | (9.988) | |

| N | 1463 | 1388 | 1387 | 1465 | 1463 | 1464 | 1462 |

| R2 | 0.957 | 0.848 | 0.959 | 0.781 | 0.957 | 0.905 | 0.957 |

| Kleibergen–Paap | 166.521 | 152.413 | 150.718 | 167.252 | 166.882 | 167.226 | 168.007 |

| [0.000] | [0.000] | [0.000] | [0.000] | [0.000] | [0.000] | [0.000] | |

| Cragg–Donald | 429.661 | 428.373 | 422.748 | 429.611 | 428.837 | 429.252 | 429.082 |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| 0.001 ** | −0.018 ** | 0.001 * | −0.005 | 0.001 ** | 0.001 | 0.001 ** | |

| (2.119) | (−2.238) | (1.692) | (−1.066) | (2.093) | (0.315) | (2.074) | |

| −0.003 ** | |||||||

| (−2.073) | |||||||

| −0.004 * | |||||||

| (−1.798) | |||||||

| −0.025 ** | |||||||

| (−2.132) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 1.600 *** | 12.680 *** | 1.527 *** | −0.259 | 1.599 *** | 0.881 | 1.622 *** |

| (9.629) | (4.380) | (8.562) | (−0.177) | (9.596) | (1.429) | (9.741) | |

| N | 1749 | 1669 | 1668 | 1751 | 1749 | 1750 | 1748 |

| R2 | 0.957 | 0.848 | 0.959 | 0.781 | 0.957 | 0.905 | 0.957 |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Eastern Sample | |||||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| 0.014 *** | −0.161 *** | 0.011 ** | 0.024 | 0.014 *** | −0.021 *** | 0.012 *** | |

| (3.101) | (−2.639) | (2.389) | (0.879) | (3.100) | (−2.967) | (2.770) | |

| −0.002 | |||||||

| (−0.575) | |||||||

| −0.001 | |||||||

| (−0.244) | |||||||

| −0.081 ** | |||||||

| (−2.095) | |||||||

| Controls | |||||||

| Constant | 1.064 | 12.234 | 0.585 | −2.925 | 1.061 | 2.344 ** | 1.225 |

| (1.090) | (0.782) | (0.597) | (−0.506) | (1.087) | (2.239) | (1.254) | |

| N | 572 | 548 | 548 | 573 | 573 | 572 | 572 |

| R2 | 0.955 | 0.835 | 0.958 | 0.796 | 0.955 | 0.958 | 0.956 |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Northeast Sample | |||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Step 1 | Step 2 | Step 3 | Step 2 | Step 3 | Step 2 | Step 3 | |

| 0.001 | 0.046 | 0.000 | −0.029 | 0.001 | 0.019 *** | 0.002 | |

| (0.588) | (1.500) | (0.169) | (−1.566) | (0.475) | (3.019) | (0.731) | |

| 0.003 | |||||||

| (0.751) | |||||||

| −0.008 | |||||||

| (−1.608) | |||||||

| −0.015 | |||||||

| (−0.558) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 2.156 *** | 29.185 ** | 1.680 ** | −1.294 | 2.146 *** | 4.313 * | 2.222 *** |

| (3.339) | (2.201) | (2.588) | (−0.216) | (3.316) | (1.955) | (3.472) | |

| N | 223 | 211 | 211 | 223 | 223 | 223 | 223 |

| R2 | 0.941 | 0.796 | 0.944 | 0.779 | 0.941 | 0.924 | 0.941 |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Central Sample | |||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Step 1 | Step 2 | Step 3 | Step 2 | Step 3 | Step 2 | Step 3 | |

| 0.004 | 0.030 | 0.005 | −0.044 | 0.003 | 0.003 | 0.003 | |

| −0.001 | |||||||

| (−0.255) | |||||||

| −0.008 ** | |||||||

| (−2.351) | |||||||

| 0.033 * | |||||||

| (1.674) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.945 *** | 7.738 ** | 0.921 *** | −5.416 * | 0.901 *** | 2.589 *** | 0.859 *** |

| (3.964) | (2.588) | (3.679) | (−1.919) | (3.735) | (2.803) | (3.423) | |

| N | 504 | 482 | 482 | 504 | 504 | 504 | 504 |

| R2 | 0.943 | 0.897 | 0.945 | 0.760 | 0.943 | 0.859 | 0.943 |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Western Sample | |||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Step 1 | Step 2 | Step 3 | Step 2 | Step 3 | Step 2 | Step 3 | |

| 0.001 | −0.056 *** | −0.001 | −0.000 | 0.001 | 0.008 * | 0.001 | |

| (0.612) | (−3.256) | (−0.498) | (−0.011) | (0.612) | (1.739) | (0.690) | |

| −0.015 *** | |||||||

| (−2.620) | |||||||

| 0.001 | |||||||

| (0.304) | |||||||

| −0.018 | |||||||

| (−0.804) | |||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.895 *** | 12.660 *** | 1.076 *** | −0.604 | 0.896 *** | 1.052 | 0.916 *** |

| (3.388) | (3.203) | (3.549) | (−0.242) | (3.390) | (1.109) | (3.463) | |

| N | 450 | 428 | 427 | 451 | 450 | 451 | 450 |

| R2 | 0.954 | 0.938 | 0.956 | 0.808 | 0.954 | 0.888 | 0.954 |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, J.; Jiang, L.; Jiang, B.; Luan, S. How Does FDI Enhance Urban Sustainable Competitiveness in China? Sustainability 2023, 15, 10393. https://doi.org/10.3390/su151310393

Li J, Jiang L, Jiang B, Luan S. How Does FDI Enhance Urban Sustainable Competitiveness in China? Sustainability. 2023; 15(13):10393. https://doi.org/10.3390/su151310393

Chicago/Turabian StyleLi, Jian, Lingyan Jiang, Bao Jiang, and Shuochen Luan. 2023. "How Does FDI Enhance Urban Sustainable Competitiveness in China?" Sustainability 15, no. 13: 10393. https://doi.org/10.3390/su151310393

APA StyleLi, J., Jiang, L., Jiang, B., & Luan, S. (2023). How Does FDI Enhance Urban Sustainable Competitiveness in China? Sustainability, 15(13), 10393. https://doi.org/10.3390/su151310393