Abstract

Applying Information and communication technologies (ICT) tools is crucial for businesses to stay competitive and sustainable. The aim of this study is to investigate the attitudes of the Hotel, Restaurant, and Catering sector (HoReCa) and wholesale companies towards using ICT tools to improve B2B communication and drive sustainable development. Through in-depth interviews with representatives from twenty HoReCa firms and seven wholesale suppliers, the ICT tool was found to be well received and could potentially improve the efficiency and sustainability of their cooperation. The hypothesis states that these sectors have significant potential to adopt novel tools to improve communication channels and make their logistics operations more sustainable. As part of the Incubator of Innovation 4.0 project grant at Gdynia Maritime University, a mobile application was developed to support the development of sustainable supply chains that minimize environmental impact, support long-term economic viability, and improve warehouse management and distribution channels for services and goods. This tool could facilitate the streamlining of processes and enable stakeholders to adapt to dynamic changes in the socio-economic environment, ultimately leading to more efficient and flexible operations.

1. Introduction

The adoption of information and communication technology (ICT) is a key goal of sustainable development as identified by the United Nations (UN), with a deadline set for 2030 [1]. The concept of a sustainable information society has gained popularity, referring to the use of ICT as a valuable enabler of long-term sustainability in businesses [2,3,4,5]. The adoption of modern technologies is a major factor in the sustainability of many businesses today, allowing enterprises to compete and improve their products and services. Entrepreneurial sustainability plays a crucial role in economies and is a key contributor to global economic growth [6]. However, sustainability is also a major challenge for these businesses. The concept of sustainable entrepreneurship refers to any activity that promotes sustained growth and advantage relative to competitors [7]. Entrepreneurial strategies for business development in a competitive environment often involve innovative sustainability methods [8,9,10,11]. The adoption of technology can facilitate business sustainability by changing the way people live, work, and conduct business. Many entrepreneurs have adopted technology and moved away from traditional structures [12,13,14]. The internet and mobile phones have become common means of communication and market research, including price comparison, customer identification, and distribution channel selection.

Why some forms of cooperation can be maintained and result in positive outcomes while others deteriorate or fail is a question known as the sustainable cooperation dilemma [15]. This dilemma is relevant to various social institutions, including families, communities, organizations, and states. Successful cooperation often involves a virtuous cycle in which the joint production of collective goods strengthens participants’ willingness to contribute [15,16]. On the other hand, an unsuccessful partnership may lead to a vicious cycle of mistrust, cheating, and neglect of the collective good [15,16]. In the context of the HoReCa and wholesale sectors, understanding the factors that facilitate sustainable cooperation can be crucial for the long-term success of businesses and their relationships with partners and customers.

This study aims to explore the attitudes of the Hotel, Restaurant, and Catering sector (HoReCa) and wholesale companies towards the adoption of an ICT tool designed to enhance the sustainability within their cooperation. The hypothesis states that these sectors have significant potential to adopt novel tools to improve communication channels and make their logistics operations more sustainable. The authors, as part of the Incubator of Innovation 4.0 project grant at Gdynia Maritime University, developed an ICT tool to support the development of sustainable supply chains and stimulate the growth of modern warehouse management and distribution channels for goods and services.

So far, few studies have examined the adoption of ICT technologies by the wholesale and HoReCa sectors in terms of sustainability. Investing in ICT tools is not only a trend, but also a necessary step towards achieving long-term sustainability in businesses. The team has developed an innovative ICT tool specifically designed to enhance B2B communication and drive sustainability in the Hotel, Restaurant, and Catering (HoReCa) and wholesale sectors. Through a pilot study, the authors found that there is a significant need for such a tool in these sectors and that it has the potential to streamline processes and increase efficiency and flexibility.

The pilot studies resulted in the development of business processes for HoReCa and wholesale companies. In addition, to give the research a personal touch, customer profiles were created called buyer personas. B2B (business-to-business) buyer persona is a fictional but realistic representation of the target group, which is a potential customer [17,18]. In the case of B2B, the buyer persona may respond to questions about business needs, decision-making processes, purchase criteria, and other important aspects of the company [17]. Creating a B2B buyer persona helps to understand the needs and expectations of customers, allowing for a more effective adaptation of the offer to their needs. It may also be helpful in communication with customers and in creating marketing and advertising content aimed at this target group [17,18].

In this research, we developed an ICT tool that allows HoReCa companies to smoothly and efficiently place orders with their suppliers. This tool includes features such as a user-friendly interface for creating and submitting orders, real-time tracking of order status and delivery, and the automatic notification of price changes or product availability. It also provides a platform for communication between HoReCa companies and their suppliers, allowing for the easy resolution of any issues that may arise during the ordering process. Overall, this ICT tool aims to streamline and simplify the process of ordering goods for HoReCa companies, helping them save time and resources while ensuring that they receive the products they need in a timely and reliable manner.

2. Literature Review

Effectively conducted management process is a method featuring social character and continuity, requiring cooperation between people in implementing every stage of the management process. The stages can be presented in the form of a “production—division—exchange—consumption” chain. In this context, it is important to consider the role of the Hotel, Restaurant, and Catering sector (HoReCa).

HoReCa is an iconic business term which primarily refers to a sector of the food service industry, establishments that prepare and serve food and beverages. This term is a syllabic abbreviation of the words Hotels and Restaurant Category, and for some includes Hotel/Restaurant/Café [19,20]. This acronym was first used in the Netherlands and subsequently utilized by other countries such as Spain, Portugal, Belgium, Romania, and the international beverage companies specializing in this sector. The HoReCa channel is a set of commercial catering food establishments whose main activity is the production and sale of direct out-of-home consumption of food [19,20]. This sector is challenging to study, mainly because the declared objective of many official databases is to provide raw data about the tourism sector [21]. Accommodation services are prioritized relative to catering services, and HoReCa’s activities are often included in the hotel organization. This paper focuses on how HoReCa cooperates with food providers.

Another important sector to consider is wholesale trade, which involves the resale of new and used goods to a variety of buyers, including retailers, industrial, and commercial users and other wholesalers [22,23,24]. Wholesaling generates nearly EUR 600 billion in value-added per year and provides employment for 10 million people in Europe [22]. Many wholesalers also offer a range of business-to-business services, such as account management, sales and after-sales support, technical assistance, category management, logistics, and financial services [23]. The wholesaling process is an intermediate step in the distribution of merchandise. Wholesalers are willing to sell or arrange the purchase or sale of goods for resale (i.e., goods sold to other wholesalers or retailers), capital or durable non-consumer goods, and raw and intermediate materials and supplies used in production [24]. Wholesalers manage everything from a warehouse or small office near a warehouse. Developing a competitive strategy in the wholesale sector, especially in traditional commercial transactions, is a valid task for companies to achieve sustainability. The weaknesses of the traditional wholesale sector are composed of experienced-based businesses without new technology, lack of knowledge/know-how transferring, and independent management without a cluster group [24].

The two entities described above cooperate on a business to business (b2b) basis. Business-to-business are areas where transactions involve companies [18]. These can be single sales, long-term contracts, and multi-annual contracts. The B2B area is wide and has a high potential for action [18]. Organizations can sell goods, such as machinery, or provide services, such as cleaning. The purchase process in B2B is specific and significantly different from B2C. It takes longer to make decisions, often involves many stakeholders, and is more complex because it involves greater risks when purchasing for the company [18]. It refers to transactions with higher value, and the choice of the solution or supplier is often binding [18].

Despite the differences in purchasing processes, many B2B customer behaviors begin to resemble B2C customer behavior [25]. It is known as B2B consumerization. Business customers today require convenient, intuitive solutions—those they use as consumers. When HoReCa employees buy on online store in their spare time, it is hard to switch to ordering through the PDF catalog.

Human2Human is the most recent approach, meaning that, regardless of the segment in which the company operates, a company must not forget that the ultimate recipient of all its products and offerings is a person, whether as a private individual or as a director or President [25,26]. By personalizing the offer to human needs, companies are able to sell effectively, collect demand data, and not generate excessive supply. Human2Human is not a face-to-face meeting if the customer is not expecting it. The H2H creates a compliant communication model and distribution channel that will keep the customer [25,26]. Due to widespread environmental and consumer awareness, an example of H2H campaigns can be ecological projects of local and international companies that motivate consumers, for example, to collect loyalty points that allow them to plant a tree in Africa.

Interestingly enough, ICT tools include computer programs and hardware, both computers and peripheral devices (printers, scanners), and instruments to enable various innovative processes to be implemented over the Internet [27]. In general terms, enormous ICT potential for improving cooperation can be approached from two angles: ICT as an industry and ICT as a tool. As an industry, ICT has become a valid economic driver in the hardware, software, telecommunications, and consulting services sectors [27]. ICT as a tool may be used to transform and improve business, people’s everyday lives and public governance [27].

Some researchers have identified ICT as one of the principal tools in building sustainable business practices and supporting the success of businesses [3,5,6,27]. It is contended that ICT enables enterprises to improve productivity, support innovation, reduce costs, increase the effectiveness of processes and services, enhance the efficiency of business decision-making, respond to customers at a faster then average rate, and acquire new customers [28]. Moreover, ICT adoption in enterprises can yield benefits in environmental preservation by increasing energy efficiency and equipment utilization as well as it can influence social development by making information available to all society stakeholders. All these possibilities make ICT enablers of sustainability in several respects, i.e., environmental protection (ecological sustainability), economic growth (economic sustainability), socio-cultural development (socio-cultural sustainability), and governance (political sustainability) [29,30]. ICT tools are willingly used in lean management enterprises [31].

Lean management evolved from lean manufacturing, which is a well-established and widely implemented concept with a long history and abundant literature [32,33,34]. The lean approach is based on creating value by disposing of seven types of waste, which were originally defined by Ohno for the automotive manufacturing environment [21]. These types are overproduction, downtime, unnecessary transport and handling, unnecessary machining, defects, and unnecessary movements and stocks [20]. The list was soon expanded to include the eighth type of waste—unexploited skills [20].

The starting point for the implementation of changes in the area of cooperation and communication in the B2B supply chain is to name and prepare documentation regarding the process. The documentation processes require cooperation and planning between stakeholders to determine the most effective and appropriate actions for the task implementation [35]. Then, a model of such a process must be provided. As a result, the future user can introduce corrections based on simulations, even before starting the system. Getting started with the system is equal to work automation, which helps to better manage and optimize processes. It is also an opportunity to perform routine, everyday tasks faster. The time gained can be used, for example, for changes in subsequent departments of the company, e.g., customer service. Undoubtedly, the introduction of new systems corresponding to the company operations based on written business processes provides an opportunity to conduct analyses of the efficiency, effectiveness, and security of the company. Thus, leading to making justified and accurate decisions.

The hotel and catering industry are next to tourism as one of the most important branches of the European economy [36]. Therefore, it is necessary to focus on innovations that directly affect their business processes, from cooperation with suppliers to waste management. Western Europe makes every effort to enable actions on significant projects. In the Central, Eastern, and Southeast Europe (CESEE) region, academia, funds, business angels, mentors, etc., face important challenges, including strengthening local innovation ecosystems, improving favorable environment and increasing access to funding for innovative, and early-stage startups and companies [37]

In this paper, a direct and personal approach has been applied in order to reach and bring people who represent the HoReCa and supplier sectors. This is why a creative method of problem-solving has been used to effectively present the results of in-depth interviews. Design thinking is an innovative and collaborative approach to problem-solving that puts the user first to create customer-centered products and services [38]. Design thinking initiates the understanding of customers or users by creating a persona. A persona is a fictional character representing a type of customer or user of a service or product [38]. This fictional character is created based on a synthesis of what the researcher has learned about real clients or users. This approach is based on research and aims to enhance our understanding of client needs, behaviors, experiences, and objectives [17,39] Additionally, the literature review reveals that the analysis of digital technologies allows for a better understanding of their most popular features in order to support their dissemination between citizens [38]. Digital technologies have been proven to be crucial in addressing the issue of information asymmetry in the food supply chain. One of the top ICT tools for the HoReCa market includes a communicator developed by the German company Choco.

In an interview with TechRound, Daniel Khachab, CEO of the billion-dollar startup, recalled that its activities were aimed at addressing the widespread issue of food waste in the global supply chain [40]. Khachab, operating in the eCommerce environment, knew that one of the answers to this issue involved the automation of the way the suppliers and restaurants connected with each other [40,41]. The solution referred to the implementation of a mobile application, initially to companies based in Berlin. Since its founding in Berlin in 2018, the company has grown rapidly and is active in markets such as the USA, Germany, France, Spain, Austria, Belgium, and, most recently, the UK, with an investment of £20 million [40,41]. Choco cooperates with over 15,000 restaurateurs and over 10,000 wholesalers around the world. By early 2022, Choco’s valuation has risen to $1.2 billion, making it a FoodTech unicorn [40,41].

A similar solution provided on the Polish market was developed by E. Siedlacka. Hurtum is a platform that allows transactions between business users from the FMCG industry (Fast Moving Consumer Goods). The B2B market is said to be several times larger than the market of individual customers [42,43]. It results from the fact that each product passes through the business customer before it reaches the individual customer. On the B2B market, the human factor plays a significant role, as this is an area overlooked by the digital transformation and can be called the offline market [42,43]. The company was founded in 2015, and in 2018 it won the LOG-UP competition for the best logistics start-up. Despite such an achievement, they still operate only on the Polish market, because they need an investor who is yet to be found in order to start the expansion. Hurtum company offers its customers great opportunities such as: integrating their offer with the use of API or XML files, in the seller’s panel you can track and change the status of orders (cancel, edit, and approve), and modifiable price lists depending on the purchase histories [42,43].

When comparing the financial and mentoring support of the Polish start-up Hurtum and the German Choco, huge differences can be observed. They can be found in the geographical location where startups are established. The technological startups in the region of Central, Eastern, and Southeast Europe (CESEE) are struggling with an investment gap compared to innovators in other regions in Europe [37]. The Digital Innovation and Scale-up Initiative (DISC) has been fulfilling its objectives while bridging the existing market gap, increasing investments, and strengthening the support programs focused on digital innovation and scaling up digital startups in the CESEE region [37]

No access to funding is a major bottleneck for CESEE in its transition to a new growth model based on innovation. The empirical data indicates that both public and private investment are not optimal. Investments in the private equity and venture capital markets in Central and Eastern European countries amount to ca. a third of the overall EU average. Public investment in R&D in the region reaches only ca. 1.2 percent of GDP compared to 2.0 percent of GDP of the EU average and are highly dependent on the government and EU funding, in particular from the European fund for strategic investments (EFSI) [37]. At the same time, the startup success stories in the region, such as UiPath from Romania and Taxify from Estonia, indicate that entrepreneurs can be highly successful in developing and scaling up their business despite the barriers.

3. Methodology and Materials

The pilot research study was conducted using an online survey, i.e., the recognized research technique related to the standardized questionnaire interview method [44]. For a wholesaler, the question was the following: What does the process of accepting an order in your company look like?”; and for the customer: “What does the ordering process carried out by your company look like?”. The customers of wholesaler could, among other things, assess the quality of websites, determine how important it is to innovate communication channels and indicate the type of market they obtain goods from for their business. Wholesaler owners were able to point out the pros and cons of the current computer software, as well as share the challenges of working with customers, such as placing orders at short notice.

In-depth interviews (IDI) are a qualitative research technique that involves conducting detailed, individual interviews with a small number of respondents in order to learn their perspective regarding a specific idea, program, or situation [45]. For example, the purpose of an interview may involve learning the thoughts, experiences, and expectations of staff towards a new process. A conversation may refer to the changes they see in themselves as a result of their involvement in the process. The role of the interviewer is to provide structure into the sequence of questions (What does the question bring into the study?), their wording and adaptation of the language used in communicating with the respondents—an interview scenario is the result of such preparation. The development of such a tool makes an interview a research technique, which is different from the standardized quantitative techniques, such as a survey or questionnaire interview, and from a natural conversation which does not involve pre-established instructions. More and more frequently, researchers from, e.g., the EU projects, turn to IDI in their evaluation studies. The evaluation is a practical process aimed at determining whether a given project has achieved its goals. The conversation should take place naturally so that the respondents could feel comfortable talking about their work, feelings, and new ideas.

The results presented in this article were obtained from an interview conducted in a partially structured formula, where researchers referred to the previously prepared questions, but flexibly developed their knowledge in the course of the interview using questions formulated ad hoc as a form of reaction to the information obtained [45].

The pilot studies verifying the survey questions resulted in redefining the goal and hypotheses. The interviews were to verify the hypothesis formulated providing that there is a problem in communication between HoReCa market entities and the wholesale trade representatives. The aim involved presenting the developed demo version of the mobile application in a near-real environment. In order to increase the equivalence of the results and ensure an atmosphere favorable to the study subjects, suitable sites were selected, and appropriate technical means were applied. Meetings were held in company headquarters, offices or at the restaurant table. The respondents, remaining in the environment they know, became open and creative. Many remarks were observed after naturally taking a look around the place. The material resources necessary to record the interviews included a voice recorder.

In order to reinforce the data obtained under the interview method, in a quantitative and qualitative sense, a broad selection of published professional reports was considered concerning the trends, innovations, opinions, and supply chains in the HoReCa industry. The analysis of the market environment, together with the data obtained in the course of collecting the materials from in-depth interviews, provides reasons for confirming the formulated hypothesis and the need for such systemic solution in order to improve the purchasing process.

The criteria for selecting the interlocutors were related to the position they have in a given company and their trust towards the researcher. The interlocutors were selected under the snowball technique with a recommendation, meaning that one interlocutor presented the researcher to another one [45]. Such a technique is the most appropriate as it disregards troublesome/inconvenient data, and such are the conversations about running a business, contacts with suppliers, opinions—among others, within the wholesale trade sector [45].

The initial surveys and in-depth interviews have been carried out as pilot research studies (see Appendix A). Among the respondents there were: a small family restaurant, seasonal bars, an intimate hotel, a large all-year-round hotel facility, dietary catering, office catering, a catering facility with a banquet hall, etc. Among the representatives of wholesalers, there were those specializing in the sale of vegetables and fruits, frozen food, and all food categories, as well as the distribution of chemicals and stainless-steel catering equipment. It is worth noting that the team specified the recipients during the study, and decided to focus only on food sector.

4. Results

The study results concern the hospitality and catering industry, which, as mentioned, apart from tourism, is one of the most significant branches of the European economy [46]. Despite its size and importance in the market, the HoReCa area lacks fundamental theoretical and practical studies in logistics, communication with suppliers, and the adoption of ICT tools [46].

A strategic approach to cooperation is crucial for building trusted and engaging B2B relationships. Buyer–seller trading requires a high level of cooperative arrangements to be successful [47]. The created tool will be an intermediary between the buyer and the supplier, where they will exchange data and seek advice and suggestions from one another to set goals together. It is to become a binder that binds relationships and is a principal factor in the development of the partnership.

The study revealed that a high level of information sharing significantly increases the purchaser’s satisfaction with the supplier’s performance. Both sides care about the durability of B2B relationships because it reduces costs and increases profitability [47]. Currently, the exchange of information is scarce. Suppliers do not inform their customers about new products—customers have to ask. They do not provide information on changes in order statuses—customers find out when checking the delivery.

One might seek the incompetence of a particular vendor, and changing the supplier might be a countermeasure contribution. However, as it turns out, this is a common problem among suppliers. Another common challenge is the organization of work based only on verbal agreements. Therefore, the research aims to improve communication channels (including the adoption of ICT tools) with suppliers for enterprises from the hotel and catering industry.

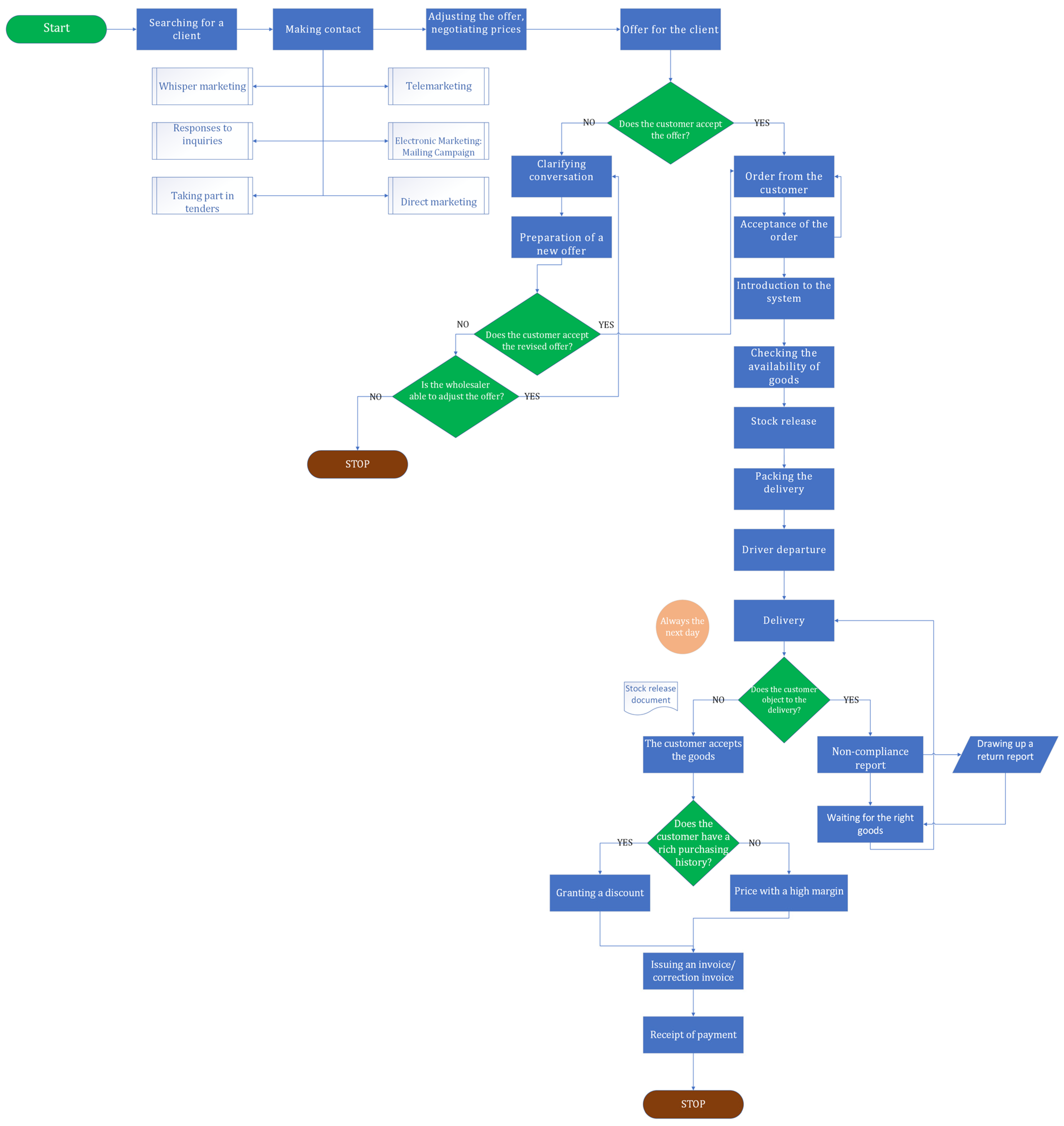

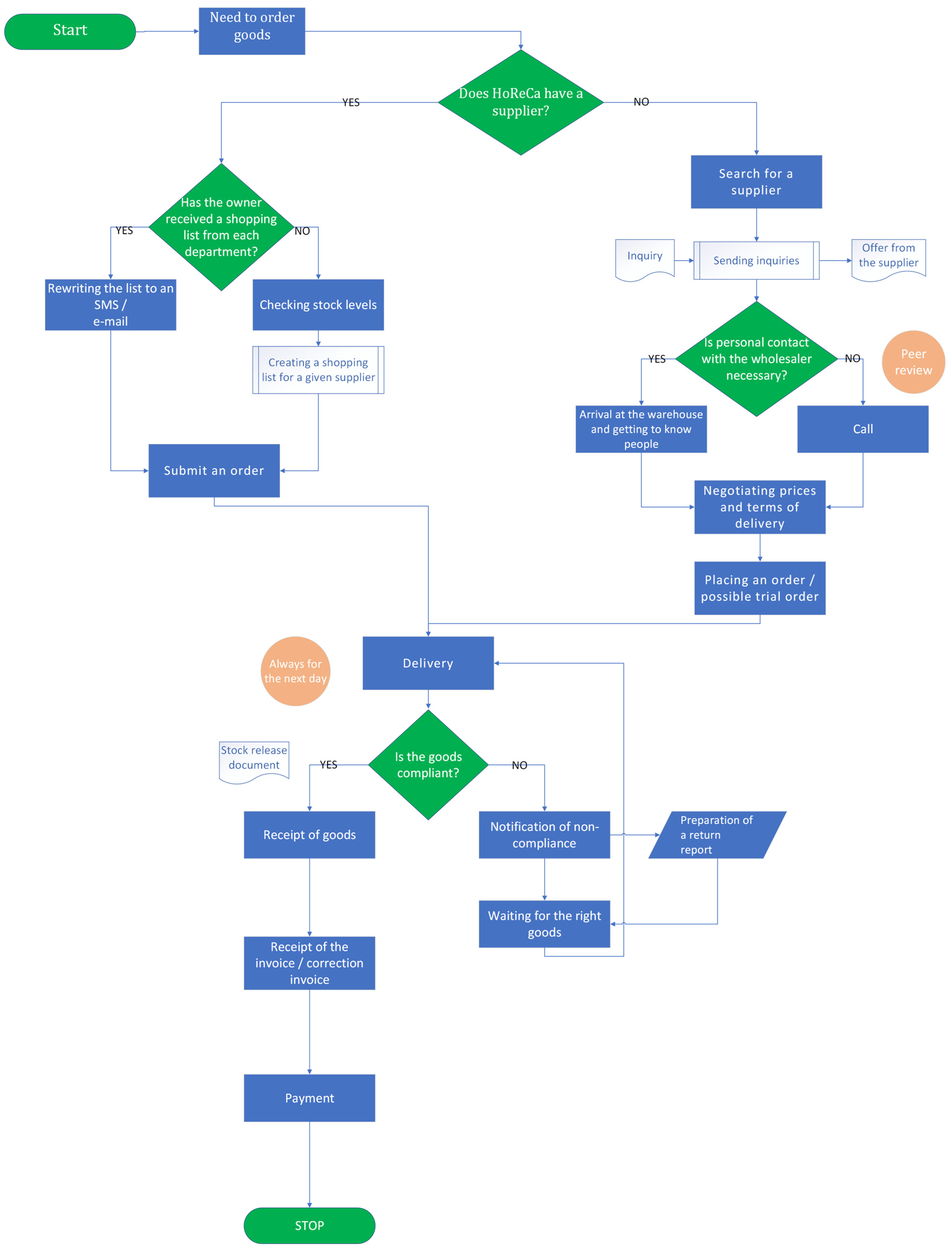

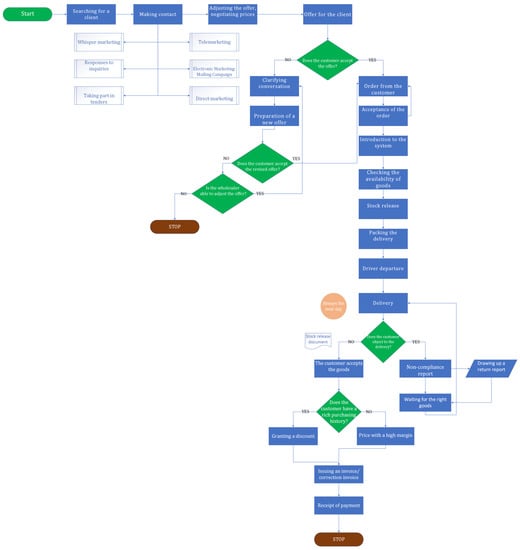

The study involved developing the process of accepting orders by the wholesale trade sector, the process of placing orders by the HoReCa market (Figure 1 and Figure 2) and resulted in proposing a new purchasing process with the use of the emerging ICT tool. Respondents’ companies are classified as micro-, small-, and medium-sized enterprises. Next in line was the question about the “stages of the process of accepting/placing orders”; there was some uncertainty among the respondents as regards this question—as if they had never asked themselves this question before.

Figure 1.

The process of accepting orders by the wholesaler.

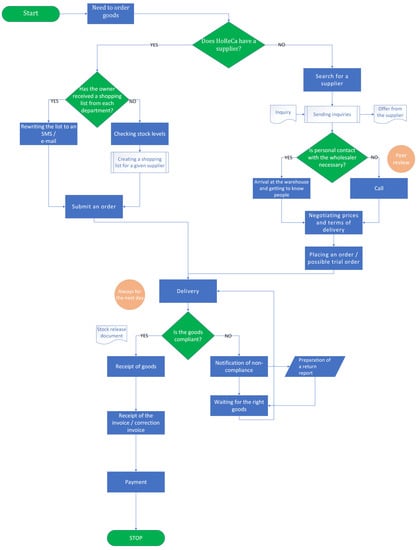

Figure 2.

The process of placing orders by the HoReCa company. Source: own elaboration.

On Figure 1, there is a presentation of the process of accepting orders by the wholesaler, aimed to support the understanding of the relationships between business partners and between different business processes, which at first glance may not influence each other.

The above process presents the activities and tasks conducted by companies in the wholesale trade, which lead to a specific goal, namely, to accept an order from a business customer. In interviews, they emphasized that they value word-of-mouth marketing the most among the many options for acquiring and establishing contact with the customer. An essential element of business cooperation refers to the duration and purchase history of the customer because it determines the final price of the product. Wholesaler owners willingly use the cross-selling technique. They believe it can be implemented most effectively when the customer calls or arrives at their premises. It is the last moment to sell additional products or maneuver the price. Because of these practices, wholesalers prefer to avoid making prices available to a broader audience. Phone calls or face-to-face meetings constitute only a verbal contract, which sometimes means that wholesalers carry out larger orders from manufacturers for the sake of declared future orders from customers. Unfortunately, these are sometimes not placed; therefore, they face an excess of goods in the warehouse, and are unable to sell the goods before their expiry date.

On Figure 2, there is a presentation of the ordering process, which is a simple and intuitive tool which, used by the HoReCa employees, would enable active participation in improving business processes.

The process of ordering goods for HoReCa (hotel, restaurant, cafe) companies can be split into two principal scenarios: when the company already has a supplier it cooperates with and when the company is searching for a new supplier. If the company has a supplier, the process concerns creating and submitting a shopping list, with the goods being delivered the following day. The HoReCa employee then checks the goods for compliance and receives the invoice or correction invoice before making the payment. If the goods are inconsistent, a return report is issued, and the process repeats until the correct goods are received. If the company does not have a supplier, the process consists of searching for one, negotiating prices and delivery terms, and placing the order by personal contact or text message. The delivery and compliance check process remains the same as described above.

Table 1 presents the characteristics of respondents from the wholesale sector participating in the research. Out of seven participants, three were females, and four were males. The ages of the participants ranged from 30 to 50 years old, with the majority of them being over 40. Four attendees held positions as owners, while the other three held positions as secretary, directors, and proxies. The participants had a range of industry experience, with the lowest being 3 years and the highest 30 years. Overall, the participants represented a diverse group with various roles and levels of experience within the wholesale industry.

Table 1.

Characteristics of the participants (Wholesale sector).

According to our research results, all wholesalers operate all year round, but the number of orders is higher during the summer, i.e., from May to October. In the winter, they fulfil about 250–300 orders a day on average. During the summer season, the daily number of orders increases to 600–700, not counting stationary sales. Smaller wholesalers indicated that they have to fight intensively with large, local wholesalers on the market, whose range of products is much larger. Any wholesaler that focuses only on deep-frozen products despite offering lower prices is not the first choice for HoReCa companies, as they meet only a small part of their needs. Ordering from many different suppliers can be problematic for small- and medium-sized companies in the HoReCa market due to the time-consuming nature of placing orders, accepting several deliveries, and larger paperwork in the organization.

Table 2 presents the characteristics of respondents representing the HoReCa market. The number of participants compared to the representatives of the wholesale trade is much larger—Table 1. We noticed their lack of willingness to participate, as most wholesalers argued that they have no time for such initiatives. These are older people than in the case of HoReCa representatives. Their reluctance to participate in the research was perceived as a lack of trust in re-searchers and such projects. The representatives of the HoReCa industry unanimously indicate difficult contact as a communication challenge. Wholesalers set an hourly deadline by which orders can be placed. For an owner who runs a seasonal business, late hours (e.g., 22:00, 23:00) are useful. For hotels with office hours until 16:00—such contact is not practical because wholesalers respond when they receive all orders on a given day. Even at 4:00 in the morning, a procurement employee can expect a call from the warehouse. Price fluctuations are another communication challenge. It turns out that the HoReCa companies often do not know the price to be invoiced by the wholesaler. In addition, they do not know what goods are to be delivered because they do not receive confirmation of purchase or information that changes were made in relation to the unavailability of the product of a given brand. Wholesalers themselves decide to change the product from company A to the product of company B, which the HoReCa companies learn about on delivery. It is the HoReCa employee who, when accepting the delivery, must carefully check the goods using the order saved on a piece of paper/text message because the stock issue confirmation (WZ) is often inconsistent with the customer’s order. Notifying possible non-compliance takes place verbally or with more demanding HoReCa customers based on the return protocol that the wholesale driver should provide.

Table 2.

Characteristics of the respondents (HoReCa).

The results of the in-depth interviews with 20 individuals in the HoReCa suggest that having a diverse and experienced team in leadership roles is very beneficial. Out of the 20 individuals interviewed, 60% were male and 40% were female. The average age was 37, with a range between 22 and 51. Concerning industry experience, the average was 16 years, with a range between 5 and 30 years.

It is worth noting that 20% of respondents indicated that they prefer personal contact when making purchasing decisions and view the websites of their suppliers as less useful. Most respondents indicated that they obtain assets for their business primarily from the local market. Moreover, the results have shown that the HoReCa sector appreciates the location and size of the warehouses compared to the quality of the cooperation. Over time, there has been an observation that smaller wholesalers with a limited range of products were generally viewed more favorably due to their lower prices compared to those offering a more comprehensive range of products.

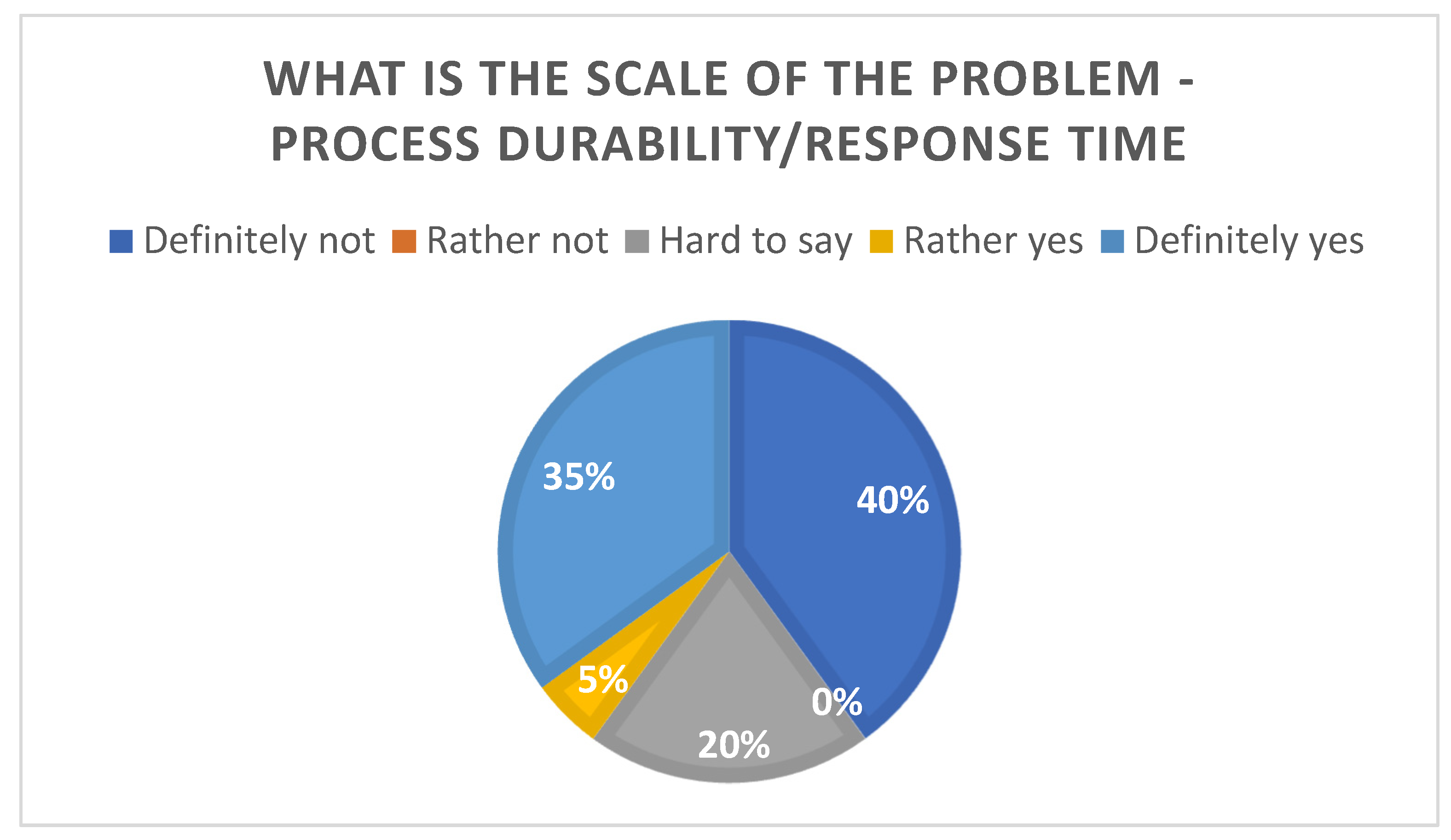

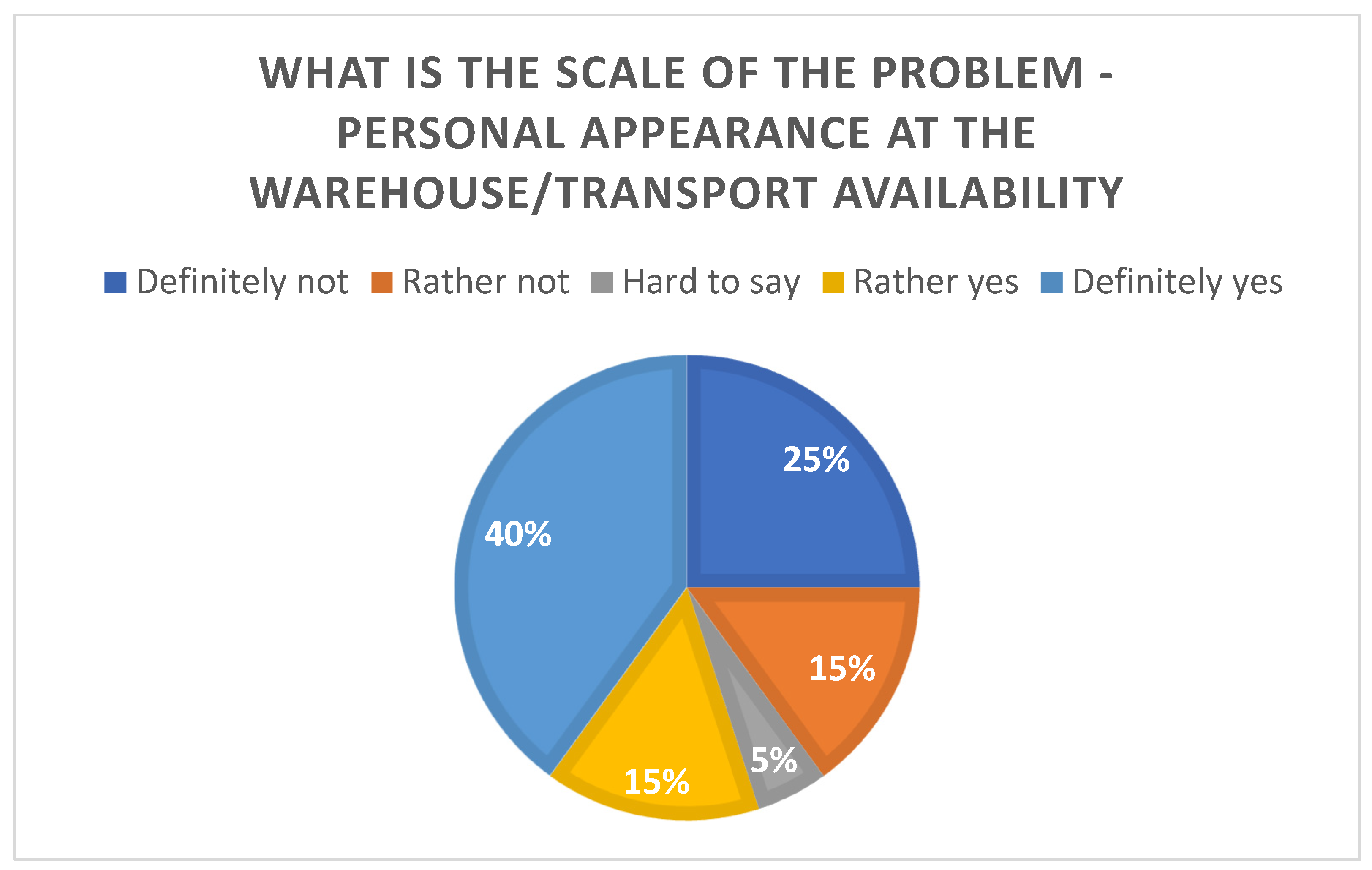

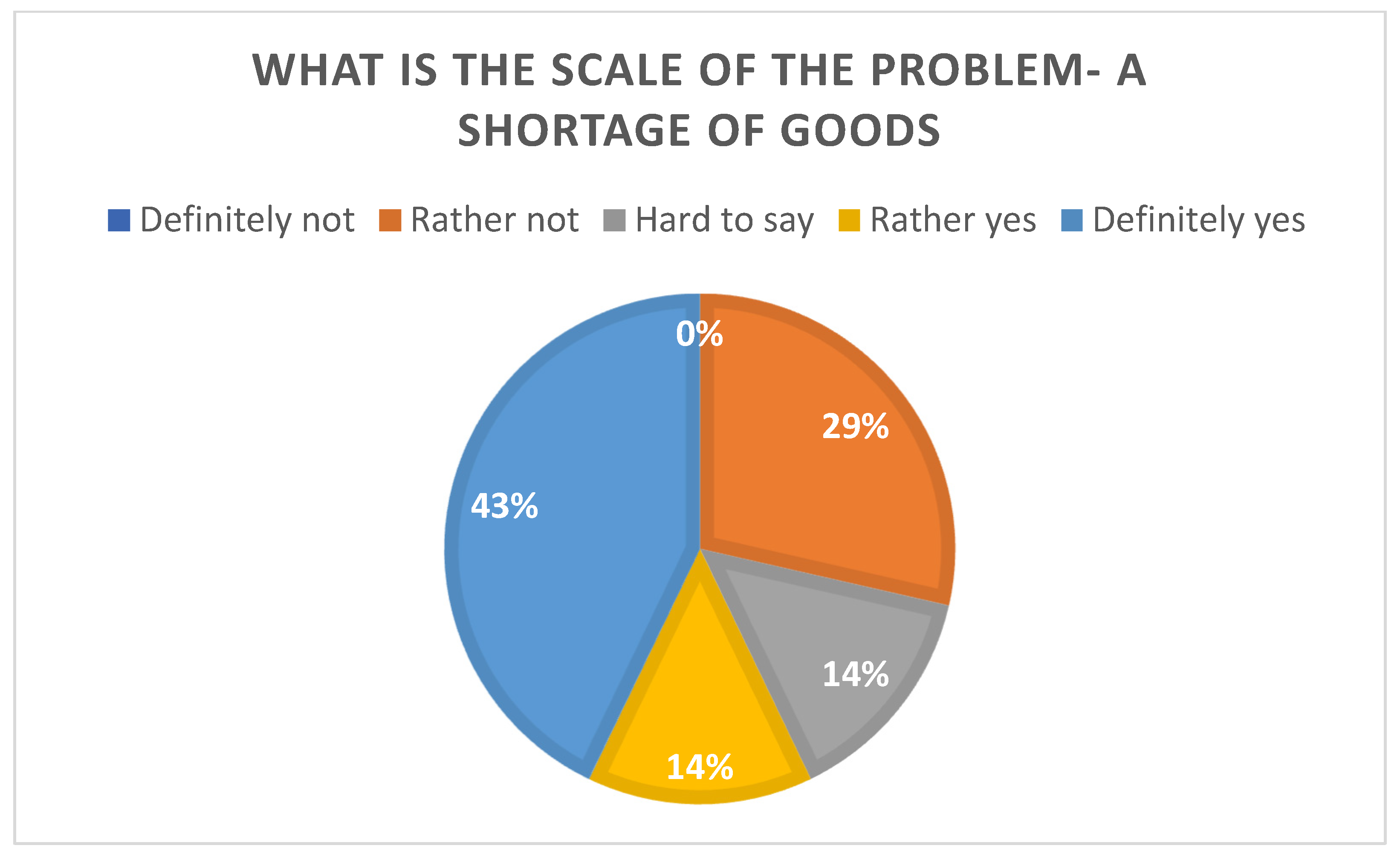

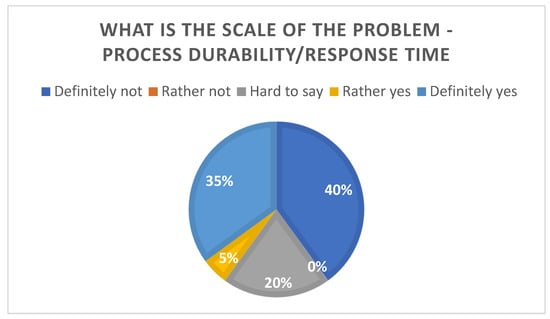

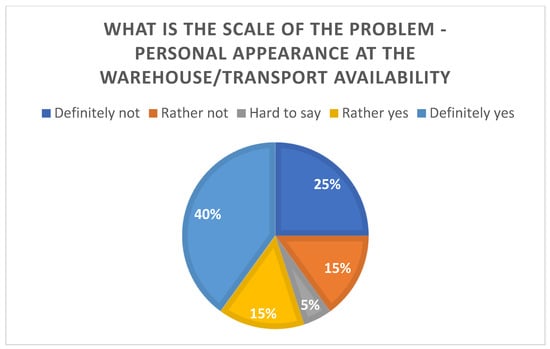

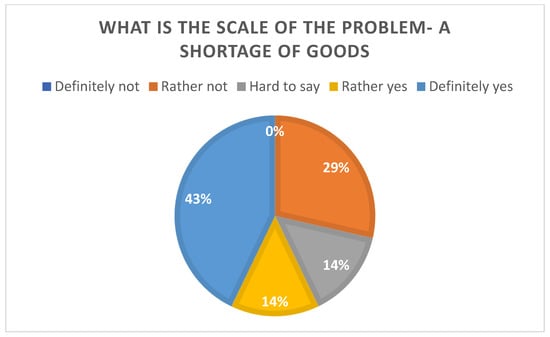

Figure 3, Figure 4 and Figure 5 present the results revealing the difficulties that HoReCa companies face in the process of ordering goods from suppliers.

Figure 3.

Problems encountered by respondents when placing orders. Source: own elaboration.

Figure 4.

Problems encountered by respondents when placing orders. Source: own elaboration.

Figure 5.

Problems encountered by respondents when placing orders. Source: own elaboration.

The first chart shows that a slightly lower number of respondents (35%) see the process durability or response time as a significant issue. The second chart indicates that a similar number of respondents (40%) feel that personal appearance at the warehouse or transport availability is a significant problem. The third chart shows that a significant number of respondents (43%) consider transportation problems to be an influential issue. Overall, these results suggest that HoReCa companies face a range of challenges when it comes to ordering goods from suppliers, with transportation and logistics processes being a particularly significant concern.

The results confirm there is a gap in the effective operation of wholesalers. Customers have to spend their time getting to the headquarters because the transport capacity of the supplier is limited. Usually getting to the warehouse is not the solution because the goods are not available there.

The last question: “Is there a need for new or innovative solutions from the suppliers to communicate more effectively?” was answered “definitely yes” by everyone. This is a positive aspect for startups willing to introduce innovations in this branch of these sectors.

5. Discussion

As mentioned beforehand, the design thinking method was used to approximate the results of in-depth interviews. A buyer persona is dedicated to B2B contacts and will talk about people who have an influence over decisions, about their problems and challenges, the goals they want to achieve, about the barriers that prevent them from making a decision. It will talk about how this company buys, what it is doing when choosing what task it has to perform in its purchase process, and, finally, what features and functions of the product or service this company is looking for and what is important to them.

The owner of an HoReCa business aims to achieve profitability and stability for the company. Their priority is providing high-quality dining experiences for customers and ensuring stable, fulfilling jobs for employees. Responsibilities for the owner include managing the overall operation of the business, including the kitchen and dining room, as well as handling finances and purchasing decisions. One of the main challenges for the owner is finding a balance between offering high-quality products and services while keeping prices competitive, which involves managing the budget. It is significant for the owner to stay up to date on industry trends and customer preferences to maintain relevance and competitiveness in the market. From the standpoint of purchasing decisions, the owner prioritizes finding reliable suppliers who can provide high-quality products at fair prices. Effective communication and customer service from suppliers are substantial to the smooth operation of the business. The owner’s ultimate goal is to create a successful and sustainable HoReCa business that is well-regarded by both customers and employees. The owner of an HoReCa business has a positive opinion about the proposed DYLLI mobile app, seeing it as a potential solution to many of the challenges they face when ordering products from suppliers. They appreciate having access to all suppliers in the area, which would eliminate artificially inflating prices and fake promotions. The owner of the restaurant believes that the possibility of creating orders together with employees will strengthen ties and make them feel trusted. Access to all suppliers and their products seemed time-consuming, but the owner will not do it alone but together with his employees. Overall, the owner is interested in using the DYLLI app to streamline their purchasing process and make their business more efficient and successful. He is willing to pay for the product.

As the head chef at a restaurant in the HoReCa industry, the main objective is to create high-quality dishes that will satisfy customers and encourage their return. The chef is responsible for managing and training kitchen staff to ensure efficient and effective teamwork. The menu and kitchen operations comply with the overall vision and goals of the restaurant through close collaboration with the owner and manager. Managing the budget for food and supplies, staying current with food trends and industry developments, and creatively incorporating locally sourced, sustainable ingredients into dishes are among the main challenges. Prioritizing the building of strong relationships with food suppliers and vendors, who play a crucial role in the restaurant’s success, is substantial. In partnerships with food suppliers and vendors, it is significant to value honesty, transparency, and reliable delivery. The ultimate goal is to create a thriving restaurant that consistently delivers memorable and unique experiences for diners. With the use of the DYLLI application, the head chef of this HoReCa business will have access to a vaster range of suppliers and their products, allowing them to compare the prices, quality, and safety of the products they are purchasing. The chef sees it as a valuable tool in managing supplier relationships.

In regards to a restaurant manager, the overall operation of the restaurant and customer satisfaction are the principal responsibilities. The goal is to ensure the smooth and efficient running of the establishment and increase customer loyalty. Some key priorities include supporting high standards of customer service and promptly responding to customer complaints. It is also significant to oversee inventory management to ensure that the restaurant is well-stocked with the necessary supplies and ingredients and develop marketing strategies to attract new customers and increase sales. Training and developing staff to ensure their competence and ability to deliver excellent customer service is crucial, as well as collaborating with the chef and other kitchen staff to create menus and specials that appeal to the target market. Continuously seeking ways to improve the customer experience and drive sales, as well as looking for new products and services that can help the restaurant stand out in a competitive market, are also crucial aspects of the job. Furthermore, the manager can also use the application features for scheduling and managing staff as well as tracking sales and customer feedback. Overall, the DYLLI application can be a valuable tool for the manager in managing the restaurant’s operations and ensuring the satisfaction of both customers and staff. The restaurant manager must request or write down the goods he needs and then give them to the chef. Through the application, he will be able to do that by adding their products to the group list. The restaurant manager would be satisfied by creating orders on his own.

When it comes to the success of the wholesale company, it relies on providing high-quality products at fair prices and maintaining excellent customer service to foster long-term relationships with clients. As the owner who has been in the industry for at least 25 years, the business’s finances, documentation, employee hiring and training, and sales negotiations fall under his responsibility. The owner recently hired a salesman to help to expand the business and manage customer relationships. However, they find it challenging to trust someone else to represent the company and make decisions because they have been running the business on their own for so long. For many years he has built a strong network of loyal customers, values maintaining a personal relationship with customers, often personally participates in sales negotiations, and now fears that someone can threaten the business. The wholesaler sees the potential benefits of using the DYLLI app as a new channel for communication and distribution. He is open to using the app to streamline the ordering process and make it more efficient for himself and his customers. He is particularly interested in the module for orders, as it would allow him to manage customer orders smoothly and efficiently. However, he is also aware of the potential downsides of using the app, such as the need to constantly update inventory information and the risk of sharing sensitive information about his business with third parties. Overall, the wholesaler sees potential in the DYLLI application, but he is also aware of the challenges associated with its usage. He values the personal relationship with his customers and is hesitant about the app’s ability to maintain the same level of trust and individual connection that he has built over many years in the industry. He would prefer to see some flexibility in the offers of the application, such as the option to customize the modules he needs and pay only for them. Additionally, he hopes for an application that will integrate with the current ERP platform.

From the perspective of a salesperson at a wholesale company, the main goal is to increase monthly revenue by keeping customers satisfied and preventing them from leaving. Providing the best service and products to develop long-term partnerships and earn recommendations is a priority. Responsibilities include: assisting customers in finding suitable products, providing product information, tracking inventory, handling orders, and escalating complaints to management. Challenges include establishing trust with a boss who has been running the company on his own for many years. This means being available to provide excellent service at all times through the phone and effectively managing time to organize transportation. As a wholesale company that specializes in a small range of high-quality products, the salesman sees the potential of the DYLLI application as a way to easily stand out in the ranking of wholesale companies. By offering a curated selection of products at fair prices, the salesman believes that he can attract customers looking for a more personalized and tailored shopping experience. Additionally, the salesperson feels the app could be valuable to manage customer relationships and keep track of inventory, orders, and shipments. However, he is also careful about the ability of the application to completely replace the personal relationships and negotiations that were built over time. He believes the application could be a practical supplement to their existing sales efforts, but they do not want to rely solely on it and lose the personal touch that is significant to their clients.

To sum up, the buyer personas created in this chapter represent the decision-making perspectives of various stakeholders in the HoReCa and wholesale sectors. Understanding these factors can help companies better tailor their products and services to meet the needs of these individuals and organizations.

The use of information and communication technologies (ICT) in organizational innovation, such as lean management/manufacturing, engineering, six Sigma and knowledge management, can also play a role in improving the efficiency and effectiveness of these decision-making processes.

Lean management consists of two main pillars: just-in-time and automation. Just-in-time includes the concept of continuous flow of production through demand, rapid tool changes, and logistics integration [20,34]. Automation is a term that groups the procedures for stopping a production line automatically in the event of a problem, the methods for eliminating the causes of the error, and the methods for analyzing the issue [20,34]. Lean manufacturers concentrate on the disposal of the waste mentioned in the second chapter [20,32,33,34]. The team noted all types of waste in these sectors. Overproduction—restaurants often prepare more food than they can sell or prepare too much food that their customers cannot eat in one time. The solution to this problem may be to suggest packing a non-eaten portion into a take-away container. Downtime—it happens when the supplier was unable to prove the goods needed for the preparation of, e.g., a hotel buffet breakfast. Unnecessary shipping and handling—where the supplier has incorrectly completed the order, confused the delivery recipients, or was unable to complete the full delivery without informing the customer. In this case, a commercial vehicle “will go on the road” more times than necessary. Defects and unnecessary machining may include the use of spare products supplied by wholesalers which are not of a certain quality to their customers. Unnecessary movements and stocks—when a customer declares that he wants to buy a new product, which a wholesaler must order specifically from the manufacturer, he then forgoes the order without informing the wholesalers. In this way, the goods remain in the warehouse until the end of their shelf life or the warehouse finds a new buyer.

Taking into consideration the above facts and received results, the authors, within the Incubator of Innovation 4.0 project at Gdynia Maritime University, whose aim was to support the process of managing the results of scientific research and development works, especially in the field of commercialization, decided to create an ICT tool enhancing sustainable development of the analyzed sectors. In particular, the solution had been designed for shaping intelligent/innovative ICT tool supporting the development of sustainable logistics/creating sustainable supply chains and, consequently, stimulating the growth of modern warehouse management and distribution channels for services and goods. This would facilitate running the business in a more integrated way. Stakeholders using the solution would be able to more efficiently implement individual processes and create their future by reducing unnecessary bureaucracy and creating flexible structures ready to face the dynamic changes occurring in the socio-economic environment. The effect of the actions taken would be the development of a mobile application—a tool dedicated to stakeholders related to the wholesale trade.

The application will have two interfaces: one for entrepreneurs who are customers of wholesalers, and the other for wholesalers’ owners (wholesalers). The fields of interest are the wholesale trade sector and the entities operating within this market. Wholesalers are entities that acquire products and then sell them to various organizations, retailers, or other companies. The solution will support the implementation of warehouse tasks, which include facilitating and streamlining the flow of goods between producers or entities collecting them and final recipients. The objectives of the mobile application are as follows:

- To be an information platform for employees of warehouses and companies from the HoReCa industry.

- To give access and transmit information (messages) without limitations at any point in time.

- To allow the users to shop from multiple suppliers by using a multi-basket option.

- To record, store, retrieve, submit, and search the status/result of an order, complaint, or delivery.

In order to strengthen the position of the brand created as part of the pre-implementation work of our solution, two trademarks of the word and graphic DYLLI and the graphic “icon D” were registered to identify goods and services related to the mobile application for the food industry.

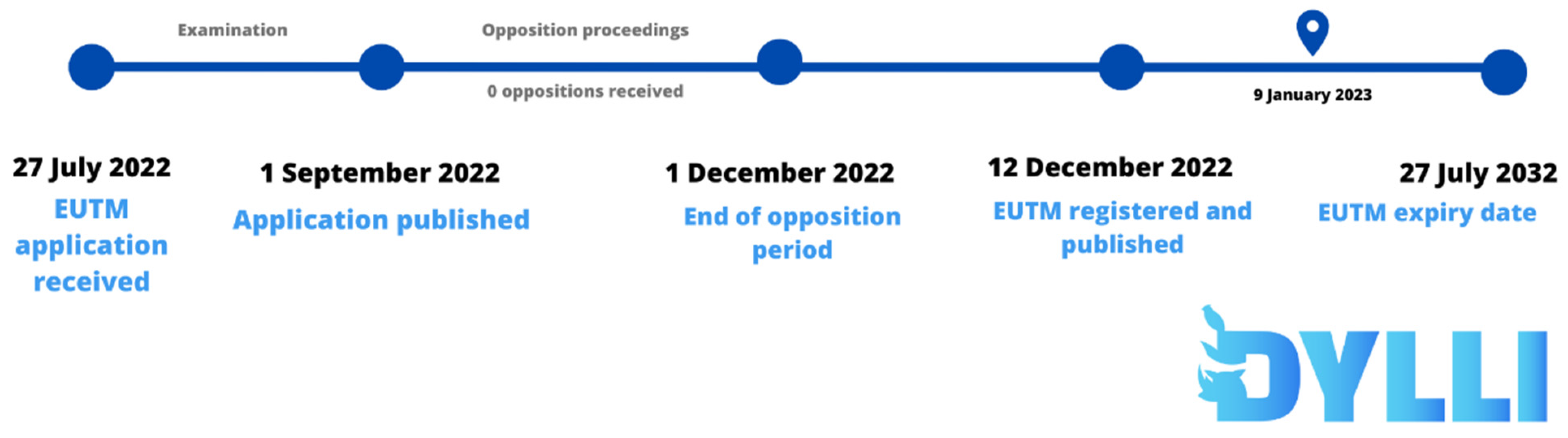

In the European procedure, the registration process is presented in Figure 6 for the graphic mark “icon D” marked No. 018738203 and for the graphic symbol “DYLLI” marked No. 018738202. The application for the “icon D” symbol was made in two classes of goods and services according to the Nice classification (9, 45), and for the graphic mark “DYLLI” in four classes of goods and services according to the Nice Classification (9, 38, 42, 45).

Figure 6.

The registration process of the trade mark—elaborated ICT tool in the European procedure. Source: https://euipo.europa.eu/eSearch/#details/trademarks/018738202 (accessed on 9 January 2023).

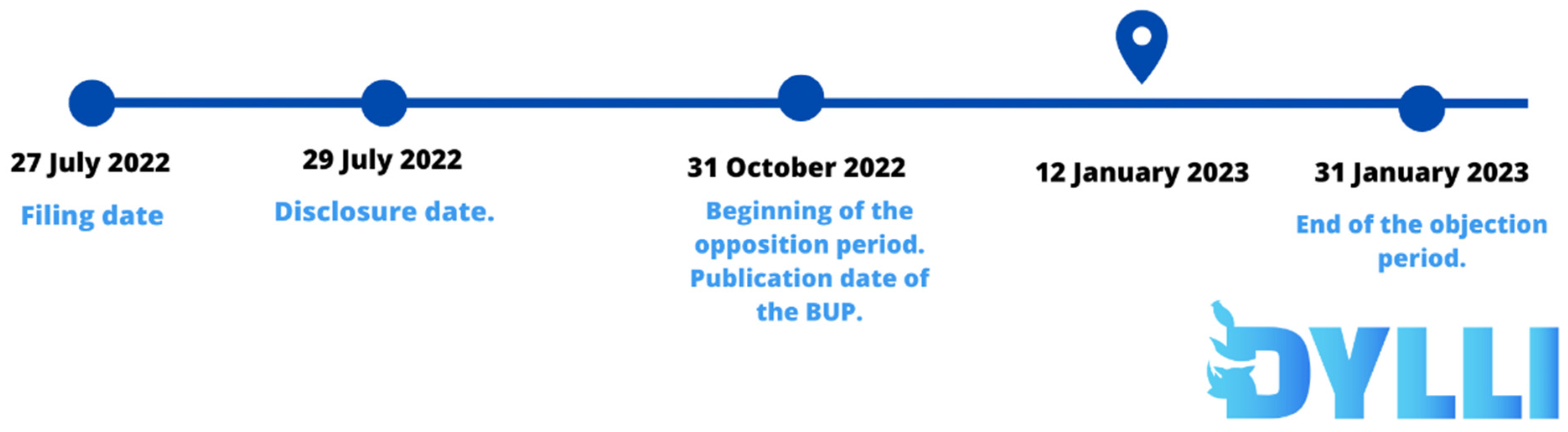

In the national procedure, the application to the Patent Office of the Republic of Poland was made on the same day as in the European Union Intellectual Property Office, indicated above.

In the domestic procedure, the registration process is presented in Figure 7 for the application of the graphic mark “icon D” marked with the number Z.545571 and for the graphic mark “DYLLI” marked with the number Z.545570. Application for the “icon D” mark was made in two classes of goods and services according to the Nice Classification (9, 45), and for the graphic mark “DYLLI” in seven classes of goods and services according to the Nice Classification (9, 35, 38, 39, 42, 43.45).

Figure 7.

The registration process of DYLLI in the domestic procedure. Source: https://ewyszukiwarka.pue.uprp.gov.pl/search/pwp-details/Z.545570 (accessed on 12 January 2023).

The Nice Classification is a system for classifying goods and services that is used by the World Intellectual Property Organization (WIPO) for the registration of trademarks [48]. The classification consists of 45 classes and is divided into three sections: goods classes, services classes, and special classes. Each class includes a detailed list of goods or services that are associated with it. The use of the Nice Classification allows for the standardization and comparison of trademark applications worldwide [49,50].

The classes in which the company logo has been registered in the following categories: class 9 includes information technology and audio-visual, multimedia, and photographic devices; class 38 pertains to providing third-party users with access to telecommunication infrastructure and various forms of communication, including mobile phone communication and data transfer by telephone; class 42 relates to the design and development of computer software for process control, as well as various services related to computer software, such as installation, updating, upgrading, and software as a service (SaaS); and class 45 covers licensing of computer software, as well as consultancy services related to patent and intellectual property licensing and legal services in the field of computer software licensing and franchise concepts. The Nice Classification is used in many countries worldwide, including the European Union, the United States, and many other countries. It is also used by WIPO under the Madrid Protocol for the International Registration of Trademarks. In Poland, it is used by the Polish Patent Office for the registration of trademarks [48].

DYLLI is inspired by Buphagidae (oxpecker), a bird that comes together with large herbivorous ungulates (e.g., rhinoceros, zebras and buffaloes). These animals live in a mutual interaction involving cooperation, in which both parties benefit, but they can also live independently. This description seems to fit well with the idea of a mobile application project that should contribute to the deepening of cooperation between wholesalers and entities in the HoReCa sector.

6. Conclusions

In all areas of socio-economic life, marketing and logistics have been developing at a rapid pace, but the HoReCa area is devoid of fundamental theoretical and practical studies [51,52]. The results of the in-depth interviews reveal interesting insights into the factors that facilitate the success or failure of cooperative arrangements in the HoReCa and wholesale sectors. Through analysis of the data collected, the team was able to identify common themes and patterns that emerged as fundamental determinants of sustainable logistics operations development. These findings provide valuable information for practitioners and policymakers looking to improve the sustainability of cooperative arrangements within these sectors and yet contribute to the broader literature on cooperation and collective action. Overall, our research highlights the importance of trust, communication, shared goals and values, and effective leadership in fostering sustainable partnerships and logistics within organizations. The following challenges were highlighted, e.g.,: transparency and price fluctuations, the importance of suppliers with a smaller range of products, susceptibility to errors, and ambiguities or time-consuming communication. These results are confirmed by the research and business approach of Hurtum company, offering the wholesalers the opportunity to modify price lists for each customer; HoReCa allows us to complete an order from many suppliers with the use of basket order.

The commercialization of the elaborated mobile application for the wholesale trade sector will bring several benefits to its users. Firstly, it will serve as an information platform for employees of warehouses and companies from the HoReCa industry, giving them access to relevant information at any time. Secondly, the application will allow users to shop for multiple suppliers using a multi-basket option, making the purchasing process more efficient and streamlined. Additionally, the application will allow users to record, store, retrieve, and search the status of an order, complaints, or delivery, reducing the risk of errors and ambiguities.

In terms of economic benefits, the application has the potential to save time and reduce costs for both HoReCa and wholesaler companies. For example, it can reduce the time spent on placing and managing orders, as well as streamline the communication process between the two parties. It can also help to reduce the risk of overstocking by providing real-time updates on the availability of goods, leading to more efficient inventory management. Furthermore, the application can help to reduce the risk of disputes and misunderstandings by providing a clear and transparent record of orders and deliveries. Overall, the introduction of the mobile application can lead to improved efficiency and profitability for all stakeholders and contribute to sustainable logistics chains development in the analyzed sectors.

To strengthen the position of the created brand, as part of the pre-implementation work of our solution, two trademarks of the word and graphic DYLLI and the graphic “icon D” were registered to identify goods and services related to the mobile application for the food industry. On the 12 December 2022, the European Union Intellectual Property Office officially registered and published the DYLLI trademark, which may be considered as an important milestone on the way to the commercialization of the elaborated ICT tool by our team in the future.

Author Contributions

Conceptualization, A.P. and W.C.; methodology, W.C. and A.P.; formal analysis, A.P., Ł.C.; investigation, A.P. and W.C.; resources, W.C., A.P. and P.W.; data curation, W.C.; funding acquisition, A.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Gdynia Maritime University—WN/2023/PZ/10 project.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Questions to wholesale sector representatives

Demographics:

- 1.

- Age, position, experience, place

- 2.

- What are you responsible for? Does someone help you in your duties?

- 3.

- Who is responsible for receiving the order?

- 4.

- Could you describe what a typical day in a warehouse looks like?

Processes:

- 5.

- Please, list the different stages of receiving orders from customers.

- 6.

- Who takes care of customers, who is looking for new customers?

- 7

- How do you inform customers about new products? How do you know that their preferences have changed?

- 8.

- Are there any solutions that you prefer to avoid, if so—which ones?

- 9.

- How well you know your competitors?

- 10.

- What is the most common problem you encounter in communication with the customer?

ICT application rating:

- 11.

- Would you like to use this app?

- 12.

- What other application do you associate this solution with?

- 13.

- What options do you like and why?

- 14.

- What do you dislike about this application?

- 15.

- What is missing in the application?

- 16.

- This application will facilitate the ordering process—is it true or false? Why?

- 17.

- This application could solve problems, such as: …

- 18.

- Which platforms/tools do you use to communicate with the customer?

Business model:

- 19.

- Have you ever met the concept of transparent price? Is this something you would be comfortable with?

- 20.

- Tell me about the latest innovation that has been introduced in the company.

- 21.

- How much would you be able to pay for this mobile application, if you were sure that it would have a positive effect on your business?

Questions to HoReCa sector representatives

Demographics:

- 1.

- Age, position, experience, place

- 2.

- What are you responsible for? Does someone help you in your duties?

- 3.

- Who is responsible for placing the orders?

Processes:

- 4.

- Please, list the different stages of ordering from the supplier.

- 5.

- Can your employees complete the order in the warehouse?

- 6.

- What do you think about recurring orders, i.e., deliveries realized in the agreed time interval?

- 7.

- Are there any solutions that you prefer to avoid, if so, which ones?

- 8.

- Do you know the wholesale competitors you cooperate with?

- 9.

- What is the most common problem you encounter in communication with a wholesaler?

ICT application rating:

- 10.

- Would you like to use this app?

- 11.

- What other application do you associate this solution with?

- 12.

- What options do you like and why?

- 13.

- What do you dislike about this application?

- 14.

- What is missing in the application?

- 15.

- This application will facilitate the ordering process—is it true or false?

- 16.

- This application could solve problems such as: …

- 17.

- Which (in your opinion) competitive platforms do you use to place the orders?

Business model:

- 18.

- Have you ever met the concept of transparent price? Is this something you would be comfortable with?

- 19.

- Is payment in advance for products a good or a bad idea?

- 20.

- Is the subscription for the recurring order you create is a good or a bad the solution?

- 21.

- How much would you be able to pay for this mobile application, if you were sure that it would have a positive effect on your business?

References

- Guterres, A. The Sustainable Development Goals Report 2020; United Nations Publication; Department of Economic and Social Affairs: New York City, NY, USA, 2020. [Google Scholar]

- Woźniak, M. Sustainable approach in it project management—methodology choice vs. Client satisfaction. Sustainability 2021, 13, 1466. [Google Scholar] [CrossRef]

- Soja, E.; Soja, P. Fostering ICT use by older workers: Lessons from perceptions of barriers to enterprise system adoption. J. Enterp. Inf. Manag. 2020, 33, 407–434. [Google Scholar] [CrossRef]

- Carrelli, C.; van Dijk, J.; Gray, J.; Majo, J.; Pestel, R.; Radermacher, F.J. Towards a Global Sustainable Information Society. Concepts Transform. 2000, 5, 43–63. [Google Scholar] [CrossRef]

- Yeh, H. The effects of successful ICT-based smart city services: From citizens’ perspectives. Gov. Inf. Q. 2017, 34, 556–565. [Google Scholar] [CrossRef]

- Xiong, J.; Qureshi, S. A model of ICTs adoption for sustainable development: An investigation of small business in the United States and China. In Proceedings of the Annual Hawaii International Conference on System Sciences, Wailea, HI, USA, 7–10 January 2013. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Abed, S.S. Social commerce adoption using TOE framework: An empirical investigation of Saudi Arabian SMEs. Int. J. Inf. Manag. 2020, 53, 102118. [Google Scholar] [CrossRef]

- Jin, S.H.; Choi, S.O. The effect of innovation capability on business performance: A focus on it and business service companies. Sustainability 2019, 11, 5246. [Google Scholar] [CrossRef]

- al Omoush, K.S.; Al-Qirem, R.M.; al Hawatmah, Z.M. The degree of e-business entrepreneurship and long-term sustainability: An institutional perspective. Inf. Syst. e-Bus. Manag. 2018, 16, 29–56. [Google Scholar] [CrossRef]

- Prasanna, R.P.I.R.; Jayasundara, J.M.S.B.; Gamage, S.K.N.; Ekanayake, E.M.S.; Rajapakshe, P.S.K.; Abeyrathne, G.A.K.N.J. Sustainability of SMEs in the competition: A systemic review on technological challenges and SME performance. J. Open Innov. Technol. Mark. Complex. 2019, 5, 100. [Google Scholar] [CrossRef]

- Graubner, C.A.; Pelzeter, A.; Pohl, S. A new approach to measure sustainability in German facility management. Facilities 2016, 34, 28–42. [Google Scholar] [CrossRef]

- Rzepka, A.; Miśkiewicz, R.; Prachowski, J. Development Opportunities and Challenges for Organizations Striving for Teal in Economy 4.0 on the Basis of Research. In Self-Management, Entrepreneurial Culture, and Economy 4.0; Routledge: London, UK, 2021. [Google Scholar] [CrossRef]

- Głodek, P.; Lobacz, K. Transforming IT small business-The perspective of business advice process. Procedia Comput. Sci. 2021, 192, 4367–4375. [Google Scholar] [CrossRef]

- Planko, J.; Chappin, M.M.H.; Cramer, J.; Hekkert, M.P. Coping with coopetition—Facing dilemmas in cooperation for sustainable development: The case of the Dutch smart grid industry. Bus. Strategy Environ. 2019, 28, 665–674. [Google Scholar] [CrossRef]

- Yamamoto, H.; Suzuki, T. Effects of beliefs about sanctions on promoting cooperation in a public goods game. Palgrave Commun. 2018, 4, 148. [Google Scholar] [CrossRef]

- Faes, W.; Knight, L.; Matthyssens, P. Buyer profiles: An empirical investigation of changing organizational requirements. Eur. J. Purch. Supply Manag. 2001, 7, 197–208. [Google Scholar] [CrossRef]

- Kauffman, R.; Pointer, L. Impact of digital technology on velocity of B2B buyer-supplier relationship development. J. Bus. Ind. Mark. 2022, 37, 1515–1529. [Google Scholar] [CrossRef]

- Khokhlov, V. Marketing of Merchandise Distribution in HoReCa Markets. Reg. Ekonomika. Yug Ross. 2019, 7, 181–184. [Google Scholar] [CrossRef]

- Gładysz, B.; Buczacki, A.; Haskins, C. Lean management approach to reduce waste in horeca food services. Resources 2020, 9, 144. [Google Scholar] [CrossRef]

- Orynycz, O.; Tucki, K.; Prystasz, M. Implementation of lean management as a tool for decrease of energy consumption and CO2 emissions in the fast food restaurant. Energies 2020, 13, 1184. [Google Scholar] [CrossRef]

- Oxford Institute of Retail Management. Retail & Wholesale: Key Sectors for the European Economy. Institute of Retail Management. 2014, pp. 11–12. Available online: https://www.eurocommerce.eu/media/87967/eurocommerce_study_v2_hd.pdf (accessed on 12 December 2022).

- Jones, P.; Comfort, D.; Hillier, D. European Food and Drink Wholesalers and Sustainability. Eur. J. Sustain. Dev. Res. 2017, 1, 3. [Google Scholar] [CrossRef]

- Jonesa, P.; Comfortb, D.; Hillierc, D. Interpretations of the concept of sustainability amongst the UK’s leading food and drink wholesalers. Mark. -Trz. 2016, 28, 213–229. [Google Scholar] [CrossRef]

- Kotler, P.; Pfoertsch, W.; Sponholz, U. H2H Marketing The Genesis of Human-to-Human Marketing; Springer International Publishing: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Kotler, P.; Pfoertsch, W.; Sponholz, U. H2h marketing: Putting trust and brand in strategic management focus. Acad. Strateg. Manag. J. 2021, 20, 1–27. [Google Scholar]

- Ziemba, E. The ICT adoption in government units in the context of the sustainable information society. In Proceedings of the 2018 Federated Conference on Computer Science and Information Systems, FedCSIS 2018, Poznan, Poland, 9–12 September 2018. [Google Scholar] [CrossRef]

- Levius, S.; Safa, M.; Weeks, K. Information and communication technology strategies to improve international competitiveness in the wholesale and retail trade sector. Int. J. Bus. Glob. 2018, 20, 128–138. [Google Scholar] [CrossRef]

- Ziemba, E.; Eisenbardt, M. The ways of prosumers’ knowledge sharing with organizations. Interdiscip. J. Inf. Knowl. Manag. 2018, 13, 95–115. [Google Scholar] [CrossRef]

- León, L.R.; Kataishi, R. Collaboration networks for innovation and socio-economic development: European and Latin American perspectives on digital ecosystems research, local readiness, deployment strategies and their policy implications. In Lecture Notes of the Institute for Computer Sciences, Social-Informatics and Telecommunications Engineering; Springer: Berlin/Heidelberg, Germany, 2010; Volume 67, pp. 1–19. [Google Scholar] [CrossRef]

- Pappas, I.O.; Mikalef, P.; Giannakos, M.N.; Krogstie, J.; Lekakos, G. Big data and business analytics ecosystems: paving the way towards digital transformation and sustainable societies. Inf. Syst. e-Bus. Manag. 2018, 16, 479–491. [Google Scholar] [CrossRef]

- Tortorella, G.L.; Rosa, M.V.L.L.; Caiado, R.; Nascimento, D.; Sawhney, R. Assessment of Lean implementation in Hotels’ supply chains. Production 2019, 29, 20190044. [Google Scholar] [CrossRef]

- Vlachos, I.; Bogdanovic, A. Lean thinking in the European hotel industry. Tour. Manag. 2013, 36, 354–363. [Google Scholar] [CrossRef]

- Caetano, A.R.S.; Tregue, A.P.; De Souza, M.C.A.; de Alencar, D.B. Lean manufacturing applied to collective food kitchens lean kitchen. Int. J. Dev. Res. 2020, 10, 18245. [Google Scholar] [CrossRef]

- Reijers, H.A. Business Process Management: The evolution of a discipline. Comput. Ind. 2021, 126, 103404. [Google Scholar] [CrossRef]

- Barbara, D. Rozwój Usług Turystycznych w Warunkach Globalizacji: Zarys Problematyki. Wyższa Szkoła Turystyki i Hotelarstwa w Gdańsku. 2006, Volume 137. Available online: https://scholar.google.pl/citations?view_op=view_citation&hl=pl&user=FWpJry8AAAAJ&citation_for_view=FWpJry8AAAAJ:u5HHmVD_uO8C (accessed on 18 November 2022).

- Gigler, B.-S. Digital Innovation and Scale-up Initiative for Central, Eastern and South Eastern Europe (DISC). In Proceedings of the Digital Assembly 2019, Bucharest, Romania, 13–14 June 2019. [Google Scholar]

- Diethelm, J. Embodied Design Thinking. She Ji J. Des. Econ. Innov. 2019, 5, 44–54. [Google Scholar] [CrossRef]

- Alguacil, M.; Crespo-Hervás, J.; Pérez-Campos, C. Sociodemographic analysis of brand perception in a public sports service: From target to person buyer. Retos 2019, 40, 139–146. [Google Scholar] [CrossRef]

- Leigh, D. Interview with Daniel Khachab, CEO at FoodTech Unicorn: Choco. TechRound 21 October 2021. Available online: https://techround.co.uk/interviews/daniel-khachab-choco/ (accessed on 8 January 2023).

- Khachab, D. Haryana, India. The Story of Building Choco|Daniel Khachab (14 July 2022). Available online: https://www.youtube.com/watch?v=0FbNFwGJA7M (accessed on 8 January 2023).

- Redakcja. Wywiad z Eweliną Siedlecką na Temat e-Commerce B2B–Bardzo Często Pełnimy Rolę Ewangelisty w Branży! Marketing i Biznes. 1 June 2017. Available online: https://marketingibiznes.pl/e-commerce/e-commerce-b2b/ (accessed on 8 January 2023).

- Ząbek, A. Sukces w e-Commerce Zależy od Tych 3 Czynników–Ewelina Siedlecka [Hurtum.pl]. Marketing i Biznes. 5 October 2022. Available online: https://marketingibiznes.pl/e-commerce/sukces-w-e-commerce-zalezy-od-tych-3-czynnikow-ewelina-siedlecka-hurtum-pl/ (accessed on 10 December 2022).

- Evans, J.R.; Mathur, A. The value of online surveys: A look back and a look ahead. Internet Res. 2018, 28, 854–860. [Google Scholar] [CrossRef]

- Healey-Etten, V.; Sharp, S. Teaching Beginning Undergraduates How to Do an In-depth Interview: A Teaching Note with 12 Handy Tips. Teach. Sociol. 2010, 38, 157–165. [Google Scholar] [CrossRef]

- Czernicki, Ł.; Kukłowicz, P.; Miniszewski, M. Branża Turystyczna w Polsce, Obraz Sprzed Pandemii. Warszawa. May 2020. Available online: https://pie.net.pl/wp-content/uploads/2020/05/PIE-Raport_Turystyka.pdf (accessed on 18 November 2022).

- Ahearne, M.; Atefi, Y.; Lam, S.K.; Pourmasoudi, M. The future of buyer–seller interactions: A conceptual framework and research agenda. J. Acad. Mark. Sci. 2022, 50, 22–45. [Google Scholar] [CrossRef] [PubMed]

- Bannerman, S. The World Intellectual Property Organization and the sustainable development agenda. Futures 2020, 122, 102586. [Google Scholar] [CrossRef]

- Zimmerman Esq. LL.M., L. Curing the Nice Classification: Expanding Trademark Classes to Include Hemp & Cannabis Goods and Services. SSRN Electron. J. 2021, 5–7. [Google Scholar] [CrossRef]

- Drivas, K. The role of technology and relatedness in regional trademark activity. Reg. Stud. 2022, 56, 242–255. [Google Scholar] [CrossRef]

- Paciarotti, C.; Torregiani, F. Short food supply chain between micro/small farms and restaurants: An exploratory study in the Marche region. Br. Food J. 2018, 120, 1722–1734. [Google Scholar] [CrossRef]

- Prajapati, D.; Kumar, M.M.; Pratap, S.; Chelladurai, H.; Zuhair, M. Sustainable Logistics Network Design for Delivery Operations with Time Horizons in B2B E-Commerce Platform. Logistics 2021, 5, 61. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).