Techno-Economic Factors Impacting the Intrinsic Value of Behind-the-Meter Distributed Storage

Abstract

:1. Introduction

1.1. Background and Motivation

1.2. Energy Storage Options

1.3. Challenges and Current State of Residential Battery Adoption

1.4. Literature Review

1.5. Highlights and Contribution

- Assessment of the financial viability of residential battery systems in fluctuating battery prices;

- Examination of the role of import tariff structures (TOU vs. flat), export, feed-in tariffs (FIT), and restrictions in determining the economic returns from residential battery storage;

- Investigating non-financial motivations such as backup power reliability and environmental sustainability in consumer decision-making;

- Consideration of the possible impact on consumer motivation and confidence in the energy transition.

2. Methodology

2.1. Case Study Reproduction for Model Validation

2.1.1. Selection of Case Studies

- Case Study A [63]: This study examines the payback periods of residential battery systems across eight Australian capital cities, including Perth. It considers a variety of scenarios based on three household load profiles and two tariff structures (flat and time-of-use, or TOU). The study’s financial viability criterion is that the battery system must recoup its costs within its warranty period. This comprehensive assessment allows a thorough understanding of the factors influencing payback times;

- Case Study B [64]: Focusing on a typical household in Perth (two adults and two children), this study compares three energy configurations: grid-only, grid combined with a 6 kW PV system, and grid with a 6 kW PV system plus a 7 kWh battery. It provides detailed information on system costs, load profiles, and operational parameters, making it an ideal candidate for model validation. The comprehensive data from this study supports a robust analysis of the financial returns on residential battery systems.

2.1.2. Modeling Tools and Software

- Verification of HOMER Grid results: The Excel model was used to cross-check the outputs from HOMER Grid to ensure accuracy and consistency;

- Additional analysis: Certain economic analyses that were not feasible within HOMER Grid were conducted using the Excel tool, such as more detailed examinations of tariff impacts and battery replacement scenarios.

2.1.3. Data Inputs and Assumptions

2.2. Sensitivity Analysis

- Battery Price Reduction: A range of cost multipliers from 0.5 to 1.0 is applied to both new and replacement battery prices. This reflects potential future declines in battery costs, similar to trends observed in other renewable technologies such as solar PV;

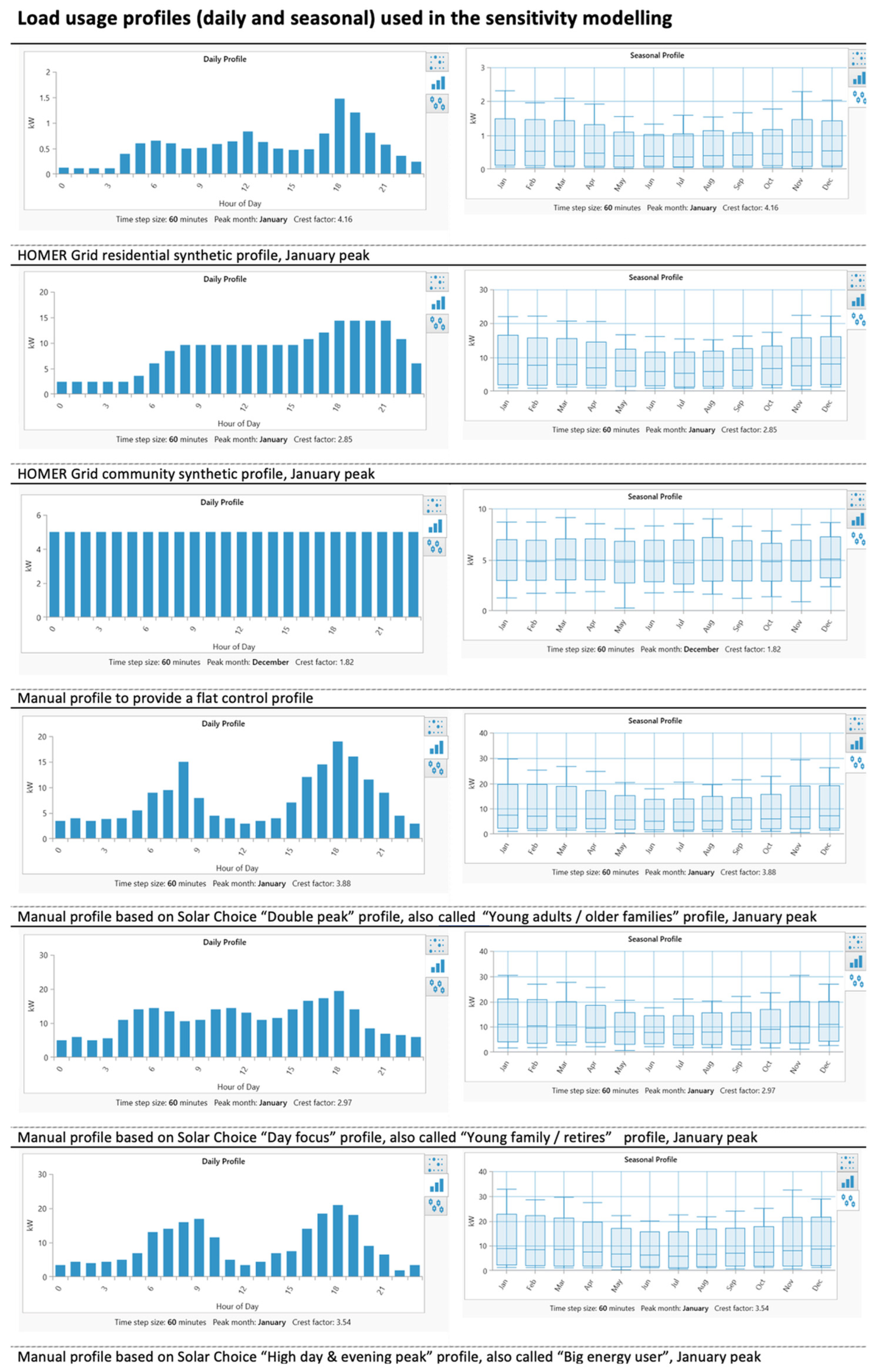

- Load Profiles: Six different residential load profiles simulate different household energy consumption patterns, accounting for energy demand variations that could influence battery systems’ performance and financial return;

- Average Daily Load: The analysis examines a range of daily load values, from 10 kWh/day to 70 kWh/day, to account for households with varying energy needs;

- Tariff Structures: Three different tariff structures are modeled based on Synergy’s 2022 tariffs: A1 (flat tariff), Smart Home, and Midday Saver (TOU tariffs). The Western Australia Distributed Energy Buyback Scheme (DEBS) export tariff is also included. Sensitivity simulations are conducted to explore the effects of tariff changes, such as removing the Smart Home tariff and adjusting the DEBS export tariff’s non-peak component;

- Grid Sales Limit: This parameter varies from 0 kW to 15 kW to examine how limits on the amount of electricity sold back to the grid affect financial outcomes;

- Discount Rates: Discount rates ranging from 0% to 15% are incorporated to reflect different perspectives on the time value of money, which is critical for long-term investment decisions;

- Carbon Emissions Penalty: A range of carbon dioxide emissions penalties from 0 AUD/t to 150 AUD/t is modeled to assess the impact of potential future carbon pricing on the financial viability of battery systems;

- Optimal System Sizing: Each simulation evaluates the optimal sizing of the battery and PV systems to minimize the NPC while meeting household demands.

2.3. Economic Analysis for Early PV Adopters

3. Results and Discussion

3.1. Modeling Case Studies

3.1.1. Case Study A

- Under TOU tariffs, the battery system’s payback period was shorter than the warranty period for the “Big Energy User” (50 kWh/day) and “Young Family/Retirees” (30 kWh/day) load profiles, indicating that the battery was financially viable in these scenarios;

- For the remaining cases, the payback period exceeded the battery warranty under flat tariffs, where the financial performance of the battery was less favorable.

3.1.2. Case Study B

3.2. Sensitivity Analysis

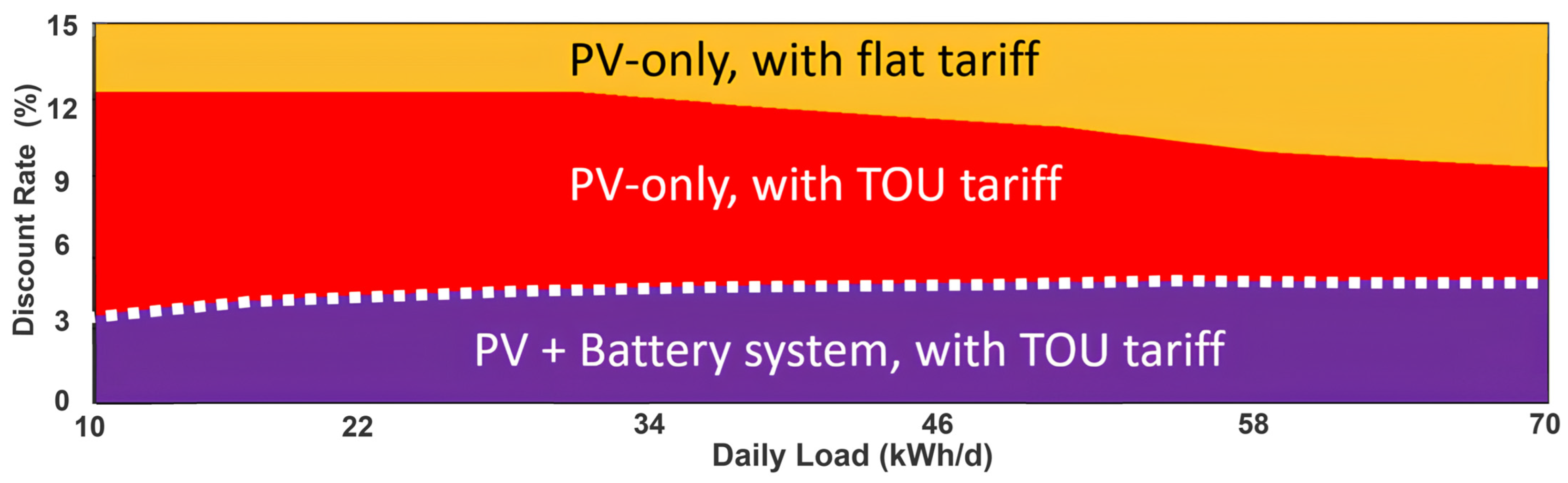

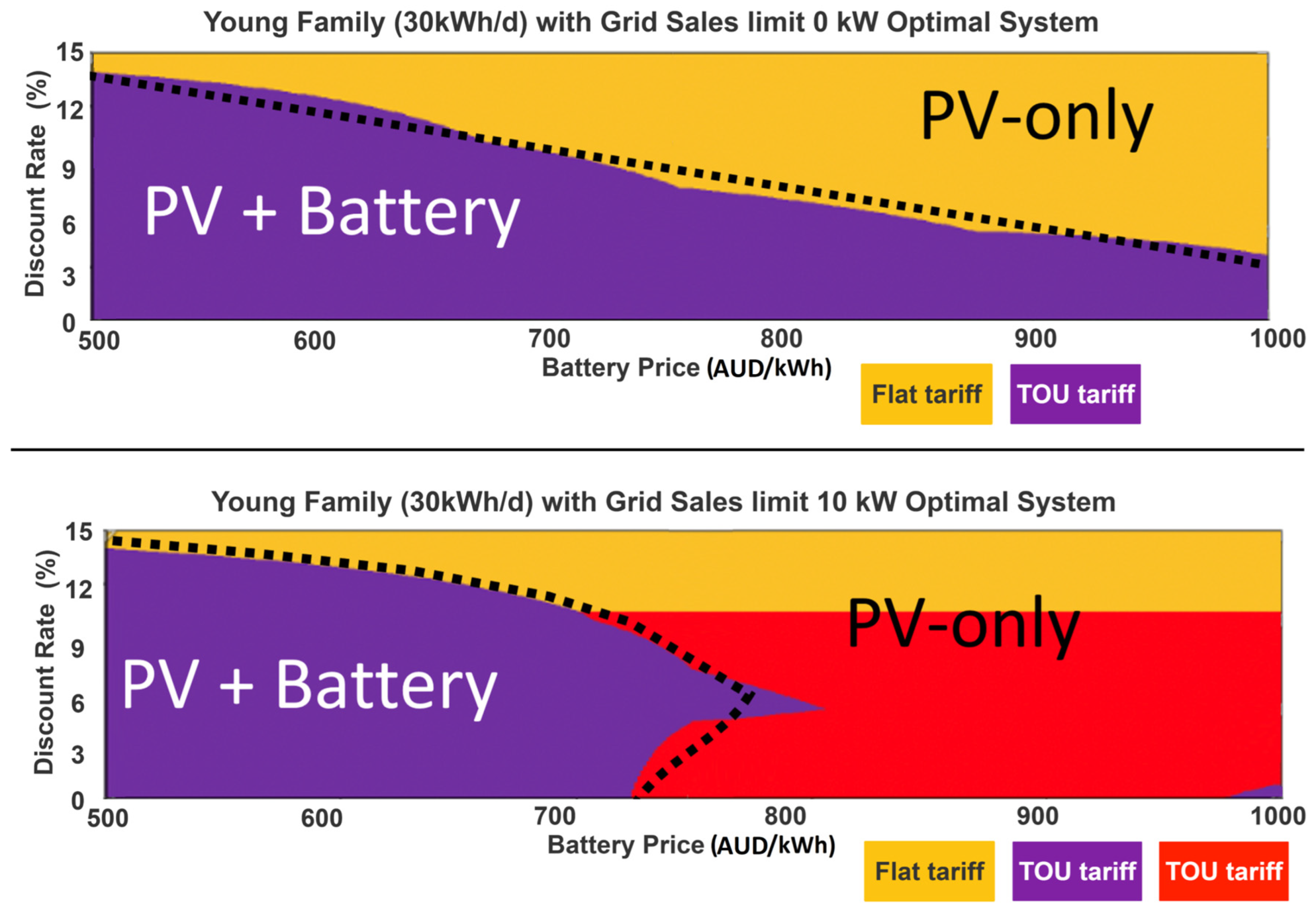

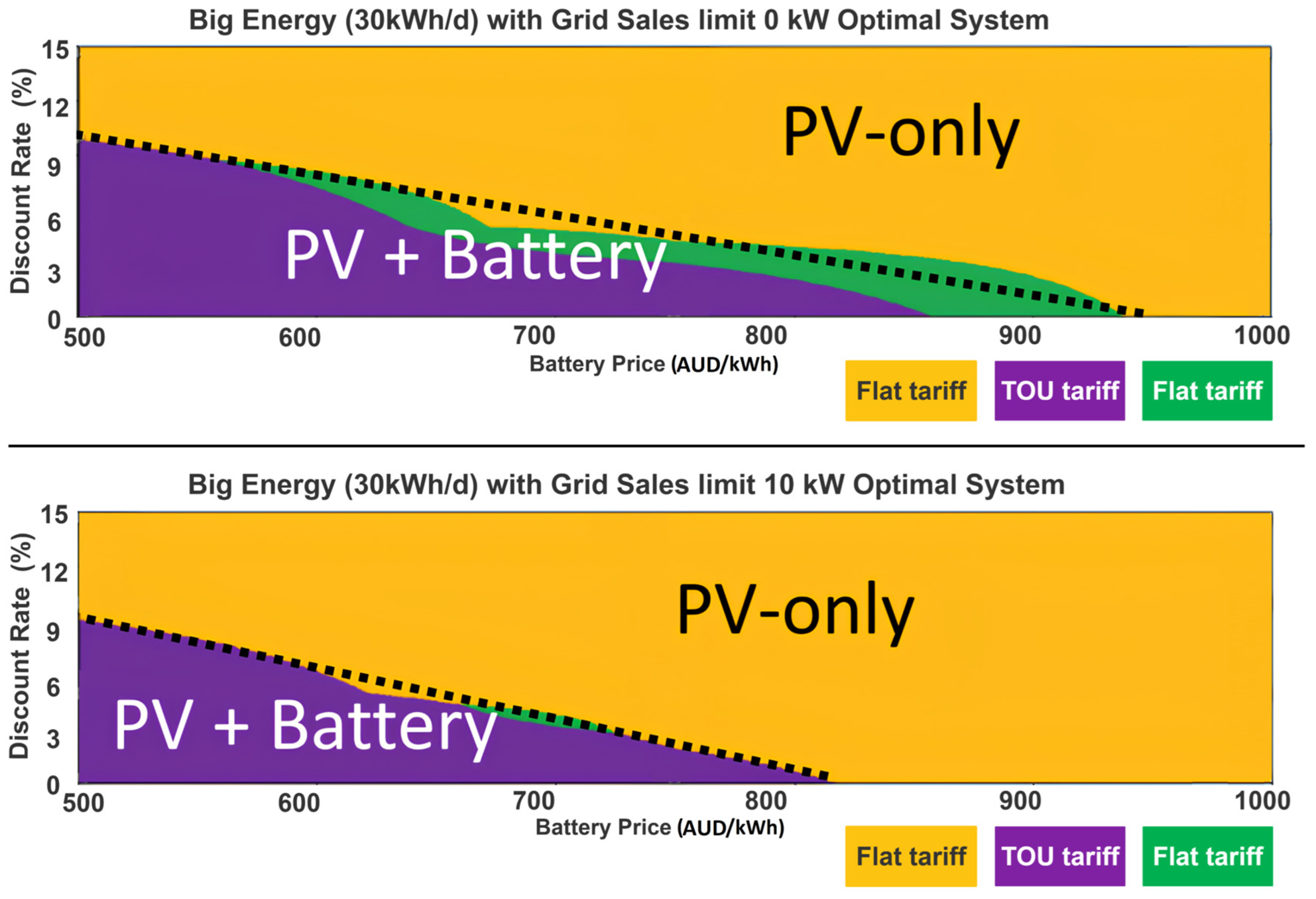

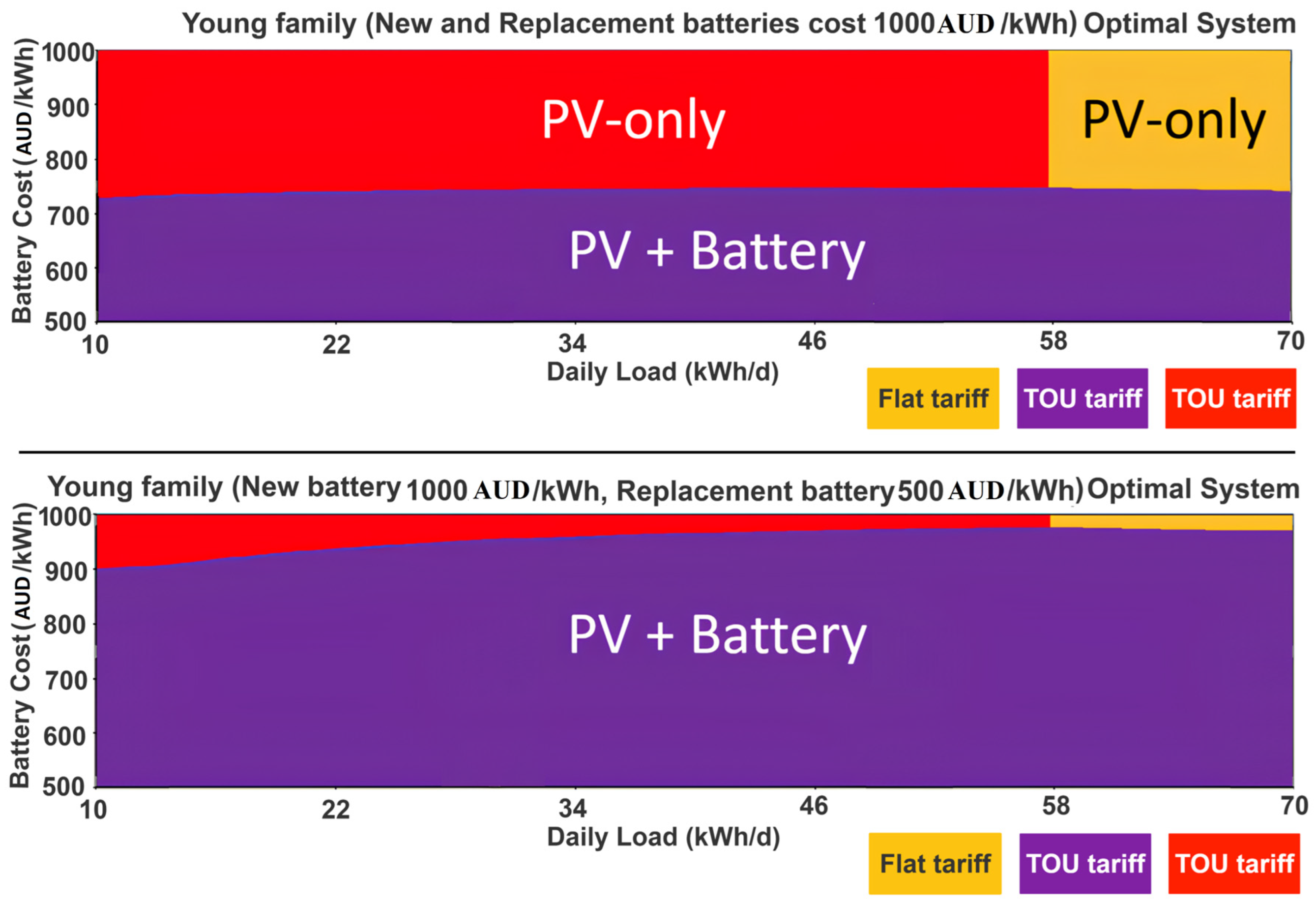

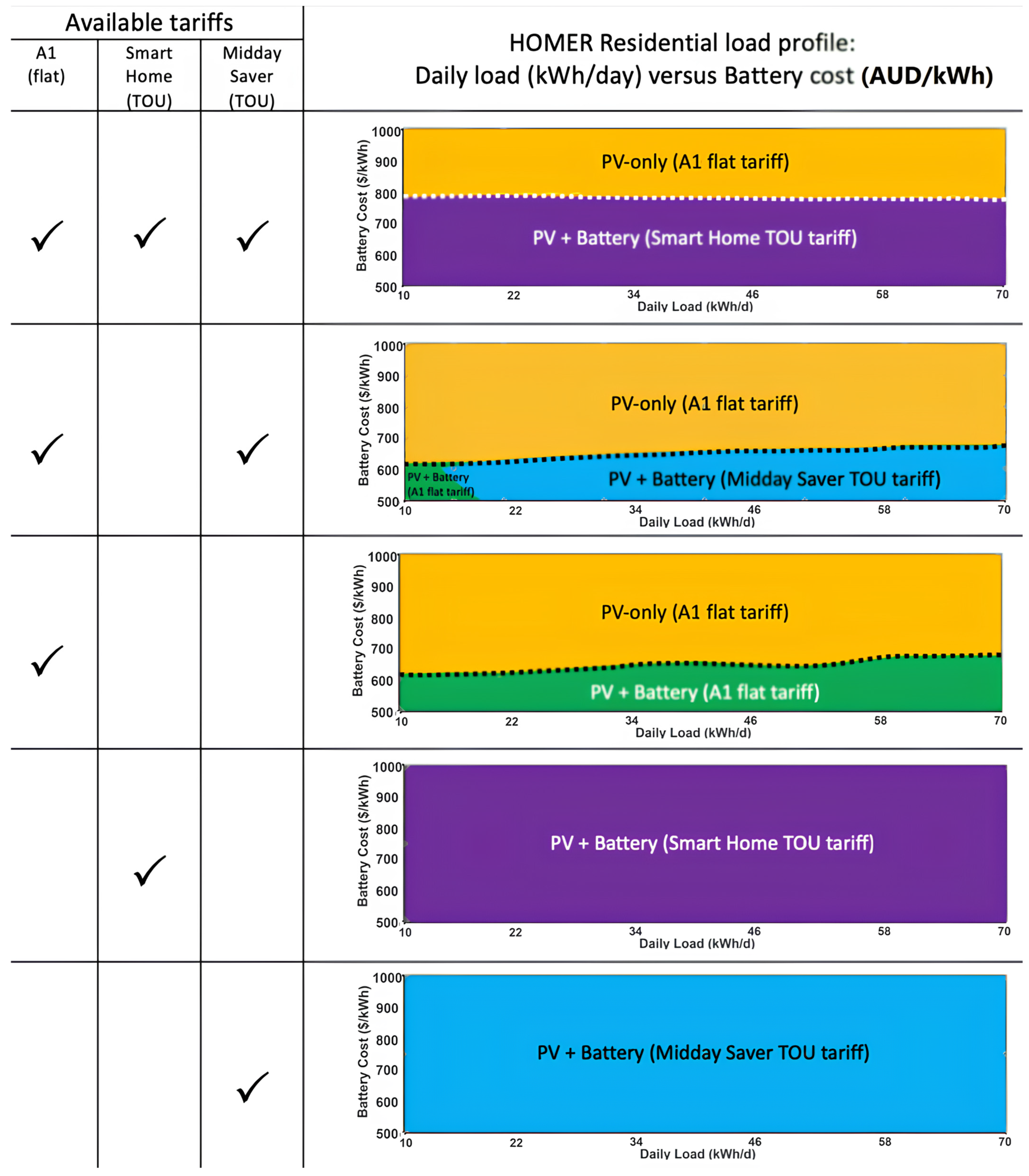

3.2.1. Sensitivity Series 1: Impact of Load Profiles and Grid Export Limits

- The yellow region at the top represents scenarios where a PV-only system with a flat tariff is optimal. This is typically the case when battery costs are high and daily energy consumption is low;

- The purple region at the bottom signifies scenarios where a PV + Battery system with a TOU tariff becomes the preferred option. This occurs when battery prices decrease, and daily energy consumption increases.

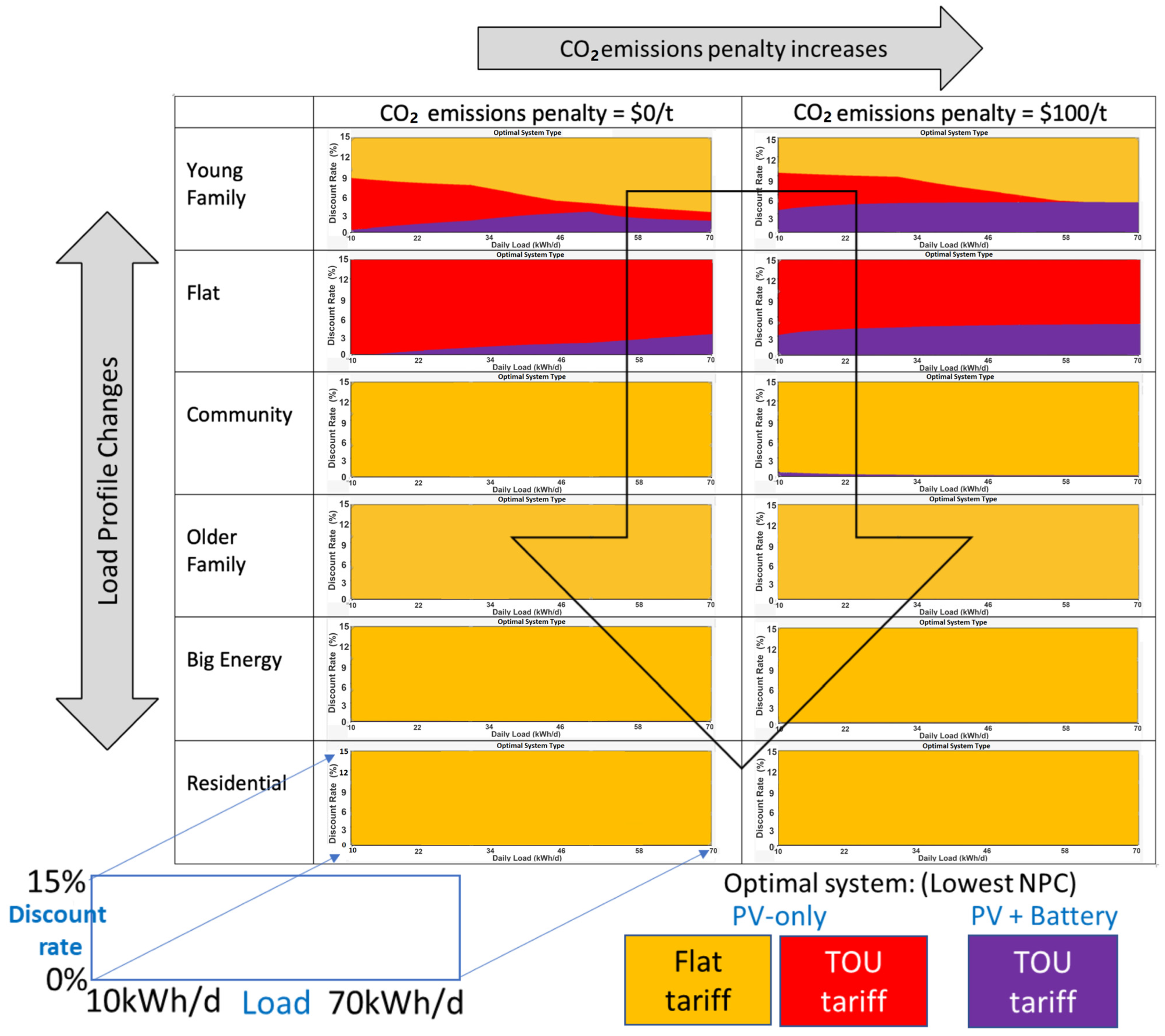

3.2.2. Sensitivity Series 2: Impact of CO2 Penalties and Discount Rates

3.2.3. Sensitivity Series 3: Combined Sensitivity Analysis of Series 1 and Series 2

3.2.4. Sensitivity Series 4: Refinement of Battery Costs

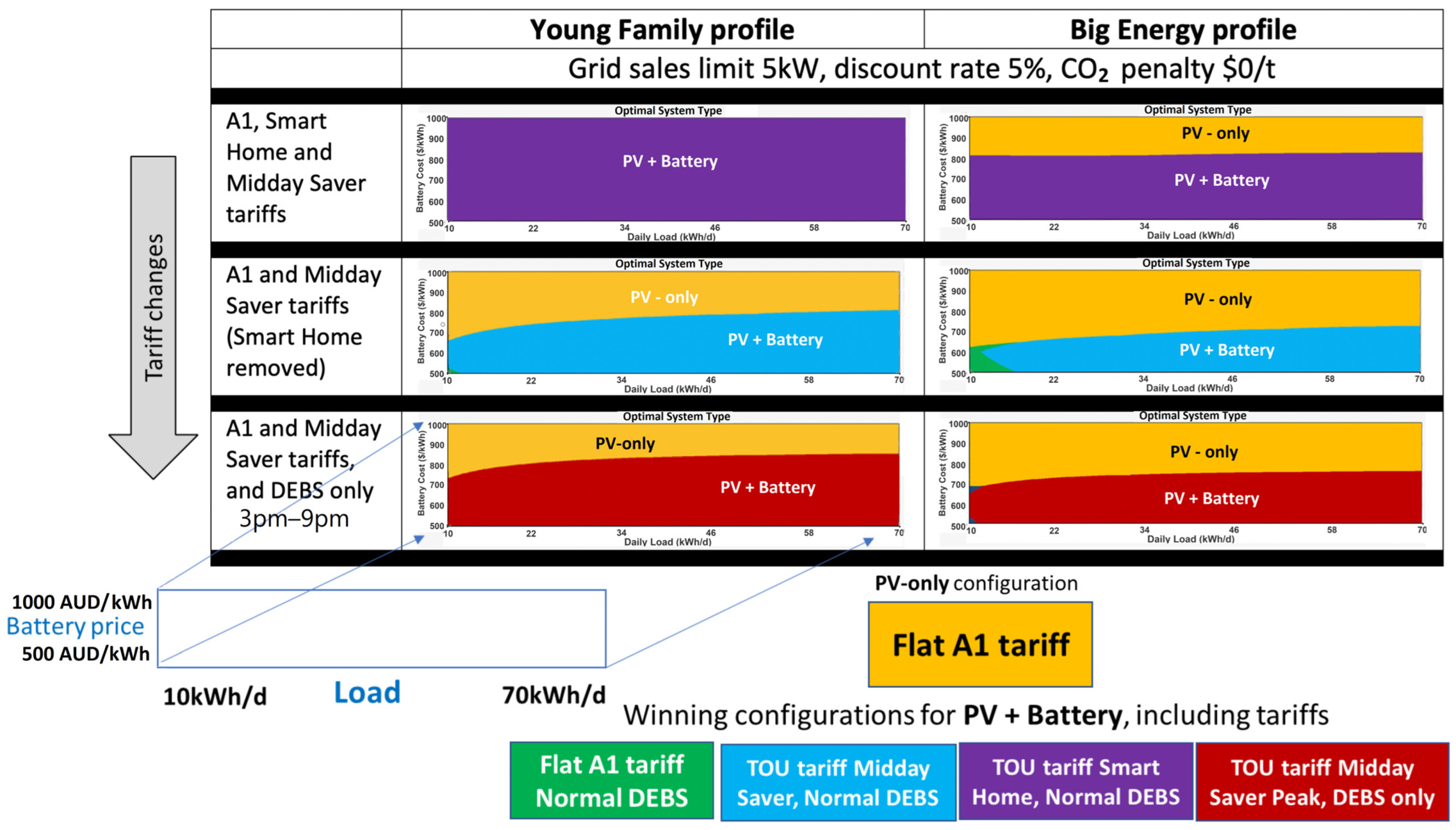

3.2.5. Sensitivity Series 5: Evaluation of the Impact of Minor Tariff Changes

3.2.6. Key Insights of Sensitivity Analyses

- Battery Price Dependency: The financial viability of PV + Battery systems is highly dependent on battery price reductions, load profiles, and available tariffs. Unlike previous research, such as [50] (which found that batteries must cost less than 463 AUD/kWh) or [49] (which argued for a 50% reduction in battery prices), this study indicates that, under certain conditions, PV + Battery systems are already viable at current battery prices, while in other cases, even a 300 AUD/kWh reduction in battery price may not be enough;

- Load Profiles Influence: The load profile significantly impacts the optimal system configuration. The Flat Control profile consistently showed the highest density of PV + Battery solutions, followed by the “Day Focused” profile, “Community” profile, “High Day & Evening Peak” profile, “Double Peak” profile, and finally, the “Residential” profile. This hierarchy indicates how well different load profiles can leverage battery storage to optimize NPC;

- Tariff Impact: Tariff structures significantly affect system optimization. The Smart Home TOU tariff is consistently associated with PV + Battery solutions, while the Synergy A1 flat tariff favors PV-only systems. Interestingly, when only the Midday Saver TOU tariff is available, PV-only systems become more prevalent, particularly at lower daily loads. Figure 11 visually represents how tariff availability influences system configuration across load profiles;

- Feed-in Tariffs: The results show that limiting FIT to evening hours (3 to 9 pm) boosts the financial return of PV + Battery systems. However, this also highlights the tension between network operator goals and consumer expectations, with consumers potentially resenting lower FIT;

- Grid Sales Limits: A grid sales limit of 0 kW (i.e., no energy exports) consistently favors PV + Battery systems, similar to the effect of lower FIT. However, increasing the grid sales limit to 5 kW or 10 kW favors PV-only systems, though there is little difference between the two higher limits;

- Carbon Emissions Penalty: A carbon emissions penalty has a small but consistent positive impact on the financial viability of PV + Battery systems. However, Australia lacks a carbon pricing mechanism, so this factor is not yet clinically relevant. A higher carbon penalty would favor PV + Battery systems more strongly if introduced;

- Discount Rate: The discount rate plays a significant role in determining the financial viability of battery systems. Even a modest increase from 0% to 5% can shift the balance in favor of lower initial capital solutions, such as PV-only systems. As the discount rate is an external macroeconomic factor, careful selection of the rate is necessary to avoid distorting financial projections;

- Optimal Sizing: The HOMER Grid optimization function identifies the optimal system configuration for each simulation point, and the optimal system size varies significantly by load profile. For some profiles, a PV-only system is optimal, while PV + Battery configurations dominate for others. This variation underscores the importance of accurate load profiling when planning energy systems.

3.3. Economic Analysis for Early PV Adopters

3.3.1. Consumer Implications

3.3.2. Recommendations

- Government agencies should establish a single, trusted source of information for consumers. Consumers need reliable, centralized information about Distributed Energy Resources (DER) options to make informed decisions;

- Energy providers and technology companies should provide consumer-appropriate technology to help households understand and manage their load profiles and energy consumption. By better understanding their energy usage, households can make more informed decisions about system sizing and investment in DERs;

- Network operators should clarify and communicate the longer-term network management perspective on community batteries (in front of the meter) versus residential batteries (behind the meter). Consumers need to understand how network operators view the role of residential batteries, particularly in the context of VPPs;

- Government agencies and energy regulators should ensure that if residential batteries are critical for the network, tariffs and subsidies should support their adoption. Engaging with consumers about potential long-term tariff changes and the possibility of future battery subsidies will help households factor this into their DER investment decisions.

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ghahramani, M.; Sadat-Mohammadi, M.; Nazari-Heris, M.; Asadi, S.; Mohammadi-Ivatloo, B. Introduction and literature review of the operation of multi-carrier energy networks. In Planning and Operation of Multi-Carrier Energy Networks; Springer: Berlin/Heidelberg, Germany, 2021; pp. 39–57. [Google Scholar]

- Wanapinit, N.; Offermann, N.; Thelen, C.; Kost, C.; Rehtanz, C. Operative Benefits of Residential Battery Storage for Decarbonizing Energy Systems: A German Case Study. Energies 2024, 17, 2376. [Google Scholar] [CrossRef]

- Ghahramani, M.; Habibi, D.; Ghahramani, M.; Nazari-Heris, M.; Aziz, A. Sustainable Buildings: A Comprehensive Review and Classification of Challenges and Issues, Benefits, and Future Directions. In Natural Energy, Lighting, and Ventilation in Sustainable Buildings; Springer: Berlin/Heidelberg, Germany, 2023; pp. 1–28. [Google Scholar]

- Brumana, G.; Ghirardi, E.; Franchini, G. Comparison of Different Power Generation Mixes for High Penetration of Renewables. Sustainability 2024, 16, 8435. [Google Scholar] [CrossRef]

- Burger, E.M.; Moura, S.J. Generation following with thermostatically controlled loads via alternating direction method of multipliers sharing algorithm. Electr. Power Syst. Res. 2017, 146, 141–160. [Google Scholar] [CrossRef]

- Soleimani, H.; Habibi, D.; Ghahramani, M.; Aziz, A. Strengthening Power Systems for Net Zero: A Review of the Role of Synchronous Condensers and Emerging Challenges. Energies 2024, 17, 3291. [Google Scholar] [CrossRef]

- Ghahramani, M.; Nazari-Heris, M.; Zare, K.; Mohammadi-ivatloo, B. Robust short-term scheduling of smart distribution systems considering renewable sources and demand response programs. In Robust Optimal Planning and Operation of Electrical Energy Systems; Springer: Berlin/Heidelberg, Germany, 2019; pp. 253–270. [Google Scholar]

- Chen, Z.; Amani, A.M.; Yu, X.; Jalili, M. Control and optimisation of power grids using smart meter data: A review. Sensors 2023, 23, 2118. [Google Scholar] [CrossRef]

- Moreno-Muñoz, A.; Giacomini, N. Energy Smart Appliances: Applications, Methodologies, and Challenges; John Wiley & Sons: Hoboken, NJ, USA, 2023. [Google Scholar]

- Ghahramani, M.; Heris, M.N.; Zare, K.; Ivatloo, B.M. Incorporation of demand response programs and wind turbines in optimal scheduling of smart distribution networks: A case study. In Proceedings of the 2017 Conference on Electrical Power Distribution Networks Conference (EPDC), Semnan, Iran, 19–20 April 2017; pp. 25–32. [Google Scholar]

- Huang, L.; Sun, W.; Li, Q.; Li, W. Distributed real-time economic dispatch for islanded microgrids with dynamic power demand. Appl. Energy 2023, 342, 121156. [Google Scholar] [CrossRef]

- Babu, K.V.S.M.; Vinay, K.S.S.; Chakraborty, P. Peer-to-peer sharing of energy storage systems under net metering and time-of-use pricing. IEEE Access 2023, 11, 3118–3128. [Google Scholar] [CrossRef]

- Ghahramani, M.; Zare, K.; Mohammadi-Ivatloo, B. Optimal energy procurement of smart large consumers incorporating parking lot, renewable energy sources and demand response program. Int. J. Smart Electr. Eng. 2018, 7, 145–154. [Google Scholar]

- Behi, B.; Jennings, P.; Arefi, A.; Azizivahed, A.; Pivrikas, A.; Muyeen, S.; Gorjy, A. A Robust Participation in the Load Following Ancillary Service and Energy Markets for a Virtual Power Plant in Western Australia. Energies 2023, 16, 3054. [Google Scholar] [CrossRef]

- ARENA. Energy Storage Study. 2015. Available online: https://arena.gov.au/knowledge-bank/energy-storage-study/ (accessed on 21 October 2024).

- Ghahramani, M.; Nazari-Heris, M.; Zare, K.; Mohammadi-Ivatloo, B. Energy and reserve management of a smart distribution system by incorporating responsive-loads/battery/wind turbines considering uncertain parameters. Energy 2019, 183, 205–219. [Google Scholar] [CrossRef]

- Graham, P.; Havas, L. Projections for Small-Scale Embedded Technologies; Report; CSIRO: Canberra, Australia, 2020. [Google Scholar]

- Laslett, D.; Carter, C.; Creagh, C.; Jennings, P. A large-scale renewable electricity supply system by 2030: Solar, wind, energy efficiency, storage and inertia for the South West Interconnected System (SWIS) in Western Australia. Renew. Energy 2017, 113, 713–731. [Google Scholar] [CrossRef]

- Lu, B.; Blakers, A.; Stocks, M. 90–100% renewable electricity for the south west interconnected system of western Australia. Energy 2017, 122, 663–674. [Google Scholar] [CrossRef]

- Wilkinson, S.; Maticka, M.J.; Liu, Y.; John, M. The duck curve in a drying pond: The impact of rooftop PV on the Western Australian electricity market transition. Util. Policy 2021, 71, 101232. [Google Scholar] [CrossRef]

- Australian Energy Market Operator. 2022 Wholesale Electricity Market Electricity Statement of Opportunities: June 2022; Australian Energy Market Operator: Melbourne, Australia, 2022. [Google Scholar]

- Helwig, A.; Bell, J. What energy storage technologies will Australia need as renewable energy penetration rises? J. Energy Storage 2024, 95, 112701. [Google Scholar]

- Shaikh, R.A.; Vowles, D.J.; Dinovitser, A.; Allison, A.; Abbott, D. Robust capital cost optimization of generation and multitimescale storage requirements for a 100% renewable Australian electricity grid. PNAS Nexus 2024, 3, 127. [Google Scholar] [CrossRef]

- Madsen, C. Low Load Responses–Distributed Photovoltaic Generation Management; Australian Energy Market Operator: Melbourne, Australia, 2021. [Google Scholar]

- Maticka, M.J. The SWIS DUCK–Value pricing analysis of commercial scale photovoltaic generation in the South West Interconnected System. Electr. J. 2019, 32, 57–65. [Google Scholar] [CrossRef]

- Alam, M.S.; Al-Ismail, F.S.; Salem, A.; Abido, M.A. High-level penetration of renewable energy sources into grid utility: Challenges and solutions. IEEE Access 2020, 8, 190277–190299. [Google Scholar] [CrossRef]

- Das, B.K.; Hassan, R.; Islam, M.S.; Rezaei, M. Influence of energy management strategies and storage devices on the techno-enviro-economic optimization of hybrid energy systems: A case study in Western Australia. J. Energy Storage 2022, 51, 104239. [Google Scholar] [CrossRef]

- Tidemann, C.; Engerer, N.; Franklin, E.; Hussey, K.; Pezzey, J.C. Promoting behind-the-meter battery storage: Options for more effective government support and regulation. Int. J. Technol. Intell. Plan. 2018, 12, 77–98. [Google Scholar] [CrossRef]

- Edelenbosch, O.Y.; Hof, A.F.; Nykvist, B.; Girod, B.; Van Vuuren, D.P. Transport electrification: The effect of recent battery cost reduction on future emission scenarios. Clim. Chang. 2018, 151, 95–108. [Google Scholar] [CrossRef]

- Say, K.; John, M.; Dargaville, R. Power to the people: Evolutionary market pressures from residential PV battery investments in Australia. Energy Policy 2019, 134, 110977. [Google Scholar] [CrossRef]

- Roberts, M.B.; Adams, S.M.; Kuch, D. Social license to automate batteries? Australian householder conditions for participation in Virtual Power Plants. Energy Res. Soc. Sci. 2023, 104, 103241. [Google Scholar] [CrossRef]

- Csereklyei, Z.; Dwyer, S.; Kallies, A.; Economou, D. The role of community-scale batteries in the energy transition: Case studies from Australia’s National Electricity Market. J. Energy Storage 2024, 93, 112277. [Google Scholar] [CrossRef]

- Ransan-Cooper, H.; Shaw, M.; Sturmberg, B.C.; Blackhall, L. Neighbourhood batteries in Australia: Anticipating questions of value conflict and (in)justice. Energy Res. Soc. Sci. 2022, 90, 102572. [Google Scholar] [CrossRef]

- Parra, D.; Swierczynski, M.; Stroe, D.I.; Norman, S.A.; Abdon, A.; Worlitschek, J.; O’Doherty, T.; Rodrigues, L.; Gillott, M.; Zhang, X. An interdisciplinary review of energy storage for communities: Challenges and perspectives. Renew. Sustain. Energy Rev. 2017, 79, 730–749. [Google Scholar] [CrossRef]

- Mohseni, S.; Rutovitz, J.; Smith, H.; Dwyer, S.; Tahir, F. Economic Viability Assessment of Neighbourhood versus Residential Batteries: Insights from an Australian Case Study. Sustainability 2023, 15, 16331. [Google Scholar] [CrossRef]

- Alipour, M.; Stewart, R.A.; Sahin, O. Beyond the diffusion of residential solar photovoltaic systems at scale: Allegorising the battery energy storage adoption behaviour. Energies 2021, 14, 5015. [Google Scholar] [CrossRef]

- Pradhan, P.; Ahmad, I.; Habibi, D.; Aziz, A.; Al-Hanahi, B.; Masoum, M.A. Optimal sizing of energy storage system to reduce impacts of transportation electrification on power distribution transformers integrated with photovoltaic. IEEE Access 2021, 9, 144687–144698. [Google Scholar] [CrossRef]

- Energy Policy WA. Distributed Energy Resources Roadmap; Energy Policy WA: Perth, Australia, 2020. [Google Scholar]

- Eghbal, D. Grid transformation driven by high uptake of distributed energy resources—An Australian case study. In Decentralized Frameworks for Future Power Systems; Elsevier: Amsterdam, The Netherlands, 2022; pp. 51–80. [Google Scholar]

- Energy Policy WA. Energy Buyback Schemes. 2022. Available online: https://www.wa.gov.au/organisation/energy-policy-wa/energy-buyback-schemes (accessed on 21 October 2024).

- Synergy. FIT Changes. 2022. Available online: https://www.synergy.net.au/Global/FIT-Faq (accessed on 21 October 2024).

- Kloppenburg, S.; Smale, R.; Verkade, N. Technologies of engagement: How battery storage technologies shape householder participation in energy transitions. Energies 2019, 12, 4384. [Google Scholar] [CrossRef]

- Feron, S. Sustainability of off-grid photovoltaic systems for rural electrification in developing countries: A review. Sustainability 2016, 8, 1326. [Google Scholar] [CrossRef]

- van Groenou, A.B.; Lovell, H.; Franklin, E. Household decision-making for home batteries. In Proceedings of the Asia Pacific Solar Research Conference, Sydney, Australia, 4–6 December 2018. [Google Scholar]

- Esplin, R.; Nelson, T. Redirecting solar feed in tariffs to residential battery storage: Would it be worth it? Econ. Anal. Policy 2022, 73, 373–389. [Google Scholar] [CrossRef]

- Agnew, S.; Smith, C.; Dargusch, P. Causal loop modelling of residential solar and battery adoption dynamics: A case study of Queensland, Australia. J. Clean. Prod. 2018, 172, 2363–2373. [Google Scholar] [CrossRef]

- Mulleriyawage, U.G.; Shen, W.; Hu, C. Battery system selection in DC microgrids for residential applications: An Australian case study. In Proceedings of the 2019 14th IEEE Conference on Industrial Electronics and Applications (ICIEA), Xi’an, China, 19–21 June 2019; pp. 1926–1931. [Google Scholar]

- Alarrouqi, R.A.; Ellabban, O.; Al-Fagih, L. An assessment of different load demands on photovoltaic plus battery storage system profitability: A case study of Australia. In Proceedings of the 2020 IEEE 29th International Symposium on Industrial Electronics (ISIE), Delft, The Netherlands, 17–19 June 2020; pp. 1497–1502. [Google Scholar]

- Khezri, R.; Mahmoudi, A.; Haque, M.H. Optimal capacity of PV and BES for grid-connected households in South Australia. In Proceedings of the 2019 IEEE Energy Conversion Congress and Exposition (ECCE), Baltimore, MD, USA, 29 September–3 October 2019; pp. 3483–3490. [Google Scholar]

- Sharma, V.; Haque, M.H.; Aziz, S.M. Comparative evaluation of alternative tariffs on energy cost of households with PV and battery. In Proceedings of the 2019 29th Australasian Universities Power Engineering Conference (AUPEC), Nadi, Fiji, 26–29 November 2019; pp. 1–6. [Google Scholar]

- Shaw-Williams, D. A Techno-Economic Network Assessment of Household Generation and Battery Storage; Queensland University of Technology: Brisbane, Australia, 2019. [Google Scholar]

- Barbour, E.; González, M.C. Projecting battery adoption in the prosumer era. Appl. Energy 2018, 215, 356–370. [Google Scholar] [CrossRef]

- Agnew, S.; Dargusch, P. Consumer preferences for household-level battery energy storage. Renew. Sustain. Energy Rev. 2017, 75, 609–617. [Google Scholar] [CrossRef]

- Nygård, H.S.; Ottesen, S.Ø.; Skonnord, O.H. Profitability Analyses for Residential Battery Investments: A Norwegian Case Study. Energies 2024, 17, 4048. [Google Scholar] [CrossRef]

- Dam, M.R.; van der Laan, M.D. Techno-Economic Assessment of Battery Systems for PV-Equipped Households with Dynamic Contracts: A Case Study of The Netherlands. Energies 2024, 17, 2991. [Google Scholar] [CrossRef]

- Orangi, S.; Manjong, N.; Clos, D.P.; Usai, L.; Burheim, O.S.; Strømman, A.H. Historical and prospective lithium-ion battery cost trajectories from a bottom-up production modeling perspective. J. Energy Storage 2024, 76, 109800. [Google Scholar] [CrossRef]

- Ratnam, E.L.; Weller, S.R.; Kellett, C.M. An optimization-based approach to scheduling residential battery storage with solar PV: Assessing customer benefit. Renew. Energy 2015, 75, 123–134. [Google Scholar]

- Zhu, B.; Lu, J.; Water, W.; Katsanevakis, M.; Moghimi, M.; Leskarac, D.; Stegen, S. Battery-Based Storage for Communities; Griffith University: Queensland, Australia, 2018. [Google Scholar]

- Yianni, C.; Florides, M.; Afxentis, S.; Efthymiou, V.; Georghiou, G.E. Economic viability of battery energy storage system applications. In Proceedings of the 2018 IEEE International Energy Conference (ENERGYCON), Limassol, Cyprus, 3–7 June 2018; pp. 1–6. [Google Scholar]

- Zhou, J.; Tsianikas, S.; Birnie, D.P., III; Coit, D.W. Economic and resilience benefit analysis of incorporating battery storage to photovoltaic array generation. Renew. Energy 2019, 135, 652–662. [Google Scholar] [CrossRef]

- Konstantinou, G.; Wang, G.A.; Zhan, Y. Current economic viability of combined PV and battery energy storage systems for Australian households. In Proceedings of the 2016 Australasian Universities Power Engineering Conference (AUPEC), Brisbane, Australia, 25–28 September 2016; pp. 1–6. [Google Scholar]

- Nicholls, A.; Sharma, R.; Saha, T. Financial and environmental analysis of rooftop photovoltaic installations with battery storage in Australia. Appl. Energy 2015, 159, 252–264. [Google Scholar]

- Sykes, J. Solar Batteries—Are They Worth It? Available online: https://www.solarchoice.net.au/research-solar/is-home-battery-storage-worth-it/ (accessed on 21 October 2024).

- Redback Technologies. We’ve Compared the Electricity Costs in a Household in WA Without Solar, with Solar, and with Solar and Battery Storage. Available online: https://redbacktech.com/wa-electricity-costs-comparison-solar-and-batteries/ (accessed on 21 October 2024).

- Shaw, M.; Sturmberg, B.; Mediwaththe, C.; Ransan-Cooper, H.; Taylor, D.; Blackhall, L. Community Batteries: A Cost/Benefit Analysis; Technical Report; Australian Renewable Energy Agency: Sydney, Australia, 2020. [Google Scholar]

- Sykes, J. How Much do Solar Panels Cost? 2024. Available online: https://www.solarchoice.net.au/residential/solar-power-system-prices/ (accessed on 21 October 2024).

| Ref. | Motivation Factors for Investing in Residential Battery Storage | Key Insights |

|---|---|---|

| [53] | Off-grid transition, climate goals | Emphasizes a variety of motivations beyond financial savings |

| [57] | Frustration with feed-in tariffs, desire for independence from utilities | Psychological factors like security and autonomy play a significant role |

| [58] | Lower peak demand, support local grid stability | Community benefits of storage include delaying the need for network upgrades |

| [53,59,60] | Returns on investment; lower cost of energy | The payback period is still a barrier; it is better in areas with high solar radiation |

| [57,60] | Backup during blackouts | Focuses on the need for energy security |

| Ref. | Challenge | Impact | Insights |

|---|---|---|---|

| [61] | High costs and market complexity | Delays in achieving financial ROI | The energy storage market is expected to grow as costs decrease, but it remains complex |

| [18] | Significant price reductions are required | High upfront costs | Widespread adoption is unlikely without major reductions in battery costs |

| [62] | Long payback periods for PV + battery systems | Payback period of 11+ years | PV-only systems are currently more financially viable than PV + battery configurations |

| Simulation Reference | Load Profiles | Battery Replacement (AUD/kWh) | Battery Price Multiplier (New & Replacement) | Load (kWh/Day) | Grid Sales Limit (kW) | Tariffs | Discount Rate (%) | CO2 Penalty (AUD/Ton) |

|---|---|---|---|---|---|---|---|---|

| 1 | 6 | 1000 | 1.0, 0.75, 0.5 | 10, 30, 50, 70 | 0, 5, 10 | Flat-A1, TOU-SH, TOU-MS | 0 | 0 |

| 2 | 6 | 1000 | 1 | 10, 30, 50, 70 | 5 | Flat-A1, TOU-SH, TOU-MS | 0, 5, 10 | 0, 50, 100 |

| 3 | 6 | 1000 | 1.0, 0.75, 0.5 | 10, 30, 50, 70 | 0, 5, 10 | Flat-A1, TOU-SH, TOU-MS | 0, 5, 10 | 0, 100 |

| 4 | 6 | 1000 | 1.0, 0.75, 0.5 | 10, 20, 30, 40, 50, 60, 70 | 0, 5, 10 | Flat-A1, TOU-SH, TOU-MS | 0, 2.5, 5, 7.5, 10, 12.5, 15 | 100 |

| 5 | 2 | 500 | 1.0, 0.75, 0.6 | 10, 30, 50, 70 | 0, 5 | Flat-A1, TOU-SH, TOU-MS | 0, 5, 10 | 0, 100 |

| 6 | 1 | 500 | 1.0, 0.8, 0.7, 0.6, 0.5 | 10, 30, 50, 70 | 0, 5 | Flat-A1, TOU-SH, TOU-MS | 0, 5, 10 | 0, 50, 100, 150 |

| 7 | 2 | 500 | 1.0, 0.8, 0.7, 0.6, 0.5 | 10, 30, 50, 70 | 0, 5 | Flat-A1, TOU-MS DEBS | 0, 5 | 0 |

| 8 | 2 | 500 | 1.0, 0.8, 0.7, 0.6, 0.5 | 10, 30, 50, 70 | 0, 5 | Flat-A1, TOU-MS DEBS | 0.5 | 0 |

| 9 | 2 | 500 | 1.0, 0.8, 0.7, 0.6, 0.5 | 10, 30, 50, 70 | 0, 5 | Flat-A1, TOU-MS—Only DEBS Export | 0, 5 | 0 |

| 10A | 6 | 500 | 1 | 10, 20, 30, 40, 50, 60, 70 | 0, 5, 10 | Flat-A1, TOU-MS | 5 | 0 |

| 10B | 6 | 350 | 1 | 10, 20, 30, 40, 50, 60, 70 | 0, 5, 10 | Flat-A1, TOU-MS | 5 | 0 |

| 10C | 6 | 400 | 1 | 10, 20, 30, 40, 50, 60, 70 | 0, 5, 10 | Flat-A1, TOU-SH, TOU-MS | 5 | 0 |

| 10D | 3 | 500 | 1 | 10, 20, 30, 40, 50, 60, 70 | 0, 5, 10 | Flat-A1 | 5 | 0 |

| 10E | 3 | 500 | 1 | 10, 20, 30, 40, 50, 60, 70 | 0, 5, 10 | TOU-SH | 5 | 0 |

| 10F | 3 | 500 | 1 | 10, 20, 30, 40, 50, 60, 70 | 0, 5, 10 | TOU-MS | 5 | 0 |

| HOMER Grid Results for the 3 Perth Load Profiles | |||

|---|---|---|---|

| Load Profile | Young Adults/Older Family | Young Family/Retirees | Big Energy User |

| Daily Consumption | 20 kWh/day | 30 kWh/day | 50 kWh/day |

| Configuration | 5 kW PV + 3.5 kWh battery | 6.6 kW PV + 6.5 kWh battery | 13 kW PV + 13.5 kWh battery |

| Capital Cost | AUD 9890 | AUD 13,225 | AUD 25,896 |

| Flat Rate Tariff | |||

| Metric | Young Adults/Older Family | Young Family/Retirees | Big Energy User |

| HOMER Payback (solar + battery) | 8.2 years | 5.9 years | 6.4 years |

| Calculated Payback (battery-only) | >32 years | >16.6 years | >12.9 years |

| HOMER Utility Bill Savings | 1202 AUD/year | 2248 AUD/year | 4031 AUD/year |

| TOU Tariff | |||

| Metric | Young Adults/Older Family | Young Family/Retirees | Big Energy User |

| HOMER Payback (solar + battery) | 6.3 years | 4.6 years | 5.0 years |

| Calculated Payback (battery-only) | >22 years | 8.5 years | 6.6 years |

| HOMER Utility Bill Savings | 1573 AUD/year | 2855 AUD/year | 5222 AUD/year |

| HOMER Grid Selection Order | Configuration | PV | Battery | Tariff | NPC | LCOE |

|---|---|---|---|---|---|---|

| Winning system | PV + Battery | 13 kW | 13.5 kWh | TOU | AUD 72,234 | 0.104 AUD/kWh |

| 2nd system | PV only | 13 kW | - | Flat | AUD 75,454 | 0.092 AUD/kWh |

| 3rd system | PV + Battery | 13 kW | 13.5 kWh | Flat | AUD 83,322 | 0.120 AUD/kWh |

| HOMER Grid Selection Order | Configuration | PV | Battery | Tariff | NPC | LCOE |

|---|---|---|---|---|---|---|

| Winning system | PV only | 21.9 kW | - | Flat | AUD 74,906 | 0.0925 AUD/kWh |

| 2nd system | PV + Battery | 21.3 kW | 1 kWh | Flat | AUD 75,694 | 0.0942 AUD/kWh |

| 3rd system | PV + Battery | 24.1 kW | 10 kWh | TOU | AUD 81,751 | 0.104 AUD/kWh |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hopley, I.; Ghahramani, M.; Aziz, A. Techno-Economic Factors Impacting the Intrinsic Value of Behind-the-Meter Distributed Storage. Sustainability 2024, 16, 10432. https://doi.org/10.3390/su162310432

Hopley I, Ghahramani M, Aziz A. Techno-Economic Factors Impacting the Intrinsic Value of Behind-the-Meter Distributed Storage. Sustainability. 2024; 16(23):10432. https://doi.org/10.3390/su162310432

Chicago/Turabian StyleHopley, Ingrid, Mehrdad Ghahramani, and Asma Aziz. 2024. "Techno-Economic Factors Impacting the Intrinsic Value of Behind-the-Meter Distributed Storage" Sustainability 16, no. 23: 10432. https://doi.org/10.3390/su162310432

APA StyleHopley, I., Ghahramani, M., & Aziz, A. (2024). Techno-Economic Factors Impacting the Intrinsic Value of Behind-the-Meter Distributed Storage. Sustainability, 16(23), 10432. https://doi.org/10.3390/su162310432