Abstract

The pursuit of efficiency or legitimacy is an important choice facing corporate sustainability, especially in uncertain environments. Digital transformation contributes to corporate efficiency, while fulfilling corporate social responsibility (CSR) is a non-market-based strategy for companies seeking legitimacy. However, sustainability research remains unclear about the link between digital transformation and CSR and the mechanisms behind it. To fill this research gap, we incorporate economic policy uncertainty (EPU) into our analytical framework and elucidate the theoretical mechanism of the simultaneous bidirectional relationship between digital transformation and CSR from the perspective of organizational legitimacy. We construct a simultaneous equation model and analyze a sample of 468 Chinese listed companies collected from 2011 to 2018 using the three-stage least squares method. Our findings reveal a mutually reinforcing bidirectional relationship between digital transformation and CSR. Furthermore, we discover that EPU weakens the facilitating influence of digital transformation on CSR but strengthens the positive impact of CSR on digital transformation. Our conclusions suggest that companies taking on more CSR in digital transformation contexts can help achieve the organic unity of efficiency and legitimacy for sustainable development, but uncertainty can undermine this positive interaction.

1. Introduction

The pursuit of efficiency or legitimacy is a popular research topic in the field of corporate sustainability [1]. Digital transformation describes the combined impacts of numerous digital innovations that create novel actors (and actor constellations), structures, practices, values, and beliefs, and can change, threaten, replace, or complement existing rules of the game within organizations, ecosystems, industries, or fields [2]. Previous studies have found that digital transformation improves information processing capabilities and technological innovation, optimizes production and operational processes, and, in turn, improves company efficiency [3,4,5]. However, the disruption of existing industry rules and management models brought about by digital transformation can make companies become unusual organizations [2,6]. Moreover, the dynamic, costly, and knowledge- and resource-intensive process of digital transformation requires companies to continuously invest substantial resources [7]. Institutionalists contend that organizations that are unusual and lack resources or are continuously dependent on external resources more urgently seek organizational legitimacy to gain recognition from external stakeholders and access the resources held by them [8,9]. As a result, finding ways to enhance organizational legitimacy has become an urgent and important issue for companies seeking to drive digital transformation for their sustainability.

Corporate social responsibility (CSR) reflects a company’s sense of responsibility toward society, as manifested in its policies and plans towards stakeholder groups such as governments, communities, and investors [10]. CSR, as a strategic decision for companies to seek legitimacy, has been widely applied in many industries [11]. Hence, whether companies are motivated to take on more CSR to alleviate the legitimacy pressures brought about by digital transformation is a crucial study topic. Additionally, greater organizational legitimacy facilitates firms’ access to benefits such as government subsidies and lower bank credit rates [12,13], and can effectively alleviate their financing constraints [14]. Access to such resources can help to reduce the costs and risks of digital transformation and enhance companies’ level of digitalization [15,16]. Therefore, does CSR, in turn, promote digital transformation in companies? In other words, is there a feedback mechanism based on legitimacy between digital transformation and CSR, resulting in a mutually dependent bidirectional relationship between them?

The existing examination on the connection between digital transformation and CSR has primarily focused on two directions. First, the prior literature has investigated the one-way impact of digital transformation on CSR [17,18,19]. Second, it has examined the joint influence of digital transformation and CSR from the standpoint of outcome variables such as financial performance, enterprise risk, and innovation [20,21,22]. As noted above, as well as access to external resources that can support companies’ digital transformation, taking on more social responsibility helps them gain recognition and support from stakeholders [12,14,23]. Thus, CSR can have an important influence on companies’ digital transformation, and it can be reasonably inferred that there exists a feedback mechanism between them. However, most existing studies have overlooked this bidirectional interactive relationship and have adopted a one-way, rather than a two-way, perspective regarding the connection between digital transformation and CSR.

It is worth noting that since the 2008 financial crisis, governments have frequently introduced various types of stimulus policies, which have increased economic policy uncertainty (EPU) [24,25]. As a systemic shock, EPU brings numerous adverse impacts to companies, including increased financing costs, reduced asset investment opportunities, and an increased probability of bankruptcy [24,26]. Legitimacy theory suggests that pragmatic legitimacy, specifically the requirement for a company to operate as a functioning economic entity, forms the foundation of organizational legitimacy and has the greatest impact on the success of an organization [27]. Due to the long payback period and uncertainty of CSR [28], taking on more social responsibility without satisfying pragmatic legitimacy can lead to negative reactions from stakeholders [10]. Increased operational costs and risks due to high EPU threaten the pragmatic legitimacy of companies. In response, company decision-makers may modify their CSR strategies to safeguard pragmatic legitimacy whilst simultaneously shifting stakeholder perceptions of their social responsibility; this, in turn, affects their effectiveness in enhancing legitimacy. In other words, the bidirectional connection between digital transformation and CSR can be influenced by EPU. Although prior studies have highlighted the significant influence of EPU on digital transformation or CSR [29,30], they have neglected its effect on the relationship between them. Taken together, these analyses lead us to the following research questions: Is there a bidirectional relationship between digital transformation and CSR? If it exists, does this bidirectional relationship vary with different levels of EPU?

China is an ideal empirical context to investigate the bidirectional connection between digital transformation and CSR, as well as the moderating impact of EPU, for two primary reasons. First, China is the country with the most rapidly developing and active digital economy among emerging markets [31]. Second, in China, CSR strategy has permeated all industries, and more and more companies view it as a non-market strategy to enhance legitimacy [11]. A simultaneous equation model is developed for analyzing the data of 468 Chinese listed companies collected from 2011–2018 using the three-stage least squares method (3SLS). Our findings reveal a mutually reinforcing bidirectional connection between digital transformation and CSR. Moreover, we discover that EPU weakens the facilitating influence of digital transformation on CSR but strengthens the positive impact of CSR on digital transformation.

Our research contributes to the literature and managerial practices in several ways. First, we reveal for the first time a bidirectional connection between digital transformation and CSR, filling the gap in current research that predominantly focuses on their unidirectional causal relationship. This study provides important managerial insights for companies to develop their own social responsibility strategies as soon as possible to better meet society’s expectations and thereby acquire stakeholder recognition and support for their digital transformation. Second, we reveal the influence of EPU on the connection between digital transformation and CSR. Our results suggest that companies should take on more social responsibility in the face of adverse shocks from high EPU, because the positive effects of CSR on digital transformation are reinforced under uncertainty. Ultimately, the results of this study show that CSR in the digital context can help to achieve the organic unity of efficiency and legitimacy, thus expanding the discussion of efficiency versus legitimacy in the field of sustainability.

2. Related Literature and Hypothesis Development

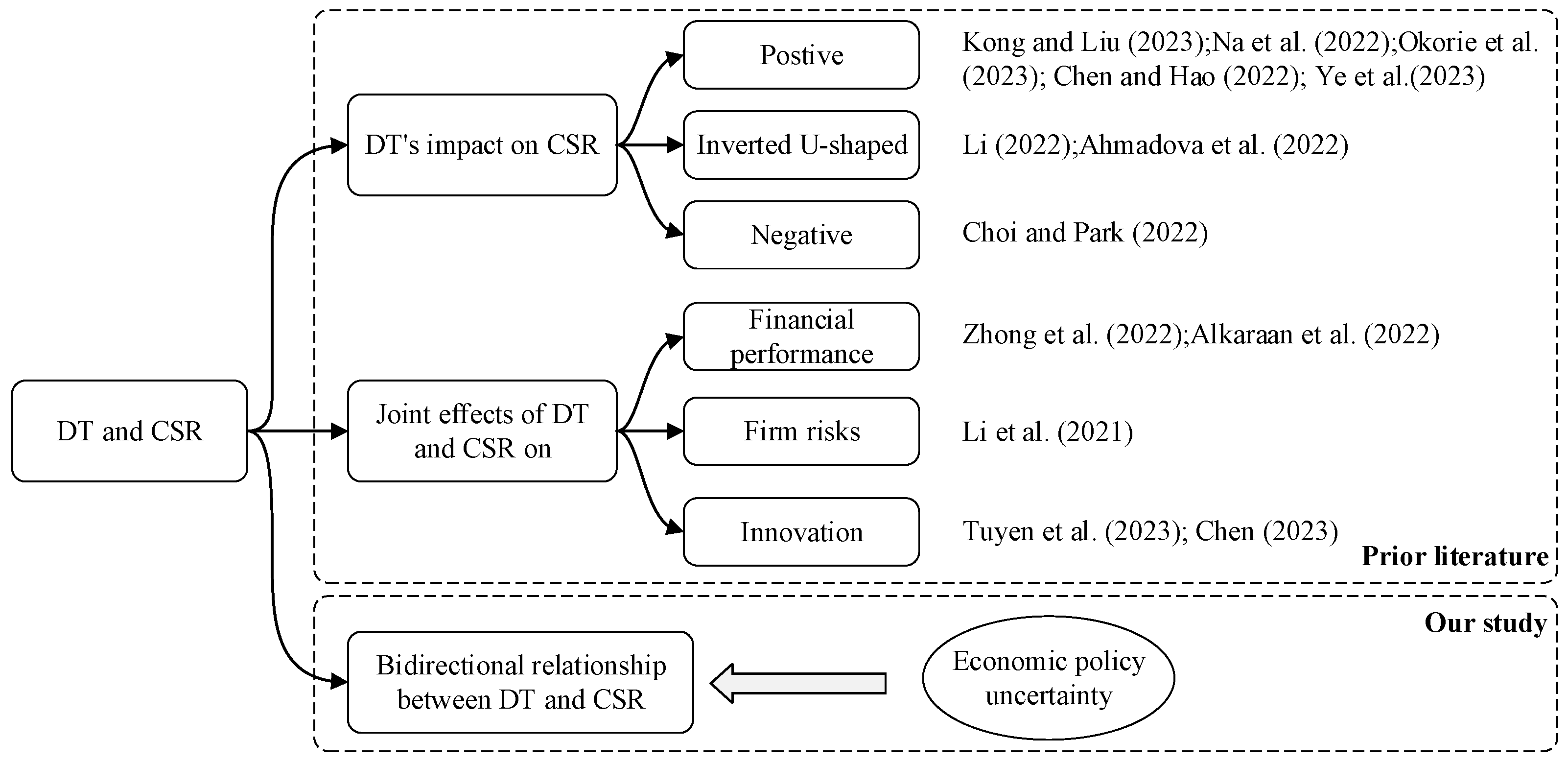

We review the literature on (1) the linkage between digital transformation and CSR and (2) the role of EPU. We then introduce legitimacy theory, discuss the bidirectional connection between digital transformation and CSR and the moderating influence of EPU in relation to the existing literature and legitimacy theory, and present our research hypotheses. Figure 1 displays the research context.

Figure 1.

Research context [17,18,19,20,21,22,32,33,34,35,36,37,38].

2.1. Related Literature

Numerous studies have investigated the connection between digital transformation and CSR [18,19,22]. As shown in Figure 1, we divide these studies into two broad categories: (1) the one-way influence of digital transformation on CSR; and (2) the interactive influence of digital transformation and CSR.

Scholars have come to different conclusions about how digital transformation affects CSR. Most scholars have concluded that digital transformation has a notable influence on improving CSR performance [15,18,32,33], but this positive effect is influenced by many contextual factors, including managerial characteristics [34], company characteristics [15,35], and external environmental factors such as industry attributes and government regulation [15,18]. However, some scholars hold a different view, emphasizing that the linkage between digital transformation and CSR is non-linear, and that either too high or too low a level of digitalization can reduce CSR performance [19,36]. Furthermore, some researchers have confirmed the negative influence of companies’ digital transformation on CSR [17]. Regarding the interactive effects of digital transformation and CSR, studies have examined them based on different outcome variables, including financial performance [22,37], corporate risk [20], and corporate innovation [21,38].

The existing literature has primarily concentrated on analyzing the one-way effect of digital transformation on CSR and the interactions between them, and has neglected the effect of CSR on digital transformation and the two-way relationships between them. Some evidence can be found in the literature to suggest that CSR does impact digital transformation. For example, Jang et al. [23] highlight that as CSR improves, companies are better able to acquire recognition and support from stakeholders for their digital transformation. The various stages of digital transformation require significant external resources [7], and gaining stakeholder support can help to obtain the required resources. These studies suggest that digital transformation affects CSR and that, in turn, CSR may affect digital transformation, i.e., there may be a two-way relationship between them that affects each other.

Researchers have highlighted the important influence of EPU on digital transformation and CSR. For example, Cheng and Masron [29] found that EPU significantly increased the level of digitalization in companies. However, other studies report conflicting findings regarding the influence of EPU on CSR. Some scholars have argued that CSR has an “insurance” effect, mitigating the increased corporate risk associated with increased EPU. Thus, increased EPU drives firms to take on more social responsibility [30,39,40,41]. Other researchers have argued that EPU discourages managers from investing in CSR due to the long and uncertain return on CSR investments [42]. For instance, Zou et al.’s study [43] found that EPU has a significant negative effect on CSR. In addition, scholars have examined the interaction between EPU and CSR through the lens of outcome variables, including financial performance and analyst prediction errors [44,45]. In summary, the existing literature examining the role of EPU has examined its impact on digital transformation and CSR in isolation, failing to examine the impact on the relationship between them. Therefore, we extend and expand the current body of knowledge by verifying the bidirectional connection between digital transformation and CSR and examine how this bidirectional connection varies with EPU.

2.2. Hypothesis Development

2.2.1. Legitimacy Theory

Legitimacy theory focuses on how organizations can enhance their status and legitimacy by conforming to the rules and norms of the institutional context [46]. Specific audiences or evaluators who watch and evaluate an organization’s actions and generalize this evaluation into a broader consensus on the appropriateness and suitability of the organization’s behavior confer legitimacy on the organization [47]. By its very nature, this signifies the “positive normative evaluation” that society holds towards an organization, and this evaluation is based on stakeholders’ perceptions of whether the organization’s actions contribute to societal welfare [27]. Legitimacy is important because once firms are perceived by society as illegitimate, they will have difficulty gaining stakeholder support [48]. Conversely, organizations that are perceived as legitimate are able to access scarce resources from stakeholders such as creditors, suppliers, trade associations, and regulators [49]. Therefore, to enhance their likelihood of survival and growth in the marketplace, firms must actively take effective measures to change stakeholders’ perceptions of their behavior in order to seek or maintain legitimacy [14]. Legitimacy theory is widely used in sustainable management research, such as sustainable development strategy [50], certification [51], and information disclosure [1,52]. From the organizational legitimacy perspective, this study seeks to explore the reciprocal connection between digital transformation and CSR, as well as the moderating effect of EPU.

2.2.2. The Bidirectional Relationship between Digital Transformation and CSR

In today’s socially conscious environment, stakeholders such as governments, creditors, suppliers, and consumers expect companies to be actively socially responsible [53]. Institutional norms require companies to be aware of their impact on stakeholders and to actively fulfil the social contract between business and society [54]. By fulfilling social responsibility, companies are able to develop and maintain socio-cultural norms within their institutional environment and thus gain organizational legitimacy [53]. Therefore, social responsibility is considered a strategic decision for companies to build legitimacy [11].

While all companies have varying degrees of social responsibility in the face of external legitimacy pressures, this need is more pressing and evident for digital companies. First, legitimacy theory suggests that non-traditional or unconventional organizations have a more urgent need for legitimacy [9]. The digital company is one such unusual organization [6]. As stated by Mangematin et al. [55], an enterprise’s digital transformation begins when existing business models, value chains, and organizational procedures are disrupted or destroyed and new arrangements are embedded and institutionalized. Second, there is a pressing need for legitimacy in organizations that lack resources or are continuously dependent on external resources [8]. The process of digital transformation for an organization is dynamic, expensive, and knowledge- and resource-intensive, and requires continuous resource investment [7]. Moreover, the limitations of an organization in terms of human capital, information resources, and skills make it urgent to gain support from external stakeholders [7]. Therefore, we conclude that it is more urgent for digitally transformed companies to seek legitimacy through greater CSR to gain stakeholder recognition and support and to access the scarce resources to support their digital transformation.

As noted above, because CSR can help to enhance organizational legitimacy [23], it can effectively alleviate financing constraints for companies [14]. Particularly in developing countries like China, where the government still controls the allocation of resources [11,12], active CSR can improve access to resources such as government subsidies and lower bank credit rates. Empirical research has confirmed the beneficial influence of these resources on the companies’ digital transformation [16,56]. For instance, an empirical study conducted by Zhao et al. [16] discovered that government subsidies reduce the expenses and risk associated with digital transformation for enterprises, resulting in a significant improvement in their digitalization levels. Additionally, although digital transformation is inhibited by financing constraints [56], CSR effectively mitigates the financing constraints [57], thereby weakening the inhibiting effect of financing constraints. Based on the above discussion, we infer that a feedback mechanism is formed between digital transformation and CSR, making a two-way relationship between them mutually reinforcing. Therefore, we propose the following hypothesis:

Hypothesis 1:

There is a mutually reinforcing bidirectional relationship between digital transformation and CSR.

Hypothesis 1a:

Digital transformation has a significant positive influence on CSR.

Hypothesis 1b:

CSR has a significant positive influence on digital transformation.

2.2.3. The Moderating Role of EPU

For companies, rising EPU can lead to a number of adverse shocks [24]. For example, it can increase the cost of financing, reduce opportunities to invest in assets, and increase the probability of bankruptcy [24,26]. The feedback mechanism based on legitimacy between digital transformation and CSR might be affected by these adverse shocks.

From the perspective of corporate decision-makers, the first requirement for an enterprise to gain legitimacy is to function as a normal operating economic entity, which is also known as pragmatic legitimacy [10]. After an enterprise has gained pragmatic legitimacy, it can participate in other social activities to address other demands for legitimacy and thus gain the support and recognition of stakeholders [10]. Conversely, if a company does not have pragmatic legitimacy but nonetheless invests limited corporate resources in other socially responsible activities, this may lead to negative stakeholder perceptions of its socially responsible activities [10,13]. Indeed, the long payback period and uncertainty of CSR investments can have a negative effect on the financial performance of companies [28]. Therefore, in the face of increased operational costs and risks due to EPU [24,26] and the resulting lack of pragmatic legitimacy, company decision-makers may be concerned that investing limited resources in social responsibility will exacerbate this negative impact and consequently reduce it. Zhao et al.’s empirical study [42] also confirms the negative effect of EPU on CSR. The logic of our previous argument is that digitally transformed companies are motivated to take on more social responsibility because of the urgent need to increase their legitimacy, which is facilitated by the fulfilment of social responsibility. However, if corporate decision-makers perceive that the effectiveness of CSR in enhancing legitimacy is diminished in the face of uncertainty, then EPU will reduce the contribution of digital transformation to CSR.

From a stakeholder perspective, while high EPU can lead to a lack of pragmatic legitimacy for firms, digital transformation itself is an important means for firms to cope with adverse shocks from EPU. It has been shown that digital transformation improves firms’ information processing capabilities, technological innovation capabilities, and production and operational processes, enabling firms to optimize the efficiency of capital utilization within the constraints of limited financial resources, thereby enhancing financial performance [5,55]. Implementing digital transformation is a crucial strategy for dealing with the rising operational expenses and dangers caused by EPU, enabling companies to fulfill the practical legitimacy requirements of stakeholders. An empirical study by Cheng and Masron [29] confirms the positive influence of EPU on digital transformation. In a high-EPU scenario, the pragmatic legitimacy of digital firms is not a serious issue for stakeholders, but rather, they are expected to accelerate their digital transformation to cope with the adverse shocks of EPU. In this scenario, rather than causing a lack of pragmatic legitimacy, companies taking on more social responsibility would gain stakeholder support and access to scarce resources such as government subsidies and bank credit to support their digital transformation. Therefore, we infer that EPU is an important driver of digital transformation, while taking up social responsibility helps companies gain access to more resources needed for digital transformation, which will be enhanced by the combined effect of resources and motivation. Hence, we posit the following hypotheses:

Hypothesis 2:

The bidirectional relationship between digital transformation and CSR varies with EPU.

Hypothesis 2a:

EPU weakens the positive effect of digital transformation on CSR.

Hypothesis 2b:

EPU enhances the positive effect of CSR on digital transformation.

3. Empirical Design

3.1. Sample and Data

We obtained and combined data from four different avenues. First, based on previous research [58,59], we obtained ratings of CSR reports of Chinese listed companies from an impartial rating organization, Rankins CSR Ratings (RKS). Second, consistent with previous research [22,60], we used machine learning-based textual analysis of publicly traded firms’ annual reports to measure digital transformation. Thus, the annual reports of firms are also an important source of data. Third, we obtained an index of EPU in China compiled by Davis et al. [61]. Finally, we obtained microdata on the financial and corporate governance of A-share listed companies in the Shanghai and Shenzhen stock exchanges from the CSMAR database, as well as macro-level data such as GDP growth rate.

Considering the special nature of the financial statements of firms in the financial sector [62], we excluded financial companies from the sample. We further excluded companies marked as special treatment (ST, *ST) or special transfer (PT) because they exhibit unusual financial conditions and their trading regulations and stock price fluctuations differ from ordinary stocks [22]. We also excluded samples with missing data. Ultimately, our sample consisted of 468 Chinese listed companies from 2011–2018, with a total of 1439 observations.

3.2. Measurements

3.2.1. Dependent and Explanatory Variables

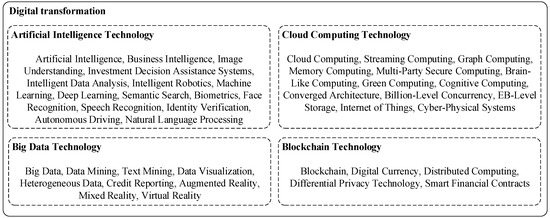

Digital transformation. Consistent with previous research [31,60], we measure digital transformation by utilizing the feature words of digital transformation identified by Wu et al. [60]. We then determine the frequency of these feature words in the annual reports of selected companies using word frequency analysis. Wu et al. [60] concluded that the digital transformation process can be categorized into two phases. The first phase involves utilizing advanced technologies like artificial intelligence, blockchain, cloud computing, and big data to enhance the digitalization of current technology systems and manufacture systems. The second phase focuses on integrating digital technologies with the core market business of the enterprise to drive innovation. Based on these two phases, Wu et al. [60] classified the digital-transformation feature-words into two dimensions: “underlying technology use” and “practical use of technology”. Considering that the sample period of this study is 2011–2018, Chinese listed companies are generally in the first phase of the digital transformation process, so we only use the characteristic words of the “underlying technology use” dimension to count the word frequency. The specific characteristic words are listed in Appendix A. Following Tian et al. [63], to mitigate the possible right-hand bias of the data, we obtain a measure of digital transformation by adding one to the frequency of the feature terms and taking the natural logarithm.

CSR. In line with earlier investigations [58,59], we utilize the scores published by RKS to assess the CSR of listed companies in China. RKS employed the MSCI KLD 400 Social Index framework and the Global Reporting Initiative (GRI 3.0) criteria to develop a CSR reporting rating system tailored to the Chinese context. The rating system contains 70 indicators in three categories: CSR strategy and innovation (14 items), disclosure content (45 items), and technical adequacy (11 items) to reflect the scope of CSR activities and the level of corporate involvement. RKS uses these indicators to assess CSR reports issued by listed companies on an anchored scale ranging from 0 to 4, with increments of 0.5 points. The three categories are weighted and averaged to obtain a final RKS score, ranging from 0 to 100. This study measures CSR by taking the natural logarithm of this score.

3.2.2. Moderating Variable

EPU. We measure EPU using the China Economic Policy Uncertainty Index developed by Davis et al. [61]. Davis et al. [61] used People’s Daily and Guangming Daily—which are authoritative newspapers in mainland China—as a search platform for news reports. They employed article content filtering to calculate the proportion of articles concerning EPU each month and normalized the resulting time-series data to the mean value. The data were calculated from October 1949 and updated on a monthly basis. As this study uses annual data for firms, we follow the method of Gulen and Ion [25] and employ a weighted average method to calculate annual indicators of EPU. Specifically, each month is weighted as 1/78, 2/78, 3/78......11/78, and 12/78 in order, and then divided by 100 to obtain the annual EPU measure. The larger the annual measurement value, the greater the level of EPU in China for that particular year.

3.2.3. Control Variables

Aside from the aforementioned variables, there are other potential variables that affect CSR and digital transformation that need to be controlled for. Detailed measurements of each variable are presented in Table 1. It should be emphasized that this study does not control for year dummies due to the presence of multicollinearity between EPU and year dummies.

Table 1.

Variable definitions.

3.3. Modeling and Estimation Approach

3.3.1. Modeling

Consistent with the prior literature [64,65], we investigate the bidirectional connection between digital transformation and CSR by developing a simultaneous equation model. The simultaneous equation consists of a CSR function and a digital transformation function, as shown in Equations (1) and (2). Both digital transformation and CSR are endogenous, and they are simultaneously influenced by each other.

To eliminate the simultaneity bias and to draw on the research design of prior studies [65,66], this research lagged the dependent variable by one period. Specifically, the dependent and explanatory variables are calculated at times t + 1 and t, respectively. By taking into account time lags, we could explore a fundamental logical question between the dependent and explanatory variables, i.e., who affects whom?

To further test whether the two-way relationship between digital transformation and CSR varies with EPU, we include EPU in the model. Specifically, we include the interaction variable between digital transformation and EPU in the CSR function (Equation (3)) and the interaction variable between CSR and EPU in the digital transformation function (Equation (4)).

3.3.2. Estimation Method

We first performed an endogeneity test (Wald test), which showed a significance level below 10%, indicating that the estimate had endogeneity problems [67]. Instrumental variables (IV) are widely used to solve endogeneity problems. In contrast, two-stage least squares (2SLS) or 3SLS yield IV estimates in a joint system of equations, which are equivalent to IV methods [65]. Moreover, compared to 2SLS, 3SLS is more effective in estimating each equation individually, as it takes into account the correlation between unobserved disturbances across different equations [68]. Considering the correlation that exists between the error terms and endogenous variables in these four equations (equations 1–4) in a joint system of equations, it is more suitable to employ 3SLS as an estimation strategy. This is because it simultaneously evaluates all equations, thereby mitigating any potential bias in the joint equations [69]. Therefore, in accordance with the methodology employed in prior research [65], we used 3SLS to estimate the simultaneous equation.

4. Results

4.1. Descriptive and Correlation Analysis

Table 2 displays all variables’ descriptive statistics and correlation analysis. Before defining the interaction terms, we standardized the independent and moderating variables to get rid of any multicollinearity that might be caused by the interaction terms [65]. To avoid potential multicollinearity problems, we computed variance inflation factors (VIFs). The findings indicated that the variables had VIFs ranging from 1.08 to 3.70, suggesting the absence of significant multicollinearity among the variables, as all the VIFs were beneath the threshold level of 10 [70].

Table 2.

Descriptive and correlation analysis of variables.

4.2. Regression Results

Table 3 displays the empirical analysis results. Models 1–4 feature CSR as the dependent variable, while Models 5–8 focus on digital transformation as the dependent variable. Model 1 demonstrates how control variables affect CSR, whereas Model 5 shows how they affect companies’ digital transformation. Next, we test hypothesis 1 by incorporating explanatory variables into models 2 and 6, which are built upon models 1 and 5, respectively. Model 2 showed that digital transformation exerts a significant and positive influence on CSR (β = 0.161, p < 0.01). Furthermore, Model 6 demonstrates that CSR exerts a significant positive influence on digital transformation (β = 2.324, p < 0.01). Thus, our empirical study indicates a mutually reinforcing two-way connection between digital transformation and CSR, and Hypotheses 1, 1a, and 1b are all supported.

Table 3.

Results of the empirical analysis.

Models 3 and 7 further incorporate EPU, and the results indicate that EPU exerts a significant negative influence on CSR (β = −0.038, p < 0.01), which aligns with the findings of Ilyas et al. [39] and Peng et al. [30]. However, it exerts a significant positive influence on digital transformation (β = 0.120, p < 0.01), which aligns with the findings of Cheng and Masron [29]. Immediately following model 3 and model 7, we examined hypothesis 2 by involving the interaction terms of the explanatory variables with EPU in models 4 and 8, respectively. Model 4 demonstrates that the coefficient of the interaction variable between digital transformation and EPU is significantly negative (β = −0.018, p < 0.01), indicating that EPU weakens the contribution of digital transformation to CSR. The findings from Model 8 show that the coefficient of the interaction variable between CSR and EPU is significantly positive (β = 0.152, p < 0.05), implying that EPU strengthens the positive influence of CSR on digital transformation, so Hypothesis 2, 2a, and 2b are all supported.

4.3. Robustness Checks

The robustness test results are displayed in Table 4. First, the textual information-based measure of digital transformation may be affected by firms’ strategic disclosure behavior, such as exaggerating the level of digital transformation in their annual reports. In view of this, drawing on a study by Jiang et al. [71], we utilize the proportion of intangible assets—disclosed in the notes of listed companies’ annual reports that are associated with digital transformation compared to total intangible assets—as a substitute measurement for digital transformation. The data is re-estimated using Model 1 and Model 5, and Table 4 presents the estimation results. As can be seen, the findings confirm that our primary conclusions remain consistent even after substituting the measure of digital transformation.

Table 4.

Robustness test results.

Next, we replace the measure of EPU. Following previous research practice [24,72], we recapture annual data on EPU by arithmetically averaging the monthly EPU index. Models 2 and 6 in Table 4 present the estimate findings and find that our main conclusions remain robust after replacing the EPU measure.

Further, drawing on Schilling and Phelps [73], we examine the time-lag effects between the dependent and explanatory variables when conducting regression analysis. Specifically, we substitute the dependent variable having a lag of one period with a lag of two periods. Model 3 and Model 7 in Table 4 present the estimate findings and find no change in our main findings.

Finally, following Almeida et al. [74], we standardized the explanatory and control variables included in the model and the estimate findings are presented in Table 3 for Model 4 and Model 8. Again, our main conclusions were unchanged.

4.4. Addition Analysis

We hypothesized that greater CSR enhances organizational legitimacy, helps companies access scarce resources (such as government subsidies and lower debt financing costs), and eases their financing constraints. This, in turn, helps facilitate their digital transformation by providing companies with the resources they need to do so. To test this view, we further assessed the impact of CSR on organizational legitimacy. In assessing legitimacy, we pay particular attention to the level of recognition of two key entities, namely, the government and banks [12,22]; we investigate the level of recognition of these two entities in terms of government subsidies and the expense of debt financing, respectively. The focus on banks is because in China, the allocation of credit resources is dominated by state-owned banks, and bank credit decisions are subject to government intervention. In addition, we examine the influence of CSR on financing constraints of firms from a holistic perspective. Financing constraints are market obstacles that might hinder companies from obtaining funding for all their targeted investments that have a positive net present value, which directly impact significant investment decisions for firms [57].

Following Cheng et al. [57], we utilize the natural logarithm of direct government subsidies to measure government subsidies. Moreover, following Vig [75], we utilize the proportion of corporate interest payments to total debt to measure the cost of debt financing. Then, following Cheng et al. [57], we utilize the WW index developed by Whited and Wu [76] as a metric for assessing financing constraints. Data on government subsidies, the cost of debt financing, and financing constraints are available from the CSMAR database. For the data analysis methodology, we used ordinary least squares estimation and constructed the following model:

where Y represents government subsidies, the cost of debt financing, and financing constraints. ControlVariables represent control variables, including firm size, profitability, growth, ownership concentration, state ownership, board size, board independence, CEO duality, GDP growth, M2 growth, GPE growth, and industry fixed effects.

The findings of data analysis are presented in Table 5. Regarding Model 1, government subsidies serve as the dependent variable. The findings show that CSR has a significant contribution to government subsidies (β = 0.410, p < 0.01), but this contribution is not affected by EPU (β = −0.076, p > 0.1). Regarding Model 2, the cost of debt financing serves as the dependent variable. The findings indicate that CSR significantly decreases the cost of debt financing (β = −0.010, p < 0.01), and this negative effect is reinforced by increased EPU (β = −0.006, p < 0.05). The dependent variable in Model 3 considers financing constraints. The findings indicate that CSR significantly decreases the financing constraints of firms (β = −0.017, p < 0.01) and that this positive impact is reinforced by increased EPU (β = −0.008, p < 0.05). Overall, the findings in Table 4 demonstrate that CSR contributes to organizational legitimacy, which in turn helps them gain more resource advantages; at the same time, this positive effect is influenced by EPU, and this effect is mainly reflected in both the cost of debt financing and capital constraints, with no significant effect on government subsidies.

Table 5.

Results of an analysis of the effect of CSR on resource advantage and the moderating effect of EPU.

5. Conclusions and Discussions

Our study investigates the bidirectional connection between digital transformation and CSR and explores how this connection varies with EPU. A sample of 468 Chinese listed companies collected from 2011–2018 was analyzed by constructing a simultaneous equation model using the 3SLS method. Upon successfully completing a battery of robustness tests, we find that there exists a mutually reinforcing bidirectional connection between digital transformation and CSR. Moreover, we find that policymakers of digitally transformed companies and stakeholders react differently in the face of adverse shocks brought about by EPU. Corporate decision-makers reduce their social responsibility commitments out of concern for pragmatic legitimacy. Conversely, for stakeholders, digital transformation itself is an important means of enhancing pragmatic legitimacy. Thus, while CSR brings about positive stakeholder responses based on securing pragmatic legitimacy through digital transformation, the drive of uncertainty towards digital transformation reinforces this positive effect, further strengthening the promoting effect of CSR on digital transformation. Our research greatly enhances the existing body of knowledge on the correlation between digital transformation and CSR and provides new perspectives for business managers to gain insight into their relationship.

5.1. Theoretical Contributions

First, this research first reveals the mutually reinforcing bidirectional connection between digital transformation and CSR. It addresses the gap in the current literature that only focuses on the one-way causal relationship between the two concepts. Although many studies in the literature emphasize that digital transformation affects CSR [17,18,19], a few scholars have highlighted that CSR helps companies garner acknowledgment and backing from stakeholders for their digital transformation [23] and that this recognition can make it easier for companies to access some scarce resources (bank credit, government subsidies). However, the impact of CSR on digital transformation was not verified further in these previous reports. In this regard, we argue that taking on more social responsibility helps companies access resources that support their digital transformation. Thus, we infer that digital transformation and CSR are highly interdependent and related, with the quest for legitimacy creating a feedback mechanism, mutually reinforcing the dynamic relationship. This inference is corroborated by our empirical research, which enhances our comprehension of the causal connection between digital transformation and CSR. More importantly, the results of this study suggest that CSR in the context of digitalization contributes to the organic unity of efficiency and legitimacy, thus expanding the discussion on efficiency and legitimacy in the field of sustainable development.

Second, our study introduces EPU into our analytical framework and confirms that the bidirectional connection between digital transformation and CSR varies with EPU. This study is therefore a clear departure from the existing research, which mostly examines the direct influence of EPU on digital transformation or CSR [29,30] and neglects the impact of EPU on their relationship. More importantly, we find that decision-makers in digital enterprises and stakeholders have different views on CSR in response to negative shocks caused by EPU. This difference has caused a change in the two-way connection between digital transformation and CSR, providing us a more profound comprehension of the interrelation between digital transformation and CSR.

Finally, our work investigates the reciprocal connection between digital transformation and CSR via the lens of organizational legitimacy, enriching and expanding the application of legitimacy theory. Moreover, this study incorporates EPU into the analytical framework of legitimacy mechanisms, confirming that the legitimacy mechanisms between digital transformation and CSR are influenced by EPU.

5.2. Practical Implications

These findings are expected to have practical consequences for companies to further optimize their strategic decisions on digital transformation and CSR in the face of adverse shocks from EPU. Business decision-makers should be fully aware of the urgent need for organizational legitimacy that arises from digital transformation, and the positive impact of CSR in enhancing organizational legitimacy. To this end, decision-makers in digital companies should form their own CSR strategies as soon as possible to better meet society’s expectations and thus obtain stakeholder recognition and support for their digital transformation.

Our findings show that CSR enhances digitalization by increasing government subsidies, reducing the cost of debt financing, and easing financing constraints. For this reason, decision-makers in digital companies should recognize that CSR is not a forced choice to increase legitimacy but rather can be used to leverage the economic benefits of CSR. It should therefore be integrated into their digital transformation strategies to improve the efficiency and value reciprocity of interactions between companies and stakeholders—thereby accelerating digital transformation.

Finally, digital business decision-makers should strive to fully understand the role of EPU. Our findings show that in a scenario of high EPU, increasing social responsibility is more likely to enhance digitalization and does not exacerbate the negative impact of EPU. Therefore, in a situation of high EPU, digitally transformed companies should take on more social responsibility to improve digitalization and thus mitigate the negative impact of EPU.

5.3. Limitations and Future Prospects

Our work has some limitations, which should be addressed in future research. First, we propose that the search for organizational legitimacy is a key mechanism driving greater social responsibility in digitally transformed firms. At the same time, we corroborate the existence of this mechanism to some extent; for example, CSR can increase access to government subsidies, diminish the cost of debt financing, and ease capital constraints. However, we were not able to directly verify the mediating role of legitimacy. Therefore, future research could expand our theoretical framework by obtaining relevant data based on a questionnaire approach. Second, although we identified that the bidirectional connection between digital transformation and social responsibility varies with EPU, previous research showed that firms have heterogeneous legitimacy [48]. For example, firms that do not have a close relationship with the government (e.g., non-state enterprises and non-politically connected firms) have only weak legitimacy [77]. Such firms may be motivated to enhance their legitimacy through CSR activities when undergoing digital transformation. Therefore, future research could further identify key factors that influence the two-way interaction between digital transformation and CSR. Finally, our study was conducted in a Chinese context; hence, the applicability of the findings may be restricted. Thus, to enhance the credibility of the findings, future study could further examine the two-way relationship between digital transformation and CSR in developed countries and other emerging economies.

Author Contributions

Conceptualization, G.H and L.S.; methodology, G.H.; software, L.S.; validation, G.H.; formal analysis, L.S.; investigation, L.S.; resources, G.H.; data curation, L.S.; writing—original draft preparation, G.H.; writing—review and editing, G.H.; visualization, G.H.; supervision, G.H.; project administration, G.H.; funding acquisition, G.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Social Science Foundation of Guangdong, grant number GD23YGL06; Guangdong Basic and Applied Basic Research Foundation, grant number 2022A1515110506.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Feature Words for Companies’ Digital Transformation

Figure A1.

Structural feature words concerning the digital transformation of companies.

Figure A1.

Structural feature words concerning the digital transformation of companies.

References

- Schaltegger, S.; Hörisch, J. In Search of the Dominant Rationale in Sustainability Management: Legitimacy- or Profit-Seeking? J. Bus. Ethics 2017, 145, 259–276. [Google Scholar] [CrossRef]

- Hinings, B.; Gegenhuber, T.; Greenwood, R. Digital innovation and transformation: An institutional perspective. Inf. Organ. 2018, 28, 52–61. [Google Scholar] [CrossRef]

- Singh, S.; Sharma, M.; Dhir, S. Modeling the effects of digital transformation in Indian manufacturing industry. Technol. Soc. 2021, 67, 101763. [Google Scholar] [CrossRef]

- Manesh, M.F.; Pellegrini, M.M.; Marzi, G.; Dabic, M. Knowledge Management in the Fourth Industrial Revolution: Mapping the Literature and Scoping Future Avenues. IEEE Trans. Eng. Manag. 2021, 68, 289–300. [Google Scholar] [CrossRef]

- Sousa-Zomer, T.T.; Neely, A.; Martinez, V. Digital transforming capability and performance: A microfoundational perspective. Int. J. Oper. Prod. Man. 2020, 40, 1095–1128. [Google Scholar] [CrossRef]

- van den Broek, T.; van Veenstra, A.F. Governance of big data collaborations: How to balance regulatory compliance and disruptive innovation. Technol. Forecast. Soc. 2018, 129, 330–338. [Google Scholar] [CrossRef]

- Mittal, S.; Khan, M.A.; Purohit, J.K.; Menon, K.; Romero, D.; Wuest, T. A smart manufacturing adoption framework for SMEs. Int. J. Prod. Res. 2020, 58, 1555–1573. [Google Scholar] [CrossRef]

- Deephouse, D.L.; Suchman, M. Legitimacy in Organizational Institutionalism. Soc. Sci. Electron. Publ. 2016, 49, 77. [Google Scholar]

- Suddaby, R.; Greenwood, R. Rhetorical strategies of legitimacy. Adm. Sci. Quart. 2005, 50, 35–67. [Google Scholar] [CrossRef]

- Wang, H.; Jia, M.; Zhang, Z. Good Deeds Done in Silence: Stakeholder Management and Quiet Giving by Chinese Firms. Organ. Sci. 2021, 32, 527–908. [Google Scholar] [CrossRef]

- Xiang, Y.; Jia, M.; Zhang, Z. Hiding in the Crowd: Government Dependence on Firms, Management Costs of Political Legitimacy, and Modest Imitation. J. Bus. Ethics 2022, 176, 629–646. [Google Scholar] [CrossRef]

- Huang, G.; Ye, F.; Li, Y.; Chen, L.; Zhang, M. Corporate social responsibility and bank credit loans: Exploring the moderating effect of the institutional environment in China. Asia Pac. J. Manag. 2023, 40, 707–742. [Google Scholar] [CrossRef]

- Wang, H.; Qian, C. Corporate Philanthropy and Financial Performance: The Roles of Social Expectations and Political Access. Acad. Manag. J. 2011, 54, 1159–1181. [Google Scholar] [CrossRef]

- Liu, Z.J.; Li, W.; Hao, C.; Liu, H. Corporate environmental performance and financing constraints: An empirical study in the Chinese context. Corp. Soc. Resp. Environ. Manag. 2021, 28, 616–629. [Google Scholar] [CrossRef]

- Xu, Q.; Li, X.; Guo, F. Digital transformation and environmental performance: Evidence from Chinese resource-based enterprises. Corp. Soc. Resp. Environ. Manag. 2023, 30, 1816–1840. [Google Scholar] [CrossRef]

- Zhao, X.; Zhao, L.; Sun, X.; Xing, Y. The incentive effect of government subsidies on the digital transformation of manufacturing enterprises. Int. J. Emerg. Mark. 2023; ahead-of-print. [Google Scholar]

- Choi, H.; Park, J. Do data-driven CSR initiatives improve CSR performance? The importance of big data analytics capability. Technol. Forecast. Soc. 2022, 182, 121802. [Google Scholar] [CrossRef]

- Kong, D.; Liu, B. Digital Technology and Corporate Social Responsibility: Evidence from China. Emerg. Mark. Financ. Trade 2023, 59, 2967–2993. [Google Scholar] [CrossRef]

- Li, L. Digital transformation and sustainable performance: The moderating role of market turbulence. Ind. Market Manag. 2022, 104, 28–37. [Google Scholar] [CrossRef]

- Li, G.; Li, N.; Sethi, S.P. Does CSR Reduce Idiosyncratic Risk? Roles of Operational Efficiency and AI Innovation. Prod. Oper. Manag. 2021, 30, 2027–2045. [Google Scholar] [CrossRef]

- Tuyen, B.Q.; Phuong Anh, D.V.; Mai, N.P.; Long, T.Q. Does corporate engagement in social responsibility affect firm innovation? The mediating role of digital transformation. Int. Rev. Econ. Financ. 2023, 84, 292–303. [Google Scholar] [CrossRef]

- Zhong, X.; Chen, W.; Ren, G. The impact of corporate social irresponsibility on emerging-economy firms’ long-term performance: An explanation based on signal theory. J. Bus. Res. 2022, 144, 345–357. [Google Scholar] [CrossRef]

- Jang, S.; Kim, B.; Lee, S. Impact of corporate social (ir)responsibility on volume and valence of online employee reviews: Evidence from the tourism and hospitality industry. Tour. Manag. 2022, 91, 104501. [Google Scholar] [CrossRef]

- Akron, S.; Demir, E.; Esteban, J.M.D.; García-Gómez, C. Economic policy uncertainty and corporate investment: Evidence from the U.S. hospitality industry. Tour. Manag. 2020, 77, 104019. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- Fedorova, E.; Ledyaeva, S.; Drogovoz, P.; Nevredinov, A. Economic policy uncertainty and bankruptcy filings. Int. Rev. Financ. Anal. 2022, 82, 102174. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing Legitimacy: Strategic and Institutional Approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Lin, W.L.; Law, S.H.; Ho, J.A.; Sambasivan, M. The causality direction of the corporate social responsibility—Corporate financial performance Nexus: Application of Panel Vector Autoregression approach. N. Am. J. Econ. Financ. 2019, 48, 401–418. [Google Scholar] [CrossRef]

- Cheng, Z.; Masron, T.A. Economic policy uncertainty and corporate digital transformation: Evidence from China. Appl. Econ. 2023, 55, 4625–4641. [Google Scholar] [CrossRef]

- Peng, D.; Colak, G.; Shen, J. Lean against the wind: The effect of policy uncertainty on a firm’s corporate social responsibility strategy. J. Corp. Financ. 2023, 79, 102376. [Google Scholar] [CrossRef]

- Zhu, Z.; Song, T.; Huang, J.; Zhong, X. Executive Cognitive Structure, Digital Policy, and Firms’ Digital Transformation. IEEE T Eng. Manag. 2022, 71, 2579–2592. [Google Scholar] [CrossRef]

- Na, C.H.; Chen, X.; Li, X.J.; Li, Y.T.; Wang, X.L. Digital Transformation of Value Chains and CSR Performance. Sustainability 2022, 14, 10245. [Google Scholar] [CrossRef]

- Okorie, O.; Russell, J.; Cherrington, R.; Fisher, O.; Charnley, F. Digital transformation and the circular economy: Creating a competitive advantage from the transition towards Net Zero Manufacturing. Resour. Conserv. Recycl. 2023, 189, 106756. [Google Scholar] [CrossRef]

- Chen, P.; Hao, Y. Digital transformation and corporate environmental performance: The moderating role of board characteristics. Corp. Soc. Resp. Environ. Manag. 2022, 29, 1757–1767. [Google Scholar] [CrossRef]

- Ye, F.; Ouyang, Y.; Li, Y. Digital investment and environmental performance: The mediating roles of production efficiency and green innovation. Int. J. Prod. Econ. 2023, 259, 108822. [Google Scholar] [CrossRef]

- Ahmadova, G.; Delgado-Márquez, B.L.; Pedauga, L.E.; Leyva-de La Hiz, D.I. Too good to be true: The inverted U-shaped relationship between home-country digitalization and environmental performance. Ecol. Econ. 2022, 196, 107393. [Google Scholar] [CrossRef]

- Alkaraan, F.; Albitar, K.; Hussainey, K.; Venkatesh, V.G. Corporate transformation toward Industry 4.0 and financial performance: The influence of environmental, social, and governance (ESG). Technol. Forecast. Soc. 2022, 175, 121423. [Google Scholar] [CrossRef]

- Chen, W. Digital economy development, corporate social responsibility and low-carbon innovation. Corp. Soc. Resp. Environ. Manag. 2023, 30, 1664–1679. [Google Scholar] [CrossRef]

- Ilyas, M.; Mian, R.U.; Suleman, M.T. Economic policy uncertainty and firm propensity to invest in corporate social responsibility. Manag. Decis. 2022, 60, 3232–3254. [Google Scholar] [CrossRef]

- Vural-Yava, I.D. Economic policy uncertainty, stakeholder engagement, and environmental, social, and governance practices: The moderating effect of competition. Corp. Soc. Resp. Environ. Manag. 2021, 28, 82–102. [Google Scholar] [CrossRef]

- Yuan, T.; Wu, J.G.; Qin, N.; Xu, J. Being nice to stakeholders: The effect of economic policy uncertainty on corporate social responsibility. Econ. Model. 2022, 108, 105737. [Google Scholar] [CrossRef]

- Zhao, T.; Xiao, X.; Zhang, B. Economic policy uncertainty and corporate social responsibility performance: Evidence from China. Sustain. Account. Manag. Policy J. 2021, 12, 1003–1026. [Google Scholar] [CrossRef]

- Zou, H.L.; Wang, R.J.; Qi, G.Y. The Response of CSR to Economic Policy Uncertainty: Evidence from China. Sustainability 2023, 15, 12978. [Google Scholar] [CrossRef]

- Chahine, S.; Daher, M.; Saade, S. Doing good in periods of high uncertainty: Economic policy uncertainty, corporate social responsibility, and analyst forecast error. J. Financ. Stabil. 2021, 56, 100919. [Google Scholar] [CrossRef]

- Ozdemir, O.; Erkmen, E.; Han, W. EPU and financial performance in the hospitality and tourism industry: Moderating effect of CSR, institutional ownership and cash holding. Tour. Manag. 2023, 98, 104769. [Google Scholar] [CrossRef]

- Zhu, H.; Hui, K.N.; Gong, Y. Uncovering the nonmarket side of internationalization: The Belt and Road Initiative and Chinese firms’ CSR reporting quality. Asia Pac. J. Manag. 2022, 40, 1703–1731. [Google Scholar] [CrossRef]

- Saeed, A.; Baloch, M.S.; Riaz, H. Global Insights on TMT Gender Diversity in Controversial Industries: A Legitimacy Perspective. J. Bus. Ethics 2022, 179, 711–731. [Google Scholar] [CrossRef]

- Darendeli, I.S.; Hill, T.L. Uncovering the complex relationships between political risk and MNE firm legitimacy: Insights from Libya. J. Int. Bus. Stud. 2016, 47, 68–92. [Google Scholar] [CrossRef]

- Huang, H.; Shang, R.; Wang, L.; Gong, Y. Corporate social responsibility and firm value: Evidence from Chinese targeted poverty alleviation. Manag. Decis. 2022, 60, 3255–3274. [Google Scholar] [CrossRef]

- Reihlen, M.; Schlapfner, J.F.; Seeger, M.; Trittin-Ulbrich, H. Strategic Venturing as Legitimacy Creation: The Case of Sustainability. J. Manag. Stud. 2022, 59, 417–459. [Google Scholar] [CrossRef]

- Feng, Y.T.; Lai, K.H.; Zhu, Q.H. Legitimacy in operations: How sustainability certification announcements by Chinese listed enterprises influence their market value? Int. J. Prod. Econ. 2020, 224, 107563. [Google Scholar] [CrossRef]

- Meqbel, R.; Altaany, M.; Kayed, S.; Al-Omush, A. Earnings management and sustainability assurance: The moderating role of CSR committee. Corp. Soc. Resp. Environ. Manag. 2023; early view. [Google Scholar] [CrossRef]

- Marano, V.; Tashman, P.; Kostova, T. Escaping the iron cage: Liabilities of origin and CSR reporting of emerging market multinational enterprises. J. Int. Bus. Stud. 2017, 48, 386–408. [Google Scholar] [CrossRef]

- Du, S.; Vieira, E.T. Striving for Legitimacy Through Corporate Social Responsibility: Insights from Oil Companies. J. Bus. Ethics 2012, 110, 413–427. [Google Scholar] [CrossRef]

- Mangematin, V.; Sapsed, J.; Schüßler, E. Disassembly and reassembly: An introduction to the Special Issue on digital technology and creative industries. Technol. Forecast. Soc. Chang. 2014, 83, 1–9. [Google Scholar] [CrossRef]

- Xu, G.; Li, G.; Sun, P.; Peng, D. Inefficient investment and digital transformation: What is the role of financing constraints? Financ. Res. Lett. 2023, 51, 103429. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate Social Responsibility and Access to Finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Li, S.; Lu, J.W. A Dual-Agency Model of Firm CSR in Response to Institutional Pressure: Evidence from Chinese Publicly Listed Firms. Acad. Manag. J. 2020, 63, 2004–2032. [Google Scholar] [CrossRef]

- Wang, H.L.; Jia, M.; Xiang, Y.; Lan, Y. Social Performance Feedback and Firm Communication Strategy. J. Manag. 2022, 48, 2382–2420. [Google Scholar] [CrossRef]

- Wu, K.; Fu, Y.; Kong, D. Does the digital transformation of enterprises affect stock price crash risk? Financ. Res. Lett. 2022, 48, 102888. [Google Scholar] [CrossRef]

- Davis, S.J.; Liu, D.; Sheng, X.S. Economic policy uncertainty in china since 1946: The view from mainland newspapers. Work. Paper 2019. [Google Scholar]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State Ownership and Firm Innovation in China: An Integrated View of Institutional and Efficiency Logics. Adm. Sci. Quart. 2016, 62, 375–404. [Google Scholar] [CrossRef]

- Tian, G.; Li, B.; Cheng, Y. Does digital transformation matter for corporate risk-taking? Financ. Res. Lett. 2022, 49, 103107. [Google Scholar] [CrossRef]

- Ghose, A.; Ipeirotis, P.; Li, B. Examining the Impact of Ranking on Consumer Behavior and Search Engine Revenue. Manag. Sci. Forthcom. 2014, 60, 1632–1654. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, K. Network growth dynamics: The simultaneous interaction between network positions and research performance of collaborative organisations. Technovation 2022, 115, 102538. [Google Scholar] [CrossRef]

- Rosiello, A.; Maleki, A. A dynamic multi-sector analysis of technological catch-up: The impact of technology cycle times, knowledge base complexity and variety. Res. Policy 2021, 50, 104194. [Google Scholar] [CrossRef]

- Honjo, Y. The impact of founders’ human capital on initial capital structure: Evidence from Japan. Technovation 2021, 100, 102191. [Google Scholar] [CrossRef]

- Wooltridge, J.M. Econometrics Analysis of Cross-Section and Panel Data; The MIT Press: Cambridge, MA, USA; London, UK, 2001; Volume 1, pp. 206–209. [Google Scholar]

- Heshmati, A.; Kim, H.S. The R&D and productivity relationship of Korean listed firms. J. Prod. Anal. 2011, 36, 125–142. [Google Scholar]

- Godart, F.C.; Shipilov, A.V.; Claes, K. Making the Most of the Revolving Door: The Impact of Outward Personnel Mobility Networks on Organizational Creativity. Organ. Sci. 2013, 25, 377–400. [Google Scholar] [CrossRef]

- Jiang, K.; Du, X.; Chen, Z. Firms’ digitalization and stock price crash risk. Int. Rev. Financ. Anal. 2022, 82, 102196. [Google Scholar] [CrossRef]

- Lou, Z.; Chen, S.; Yin, W.; Zhang, C.; Yu, X. Economic policy uncertainty and firm innovation: Evidence from a risk-taking perspective. Int. Rev. Econ. Financ. 2022, 77, 78–96. [Google Scholar] [CrossRef]

- Schilling, M.A.; Phelps, C.C. Interfirm Collaboration Networks: The Impact of Large-Scale Network Structure on Firm Innovation. Manag. Sci. 2007, 53, 1113–1126. [Google Scholar] [CrossRef]

- Almeida, P.; Phene, A.; Li, S. The Influence of Ethnic Community Knowledge on Indian Inventor Innovativeness. Organ. Sci. 2014, 26, 221671228. [Google Scholar] [CrossRef]

- Vig, V. Access to Collateral and Corporate Debt Structure: Evidence from a Natural Experiment. J. Financ. 2013, 68, 881–928. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G.J. Financial constraints risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Sun, S.L.; Peng, M.W.; Tan, W. Institutional relatedness behind product diversification and international diversification. Asia Pac. J. Manag. 2017, 34, 339–366. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).