Abstract

Sustainable economic decision making increasingly requires robust methodologies capable of withstanding deep uncertainty, particularly in volatile financial and resource-constrained environments. This paper introduces a unified optimization framework based on nonlinear scalarizing functionals, designed to support resilient planning under structural ambiguity. By integrating performance objectives with risk boundaries, the proposed model generalizes classical robustness paradigms—such as strict and reliable robustness—into a single tractable and economically interpretable formulation. A key innovation lies in translating scenario-based uncertainty into a directional performance index, aligned with stakeholder-defined sustainability criteria and encoded via a preference vector k. This scalarization approach supports behaviorally consistent and computationally efficient decision-making even in the absence of complete probabilistic information. A case study in multi-scenario portfolio allocation demonstrates the model’s capacity to maintain return stability while respecting predefined risk tolerances. Computational benchmarks confirm the framework’s scalability to larger problem instances, validating its practical applicability. Beyond financial applications, the model also holds promise for sustainable policy design, infrastructure planning, and resource allocation under deep uncertainty. This work contributes to bridging the gap between abstract optimization theory and applied sustainability challenges, offering a robust and adaptive decision-support tool for real-world implementation.

1. Introduction

In an era where sustainability is no longer optional but imperative, economic decision-making must be equipped to navigate uncertainty with both resilience and foresight. Optimization problems arising in economic, financial, and engineering systems are often plagued by significant uncertainty in their input parameters. Classical optimization techniques typically rely on the assumption of complete and accurate knowledge regarding all relevant data; however, such assumptions rarely hold in practice. Variations in market conditions, model misspecification, and data estimation errors frequently lead to suboptimal or even misleading results when deterministic approaches are applied [1,2].

To address these limitations, robust optimization (RO) has emerged as a powerful modeling paradigm for decision-making under uncertainty. Rather than optimizing for a single, potentially inaccurate scenario, RO seeks strategies that perform acceptably across a spectrum of plausible configurations—an approach particularly valuable for sustainable resource allocation and resilient economic planning. Seminal contributions by Ben-Tal and Nemirovski [3,4], as well as El Ghaoui and Lebret [5], have laid the theoretical foundation for robust optimization, introducing duality principles, tractable reformulations, and structured uncertainty sets. These foundations have been widely extended [6], with applications in portfolio optimization [4,7], control systems [8], logistics [9], and infrastructure planning [10,11].

Traditional RO techniques operate by defining convex uncertainty sets and enforcing worst-case performance guarantees. This idea is exemplified by the robust counterpart formulation [12], enriched later through polyhedral and ellipsoidal models [3,6,13]. Recent developments have focused on data-driven uncertainty sets [13,14], entropy-based robustness metrics [15], and scalarization methods from multi-objective optimization [16,17,18], thereby improving the flexibility and interpretability of RO in practice.

A key innovation in modern RO theory is the integration of value-driven decision criteria, enabling models to reflect real-world preferences. Scalarizing functionals are central to this evolution: they map multi-scenario evaluations into interpretable scalar indices, facilitating both comparison and optimization [16,19]. This aligns with classical economic notions such as risk aversion and supports behavioral interpretations of robustness [20]. Despite the field’s maturity, a key challenge remains: to construct robust models that are both theoretically rigorous and economically interpretable. In particular, the encoding of investor preferences and structural feasibility through directional scalarization continues to attract interest [17,21]. Recent studies have also explored entropy-inspired formulations [15], behavioral robustness [22], and automated solution methods [8,23], reflecting the demand for robust yet accessible decision-support tools.

In line with these developments, recent literature published in journals such as OMEGA, Sustainability, and JOTA has explored robust methods in energy planning, logistics, and environmental policy, yet often remains context-specific or lacks general interpretability [1,2,15]. Classical paradigms such as strict robustness [3], adjustable robustness [7], and distributionally robust optimization [17] each bring useful insights but are limited in scope or generality. Strict robustness emphasizes feasibility under all uncertainty realizations but tends to be overly conservative. Adjustable robustness allows for post-realization adjustment but adds complexity, while distributionally robust optimization models probability ambiguity at the cost of stronger assumptions.

As global economic systems face increasing levels of uncertainty, volatility, and structural disruption, the need for robust and adaptable decision-making frameworks has become more pronounced. This is particularly true in contexts where sustainability objectives—such as long-term stability, efficient resource allocation, and risk resilience—intersect with economic planning under ambiguity. In this landscape, robust optimization techniques are not merely mathematical constructs but rather essential tools for ensuring that decisions remain feasible, consistent, and aligned with broader sustainability goals across a variety of scenarios.

Within this conceptual space, the present work introduces a scalarization-based robust optimization framework that unifies strict and reliable robustness within a single coherent model. By interpreting robustness as a directional projection within a risk-constrained space, the model preserves feasibility under uncertainty while offering a clear economic interpretation. Rather than seeking to replace existing robust techniques, this approach complements them by offering a versatile and interpretable alternative that captures both structural constraints and behavioral preferences. In doing so, the model bridges geometric robustness and sustainable economic decision-making, contributing to the development of resilient, uncertainty-aware optimization strategies.

To highlight the distinctiveness of this approach, we include a comparative table (Table 1) summarizing the main characteristics of our scalarization-based method relative to classical robust optimization frameworks. The key advantage lies in its ability to incorporate multi-criteria preferences via directional performance indices without relying on prior distributional assumptions, making it well-suited to sustainable decision-making contexts.

Table 1.

Comparative analysis of robust optimization frameworks.

The remainder of the paper is structured as follows. Section 2 presents the scalarization-based formulation, explains the mathematical construction, and illustrates the method using a portfolio selection case study. Section 3 discusses the numerical results, and Section 4 offers concluding remarks along with directions for future research, including generalizations to infinite-dimensional settings and the integration of coherent risk measures. Ultimately, this work aims to support sustainable economic decision-making by providing a robust, interpretable, and adaptable optimization framework suited for long-term planning under uncertainty.

2. Materials and Methods

2.1. Statement and Interpretation of the Problem from the Economic Point of View

In the context of financial decision-making, portfolio optimization remains a central concern due to its significance in the efficient allocation of resources under uncertainty. A portfolio of financial assets can be interpreted as a weighted combination of investments across various instruments, with weights representing the proportion of capital allocated to each asset. Let us consider a portfolio composed of n assets, where the investment decisions are represented by a weight vector , indicating the set of proportions of capital allocated to each asset. From a sustainability perspective, portfolio decisions are not only about maximizing returns but also about ensuring long-term resilience and responsible capital allocation in uncertain environments.

We define the following sets and vectors:

- , the set of weight vectors associated with very low-risk investments.

- , the set of admissible portfolios, reflecting feasible investment allocations.

- , a reference direction vector that represents the profile of profitable investments.

A key assumption is that the low-risk set B satisfies the condition , which intuitively means that any scaled version of the profitable direction k (t⋅k), when added to a low-risk investment (b′), results in a new investment (b′ + t⋅k) that still lies within the low-risk set .

To evaluate the profitability and risk-adjusted quality of a given investment y, we define the scalarizing functional:

which represents the maximum scalar multiple of k that can be added to y to belong B. Economically, this captures the degree to which an admissible investment can be “aligned” with the profitable direction k, while remaining within acceptable risk levels.

The optimization problem then becomes:

which seeks the admissible portfolio y ∈ that achieves the highest .

While the proposed scalarization-based robust optimization model is formulated in a mathematically general framework, certain limitations regarding its applicability across diverse fields must be acknowledged. In particular, the approach assumes access to well-defined objective functions, quantifiable trade-offs, and structured uncertainty scenarios. These conditions may not hold in domains involving qualitative decision criteria, ill-structured data, or dynamically evolving systems with limited predictability. To enhance the model’s applicability, future research could explore extensions involving alternative uncertainty representations such as fuzzy sets or belief structures, integration with AI-based inference for handling non-convex or learning-driven dynamics, and participatory optimization frameworks that incorporate behavioral feedback and stakeholder-driven objectives. These enhancements would enable the application of the proposed methodology in complex fields such as environmental policy, disaster risk planning, and sustainable healthcare systems.

2.2. Optimization Under Uncertainty Using Nonlinear Scalarizing Functionals and Robustness Concepts

2.2.1. Formulation Optimization Problem with Nonlinear Scaling Functionals ()

In real-world financial contexts, data such as expected returns, volatilities, and correlations are rarely known with certainty. These parameters are often estimated from historical data and are subject to errors, structural breaks, and market volatility. To address these challenges, we extend the scalarization-based optimization framework to account explicitly for uncertainty using the robust optimization technique.

Moreover, the selection of the scalarizing function should be made in accordance with the economic nature of the problem and the preferences of the stakeholders. For instance, when the decision-maker aims to ensure robustness under the worst-case scenario, a scalarizing function emphasizing maximin behavior is appropriate, typically using a direction vector aligned with the worst outcome. Conversely, when the decision-maker is willing to accept bounded uncertainty or has clear aspiration levels, scalarizing functions based on target-oriented or utility-based approaches can be employed. In sustainability-related decisions, the scalarization may incorporate ESG-related indicators directly into the trade-off structure to reflect environmental or social priorities.

Let Y be a topological linear space and k ∈ Y\ be a fixed-direction vector representing the orientation of profitable decisions.

Let ⊂ Y and ⊂ Y be a proper subset of Y. Suppose that (#).

We define : Y → R ∪ {±∞}, = sup {t ∈ R/y ∈ B − t⋅k}.

We search .

In this extended formulation, the scalar function serves as a directional performance indicator, where the vector encodes stakeholder preferences across multiple sustainability criteria. The components of k reflect the relative importance of objectives such as return, risk, or liquidity, and thereby allow for tailored prioritization according to the decision-maker’s perspective. From an economic standpoint, this representation enables flexible trade-offs: for instance, amplifying risk aversion through higher weights on variance components or promoting liquidity by emphasizing low-volatility assets. Moreover, the scalarization transforms scenario-dependent evaluations f (x, into a single-index measure that facilitates robust optimization under uncertainty. Variations in S(x) across different reflect how robust a solution is in a given direction, essentially turning the scalar into a directional robustness index. This approach provides both tractability and interpretability while preserving sensitivity to stakeholder-defined sustainability priorities.

2.2.2. Formulation of the Optimization Problem Under Uncertainty Using Concepts of Robustness ()

Robust optimization has become very popular in recent years because it is a realistic approach. Usually, when we solve an OP, all its parameters are known. However, in most real-world applications, there are certain parameters that are not accurately known and are available only as estimates or with many possible values.

In this paper, we assume that the set of scenarios is an interval.

We formulate an optimization problem under uncertainty.

An optimization problem under uncertainty is defined as an optimization problem with parameter (OP uncertain) (Q(ξ), ξ ∈ ), where, for ξ0 ∈ given, the optimization problem is:

At the time of OP uncertain to be solved, it is not known which value ξ ∈ will take. We call ∈ the nominal value, i.e., the value of ξ which is assumed to be true at the present time. Q () is called the nominal problem.

In this paper, we assume that there are maximum problems that will be proposed in the following sections. Next, we will assign optimization problem conditions with an equivalent robust uncertainty. Note:

- OP = real-world optimization problem.

- = counterpart robust optimization problem.

- = the problem formulated with linear scalarizing functionals.

In conclusion, the optimization problem can be addressed as follows:

- OP (formulated with economic concepts) ↔ ⇔ ↔ OP (under uncertainty), or Financial Market ↔ F of ↔ constraints in

- Financial Market ↔ k of ↔ x of

This unified formulation allows us to interpret robustness, not only as protection against uncertainty but also as a nonlinear projection toward profitability under structural risk constraints. Viewed through the lens of sustainability, this interpretation aligns with the need for resilient and responsible financial strategies that remain viable across a range of uncertain futures.

2.2.3. Strict Robustness

The convenience of the objective function value is maximized in order to achieve a sufficiently good solution, even in the worst case. It is intended that all restrictions be checked for each scenario ξ ∈ .

Then, the strictly robust counterpart equivalence robust optimization problem (Q(ξ), ξ ∈ ) is given by

In [14], it was demonstrated that (sR) can be characterized through a scaling function zB,k by appropriately selecting the parameters k and .

2.2.4. Reliable Robustness

When it is difficult or impossible to find a solution that satisfies all constraints for all scenarios, we introduce reliable robustness. Instead of working with restrictions , in this case, we allow the constraints to satisfy a tolerance δi ∈ R− provided that the possible solution for obtaining a restriction is weak . However, initial nominal constraints must be verified, i.e., , .

The reliable robust optimization problem is

In [14], it is demonstrated that (sR) can be characterized through a scaling function zB,k by appropriately selecting the parameters k and .

2.3. Case Studies

To illustrate the theoretical framework developed in the previous sections, we consider a portfolio optimization problem involving three risky assets, denoted by A, B, and C. The investor is tasked with allocating capital among these assets in the presence of uncertainty regarding future market conditions, represented by a finite set of four possible scenarios, denoted by = {ξ1, ξ2, ξ3, ξ4}. This scenario-based setup also serves as a proxy for sustainable investment planning, where robustness under multiple futures is essential for economic resilience. For any allocation vector x ∈ R+3, we define:

- -

- f (x,ξ) is the return associated with allocation x under scenario ξ.

- -

- μ (x,ξ) represents a risk measure associated with scenario ξ.

- -

- ε is the investor’s risk tolerance level.

- -

- F (x,ξ) ≥ 0, i.e., the feasibility constraint that must be satisfied in each scenario ξ of U, reflecting regulatory, budgetary, or structural requirements.

We define the set Bε ⊂ R4 as the collection of return vectors (f(x,ξ1),…,f(x,ξ4) ) corresponding to portfolios whose risk remains below the investor’s tolerance level in all scenarios, i.e., μ(x,ξi) < ε for all i = 1,…,4, which corresponds to all portfolios whose associated risk remains below the tolerance level ε in each scenario.

The admissible set F ⊂ R4 contains all return vectors that satisfy the feasibility condition F(x,ξ) ≥ 0 in every scenario. The reference direction vector is taken as k = (1,1,1,1), representing a uniform preference for increasing returns across all scenarios. We assume the scalarization condition − t⋅k ⊇ for all t ≥ 0, ensuring that the nonlinear functional is well defined and satisfies the structural requirements outlined in Section 2.2. The investor’s objective is to identify a portfolio x ∈ R+3 that maximizes the worst-case return across all scenarios, while remaining feasible. This leads to the robust optimization problem:

Using the equivalence result established earlier, this robust formulation can be recast into a scalar optimization problem of the form , where is the nonlinear scalarizing functional defined as = sup {t ∈ R/y ∈ − t⋅k}.

Under the stated assumptions, the two problems are equivalent, and the scalarization approach provides a mathematically consistent and computationally tractable method to determine robust investment strategies in the presence of uncertainty.

Under convexity assumptions, the scalar optimization problem satisfies standard Karush–Kuhn–Tucker (KKT) optimality conditions, which facilitate both interpretability and reproducibility of the solution.

2.4. Equivalence with Classical Robust Optimization Paradigms

The scalarization-based robust optimization model proposed in this study generalizes foundational principles of classical robust optimization by embedding uncertainty management within a geometric and preference-sensitive framework. Specifically, we consider the scalar optimization problem:

which defines robustness as the extent to which a given outcome y can be translated in the direction of vector k while remaining within a reference set B. The scalar value thus serves as a directional robustness index, quantifying the allowable deviation before exiting the feasible region.

We demonstrate that if the direction vector k is chosen to align with the worst-case performance axis—such as the direction of maximum cost or minimal return—the scalar function becomes equivalent to the strict robustness criterion of Ben-Tal and Nemirovski. In this regime, the scalarization encodes a hard feasibility requirement across all uncertainty realizations, mirroring the conservative nature of classical robust formulations. Alternatively, when the vector k reflects a balanced trade-off—such as between expected return and acceptable risk—the scalarization behaves like a reliable robustness criterion. In this case, the solution is allowed to slightly exceed constraint bounds within controlled margins, and the reference set B encodes a relaxed feasibility region that accounts for tolerances. This structure corresponds to soft-robustness frameworks developed in more recent literature.

This dual interpretability confirms that the scalarization-based formulation not only generalizes but also unifies classical robustness paradigms. It inherits the guarantees of strict robustness while incorporating behavioral nuance, making it well-suited for applications in sustainable economic planning where hard constraints and stakeholder-driven flexibility must be reconciled.

Compared to alternative approaches, such as strict robustness, adjustable robustness, and distributionally robust optimization (DRO), our scalarization-based model provides a balanced and interpretable framework for sustainable economic planning. Strict robustness ensures feasibility under all uncertainty realizations but often leads to overly conservative solutions, limiting practical applicability in sustainability contexts where flexibility is key. Adjustable robustness allows decision adaptivity but typically demands complex rule-based formulations that may be computationally burdensome. DRO models benefit from ambiguity-set structures but may lack interpretability and explicit control over trade-offs. In contrast, scalarization allows the direct embedding of sustainability priorities (e.g., ESG goals) within the optimization direction or benchmark set, offering clarity, adaptability, and computational tractability for long-term planning under uncertainty.

2.5. Guidelines for Parameter Selection

The efficacy and interpretability of the scalarization-based robust optimization framework depend critically on the appropriate calibration of two key parameters: the direction vector and the reference set . This section provides practical guidelines for their selection, ensuring both mathematical rigor and real-world relevance.

The vector k captures the decision-maker’s preferences over multiple objectives—typically return, risk, and liquidity. In sustainability contexts, the components of k can reflect broader ESG goals—for instance, prioritizing environmental stability or social inclusion alongside financial performance.

The reference set defines the threshold of acceptable performance across all considered criteria. It typically encodes institutional constraints such as minimum return requirements, maximum volatility bounds, or regulatory compliance targets.

By thoughtfully selecting k and , decision-makers can tailor the scalarization process to reflect their strategic priorities, institutional context, and acceptable risk exposure. This enhances the transparency and applicability of the model while ensuring that robustness is interpreted consistently with stakeholder values and policy goals.

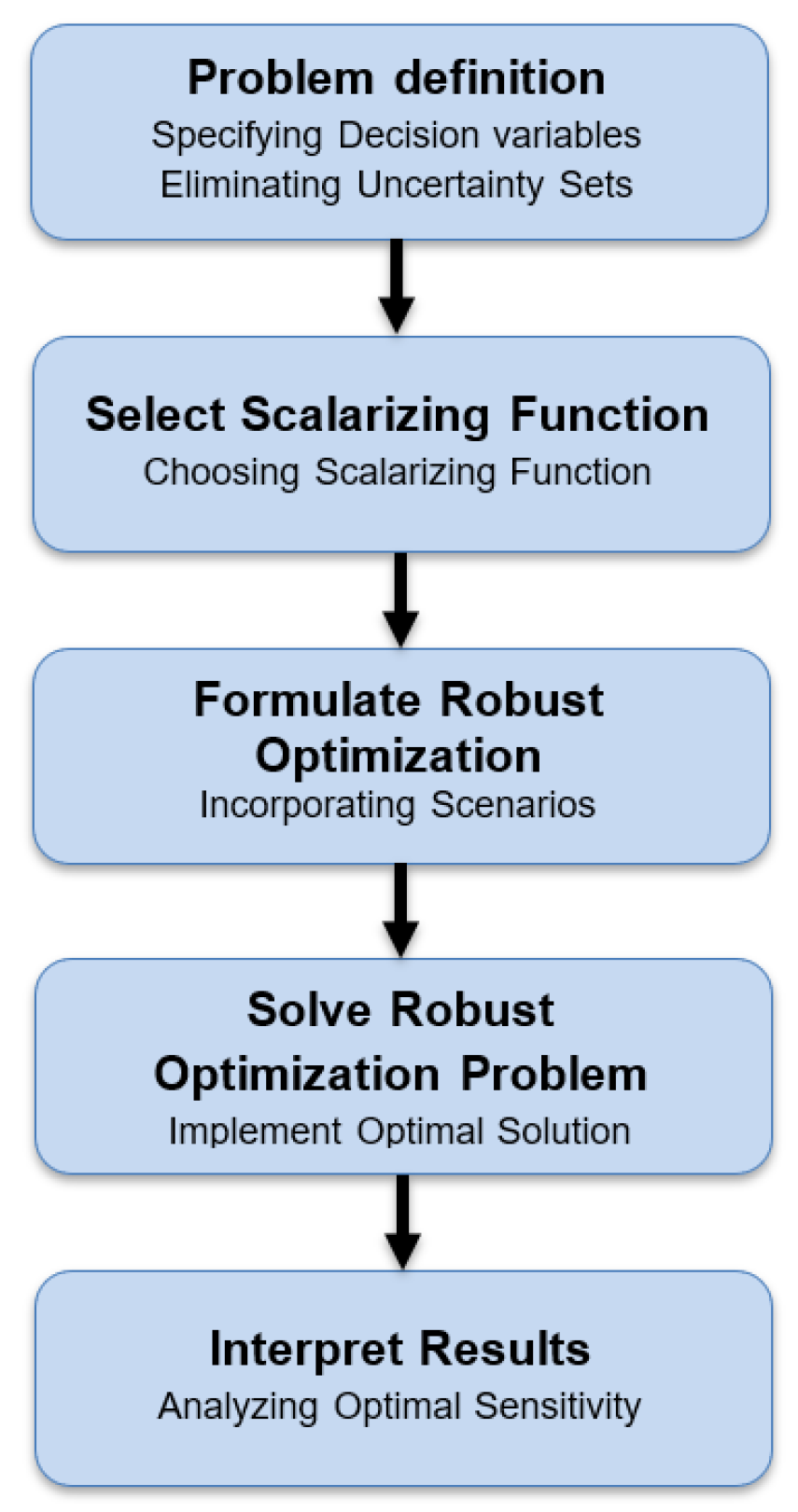

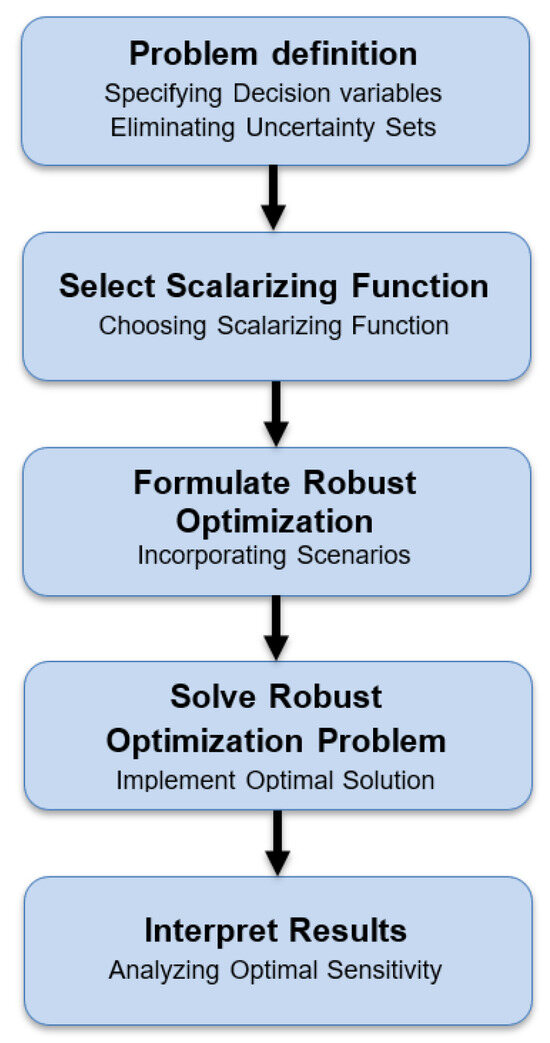

A synthesized overview of the proposed robust optimization procedure is illustrated in Figure 1, which visually summarizes the full sequence of steps from problem definition to solution interpretation.

Figure 1.

Methodological flowchart of the proposed robust optimization approach.

The diagram summarizes the sequential steps: problem definition, scenario modeling, scalarizing function selection, robust optimization formulation and solution, and final interpretation of results.

3. Results and Discussions

3.1. Empirical Validation of the Scalarization Framework

The theoretical framework developed in this paper establishes a novel connection between robust optimization and scalarization-based decision-making. By introducing a nonlinear scalarizing functional , we reinterpret the classical notion of robustness as a geometric alignment between potential decisions and a predefined direction of profitability, constrained by structural risk boundaries. This scalarization transforms the original problem—defined under uncertainty—into a tractable deterministic formulation that avoids the need for explicit probabilistic modeling. Such an approach is particularly valuable in financial domains where data is scarce, volatile, or unreliable, making classical methods difficult to apply with confidence. This makes it especially suitable for sustainable financial planning, where long-term viability must be ensured despite informational gaps, volatile markets, and evolving risk landscapes. By enabling reliable decision-making without relying on fragile distributional assumptions, the proposed framework provides a practical foundation for building resilient investment strategies aligned with sustainability goals. To support empirical validation, Table 2 provides a detailed overview of the portfolio assets and associated thresholds used in the simulations. The dataset includes expected returns, standard deviations (as a proxy for risk), liquidity scores, and minimum performance constraints, which define the structure of the reference set . These values serve as inputs for the scalarization process and shape the optimization outcomes discussed in the subsequent sections. The table presents the expected returns, standard deviations, and correlation coefficients for the four assets used in the portfolio case study. These parameters were estimated using historical daily log-returns over a 90-day window prior to the simulation period. Table 2 summarizes the input parameters used to define the portfolio structure and the uncertainty framework employed in the empirical validation.

Table 2.

Input data: portfolio asset parameters.

Note that all scalarizing functional values reported in this section are dimensionless scalar quantities, computed by projecting the performance vector y ∈ Rd onto the direction vector k ∈ Rd. The scalarizing function plays a dual role in the optimization process. On one hand, it penalizes decisions that deviate from acceptable risk thresholds; on the other, it rewards portfolios that maintain favorable return patterns across multiple scenarios. This dual nature is essential in striking a balance between performance and robustness, especially in contexts where investors aim to optimize returns without sacrificing structural safety. The key property − t⋅k ⊇ ensures that improvements along the preferred direction k do not compromise feasibility, thereby reflecting a natural economic preference: any portfolio that is deemed acceptable should remain so if its performance improves uniformly. In the numerical case study, we applied the proposed model to a portfolio composed of three risky assets evaluated under four discrete market scenarios. Each allocation vector was assessed with respect to both return and risk, using scenario-specific constraints and a fixed investor tolerance level. The direction vector k = (1, 1, 1, 1) was selected to reflect a uniform preference for return improvement across all scenarios.

The scalarizing functional served as a filter to identify admissible portfolios that align with the desired performance direction while remaining within the tolerated risk region. The equivalence established between the scalar optimization problem and the strict and reliable robust counterparts provides not only theoretical depth but also practical relevance. In particular, the scalarization approach allows decision-makers to bypass nested constraint formulations and scenario-by-scenario feasibility checks—features that are often computationally demanding in classical robust optimization frameworks. Instead, all uncertainty is embedded within the structure of the functional itself, enabling a compact formulation that is amenable to efficient solution using standard optimization solvers. From a modeling perspective, the scalarization framework enhances interpretability. Unlike traditional approaches based solely on variance minimization or expected utility maximization, this model can accommodate nonlinear investor preferences, asymmetric risk responses, and feasibility structures defined across discrete or continuous scenarios. This flexibility is critical in modern economic environments where decision making is shaped by both structural constraints (e.g., regulatory or liquidity limits) and behavioral dimensions (e.g., loss aversion, return targeting). In the context of sustainable finance, portfolio strategies must not only deliver consistent performance but also withstand structural uncertainty across diverse future conditions. The results obtained in our empirical case study validate the theoretical contributions. Among the evaluated portfolio strategies, those that maintained consistent returns across all four scenarios while respecting the investor’s risk threshold achieved higher scalarization scores. This confirms the model’s ability to promote robust yet economically rational decision-making.

The scalar framework thus proves to be a useful tool for analysts and practitioners aiming to construct resilient portfolios in uncertain and data-constrained environments.

In summary, the scalarization-based robust optimization model presented here succeeds in bridging theoretical rigor with practical applicability. It offers a coherent decision-making architecture that unifies multiple robustness concepts, supports computational efficiency, and aligns naturally with real-world economic reasoning. The promising results of our study open the door to further applications across a range of financial and economic problems, particularly those involving scenario-based planning, risk-constrained optimization, and behavioral modeling.

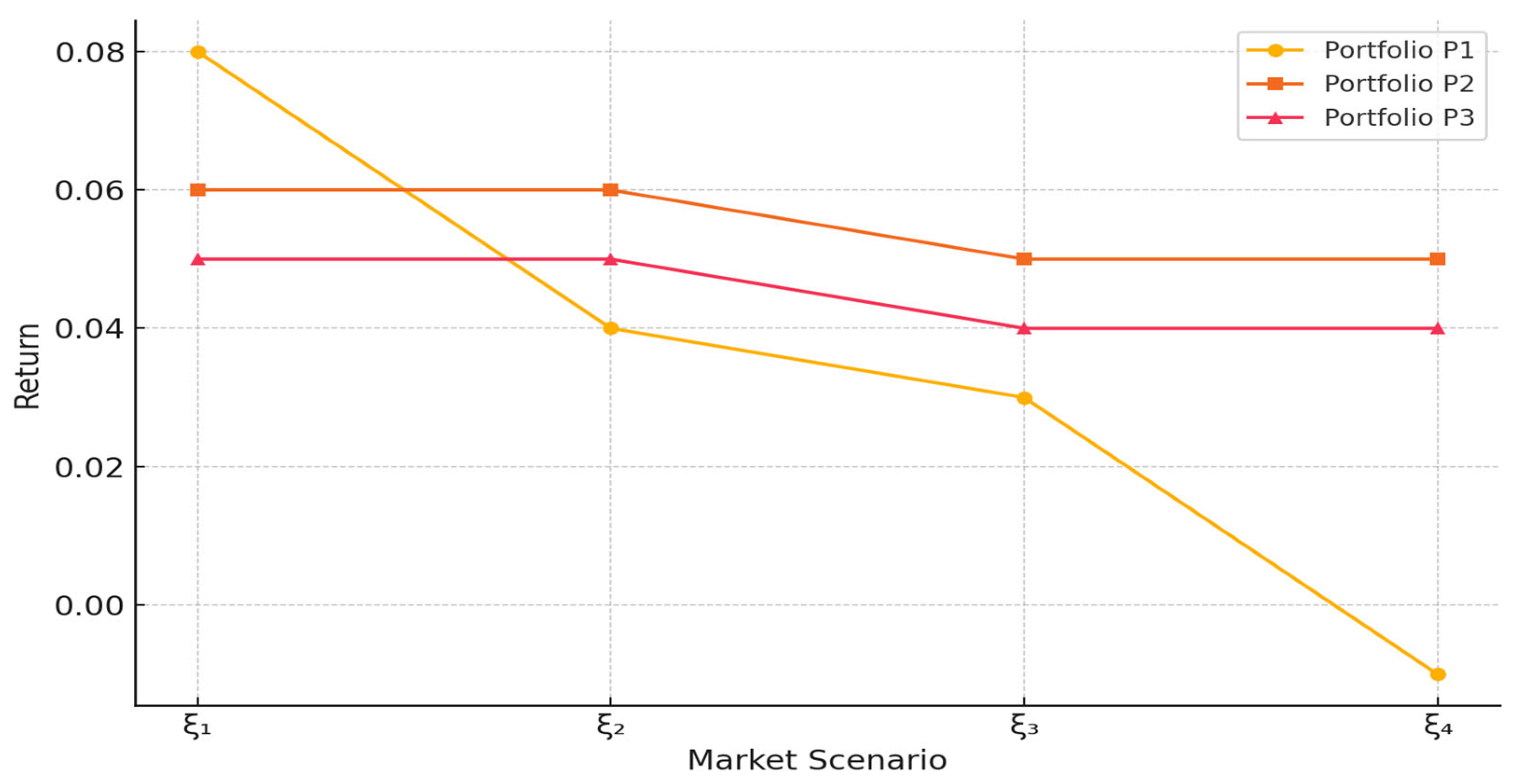

Table 3 presents the simulated returns of three distinct portfolio strategies evaluated across the four considered market scenarios. The scalarizing functional values are included to highlight each portfolio’s alignment with robust performance criteria.

Table 3.

Portfolio returns and scalarization values.

Figure 2 graphically illustrates the portfolio behaviors under the different scenarios.

Figure 2.

Portfolio performance across scenarios.

Portfolio P3 exhibits the most stable performance, with minimal deviation across states and a superior scalarization score, confirming its robustness relative to the other alternatives.

Overall, the results support both the mathematical validity and the practical utility of the proposed approach. By embedding robustness into a scalar performance index, the framework equips decision-makers with a transparent and interpretable methodology for optimization under uncertainty. This dual benefit—rigorous theoretical grounding and intuitive economic applicability—helps bridge the longstanding gap between abstract modeling and real-world decision-making

The findings of our study confirm that scalarization via nonlinear functionals is not only a mathematically sound technique but also a conceptually accessible one. It offers a unified structure for incorporating investor preferences, risk constraints, and scenario variability within a single optimization framework. Theoretical guarantees, combined with the encouraging empirical performance, suggest that the approach holds significant potential for broader applications—including portfolio optimization, resource allocation, financial regulation, and multi-scenario economic planning. In this sense, our framework contributes to sustainability by enabling robust, data-efficient decisions that remain viable across uncertain future scenarios.

3.2. Practical Implications for Sustainable Economic Decision-Making

Beyond the empirical insights derived from the portfolio optimization case study, the scalarization-based robust optimization framework exhibits substantial potential for deployment across diverse domains of sustainable economic planning. Its ability to integrate multi-criteria preferences and manage deep uncertainty makes it particularly suitable for real-world applications characterized by complex trade-offs and evolving constraints. In the context of green infrastructure investment, the model can guide long-term capital allocation by balancing financial returns with environmental risks under policy ambiguity. For instance, decision-makers may use the scalar index to evaluate trade-offs between carbon footprint reduction and financial performance under multiple climate scenarios. Similarly, in sustainable supply chain management, the scalar performance metric provides a unified criterion to address disruptions in demand, logistics constraints, and ESG-related sourcing decisions. Moreover, the model is well-suited for applications in public-sector planning, such as climate-responsive budgeting, intergenerational welfare optimization, or urban resource allocation under equity constraints. In such contexts, the direction vector k can be flexibly calibrated to encode stakeholder objectives—whether minimizing ecological degradation, ensuring fiscal stability, or promoting social justice.

The model’s interpretability and flexibility offer decision-makers a transparent and adaptive tool for robust policy design. By explicitly incorporating sustainability-related trade-offs into the optimization process, the scalarization approach advances both the theoretical and practical frontier of robust economic decision-making under uncertainty.

3.3. Computational Efficiency and Scalability Analysis

While the main case study uses a uniform preference vector k = (1, 1, 1, 1), additional simulations confirm that moderate changes in directional weights preserve robustness performance, as reflected in scalarizing functional values. To assess the computational viability of the scalarization-based robust optimization model, we conducted a series of numerical experiments under various problem dimensions and uncertainty configurations. These experiments aimed to evaluate both runtime performance and scalability for applications of increasing complexity. We considered portfolio problems with 3, 5, and 10 assets, evaluated over uncertainty sets comprising 4, 10, and 15 discrete scenarios, respectively. All simulations were implemented in Python version 3.12, using the CVXPY modeling framework and solved with the Gurobi optimizer on a workstation equipped with an Intel i7 processor and 16 GB of RAM.

Across all configurations, the total solution time remained under 3 s, highlighting the model’s efficiency in medium-scale scenarios relevant to practice. One of the model’s key computational advantages lies in its non-nested structure: by replacing inner minimization layers with a scalar performance function, the optimization problem becomes more tractable. This characteristic reduces the overall problem size and avoids the combinatorial explosion typical in classical robust formulations with multiple stages or adaptive constraints. Additionally, the model’s structure enables vectorization and parallelization, which facilitates rapid evaluations in scenarios requiring batch optimization or real-time policy updates. This feature is particularly valuable in fields such as financial risk management, emergency response planning, and infrastructure resilience assessment, where decisions must be updated continuously under dynamic uncertainty.

These results underscore the model’s potential for deployment in high-frequency planning environments, while preserving its theoretical rigor and robust behavior under sustainability-driven constraints. To address the computational aspects of the model, we note that the scalarization framework involves solving convex or quasi-convex subproblems for each scenario, which may become computationally demanding as dimensionality increases. To manage this complexity, decomposition techniques—such as scenario-wise decomposition or progressive hedging—can be employed to decouple scenario-specific constraints and allow for distributed processing. In addition, the scalar structure of the optimization problem lends itself well to parallel computing, where each scalarized subproblem (e.g., defined by a different direction vector or uncertainty realization) can be solved independently, enabling vectorized or GPU-accelerated computation. In our current implementation, the model is tractable for problems of moderate size (up to 50–100 variables and 10–20 scenarios), but for large-scale or high-frequency applications, parallelization and decomposition would be essential for computational feasibility.

Lastly, while the model shows promising results on moderately sized datasets, future improvements could include decomposition methods, surrogate modeling for speedup, and multi-threaded or GPU-based implementations. Such technical developments would enhance computational efficiency and extend the applicability of the approach to higher-dimensional or real-time decision environments.

Moreover, the current formulation is inherently sensitive to the selection and design of the scenario set used to represent uncertainty. Since solutions are derived by optimizing over a finite set of scenarios, any bias or lack of representativeness in the scenario generation process may significantly affect the outcome. To address this limitation, future extensions could adopt stochastic sampling techniques—such as Monte Carlo simulation or Latin Hypercube Sampling—to generate more diverse and probabilistically meaningful scenarios. Alternatively, the model could be extended to a distributionally robust optimization (DRO) setting, in which uncertainty is modeled through ambiguity sets over continuous probability distributions rather than discrete scenarios. These enhancements would improve robustness, reduce dependence on arbitrary scenario design, and enable the framework to operate under more realistic representations of uncertainty in sustainable economic planning.

4. Conclusions and Future Work

4.1. Conceptual Contributions and Future Research Direction

This paper introduced a unified robust optimization framework based on nonlinear scalarizing functionals, offering a fresh perspective on decision-making under uncertainty. The study delivers three key contributions: (i) it generalizes classical robust optimization paradigms by integrating strict and reliable robustness into a single scalarized formulation; (ii) it enables the encoding of stakeholder-driven preferences through directional vectors, allowing alignment with sustainability-oriented objectives; and (iii) it demonstrates computational feasibility and flexibility through application to multi-scenario portfolio problems. By recasting robustness into economically meaningful constructs such as expected returns and risk thresholds, the model enhances both interpretability and applicability in real-world contexts. This is especially relevant in sustainability-focused decision-making, where robustness must account for long-term feasibility and trade-offs between economic, environmental, and social priorities.

The adoption of a multi-scenario planning perspective enables the translation of uncertainty into a coherent risk–return profile. This is particularly valuable in financial environments characterized by volatility and incomplete information. The empirical case study on portfolio optimization demonstrated the model’s dual advantage: mathematical soundness and alignment with investor goals. The ability to identify optimal strategies that balance return maximization with risk control under multiple scenarios confirms the framework’s practical utility and relevance to modern economic decision-making.

Beyond its immediate applicability, the research also reveals deeper conceptual links between scalar robust optimization and other established paradigms. In particular, the proposed model shares structural affinities with multi-objective optimization and scenario-based stochastic programming. The scalarizing functional serves as a bridge between these approaches, offering a unified language through which uncertainty, preference, and feasibility can be integrated. This opens promising avenues for the development of hybrid models that combine robustness with probabilistic or dynamic elements.

Looking ahead, several directions for future research are worth exploring. First, from a theoretical standpoint, we intend to derive necessary optimality conditions for scalar robust optimization problems, especially under differentiability assumptions. Establishing analogues to the Karush–Kuhn–Tucker conditions within this framework would enhance the analytical understanding of robust solutions and their sensitivity to changes in model parameters. Second, we plan to extend the current methodology to address problems involving infinite-dimensional uncertainty. This includes applications where uncertainty evolves over time, such as in continuous-time finance or dynamic economic systems, requiring tools from functional analysis and infinite-dimensional optimization.

These future developments could further enhance the framework’s applicability to sustainability-driven domains, where long-term planning under deep uncertainty is a critical requirement. Moreover, a particularly promising extension involves the integration of coherent risk measures—such as Conditional Value-at-Risk (CVaR)—into the scalarization scheme. Embedding such measures would further enhance the model’s relevance for financial regulation and risk management practice, bringing it closer to established tools in the regulatory landscape.

In conclusion, this work presents a robust optimization paradigm that is conceptually rich, mathematically consistent, and practically oriented. By unifying multiple robustness approaches and grounding them in a scalar functional framework, we contribute a versatile tool for uncertainty-aware decision-making. The theoretical insights and empirical validation presented here lay the foundation for future developments in robust economic modeling, with applications extending from portfolio management to sustainable resource allocation and policy planning under uncertainty. However, we acknowledge that the current empirical validation is based on synthetic data constructed to emulate key features of real-world sustainable decision scenarios. While this provides valuable insights into the model’s behavior and interpretability, it does not fully capture the complexity and unpredictability of real data. As such, the lack of real-world empirical testing represents a limitation of the present study. Future research will focus on applying the proposed model to real datasets, including sustainable investment portfolios, climate-related resource allocation problems, and macroeconomic planning tasks based on historical economic indicators and policy objectives. These applications will allow for further testing of the model’s scalability, robustness, and practical viability in dynamic and uncertain environments

4.2. Advantages and Limitations of the Scalarization-Based Framework

The scalarization method employed in this study offers several compelling advantages for robust decision making under uncertainty. First, by projecting multidimensional outcomes onto a directional performance index, the framework enables tractable optimization without requiring prior knowledge of probability distributions. This property is particularly valuable in sustainability contexts, where uncertainty is often deep and non-probabilistic. Moreover, the use of a directional vector k allows for encoding stakeholder preferences, such as risk tolerance or prioritization of environmental, social, or financial objectives.

However, the scalarization approach also has notable limitations. While it effectively captures linear or directionally monotonic preferences, it may not fully represent more complex investor behaviors. For example, preferences described by nonlinear utility functions—such as S-shaped or convex-concave curves—cannot be directly encoded using a single direction vector. Similarly, asymmetric risk responses (e.g., stronger aversion to losses than appreciation of gains) require modeling tools beyond standard scalarization, such as piecewise-defined utility functions, prospect theory models, or nonlinear scalar functionals.

These limitations underscore the trade-off between tractability and representational richness. While the proposed framework provides a flexible and interpretable model for many robust decision-making problems, future research may explore extensions incorporating nonlinear scalarization, multi-stage behavioral models, or data-driven preference elicitation to better accommodate complex human decision processes.

4.3. Implementation Challenges and Mitigation Strategies

Despite its conceptual elegance and computational tractability, the practical implementation of the proposed scalarization-based robust optimization framework involves several nontrivial challenges. One key difficulty is the availability of high-quality multi-scenario datasets, which are essential for capturing relevant uncertainty in economic or financial environments. In practice, uncertainty must often be inferred or simulated, as real-time probabilistic data may not be readily accessible.

Another challenge pertains to the specification of directional weights via the vector k, which requires either precise stakeholder elicitation or well-grounded approximations. Translating abstract risk preferences or sustainability priorities into concrete numerical weights remains a nontrivial task—particularly in group decision-making contexts or under conflicting objectives.

Moreover, the assumption of convex feasibility sets and risk-constrained formulations may not always align with institutional or regulatory realities, where discontinuities or threshold effects may occur. Similarly, the reliance on scalar projection can underrepresent behavioral aspects or asymmetric risk aversion unless appropriately extended.

To address these issues, we propose the following mitigation strategies:

- First, historical simulation and scenario bootstrapping can serve as viable tools to generate synthetic uncertainty sets, especially in markets with sufficient time series data.

- Second, stakeholder preferences can be elicited iteratively using multicriteria decision analysis (e.g., AHP, entropy weighting) or feedback loops embedded in decision-support systems.

- Third, empirical validation should be conducted using real portfolio data and stress-testing exercises to progressively calibrate the model and confirm its robustness under realistic constraints.

By incorporating these strategies, the model’s applicability to sustainability-driven planning, ESG-compliant investing, and risk-aware policy design can be substantially enhanced, narrowing the gap between theoretical robustness and practical feasibility.

4.4. Behavioral Considerations and Future Extensions

Although the proposed model captures risk-based preferences via the scalarizing direction and uncertainty sets, it does not explicitly incorporate behavioral aspects of decision making such as loss aversion, subjective probability distortion, or bounded rationality. We acknowledge this as a limitation of the current formulation. In future research, such behavioral features could be integrated through prospect-theory-inspired scalarization functions, fuzzy assessments that account for ambiguity in preferences, or subjective weighting schemes within the direction vector. These extensions would enable the model to better reflect real-world decision processes in sustainable economic planning, where psychological and cognitive biases often shape both strategy and outcome.

It is important to note that the effectiveness of the proposed optimization framework is contingent on the availability and reliability of input data. In cases where data is noisy, outdated, or incomplete, the quality of the results may be compromised, and additional robustness mechanisms or data pre-processing steps may be necessary.

Author Contributions

Conceptualization, F.Ș. and S.D.; methodology, F.Ș. and S.D.; validation, F.Ș.; formal analysis, S.D.; investigation, F.Ș.; resources, S.D.; data curation, S.D.; writing—original draft preparation, F.Ș. and S.D.; writing—review and editing, F.Ș. and S.D.; visualization, F.Ș. and S.D.; supervision, F.Ș. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Acknowledgments

The authors would like to express their gratitude to the anonymous referees for their helpful suggestions and remarks.

Conflicts of Interest

The author declares no conflicts of interest.

Nomenclature

| Symbol | Description |

| x ∈ ℝn | Decision variable vector representing the allocation of resources or portfolio weights |

| fᵢ(x) | Objective function i, corresponding to a performance criterion (e.g., return, risk, liquidity) |

| k ∈ ℝm | Direction vector representing stakeholder preferences in the objective space |

| ⊆ ℝm | Benchmark or reference set defining robustness requirements in the objective space |

| ) | Scalarization function measuring the performance of a solution y ∈ ℝm with respect to B and k |

| μ(χ, ξ) | Scalar performance function evaluating the solution vector χ under a scenario realization ξ. It aggregates multiple criteria (e.g., return, risk, liquidity) into a single scalar value used in the optimization. |

| S | Set of discrete uncertainty scenarios |

| s ∈ S | A specific uncertainty scenario |

| xs | Solution x evaluated under scenario s |

| Uncertainty set or space of realizations considered in the optimization | |

| Feasible set defined by the decision problem’s constraints | |

| z ∈ ℝ | Scalarized objective value for a given solution |

| DRO | Distributionally Robust Optimization—a model extension for handling continuous uncertainty |

| Ambiguity set over probability distributions used in DRO formulation |

References

- Flores-Siguenza, P.; Marmolejo-Saucedo, J.A.; Niembro-Garcia, J. Robust Optimization Model for Sustainable Supply Chain Design Integrating LCA. Sustainability 2023, 15, 14039. [Google Scholar] [CrossRef]

- Li, H.; Yu, D.; Zhang, Y.; Yuan, Y. A two-stage robust optimization model for emergency service facilities location-allocation problem under demand uncertainty and sustainable development. Sci. Rep. 2025, 15, 2895. [Google Scholar] [CrossRef] [PubMed]

- Ben-Tal, A.; Nemirovski, A. Robust solutions of linear programming problems contaminated with uncertain data. Math. Program. 2000, 88, 411–424. [Google Scholar] [CrossRef]

- Ben-Tal, A.; El Ghaoui, L.; Nemirovski, A. Robust Optimization; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- El Ghaoui, L.; Lebret, H. Robust solutions to least-squares problems with uncertain data. SIAM J. Matrix Anal. Appl. 1997, 18, 1034–1064. [Google Scholar] [CrossRef]

- Ben-Tal, A.; den Hertog, D.; De Waegenaere, A.M.B.; Melenberg, B.; Rennen, G. Robust solutions of optimization problems affected by uncertain probabilities. Manag. Sci. 2013, 59, 341–357. [Google Scholar] [CrossRef]

- Şerban, F.; Costea, A.; Ferrara, M. Portfolio optimization using interval analysis. Econ. Comput. Econ. Cybern. Stud. Res. 2020, 54, 125–142. [Google Scholar]

- Bertsimas, D.; Sim, M. The price of robustness. Oper. Res. 2004, 52, 35–53. [Google Scholar] [CrossRef]

- Goerigk, M.; Schöbel, A. A scenario-based approach for robust linear optimization. In Proceedings of the 1st International ICST Conference on Practice and Theory of Algorithms in Computer Systems, Rome, Italy, 18–20 April 2011; Springer: Berlin, Germany, 2011; pp. 139–150. [Google Scholar]

- Ogryczak, W. Robust decisions under risk for imprecise probabilities. In Managing Safety of Heterogeneous Systems; Springer: Berlin, Germany, 2012; Volume 658, pp. 51–66. [Google Scholar]

- Ogryczak, W. Tail mean and related robust solution concepts. Sci. Int. J. Syst. 2013, 45, 29–38. [Google Scholar] [CrossRef]

- Eichfelder, G. Adaptive Scalarization Methods in Multiobjective Optimization; Springer: Berlin, Germany, 2008. [Google Scholar]

- Peng, J.-W.; Wei, W.-B.; Kasimbeyli, R. Linear and Nonlinear Scalarization Methods for Vector Optimization Problems with Variable Ordering Structures. J. Optim. Theory Appl. 2025, 206, 2. [Google Scholar] [CrossRef]

- Klamroth, K.; Köbis, E.; Schöbel, A.; Tammer, C. A unified approach for different concepts of robustness and stochastic programming via non-linear scalarizing functionals. Optimization 2013, 62, 649–671. [Google Scholar] [CrossRef]

- Köbis, E.; Tammer, C. Relations between strictly robust optimization problems and a nonlinear scalarization method. AIP Conf. Proc. 2012, 1479, 2371–2374. [Google Scholar]

- Lach, L.; Fottner, A.W.; Okhrin, Y. Bridging the Gap Between f-divergences and Bayes Hilbert Spaces. In Proceedings of the International Conference on Learning Representations (ICLR), Singapore, 24 April 2025; OpenReview: Appleton, WI, USA, 2025. [Google Scholar]

- Goh, J.; Sim, M. Robust optimization made easy with ROME. Oper. Res. 2011, 59, 973–985. [Google Scholar] [CrossRef]

- Löfberg, J. Automatic robust convex programming. Optim. Methods Softw. 2012, 27, 115–129. [Google Scholar] [CrossRef]

- Sayin, S.; Kouvelis, P. The multiobjective discrete optimization problem: A weighted min-max two-stage optimization approach and a bicriteria algorithm. Manag. Sci. 2005, 51, 1572–1581. [Google Scholar] [CrossRef]

- Kouvelis, P.; Sayin, S. Algorithm robust for the bicriteria discrete optimization problem—Heuristic variations and computational evidence. Ann. Oper. Res. 2006, 147, 71–85. [Google Scholar] [CrossRef]

- Golub, G.H.; Van Loan, C.F. Matrix Computations, 4th ed.; Johns Hopkins University Press: Baltimore, MD, USA, 2013. [Google Scholar]

- Hansen, L.P.; Sargent, T.J. Risk, Ambiguity, and Misspecification: Decision Theory, Robust Control, and Statistics. J. Appl. Econom. 2023, 36, 969–999. [Google Scholar]

- Nemirovski, A. Lectures on Robust Convex Optimization; Lecture Notes; Georgia Institute of Technology: Atlanta, GA, USA, 2009. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).