How Does Climate Policy Uncertainty Affect Green Innovation Among Chinese Companies?

Abstract

:1. Background and Introduction

1.1. Introduction

1.2. Literature Review

1.2.1. Studies on CPU

1.2.2. Studies on Policy Uncertainty-Related Corporate Innovation

1.2.3. A Summary

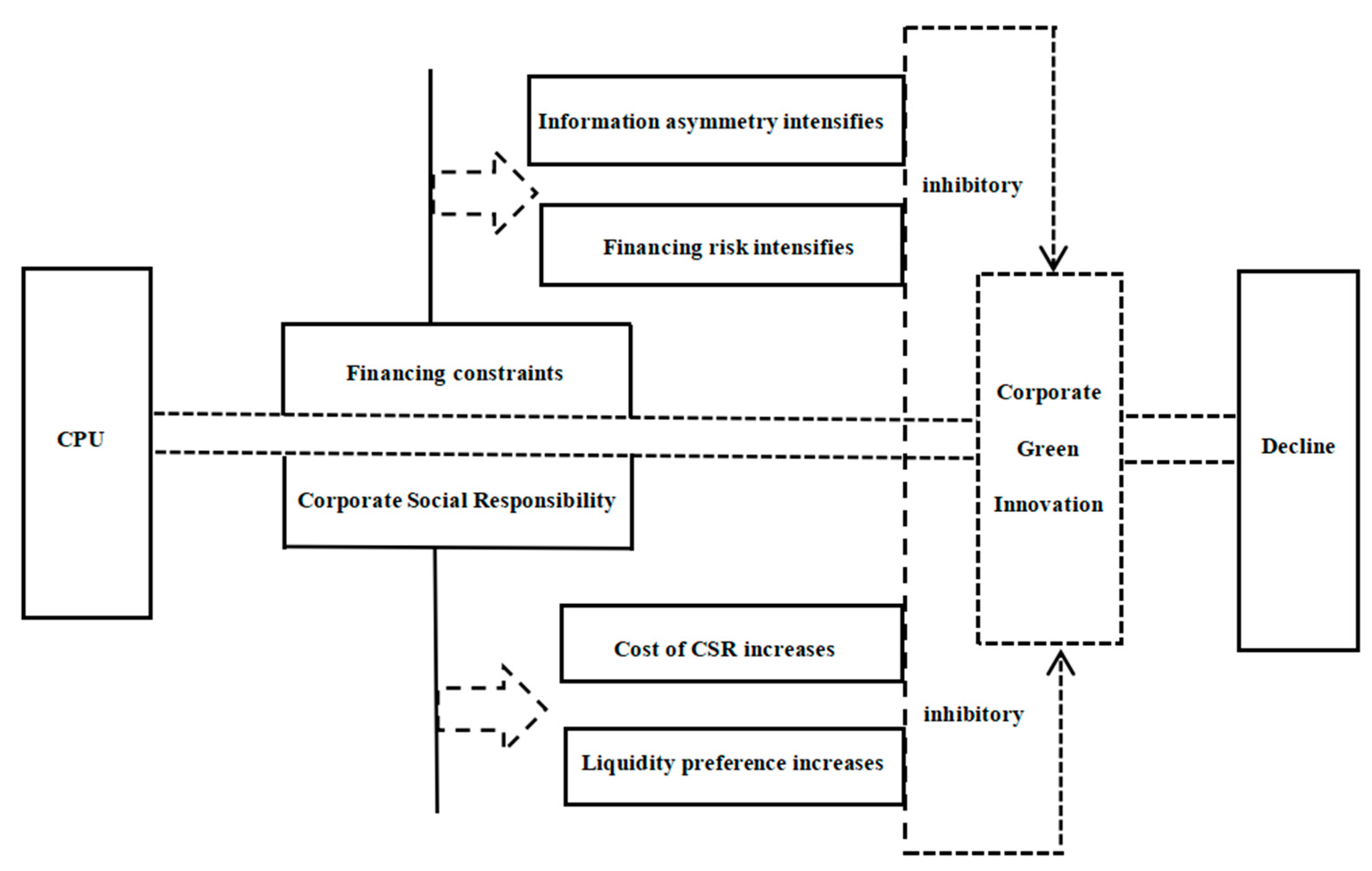

2. Research Hypotheses

3. Research Design

3.1. Data Sources

3.2. Methodology

3.3. Variable Selection

3.3.1. Measuring Corporate Green Innovation

3.3.2. Measuring CPU

3.3.3. Mechanism Variables

3.3.4. Control Variables

4. Empirical Results and Analysis

4.1. Benchmark Regression

4.2. Robustness Tests

4.2.1. Endogeneity Test

4.2.2. Other Robustness Tests

4.3. Mechanism Tests

4.4. Heterogeneity Tests

4.4.1. Industry Heterogeneity

4.4.2. Property Rights Heterogeneity

4.4.3. Concentrated Ownership Heterogeneity

4.5. Economic Consequences Tests

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bi, S.H.; Kang, C.Y.; Bai, T.T.; Yi, X.T. The effect of green fiscal policy on green technological innovation: Evidence from energy saving and emission reduction fiscal policy. Environ. Sci. Pollut. Res. 2024, 31, 10483–10500. [Google Scholar] [CrossRef] [PubMed]

- Liu, X.L.; Xue, C.J.; Xie, F.J. The impact of policy mix characteristics of multi-level governance on innovation output of the new energy vehicle industry in China. Technol. Anal. Strateg. Manag. 2024, 2, 1–14. [Google Scholar] [CrossRef]

- Burns, C. British environmental foreign policy identity post-Brexit: Environment and climate policy. Int. Polit. 2023. [Google Scholar] [CrossRef]

- Nadin, V.; Rauhut, D.; Sielker, F.; Humer, A. EU Cohesion Policy and spatial governance: Territorial, social and economic challenges. Reg. Stud. 2024, 58, 423–424. [Google Scholar] [CrossRef]

- Banerjee, A.K.; Boubaker, S.; Al-Nassar, N.S. Climate policy initiatives, green finance, and carbon risk interconnectedness. Financ. Res. Lett. 2024, 67, 105776. [Google Scholar] [CrossRef]

- Kumar, R.; Goel, R.; Singh, T.; Mohanty, S.M.; Gupta, D.; Alkhayyat, A.; Khanna, R. Sustainable Finance Factors in Indian Economy: Analysis on Policy of Climate Change and Energy Sector. Fluct. Noise Lett. 2024, 23, 2440004. [Google Scholar] [CrossRef]

- Cai, X.S.; Huang, Y.T.; Ying, S.X.; Chen, H. Can climate policy promote high-quality development of enterprises? Evidence from China. Front. Environ. Sci. 2023, 11, 1115037. [Google Scholar] [CrossRef]

- Löscher, A.; Kaltenbrunner, A. Climate change and macroeconomic policy space in developing and emerging economies. J. Post Keynes. Econ. 2023, 46, 113–141. [Google Scholar] [CrossRef]

- Fried, S. Climate Policy and Innovation: A Quantitative Macroeconomic Analysis. Am. Econ. J.-Macroecon. 2018, 10, 90–118. [Google Scholar] [CrossRef]

- Ahsan, T.; Qureshi, M.A. The nexus between policy uncertainty, sustainability disclosure and firm performance. Appl. Econ. 2021, 53, 441–453. [Google Scholar] [CrossRef]

- Di Tommaso, C.; Thornton, J. Do ESG scores effect bank risk taking and value? Evidence from European banks. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2286–2298. [Google Scholar] [CrossRef]

- Hao, X.L.; Sun, Q.Y.; Li, K.; Xue, Y.; Wu, H.T. Can CSR effectively promote corporate green innovation efficiency? Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

- Ma, Y.X.; Li, S.M.; Zhou, L.Y. Why are enterprises willing to assume social responsibility? Answers from the perspective of innovation. Econ. Anal. Policy 2024, 82, 188–198. [Google Scholar] [CrossRef]

- Khurshid, A.; Ying, H.B.; Cifuentes-Faura, J.; Saleem, S.F. Does corporate social responsibility and environmental governance drive green innovation? Corp. Soc. Responsib. Environ. Manag. 2024, 32, 58–70. [Google Scholar] [CrossRef]

- Orlitzky, M. Corporate Social Responsibility, Noise, and Stock Market Volatility. Acad. Manag. Perspect. 2013, 27, 238–254. [Google Scholar] [CrossRef]

- Lee, K.; Cho, J.K. Measuring Chinese climate uncertainty. Int. Rev. Econ. Financ. 2023, 88, 891–901. [Google Scholar] [CrossRef]

- Stroebel, J.; Wurgler, J. What do you think about climate finance? J. Financ. Econ. 2021, 142, 487–498. [Google Scholar] [CrossRef]

- Farooq, U.; Shafiq, M.N.; Subhani, B.H.; Gillani, S. Climate policy uncertainty and regional innovation performance: New empirical evidence from the United States. Manag. Decis. Econ. 2024, 45, 1497–1510. [Google Scholar] [CrossRef]

- Nguyen, J.H.; Phan, H.V. Carbon risk and corporate capital structure. J. Corp. Financ. 2020, 64, 101713. [Google Scholar] [CrossRef]

- Ilhan, E.; Sautner, Z.; Vilkov, G. Carbon Tail Risk. Rev. Financ. Stud. 2021, 34, 1540–1571. [Google Scholar] [CrossRef]

- Pan, W.F.; Wang, X.J.; Yang, S.X. Debt maturity, leverage, and political uncertainty. N. Am. Econ. Financ. 2019, 50, 100981. [Google Scholar] [CrossRef]

- Wei, W.; Hu, H.Q. Economic Policy Uncertainty and Innovation: Evidence from China Energy Enterprises. Emerg. Mark. Financ. Trade 2024, 60, 2869–2888. [Google Scholar] [CrossRef]

- Zhang, S.L.; Wu, Z.H.; Dou, W.; Hao, Y. How does economic policy uncertainty affect corporate green innovation? Evidence from China. J. Environ. Plan. Manag. 2023, 68, 1363–1389. [Google Scholar] [CrossRef]

- Mirza, S.S.; Ahsan, T.; Al-Gamrh, B.; Majeed, M.A.; Muhammad, F. The impact of economic policy uncertainty on corporate innovation in China: The role of family ownership and political connections. Appl. Econ. 2023, 56, 8586–8605. [Google Scholar] [CrossRef]

- Liang, C.; Lee, P.K.C.; Zhu, M.H.; Yeung, A.C.L.; Cheng, T.C.E.; Zhou, H.G. The bright side of being uncertain: The impact of economic policy uncertainty on corporate innovation. Int. J. Oper. Prod. Manag. 2024, 44, 1918–1945. [Google Scholar] [CrossRef]

- Van Vo, L.; Le, H.T.T. Strategic growth option, uncertainty, and R&D investment. Int. Rev. Financ. Anal. 2017, 51, 16–24. [Google Scholar]

- Guan, J.L.; Xu, H.J.; Huo, D.; Hua, Y.C.; Wang, Y.F. Economic policy uncertainty and corporate innovation: Evidence from China. Pac.-Basin Financ. J. 2021, 67, 101542. [Google Scholar] [CrossRef]

- Trigeorgis, L.; Reuer, J.J. Real Options theory in Strategic Management. Strateg. Manag. J. 2017, 38, 42–63. [Google Scholar] [CrossRef]

- Qi, Y.; Dong, S.Y.; Lyu, S.; Yang, S. Economic Policy Uncertainty and Family Firm Innovation: Evidence From Listed Companies in China. Front. Psychol. 2022, 13, 901051. [Google Scholar] [CrossRef]

- Hillmann, J.; Guenther, E. Organizational Resilience: A Valuable Construct for Management Research? Int. J. Manag. Rev. 2021, 23, 7–44. [Google Scholar] [CrossRef]

- Liu, B.; Liu, Z.; Zhao, Y.B. Corporate uncertainty perception, innovation resilience and environmental performance: Evidence from Chinese listed companies. Appl. Econ. 2024. [Google Scholar] [CrossRef]

- Bhattacharya, U.; Hsu, P.H.; Tian, X.; Xu, Y. What Affects Innovation More: Policy or Policy Uncertainty? J. Financ. Quant. Anal. 2017, 52, 1869–1901. [Google Scholar] [CrossRef]

- Wang, Y.D.; Wu, C.F.; Yang, L. Hedging with Futures: Does Anything Beat the Naive Hedging Strategy? Manag. Sci. 2015, 61, 2870–2889. [Google Scholar] [CrossRef]

- Engle, R.F.; Giglio, S.; Kelly, B.; Lee, H.; Stroebel, J. Hedging Climate Change News. Rev. Financ. Stud. 2020, 33, 1184–1216. [Google Scholar] [CrossRef]

- Zheng, S.Y.; Wen, J.D. How Does Firm-Level Economic Policy Uncertainty Affect Corporate Innovation? Evidence from China. Sustainability 2023, 15, 6219. [Google Scholar] [CrossRef]

- Cui, X.; Wang, C.F.; Sensoy, A.; Liao, J.; Xie, X.C. Economic policy uncertainty and green innovation: Evidence from China. Econ. Model. 2023, 118, 106104. [Google Scholar] [CrossRef]

- Ren, X.H.; Xia, X.X.; Taghizadeh-Hesary, F. Uncertainty of uncertainty and corporate green innovation-Evidence from China. Econ. Anal. Policy. 2023, 78, 634–647. [Google Scholar] [CrossRef]

- Tian, J.; Li, H.W.; You, P. Economic policy uncertainty, bank loan, and corporate innovation. Pac.-Basin Financ. J. 2022, 76, 101873. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- Xu, Z.X. Economic policy uncertainty, cost of capital, and corporate innovation. J. Bank. Financ. 2020, 111, 105698. [Google Scholar] [CrossRef]

- Bloom, N. The Impact of Uncertainty Shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Ross, J.M.; Fisch, J.H.; Varga, E. Unlocking the value of real options: How firm-specific learning conditions affect R&D investments under uncertainty. Strateg. Entrep. J. 2018, 12, 335–353. [Google Scholar]

- Yu, C.H.; Wu, X.Q.; Zhang, D.Y.; Chen, S.; Zhao, J.S. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Kellogg, R. The Effect of Uncertainty on Investment: Evidence from Texas Oil Drilling. Am. Econ. Rev. 2014, 104, 1698–1734. [Google Scholar] [CrossRef]

- Fuss, S.; Szolgayova, J.; Obersteiner, M.; Gusti, M. Investment under market and climate policy uncertainty. Appl. Energy 2008, 85, 708–721. [Google Scholar] [CrossRef]

- Kong, T.; Sun, R.J.; Sun, G.L.; Song, Y.T. Effects of Digital Finance on Green Innovation considering Information Asymmetry: An Empirical Study Based on Chinese Listed Firms. Emerg. Mark. Financ. Trade 2022, 58, 4399–4411. [Google Scholar] [CrossRef]

- Pan, X.Y.; Mangla, S.K.; Song, M.L.; Vrontis, D. Climate Policy Uncertainty and Entrepreneur Eco-Investment Behavior for Green Growth-Moderate Effect Analysis of Twin Transition. IEEE Trans. Eng. Manag. 2024, 71, 8459–8468. [Google Scholar] [CrossRef]

- Akhtar, S.; Tian, H.Y.; Iqbal, S.; Hussain, R.Y. Environmental regulations and government support drive green innovation performance: Role of competitive pressure and digital transformation. Clean Technol. Environ. Policy 2024, 26, 4433–4453. [Google Scholar] [CrossRef]

- Hsu, P.H.; Li, K.; Tsou, C.Y. The Pollution Premium. J. Financ. 2023, 78, 1343–1392. [Google Scholar] [CrossRef]

- Liu, J.R.; Deng, G.Y.; Yan, J.Z.; Ma, S.B. Unraveling the impact of climate policy uncertainty on corporate default risk: Evidence from China? Financ. Res. Lett. 2023, 58, 104385. [Google Scholar] [CrossRef]

- Hoang, K. How does corporate R&D investment respond to climate policy uncertainty? Evidence from heavy emitter firms in the United States. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 936–949. [Google Scholar]

- Fang, X.M.; Hu, D. Corporate ESG Performance and Innovation: Empirical Evidence from A-share Listed Companies. J. Econ. Res. 2023, 58, 91–106. [Google Scholar]

- Lu, T.; Dang, Y. Corporate governance and innovation: Differences among industry categories. Econ. Res. J. 2014, 49, 115–128. [Google Scholar]

- Belas, J.; Balcerzak, A.P.; Dvorsky, J.; Streimikis, J. Influencing ESG Perception in SMES Through CSR, Business Ethics, and HRM: AN Empirical Study in V4 Countries. Amfiteatru Econ. 2024, 26, 532–549. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy and society: The link between competitive advantage and corporate social responsibility—Reply. Harv. Bus. Rev. 2007, 85, 133. [Google Scholar]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Bloom, N.; Bond, S.; Van, R.J. Uncertainty and Investment Dynamics. Rev. Econ. Stud. 2007, 74, 391–415. [Google Scholar] [CrossRef]

- Feng, G.F.; Niu, P.; Wang, J.Z.; Liu, J. Capital market liberalization and green innovation for sustainability: Evidence from China. Econ. Anal. Policy 2022, 75, 610–623. [Google Scholar] [CrossRef]

- Fan, J.R.; Zhou, Y.N. Empirical Analysis of Financing Efficiency and Constraints Effects on the Green Innovation of Green Supply Chain Enterprises: A Case Study of China. Sustainability 2023, 15, 5300. [Google Scholar] [CrossRef]

- Wang, H.T.; Qi, S.Z.; Zhou, C.B.; Zhou, J.J.; Huang, X.Y. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Ascioglu, A.; Hegde, S.P.; McDermott, J.B. Information asymmetry and investment-cash flow sensitivity. J. Bank Financ. 2008, 32, 1036–1048. [Google Scholar] [CrossRef]

- Bronzini, R.; Piselli, P. The impact of R&D subsidies on firm innovation. Res. Policy 2016, 45, 442–457. [Google Scholar]

- Ma, Y.R.; Liu, Z.H.; Ma, D.D.; Zhai, P.X.; Guo, K.; Zhang, D.Y.; Ji, Q. A news-based climate policy uncertainty index for China. Sci. Data. 2023, 10, 881. [Google Scholar] [CrossRef]

- Lamont, O.; Polk, C. Financial Constraints and Stock Returns. Rev. Financ. Stud. 2001, 14, 529–554. [Google Scholar] [CrossRef]

- Pan, M.; Liu, H.; Cheng, Z.S. The Impact of Extreme Climate on Commercial Banks’ Risk-taking: Evidence from Local Commercial Banks in China. J. Financ. Res. 2022, 10, 39–57. [Google Scholar]

- Si, D.K.; Zhuang, J.; Ge, X.; Yu, Y. The nexus between trade policy uncertainty and corporate financialization: Evidence from China. China Econ. Rev. 2024, 4, 102113. [Google Scholar] [CrossRef]

- Tone, K. A Slacks-based Measure of Super-Efficiency in Data Envelopment Analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- van Zanten, J.A.; van Tulder, R. Improving companies’ impacts on sustainable development: A nexus approach to the SDGs. Bus. Strateg. Environ. 2021, 30, 3703–3720. [Google Scholar] [CrossRef]

| Variables | Obs | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| CPU | 32,314 | 1.4938 | 0.6879 | 0 | 4.0567 |

| Green | 32,314 | 0.2183 | 0.5919 | 0 | 5.7807 |

| Size | 32,314 | 21.8326 | 1.2362 | 17.1218 | 28.2565 |

| Lev | 32,314 | 0.4478 | 0.2295 | 0.0070 | 9.6988 |

| Roa | 32,314 | 0.0325 | 0.0882 | −1.6806 | 0.8795 |

| Roe | 32,314 | 0.0210 | 0.8553 | −75.8922 | 2.3789 |

| Ato | 32,314 | 0.6724 | 0.5464 | 0.0015 | 11.4529 |

| Cashflow | 32,314 | 0.0451 | 0.0781 | −0.7418 | 0.8759 |

| Rec | 32,314 | 0.1218 | 0.1067 | 0 | 0.8133 |

| Inv | 32,314 | 0.1485 | 0.1342 | 0 | 0.9426 |

| Fixed | 32,314 | 0.2450 | 0.1713 | −0.2062 | 0.9599 |

| Growth | 32,314 | 12.7253 | 1169.73 | −0.9860 | 134,607.1 |

| Dturn | 32,314 | −0.0996 | 0.5204 | −6.8859 | 4.3290 |

| KZ | 31,530 | 2.0034 | 2.7812 | −15.2971 | 28.8377 |

| CSR | 24,313 | 3.9756 | 1.0315 | 1 | 8 |

| EnterMarketShare | 32,288 | 0.0257 | 0.0737 | 0 | 1 |

| Bm | 30,704 | 0.9979 | 1.1524 | 0.0098 | 27.8578 |

| Htd | 26,607 | 4.0062 | 0.2837 | 1.0986 | 4.8202 |

| Variables | Definition |

|---|---|

| CPU | CPU (MacBERT method) |

| Green | Green (ln(number of green invention patent applications + number of green utility model applications + 1)) |

| Size | Total assets |

| Lev | Asset/liability ratio |

| Roa | Net profit/average balance of total assets |

| Roe | Net profit/average balance of shareholders’ equity |

| Ato | Operating income/average total assets |

| Cashflow | Net cash flows from operating activities divided by total assets |

| Rec | Net accounts receivable to total assets |

| Inv | The ratio of net inventories to total assets |

| Fixed | The ratio of net fixed assets to total assets |

| Growth | Operating income of the current year/operating income of the previous year-1 |

| Dturn | Average monthly turnover of stocks in the current year/average monthly turnover of stocks in the previous year |

| KZ | KZ (KZ index method) |

| CSR | CSR (China Securities ESG rating) |

| EnterMarket-Share | EnterMarketShare (Lerner index) corporate market share |

| Bm | Bm (book value/total market capitalization) corporate market value |

| Mfee | Corporate Management Efficiency (overhead divided by revenue) |

| Htd | Extreme heat |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Green | Green | Green | Green | Green | Green | |

| CPU | −0.032 *** | −0.035 *** | −0.035 *** | −0.032 *** | −0.033 *** | −0.033 *** |

| (−2.781) | (−3.149) | (−2.646) | (−4.274) | (−4.456) | (−2.974) | |

| Size | 0.100 *** | 0.100 *** | 0.054 *** | 0.054 *** | ||

| (9.317) | (9.128) | (6.291) | (5.385) | |||

| Lev | 0.093 ** | 0.093 ** | 0.053 ** | 0.053 ** | ||

| (2.574) | (2.328) | (2.214) | (2.092) | |||

| Roa | 0.171 *** | 0.171 ** | 0.053 | 0.053 | ||

| (2.666) | (2.361) | (1.183) | (1.221) | |||

| Roe | 0.004 * | 0.004 * | 0.003 * | 0.003 | ||

| (1.681) | (1.669) | (1.689) | (1.645) | |||

| Ato | −0.005 | −0.005 | −0.043 *** | −0.043 *** | ||

| (−0.497) | (−0.467) | (−3.549) | (−3.714) | |||

| Cashflow | 0.108 ** | 0.108 * | −0.025 | −0.025 | ||

| (2.034) | (1.969) | (−0.641) | (−0.512) | |||

| Rec | 0.391 *** | 0.391 *** | 0.322 *** | 0.322 *** | ||

| (4.352) | (5.051) | (4.498) | (4.761) | |||

| Inv | −0.174 *** | −0.174 ** | −0.097 ** | −0.097 * | ||

| (−2.880) | (−2.580) | (−2.128) | (−1.918) | |||

| Fixed | −0.136 ** | −0.136 ** | 0.108 *** | 0.108 ** | ||

| (−2.574) | (−2.447) | (3.008) | (2.659) | |||

| Growth | −0.000 *** | −0.000 *** | 0.000 * | 0.000 | ||

| (−4.503) | (−4.483) | (1.754) | (1.609) | |||

| Dturn | −0.006 | −0.006 | 0.002 | 0.002 | ||

| (−0.846) | (−0.921) | (0.334) | (0.333) | |||

| _cons | 0.275 *** | −1.955 *** | −1.955 *** | 0.266 *** | −0.952 *** | −0.952 *** |

| (13.023) | (−8.760) | (−8.410) | (24.001) | (−5.168) | (−4.376) | |

| Year | √ | √ | √ | √ | √ | √ |

| Ind | √ | √ | √ | |||

| Firm | √ | √ | √ | |||

| N | 30,703 | 30,703 | 30,703 | 32,314 | 32,314 | 32,314 |

| R2 | 0.090 | 0.129 | 0.129 | 0.548 | 0.552 | 0.552 |

| F | 7.735 | 11.291 | 12.281 | 18.269 | 7.253 | 7.273 |

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| IV | Lagged Independent Variable | Lagged Dependent Variable | Control for High-Dimensional Fixed Effects | Replacement of Independent Variables | Replacement of the Dependent Variable | ||

| CPU | Green | Green | L.Green | Green | Green | GTFP | |

| CPU | −0.274 * | −0.023 *** | −0.038 *** | −0.063 ** | |||

| (−1.687) | (−3.115) | (−3.572) | (−2.550) | ||||

| L.CPU | −0.018 *** | ||||||

| (−3.040) | |||||||

| CPU * CIV | −0.060 *** | ||||||

| (−5.450) | |||||||

| Htd | 0.091 *** | ||||||

| (6.690) | |||||||

| _cons | −0.753 *** | −0.888 *** | −0.939 *** | ||||

| (−5.300) | (−5.090) | (−4.126) | |||||

| Control | √ | √ | √ | √ | √ | √ | √ |

| Year | √ | √ | √ | √ | √ | √ | |

| Firm | √ | √ | √ | √ | √ | √ | √ |

| Year * Province | √ | ||||||

| N | 26,607 | 26,607 | 29,630 | 29,459 | 32,314 | 24,635 | 22,676 |

| R2 | −0.060 | 0.514 | 0.536 | 0.562 | 0.607 | 0.987 | |

| F | 7.313 | 5.610 | 6.927 | 8.810 | 5.000 | 92.940 | |

| (1) | (2) | |

|---|---|---|

| KZ | CSR | |

| CPU | 0.079 *** | −0.045 *** |

| (3.230) | (−3.600) | |

| _cons | 4.676 *** | −0.543 |

| (3.240) | (−1.282) | |

| Control Variables | √ | √ |

| Yea | √ | √ |

| Firm | √ | √ |

| N | 31,530 | 24,313 |

| R2 | 0.793 | 0.541 |

| F | 2650.890 | 475.680 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Highly Polluting Enterprises | Non-Highly Polluting Enterprises | State-Owned Enterprises | Non-State-Owned Enterprises | Highly Concentrated Ownership Corporations | Lowly Concentrated Ownership Corporations | |

| Green | Green | Green | Green | Green | Green | |

| CPU | −0.054 *** | −0.024 *** | −0.041 *** | −0.022 ** | −0.032 *** | −0.019 * |

| (−3.728) | (−2.749) | (−2.945) | (−2.587) | (−3.234) | (−1.826) | |

| _cons | −1.323 *** | −1.086 *** | −0.433 | −0.999 *** | −0.836 *** | −1.089 *** |

| (−3.516) | (−4.768) | (−1.086) | (−3.844) | (−3.286) | (−4.082) | |

| Control | √ | √ | √ | √ | √ | √ |

| Year | √ | √ | √ | √ | √ | √ |

| Firm | √ | √ | √ | √ | √ | √ |

| N | 8639 | 23,651 | 10,741 | 17,073 | 17,951 | 14,208 |

| R2 | 0.442 | 0.589 | 0.584 | 0.596 | 0.566 | 0.612 |

| F | 2.734 | 6.392 | 4.205 | 4.081 | 4.964 | 3.629 |

| (1) | (2) | (3) | |

|---|---|---|---|

| EnterMarketShare | Bm | Mfee | |

| CPU | −0.002 * | −0.026 * | −0.009 * |

| (−1.754) | (−1.866) | (−1.844) | |

| _cons | −0.266 *** | −11.212 *** | 1.421 *** |

| (−6.132) | (−13.612) | (2.614) | |

| Control Variables | √ | √ | √ |

| Year | √ | √ | √ |

| Firm | √ | √ | √ |

| N | 32,288 | 30,704 | 30,701 |

| R2 | 0.576 | 0.641 | 0.114 |

| F | 74.020 | 172.130 | 22.092 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, A.; Feng, J.; Cheng, Y. How Does Climate Policy Uncertainty Affect Green Innovation Among Chinese Companies? Sustainability 2025, 17, 3857. https://doi.org/10.3390/su17093857

Chen A, Feng J, Cheng Y. How Does Climate Policy Uncertainty Affect Green Innovation Among Chinese Companies? Sustainability. 2025; 17(9):3857. https://doi.org/10.3390/su17093857

Chicago/Turabian StyleChen, Aonan, Jingwen Feng, and Yangyang Cheng. 2025. "How Does Climate Policy Uncertainty Affect Green Innovation Among Chinese Companies?" Sustainability 17, no. 9: 3857. https://doi.org/10.3390/su17093857

APA StyleChen, A., Feng, J., & Cheng, Y. (2025). How Does Climate Policy Uncertainty Affect Green Innovation Among Chinese Companies? Sustainability, 17(9), 3857. https://doi.org/10.3390/su17093857