Abstract

In the context of China’s swift urbanization and heightened sustainability challenges, SMCEs in the construction industry play a critical role in driving both economic growth and sustainable development. This pioneering study introduces an integrative approach blending sustainability-oriented strategies (SSs) with financing guarantees, addressing key obstacles faced by these firms. Leveraging a multi-agent computational model, we dissect the dynamic interplay among construction SMCEs, governmental bodies, financial institutions, and guarantors, underscoring the transformative impact of financing guarantees on sustainable advancement. Our investigation reveals that optimally structured financing guarantees not only resolve funding challenges but also actively foster adherence to sustainability practices. This dual functionality positions such financial instruments as key enablers of SMCEs’ quest for sustainability, aligning economic objectives with ecological imperatives. Furthermore, we spotlight the transformative effect of strategic management on elevating SMCEs’ commitment to sustainable operations. Collectively, these insights offer actionable pathways for SMCEs embarking on sustainability endeavors, showcasing innovative financial solutions that do not detract from their economic prosperity.

1. Introduction

As the Chinese economy and urbanization rapidly progress, the construction industry is experiencing unprecedented growth [1]. Small- and medium-sized construction enterprises (SMCEs) are pivotal in this expansion, driving urban and community infrastructure development [2,3]. Concurrently, the global push for sustainability, coupled with the Chinese government’s focus on sustainability, imposes pressure on the construction sector to transform [4]. The Chinese government has responded with policies like the “General Specification for Energy Conservation and Renewable Energy Utilization in Buildings”, setting clear energy conservation standards, and the “14th Five-Year Plan for Energy Conservation and Green Building Development”, which outlines sustainable goals for the industry. In this context, SMCEs, as industry linchpins, are crucial for achieving sustainable transformation, and to contribute significantly to societal and environmental sustainability, they should adopt a sustainability-oriented strategy (SS) [5]. Economically, SMCEs can drive development by embracing advanced green technologies and optimizing resource use [6,7,8]; socially, their use of green building materials can mitigate environmental impacts and enhance societal safety [9]. Specifically, SSs refer to enterprises adopting safe, environmentally friendly, and green development means to conform to safety, environmental, and green development requirements, thereby achieving sustainable development [10], and SMCEs’ SSs can provide an effective template for promoting societal sustainable development on a broader scale.

Despite SMCEs’ active efforts toward sustainable development, they face a range of complex and urgent challenges [11]. On one hand, the transformation toward sustainability in China’s construction industry has progressed rapidly. Since the first sustainability standard in construction was introduced in 1986, the Chinese government has established a comprehensive policy framework covering sustainability goals, strategies, and pathways, and 84% of construction projects in China currently meet sustainability criteria, with the scale continuing to grow. This market competition therefore puts pressure on SMCEs that have yet to transition. On the other hand, many SMCEs struggle to implement SSs due to factors such as a small scale, limited resources, slow technology adoption, and funding shortages [12]. For instance, liquidity issues often hinder investment in green technologies or the implementation of sustainable measures [13,14]. Meeting these sustainability standards raises development costs by 5–15% compared to traditional construction, creating significant barriers for SMCEs transitioning to sustainable practices [15,16]. These challenges not only affect the competitiveness of SMCEs but also exacerbate broader societal sustainability issues. Supporting SMCEs in successfully implementing SSs and finding effective solutions to these challenges is therefore crucial for achieving both industry and societal sustainability goals [17].

To tackle these challenges, the government has implemented measures to guide and regulate SMCEs’ sustainable development. Revised laws like the “Environmental Protection Law” and “Occupational Safety and Health Law” set minimum standards and enforce penalties for non-compliance. The government also engages the public and media to expose unsustainable practices, encouraging enterprises to improve their social responsibility. A key new approach is to link SSs with financial tools, particularly financing guarantees. Given the close link between sustainable development and financial health, a company’s financial credit status is crucial [18]. It is thus feasible for government agencies to use financial tools, particularly inclusive finance mechanisms like financing guarantees, to reinforce SS guidance. Some practices already include enterprises’ SS choices as part of financing conditions. For example, Sichuan’s re-guarantee institutions have partnered with the Environmental Protection Bureau to support sustainable projects. The People’s Bank of China in Taizhou promotes integrating sustainability with inclusive finance, focusing on SMCEs to drive their sustainable growth. In Zhejiang, a strategic agreement ties corporate safety and environmental standards to credit, and Jiangnan Bank in Jiangsu offers up to CNY 20 million in loans to SMCEs meeting these standards.

Using inclusive finance tools like financing guarantees to guide SMCEs toward SSs has proven effective. In the Chinese construction industry, green finance has significantly advanced technologies such as renewable energy utilization, advanced lighting, and water-saving innovations, leading to the development of green materials. These technological advancements have increased the market acceptance of green buildings, encouraging SMCEs to adopt SSs more actively [19]. The integration of green buildings with inclusive finance has also broken the capital-intensive development bottleneck in the construction industry, fostering a virtuous development cycle. This not only expands the prospects for SMCEs adopting SSs but also helps address financing challenges and maturity mismatches, supporting structural adjustments and improving the information disclosure system [20]. Additionally, government-backed guarantee agencies have implemented sustainable development certifications for construction projects, establishing risk-sharing mechanisms to encourage capital flow into SMCEs adopting SSs [21,22,23]. For example, the Huzhou government has developed a sustainability evaluation system for the construction industry, requiring that applications for inclusive loans meet this certification. Similarly, Jiangxi government’s “Safety, Environmental Protection Qualified Loan” plan provides financing to enterprises that meet both safety and environmental standards. These measures have not only promoted SMCEs’ adoption of SSs but also demonstrate the effective of financial means.

Nevertheless, the effective use of financial tools like financing guarantees to guide SMCEs’ sustainable development and encourage their adoption of SSs remains underexplored. While the relationship between corporate financing and sustainability has been studied, the literature lacks focus on the heterogeneity and interactive complexity of SS guidance, particularly from the perspective of financing guarantee policies [24]. For instance, questions remain about the effectiveness of policy guidance that relies solely on monitoring sustainable development levels, how financing guarantees can drive SMCEs to adopt SSs, and how to maximize the effectiveness of these policies. Government departments, as the primary entities guiding SMCEs’ SSs and overseeing the financing guarantee system, should, with fiscal support and institutional alignment, enhance the supervision of the financing guarantee system and use market-based incentives to encourage SS adoption, thereby injecting “financial vitality” into corporate sustainability efforts, an approach that can elevate enterprises’ sustainable development levels. Therefore, this research aims to (1) explore the pathways and mechanisms by which financing guarantee policies guide the SS behaviors of small- and medium-sized construction enterprises and (2) investigate effective strategies for this guidance.

To address these issues, this study employs a computational experiment method based on multi-agent interactions to simulate the evolution of SMCEs’ SS decisions under different guidance strategies, offering insights for optimizing government policies that guide SMCEs in adopting SSs. This research makes several innovative contributions. First, it explores the pathways and mechanisms for guiding corporate SSs, going beyond a mere analysis of influencing factors. Second, by introducing financing guarantees as a new perspective, it comprehensively examines the relationship between SMCEs’ financing and sustainable development, offering a novel approach to guiding SMCEs’ SSs. Third, using a computational experimental method, it accounts for subject heterogeneity and simulates multi-agent interactions at the micro level, with macro-level phenomena emerging as a result, thereby more accurately reflecting reality. This research illuminates the impact of government strategies on guiding SMCEs’ SSs, aligning corporate behavior with regulatory objectives, and provides valuable insights for optimizing policies aimed at enhancing SMCEs’ sustainable development.

2. Literature Review

In the face of global environmental challenges and economic transitions, the sustainable development of SMCEs has increasingly become a focal point for policymakers and academic researchers alike [25,26,27]. To address the common barriers SMCEs face in their sustainable development journey—such as resource shortages, a lack of initial capital for sustainable initiatives, and high costs [28]—Álvarez (2019) identifies financing difficulties and inadequate working capital as significant constraints [29]. Gimhani (2021) further confirms the negative impacts of these constraints on the sustainability of SMCEs in construction [30]. Zulu (2023) argues that cognitive, regulatory, economic, and cost-related factors collectively hinder the sustainable development of SMCEs in the construction sector [31]. Government policy interventions also play a crucial role in guiding corporate behavior. Zhang (2022) finds that government policies can effectively shape corporate behavior by creating incentives for internalizing sustainable production strategies [13]. Joo (2018) highlights that government interventions can enhance corporate environmental and technological innovation capabilities [32]. Peng H. (2021) shows that command-and-control environmental regulations have greater impacts on the willingness to undertake green innovation compared to incentives [33], while Xu (2022) argues that a combination of environmental regulation and subsidies is more conducive to fostering corporate green innovation [34]. Furthermore, the combined use of direct subsidies and tax incentives is more effective for carbon emission reduction programs [35]. Green credit policies, which rely on fiscal measures to regulate environmental governance, have significantly reduced enterprise wastewater and harmful gas emissions while promoting green innovation [36,37]. Liu (2023), through a credit market and safety production linkage model, demonstrates the government’s key role in guiding SMCEs’ safe production behaviors [38]. Mei (2017), through qualitative research, illustrates that achieving safety production objectives in SMCEs requires government intervention and guidance [39]. Feng (2022) argues that linking financing with enterprise safety and environmental requirements through compatible incentive mechanisms can achieve mutual benefits [40]. Chen (2022) suggests that by disclosing sustainability information, setting realistic expectation targets, and determining appropriate penalties, the government can effectively guide enterprises toward positive development [41]. Taking a supply chain management perspective, Zhou (2022) notes that the influence of core enterprises’ safety production management behaviors is closely tied to government policies [42].

The above studies clearly demonstrate that the government can effectively influence SMCEs’ sustainable development behaviors [43,44]. However, SMCEs often face significant constraints in their sustainable development due to financing difficulties, a challenge that is particularly pronounced [29]. Financing guarantees, as a crucial financial tool, can significantly shape the development models of enterprises, especially in the areas of innovation and green technology [45,46]. Although the current body of literature provides a strong foundation for this study, the aforementioned studies tend to focus on the impacts of individual factors, lacking an analysis of the interaction mechanisms among multiple factors under complex strategies. Moreover, the research on the impacts of financing guarantee systems on corporate behavior primarily centers on innovation and financing activities. Research that integrates financing guarantees with corporate SS guidance from a sustainable development perspective is limited, with most studies emphasizing traditional regulatory approaches. In terms of methodology, most studies employ static empirical surveys or econometric methods to analyze the relationships between influencing factors. While some scholars utilize evolutionary game theory, it fails to fully capture the complex, multi-agent interactions characteristic of intricate systems. Computational experimentation methods based on multiple parties offer a more comprehensive approach to analyzing the complex nonlinear interactions among parties, with macro-level phenomena emerging from micro-level behaviors. These methods are particularly useful for exploring impact mechanisms and pathways and solving complex system problems, and have been widely applied in corporate safety and environmental protection research [47,48]. For instance, Fang (2023) used a computational experiment model to explore the factors influencing employee safety production behaviors [49].

Building on this rationale, this study constructs a multi-agent computational experiment model that considers the interactions among multiple parties, simulates the evolution of SMCEs’ SSs under various regulatory guidance strategies, and explores the evolutionary paths and intrinsic impact mechanisms of SS guidance for SMCEs from the perspective of financing guarantees.

3. Mechanistic Analysis of Guiding SMCE SSs in the Construction Industry under Financing Guarantee Constraints

3.1. Research Method

The multi-agent computational modeling approach is a powerful research method that is widely used in fields such as economics, social sciences, and artificial intelligence to simulate and analyze complex systems composed of multiple interacting agents. In this approach, each agent operates autonomously, following specific rules and behaviors, which may include decision making, learning, and adaptation based on interactions with the environment or other agents. This approach is particularly useful for studying collective behaviors or patterns arising from agent interactions, offering insights that are difficult to discern when analyzing components in isolation.

Given that this research involves interactions among entities like the government, SMCEs, banks, and guarantee institutions, and addresses activities such as financing constraints, SS selection, and supervision—encompassing mechanisms like financing, sustainability guidance, and government regulation—it represents a complex system. Additionally, this study is grounded in practical scenarios, making the multi-agent computational modeling approach an appropriate method for this research.

3.2. Research Mechanism

The SSs of SMCEs in the construction industry are critical to their contributions at economic, environmental, and social levels. SSs refer to enterprises adopting safe, environmentally friendly, and green development practices to comply with safety, environmental, and green development standards, thereby achieving sustainable development. These include proactively implementing eco-friendly policies in production activities, adhering to safety and health standards, and fulfilling social responsibilities across various dimensions. These practices not only demonstrate the enterprises’ foresight and long-term development strategy but also ensure their competitiveness amid increasing environmental and safety challenges. Studies by Xu (2022) and Zulu (2023) highlight the key roles of government environmental oversight, credit guarantee financing, and effective financial tools in promoting the sustainable development of SMCEs in the construction industry [31,34]. Together, these factors form a dynamic system that influences sustainable behavior in enterprises, integrating aspects such as the environment, health, regulation, industry, economy, and corporate governance. In this context, this study constructs a four-party system comprising SMCEs in the construction industry, banks, the government, and financing guarantee companies. In practice, the guidance of an enterprise’s sustainable development through financing guarantees is predominantly led by the industrial and information departments and supported by regulatory agencies. Therefore, in model construction, the government entity includes both regulatory agencies and the industrial and information departments—the latter leading and supervising financing guarantees, while regulatory agencies such as the safety supervision bureau and the environmental protection bureau are responsible for overseeing daily safety and environmental compliance, as well as assessing the sustainable development levels of enterprises.

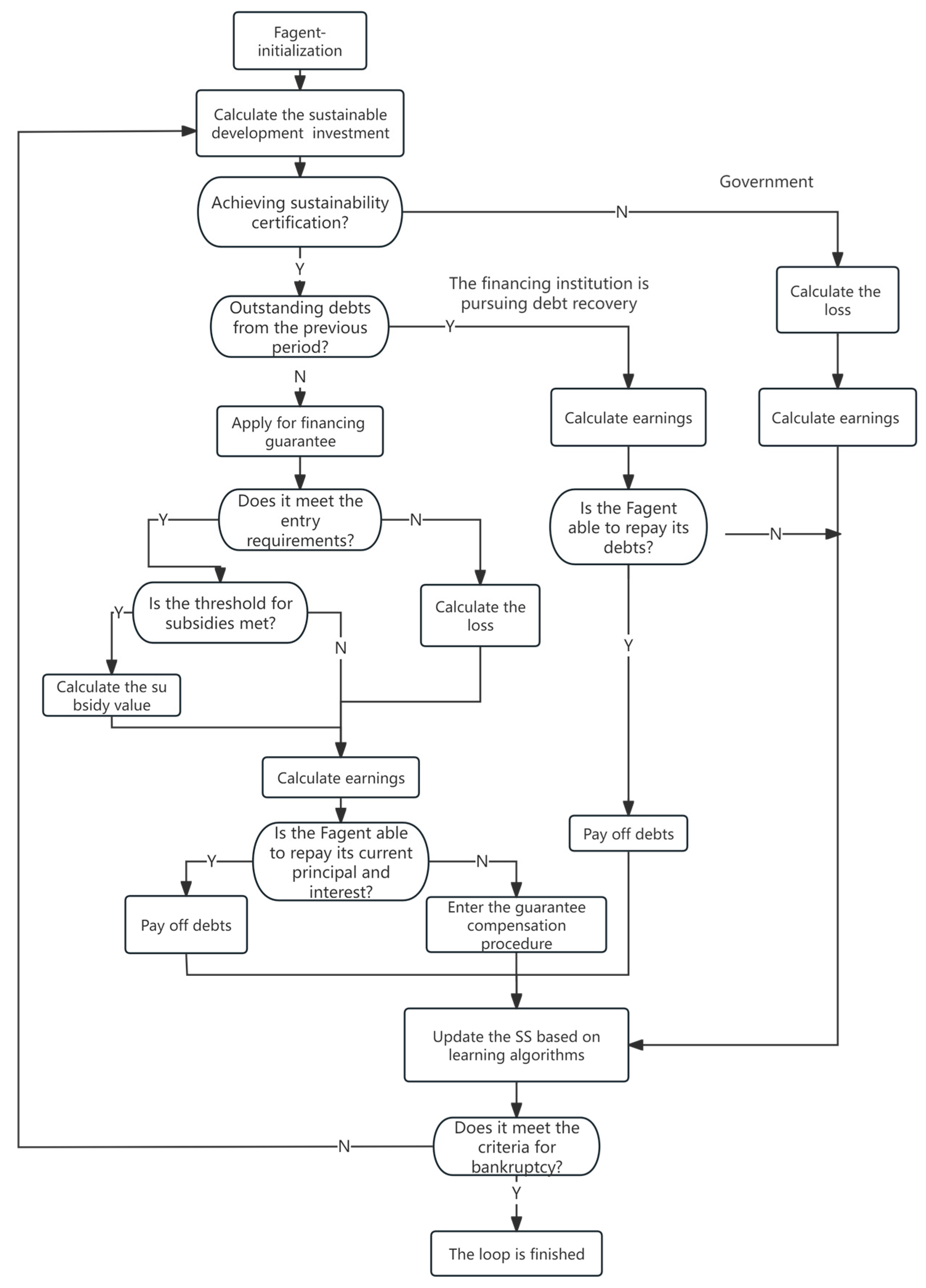

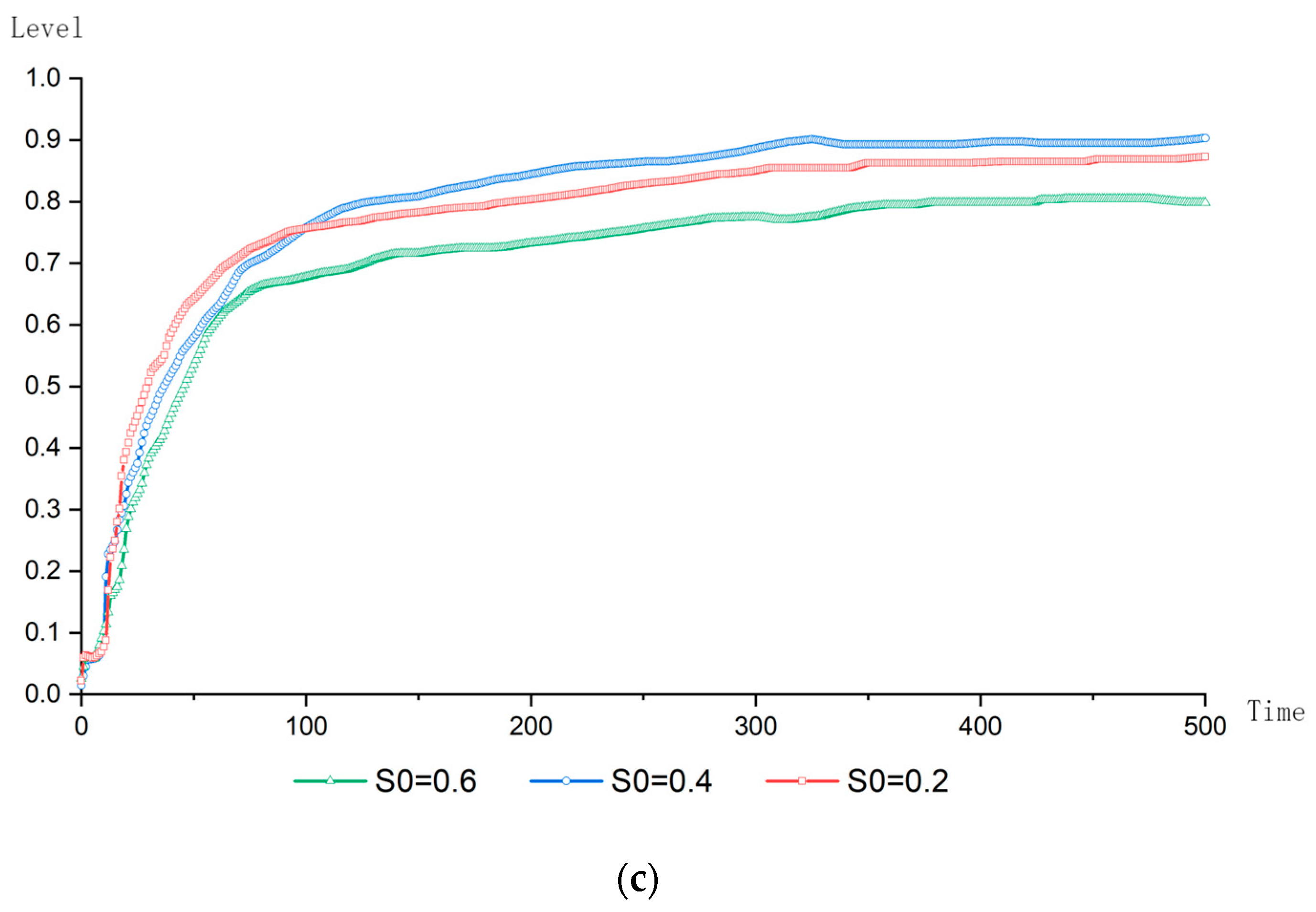

Firstly, to ensure that the daily operations of SMCEs in the construction industry align with sustainable development standards—such as safety, environmental protection, and green practices—SMCEs must comply with government regulations to achieve sustainable development goals. Enterprises seeking financial support through financing guarantees must meet government-imposed sustainability criteria, ensuring that the lender only supports companies that align with sustainable development principles. SMCEs that meet these criteria can access bank loans through the financing guarantee system, where guarantee institutions and cooperative banks sign contracts and provide loans to qualifying enterprises. The government then evaluates the sustainability of SMCEs within the financing guarantee system, penalizing those whose sustainability levels fall below the required standards and offering financial incentives, such as interest rate discounts and premium subsidies, to those that meet the criteria. At the end of each cycle, all entities calculate their profits, with SMCEs required to repay the principal and interest on time; failure to do so triggers the guarantee process, where the guarantee institution and cooperative bank compensate according to a predefined ratio. Subsequently, SMCEs adjust their investments and enter the next cycle; those that become insolvent exit the system. For SMCEs that enter the compensation process, the guarantee institutions and cooperative banks must recover the principal and interest in the following period. At the end of the system cycle, the involved entities evaluate each other’s profits to determine operational strategies for the next cycle. If SMCEs cannot repay the loan, they enter the compensation process, and the guarantee institution and cooperative bank execute the corresponding compensation based on the agreed ratio. Throughout each cycle, the interactions and decisions of all members aim to optimize sustainable development and ensure the long-term stability of the entire system. All events in the experiment are related to the focal party (Fagent, representing SMCEs in the model), with other entities playing various roles at different stages of the Fagent behavior cycle iteration. To facilitate the computational experiment simulation, the sequence of events is represented in the workflow diagram shown in Figure 1.

Figure 1.

Model workflow diagram.

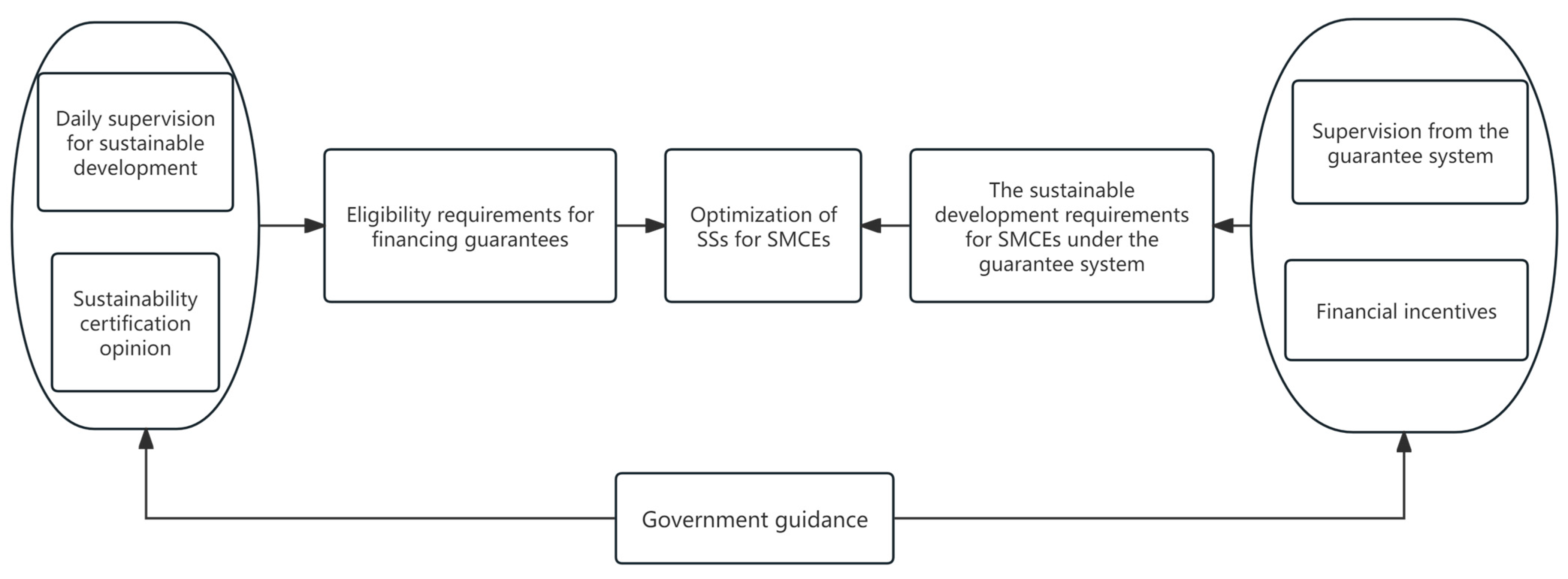

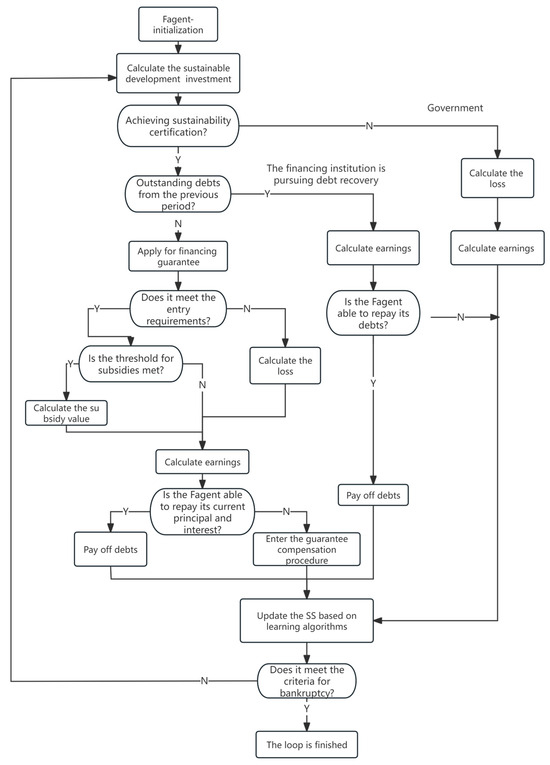

From the above, it is clear that the guidance of SMCEs to maintain SSs is primarily achieved through two aspects. On one hand, government departments directly guide SSs by setting access conditions for SMCEs’ financing guarantees. On the other hand, government departments regularly assess the sustainability levels of SMCEs, implement preferential policies related to sustainability within the financing guarantee system, and define the relevant operational procedures and specific requirements of the financing guarantee system, such as loan interest rates, risk-sharing proportions, and compensation procedures. By creating a favorable financing environment, SMCEs are incentivized to participate and meet the corresponding sustainable development requirements, thereby indirectly guiding SSs. The guiding mechanism is illustrated in Figure 2.

Figure 2.

Guidance mechanism.

4. Model Construction

This study abstracts four types of parties based on real-life scenarios, including the government (represented as Gagent in the model), small- and medium-sized construction enterprises (represented as Fagent in the model), banks (represented as Bagent in the model), and the guarantee institution (represented as Iagent in the model). Among these, the SMCE (Fagent) is adaptive, making choices based on the environment and interactions with other parties.

4.1. Model Assumptions

To construct the model more effectively based on the real-life circumstances of SMCEs in the construction industry, the following assumptions are proposed:

Assumption 1.

SMCEs construct homogeneous buildings with no significant differences in production costs, and the decision making of these enterprises regarding SSs is bounded rational behavior, all aiming to maximize profit.

Assumption 2.

The guarantee institution is a policy-oriented guarantee company, financed by government funds and supported by a fiscal compensation mechanism, and it does not aim for profit.

Assumption 3.

The complex influencing factors of an SMCE’s sustainable production level are simplified into the cost input of sustainable behavior and the attitude towards it. The higher the input and the better the attitude, the higher the level of sustainable production, and increased input is the most direct manifestation of the effectiveness of SS guidance.

Assumption 4.

All SMCEs face financial constraints. Given the objective reasons such as a low collateral value and low credit level, the possibility of obtaining loans through other means is minimal; therefore, this study assumes that SMCEs can only obtain bank loans through financing guarantees, without collateral, excluding other loan methods, and the finances obtained through financing guarantees can only be used for regular production operations or sustainable production activities.

Assumption 5.

Apart from the level of sustainable production, it is assumed that SMCEs in the construction industry can satisfy all other entrance conditions set by the bank and guarantee institutions.

4.2. Description of Parties

4.2.1. SMCEs in the Construction Industry: Fagent

At the beginning of the system, an Fagent is generated, whose main purpose in the system is to obtain bank loans to maintain normal production and operations and to maximize profits. Their main activities are as follows:

- Production and operation activities

Production and operation activities are the focus of SMCEs in the construction industry. Based on the principle of rational economic parties, the objective of each Fagent is to produce and manage to achieve maximized profits. SMCEs in the construction industry deliver or sell completed projects for profit, and assuming that this profit Li,t follows a uniform distribution between e1 and e2, then Li,t can be represented as follows:

- 2.

- Sustainability-oriented production activities

The sustainable production activities of SMCEs in the construction industry are carried out simultaneously with production and operation activities. The cost of sustainable production is described by the company’s sustainable production investment, which mainly includes investments in sustainable production facilities, sustainable production training for employees, emergency rescue, sustainable production management, and participation in the standardization rating for sustainable production, which is closely related to the enterprise’s sustainable production level and can reflect the enterprise’s level of sustainability to a certain extent.

The sustainable production investment of construction enterprise i in period t is represented by Ii,t. Each Fagent will have a certain initial sustainable production investment. In accordance with the literature [40], this study considers that the sustainable production level of the Fagent is related to the investment—the higher the cost of sustainable production invested by the enterprise, the higher the level of sustainability of the enterprise. The sustainable production level of enterprise i in period t, Si,t, can be expressed by the following formula, where a and b are control coefficients, and Sa is the sustainable production attitude possessed by the Fagent:

The system will generate an initial value of Sa for the Fagent, which is related to the Fagent’s sustainable production investment in the first period, Ii,1, and can be represented as . Starting from the second period, the system will dynamically adjust the sustainable production investment value according to the automatic learning algorithm (which will be described later).

The enterprise’s investment in sustainable production not only yields outputs [4], but according to the input–output function, the sustainable production output of construction SMCEs can be represented as , where B is the sustainable production level coefficient, γ is the output elasticity of sustainable production cost investment, and eu represents the randomness factor affecting the level of sustainability. Therefore, the income from sustainable production for this period can be represented as follows:

- 3.

- Financing activities

When the government proposes sustainable development level access requirements for the financing guarantee system, enterprises that meet the sustainable production access conditions S0 can submit a written application to the government and accept the qualification review by the financing guarantee company and the cooperative bank. If they pass the review, they need to pay a guarantee premium ( is the guarantee rate) to the guarantee company, then sign a contract according to the regulations, obtain the loan, and repay the principal and interest on time. Assume that the loan an SMCE can obtain in period t is mi,t, the bank loan interest rate is r, and the investment income of SMCE i in period t after obtaining the loan is VFi,t.

If the SMCE fails to repay the principal and interest on time (default), the cooperative bank will pursue recovery through legal means. If the recovery amount after the T0 period is still insufficient to settle the principal and interest, the guarantee institution and the cooperative bank will share the compensation loss according to a certain ratio, and the SMCE will bear the cost of breach of trust Di,t. Moreover, in the next period of the enterprise’s default, they will assume the responsibility of being pursued for recovery, represented by Qi,t as the amount of principal and interest owed from the previous period recovered in this period.

- 4.

- Expected earnings

Based on the above analysis, the expected earnings of SMCE i in period t when is Ui,t can be expressed as the following formula:

where ti,t and Gi,t are the government’s interest discount rate and premium subsidy to the enterprise, respectively, and φi,t and φ′i,t are the fines for not meeting daily sustainable production supervision standards and for enterprises whose sustainable development level falls below the entry conditions after entering the financing guarantee system, respectively. These parameters will be detailed later in the text.

- 5.

- Learning mechanism

SMCEs have the capacity to learn, which is mainly reflected in sustainable production investments. This study uses an automatic learning algorithm to describe the bounded rationality of the Fagent’s learning ability. The algorithm first needs to assess the following:

- Whether the sustainable production investment for this period has increased compared to the last period;

- Whether the earnings for this period have increased compared to the last period.

Based on the results of the assessment, SMCEs adjust the probability of changes in the sustainable production investment according to the rules shown in Table 1.

Table 1.

Probabilistic adjustment rules for sustainability-oriented inputs.

In this context, ε represents the change in the probability of the volume of sustainable production inputs. The probability vector for changes in a company’s sustainable production input can be expressed as p = (pd, pi, pc), where pd, pi, and pc represent the probabilities that the company’s sustainable production inputs for the next period will decrease, increase, or remain unchanged, respectively, and pd + pi + pc = 1. The initial value is set to p = (pd, pi, pc) = (0.3, 0.3, 0.4). During the experiment, pd, pi, and pc are adjusted according to the rules presented in the table mentioned above.

The probability of change in the sustainable production input of SMCEs in the construction industry is a learning process. The system generates a random number c ∈ [0, 1], and companies adjust the probability of change in their safety production input volume at the end of each period based on the interval value of the random number. The rule for this adjustment is

where and represent the amount by which the company’s sustainable development cost input decreases or increases each period.

- 6.

- “Death” and “rebirth” of SMCEs in the construction industry

To better reflect reality, the model posits that Fagents can go bankrupt and exit the system, while also positing the entry of new Fagents. An Fagent will go bankrupt and exit the system if it meets one of the following conditions: (1) if SMCE i lacks sufficient funds for two consecutive periods (indicating that pursuit of compensation still cannot cover the previous period’s debts), then (Ki,t represents the total funds of enterprise i in period t); (2) if the actual earnings for consecutive t periods are less than 0, then ; and (3) under daily government supervision of SMCEs, when these enterprises i have a high frequency of not meeting sustainable development standards. Additionally, new Fagents will be generated and join the system.

4.2.2. Government Entity: Gagent

In the system, the Gagent plays crucial roles in supervising the level of sustainable development, regulating the market as a whole, and optimizing the environment of the financing guarantee system. It acts as the guiding body for the SSs of small- and medium-sized construction enterprises. Since government policies, once set, will not be frequently altered in the short term, the government’s capacity for learning is not considered. The main activities of Gagent are as follows:

- (1)

- Supervision of sustainability levels

The traditional method of the government to guide the sustainable development activities of small- and medium-sized construction enterprises involves the measurement and supervision of sustainability levels, as mentioned in reference [19]. Assuming the government periodically evaluates the sustainability levels of all small- and medium-sized construction enterprises in the market, if it is found that these companies’ sustainability levels have not reached the government’s prescribed sustainable production standard S1 during inspections, penalties will be imposed on the enterprises in the form of fines. The amount of penalty φi,t is related to the gap between the sustainability level of enterprise i in period t and standard S1, with the penalty rule as follows:

where χ represents the government’s penalty adjustment coefficient for small- and medium-sized construction enterprises that do not meet the sustainability levels, measuring the intensity of penalties. In addition, the government also needs to supervise small- and medium-sized construction enterprises entering the financing guarantee system to encourage their sustainability levels to continuously meet the system’s entry conditions and penalize companies whose sustainability levels have fallen below these conditions (e.g., non-compliance with safety levels and environmental standards), with the penalty rule as follows:

where Pi,t denotes the base value of the penalties imposed by the government on companies within the financing guarantee system whose sustainability levels are below the entry conditions.

- (2)

- Subsidies for the financing guarantee system

The government intervenes in the financing guarantee system in a timely and encouraging manner, designing reasonable mechanisms, formulating and implementing relevant policies to guide the mutual cooperation among various entities in the financing guarantee system, and forming long-term alliance constraints [20]. The government’s subsidies to the financing guarantee system mainly manifest in providing loan interest subsidy mechanisms for small- and medium-sized construction enterprises. The extent of government interest subsidies is related to the sustainability development levels of these small- and medium-sized construction enterprises, and the rules for setting government financing subsidy t are as follows:

S2 is the threshold level of sustainable development that small- and medium-sized construction enterprises need to reach when receiving subsidies, and . In addition, the government will also subsidize the premium for financing guarantees according to the sustainability development situations of these companies. Let us denote Gi,t as the premium subsidy given by the government to company i in period t, with the subsidy rule as follows:

By actively addressing the financing difficulties of small- and medium-sized construction enterprises and improving their SSs, the government can enhance its reputation, expand the scale of commercial bank profits, and increase the number of employment positions. These social welfare benefits can be accounted for as additional income for the government, Sgov. The supervision and intervention of the government in the financing guarantee system entail certain costs, denoted as Csup, including resource allocation, platform construction, etc.

4.2.3. Bank Entity: Bagent

The bank cooperates with the financing guarantee companies, providing loans to small- and medium-sized construction enterprises and generating interest income. If the enterprises do not default, the interest income acquired by the bank from them is , and represents the bank’s investment returns, with being the bank’s investment return rate. If small- and medium-sized construction enterprises default, the bank will proceed to compensation, and if the shortfall is still not covered after a T0 period, the bank will bear a certain proportion of the compensation loss, denoted as the bank’s share of compensation loss ratio A1.

Moreover, the bank also incurs certain costs, including the credit qualification review cost of the loaned small- and medium-sized construction enterprises C1, loan cost C2, the compensation loss Lbank of small- and medium-sized construction enterprises in case of default, and the collection cost C3. Based on the analysis above, the expected revenue expression of the bank Ubank can be described as follows:

where the costs of qualification review C1 and collection cost C3 for small- and medium-sized construction enterprises are shared between the financing guarantee companies and cooperating banks, and and k1 are the proportions of these two costs shared by the cooperating banks. Additionally, Lbank can be calculated from the total compensation amount of all enterprises in the current period, ; the bank’s loan cost C2 is related to the loan amount mi,t; and the collection cost is related to the amount Qi,t to be collected.

4.2.4. Guarantee Institution Entity: Iagent

Entrusted by government departments, guarantee institutions provide loan guarantees for small- and medium-sized construction enterprises, earning premium income, supported by the treasury. The activities of the guarantee institution entity can be divided into pre-event, during-event, and post-event stages.

In the pre-event stage, the guarantee institution and cooperating banks jointly screen small- and medium-sized construction enterprises that meet the entry conditions (i.e., credit qualification review), sharing the credit qualification review cost C1 with the bank. During the event (guarantee stage), the guarantee institution provides financing guarantees for approved small- and medium-sized construction enterprises, with the guarantee cost being GI and earning premium income , being the guarantee rate, while also earning investment income , with being the guarantee institution’s investment return rate. When small- and medium-sized construction enterprises default, entering the post-event stage (compensation stage), the bank proceeds with collection first, and if the shortfall is still not covered after a T0 period, the guarantee institution needs to compensate according to the risk-sharing ratio, denoted as A2, with the possible compensation loss being .

In summary, the expected revenue expression of the guarantee institution entity Uins can be represented as follows:

where and k2, respectively, denote the proportion of the costs of credit qualification review and collection cost borne by the guarantee institution amongst small- and medium-sized construction enterprises, and the guarantee cost GI is related to the guarantee amount mi,t.

5. Simulated Experiments

5.1. Experimental Parameter Design

This study utilized the Netlogo 6.1.0 software package to simulate the evolution of the sustainable development level of SMCEs under different scenarios, aiming to measure the guiding effects of various measures on the SSs of these companies. The study also simulated the changes in the earnings of three entities, namely Fagent, Bagent, and Iagent, to assess the economic impacts of related guiding measures on each entity.

To closely align with reality, this study designed the number of experimental samples based on the average number of SMCEs involved in sustainability level standard loans in real prototypes. Certain parameters, such as the profit Li,t, sustainable production attitude Sa, and loan amount mi,t, are distributed within a specific range randomly to accommodate the heterogeneous characteristics of different small- and mid-sized construction enterprises. Other parameters, such as the qualification review costs for Fagent, compensation and recourse costs, loan costs for Bagent, and guarantee costs for Iagent, are all related to the loan amount mi,t obtained by the SMCEs and the unpaid principal and interest Qi,t. The settings of the common experimental parameters and the personalized parameters for each entity, considering the real objective prototypes, are derived from empirical values obtained after multiple software tests and training and comparisons with real prototypes. Table 2 lists the main parameters’ values and assignment rules.

Table 2.

Table of main system variables, parameter ranges, and assignment rules.

5.2. Simulated Experiments and Result Analysis

This study designed three experimental scenarios: Scenario 1 is restricted by only the government’s regular sustainability level supervision, which serves as a control group that allows for a comparison between the guidance provided by the financing guarantee system and traditional government intervention methods; Scenario 2 stipulates that besides sustainability level supervision, the government also puts forward sustainability development level requirements for SMCEs in the construction industry within the entrance criteria of the financing guarantee system; Scenario 3, apart from the government’s regular sustainability supervision and the sustainable development level requirements in the entrance criteria, introduces subsidy measures related to sustainable development into the financing guarantee system, specifically in the form of penalties for system-internal SMCEs in the construction industry that do not meet sustainability levels along with discount interest and premium subsidies. At the onset of the experiment, one hundred Fagent entities, one Gagent entity, one Bagent entity, and one Iagent entity are generated, with a set operational cycle of 500 periods.

5.2.1. Experiments on the Evolutionary Impacts of Different Guidance Strategies on the SSs of SMCEs in the Construction Industry

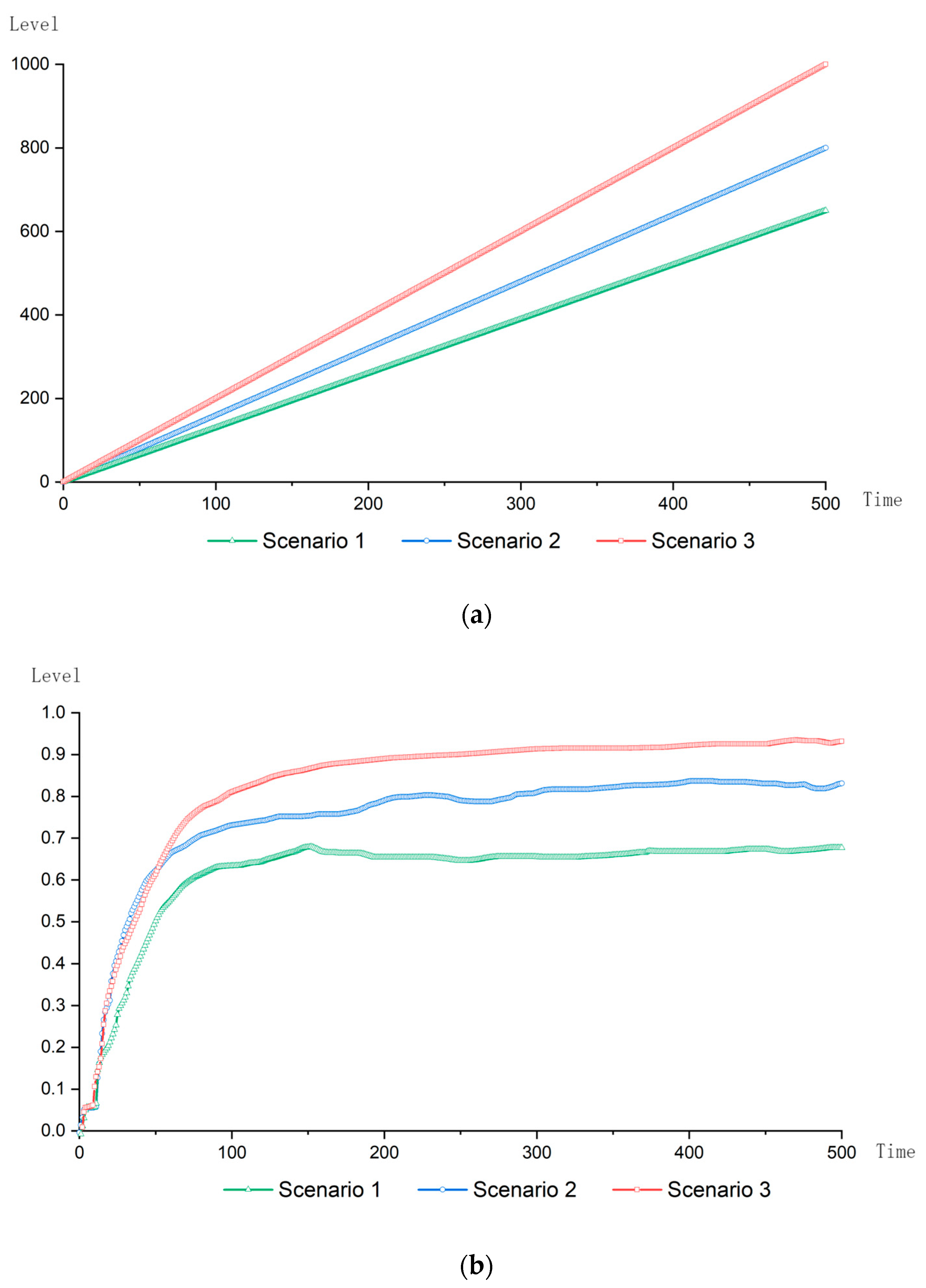

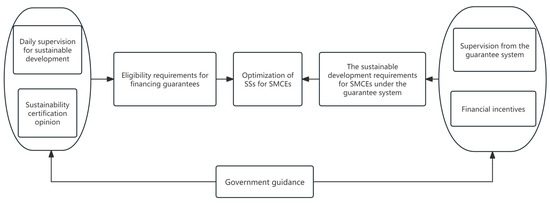

The purposes of this experiment are to explore the evolutionary trends of the average sustainable development investment amount and average sustainable development level among SMCE groups under the three scenarios, and to compare the guiding effects of different policies on the SSs of SMCEs in these scenarios. The experimental results are shown in Figure 3.

Figure 3.

(a) The impacts of different guidance strategies on SS investments by SMCEs. (b) The impacts of different guidance strategies on the sustainable development level of SMCEs.

As indicated in Figure 3a, all three scenarios exert a certain guiding effect on the SSs of SMCEs. These enterprises are motivated to increase their investments in sustainable production. During the 500 cycles, the average sustainable production investment level of the SMCE groups shows an increasing trend, but the speed of increase and the maximum investment level reached at the end of the evolution differ among the scenarios. Under Scenario 1, regular government supervision has a certain guiding effect on the SSs of SMCEs, but the growth rate is the slowest, with the sustainable production investment level reaching only about 650 at the end of the evolution. Under Scenario 2, the average sustainable production investment level of the construction company groups increases faster than in Scenario 1, with the level reaching about 800 at the end. In Scenario 3, the sustainable production investment level increases the fastest, with the level reaching around 1000 at the end of the evolution.

From Figure 3b, we learn that in all three scenarios, the average sustainable development level of SMCEs improves to some extent, but the level reached at the stable state after evolution differs. Starting from around the 100th cycle, all three scenarios enter a stable evolutionary state. Scenario 1 fluctuates between 0.5 and 0.6, the lowest among the three scenarios. Scenario 2 is higher than Scenario 1, stabilizing at the fluctuation between 0.7 and 0.8. Scenario 3 is the highest, stabilizing around 0.9; starting from the 220th cycle, it reaches 0.9 and remains stable.

The reasons for the above states are as follows: When the government only supervises the everyday sustainability level of the companies, penalty measures can force the enterprises to pay attention to sustainable production, but the effect is limited. The sustainability level standards set via the everyday safety supervision procedures are not very high, and so their impacts on the sustainability development investments and sustainable production levels of the enterprises are limited. With the introduction of the government’s sustainable development requirements in the entrance conditions of the financing guarantee system, the SS guiding effect becomes evident for SMCEs, with significant improvements in both the investment in sustainable development and the sustainable development level. This implies that the inclusive finance role of the financing guarantee system can attract SMCEs. The enterprises have an incentive to enhance SSs to meet the entry conditions for obtaining loans, and the sustainability assessment and supervision measures within the system have a certain deterrent effect on these enterprises. When the government implements interest subsidies and premium subsidies for the financing guarantee system, if enterprises can obtain these subsidies, the cost of the loan is significantly reduced. The reduced loan costs can effectively compensate for the cost of the sustainable production investment, and so SMCEs are willing to invest more to enhance sustainable production levels to meet the subsidy standards and obtain loans at a lower cost. Under this scenario, the investment in sustainable production and the sustainable development level of the enterprises reach a more ideal state, hence showing the most optimal guiding effect.

The results indicate the following: (1) The current singular regulatory guidance measures for sustainable development can have a certain guiding effect. Still, as the measures are not very forceful or demanding, they cannot further guide the SSs of SMCEs, and so other strategies should be used in combination. (2) Through the government’s implementation of regular supervision of sustainable production using the financing guarantee system and raising the sustainable development requirements for SMCEs entering the system, effective SS guidance can be realized. (3) Subsidy measures related to sustainable production have a better guiding effect than merely setting sustainable production requirements in the entrance criteria.

5.2.2. Experiments on the Evolutionary Impacts of Parameter Changes in Different Guidance Strategies on the SSs of SMCEs in the Construction Industry

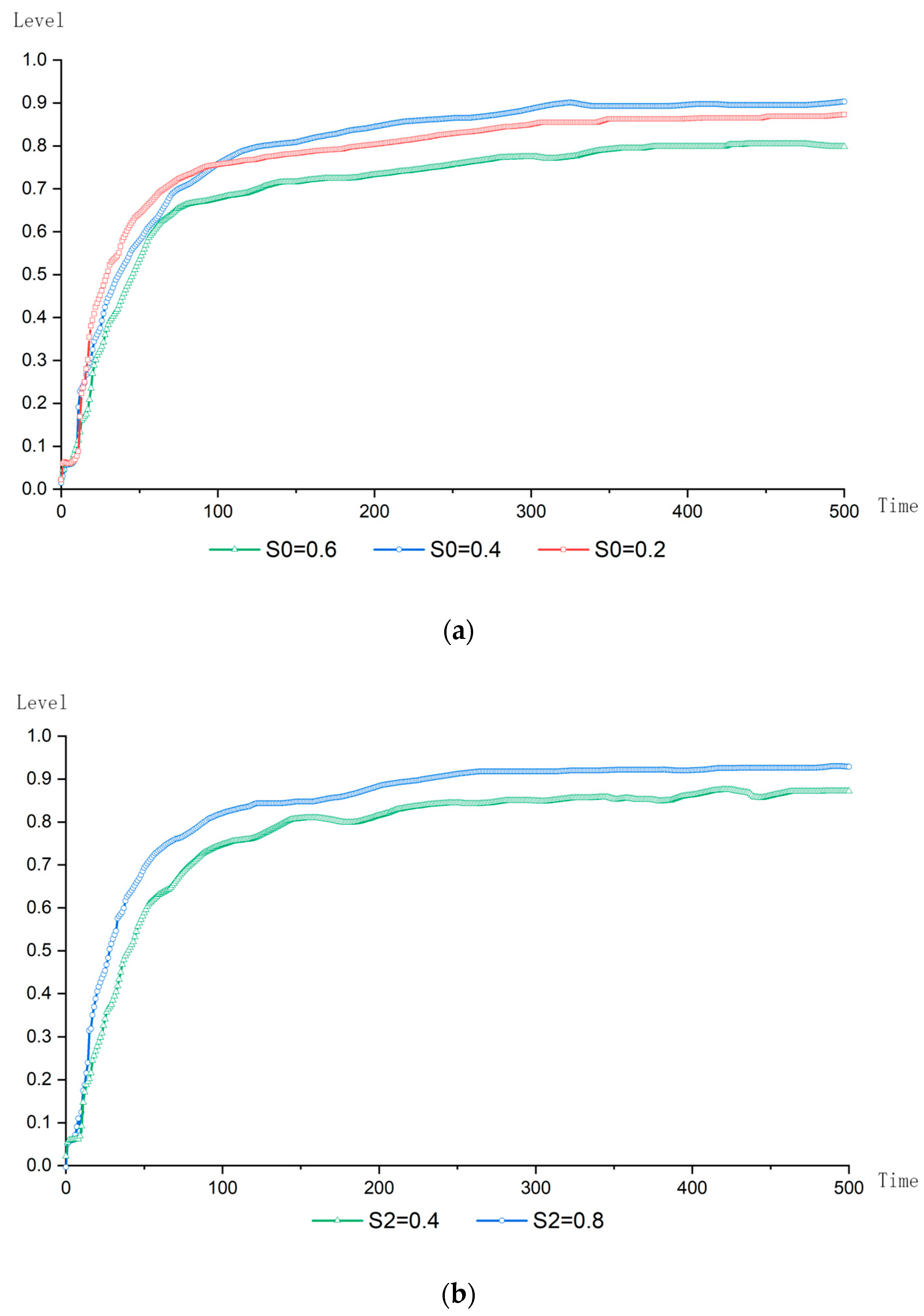

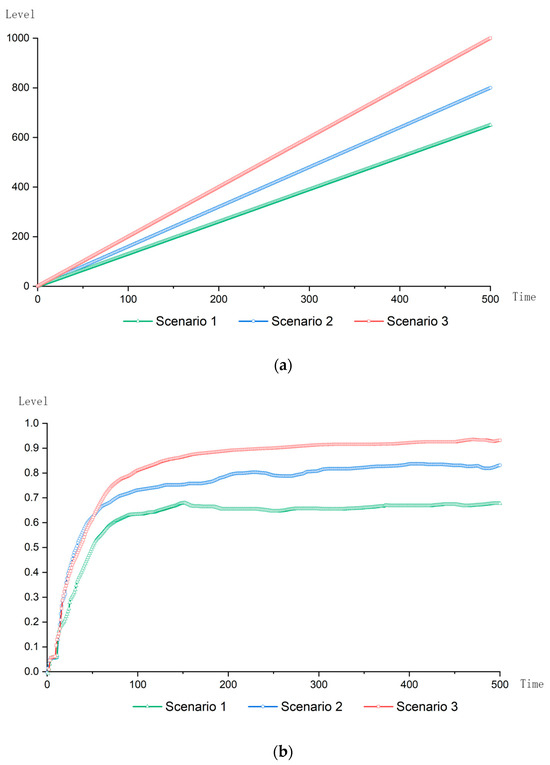

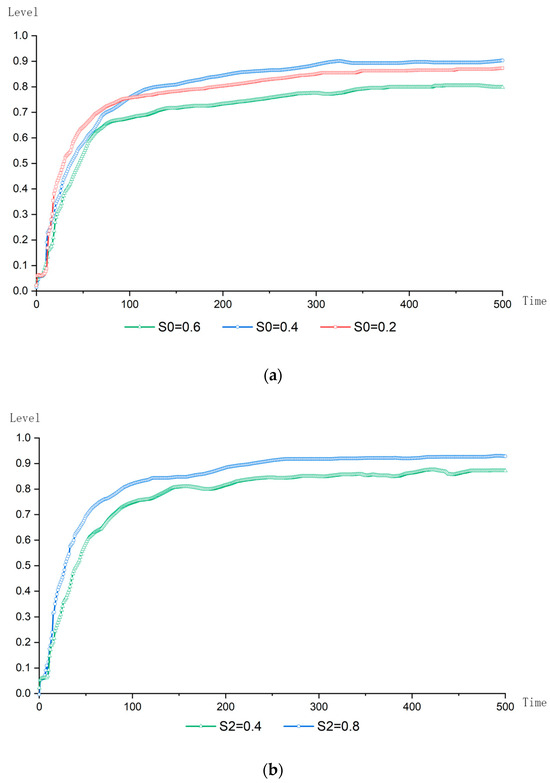

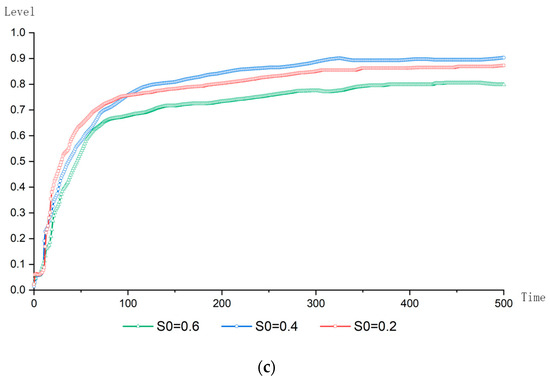

To further investigate the impacts of parameter changes in the SS guidance strategy on the guidance effect for SMCEs, this experiment takes Scenario 3—which has the highest average sustainable development level after evolutionary stabilization—as an example to explore the impacts of changes in the entrance criteria S0, as well as the subsidy conditions for interest and premiums (S2 and S3), on the SSs of the group of SMCEs. The experimental results are as shown in Figure 4.

Figure 4.

(a) The impact of changes in S0 on the average sustainable development level of SMCEs. (b) The impacts of interest and a 50% subsidy threshold on the average sustainable development level of SMCEs. (c) The impact of a 100% premium subsidy threshold on the average sustainable development level of SMCEs.

In the experiment investigating the impact of entrance condition changes on the average sustainable development level of SMCEs, with fixed parameters S1 = 0.45, S2 = 0.65, and S3 = 0.75, we observed the influence of variations in S0 on the experimental outcomes. From Figure 4a, it is evident that changes in entrance conditions have a minimal impact on the average sustainable development level of SMCEs in the initial stage. In the mid-stage, low and medium entrance conditions do not significantly affect the companies’ average sustainable development level, but higher entrance conditions surprisingly do not offer better guidance. The medium level of entrance conditions in the later stages has the best guiding effect on the SSs of SMCEs. The reason might be that, regardless of the entrance conditions, SMCEs can afford the costs associated with pursuing those conditions and are capable of striving for a higher level of sustainable development in the initial stage. As the entrance conditions gradually become stricter, SMCEs need to expend more costs to enter the financing guarantee system, and maintaining a sustainable development level higher than the entrance conditions after entering the system also puts pressure on these companies. When the entrance condition is at a medium level, the enterprises can afford the costs of achieving these conditions and are motivated to pursue subsidies to offset the costs, and the sustainable development level can therefore evolve to the highest level. However, when the entrance conditions are high, although the enterprises’ average sustainable development level can meet the conditions, the high costs involved mean that after reaching the subsidy threshold, the companies no longer have the motivation to pursue a higher level of sustainable development due to the excessive investment.

In the experiment analyzing the impacts of the interest and a 50% premium subsidy threshold on the average sustainable development level of SMCEs with fixed parameters S0 = 0.45, S1 = 0.45, and S3 = 0.85, a change in S2 was observed due to its influence on the experimental outcomes. As depicted in Figure 4b, a higher threshold evidently produces a more pronounced effect on the SS guidance, with a faster growth rate. The reason for this phenomenon may be that the threshold is related to both the interest subsidy and premium subsidy. Since the subsidies are relatively generous, they have a strong appeal to SMCEs. Therefore, regardless of the changes in the threshold, if the amount of subsidy can cover the costs of sustainable development for the SMCEs, these companies are motivated to adopt SSs.

In the experiment evaluating the impact of a 100% premium subsidy threshold on the average sustainable development level of SMCEs with fixed parameters S0 = 0.45, S1 = 0.45, and S2 = 0.55, the effect of variations in S3 on the experimental outcome was observed. According to Figure 4c, the difference between low and high subsidy thresholds is minimal, with the guidance effect of the lower threshold being slightly better than that of the higher one. This is because when the subsidy threshold is low, companies incur lower costs but can still obtain subsidies, and so they can therefore afford to pursue a higher level of sustainable development. However, when the subsidy threshold is high, companies must first incur higher costs to improve their sustainable development level before they can use subsidies to compensate for the considerable costs of reaching the threshold. Consequently, once they reach the threshold, they no longer have the incentive to incur additional costs to pursue even higher thresholds.

The experiment indicates that under the guidance policy of Scenario 3, the average sustainable development level of the group of SMCEs has reached the highest level among all scenarios. Adjusting the strategy parameters can still affect the average sustainable development level within a small range, but it needs to be maintained within a reasonable scope. Thresholds that are neither too high nor too low produce optimal guidance effects, while a moderate threshold can both play a guiding role and not impair the profits of SMCEs, thus achieving the best guidance effect.

6. Conclusions

This study constructs a multi-agent computational experiment model to explore the mechanism of guiding the SSs of SMCEs through the financing guarantee system in practice. It compares the evolution of the average sustainable development level of SMCEs under different guidance strategies and examines the impacts of changes in various guidance strategy parameters on the SSs of SMCEs. This study provides decision-making references for strategies to guide the SSs of SMCEs, and the main conclusions are as follows:

- (1)

- Different guidance strategies can influence the SSs of SMCEs to varying degrees, with different effects. The most effective strategy combines daily supervision with the sustainable development entrance conditions of the financing guarantee system, along with related premium and interest subsidy strategies. While continuing daily supervision, the government should therefore implement the financing guarantee system linked to the sustainable development levels of loan-seeking enterprises and establish a subsidy mechanism. This approach would not only enhance the role of the financing guarantee system in inclusive finance but also guide SMCEs to improve their sustainable development levels.

- (2)

- In the scenario where SS is guided through the financing guarantee system, changes in subsidy thresholds and entrance conditions have moderate impacts on SMCEs’ SSs. However, excessively high subsidy thresholds and entrance conditions can lead to unsustainable development costs, causing SMCEs to abandon the pursuit of higher sustainable development levels. Conversely, if thresholds and conditions are too low, there is little incentive for these enterprises to strive for higher sustainable development levels. Both extremes are therefore counterproductive to guiding SMCEs’ SSs. The government should maintain reasonable entrance conditions and subsidy thresholds to ensure that the expected profits of SMCEs can offset their sustainable development costs.

- (3)

- Guiding the SSs of SMCEs essentially involves enabling these enterprises to make satisfactory decisions regarding sustainable development under bounded rationality. The SS decisions made by enterprises are influenced not only by their own profits but also by their environment and the behavior of other enterprises. The government should recognize the uniqueness of SMCEs, actively promote sustainable development education, guide them to voluntarily enhance their awareness of sustainable development, and foster a supportive atmosphere for sustainable development.

7. Contributions, Limitations, and Future Research

7.1. Theoretical Contributions

This study contributes to the research on guiding the SSs of SMEs, particularly by integrating financial constraints with government guidance, and exploring new policy guidance methods. Utilizing a multi-agent computational experiment model, our study advances the current understanding of the subject in several groundbreaking ways.

- (1)

- We introduce a new model designed to map the execution complexities of SSs among SMCEs in detail. This innovative approach highlights the intricate interdependencies and the multifaceted pathways of interaction between parties. Unlike conventional econometric frameworks that often oversimplify these dynamics, our model provides a more comprehensive and integrative perspective on the mechanisms driving SS implementation.

- (2)

- A key finding of our research is that financing guarantees go beyond their traditional role as funding mechanisms, emerging as strategic tools crucial for endorsing sustainable practices. This insight supports the argument that inclusive financial instruments should be carefully designed to meet economic goals while also serving as vital catalysts for broader environmental and societal impacts.

- (3)

- Our findings contribute to the discussion on bounded rationality, revealing the complex balancing act SMCEs perform in aligning sustainability goals with financial constraints. This diverges from the traditional view of these entities as purely rational parties, uncovering a more nuanced decision-making process influenced by a combination of regulatory mandates, financial incentives, and sustainability orientations.

- (4)

- The methodological advancements in this research offer a powerful tool for dynamically analyzing policy interventions, significantly enhancing the framework for evaluating the immediate impacts of regulatory changes on business behavior. This novel approach encourages scholars and policymakers to replicate our model in various scenarios, thereby deepening the understanding of different policy instruments’ effectiveness over time.

In summary, our study challenges and extends conventional theoretical paradigms, providing fresh insights into the interconnected areas of strategic management, sustainable development, and corporate finance. This work bridges critical gaps and lays the groundwork for future research aimed at navigating the complexities of sustainable transformation in the construction sector. Through these theoretical innovations, we aim to elevate both academic and practical discussions, steering them toward more sustainable, inclusive, and financially viable outcomes.

7.2. Practical Contributions

This research not only illuminates new academic pathways but also opens the door to tangible, actionable strategies for industry practitioners and policymakers, marking a significant step towards blending theory with practice.

Our findings carve out a roadmap for the integration of sustainable and financial strategies within SMCEs, particularly those in the construction sector. This study guides business leaders towards seamlessly incorporating SSs with their economic objectives. By viewing sustainability as a key strategic asset rather than merely a regulatory hurdle, companies can unlock new dimensions of competitive advantage. This holistic approach not only champions environmental stewardship but also propels businesses towards a sustainably profitable future.

The insights derived from our investigation are instrumental for policy architects. The nuanced understanding of the varying impacts of financing guarantees on SMCEs’ sustainability practices highlights the necessity of balanced policy frameworks. Moderate, well-calibrated policy thresholds emerge as essential levers for fostering sustainable development synergies alongside economic vitality. Hence, our research enriches the policy toolkit with nuanced strategies tailored for nurturing a sustainable business ecosystem without compromising on growth dynamics.

One of the salient contributions of this study lies in demonstrating the dual utility of financing guarantees—mitigating financial barriers while simultaneously propelling sustainability initiatives. Our analysis urges financial entities to recalibrate their service portfolios to encompass sustainability-centric offerings, thus enabling SMCEs to pursue their sustainability agendas effectively. By evidencing the symbiotic potential between finance and sustainability, we pave the way for financial products that act as conduits for sustainable transformation within the SMCE domain.

In summary, the practical dimensions of our study have far-reaching implications, offering a rich tapestry of strategies for industry leaders, policymakers, and financial institutions. By foregrounding a nuanced appreciation of the complex interplay between sustainability, finance, and policy, our research charts a course towards a more sustainable, economically robust future for SMCEs. With these practical contributions, we aspire to foster a paradigm shift in how sustainability is perceived, practiced, and promoted within the business community and beyond.

7.3. Limitations and Future Research

While acknowledging the rigorous and methodical nature of our research, it is also imperative to recognize its limitations. Firstly, given the reliance of this study on computational simulations, the robustness of our projected scenarios is contingent upon the underlying assumptions of model parameters. As a result, discrepancies may arise when these scenarios are compared with the complex realities of the world. Secondly, since this study is based solely on the Chinese context, it does not account for cultural diversity or differences in institutional environments, thereby presenting an opportunity for future research to integrate cultural and institutional diversity and consider cross-regional studies. Thirdly, this study simplifies the consideration of the breadth and diversity of financial mechanisms such that future research could further incorporate a broader range of financial mechanisms to enhance the model’s universality and precision.

Author Contributions

Methodology, Q.Z.; Software, Q.Z.; Writing—original draft, Z.M. and W.H.; Writing—review & editing, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Natural Science Foundation of China (grant number 72004081) and The Key Project of Philosophy and Social Science Research in Colleges and Universities in Jiangsu Province (grant number 2022SJZD017).

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding authors.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cai, Z.; Liu, Q.; Cao, S. Real estate supports rapid development of China’s urbanization. Land Use Policy 2020, 95, 104582. [Google Scholar] [CrossRef]

- Sarvari, H.; Chan, D.W.; Alaeos, A.K.F.; Olawumi, T.O.; Aldaud, A.A.A. Critical success factors for managing construction small and medium-sized enterprises in developing countries of Middle East: Evidence from Iranian construction enterprises. J. Build. Eng. 2021, 43, 103152. [Google Scholar] [CrossRef]

- Mabasa, K.; Akinradewo, O.; Aigbavboa, C.; Oguntona, O. Contributions of construction small, medium, and micro enterprises towards the sustainable growth of Zambia. Sustainability 2023, 15, 7746. [Google Scholar] [CrossRef]

- Wang, N. The role of the construction industry in China’s sustainable urban development. Habitat Int. 2014, 44, 442–450. [Google Scholar] [CrossRef]

- DiBella, J.; Forrest, N.; Burch, S.; Rao-Williams, J.; Ninomiya, S.M.; Hermelingmeier, V.; Chisholm, K. Exploring the potential of SMCEs to build individual, organizational, and community resilience through sustainability–oriented business practices. Bus. Strategy Environ. 2023, 32, 721–735. [Google Scholar] [CrossRef]

- İncekara, M. Determinants of process reengineering and waste management as resource efficiency practices and their impact on production cost performance of Small and Medium Enterprises in the manufacturing sector. J. Clean. Prod. 2022, 356, 131712. [Google Scholar] [CrossRef]

- Alraja, M.N.; Imran, R.; Khashab, B.M.; Shah, M. Technological innovation, sustainable green practices and SMCEs sustainable performance in times of crisis (COVID-19 pandemic). Inf. Syst. Front. 2022, 24, 1081–1105. [Google Scholar] [CrossRef]

- Chien, F.; Kamran, H.W.; Nawaz, M.A.; Thach, N.N.; Long, P.D.; Baloch, Z.A. Assessing the prioritization of barriers toward green innovation: Small and medium enterprises Nexus. Environ. Dev. Sustain. 2021, 24, 1897–1927. [Google Scholar] [CrossRef]

- Fatourehchi, D.; Zarghami, E. Social sustainability assessment framework for managing sustainable construction in residential buildings. J. Build. Eng. 2020, 32, 101761. [Google Scholar] [CrossRef]

- Ortiz-Avram, D.; Ovcharova, N.; Engelmann, A. Dynamic capabilities for sustainability: Toward a typology based on dimensions of sustainability-oriented innovation and stakeholder integration. Bus. Strategy Environ. 2024, 33, 2969–3004. [Google Scholar] [CrossRef]

- De Steur, H.; Temmerman, H.; Gellynck, X.; Canavari, M. Drivers, adoption, and evaluation of sustainability practices in Italian wine SMCEs. Bus. Strategy Environ. 2020, 29, 744–762. [Google Scholar] [CrossRef]

- Abdmouleh, Z.; Alammari, R.A.M.; Gastli, A. Review of policies encouraging renewable energy integration & best practices. Renew. Sustain. Energy Rev. 2015, 45, 249–262. [Google Scholar]

- Zhang, L.; Saydaliev, H.B.; Ma, X. Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renew. Energy 2022, 193, 991–1000. [Google Scholar] [CrossRef]

- Bungau, C.C.; Bungau, T.; Prada, I.F.; Prada, M.F. Green buildings as a necessity for sustainable environment development: Dilemmas and challenges. Sustainability 2022, 14, 13121. [Google Scholar] [CrossRef]

- Rehm, M.; Ade, R. Construction costs comparison between ‘green’and conventional office buildings. Build. Res. Inf. 2013, 41, 198–208. [Google Scholar] [CrossRef]

- Matt, D.T.; Orzes, G.; Rauch, E.; Dallasega, P. Urban production—A socially sustainable factory concept to overcome shortcomings of qualified workers in smart SMCEs. Comput. Ind. Eng. 2020, 139, 105384. [Google Scholar] [CrossRef]

- Ridwan Maksum, I.; Yayuk Sri Rahayu, A.; Kusumawardhani, D. A Social Enterprise Approach to Empowering Micro, Small and Medium Enterprises (SMCEs) in Indonesia. J. Open Innov. Technol. Mark. Complex. 2020, 6, 50. [Google Scholar] [CrossRef]

- Harsanto, B.; Kumar, N.; Michaelides, R. Sustainability-oriented innovation in manufacturing firms: Implementation and evaluation framework. Bus. Strategy Environ. 2024, 33, 5086–5108. [Google Scholar] [CrossRef]

- Peng, Y.; Fan, Y.; Liang, Y. A green technological innovation efficiency evaluation of technology-based SMCEs based on the undesirable sbm and the malmquist index: A case of Hebei province in China. Sustainability 2021, 13, 11079. [Google Scholar] [CrossRef]

- Cimoli, M.; Dosi, G.; Landesmann, M.A.; Mazzucato, M.; Page, T.; Pianta, M.; Stiglitz, J.E.; Walz, R. Which industrial policy does Europe need? Intereconomics 2015, 50, 120–155. [Google Scholar]

- Phung, Q.; Erdogan, B.; Nielsen, Y. Project management for sustainable buildings: A comprehensive insight into the relationship to project success. Eng. Constr. Archit. Manag. 2023, 30, 2862–2878. [Google Scholar] [CrossRef]

- Dainty, A.; Leiringer, R.; Fernie, S.; Harty, C. BIM and the small construction firm: A critical perspective. Build. Res. Inf. 2017, 45, 696–709. [Google Scholar] [CrossRef]

- Lu, Y.; Zhang, X. Corporate sustainability for architecture engineering and construction (AEC) organizations: Framework, transition and implication strategies. Ecol. Indic. 2016, 61, 911–922. [Google Scholar] [CrossRef]

- Rivera-Lirio, J.M.; Muñoz-Torres, M.J. The effectiveness of the public support policies for the European industry financing as a contribution to sustainable development. J. Bus. Ethics 2010, 94, 489–515. [Google Scholar] [CrossRef]

- Biryukov, E.; Elina, O.; Lyandau, Y.; Mrochkovskiy, N. Russian SMCEs in achieving sustainable development goals. In E3S Web of Conferences, Proceedings of the Ural Environmental Science Forum “Sustainable Development of Industrial Region” (UESF-2021), Chelyabinsk, Russia, 17–19 February 2021; EDP Sciences: Les Ulis, France, 2021; Volume 258, p. 06021. [Google Scholar]

- Chatzistamoulou, N.; Tyllianakis, E. Green growth & sustainability transition through information. Are the greener better informed? Evid. Eur. SMCEs. J. Environ. Manag. 2022, 306, 114457. [Google Scholar]

- Bakar, K.A.; Senin, A.A. Modelling sustainability of SMCEs business in the new economic transition. Int. J. Bus. Econ. Law 2016, 11, 31–37. [Google Scholar]

- Kumar, S.; Raut, R.D.; Aktas, E.; Narkhede, B.E.; Gedam, V. Barriers to adoption of industry 4.0 and sustainability: A case study with SMCEs. Int. J. Comput. Integr. Manuf. 2023, 36, 657–677. [Google Scholar] [CrossRef]

- Jaramillo, J.Á.; Sossa, J.W.Z.; Mendoza, G.L.O. Barriers to sustainability for small and medium enterprises in the framework of sustainable development—Literature review. Bus. Strategy Environ. 2019, 28, 512–524. [Google Scholar] [CrossRef]

- Gimhani, K.D.M.; Perera, P.L. Critical Barriers in Implementing Sustainable Construction Methods among Small-Medium Contractors in Sri Lanka. In Fostering Opportunities for Technopreneurship in the New Normal; University of Vocational Technology: Dehiwala-Mount Lavinia, Sri Lanka, 2021. [Google Scholar]

- Zulu, S.L.; Zulu, E.; Chabala, M.; Chunda, N. Drivers and barriers to sustainability practices in the Zambian Construction Industry. Int. J. Constr. Manag. 2023, 23, 2116–2125. [Google Scholar] [CrossRef]

- Joo, H.Y.; Seo, Y.W.; Min, H. Examining the effects of government intervention on the firm’s environmental and technological innovation capabilities and export performance. Int. J. Prod. Res. 2018, 56, 6090–6111. [Google Scholar] [CrossRef]

- Peng, H.; Shen, N.; Ying, H.; Wang, Q. Can environmental regulation directly promote green innovation behavior?—Based on situation of industrial agglomeration. J. Clean. Prod. 2021, 314, 128044. [Google Scholar] [CrossRef]

- Xu, Y.; Liang, J.; Dong, Z.; Shi, M. Can environmental regulation promote green innovation and productivity? The moderating role of government interventions in urban China. Int. J. Environ. Res. Public Health 2022, 19, 13974. [Google Scholar] [CrossRef] [PubMed]

- Zhao, R.; Zhou, X.; Han, J.; Liu, C. For the sustainable performance of the carbon reduction labeling policies under an evolutionary game simulation. Technol. Forecast. Soc. Chang. 2016, 112, 262–274. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Zheng, C.; Deng, F.; Zhuo, C.; Sun, W. Green credit policy, institution supply and enterprise green innovation. JEA 2022, 1, 3. [Google Scholar] [CrossRef]

- Liu, S.; Du, J.; Mei, Q.; Zhang, J. Path and Mechanism of Collaborative Governance for Small and Medium Enterprises’ Safety Production. China Saf. Sci. J. 2023, 19, 49–54. [Google Scholar]

- Mei, Q.; Zhang, J.; Liu, S.; Zhong, J.; Wang, Q. Study on the Formation Mechanism of Safety Production Evaluation System’s Goal Deviation. Manag. Rev. 2017, 29, 216–225. [Google Scholar]

- Feng, S.; Zhang, R.; Li, G. Environmental decentralization, digital finance and green technology innovation. Struct. Chang. Econ. Dyn. 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Chen, S.; Ren, Y.; Xi, Y.; Xiang, L.; Cui, J. Analysis on the Evolution of Enterprises’ Safety Production Behavior under Dynamic Punishment Mechanism. J. Saf. Sci. Technol. 2022, 32, 51–57. [Google Scholar]

- Zhou, Q.; Mei, Q.; Liu, S.; Zhang, J.; Wang, Q. Driving mechanism model for the supply chain work safety management behavior of core enterprises-an exploratory research based on grounded theory. Front. Psychol. 2022, 12, 807370. [Google Scholar] [CrossRef]

- Bakar, M.F.A.; Talukder, M.; Quazi, A.; Khan, I. Adoption of sustainable technology in the Malaysian SMCEs sector: Does the role of government matter? Information 2020, 11, 215. [Google Scholar] [CrossRef]

- Ayuso, S.; Navarrete-Báez, F.E. How does entrepreneurial and international orientation influence SMCEs’ commitment to sustainable development? Empirical evidence from Spain and Mexico. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 80–94. [Google Scholar] [CrossRef]

- Leng, A.; Wang, M.; Chen, H.; Duan, Z. Can loan guarantee promote innovation behaviour in firms? Evidence from Chinese listed firms. Appl. Econ. 2022, 54, 1318–1334. [Google Scholar] [CrossRef]

- Xu, R.Z.; Guo, T.T.; Zhao, H.W. Research on the path of policy financing guarantee to promote SME’s green technology innovation. Mathematics 2022, 10, 642. [Google Scholar] [CrossRef]

- Zhang, Q.; Bhattacharya, S.; Andersen, M.E.; Conolly, R.B. Computational systems biology and dose-response modeling in relation to new directions in toxicity testing. J. Toxicol. Environ. Health Part B 2010, 13, 253–276. [Google Scholar] [CrossRef]

- Anderson, J.; Chaturvedi, A.; Cibulskis, M. Simulation tools for develop policies for complex systems: Modeling the health and safety of refugee communities. Health Care Manag. Sci. 2007, 10, 331–339. [Google Scholar] [CrossRef]

- Fang, Q.; Chen, X.; Castro-Lacouture, D.; Li, C. Intervention and management of construction workers’ unsafe behavior: A simulation digital twin model. Adv. Eng. Inform. 2023, 58, 102182. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).