Abstract

Herein, an evolutionary game model involving the government and practitioners during the registration phase was constructed based on the bounded rationality assumption of prospect theory. The evolutionary stability of equilibrium points was explored under scenarios of ineffective, effective, and highly effective regulation, respectively. The construction industry is a vital pillar of the national economy, and the credit regulation of practitioners in the engineering and construction sector is an essential component of the social credit system. This model forges the foundation for maintaining a well-ordered construction market. In order to illustrate the dynamic decision-making process of working professionals in the engineering and construction fields, numerical experiments were hereby conducted to examine important factors influencing the evolutionary stable outcomes, and comparative experiments were performed by adjusting the discount factor parameter settings. The research findings include the following: (1) evolutionary trends are consistently influenced by the risk preferences of the subjects; (2) inspection intensity exerts a stronger short-term impact on low-credit groups, yet unilaterally increasing inspection intensity has limited policy effectiveness; (3) process restructuring and technological advancements significantly influence the behavior of high-credit groups but have a limited impact on low-credit groups. Additionally, this paper suggests specific regulatory strategies from three perspectives: the role of industry associations, the design of short-term disciplinary mechanisms, and the adjustment of long-term regulatory costs. These strategies are grounded on the experimental results and adapted to the distinct characteristics of high- and low-credit groups.

1. Introduction

As a pivotal sector of China’s national economy, the construction industry is instrumental in advancing urbanization and modernization. Enterprise qualification, traditionally a cornerstone of qualification management in China’s construction sector, has long regulated the qualifications of practicing units. However, with economic growth, the absence of personal behavioral restrictions on practitioners has increasingly exposed issues within the building industry. The supervisory authority can enhance its ability to regulate practitioners’ credibility in the engineering construction field by increasing the transparency of decision-making processes among stakeholders.

Most studies concentrate on the credit regulation game between the government and construction companies [,,], with China’s present credit regulation of the construction sector primarily reliant on corporate credentials. The integrity system, social credit system, and regulatory mechanism of China’s building sector are the main subjects of this study. The Construction Contractor Credit Scoring (CCCS) system does not significantly enhance companies’ credit scores, yet the credit ratings of high-branch offices improve more rapidly. It suggests that the policy’s adoption requires time to have a cumulative effect []. By reducing information asymmetry and enhancing internal governance, the social credit system dramatically increases the effectiveness of corporate investment. This impact is particularly noticeable for monopolies and non-state-owned businesses [,]. Government incentives and disincentives are important in encouraging the sustainable development of small and medium-sized businesses (SMEs) and lowering the risk of default [,]. The trust mechanism holds considerable significance in preventing opportunistic behavior in construction projects [], which is primarily led by the government. The government may successfully direct and control business conduct and support the long-term growth of the construction sector by strengthening the credit system, streamlining the regulatory approach, and establishing a trust mechanism. Many researchers have put forth techniques for evaluating credit in the context of personal credit that are based on approaches like tree models and XGBoost (v2.0) [,,,]. The government serves as the primary regulatory authority, while construction companies and practitioners constitute the regulated entities, and stakeholders engage in games centered around regulatory matters to form the credit system of the construction sector. In order to investigate the mechanisms of interaction between contractor groups, owners, and other business subjects, evolutionary game approaches and system dynamics theory have been frequently employed. Therefore, the evolutionary game method has been extensively used in research related to construction and is currently primarily utilized to analyze the dynamic interactive behavioral relationship between the government and construction enterprises’ unsafe behaviors, green innovations, etc. By coordinating the low regulatory costs and high penalties for breach of trust, the government can promote the sustainable development of the construction industry []. Meanwhile, researchers have discovered that corporate breach of trust is significantly impacted by reputation difficulties, and that stringent regulations and a strong company reputation may assist in reducing the breach of trust of multinational engineering firms [,]. Furthermore, the complex regulatory framework of the construction industry and the variable rewards and punishments imposed by government agencies lead practitioners to develop nonlinear risk preferences and base their decisions on loss aversion.

Market participants’ decision-making behavior can be explained by behavioral finance theory, which has been extensively researched in relation to anchoring bias, loss aversion, and herd prejudice []. Real estate finance [], project bidding, and behavioral finance are the starting points for researchers studying the institutional aspects of construction industry regulation. Researchers also proposed a project pricing framework based on cumulative prospect theory [], which takes into account the psychology of contractors’ risk appetite and demonstrates that the theory is also well-suited to the majority of the construction market. Prospect theory has been applied to the problem of multi-expert group decision-making by more researchers, and the results demonstrate how well it describes risk-averse profits and risk-seeking losses in uncertain decision-making processes []. Practitioners’ decision-making habits are influenced by the market environment, contractual conduct, and opportunistic thinking. Contractual behavior and opportunistic behaviorism are not distinct systems, formal contracts have little impact on weak forms of opportunistic behavior. Penalties should be added to discourage opportunistic behavior among construction practitioners; relational governance among multiple actors can aid in dealing with such opportunistic behavior []. Behavioral finance plays a crucial role in analyzing the irrational behaviors of multiple agents in the theoretical construction market. Overconfidence, herd behavior, and availability bias are key behavioral factors contributing to fluctuations in China’s real estate market []. Scholars have employed behavioral finance to study the strategic interactions between governments and practitioners, effectively evaluating the impact of incentives, penalties, standards, and certifications in curbing dishonest practices []. However, most existing studies focus on the macro level, making it difficult to capture the dynamic changes in practitioners’ psychological expectations.

Expected utility theory is a fundamental approach for assessing decision-making under risk. However, it fails to account for the influence of subjective experience and cognitive biases in construction processes. It struggles to describe scenarios where individuals, facing uncertain prospects, make decisions based on risk preferences that deviate from traditional expected value calculations. The emergence of prospect theory, grounded in psychological and economic principles, addresses these limitations. Prospect theory posits that decision-makers exhibit different preferences when facing gains versus losses. Since individuals do not operate under conditions of full rationality, their behavior deviates significantly from theoretical assumptions. Specifically, prospect theory suggests that individuals display a stronger preference for certain gains while experiencing asymmetric psychological effects when gaining or losing equivalent value. Decision-makers tend to exhibit risk aversion in the face of certain gains but demonstrate risk-seeking behavior when confronting potential losses.

Prospect theory has been extensively studied both domestically and internationally and is widely applied in multi-agent decision-making research. In terms of the methodological aspect, scholars have developed a heterogeneous multi-attribute group decision-making approach based on prospect theory, incorporating both positive and negative ideal solutions. By integrating individual prospect values to determine overall prospect values, this approach provides new insights into the application of prospect theory []. Building upon this foundation, subsequent research has introduced value functions within prospect theory to propose intuitive fuzzy scoring functions [] and linguistic variable inverse prospect functions [], offering a more explicit representation of priority relationships in decision-making. Additionally, new numerical computation methods have been developed to address decision problems under cumulative prospect theory, optimizing utility under practical constraints [].

At the applied research level, scholars have extended prospect theory to explore interactions between social media and financial markets []. Studies indicate that decision-makers exhibit behaviors such as reference dependence, loss aversion, and diminishing marginal utility []. Loss aversion and reduced sensitivity contribute to systemic anomalies, and these psychological factors are quantifiable. Furthermore, increases in the risk–reward coefficient and loss aversion coefficient in prospect theory facilitate the evolution of game outcomes toward theoretical equilibrium [,].

Prospect theory uncovers the mechanism underlying trustworthy behaviors of practitioners in the construction business under government supervision and facilitates an understanding of the restricted rationality characteristics of practitioners from perception to decision-making process []. The steady state of the government-firm game is significantly impacted by the expense of regulation, the severity of penalties, and the mechanism for third-party involvement [,].

The principles of prospect theory, including the certainty effect, reflection effect, and loss aversion, provide valuable insights into the behavior of construction industry practitioners and government regulatory actions. For practitioners, when a project progresses steadily over the long term and yields significant interim benefits, they tend to exhibit risk-averse behavior. However, in adverse situations such as cost overruns or schedule delays, practitioners are more likely to develop a risk-seeking preference, potentially resorting to opportunistic misconduct to avoid project losses. Practitioners highly value the certainty of benefits associated with compliance, as it ensures stable income and a good professional reputation. This stability incentivizes them to adopt honest strategies. Conversely, when considering dishonest actions, they may focus excessively on immediate economic gains while overlooking potential long-term risks, highlighting the significant interaction between project characteristics and practitioners’ strategic choices. Both government authorities and construction practitioners exhibit distinct risk preferences when evaluating gains and losses. Their decision-making is primarily influenced by changes in existing wealth rather than absolute final wealth, and they experience the pain of losses more acutely than the pleasure of equivalent gains. Their behavior is largely shaped by reference points. From the government’s perspective, regulatory bodies tend to adopt proactive oversight strategies to prevent economic and reputational losses. In response, practitioners are inclined to comply with regulations, demonstrating loss-averse tendencies on both sides.

Additionally, the isolation effect in prospect theory influences practitioners’ decision-making by causing them to filter out complex information and decompose problems into distinct features using a structured framework. The way regulatory policies are framed can significantly impact practitioners’ decisions, leading them to focus only on short-term, quantifiable differences while neglecting broader contextual or long-term consequences, which may result in irrational choices. Therefore, in regulatory communication, it is crucial to optimize the framing of issues and avoid overly rigid or structured expressions that might inadvertently contribute to suboptimal decision-making.

In conclusion, the construction market credit scoring system and social credit mechanism have established a solid research foundation, while emphasizing the crucial role of the government in directing and regulating corporate behavior. Additionally, the evolutionary game method has also been better applied in the government’s research regarding the construction industry to encourage corporate sustainability innovation and regulate unsafe behaviors [,,,]. Previous studies have been carried out using static research methodologies, which can merely examine behavioral outcomes, failing to delve into the dynamic evolution of practitioners’ behavior in the construction sector. Construction workers’ safety behavior will also be impacted by the interaction and competition amongst practitioners as well as the level of government regulation, incentives, and penalties. The development of the credit behavior model for practice qualification personnel significantly enriches the research on credit deficiency in the engineering and construction sectors, addressing the evident gap in current studies regarding the enhancement of individual practice qualifications. Accordingly, this paper shifted its focus from regulating businesses to regulating individual licensed personnel. It also examined the subject’s decision-making law using evolutionary game theory in conjunction with prospect theory, investigated the subject’s strategic choice in the face of uncertainty, and compensated for the evolutionary game’s shortcomings in terms of the excessively stringent requirements of limited rationality. A methodical framework was established for research on credit regulation, facilitating the exploration of credit regulation mechanisms, the dynamics of multi-agent interactions, and the establishment of virtuous cycles. Furthermore, this framework promotes self-development among practitioners in engineering and construction fields, encouraging adherence to credibility and high performance. Additionally, it also provides valuable insights for regulatory authorities’ decision-making processes.

This article distinguishes itself from the existing literature in three ways. The paper object first shifted from regulating companies to regulating individual practitioners to support individual practice certification in the industrial environment. Second, a research strategy based on prospect theory and evolutionary games was employed to conduct the article on the issue of decision-making laws. This article imaginatively integrated prospect theory to the subject decision-making behavior in the engineering and construction domains, thereby addressing the limitations of the evolutionary game theory stemming from its overly stringent assumptions of bounded rationality. It also examined the strategic decision-making of the subject under uncertainty. A design scheme of the credit regulation framework was proposed to optimize engineering construction, minimize resource wastage, and achieve efficient allocation of regulatory resources. The overall objective is to empower practitioners with good credit to achieve self-promotion and self-development, and to integrate into a virtuous cycle of growth, all while sustaining high performance and preserving their reputation.

2. Model Building

2.1. Prospect Theory

Tversky and Kahneman [] suggested prospect theory as a psychological improvement on anticipated utility theory. According to the notion, individuals possess a personal value reference point, and their perception of value is anchored to this reference point. Instead of considering the actual value of various strategies, people base their decisions on their perception of their worth. Under dangerous circumstances, people’s actions are impacted by intricate psychological processes and may not always adhere to utility maximization. Individual behavioral traits cannot be well explained by anticipated utility theory. As a result, this paper presented the prospect theory. The two decision-making parties based their choice of strategy on the prospect theory’s value function and decision weight function, using the value reference point as a foundation. Prospect theory states that the relative worth of the greater reference point is what individuals perceive as profit and loss, i.e., . The reference point of profit and loss perception was selected based on the current regulatory research background. The following is an expression for a prospective value:

where is the objective probability of occurrence of the event , the weighting function , which is monotonically increasing in the interval . Prospect theory suggests that low probability events are usually overestimated, while high probability events are usually underestimated. Specifically, when is small, ; in the case of a large , . In the field of engineering construction, it is reflected that practitioners tend to underestimate the high probability events, such as the probability of accidents, the probability of inspection, and the probability of reporting, when they have a speculative mentality. In addition, there are , .

The value function represents the subjective perceived value of the decision-maker. Tversky and Kahneman [] proposed the value function as a power function: . denotes the risk attitude coefficient, which indicates the marginal decreasing degree of the perceived value of the game subject to the profit and loss, with a higher value representing a greater marginal decreasing degree. for the loss aversion coefficient, the higher its value, the higher the sensitivity of the subject of the game to losses; if , it represents that the subject of the game is more sensitive to losses than gains.

2.2. Problem Description and Model Assumptions

There are two types of key credit subjects in the registration stage of the engineering and construction market practice: government regulators and individual practitioners. The government represents the interests of society. Since the 18th National Congress of the Party, government departments have focused more on the coordinated development of the national economy and the social and environmental benefits brought about by healthy operation. The social benefits include improving people’s lives, generating more employment opportunities, preserving social stability, and boosting government credibility. Environmental benefits include reducing energy consumption, minimizing pollutant emissions, and fostering the growth of sectors linked to green management and operation. The government can implement policies such as project subsidies and rent concessions to encourage participating entities to choose reliable strategies and implement best practices for achieving the market’s healthy and quick development. These policies can facilitate reducing resource wastage, protect the environment, and promote economic development. Additionally, practitioners desire to increase their own utility. The conflicting objectives of both parties cannot be resolved by the regulatory body through the creation of a well-structured and well-written contract.

Practitioners’ risk preferences are shaped by a complex interplay of multiple factors, including legal and regulatory compliance risks, economic and financial risks, operational and technical risks, market competition risks, credit and reputational risks, environmental and social risks, and institutional risks [,,,]. The risks to practitioners’ choice of behavior are shown in Table 1. The impact of these factors is assessed based on a comprehensive evaluation of both the probability of occurrence and the severity of consequences. Specifically, risks are categorized as high when the probability exceeds 50% or potential losses surpass 10% of the contract value; moderately high when the probability ranges from 30% to 50% or losses amount to 5–10% of the contract value; moderate when the probability falls between 10% and 30% or losses range from 1% to 5% of the contract value; and low when the probability is below 10% or losses remain under 1% of the contract value.

Table 1.

Practitioner Risk Scale.

During the professional registration phase, practitioners’ decision-making is shaped by the combined influence of cognitive biases, institutional constraints, economic incentives, and industry characteristics. From a behavioral finance perspective, their decision-making mechanisms are primarily governed by cognitive biases within the framework of prospect theory, including loss aversion, risk attitude coefficients, and the isolation effect. When the combination of penalty severity () and inspection probability () results in an expected loss exceeding short-term gains, loss aversion tends to suppress dishonest behavior, while the risk attitude coefficient determines the diminishing marginal sensitivity to gains and losses. Institutional and environmental factors serve as external drivers of risk selection. When the expected benefits of strict regulation outweigh enforcement costs, governments tend to adopt proactive regulatory strategies. Moreover, industry characteristics significantly influence practitioners’ risk choices—issues such as collusive bidding, lack of information transparency, and absence of third-party oversight distort risk perceptions, leading to an adverse selection effect where dishonest actors outcompete ethical practitioners, highlighting the regulatory shortcomings in risk governance. Practitioners’ professional experience and ethical values shape their risk tolerance by affecting their ability to assess risks and their ethical judgment thresholds. A higher discount factor indicates a stronger emphasis on long-term reputation. The root cause of dishonest behavior lies in the fundamental drive to maximize individual benefits. Strict enforcement by regulatory authorities, through investigations and crackdowns, generally reduces the occurrence of dishonest practices. However, the effectiveness of such enforcement depends on the success rate of investigations, the scope and intensity of regulatory actions, and specific enforcement measures.

When regulatory intensity is insufficient, the success rate of government investigations remains low, making it difficult to effectively control the credibility of industry entrants. In the absence of regulatory intervention, some practitioners may perceive their short-term gains as outweighing expected losses, leading them to persist in dishonest behavior for additional profits. However, those who opt for dishonest strategies also bear the increased risk of engineering failures and the associated response costs. If a government investigation successfully identifies violations and the expected additional profits are not realized, individuals engaging in dishonest practices will face economic losses and reputational damage. Meanwhile, governments utilize fines collected from violators to sustain regulatory operations. In the context of credit regulation in the construction sector, when the cost of strict regulation significantly exceeds that of relaxed regulation and budget constraints exist, regulatory failure may also occur.

Long-term profits and losses are valued differently by practitioners. In this paper, the notion of the discount factor, characterized as an individual’s assessment of current period long-term profits and losses, was introduced. People are more inclined to choose short-term profits from trustworthiness when the discount factor is low, as long-term benefits are discounted to a smaller value of benefits in the current era. In contrast, when the discount factor is large, they may be more skewed toward the long-term advantages of trustworthiness, since these benefits are discounted to a higher value of benefits in the present. Given that an excessive focus on short-term gains can readily lead to breaches of trust, it is reasonable to posit that practitioners’ initial credit level is characterized by the discount factor.

Based on the above industry status quo, the following basic assumptions were hereby proposed:

- (1)

- In the registration stage, in the credit supervision of practitioners in the field of engineering and construction, the supervisory department (governmental department of housing and construction) and the practitioners are both limited rational groups. Their strategy selection is based on their own psychological perception of the value of strategy gains and losses, independent of the direct gains and losses of the strategy itself. In this paper, the perceived values of gains and losses were calculated based on prospect theory.

- (2)

- The set of strategies for government subjects is {positive regulation, negative regulation} and the set of strategies for practitioner subjects is {trustworthiness, trustworthiness}. The government subject chooses the positive regulation strategy by the proportion of and the negative regulation strategy by the proportion of . Practitioner subjects choose the trustworthy strategy with the proportion of , and the trustworthy strategy with the proportion of , where and are functions of time .

- (3)

- The goal of government regulatory efforts is to maximize total governmental benefits, which in this case combines quantifiable economic benefits and difficult-to-quantify social benefits. In contrast, practitioners aim to maximize their personal utility.

2.3. Model Buildings

Herein, the individual criteria were established based on the actual conditions of the registration phase for practitioners in the engineering construction industry, as detailed in Table 2.

Table 2.

Specific meaning of parameters.

It is clear from the prospect theory that psychological feelings, experience, other ambiguous costs, and advantages of the final computation forge the foundation for the decision-making process. In other words, there is a psychological impression of utility. The actual value is utilized because the cost of positive or negative regulation, honest or dishonest tactics, can be precisely assessed for government departments and practitioners. This is a deterministic expense free from perceptual bias. Since it is challenging to evaluate distant accident costs and other reputation damage that are tied to the subject’s perception, the benefit matrix adopts the prospective value. Presumably, there is .

In addition, the discount factor () for setting practitioners is a function of the time preference of the subject of interest and can be considered as a characterization of the initial credit level. For the government, the discount factor is 1. For individuals, a greater emphasis on short-term gains and losses results in a lower discounted value of long-term gains and losses in the current period, thereby lowering the initial credit level.

The matrix of perceived benefits for both sides of the behavioral evolution game of practitioners in engineering and construction in the registration stage was hereby constructed based on the aforementioned assumptions and discussions, as indicated in Table 3.

Table 3.

Matrix of perceived benefits for subjects in the registration phase.

In the case of a positive regulatory strategy adopted by a government department, for example, when a practitioner adopts a trustworthy strategy, the perceived benefit to the government is the psychological perceived benefit of positive government regulation, , with the cost of the regulatory process denoted by , and the perceived benefit to the practitioner recorded as . When the practitioner adopts a trustworthy strategy, the perceived benefit to the government is divided into three parts, including the cost of positive regulation, , the perceived benefit of the successful case of an investigation and prosecution, . The perceived benefit of the practitioner is divided into four parts, including the cost of the bad faith strategy , the perceived benefit of successful investigation by the government , the perceived benefit of unsuccessful investigation by the government , and the perceived benefit of unsuccessful investigation by the government and a safety incident .

Based on the perceived returns of the strategy portfolios in Table 3, the expected prospective value of active supervision and management of the government sector, negative supervision, and the average expected prospective value can be derived:

The expected prospective value of a practitioner’s trustworthiness, the prospective value of a breach of trustworthiness, and the average expected prospective value of a practitioner’s trustworthiness can be obtained, respectively:

Based on the Malthusian equations, the following equations for the replication dynamics are obtained:

Prospect theory is an effective tool for portraying the cognition and decision-making of limited rational actors in uncertain situations. When the probability of the government department choosing positive regulation is 1, the social benefit obtained by the government department is ; when adopting a negative regulation strategy, the social benefit obtained is 0. Therefore, the prospect value of is .

When the practitioner chooses the bad faith strategy, the probability of successful government investigation is and a penalty is imposed. When the practitioner chooses a trustworthy strategy, the penalty is 0. Thus, there are , and .

The same applies to the foreground values of and . Substituting the values of the profit and loss prospects into (5) and (6), respectively, the replication dynamic equations for the two sides of the game choosing an active strategy can be obtained:

Government regulators:

Practitioners:

From Equation (6), , and (denoted as ) are the roots of . According to the stability principle, when ,, is ESS (Evolutionary Stability Solution), i.e., the government can achieve local stability by choosing active regulation. When , , at this time for all are stable; when , meets the necessary conditions and is the evolutionary stability point; when , meets the necessary conditions and is the evolutionary stability point. Similarly, for the practitioner subject, , , and (denoted as ) are the roots of . When is , it is a stable state for all ; when is , it satisfies the necessary conditions and is an evolutionary stable point; when is , it satisfies the necessary conditions and is an evolutionary stable point.

3. Evolutionary Stability Analysis

Two-dimensional nonlinear replicated dynamical systems for government agencies and practitioners are derived from the aforementioned analysis.

There are five equilibrium points in the game between the two types of subjects, government departments and practitioners:, , , , and ; where:

According to the Jacobi matrix stability judgment condition, when , and , it is a stable point (ESS). The Jacobi matrix of this game system is shown in Table 4. To ensure the conciseness of the presentation, let the eigenvalues of satisfy:

Table 4.

Expressions for each element of Jacobi matrix in the registration phase.

Based on the above expressions of each equilibrium point corresponding to Jacobi matrix, the eigenvalues of the five equilibrium points corresponding to Jacobi matrix can be obtained, as shown in Table 5. Given that practitioners’ malpractice in real life is driven by the fact that their perceived short-term profit exceeds their perceived long-term risk of accidents, it is assumed that . In the case of and , the stability of each equilibrium point can be discussed in six scenarios according to the range of values of each parameter in the expression, as shown in Table 6. For the convenience of representation, is , is , is , is .

Table 5.

Eigenvalues of the corresponding Jacobi matrix for each equilibrium point.

Table 6.

Results of evolutionary stability analysis of a side.

Scenario 1-1: When the conditions and are satisfied, i.e., the benefit of positive regulation by the government department is smaller than that of negative regulation, and the benefit of trustworthiness of the practitioners is smaller than that of bad faith under positive regulation. As shown in Table 6, only the eigenvalues of the Jacobi matrix corresponding to are all less than 0, indicating an evolutionary stability point. At this point, corresponding to the strategy combination of (negative regulation, breach of trust), the practitioners’ credit level is low, and market operations face significant risks. This scenario is clearly undesirable in the context of construction market credit regulation.

Scenario 1-2: When the conditions and are satisfied, i.e., the benefit of positive regulation by government departments is smaller than that of negative regulation, and the benefit of trustworthiness of practitioners is larger than that of dishonesty in the case of positive regulation. As shown in Table 6, only represents the evolutionary stability point, the practitioners’ credit level is low, the market operation entails higher risks. This scenario should be avoided in construction market credit regulation.

Scenario 2-1: When the conditions and are satisfied, i.e., when practitioners choose trustworthy strategies, the benefit of positive regulation from the government department is smaller than that of negative regulation. Meanwhile, when practitioners choose trustworthy strategies, the benefit of positive regulation from the government department is higher, and the benefit of trustworthy practitioners is smaller than that of trustworthy practitioners. As shown in Table 6, only the eigenvalues of the Jacobi matrix corresponding to are all less than 0, indicating an evolutionary stability point. At this time, corresponding to the strategy combination of (positive regulation, breach of trust), the practitioners’ credit level is low, and the effect of regulation cannot be realized. Given that practitioners can still reap greater benefits from breach of trust strategies despite high levels of supervision, such behavior remains an optimal choice. This scenario is undesirable and should be avoided in the credit supervision of the construction market.

Scenario 2-2: When the conditions and are satisfied, i.e., when the practitioners’ compliance level is higher, the benefit of active regulation by the government department is smaller than that of negative regulation. Conversely, when the practitioners’ compliance level is lower, the benefit of active regulation by the government department is higher. Additionally, the benefit of compliance for practitioners under active regulation exceeds that associated with breach of trust. As shown in Table 6, only the eigenvalues of the Jacobi matrix corresponding to are all less than 0, indicating an evolutionary stable point. This suggests that the proportion of regulators among practitioners chooses the trustworthy strategy and the regulatory effect is reflected.

Scenario 3-1: When the conditions and are satisfied, i.e., the benefit of positive regulation by government departments is greater than that of negative regulation, while the benefit of trustworthy strategies by practitioners is less than that of untrustworthy strategies. As shown in Table 6, only the eigenvalues of the Jacobi matrix corresponding to are all less than 0, indicating an evolutionary stable point. At this point, corresponding to the strategy combination of (active regulation and breach of trust), the practitioners’ credit level is low, and the regulatory effect cannot be realized. For practitioners, the breach of trust strategy remains optimal and yields higher benefits, even under stringent supervision. This scenario is undesirable and should be mitigated in construction market credit regulation.

Scenario 3-2: When the conditions and are satisfied, i.e., the benefit of positive regulation by government departments is greater than that of negative regulation, while the benefit of trustworthiness by practitioners in the case of positive regulation is greater than that under untrustworthy strategies. As shown in Table 6, only the eigenvalues of the Jacobi matrix corresponding to are all less than 0, indicating an evolutionary stable point. At this point, the strategy combination corresponding to (active regulation and trustworthiness) corresponds to a high level of practitioner creditworthiness, while also necessitating the constraints imposed by governmental regulation.

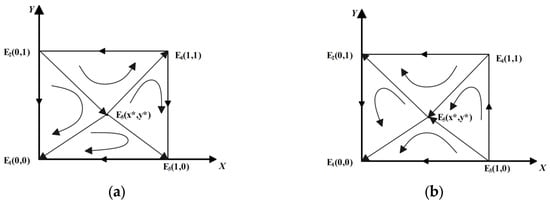

The evolutionary game analysis reveals the following stability points: for scenarios 1-1, 2-1, 2-2, and 3-1, the stability points are , , , and , respectively (Figure 1). In these scenarios, practitioners opt for breach of trust, and government regulation is highly ineffective. For scenario 3-2, the stability point is , where practitioners partially choose to breach trust, resulting in a moderate level of group compliance with trustworthiness. For scenario 1-2, the stability point is , indicating that active government regulation is required to achieve a high level of practitioner creditworthiness.

Figure 1.

Phase diagram of dynamic evolution of both sides. (a) Scenario 1-1. (b) Scenario 1-2. (c) Scenario 2-1. (d) Scenario 2-2. (e) Scenario 3-1. (f) Scenario 3-2.

As a result, the credit regulation of practitioners in the registration stage was hereby divided into three stages: the ineffective stage, the effective stage, and the efficient stage. The ineffective stage corresponds to scenarios 1-1, 1-2, 2-1, and 3-1, featuring extremely low regulatory effect of government departments, higher perceived benefits of practitioners’ credit failure strategies, and frequent malpractice. It is necessary to improve the perceived benefits of active regulation by government departments through in-depth institutional reform, change in work methods, and improvement of work capacity. The effective stage corresponds to scenario 2-2, where the government department’s strategy choice is adjusted according to the practitioners’ trustworthiness level. The eventual evolutionary outcome is that some practitioners will adopt trustworthy strategies, while malpractice remains extant. The binary system is in a dynamic game process. The efficient stage of government regulation is promoted through system reform measures and the effective adjustment of relevant parameters on this basis. The efficient stage corresponds to scenario 3-2, characterized by higher perceived benefits of practitioners’ trustworthiness and a significant regulatory impact from the government sector, driving the system’s evolution toward a positive outcome.

In the theoretical analysis, when the parameters satisfy conditions of and , the two-party evolutionary game system of government regulators and practitioners reaches a (1,1) stable state. This is also the optimal strategy of the system and is the construction goal of the credit system in engineering construction. As a limited rational individual, the game subject cannot maximize the use of existing information to support decision-making, presenting subjective differences in terms of profit and loss reference points, risk preferences, etc., which can easily lead to systematic bias in their behaviors.

When the actual project is constructed, the line regulator subject’s low perceived gain of social benefit causes , making it difficult to satisfy the condition of ; while the practitioner tends to underestimate the large probability event, which leads to , the high perceived gain of governmental departmental fines ; and the practitioner overestimates the small probability event that the governmental regulator’s daily supervision does not find malpractice, which leads to . Thus, while the regulator actually controls the and conditions, it cannot fully guarantee the satisfaction of the and stability conditions in the value perception condition due to subjects’ limited rationality and risk preferences. As a result, various types of malpractices such as qualification lending persist, and the system evolves from scenario 3-2 to scenarios 1-1 and 2-1.

From the viewpoint of the external environment, the rules of the construction market have not yet been perfected. Information asymmetry leads to inconsistent information holdings and difficulty in fully guaranteeing the authenticity of each subject during transactions in the construction market. This may further induce various types of opportunistic behaviors. Due to the extended project cycle and substantial capital flow, the additional benefits from breach of trust behavior are high, making it difficult to meet the conditions of practitioners’ behavioral parameters.

4. Behavioral Evolution Influencing Factors and Simulation Analysis

4.1. Case Overview and Parameter Settings

To further investigate the evolutionary decision-making process between construction market practitioners and government regulators, this section conducts a numerical simulation of the evolutionary game using MATLAB 2023b. To ensure that the game scenario closely aligns with real-world conditions and accurately reflects the generality of the initial strategy choices of the game participants, this study determines the initial values of certain exogenous variables based on survey data and literature review [,,,,,]. All initial values are normalized to enhance comparability and analytical rigor. In this paper, the reference point of prospect theory was selected. Referring to the studies of Gurevich [], the value of was taken as 0.98, the value of was taken as 1.12, the value of was taken as 0.75, and the subject’s perceived value of uncertainty gain or loss was measured.

4.1.1. Case Overview

The S City M River Basin Comprehensive Water Environment Management Project was proposed to address severe water pollution in the M River Basin, where the water quality of both the main and tributary streams was worse than Class V of surface water standards. The project includes 46 subprojects covering pipeline network engineering, drainage engineering, river treatment engineering, and water quality improvement engineering. It is fully funded by the government and classified as a government-led public welfare project. With a total investment of 15.21 billion yuan, this project was fully completed by the end of 2017. The initial values of exogenous variables were set based on actual conditions observed during this project.

4.1.2. Parameter Settings

The government supervision costs are estimated based on the 13,982 public complaints in S City’s construction sector, average processing time, and average salary. The active supervision costs for Scenarios 1, 2, and 3 are set as 0.55, 0.4, and 0.3, respectively. Scenario 1 includes Sub-scenarios 1-1 and 1-2, and other scenarios follow a similar structure. The passive supervision costs of the government are derived from the active costs and are recorded as 0.15, 0.12, and 0.1. S City’s total construction penalty and confiscation income is 3.392 billion yuan, and the active supervision benefits are estimated by combining penalty income with improvements in government performance, with values set as 0.05, 0.25, and 0.25 for Scenarios 1, 2, and 3, respectively. If the government engages in passive supervision and practitioners choose dishonesty, the government will incur similar economic and reputational losses, so the loss from (passive supervision and dishonesty) is set to be the same as the active supervision benefits . The practitioners’ honesty costs consist of time, economic, and labor costs incurred during the qualification stage, with the honesty cost set as 0.15 and the dishonesty cost set as 0.05. The total number of completed complaints in S City’s construction sector is 6901, so the probability of the government successfully handling a case is set at 0.5. In Scenarios 2-2 and 2-3, where practitioners choose honest strategies, government enforcement efficiency significantly increases, with the government’s case success rate set at 0.8. According to the penalty regulations in S City’s construction industry qualification evaluation standards, practitioners who violate regulations by obtaining or failing to provide qualification certificates on time can be fined between 1000 and 10,000 yuan, with the practitioner’s penalty set as 0.35. In Scenarios 1-1 and 2-1, this penalty is significantly lower than in other scenarios, so is set as 0.05. The government supervision costs are approximately half of the fines, so the proportion of fines contributing to government income is around 0.5, set as 0.5. Based on these parameter ratios, we set the following values: , , , and . The values for each variable are shown in Table 7.

Table 7.

Setting of parameters in each case.

In order to visualize and compare the evolution trend of the proportion of subjective strategies of government departments and access personnel, the initial proportion of active regulatory strategies of government departments at the registration stage was set at 50%, while that of access personnel choosing honest practice at the registration stage was set at 30%. The parameter setting vector of situation was denoted as . The initial state and the parameter settings for scenarios 1-1 through 3-2 are as follows.

4.2. Numerical Simulation

4.2.1. Simulation of Asymptotic Stabilization Point of System

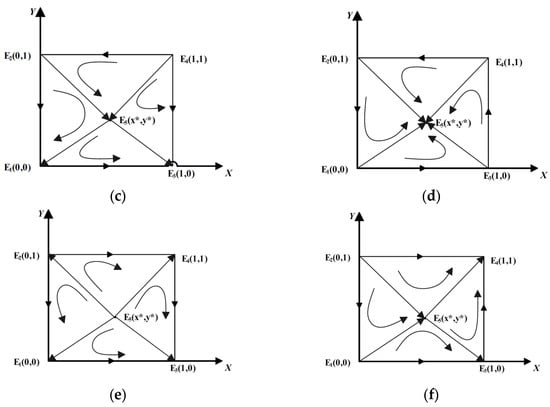

In this paper, a deterministic evolutionary game model was initially employed to simulate and evaluate the system asymptotes from six scenarios. From the perspective of the government, the evolution of the government’s approach appears to be the outcome of the declining cost of active regulation and the rising value of long-term societal benefits, as consistently observed in scenarios 1-1 through 3-2. The level of government inquiry and punishment of potential entrants during the registration phase does not support the government’s transition to an active regulatory approach. In the longer term, scientific and technological advancements improve government supervision’s intelligence level and digitization, thereby lowering the high labor costs associated with performing a number of risk management tasks. This is a surefire way to encourage active government supervision. Furthermore, the government’s proactive regulatory measures are increasingly motivated by the growing perceived worth of social and ecological advantages in the context of China’s new economic normal.

Indeed, cross-sectional observations of scenarios 1-1 against 1-2, 2-1 versus 2-2, and 3-1 versus 3-2 demonstrate that government departments employ short-term control measures at every level of development to support the integrity of access staff in registration and test-taking (Figure 2). Cross-sectional analyses indicate that the evolutionary effectiveness of the admission staff’s adherence strategy is consistently superior when the short-term control approach is applied compared to when it is not. The short-term practice cost for access staff remains constant, and government agencies can implement tactics to change practice behavior by intensifying ex post punishment and improving ex ante inquiry and punishment. In essence, this involves adjusting the values of the two parameters to minimize the expression’s value.

Figure 2.

Phase diagram of dynamic evolution of both sides in the registration phase. (a) Scenario 1-1 evolutionary pathway. (b) Scenario 1-2 evolutionary pathway. (c) Scenario 2-1 evolutionary pathway. (d) Scenario 2-2 evolutionary pathway. (e) Scenario 3-1 evolutionary pathway. (f) Scenario 3-2 evolutionary pathway.

Scenario 3-2 was used as an illustrative example to examine the influence of initial probability on evolutionary dynamics. When the starting probabilities of the two individuals are adjusted, as illustrated in Figure 3, the system’s evolutionary stable point remains at (1,1), indicating that both subjects select positive strategies. Except for the extreme scenario, it is discovered that as the starting probability rises, the system evolution time to achieve the stable state will be shortened, and the rate of strategy change will remain at a low level. In other words, the system may converge to an optimal state rapidly and stably. Government departments can implement effective incentives to increase the willingness of the access staff stage to take the test in good faith, and the initial likelihood of both sides positively influence the system’s evolution.

Figure 3.

Impact of initial probability on the evolution of the system based on scenario 3-2. (a) Impact of initial probability on the government sector. (b) Impact of initial probability on practitioners.

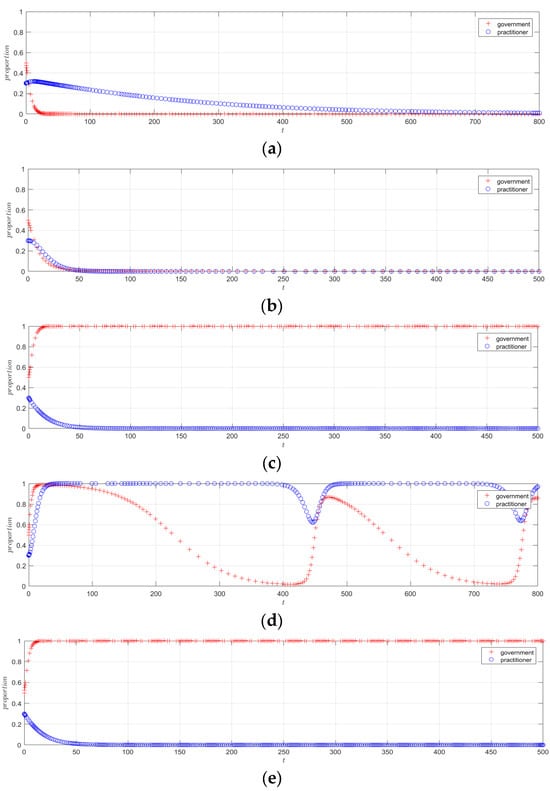

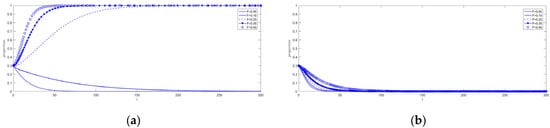

4.2.2. Impact of Subjective Risk Preferences on System Evolutionary Outcomes

Scenario 3-2 was utilized as an illustrative example to examine the impact of the subject’s risk choice on the evolutionary rate. Figure 4 illustrates how the shift in the loss aversion coefficient affects the game’s subject’s strategy choice. With the increase of , the proportion of positive strategy selection of game subjects , approaches 1 more rapidly. This indicates that the coefficient of loss aversion affects the likelihood of positive tactic selection by government agencies and access staff. Specifically, the greater the sensitivity of game subjects to loss, the higher the likelihood of adopting positive strategies. In addition, the loss aversion coefficient has a pronounced impact on access personnel. When is taken as 1 and 2.25, a significant divergence in their strategy evolution tendency is observed, consistent with the practical application of prospect theory.

Figure 4.

Impact of loss aversion coefficient on game subjects. (a) Impact of loss aversion factor on government departments. (b) Impact of loss aversion factor λ on government departments.

The effect of changes in the risk attitude coefficient on the strategy choice of the game subject is shown in Figure 5. With the increase of , the proportion of positive strategy selection of game subjects , tends to decrease to 1. This suggests that the coefficient of risk attitude affects the likelihood that government agencies and access staff will adopt positive strategies, and that the more risk-taking game participants are, the more difficult it will be for their selections to converge to positive strategies. The rationale behind adding prospect theory is confirmed by the fact that access workers are more severely impacted by the risk attitude coefficient.

Figure 5.

Impact of risk attitude coefficient on game subjects. (a) Impact of risk attitude factor on government departments. (b) Impact of risk attitude factor θ on practitioners.

In conclusion, subject risk preferences are more noticeable for practitioners and influence the direction of strategy ratio evolution. The primary cause is that the government department’s primary payment is the regulation cost, which is a certainty benefit, while practitioners’ additional benefits, penalties, accident losses, etc., are uncertainty benefits. As a result, practitioners’ risk preference increases behavioral bias. The integration of prospect theory analysis holds significant practical value, as it more accurately captures the game subject’s risk-averse and avoidance-motivated behavioral choice tendency.

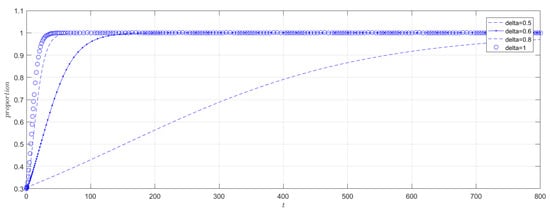

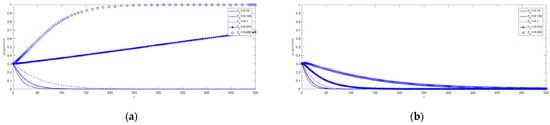

4.2.3. Impact of Initial Credit Level on System Evolution Results

Scenario 2-2 was taken as an example to discuss the impact of the discount factor on the strategy evolution path of practitioners. The impact of the reduction in the discount factor of () on the strategy choice of the registered personnel is shown in Figure 6. When decreases from 1 to 0.5, the strategy evolution path produces a large difference. The lower is, the smaller the numerical slope of the curve, and the more pronounced the difference in marginal adjustment. This suggests that in addition to enhancing administrative oversight, boosting public awareness of the integrity of the educational process, and creating a favorable credit climate in the construction industry, the credit standing of the registered personnel itself has a significant influence on the strategies they choose.

Figure 6.

Impact of credit level on practitioners’ strategy choices.

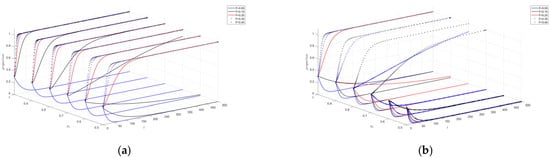

4.2.4. Short-Term: The Impact of Disciplinary Mechanisms on Subjects’ Strategic Choices

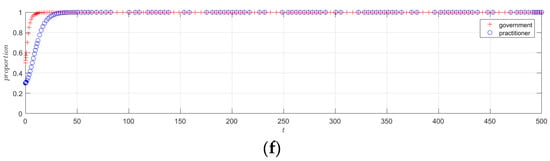

Given that the cost of regulation and registration, etc., cannot be reduced quickly in the short term, and the subject’s estimation of the social benefits is certain, this subsection focuses on the impact of the intensity of penalties and investigations, etc., on the dynamic evolutionary process. The discussion above concludes that the binary system under scenario 3-1 eventually evolves to , which corresponds to the strategy combination of (active regulation and breach of trust). In the contemporary engineering and construction sectors, the government prioritizes credit building within the industry, yet the outcomes remain limited. This section’s analysis of how disciplinary mechanism design can influence the development of scenario 3-1 is particularly relevant to the two scenarios involving high and low initial group credit levels.

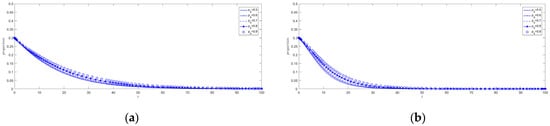

When the inquiry and punishment intensity rises from 0.5 to 0.9, the lifting impact on the strategy evolution trend of low-credit practitioners becomes more noticeable, even after adjusting for a particular degree of punishment, as shown in Figure 7. Figure 8 illustrates the abrupt change in the behavioral evolution trend of high-credit practitioners within the 0.15 to 0.25 interval as the punishment intensity increases from 0.05 to 0.45, following adjustments in punishment and investigation levels. For low credit practitioners, the punishment intensity has a resisting effect on the evolution trend yet is unable to alter the ultimate evolution tendency. It is possible to draw the conclusion that whereas high credit personnel are more significantly impacted by the severity of punishment, low credit personnel are more profoundly impacted by the checking intensity.

Figure 7.

Impact of investigation intensity on practitioner behavior. (a) Impact of enforcement on high-credit personnel. (b) Impact of enforcement on low-credit personnel.

Figure 8.

Impact of penalty intensity on practitioner behavior. (a) Impact of penalties on High Credit Practitioners. (b) Impact of penalties on Low Credit Practitioners.

This paper examined the effects of various parameter combinations to better examine the interaction between the two parameters of the penalty mechanism. Depending on the state of the market, the regulator may select “high investigation and punishment+ and low punishment perception” or “low investigation and punishment+ and high punishment perception” for the high-credit group, as illustrated in Figure 9a. Low-credit organizations are motivated by illegal advantages to pick the approach of breaking creditworthiness, even if they incur larger predicted penalties and reputational damages when the investigation and punishment are minimal. As a result, the regulator ought to implement a disciplinary system that emphasizes thorough investigations, severe penalties, and a strong sense of penalties.

Figure 9.

Overall impact of investigation and punishment intensity on practitioner behavior. (a) Mixed impact of investigation and punishment intensity on practitioner behavior. (b) Combined impact of penalization mechanisms on low-credit personnel.

4.2.5. Long Term: The Effect of Trustworthiness Costs on Subjects’ Strategy Choices

The discussion of long-term tactics that regulators can implement to enhance the market credit environment is based on scenario 3-1. The evolutionary stabilizing strategy of the high-credit group shifts from faithlessness to trustworthiness when the cost of trustworthiness drops from 0.15 to 0.055, as illustrated in Figure 10. Meanwhile, the evolutionary trend of the low-credit group slows down. This suggests that the group’s strategy is impacted by the drop in the cost of trustworthiness. High-credit individuals, on the other hand, are more sensitive to reductions in the cost of acting honorably, resulting in an abrupt shift in stabilizing strategy between cost drops of 0.075 and 0.055.

Figure 10.

Impact of integrity practice costs on practitioner behavior. (a) Impact of compliance costs on highly credit personnel. (b) Impact of compliance costs on low-credit personnel.

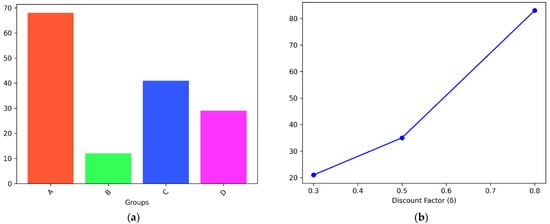

4.2.6. Comparative Analyses

- (1)

- Compared to existing research

Scholars have studied the principal-agent game in the construction market based on traditional game theory frameworks and system dynamics. However, this research, which builds an evolutionary game model based on prospect theory, differs significantly from traditional studies. Xiong et al. [] used a traditional game theory framework and found that improving credit scores could reduce contractor default rates by 15–20%. However, their model assumes complete rationality and does not consider psychological biases. In contrast, this study introduces loss aversion and risk attitude coefficients, quantifying practitioners’ hypersensitivity to losses. The study finds that when the probability of inspection () and penalty intensity ), the default rate can further decrease to 12%, validating the amplifying effect of psychological parameters on decision-making. This improvement aligns with the core concept of behavioral finance, which posits that the risk preferences of bounded rational agents are asymmetric

Compared to the system dynamics research by Yang et al. [], this study reveals practitioners’ time preferences through the discount factor. While Yang et al. emphasize the balance between regulatory costs and penalties, they do not account for the difference in how practitioners discount long-term benefits. This study finds that when the discount factor increases from 0.5 to 0.8, the probability of active government regulation increases from 35% to 79%, indicating that perceptions of long-term benefits significantly influence regulatory strategy choices. This finding expands on existing research by applying the time discounting theory from behavioral finance to the field of credit regulation in the construction market.

- (2)

- Parameter combinations comparison

Through the four sets of parameter combination experiments shown in Table 8 and the result of variance analysis shown in Table 9, it was found that inspection probability () is the most critical factor affecting the breach of trust rate (, ). When and , the default rate dropped to 12%, whereas when (), the breach of trust rate reached 68%. This result shown in Figure 11 is consistent with the 2023 data from the China Construction Industry Association—when inspection coverage increased to 75%, cases of qualification misrepresentation decreased by 32%. The marginal effect of penalty strength () is secondary (). When (), the expected loss exceeds the benefit of dishonesty, triggering the loss aversion mechanism. The cost of maintaining integrity () has a significant impact on high-credit groups. When decreases from 0.15I to 0.05I, the default rate drops by 27%, but the effect on low-credit groups is only 5%.

Table 8.

Setting of parameters in each experiment.

Table 9.

Analysis of variance (ANOVA) results.

Figure 11.

Comparison of experimental results. (a) Impact of parameter combinations on breach of trust rates. (b) Impact of discounting factor on government regulatory strategies.

It confirms the core conclusion of this study—process reengineering and technological introduction (such as BIM application) can guide the behavior of high-credit groups by reducing , but other measures (such as increasing ) are needed to affect low-credit groups. The effect of the discount factor () shows that when , the probability of active government regulation is 44% higher than when , highlighting the importance of long-term incentive design.

5. Conclusions and Limitations

5.1. Conclusions

Constructing a new social credit system that satisfies contemporary development demands is crucial in the context of modern societal evolution. Credit monitoring of professionals in the field of engineering construction is a key component of the social credit system and serves as the foundation for maintaining order in the construction market. The construction sector is a significant pillar of the national economy. This study primarily examined the supervision and personal credit practices of engineering construction practitioners. Evolutionary game theory and behavioral economics techniques were employed to examine the behavior of practitioners throughout the registration phase.

In order to illustrate the dynamic growth of practitioners’ behavioral decision-making process in the field of engineering construction, a game model was hereby developed for the evolution of practitioners’ credit behavior in the registration stage based on prospect theory. The stability of the equilibrium point’s development under the conditions of ineffective, effective, and efficient regulation was discussed first in this study. Subsequently, this study further explored the impact of short-term disciplinary measures, long-term compliance costs during registration, and incentive mechanisms during practice on the evolutionary trend. Finally, random perturbations were introduced to perform sensitivity tests, and parameters of the discounting factor were adjusted to set up comparative experiments. The following discoveries could be acquired: 1. the evolutionary trend is always influenced by the subject’s risk preference; 2. the short-term impact of investigation and punishment is more pronounced on the low credit group, yet the policy effect of unilaterally increasing the investigation and punishment is limited; and 3. cost reduction through process reorganization and technology introduction is a significant way to control the behavior of the high credit group over the long term, but it has less of an effect on the low credit group.

Overall, this paper suggests particular regulatory remedies from the three viewpoints of the role played by industry organizations, short-term disciplinary mechanism, and long-term cost strategy. These approaches are based on the experimental findings for the various features of high and low credit groups. This paper offers some practical implications for enhancing engineering quality and upholding market order in addition to conceptually enhancing the credit governance system in the field of engineering construction.

5.2. Limitations and Future Research

There are several limitations to this study. First, the replicator dynamics mechanism was adopted as the sole learning mechanism in evolutionary game analysis, which may not fully capture the behavioral patterns of agents under alternative learning frameworks. Second, while integrating the practical context of China’s engineering construction sector, the coordinating role of industry associations in sub-domains (e.g., survey and design, bidding, and construction) was not explicitly modeled. Third, the current model relies on static parameter assumptions, which may not account for dynamic changes in market conditions or heterogeneous behavioral preferences among stakeholders.

To address these limitations, future research can focus on two directions. First, an agent-based modeling (ABM) approach using Python 3.11’s Mesa package or NetLogo simulation tool 6.4.0 could be implemented. By incorporating diverse neighbor selection rules (e.g., Moore neighborhood or global coupling) and strategy selection mechanisms with error terms in expected perception value calculations, the model would better reflect real-world decision-making complexity. Second, case studies in specific sub-domains (e.g., green building projects) should be conducted to systematically analyze the role of industry associations. It would involve abstracting key parameters related to association functions (e.g., information sharing and norm enforcement) and integrating them into evolutionary game models for in-depth exploration.

Author Contributions

Conceptualization, T.S.; Methodology, S.X.; Software, J.M.; Validation, S.X.; Formal analysis, J.M.; Investigation, J.M.; Data curation, T.S. and N.L.; Writing—original draft, J.M. and T.S.; Writing—review & editing, S.X. and J.M.; Project administration, S.X. and N.L.; Funding acquisition, S.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the youth program of National Social Science Foundation of China (grant No. 15CJL023).

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wang, J.; Li, H.; Xu, W.W.; Xu, W. Envisioning a Credit Society: Social Credit Systems and the Institutionalization of Moral Standards in China. Media Cult. Soc. 2023, 45, 451–470. [Google Scholar] [CrossRef]

- Liu, J.; Liu, S.; Li, J.; Li, J. Financial Credit Risk Assessment of Online Supply Chain in Construction Industry with a Hybrid Model Chain. Int. J. Intell. Syst. 2022, 37, 8790–8813. [Google Scholar] [CrossRef]

- Mei, T.; Wang, Q.; Xiao, Y.; Yang, M. Rent-Seeking Behavior of BIM- and IPD-Based Construction Project in China. Eng. Constr. Archit. Manag. 2017, 24, 514–536. [Google Scholar] [CrossRef]

- Xiong, B.; Skitmore, M.; Xia, P.; Ballesteros-Pérez, P.; Ye, K.; Zhang, X. Impact of Corporate Credit Scoring on Construction Contractors in China. J. Constr. Eng. Manag. 2019, 145, 05019002. [Google Scholar] [CrossRef]

- Zhao, Y.; Yang, Y.; Hua, M.; Chan, K.C. Social Credit Scoring System and Corporate Pollution Governance: Insights from China’s Social Credit System Construction. Int. Rev. Financ. Anal. 2024, 96, 103774. [Google Scholar] [CrossRef]

- Wang, Y.; Cui, R.; Gao, H.; Lu, X.; Hu, X. Can the Construction of the Social Credit System Improve the Efficiency of Corporate Investment? Int. Rev. Econ. Financ. 2024, 96, 103510. [Google Scholar] [CrossRef]

- Li, P.; Lu, Y.; Xiao, X. Proposing a Development Framework for Sustainable Architecture, Engineering, and Construction Industry in China: Challenges, Best Practice, and Future Directions. Front. Struct. Civ. Eng. 2024, 18, 805–814. [Google Scholar] [CrossRef]

- Wang, Z.; Jian, Z.; Ren, X. Pollution Prevention Strategies of SMEs in a Green Supply Chain Finance under External Government Intervention. Env. Sci. Pollut. Res. 2023, 30, 45195–45208. [Google Scholar] [CrossRef]

- Chow, P.T.; Cheung, S.O.; Chan, K.Y. Trust-Building in Construction Contracting: Mechanism and Expectation. Int. J. Proj. Manag. 2012, 30, 927–937. [Google Scholar] [CrossRef]

- Liu, W.; Fan, H.; Xia, M. Tree-Based Heterogeneous Cascade Ensemble Model for Credit Scoring. Int. J. Forecast. 2023, 39, 1593–1614. [Google Scholar] [CrossRef]

- Li, H.; Cao, Y.; Li, S.; Zhao, J.; Sun, Y. XGBoost Model and Its Application to Personal Credit Evaluation. IEEE Intell. Syst. 2020, 35, 52–61. [Google Scholar] [CrossRef]

- Runchi, Z.; Liguo, X.; Qin, W. An Ensemble Credit Scoring Model Based on Logistic Regression with Heterogeneous Balancing and Weighting Effects. Expert Syst. Appl. 2023, 212, 118732. [Google Scholar] [CrossRef]

- Yang, F.; Qiao, Y.; Huang, C.; Wang, S.; Wang, X. An Automatic Credit Scoring Strategy (ACSS) Using Memetic Evolutionary Algorithm and Neural Architecture Search. Appl. Soft Comput. 2021, 113, 107871. [Google Scholar] [CrossRef]

- Yang, K.; Wang, W.; Xiong, W. Promoting the Sustainable Development of Infrastructure Projects through Responsible Innovation: An Evolutionary Game Analysis. Util. Policy 2021, 70, 101196. [Google Scholar] [CrossRef]

- Haiyirete, X.; Wang, J.; Tuluhong, A.; Zhang, H. Analysis of Multinational Builders’ Corruption Based on Evolutionary Game from the Perspective of International Reputation. Sustainability 2024, 16, 1768. [Google Scholar] [CrossRef]

- Wang, Q.; Pan, L. Tripartite Evolutionary Game Analysis of Participants’ Behaviors in Technological Innovation of Mega Construction Projects under Risk Orientation. Buildings 2023, 13, 287. [Google Scholar] [CrossRef]

- Singh, A.; Kumar, S.; Goel, U.; Johri, A. Behavioural Biases in Real Estate Investment: A Literature Review and Future Research Agenda. Humanit. Soc. Sci. Commun. 2023, 10, 846. [Google Scholar] [CrossRef]

- White, M. Behavioural Real Estate Finance. In Routledge Companion to Real Estate Investment; Routledge: Oxford, UK, 2018; ISBN 978-1-315-77557-9. [Google Scholar]

- Cattell, D.W.; Bowen, P.A.; Kaka, A.P. Proposed Framework for Applying Cumulative Prospect Theory to an Unbalanced Bidding Model. J. Constr. Eng. Manag. 2011, 137, 1052–1059. [Google Scholar] [CrossRef]

- Gou, X.; Xu, Z.; Zhou, W.; Herrera-Viedma, E. The Risk Assessment of Construction Project Investment Based on Prospect Theory with Linguistic Preference Orderings. Econ. Res. Ekon. Istraž. 2021, 34, 709–731. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, Y.; Wang, W.; Chen, Y.; Jin, M. Revisiting the Relationship Between Contract Governance and Contractors’ Opportunistic Behavior in Construction Projects. IEEE Trans. Eng. Manag. 2022, 69, 2517–2529. [Google Scholar] [CrossRef]

- Cho, S.; Jung, J. Behavioral Finance Insights into Land Management: Decision Aggregation and Real Estate Market Dynamics in China. Land 2024, 13, 1478. [Google Scholar] [CrossRef]

- Liu, C.; Wang, J.; Ji, Q.; Zhang, D. To Be Green or Not to Be: How Governmental Regulation Shapes Financial Institutions’ Greenwashing Behaviors in Green Finance. Int. Rev. Financ. Anal. 2024, 93, 103225. [Google Scholar] [CrossRef]

- Wan, S.-P.; Zou, W.; Dong, J.-Y. Prospect Theory Based Method for Heterogeneous Group Decision Making with Hybrid Truth Degrees of Alternative Comparisons. Comput. Ind. Eng. 2020, 141, 106285. [Google Scholar] [CrossRef]

- Dai, J.; Chen, T.; Zhang, K.; Liu, D.; Ding, W. GIFTWD: A Prospect Theory-Based Generalized Intuitionistic Fuzzy Three-Way Decision Model. IEEE Trans. Fuzzy Syst. 2024, 32, 4805–4819. [Google Scholar] [CrossRef]

- Wan, S.-P.; Wu, H.; Dong, J.-Y. An Integrated Method for Complex Heterogeneous Multi-Attribute Group Decision-Making and Application to Photovoltaic Power Station Site Selection. Expert Syst. Appl. 2024, 242, 122456. [Google Scholar] [CrossRef]

- Cui, X.; Jiang, R.; Shi, Y.; Xiao, R.; Yan, Y. Decision Making Under Cumulative Prospect Theory: An Alternating Direction Method of Multipliers. Inf. J. Comput. 2024. [Google Scholar] [CrossRef]

- Reichenbach, F.; Walther, M. Attention Allocation of Investors on Social Media: The Role of Prospect Theory. J. Behav. Financ. 2024, 1–18. [Google Scholar] [CrossRef]

- Lei, X.; Tu, Q. ESG Performance and Innovation in Listed Manufacturing Companies—A Prospect Theory Perspective. Financ. Res. Lett. 2025, 72, 106603. [Google Scholar] [CrossRef]

- Ao, Z.; Ji, X.; Liang, X. Can Prospect Theory Explain Anomalies in the Chinese Stock Market? Financ. Res. Lett. 2023, 58, 104466. [Google Scholar] [CrossRef]

- Wang, T.-Y.; Zhang, H. Research on the Game of Manufacturing Capacity Sharing Based on Prospect Theory. Sci. Rep. 2023, 13, 18093. [Google Scholar] [CrossRef]

- Dong, Y.; Li, J.; Liu, T.; Fan, M.; Yu, S.; Zhu, Y. Evolutionary Game Analysis for Protecting Suppliers’ Privacy between Government and Waste Mobile Phone Recycling Companies: Insights from Prospect Theory. J. Intell. Fuzzy Syst. 2022, 43, 3115–3132. [Google Scholar] [CrossRef]

- Lv, L.; Li, H.; Wang, Z.; Zhang, C.; Qiao, R. Evolutionary Game Analysis for Rent-Seeking Behavior Supervision of Major Infrastructure Projects Based on Prospect Theory. J. Civ. Eng. Manag. 2021, 28, 6–24. [Google Scholar] [CrossRef]

- Ning, X.; Qiu, Y.; Wu, C.; Jia, K. Developing a Decision-Making Model for Construction Safety Behavior Supervision: An Evolutionary Game Theory-Based Analysis. Front. Psychol. 2022, 13, 861828. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.; Yi, X.; Li, S.; Qiu, H. Evolutionary Game of Government Safety Supervision for Prefabricated Building Construction Using System Dynamics. Eng. Constr. Archit. Manag. 2023, 30, 2947–2968. [Google Scholar] [CrossRef]

- Jiang, X.; Sun, H.; Lu, K.; Lyu, S.; Skitmore, M. Using Evolutionary Game Theory to Study Construction Safety Supervisory Mechanism in China. Eng. Constr. Archit. Manag. 2023, 30, 514–537. [Google Scholar] [CrossRef]

- Liu, J.; Wang, X.; Liu, T. Behavior Choice Mechanisms and Tax Incentive Mechanisms in the Game of Construction Safety. Buildings 2022, 12, 1078. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263. [Google Scholar] [CrossRef]

- Bahamid, R.A.; Doh, S.I. A Review of Risk Management Process in Construction Projects of Developing Countries. IOP Conf. Ser. Mater. Sci. Eng. 2017, 271, 012042. [Google Scholar] [CrossRef]

- Chen, Q.; Long, D.; Yang, C.; Xu, H. Knowledge Graph Improved Dynamic Risk Analysis Method for Behavior-Based Safety Management on a Construction Site. J. Manag. Eng. 2023, 39, 04023023. [Google Scholar] [CrossRef]

- Na, S.B.; Lee, J.; Jang, W.; Lee, G. Analyzing Spatial Differences in Construction Risk Management: A Comparative Study of Regional Perception. Sens. Mater. 2024, 36, 4043. [Google Scholar] [CrossRef]

- Deng, B.; Lv, X.; Du, Y.; Li, X.; Yin, Y. Critical Risk Factors for Construction Supply Chain in China: A Fuzzy Synthetic Evaluation Analysis. Eng. Constr. Archit. Manag. 2025, 32, 483–506. [Google Scholar] [CrossRef]

- Jones, C.A.; Scotchmer, S. The Social Cost of Uniform Regulatory Standards in a Hierarchical Government. J. Environ. Econ. Manag. 1990, 19, 61–72. [Google Scholar] [CrossRef]

- Bai, Y.; Ding, L. Supply and Demand Behaviors in the Chinese Emission Allowances Pledge Credit Market under Different Value Type: An Evolutionary Game Analysis. J. Clean. Prod. 2024, 455, 142374. [Google Scholar] [CrossRef]

- Guo, P.; Wang, X.; Meng, X. Evolutionary Game Study and Empirical Analysis of the Adoption of Green Coal Mining Technology: A Case Study of ITMDB. Energy 2024, 313, 134019. [Google Scholar] [CrossRef]

- He, W.; Zhang, Y.; Li, S.; Li, W.; Wang, Z.; Liu, P.; Zhang, L.; Kong, D. Reducing Betrayal Behavior in Green Building Construction: A Quantum Game Approach. J. Clean. Prod. 2024, 463, 142760. [Google Scholar] [CrossRef]

- Valer Dávila, J.C.; Galarza, V.G.; Monteverde, E.C. High-Dimensional Private and Social Optimal Policy Valuation Model for Non-Renewable Natural Resource Extraction Projects for Multivariate Public Policy Decisions. Resour. Policy 2024, 96, 105230. [Google Scholar] [CrossRef]

- Lu, Y.; Karunasena, G.; Liu, C. Exploring Beyond-Compliance Behaviors of Australian Building Practitioners: A Cluster Analysis. Energy Res. Soc. Sci. 2025, 121, 103969. [Google Scholar] [CrossRef]

- Gurevich, G.; Kliger, D.; Levy, O. Decision-Making under Uncertainty—A Field Study of Cumulative Prospect Theory. J. Bank. Financ. 2009, 33, 1221–1229. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).