A Systematic Literature Review on the Revolutionary Impact of Blockchain in Modern Business

Abstract

1. Introduction

- What are the key research themes in the literature on blockchain technology adoption by businesses?

- Which theories are prevalent in the literature on blockchain technology adoption by businesses?

- What conceptual frameworks have been developed to analyze the dynamic between blockchain technology and business adoption processes?

- What challenges do businesses face when adopting blockchain technology?

- What benefits do businesses gain from adopting blockchain technology?

2. Theoretical Background

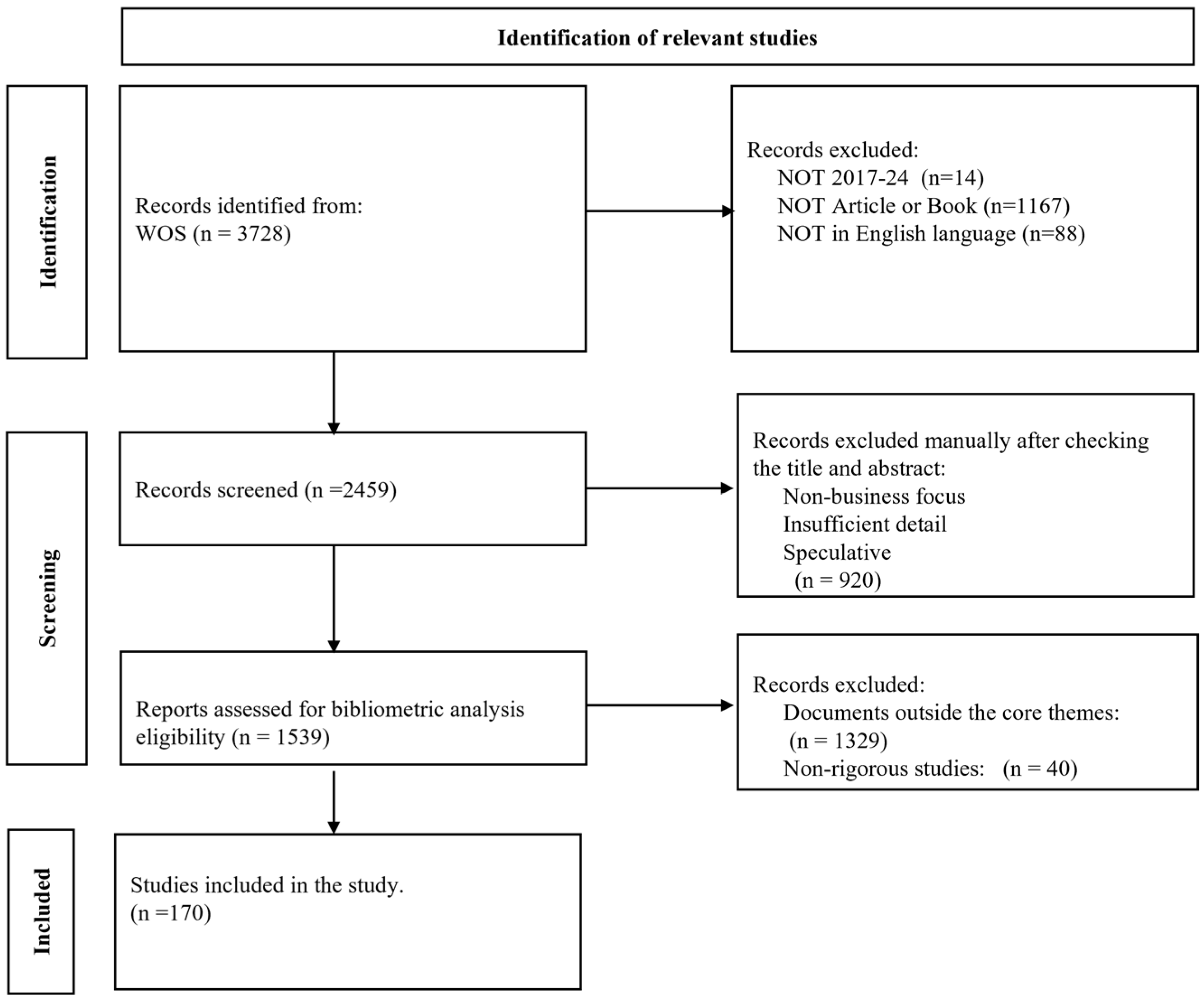

3. Methodology

Databases, Document Inclusion and Exclusion Criteria

4. Findings and Discussions

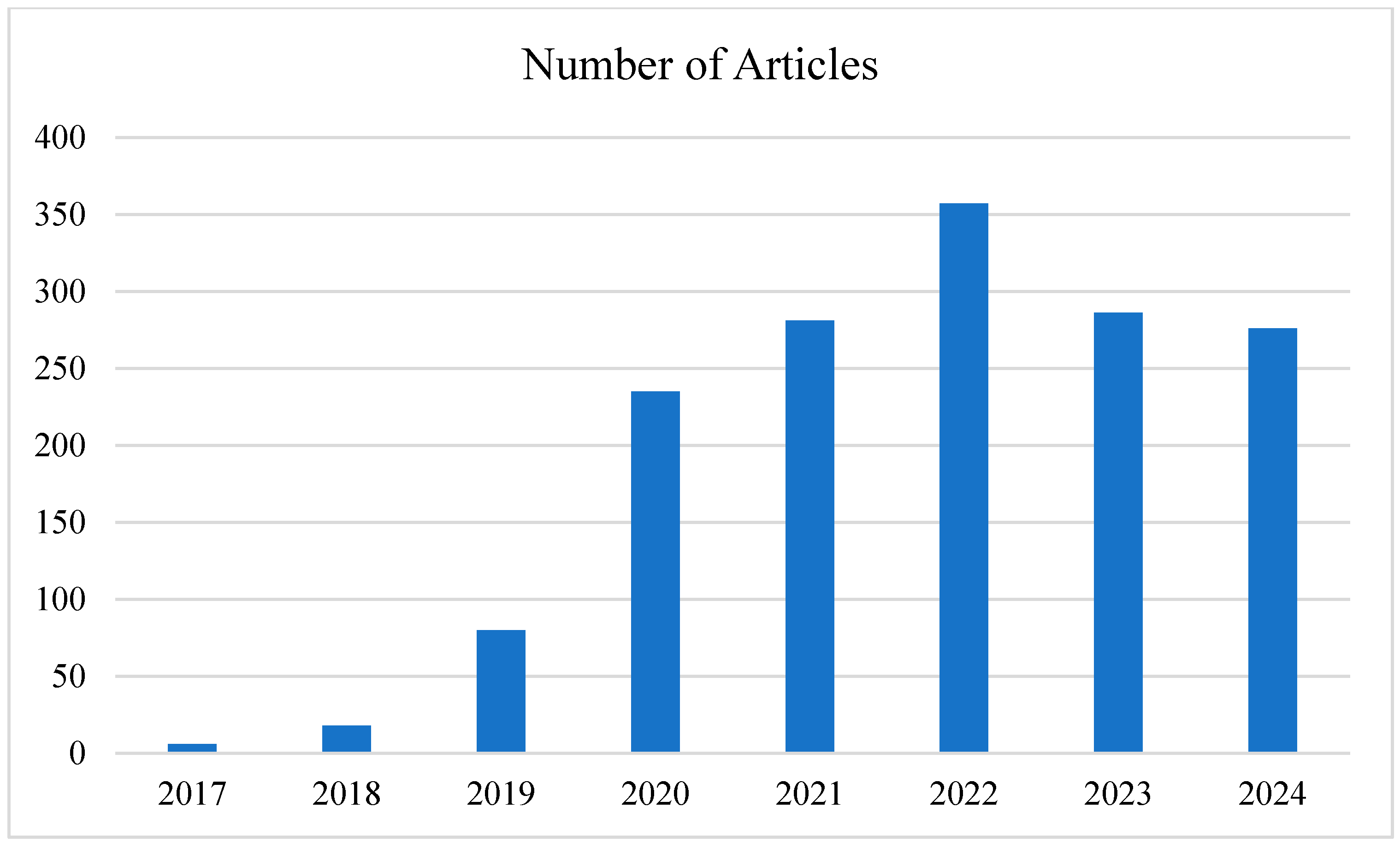

4.1. Publication Trends over Time

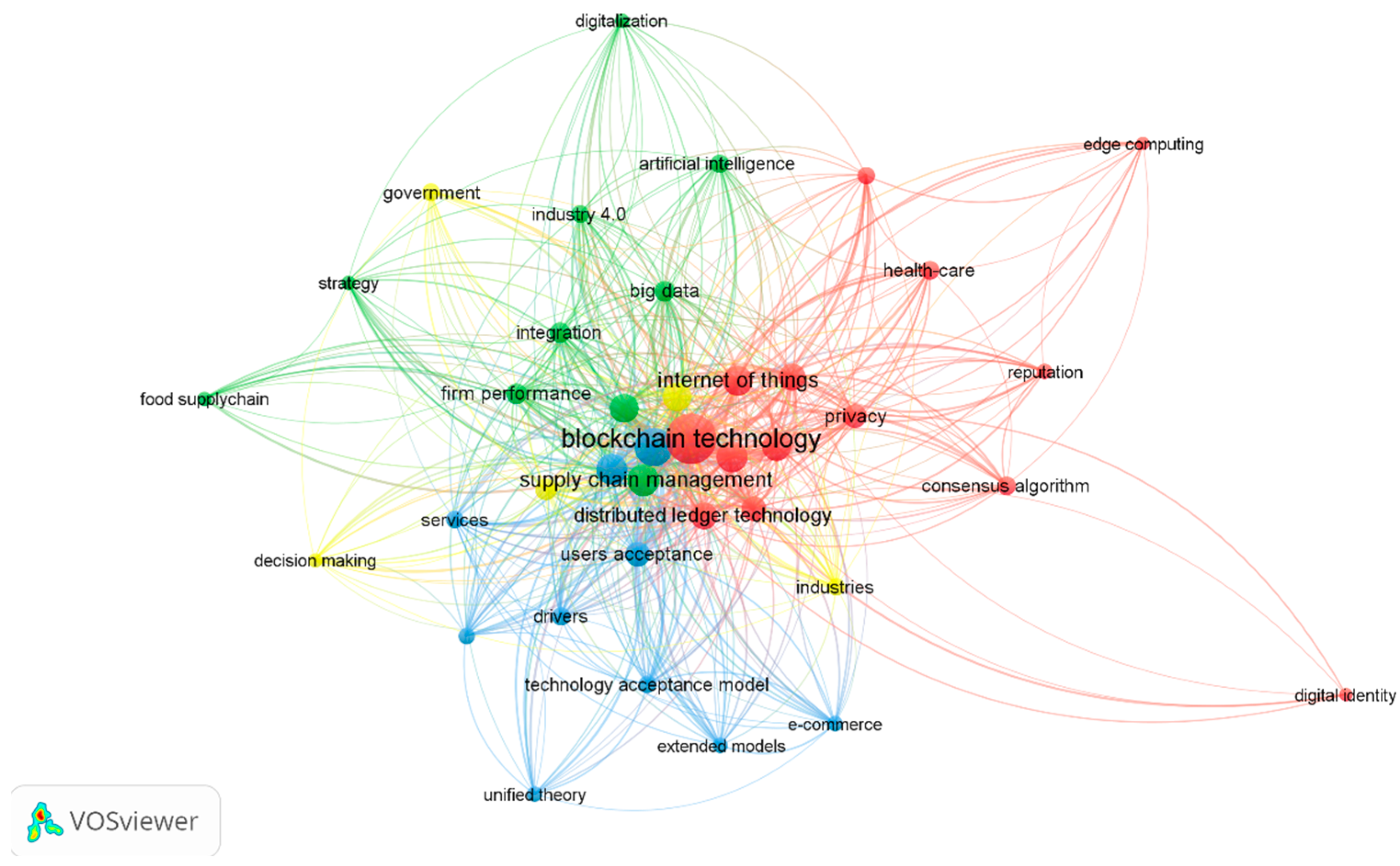

4.2. Co-Word Analysis

4.3. Core Themes and Clusters

4.3.1. Theme 1 Supply Chain Management

Logistics Tracking and Tracing

Supply Chain Data Reconciliation

4.3.2. Theme 2 Decentralized Data Management

Medical Record Data Management

Financial Data Management

Internet of Things

E-Commerce

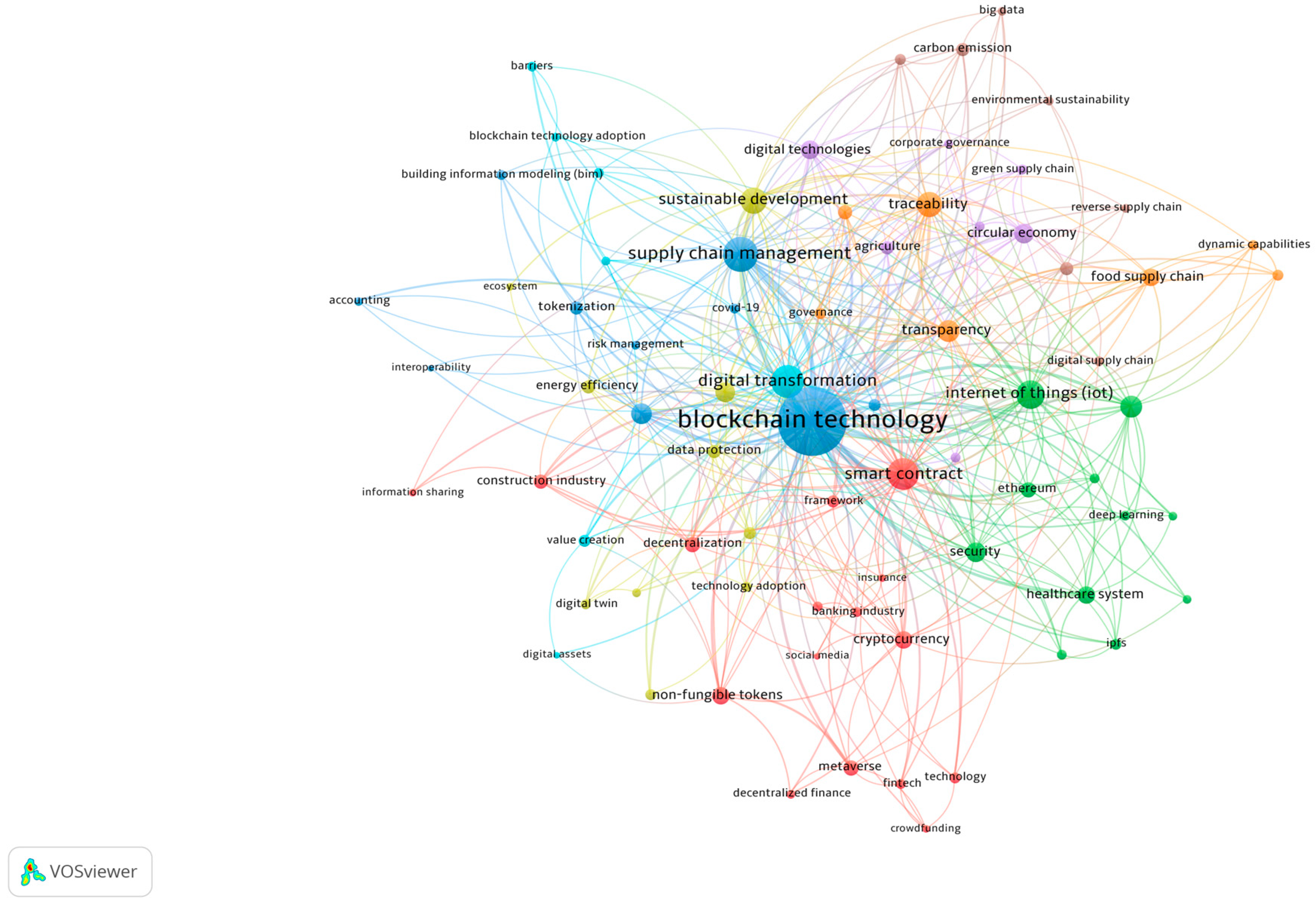

4.4. Recent Advances and Emerging Clusters

4.4.1. Sustainability-Oriented Supply Chains

4.4.2. Digital Finance and Assets: DeFi, Digital Assets, and NFTs

4.4.3. Virtual Environments: Emerging Focus on the Metaverse and Digital Twins

4.5. Theoretical Frameworks and Models in the Literature

4.5.1. Value Creation Using Blockchain

4.5.2. Organizational Theories: Drivers of BCT Adoption

4.5.3. Behavioral Theories: Behavioral Determinants of BCT Adoption

4.5.4. Moderators and Mediators

Moderating Variables

Mediating Variables

4.6. Conceptual Frameworks Developed in the Reviewed Literature

4.7. Outcomes of BCT Adoption

4.7.1. Value Creation

4.7.2. Business Process Enhancement

4.8. Challenges to BCT Adoption

4.9. Framework Mapping

5. Conclusions, Limitations, and Directions for Further Research

5.1. Conclusions

5.2. Limitations of This Study

5.3. Implications and Directions for Further Research

5.3.1. Implications of This Study

5.3.2. Directions for Further Research

Author Contributions

Funding

Conflicts of Interest

References

- Saheb, T.; Mamaghani, F.H. Exploring the barriers and organizational values of blockchain adoption in the banking industry. J. High Technol. Manag. Res. 2021, 32, 100417. [Google Scholar] [CrossRef]

- Komalavalli, C.; Saxena, D.; Laroiya, C. Overview of Blockchain Technology Concepts. In Handbook of Research on Blockchain Technology; Academic Press: Cambridge, MA, USA, 2020; pp. 349–371. [Google Scholar] [CrossRef]

- Deloitte Insights. Deloitte’s 2021 Global Blockchain Survey. Available online: https://www2.deloitte.com/us/en/insights/topics/understanding-blockchain-potential/global-blockchain-survey.html (accessed on 23 March 2022).

- Baharmand, H.; Maghsoudi, A.; Coppi, G. Exploring the application of blockchain to humanitarian supply chains: Insights from Humanitarian Supply Blockchain pilot project. Int. J. Oper. Prod. Manag. 2021, 41, 1522–1543. [Google Scholar] [CrossRef]

- Kouhizadeh, M.; Saberi, S.; Sarkis, J. Blockchain technology and the sustainable supply chain: Theoretically exploring adoption barriers. Int. J. Prod. Econ. 2021, 231, 107831. [Google Scholar] [CrossRef]

- Liu, Y.; Zhu, Q.; Seuring, S. New technologies in operations and supply chains: Implications for sustainability. Int. J. Prod. Econ. 2020, 229, 107889. [Google Scholar] [CrossRef]

- Ku-Mahamud, K.R.; Bakar, N.A.A.; Omar, M. Blockchain, cryptocurrency and Fintech market growth in Malaysia. J. Adv. Res. Dyn. Control. Syst. 2018, 10, 2074–2082. [Google Scholar]

- Rijanto, A. Business financing and blockchain technology adoption in agroindustry. J. Sci. Technol. Policy Manag. 2020, 12, 215–235. [Google Scholar] [CrossRef]

- Aivaz, K.-A.; Munteanu, I.F.; Jakubowicz, F.V. Bitcoin in Conventional Markets: A Study on Blockchain-Induced Reliability, Investment Slopes, Financial and Accounting Aspects. Mathematics 2023, 11, 4508. [Google Scholar] [CrossRef]

- Mackey, T.K.; Kuo, T.T.; Gummadi, B.; Clauson, K.A.; Church, G.; Grishin, D.; Obbad, K.; Barkovich, R.; Palombini, M. “Fit-for-purpose?”-Challenges and opportunities for applications of blockchain technology in the future of healthcare. BMC Med. 2019, 17, 68. [Google Scholar] [CrossRef]

- Bdiwi, R.; de Runz, C.; Cherif, A.A.; Faiz, S. Blockchain-Based Platform for Smart Learning Environments. In Business Information Systems, Proceedings of the 22nd International Conference, BIS 2019, Seville, Spain, 26–28 June 2019; Lecture Notes in Business Information Processing; Springer International Publishing: Cham, Switzerland, 2019; Volume 353, pp. 487–499. [Google Scholar] [CrossRef]

- Naser, F. Review: The Potential Use of Blockchain Technology in Railway Applications an Introduction of A Mobility and Speech Recognition Prototype. In Proceedings of the 2018 IEEE International Conference on Big Data (Big Data), Seattle, WA, USA, 10–13 December 2018; pp. 4516–4524. [Google Scholar]

- Hylock, R.H.; Zeng, X. A Blockchain Framework for Patient-Centered Health Records and Exchange (HealthChain): Evaluation and Proof-of-Concept Study. J. Med. Internet Res. 2019, 21, e13592. [Google Scholar] [CrossRef]

- Tripathi, G.; Ahad, M.A.; Paiva, S. S2HS- A blockchain based approach for smart healthcare system. Healthcare 2020, 8, 100391. [Google Scholar] [CrossRef]

- Alharthi, S.; Cerotti, P.; Far, S.M. The Impact of Blockchain Implementation on Pharmaceutical Supply Chain Sustainability: A Conceptual Study. In Education Excellence and Innovation Management: A 2025 Vision to Sustain Economic Development During Global Challenges; Soliman, K.S., Ed.; IBIMA: Madrid, Spain, 2020; pp. 9231–9252. [Google Scholar]

- Lahkani, M.J.; Wang, S.; Urbański, M.; Egorova, M. Sustainable B2B E-Commerce and Blockchain-Based Supply Chain Finance. Sustainability 2020, 12, 3968. [Google Scholar] [CrossRef]

- Treiblmaier, H.; Sillaber, C. The impact of blockchain on e-commerce: A framework for salient research topics. Electron. Commer. Res. Appl. 2021, 48, 101054. [Google Scholar] [CrossRef]

- Lustenberger, M.; Malešević, S.; Spychiger, F. Ecosystem Readiness: Blockchain Adoption is Driven Externally. Front. Blockchain 2021, 4, 720454. [Google Scholar] [CrossRef]

- Hijazi, A.A.; Perera, S.; Alashwal, A.M.; Alashwal, A.; Calheiros, R.N. Blockchain Adaption in Construction Supply Chain: A Review of Studies Across Multiple Sectors. In Proceedings of the 22nd Cib World Building Congress (Cib2019), The Hong Kong Polytechnic University, Hong Kong, China, 17–21 June 2019; Available online: https://www.researchgate.net/profile/Amer-Hijazi/publication/333879452_Blockchain_Adoption_in_Construction_Supply_Chain_A_Review_of_Studies_Across_Multiple_Sectors/links/5d0a66a192851cfcc624bd8f/Blockchain-Adoption-in-Construction-Supply-Chain-A-Review-of (accessed on 10 September 2024).

- Surjandy; Meyliana; Hidayanto, A.N.; Prabowo, H. The latest adoption blockchain technology in supply chain management: A systematic literature review. ICIC Express Lett. 2019, 13, 913–920. [Google Scholar] [CrossRef]

- Duan, J.; Zhang, C.; Gong, Y.; Brown, S.; Li, Z. A Content-Analysis Based Literature Review in Blockchain Adoption within Food Supply Chain. Int. J. Environ. Res. Public Health 2020, 17, 1784. [Google Scholar] [CrossRef]

- Durneva, P.; Cousins, K.; Chen, M. The Current State of Research, Challenges, and Future Research Directions of Blockchain Technology in Patient Care: Systematic Review. J. Med. Internet Res. 2020, 22, e18619. [Google Scholar] [CrossRef]

- Ali, O.; Ally, M.; Clutterbuck; Dwivedi, Y. The state of play of blockchain technology in the financial services sector: A systematic literature review. J. Inf. Manag. 2020, 54, 102199. [Google Scholar] [CrossRef]

- Kaushik, A.; Khatri, A. Systematic literature review on blockchain adoption in banking. Pressacademia 2021, 8, 126–146. [Google Scholar] [CrossRef]

- Scott, D.J.; Broyd, T.; Ma, L. Exploratory literature review of blockchain in the construction industry. Autom. Constr. 2021, 132, 103914. [Google Scholar] [CrossRef]

- Upadhyay, A.; Ayodele, J.O.; Kumar, A.; Garza-Reyes, J.A. A review of challenges and opportunities of blockchain adoption for operational excellence in the UK automotive industry. J. Glob. Oper. Strateg. Sourc. 2021, 14, 7–60. [Google Scholar] [CrossRef]

- Loukil, F.; Abed, M.; Boukadi, K. Blockchain adoption in education: A systematic literature review. Educ. Inf. Technol. 2021, 26, 5779–5797. [Google Scholar] [CrossRef]

- Perera, S.; Nanayakkara, S.; Rodrigo, M.N.N.; Senaratne, S.; Weinand, R. Blockchain technology: Is it hype or real in the construction industry? J. Ind. Inf. Integr. 2020, 17, 100125. [Google Scholar] [CrossRef]

- Batta, A.; Gandhi, M.; Kar, A.K.; Loganayagam, N.; Ilavarasan, V. Diffusion of blockchain in logistics and transportation industry: An analysis through the synthesis of academic and trade literature. J. Sci. Technol. Policy Manag. 2020, 12, 378–398. [Google Scholar] [CrossRef]

- Sai, A.R.; Buckley, J.; Fitzgerald, B.; Le Gear, A. Taxonomy of centralization in public blockchain systems: A systematic literature review. Inf. Process. Manag. 2021, 58, 102584. [Google Scholar] [CrossRef]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inform. 2019, 36, 55–81. [Google Scholar] [CrossRef]

- Koteska, B.; Karafiloski, E.; Mishev, A. Blockchain implementation quality challenges: A literature review. In Proceedings of the 6th Workshop of Software Quality, Analysis, Monitoring, Improvement, and Applications, Belgrade, Serbia, 11–13 September 2017. [Google Scholar]

- Batubara, F.R.; Ubacht, J.; Janssen, M.; Barubara, F.R.; Ubacht, J.; Janssen, M. Challenges of blockchain technology adoption for e-government: A systematic literature review. In ACM International Conference Proceeding Series; Zuiderwijk, A., Hinnant, C.C., Eds.; Association for Computing Machinery: New York, NY, USA, 2018; pp. 648–656. [Google Scholar] [CrossRef]

- Cizmesija, A.; Vrcek, N. Organizational challenges of blockchain adoption: An exploratory literature review. In Proceedings of the 2021 IEEE Technology and Engineering Management Conference-Europe, TEMSCON-EUR, Dubrovnik, Croatia, 17–20 May 2021. [Google Scholar] [CrossRef]

- Bag, S.; Viktorovich, D.A.; Sahu, A.K.; Sahu, A.K. Barriers to adoption of blockchain technology in green supply chain management. J. Glob. Oper. Strateg. Sourc. 2021, 14, 104–133. [Google Scholar] [CrossRef]

- Haber, S.; Stornetta, W.S. How to Time-Stamp a Digital Document. In Advances in Cryptology-CRYPTO’ 90; Springer: Berlin/Heidelberg, Germany, 1990; pp. 437–455. [Google Scholar] [CrossRef]

- Syed, T.A.; Alzahrani, A.; Jan, S.; Siddiqui, M.S.; Nadeem, A.; Alghamdi, T. A Comparative Analysis of Blockchain Architecture and its Applications: Problems and Recommendations. IEEE Access 2019, 7, 176838–176869. [Google Scholar] [CrossRef]

- Dib, O.; Brousmiche, K.L.; Durand, A.; Thea, E.; Hamida, E.B. Consortium blockchains: Overview, applications and challenges. Int. J. Adv. Telecommun. 2018, 11, 51–64. Available online: https://www.researchgate.net/profile/Omar-Dib-3/publication/328887130_Consortium_Blockchains_Overview_Applications_and_Challenges/links/5be99602299bf1124fce0ab9/Consortium-Blockchains-Overview-Applications-and-Challenges.pdf (accessed on 12 February 2023).

- Mahajan, A.; Issa, T. Australian users’ perspective of green blockchain technology adoption in businesses. In Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2020. [Google Scholar] [CrossRef]

- Almekhlafi, S.; Al-Shaibany, N. The Literature Review of Blockchain Adoption. Asian J. Res. Comput. Sci. 2021, 7, 29–50. [Google Scholar] [CrossRef]

- Maesa, D.D.F.; Mori, P. Blockchain 3.0 applications survey. J. Parallel Distrib. Comput. 2020, 138, 99–114. [Google Scholar] [CrossRef]

- Maden, A.; Alptekin, E. Evaluation of factors affecting the decision to adopt blockchain technology: A logistics company case study using Fuzzy DEMATEL. J. Intell. Fuzzy Syst. 2020, 39, 6279–6291. [Google Scholar] [CrossRef]

- Marzi, G.; Balzano, M.; Caputo, A.; Pellegrini, M.M. Guidelines for Bibliometric-Systematic Literature Reviews: 10 steps to combine analysis, synthesis and theory development. Int. J. Manag. Rev. 2024. ahead of print. [Google Scholar] [CrossRef]

- Singh, V.K.; Singh, P.; Karmakar, M.; Leta, J.; Mayr, P. The journal coverage of Web of Science, Scopus and Dimensions: A comparative analysis. Scientometrics 2021, 126, 5113–5142. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, 71. [Google Scholar] [CrossRef] [PubMed]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to conduct a bibliometric analysis: An overview and guidelines. J. Bus. Res. 2021, 133, 285–296. [Google Scholar] [CrossRef]

- Sadeghi, M.; Mahmoudi, A.; Deng, X. Adopting distributed ledger technology for the sustainable construction industry: Evaluating the barriers using Ordinal Priority Approach. Environ. Sci. Pollut. Res. 2022, 29, 10495–10520. [Google Scholar] [CrossRef]

- Alharthi, S.; Cerotti, P.R.C.; Far, S.M. An Exploration of The Role of Blockchain in The Sustainability and Effectiveness of The Pharmaceutical Supply Chain. J. Suppl. Chain Cust. Relatsh. Manag. 2020, 2020, 1–29. [Google Scholar] [CrossRef]

- Yadav, V.S.; Singh, A.R.; Raut, R.D.; Govindarajan, U.H. Blockchain technology adoption barriers in the Indian agricultural supply chain: An integrated approach. Resour. Conserv. Recycl. 2020, 161, 104877. [Google Scholar] [CrossRef]

- Li, Y. Benefits and Barriers of Blockchain Implementation and Adoption. In Proceedings of the Digital Innovation and Entrepreneurship (AMCIS), Virtual Conference, 9–13 August 2021. [Google Scholar]

- Al-Farsi, K.M.; Al-Badi, A.H.; Khalique, S.A. Behavioral Intention for Adopting Blockchain in Supply Chain Management: Case Study of an Omani Industry. In Vision 2025: Education Excellence and Management of Innovations Through Sustainable Economic Competitive Advantage, Proceedings of the 34th International Business Information Management Association Conference (IBIMA), Madrid, Spain, 13–14 November 2019; IBIMA: Madrid, Spain, 2019. [Google Scholar]

- Queiroz, M.M.; Fosso Wamba, S. Blockchain adoption challenges in supply chain: An empirical investigation of the main drivers in India and the USA. Int. J. Inf. Manag. 2019, 46, 70–82. [Google Scholar] [CrossRef]

- Hye, A.K.M.; Miraz, M.H.; Sharif, K.I.M.; Hassan, M.G. Factors affecting logistic supply chain performance: Mediating role of block chain adoption. Test Eng. Manag. 2020, 82, 9338–9348. [Google Scholar]

- Vafadarnikjoo, A.; Badri Ahmadi, H.; Liou, J.J.H.; Botelho, T.; Chalvatzis, K. Analyzing blockchain adoption barriers in manufacturing supply chains by the neutrosophic analytic hierarchy process. Ann. Oper. Res. 2021, 327, 129–156. [Google Scholar] [CrossRef]

- Kurpjuweit, S.; Schmidt, C.G.; Maximilian, S.M.K.; Wagner Klöckner, M.; Wagner, S.M.; Klockner, M.; Wagner, S.M. Blockchain in Additive Manufacturing and its Impact on Supply Chains. J. Bus. Logist. 2021, 42, 46–70. [Google Scholar] [CrossRef]

- Rejeb, A.; Keogh, J.G.; Zailani, S.; Treiblmaier, H.; Rejeb, K. Blockchain Technology in the Food Industry: A Review of Potentials, Challenges and Future Research Directions. Logistics 2020, 4, 27. [Google Scholar] [CrossRef]

- Dobrovnik, M.; Herold, D.; Fürst, E.; Kummer, S. Blockchain for and in Logistics: What to Adopt and Where to Start. Logistics 2018, 2, 18. [Google Scholar] [CrossRef]

- Bhardwaj, A.K.; Garg, A.; Gajpal, Y. Determinants of Blockchain Technology Adoption in Supply Chains by Small and Medium Enterprises (SMEs) in India. Math. Probl. Eng. 2021, 2021, 5537395. [Google Scholar] [CrossRef]

- Tan, W.K.A.; Sundarakani, B. Assessing Blockchain Technology application for freight booking business: A case study from Technology Acceptance Model perspective. J. Glob. Oper. Strateg. Sourc. 2021, 14, 202–223. [Google Scholar] [CrossRef]

- Rainero, C.; Modarelli, G. Food tracking and blockchain-induced knowledge: A corporate social responsibility tool for sustainable decision-making. Br. Food J. 2021, 123, 4284–4308. [Google Scholar] [CrossRef]

- Khan, S.; Amin, M.B.; Azar, A.T.; Aslam, S. Towards Interoperable Blockchains: A Survey on the Role of Smart Contracts in Blockchain Interoperability. IEEE Access 2021, 9, 116672–116691. [Google Scholar] [CrossRef]

- Sharma, M.; Joshi, S. Barriers to blockchain adoption in health-care industry: An Indian perspective. J. Glob. Oper. Strateg. Sourc. 2021, 14, 134–169. [Google Scholar] [CrossRef]

- Pereira, T.; Morgado, J.; Silva, F.; Pelter, M.M.; Dias, V.R.; Barros, R.; Claudia, E.F.; Negrao de Lima, B.F.; da Silva, M.C.; Madureira, A.J.; et al. Sharing Biomedical Data: Strengthening AI Development in Healthcare. Healthcare 2021, 9, 827. [Google Scholar] [CrossRef]

- Przhedetskiy, Y.V.; Przhedetskaya, N.V.; Borzenko, K.V.; Bondarenko, V.A. Blockchain technologies in healthcare institutions: Focus on security and effective cooperation with the government. Int. J. Econ. Bus. Adm. 2019, VII, 92–99. [Google Scholar] [CrossRef]

- Mackey, T.; Bekki, H.; Matsuzaki, T.; Mizushima, H. Examining the Potential of Blockchain Technology to Meet the Needs of 21st-Century Japanese Health Care: Viewpoint on Use Cases and Policy. J. Med. Internet Res. 2020, 22, e13649. [Google Scholar] [CrossRef] [PubMed]

- Yeung, K. The Health Care Sector’s Experience of Blockchain: A Cross-disciplinary Investigation of Its Real Transformative Potential. J. Med. Internet Res. 2021, 23, e24109. [Google Scholar] [CrossRef] [PubMed]

- Kabir, M.R.; Islam, M.A. Behavioural intention to adopt blockchain technology in Bangladeshi banking companies. AIP Conf. Proc. 2021, 2347, 020025. [Google Scholar] [CrossRef]

- Raddatz, N.; Coyne, J.; Menard, P.; Crossler, R.E. Becoming a blockchain user: Understanding consumers’ benefits realisation to use blockchain-based applications. Eur. J. Inf. Syst. 2021, 32, 287–314. [Google Scholar] [CrossRef]

- Shukla, R.G.; Agarwal, A.; Shekhar, V. Leveraging Blockchain Technology for Indian Healthcare system: An assessment using value-focused thinking approach. J. High Technol. Manag. Res. 2021, 32, 100415. [Google Scholar] [CrossRef]

- Nazim, N.F.; Razis, N.M.; Hatta, M.F.M. Behavioural intention to adopt blockchain technology among bankers in islamic financial system: Perspectives in Malaysia. Rev. Română Informatică Și Autom. 2021, 31, 11–28. [Google Scholar] [CrossRef]

- Grima, S.; Spiteri, J.; Romānova, I. A STEEP framework analysis of the key factors impacting the use of blockchain technology in the insurance industry. Geneva Pap. Risk Insur. Issues Pr. 2020, 45, 398–425. [Google Scholar] [CrossRef]

- Kulkarni, M.; Patil, K. Block chain technology adoption using toe framework. Int. J. Sci. Technol. Res. 2020, 9, 1109–1117. [Google Scholar]

- Al-Khazaali, A.A.T.; Kurnaz, S. Study of integration of block chain and Internet of Things (IoT): An opportunity, challenges, and applications as medical sector and healthcare. Appl. Nanosci. 2021, 13, 1531–1537. [Google Scholar] [CrossRef]

- Khor, J.H.; Sidorov, M.; Woon, P.Y. Public Blockchains for Resource-Constrained IoT Devices-A State-of-the-Art Survey. IEEE Internet Things J. 2021, 8, 11960–11982. [Google Scholar] [CrossRef]

- Al Habsi, M.M.A.; Nair, S.S.K.; Al Sulti, S.J.S.J.; Adarsh, S. Blockchain Technology Adoption and Implementation for Securing IoT Devices. Rev. Geintec-Gest. Inov. E Tecnol. 2021, 11, 3823–3836. [Google Scholar] [CrossRef]

- Rane, S.B.; Thakker, S.V. Green procurement process model based on blockchain–IoT integrated architecture for a sustainable business. Manag. Environ. Qual. Int. J. 2020, 31, 741–763. [Google Scholar] [CrossRef]

- Rejeb, A.; Keogh, J.G.; Treiblmaier, H. How Blockchain Technology Can Benefit Marketing: Six Pending Research Areas. Front. Blockchain 2020, 3, 3. [Google Scholar] [CrossRef]

- Ismail, S.; Nouman, M.; Reza, H.; Vasefi, F.; Zadeh, H.K. A Blockchain-Based Fish Supply Chain Framework for Maintaining Fish Quality and Authenticity. IEEE Trans. Serv. Comput. 2024, 17, 1877–1886. [Google Scholar] [CrossRef]

- Naseem, M.H.; Yang, J.; Zhang, T.; Alam, W. Utilizing Fuzzy AHP in the Evaluation of Barriers to Blockchain Implementation in Reverse Logistics. Sustainability 2023, 15, 7961. [Google Scholar] [CrossRef]

- Zhang, X.; Feng, X.; Jiang, Z.; Gong, Q.; Wang, Y. A blockchain-enabled framework for reverse supply chain management of power batteries. J. Clean. Prod. 2023, 415, 137823. [Google Scholar] [CrossRef]

- Chen, Z.; Sarkis, J.; Yildizbasi, A. Digital transformation for safer circular lithium-ion battery supply chains: A blockchain ecosystem-data perspective. Int. J. Prod. Res. 2024, 62, 1–22. [Google Scholar] [CrossRef]

- Ibáñez-Jiménez, J.W.; Palomo-Zurdo, R. Wine tokenisation: The opportunity of DLT technology for the economic and social challenges of the wine sector; [Tokenización del vino: La oportunidad de la tecnología DLT para los retos económicos y sociales del sector vinícola]. REVESCO Rev. De Estud. Coop. 2024, 146, e95352. [Google Scholar] [CrossRef]

- Kayani, U.; Hasan, F. Unveiling Cryptocurrency Impact on Financial Markets and Traditional Banking Systems: Lessons for Sustainable Blockchain and Interdisciplinary Collaborations. J. Risk Financ. Manag. 2024, 17, 58. [Google Scholar] [CrossRef]

- Jia, W.; Yao, B. NFTs applied to the art sector. Leg. Issues Recent Jurisprudence. Converg. 2024, 30, 807–822. [Google Scholar] [CrossRef]

- Davies, J.; Sharifi, H.; Lyons, A.; Forster, R.; Elsayed, O.K.S.M. Non-fungible tokens: The missing ingredient for sustainable supply chains in the metaverse age? Transp. Res. Part E Logist. Transp. Rev. 2024, 182, 103412. [Google Scholar] [CrossRef]

- Jin, S.V. “In the Metaverse We (Mis)trust?” Third-Level Digital (In)equality, Social Phobia, Neo-Luddism, and Blockchain/Cryptocurrency Transparency in the Artificial Intelligence-Powered Metaverse. Cyberpsychol. Behav. Soc. Netw. 2024, 27, 64–75. [Google Scholar] [CrossRef] [PubMed]

- Yaqoob, I.; Salah, K.; Jayaraman, R.; Omar, M. Metaverse applications in smart cities: Enabling technologies, opportunities, challenges, and future directions. Internet Things 2023, 23, 100884. [Google Scholar] [CrossRef]

- Wei, D. Gemiverse: The blockchain-based professional certification and tourism platform with its own ecosystem in the metaverse. Int. J. Geoherit. Parks 2022, 10, 322–336. [Google Scholar] [CrossRef]

- Li, Q.; Kong, L.; Min, X.; Zhang, B. DareChain: A Blockchain-Based Trusted Collaborative Network Infrastructure for Metaverse. Int. J. Crowd Sci. 2023, 7, 168–179. [Google Scholar] [CrossRef]

- Tavakoli, P.; Yitmen, I.; Sadri, H.; Taheri, A. Blockchain-based digital twin data provenance for predictive asset management in building facilities. Smart Sustain. Built Environ. 2024, 13, 4–21. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Kant, N. Blockchain: A strategic resource to attain and sustain competitive advantage. Int. J. Innov. Sci. 2021, 13, 520–538. [Google Scholar] [CrossRef]

- Yuthas, K. Strategic Value Creation through Enterprise Blockchain. J. Br. Blockchain Assoc. 2021, 4, 18–25. [Google Scholar] [CrossRef]

- Nandi, S.; Sarkis, J.; Hervani, A.; Helms, M. Do blockchain and circular economy practices improve post COVID-19 supply chains? A resource-based and resource dependence perspective. Ind. Manag. Data Syst. 2021, 121, 333–363. [Google Scholar] [CrossRef]

- Tipmontian, J.; Alcover, J.C.; Rajmohan, M. Impact of Blockchain Adoption for Safe Food Supply Chain Management through System Dynamics Approach from Management Perspectives in Thailand. Proceedings 2020, 39, 14. [Google Scholar] [CrossRef]

- Paul, T.; Mondal, S.; Islam, N.; Rakshit, S. The impact of blockchain technology on the tea supply chain and its sustainable performance. Technol. Forecast. Soc. Chang. 2021, 173, 121163. [Google Scholar] [CrossRef]

- Kumar, A. Value and incentives for adoption of Blockchain technology for a single supplier multiple retailer networks. J. High Technol. Manag. Res. 2021, 32, 100407. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Fleischer, M.; Chakrabarti, A.K. Processes of Technological Innovation; Lexington Books: Lexington, MA, USA, 1990; Volume 6, pp. 326–340. Available online: https://books.google.com/books/about/The_Processes_of_Technological_Innovatio.html?id=EotRAAAAMAAJ (accessed on 10 September 2024).

- Rogers, E.M. Diffusion of Innovations, 5th ed.; Free Press: New York, NY, USA, 2003. [Google Scholar]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. Manag. Inf. Syst. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. Manag. Inf. Syst. 1989, 13, 319–339. [Google Scholar] [CrossRef]

- Elliot, V.; Floden, J.; Overland, C.; Raza, Z.; Staron, M.; Woxenius, J.; Basu, A.; Rajput, T.; Schneider, G.; Stefansson, G. CEOs’ understanding of blockchain technology and its adoption in export-oriented companies in West Sweden: A survey. J. Glob. Oper. Strat. Sourc. 2021. ahead of print. [Google Scholar] [CrossRef]

- Vo, H.T.; Kundu, A.; Mohania, M. Research directions in blockchain data management and analytics. In Advances in Database Technology—EDBT, Proceedings of the 21st International Conference on Extending Database Technology (EDBT), Vienna, Austria, 26–29 March 2018; OpenProceedings: Konstanz, Germany, 2018. [Google Scholar] [CrossRef]

- Momoh, M.O.; Chinedu, P.U.; Nwankwo, W.; Aliu, D.; Shaba, M.S. Blockchain Adoption: Applications And Challenges. Int. J. Softw. Eng. Comput. Syst. 2021, 7, 19–25. [Google Scholar] [CrossRef]

- Toufaily, E.; Zalan, T.; Dhaou, S.B. A framework of blockchain technology adoption: An investigation of challenges and expected value. Inf. Manag. 2021, 58, 103444. [Google Scholar] [CrossRef]

- Sanka, A.I.; Irfan, M.; Huang, I.; Cheung, R.C.C. A survey of breakthrough in blockchain technology: Adoptions, applications, challenges and future research. Comput. Commun. 2021, 169, 179–201. [Google Scholar] [CrossRef]

- Karuppiah, K.; Sankaranarayanan, B.; Ali, S.M. A decision-aid model for evaluating challenges to blockchain adoption in supply chains. Int. J. Logist. Res. Appl. 2021, 26, 257–278. [Google Scholar] [CrossRef]

- Gokalp, E.; Coban, S.; Gokalp, M.O. Acceptance of Blockchain Based Supply Chain Management System: Research Model Proposal [Blokzincir Tabanli Tedarik Zinciri Yönetimi Sistemi Kabulü: Arastirma Modeli Önerisi]. In Proceedings of the 1st International Informatics and Software Engineering Conference: Innovative Technologies for Digital Transformation, IISEC 2019-Proceedings, Princeton, NJ, USA, 16 March 2019. [Google Scholar]

- Valeri, M.; Baggio, R. A critical reflection on the adoption of blockchain in tourism. Inf. Technol. Tour. 2021, 23, 121–132. [Google Scholar] [CrossRef]

- Werner, F.; Basalla, M.; Schneider, J.; Hays, D.; Vom Brocke, J. Blockchain Adoption from an Interorganizational Systems Perspective–A Mixed-Methods Approach. Inf. Syst. Manag. 2021, 38, 135–150. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Sharma, R. Modeling the blockchain enabled traceability in agriculture supply chain. Int. J. Inf. Manag. 2020, 52, 101967. [Google Scholar] [CrossRef]

- Yadav, V.S.; Singh, A.R.; Raut, R.D.; Cheikhrouhou, N. Blockchain drivers to achieve sustainable food security in the Indian context. Ann. Oper. Res. 2021, 327, 211–249. [Google Scholar] [CrossRef]

- Vivaldini, M. Blockchain in operations for food service distribution: Steps before implementation. Int. J. Logist. Manag. 2021, 32, 995–1029. [Google Scholar] [CrossRef]

- Malik, S.; Chadhar, M.; Chetty, M.; Vatanasakdakul, S. An Exploratory Study of the Adoption of Blockchain Technology Among Australian Organizations: A Theoretical Model. In Proceedings of the Information Systems: 17th European, Mediterranean, and Middle Eastern Conference, EMCIS 2020, Dubai, United Arab Emirates, 25–26 November 2020. [Google Scholar] [CrossRef]

- Liang, T.P.; Kohli, R.; Huang, H.C.; Li, Z.L. What Drives the Adoption of the Blockchain Technology? A Fit-Viability Perspective. J. Manag. Inf. Syst. 2021, 38, 314–337. [Google Scholar] [CrossRef]

- Malope, E.T.; van der Poll, J.A.; Ncube, O. Digitalisation practices in South-African state-owned enterprises: A framework for rapid adoption of digital solutions. In Proceedings of the Annual Hawaii International Conference on System Sciences, Honolulu, HI, USA, 6–10 January 2020. [Google Scholar] [CrossRef]

- Barnes, B.W., III; Xiao, B. Organizational Adoption of Blockchain Technology: An Ecosystem Perspective. In Proceedings of the 2019 DIGIT Workshop, Munich, Germany, 17–19 September 2019. [Google Scholar]

- Boutkhoum, O.; Hanine, M.; Nabil, M.; El Barakaz, F.; Lee, E.; Rustam, F.; Ashraf, I. Analysis and Evaluation of Barriers Influencing Blockchain Implementation in Moroccan Sustainable Supply Chain Management: An Integrated IFAHP-DEMATEL Framework. Mathematics 2021, 9, 1601. [Google Scholar] [CrossRef]

- Wamba, S.F.; Queiroz, M.M. The role of social influence in blockchain adoption: The Brazilian supply chain case. IFAC-PapersOnLine 2019, 52, 1715–1720. [Google Scholar] [CrossRef]

- Sheel, A.; Nath, V. Blockchain technology adoption in the supply chain (UTAUT2 with risk)—Evidence from Indian supply chains. Int. J. Appl. Manag. Sci. 2020, 12, 324. [Google Scholar] [CrossRef]

- Saurabh, S.; Dey, K. Blockchain technology adoption, architecture, and sustainable agri-food supply chains. J. Clean. Prod. 2021, 284, 124731. [Google Scholar] [CrossRef]

- A-Jalil, E.E. The adoption of blockchain in supply chain: Is supply chain ready? Int. J. Supply Chain. Manag. 2020, 9, 602–606. [Google Scholar]

- Mathivathanan, D.; Mathiyazhagan, K.; Rana, N.P.; Khorana, S.; Dwivedi, Y.K. Barriers to the adoption of blockchain technology in business supply chains: A total interpretive structural modelling (TISM) approach. Int. J. Prod. Res. 2021, 59, 3338–3359. [Google Scholar] [CrossRef]

- Presthus, W.; O’Malley, N.O. Motivations and Barriers for End-User Adoption of Bitcoin as Digital Currency. Procedia Comput. Sci. 2017, 121, 89–97. [Google Scholar] [CrossRef]

- Rogerson, M.; Parry, G.C. Blockchain: Case studies in food supply chain visibility. Supply Chain. Manag. 2020, 25, 601–614. [Google Scholar] [CrossRef]

- Palos-Sanchez, P.; Saura, J.R.; Ayestaran, R. An exploratory approach to the adoption process of bitcoin by business executives. Mathematics 2021, 9, 355. [Google Scholar] [CrossRef]

- Yeong, Y.C.; Kalid, K.S.; Sugathan, S.K. Cryptocurrency adoption in Malaysia: Does age, income and education level matter? Int. J. Innov. Technol. Explor. Eng. 2019, 8, 2179–2184. [Google Scholar] [CrossRef]

- Shrestha, A.K.; Vassileva, J.; Joshi, S.; Just, J. Augmenting the technology acceptance model with trust model for the initial adoption of a blockchain-based system. PeerJ Comput. Sci. 2021, 7, e502. [Google Scholar] [CrossRef]

- Mubarik, M.; Rasi, R.Z.R.M.; Mubarak, M.F.; Ashraf, R. Impact of blockchain technology on green supply chain practices: Evidence from emerging economy. Manag. Environ. Qual. Int. J. 2021, 32, 1023–1039. [Google Scholar] [CrossRef]

- Shin, Y.-C.; Kim, K.; Han, S.-L. The Role of Technology Readiness in Customers’ Adoption of Smart Contract on Blockchain. J. Korean Entrep. Socieity 2019, 14, 35–56. [Google Scholar] [CrossRef]

- Ku-Mahamud, K.R.; Omar, M.; Bakar, N.A.A.; Muraina, I.D. Awareness, trust, and adoption of blockchain technology and cryptocurrency among blockchain communities in Malaysia. Int. J. Adv. Sci. Eng. Inf. Technol. 2019, 9, 1217–1222. [Google Scholar] [CrossRef]

- Bhimani, A.; Hausken, K.; Arif, S. Blockchain technology adoption decisions: Developed vs. developing economies. In Information For Efficient Decision Making: Big Data, Blockchain and Relevance; World Scientific Publishing: Singapore, 2020. [Google Scholar] [CrossRef]

- Koh, J.-W.; Kim, J.-Y.; Kim, H.-U.; Han, K.-S. An Empirical Study on the Effects of Innovation Resistance on the Factors affecting the Intention to accept Blockchain in the Finance Sector. J. Digit. Contents Soc. 2019, 20, 783–795. [Google Scholar] [CrossRef]

- Zhuang, Y.; Sheets, L.R.; Chen, Y.-W.; Shae, Z.-Y.; Tsai, J.J.P.; Shyu, C.-R.; Zon-Yin, J.J.P.S.; Tsai Shyu, C.-R. A Patient-Centric Health Information Exchange Framework Using Blockchain Technology. IEEE J. Biomed. Health Inform. 2020, 24, 2169–2176. [Google Scholar] [CrossRef] [PubMed]

- Elghaish, F.; Abrishami, S.; Hosseini, M.R. Integrated project delivery with blockchain: An automated financial system. Autom. Constr. 2020, 114, 103182. [Google Scholar] [CrossRef]

- Biswas, B.; Gupta, R. Analysis of barriers to implement blockchain in industry and service sectors. Comput. Ind. Eng. 2019, 136, 225–241. [Google Scholar] [CrossRef]

- Sheel, A.; Nath, V. Effect of blockchain technology adoption on supply chain adaptability, agility, alignment and performance. Manag. Res. Rev. 2019, 42, 1353–1374. [Google Scholar] [CrossRef]

- Lanzini, F.; Ubacht, J.; De Greeff, J. Blockchain adoption factors for SMEs in supply chain management. J. Supply Chain. Manag. Sci. 2021, 2, 47–68. [Google Scholar] [CrossRef]

- Mukkamala, R.R.; Vatrapu, R.; Ray, P.K.; Sengupta, G.; Halder, S. Converging Blockchain and Social Business for Socio-Economic Development. In Proceedings of the 2018 IEEE International Conference On Big Data (Big Data), Seattle, WA, USA, 10–13 December 2018; pp. 3039–3048. [Google Scholar]

- Kwok, A.O.J.; Koh, S.G.M. Is blockchain technology a watershed for tourism development? In Current Issues in Tourism; Taylor & Francis: Abingdon, UK, 2019; Volume 22. [Google Scholar] [CrossRef]

- Shardeo, V.; Patil, A.; Madaan, J. Critical Success Factors for Blockchain Technology Adoption in Freight Transportation Using Fuzzy ANP-Modified TISM Approach. Int. J. Inf. Technol. Decis. Mak. 2020, 19, 1549–1580. [Google Scholar] [CrossRef]

- Ullah, N. Integrating TAM/TRI/TPB frameworks and expanding their characteristic constructs for DLT adoption by Service and Manufacturing Industries-Pakistan Context. In Proceedings of the 2020 International Conference on Technology and Entrepreneurship, ICTE, Bologna, Italy, 21–23 September 2020. [Google Scholar] [CrossRef]

- Rao, K.V.; Murala, D.K.; Panda, S.K. Blockchain: A Study of New Business Model. In Recent Advances in Blockchain Technology: Real-World Applications; Springer International Publishing: Cham, Switzerland, 2023; pp. 187–214. [Google Scholar] [CrossRef]

- Chang, S.E.; Chen, Y.C.; Wu, T.C. Exploring blockchain technology in international trade: Business process re-engineering for letter of credit. Ind. Manag. Data Syst. 2019, 119, 1712–1733. [Google Scholar] [CrossRef]

- Rugeviciute, A.; Mehrpouya, A. Blockchain, a Panacea for Development Accountability? A Study of the Barriers and Enablers for Blockchain’s Adoption by Development Aid Organizations. Front. Blockchain 2019, 2, 15. [Google Scholar] [CrossRef]

- Iftikhar, W.; Vistro, D.M.; Mahmood, Z. Blockchain Technology Adoption by Malaysian Higher Education Institutes: A Perspective of Integrated Tam Model and Toe Framework. In Proceedings of the 3rd International Conference on Integrated Intelligent Computing Communication Security (ICIIC 2021), Bangalore, India, 6–7 August 2021. [Google Scholar] [CrossRef]

- Fernando, Y.; Rozuar, N.H.M.; Mergeresa, F. The blockchain-enabled technology and carbon performance: Insights from early adopters. Technol. Soc. 2021, 64, 101507. [Google Scholar] [CrossRef]

- Kamarulzaman, M.S.; Hassan, N.H.; Bakar, N.A.A.; Maarop, N.; Samy, G.A.L.N.; Aziz, N. Factors Influencing Blockchain Adoption in Government Organization: A Proposed Framework. In Proceedings of the Proceedings-International Conference on Computer and Information Sciences: Sustaining Tomorrow with Digital Innovation, ICCOINS 2021, Kuching, Malaysia, 13–15 July 2021. [Google Scholar] [CrossRef]

- Koster, F.; Borgman, H.P. New Kid on the block! Understanding blockchain adoption in the public sector. In Proceedings of the Annual Hawaii International Conference on System Sciences, Maui, HI, USA, 7–10 January 2020. [Google Scholar] [CrossRef]

- Park, K.O. A study on sustainable usage intention of blockchain in the big data era: Logistics and supply chain management companies. Sustainability 2020, 12, 10670. [Google Scholar] [CrossRef]

- Gökalp, E.; Gökalp, M.O.; Çoban, S. Blockchain-Based Supply Chain Management: Understanding the Determinants of Adoption in the Context of Organizations. Inf. Syst. Manag. 2020, 39, 100–121. [Google Scholar] [CrossRef]

- Bhattacharyya, S.S.; Shah, Y. Emerging technologies in Indian mining industry: An exploratory empirical investigation regarding the adoption challenges. J. Sci. Technol. Policy Manag. 2021, 13, 358–381. [Google Scholar] [CrossRef]

- Gausdal, A.H.; Czachorowski, K.V.; Solesvik, M.Z. Applying Blockchain Technology: Evidence from Norwegian Companies. Sustainability 2018, 10, 1985. [Google Scholar] [CrossRef]

- Mathivathanan, D.; Mathiyazhagan, K.; Rana, N.P.; Khorana, S.; Dwivedi, Y.K.; Öztürk, C.; Yildizbaşi, A.; Tripathi, G.; Ahad, M.A.; Paiva, S.; et al. A readiness assessment framework for Blockchain adoption: A healthcare case study. Technol. Forecast. Soc. Chang. 2020, 3, 120536. [Google Scholar] [CrossRef]

- Nuryyev, G.; Wang, Y.P.; Achyldurdyyeva, J.; Jaw, B.S.; Yeh, Y.S.; Lin, H.T.; Wu, L.F. Blockchain technology adoption behavior and sustainability of the business in tourism and hospitality SMEs: An empirical study. Sustainability 2020, 12, 1256. [Google Scholar] [CrossRef]

- Albayati, H.; Kim, S.K.; Rho, J.J. Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach. Technol. Soc. 2020, 62, 101320. [Google Scholar] [CrossRef]

- Schwiderowski, J.; Pedersen, A.B.; Jensen, J.K.; Beck, R. Value creation and capture in decentralized finance markets: Non-fungible tokens as a class of digital assets. Electron. Mark. 2023, 33, 45. [Google Scholar] [CrossRef]

- Catalini, C.; de Gortari, A.; Shah, N. Some Simple Economics of Stablecoins. Annu. Rev. Financial Econ. 2022, 14, 117–135. [Google Scholar] [CrossRef]

- Mulaji, S.M.; Roodt, S. Factors Affecting Organisations’ Adoption Behaviour toward Blockchain-Based Distributed Identity Management: The Sustainability of Self-Sovereign Identity in Organisations. Sustainability 2022, 14, 11534. [Google Scholar] [CrossRef]

- Gans, R.B.; Ubacht, J.; Janssen, M. Governance and societal impact of blockchain-based self-sovereign identities. Policy Soc. 2022, 41, 402–413. [Google Scholar] [CrossRef]

- Klöckner, M.; Schmidt, C.G.; Fink, A.; Flückiger, L.; Wagner, S.M. Exploring the physical–digital interface in blockchain applications: Insights from the luxury watch industry. Transp. Res. Part E Logist. Transp. Rev. 2023, 179, 103300. [Google Scholar] [CrossRef]

- Sung, E.; Kwon, O.; Sohn, K. NFT luxury brand marketing in the metaverse: Leveraging blockchain-certified NFTs to drive consumer behavior. Psychol. Mark. 2023, 40, 2306–2325. [Google Scholar] [CrossRef]

- Alshater, M.; Nasrallah, N.; Khoury, R.; Joshipura, M. Deciphering the world of NFTs: A scholarly review of trends, challenges, and opportunities. Electron. Commer. Res. 2024, 24, 1–57. [Google Scholar] [CrossRef]

- Negi, S. A blockchain technology for improving financial flows in humanitarian supply chains: Benefits and challenges. J. Humanit. Logist. Supply Chain. Manag. 2024. online ahead of print. [Google Scholar] [CrossRef]

| Theories Used | References | Type of Value | Approach | Outcomes | Challenges | Solutions |

|---|---|---|---|---|---|---|

| RBV | Kant [92], Nandi et al. [94], Tipmontian et al. [95] |

| When exploited through a business model |

| The number of applications grows. | Constant adjustment |

| RBV with Network Theory | Paul et al. [96] |

|

| No sufficient utilization by a corporation as a strategic resource | Foster organizational buy-in for strategic resource use | |

| RBV with Game theory | Kumar [97] | Improve expected profit | Developing blockchain-specific capabilities |

| Category | References | Determinants | Facilitators |

|---|---|---|---|

| Technological factors | [93,102,103,104,105,106,107,108,109,110,111] | Technological maturity, Confidentiality, Transaction speed, Scalability, Network attacks (threat of a 51% attack), Security and privacy, Cost and Efficiency. | Decentralized management [107,108]; Immutability [109,110], Data security [111], Traceability [110,112] and Enhanced transparency [93]. |

| Organizational factors | [2,113] Rainero and Modarelli [60] highlighted use of blockchain technology as corporate social responsibility (CSR) | Availability of specific blockchain tools, Infrastructural facilities, IT knowledge of employees, and initial cost for the infrastructure. Organizational readiness, Organization’s complexity, and An organization’s strategic orientation. | Organizational innovativeness, Organizational learning capability, Top management support, Skilled professionals. |

| Environmental factors | [35,108,114,115,116,117,118] | Trading partner readiness, Environmental Responsibility | Government support [107,116], Trading partner support and collaboration [35,117], and customer support [118]. |

| Behavioral factors | [49,67,102,114,119,120,121,122,123,124] |

| Managers’ technological curiosity or learning [124], Managers’ risk-taking behavior, and Corporate leaders and managers’ familiarity with the benefits of blockchain technology [102,123]. |

| Moderating factors | [125,126] | Technological characteristics

| Affects

|

| Frameworks | Purpose | Applied | References | Benefits |

|---|---|---|---|---|

| User Oriented |

|

|

|

|

|

|

|

| |

| Business oriented | Managers’ decision aid model, Assists managers in devising effective strategies,

| Service industry | [53,93,136,137] | Helps managers efficiently implement blockchain technologies by identifying the cause-and-effect relationship among the barriers to adoption. |

| Environmental Oriented |

|

|

| |

|

|

|

| Theories | References | Applied On | Challenges | Solutions |

|---|---|---|---|---|

| TOE framework (Organizational factors) |

|

| Prioritizing cost reduction, Improved security and new blockchain-enabled business models can promote wider blockchain adoption [102]. | |

| TOE framework (Environmental factors. Mainly industry pressure) |

|

| Awareness creation among stakeholders | |

| TOE framework (Organization demography) | [58,138] | Various industries without classification | Lack of support for SMEs | Awareness creation and support of SMEs |

| Diffusion of Innovation | [29,57,145,153] | Analyzing diffusion across businesses in different industries without classification |

|

|

| Technology acceptance model (Davis, 1989) | [58,59,67,126,154,155,156] | General user behavior across sectors |

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohammed, M.A.; De-Pablos-Heredero, C.; Montes Botella, J.L. A Systematic Literature Review on the Revolutionary Impact of Blockchain in Modern Business. Appl. Sci. 2024, 14, 11077. https://doi.org/10.3390/app142311077

Mohammed MA, De-Pablos-Heredero C, Montes Botella JL. A Systematic Literature Review on the Revolutionary Impact of Blockchain in Modern Business. Applied Sciences. 2024; 14(23):11077. https://doi.org/10.3390/app142311077

Chicago/Turabian StyleMohammed, Medina Ayta, Carmen De-Pablos-Heredero, and José Luis Montes Botella. 2024. "A Systematic Literature Review on the Revolutionary Impact of Blockchain in Modern Business" Applied Sciences 14, no. 23: 11077. https://doi.org/10.3390/app142311077

APA StyleMohammed, M. A., De-Pablos-Heredero, C., & Montes Botella, J. L. (2024). A Systematic Literature Review on the Revolutionary Impact of Blockchain in Modern Business. Applied Sciences, 14(23), 11077. https://doi.org/10.3390/app142311077