Virtual Power Plant’s Optimal Scheduling Strategy in Day-Ahead and Balancing Markets Considering Reserve Provision Model of Energy Storage System

Abstract

1. Introduction

- This research presents a two-stage stochastic optimization model to determine the VPP’s optimal trading strategy in the DA and BE markets. This scheduling model considers the requirements of the pre-signed BC contract, the probability of reserve activation in the BE market, and the uncertainty in RESs and demand.

- ESS’s reserve provisioning model is proposed to fully exploit ESS’s capacity in the BE market without affecting the operating schemes of ESS and VPP in the DA market.

- The impacts of the BC contract and the reserve activation probability on the VPP’s optimal trading strategy are analyzed.

2. Problem Description

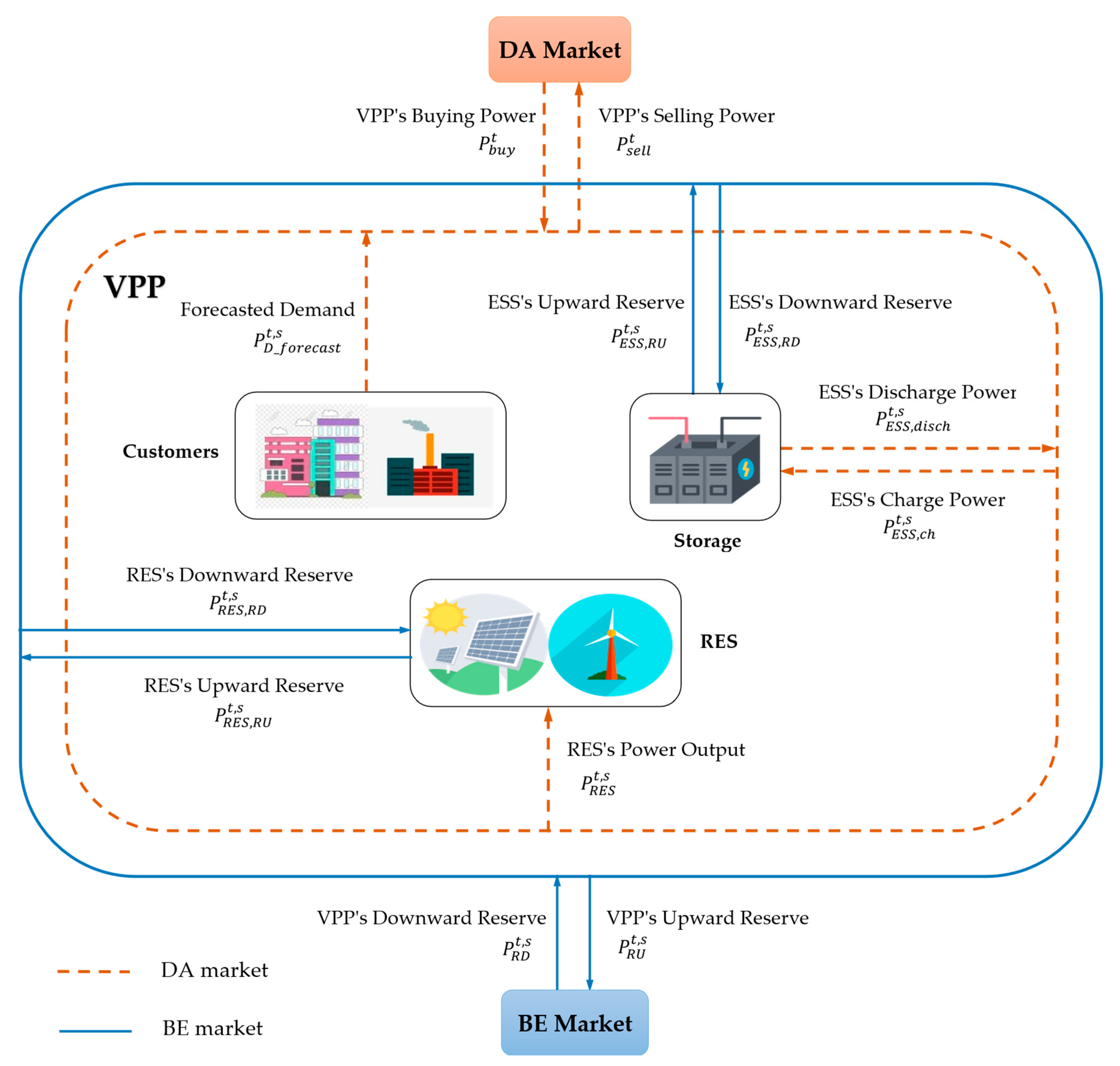

2.1. The VPP’s Trading Strategy in the Day-Ahead and Balancing Market

2.2. The CVPP’s Optimal Scheduling Problem and Assumptions

- In the first stage, the CVPP defines its selling/buying power on the operating day based on the day-head hourly forecasted RES power output and demand data. This trading strategy is submitted to the DA market, and changes are not allowed in real-time operations; otherwise, penalties will apply.

- Closer to real-time, the CVPP receives the newest short-term forecast data of RES and demand. Normally, the very short-term forecasted results are quite accurate, so the CVPP can consider these values as the actual data. Hence, considering the BC contract’s requirements, the CVPP decides its upward/downward reserve energy trading strategy in the BE market each quarter hour. Also, the operating parameters of each internal resource, especially the ESS, are determined to ensure compliance with trading strategy in the energy and reserve markets.

- All contracted upward reserve capacity and non-contracted upward/downward reserve energy bids are selected and fully activated with the probability assumed to be known in all quarter hours. To simplify the model, this article does not consider the inactivated or partially activated reserve scenarios.

- The very short-term forecasting results of RES and demand in the second stage are handled as the sum of the day-ahead hourly forecasting values and forecasting errors.

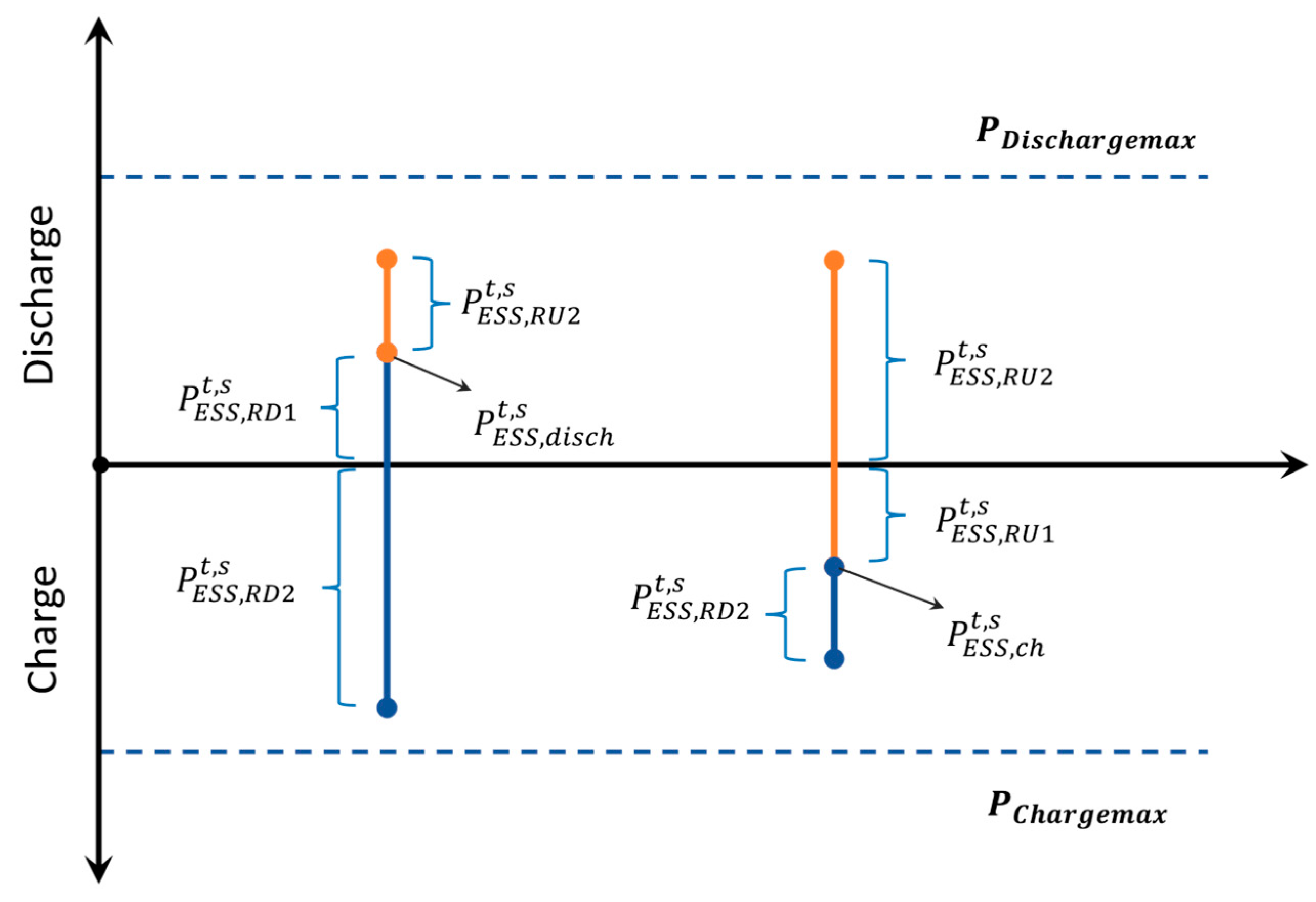

2.3. The Reserve Provision Model of ESS

- If TSO requests an upward reserve while the ESS is charging, the ESS’s maximum upward reserve power is .

- If TSO requests an upward reserve while the ESS is discharging, the ESS’s maximum upward reserve power is .

- If TSO requests a downward reserve while the ESS is charging, the ESS’s maximum downward reserve power is .

- If TSO requests a downward reserve while the ESS is discharging, the ESS’s maximum downward reserve power is .

- Situation 1: In this situation, and are equal to 1 (Table 1). Consequently, Equation (7) is non-binding while Equation (8) forces not to exceed . Besides, means that , so that Equation (6) forces to be equal to zero.

- Situation 3: With and , Equation (6) forces to be equal to while Equation (8) ensures is limitted by . Additionally, it can be seen that Equations (5) and (7) do not affect Equations (6) and (8).

- Situation 4: With and are equal to 0, Equations (6) and (8) become to be non-binding. Equation (5) limits by while Equation (7) forces to be equal to zero.

3. Optimization Formulation

3.1. Objective Function

3.2. Constraints

3.2.1. The First-Stage Constraints

3.2.2. The Second-Stage Constraints

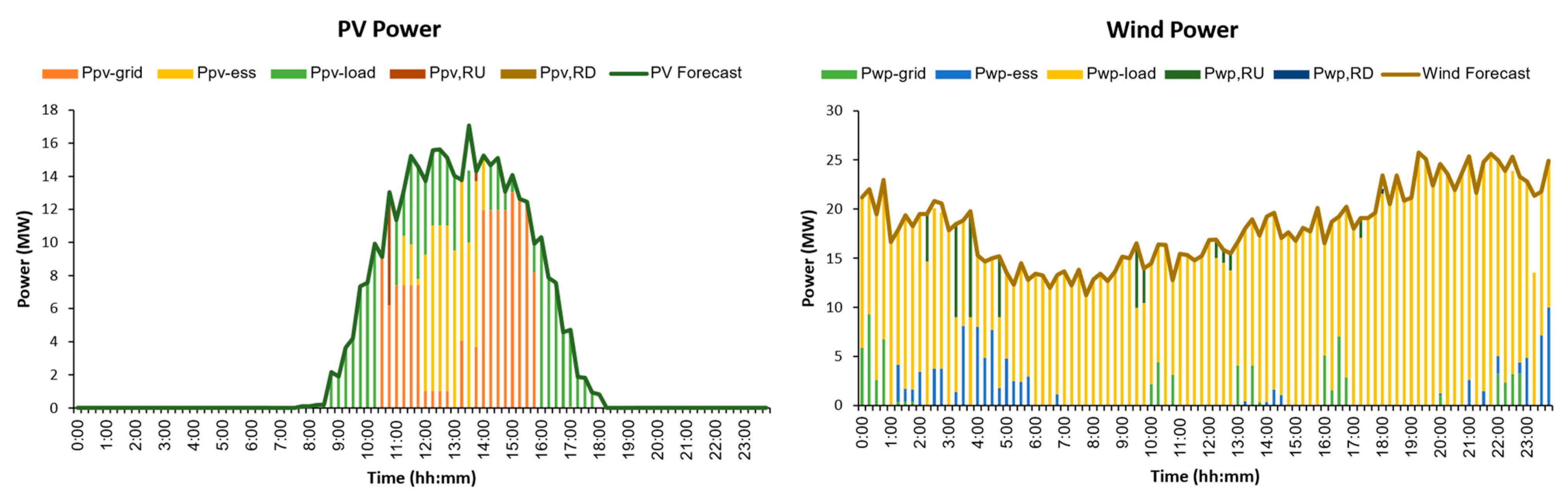

- Active power balance constraint in the DA market: Equation (21) shows that at any time , the CVPP’s net production/consumption should equal the selling/buying power in the DA contract. Equation (22) shows that customers can be supplied by RES, ESS, or from the market.

- RES operation: At time , the RES’ actual power output corresponding to scenario of uncertain parameters is . Equation (23) shows that the upward reserve supply capacity of RES is limited by the difference between the predicted available power output and the actual power output . Similarly, Equation (24) shows that RES’ limitation of downward reserve capacity is the difference between the actual power output and the minimum power threshold . Equation (25) shows that RES provides a part of CVPP’s contract in the DA market while meeting customers’ electricity consumption in CVPP. Additionally, the excess energy from the RES can be accumulated in the ESS to utilize the RES’ available power output.

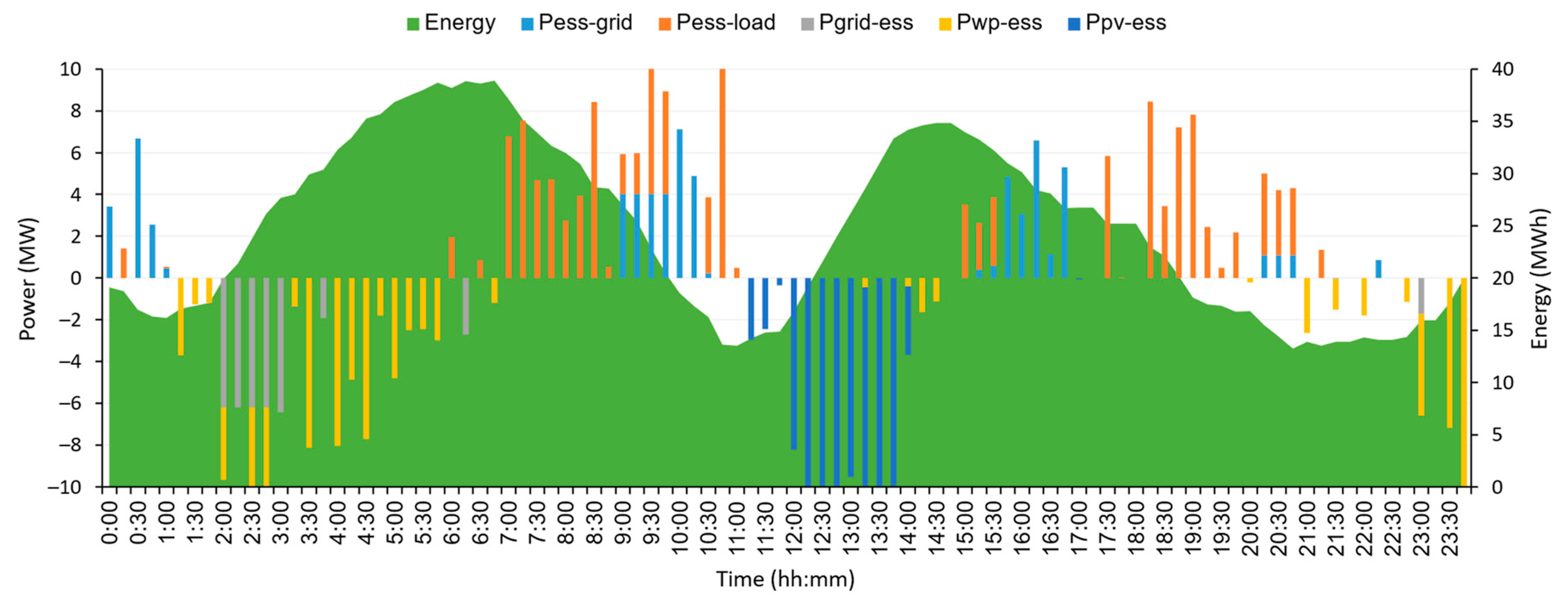

- ESS operation: The operating model of ESS in the energy and reserve markets is described by two sets of constraints as follows:

- The ESS operating parameters in the DA market are described in Equations (26)–(29). Equations (26) and (27) limit the ESS charging/discharging power, while Equation (28) describes the change in the ESS energy level after each time block . Equation (29) shows that the ESS energy level should be set to an initial level at the end of each day to ensure its operation the next day. This paper assumes that the initial energy level is 50% of the ESS rating capacity.

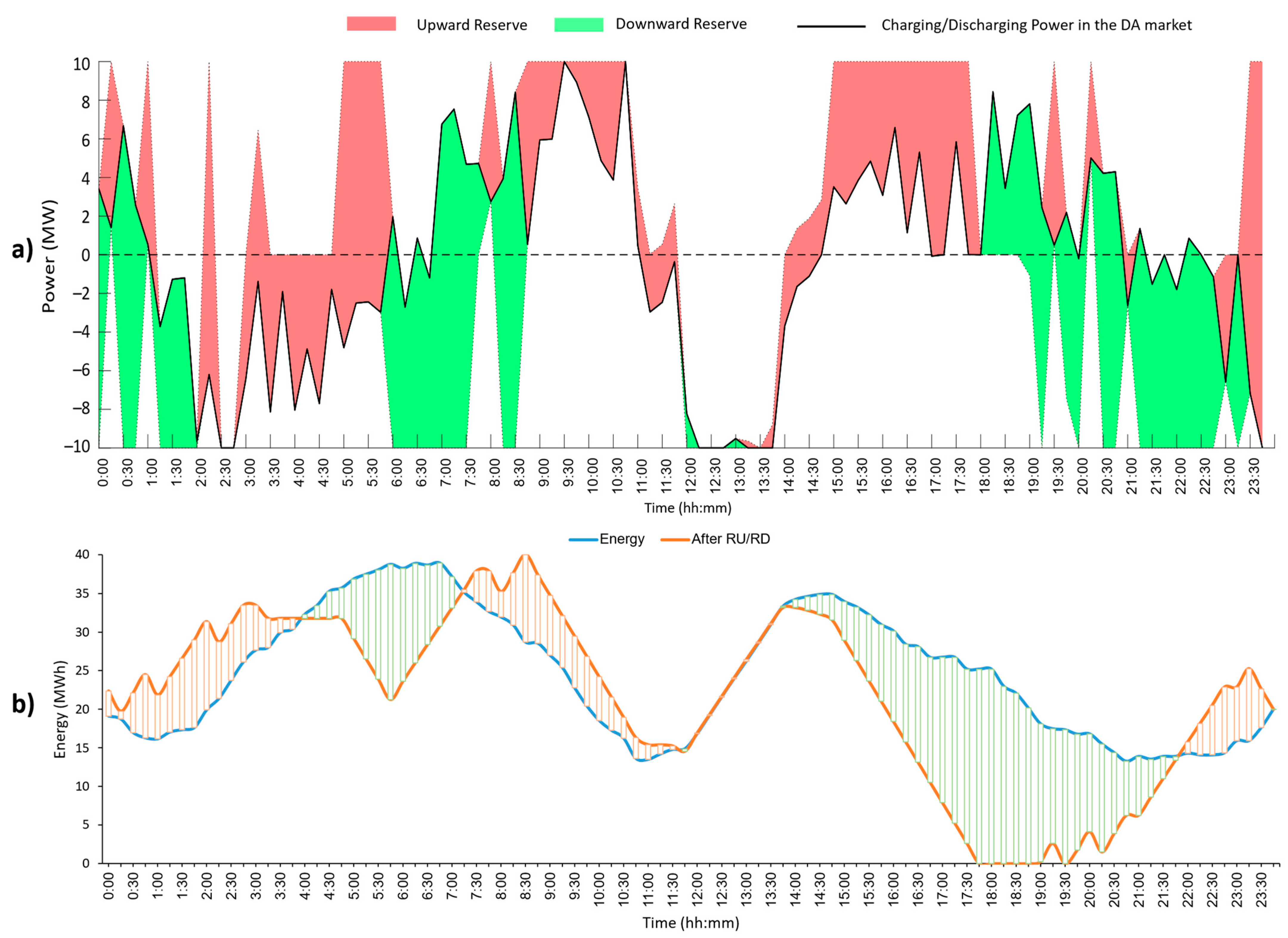

- The association between the ESS’s upward/downward reserve provision ability in the BE market and its scheduling in the DA market, as well as its status switching, is described by Equations (2)–(15).

- Besides, this study only focuses on the CVPP’s operating schedule within one day, so the degradation and self-discharging levels of ESS are considered negligible and can be ignored.

- The CVPP’s reserve energy provision in the BE market: The following equations describe the CVPP’s ability in the BE market. Equations (30) and (31) show that reserve energy can be provided by RES, ESS, and customers. The binary parameter in (30) represents whether CVPP has a BC contract to provide upward reserve capacity at time t. During the periods with an upward reserve capacity contract, equals 1, and the CVPP needs to provide reserve energy at least equal to the signed reserve capacity . By contrast, during the rest of the day, CVPP can take full advantage of its capabilities in providing both upward and downward reserve energy (32). However, Equation (1) ensures that CVPP can provide only one of the above reserve types at any time block.

4. Numerical Results

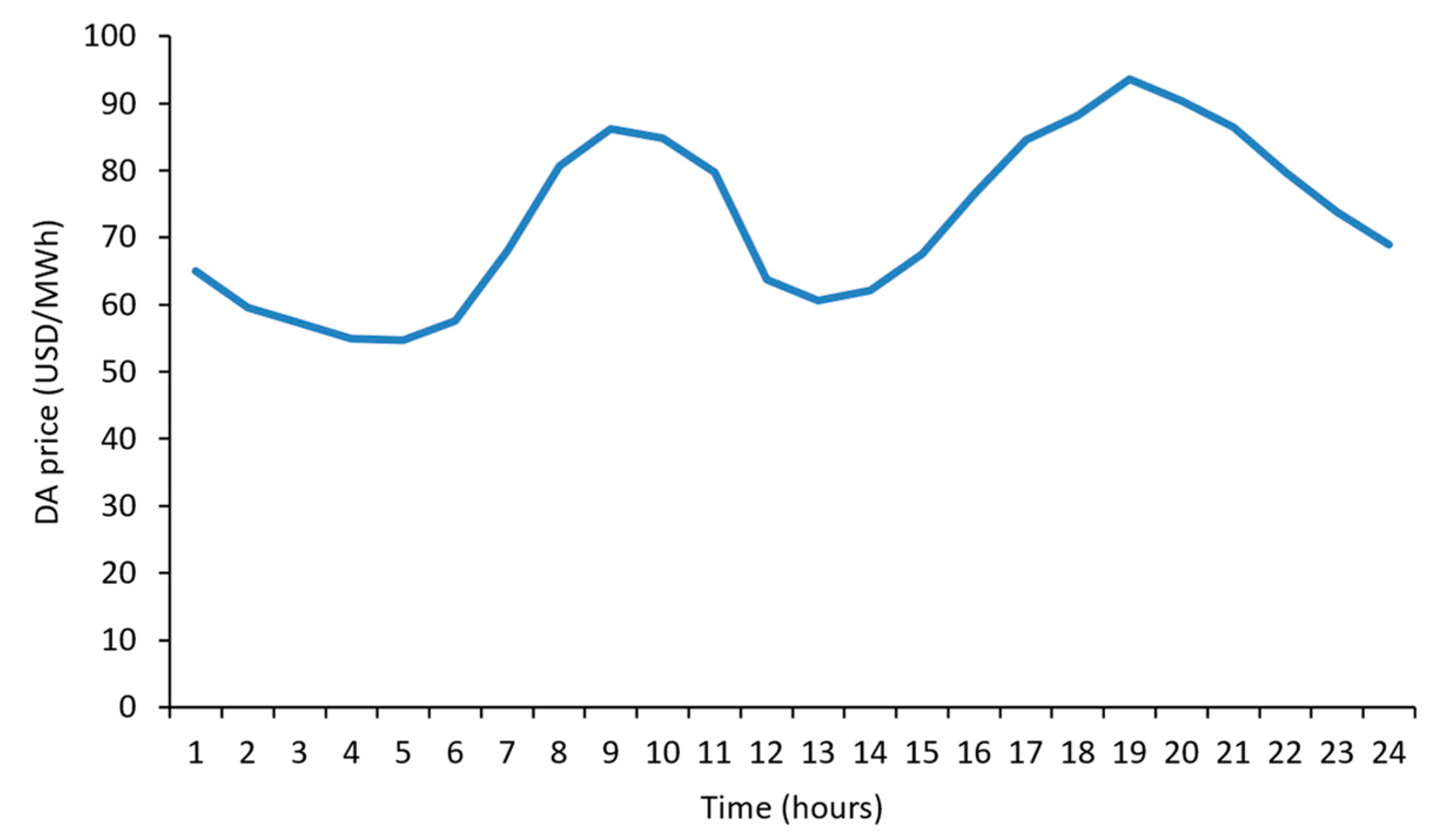

4.1. Study System

- The Monte Carlo simulation is applied to generate 1000 samples from the distribution functions of uncertain parameters.

- Use the K-means method to divide these samples into ten clusters. The centroid of each cluster is treated as a scenario with a probability equal to the total probability of all samples in the corresponding cluster.

4.2. Case Studies and Discussions

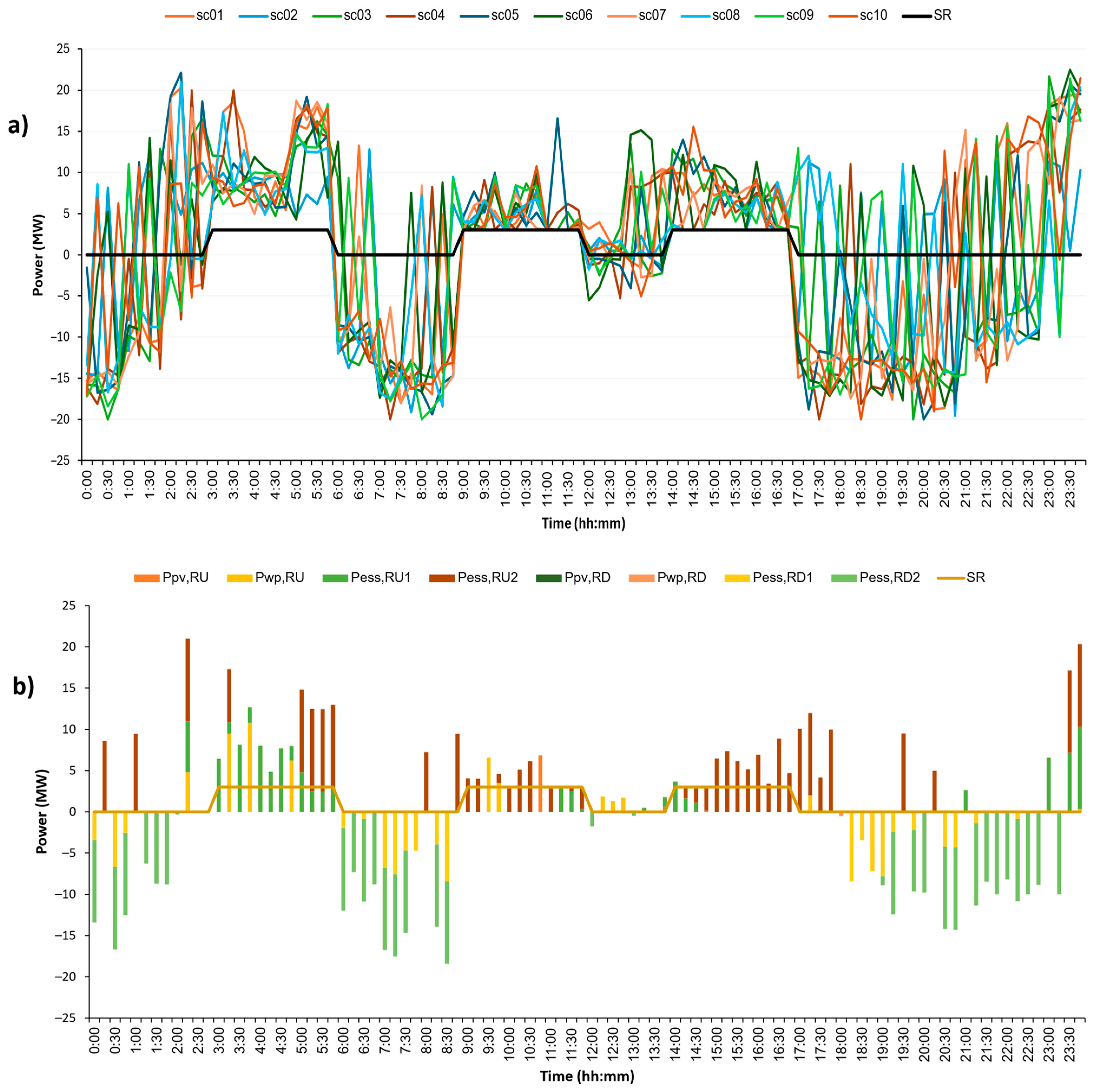

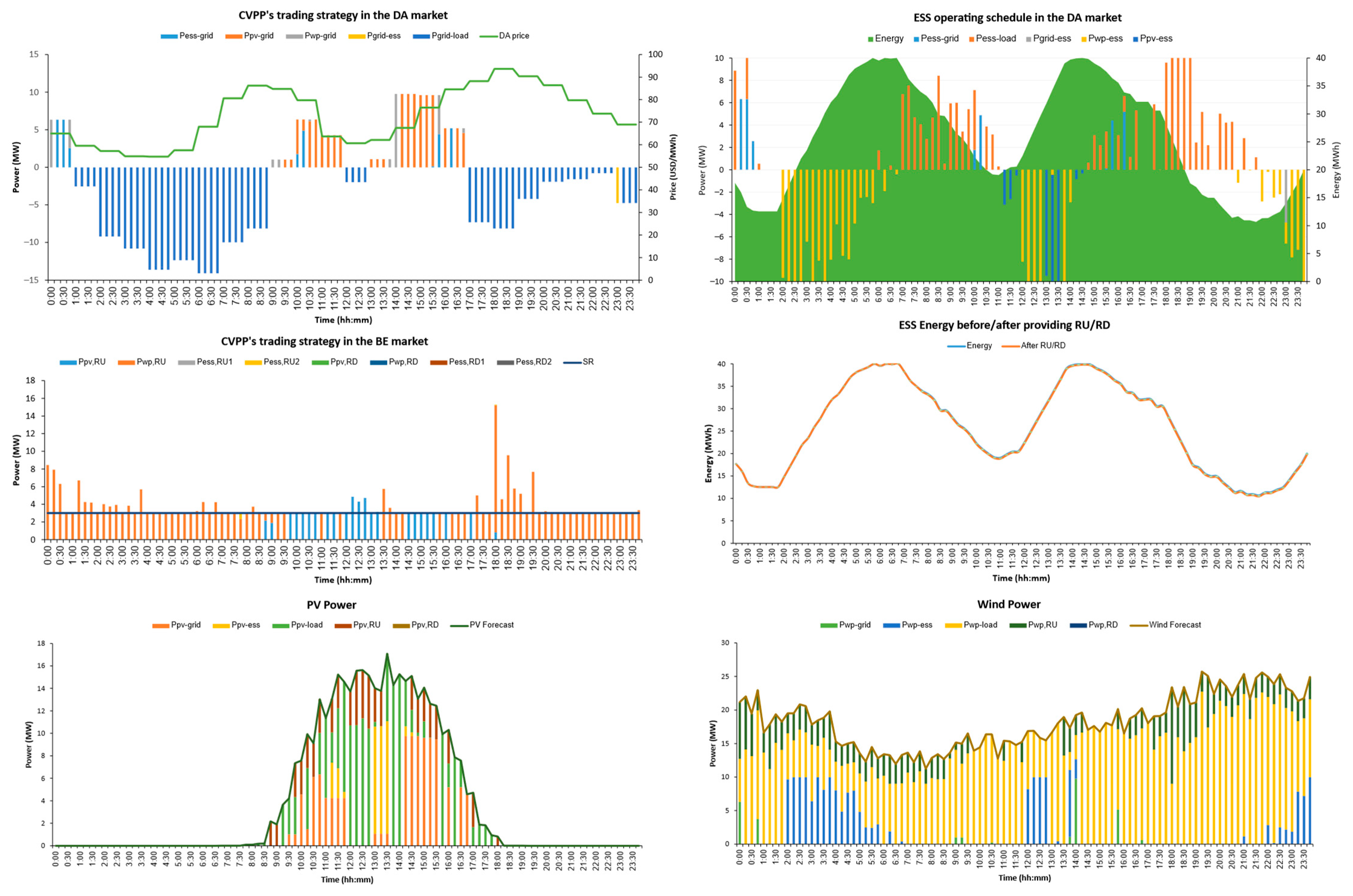

4.2.1. Optimal Solution Results in the Base Case

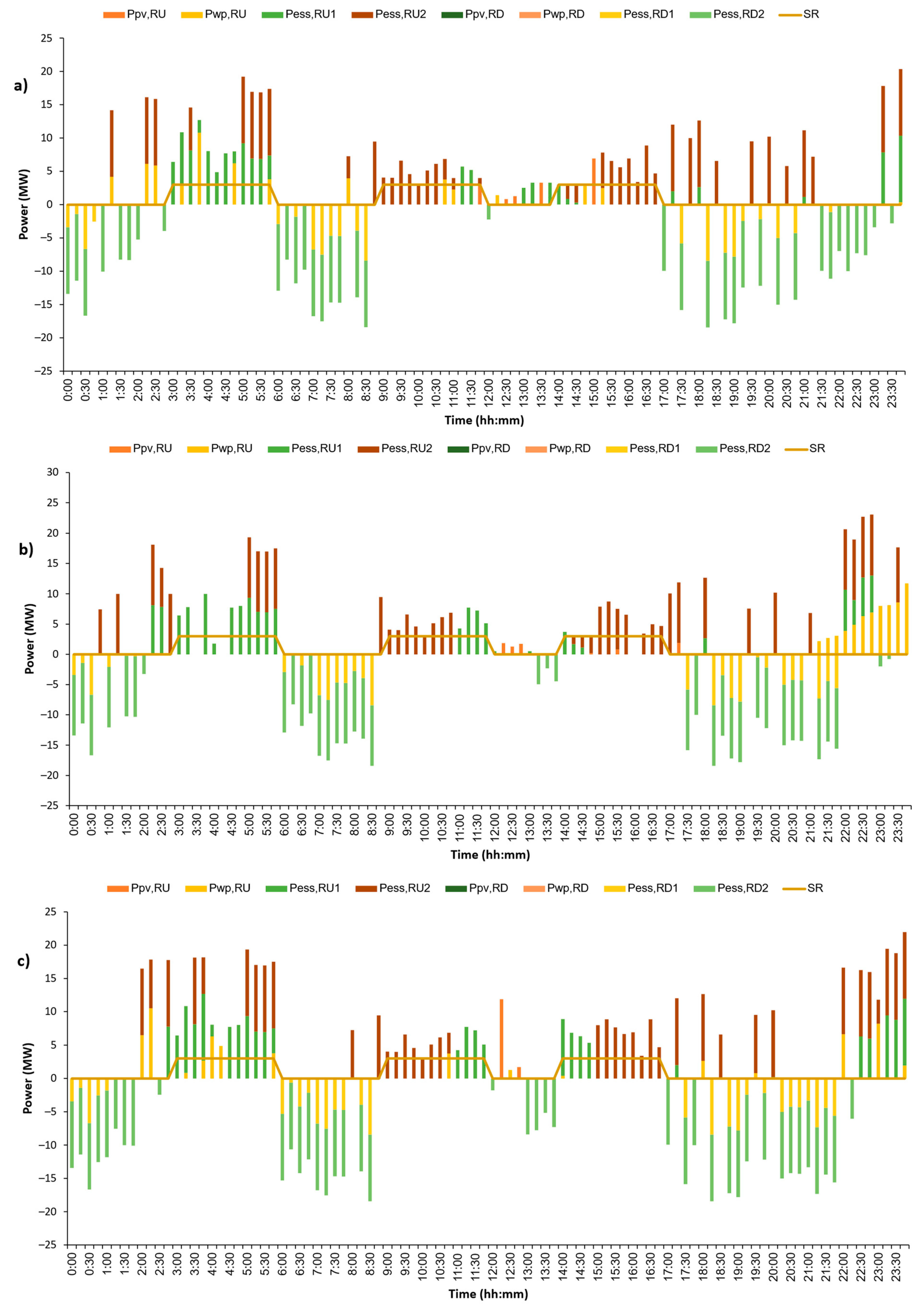

4.2.2. Evaluating the Impact of Reserve Activation Probability

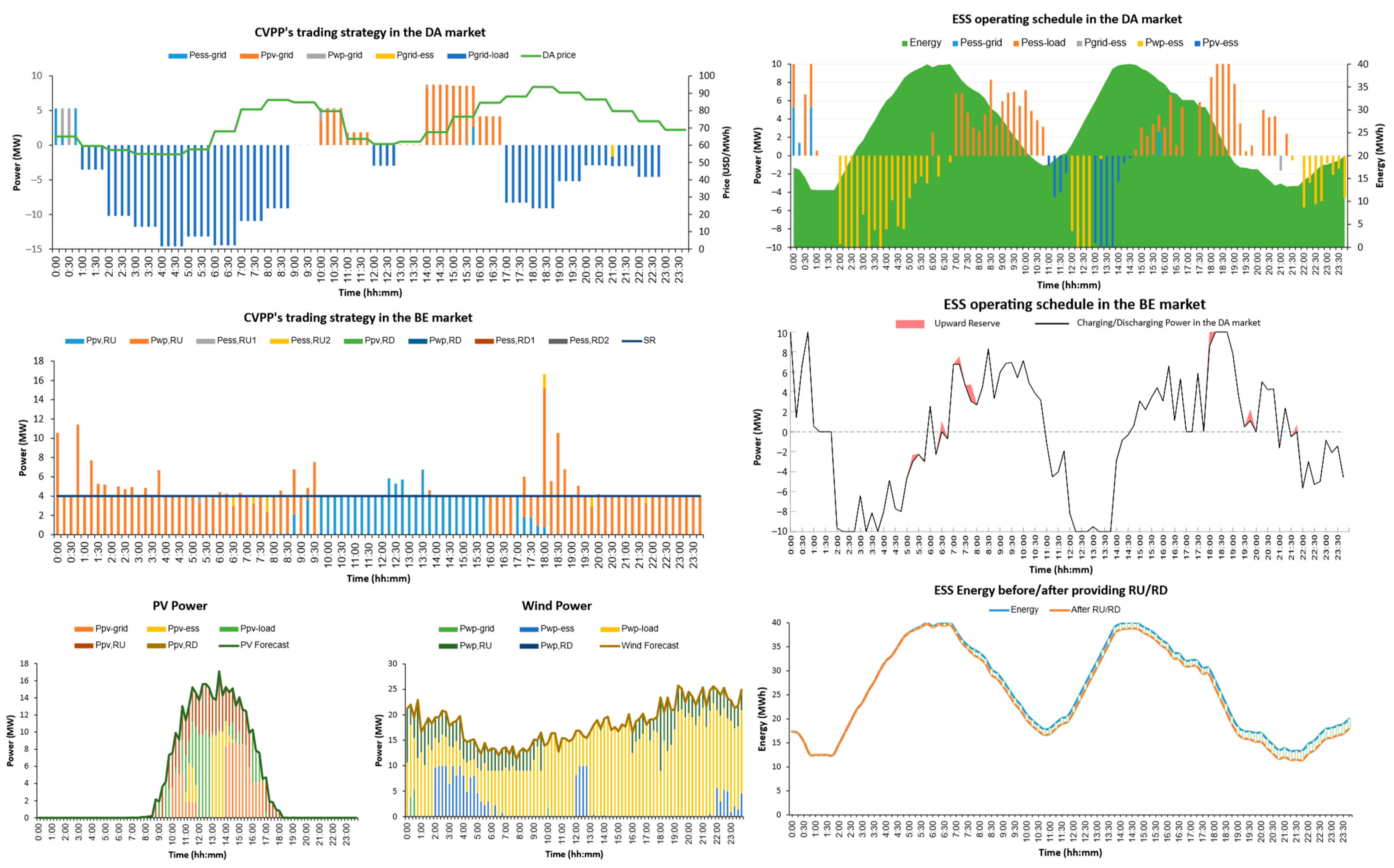

4.2.3. The CVPP’s Optimal Schedule in an Extreme Operating Scenario: Plan 2 of the BC Contract

5. Conclusions

- The effectiveness of the proposed model is shown by analyzing the results. The proposed model determined the CVPP’s optimal scheduling in the DA and BE markets. The RESs and ESS in the CVPP were coordinated to ensure that the CVPP can buy electricity during low-priced hours and sell electricity during high-priced hours in the DA market. The pre-signed BC contract was satisfied, even in an extreme scenario. Based on the probability of reserve activation, the type and amount of reserve energy CVPP should provide in the BE market were determined. This helps increase profit opportunities for CVPP.

- The results also show the effectiveness of the ESS’s reserve provision model. The ESS operating states before and after provisioning reserve energy were determined in detail. The CVPP’s trading schedule in the DA market did not change after activating reserve energy from ESS. This is a remarkable advantage of the proposed model. As discussed in Section 1, only a few studies currently focus on the role of ESS in both the energy and reserve markets. Besides, these studies only focus on the ability to adjust the ESS’s power output to provide reserve service but do not consider maintaining the ESS’s predetermined operating plan in the DA market.

- The ESS plays a vital role in the CVPP’s operation. In the DA market, the ESS is fully utilized to profit from energy arbitrage. In the BE market, the ESS’s reserve provision ability helps CVPP provide upward reserve energy even if the total available power output of RESs within CVPP is less than the local consumption or the BC contract lasts all day.

- The reserve activation probability is low, so CVPP focuses on making profits from the DA market rather than the BE market. Consequently, although RES’s power output is surplus in some time blocks, the upward capacity is relatively low, just enough for the requirements of the BC contract.

- The relaxation of the proposed model allows the CVPP to determine an appropriate operating scenario in extreme situations due to over-forecasting the RESs’ available power output or underestimating the local demand when signing the BC contract.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Indices and Sets | |

| Time intervals. | |

| Scenarios of uncertain parameters. | |

| Constants | |

| The DA market’s price at time t ($/MWh). | |

| Upward reserve energy price at time t ($/MWh). | |

| Downward reserve energy price at time t ($/MWh). | |

| Time block (equals 15 min). | |

| Probability of scenario of uncertain parameters. | |

| Probability of reserve activation in the BE market. | |

| RES power rating (MW). | |

| The minimum level of RES power output (MW). | |

| ESS power rating (MW). | |

| ESS capacity rating (MWh). | |

| ESS minimum energy level (MWh). | |

| ESS charging/discharging efficiency. | |

| The highest possible value of demand (MW). | |

| A sufficiently large constant | |

| Semi-Constants | |

| Forecasted power output of RES at time t in scenario s (MW). | |

| Forecasted demand at time t in scenario S (MW). | |

| The requirement of upward reserve capacity in the BC contract at time t (MW). | |

| Binary parameter represents whether CVPP has a BC contract at time t. | |

| ESS initial energy in the DA market at t = 0, and in scenario s (MWh). | |

| Variables | |

| Binary variable shows CVPP’s sell/buy situation in the DA market at time t, 1 for selling and 1 for buying. | |

| The CVPP’s selling power in the DA market at time t (MW). | |

| The CVPP’s buying power in the DA market at time t (MW). | |

| The CVPP’s upward reserve power in the BE market at time t in scenario s (MW). | |

| The CVPP’s downward reserve power in the BE market at time t in scenario s (MW). | |

| Binary variable equals 1 if CVPP provides upward reserve energy at time t in scenario s. | |

| Binary variable, equals 1 if CVPP provides downward reserve energy at time t in scenario s. | |

| RES on/off state at time t in scenario s (Binary). | |

| RES actual power output at time t in scenario s (MW). | |

| RES power output is provided to the main grid at time t in scenario s (MW). | |

| RES power output provides to demand at time t in scenario s (MW). | |

| RES power output is provided to ESS at time t in scenario s (MW). | |

| RES upward reserve power at time t in scenario s (MW). | |

| RES downward reserve power at time t in scenario s (MW). | |

| ESS charging/discharging state at time t in scenario s (Binary). | |

| ESS charging power at time t in scenario s (MW) | |

| ESS discharging power at time t in scenario s (MW) | |

| ESS charging power buy from the DA market at time t in scenario s (MW). | |

| ESS charging power from RES at time t in scenario s (MW). | |

| ESS discharging power sell to the DA market at time t in scenario s (MW). | |

| ESS discharging power supply to demand at time t in scenario s (MW). | |

| ESS upward reserve power at time t in scenario s (MW). | |

| ESS downward reserve power at time t in scenario s (MW). | |

| ESS energy in the DA market at time t in scenario S (MWh). | |

| ESS energy at the end of the day (t = 96) in scenario S (MWh). | |

| Changes in ESS energy after providing upward/downward reserve at time t in scenario s (MW). | |

| ESS state after providing upward/downward reserve at time t in scenario s (binary). |

References

- Neme, C.; Energy Futures Group; Cowart, R.; Regulator Assistance Project. Energy Efficiency Participation in Electricity Capacity Markets—The US Experience; The Regulatory Assistance Project (RAP): Montpelier, VT, USA, 2014. [Google Scholar]

- Oureilidis, K.; Malamaki, K.N.; Gallos, K.; Tsitsimelis, A.; Dikaiakos, C.; Gkavanoudis, S.; Cvetkovic, M.; Mauricio, J.M.; Ortega, J.M.M.; Ramos, J.L.M.; et al. Ancillary Services Market Design in Distribution Networks: Review and Identification of Barriers. Energies 2020, 13, 917. [Google Scholar] [CrossRef]

- Helman, U. Distributed Energy Resources in the US Wholesale Markets: Recent Trends, New Models, and Forecasts. In Consumer, Prosumer, Prosumager: How Service Innovations will Disrupt the Utility Business Model; Academic Press: Cambridge, MA, USA; Elsevier: San Diego, CA, USA, 2019; pp. 431–469. ISBN 9780128168356. [Google Scholar]

- IRENA Redesigning Capacity Markets: Innovation Landscape Brief; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019; ISBN 978-92-9260-130-0.

- Pudjianto, D.; Ramsay, C.; Strbac, G. Microgrids and Virtual Power Plants: Concepts to Support the Integration of Distributed Energy Resources. Proc. Inst. Mech. Eng. Part A J. Power Energy 2008, 222, 731–741. [Google Scholar] [CrossRef]

- Arias, J. Solar Energy, Energy Storage and Virtual Power Plants in Japan. Available online: https://www.eu-japan.eu/sites/default/files/publications/docs/min18_1_arias_solarenergy-energystorageandvirtualpowerplantsinjapan.pdf (accessed on 18 September 2021).

- Thavlov, A.; Bindner, H.W. Utilization of Flexible Demand in a Virtual Power Plant Set-Up. IEEE Trans. Smart Grid 2015, 6, 640–647. [Google Scholar] [CrossRef]

- Pudjianto, D.; Ramsay, C.; Strbac, G. Virtual Power Plant and System Integration of Distributed Energy Resources. IET Renew. Power Gener. 2007, 1, 10–16. [Google Scholar] [CrossRef]

- Kuiper, G. What Is the State of Virtual Power Plants in Australia? From Thin Margins to a Future of VPP-Tailers. 2022. Available online: https://ieefa.org/wp-content/uploads/2022/03/What-Is-the-State-of-Virtual-Power-Plants-in-Australia_March-2022_2.pdf (accessed on 26 January 2024).

- Sarmiento-Vintimilla, J.C.; Torres, E.; Larruskain, D.M.; Pérez-Molina, M.J. Applications, Operational Architectures and Development of Virtual Power Plants as a Strategy to Facilitate the Integration of Distributed Energy Resources. Energies 2022, 15, 775. [Google Scholar] [CrossRef]

- Paavilainen, E. Aggregated Demand Response in a Virtual Power Plant: A Finnish Case Study; Aalto University: Espoo, Finland, 2020. [Google Scholar]

- Virtual Power Plant Reaches 1000 MW in Poland—Modern Power Systems. Available online: https://www.modernpowersystems.com/news/newsvirtual-power-plant-reaches-1000-mw-in-poland-9097170 (accessed on 13 October 2021).

- Naval, N.; Yusta, J.M. Virtual Power Plant Models and Electricity Markets—A Review. Renew. Sustain. Energy Rev. 2021, 149, 111393. [Google Scholar] [CrossRef]

- Yazdaninejad, M.; Amjady, N.; Dehghan, S. VPP Self-Scheduling Strategy Using Multi-Horizon IGDT, Enhanced Normalized Normal Constraint, and Bi-Directional Decision-Making Approach. IEEE Trans. Smart Grid 2020, 11, 3632–3645. [Google Scholar] [CrossRef]

- Hu, J.; Jiang, C.; Liu, Y. Short-Term Bidding Strategy for a Price-Maker Virtual Power Plant Based on Interval Optimization. Energies 2019, 12, 3662. [Google Scholar] [CrossRef]

- Kuang, Y.; Wang, X.; Zhao, H.; Qian, T.; Li, N.; Wang, J.; Wang, X. Model-Free Demand Response Scheduling Strategy for Virtual Power Plants Considering Risk Attitude of Consumers. CSEE J. Power Energy Syst. 2023, 9, 516–528. [Google Scholar] [CrossRef]

- Khaloie, H.; Mollahassani-Pour, M.; Anvari-Moghaddam, A. Optimal Behavior of a Hybrid Power Producer in Day-Ahead and Intraday Markets: A Bi-Objective CVaR-Based Approach. IEEE Trans. Sustain. Energy 2021, 12, 931–943. [Google Scholar] [CrossRef]

- Guo, W.; Liu, P.; Shu, X. Optimal Dispatching of Electric-Thermal Interconnected Virtual Power Plant Considering Market Trading Mechanism. J. Clean. Prod. 2021, 279, 123446. [Google Scholar] [CrossRef]

- Rahmani-Dabbagh, S.; Sheikh-El-Eslami, M.K. A Profit Sharing Scheme for Distributed Energy Resources Integrated into a Virtual Power Plant. Appl. Energy 2016, 184, 313–328. [Google Scholar] [CrossRef]

- Tang, W.; Yang, H.T. Optimal Operation and Bidding Strategy of a Virtual Power Plant Integrated with Energy Storage Systems and Elasticity Demand Response. IEEE Access 2019, 7, 79798–79809. [Google Scholar] [CrossRef]

- PandŽić, H.; Morales, J.M.; Conejo, A.J.; Kuzle, I. Offering Model for a Virtual Power Plant Based on Stochastic Programming. Appl. Energy 2013, 105, 282–292. [Google Scholar] [CrossRef]

- Dabbagh, S.R.; Sheikh-El-Eslami, M.K. Risk-Based Profit Allocation to DERs Integrated with a Virtual Power Plant Using Cooperative Game Theory. Electr. Power Syst. Res. 2015, 121, 368–378. [Google Scholar] [CrossRef]

- Rahimiyan, M.; Baringo, L. Strategic Bidding for a Virtual Power Plant in the Day-Ahead and Real-Time Markets: A Price-Taker Robust Optimization Approach. IEEE Trans. Power Syst. 2016, 31, 2676–2687. [Google Scholar] [CrossRef]

- Gazijahani, F.S.; Salehi, J. IGDT-Based Complementarity Approach for Dealing with Strategic Decision Making of Price-Maker VPP Considering Demand Flexibility. IEEE Trans. Ind. Inform. 2020, 16, 2212–2220. [Google Scholar] [CrossRef]

- Poplavskaya, K.; Lago, J.; de Vries, L. Effect of Market Design on Strategic Bidding Behavior: Model-Based Analysis of European Electricity Balancing Markets. Appl. Energy 2020, 270, 115130. [Google Scholar] [CrossRef]

- FINGRID. Reserve Products and Reserve Market Places. Available online: https://www.fingrid.fi/globalassets/dokumentit/en/electricity-market/reserves/reserve-products-and-reserve-market-places.pdf (accessed on 18 September 2021).

- Hayashi, K.; Mikami, Y.; Hirano, K.; Terayama, H. Development of Large-Scale Hybrid Power Storage System: System Demonstration Project in Lower Saxony, Germany: Hitachi Review. Available online: http://www.hitachi.com/rev/archive/2020/r2020_04/04c02/index.html (accessed on 18 September 2021).

- IRENA Electricity Storage Valuation Framework: Assessing System Value and Ensuring Project Viability; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020; ISBN 978-92-9260-161-4.

- Liu, J.; Hu, C.; Kimber, A.; Wang, Z. Uses, Cost-Benefit Analysis, and Markets of Energy Storage Systems for Electric Grid Applications. J. Energy Storage 2020, 32, 101731. [Google Scholar] [CrossRef]

- Georgious, R.; Refaat, R.; Garcia, J.; Daoud, A.A. Review on Energy Storage Systems in Microgrids. Electronics 2021, 10, 2134. [Google Scholar] [CrossRef]

- Dabbagh, S.R.; Sheikh-El-Eslami, M.K. Risk Assessment of Virtual Power Plants Offering in Energy and Reserve Markets. IEEE Trans. Power Syst. 2016, 31, 3572–3582. [Google Scholar] [CrossRef]

- Vahedipour-Dahraie, M.; Rashidizade-Kermani, H.; Shafie-khah, M.; Catalao, J.P.S. Risk-Averse Optimal Energy and Reserve Scheduling for Virtual Power Plants Incorporating Demand Response Programs. IEEE Trans. Smart Grid 2020, 12, 1405–1415. [Google Scholar] [CrossRef]

- Zhou, Y.; Wei, Z.; Sun, G.; Cheung, K.W.; Zang, H.; Chen, S. Four-Level Robust Model for a Virtual Power Plant in Energy and Reserve Markets. IET Gener. Transm. Distrib. 2019, 13, 2006–2014. [Google Scholar] [CrossRef]

- Baringo, A.; Baringo, L.; Arroyo, J.M. Day-Ahead Self-Scheduling of a Virtual Power Plant in Energy and Reserve Electricity Markets under Uncertainty. IEEE Trans. Power Syst. 2019, 34, 1881–1894. [Google Scholar] [CrossRef]

- Zhang, M.; Xu, Y.; Sun, H. Optimal Coordinated Operation for a Distribution Network with Virtual Power Plants Considering Load Shaping. IEEE Trans. Sustain. Energy 2023, 14, 550–562. [Google Scholar] [CrossRef]

- Mazzi, N.N.; Trivella, A.; Morales, J.M. Enabling Active/Passive Electricity Trading in Dual-Price Balancing Markets. arXiv 2018, 34, 1980–1990. [Google Scholar] [CrossRef]

- Ning, L.; Liu, Y.; Chen, Y.; Zhao, Y.; Li, G.; Wang, Y. Research on the Optimal Scheduling Method of Virtual Power Plant with Industrial Loads Participating the Peak Regulation Ancillary Service. In Proceedings of the 2023 5th Asia Energy and Electrical Engineering Symposium (AEEES), Chengdu, China, 23–26 March 2023; pp. 1080–1087. [Google Scholar] [CrossRef]

- Ma, Y.; Chen, Y.; Tang, J.; Qiu, W.; Chen, X.; Li, J.; Lin, Z. Optimal Operational Strategy of Virtual Power Plant Considering the Participation in the Joint Markets of the Electricity Spot and Auxiliary Service Market. In Proceedings of the 2023 6th International Conference on Energy, Electrical and Power Engineering (CEEPE), Guangzhou, China, 12–14 May 2023; pp. 1586–1590. [Google Scholar] [CrossRef]

- Toubeau, J.F.; Nguyen, T.H.; Khaloie, H.; Wang, Y.; Vallee, F. Forecast-Driven Stochastic Scheduling of a Virtual Power Plant in Energy and Reserve Markets. IEEE Syst. J. 2022, 16, 5212–5223. [Google Scholar] [CrossRef]

- Padmanabhan, N.; Ahmed, M.; Bhattacharya, K. Battery Energy Storage Systems in Energy and Reserve Markets. IEEE Trans. Power Syst. 2020, 35, 215–226. [Google Scholar] [CrossRef]

- Mimica, M.; Sinovčić, Z.; Jokić, A.; Krajačić, G. The Role of the Energy Storage and the Demand Response in the Robust Reserve and Network-Constrained Joint Electricity and Reserve Market. Electr. Power Syst. Res. 2022, 204, 107716. [Google Scholar] [CrossRef]

- Sigrist, L.; Lobato, E.; Rouco, L. Energy Storage Systems Providing Primary Reserve and Peak Shaving in Small Isolated Power Systems: An Economic Assessment. Int. J. Electr. Power Energy Syst. 2013, 53, 675–683. [Google Scholar] [CrossRef]

- van der Veen, R.A.C.; Hakvoort, R.A. The Electricity Balancing Market: Exploring the Design Challenge. Util. Policy 2016, 43, 186–194. [Google Scholar] [CrossRef]

- Poplavskaya, K.; de Vries, L. Distributed Energy Resources and the Organized Balancing Market: A Symbiosis yet? Case of Three European Balancing Markets. Energy Policy 2019, 126, 264–276. [Google Scholar] [CrossRef]

- Elia Group Design Note—Balancing Services: MFRR; Elia Group: Brussels, Belgium, 2022.

- Sakuma, Y. Japanese Energy Market-Optimum Use of Distributed Energy Resources for Demand-Side Response; Japanese Energy Market: Tokyo, Japan, 2021. [Google Scholar]

- Forouli, A.; Bakirtzis, E.A.; Papazoglou, G.; Oureilidis, K.; Gkountis, V.; Candido, L.; Ferrer, E.D.; Biskas, P. Assessment of Demand Side Flexibility in European Electricity Markets: A Country Level Review. Energies 2021, 14, 2324. [Google Scholar] [CrossRef]

- AEMO Emerging Generation and Energy Storage in the NEM. Available online: https://aemo.com.au/-/media/files/electricity/nem/initiatives/emerging-generation/eges_stakeholder_paper_final.pdf?la=en&hash=5E82D40582C56B34327D120A366EF044 (accessed on 12 October 2021).

- ARENA South Australia Virtual Power Plant Phase 3A. 2021. Available online: https://arena.gov.au/assets/2022/09/south-australia-virtual-power-plant-lessons-learnt-2.pdf (accessed on 26 January 2024).

- Huy, N.D.; Nhung, N.H. Optimal Reserve and Energy Scheduling for a Virtual Power Plant Considering Reserve Activation Probability. Appl. Sci. 2021, 11, 9717. [Google Scholar] [CrossRef]

- Bussieck, M.R.; Meeraus, A. General Algebraic Modeling System (GAMS). In Modeling Languages in Mathematical Optimization; Josef Kallrath, Ed.; Springer: Berlin/Heidelberg, Germany, 2004; pp. 137–157. [Google Scholar]

- IBM ILOG CPLEX Optimization Studio|IBM. Available online: https://www.ibm.com/products/ilog-cplex-optimization-studio (accessed on 31 March 2022).

| Situation | ESS Status | Upward Reserve | Downward Reserve | |

|---|---|---|---|---|

| Before Reserve Activation | After Reserve Activation | |||

| 1 | 1 | 1 | ||

| 2 | 1 | 0 | infeasible | |

| 3 | 0 | 1 | infeasible | |

| 4 | 0 | 0 | ||

| Time | 0:00–1:00 | 1:00–2:00 | 2:00–3:00 | 3:00–4:00 | 4:00–5:00 | 5:00–6:00 | 6:00–7:00 | 7:00–8:00 | 8:00–9:00 | 9:00–10:00 | 10:00–11:00 | 11:00–12:00 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Plan 1 | 0 | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 0 | 1 | 1 | 1 |

| Plan 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Time | 12:00–13:00 | 13:00–14:00 | 14:00–15:00 | 15:00–16:00 | 16:00–17:00 | 17:00–18:00 | 18:00–19:00 | 19:00–20:00 | 20:00–21:00 | 21:00–22:00 | 22:00–23:00 | 23:00–24:00 |

| Plan 1 | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Plan 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Case Study | Base Case | Case 1 | Case 2 | Case 3 |

|---|---|---|---|---|

| Upward Reserve Energy (MWh) | 109.54 | 116.89 | 126.69 | 138.88 |

| Downward Reserve Energy (MWh) | 96.59 | 103.37 | 112.49 | 124.71 |

| DA Profit (USD) | 612.69 | 608.78 | 592.3 | 566.11 |

| BE Profit if Reserve Activated (USD) | 6374 | 6911.23 | 7672.93 | 7956.05 |

| Total Profit Considering Reserve Activation Probability (USD) | 676.43 | 747.01 | 975.95 | 1361.71 |

| Relaxation Level | 5% | 10% | 15% | 20% |

|---|---|---|---|---|

| DA profit (USD) | −6231.38 | −6087.32 | −5916 | −5758.29 |

| BE Profit if Reserve Activated (USD) | 11,656.25 | 11,685.09 | 11,660.63 | 11,642.81 |

| Total Profit Considering Reserve Activation Probability (USD) | −6114.81 | −5970.47 | −5799.39 | −5641.86 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen Hong, N.; Nguyen Duc, H. Virtual Power Plant’s Optimal Scheduling Strategy in Day-Ahead and Balancing Markets Considering Reserve Provision Model of Energy Storage System. Appl. Sci. 2024, 14, 2175. https://doi.org/10.3390/app14052175

Nguyen Hong N, Nguyen Duc H. Virtual Power Plant’s Optimal Scheduling Strategy in Day-Ahead and Balancing Markets Considering Reserve Provision Model of Energy Storage System. Applied Sciences. 2024; 14(5):2175. https://doi.org/10.3390/app14052175

Chicago/Turabian StyleNguyen Hong, Nhung, and Huy Nguyen Duc. 2024. "Virtual Power Plant’s Optimal Scheduling Strategy in Day-Ahead and Balancing Markets Considering Reserve Provision Model of Energy Storage System" Applied Sciences 14, no. 5: 2175. https://doi.org/10.3390/app14052175

APA StyleNguyen Hong, N., & Nguyen Duc, H. (2024). Virtual Power Plant’s Optimal Scheduling Strategy in Day-Ahead and Balancing Markets Considering Reserve Provision Model of Energy Storage System. Applied Sciences, 14(5), 2175. https://doi.org/10.3390/app14052175