Abstract

The article suggests a Value Proposition (VP) framework that enables analysis of the beneficial impact of Artificial Intelligence (AI) resources and capabilities on specific VP activities. To develop such a framework, we examined existing business and management research publications to identify and extract assertions that could be used as a source of actionable insights for early-stage growth-oriented companies. The extracted assertions were assembled into a corpus of texts that was subjected to topic modelling analysis—a machine learning approach to natural language processing that is used to identify latent themes in large corpora of text documents. The topic modelling resulted in the identification of seven topics. Each topic is defined by a set of most frequent words co-occurring in a distinctive subset of texts that could be interpreted in terms of activities constituting the core elements of the VP framework. We then examined each activity in terms of its potential to be enhanced by employing AI resources and capabilities. The interpretation of the topic modelling results led to the identification of seven topics: (1) Value created; (2) Stakeholder value propositions; (3) Foreign market entry; (4) Customer base; (5) Continuous improvement; (6) Cross-border operations; and (7) Company image. The uniqueness of the adopted topic modelling approach consists in the quality of the assertions and the interpretation of the seven topics as an activity framework, i.e., in its capacity to generate actionable insights for practitioners. The additional analysis suggests that there is a potential for AI to enhance the emerging four core elements of the VP framework: Value created, Stakeholder value propositions, Foreign market entry, and Customer base. More importantly, we found that the greatest number of assertions related to activities that could be enhanced by AI are part of the Customer base topic, i.e., the topic that is most directly related to the growth potential of the companies. In addition, the VP framework suggests that a company’s customer base growth is continuously enhanced through a positive loop enabled by activities focused on the Continuous improvement of the activities and the amount of Value created, the alignment of Stakeholder value propositions, and companies’ Foreign market entry. Thus, the multiple-stakeholder perspective on VP development and foreign market entry appears as a factor that helps in understanding the beneficial impact of AI on the enhancement of the VP of early-stage growth-oriented companies.

1. Introduction

Artificial intelligence (AI) is a constellation of many different technologies designed to work together to enable machines to perform tasks with human-like levels of intelligence. The adoption of AI technologies helps companies to reinvent the key elements of their business strategies focusing on customers, competition, data, innovation, and value creation logic [1,2]. The need to synergize these elements is part of the challenges many businesses face today. AI technologies have become a key business factor (some would even say actor) that enables the kind of autonomous work processes and self-organizing systems that can increase a firm’s economic rationality [3], market reach [4], and reduce barriers to its international expansion [5,6]. AI technologies should therefore be seen as a key component in the development of any firm’s digital strategy and one of the pillars of its value proposition (VP) and business model innovation [7,8]. A firm’s meaningful adoption of AI technologies increases the quality of its cross-border interactions with key business stakeholders no matter what their geographic location or institutional distance are [5,9]. It should be therefore considered from an ecosystem business perspective [5,10].

In this article, we examine how AI can enhance the VPs of early-stage companies committed to business growth. These are not necessarily technology-based companies that could somehow leverage the distinctive attributes of AI resources and capabilities as part of their growth mechanisms. For such firms, leveraging AI resources and capabilities would usually mean entering a dynamic three-party relationship involving its internal users of AI as a principal, the AI agent or system, and the provider of the AI agent or system [3]. Examples of the potential benefits of adopting AI resources, agents, and systems by such companies include: transforming the efficiency of business processes that require human intelligence; intensifying the economic rationality of the firm by enhancing decision-making processes based on evidence-based, data-driven insights; enabling or facilitating interactions between key stakeholders and other value creation actors that might otherwise be inefficient or impossible; crossing the traditional boundaries of the firm to enable seamless resource integration and communication across business units and partners, fostering the emergence of a more agile and interconnected value creation and delivery framework [3].

The early-stage companies we have in mind are not startups, but they are not fully established or mature either. A key characteristic of such companies is their growth orientation, which makes them open to refining and enhancing their VPs and value delivery mechanisms in a way that could enable business growth. We focus on such companies for two reasons. Firstly, the majority of early-stage firms are faced with the challenges of scaling up. Though this challenge is not specific to unique countries or geographical regions, it is particularly relevant to Canadian firms to which we are most directly exposed. For example, a recent report by the Toronto Board of Trade states that “Canada is a terrific start-up nation but a dismal failure as a scale-up nation” [11]. Secondly, another key challenge for such companies is the need to develop capabilities to access, combine, and deploy resources provided by external resource owners (including AI resources, agents, and systems) that they could not develop on their own [12,13,14]. Thus, examining such firms necessarily requires a multi-stakeholder perspective on VP development since they must design and align a VP portfolio to engage with all relevant stakeholders, including investors, suppliers, distributors, and partners, rather than trying to address the needs of customers alone [12].

Our focus on the VP construct is not accidental. A VP is the best expression of a company’s business strategy and innovative capacity, that is, its ability to coordinate a combination of resources from multiple stakeholders to develop new products and services and shape valuable market offers to address the needs of specific customer target groups and compete in the marketplace [15,16]. Our study considers the VP as an integrative construct and positions VP design, development, and delivery as a bridge between the formulation of a business strategy and the development and implementation of a corresponding viable business model. Our research focus aligns with recent VP research studies which emphasize that a VP is “a strategic tool that is used by a company to communicate how it aims to provide value to customers” ([16], p. 467) and a concept that was initially “meant to help re-focus how managers think about business strategy” ([17], p. 307). The unique strategic role of VPs in engaging customers and other relevant business stakeholders has been widely acknowledged in the literature (e.g., [12,18,19,20]).

Our research study stems from a belief that research on early-stage growth-oriented companies is a fruitful arena where AI-based digitalization and VP research streams could be merged to help develop valuable insights for both scholars and practitioners [12]. The integration of the two streams helps to address an existing research gap associated with the lack of actionable VP frameworks that incorporate a multiple-stakeholder perspective, a focus on growth orientation in the context of early-stage companies, and the role of AI resources and capabilities in enhancing the VPs of such companies. The logic behind this integrative approach could be summarized as follows: (i) to grow, early-stage companies need resources and capabilities provided by multiple external stakeholders; (ii) the need to engage multiple external stakeholders requires a multiple-stakeholder perspective on the reshaping and enhancement of their VPs in line with their strategic growth objectives; (iii) AI agents and systems are among the most valuable resources that could be provided by external stakeholders to early-stage companies interested in growing by enhancing their VPs; (iv) there is a lack of actionable frameworks that could help in using AI resources and capabilities to enhance the VPs of growth-oriented early stage companies. There is a need, therefore, for the development of such an actionable VP enhancement network to bridge the gap between management research and business practice. Indeed, Berglund et al. [21] highlighted the need for a distinct body of pragmatically oriented knowledge that could bridge the gap between entrepreneurship theory and entrepreneurial practice. The research problematics addressed in this article is an explicit attempt to address this need.

Therefore, this article aims to explore how AI can help the enhancement of the VPs of early-stage companies. To do so, we sought to develop a VP framework providing an explicit business activity structure that could enable an analysis of the potential beneficial impacts of AI resources and capabilities. To develop such a framework, we examined the extant literature to generate a corpus of assertions articulating actionable insights that could inform the enhancement of firms’ VPs. We then performed topic modelling [22,23,24,25,26] to identify an emerging set of groups of activities that could constitute the core elements of a VP enhancement framework. We then examined each activity in terms of its potential to be enhanced by AI resources and capabilities and identified the ones that could. Our analysis then sought conclusions that could be used as future research propositions for scholars or as actionable insights for practitioners as advised by Makadok et al. [27].

The study we led contributes to the literature in two different ways. The first is methodological, since this is the first time that topic modelling has been applied to a corpus of management research assertions to develop an activity-based VP enhancement framework. Topic modelling is the process of identifying latent topics in a large set of text documents. It is an example of a Natural Language Processing (NLP) method that examines large collections of unstructured text data to identify topics otherwise impossible to find through human efforts alone. The various applications of topic modelling in management research have recently been summarized by Hannigan et al. [24]. Its application in the study discussed here is an example of how an NLP technique could benefit VP research in the context of early-stage growth-oriented companies. The study’s second contribution lies in developing insights into how the adoption of AI resources and capabilities can enhance the business activities identified as core elements of the proposed VP enhancement framework. As such, our results ultimately seek to make explicit the link between companies’ AI resources and capabilities and the enhancement of their VPs, and inspire business practitioners to examine the applicability of the analytical framework, as well as motivate other scholars to apply the framework in future empirical studies involving real-life company cases.

2. Literature Review

2.1. The Business Value of AI Resources and Capabilities

Recent research on the business value of AI suggests that AI resources and capabilities could offer firms a significant value-driving impact and help them achieve an operational and competitive advantage, even if there is a significant lack of understanding about how to appropriate value from AI [28]. An increasing number of studies focus on examining the specific dimensions of value that could be enabled through AI resources and capabilities. For example, Wagner ([3], p. 3) defines a firm as artificially intelligent if it “deploys classic economic factors of production human labor, capital and land in combination with machine labor in the form of AI agents.” He adopts the economic theory of the firm to systematically explore five ways AI might impact it, specifically: AI intensifies the effects of economic rationality on the firm; AI introduces a new type of information asymmetry; AI can perforate the boundaries of the firm; AI can create triangular agency relationships; and, AI has the potential to remove the traditional limitations of integration.

Davenport and Ronanki [29] emphasize how businesses should examine the potential value of AI through the lens of business rather than technological capabilities. They point out that AI can support the automation of business processes, gain competitive insight through data analysis, and engage with customers and employees. Majhi et al. [30] consider AI and machine learning as subfields of cognitive computing and cognitive technologies. They developed a conceptual model that shows how cognitive analytics (CA) technologies can add value to organizations by enabling and enhancing three dynamic organizational capabilities: sensing, seizing, and reconfiguring. CA technologies enhance a firm’s sensing capabilities by helping them to collect and analyze real-time data, anticipate and explore new trends, and gather information from multiple sources to capture emerging user behaviour across different markets and contexts. In addition, CA helps firms seize opportunities by facilitating agile development and allowing production and resource utilization process adjustments. It facilitates the shaping of new strategies and innovative offerings by substantially increasing the speed and efficiency of decision-making. Finally, CA enhances the capacity of firms to reconfigure which, according to Teece ([31], p. 1319), involves “enhancing, combining, protecting and, when necessary, reconfiguring the business enterprise’s intangible and tangible assets” to avoid inertia and path dependencies. CA technologies empower a firm’s dynamic reconfiguring capabilities and enable them to reshape markets [32] and expand the frontiers of analytics-based decision-making by shaping new valuable partnerships, mergers, and acquisitions [33].

Huang and Rust [34] developed a strategic AI-usage framework to help firms engage with customers and offer them different service-based benefits. This framework sees AI expanding across three fronts: mechanical, thinking, and feeling. Mechanical AI could help in terms of cost leadership and standardization, primarily at the service delivery stage and when service is routine and transactional. Thinking AI could help in terms of quality leadership and personalization, primarily at the service creation stage and when service is data-rich and utilitarian. Feeling AI could help in terms of relationship leadership, primarily at the service interaction stage and when service is relational and high contact ([34], p. 36).

Paschen, Wilson and Ferreira [35] offer a comprehensive discussion of the role of AI in enhancing sales processes. They identified the value of AI systems at each stage of the sales funnel, and also clarified the role of human intelligence and decision-making at each stage of this AI-enabled sales funnel. They posit that there is a complementarity between humans and AI, and that AI’s enormous information processing capacity can augment human intelligence or even replace well-defined and repeatable human tasks in a B2B sales context. For example, it could help build rich customer prospect profiles, update lead generation and lead qualification models via machine learning, personalize and customize communication messages and channels, establish contacts via digital agents (e.g., chatbots), enable fast prototyping, curate competitive intelligence, enable dynamic pricing, automate workflows and post-order services, and uncover new customer needs, just to name a few.

Güngör [36] explains that organizations can explore two major AI value-creation opportunity pathways: one lying in the value chain, and one emerging from the adoption of a multi-stakeholder benefit analysis perspective. For example, AI could be fully integrated into business value chains and, more specifically, use replenishment models to manage inbound logistics, robots in operations and order fulfillment, dispatch algorithms for delivery cost optimization, and recommendation engines to optimize service levels. Güngör argues that AI could also provide support functions in human resources “to predict the best candidates to hire, in finance to prevent frauds, in procurement to optimize number of suppliers, etc.” ([36], p. 75). The second opportunity pathway relates to multi-stakeholder benefit analysis of revenue growth, cost savings, risk mitigation or customer experience, and more. Such analyses should help evaluate how value is shared or distributed and if there exists any potential conflict of interest between stakeholders (be they customers, employees, suppliers, co-innovation partners, or society at large).

AI researchers and practitioners have worked together to instrumentalize the integration of AI resources and capabilities into business development processes. One example of these joint efforts is the development of canvas approaches in the implementation of AI business value [37,38]. The adoption of AI canvas approaches would indicate that the AI field is moving toward a higher stage of maturity which should inspire even more researchers to invest themselves in this domain.

2.2. Value Propositions in the Context of New Growth-Oriented Companies

The importance of the VP construct, and the multiple issues associated with the development of VPs, have been discussed in the literature [39,40,41]. Despite this, the VP construct has often been used casually and applied haphazardly rather than strategically and rigorously [42]. According to Webster [43], a VP should be the company’s single most important organizing principle and thus one of the company’s most valuable resources [12]. VPs should therefore have a strong influence on key aspects of any business, such as the acquisition of complementary resources needed for the value creation process, operations management, inter-organizational structures, and interactions with all relevant stakeholders. The design and formulation of VPs should therefore be done using a multi-stakeholder perspective to reciprocally align all VPs for all relevant actors in the business ecosystem [12,44,45].

According to Bailetti et al. [12] and Nambisan et al. [5], the extant literature appears to overlook the important link between a company’s VP portfolio and its business strategy. Onetti et al. [19] make a clear distinction between a firm’s business model and its strategic concepts and claim that business model frameworks should exclude the VP construct which, according to them, should be part of the higher order of a firm’s strategic elements (Onetti et al. [19] refer to Kothandaraman and Wilson [46], and Winter [20]). Amit and Zott [18] also point out that early definitions of the VP construct emphasize links to a firm’s strategy and performance by observing that a winning strategy is always rooted in a superior VP (Amit and Zott [18] refer to Lanning and Michaels [47]). Amit and Zott [18], Bailetti et al. [12], and Nambisan et al. [5] agree that VPs should be examined from a strategic point of view since every focal firm needs to offer some form of VP not only to customers but also to all other stakeholders involved in its business model. In a recent article, Michael Lanning [17], who is the inventor of the term VP, has explicitly emphasized the strategic aspect of VPs. According to Lanning, “the strategic point of a VP should be to deliver it: choose, then both provide it (actually make it happen in the experiences of customers) and, of course, communicate it. Thus, a business should be understood and managed as a ‘value delivery system’” ([17], p. 306), Lanning’s italic. For him, the context for VPs is the concept of a value delivery system. This concept “was meant to help re-focus how managers think about business strategy (a suggestion which I still think appropriate though not fully appreciated today). Rather than deciding what product (or service) a business should invent, produce and market (and how), strategy should instead design what VP to provide and communicate to customers (and how)” ([17], p. 307).

Several studies have highlighted the importance given by marketing scholars to customer VPs [41,48]. Payne et al. ([16], p. 472) define a customer VP as “a strategic tool facilitating communication of an organization’s ability to share resources and offer a superior value package to targeted customers”. The marketing literature has emphasized the need for firms to articulate benefits and costs relevant to targeted customers as well as functional and experiential features of the differentiation aspects of their offerings and of customer experience in particular [16,49]. The customer is indeed a key stakeholder, but not the only stakeholder, and, for many ventures, not always the most important one. The entrepreneurship and innovation literature shows that ventures tend to focus on the development of new products and services when targeted markets are not clearly defined [50,51]. Recent literature has also emphasized the importance of proper resource configuration and practices in enabling the delivery of key benefits, the sharing of resources, and the integration of the value chain’s key actors in a value co-creation process [52]. Skålén et al. [53] define VPs as “promises of value creation that build upon the configuration of resources and practices” (p. 144). They emphasize the importance of value co-creation with customers as well as the integration of resources provided by other relevant stakeholders.

Little is known about the factors that enable early-stage growth-oriented companies to scale rapidly and the ways they can align their VP portfolio with their scaling objectives. Such an alignment implies the need to incorporate any scale-up objectives into a company’s business model through its configuration of the resources and activities that not only create value for customers but also allow it to capture part of that value and distribute it back to key resource owners [54]. Scalability is defined as the extent to which a VP and its corresponding business model can help achieve the desired value creation and value capture targets by increasing the customer base without having to proportionately add additional resources [55]. As suggested by Shepherd et al. [56], the organizing phase of a venture has a profound impact on its performing phase that in turn will (or will not) lead to any potential scale-up.

Recent studies have identified an explicit link between the growth orientation of new technology companies and the novelty and attractiveness of their VPs. Rydehell et al. [57] point out that finding new and innovative ways to offer value to customers is important for any company to achieve high sales growth, as well as rapid geographic expansion to new markets. Malnight et al. [58] suggest that companies pursue high growth by creating new markets, serving broader stakeholder needs, changing the rules of the game, redefining the playing field, and reshaping their VPs. Bailetti et al. [12] point out that such companies should develop capabilities to access, combine, and deploy the resources required to create value and scale by offering their external resource owners returns they could not otherwise obtain on their own [13,14]. According to Bailetti et al. [12], the VPs of new growth-oriented companies have two distinctive features: they enable themselves and any number of external stakeholders to directly transact without an intermediary, and they increase investments that help create and improve business transactions over time.

Bailetti et al. [12] also identified three factors that make the VP portfolio one of the most valuable company resources: it strengthens the company’s scale-up capabilities, it increases the demand for its products and services, and it fosters investments in the conceptualization, development, maintenance, and refinement of its VPs [12].

2.3. Ecosystem Perspective on Value Propositions

Any new venture requires people with entrepreneurial imaginativeness [56]. The act of conceptualizing a new venture is “a cognitive skill that combines the ability of imagination with the knowledge needed to stimulate various task-related scenarios in entrepreneurship” ([59], p. 2266). This cognitive skill is essential to take an idea and move toward identifying an opportunity and then creating a venture to exploit it [56]. It implies the shaping of a novel offering [60] through the exploitation of resources beyond the ones controlled by the nascent company [61,62]. Such exploitation results from a multi-actor process in which different business ecosystem stakeholders are actively engaged [63] (Stam and van de Ven 2019).

In a globalized world with increasingly complex and interrelated technologies, entrepreneurial innovation ecosystems are vital for ventures looking to implement complex VPs (e.g., [63,64]). Every venture committed to scale operates in an environment where different ecosystem actors are actively engaged in complementing the value creation process. Any such venture needs to join a business ecosystem that provides it with the “alignment structure of the multilateral set of partners that need to interact in order for a focal value proposition to materialize” ([63], p. 42). Securing the commitment of valuable stakeholders can be crucial to a venture’s scaling performance [56,65]. An ecosystem defines and provides processes and rules that help resolve any emerging coordination issues and also encourages alignment between ecosystem actors through rules of engagement, standards, and codified interfaces [66]. The modularity of resources and contributions is necessary, but in and of itself an insufficient condition for the existence of an ecosystem (Baldwin 2008; Langlois 2003). For an ecosystem to emerge and be useful, there must be a significant need for coordination that cannot be met by the hierarchy imposed by a focal firm [64]. What makes ecosystems unique is that actors “can choose among the components (or elements of offering) that are supplied by each participant, and can also, in some cases, choose how they are combined” ([66], p. 2260).

Jacobides et al. [66] identified two types of complementarities that can unambiguously characterize the coordination of activities and resource sharing between ecosystem actors. The first is unique complementarity, either where an activity or component offered by one actor requires the activity or component of another, but not vice versa, or where two activities, A and B, of two different actors both require each other. The second, supermodular complementarity, could be described as “more of A makes B more valuable, where A and B are two different products, assets, or activities” (p. 2262). The distinctive feature of ecosystems is that they provide an alignment structure where different actors can engage with each other in value creation through these unique and supermodular complementarities, in production and/or consumption, which can both be coordinated without the need for vertical integration. Defining business ecosystems in this way offers an opportunity to advance VP research and practice.

3. Research Methodology

The objective of our research study is to explore how AI can help the enhancement of the VPs of early-stage growth-oriented companies. We address the lack of research in this domain by developing an actionable VP framework providing an explicit business activity structure that could enable the analysis of the potential beneficial impact of AI resources and capabilities.

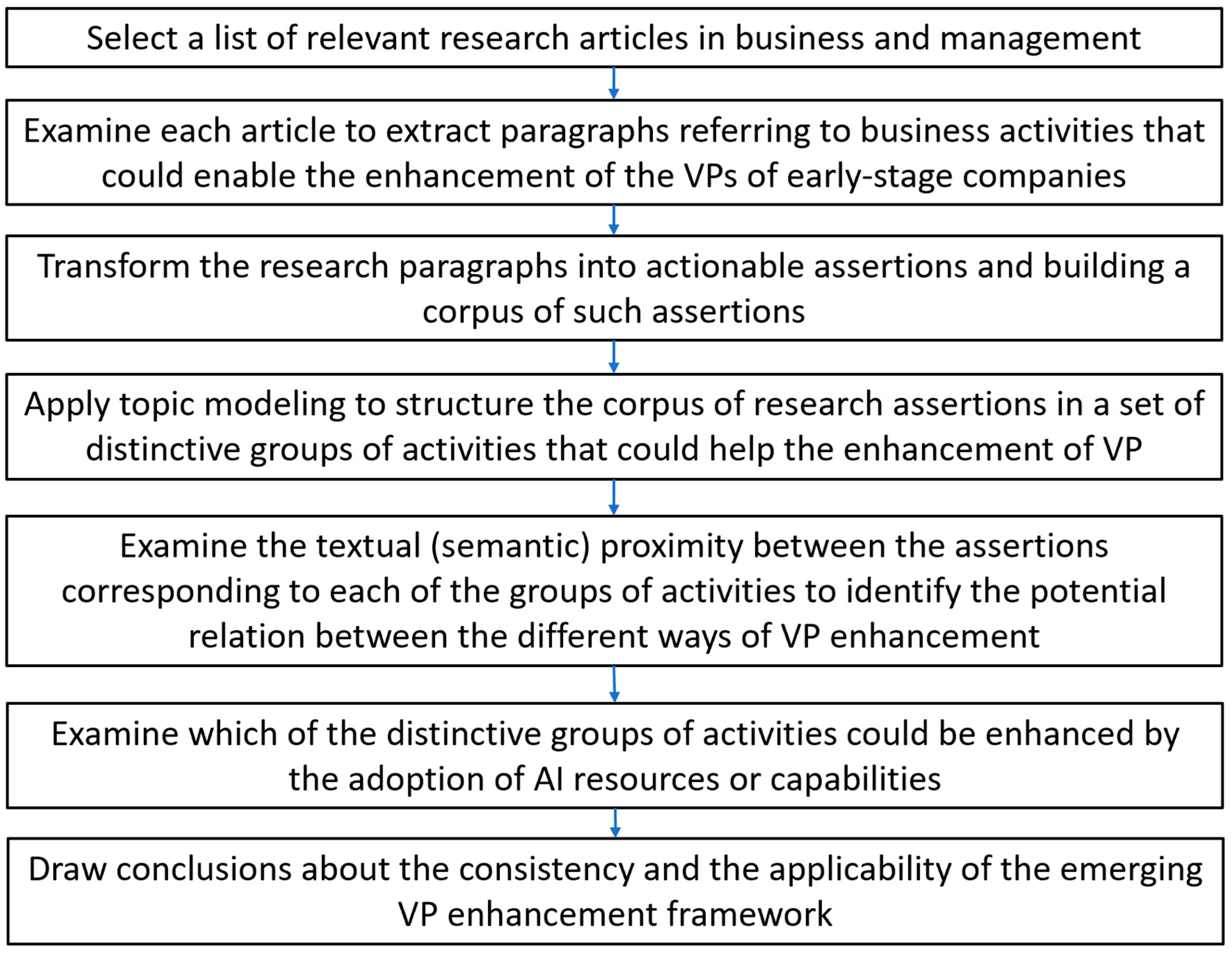

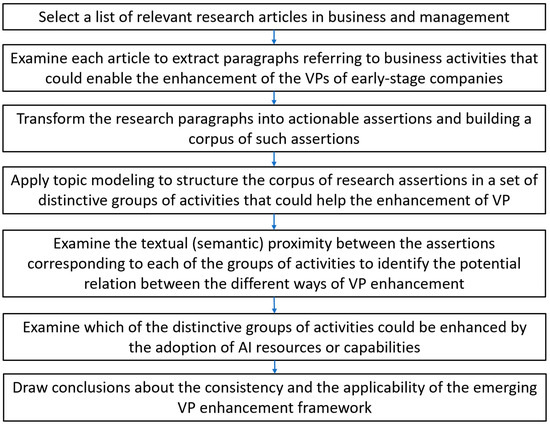

In earlier publications, we articulated some preliminary insights referring to VP enhancement in the context of new growth-oriented companies [12,67,68]. In the present article, we summarize the outcomes of the research process we used (see Figure 1) to build on our preliminary insights by: (a) selecting a list of relevant research articles in business and management; (b) examining each article to extract paragraphs suggesting or implying business activities that could enable the enhancement of the VPs of early-stage growth-oriented companies; (c) transforming the paragraphs into actionable assertions and building a corpus of such assertions that could be used as a basis for text analytics; (d) using topic modelling to structure the corpus of research assertions in a set of emerging themes to be interpreted as distinctive groups of activities that could help to enhance the VPs of early-stage growth-oriented companies; (e) identifying the potential relation between the different ways of enhancing the VPs by examining the textual (semantic) proximity between the assertions included in each of the groups of activities identified in the topic modelling process; (f) examining which of the distinctive groups of activities could be enhanced by the adoption of AI resources or capabilities; and (g) drawing conclusions based on the results.

Figure 1.

Research steps used to develop a value proposition enhancement framework.

We searched the Web of Science Core Collection database for journal research articles containing the string “value proposition” in the titles, then selected the subset of articles corresponding to the Business or Management Web of Science categories, then searched everywhere within the last subset of articles for “business model”, which narrowed down our search to a list of 84 articles. The use of the additional “business model” search term was justified by the assumption that it will help in selecting articles including more operational or actionable insights. This initial list of 84 articles was further examined by all co-authors to gauge the potential relevance of the articles to the objective of our study by providing more comprehensive analysis, descriptions of VP frameworks, managerial recommendations, and actionable insights of practical relevance for real-world companies. A subset of 14 articles was selected as the core source of research assertions [12,16,32,41,44,45,48,53,57,58,69,70,71,72]. These articles were then examined independently by all co-authors and used as a source for the formulation of distinguishable actionable insights. The VP insights were complemented by insights extracted from some of the most representative references provided in the above 14 articles as well as from recent research articles focused on business ecosystems [63,64,66] and AI-based business value [28,30,35,36].

The process of turning research paragraphs into assertions (see examples provided in Table 1) included multiple informal discussions with representatives of our local entrepreneurial and innovation ecosystem such as entrepreneurs, business mentors, representatives of organizations supporting small and medium company innovation, and other researchers, who had experience working with early-stage companies. This feedback helped the final formulation of the assertions and ensured the use of language that is familiar to executive managers of such companies. The process resulted in a corpus of 182 assertions referring to the shaping, enhancement and alignment of VPs (most of these assertions are shown in Appendix A under the specific topics that were identified in the topic modelling results section).

Table 1.

Three examples of transforming research paragraphs into actionable assertions.

The next step of our study involved topic modelling analysis [12,23,24,25,26] as a text mining approach to the identification of emerging latent themes that could be associated with the groups of activities defined by the texts included in the corpus of 182 assertions. In our study, we have used the Topic Model Explorer (https://github.com/michaelweiss/topic-model-explorer (accessed 6 April 2024)) and the text analytics capabilities of the Orange Data Mining tool, (Orange Data Mining open source software tool: https://orangedatamining.com/ (accessed on 6 April 2024)) which incorporates one of the most popular topic modelling algorithms, known as Latent Dirichlet Allocation, or LDA [22]. Details about topic modelling with the Orange tool can be found here: https://orangedatamining.com/widget-catalog/text-mining/topicmodelling-widget/ (accessed on 6 April 2024)). The LDA method has gained popularity due to its ability to process large corpora of text documents, resulting in the identification of emerging latent topics across all the documents (it is now a built-in option in many commercial and open source text analytics tools). It posits that each document is a mixture of a small number of topics and that each word in a document could be associated with one or more of the document’s topics. In more technical terms, the LDA approach inputs a document-term matrix, for which the rows are the specific word counts and the columns are the specific texts corresponding to the documents in the corpus.

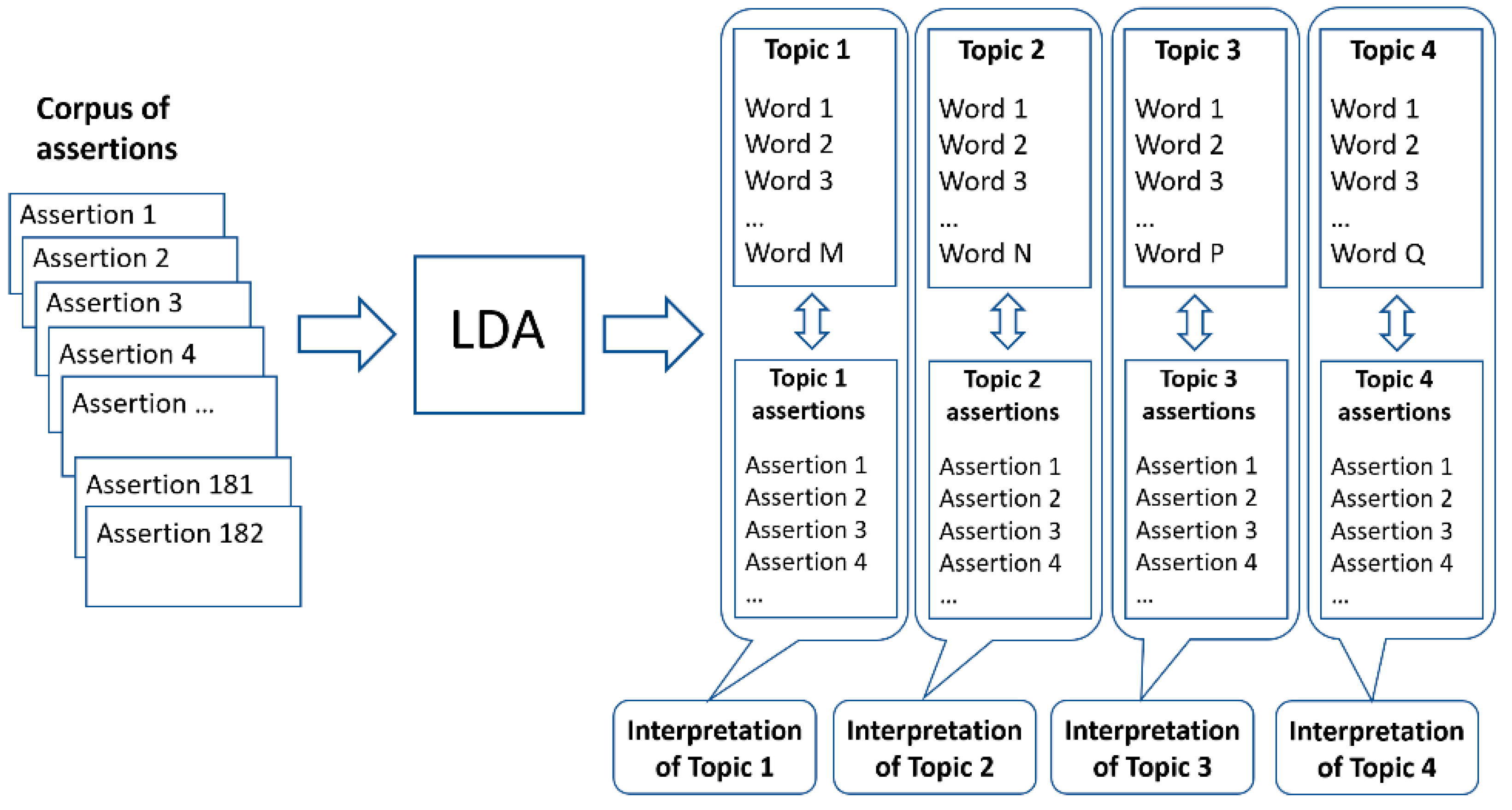

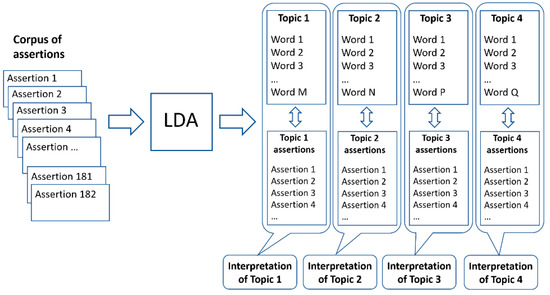

LDA identifies distinct topics across the corpus by observing words that tend to co-occur frequently within each of the texts. It outputs a document-topic matrix, for which each document is assigned to a probabilistic mixture of topics. The combinations of words per topic help identify specific themes that are latently present in the corpus. LDA also organizes the corpus by clustering the assertions corresponding to each topic (as shown in Figure 2). The assertions clustered in a given topic are ranked in terms of the degree of their association with it. A closer examination of the topical organization of the assertions enables the interpretation of the overall theme and the labelling of the topics [73]. The number of topics to be used in the analysis is specified by the researchers. Figure 2 provides a symbolic representation of the topic modelling process. A more detailed description of the original algorithm can be found in Blei [22].

Figure 2.

Symbolic representation of the logic and outcomes of the LDA topic modelling algorithm. This is just an example with four topics, which is not the case for the results presented in this article.

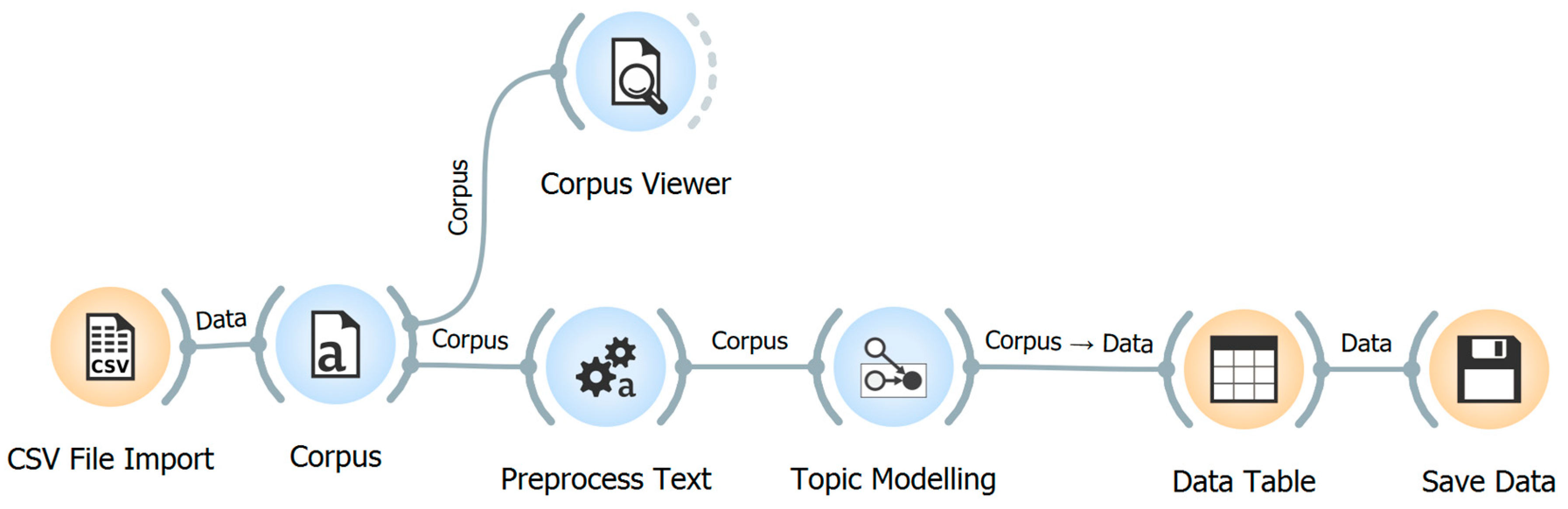

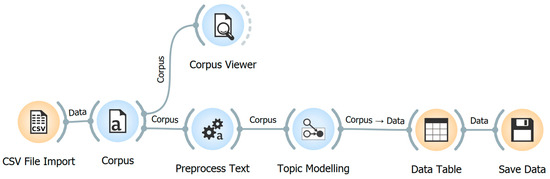

Figure 3 provides a process view of the topic modelling analysis in the way it was performed in the Orange Data Mining tool. The key steps in the process include the loading of the corpus of 182 assertions, pre-processing of the text (lowercase the text, split it into words with tokenization, lemmatize tokens to their base form and finally remove stopwords, i.e., common frequent words that appear in multiple topics and do not contribute to the distinctiveness of the topic), topic modelling using the built-in LDA algorithm, and post-processing and saving the results for further analysis, which includes the interpretation of the topics such as is shown in Figure 2.

Figure 3.

Schematics of the workflow of the Orange Data Mining text analytics tool used to perform the topic modelling analysis.

Our next step was to examine the consistency of the topics as a whole and the possibility of considering the groups of VP enhancement activities associated with each of them as key elements of an analytical VP framework suitable for early-stage growth-oriented companies. The last step, and the ultimate goal of our study, was to examine the extent to which the activities suggested by the assertions and associated with a given topic could be enhanced by means of AI resources and capabilities. Following this examination, we reflected on the ability of AI and AI-driven digitalization to enhance the VPs of early-stage growth-oriented companies.

4. Topic Modelling Results

4.1. Topic Model of the Corpus of Actionable Value Proposition Insights

Our topic modelling analysis identified seven topics, each defined by a set of words and a set of topic-specific assertions. The words and the assertions associated with each of the seven topics are listed in Appendix A. A close examination of these sets of assertions allowed us to label each of the sets as follows: Value created, Stakeholder value propositions, Foreign market entry, Customer base, Continuous improvement, Cross-border operations, and Company image. The purpose of the selection of these specific labels was to emphasize the thematic distinctiveness of each topic and shed light on the overall content of their corresponding assertions. The labels should therefore be seen as thematic pointers emerging from the topics and not as comprehensive content signifiers. The specific assertions are the real content of each topic.

Topic 1 (Value created) refers to a given venture’s access to, and combination of, complementary internal and external resources relevant to value creation for all its relevant stakeholders. Topic 2 (Stakeholder value propositions) focuses on various aspects and the alignment of the VPs to key stakeholders such as investors, customers, suppliers, etc. Topic 3 (Foreign market entry) includes assertions related to successfully turning local offers into global ones. Topic 4 (Customer base) focuses on activities that result in engaging and attracting more customers, i.e., activities associated with the ultimate goal of a scaling strategy, that is, increasing the customer base profitably. Topic 5 (Continuous improvement) includes assertions about improving the value creation process and refining the alignment of the company’s VP portfolio. Interestingly, we find here specific assertions about improving the firm’s cybersecurity practices, which refer to online business interactions and global reach. Topic 6 (Cross-border operations) focuses on knowledge sharing and cross-border coordination activities as well as on the need for stronger positioning in cross-border business networks. Topic 7 (Company image) refers to the brand identity of the company and how it differentiates itself from its competitors.

4.2. Shaping a Value Proposition Enhancement Framework

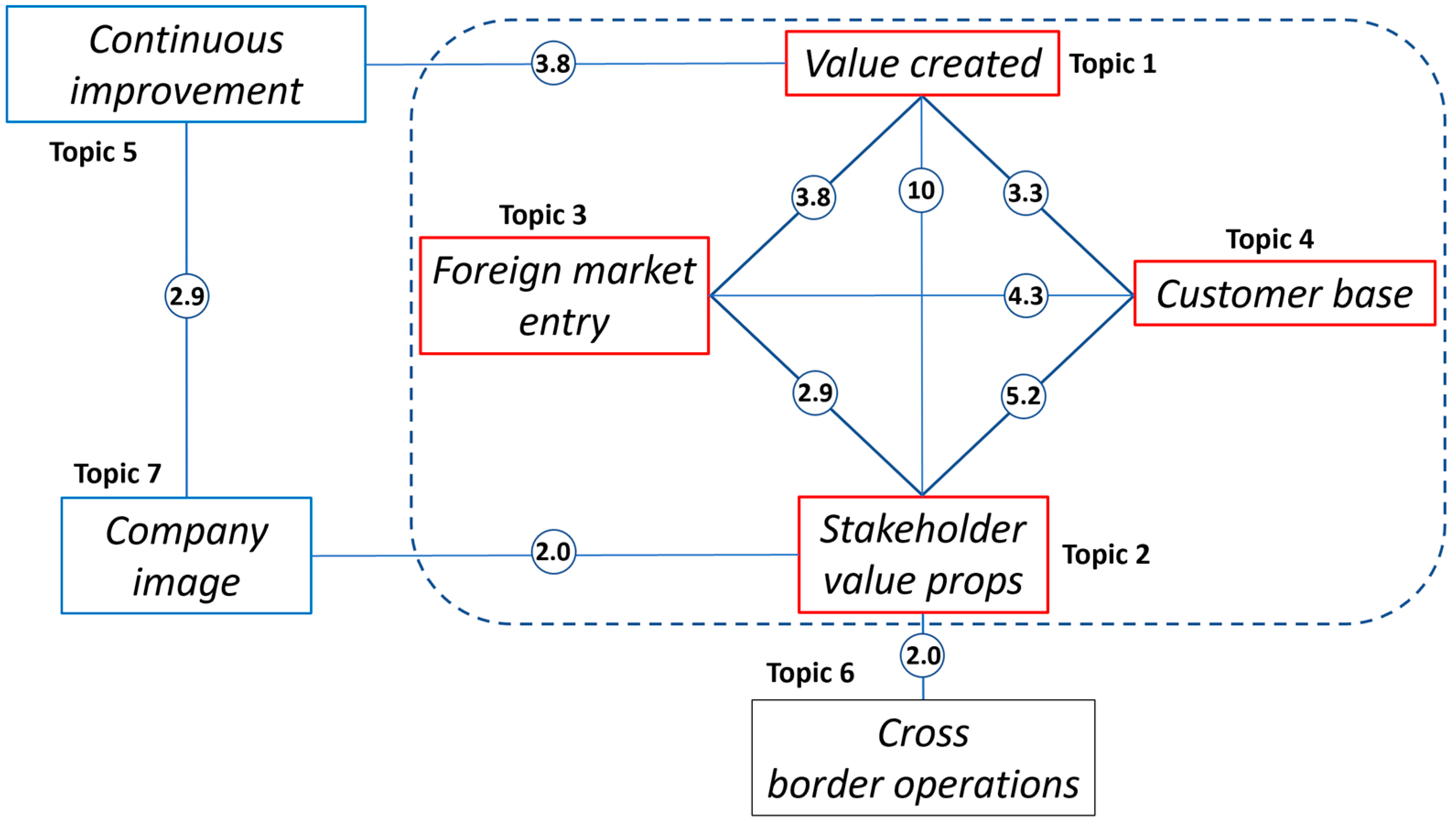

The seven topics outlined above do already suggest a conceptual framework substantiated by the specificity of the groups of assertions associated with each topic. To examine the potential logical relations between them, the assertions associated with each topic were conglomerated into seven documents, one per topic, and the cosine similarity values between the seven documents were calculated. Cosine similarity is a measure used to evaluate the semantic proximity of documents or provide a ranking of documents with respect to a given set of search words, a search phrase, or a paragraph [74].

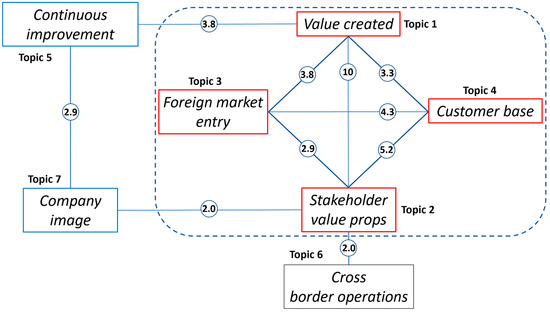

The resulting VP framework is shown in Figure 4. The numbers along the links between topics indicate the normalized cosine similarity between the seven documents created by the process. The cosine similarity values were normalized by the maximum value that was found between Topic 1 (Value created) and Topic 2 (Stakeholder value propositions). The cosine similarity values shown here are presented on a 1 to 10 scale, including only the values/links that are equal to or greater than 2.

Figure 4.

VP enhancement framework showing the textual proximity (or semantic relations) between the seven emerging topics. Each topic is interpreted as a VP element including a set of actionable insights for early-stage companies for which Customer base appears as a natural growth-related metric.

It is important to note that the relationships between different topics should not be considered in absolute terms. Rather, they should be seen as a way of using the semantic proximity of the topic-specific assertions to form the basis for shaping the VP enhancement framework. It should be also noted that this is not just a conceptual framework, this is actually a structured business activity system which provides actionable insights for practitioners. The seven elements of this VP framework and the resulting semantic links between them allowed us to develop multiple insights, which we outline next.

5. Analysis of the Results

5.1. Three VP Elements Related to Customer Base Growth

A straightforward interpretation of the VP enhancement framework shown in Figure 4 suggests that there is a close interrelation between four core VP elements (shown in red boxes in Figure 4): Stakeholder value propositions, Foreign market entry, Value created and Customer base. Our claim about a closer interrelationship between these four core elements is based on the fact that each of these elements is related to the other three. Customer base appears as a natural dependent variable associated with the context of early-stage growth-oriented companies. Our framework suggests that a company’s customer base is related to the efficiency of the company’s value creation processes (i.e., its ability to access, combine and align resources provided by the key actors engaged in their business ecosystem; see assertions associated with Value created [Topic 1] in Appendix A), its foreign market entry strategy (i.e., its strategic plan to penetrate global market locations by transforming its local offers into global ones; see assertions associated with Foreign market entry [Topic 3] in Appendix A); and the attractiveness and alignment of its VPs in relation to key members of their business ecosystem (i.e., its ability to shape a VP portfolio in alignment with its scaling objectives; see assertions associated with Stakeholder value propositions [Topic 2] in Appendix A). From a logical point of view, the link between Topic 1 (Value created) and Topic 2 (Stakeholder value propositions) could be considered as a core value creation axis that could be further enhanced by Foreign market entry (Topic 3) and Cross-border business activities (Topic 6) to enable Customer base growth (Topic 4).

These findings are in line with some of the key insights highlighted in our literature review—the multiple-stakeholder perspective on VPs and business growth. The main value of our suggested framework (Figure 4) is in: (i) the specificity of the activities it incorporates; (ii) the way it structures the actionable insights around specific topics (VP elements); and (iii) its explicit identification of the logical relation between the four core VP elements in the context of early-stage growth-oriented companies.

5.2. VP Enhancement Is a Continuous Process

Our VP framework suggests that a company’s Customer base growth is continuously enhanced through a positive loop enabled by activities focused on the Continuous improvement of the Value created, the alignment of Stakeholder value propositions, and Foreign market entry processes (see assertions associated with Continuous improvement [Topic 5] in Appendix A) and on the Company image (see assertions associated with this topic [Topic 7] in Appendix A). This finding helps emphasize the dynamic nature of VP enhancement activities in early-stage growth-oriented companies. Our VP model also identifies an alignment between Stakeholder value propositions and the knowledge-management learning emerging from Cross-border operations (see assertions associated with this topic [Topic 6] in Appendix A). This puts the Stakeholder value propositions element in a central position and underlines its importance in terms of VP portfolio enhancement and alignment in cross-border contexts. Interestingly, our topic modelling separates Foreign market entry activities from Cross-border operations activities, the latter focusing on managing knowledge flow and learning rather than foreign market development. The emergence of this distinction is an interesting finding that merits future study.

5.3. How AI Resources and Capabilities Can Enhance the VPs of Early-Stage Growth-Oriented Companies

Given our findings, we can now elaborate on our central question: how can the VPs of early-stage growth-oriented companies be enhanced by the adoption of AI resources and capabilities? Our choice of criteria for the selection of specific assertions was based on the insights of Mishra and Pani [28], Güngör [36], Majhi et al. [30], and Rogers [2] about the capability of the activities described by these assertions to be enhanced by AI technologies, more specifically sensing and seizing opportunities and reconfiguring key business aspects related to customers, competition, data utilization, innovation, and value creation. These included the following:

- automating business processes;

- gaining decision-making insights through data analysis;

- enhancing engagement or relationships with customers, employees, investors, partners, and other relevant stakeholders;

- identifying opportunities in the value chain from the adoption of a multi-stakeholder benefit analysis perspective;

- building rich customer prospect profiles, enabling dynamic pricing, and automating workflows and post-order services;

- uncovering new customer needs, business opportunities, and corresponding innovative offers.

The actionable insights selected on the basis of the above criteria are shown in Table 2 alongside specific potential benefits of enabling or enhancing them using AI. The analysis was performed in keeping with the logic of our VP enhancement framework model (Figure 4). A straightforward examination of the assertions in Table 2 suggests that AI resources and capabilities could indeed enhance VP activities across all parts of the VP framework, bringing us to the possibility of a quantitative comparison between the degrees to which the different VP elements could be enhanced by AI. However, our results do not allow for such a straightforward comparison. Still, we posit being able to achieve the development of valuable insights about overarching topics with the highest or lowest potential to be enhanced by AI resources and capabilities.

Table 2.

VP-related activities that could be enhanced by AI resources and capabilities.

Based on Table 2, we could claim that there is a clear potential for AI to enhance the four core elements of our VP model: Value created, Stakeholder value propositions, Foreign market entry, and Customer base (topics 1 to 4, respectively). More importantly, we find the greatest number of assertions related to activities that could be enhanced by AI under Topic 4 (Customer base), which is the one associated with scaling potential. We therefore see the adoption of AI resources and capabilities as potentially most influential in shaping strategic activities focusing on growing a company’s customer base (a finding supported by Rogers [2]).

The contents of Table 2 also suggest that Continuous improvement may be another VP element that could be enhanced by AI. Interestingly, this is the VP element under which falls the assertion that appears to be most strictly related to AI, i.e., using data and artificial intelligence to personalize offers to consumers. Our VP model shows that Continuous improvement links Stakeholder value propositions and Value created via the Company image. Two of the most relevant assertions under value created refer to the ability of firms to choose to combine their internal resources with those of other resource owners to create value they could not otherwise create on their own, in the context of complying with all relevant cultural, legal, and regulatory norms. This speaks directly to the power of AI resources and capabilities to enable a company’s reconfiguring capacity [30]. The potential of AI in enabling a dynamic Continuous improvement link between Value created (reconfiguring capacity), Stakeholder value propositions (business ecosystem alignment structure), Foreign market entry (ability to address new global markets by using insights from successful local products and services), and companies’ scaling potential (Customer base) is an important finding that should become the subject of more comprehensive future studies.

Another interesting finding is the seemingly central role of Stakeholder value propositions (development and alignment) in both our VP framework and the set of activities that could be enhanced by the adoption of AI resources and capabilities (Table 2). Activities related to Stakeholder value propositions appear to be uniquely related to Cross-border operations in addition to their inherent relation with three of the four core VP elements, Foreign market entry, Value created, and Customer base. These interrelationships are also part of the positive loop enabled by the Continuous improvement VP element. Our analysis suggests that the adoption of AI resources and capabilities can enable and strengthen these interrelations.

6. Conclusions

The objective of this article was to explore how AI can help the enhancement of the VPs of early-stage growth-oriented companies. Therefore, we have suggested an actionable VP framework providing a structured business activity system that could enable both scholars and business practitioners involved in growth-oriented companies to examine the potential beneficial impact of AI resources and capabilities on their VPs. Based on the literature pertaining to AI-based business value, VP frameworks, and business ecosystems, we generated a corpus of assertions referring to actionable insights and applied topic modelling to identify seven interrelated groups of activities that were labelled as Value created, Stakeholder value propositions, Foreign market entry, Customer base, Continuous improvement, Cross-border operations, and Company image. The link between Value created and Stakeholder value propositions could be considered as a core value creation axis that could be strengthened by Foreign market entry and Cross-border business activities to enable Customer base growth. At the same time, the company’s Customer base growth is continuously enhanced through a positive loop enabled by the Continuous improvement of the value creation process, the alignment of Stakeholder value propositions, the Foreign market entry efforts and the overall Company image. The suggested framework is not just conceptual but practically actionable, since it comes with a structured system of activities related to each of the seven generic VP elements.

Each of the VP elements (groups of activities) was then examined in terms of its capacity to be enhanced by the adoption of AI resources and capabilities. Thus, the study makes a methodological contribution by demonstrating a way of applying topic modelling to turn research assertions into actionable insights for entrepreneurs and executive managers. The second main contribution is the actionable framework itself since, to the best of our knowledge, there has not been any framework published that could explicitly address the opportunity to enhance VPs by the adoption of AI resources and capabilities.

The study of how AI affects the VPs and growth of early-stage growth-oriented companies is highly relevant independently of the economic sector, and needs more attention by researchers. A necessary next step in the advancement of this line of research would be the adoption of the proposed VP enhancement framework to examine the practices of real-life companies. It is, however, outside of the scope of the present article and will be considered in future works. Future empirical studies should also address other important questions, the answers to which, unfortunately, are also out of the scope of the present study:

- How does AI enable early-stage growth-oriented companies to analyze large volumes of data for the development of VP-related insights that could result in distinctive competitive advantage?

- What are the implications of AI for the scalability and growth potential of such companies in different industries? How does the specific nature of the industry affect the scaling and growth potential?

- What skills and resources are necessary for new companies to effectively implement AI initiatives? How are these skills and resources related to the skills and resources required for the articulation and delivery of competitive VPs of growth-oriented firms?

- What role does AI play in business analytics and forecasting for early-stage growth-oriented companies, particularly in industries with high uncertainty? Can AI reduce the uncertainty in decision making relevant to strategic and competitive VP enhancement?

Finally, we should emphasize again that this article sought to contribute to an emerging stream in entrepreneurship and innovation management research which calls for a stronger focus on the development of actionable principles for practitioners [21]. It highlights the need for a distinct body of knowledge around pragmatically oriented, actionable principles that could bridge the gap between the causal mechanisms of entrepreneurship theory and the complex realities of entrepreneurial practice. Our focus on actionable insights is ultimately an expression of our commitment to the cause of applied research articulated by Berglund et al. [21] and Shepherd and Gruber [75].

Author Contributions

Conceptualization, S.T., C.K. and T.B; methodology, T.B., S.T. and C.K.; software modelling, S.T. and T.B.; validation, D.H., S.T., T.B. and C.K.; formal analysis, S.T., C.K. and D.H.; investigation, S.T., C.K. and T.B.; resources, S.T., T.B. and C.K.; data curation, S.T.; writing—original draft preparation, S.T. and C.K.; writing—review and editing, C.K. and S.T.; visualization, S.T.; project administration, S.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors express their sincere gratitude to Michael Weiss from the Technology Innovation Management Program at Carleton University, Ottawa, ON, Canada, for the access to the Topic Model Explorer tool: https://github.com/michaelweiss/topic-model-explorer accessed on 6 April 2024.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Topic Modelling Results (Including Most Frequent Words and Assertions)

- (1)

- Topic 1—VC—Value created (product, service, sale, investor, norm, scaling master plan, benefit, resource)

- Identify and access resources that allow scaling at lower costs by creating benefits for the resource owners that they cannot create alone.

- Allow resource owners to make money using your products and services.

- Align value created from the combination and deployment of external resources with scaling master plan.

- Combine company resources with those of other resource owners to create value that cannot be created by your company alone.

- Make decisions on how to best deploy value-adding combinations of external and internal resources, while complying with all relevant cultural, legal, and regulatory norms.

- Establish partnerships that increase the demand for, and complement, your products.

- Enable your freelance workers to become world-class service providers.

- Increase order fulfillment and delivery capacity through partnering with third-party service providers and acquiring drop-shipping facilities.

- Provide investors with evidence that your business model and target market can generate enough sales for the company to be investable in.

- Provide returns that leave the most important resource owners better off than they would have been if they had not engaged with you.

- Simplify the complementarity of your company products and services.

- Combine two or more resources to create value that exceeds the sum of the value created from each resource separately.

- Provide vendors and suppliers with real-time analytics on sales required to boost their own operational efficiency, sales and profits.

- Use the company’s technical and knowledge expertise to develop prototypes that demonstrate the value of your products and services.

- Demonstrate how your technology, knowledge and experience contribute to the company’s scaling master plan.

- Contribute to university research projects and enhance the academic and technical reputation of your team to ensure that your company’s proposed technological concept is valid.

- Develop a compelling image of your future company and use it to convince investors to provide funding and resource owners to provide resources needed to scale.

- (2)

- Topic 2—SVP—Stakeholder value propositions (value proposition, vision, future, salesperson, path)

- Instill a sense of purpose by articulating and pursuing a compelling vision for the company in the future.

- Provide investors a compelling short-term financial VP and a vision of favourable medium- and long-term VPs.

- Develop VPs that enhance employee satisfaction, psychological attachment, and behavioural commitment to your company.

- Continuously improve VPs based on results and feedback.

- Learn from VPs of companies that have scaled early, rapidly, and securely, and use them to differentiate your company on the market.

- Track changes in stakeholders’ VPs and use the information to realign your VPs to them.

- Develop VPs for key members of the value chain that align with key members’ VPs and improve the competence of the value chain.

- Develop VPs that enhance your customers’ and suppliers’ outcomes, marketing strategies, and competitive advantages.

- Develop investor VPs describing the path to return on investment in return for investors’ funds and confidence.

- (3)

- Topic 3—FME—Foreign market entry (local, prototype, alliance, patent, regulation)

- Develop a replicable formula to repeat what worked in one location in other locations.

- Promote the company’s achievements to date, e.g., awards, high-profile endorsements from established companies, sales, successful alliances and interactions with potential customers, strength of the company’s scaling master plan and the company’s potential to create local jobs, contributions to social causes, and advancement of knowledge.

- Enable locals in other locations to succeed because of your company.

- Enter a different geographical market by partnering with or purchasing local companies.

- Improve links, interactions, and shared purpose with locals in each region the company operates in.

- To globalize a local product, develop core product that can be readily disseminated worldwide.

- Integrate local innovation into global themes, products, and services.

- Include local actors in your global communication system and learn from multiple local experiences.

- (4)

- Topic 4—CB—Customer base (customer, stakeholder, user, supplier, loyalty, referral)

- Apply big data analytics to produce insightful information about users, suppliers and customers to enhance shopping pattern analysis, improve customer experience, predict market trends, provide more secure online payment solutions, increase personalization, optimize and automate pricing, and provide dynamic customer service.

- Attract traffic and new customers by targeting and retargeting users from search engines, referrals, adds and social media.

- Engage customers to produce testimonials, reviews and ratings that help new customers to make purchasing decisions with knowledge of other customers’ experiences.

- Provide rewards that satisfy customer needs for recognition of their loyalty.

- Continuously improve user interfaces and applications that directly influence the entirety of customer experience including personalized content, quality messaging, and the delivery and returns process.

- Implement a stakeholder-centric approach to satisfy stakeholder expectations in all markets.

- Automatically extract the information a user, customer, investor, or stakeholder wants from the vast amount of available information.

- Build internet-based capabilities to acquire and retain customers during the initial stages of the company’s life cycle.

- Define the ideal target customer profiles and engage them relentlessly.

- Use an end-to-end solution that links procurement directly with end customers to eliminate or reduce inventory and the number of intermediaries between the company and customers.

- Enable employees, customers, users, investors, and other relevant parties to automatically extract information from company data for the purpose of decreasing costs and adding value to other stakeholders.

- Establish trust and positive rapport with your customers that leads to long-term, mutually beneficial business relationships.

- Adjust to your customers’ moods and work to find common ground to build familiarity.

- Listen to your customers, take their feedback seriously, and adjust operations as needed.

- Digitize as much of your company as you can to create value for customers, reduce costs, and increase security.

- Deliver better performance on the metrics that customers care about.

- (5)

- Topic 5—CI—Continuous improvement (offer, channel, artificial intelligence, threshold, value chain, data)

- Continuously improve individuals, operations, and infrastructures to advance and deliver a portfolio of innovative offers.

- Apply processes that make offers easier to understand, produce, and deliver.

- Invest to improve cybersecurity of the value chain.

- Expand information about the company, its offers, its achievements, and its affiliations.

- Apply processes that continuously improve the cybersecurity of the company as well as its offers, channels, and resources.

- Adapt offers to each market.

- Provide a variety of complementary offers to each market.

- Sell online using a variety of online and offline promotional channels.

- Sell offers the target market perceives to be better than relevant alternatives.

- Strengthen cybersecurity attributes of offers compared to competitors.

- Use scientific and technological advances to develop innovative offers.

- Broaden company offers to address more customer jobs to be done.

- Unbundle the value chain and the jobs to be done within it to outsource lower value tasks to freelance workers and perform higher value tasks internally.

- Use data and artificial intelligence to personalize offers to consumers.

- (6)

- Topic 6—CBO—Cross-border operations (community, founder, regulation, cross border)

- Attain positions in cross-border networks which provide access to privileged information.

- Build operational cross-border capabilities early.

- Coordinate, evaluate, and share knowledge between headquarters and cross-border units, and among the units themselves.

- Simultaneously develop global learning capabilities, cross-border flexibility, and global competitiveness.

- Build a community where each member supports others rather than building many separate businesses.

- Contribute to the creation of public goods such as open source code, standards, and test beds.

- (7)

- Topic 7—IMG—Company image (brand, identity, competitor, competition, e-commerce, price)

- Create a unique brand identity to differentiate from the competition.

- Expand brand coverage and eliminate intermediaries.

- Brand the company and build a brand that has a strong market presence.

- Select and retain a consistent identity for the multiple audiences with which you interact.

- Deploy efficient e-commerce technologies and automation to reduce company costs and lower prices of offers.

- Sell high-quality offers at lower prices compared to competitors.

References

- Sjödin, D.; Parida, V.; Palmié, M.; Wincent, J. How AI capabilities enable business model innovation: Scaling AI through co-evolutionary processes and feedback loops. J. Bus. Res. 2021, 134, 574–587. [Google Scholar] [CrossRef]

- Rogers, D. The Digital Transformation Playbook—Rethink Your Business for the Digital Age; Columbia University Press: New York, NY, USA, 2016. [Google Scholar]

- Wagner, D.N. The nature of the Artificially Intelligent Firm—An economic investigation into changes that AI brings to the firm. Telecommun. Policy 2020, 44, 101954. [Google Scholar] [CrossRef]

- Schallmo, D.; Williams, C.; Boardman, L. Digital Transformation Of Business Models—Best Practice, Enablers, And Roadmap. Int. J. Innov. Manag. 2017, 21, 1740014. [Google Scholar] [CrossRef]

- Nambisan, S.; Zahra, S.; Luo, Y. Global platforms and ecosystems: Implications for international business theories. J. Int. Bus. Stud. 2019, 50, 1464–1486. [Google Scholar] [CrossRef]

- Schallmo, D.; Tidd, J. Digitalization: Approaches, Case Studies, and Tools for Strategy, Transformation and Implementation; Series on Management for Professionals; Springer: New York, NY, USA, 2021. [Google Scholar]

- Niemand, T.; Coen Rigtering, J.P.; Kallmünzer, A.; Kraus, S.; Maalaoui, A. Digitalization in the financial industry: A contingency approach of entrepreneurial orientation and strategic vision on digitalization. Eur. Manag. J. 2021, 39, 317–326. [Google Scholar] [CrossRef]

- Soluk, J.; Miroshnychenko, I.; Kammerlander, N.; De Massis, A. Family Influence and Digital Business Model Innovation: The Enabling Role of Dynamic Capabilities. Entrep. Theory Pract. 2021, 45, 867–905. [Google Scholar] [CrossRef]

- Verhoef, P.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Qi Dong, J.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Kraus, S.; Jones, P.; Kailer, N.; Weinmann, A.; Chaparro-Banegas, N.; Roig-Tierno, N. Digital Transformation: An Overview of the Current State of the Art of Research. SAGE Open 2021, 11, 1–15. [Google Scholar] [CrossRef]

- Crane, D. It’s Time for Canada to Focus on the Scale-Up Challenge. IT World Canada. 2019. Available online: https://www.itworldcanada.com/article/its-time-for-canada-to-focus-on-the-scale-up-challenge/420027 (accessed on 6 April 2024).

- Bailetti, T.; Tanev, S.; Keen, C. What Makes Value Propositions Distinct and Valuable to New Companies Committed to Scale Rapidly? Technol. Innov. Manag. Rev. 2020, 10, 14–27. [Google Scholar] [CrossRef]

- Bussgang, J.; Stern, O. How Israeli Startups Can Scale. Harv. Bus. Rev. 2015. Available online: https://hbr.org/2015/09/how-israeli-startups-can-scale (accessed on 6 April 2024).

- Girotra, K.; Netessine, S. OM Forum—Business Model Innovation for Sustainability. Manuf. Serv. Oper. Manag. 2013, 15, 537–544. [Google Scholar] [CrossRef]

- Baldassarre, B.; Calabretta, G.; Bocken, N.; Jaskiewicz, T. Bridging sustainable business model innovation and user-driven innovation: A process for sustainable value proposition design. J. Clean. Prod. 2017, 147, 175–186. [Google Scholar] [CrossRef]

- Payne, A.; Frow, P.; Eggert, A. The customer value proposition: Evolution, development, and application in marketing. J. Acad. Mark. Sci. 2017, 45, 467–489. [Google Scholar] [CrossRef]

- Lanning, M. Try taking your value proposition seriously—Why delivering winning value propositions should be but usually is not the core strategy for B2B (and other businesses). Ind. Mark. Manag. 2020, 87, 306–308. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Business Model Innovation Strategy; John Wiley & Sons: Hoboken, NJ, USA, 2021. [Google Scholar]

- Onetti, A.; Zucchella, A.; Jones, M.; McDougall-Covin, P. Internationalization, innovation and entrepreneurship: Business models for new technology-based firms. J. Manag. Gov. 2012, 16, 337–368. [Google Scholar] [CrossRef]

- Winter, S. Understanding dynamic capabilities. Strateg. Manag. J. 2003, 24, 991–995. [Google Scholar] [CrossRef]

- Berglund, H.; Dimov, D.; Wennberg, K. Beyond bridging rigor and relevance: The three-body problem in entrepreneurship. J. Bus. Ventur. Insights 2018, 9, 87–91. [Google Scholar] [CrossRef]

- Blei, D. Probabilistic Topic Models. Commun. ACM 2012, 55, 77–84. [Google Scholar] [CrossRef]

- Alghamdi, R.; Alfalqi, K. A survey of topic modeling in text mining. International J. Adv. Comput. Sci. Appl. (IJACSA) 2015, 6, 147–153. [Google Scholar] [CrossRef]

- Hannigan, T.; Haans, R.; Vakili, K.; Tchalian, H.; Glaser, V.; Wang, M.; Kaplan, S.; Jennings, P. Topic Modeling in Management Research: Rendering New Theory from Textual Data. Acad. Manag. Ann. 2019, 13, 586–632. [Google Scholar] [CrossRef]

- Lu, Q.; Chesbrough, H. Measuring open innovation practices through topic modelling: Revisiting their impact on firm financial performance. Technovation 2022, 114, 102434. [Google Scholar] [CrossRef]

- Thakral, P.; Sharma, D.; Ghosh, K. Evidence-based knowledge management: A topic modeling analysis of research on knowledge management and analytics. VINE J. Inf. Knowl. Manag. Syst. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Makadok, R.; Burton, R.; Barney, J. A practical guide for making theory contributions in strategic management. Strateg. Manag. J. 2018, 39, 1530–1545. [Google Scholar] [CrossRef]

- Mishra, A.; Pani, A. Business value appropriation roadmap for artificial intelligence. VINE J. Inf. Knowl. Manag. Syst. 2020, 51, 2059–5891. [Google Scholar] [CrossRef]

- Davenport, T.; Ronanki, R. Artificial Intelligence for the Real World. Harv. Bus. Rev. 2018, 108–116. [Google Scholar]

- Majhi, S.G.; Mukherjee, A.; Anand, A. Business value of cognitive analytics technology: A dynamic capabilities perspective. VINE J. Inf. Knowl. Manag. Syst. 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Teece, D. Explicating dynamic capabilities: The nature and micro foundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Nenonen, S.; Storbacka, K.; Windahl, C. Capabilities for market-shaping: Triggering and facilitating increased value creation. J. Acad. Mark. Sci. 2019, 47, 617–639. [Google Scholar] [CrossRef]

- Berman, S.; Dalzell-Payne, P. The Interaction of Strategy and Technology in an Era of Business Re-Invention. Strategy Leadersh. 2018, 46, 10–15. [Google Scholar] [CrossRef]

- Huang, M.-H.; Rust, R. Engaged to a Robot? The Role of AI in Service. J. Serv. Res. 2021, 24, 30–41. [Google Scholar] [CrossRef]

- Paschen, J.; Wilson, M.; Ferreira, J. Collaborative intelligence: How human and artificial intelligence create value along the B2B sales funnel. Bus. Horiz. 2020, 63, 403–414. [Google Scholar] [CrossRef]

- Güngör, H. Creating Value with Artificial Intelligence: A Multi-stakeholder Perspective. J. Creat. Value 2020, 6, 72–85. [Google Scholar] [CrossRef]

- Zawadzki, J. Introducing the AI Project Canvas. Medium. 2020. Available online: https://towardsdatascience.com/introducing-the-ai-project-canvas-e88e29eb7024 (accessed on 6 April 2024).

- Kerznel, U. Enterprise AI Canvas Integrating Artificial Intelligence into Business. Appl. Artif. Intell. 2021, 35, 1–12. Available online: https://arxiv.org/pdf/2009.11190.pdf (accessed on 6 April 2024). [CrossRef]

- Anderson, J.; Narus, J.; Van Rossum, W. Customer VPs in business markets. Harv. Bus. Rev. 2006, 84, 91–99. [Google Scholar]

- Frow, P.; Payne, A. A stakeholder perspective of the value proposition concept. Eur. J. Mark. 2011, 45, 223–240. [Google Scholar] [CrossRef]

- Payne, A.; Frow, P.; Steinhoff, L.; Eggert, A. Toward a comprehensive framework of value proposition development: From strategy to implementation. Ind. Mark. Manag. 2020, 87, 244–255. [Google Scholar] [CrossRef]

- Lanning, M. Delivering Profitable Value: A Revolutionary Framework to Accelerate Growth, Generate Wealth, and Rediscover the Heart of Business; Perseus Press: Cambridge, MA, USA, 2000. [Google Scholar]

- Webster, F. Market-Driven Management: How to Define, Develop and Deliver Customer Value, 2nd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2002. [Google Scholar]

- Ballantyne, D.; Frow, P.; Varey, R.; Payne, A. VPs as communication practice: Taking a wider view. Ind. Mark. Manag. 2011, 40, 202–210. [Google Scholar] [CrossRef]

- Eggert, A.; Ulaga, W.; Frow, P.; Payne, A. Conceptualizing and communicating value in business markets: From value in exchange to value in use. Ind. Mark. Manag. 2018, 69, 80–90. [Google Scholar] [CrossRef]

- Kothandaraman, P.; Wilson, D. The future of competition: Value-creating networks. Ind. Mark. Manag. 2001, 30, 379–389. [Google Scholar] [CrossRef]

- Lanning, M.; Michaels, E. A business is a value delivery system. McKinsey Staff Pap. 1988, 41, 1–16. [Google Scholar]

- Wouters, M.; Anderson, J.; Kirchberger, M. New-Technology Startups Seeking Pilot Customers: Crafting a Pair of VPs. Calif. Manag. Rev. 2018, 60, 101–124. [Google Scholar] [CrossRef]

- Holttinen, H. Contextualizing value propositions: Examining how consumers experience value propositions in their practices. Australas. Mark. J. 2014, 22, 103–110. [Google Scholar] [CrossRef]

- Bocken, N.; Snihur, Y. Lean Startup and the business model: Experimenting for novelty and impact. Long Range Plan. 2020, 53, 101953. [Google Scholar] [CrossRef]

- Schepis, D. How innovation intermediaries support start-up internationalization: A relational proximity perspective. J. Bus. Ind. Mark. 2020, 36, 2062–2073. [Google Scholar] [CrossRef]

- Grönroos, C. A service perspective on business relationships: The value creation, interaction and marketing interface. Ind. Mark. Manag. 2011, 40, 240–247. [Google Scholar] [CrossRef]

- Skålén, P.; Gummerus, J.; von Koskull, C.; Magnusson, P. Exploring value propositions and service innovation: A service-dominant logic study. J. Acad. Mark. Sci. 2015, 43, 137–158. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R.; Massa, L. The Business Model: Recent Developments and Future Research. J. Manag. 2011, 37, 1019–1042. [Google Scholar]

- Zhang, J.; Lichtenstein, Y.; Gander, J. Designing scalable digital business model. Business models and modelling. Adv. Strateg. Manag. 2015, 33, 241–277. [Google Scholar]

- Shepherd, D.; Souitaris, V.; Gruber, M. Creating New Ventures: A Review and Research Agenda. J. Manag. 2020, 47, 11–42. [Google Scholar] [CrossRef]

- Rydehell, H.; Löfsten, H.; Isaksson, A. Novelty-oriented value propositions for new technology-based companies: Impact of business networks and growth orientation. J. High Technol. Manag. Res. 2018, 29, 161–171. [Google Scholar] [CrossRef]

- Malnight, T.; Buche, I.; Dhanaraj, C. Put Purpose at the CORE of Your Strategy. Harv. Bus. Rev. 2019, 97, 70–78. [Google Scholar]

- Kier, A.; McMullen, J. Entrepreneurial imaginativeness in new venture ideation. Acad. Manag. J. 2018, 61, 2265–2295. [Google Scholar] [CrossRef]

- Eisenmann, T.R. Entrepreneurship: A working definition. Harv. Bus. Rev. 2013, 1–3. [Google Scholar]

- Casali, G.; Perano, M.; Presenza, A.; Abbate, T. Does innovation propensity influence wineries’ distribution channel decisions? Int. J. Wine Bus. Res. 2018, 30, 446–462. [Google Scholar] [CrossRef]

- Kollmann, T.; Stöckmann, C.; Kensbock, J.M. Fear of failure as a mediator of the relationship between obstacles and nascent entrepreneurial activity—An experimental approach. J. Bus. Ventur. 2017, 32, 280–301. [Google Scholar] [CrossRef]

- Adner, R. Ecosystem as structure: An actionable construct for strategy. J. Manag. 2017, 43, 39–58. [Google Scholar] [CrossRef]

- Dattée, B.; Alexy, O.; Autio, E. Maneuvering in Poor Visibility: How Firms Play the Ecosystem Game when Uncertainty is High. Acad. Manag. J. 2018, 61, 466–498. [Google Scholar] [CrossRef]

- Akemu, O.; Whiteman, G.; Kennedy, S. Social enterprise emergence from social movement activism: The Fairphone case. J. Manag. Stud. 2016, 53, 846–877. [Google Scholar] [CrossRef]

- Jacobides, M.G.; Cennamo, C.; Gawer, A. Towards a theory of ecosystems. Strateg. Manag. J. 2018, 39, 2255–2276. [Google Scholar] [CrossRef]

- Bailetti, T.; Tanev, S. Examining the Relationship between Value Propositions and Scaling Value for New Companies. Technol. Innov. Manag. Rev. 2020, 10, 5–13. [Google Scholar] [CrossRef]

- Tanev, S.; Bailetti, T.; Keen, C.; Hudson, D. The Potential of AI to Enhance the Value Propositions of New Companies Committed to Scale Early and Rapidly. In Artificial Intelligence and Innovation Management; Series on Technology Management; Tanev, S., Blackbright, H., Eds.; World Scientific: Singapore, 2022. [Google Scholar] [CrossRef]

- Frow, P.; McColl-Kennedy, J.; Hilton, T.; Davidson, A.; Payne, A.; Brozovic, D. Value propositions: A service ecosystems perspective. Mark. Theory 2014, 14, 327–351. [Google Scholar] [CrossRef]

- Kristensen, H.S.; Remmen, A. A framework for sustainable value propositions in product-service systems. J. Clean. Prod. 2019, 223, 25–35. [Google Scholar] [CrossRef]

- Mishra, S.; Ewing, M.T.; Pitt, L.F. The effects of an articulated customer value proposition (CVP) on promotional expense, brand investment and firm performance in B2B markets: A text based analysis. Ind. Mark. Manag. 2019, 87, 264–275. [Google Scholar] [CrossRef]

- Truong, Y.; Simmons, G.; Palmer, M. Reciprocal value propositions in practice: Constraints in digital markets. Ind. Mark. Manag. 2012, 41, 197–206. [Google Scholar] [CrossRef]

- Boyd-Graber, J.; Mimno, D.; Newman, D. Care and Feeding of Topic Models: Problems, Diagnostics, and Improvements. In Handbook of Mixed Membership Models and Its Applications; Airoldi, E.M., Blei, D., Erosheva, E., Fienberg, S., Eds.; Chapman and Hall/CRC: New York, NY, USA, 2014; pp. 225–254. [Google Scholar]

- Anandarajan, M.; Hill, C.; Nolan, T. Chapter 6. Semantic Space Representation and Latent Semantic Analysis. In Practical Text Analytics: Maximizing the Value of Text Data; Springer: New York, NY, USA, 2019; pp. 77–92. [Google Scholar]

- Shepherd, D.; Gruber, M. The Lean Startup Framework: Closing the Academic–Practitioner Divide. Entrep. Theory Pract. 2021, 45, 967–998. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |