Current Status and Economic Prospects of Alternative Protein Sources for the Food Industry

Abstract

:1. Introduction

2. Alternative Protein Sources

2.1. Plant-Based

2.2. Algae

2.3. Edible Insects

2.4. Cultured (Cell-Based) Protein

2.5. Fungi

3. Economic Potential and Market Perspectives of Alternative Protein

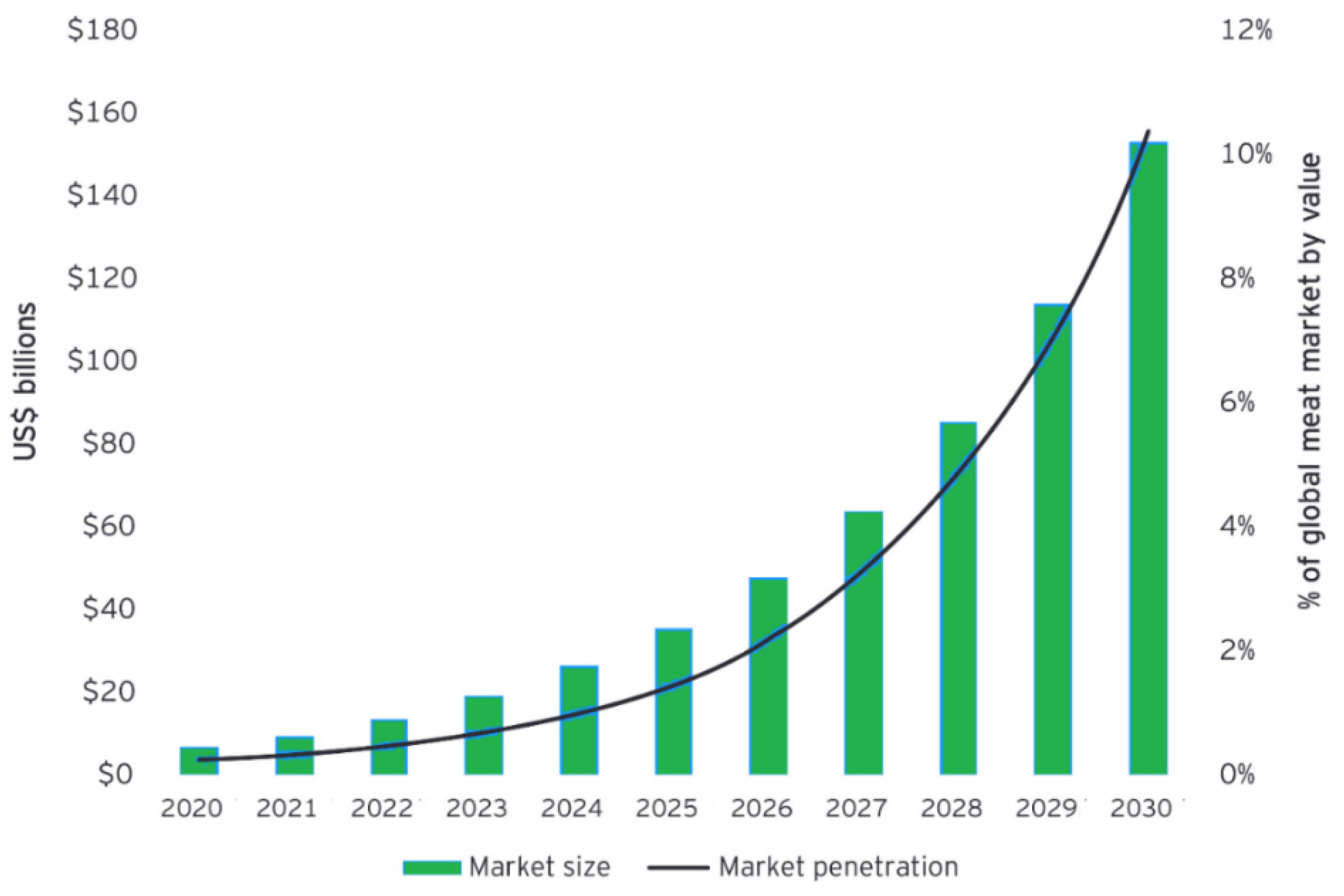

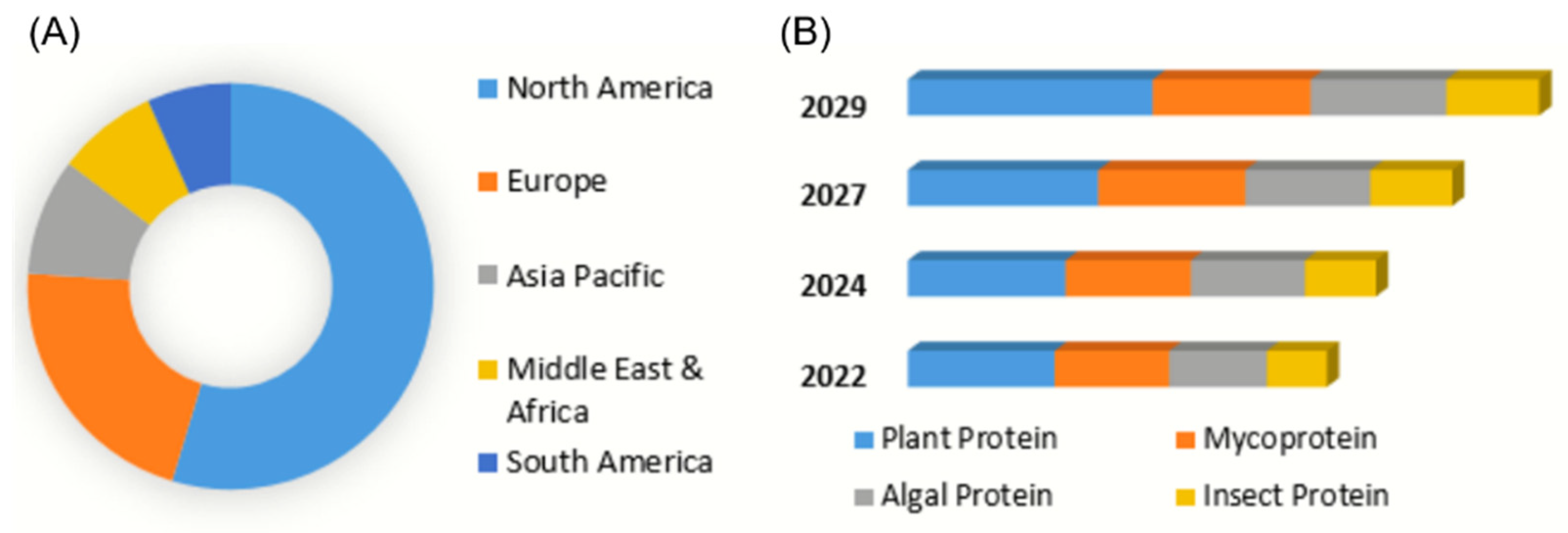

3.1. Global Market

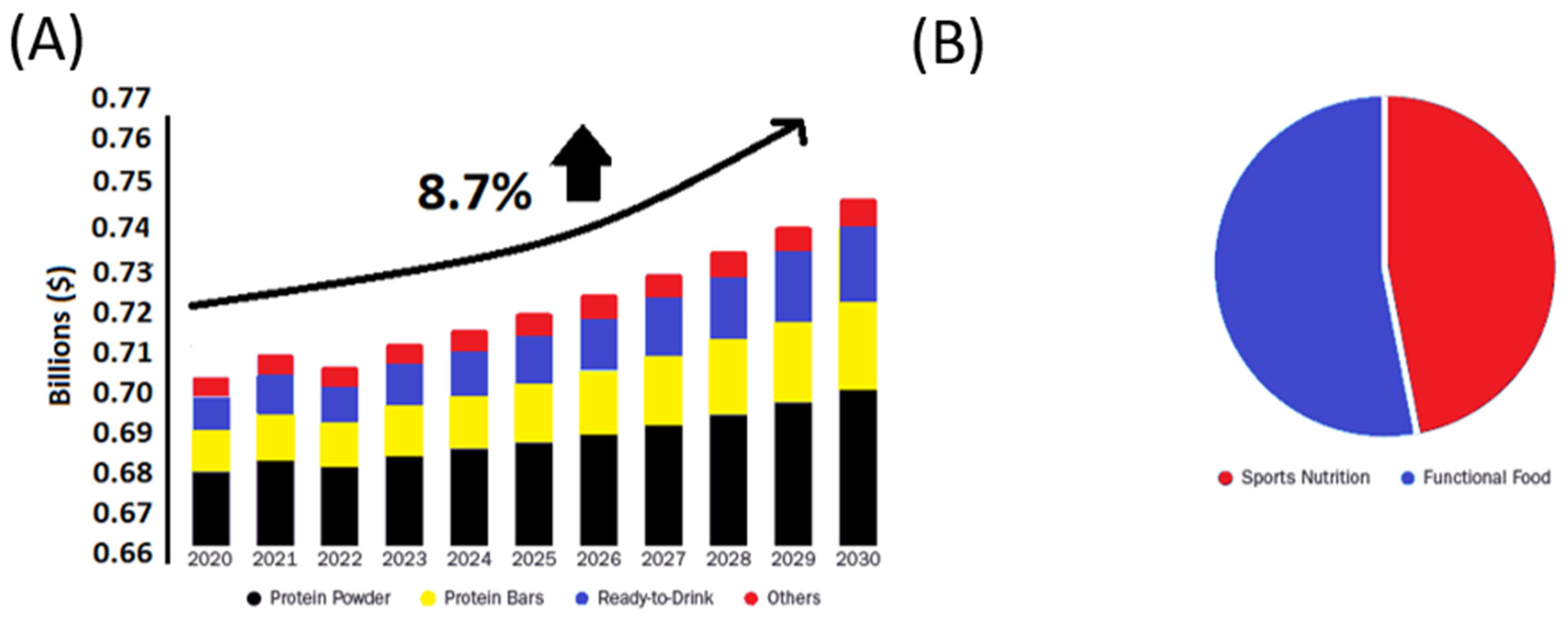

3.2. Plant-Based Protein

3.3. Insect Protein

3.4. Cultured Meats

3.5. Fungi Proteins

4. Conclusions and Outlook

Funding

Conflicts of Interest

References

- Aiking, H.; de Boer, J. The next protein transition. Trends Food Sci. Technol. 2020, 105, 515–522. [Google Scholar] [CrossRef] [PubMed]

- Deprá, M.C.; Dias, R.R.; Sartori, R.B.; de Menezes, C.R.; Zepka, L.Q.; Jacob-Lopes, E. Nexus on animal proteins and the climate change: The plant-based proteins are part of the solution? Food Bioprod. Process. 2022, 133, 119–131. [Google Scholar] [CrossRef]

- Shabir, I.; Dash, K.K.; Dar, A.H.; Pandey, V.K.; Fayaz, U.; Srivastava, S.R.N. Carbon footprints evaluation for sustainable food processing system development: A comprehensive review. Future Foods 2023, 7, 100215. [Google Scholar] [CrossRef]

- Amato, M.; Riverso, R.; Palmieri, R.; Verneau, F.; La Barbera, F. Stakeholder Beliefs about Alternative Proteins: A Systematic Review. Nutrients 2023, 15, 837. [Google Scholar] [CrossRef] [PubMed]

- Cucurachi, S.; Scherer, L.; Guinée, J.; Tukker, A. Life Cycle Assessment of Food Systems. In One Earth; Cell Press: Cambridge, MA, USA, 2019; Volume 1, pp. 292–297. [Google Scholar] [CrossRef]

- UN. Global Sustainable Development Report 2023. 2023. Available online: https://sdgs.un.org/gsdr/gsdr2023 (accessed on 11 July 2023).

- Hemler, E.C.; Hu, F.B. Plant-Based Diets for Cardiovascular Disease Prevention: All Plant Foods Are Not Created Equal. Curr. Atheroscler. Rep. 2019, 21, 18. [Google Scholar] [CrossRef] [PubMed]

- Grahl, S.; Strack, M.; Mensching, A.; Mörlein, D. Alternative protein sources in Western diets: Food product development and consumer acceptance of spirulina-filled pasta. Food Qual. Prefer. 2020, 84, 103933. [Google Scholar] [CrossRef]

- UN. The 17 Goals. Sustainable Development. Available online: https://sdgs.un.org/goals (accessed on 11 July 2023).

- Bashi, Z.; Mccullough, R.; Ong, L.; Ramirez, M. Alternative Proteins: The Race for Market Share Is on. 2019. Available online: https://www.mckinsey.com/industries/agriculture/our-insights/alternative-proteins-the-race-for-market-share-is-on (accessed on 12 July 2023).

- Grossmann, L.; Weiss, J. Alternative Protein Sources as Technofunctional Food Ingredients. Annu. Rev. Food Sci. Technol. 2021, 12, 93–117. [Google Scholar] [CrossRef] [PubMed]

- Kent, G.; Kehoe, L.; Flynn, A.; Walton, J. Plant-based diets: A review of the definitions and nutritional role in the adult diet. Proc. Nutr. Soc. 2022, 81, 62–74. [Google Scholar] [CrossRef] [PubMed]

- Talwar, R.; Freymond, M.; Beesabathuni, K.; Lingala, S. Current and Future Market Opportunities for Alternative Proteins in Low- and Middle-Income Countries. Curr. Dev. Nutr. 2024, 8, 102035. [Google Scholar] [CrossRef]

- EY Parthenon Analysis. Protein Reimagined. 2021. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_us/topics/food/ey-alternative-proteins-by-ey.pdf?download (accessed on 4 November 2023).

- Lähteenmäki-Uutela, A.; Rahikainen, M.; Lonkila, A.; Yang, B. Alternative proteins and EU food law. Food Control 2021, 130, 108336. [Google Scholar] [CrossRef]

- Balfany, C.; Gutierrez, J.; Moncada, M.; Komarnytsky, S. Current Status and Nutritional Value of Green Leaf Protein. Nutrients 2023, 15, 1327. [Google Scholar] [CrossRef] [PubMed]

- Siegrist, M.; Hartmann, C. Why alternative proteins will not disrupt the meat industry. Meat Sci. 2023, 203, 109223. [Google Scholar] [CrossRef] [PubMed]

- Wood, P.; Tavan, M. A review of the alternative protein industry. Curr. Opin. Food Sci. 2022, 47, 100869. [Google Scholar] [CrossRef]

- Malek, L.; Umberger, W.J. Protein source matters: Understanding consumer segments with distinct preferences for alternative proteins. Future Foods 2023, 7, 100220. [Google Scholar] [CrossRef]

- Mancini, M.C.; Antonioli, F. Exploring consumers’ attitude towards cultured meat in Italy. Meat Sci. 2019, 150, 101–110. [Google Scholar] [CrossRef]

- Gomes, A.; Sobral, P.J.D.A. Plant protein-based delivery systems: An emerging approach for increasing the efficacy of lipophilic bioactive compounds. Molecules 2022, 27, 60. [Google Scholar] [CrossRef]

- Nicholson, A. (Ed.) Alternative Protein Sources; National Academies Press: Washington, DC, USA, 2022. [Google Scholar] [CrossRef]

- Roser, M.; Ritchie, H.; Rosado, P. Food Supply. Available online: https://ourworldindata.org/food-supply (accessed on 11 July 2023).

- Maestri, E.; Marmiroli, M.; Marmiroli, N. Bioactive peptides in plant-derived foodstuffs. J. Proteom. 2016, 147, 140–155. [Google Scholar] [CrossRef] [PubMed]

- Mariotti, F.; Gardner, C.D. Dietary protein and amino acids in vegetarian diets—A review. Nutrients 2019, 11, 2661. [Google Scholar] [CrossRef] [PubMed]

- McCusker, S.; Buff, P.R.; Yu, Z.; Fascetti, A.J. Amino acid content of selected plant, algae and insect species: A search for alternative protein sources for use in pet foods. J. Nutr. Sci. 2014, 3, e39. [Google Scholar] [CrossRef]

- Jiménez-Munoz, L.M.; Tavares, G.M.; Corredig, M. Design future foods using plant protein blends for best nutritional and technological functionality. Trends Food Sci. Technol. 2021, 113, 139–150. [Google Scholar] [CrossRef]

- Samarakoon, K.; Jeon, Y.J. Bio-functionalities of proteins derived from marine algae—A review. Food Res. Int. 2012, 48, 948–960. [Google Scholar] [CrossRef]

- Singh, B.P.; Vij, S.; Hati, S. Functional significance of bioactive peptides derived from soybean. Peptides 2014, 54, 171–179. [Google Scholar] [CrossRef] [PubMed]

- Ma, K.K.; Greis, M.; Lu, J.; Nolden, A.A.; McClements, D.J.; Kinchla, A.J. Functional Performance of Plant Proteins. Foods 2022, 11, 594. [Google Scholar] [CrossRef] [PubMed]

- Akharume, F.U.; Aluko, R.E.; Adedeji, A.A. Modification of plant proteins for improved functionality: A review. In Comprehensive Reviews in Food Science and Food Safety; Blackwell Publishing Inc.: Hoboken, NJ, USA, 2021; Volume 20, pp. 198–224. [Google Scholar] [CrossRef]

- Pérez-Vila, S.; Fenelon, M.A.; O’Mahony, J.A.; Gómez-Mascaraque, L.G. Extraction of plant protein from green leaves: Biomass composition and processing considerations. Food Hydrocoll. 2022, 133, 107902. [Google Scholar] [CrossRef]

- Adámek, M.; Adámková, A.; Mlček, J.; Borkovcová, M.; Bednářová, M. Acceptability and sensory evaluation of energy bars and protein bars enriched with edible insect. Potravin. Slovak J. Food Sci. 2018, 12, 431–437. [Google Scholar] [CrossRef] [PubMed]

- Aimutis, W.R. Plant-Based Proteins: The Good, Bad, and Ugly. Annu. Rev. Food Sci. Technol. 2022, 13, 1–17. [Google Scholar] [CrossRef]

- Aschemann-Witzel, J.; Gantriis, R.F.; Fraga, P.; Perez-Cueto, F.J.A. Plant-based food and protein trend from a business perspective: Markets, consumers, and the challenges and opportunities in the future. In Critical Reviews in Food Science and Nutrition; Taylor and Francis Inc.: Abingdon, UK, 2020; pp. 1–10. [Google Scholar] [CrossRef]

- Gkarane, V.; Ciulu, M.; Altmann, B.A.; Schmitt, A.O.; Mörlein, D. The effect of algae or insect supplementation as alternative protein sources on the volatile profile of chicken meat. Foods 2020, 9, 1235. [Google Scholar] [CrossRef] [PubMed]

- Thiviya, P.; Gamage, A.; Gama-Arachchige, N.S.; Merah, O.; Madhujith, T. Seaweeds as a Source of Functional Proteins. Phycology 2022, 2, 216–243. [Google Scholar] [CrossRef]

- Birch, D.; Skallerud, K.; Paul, N.A. Who are the future seaweed consumers in a Western society? Insights from Australia. Br. Food J. 2019, 121, 603–615. [Google Scholar] [CrossRef]

- Rawiwan, P.; Peng, Y.; Paramayuda, I.G.P.B.; Quek, S.Y. Red seaweed: A promising alternative protein source for global food sustainability. Trends Food Sci. Technol. 2022, 123, 37–56. [Google Scholar] [CrossRef]

- FAO. Food Balance Sheet; FAO: New York, NY, USA, 2023. [Google Scholar]

- Lucakova, S.; Branyikova, I.; Hayes, M. Microalgal Proteins and Bioactives for Food, Feed, and Other Applications. Appl. Sci. 2022, 12, 4402. [Google Scholar] [CrossRef]

- Wang, Y.; Tibbetts, S.M.; McGinn, P.J. Microalgae as sources of high-quality protein for human food and protein supplements. Foods 2021, 10, 3002. [Google Scholar] [CrossRef] [PubMed]

- Eilam, Y.; Khattib, H.; Pintel, N.; Avni, D. Microalgae—Sustainable Source for Alternative Proteins and Functional Ingredients Promoting Gut and Liver Health. In Global Challenges; John Wiley and Sons Inc.: Hoboken, NJ, USA, 2023; Volume 7. [Google Scholar] [CrossRef]

- De Bhowmick, G.; Hayes, M. In Vitro Protein Digestibility of Selected Seaweeds. Foods 2022, 11, 289. [Google Scholar] [CrossRef] [PubMed]

- López-Pedrouso, M.; Lorenzo, J.M.; Cantalapiedra, J.; Zapata, C.; Franco, J.M.; Franco, D. Aquaculture and by-products: Challenges and opportunities in the use of alternative protein sources and bioactive compounds. Adv. Food Nutr. Res. 2020, 92, 127–185. [Google Scholar] [CrossRef] [PubMed]

- Fidelis e Moura, M.A.; de Almeida Martins, B.; de Oliveira, G.P.; Takahashi, J.A. Alternative protein sources of plant, algal, fungal and insect origins for dietary diversification in search of nutrition and health. In Critical Reviews in Food Science and Nutrition; Taylor and Francis Ltd.: Abingdon, UK, 2022. [Google Scholar] [CrossRef]

- Bleakley, S.; Hayes, M. Algal proteins: Extraction, application, and challenges concerning production. Foods 2017, 6, 33. [Google Scholar] [CrossRef] [PubMed]

- Gómez, B.; Munekata, P.E.S.; Zhu, Z.; Barba, F.J.; Toldrá, F.; Putnik, P.; Bursać Kovačević, D.; Lorenzo, J.M. Challenges and opportunities regarding the use of alternative protein sources: Aquaculture and insects. Adv. Food Nutr. Res. 2019, 89, 259–295. [Google Scholar] [CrossRef] [PubMed]

- Strauch, R.C.; Lila, M.A. Pea protein isolate characteristics modulate functional properties of pea protein–cranberry polyphenol particles. Food Sci. Nutr. 2021, 9, 3740–3751. [Google Scholar] [CrossRef] [PubMed]

- De Castro, R.J.S.; Ohara, A.; Aguilar, J.G.D.S.; Domingues, M.A.F. Nutritional, functional and biological properties of insect proteins: Processes for obtaining, consumption and future challenges. Trends Food Sci. Technol. 2018, 76, 82–89. [Google Scholar] [CrossRef]

- Chéreau, D.; Pauline, V.; Ruffieux, C.; Pichon, L.; Motte, J.-C.; Belaid, S.; Ventureira, J.; Lopez, M. Combination of existing and alternative technologies to promote oilseeds and pulses proteins in food applications. OCL 2016, 41, 11. [Google Scholar] [CrossRef]

- Yi, L.; Lakemond, C.M.M.; Sagis, L.M.C.; Eisner-Schadler, V.; van Huis, A.; van Boekel, M.A.J.S. Extraction and characterisation of protein fractions from five insect species. Food Chem. 2013, 141, 3341–3348. [Google Scholar] [CrossRef]

- Mishyna, M.; Keppler, J.K.; Chen, J. Techno-functional properties of edible insect proteins and effects of processing. Curr. Opin. Colloid Interface Sci. 2021, 56, 101508. [Google Scholar] [CrossRef]

- WHO. Joint FAO/WHO/UNU Expert Consultation on Protein and Amino Acid Requirements in Human Nutrition (2002: Geneva, Switzerland). In Protein and Amino Acid Requirements in Human Nutrition: Report of a Joint FAO/WHO/UNU Expert Consultation; Food and Agriculture Organization of the United Nations, World Health Organization & United Nations University: New York, NY, USA, 2007; Available online: https://iris.who.int/handle/10665/43411 (accessed on 28 June 2023).

- Verkerk, M.C.; Tramper, J.; van Trijp, J.C.M.; Martens, D.E. Insect cells for human food. Biotechnol. Adv. 2007, 25, 198–202. [Google Scholar] [CrossRef]

- Huang, C.; Feng, W.; Xiong, J.; Wang, T.; Wang, W.; Wang, C.; Yang, F. Impact of drying method on the nutritional value of the edible insect protein from black soldier fly (Hermetia illucens L.) larvae: Amino acid composition, nutritional value evaluation, in vitro digestibility, and thermal properties. Eur. Food Res. Technol. 2019, 245, 11–21. [Google Scholar] [CrossRef]

- Liang, Z.; Zhu, Y.; Leonard, W.; Fang, Z. Recent advances in edible insect processing technologies. Food Res. Int. 2024, 182, 114137. [Google Scholar] [CrossRef]

- Laroche, M.; Perreault, V.; Marciniak, A.; Gravel, A.; Chamberland, J.; Doyen, A. Comparison of conventional and sustainable lipid extraction methods for the production of oil and protein isolate from edible insect meal. Foods 2019, 8, 572. [Google Scholar] [CrossRef] [PubMed]

- Singh, Y.; Cullere, M.; Kovitvadhi, A.; Chundang, P.; Dalle Zotte, A. Effect of different killing methods on physicochemical traits, nutritional characteristics, in vitro human digestibility and oxidative stability during storage of the house cricket (Acheta domesticus L.). Innov. Food Sci. Emerg. Technol. 2020, 65, 102444. [Google Scholar] [CrossRef]

- Yongkang, Z.; Chundang, P.; Zhang, Y.; Wang, M.; Vongsangnak, W.; Pruksakorn, C.; Kovitvadhi, A. Impacts of killing process on the nutrient content, product stability and in vitro digestibility of black soldier fly (Hermetia illucens) larvae meals. Appl. Sci. 2020, 10, 6099. [Google Scholar] [CrossRef]

- Queiroz, L.S.; Nogueira Silva, N.F.; Jessen, F.; Mohammadifar, M.A.; Stephani, R.; Fernandes de Carvalho, A.; Perrone, Í.T.; Casanova, F. Edible insect as an alternative protein source: A review on the chemistry and functionalities of proteins under different processing methods. Heliyon 2023, 9, e14831. [Google Scholar] [CrossRef]

- Mishyna, M.; Martinez, J.-J.I.; Chen, J.; Benjamin, O. Extraction, characterization and functional properties of soluble proteins from edible grasshopper (Schistocerca gregaria) and honey bee (Apis mellifera). Food Res. Int. 2019, 116, 697–706. [Google Scholar] [CrossRef]

- Alhujaili, A.; Nocella, G.; Macready, A. Insects as Food: Consumers’ Acceptance and Marketing. Foods 2023, 12, 886. [Google Scholar] [CrossRef]

- Caparros Megido, R.; Gierts, C.; Blecker, C.; Brostaux, Y.; Haubruge, É.; Alabi, T.; Francis, F. Consumer acceptance of insect-based alternative meat products in Western countries. Food Qual. Prefer. 2016, 52, 237–243. [Google Scholar] [CrossRef]

- Kim, T.-K.; Cha, J.Y.; Yong, H.I.; Jang, H.W.; Jung, S.; Choi, Y.-S. Application of Edible Insects as Novel Protein Sources and Strategies for Improving Their Processing. Food Sci. Anim. Resour. 2022, 42, 372. [Google Scholar] [CrossRef] [PubMed]

- Wendin, K.; Olsson, V.; Langton, M. Mealworms as Food Ingredient—Sensory Investigation of a Model System. Foods 2019, 8, 319. [Google Scholar] [CrossRef] [PubMed]

- Biró, B.; Sipos, M.A.; Kovács, A.; Badak-Kerti, K.; Pásztor-Huszár, K.; Gere, A. Cricket-Enriched Oat Biscuit: Technological Analysis and Sensory Evaluation. Foods 2020, 9, 1561. [Google Scholar] [CrossRef] [PubMed]

- Lone, A.B.; Bhat, H.F.; Aït-Kaddour, A.; Hassoun, A.; Aadil, R.M.; Dar, B.N.; Bhat, Z.F. Cricket protein hydrolysates pre-processed with ultrasonication and microwave improved storage stability of goat meat emulsion. Innov. Food Sci. Emerg. Technol. 2023, 86, 103364. [Google Scholar] [CrossRef]

- Lone, A.B.; Bhat, H.F.; Kumar, S.; Manzoor, M.; Hassoun, A.; Aït-Kaddour, A.; Mungure, T.E.; Muhammad Aadil, R.; Bhat, Z.F. Improving microbial and lipid oxidative stability of cheddar cheese using cricket protein hydrolysates pre-treated with microwave and ultrasonication. Food Chem. 2023, 423, 136350. [Google Scholar] [CrossRef] [PubMed]

- Singh, R.; Dutt, S.; Sharma, P.; Sundramoorthy, A.K.; Dubey, A.; Singh, A.; Arya, S. Future of Nanotechnology in Food Industry: Challenges in Processing, Packaging, and Food Safety. Glob. Chall. 2023, 7, 2200209. [Google Scholar] [CrossRef]

- Hadi, J.; Brightwell, G. Safety of alternative proteins: Technological, environmental and regulatory aspects of cultured meat, plant-based meat, insect protein and single-cell protein. Foods 2021, 10, 1226. [Google Scholar] [CrossRef]

- Chriki, S.; Hocquette, J.-F. The Myth of Cultured Meat: A Review. Front. Nutr. 2020, 7, 507645. [Google Scholar] [CrossRef]

- Specht, L. An Analysis of Culture Medium Costs and Production Volumes for Cultivated Meat. 2020. Available online: https://gfi.org/wp-content/uploads/2021/01/clean-meat-production-volume-and-medium-cost.pdf (accessed on 20 October 2023).

- Post, M.J. An alternative animal protein source: Cultured beef. Ann. N. Y. Acad. Sci. 2014, 1328, 29–33. [Google Scholar] [CrossRef]

- Bogliotti, Y.S.; Wu, J.; Vilarino, M.; Okamura, D.; Soto, D.A.; Zhong, C.; Sakurai, M.; Sampaio, R.V.; Suzuki, K.; Izpisua Belmonte, J.C.; et al. Efficient derivation of stable primed pluripotent embryonic stem cells from bovine blastocysts. Proc. Natl. Acad. Sci. USA 2018, 115, 2090–2095. [Google Scholar] [CrossRef] [PubMed]

- Post, M.J.; Levenberg, S.; Kaplan, D.L.; Genovese, N.; Fu, J.; Bryant, C.J.; Negowetti, N.; Verzijden, K.; Moutsatsou, P. Scientific, sustainability and regulatory challenges of cultured meat. Nat. Food 2020, 1, 403–415. [Google Scholar] [CrossRef]

- Bryant, C.; Barnett, J. Consumer acceptance of cultured meat: An updated review (2018–2020). Appl. Sci. 2020, 10, 5201. [Google Scholar] [CrossRef]

- Bryant, C.; Sanctorum, H. Alternative proteins, evolving attitudes: Comparing consumer attitudes to plant-based and cultured meat in Belgium in two consecutive years. Appetite 2021, 161, 105161. [Google Scholar] [CrossRef] [PubMed]

- Ben-Arye, T.; Levenberg, S. Tissue Engineering for Clean Meat Production. Front. Sustain. Food Syst. 2019, 3, 6033. [Google Scholar] [CrossRef]

- Onwezen, M.C.; Bouwman, E.P.; Reinders, M.J.; Dagevos, H. A systematic review on consumer acceptance of alternative proteins: Pulses, algae, insects, plant-based meat alternatives, and cultured meat. Appetite 2021, 159, 105058. [Google Scholar] [CrossRef] [PubMed]

- Hurrell, R.; Egli, I. Iron bioavailability and dietary reference values. Am. J. Clin. Nutr. 2010, 91, 1461S–1467S. [Google Scholar] [CrossRef] [PubMed]

- You, S.W.; Hoskin, R.T.; Komarnytsky, S.; Moncada, M. Mushrooms as Functional and Nutritious Food Ingredients for Multiple Applications. ACS Food Sci. Technol. 2022, 2, 1184–1195. [Google Scholar] [CrossRef]

- Okuda, Y. Sustainability perspectives for future continuity of mushroom production: The bright and dark sides. Front. Sustain. Food Syst. 2022, 6, 1026508. [Google Scholar] [CrossRef]

- El-Ramady, H.; Abdalla, N.; Badgar, K.; Llanaj, X.; Törős, G.; Hajdú, P.; Eid, Y.; Prokisch, J. Edible Mushrooms for Sustainable and Healthy Human Food: Nutritional and Medicinal Attributes. Sustainability 2022, 14, 4941. [Google Scholar] [CrossRef]

- Beghi, R.; Giovenzana, V.; Tugnolo, A.; Pessina, D.; Guidetti, R. Evaluation of energy requirements of an industrial scale plant for the cultivation of white button mushroom Agaricus bisporus. J. Agric. Eng. 2020, 51, 2. [Google Scholar] [CrossRef]

- Chiu, S.-W.; Law, S.-C.; Ching, M.-L.; Cheung, K.-W.; Chen, M.-J. Themes for mushroom exploitation in the 21st century: Sustainability, waste management, and conservation. J. Gen. Appl. Microbiol. 2000, 46, 269–282. [Google Scholar] [CrossRef] [PubMed]

- Kalač, P. A review of chemical composition and nutritional value of wild-growing and cultivated mushrooms: Chemical composition of edible mushrooms. J. Sci. Food Agric. 2013, 93, 209–218. [Google Scholar] [CrossRef] [PubMed]

- Goswami, B.; Majumdar, S.; Das, A.; Barui, A.; Bhowal, J. Evaluation of bioactive properties of Pleurotus ostreatus mushroom protein hydrolysate of different degree of hydrolysis. LWT 2021, 149, 111768. [Google Scholar] [CrossRef]

- Khongdetch, J.; Laohakunjit, N.; Kaprasob, R. King Boletus mushroom-derived bioactive protein hydrolysate: Characterisation, antioxidant, ACE inhibitory and cytotoxic activities. Int. J. Food Sci. Technol. 2022, 57, 1399–1410. [Google Scholar] [CrossRef]

- Bovi, M.; Cenci, L.; Perduca, M.; Capaldi, S.; Carrizo, M.E.; Civiero, L.; Chiarelli, L.R.; Galliano, M.; Monaco, H.L. BEL β-trefoil: A novel lectin with antineoplastic properties in king bolete (Boletus edulis) mushrooms. Glycobiology 2013, 23, 578–592. [Google Scholar] [CrossRef] [PubMed]

- De Mejía, E.G.; Prisecaru, V.I. Lectins as bioactive plant proteins: A potential in cancer treatment. Crit. Rev. Food Sci. Nutr. 2005, 45, 425–445. [Google Scholar] [CrossRef]

- Ditamo, Y.; Rupil, L.L.; Sendra, V.G.; Nores, G.A.; Roth, G.A.; Irazoqui, F.J. In vivo immunomodulatory effect of the lectin from edible mushroom Agaricus bisporus. Food Funct. 2016, 7, 262–269. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, D.; Chen, Y.; Liu, T.; Zhang, S.; Fan, H.; Liu, H.; Li, Y. Healthy function and high valued utilization of edible fungi. Food Sci. Hum. Wellness 2021, 10, 408–420. [Google Scholar] [CrossRef]

- Barzee, T.J.; Cao, L.; Pan, Z.; Zhang, R. Fungi for future foods. J. Future Foods 2021, 1, 25–37. [Google Scholar] [CrossRef]

- Petrovska, B.B. Protein Fraction in Edible Macedonian Mushrooms. Eur. Food Res. Technol. 2001, 212, 469–472. [Google Scholar] [CrossRef]

- Yang, J.; Kornet, R.; Diedericks, C.F.; Yang, Q.; Berton-Carabin, C.C.; Nikiforidis, C.V.; Venema, P.; van der Linden, E.; Sagis, L.M.C. Rethinking plant protein extraction: Albumin—From side stream to an excellent foaming ingredient. Food Struct. 2022, 31, 100254. [Google Scholar] [CrossRef]

- Research and Markets. United States Plant Based Food Market Forecast by Segments, Food Services, Merger and Acquisitions, Company Analysis. 2021. Available online: https://www.researchandmarkets.com/reports/5308265/united-states-plant-based-food-marketforecastby?utm_source=CI&utm_medium=PressRelease&utm_code=mvh8r2&utm_campaign=1519279+-+United+States+%2410.7+Billion+Plant+Based+Food+Market+to+2027&utm_exec=chdo54prd (accessed on 2 October 2023).

- Vegconomist. Global Alternative Proteins to Reach US$4.8 Bn by 2027, China & Mycoprotein as Key Drivers. 2021. Available online: https://vegconomist.com/studies-and-numbers/global-alternative-proteins-to-reach-us4-8-bn-by-2027-china-mycoprotein-as-key-drivers/ (accessed on 2 December 2023).

- Albrecht, C. GFI: $3.1 Billion Invested in Alternative Proteins in 2020, Tripling the Money Raised in 2019. 2021. Available online: https://thespoon.tech/gfi-3-1-billion-invested-in-alternative-proteins-in-2020-tripling-the-money-raised-in-2019/ (accessed on 20 January 2024).

- Maximize Market Research—MMR. Alternative Protein Market: Global Industry Analysis and Forecast (2023–2029). 2023. Available online: https://www.maximizemarketresearch.com/market-report/global-alternative-protein-market/52719/ (accessed on 17 November 2023).

- Knorr, D.; Augustin, M.A. The future of foods. Sustain. Food Technol. 2024, 2, 253–265. [Google Scholar] [CrossRef]

- Kearney, A.T. How Will Cultured Meat and Meat Alternatives Disrupt the Agricultural and Food Industry. Ind. Biotechnol. 2019, 16. [Google Scholar] [CrossRef]

- Grand View Research. Plant Based Protein Supplements Market Size, Share & Trends Analysis Report by Raw Material (Soy, Spirulina, Pumpkin Seed, Wheat, Hemp, Rice, Pea, Others), by Product, by Distribution Channel, by Application, by Region, and Segment Forecasts, 2024–2030. 2023. Available online: https://www.grandviewresearch.com/industry-analysis/plant-based-protein-supplements-market (accessed on 12 November 2023).

- The Good Food Institute—GFI. Plant-Based: The Business Case. The Good Food Institute, 2021B. GFI Investment Insights: Q3, 2021. 2021. Available online: https://gfi.org/ (accessed on 20 November 2023).

- Market Data Forecast. Global Insect Protein Market by Product (Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, Hemiptera, Diptera), Application (Food and Beverages, Personal Care and Cosmetics), and by Regional Analysis (North America, Europe, Asia Pacific, Latin America, andMiddle East & Africa)—Global Industry Analysis, Size, Share, Growth, Trends, and Forecast (2021–2026). 2021. Available online: https://www.marketdataforecast.com/market-reports/insect-protein-market (accessed on 16 November 2023).

- Barclays. The Future of Food. 2021. Available online: https://home.barclays/news/2021/05/the-future-of-food/ (accessed on 5 October 2023).

- Pitchbook. Emerging Space: Insect-Based Foods. 2021. Available online: https://pitchbook.com/blog/emerging-space-insect-based-foods (accessed on 22 November 2023).

- Market Research Future. Insect Protein Market Research Report: Information by Insect Type (Crickets, Mealworms, Grasshoppers, Ants, Bees, Termites, Black Soldier Fly, Silkworm, Houseflies, Cicadas, & Others), Application (Human & Animal Nutrition), & Region—Global Forecast Till 2027. 2021. Available online: https://www.marketresearchfuture.com/reports/insect-protein-market-6094 (accessed on 10 November 2023).

- Sogari, G.; Amato, M.; Palmieri, R.; Hadj Saadoun, J.; Formici, G.; Verneau, F.; Mancini, S. The future is crawling: Evaluating the potential of insects for food and feed security. Curr. Res. Food Sci. 2023, 6, 100504. [Google Scholar] [CrossRef] [PubMed]

- Rabb, M. Lab-Grown Protein Is Set to Disrupt the Meat Industry, Says an Expert. The Beet. Available online: https://thebeet.com/lab-grown-protein-is-set-to-disrupt-the-meat-industry-says-an-expert/ (accessed on 28 September 2023).

- Jefferies. The Great Protein Shake-Up? 2019. Available online: https://www.jefferies.com/CMSFiles/Jefferies.com/Files/Insights/The_Great_Protein_Shakeup.pdf (accessed on 20 October 2023).

- Poinski, M. From Science to Reality: What Approval of Cell-Based Meat Means for the Industry. Food Dive. 2021. Available online: https://www.fooddive.com/news/what-approval-of-cell-based-meat-means-forthe-ind/591762/ (accessed on 29 January 2024).

- Research and Markets. Fermented Plant-Based Alternatives Market—A Global and Regional Analysis: Focus on Applications, Products, Patent Analysis, and Country Analysis—Analysis and Forecast, 2019–2026. 2021. Available online: https://www.researchandmarkets.com/reports/5359984/fermented-plantbased-alternatives marketa?utm_source=GNOM&utm_medium=PressRelease&utm_code=ww64qg&utm_campaign=1570640+-+Insights+on+the+Fermented+Plant-Based+Alternatives+Global+Market+Focus+on+Applications %2c+Products %2c+Patent+Analysis%2c+and+Country+Analysis&utm_exec=jamu273prd (accessed on 19 September 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Medeiros, F.; Aleman, R.S.; Gabríny, L.; You, S.W.; Hoskin, R.T.; Moncada, M. Current Status and Economic Prospects of Alternative Protein Sources for the Food Industry. Appl. Sci. 2024, 14, 3733. https://doi.org/10.3390/app14093733

Medeiros F, Aleman RS, Gabríny L, You SW, Hoskin RT, Moncada M. Current Status and Economic Prospects of Alternative Protein Sources for the Food Industry. Applied Sciences. 2024; 14(9):3733. https://doi.org/10.3390/app14093733

Chicago/Turabian StyleMedeiros, Fábio, Ricardo S. Aleman, Lucia Gabríny, Seung Woon You, Roberta Targino Hoskin, and Marvin Moncada. 2024. "Current Status and Economic Prospects of Alternative Protein Sources for the Food Industry" Applied Sciences 14, no. 9: 3733. https://doi.org/10.3390/app14093733

APA StyleMedeiros, F., Aleman, R. S., Gabríny, L., You, S. W., Hoskin, R. T., & Moncada, M. (2024). Current Status and Economic Prospects of Alternative Protein Sources for the Food Industry. Applied Sciences, 14(9), 3733. https://doi.org/10.3390/app14093733