Energy Trading with Electric Vehicles in Smart Campus Parking Lots

Abstract

:1. Introduction

- A framework for energy trading with electric vehicles in smart parking lots is designed.

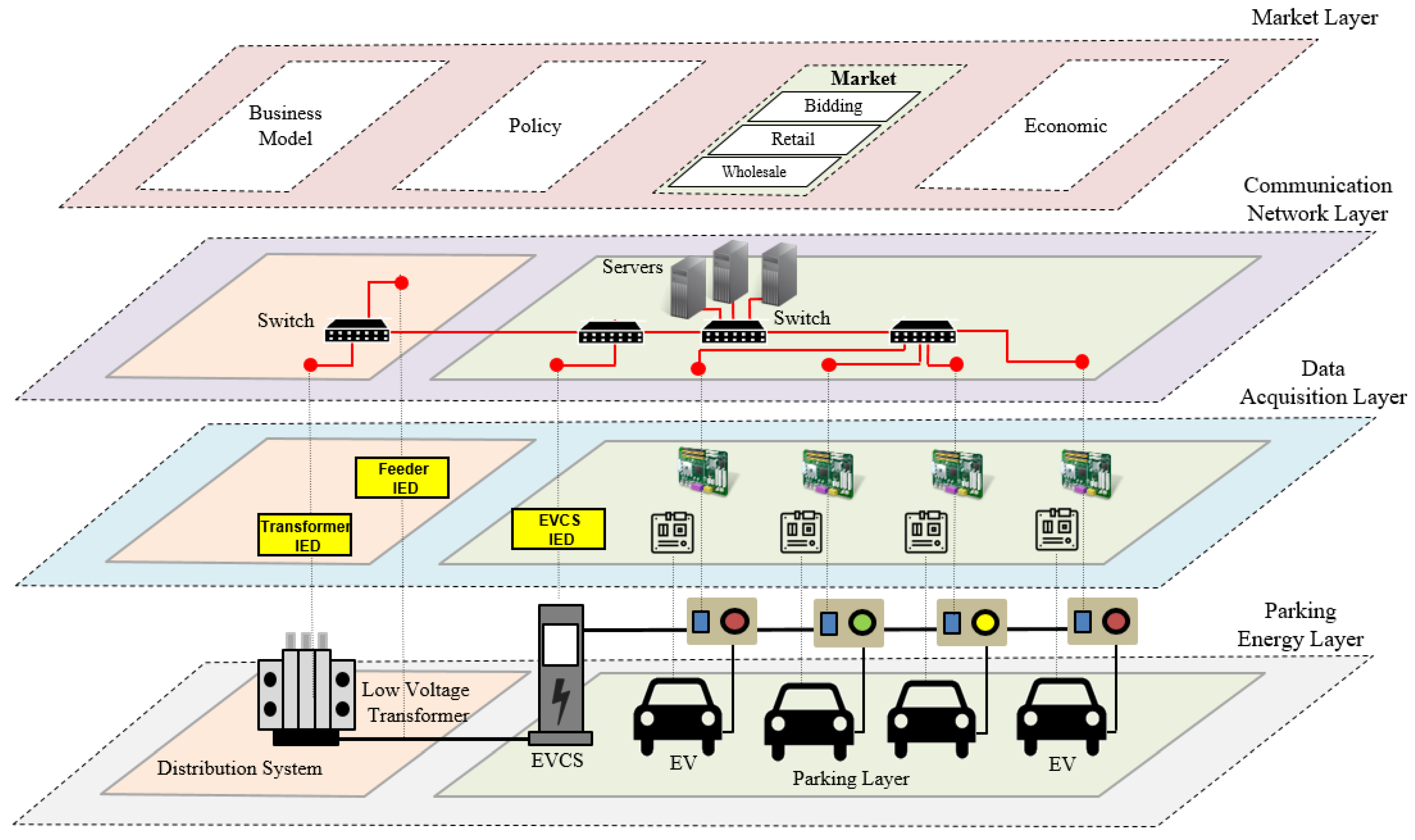

- A four-layered architecture for energy trading in smart parking lots is proposed. It consists of a parking energy layer, a data acquisition layer, a communication network layer, and a market layer.

- A market mechanism based on the Knapsack Algorithm is proposed to maximize the profit of the parking lot operator.

- A real case study with a realistic parking pattern of a parking lot on a university campus is considered.

2. Proposed System Architecture for Energy Trading in a Smart Parking Lot

2.1. Parking Energy Layer

2.2. Data Acquistion Layer

2.3. Communication Network Layer

2.4. Market Layer

3. Proposed Market Mechanism

- Seller electric vehicles (SEVs) denoted SEVi, i = 1, 2, …, N. SEVs have extra power and represent energy providers.

- Buyer electric vehicles (BEVs) denoted BEVj, j = 1, 2, …, K. BEVs demand power for charging and represent energy consumers.

- Idle electric vehicles (IEVs) do not participate in any energy trading activities.

| Buying amount of energy by BEVj at time t | |

| Buying price by BEVj at time t | |

| Allocation index for BEVj at time t | |

| Selling amount of energy by SEVi at time t | |

| Selling price by SEVi at time t | |

| Allocation index for SEVi at time t | |

| T | Number of auction time interval |

| N | Number of SEVs |

| K | Number of BEVs |

| RevenuePLCC,t | Total revenue earned by PLCC |

| COSTPLCC,t | Total cost paid by the PLCC |

| T | Number of scheduling intervals per day |

| RevenueSTG,t | Revenue earned by providing power from SEVs to the grid (selling to grid) |

| RevenueSTV,t | Revenue earned by supporting power to charging BEVs (selling to BEVs) |

| PSTG,t | Power sold to the grid in kW |

| pSTG,t | Electricity price in money unit per kWh |

| Δt | Length of scheduling interval |

| K | Number of BEVs |

| PSTV,i,t | Power used to charge BEVi in kW |

| pSTV,i,t | Electricity price in money unit per kWh |

| COSTBFG,t | Cost of energy purchased from the grid |

| COSTBFV,t | Cost of energy purchased from SEVs |

| PBFG,t | Power bought from the grid in kW |

| pBFG,t | Electricity price in money units per kWh |

| Δt | Length of scheduling interval |

| N | Number of SEVs |

| PBFV,i, | Discharge power from SEVi in kW |

| pBFV,i | Electricity price in money unit per kWh |

4. Simulation Results

4.1. Electric Vehicle Model

4.2. Standalone Parking Lot: Electric Vehicles as Sellers and the PLCC as a Buyer

| Algorithm 1. Market Mechanism for Discharging-Seller Vehicles (SEVs) |

| Input:W—Peak Demand, SA—Selling Amount, SP—Selling Price |

| Output: Total Profits, Total Selling Energy, Number of Served EVs |

| 1: Compute Profit |

| 2: Sort Profit in ascending order |

| 3: for i = 1 to N do |

| 4: x[i] = 0 |

| 5: end for |

| 6: weight = 0 |

| 7: for i = 1 to N |

| 8: if weight + SA[i] ≤ W then |

| 9: x[i] = 1 |

| 10: weight = weight + w[i] |

| 11: else |

| 12: x[i] = (W − weight)/w[i] |

| 13: Weight = W |

| 14: break |

| 15: end if |

| 16: end for |

4.3. Standalone Parking Lot: Electric Vehicles as Buyers and the PLCC as a Seller

| Algorithm 2. Market Mechanism for Charging-Buyer Vehicles (BEVs) |

| Input:W—Peak Demand, BA—Buying Amount, BP—Buying Price |

| Output: Total Profits, Total Buying Energy, Number of Served EVs |

| 1: Compute Profit |

| 2: Sort Profit in descending order |

| 3: for j = 1 to K do |

| 4: x[j] = 0 |

| 5: end for |

| 6: weight = 0 |

| 7: for j = 1 to k |

| 8: if weight + BA[j] ≤ W then |

| 9: x[j] = 1 |

| 10: weight = weight + w[j] |

| 11: else |

| 12: x[j] = (W − weight)/w[j] |

| 13: Weight = W |

| 14: break |

| 15: end if |

| 16: end for |

4.4. Multiple Parking Lots

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| SEVs | Seller electric vehicles |

| BEVs | Buyer electric vehicles |

| IEVs | Idle electric vehicles |

| PLCC | Parking lot control center |

| KPA | Knapsack Algorithm |

| KEPCO | Korea Electric Power Corporation |

| RES | Renewable energy sources |

| ICT | Information and communication technologies |

| EV | Electric vehicle |

| EVCS | Electric vehicle charging station |

| IED | Intelligent electronic device |

| PLO | Parking lot operator |

| DSO | Distribution system operator |

| PL2V | Parking lot-to-vehicles |

| V2PL | Vehicles to-parking lot |

| TOU | Time of use |

| RTP | Real-time price |

| SOC | state of charge |

| Buying amount of energy by BEVj at time t | |

| Buying price by BEVj at time t | |

| Allocation index for BEVj at time t | |

| Selling amount of energy by SEVi at time t | |

| Selling price by SEVi at time t | |

| Allocation index for SEVi at time t | |

| T | Number of auction time interval |

| N | Number of SEVs |

| K | Number of BEVs |

| RevenuePLCC,t | Total revenue earned by PLCC |

| COSTPLCC,t | Total cost paid by the PLCC |

| RevenueSTG,t | Revenue earned by providing power from SEVs to the grid |

| RevenueSTV,t | Revenue earned by supporting power to BEVs charging |

| PSTG,t | Power sold to the grid in kW |

| pSTG,t | Electricity price in money unit per kWh |

| Δt | Length of scheduling interval |

| PSTV,i,t | Power used to charge BEVi in kW |

| pSTV,i,t | Electricity price in money unit per kWh |

| COSTBFG,t | Cost of energy purchased from grid |

| COSTBFV,t | Cost of energy purchased from SEVs |

| PBFG,t | Power bought from grid in kW |

| pBFG,t | Electricity price in money unit per kWh |

| PBFV,i, | Discharge power from SEVi in kW |

| pBFV,i, | Electricity price in money unit per kWh |

| CBNU | Chonbuk National University |

| PL | Parking lot |

| FCFS | First-come-first-serve |

References

- Shuai, W.; Maille, P.; Pelov, A. Charging Electric Vehicles in the Smart City: A Survey of Economy-Driven Approaches. IEEE Trans. Intell. Transp. Syst. 2016, 17, 2089–2106. [Google Scholar] [CrossRef]

- Park, L.; Lee, S.; Chang, H. A Sustainable Home Energy Prosumer-Chain Methodology with Energy Tags over the Blockchain. Sustainability 2018, 10, 658. [Google Scholar] [CrossRef]

- Bayram, I.S.; Shakir, M.Z.; Abdallah, M.; Qaraqe, K. A Survey on Energy Trading in Smart Grid. In Proceedings of the 2014 IEEE Global Conference on Signal and Information Processing (GlobalSIP), Atlanta, GA, USA, 3–5 December 2014; pp. 258–262. [Google Scholar]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Peer-to-peer market clearing framework for DERs using knapsack approximation algorithm. In Proceedings of the 2017 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT-Europe), Torino, Italy, 26–29 September 2017; IEEE: Piscataway, NJ, USA, 2017; pp. 1–6. [Google Scholar]

- Jogunola, O.; Ikpehai, A.; Anoh, K.; Adebisi, B.; Hammoudeh, M.; Gacanin, H.; Harris, G. Comparative Analysis of P2P Architectures for Energy Trading and Sharing. Energies 2017, 11, 62. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of Existing Peer-to-Peer Energy Trading Projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Alvaro-Hermana, R.; Fraile-Ardanuy, J.; Zufiria, P.J.; Knapen, L.; Janssens, D. Peer to Peer Energy Trading with Electric Vehicles. IEEE Intell. Transp. Syst. Mag. 2016, 8, 33–44. [Google Scholar] [CrossRef] [Green Version]

- Long, C.; Wu, J.; Zhang, C.; Thomas, L.; Cheng, M.; Jenkins, N. Peer-to-peer energy trading in a community microgrid. In Proceedings of the 2017 IEEE Power & Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; IEEE: New York, NY, USA, 2017; pp. 1–5. [Google Scholar]

- Babic, J.; Carvalho, A.; Ketter, W.; Podobnik, V. Evaluating Policies for Parking Lots Handling Electric Vehicles. IEEE Access 2018, 6, 944–961. [Google Scholar] [CrossRef]

- Jogunola, O.; Ikpehai, A.; Anoh, K.; Adebisi, B.; Hammoudeh, M.; Son, S.-Y.; Harris, G. State-of-the-Art and Prospects for Peer-to-Peer Transaction-Based Energy System. Energies 2017, 10, 2106. [Google Scholar] [CrossRef]

- Smart Grid Reference Architecture, CEN-CENELEC-ETSI Smart Grid Coordination Group, November 2012. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/xpert_group1_reference_architecture.pdf (accessed on 1 August 2018).

- Framework for Cyber-Physical Systems. 2016. Available online: https://s3.amazonaws.com/nist-sgcps/cpspwg/files/pwgglobal/CPS_PWG_Framework_for_Cyber_Physical_Systems_Release_1_0Final.pdf (accessed on 1 August 2018).

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Martello, S.; Toth, P. Knapsack Problems: Algorithms and Computer Implementations; John Wiley & Amp; Sons, Inc.: New York, NY, USA, 1990; ISBN 0-471-92420-2. [Google Scholar]

- Vehicle Fuel Economy and CO2 Emisssions: Data and Analyses. Available online: www.energy.or.kr (accessed on 1 August 2018).

- Electric Vehicle Charging Tariff. Available online: http.www.kepco.co.kr (accessed on 1 August 2018).

| Characteristic | |

|---|---|

| Smart Parking Lot | PL2V and V2PL |

| Energy Trading Objective | Profit maximization for PLCC |

| Scale | Single parking lot, multiple parking lots |

| Control Type | Centralized solution, decentralized solution |

| Price Model | Time of use (TOU), real-time price (RTP) |

| Vehicle Model | Battery Capacity | Fuel Economy (Km/kWh) | Release Year |

|---|---|---|---|

| SOUL | 27 kWh | 5.0 | 2014 |

| LEAF | 24 kWh | 5.2 | 2014 |

| SM3 Z.E. | 22 kWh | 4.4 | 2013 |

| BMW i3 | 18 kWh | 5.9 | 2014 |

| RAY | 16 kWh | 5.0 | 2012 |

| Time | Classification | Energy Charge (KRW/kWh) | ||

|---|---|---|---|---|

| Summer | Spring/Fall | Winter | ||

| Off-Peak | Low voltage | 57.6 | 58.7 | 80.7 |

| Mid-Peak | 145.3 | 70.5 | 128.2 | |

| On-Peak | 232.5 | 75.4 | 190.8 | |

| Day | Power Consumption (kW) | |

|---|---|---|

| Min | Max | |

| Tuesday | 75 | 152 |

| Wednesday | 77.8 | 144.6 |

| Thursday | 79.7 | 243 |

| Friday | 72.6 | 131.1 |

| Saturday | 78 | 102.5 |

| Sunday | 74.7 | 101.8 |

| Monday | 77.8 | 150.5 |

| Number of Parking Lots | Case | Demand | |

|---|---|---|---|

| Scenario (1) | Single PL 10 Charging Stations | Case (1): SEVs Case (2): BEVs | 50 kWh |

| Scenario (2) | 2-PLs 20 Charging Stations | Case (3): SEVs Case (4): BEVs | 100 kWh |

| Scenario (3) | 4-PLs 40 Charging Stations | Case (5): SEVs Case (6): BEVs | 200 kWh |

| Scenario (4) | 8-PLs 80 Charging Stations | Case (7): SEVs Case (8): BEVs | 400 kWh |

| Seller Vehicles | FCFS | ||||||

|---|---|---|---|---|---|---|---|

| Amount (kWh) | Price (KRW/kWh) | Amount (kWh) | EV’s Revenue (KRW) | OPEX KRW/kWh | COSTPLCC Seller Profit (KRW) | ||

| SEV1 | 12 | 81 | 1 | 12 | 972 | 516 | 456 |

| SEV2 | 12 | 60 | 1 | 12 | 720 | 516 | 204 |

| SEV3 | 9 | 171 | 1 | 9 | 1539 | 387 | 1152 |

| SEV4 | 8 | 146 | 1 | 8 | 1168 | 344 | 824 |

| SEV5 | 11 | 189 | 0.81 | 9 | 1701 | 387 | 1314 |

| SEV6 | 9 | 59 | 0 | 0 | 0 | 0 | 0 |

| SEV7 | 12 | 166 | 0 | 0 | 0 | 0 | 0 |

| SEV8 | 13.5 | 190 | 0 | 0 | 0 | 0 | 0 |

| SEV9 | 8 | 85 | 0 | 0 | 0 | 0 | 0 |

| SEV10 | 12 | 193 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 50 | 6100 | 2150 | 3950 | ||

| Seller Vehicles | Proposed KPA | ||||||

|---|---|---|---|---|---|---|---|

| Amount (kWh) | Price (KRW/kWh) | Amount (kWh) | EVs Revenue (KRW) | OPEX KRW/kWh | COSTPLCC Seller Profit (KRW) | ||

| SEV6 | 9 | 59 | 1 | 9 | 531 | 387 | 144 |

| SEV2 | 12 | 60 | 1 | 12 | 720 | 516 | 204 |

| SEV9 | 8 | 85 | 1 | 8 | 680 | 344 | 336 |

| SEV1 | 12 | 81 | 1 | 12 | 972 | 516 | 456 |

| SEV4 | 8 | 146 | 1 | 8 | 1168 | 344 | 824 |

| SEV3 | 9 | 171 | 0.11 | 1 | 171 | 43 | 128 |

| SEV7 | 12 | 166 | 0 | 0 | 0 | 0 | 0 |

| SEV5 | 11 | 189 | 0 | 0 | 0 | 0 | 0 |

| SEV10 | 12 | 193 | 0 | 0 | 0 | 0 | 0 |

| SEV8 | 13.5 | 190 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 50 | 4242 | 2150 | 2092 | ||

| Buyer Vehicles | FCFS | ||||||

|---|---|---|---|---|---|---|---|

| Amount (kWh) | Price (KRW/kWh) | Amount (kWh) | Revenue (KRW) | OPEX KRW/kWh | PLCC Profit (KRW) | ||

| BEV1 | 12 | 81 | 1 | 12 | 972 | 516 | 456 |

| BEV2 | 12 | 60 | 1 | 12 | 720 | 516 | 204 |

| BEV3 | 9 | 171 | 1 | 9 | 1539 | 387 | 1152 |

| BEV4 | 8 | 146 | 1 | 8 | 1168 | 344 | 824 |

| BEV5 | 11 | 189 | 0.81 | 9 | 1701 | 387 | 1314 |

| BEV6 | 9 | 59 | 0 | 0 | 0 | 0 | 0 |

| BEV7 | 12 | 166 | 0 | 0 | 0 | 0 | 0 |

| BEV8 | 13.5 | 190 | 0 | 0 | 0 | 0 | 0 |

| BEV9 | 8 | 85 | 0 | 0 | 0 | 0 | 0 |

| BEV10 | 12 | 193 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 50 | 6100 | 2150 | 3950 | ||

| Buyer Vehicles | Proposed FNS | ||||||

|---|---|---|---|---|---|---|---|

| Amount (kWh) | Price (KRW/kWh) | Amount (kWh) | Revenue (KRW) | OPEX KRW/kWh | PLCC Profit (KRW) | ||

| BEV8 | 13.5 | 190 | 1 | 13.5 | 2565 | 580.5 | 1984 |

| BEV10 | 12 | 193 | 1 | 12 | 2316 | 516 | 1800 |

| BEV5 | 11 | 189 | 1 | 11 | 2079 | 473 | 1606 |

| BEV7 | 12 | 166 | 1 | 12 | 1992 | 516 | 1476 |

| BEV3 | 9 | 171 | 0.16 | 1.5 | 256 | 64.5 | 192 |

| BEV4 | 8 | 146 | 0 | 0 | 0 | 0 | 0 |

| BEV1 | 12 | 81 | 0 | 0 | 0 | 0 | 0 |

| BEV9 | 8 | 85 | 0 | 0 | 0 | 0 | 0 |

| BEV2 | 12 | 60 | 0 | 0 | 0 | 0 | 0 |

| BEV6 | 9 | 59 | 0 | 0 | 0 | 0 | 0 |

| Total | 106.5 | 50 | 9208 | 2150 | 7058 | ||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmed, M.A.; Kim, Y.-C. Energy Trading with Electric Vehicles in Smart Campus Parking Lots. Appl. Sci. 2018, 8, 1749. https://doi.org/10.3390/app8101749

Ahmed MA, Kim Y-C. Energy Trading with Electric Vehicles in Smart Campus Parking Lots. Applied Sciences. 2018; 8(10):1749. https://doi.org/10.3390/app8101749

Chicago/Turabian StyleAhmed, Mohamed A., and Young-Chon Kim. 2018. "Energy Trading with Electric Vehicles in Smart Campus Parking Lots" Applied Sciences 8, no. 10: 1749. https://doi.org/10.3390/app8101749

APA StyleAhmed, M. A., & Kim, Y.-C. (2018). Energy Trading with Electric Vehicles in Smart Campus Parking Lots. Applied Sciences, 8(10), 1749. https://doi.org/10.3390/app8101749