Abstract

With the evolution of today’s economy, supply chain management for raw materials is a complex task, but it can be simplified with the appropriate strategies. Thus, relationships between firms and suppliers have become critical for enterprise success and country development. This study investigates the effects of raw materials sources, including domestic and international ones, on small and medium enterprises (SMEs) performance. Supporting this research, all the regression models are conducted on Stata version 16.0 software with the dataset of 3485 manufacturing SMEs, utilizing longitudinal data derived from bi-annually repeated surveys of randomly selected SMEs in ten provinces in Vietnam over the period of 2011–2015. Additionally, the results of this study indicate the significant positive effects of domestic raw materials on firm performance. Meanwhile, international raw material sources present SMEs with several disadvantages in maintaining the effectiveness of SMEs’ operations. In addition, the results also highlight that the overflow of raw materials from non-state enterprises has negative effects on firm performance. Alternatively, this study aims to fill the literature gap on supply chain management to suggest to SMEs some justifiable strategies to fortify sustainable growth and the rational flow of raw materials.

Keywords:

domestic raw materials; international raw materials; supply chain management; firm performance; SMEs MSC:

97M30; 91B02; 62P05; 91B84

1. Introduction

1.1. Role of Raw Materials

Raw materials have always been a key factor in supply chain management, diversifying products, and fostering the company’s advantages [1]. Thus, raw materials are considered a core of sustainable economic development and the success of high-tech product lines and diversifications [2]. As stated in prior studies [1,3], to fortify the effectiveness of supply chain management, enterprises also need to consider sustainability, which is often measured by social responsibility, environment, and economics financial. Drilling deeper into supply chain management is key to effective business performance by forming the relationship between manufacturers, suppliers, and customers [4,5]. Since the demand for different and quality goods has risen in recent years, enterprises have had to swiftly upgrade their production batches to accommodate the requirements [4]. Regarding the role of raw materials, Yunarto and Icun [6] argued that the source of raw materials has a positive and significant relationship with the performance of enterprises. Firms chose to chase flexibility, cost reduction (including delivery and inventory, advanced products, and sustainable and active suppliers [7,8] to adapt to the situation. As a result, enterprises’ supply chain management became a competitive advantage in establishing their uniqueness, brand, and business success. Additionally, the prior research of Choon Tan et al. [4] indicated that, in the short-term, applying supply chain management might foster the effectiveness of firm and suppliers’ operation and product life cycle. However, all supply chain members may benefit from customer satisfaction and greater market share when it comes to long-term implications.

Despite these pertinent attempts to analyze and synthesize past studies on relationships between raw materials and firm performance, up-to-date and comprehensive review studies, with a specific focus on raw materials, simultaneously addressing precedents, outcomes, and effective factors for SMEs performances in the context of an emerging country such as Vietnam, have so far been lacking. In this study, we estimate the effects of domestic raw materials and international raw materials on firm performance based on regression models. These estimations rely on the question of what extent the source of raw materials may affect the effectiveness of firm operation, which also contribute to the sustainable growth of enterprises literature since the role of raw materials has been proved in documents, as follows.

Along with this topic, Bendiksen and Dreyer [7] have measured the effects of diversifying sources of raw materials on firm operation performance. Likewise, Oyelaran-Oyeyinka [8] claimed that domestic raw materials are highly recommended to boost firm performance. Conversely, the studies of Behrens et al. [9] and Georgise et al. [10] stated that importing raw materials seems to have great advantages on the productivity of the firm’s operation. Notably, Graedel, et al. [11] reported that some kinds of products might comprise up to 60 different raw materials, directly affecting the company’s stream of raw materials.

This study aims to provide a complete picture of the research conducted on raw material sourcing characteristics, provide future research directions on the topic, and encourage firm performance by giving clear suggestions to shareholders in terms of SMEs in an emerging country. A comprehensive review of the relevant literature on raw materials was performed by three main research questions:

- (i)

- How do sources of raw materials affect SME’s performance?

- (ii)

- How do domestic sources of raw materials affect SME’s performance?

- (iii)

- How do international sources of raw materials affect SME’s performance?

1.2. Research Backgrounds

Vietnam been an important transfer point in the world economic hub for nearly 30 years due to the shifted from the central planning principle in 1986 and being a member of the World Trade Organization (WTO) in 2007 [3,12]. Since the development of trade relations between Vietnam and countries in Asia and Africa during the past 70 years, Vietnam’s import and export operations have enhanced rapidly and effectively [13]. As a result, Vietnam stands more chances of accessing more material input resources from the international market, namely Northeast Asia, ASEAN, South Asia, West Asia, and Africa. Alternatively, Vietnam is considered a country with prosperous material input sources. Most of them also depend on domestic raw materials to fortify their performances; several SMEs run their business by importing raw materials from foreign firms. The supply chain is increasingly becoming a critical factor in deciding the sustainable growth of a country and the success of an enterprise due to the importance of SMEs in facilitating development [10]. However, since the transformation of the world economy, manufacturers have constantly faced many obstacles in surpassing others in recent tough markets; thus, diversifying commodities and new products appear more recently, creating a new competition between suppliers [10]. The effects of sourcing raw materials are also confirmed in previous studies by Haider and Ziaul [14] and Sucky and Zitzmann [15] that provide the relationship between suppliers and firms, which may offer great benefits to suppliers while also fostering the firm’s productivity, innovation, flexibility, stability, and efficiency.

Vietnam’s business environment has undergone fundamental changes in recent years, creating favorable conditions for SMEs to develop. Up to now, SMEs account for 96.7% of the total number of enterprises in the country. The growth in the quantity, scale of operation, and internal resources of the SMEs sector has greatly contributed to Vietnam’s socio-economic development and international integration. That creates the trend of globalization and international economic integration, which has significantly impacted Vietnam’s economic growth. Because of that development, SMEs were and are facing differences in many aspects related to business and commercial activities, such as perceptions, ideas, business beliefs, attracting customers, and behavioral culture. Thus, each enterprise needs to take advantage of government and social community support packages.

The Government Decree No. 39/2018/ND-CP [16] has defined the classification of firms into three categories based on the number of employees and total capital, as well as total revenue of the enterprise, as shown in Table 1. With manufacturing enterprises, firms with a total annual revenue lower than three VND billion or three in total capital and less than ten people are defined as micro-enterprises. Meanwhile, small enterprises are defined as firms with total annual revenue of less than 50 VND billion or 20 in total capital, and total employees in these companies range from 10 to 100 people. In terms of medium enterprises, these firms can include from 10 up to 200 employees, and total annual revenue must be less than 200 VND billion or 100 in total capital.

Table 1.

Small and medium manufacturing enterprise (SME) definitions.

1.3. Contributions

Despite the vital role of supply chain management in each firm’s operation, there are no documents related to considering raw materials from both domestic and international sources on firm performance. Thus, this study is presumed to be unique and critical in helping firms consider rational strategies and policies for sustainable growth based on the flow of raw materials. In this study, the main findings indicate that local sourcing of raw materials has a significant positive effect on firm performance, due to the popularity of this source in maintaining the normal performances of SMEs in a developing country. In contrast, international raw materials offer negative results in the relationship between raw materials imported from across the globe and firm performance. However, the overflow of raw materials input from non-state enterprises and importing materials surprisingly offer advantages to firms’ operations. Additionally, the non-state sources of raw materials seem to be used most by medium-scale firms, whereas imported raw materials show considerably negative effects on small and larger enterprises.

Based on the statements about the pivotal role of Vietnam’s economy in the economic hub generally, and the contributions of Vietnam SMEs in its economy specifically, this study will directly help SMEs improve along with greatly availing the source of materials. This study will highlight several contributions as follows:

- (i)

- By using fixed-effects regression models with year (Year_FEs), industry (Industry_FEs), and sectors (Sector_FEs), the findings precisely reflect domestic and international sources of materials, which provide firms with more opportunities to improve their productivity and engage in new product lines.

- (ii)

- Based on firm size and excessive raw material sourcing behaviors, this study strongly suggests the results of these effects, ensuring the application of the results in the long term for manufacturing firms.

- (iii)

- With the characteristics of an emerging country such as Vietnam, this study may apply to SMEs in other countries, reducing research time and providing more potential extensions for suppliers.

- (iv)

- More importantly, this study significantly contributes to this area, which is regarded as a foundation for future studies to exemplify more effects of the source of materials on firm performance.

In the remainder of this paper, the literature review is reported in Section 2, and data descriptions and the methodology are documented in Section 3. Section 4 present the main analysis and additional analysis, respectively. Finally, Section 5 summarizes this research’s conclusions, limitations, and implications.

2. Literature Review

Sustainability is increasingly pivotal in all kinds of economies in today’s world. Parallel with that, the demand for all products has significantly risen, exceeding the number of available selling products, and this situation partially stems from the shortage of raw materials and the capacity of firms [15]. A previous study has dictated that some special products may require various materials to finalize [11]. Therefore, it raises firms’ demands depending on several different material sources to accommodate the supply chains, which puts more strain on economic-related issues, namely shortages, environmental and social problems, and suppliers [1]. Moreover, in several countries, the regulations on some exclusive raw materials cause a host of constraints on firm performance and the production of those enterprises [17,18]. Consequently, the concern of sourcing raw materials has always been considered carefully throughout the years.

To have a broader perspective on this important role of raw materials, several studies have been devoted to developing and utilizing the assessment of the criticality of raw materials to mitigate the risk, as well as the concern, of the source of materials [19]. Prior studies [20,21,22,23] have been conducted to measure the effects of critical raw materials on a specific product. To be more precise, Bach et al. [20] predicted that the risk that the source of materials brings to a particular product is the restrictions in accessing materials due to social problems and economic factors. Besides, Cimprich et al. [21] indicated that the constraints caused by supply disruptions also affect product processing plans, supply chain management, and the source of materials. Meanwhile, Bauer et al. [23] found that the supply disruptions in a short period had significant effects on the deployment of energy technologies. In addition, most studies that examined the impact of materials on technology were constrained by geographical factors, political factors, and the availability of materials [23,24,25,26,27,28]. The effects continued to be employed on the firms [29], country or region [30,31,32,33,34], and also at a global level [31,35]. Since the rapid development of the economy, Duclos et al. [29] argue that firms’ success has become increasingly dependent on the source of their raw materials. When it comes to the effects of materials on country and region, most problems come from the unsustainable source of materials due to geographical, technological, economic, regulatory, and principles related to materials [30,31,32,33,34]. Eventually, the global level caused difficulties, namely the unstable source of supply which directly stems from the price of the source, the shortage, and environmental factors [31,35]. However, these studies only consider the relationship of critical raw materials on the purpose mentioned above; therefore, in this study, the flow of raw materials is mostly utilized to measure its effects on firm performance. However, to make it even more precise and unique, this study separates the source of raw materials into domestic and international. The importance of raw materials has been well known recently, as well as the constraints caused by a wide range of problems of some kinds of materials on the performance of firms and the country’s economy. Materials inputs contain raw materials from non-state enterprises (M_NSE), raw materials from state enterprises (M_SE), raw materials from state agencies (M_SEA), and raw materials that are imported nationally (Importing_M). Hence, this study may strengthen the assessment of criticality in materials theory by reporting the significant effects of each characteristic of the source of raw materials in ascending the productivity of enterprises.

2.1. Firm Performance

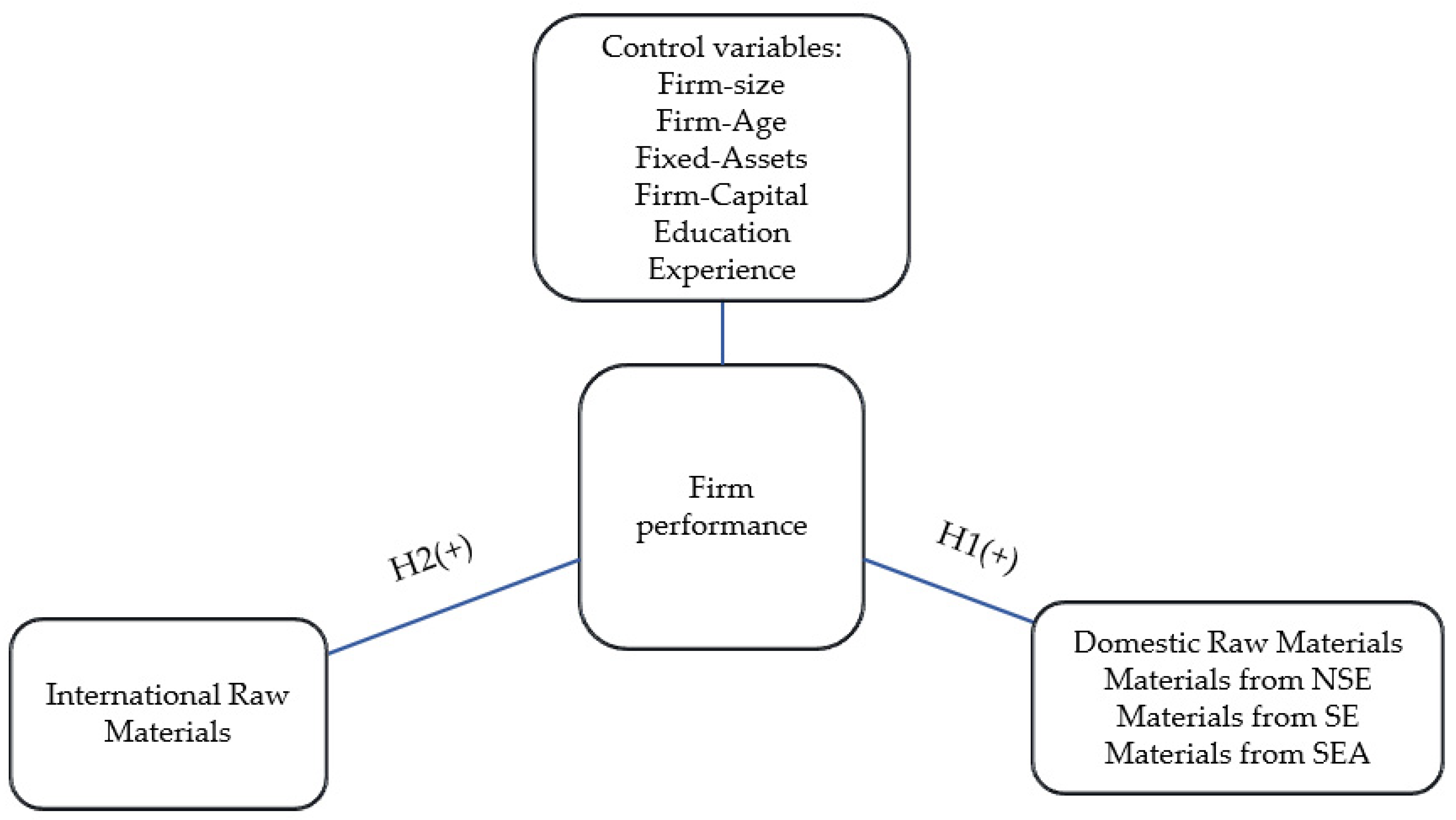

Regarding the resource-based theory of strategy, firms control unique strategic resources that enable them to maintain their competitive advantage and firm performance. Firms may not fully optimize their cost and performance without proper raw material resources. Managers select sources of raw materials, such as domestic and international ones, which stabilize the relationship with suppliers. Through the proper flow of sources of raw materials, firm performance is positively correlated with cost, government policies, and environmental issues. Saha et al. [36] conducted a systematic review of ethical leadership and corporate social responsibility (CSR) oncepts and their impact on firm performance. Additionally, Fernández-Temprano et al. [37] investigated the relationship between board diversity and firm performance. Meanwhile, Ferraris et al. [38] found that colossal data analysis fosters the productivity of firm performance through related knowledge and efficient decision-making processes. However, no documents exemplify whether firms with greater performance tend to input a certain kind of raw materials (Figure 1).

Figure 1.

Research framework.

2.2. Domestic Raw Materials

The ideas mentioned above about material sourcing, sustainability, stability, and scrutiny strategies regarding the source of raw materials seem vital to manufacturers [39]. Indeed, a prior study claimed the importance of raw materials in companies’ sustainability [1]. In addition, Bendiksen and Dreyer [7] also emphasize the deterioration in firm performance when firms decide to alter the source of raw materials, which means stabilizing the sourcing of raw materials may positively affect firm productivity. Besides, the popularity of domestic raw materials was also supported by Oyelaran-Oyeyinka [8]. However, as already mentioned, our study will be the pioneer in this field in Vietnam, and this study will be performed with local raw materials sources such as sourcing from state enterprises, state agencies, and non-state enterprises (Figure 1).

Hypothesis 1 (H1).

Domestic raw materials somehow positively affect the firm performance.

2.3. International Raw Materials

According to Giljum et al. [40], most operating enterprises in industrialized countries are based on raw materials imported from other regions instead of local ones because of the limitation of the source of raw materials and the exploitation ability. Likewise, this propensity is also fortified by Burger [41], who stated that the input of international raw materials might boost the competitiveness and position of the firm as well in the long run. Since the restrictions, regulations, and environmental certificates are required, enterprises may seek international raw materials to meet manufacturing demand. A previous study also indicated that raw materials such as minerals suffer from political issues, inadequate quantifications, and country conditions [2]. Thus, international raw materials offer an important role in the development of firms. Although most domestic raw materials are considered by firms, importing materials acts as an advantage for firms to surpass others in bitter competition [10]. However, there is still a wide range of barriers when a firm desires to access international raw materials: regulations, exchange rate, quality, delivery cost, and delays [10]. Moreover, in the study of Georgise et al. [10], they also claim that, to meet the requirement of importing raw materials from other countries, companies also need to improve their relationship first and distinguish the way of approaching international partners to ensure the stability of transaction, as well as input, in the long-term. Hence, because of the effect of importing materials mentioned above, we also test the influence on SMEs in this study (Figure 1).

Hypothesis 2 (H2).

International raw materials have negative effects on the firm performance.

3. Methodology

3.1. Methodology

To provide the effects of material input characteristics on firm performance, we employ the regression model as follows:

where i is the firm and t is the year. In this study, firm performance is measured by return in assets (ROA) and return in equity (ROE), which, in turn, represent the productivity of firm operation in given years [3,42]. Along with all our suggested models in this paper, we fortify the accreditation by adding several fixed effects, namely year, industry, and sector fixed effects, to taper off the risk of endogeneity. Those fixed effects are for capturing all factors to avoid being varied through the given industry, year, and period.

Materials input is our main independent variable, which contains raw materials from non-state enterprises (M_NSE), raw materials from state enterprises (M_SE), raw materials from state agencies (M_SEA), and raw materials that are imported nationally (Importing_M). Documents relating to material input source and firm performance are still scarce and not highly recommended because of the lack of references in this area; therefore, our empirical analysis may be a unique and distinctive study retrieved from Vietnamese SMEs’ data sources. However, Haider and Ziaul [14] pointed out many interesting results related to sourcing raw materials from different regions and firm performance. They documented that to improve the effectiveness of firm performance in South-West Bangladesh, importing or raising material sources is incentivized. Therefore, to drill deeper into this topic and determine the effects of those factors in Vietnam, we utilize those independent variables in our regression models (Table 2).

Table 2.

Proposed variables.

In terms of control variables, following several prior studies, this paper also uses specific firm-related variables (Table 2), including size, firm age, fixed assets, firm capital, education, and experience [3], in which size is measured by the natural logarithm of total assets [3], and firm age is calculated by the logarithm of firm’s year of establishment plus one. Additionally, fixed assets result from the probability of total fixed assets over total assets [3,43,44]; likewise, firm capital equals the probability of equity over total assets. In addition, the education, knowledge, and experience of enterprises’ owners are also considered as significant factors affecting firm performance [45,46]. Hence, the control variables also are supplemented with education and experience, which are defined as dummy variables (one if the entrepreneur had their upper secondary school certificate and zero otherwise) as the former, and the latter are measured by the logarithm of the year of the owner in charge their business [3]. By using regression models, it offers to this study several advantages, as follows:

- (i)

- The results accurately reflect the effects of each source of raw material on firm performance.

- (ii)

- Examining the effects with firms under similar years and industries.

- (iii)

- Combining greatly with panel data.

- (iv)

- Proposing long-term applications.

3.2. Data Description

The data is retrieved from Vietnamese SMEs in the period between 2005 and 2015, employed by the Central Institute for Economic Management of the United Nations University with the Development Economics Research Group and the World Institute for Development Economics Research (UNU-WIDER) [47]. However, we avail this panel data and concentrate on the period between 2011 and 2015 to conduct our empirical analysis to minimize the scope and offer accurate and close-to-recent data in this research. Besides, Vietnamese SMEs’ data consist of three parts, which are questions for owners and managers (1), ones for economic accounts (2), and residue ones that focus on employees (3). During our analysis, the data is sorted out from only parts (1) and (2) to offer the closest results to SMEs’ performance. Moreover, most of the SMEs in this data source are in Hanoi (2630) and Hochiminh City (3682), the two largest cities in Vietnam. The rest of the number of enterprises spread across eight provinces.

When it comes to sorting and analyzing data, we first considered companies with around 10–500 employees as SMEs [16]. Secondly, we eliminated all kinds of variables with the conditions as follows: equity below 0, total assets above or equal to 1, and the probability of fixed assets on total assets higher or equal to 1. In terms of independent variables, we also retrofit the winsorize process from the 1st to the 99th percentiles during the analysis of data to lower the risk of drastic variables (4). With the problem of the time period of data, which is 2011 to 2015, we also want to update the period of data to 2020 or 2021; however, this problem relates to the standstill of SMEs survey, which has not been continually conducted by the General Statistics Office (GSO) and UNU-WIDER since 2015. Thus, we utilize 3485 firms from the data in the period between 2011 and 2015 because of the consistency in replying and the content of the questions.

4. Main Analysis and Discussion

4.1. Descriptive Statistic

Table 3 presents the statistics of our data based on the firm level. To begin with, firms in our data sample seemed to have sufficiently effective performance due to the statistics of ROA and ROE, which were 0.297 and 0.307, respectively. In terms of domestic raw materials input, SMEs in this data had a propensity to receive a high volume of materials from non-state enterprises, with 74.7% on average. Ranked second in the amount of raw materials input, materials from state-owned enterprises made up approximately 14.5% of the mean value. Furthermore, SMEs did not consider the derive state agencies from materials, with only 0.3%. When it comes to international raw materials, a staggering 1.5% of raw materials from those firms are imported internationally. Regarding the results, fixed assets shared about 76% firm’s value, and the average year of establishment of SMEs in this data was 7.6 years.

Table 3.

Descriptive statistics.

4.2. Correlation Matrix

In this part, we employed the correlation matrix method (Pearson’s correlation) [48] to investigate the relationship between local and international raw materials and firm performance, including ROA, ROE, size, firm age, fixed assets, firm capital, education, and experience.

Table 4 describes the value of estimated coefficients in the correlation matrix method between material input characteristics and firm performance. In detail, to measure the effects of independent variables when firm performance is optimized, we conduct a correlation matrix to estimate the relationship between independent variables and dependent variables at the highest altitude. As can be seen, under ROA measurement, to maximize the effectiveness of firm operation, enterprises are recommended to reduce the amount of material input from state enterprises by 0.503 (p < 0.01). Conversely, when we estimate the firm performance with ROE measurement, firms with greater effective performance tend to incentivize the source of material from non-state enterprises. Referring to other correlations, most of the estimated coefficients are below 0.5, and the highest estimated coefficient is the correlation between Size and Importing M, with 0.214 (p < 0.01), and our analysis is bound not to be affected by multicollinearity.

Table 4.

Correlation matrix.

4.3. Regression Analysis

Table 5 describes the impact of raw materials imported from non-state, state-owned enterprises, and state agencies M_NSE, M_SE, M_SEA, and Importing_M on firm performance, examined using ROA ROE metrics.

Table 5.

Regression model.

We first testify only the effect of material importing from abroad on the productivity of the firms’ operation to see whether firm performance is affected by the only source of raw material being international. Under ROA measurement, importing raw materials appears to have no significant impact on firm performance. However, importing raw materials has a significantly negative effect on the effectiveness of firm performance under ROE metrics, with −0.301 (p < 0.5). This correlation is even duplicated with enterprises with both domestic and international sources of raw materials, with −0.215 (p < 0.1). These results can be explained by Georgise et al. [10], who indicated that importing raw materials might suffer from various barriers, namely laws, exchange rates, and the cost of delivery, and this finding is also consistent with the first hypothesis. Additionally, Massrai and Ruberti [49] indicated that this performance is also affected by political reasons and substantial proportions of added valuation and export taxes. Additionally, since Vietnam is a country with affluent natural resources, Vietnam SMEs tend to raise the flow of domestic resources instead of international ones to avoid the disadvantages of importing raw materials.

In contrast, if the enterprises only utilize domestic raw materials, which are materials from non-state (M_NSE), state-owned enterprises (M_SE), and state agencies (M_SEA), the input of raw materials that non-state enterprises and state agencies offer to the firms has considerable positive effects on its performance, with 0.124 (p < 0.01) and 0.824 (p < 0.05), respectively. Bendiksen and Dreyer [7] emphasized the importance of maintaining the source of raw materials, which means those firms probably have a close relationship with those suppliers; therefore, their performance seems to be directly proportional to those local suppliers. Moreover, in terms of firms including both domestic and international raw materials, M_NSE and M_SEA also show positive effects on these firms’ performances, with 0.087 (p < 0.05) and 0.735 (p < 0.05). Seemingly, Vietnam SMEs bear no burdens, such as environmental conditions, government regulations, and pricy sources of raw materials, in maintaining the durable flow of raw materials. In addition, this correlation also fortifies our hypothesis and is consistent with the study of Oyelaran-Oyeyinka [8]. Meanwhile, the materials input from state agencies appears not to affect the firm performance. With those results, it is highly recommended that the manipulating raw materials from non-state enterprises and state agencies significantly boosts SMEs’ performance.

In terms of control variables, firm size and fixed assets appear to have significantly negative effects on firm performance regardless of metric, while other study offers a positive result between this relationship [3,50]. The possible explanation for this correlation is that when the firm’s expansion is needed for the product diversity, enterprises are required to lessen the amount of source of raw materials to ensure the expansion, which directly deducts the effectiveness of firm performance. When it comes to fixed assets, Tsai et al. [3] noted that the replacement of a large number of fixed assets to accommodate the innovation or diversification (since the propensity of diversifying firms when having an appropriate source of raw materials [1]) may also lead to the deduction of the source of raw materials, which negatively affects the firm performance.

4.4. Additional Analysis

4.4.1. Non-Linear Regression

After measuring the impacts of materials input characteristics on firm performance normally, this study continued the estimation of regression analysis by using non-linear regression to view the effects of excessive material input (by squaring the original independent variables) on firm performance.

Regarding the non-linear regression analysis, Table 6 delineates the estimated coefficients of independent variables, namely M_NSE, M_SE, M_SEA, and square form and firm performance (under both ROA and ROE metrics). The analysis is performed as follows; columns (1) and (2) estimate the influences of domestic raw materials on firm performance under ROA and ROE measurement, whereas two residue columns describe the relationship between international raw materials input on firm performance under ROA and ROE metrics, respectively. Regarding local sourcing of raw materials, firm performance seems not to be affected by the volume of raw materials under both ROA and ROE metrics. However, the excessive inflow of non-state enterprises entails the degradation of the effectiveness of firm performance, with estimated coefficients of −0.259 (p < 0.01). As prior researchers have indicated, the desire for commodities has risen unprecedentedly in recent years; therefore, the overflow of domestic raw materials such as raw materials from state-owned enterprises and state agencies seem to offer no merits, as well as demerits because the striving to accommodate the market of firms is currently huge [4,5].

Table 6.

Non-linear regression model.

Nevertheless, although there are no documents related to why raw materials are retrieved from non-state enterprises offering SMEs disadvantages, these results are bound to stem from the government’s policies or the cost of accessing this source and the inflexibility of those kinds of suppliers. When it comes to importing raw materials, surprisingly, the excess of importing raw materials also shows no significant effects on firm performance, even though the advantages of international raw materials have been discussed as the competitiveness of firms to eclipse other competitors [10,41]. With control variables, these estimated coefficients remain consistent with our main model.

4.4.2. Firm-Size and Sourcing of Raw Materials

In order to offer more precise results about the relationship between sourcing of raw materials characteristics on firm performance, we conduct the regression analysis based on three quantiles of firms: small, medium, and larger enterprises.

In Table 7, the results of relationships between raw materials input characteristics on each size of firm are described. In terms of small-scale enterprises, local sourcing of raw materials seems to have no effect on firm performance, while importing raw materials results in significantly negative effects on the firm’s productivity under the ROA metric, with −99.391 (p < 0.01). The negative impacts of international raw materials on firm performance stem from the exchange rate, policies, expenses, and supplier relationship problems [10]. In addition, medium enterprises have benefits by raising the volume of raw materials obtained from non-state firms, with 0.148 (p < 0.05). However, the remaining factors, namely materials from international or state enterprises and state agencies, appear to have no effects on firm performance. With larger-scaled enterprises, a firm with greater performance is incentivized to mitigate the rate of importing raw materials internationally, with the estimated coefficient of −0.274 (p < 0.1) under the ROE measurement. The sustainability of larger enterprises may be disrupted by the change in the source of raw materials. Those enterprises seem to form a great relationship with suppliers; hence, the change in receiving a higher volume of importing materials offers those firms considerably negative effects. Meanwhile, other raw materials sources seem to bring no significant effects on those firms’ operations.

Table 7.

Firm performance and raw materials classified by firm-size.

5. Conclusions, Implications and Limitations

5.1. Conclusions

Supply chain management has become a vital role in developing an enterprise specifically, and the sustainable growth of the economy in general, since the demand for a variety of products is increasingly soaring. Therefore, the source of raw materials in several industrialized countries becomes scarce, which directly makes them choose suppliers from other countries to maintain the stability of the firm’s operation. Thus, this study was conducted to address and identify the impacts of domestic raw materials and international ones on firm performance, which would help firms facilitate their enterprises in diversifying products and generating products, while accommodating the harsh requirements of today’s market. Therefore, this study explores the relationship between raw materials imported from domestic and international sources and firm performance, by using a total number of 3485 manufacturing SMEs between 2011 and 2015 in Vietnam to clearly understand which source of raw materials helps enterprises boost their performance.

Domestic raw materials remain inevitable throughout the analysis, boosting the firm’s performance and maintaining sustainable growth. However, even when customers demand new and high-tech devices or products, Vietnam SMEs prefer to use local raw materials instead of international ones. This tendency is explained by the characteristic of industrial countries such as Vietnam, as well as the cost of approaching materials from international being relatively high. Barriers to accessing international raw materials also stem from the government’s policies, supplier relationships, and risks; therefore, no matter how the demand raises, this source still presents negative results in the effectiveness of firm performance in Vietnam SMEs.

However, even though firms are incentivized to raise the volume of domestic raw material input, especially from non-state enterprises, its overflow still negatively affects firm performance. Hence, firms should depend largely on the demand of customers to store the rational volume of domestic raw materials to optimize the effectiveness of the firm’s operation and lower the risks of degradation in the firm’s development strategies. Moreover, medium enterprises should avail their scale to make the most use of the source of domestic raw materials, since the effectiveness of materials from non-state enterprises offered to them is higher compared to small and larger enterprises. Conversely, as already mentioned, importing raw materials should be considered carefully since both small and larger enterprises’ performances still suffer severely if they decide to access these sources.

5.2. Implications

According to the results from our analysis, firm performance tends to largely depend on the inflow of raw materials from non-state enterprises and state agencies, which means that firms are highly recommended to increase their sourcing of raw materials from those sources due to the importance of domestic raw materials in forming relationships with suppliers. Conversely, to foster the productivity of firms’ operation, firms should prioritize reducing the input of international raw materials because political issues and substantial taxes negatively affect the effectiveness of firm performance.

However, despite the positive effect that materials from non-state enterprises offer to SMEs, excess inflow should be avoided since the inflexibility, government policies, and accessing costs may impede the firm’s sustainable growth.

Regarding each firm’s size, when it comes to raw materials from non-state enterprises, medium-scaled firms seem to have the greatest benefits from this source. Meanwhile, importing materials presents disadvantages to all sizes of firms in our empirical data, except medium-scaled firms.

5.3. Limitations

This study is based on Vietnam SMEs survey data from 2011, 2013, and 2015, which indicate that the results may bear some disparities in other data and other markets. Therefore, it is highly recommended to reconduct all these regression models corresponding with other data, country policies, and market terms to apply all these conclusions. Additionally, the scope of this data only ranges from 2011 to 2015. However, we tried to update the data to make this study more practical; the data seemed to be postponed by the Central Institute for Economic Management of the United Nations University and the World Institute for Development Economics Research (UNU-WIDER). Moreover, there is a lack of precedent literature in this area; we had difficulty in referring to prior studies to fortify our results. Therefore, this study will become a bootstrapping for other future studies to learn more about this topic.

Furthermore, when it comes to the source of raw materials characteristics, each country may have its unique background and unique source of raw materials, which directly affect whether it is necessary to consider international raw materials or if they can be fully supplied by themselves. Thus, this result may need to be carefully revised for countries with prosperous sources of raw materials.

Author Contributions

Conceptualization; methodology, software: P.-H.N. and L.H.-H.; Validation: H.-A.P.; Formal analysis: L.H.-H.; Investigation: H.L.T.; Resources: Q.M.D.; Data curation: D.H.N.; Writing—original draft preparation: P.-H.N. and L.H.-H.; Writing—review and editing: P.-H.N.; Visualization: T.-H.N.; Supervision: P.-H.N.; Project administration: P.-H.N. and L.H.-H.; Funding acquisition: P.-H.N. and L.H.-H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors appreciate the support from the National Taipei University of Technology, Taiwan, and FPT University, Vietnam.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Kolotzek, C.; Helbig, C.; Thorenz, A.; Reller, A.; Tuma, A. A Company-Oriented Model for the Assessment of Raw Material Supply Risks, Environmental Impact and Social Implications. J. Clean. Prod. 2018, 176, 566–580. [Google Scholar] [CrossRef]

- Glöser, S.; Tercero Espinoza, L.; Gandenberger, C.; Faulstich, M. Raw Material Criticality in the Context of Classical Risk Assessment. Resour. Policy 2015, 44, 35–46. [Google Scholar] [CrossRef]

- Tsai, J.F.; Nguyen, P.H.; Lin, M.H.; van Nguyen, D.; Lin, H.H.; Ngo, A.T. Impacts of Environmental Certificate and Pollution Abatement Equipment on Smes’ Performance: An Empirical Case in Vietnam. Sustainability 2021, 13, 9705. [Google Scholar] [CrossRef]

- Hsu, C.-C.; Choon Tan, K.; Laosirihongthong, T. Antecedents of SCM practices in ASEAN automotive industry: Corporate entrepreneurship, social capital, and resource-based perspectives. Int. J. Logist. Manag. 2014, 25, 334–357. [Google Scholar] [CrossRef]

- Wisner, J.D. A Structural Equation Model Of Supply Chain Management Strategies And Firm Performance. J. Bus. Logist. 2003, 24, 1–26. [Google Scholar] [CrossRef]

- Yunarto, H.I.; Santika, M.G. Business Concepts Implementation Series in Inventory Management. Language 2005, 29, 24cm. [Google Scholar]

- Bendiksen, B.I.; Dreyer, B. Technological Changes—The Impact on the Raw Material Flow and Production. Eur. J. Oper. Res. 2003, 144, 237–246. [Google Scholar] [CrossRef]

- Oyelaran-Oyeyinka, B. Manufacturing Response in a National System of Innovation: Evidence from the Brewing Firms in Nigeria. Discuss. Pap. Ser. 2002, 3, 1–60. [Google Scholar]

- Behrens, A.; Giljum, S.; Kovanda, J.; Niza, S. The Material Basis of the Global Economy: Worldwide Patterns of Natural Resource Extraction and Their Implications for Sustainable Resource Use Policies. Ecol. Econ. 2007, 64, 444–453. [Google Scholar] [CrossRef]

- Georgise, F.B.; Thoben, K.-D.; Seifert, M. Supply Chain Integration in the Manufacturing Firms in Developing Country: An Ethiopian Case Study. J. Ind. Eng. 2014, 2014, 1–13. [Google Scholar] [CrossRef][Green Version]

- Graedel, T.E.; Harper, E.M.; Nassar, N.T.; Nuss, P.; Reck, B.K. Criticality of Metals and Metalloids. Proc. Natl. Acad. Sci. USA 2015, 112, 4257–4262. [Google Scholar] [CrossRef] [PubMed]

- Trung, N.N.; Nghi, P.T.; Soldier, L.L.; Hoi, T.V.; Kim, W.J. Leadership, Resource and Organisational Innovation: Findings from State and Non-State Enterprises. Int. J. Innov. Manag. 2014, 18, 1450034. [Google Scholar] [CrossRef]

- Trang, H. Ministry of Industry and Trade: It Is Perfectly Acceptable to Continue Importing Raw Materials. Available online: https://doanhnhantrevietnam.vn/bo-cong-thuong-viec-tiep-tuc-nhap-khau-cac-nguyen-lieu-tho-la-hoan-toan-chap-nhan-duoc-d5274.html?fbclid=IwAR3CCrEOXvdBM6ONpkB7OkVKFxLYfaI3hizKFgXtORgcPxyVuY3C_F0lLJ8 (accessed on 14 March 2022).

- Haider, M.Z.; Ziaul, M. Raw Material Sourcing and Firm Performance: Evidence from Manufacturing Firms in South-West Bangladesh. Bangladesh Dev. Stud. 2010, 33, 51–61. [Google Scholar]

- Sucky, E.; Zitzmann, I. Supply Chain Risk Management in Sustainable Sourcing. In Social and Environmental Dimensions of Organizations and Supply Chains; Springer: Cham, Switzerland, 2018; pp. 135–151. [Google Scholar] [CrossRef]

- LuatVietnam. Decree No. 39/2018/ND-CP Dated March 11, 2018 of the Government on Detailing a Number of Articles of the Laws on Small and Medium-Sized Enterprises. Available online: https://english.luatvietnam.vn/decree-no-39-2018-nd-cp-dated-march-11-2018-of-the-government-on-detailing-a-number-of-articles-of-the-laws-on-small-and-medium-sized-enterprises-160820-Doc1.html#:~:text=39%2F2018%2FND%2DCP%20on%20detailing%20a%20number%20of,being%20offered%20free%20tuition%20frees (accessed on 5 April 2022).

- Bleischwitz, R.; Dittrich, M.; Pierdicca, C. Coltan from Central Africa, International Trade and Implications for Any Certification. Resour. Policy 2012, 37, 19–29. [Google Scholar] [CrossRef]

- Norgate, T.E.; Jahanshahi, S.; Rankin, W.J. Assessing the Environmental Impact of Metal Production Processes. J. Clean. Prod. 2007, 15, 838–848. [Google Scholar] [CrossRef]

- Schrijvers, D.; Hool, A.; Andrea Blengini, G.; Chen, W.-Q.; Dewulf, J.; Eggert, R.; Ellen, L.; Gauss, R.; Goddin, J.; Habib, K.; et al. A Review of Methods and Data to Determine Raw Material Criticality. Resour. Conserv. Recycl. 2019, 155, 104617. [Google Scholar] [CrossRef]

- Bach, V.; Berger, M.; Henßler, M.; Kirchner, M.; Leiser, S.; Mohr, L.; Rother, E.; Ruhland, K.; Schneider, L.; Tikana, L. Integrated Method to Assess Resource Efficiency–ESSENZ. J. Clean. Prod. 2016, 137, 118–130. [Google Scholar] [CrossRef]

- Cimprich, A.; Karim, K.S.; Young, S.B. Extending the Geopolitical Supply Risk Method: Material “Substitutability” Indicators Applied to Electric Vehicles and Dental X-Ray Equipment. Int. J. Life Cycle Assess. 2018, 23, 2024–2042. [Google Scholar] [CrossRef]

- Gemechu, E.D.; Sonnemann, G.; Young, S.B. Geopolitical-Related Supply Risk Assessment as a Complement to Environmental Impact Assessment: The Case of Electric Vehicles. Int. J. Life Cycle Assess. 2017, 22, 31–39. [Google Scholar] [CrossRef]

- Bauer, D.; Diamond, D.; Li, J.; Sandalow, D.; Telleen, P.; Wanner, B. US Department of Energy: Critical Materials Strategy. December 2010. Available online: https://www.osti.gov/servlets/purl/1000846 (accessed on 5 April 2022).

- Gauß, R.; Homm, G.; Gutfleisch, O. The Resource Basis of Magnetic Refrigeration. J. Ind. Ecol. 2017, 21, 1291–1300. [Google Scholar] [CrossRef]

- Habib, K.; Wenzel, H. Reviewing Resource Criticality Assessment from a Dynamic and Technology Specific Perspective–Using the Case of Direct-Drive Wind Turbines. J. Clean. Prod. 2016, 112, 3852–3863. [Google Scholar] [CrossRef]

- Helbig, C.; Bradshaw, A.M.; Wietschel, L.; Thorenz, A.; Tuma, A. Supply Risks Associated with Lithium-Ion Battery Materials. J. Clean. Prod. 2018, 172, 274–286. [Google Scholar] [CrossRef]

- Moss, R.L.; Tzimas, E.; Kara, H.; Willis, P.; Kooroshy, J. Critical Metals in Strategic Energy Technologies. Assessing Rare Metals as Supply-Chain Bottlenecks in Low-Carbon Energy Technologies. JRC Scientific and Technical Reports EUR 24884. 2011. Available online: https://static1.squarespace.com/static/5a60c3cc9f07f58443081f58/t/5ab3d83f0e2e721919e94cf3/1521735755642/CriticalMetalsinSET.pdf (accessed on 5 April 2022).

- Althaf, S.; Babbitt, C.W. Disruption risks to material supply chains in the electronics sector. Resour. Conserv. Recycl. 2021, 167, 105248. [Google Scholar] [CrossRef]

- Duclos, S.J.; Otto, J.P.; Konitzer, D.G. Design in an Era of Constrained Resources. Mech. Eng. 2010, 132, 36–40. [Google Scholar] [CrossRef]

- European Commission; Directorate-General for Internal Market Entrepreneurship and SMEs; Pennington, D.; Tzimas, E.; Baranzelli, C.; Dewulf, J.; Manfredi, S.; Nuss, P.; Grohol, M.; van Maercke, A.; et al. Methodology for Establishing the EU List of Critical Raw Materials: Guidelines; Publications Office of the European Union: Luxemburg, 2017. [Google Scholar]

- Liu, L.; Zhao, Q.; Goh, M. Perishable material sourcing and final product pricing decisions for two-echelon supply chain under price-sensitive demand. Comput. Ind. Eng. 2021, 156, 107260. [Google Scholar] [CrossRef]

- Hatayama, H.; Tahara, K. Criticality Assessment of Metals for Japan’s Resource Strategy. Mater. Trans. 2015, 56, 229–235. [Google Scholar] [CrossRef]

- Kuo, T.C.; Chen, K.J.; Shiang, W.J.; Huang, P.B.; Otieno, W.; Chiu, M.C. A collaborative data-driven analytics of material resource management in smart supply chain by using a hybrid Industry 3.5 strategy. Resour. Conserv. Recycl. 2021, 164, 105160. [Google Scholar] [CrossRef]

- National Research Council. Minerals, Critical Minerals, and the US Economy; National Academies Press: Washington, DC, USA, 2008; ISBN 0309112826. [Google Scholar]

- Morley, N.; Eatherley, D. Material Security: Ensuring Resource Availability for the UK Economy; C-Tech Innovation Limited: Chester, UK, 2008; ISBN 1906237034. [Google Scholar]

- Saha, R.; Shashi; Cerchione, R.; Singh, R.; Dahiya, R. Effect of Ethical Leadership and Corporate Social Responsibility on Firm Performance: A Systematic Review. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 409–429. [Google Scholar] [CrossRef]

- Fernández-Temprano, M.A.; Tejerina-Gaite, F. Types of Director, Board Diversity and Firm Performance. Corp. Gov. 2020, 20, 324–342. [Google Scholar] [CrossRef]

- Ferraris, A.; Mazzoleni, A.; Devalle, A.; Couturier, J. Big Data Analytics Capabilities and Knowledge Management: Impact on Firm Performance. Manag. Decis. 2019, 57, 1923–1936. [Google Scholar] [CrossRef]

- Giljum, S.; Dittrich, M.; Lieber, M.; Lutter, S. Global Patterns of Material Flows and their Socio-Economic and Environmental Implications: A MFA Study on All Countries World-Wide from 1980 to 2009. Resources 2014, 3, 319–339. [Google Scholar] [CrossRef]

- Burger, A. Dynamic Effects of International Fragmentation of Production: Empirical Analysis of Slovenian Manufacturing Firms. Ph.D. Thesis, University of Ljubljana, Faculty of Economics, Ljubljana, Slovenia, 2009. Available online: http://www.cek.ef.uni-lj.si/doktor/burger267.pdf (accessed on 5 April 2022).

- Kristoffersen, E.; Mikalef, P.; Blomsma, F.; Li, J. The effects of business analytics capability on circular economy implementation, resource orchestration capability, and firm performance. Int. J. Prod. Econ. 2021, 239, 108205. [Google Scholar] [CrossRef]

- Luu, H.N.; Nguyen, L.Q.T.; Vu, Q.H.; Tuan, L.Q. Income Diversification and Financial Performance of Commercial Banks in Vietnam, Do Experience and Ownership Structure Matter? Rev. Behav. Financ. 2019, 12, 185–199. [Google Scholar] [CrossRef]

- Kamasak, R. The Contribution of Tangible and Intangible Resources, and Capabilities to a Firm’s Profitability and Market Performance. Eur. J. Manag. Bus. Econ. 2017, 26, 252–275. [Google Scholar] [CrossRef]

- Wu, M.-W.; Shen, C.-H. Corporate Social Responsibility in the Banking Industry: Motives and Financial Performance. J. Bank. Financ. 2013, 37, 3529–3547. [Google Scholar] [CrossRef]

- Becker, G.S. Human Capital: A Theoretical and Empirical Analysis with Special Reference to Education; University of Chicago Press: Chicago, IL, USA, 1964; ISBN 0-226-04119-0. Available online: https://www.nber.org/books-and-chapters/human-capital-theoretical-and-empirical-analysis-special-reference-education-third-edition (accessed on 5 April 2022).

- Peni, E. CEO and Chairperson Characteristics and Firm Performance. J. Manag. Gov. 2014, 18, 185–205. [Google Scholar] [CrossRef]

- UNU-WIDER. Viet Nam SME Database. Available online: https://www.wider.unu.edu/database/viet-nam-sme-database (accessed on 5 April 2022).

- Taylor, R. Interpretation of the Correlation Coefficient: A Basic Review. J. Diagn. Med. Sonogr. 1990, 6, 35–39. [Google Scholar] [CrossRef]

- Massari, S.; Ruberti, M. Rare Earth Elements as Critical Raw Materials: Focus on International Markets and Future Strategies. Resour. Policy 2013, 38, 36–43. [Google Scholar] [CrossRef]

- Aron, D.J. Ability, Moral Hazard, Firm Size, and Diversification. Rand J. Econ. 1988, 19, 72–87. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).