A Comprehensive Model for Evaluating Titanium Industry Security in China

Abstract

1. Introduction

- (1)

- Presentation of comprehensive evaluation criteria for assessing the security of the Ti industry chain. These criteria comprise 34 indicators that cover various aspects of the industry’s safety.

- (2)

- Development of a systematic method for assessing the safety of China’s Ti industry chain from 2010 to 2020. This method considers the entire industrial chain, dimension layers, and individual indicators.

- (3)

- Analyses of the changes observed in different dimensional layers and indicators of China’s Ti industry, along with the formulation of policy suggestions based on the findings.

2. Literature Review

3. Materials and Methods

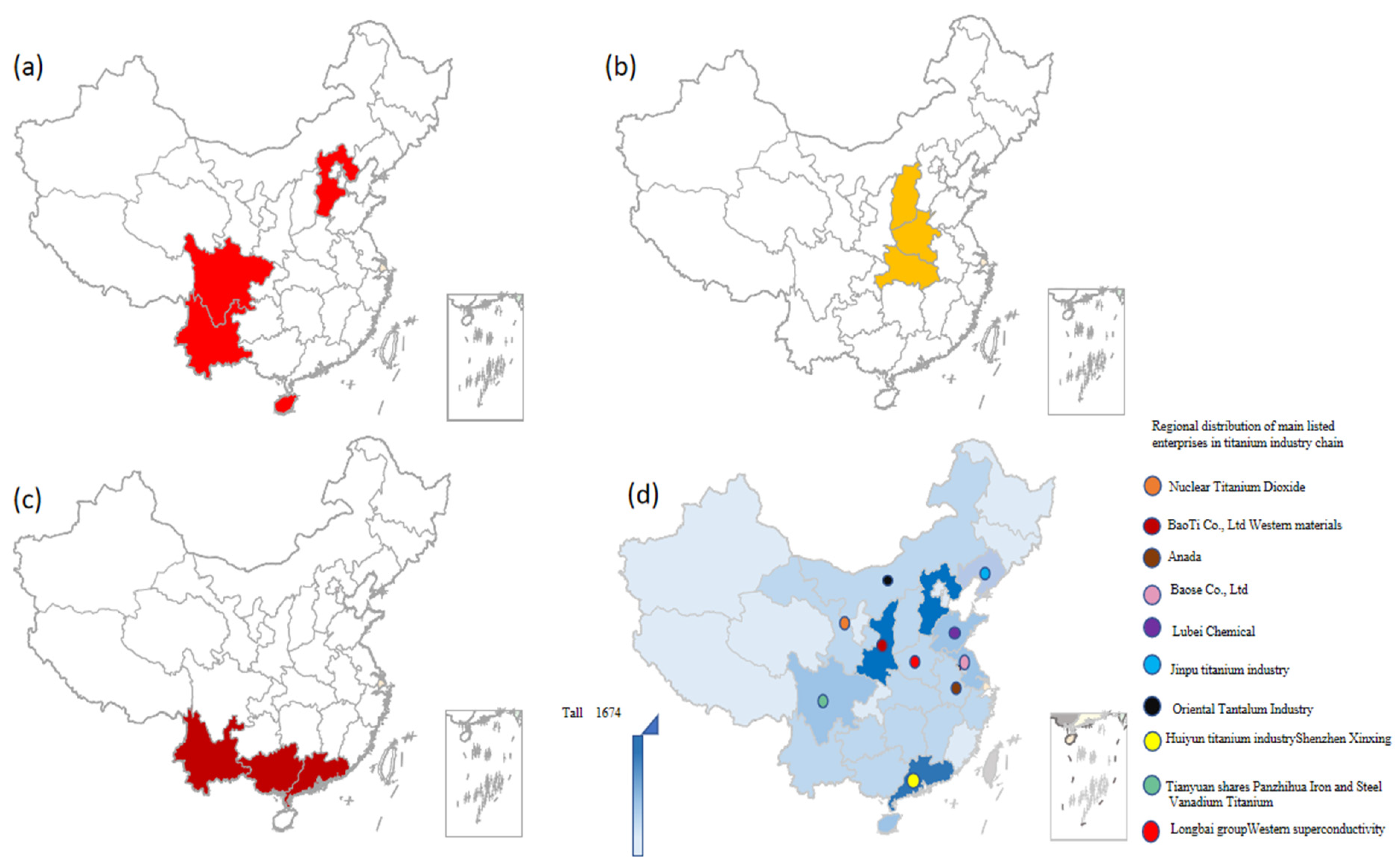

3.1. System Definition

3.2. Construction of Index System

- (1)

- Within these dimensions, there are 10 availability indicators, which mainly reflect the self-supply of Ti and its products, as well as the availability of foreign Ti resources and products.

- (2)

- Additionally, there are 14 economic indicators, which reflect whether the price of Ti resources and products is reasonable and stable under the conditions of continuous and sufficient supply, the income of related enterprises, and the operational status of domestic and foreign Ti markets.

- (3)

- Furthermore, 10 sustainability indicators evaluate the future development capabilities of Ti resources and products.

3.3. Assessment Model

3.3.1. Normalisation of the Raw Data

3.3.2. Obtaining the Weights of Resource Security Evaluation Indicators

3.3.3. Measurement of the Safety Level of China’s Titanium Industry Chain

3.3.4. Correlation Analysis of Factors Affecting the Safety Level of the Ti Industry Chain

4. Results and Discussions

4.1. Model Results

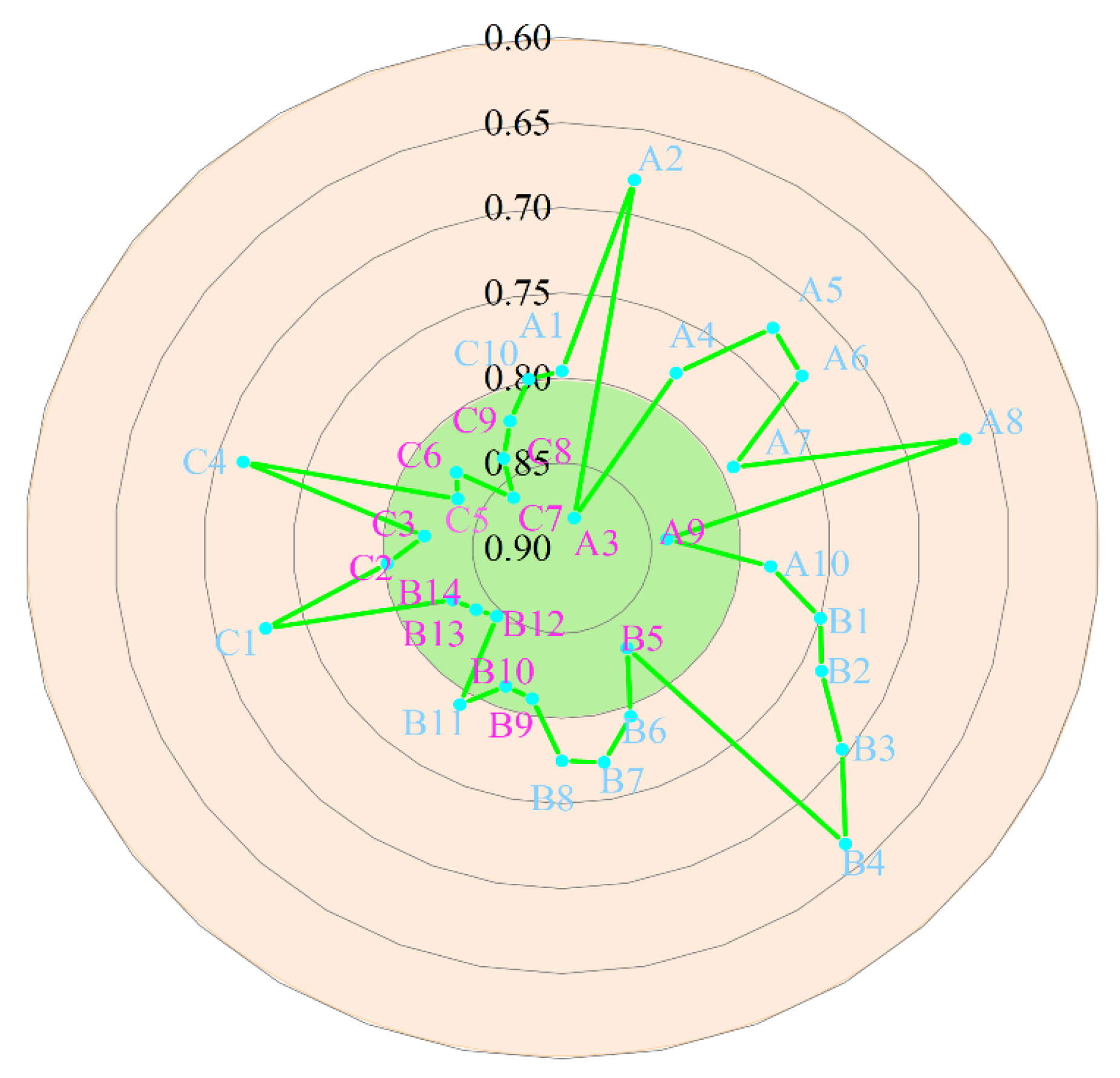

4.1.1. The Weight of the Safety Level Indicator

4.1.2. Safety Level of the Titanium Industry

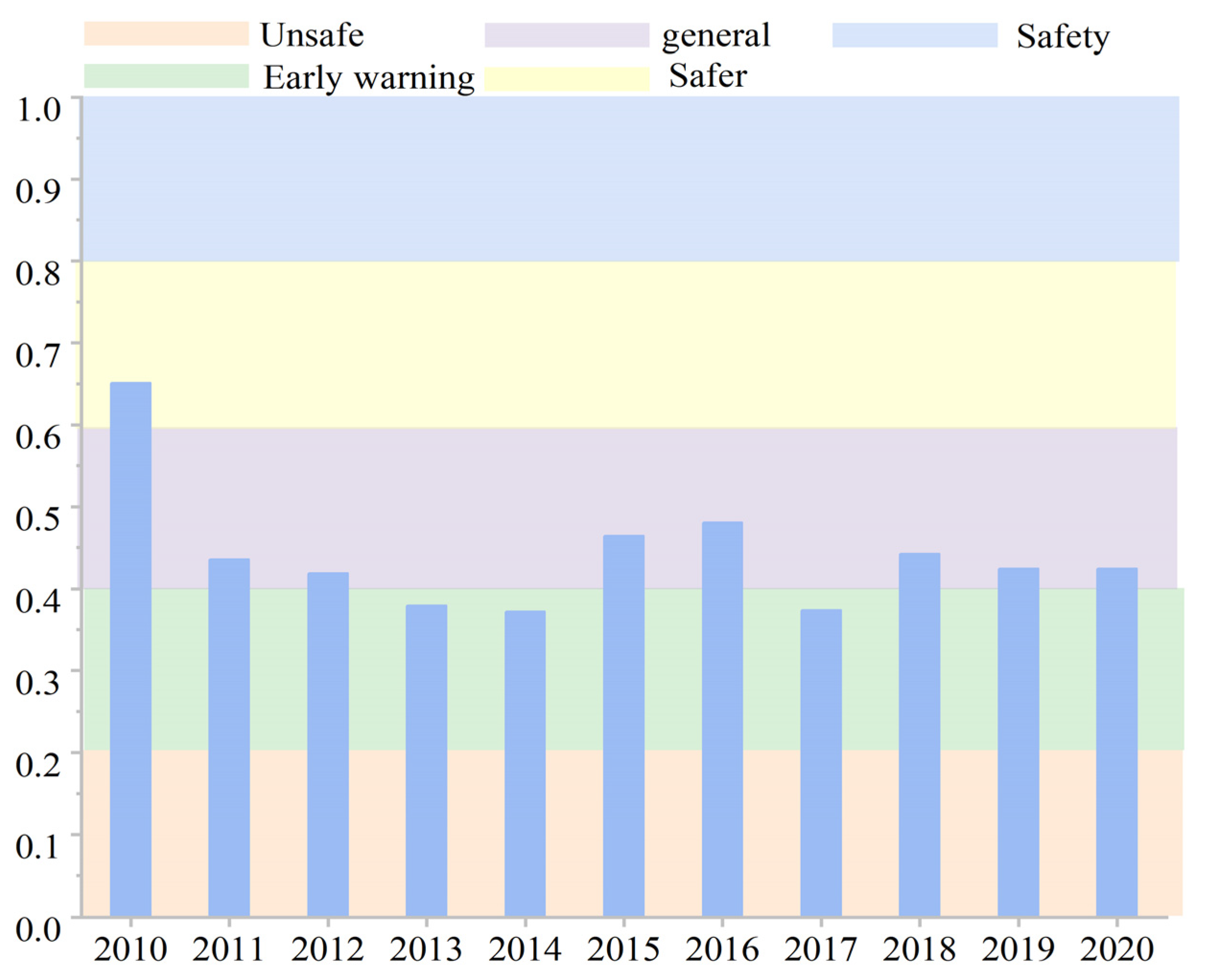

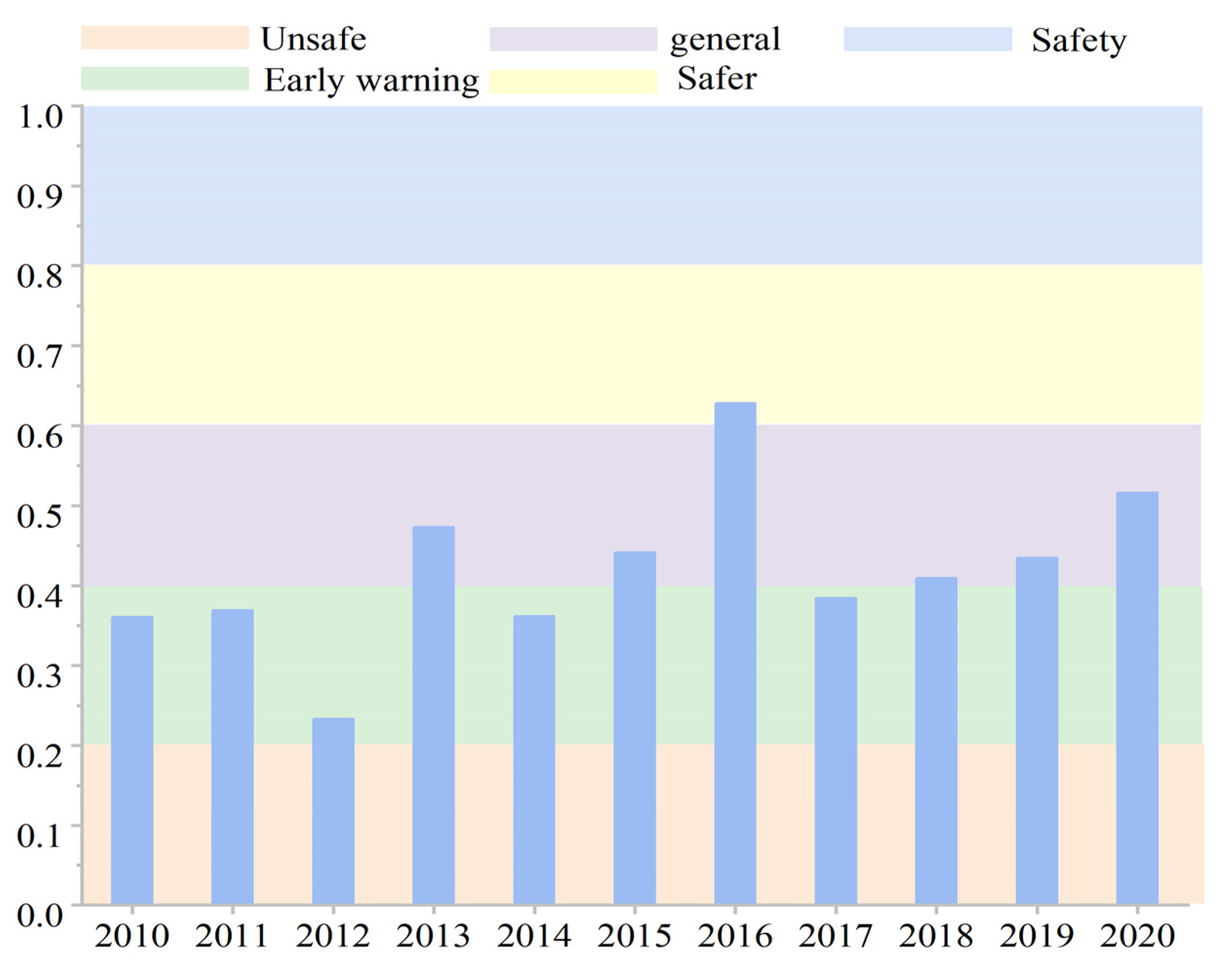

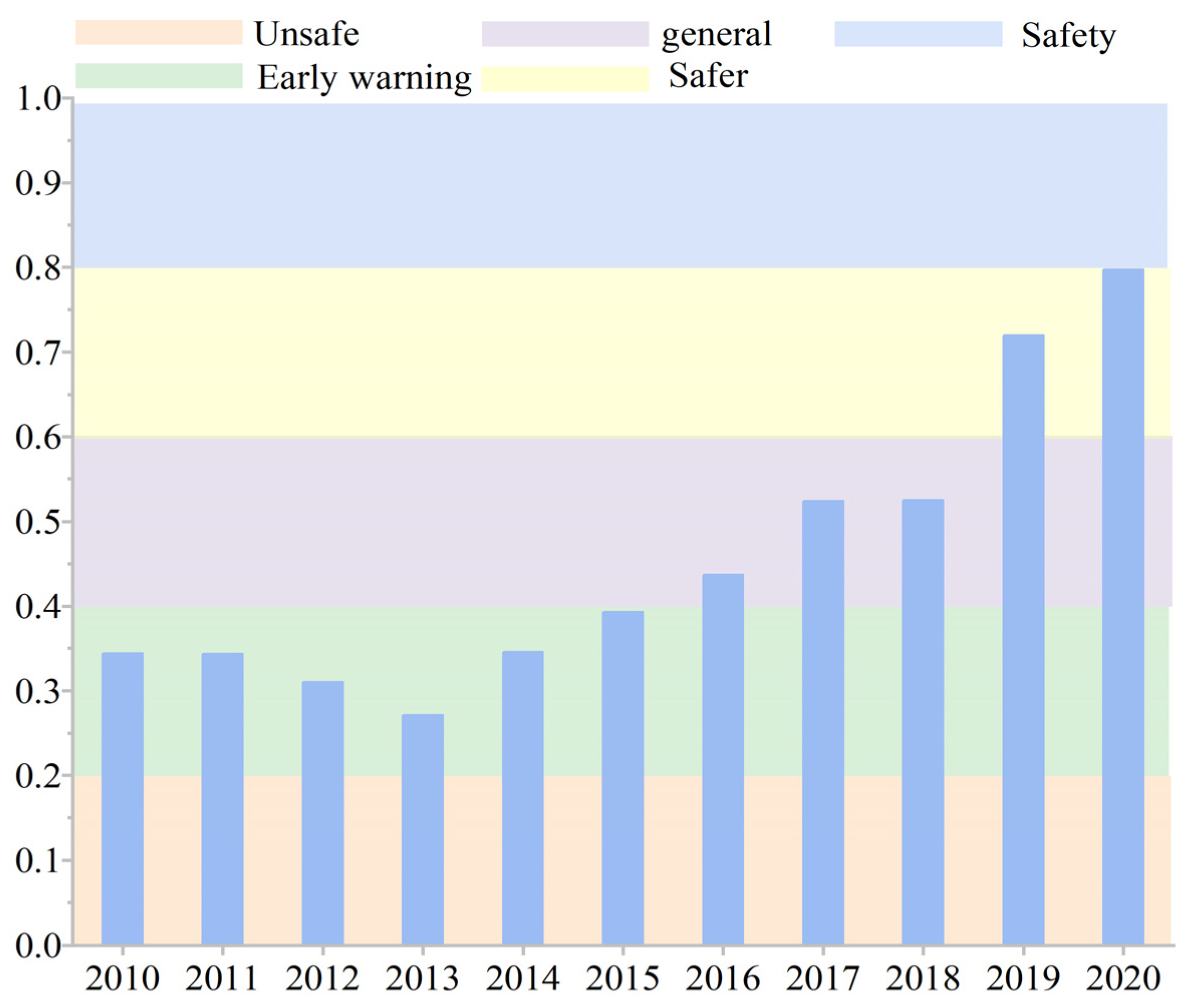

4.2. Security Dimension Layer Analysis of the Ti-Industry Chain

4.2.1. Analysis of Coupling Coordination Degree

4.2.2. Security Level Analysis of Dimension Layer

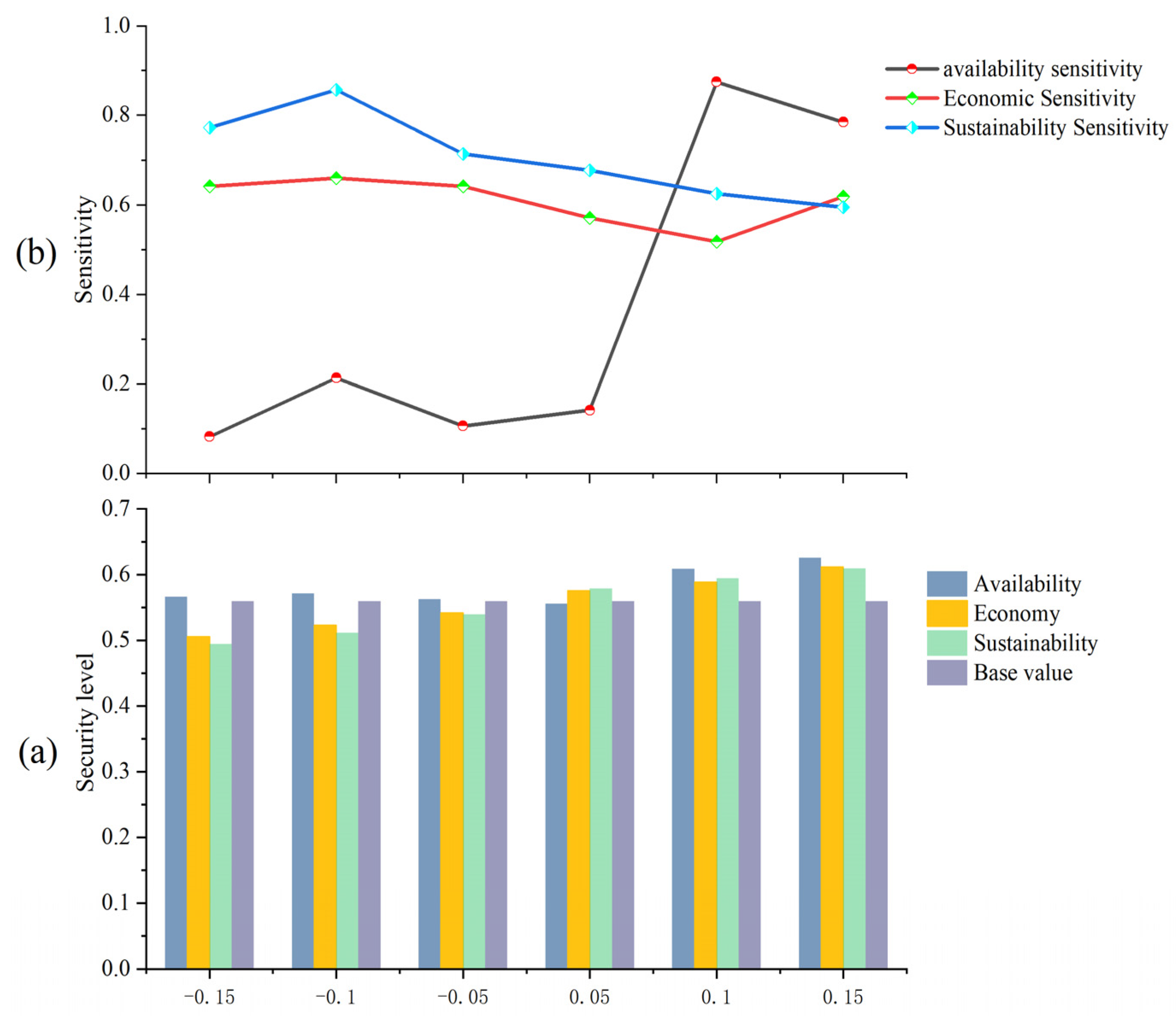

4.2.3. Sensitivity Analysis

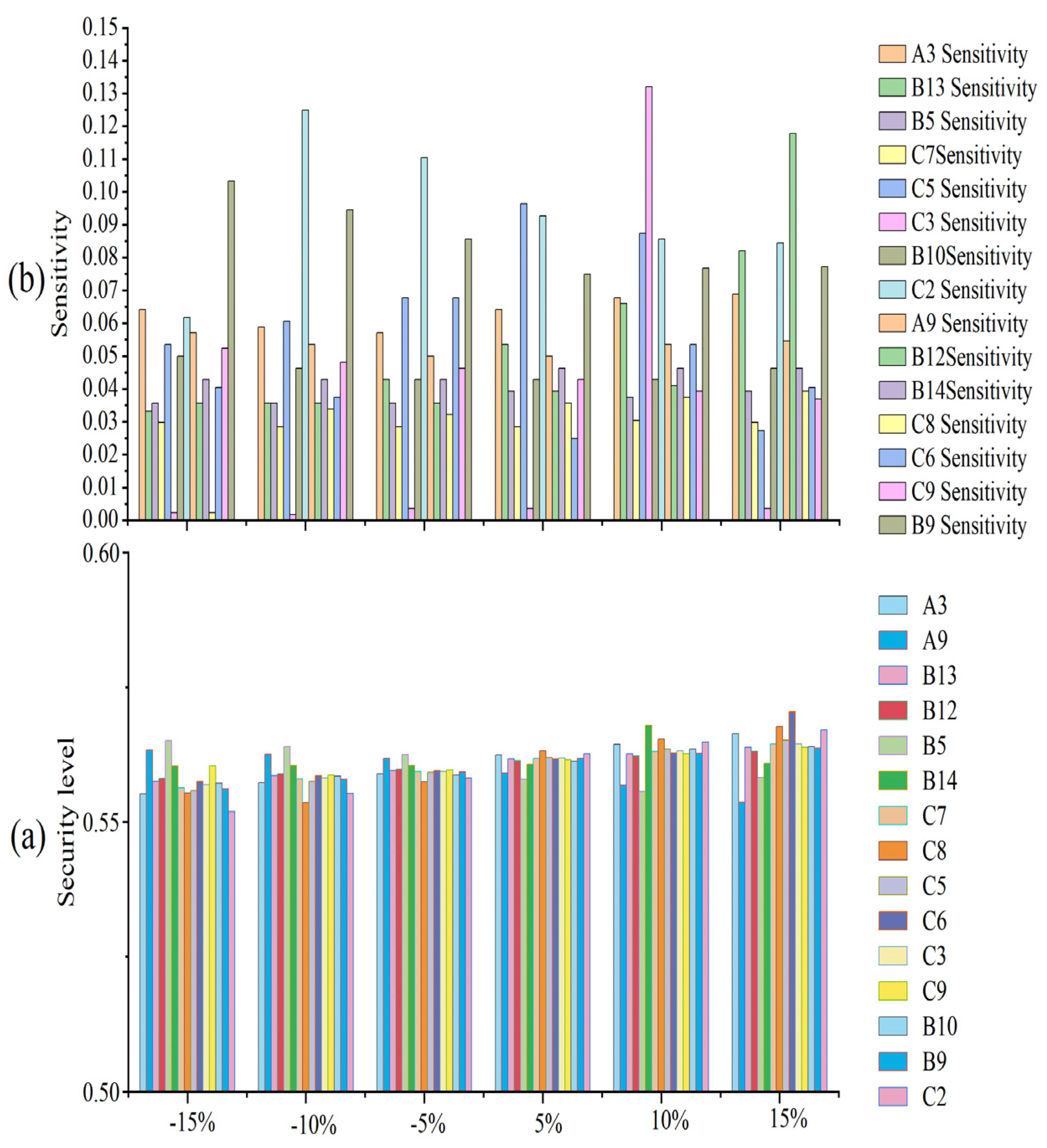

4.3. Correlation Analysis of the Ti Industry Chain and Sensitivity Analysis

5. Conclusions and Policy Suggestions

5.1. Conclusions

5.2. Polic Suggestions

- (1)

- First, we consider the existing patented technologies in the Ti industry chain. Some developed countries have monopoly advantages over the Ti industry and cannot be surpassed in a short period, such as the preparation of high-end Ti materials and recycling of Ti waste. In the processing field, the Ti industry in China should adhere to bottom-line thinking, such as the production of high-end Ti materials, the production technology of high-grade sponge Ti, and other fields to focus on tackling key problems to maintain adequate stability and safety in the face of any form.

- (2)

- The availability of Ti resources is important for consolidating the security of the Ti industry. Based on the distribution characteristics of Ti resources in China and related policies, the first task is to promote market-oriented reform in the upstream areas of the Ti industry chain, stimulate the vitality of upstream exploration and mining enterprises of Ti resources, and increase the strength of exploration and mining development through the reform of upstream mining rights, and opening and exit mechanisms to improve the self-sufficiency guarantee level of Ti resources in China. Second, the import channels of Ti resources must be broadened, and the impact of Ti raw materials, Ti product import concentrations, and geopolitical risks on the security of the Ti industry in China must be reduced. Simultaneously, research and development of Ti waste recycling technology is needed to improve the recycling rate of Ti waste in China.

- (3)

- To adhere to long- and short-term safety relationships of Ti resources, from the perspective of import and export trades, China mainly exports low-grade Ti at low prices. Most of the total trade balance has been reduced in quantity, thereby reducing the availability of Ti resources in China. Therefore, the exploitation of Ti resources in China should be reasonably conducted such that the lean ore is mined by force and the rich ore is mined by fines. According to the distribution characteristics of Ti resources in China, the cost of domestic Ti resources, international Ti resource prices, geopolitical reforms, and other factors are comprehensively considered to achieve the best balance between self-sufficiency and import supplementation of Ti raw materials and products. For example, when the price of international Ti resources is reasonable, the import of Ti resources should increase, the mineable life of Ti resources in China should increase, and the future security level of Ti resources in China should be improved.

- (4)

- By carrying forward alliance thinking, attaching importance to industry alliances, and strengthening industry concentration, currently, the evolution of the industry chain is progressing toward a decentralized high-end industry. Enterprises on the same information platform can form strategic alliances to achieve complementary advantages, such as process docking, resource sharing, and cultural integration.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhang, L.; Wang, X.D.; Qu, X.H. Application Status and Market Analysis of Non-Aero Titanium in China. Key Eng. Mater. 2012, 520, 8–14. [Google Scholar] [CrossRef]

- Santhosh, R.; Geetha, M.; Nageswara Rao, M. Recent Developments in Heat Treatment of Beta Titanium Alloys for Aerospace Applications. Trans. Indian Inst. Met. 2017, 70, 1681–1688. [Google Scholar] [CrossRef]

- Ares, G.G.; Mandal, P.; Diego, G.; Nicola, Z.; Paul, B. Studies on Titanium Alloys for Aerospace Applications. Defect Diffus. Forum 2018, 385, 419–423. [Google Scholar] [CrossRef]

- Akinribide, O.; Obadele, B.; Akinwamide, S.; Bilal, H.; Ajibola, O.; Ayeleru, O.; Ringer, S.; Olubambi, P. Sintering of binderless TiN and TiCN-based cermet for toughness applications: Processing techniques and mechanical properties: A review. Ceram. Int. 2019, 45, 21077–21090. [Google Scholar] [CrossRef]

- Froes, F.; Qian, M.; Niinomi, M. Titanium for Consumer Applications; Elsevier: Amsterdam, The Netherlands, 2019; pp. 77–90. [Google Scholar]

- Mekgwe, G.N.; Akinribide, O.J.; Akinwamide, S.O.; Olubambi, P.A. Fabrication of graphite reinforced TiCxNy by spark plasma sintering technique: A comparative assessment of microstructural integrity and nanoindentation properties. Vacuum 2021, 187, 110144. [Google Scholar] [CrossRef]

- You, S.H.; Lee, J.H.; Oh, S.H. A Study on Cutting Characteristics in Turning Operations of Titanium Alloy used in Automobile. Int. J. Precis. Eng. Man. 2019, 20, 209–216. [Google Scholar] [CrossRef]

- Schulz, K.J.; Deyoung, J.H.; Seal, R.R.; Bradley, D.C. Critical mineral resources of the United States—Economic and environmental geology and prospects for future supply. Geol. Surv. 2017, 1802, 797. [Google Scholar] [CrossRef]

- Chong, Y.; Poschmann, M.; Zhang, R.; Zhao, S.; Hooshmand, M.S.; Rothchild, E.; Olmsted, D.L.; Morris, J.W.; Chrzan, D.C.; Asta, M.; et al. Mechanistic basis of oxygen sensitivity in titanium. Sci. Adv. 2020, 6, eabc4060. [Google Scholar] [CrossRef]

- Zhang, T. Analyzing titanium patents at home and abroad. Iron Steel Vanadium Titan. 2017, 38, 158–164. [Google Scholar]

- Wu, X.; Zhang, J. Geographical Distribution and Characteristics of Titanium Resources in China. Titan. Ind. Prog. 2006, 6, 8–12. [Google Scholar]

- Li, Q.L.; Li, S.G.; Zheng, Y.F.; Li, H.M.; Massonne, H.J.; Wang, Q.C. A high precision U–Pb age of metamorphic rutile in coesite-bearing eclogite from the Dabie Mountains in central China: A new constraint on the cooling history. Chem. Geol. 2003, 200, 255–265. [Google Scholar] [CrossRef]

- Wang, X.D.; Lu, F.S.; Jia, H.; Hao, B. Report on China Titanium Industry Progress in 2010. Titan. Ind. Prog. 2011, 28, 1–6. [Google Scholar] [CrossRef]

- Qiu, G.Z.; Guo, Y.F. Current situation and development trend of the titanium metal industry in China. Int. J. Miner. Metall. Mater. 2022, 29, 599–610. [Google Scholar] [CrossRef]

- Wang, J.; Huang, Y. Exploration of Cooperation Mode of Vanadium and Titanium Enterprises in Panzhihua and Xichang and Applied Undergraduate Colleges. J. Chengdu Text. Coll. 2016, 2, 242–244. [Google Scholar]

- Mcmichael, P.; Gereffi, G.; Korzeniewicz, M. Commodity chains, and global capitalism. Contemp. Sociol. 1995, 24, 348. [Google Scholar] [CrossRef]

- Constantin, B.; Tobias, S.; Daniel, R. Antecedents and enablers of supply chain agility and its effect on performance: A dynamic capabilities perspective. Int. J. Prod. Res. 2013, 51, 1295–1318. [Google Scholar] [CrossRef]

- Priem, R.L.; Swink, M. A Demand-side Perspective on Supply Chain Management. J. Supply Chain. Manag. 2012, 48, 7–13. [Google Scholar] [CrossRef]

- Stabell, C.B.; Fjeldstad, Ø.D. Configuring value for competitive advantage: On chains, shops, and networks. Strateg. Manag. J. 1998, 19, 413–437. [Google Scholar] [CrossRef]

- Liu, M.; Li, H.; Zhou, J.; Feng, S.; Wang, Y.; Wang, X. Analysis of material flow among multiple phases of cobalt industrial chain based on a complex network. Resour. Policy 2022, 77, 102691. [Google Scholar] [CrossRef]

- Li, Y.L.; Huang, J.B.; Zhang, H.W. The impact of country risks on cobalt trade patterns from the perspective of the industrial chain. Resour. Policy 2022, 77, 102641. [Google Scholar] [CrossRef]

- Li, B.H.; Li, H.J.; Dong, Z.L.; Lu, Y.; Liu, N.R.; Hao, X.Q. The global copper material trade network and risk evaluation: A industry chain perspective. Resour. Policy 2021, 74, 102275. [Google Scholar] [CrossRef]

- Huang, J.B.; Ding, Q.; Wang, Y.; Hong, H.J.; Zhang, H.W. The evolution and influencing factors of international tungsten competition from the industrial chain perspective. Resour. Policy 2021, 73, 102185. [Google Scholar] [CrossRef]

- Lin, J.; Li, X.; Wang, M.X.; Liu, L.T.; Dai, T. How Can China’s Indium Resources Have a Sustainable Future? Research Based on the Industry Chain Perspective. Sustainability 2021, 13, 12042. [Google Scholar] [CrossRef]

- Svanidze, E.; Besara, T.; Ozaydin, M.F.; Tiwary, C.S.; Wang, J.K.; Radhakrishnan, S.; Mani, S.; Xin, Y.; Han, K.; Liang, H.; et al. High hardness in the biocompatible intermetallic compound β-Ti3Au. Sci. Adv. 2016, 2, e1600319. [Google Scholar] [CrossRef]

- Shon, H.K.; Phuntsho, S.; Vigneswaran, S.; Kandasamy, J.; Nghiem, L.D.; Kim, G.J.; Kim, J.B.; Kim, J. Preparation of titanium dioxide nanoparticles from electrocoagulation sludge using sacrificial titanium electrodes. Environ. Sci. Technol. 2010, 44, 5553–5557. [Google Scholar] [CrossRef] [PubMed]

- Sun, J.F.; Li, A.S.; Su, F.H. The excellent lubricating ability of functionalization graphene dispersed in perfluoropolyether for titanium alloy. ACS Appl. Nano Mater. 2019, 2, 1391–1401. [Google Scholar] [CrossRef]

- Li, X.; Liu, J.; Zhang, D.; Xiong, Z.H.; He, X.Q.; Yuan, M.; Wang, M.X. Material flow analysis of titanium dioxide and sustainable policy suggestion in China. Resour. Policy 2020, 67, 101685. [Google Scholar] [CrossRef]

- Li, M.H.; Geng, P.Y.; Liu, G.; Gao, Z.Y.; Rui, X.; Xiao, S.J. Uncovering spatiotemporal evolution of titanium in China: A dynamic material flow analysis. Resour. Conserv. Recycl. 2022, 180, 106166. [Google Scholar] [CrossRef]

- Song, M.; Tao, W. Research on the evaluation of China’s regional energy security and influencing factors. Energy Sources Part B Econ. Plan. Policy 2022, 17, 1993383. [Google Scholar] [CrossRef]

- Ma, L.; Liu, S.; Ai, L.; Sun, Y. Research on an Evaluation of the Work Suitability in the New First-Tier Cities. In International Conference on Harmony Search Algorithm; Springer: Cham, Switzerland, 2020; Volume 1063, pp. 175–185. [Google Scholar] [CrossRef]

- Zhang, S.L.; Liu, L.L.; Ran, J.X. Evaluation and Analysis of Competitiveness of Pharmaceutical Industry in China—An Empirical Study Based on Provincial Data From the Mainland. J. Hangzhou Dianzi Univ. 2011, 1, 1–5. [Google Scholar] [CrossRef]

- Hu, H.Q.; Ma, Y.; Wu, S.J. Fuzzy comprehensive evaluation on high-quality development of China’s rural economy based on entropy weight. J. Intell. Fuzzy Syst. 2020, 38, 7531–7539. [Google Scholar] [CrossRef]

- Ding, Q.Y.; Wang, Y.M. Intuitionistic Fuzzy TOPSIS Multi-attribute Decision Making Method Based on Revised Scoring Function and Entropy Weight Method. J. Intell. Fuzzy Syst. 2019, 36, 625–63510. [Google Scholar] [CrossRef]

- Wang, L.-J.; Shao, X.-L. Study on the safety production evaluation of the coal mine based on entropy-TOPSIS. J. Coal Sci. Eng. 2010, 16, 284–287. [Google Scholar] [CrossRef]

- Lu, J.P.; Wei, C.; Wu, J.; Wei, G.W. TOPSIS method for probabilistic linguistic MAGDM with entropy weight and its application to supplier selection of new agricultural machinery products. Entropy Switz. 2019, 21, 953. [Google Scholar] [CrossRef]

- Naeem, M.; Khan, M.A.; Abdullah, S.; Qiyas, M.; Khan, S. Extended TOPSIS method based on the entropy measure and probabilistic hesitant fuzzy information and their application in decision support system. J. Intell. Fuzzy Syst. 2021, 40, 11479–11490. [Google Scholar] [CrossRef]

- Niu, D.X.; Li, S.; Dai, S.Y. A comprehensive evaluation of the operating efficiency of electricity retail companies based on the improved TOPSIS method and LSSVM optimized by modified ant colony algorithm from the view of sustainable development. Sustainability 2018, 10, 860. [Google Scholar] [CrossRef]

- Tang, J.; Zhu, H.L.; Liu, Z.; Jia, F.; Zheng, X.X. Urban Sustainability Evaluation under the Modified TOPSIS Based on Grey Relational Analysis. Int. J. Env. Res. Pub. He. 2019, 16, 256. [Google Scholar] [CrossRef]

- Chang, J.X. Study on Evaluation System of Energy Security and Policy in China. Ph.D. Thesis, China University of Geosciences, Beijing, China, 2010. [Google Scholar]

- Wu, C.G.; He, S.J.; Sheng, C.M.; Liu, Z.J.; Wan, H. Discussion on Comprehensive Evaluation Method of Energy Security. J. Nat. Resour. 2011, 26, 964–970. [Google Scholar]

- Yang, B.; Ding, L.J.; Zhan, X.Y.; Tao, X.Z.; Peng, F. Evaluation and analysis of energy security in China based on the DPSIR model. Energy Rep. 2022, 8, 607–615. [Google Scholar] [CrossRef]

- Dong, F.; Li, W. Research on the coupling coordination degree of “upstream-midstream-downstream” of China’s wind power industry chain. J. Clean. Prod. 2021, 283, 124633. [Google Scholar] [CrossRef]

| Dimension Layer | Basic Indicators | Indicator Attribute | Meaning and Interpretation of the Indicators | ||

|---|---|---|---|---|---|

| Availability | Self-security ability | A1 | Titanium concentrate self-sufficiency rate | + | The ratio of the total annual production of titanium resources to the total consumption of titanium resources reflects the self-protection ability of titanium resources in my country. |

| A2 | The self-sufficiency rate of sponge titanium | + | |||

| A3 | Titanium dioxide self-sufficiency rate | + | |||

| A4 | Titanium self-sufficiency rate | + | |||

| Import risk | A5 | Import concentration of titanium ore | − | The ratio of imports from China’s top three titanium resources import source countries to the total imports reflects the market concentration risk of titanium resources imports. | |

| A6 | Import concentration of titanium sponge | − | |||

| External dependence | A7 | External dependence on titanium concentrate | − | External dependence degree = (import volume − export volume)/[output + (import volume − export volume)] × 100% It reflects the dependence of China’s titanium resources on the international market. | |

| A8 | External dependence on titanium sponge | − | |||

| A9 | Titanium dioxide to the external dependence degree | − | |||

| A10 | External dependence on titanium material | − | - | ||

| Reliability | Import and export trade; foreign trade | B1 | Titanium sponge import and export unit price ratio | − | The ratio of the average import price of titanium resources to the average export price reflects the international trade status of titanium resources in China. |

| B2 | Titanium dioxides import and export unit price ratio | − | |||

| B3 | Titanium material import and export unit price ratio | − | |||

| B4 | Titanium sponge trade deficit | − | The ratio of the total import and export of titanium resources reflects the international trade status of titanium resources in my country. | ||

| B5 | Titanium dioxide trade deficit | − | |||

| B6 | Titanium trade deficit | − | |||

| Domestic price volatility | B7 | The price volatility on pure titanium plate of TA2 | − | The difference between the price fluctuations of titanium products within one year, the smaller the fluctuation value, the higher the guarantee for the safe development of the titanium industry. | |

| B8 | Level 1 sea sponge titanium price volatility | − | |||

| Market demand | B9 | Titanium sponge production capacity utilization rate | + | The ratio of the production volume and production capacity of titanium products, that is, the operating rate size indirectly reflects the demand situation for titanium products. | |

| B10 | Titanium dioxide production capacity utilization rate | + | |||

| B11 | Titanium ingot production capacity utilization rate | + | |||

| B12 | Gross domestic product | + | The size of the GDP indirectly reflects the development of the titanium industry. | ||

| Expenditure on national defense | B13 | Military spending | + | Military expenditure reflects the income and development of military titanium | |

| Product revenue | B14 | The net interest rate of titanium products | + | The net interest rate of titanium products reflects the titanium industry earnings. | |

| Sustainability | Resource stock | C1 | The recoverable life of titanium ore | + | The ratio of the proven technical recoverable volume of titanium ore to the mining volume of the current year reflects the sustainable capacity of titanium ore. |

| Sustainable development potential | C2 | China Innovation Index | + | The ratio of the number of patents applied for by the titanium industry in China each year to the annual patents in the global titanium industry reflects my country’s independent innovation capability. | |

| C3 | Industrial structure | + | The proportion of high-end titanium materials reflects the sustainability of the titanium industry structure in China. | ||

| C4 | Sponge titanium capacity | + | The size of the production capacity of titanium products in China reflects the supply of titanium product production equipment in China. | ||

| C5 | Titanium dioxide production capacity | + | |||

| C6 | Titanium ingot production capacity | + | |||

| C7 | CR3 | + | The output of titanium materials in my country ranks among the top three (CR3), and the ratio of the output of titanium materials in the top five (CR5) enterprises to the total output reflect the concentration of my country’s titanium materials industry. | ||

| C8 | CR5 | + | |||

| C9 | The gross profit margin of titanium products | + | Gross margin = (gross margin / operating income)× 100%, reflecting the competitiveness of the enterprise | ||

| Security capability | C10 | National Defense Support Capability | + | Defense spending as a percentage of GDP. In the long run, the security of the industrial chain cannot be separated from the guarantee of strong national defense capabilities. |

| Index | Wj | Years | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||

| A1 | 0.029 | 0.662 | 0.6240 | 0.5484 | 0.6011 | 0.6543 | 0.6947 | 0.6061 | 0.5531 | 0.5738 | 0.6463 | 0.6777 |

| A2 | 0.032 | 1.045 | 1.1506 | 1.1098 | 1.0464 | 1.0895 | 1.0592 | 0.9794 | 0.9740 | 0.9533 | 0.9330 | 0.9672 |

| A3 | 0.027 | 0.993 | 1.1173 | 1.0556 | 1.1309 | 1.0676 | 1.1669 | 1.2586 | 1.2738 | 1.3149 | 1.3569 | 1.4232 |

| A4 | 0.057 | 1.495 | 1.1445 | 1.1986 | 1.1544 | 1.1622 | 1.3001 | 1.3597 | 1.1852 | 1.3476 | 1.3428 | 1.1484 |

| A5 | 0.017 | 0.648 | 0.5891 | 0.5478 | 0.5321 | 0.4264 | 0.2234 | 0.3145 | 0.4530 | 0.5474 | 0.5890 | 0.6281 |

| A6 | 0.018 | 0.553 | 0.4135 | 0.9553 | 0.9344 | 1.0000 | 0.9915 | 0.9216 | 0.9325 | 0.8588 | 0.6000 | 0.8125 |

| A7 | 0.029 | 0.338 | 0.3760 | 0.4516 | 0.3989 | 0.3457 | 0.3054 | 0.3941 | 0.4631 | 0.4239 | 0.3523 | 0.3204 |

| A8 | 0.017 | −0.003 | −0.1506 | −0.0599 | −0.0464 | −0.0895 | −0.0592 | 0.0260 | 0.0208 | 0.0467 | 0.0670 | 0.0328 |

| A9 | 0.024 | 0.066 | −0.1033 | −0.1320 | −0.1073 | −0.1770 | −0.0430 | −0.2568 | −0.2732 | −0.3168 | −0.3568 | −0.4243 |

| A10 | 0.036 | −0.038 | −0.1056 | −0.1654 | −0.1544 | −0.1622 | −0.1622 | −0.1488 | −0.1860 | −0.1962 | −0.2049 | −0.1036 |

| B1 | 0.018 | 0.877 | 1.0829 | 1.0829 | 0.7370 | 1.3305 | 1.0161 | 1.2327 | 1.2773 | 1.0567 | 0.9743 | 1.1749 |

| B2 | 0.036 | 1.273 | 1.0612 | 1.1351 | 1.1621 | 1.3312 | 1.7625 | 1.4908 | 1.1228 | 1.2071 | 1.3583 | 1.4715 |

| B3 | 0.029 | 1.976 | 1.7236 | 1.7236 | 3.0951 | 3.1576 | 3.3439 | 3.1915 | 3.0015 | 2.8495 | 3.0036 | 2.6922 |

| B4 | 0.011 | −415.918 | −8705.5954 | −3204.7844 | −33,418.7158 | −3563.7000 | −2108.1418 | 950.6452 | 1627.0000 | 2717.0000 | 4723.0000 | 3267.0000 |

| B5 | 0.031 | 44,940 | −45,097 | −58,774 | −41,743 | −54,313 | −45,000 | −72,900 | −140,900 | −168,600 | −170,700 | −186,900 |

| B6 | 0.031 | 10,588.328 | −658.1663 | −989.8339 | 35,091.6428 | 10,222.800 | 16,358.5376 | 11,068.7651 | 12,128.000 | 11,777.000 | 8298.000 | 3518.000 |

| B7 | 0.039 | 2.000 | 2.000 | 0.500 | 2.000 | 2.200 | 0.500 | 4.600 | 0.800 | 1.500 | 1.900 | 2.000 |

| B8 | 0.035 | 1.100 | 1.4000 | 1.3000 | 1.5000 | 0.0000 | 0.8000 | 4.6000 | 0.1000 | 1.4000 | 1.4000 | 1.5000 |

| B9 | 0.027 | 0.558 | 0.5055 | 0.5485 | 0.5411 | 0.4522 | 0.7049 | 0.7619 | 0.7841 | 0.7005 | 0.5372 | 0.6947 |

| B10 | 0.023 | 0.613 | 0.6285 | 0.7308 | 0.7714 | 0.7320 | 0.8345 | 0.8497 | 0.8969 | 0.8676 | 0.8368 | 0.9129 |

| B11 | 0.042 | 0.519 | 0.6422 | 0.4372 | 0.5708 | 0.4600 | 0.4425 | 0.4924 | 0.4841 | 0.4729 | 0.4997 | 0.6027 |

| B12 | 0.027 | 412,119 | 487,940.2 | 538,580.0 | 592,963.2 | 643,563.1 | 676,708.0 | 746,395.1 | 832,035.9 | 919,281.1 | 986,515.2 | 1,015,986.2 |

| B13 | 0.030 | 5321.0 | 6011.0 | 6702.7 | 7202.0 | 8082.0 | 8869.0 | 9543.5 | 10,211.0 | 11,069.0 | 12,680.0 | 13,795.4 |

| B14 | 0.013 | 4.500 | 4.2000 | 0.3000 | 0.5000 | 2.1000 | −10.0000 | 3.3000 | 2.3400 | 7.6200 | 8.8300 | 9.2500 |

| C1 | 0.020 | 1309.091 | 1090.9091 | 750.0000 | 745.0980 | 793.7500 | 898.8235 | 935.7143 | 975.0000 | 395.2381 | 404.7619 | 159.6330 |

| C2 | 0.051 | 0.381 | 0.3942 | 0.3525 | 0.3552 | 0.3745 | 0.4007 | 0.4334 | 0.5125 | 0.5796 | 0.5783 | 0.5753 |

| C3 | 0.043 | 13.500 | 12.5000 | 12.2000 | 14.3000 | 15.0000 | 19.8000 | 25.6000 | 24.7000 | 25.0000 | 26.0000 | 29.0000 |

| C4 | 0.043 | 103,500 | 128,500 | 148,500 | 150,000 | 150,000 | 88,000 | 88,000 | 93,000 | 107,000 | 158,000 | 177,000 |

| C5 | 0.026 | 2,400,000 | 2,880,000 | 2,600,000 | 2,800,000 | 3,060,000 | 2,780,000 | 3,060,000 | 3,200,000 | 3,400,000 | 3,800,000 | 3,845,000 |

| C6 | 0.027 | 89,200 | 96,200 | 148,500 | 109,000 | 124,000 | 135,000 | 135,000 | 146,700 | 158,700 | 177,500 | 199,000 |

| C7 | 0.023 | 46.000 | 45.0000 | 35.9000 | 32.0000 | 35.0000 | 40.1000 | 39.2000 | 36.0000 | 39.8000 | 44.0000 | 46.0000 |

| C8 | 0.032 | 50.100 | 52.0000 | 45.0000 | 48.0000 | 45.8000 | 51.5000 | 50.5000 | 62.6000 | 53.0000 | 58.6000 | 59.0000 |

| C9 | 0.022 | 16.60 | 17.30 | 18.00 | 14.20 | 19.30 | 18.82 | 20.26 | 22.75 | 24.74 | 21.34 | 25.90 |

| C10 | 0.032 | 0.0129 | 0.0123 | 0.0124 | 0.0121 | 0.0126 | 0.0131 | 0.0128 | 0.0123 | 0.0120 | 0.0129 | 0.0136 |

| Years | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.386 | 0.422 | 0.455 | 0.402 | 0.413 | 0.377 | 0.301 | 0.399 | 0.363 | 0.332 | 0.319 | |

| 0.317 | 0.261 | 0.210 | 0.261 | 0.232 | 0.291 | 0.349 | 0.290 | 0.303 | 0.341 | 0.407 | |

| Safety level | 0.451 | 0.382 | 0.316 | 0.394 | 0.360 | 0.436 | 0.537 | 0.421 | 0.455 | 0.507 | 0.561 |

| Security level [40,41,42] | General | Early warning | Early warning | Early warning | Early warning | General | General | General | General | General | General |

| Years | The Safety Level of Titanium Industry Chain | Availability Level | C | T | D | Coupling Coordination Type |

|---|---|---|---|---|---|---|

| 2010 | 0.451 | 0.651 | 0.641 | 0.451 | 0.538 | Grudging coordination |

| 2011 | 0.382 | 0.435 | 0.392 | 0.382 | 0.387 | Mild maladjustment |

| 2012 | 0.316 | 0.419 | 0.618 | 0.316 | 0.442 | On the verge of maladjustment |

| 2013 | 0.394 | 0.380 | 0.802 | 0.394 | 0.562 | Grudging coordination |

| 2014 | 0.360 | 0.372 | 0.780 | 0.360 | 0.530 | Grudging coordination |

| 2015 | 0.436 | 0.465 | 0.508 | 0.436 | 0.470 | On the verge of maladjustment |

| 2016 | 0.537 | 0.480 | 0.901 | 0.537 | 0.696 | Primary coordination |

| 2017 | 0.421 | 0.374 | 0.676 | 0.421 | 0.534 | Grudging coordination |

| 2018 | 0.455 | 0.442 | 0.723 | 0.455 | 0.573 | Grudging coordination |

| 2019 | 0.507 | 0.425 | 0.484 | 0.507 | 0.496 | On the verge of maladjustment |

| 2020 | 0.561 | 0.425 | 0.480 | 0.561 | 0.519 | Grudging coordination |

| Years | The Safety Level of Titanium Industry Chain | Economical Level | C | T | D | Coupling Coordination Type |

|---|---|---|---|---|---|---|

| 2010 | 0.451 | 0.361 | 0.507 | 0.451 | 0.478 | On the verge of maladjustment |

| 2011 | 0.382 | 0.369 | 0.473 | 0.382 | 0.425 | On the verge of maladjustment |

| 2012 | 0.316 | 0.233 | 0.443 | 0.316 | 0.374 | Mild maladjustment |

| 2013 | 0.394 | 0.473 | 0.491 | 0.394 | 0.440 | On the verge of maladjustment |

| 2014 | 0.360 | 0.362 | 0.595 | 0.360 | 0.463 | On the verge of maladjustment |

| 2015 | 0.436 | 0.441 | 0.651 | 0.436 | 0.533 | Grudging coordination |

| 2016 | 0.537 | 0.628 | 0.932 | 0.537 | 0.707 | Intermediate coordination |

| 2017 | 0.421 | 0.384 | 0.679 | 0.421 | 0.535 | Grudging coordination |

| 2018 | 0.455 | 0.409 | 0.816 | 0.455 | 0.609 | Primary coordination |

| 2019 | 0.507 | 0.435 | 0.831 | 0.507 | 0.649 | Primary coordination |

| 2020 | 0.561 | 0.516 | 0.708 | 0.561 | 0.630 | Primary coordination |

| Years | The Safety Level of Titanium Industry Chain | Sustainability Level | C | T | D | Coupling Coordination Type |

|---|---|---|---|---|---|---|

| 2010 | 0.451 | 0.344 | 0.433 | 0.451 | 0.442 | On the verge of maladjustment |

| 2011 | 0.382 | 0.343 | 0.663 | 0.382 | 0.504 | Grudging coordination |

| 2012 | 0.316 | 0.310 | 0.425 | 0.316 | 0.367 | Mild maladjustment |

| 2013 | 0.394 | 0.271 | 0.548 | 0.394 | 0.465 | On the verge of maladjustment |

| 2014 | 0.360 | 0.346 | 0.781 | 0.360 | 0.530 | Grudging coordination |

| 2015 | 0.436 | 0.393 | 0.548 | 0.436 | 0.489 | On the verge of maladjustment |

| 2016 | 0.537 | 0.437 | 0.719 | 0.537 | 0.621 | Primary coordination |

| 2017 | 0.421 | 0.524 | 0.795 | 0.421 | 0.579 | Grudging coordination |

| 2018 | 0.455 | 0.525 | 0.660 | 0.455 | 0.548 | Grudging coordination |

| 2019 | 0.507 | 0.720 | 0.932 | 0.507 | 0.687 | Primary coordination |

| 2020 | 0.561 | 0.797 | 0.701 | 0.561 | 0.627 | Primary coordination |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hui, X.; Qi, M.; Wang, W.; Yang, S.; Zhang, C. A Comprehensive Model for Evaluating Titanium Industry Security in China. Processes 2023, 11, 2286. https://doi.org/10.3390/pr11082286

Hui X, Qi M, Wang W, Yang S, Zhang C. A Comprehensive Model for Evaluating Titanium Industry Security in China. Processes. 2023; 11(8):2286. https://doi.org/10.3390/pr11082286

Chicago/Turabian StyleHui, Xiangwei, Ming Qi, Wenhao Wang, Sen Yang, and Chengqi Zhang. 2023. "A Comprehensive Model for Evaluating Titanium Industry Security in China" Processes 11, no. 8: 2286. https://doi.org/10.3390/pr11082286

APA StyleHui, X., Qi, M., Wang, W., Yang, S., & Zhang, C. (2023). A Comprehensive Model for Evaluating Titanium Industry Security in China. Processes, 11(8), 2286. https://doi.org/10.3390/pr11082286