Abstract

This study delves into the intricate interplay of economic growth components, specifically focusing on consumption and investment in Saudi Arabia from 2000 to 2022. Employing vector error correction models and co-integration techniques, we analyze the short- and long-term dynamics within the relationship of consumption, investment, and economic growth. Granger causality analysis is also used to discern these pivotal variables’ causal connections. Our empirical analysis reveals a persistent long-term cointegration relationship among the variables, underscoring the enduring nature of their interdependency. Furthermore, our findings highlight consumption and investment’s statistically significant positive impact on economic growth. Notably, the short-term analysis unveils a stable model characterized by an annual adjustment to equilibrium of 100%. Moreover, the Granger causality study demonstrates unidirectional causal linkages among consumption, investment, and economic growth. These findings hold substantial implications for policy formulation in Saudi Arabia. Policymakers must grasp the ramifications of burgeoning prosperity and evolving private consumption patterns on future environmental outcomes. Achieving sustainable long-term results necessitates equal emphasis on bolstering private consumption and fostering other facets of economic growth.

1. Introduction

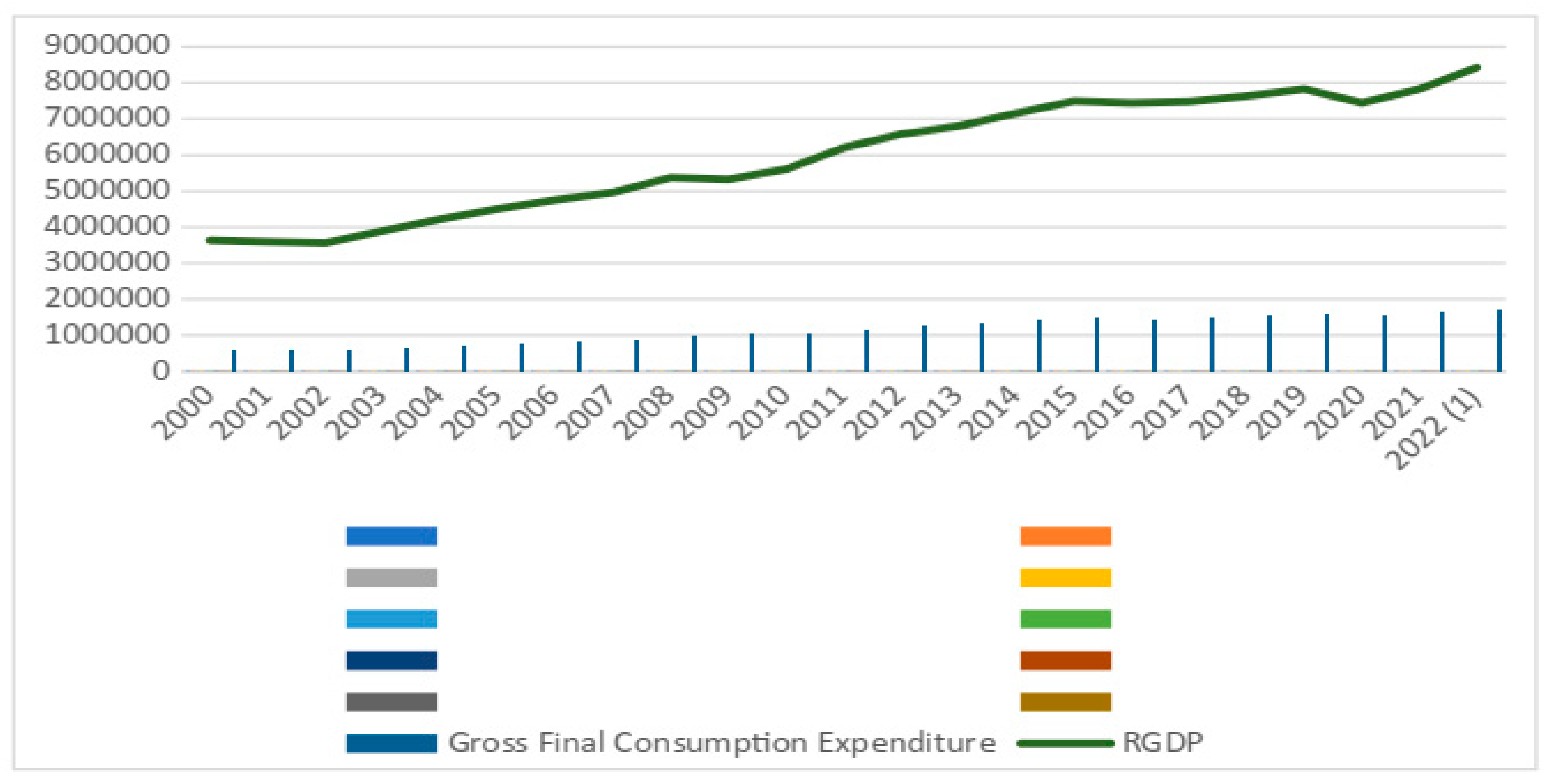

The increase in a country’s GDP is commonly used to gauge economic growth or wealth expansion [1]. Consumption and investment are two crucial macroeconomic components associated with any economy. Researchers have embarked on estimating the numerical correlation between consumption and income through econometric analysis while also considering other causal factors. Keynes’ theory emphasizes aggregate consumption as fundamental to increasing GDP. He contends that household consumption expenditure, particularly in the long term, impacts economic activity [2]. The contribution of total expenditure, covering both household and public expenditures, is pivotal in driving economic growth. Consumption stands out among the key components of GDP. Reductions in consumption, whether in the private or public sector, can diminish firm revenues, leading to decreases in tax revenues from direct and indirect taxes over time [3]. The notable rise in aggregate consumption has been instrumental in driving economic progress in Saudi Arabia. The surge in final consumption expenditure has been especially impressive, tripling from 2000 to 2022, as shown in Figure 1.

Figure 1.

Saudi share of consumption in GDP (2000–2022), (unit: million, currency: Riyals) [4]. Source: Saudi Central Bank statistical reports. Statistical Report (sama.gov.sa). https://www.sama.gov.sa/en-us/economicreports/pages/report.aspx?cid=55 (accessed on 10 January 2024).

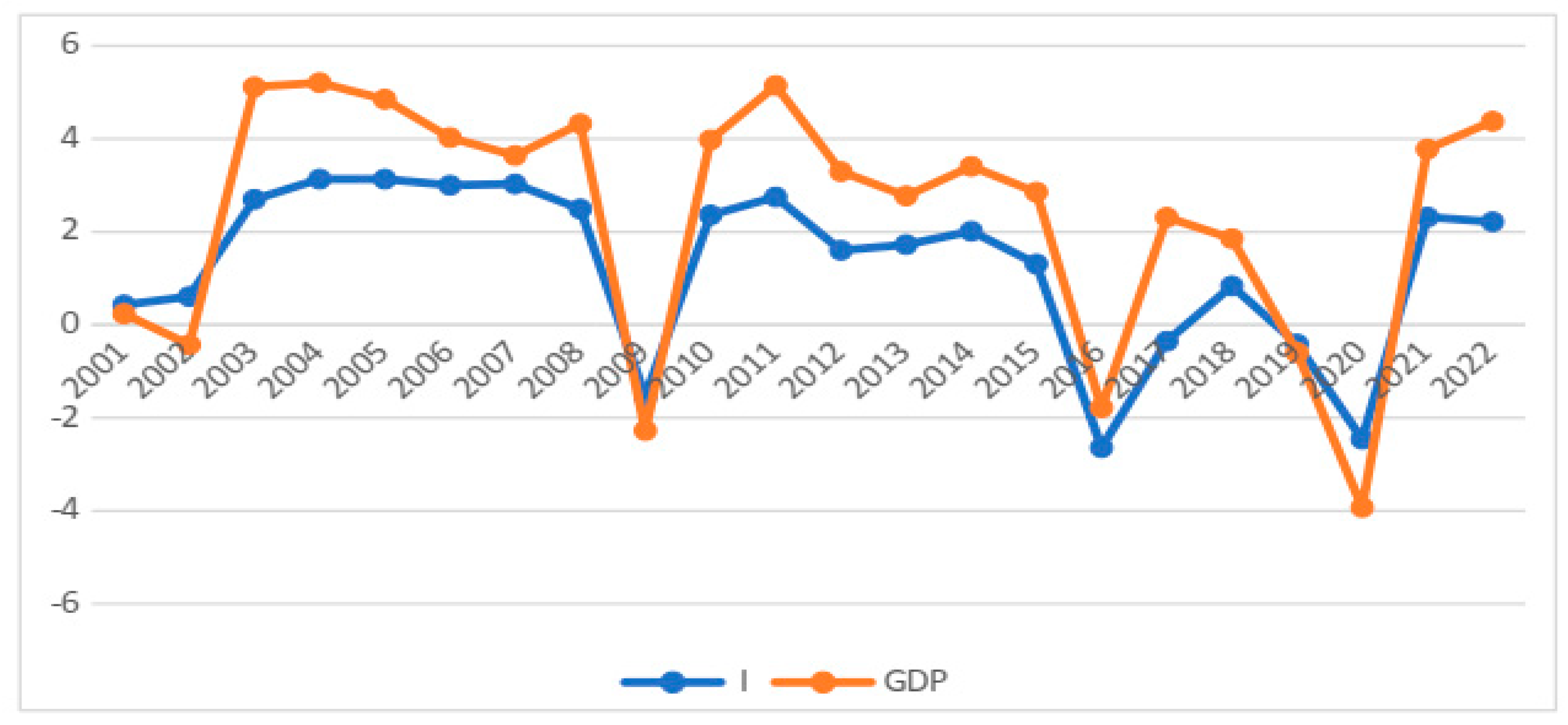

On the other side, investment refers to the allocation of resources to produce goods and services, thereby increasing output and fostering economic growth. In the context of crowding out, private and public investments are viewed as mutually reinforcing economic endeavors that necessitate additional resources to enhance output and GDP. However, Keynes contended that for a country to amass wealth and consequently attain economic advancement, a level of effective demand that aligns with full employment must exist. This implies that when a nation seeks to enhance its GDP, it should prioritize and encourage investment and consumption to the greatest extent possible (Figure 2).

Figure 2.

Saudi share of investment (I) in GDP (2000–2022), (unit: million, currency: Riyals) [4]. Source: Saudi Central Bankstatistical reports. Statistical Report (sama.gov.sa). https://www.sama.gov.sa/en-us/economicreports/pages/report.aspx?cid=55 (accessed on 10 January 2024).

Saudi Arabia is oil-dependent, contributing 87% of budget revenues, 90% of export earnings, and 42% of the nation’s GDP [5]. By Vision 2030, Saudi Arabia has constructed its framework based on three primary themes, each encompassing distinct goals slated to be accomplished by 2030. 1. Vision 2030 aims to establish a robust economy by enhancing investment strategies to tap into lucrative economic sectors, encourage economic variety, and create employment prospects. Additionally, the objective is to elevate the proportion of non-oil exports in non-oil GDP from 16% to 50%. Nonetheless, this research delves into the complex relationship among the different elements of economic growth, with a particular emphasis on consumption and investment in Saudi Arabia throughout the duration encompassing 2000 to 2022. Consequently, examining the intricate link among economic growth, consumption, investment, and the diverse factors affecting GDP holds the potential to uncover fresh perspectives on this pivotal connection. Moreover, this exploration may yield valuable and enlightening insights into the subject matter. In an instance of complete employment, wherein the economy is functioning at its utmost sustainable capacity and unemployment is at its natural rate, the factors influencing aggregate demand can still influence output, albeit with restricted effects because of the limitations imposed by full employment. However, the sentiment levels of both consumers and businesses have the potential to impact their financial decisions, particularly in terms of spending and investment. When confidence levels are higher, there is a likelihood of increased spending and investment, which in turn can stimulate aggregate demand and output, even in a situation where employment is already at its maximum capacity. A possible explanation of this paradox in the situation of Saudi is that economic stability reinforces the high confidence of the economy as a whole. From the standpoint of New Keynesian theory, the factors that influence overall demand can still impact economic output even when the economy is operating at full employment. However, the mechanisms through which this influence occurs differ from those proposed by classical or neoclassical perspectives. The need for this study arises from the fact that previous research has not explicitly explored the correlation among economic growth, consumption, and investment within the Saudi Arabian context. Consequently, this gap in knowledge highlights the importance of conducting this research. The second methodological addition of this paper is the utilization of various econometric techniques, including dynamic ordinary least squares (DOLS) and cointegration tests, to assess the long-run behavior of the variables. To clarify the direction of causation among these variables, this study also uses panel Granger causality. The uniqueness of this study is based on the fact that it attempts to answer the question “which is a driving force of Saudi economic growth, investment or consumption?”. This study is organized as follows: Section 2 presents a related literature review. Section 3 comprises a model specification and the data employed to examine the correlation among economic growth, consumption, and investment in Saudi Arabia. Section 4 presents the findings and a discussion of the analysis. Subsequently, Section 5 provides an overview of the conclusion and the potential implications for policymakers.

2. Related Literature

2.1. Gross Domestic Product (GDP)

Numerous research endeavors have delved into the factors influencing Saudi GDP [6]. One such study scrutinized the correlation between oil production and economic growth using time-series data from 1971 to 2010. The results indicate a beneficial influence of oil income on the actual GDP over both immediate and extended periods, across various model specifications. While Saudi Arabia’s non-oil GDP maintains an impressive level, the contribution of oil GDP to overall GDP growth demonstrates notable volatility and instability. Other studies have underscored the necessity for diversification in Saudi GDP [7]. The impact of key macroeconomic factors, such as private investment and public investment, on the non-oil GDP of the Saudi Arabian economy, which heavily relies on oil, was thoroughly investigated. Results indicate that past non-oil GDP shocks strongly influence current non-oil GDP in the short term. Additionally, increases in public investment boost non-oil GDP both in the short and long terms, while negative private investment shocks diminish it in both time frames. Moreover, positive (negative) oil production shocks also enhance (decrease) non-oil GDP in both the short and long terms. Utilizing the non-parametric causality-in-quantile approach, the study discerned that causality-in-the-mean and causality-in-the-variance stemming from the four explanatory variables vary across quantiles. Significantly, these macroeconomic variables are not impacted causally by the non-oil GDP. Ref. [8] explored the interconnection between oil and non-oil GDP in Saudi Arabia in their study. By utilizing the autoregressive distributed lag (ARDL) cointegration technique, the research investigated the relationships among various variables. The findings from the ARDL analysis confirm a long-term cointegration between non-oil GDP and oil rent, indicating the continued adherence to oil rent-seeking strategies within Saudi Arabia. Moreover, the examination of short-term dynamics provides evidence for the impact of oil rent on non-oil GDP. The ARDL model further analyzed the asymmetric effects and successfully estimated and validated the symmetric effect of oil rent on non-oil GDP.

On the other hand, ref. [9] examined the extent to which the rapid economic growth rates observed in Central and Eastern European (CEE) countries were driven by either Consumption or investments, taking into account various external factors influencing economic growth and their potential implications for the labor market in CEE economies to determine the sustainability of these economic growth and employment patterns in the long term. Their findings indicate that private consumption has a positive impact on short-term economic growth. Additionally, public expenditure is significantly and adversely associated with economic growth, whereas net exports have a weak effect on the economic growth of the CEE region. Domestic investments have a lesser effect on economic growth in the CEE region compared with private and public spending. Nevertheless, there is a positive correlation between domestic investments and economic growth. Both direct and portfolio investments play a role in shaping the long-term GDP [10]. On 25 April 2016, Saudi Arabia introduced its 2030 Vision to diversify the economy and decrease the nation’s reliance on oil. Furthermore, the implementation of various initiatives by the government has facilitated the transformation of the private sector into the foremost driving force behind the economy. A total of thirteen initiatives were initiated under the 2030 Vision. These programs aimed to enhance human resources and foster economic growth by attracting foreign investments and facilitating business operations. Ref. [11] observed that the estimation of Saudi GDP can be derived from scientific and technical journal articles. Furthermore, the predicted GDP demonstrates a noticeable variance in values when compared with the actual GDP, a difference that can be elucidated by considering the influence of various economic factors on GDP. The comprehension of the interplay among investment, consumption, and GDP is crucial in grasping the fundamental framework that underpins the overall economic activity.

2.2. Investment and Economic Growth

Theoretical and statistical studies have shown a relationship between investment and GDP. Investment, especially in physical assets like machinery, equipment, and infrastructure, plays a crucial role in stimulating economic development. Based on the Keynesian perspective, investment depends on the marginal efficiency of capital as an expectation in terms of monetary value. That is to say, saving never acts as a source of investment and never deviates from investment, so S = I [12]. In addition, investment influences the gross fixed capital formation, which is an integral part of GDP that accounts for the overall increase in physical assets. Increased levels of investment directly contribute to a rise in GDP, as evident in the expenditure approach used to calculate GDP. Nevertheless, as [13] argued, Foreign Direct Investment (FDI) plays a crucial role in shaping the behavior of a country’s GDP, steering it toward a destination of trade surplus and alleviating unemployment through job creation. However, FDI contributes to economic growth only when a sufficient absorptive capability of advanced technologies is available in the host economy [14]. Furthermore, the Saudi economy experienced a higher inflow of FDI during the global financial crisis because of economic stability [15].

Ref. [12] investigated the relationship between saving and investment and the mechanism underlying the way they influence the GDP. The results show a unidirectional causality running from private savings to private investment. However, an ambiguous relationship between investment and GDP at both aggregate and private levels is missing.

On the contrary, ref. [16] presented a different perspective, asserting that not only does FDI play a significant role in driving economic development, but domestic investment (both public and private) can also be a crucial causal factor in fostering economic growth and generating employment opportunities. Their study investigated the causal relationships among domestic capital investment (DCI), FDI, and GDP in Saudi Arabia spanning from 1970 to 2015. The findings reveal various significant trends. In the extended period, a negative bidirectional causality is evident between the expansion of non-oil GDP and FDI, as well as between the growth in non-oil GDP and FDI. Additionally, a bidirectional causality is identified between FDI and DCI.

Interestingly, in the short run, FDI hurts DCI, while DCI negatively influences FDI in the long term. Additionally, financial development and trade openness positively affect the inflow of FDI and domestic capital investment in the long term. However, numerous investigations [17,18,19,20,21,22,23,24,25] have agreed that foreign direct investment (FDI) can augment the GDP through overflow effects. These effects encompass the introduction of novel technologies, the accumulation of capital, the expansion of exports, and the fostering of human capital. In contrast, several research studies have indicated that FDI can have a detrimental impact on the GDP of certain nations. For instance, refs. [26,27,28,29] found evidence supporting this claim. A different study [30] concluded that domestic investment, FDI, imports, exports, or labor do not influence the long-term economic growth in Nigeria. One potential explanation for this paradox is that the effectiveness of FDI depends on the host country’s initial conditions. These conditions include the host country’s absorptive capacity and the level of complementarity between domestic investment and FDI [16]. However, investments can also impact GDP indirectly by affecting productivity growth, fostering innovation, and driving technological advancements.

2.3. Consumption Expenditure and GDP

Household consumption expenditure, which denotes the amount spent by households on goods and services, stands as the predominant element of GDP in numerous economies. The expenditure by consumers stimulates the demand for goods and services, consequently fostering heightened levels of production and economic activity. Consumer sentiment, disposable income levels, interest rates, and wealth fluctuations all have an impact on individuals’ consumption choices and, subsequently, aggregate demand and GDP. Low- and middle-income countries tend to exhibit a stronger relationship between consumption and GDP than high-income countries. This is attributed to high-income countries allocating a greater proportion of their capital toward investment and research and development endeavors [31]. It is widely agreed upon that economic growth in developing nations is primarily driven by consumption rather than investment. This is primarily because the private consumption share of GDP in these economies typically falls between 70% and 75% [32]. Over the past decades, there has been a consistent increase in the ratio of consumption to GDP in Saudi Arabia. However, the conventional neoclassical theory of constrained optimization, which forms the basis of the consumption function, fails to adequately explain this significant rise according to standard models. The concept of aggregate consumption is perceived as the outcome of two distinct historical processes. Predetermined and regulated decisions primarily characterize the first process, while the second involves flexible choices made with an understanding of uncertainty. These choices aim to embrace new intermediate rules related to consuming innovative goods and services. A similar study [33] examined the consumption ratio to GDP in the United States. The research presented a different viewpoint in which the overall expenditure on consumption predominantly results from the population’s adoption of widely accepted principles within an intricate economic framework. The data substantiate that the proportion of consumption in GDP increased because of the spread of a “consumerism culture” during the period following the war, and it is now reaching its threshold, carrying significant implications for both macroeconomics and society.

In the previous century, the discussion surrounding the factors that impact aggregate consumption played a pivotal role in shaping the field of macroeconomics in subsequent years. Keynesian economists emphasized the significance of the multiplier in maintaining stability, as well as the marginal propensity to consume, which increases during economic downturns and reverts to a proportional average propensity to consume during upturns. The relationship between consumption and GDP is intricately connected by the multiplier effect. A rise in consumption expenditure initially boosts the demand for goods and services, which in turn encourages businesses to ramp up production and expand their workforce. This subsequent rise in income then fuels even more consumption, setting off a self-perpetuating cycle of economic expansion. However, some economists who shared Friedman’s perspective faced difficulties incorporating the consumption function into neoclassical micro-foundations, particularly in constructing permanent income as an adaptive expectation. In modern macroeconomics, the neoclassical representation of consumption behavior is widely embraced [34]. Nevertheless, the economy is viewed as a complex system that is not deterministic, predictable, or mechanistic but process-dependent, organic, and constantly evolving [35]. As a complex system, it is argued that the economy must exhibit a certain degree of order to function. Much of consumption expenditure is influenced by prior commitments to behavioral rules. Individuals tend to repurchase similar goods and services, replace durable goods with similar models at comparable real prices, and fulfill contractual obligations that have not yet expired [33]. Likewise, consumption will encompass an “entrepreneurial” element, wherein individuals seize the opportunities that arise amidst favorable uncertainty [36].

Ref. [37] identified three significant aggregate consumption behaviors as follows: habit formation (HF), rule-of-thumb consumption (RC), and the complementarity of government consumption (CGC) in private utility. The study’s findings are as follows:

(1) The presence of HF is evident, indicating that individuals continue their consumption patterns based on past behavior.

(2) Around 38% of consumers abide by the principle of thumb, which suggests that they consume their current income without considering other factors. This behavior is particularly prominent in the period preceding the emergence of mobile money in the 2000s.

(3) Their study also reveals that public consumption acts as a counterpart to private consumption within the framework of Edge-worth-Pareto optimality. This indicates that a rise in government spending can have a beneficial effect on overall demand by means of a positive marginal utility pathway. Furthermore, it indicates that a greater share of consumption in the GDP aligns with a smaller share in other areas of the macroeconomy. In addition, a study was carried out by [38] to investigate the relationship between private consumption and different variables and its influence on the economic growth of 52 Asian countries/territories. Their research provides evidence in favor of the hypothesis that economic growth in Asia is driven by consumption. It is worth mentioning that their study considered the distinctive features of Asian economies, including their impressive global competitiveness, substantial savings rates, and significant public expenditure. Adoption rates have demonstrated steady growth over the course of several decades, both in Saudi Arabia and the United States. This upward trend is evident in the expanding proportion of the GDP allocated to consumption expenditures, as noted by [33]. Consumer confidence, fueled by economic stability, serves as a driving force behind this phenomenon. Notably, it plays a significant and positive role in stimulating expenditures, particularly for durable and semi-durable goods as well as services, as highlighted by [39]. Furthermore, embracing positive uncertainty can facilitate the integration of novel types of goods and services, paving the way for implementing innovative ideas, capabilities, and skills.

On the other hand, Saudi consumption can be classified into the following two bold categories: The first is goods and services, which can be recycled. This section has no major and/or controllable drawbacks to environmental pollution. The second is energy consumption, where the hazards toward the planet (gas emissions) increase. According to the study conducted by [40], it is evident that China’s exponential economic expansion has resulted in a substantial surge in energy usage. However, despite this growth, the improvements in energy efficiency and the reduction in environmental impact from energy consumption have not kept pace. Similarly, ref. [6] discovered that the domestic oil consumption in Saudi Arabia’s industrial sector has had a detrimental impact on both the short-run and long-run GDP. The persistent conflict among the economy, energy sector, and air quality protection remains a pressing issue, primarily because of Saudi Arabia’s heavy reliance on fossil fuel energy sources. Furthermore, the challenges associated with implementing effective environmental protection measures continue to persist.

Investment and consumption are closely connected elements of aggregate demand, playing a dominant role in stimulating economic activity. Variations in investment expenditure have the potential to impact consumer sentiment and income projections, thereby shaping consumption patterns. On the other hand, investment decisions can be influenced by consumer spending behaviors. Robust consumer demand serves as an indicator of potential business prospects, prompting companies to consider expanding their operations to cater to anticipated future demand. Hence, the interplay between investment and consumption is crucial in influencing the business cycle and setting the path for economic growth. In times of economic expansion, increasing investment and consumer spending work together to drive strong GDP growth. Likewise, in periods of economic downturn, decreases in investment and consumption can worsen recessionary trends.

3. Specification of the Model, Data, and Econometric Approach

3.1. Specification of the Model

The following models examine the dynamic relationship among household consumption, government expenditure, investment, trade balance (X−M), and Saudi Arabia’s real gross domestic product (GDP). The models used to investigate this relationship are as follows:

RGDP = C + I + G + NX

RGDPit = α + Cit + I + Git + (X − M)it

RGDPit = α0 + α1 Cit + α2 Iit + α3 Git + α4 (X − M) + εit

After taking the log, the model becomes

where RGDPit represents real gross domestic product, which is a dependent variable. The independent variables include household consumption (Cit), investment (I), government expenditure (Git), and net exports (NX), given by the difference between exports and imports (X−M). The error term εit is subject to conventional statistical characteristics.

Ln RGDPcit = α0+ α1Ln Cit + α2 Ln Iit + α3 Ln Git + α4 Ln (X − M)it

3.2. Data Analysis

The analysis in this study utilized data sourced from the official Saudi Central Bank open portal. The variables employed were meticulously defined with information sourced from the World Bank. EViews 12 software was employed for the analysis, recognized for its flexibility and intuitive characteristics. This software efficiently facilitated tasks such as data organization, visualization, and analysis, ensuring a comprehensive and streamlined analytical process.

Definition of the Variables (World Bank)

1. Economic growth (RGDP): RGDP, which stands for real gross domestic product, is this research’s dependent variable. It serves as a comprehensive measure that considers inflation and accurately depicts the overall worth of goods and services generated by the Saudi Arabian economy in the year 2010. This metric is expressed in prices from a reference year and is widely recognized as constant-price, inflation-adjusted, or constant Saudi Riyal (SR).

2. Private final consumption expenditure (C): Denoted as (C), household final consumption expenditure, also known as private consumption, refers to the total value of goods and services acquired by households, encompassing durable products. This measure excludes the purchase of dwellings but incorporates imputed rent for owner-occupied dwellings. Additionally, it encompasses payments and fees made to governments in order to obtain permits and licenses. Notably, this indicator incorporates the expenditures of nonprofit institutions serving households, even if they are reported separately by the country.

3. Investment spending (I): Denoted as I, gross fixed capital formation is a measure that accounts for investments made in a country’s economy using constant local currency. This measure is based on aggregates calculated using constant 2010 prices and expressed in SR. Gross fixed capital formation encompasses various types of investments, such as land improvements, purchases of plant, machinery, and equipment, as well as the construction of infrastructure like roads, railways, schools, offices, hospitals, residential dwellings, and commercial and industrial buildings. Additionally, according to the 2008 System of National Accounts (SNA), net valuables acquisitions are also considered part of capital formation.

4. General government final consumption expenditure (G): Denoted as G, the general government final consumption expenditure is determined using constant local currency. This encompasses all current expenses made by the government for the acquisition of goods and services, including employee compensation. Additionally, it comprises a significant portion of the funds allocated toward national defense and security. However, it does not encompass military expenditures contributing to government capital formation.

5. Exports of goods and services (X): Denoted as X, exports are measured in a consistent local currency, SR. The aggregates are calculated using constant 2010 prices and are expressed in SR. The exports of goods and services encompass the total value of all goods and various market services provided to other countries. This includes the value of merchandise, freight, insurance, transportation, travel, royalties, license fees, and other services such as communication, construction, financial, information, business, personal, and government services. However, it does not include compensation of employees, investment income (previously referred to as factor services), or transfer payments.

6. Imports of goods and services (M): Denoted as (M), these are the imports of goods and services measured in a consistent local currency, specifically the Saudi riyal. The aggregates are computed using constant 2010 prices and are expressed in SR. Imports of goods and services encompass the total monetary value of all goods and other market services procured from the international community. This includes the value of merchandise, freight, insurance, transportation, travel, royalties, license fees, and other services such as communication, construction, financial, information, business, personal, and government services. However, it does not include compensation of employees and investment income, previously referred to as factor services, nor does it include transfer payments.

3.3. Econometric Methodology

This research utilizes various econometric methodologies to tackle the unique obstacles presented by time series data, causality, and cointegration (Table 1).

Table 1.

Description of variables and sources of data.

The Autoregressive Distributed Lag (ARDL) approach is a technique utilized in econometrics to estimate and examine the long-term connections among variables, especially within the realm of time series data analysis. This method is frequently utilized to model cointegration and dynamic relationships among economic variables. Furthermore, model specification in the ARDL model, in contrast to conventional regression models, incorporates lagged values of both the dependent and independent variables to capture the dynamics of the relationship over time. In ARDL models that incorporate cointegrated variables, an Error Correction Mechanism (ECM) is commonly integrated to account for the short-term adjustment dynamics toward the long-term equilibrium. The ECM signifies the rate at which any imbalance among the variables is rectified. Likewise, the ARDL technique is capable of examining the presence of cointegration among variables, indicating the existence of a long-term relationship. In ARDL models, the bounds testing approach, pioneered by [41], is frequently employed to assess cointegration.

The econometric techniques that can be utilized for analysis include the dynamic ordinary least squares (DOLS) estimation method, the Johansen cointegration test, and the error correction model (ECM). These methodologies are particularly suitable for investigating the long-term associations, short-term dynamics, and causal connections between the expenditure components and the RGDP in Saudi Arabia.

DOLS is a statistical approach utilized for parameter estimation in dynamic regression models that incorporate time series data with potential integration. This method is particularly popular in the analysis of cointegrated time series, as highlighted by [42].

The general formula for DOLS is:

where:

∆Yt = α + β1∆Xt + εt

- ∆Yt is the dependent variable at time t;

- ∆Xt is the independent variable(s) that exists at time t;

- α is the intercept;

- β is/are the coefficient(s) of the independent variable(s);

- εt is the error term at time t.

Johansen cointegration test

The Johansen cointegration test is a pivotal statistical tool in exploring the presence of cointegration among a set of time series variables, indicating enduring relationships among them. Primarily utilized in econometrics, this approach consists of estimating a vector autoregressive (VAR) model and then performing likelihood ratio tests to evaluate the model’s adequacy. The equation for the Johansen cointegration test is as follows:

where:

Δyt = Πyt−1 + Γ1Δyt−1 + Γ2Δyt−2…….. + ΓpΔyt−p + ϵt

- Δyt represents the difference vector of time series variables at time t.

- Π is the matrix of cointegration coefficients.

- Γi is the matrices of adjustment coefficients.

- p is the lag length of the VAR model.

- ϵt is the error term.

The error correction model (ECM) serves as a theoretical structure used to analyze the short-term and long-term dynamics among variables within a cointegrated relationship. The fundamental formula of ECM is:

where:

∆Yt = α + β1(∆Yt − 1 − β2∆Xt − 1) + γ∆Xt + δ1∆Yt − 1 + δ2∆Xt − 1 + εt

∆Yt: The short-term dependent variable changes at time “t”.

∆Xt: The short-term variations in the independent variable(s) at time point “t”.

α: The intercept term that indicates the constant effect on the dependent variable.

β1: The coefficient that measures the speed at which the adjustment or correction process functions, particularly in reaction to deviations from the long-term balance seen in the previous period.

β2: The coefficient associated with the lagged difference in the independent variable(s) that is utilized to adjust for deviations from the equilibrium condition.

γ: The initial modification in the coefficient of the explanatory variable that signifies the direct influence of variations in the explanatory variable on the response variable.

δ1: The coefficient of the lagged first difference in the dependent variable that is accountable for capturing any persistence or autocorrelation.

δ2: The inclusion of the lagged first difference coefficient within the independent variable(s) that takes into consideration the presence of potential persistence or autocorrelation effects.

εt: The error term that denotes the unaccounted variability in the dependent variable during time “t”.

4. Findings and Discussion of the Analysis

Table 2 displays descriptive statistics for the variables, encompassing maximum, minimum, mean, standard deviation (Std. Dev.), and coefficient of variation (CV). Additionally, it includes the average ratio of the natural logarithm of C from 2000 to 2022, which is approximately 13.3%, with a standard deviation of 0.28. As for Ln I, its average is around 13%, with a standard deviation of 0.53. These statistics collectively suggest that the model is largely stable.

Table 2.

Descriptive statistics.

Table 3 presents the correlation matrix, revealing that private consumption exhibits the strongest positive association with RGDP (0.233), followed by government expenditure (G) (0.226), net trade balance (X−M) (0.137), and investment (0.022), respectively. These findings are significant for elucidating the structure of Saudi RGDP and identifying the most influential factors in real economic growth from a different perspective.

Table 3.

Model’s correlation matrix.

The ordinary least squares (OLS) estimation approach was employed in this study to analyze the model and assess the relationship among Saudi household consumption, investment, and real gross domestic product (RGDP). As depicted in Table 4, the positive and statistically significant coefficient of Ln C (t-Statistic = 3.4425, Prob. = 0.0412) suggests a robust positive correlation between household consumption and RGDP. This implies that an increase in aggregate consumption is likely to lead to an elevation in RGDP, indicating a potential link between economic growth and heightened consumption, consistent with the findings of [9].

Table 4.

DOLS estimate of RGDP.

Furthermore, although the coefficient for Ln G is positively associated, it lacks statistical significance (t-Statistic = 0.2408, Prob. = 0.8252), indicating that government expenditure may not have substantially impacted Saudi RGDP during the study period. Conversely, evidence of a negative relationship between investment (I) and RGDP in Saudi Arabia is apparent, as indicated by the highly significant negative coefficient for Ln I (t-Statistic = −3.992, Prob. = 0.0282).

Moreover, based on Table 4, it was observed that the coefficient for Ln (X−M) exhibited a negative value and displayed a high level of statistical significance (t-Statistic = −3.6028, Prob. = 0.0367). This finding implies that the balance in trade, encompassing net exports and imports, had an adverse impact on the Saudi Arabian real gross domestic product (RGDP).

Table 4 displays an R-squared value of 0.9099, signifying that the model elucidates around 91% of the fluctuation in RGDP. The adjusted R2, which takes into account the number of variables in the model, is 0.4294.

Overall, the results demonstrate a nuanced relationship between real gross domestic product and expenditure components in Saudi Arabia, with certain variables exhibiting positive effects (i.e., C and G). In contrast, others display negative effects (i.e., I and (X−M)).

According to Table 5, the unit root (ADF) test reveals that all series exhibited non-stationarity at a significance level of 0.05, as confirmed by the p-values. If the t-statistics for the ADF test of the variables C, G, I, and X−M fail to surpass the critical values at the 5% level, it suggests non-stationarity in their level forms. Subsequently, after taking the first difference, all variables were observed to become stationary, with a p-value below 0.05.

Table 5.

The unit root (ADF) test.

Upon analysis of Table 6, it becomes evident that lag two emerges as the optimal choice for a VAR model, denoted by asterisks across the Final Prediction Error (FPE), Akaike Information Criterion (AIC), and Hannan–Quinn Information Criterion (HQ) columns. The table incorporates various factors such as log-likelihood (LogL), sequential modified LR (LR), FPE, AIC, Schwarz information criterion (SC), and HQ, which aid in determining the appropriate lag order for the VAR model.

Table 6.

Criteria for selecting VAR lag length.

The Johansen cointegration test plays a crucial role in revealing the enduring associations among the variables under investigation. Hence, cointegration analysis is pivotal for investigating stable associations among Ln RGDP, Ln C, Ln G, Ln I, and Ln (X−M) across periods. Criteria such as the Akaike Information Criterion (AIC) and Schwarz Criterion (SC) were utilized to determine the lag length that best fits the model. These criteria aided in model selection and were computed based on the estimation of an unconstrained vector autoregressive model using the first differences of the variables. The analysis outcomes indicate that the model’s most optimal lag length is one. Additionally, Table 7 illustrates that one significant cointegration equation exists at the 5% level.

Table 7.

Johansen cointegration test: E-views 12 output.

We test the short-run model with the lag in ECT as an independent model. As shown in Table 8, the negative sign and significance of ECT (−1) imply that adjustment of the model will be possible. The coefficient of ECT (−1) is 1.00, which shows the speed of adjustment toward equilibrium. Therefore, the model is stable in the short run accordingly. Likewise, Table 9 indicates the stationary of ECT at level (i.e., rejection H0). Hence, cointegration and a stable long-run relationship among the model constructs exist (Prob. = 0.0045 < 0.05).

Table 8.

Short-run error correction term.

Table 9.

Error correction model (LONG RUN).

The outcomes of the Johansen cointegration test hold significance in extracting additional analyses and drawing conclusions regarding the dynamics of Saudi RGDP and expenditure component factors.

Based on Table 9, it appears that private consumption and government expenditure positively impact Saudi real GDP in the long run. At the same time, ECT does not yield a statistically significant result for investment and trade balance (i.e., net value of exports and imports) on average, citrus paribus.

To sum up, the null hypothesis of no cointegration is rejected against the alternative of the cointegration relationship in the model.

The causal relationship among the relevant factors used in this study is shown in Table 10. The results are summarized as follows:

Table 10.

Granger causality tests.

- -

- C → RDGP rejection of H0 (i.e., causality relationship exists). This indicates a statistically significant unidirectional causal connection between C and RGDP, implying that fluctuations in household consumption can lead to notable changes in Rwal GDP in Saudi Arabia.

- -

- G → RGDP rejection of H0 (i.e., causality relationship exists). A unidirectional causal relationship from G to RGDP is observed, indicating that fluctuations in government expenditure have a substantial impact on the Saudi real GDP.

- -

- I → RGDP rejection of H0 (i.e., causality relationship exists). Investment exhibits a statistically significant unidirectional causal relationship with RGDP. Changes in G has a significant impact on the RGDP in Saudi Arabia.

- -

- (X−M) → RGDP rejection of H0 (i.e., causality relationship exists). A statistically significant unidirectional causal relationship exists between the net trade balance (i.e., exports- imports) and real GDP. Alterations in the trade balance exert a noteworthy influence on Saudi RGDP.

Discussion of the Analysis

The correlation matrix in Table 3 indicates that private consumption has the highest positive association with RGDP (0.233). The result implies that consumption is a leading driver of Saudi economic growth. Moreover, the long-term relationship analysis results indicate stable associations between consumption and economic growth in Saudi Arabia. Subsequently, the results uncover the stability of the Saudi economic growth model in the short run supported by the positive impact of consumption and government expenditure on Saudi real GDP in the long run. However, the power of Saudi consumption and economic growth as well are probably supported by two factors. First, non-Saudi individuals form a considerable part of the manpower in Saudi Arabia, especially in areas including construction, healthcare, hospitality, and domestic labor. Foreigners in Saudi Arabia play a significant role in various aspects of the country’s economy, society, and culture. Moreover, they are essential participants in a range of industries such as oil and gas, manufacturing, finance, and services, thereby driving consumption, enhancing productivity, and fostering economic development. Second, Saudi Arabia has been proactively engaged in enhancing tourism as a component of its Vision 2030 initiative, with the objective of broadening its economy and diminishing reliance on oil revenues. The influx of tourists to Saudi Arabia has been progressively rising in recent times, owing to a multitude of endeavors such as the implementation of tourist visas, the enhancement of tourist destinations, and the organization of prominent events and festivals. Saudi Arabia has achieved a remarkable milestone in the tourism sector, experiencing a complete resurgence and registering a 56% increase in international visitors in 2023 as opposed to 2019 (pre-pandemic) [42].

Although government expenditure is positively associated with GDP, it is insignificant, implying that government expenditure may not have substantially impacted Saudi RGDP during the study period. Government expenditure can have lag effects, whereby the positive outcomes of such spending may not be immediately evident in terms of enhanced economic activity and GDP growth. This delay can occur because of various factors, such as delays in project implementation or the gradual dissemination of funds throughout the economy. Consequently, in the short term, the impact on GDP might not be readily observable. This result aligns with [44,45,46]. This result supports the theories of Keynesian and Endogenous Growth Models, which suggest that public expenditure plays a crucial role in stimulating economic growth in Saudi Arabia over the long term. Furthermore, it provides evidence for Saudi policymakers to eliminate any government expenditure that does not promote economic growth.

Investment encompasses the generation, accumulation, and improvement of both physical and human capital, which are indispensable for the advancement and prosperity of the economy. The analysis results show a negative relationship between investment and economic growth in Saudi Arabia, as indicated by the highly significant negative coefficient for Ln I. Therefore, it can be inferred that investment did not significantly influence Saudi Arabia’s RGDP during this period. This result is consistent with [16,20,22,26,28,29,30,47]. However, in certain situations, investment might have a weak effect on the GDP. Various elements could play a role in this Saudi phenomenon and external factors, including shifts in worldwide economic circumstances, fluctuations in financial market stability, or geopolitical conflicts, may also play a role in shaping investment choices and their effects on GDP. Moreover, excessive investment is frequently linked with periods of economic expansion followed by contraction in the economy. Furthermore, over-investment can also result in surplus capacity within specific sectors, wherein the production capability surpasses the demand for goods and services. It is worth noting that Saudi Arabia accounts for approximately 60.3% of all foreign investments, thereby playing a significant role in fostering economic growth for the host nation. However, FDI plays a crucial role in fostering economic growth, but its impact is contingent on the presence of a robust absorptive capability for advanced technologies within the host economy. The effectiveness of FDI is intricately tied to the initial conditions of the host country. These conditions encompass the host country’s absorptive capacity, which determines its ability to assimilate and utilize foreign technologies, as well as the level of complementarity between domestic investment and FDI. Therefore, it is important for policymakers to implement impactful strategies that facilitate both domestic and foreign investments and consider absorptive capabilities for advanced technologies thereby stimulating economic growth.

Many countries are actively pursuing economic growth and aiming for high levels of development; however, there is a concerning trend emerging where societal focus on environmental safety is diminishing, ultimately leading to negative impacts on the health of citizens [47]. The relationship between consumption patterns and environmental pollution is intricately connected, as the production and utilization of goods and services frequently result in noteworthy environmental impacts. Excessive levels of consumption contribute to a rise in waste production, encompassing non-biodegradable substances. Inadequate disposal and handling of this waste can lead to the contamination of land, water, and air, thereby endangering both human health and the integrity of ecosystems. This can be mitigated by promoting resource-efficient consumption behaviors, such as waste reduction, recycling, and the utilization of renewable resources. Furthermore, excessive consumption habits have the potential to result in the excessive use and exhaustion of essential natural resources like fossil fuels, minerals, forests, and fisheries. Consistent and excessive consumption levels, without consideration for the replenishment of resources, may undermine the capacity of ecosystems to offer crucial services and sustain the needs of upcoming generations. Shifting toward a circular economy framework, which emphasizes the reduction, reuse, and recycling of materials, has the potential to decrease waste production and encourage the conservation and repurposing of resources.

It is essential for Saudi Arabia to enhance public awareness and education regarding the significance of sustainable consumption and its positive impacts on the environment, society, and future generations in order to promote behavioral change.

5. Conclusions and Policy Implications

In summary, our research delves into the intricate relationship among real gross domestic product (RGDP), private consumption, and investment within the Saudi Arabian context spanning from 2000 to 2022. Through a comprehensive analysis employing diverse statistical methodologies, our study yielded significant insights with profound implications for the nation’s future progress. Our key findings include the following:

- The identification of significant long-term cointegration among the variables suggests a durable association between the expenditure components in GDP and the RGDP.

- Unveiling a positive correlation between household consumption and RGDP. Our analysis highlights a significant association between private consumption (C) and RGDP, suggesting that an increase in private consumption corresponds to a rise in RGDP.

- Discovery of the Saudi RGDP model’s short-term stability and an annual correction rate of 100%, indicating a dynamic tendency toward equilibrium.

- The Granger causality analysis reveals the presence of unidirectional causal links between private consumption and RGDP, underscoring private consumption as a driving force behind RGDP. Moreover, it highlights the dynamic interplay between private consumption and RGDP in Saudi Arabia.

5.1. Policy Implications for Saudi Sustainable Development

The findings of this study have important policy implications for Saudi sustainable development as follows:

- This study provides a well-rounded approach to development that acknowledges the role of private consumption as a driver for real gross domestic product is crucial. Policymakers should focus on policies and procedures that encourage aggregate consumption. Furthermore, they must give equal importance to both an enhancement in private consumption and other components of RGDP in order to guarantee sustainable long-term outcomes.

- Given the apparent paradox between the sustainable development objectives of economic expansion and safeguarding the environment, it becomes crucial for policymakers to comprehend the influence of increasing prosperity and simultaneous shifts in private consumption habits on forthcoming environmental consequences.

- Investment plays a dominant role in economic growth globally, unlike Saudi RGDP; this possibly refers to a contingency depending on the initial circumstances, which encompass the ability to absorb and the level of compatibility between local investments and foreign direct investments. Policymakers need comprehensive strategies and regulations to promote this sector, especially no-oil investments.

In summary, the interrelationship among consumption, investment, and economic growth in Saudi Arabia is complex and dynamic. This research ensures the priority of private consumption as a driving force for fostering economic development. These findings are expected to contribute to interpreting the power of the Saudi economy and provide valuable insights for policymakers to secure sustainable development and researchers to conduct seminal studies as well.

5.2. Limitations and Future Research Directions

Although this study makes great contributions that support academics and Saudi policymakers, it faces various limitations. Complex models often have the potential to encounter overfitting issues, which can result in inadequate generalization to novel data or estimations of model performance. As such, the findings of this study are constrained by contextual factors and specific characteristics of the study context.

In addition, datasets commonly include a variety of variables and time points, which can lead to an increased risk of data mining and the discovery of spurious results. Furthermore, assessing the precision of the model predictions can pose challenges, especially when dealing with periods characterized by significant structural alterations.

According to the results outlined in this article, numerous potential paths for future investigation arise as follows:

- Private consumption has been a driving force for economic growth in Saudi Arabia for the last two decades, which stresses the importance of analyzing the structure of consumption function. Further research may conduct a thorough analysis to clarify which factors are predominantly accountable for the observed relationships.

- Regarding the coupled relationship between private consumption and pollution, further research can investigate the impacts of Saudi private consumption on the environment.

- Different Gulf region countries can be analyzed to detect variations in the relationship between GDP and household consumption. By conducting comparative analyses, it is possible to uncover regional disparities and gain insights into the interplay among these factors. This approach can provide valuable information regarding best practices and lessons that can be applied to Saudi Arabia.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The author declares no conflict of interest.

References

- Petrakis, P.E. Theoretical Approaches to Economic Growth and Development: An Interdisciplinary Perspective; Palgrave Macmillan: Athens, Greece, 2020. [Google Scholar] [CrossRef]

- Pratama, H.P.; Syaparuddin, S.; Emilia, E. Determinants of economic growth regencies/cities in Jambi Province with dynamic panel data approach. J. Perspekt. Pembiayaan Dan Pembang. Drh. 2022, 10, 311–324. [Google Scholar] [CrossRef]

- Alper, A. The relationship of economic growth with Consumption, investment, unemployment rates, saving rates and portfolio investments in developing countries. Gaziantep Univ. J. Soc. Sci. 2018, 17, 980–987. [Google Scholar] [CrossRef]

- Saudi Central Bank. Statistical Report. Available online: https://www.sama.gov.sa/en-US/EconomicReports/Financial%20Stability%20Report/Financial%20Stability%20Report%202023.pdf (accessed on 24 February 2024).

- Sayed, M.N.; Alayis, M.M.H. The Nature of the Relationship between GDP and Energy Consumption in Saudi Arabia. Int. J. Bus. Manag. 2019, 14, 8. [Google Scholar]

- Alkhathlan, K.A. Contribution of oil to the economic growth of Saudi Arabia. Appl. Econ. Lett. 2013, 20, 343–348. [Google Scholar] [CrossRef]

- Mensi, W.; Shahzad, S.J.H.; Hammoudeh, S.; Al-Yahyaee, K.H. Asymmetric impacts of public and private investments on the nonoil GDP of Saudi Arabia. Int. Econ. 2018, 156, 15–30. [Google Scholar] [CrossRef]

- Alabdulwahab, S. The linkage between oil and nonoil GDP in Saudi Arabia. Economies 2021, 9, 202. [Google Scholar] [CrossRef]

- Radulescu, M.; Serbanescu, L.; Sinisi, C.I. Consumption vs Investments for stimulating economic growth and employment in the CEE Countries–A panel analysis. Econ. Res.-Ekon. Istraživanja 2019, 32, 2329–2352. [Google Scholar] [CrossRef]

- Albulescu, C.T. Do Foreign Direct and Portfolio Investments Affect Long-term Economic Growth in Central and Eastern Europe? Procedia Econ. Financ. 2015, 23, 507–512. [Google Scholar] [CrossRef]

- Amirat, A.; Zaidi, M. Estimating GDP growth in Saudi Arabia under the government’s Vision 2030: A knowledge-based economy approach. J. Knowl. Econ. 2020, 11, 1145–1170. [Google Scholar] [CrossRef]

- Alrasheedy, A.; Alaidarous, H. The Relationship between Saving and Investment: The Case of Saudi Arabia. Int. J. Econ. Financ. 2019, 11, 10–5539. [Google Scholar] [CrossRef]

- Rahman, M.N. Dynamics of Foreign Direct Investment In Saudi Arabian Economy. Acad. Entrep. J. 2021, 27, 1–16. [Google Scholar]

- Borensztein, E.; De Gregorio, J.; Lee, J.W. How does a foreign direct investment affect economic growth? J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Samargandi, N.; Alghfais, M.A.; AlHuthail, H.M. Factors in Saudi FDI inflow. SAGE Open 2022, 12, 21582440211067242. [Google Scholar] [CrossRef]

- Belloumi, M.; Alshehry, A. The impacts of domestic and foreign direct investments on economic growth in Saudi Arabia. Economies 2018, 6, 18. [Google Scholar] [CrossRef]

- Ahmed, E.M. Are the FDI inflow spillover effects on Malaysia's economic growth input-driven? Econ. Model. 2012, 29, 1498–1504. [Google Scholar] [CrossRef]

- Ekperiware, C.M. Oil and nonoil FDI and economic growth in Nigeria. J. Emerg. Trends Econ. Manag. Sci. 2011, 2, 333–343. [Google Scholar]

- Akiri, S.E.; Vehe, B.M.; Ijuo, O. A Foreign direct investment and economic growth in Nigeria: An empirical investigation. J. Policy Model. 2004, 26, 627–639. [Google Scholar]

- Eller, M.; Haiss, P.R.; Steiner, K. Foreign Direct Investment in the Financial Sector: The Growth Engine for Central and Eastern Europe? Europa Institute Working Paper No. 69; Vienna University of Economics and Business Administration: Vienna, Austria.

- Ridzuan, A.R.; Ismail, N.A.; Che Hamat, A.F. Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore? Economies 2017, 5, 29. [Google Scholar] [CrossRef]

- Ehimare, O.A. Foreign direct investment and its effect on the Nigerian economy. Bus. Intell. J. 2011, 4, 253–261. [Google Scholar]

- Tintin, C. Does foreign direct investment spur economic growth and development? A comparative study. In Proceedings of the 14th Annual European Trade Study Group Conference, Leuven, Belgium, 13–15 September 2012. [Google Scholar]

- Hussain, M.E.; Haque, M. Foreign Direct Investment, Trade, and Economic Growth: An Empirical Analysis of Bangladesh. Economies 2016, 4, 7. [Google Scholar] [CrossRef]

- Choi, Y.J.; Baek, J. Does FDI Really Matter to Economic Growth in India? Economies 2017, 5, 20. [Google Scholar] [CrossRef]

- Durham, J.B. Absorptive capacity and the effects of foreign direct investment and equity foreign portfolio investment on economic growth. Eur. Econ. Rev. 2004, 84, 285–306. [Google Scholar] [CrossRef]

- Meschi, E. FDI and growth in MENA countries: An empirical analysis. In Proceedings of the Fifth International Conference of the Middle East Economic Association, Sousse, Tunisia, 10–12 March 2006. [Google Scholar]

- Lensink, R.; Morrissey, O. Foreign Direct Investment: Flows, Volatility, and the Impact on Growth. Review of International Economics 2006, 14, 478–493. [Google Scholar] [CrossRef]

- Adams, S. Foreign Direct investment, domestic investment, and economic growth in Sub-Saharan Africa. J. Policy Model. 2009, 31, 939–949. [Google Scholar] [CrossRef]

- Bakari, S.; Mabrouki, M.; Othmani, A. The six linkages between foreign direct investment, domestic investment, exports, imports, labour force and economic growth: New empirical and policy analysis from Nigeria. J. Smart Econ. Growth 2018, 3, 25–43. [Google Scholar]

- Diacon, P.E.; Maha, L.G. The relationship between income, Consumption and GDP: A time series, cross-country analysis. Procedia Econ. Financ. 2015, 23, 1535–1543. [Google Scholar] [CrossRef]

- Mishra, P.K. Dynamics of the relationship between real consumption expenditure and economic growth in India. Indian J. Econ. Bus. 2011, 10, 541–551. [Google Scholar]

- Foster, J. The US consumption function: A new perspective. J. Evol. Econ. 2021, 31, 773–798. [Google Scholar] [CrossRef]

- Laidler, D.E.W. Lucas, Keynes, and the crisis. J. Hist. Econ. Thought (JHET) 2010, 32, 39–62. [Google Scholar] [CrossRef]

- Arthur, W.B. Complexity and the Economy; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- El Quaoumi, K.; Le Masson, P.; Weil, B.; Un, A. Testing the evolutionary theory of household consumption behaviour in the case of novelty—A product characteristics approach. J. Evol. Econ. 2018, 28, 437–460. [Google Scholar] [CrossRef]

- Francois, J.N. Habits, Rule-of-Thumb Consumption and Useful Public Consumption in Sub-Saharan Africa: Theory and New Evidence. J. Afr. Econ. 2023, 32, 469–494. [Google Scholar] [CrossRef]

- Kim, H.S. Patterns of economic development: Correlations affecting economic growth and quality of life in 222 countries. Politics Policy 2017, 45, 83–104. [Google Scholar] [CrossRef]

- Mynaříková, L.; Pošta, V. The effect of consumer confidence and subjective well-being on consumers’ spending behaviour. J. Happiness Stud. 2023, 24, 429–453. [Google Scholar] [CrossRef]

- Zhang, X.; Wu, L.; Zhang, R.; Deng, S.; Zhang, Y.; Wu, J.; Li, Y.; Lin, L.; Li, L.; Wang, Y.; et al. Evaluating the relationships among economic growth, energy consumption, air emissions and environmental protection investment in China. Renew. Sustain. Energy Rev. 2013, 18, 259–270. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Home|Ministry of Tourism|KSA. Available online: https://mt.gov.sa/ (accessed on 24 February 2024).

- MacKinnon, J.G.; Haug, A.A.; Michelis, L. Numerical Distribution Functions of Likelihood Ratio Tests for Cointegration. J. Appl. Econom. 1999, 14, 563–577. [Google Scholar] [CrossRef]

- Muhammad, B.; Khan, M.K.; Khan, M.I.; Khan, S. Impact of foreign direct investment, natural resources, renewable energy consumption, and economic growth on environmental degradation: Evidence from BRICS, developing, developed and global countries. Environ. Sci. Pollut. Res. 2021, 28, 21789–21798. [Google Scholar] [CrossRef]

- Javed, S.; Husain, U. Influence of government expenditure on economic growth: An empirical retrospection based on ARDL approach. FIIB Bus. Rev. 2024, 13, 208–219. [Google Scholar] [CrossRef]

- Ehmaidat, A.; Jajuga, K. Foreign Direct Investment in Saudi Arabia. J. Contemp. Issues Bus. Gov. 2023, 13, 237–251. Available online: https://www.ijarst.in/public/uploads/paper/295691681902286.pdf (accessed on 24 February 2024).

- Mohammed, M.; Abdel-Gadir, S. Unveiling the Environmental–Economic Nexus: Cointegration and Causality Analysis of Air Pollution and Growth in Oman. Sustainability 2023, 15, 16918. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).